Managing loans for business assets in Odoo 18 Accounting makes it easier to track and manage debts linked to certain assets, like real estate, machinery, or cars. It makes it possible for companies to directly tie loans to assets, guaranteeing that associated financial responsibilities are clearly visible. The technology streamlines the administration of intricate loan arrangements by automating the compilation of journal entries, interest computations, and payment schedules. A thorough picture of how loan repayments affect the asset's value over time is provided by integration with the asset depreciation module. This enhances financial transparency by guaranteeing correct accounting for both liabilities and asset assessment. In order to make informed decisions, users can also create comprehensive reports that examine loan performance, repayment status, and interest expenses. The function improves financial control and lessens the manual labor involved in managing asset-linked loans.

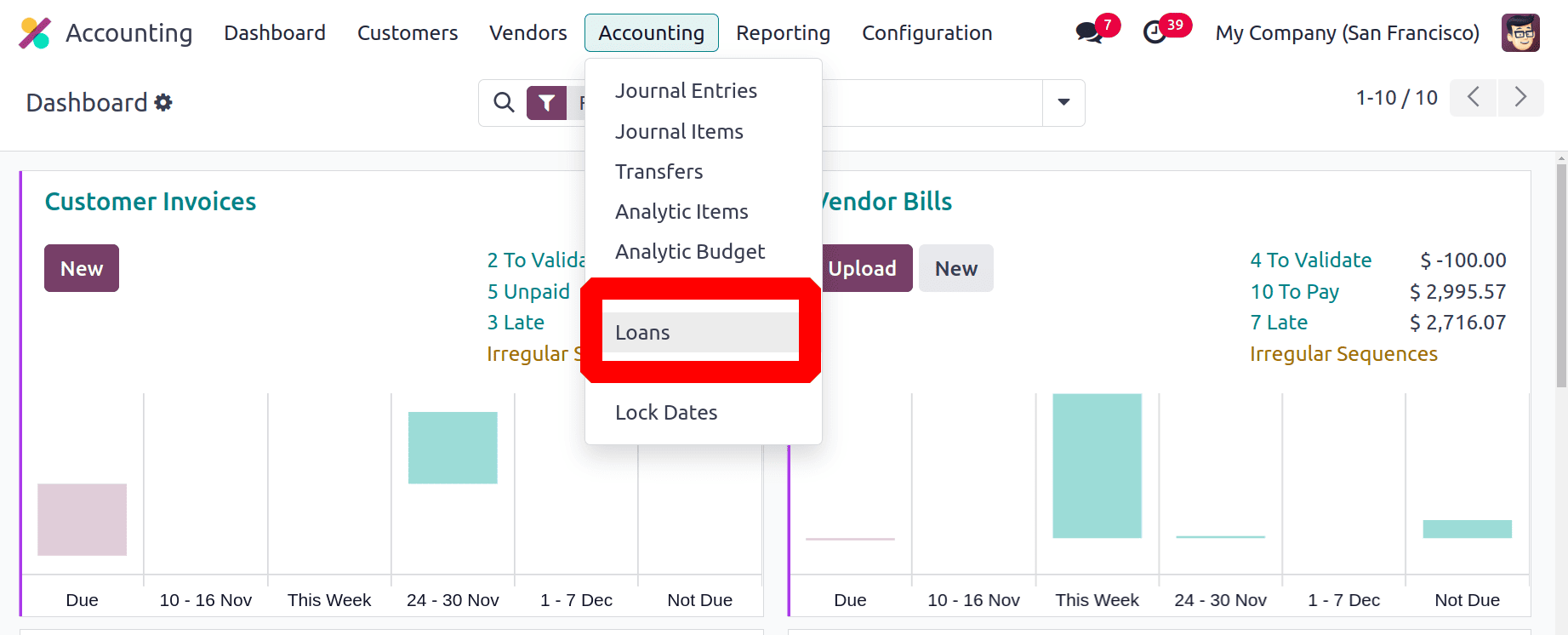

Now let's check how Loan Management is handled in Odoo 18 Accounting. The accounting menu of the module contains the Loans as shown in the screenshot below.

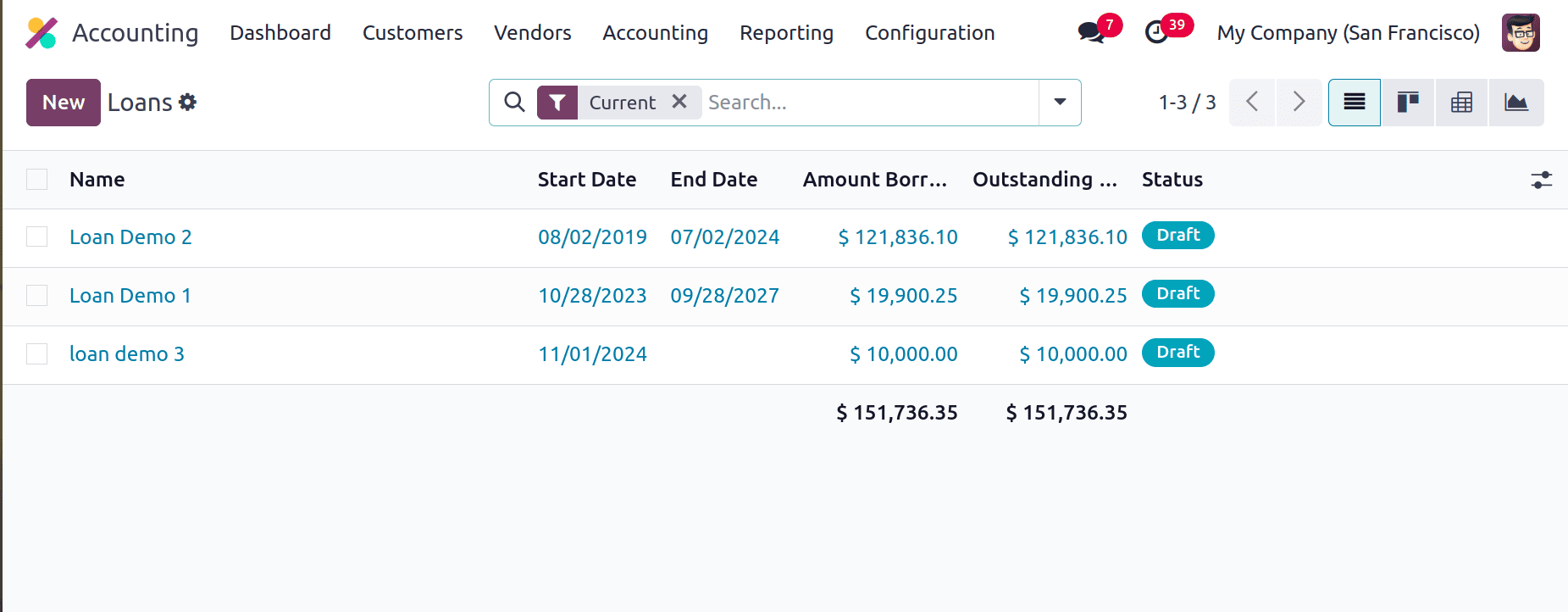

The already created Loans are shown as a list here. The Loan Name, Start Date, End Date, Amount borrowed, Outstanding Balance, and Status are visible in the list. To add a new loan click on the New button.

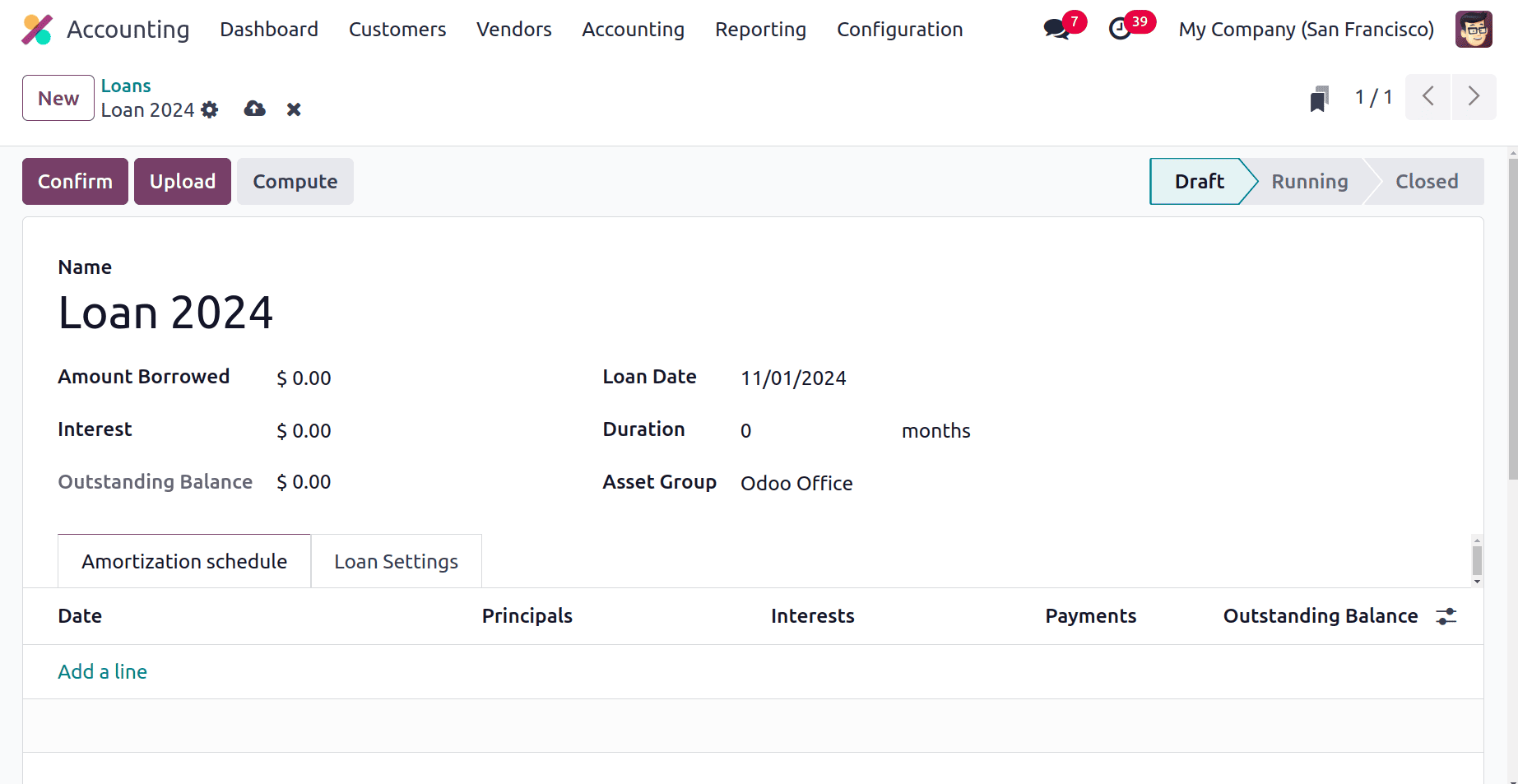

Then inside the creation form first mention the Loan name. Then add the Amount Borrowed, interest, loan date, duration of the loan. The Outstanding Balance will be filled there after mentioning the Asset Group.

Amount Borrowed: The main amount that a borrower consents to receive from the lender and that must be paid back over a certain period of time with interest is referred to as the amount borrowed in a loan.

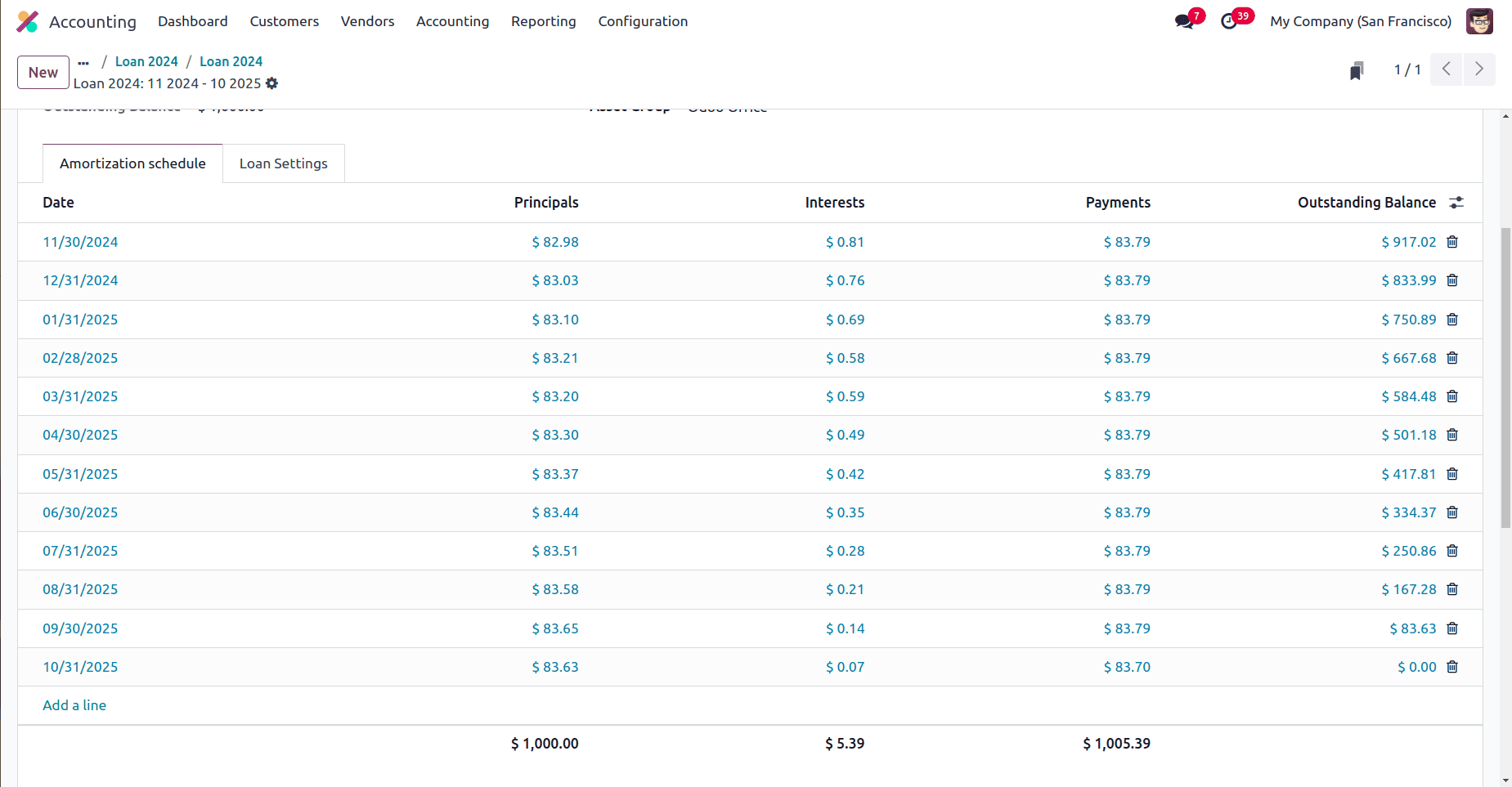

Then the Amortization Schedule can be shown in the screenshot. A loan's amortization schedule is a comprehensive chart that breaks down each payment into principal and interest components and shows the total amount owed over the course of the loan. Users can either manually add the schedule by clicking on the ‘Add a Line’ button, or it will fill automatically based on the chosen Compounding Method.

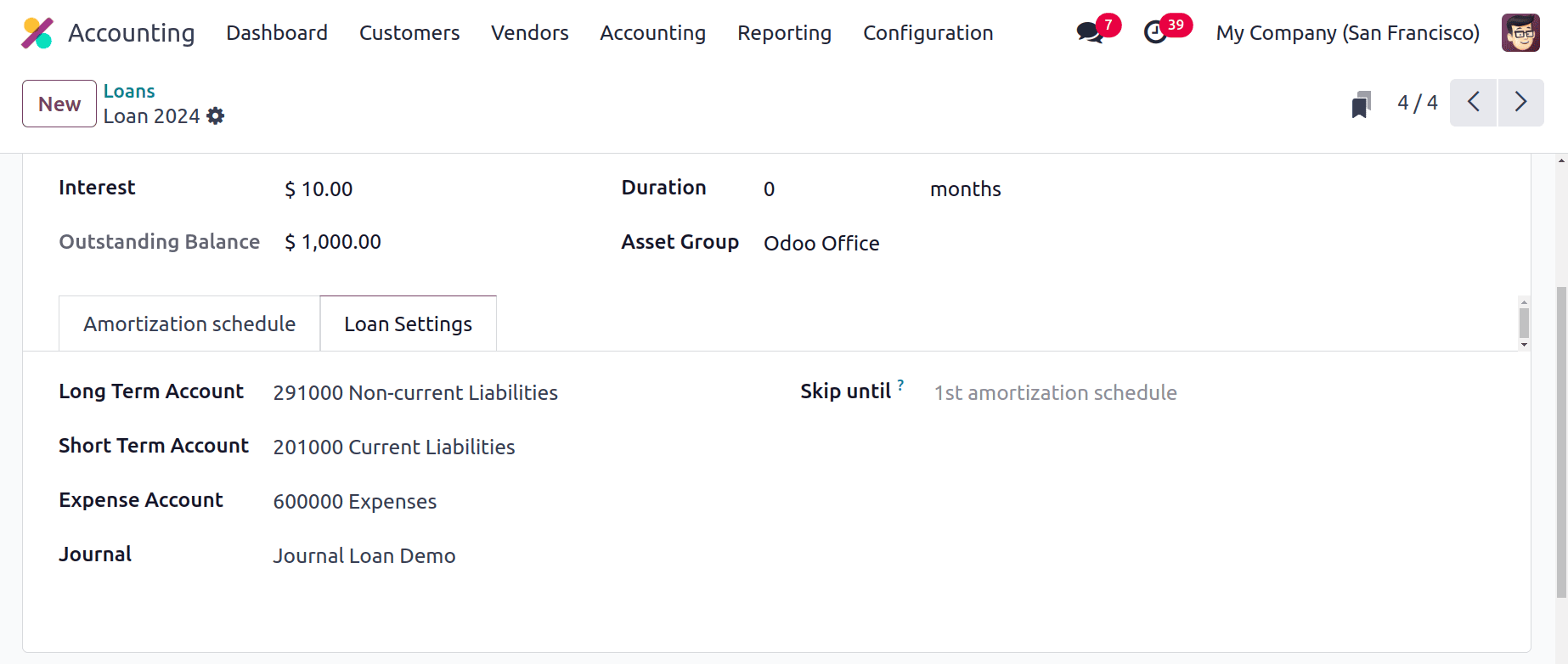

The Loan Settings tab comes next. The loan settings are where the accounts are configured. Include the Journal, the Expense Account, the Long Term Account, and the Short Term Account.

Skip until the loan is that, Odoo will not create entries for loan lines that are up to this date (inclusive). If the user had previously made entries by hand before this loan was formed, this is helpful.

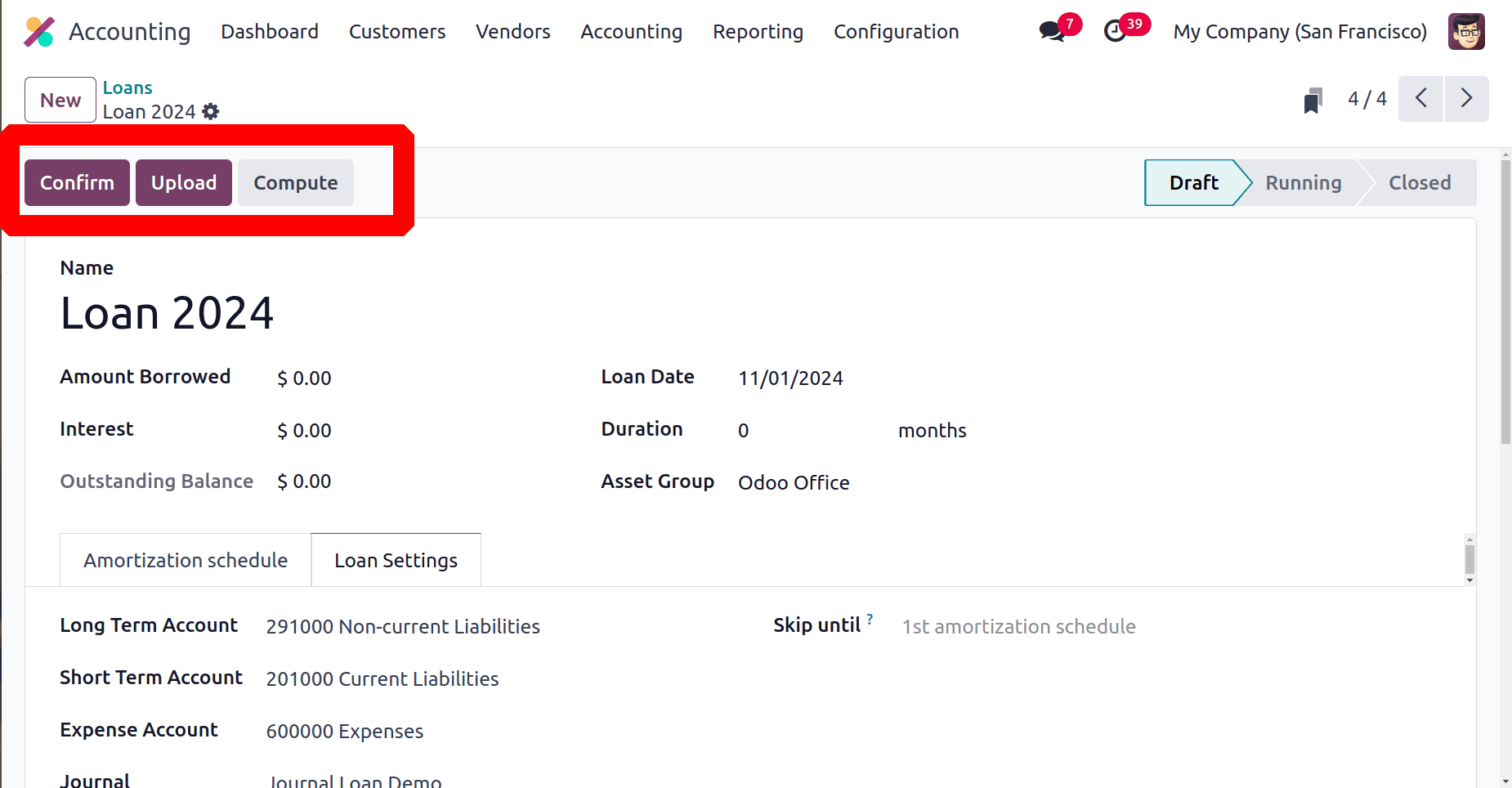

There are three buttons shown in the upper left corner of the screen. The first one is Confirm, used to confirm the loan. The second one is Upload, which helps to upload the corresponding document to the loan. The last one is Compute.

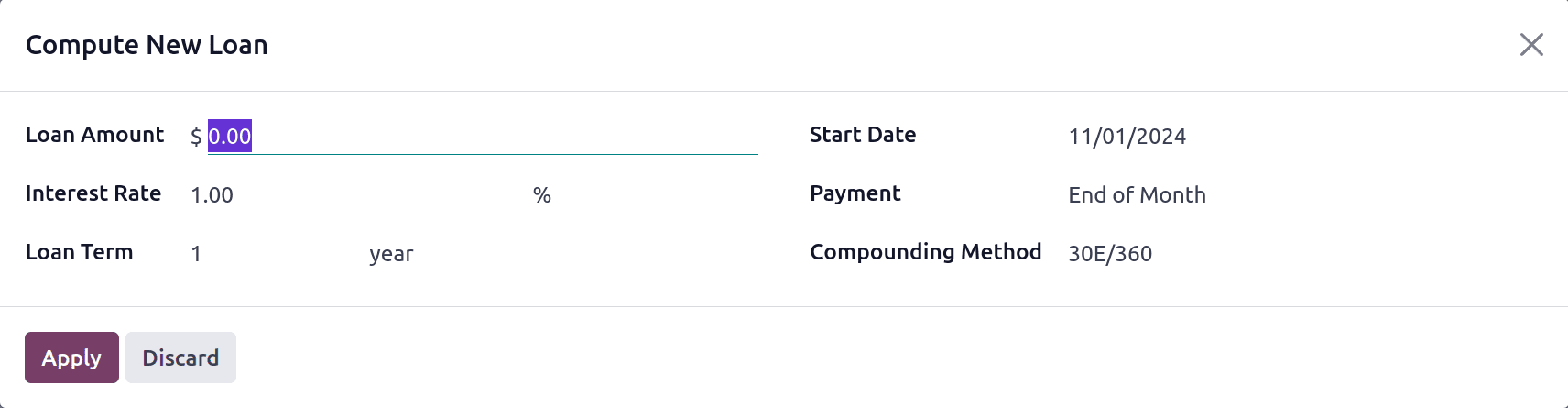

While clicking on the Compute button, another window will appear shown in the below screenshot. Mention the Loan Amount, Interest Rate, Loan Term, Start Date, Payment.

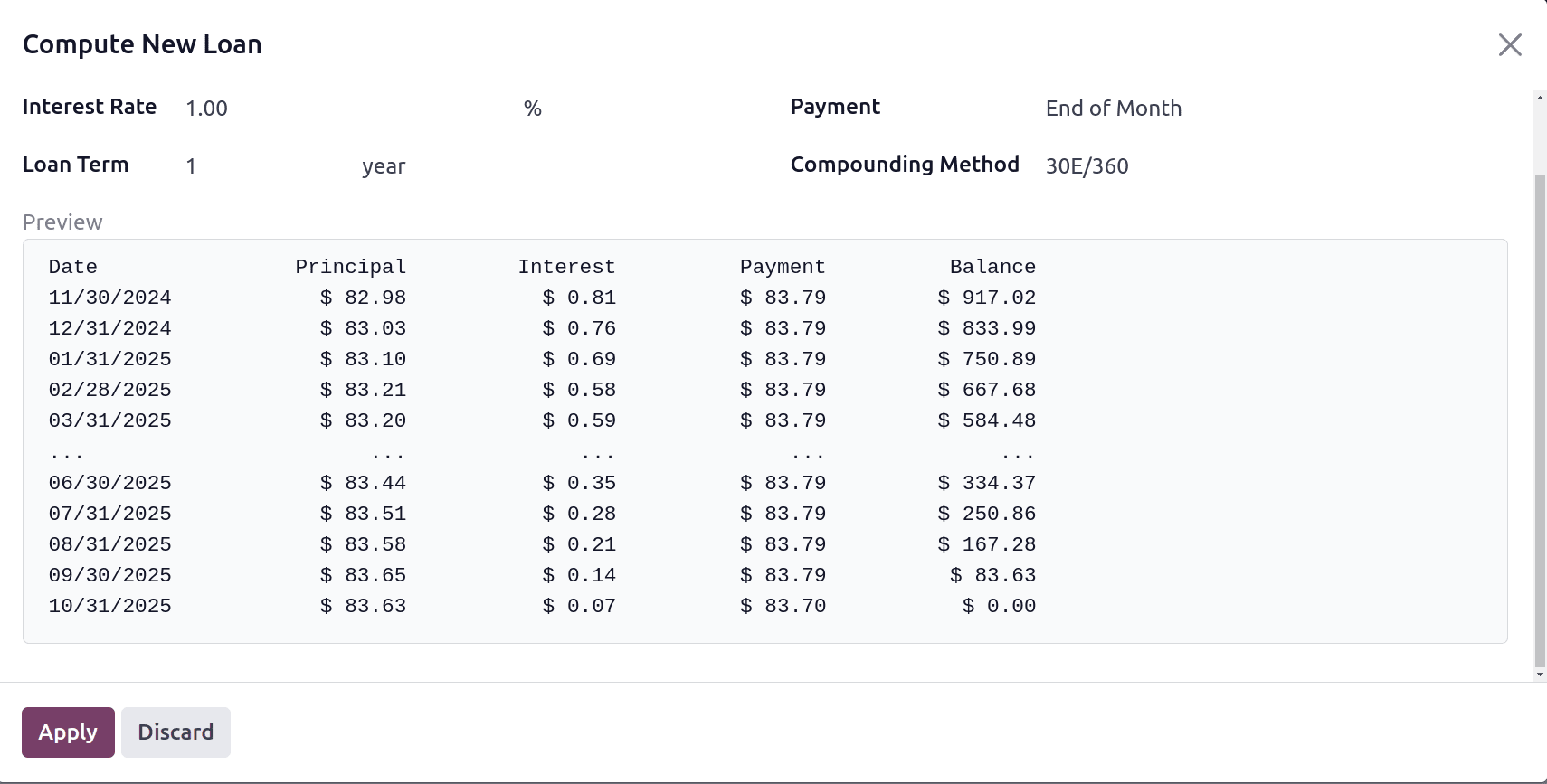

There are options to choose the Compounding Method, according to the chosen method, there is a preview of the amortization schedule.

The date, principal amount, interest, payment, and balance are shown inside the preview. So click on the Apply button to add this to the Amortization Schedule.

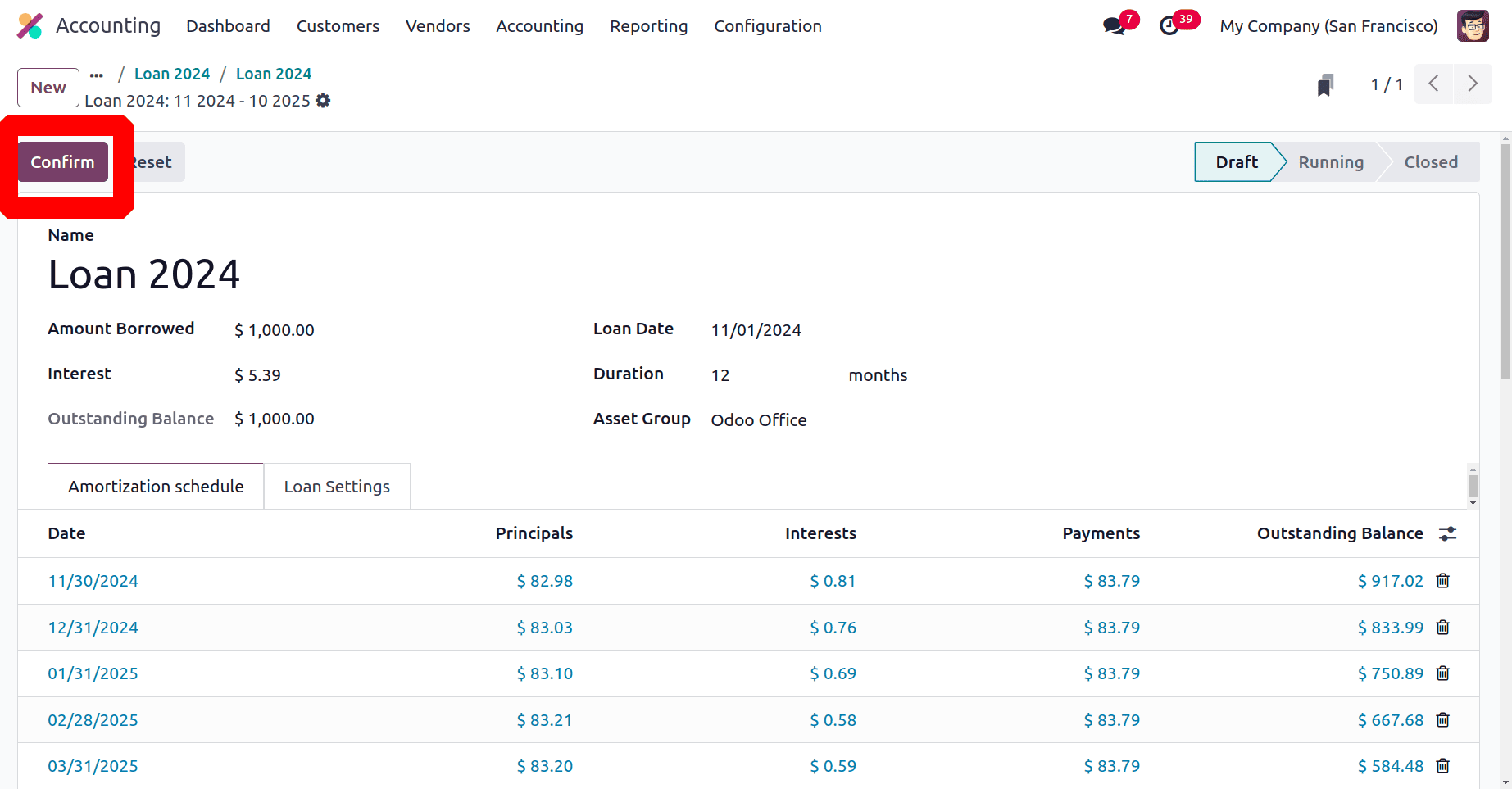

The interest, Duration, and Outstanding Balance are automatically updated there based on the chosen computation method. Then click on the Confirm button.

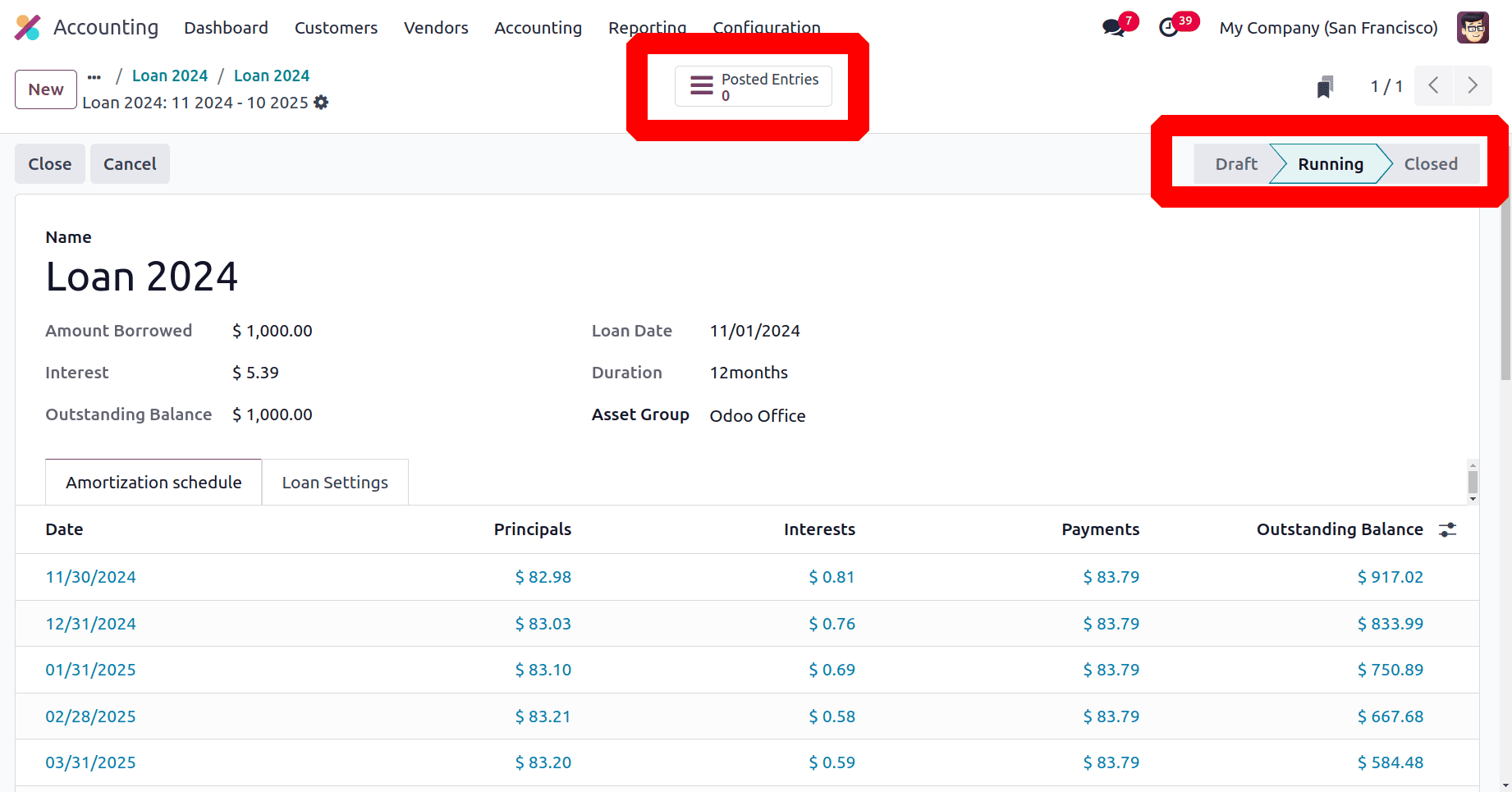

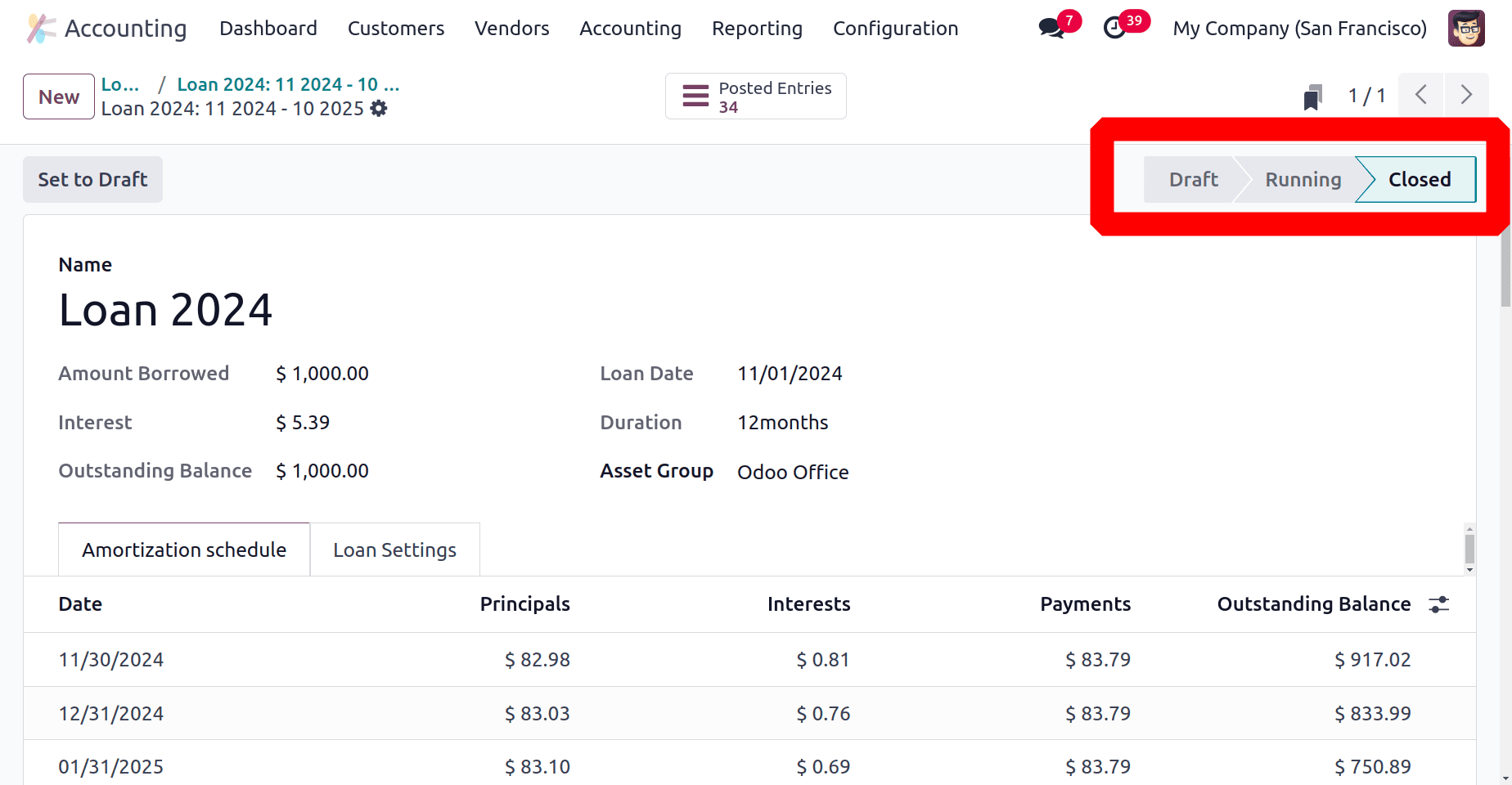

After confirming the loan the stage will change from Draft to Running. And there is a smart tab named Posted Entries.

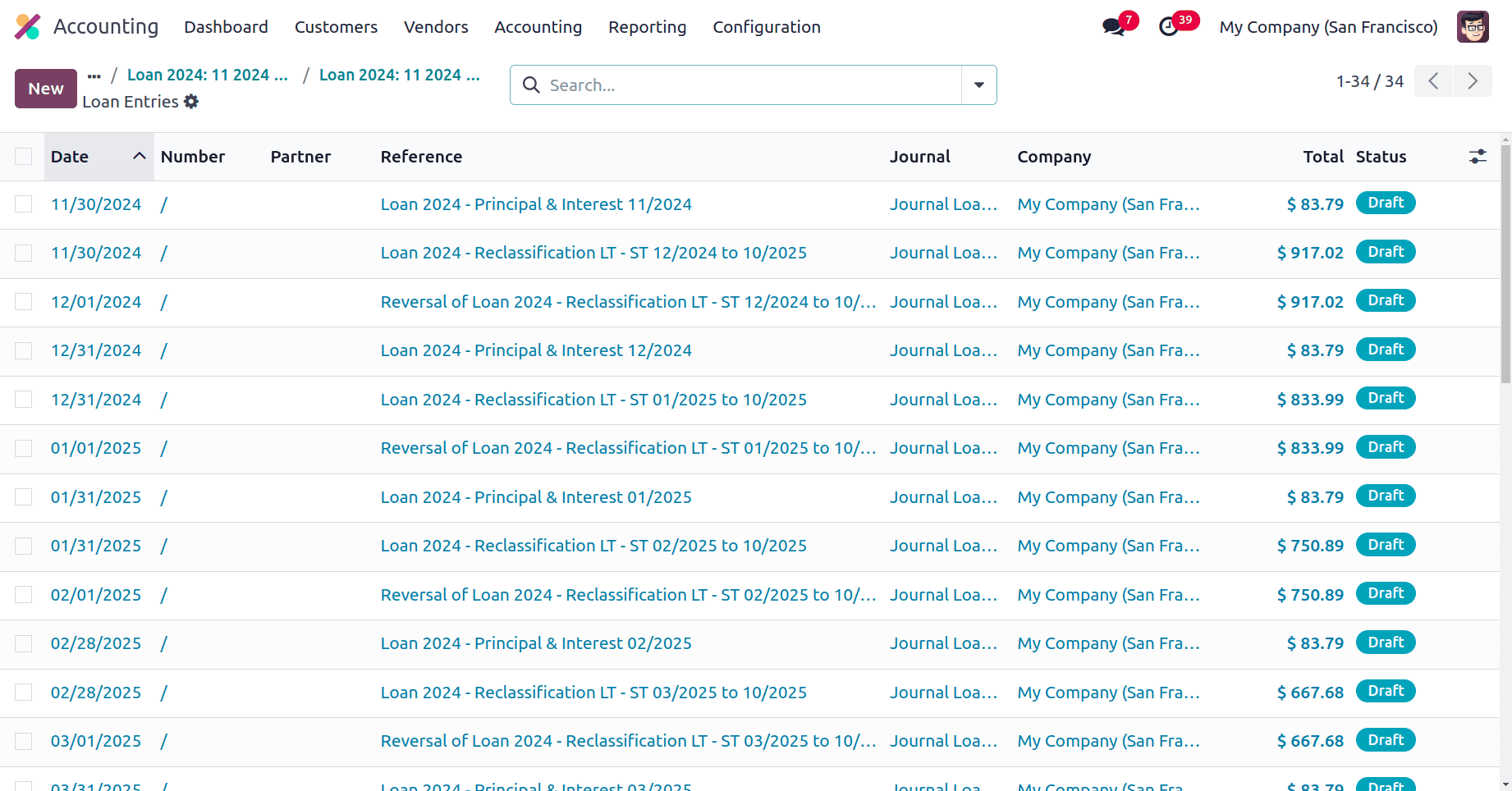

Open the smart tab to check the journal entries.

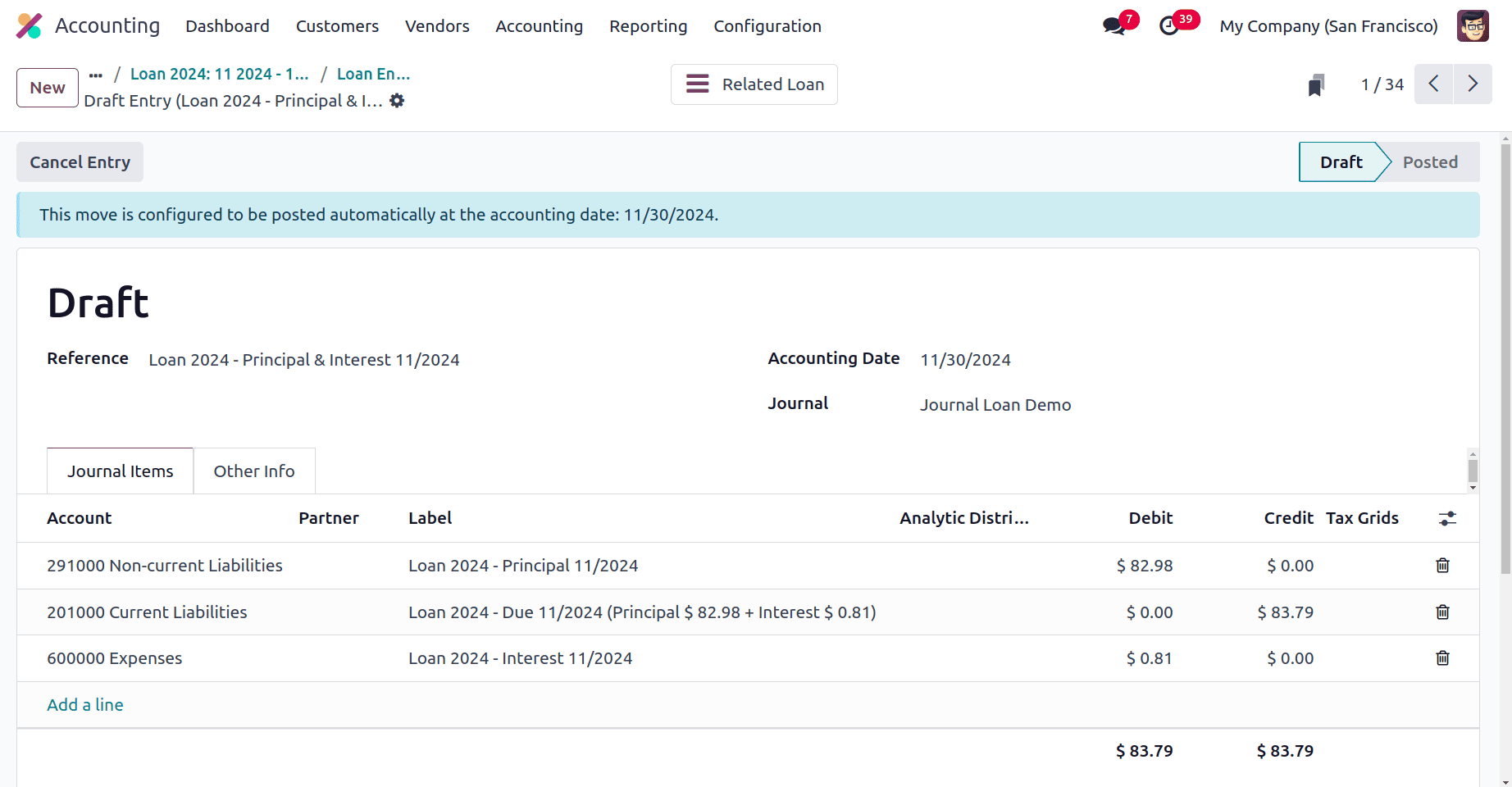

Let's open the first journal entry. Here the principal amount for the first month is debited in the Long Term Account. Which is a noncurrent liability. Here the liability is decreasing so the account is Debited. Then the payment is credited to the Short Term Account. Which is also a liability account, when liability increases then the credit happens. The interest of the loan is debited in the Expense account. Here the expense is increased so the account is debited.

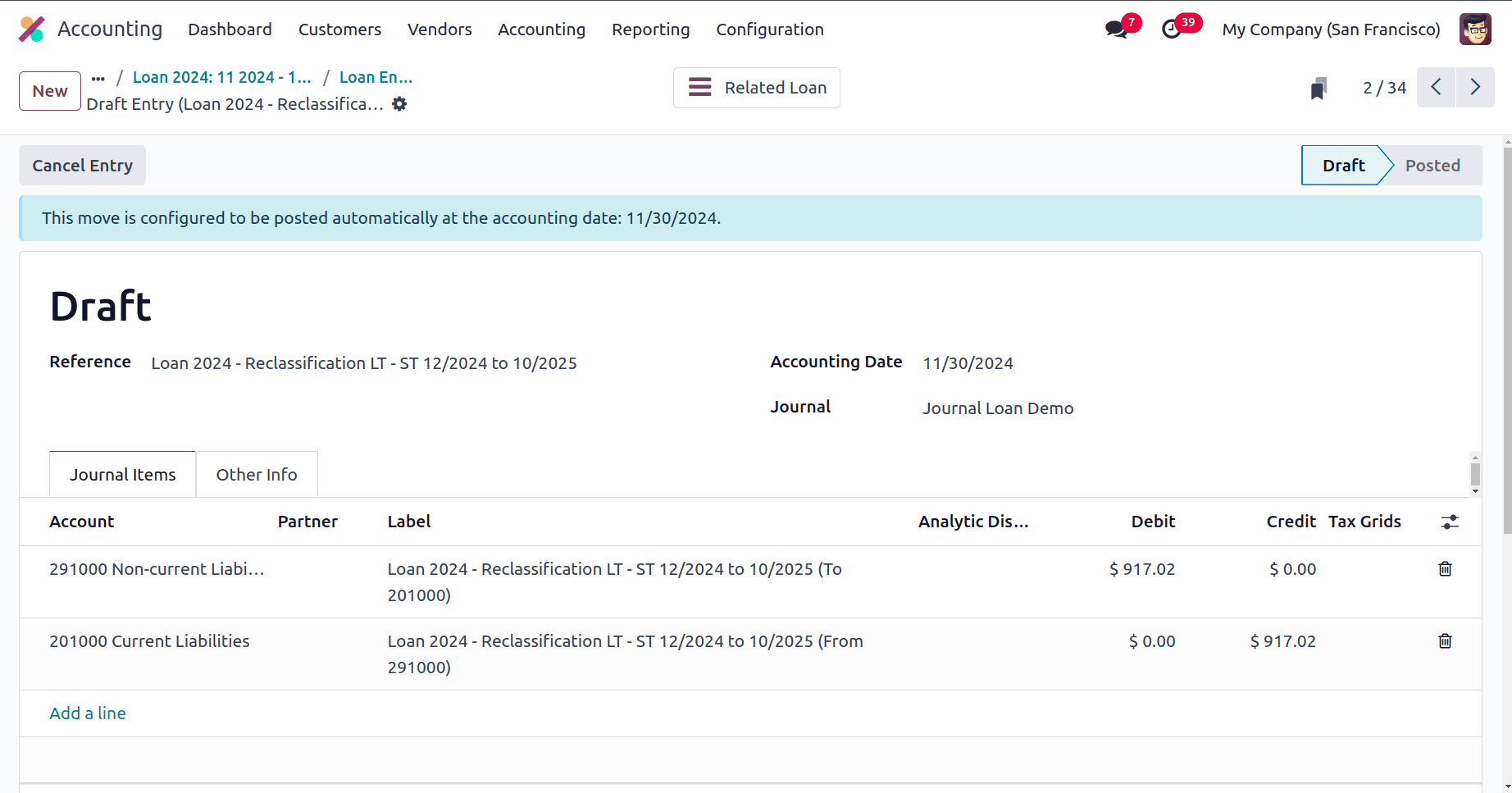

Then, open the second journal entry. Here the Long Term Account is debited and the Short Term Account is credited with the outstanding balance amount. Here the liability is decreasing. That's why the Long Term Account (Non-current Liability) is debited, and the Short Term Account (Current Liability) is credited.

After posting all the entries, the loan stage will automatically change to Closed. Otherwise, click on the Close button to close the loan. All the unposted journal entries will be deleted, and the loan will close.

Loan Analysis Report

A thorough understanding of loan performance is provided by the Loan Analysis Report in Odoo 18 Accounting, which includes information on principal balances, interest accrued, and repayment dates. Businesses can use it to monitor loan progress and evaluate how loans affect cash flow and balance sheets.

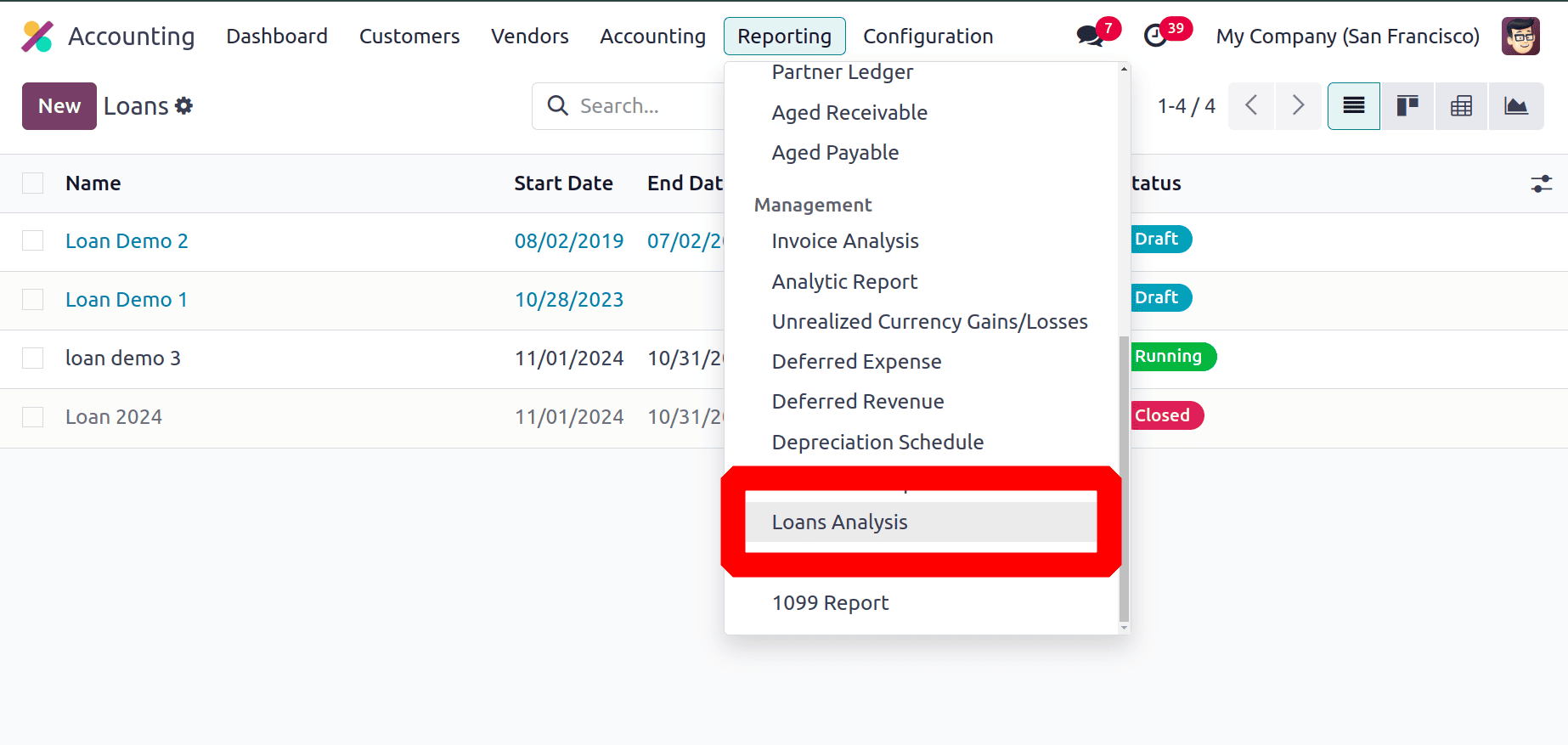

To get the Loan Analysis report, click on the Reporting Menu and choose the Loan Analysis, placed under the Management report.

: Reporting > Loan Analysis

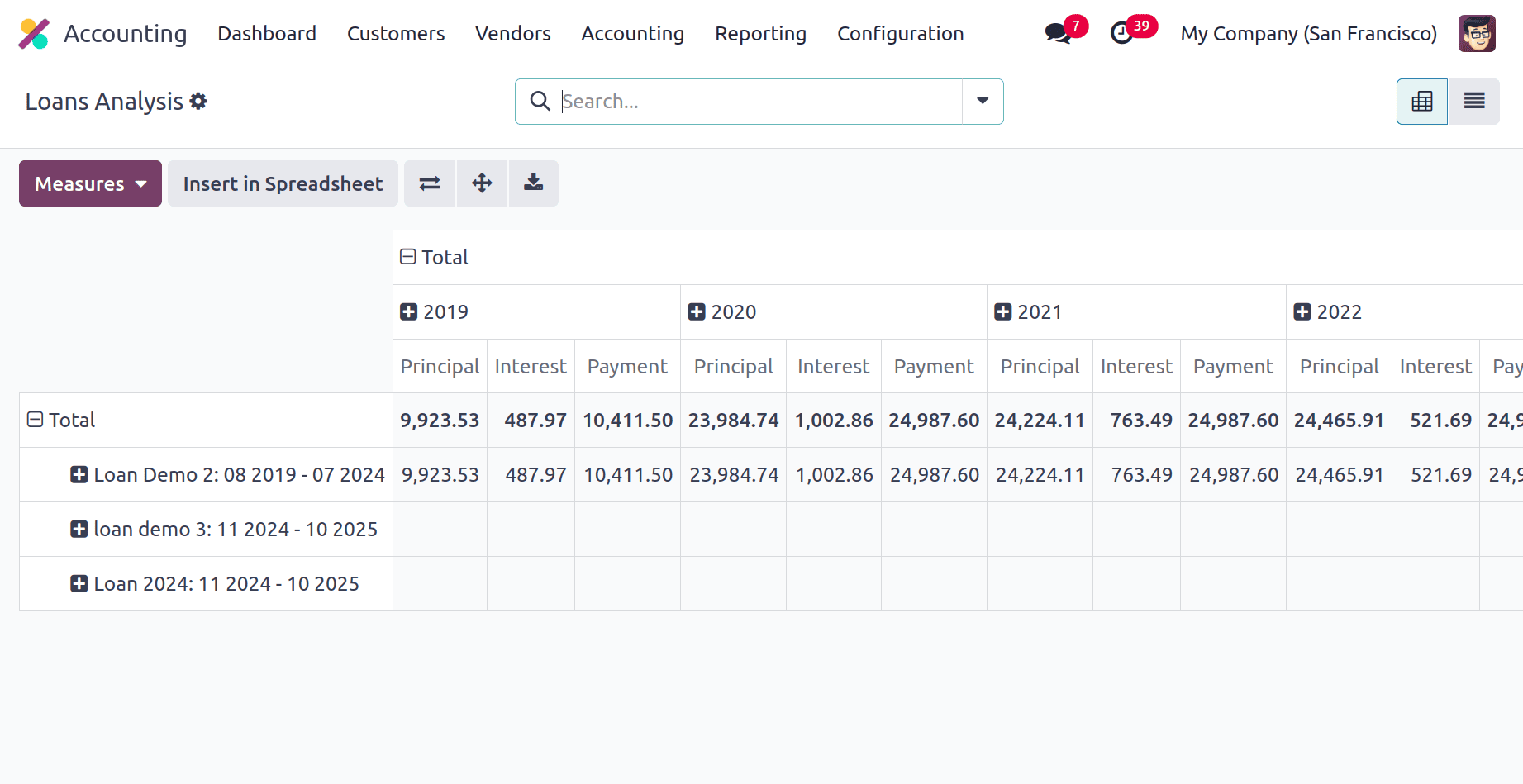

A pivot view of the Loan analysis report will open first. The loan names in the Y axis and the X axis show the total principal amount, interest, and the payment of each year, which will help to better understand each loan in the company.

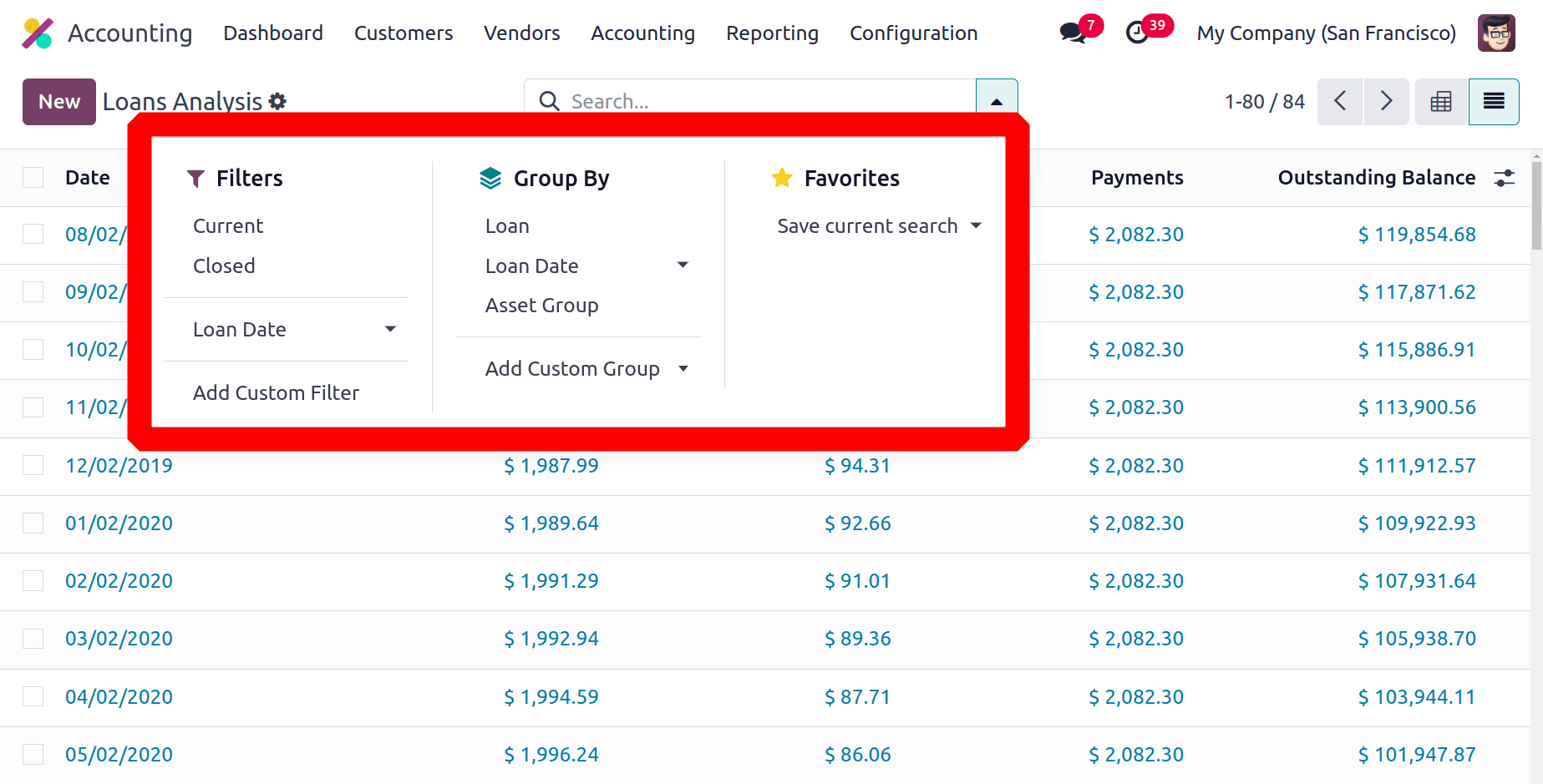

A list view is also available. The report guarantees adherence to financial management policies and facilitates well-informed decision-making with its customizable filters and actionable insights. Users can filter the report based on Current Loans, Closed loans, and the Loan Date. We can group it based on Loan, Loan Date, and Asset Group. Custom Filters and Custom Group By options are available there. And it's possible to save the search by clicking on the Save current search

Ultimately, by automating journal entries, interest computations, and payment tracking, Odoo 18 Accounting's Loan Management feature simplifies the administration of loans pertaining to business assets. Businesses may more easily manage obligations and their effect on asset valuation thanks to this technology, which improves financial correctness and transparency.

To read more about How to Setup Odoo 17 Accounting for Financial Management, refer to our blog How to Setup Odoo 17 Accounting for Financial Management.