Employee payroll processing is all about preparing employee’s financial records. This is nothing but the compensation paid to an employee by the employer in the form of salaries, wages, bonuses, and deductions. It is given for the work done by an employee during a specific period of time.

Employee payroll processing can be done effectively by Odoo Human Resource Management module. The application has all that features that cover the entire process of payroll calculation in a company, no matter how big or small the workforce size is.

Odoo comes with a large collection of business-related applications and modules ranging like CRM, Sales, Purchase, Human Resource, E-commerce, Manufacturing, etc. All these modules collectively make Odoo ERP a complete business management application.

What makes the open-source ERP highly significant and prominent among the business group is – the high-end versatility and ease of use. Apart from the 30 main basic modules, Odoo comprises more than 16,000+ third party Apps/Plugins offering extensive functionalities catering to specific business requirements. Each module is custom-built for different user needs. And the interesting part is that these applications stand ahead of time and fulfill every business requirement in the most professional manner.

Today Odoo ERP has more than 3.7 million users ranging from SMEs, start-ups and larger enterprises. The user list includes leading brands like Toyota, Hyundai, and PCI.

The error-free payroll management by Odoo ERP can simply take the company’s human resource management to its next level. Automated and integrated management makes sure that no relevant data is missed or misrepresented. With Odoo Payroll, the company can significantly bring down the need of manpower in calculating the employee compensations, thereby save their cost and also shift their focus to more strategic development and core tasks of the company.

Let’s see how Odoo suits Indian Payroll processing. When it comes to the Indian context, Salary, Bonus, Deductions, Gross and Net Pay come into the administration of payroll calculation. Therefore, factors like Employee Leaves, Employee Attendances, Employee Timesheets, and Employee Expenses come into play. Odoo has different modules to cater to all the above-said elements.

To finish off a payroll process, there are different steps to be carried in order. Initially, the salary rule, salary structure, and salary category must be charted as per the company policy. Secondly, creating Employee contracts with relevant salary structure and salary rule. Thirdly, the generation of payslips based on salary rule and salary structure.

One or more contracts can be set for an employee, however, one that is active shall be taken into consideration for calculating the Employee payroll.

Let’s see how these steps are carried in Odoo Payroll Module.

SALARY RULE

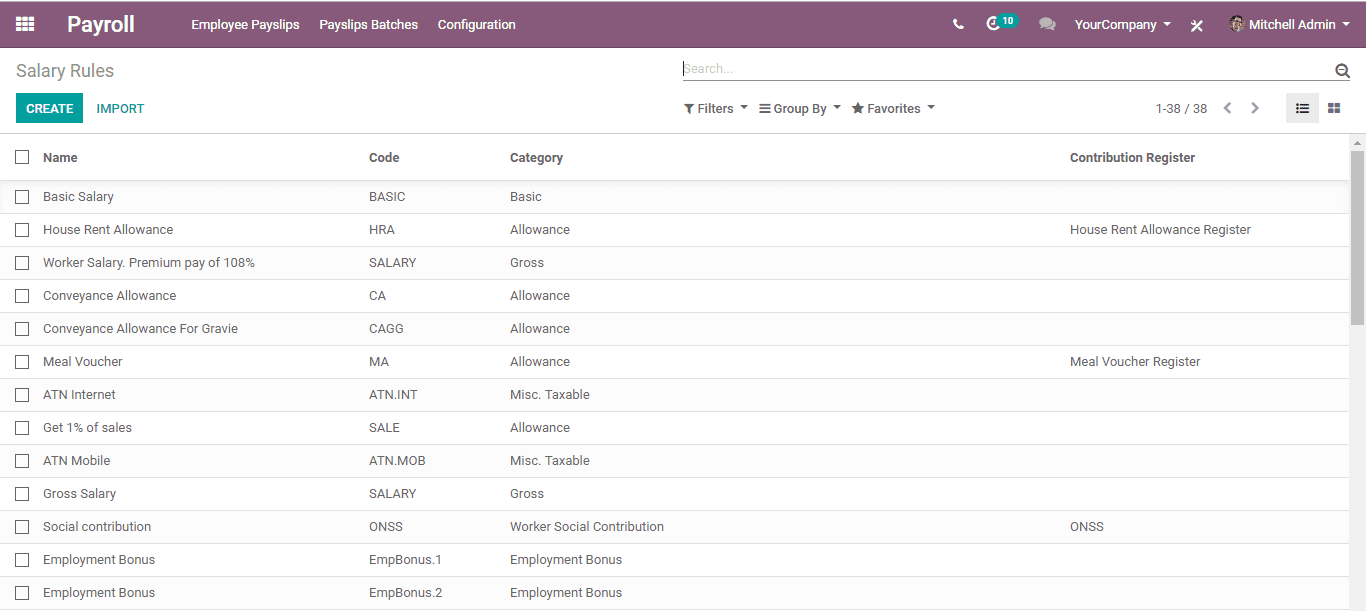

Combination of different salary rules constitutes a salary structure or influences the computation of a salary structure. Salary rules can be of different category like Basic, Allowance, Gross, Deduction, Net, etc.

By default, Odoo provides different salary rules. However, business organizations can create new salary rule based on company policy.

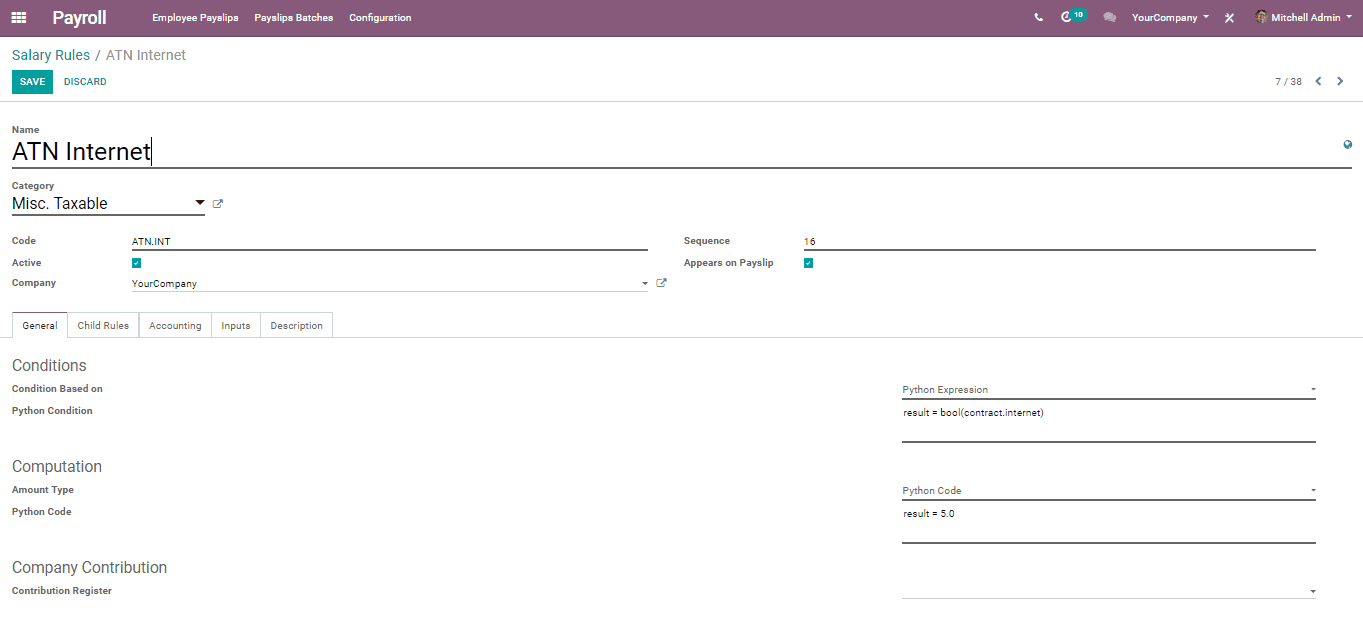

Here, one needs to define rules of sequence and a unique code for salary rules.

Under the general tab, one can also set the condition and various computations for each salary rule. Conditions can be based on:

• Range

• Python expression

• Always true

And the computation can be based on:

• Percentage

• Fixed Amount

• Python code

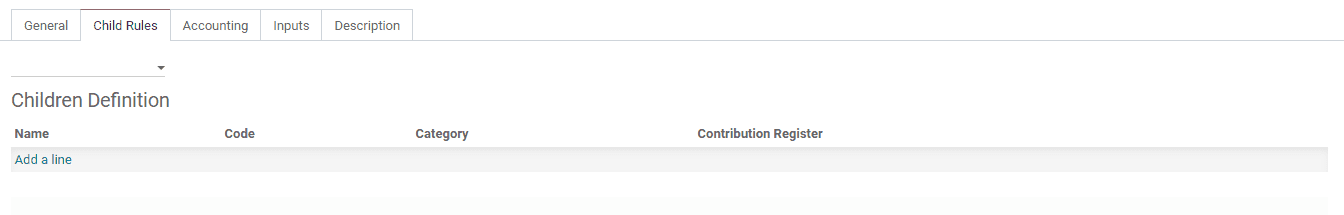

Here, one can also add various child rules for the specific salary rule.

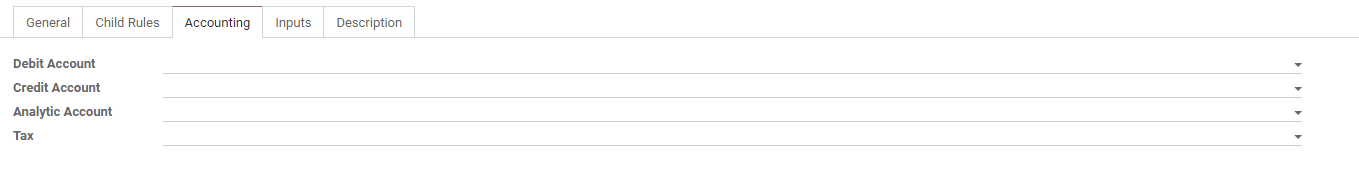

Under the accounting tab, one can enter the debit and credit amount for the salary rule, making the process easier.

Additionally, attachments can also have inserted for every salary rule created.

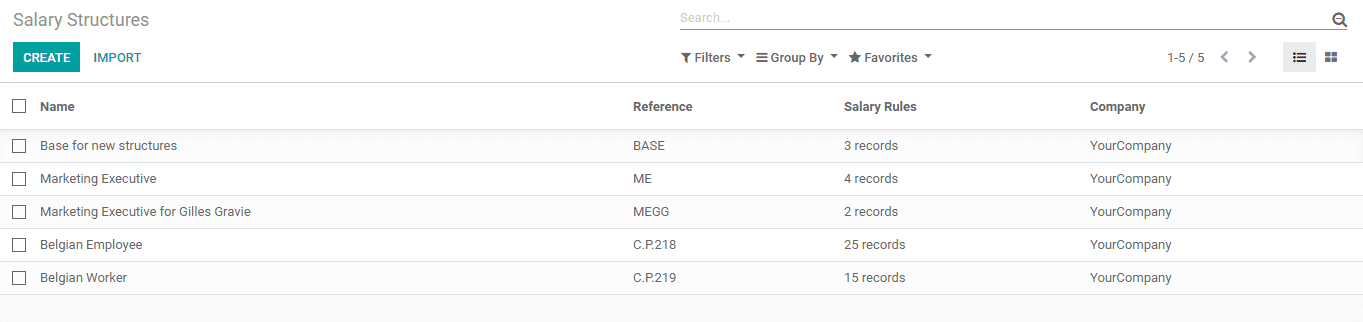

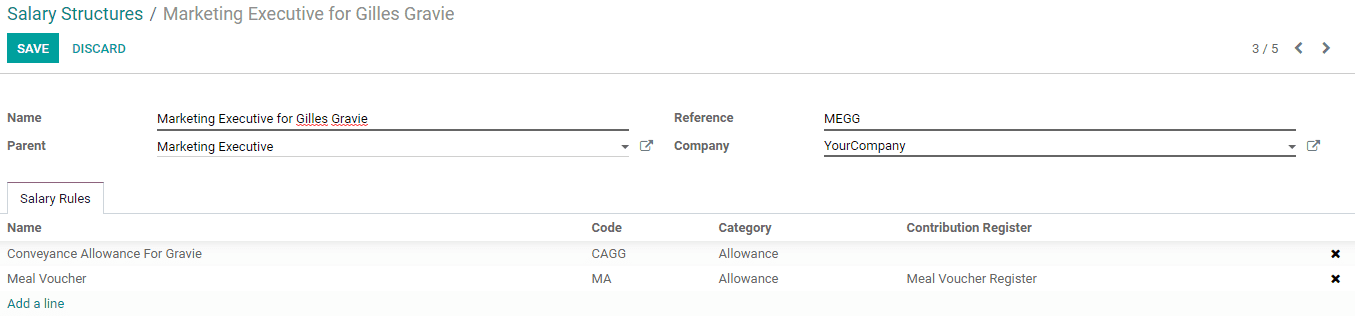

SALARY STRUCTURE

For computing a payslip, salary structure is very important. Salary structure is defined in the combination of salary rules selected. It can have named according to each worker like Marketing Executive, Sales Manager and so on., The name, reference, and Company must be determined alongside the set of pay rules for the salary structure. The base structure is already present and it incorporates Basic, Gross, and Net.

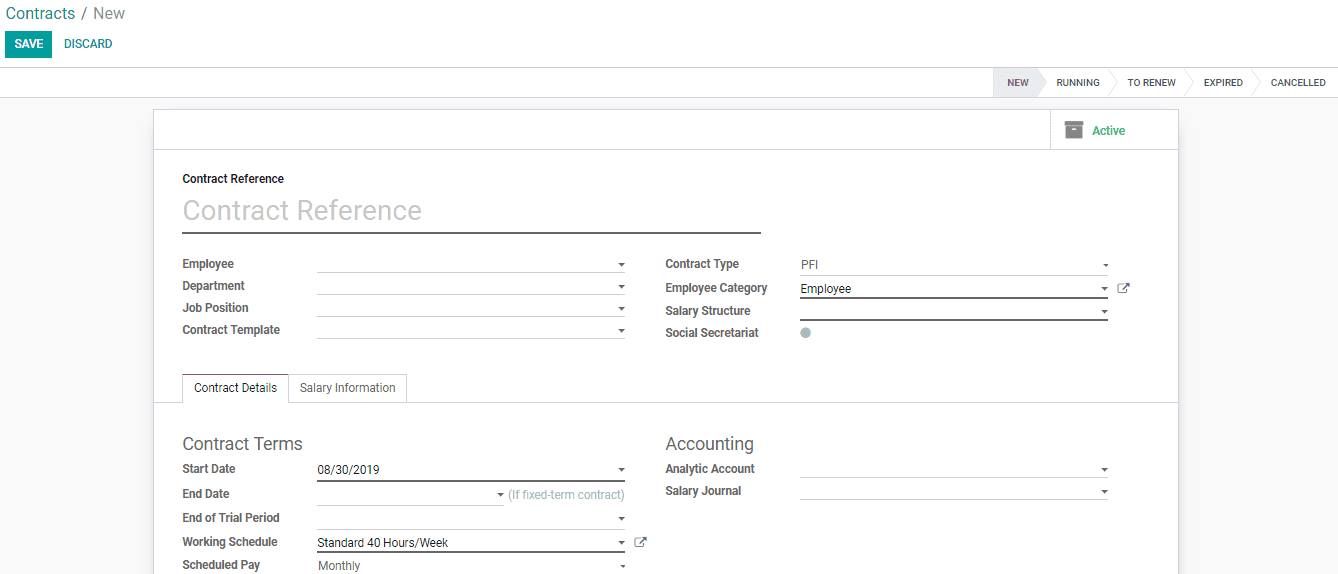

CONTRACT

Employee payroll is calculated on the basis of the contract assigned to an employee. The active contract will be taken into consideration of calculating employee’s pay as it contains the salary structure which again consists the salary rules.

Under the contract, one can specify the employee name, department, job positions, contract type, employee category, salary structure for the employee, the start date and the end date of the contract, the scheduled payment option and much other relevant information.

Upon creating a new employee contract, it can be seen as active, meaning the contract is in the running stage and can be accounted for the payroll processing of the particular employee.

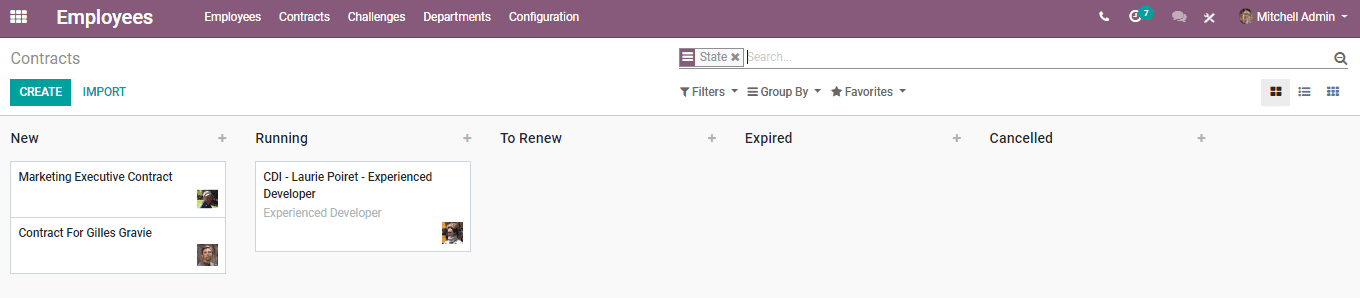

In order to arrange different employee contracts, Odoo also provides a pipeline.

From here, you can easily view which employee contracts are active and running, also which are new, expired and so on.

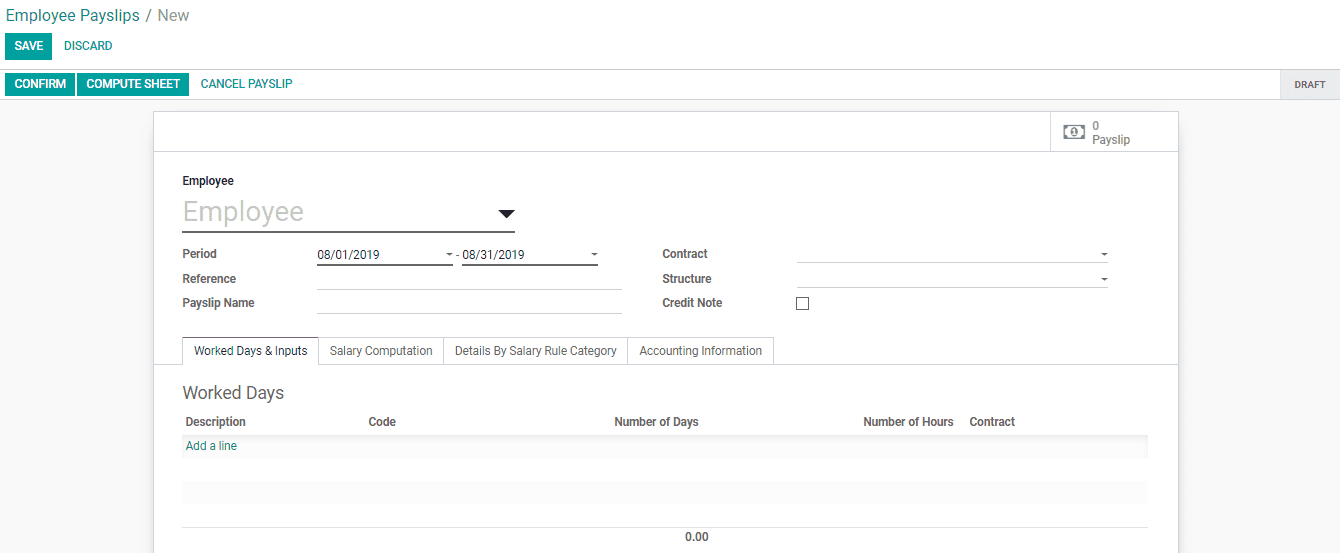

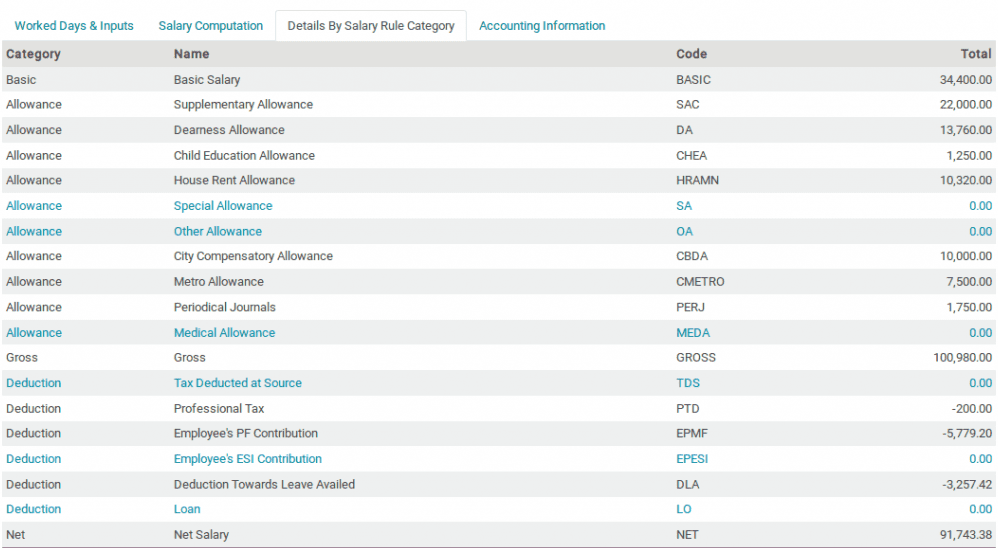

EMPLOYEE PAYSLIP

Payslip can be generated for those employees who come under active contract. Employee payslip will be determined by the pay/salary structure that is made available for that employee contract. Once the employee name and contract is chosen, the quantity of worked days will be consequently figured with respect to working days marked for the employee.

Upon clicking, “Compute Payslip” button, both salary computation, and salary rule details get automatically computed. Alongside, information like a loan, availed leaves get mentioned in the employee payslip.

Payslip can also be generated for a bundle or bunch of employees.