Employee expenses are the costs incurred by an employee on behalf of the company they work for to complete a task that is a part of their employment. These costs may include travel, food, communication, office supplies, etc. Therefore, the employee must pay out of pocket to meet these demands. As a result, the company will give the employee their money back. Managing these costs effectively is essential for guaranteeing employee happiness. Odoo thereby assists the business in managing these costs effectively. The employer may remit the money to the employee directly or may occasionally do it via the employee's payslip.

It's crucial to carefully handle employee expenses and reimbursements if the company wants to keep the workplace open and equitable. Using the Expense module in Odoo 16, businesses can now easily integrate the procedure of compensating employee costs through payslips.

Let's look at how the payroll and expense modules in Odoo 16 are connected to fulfill payslip reimbursement for employee expenses.

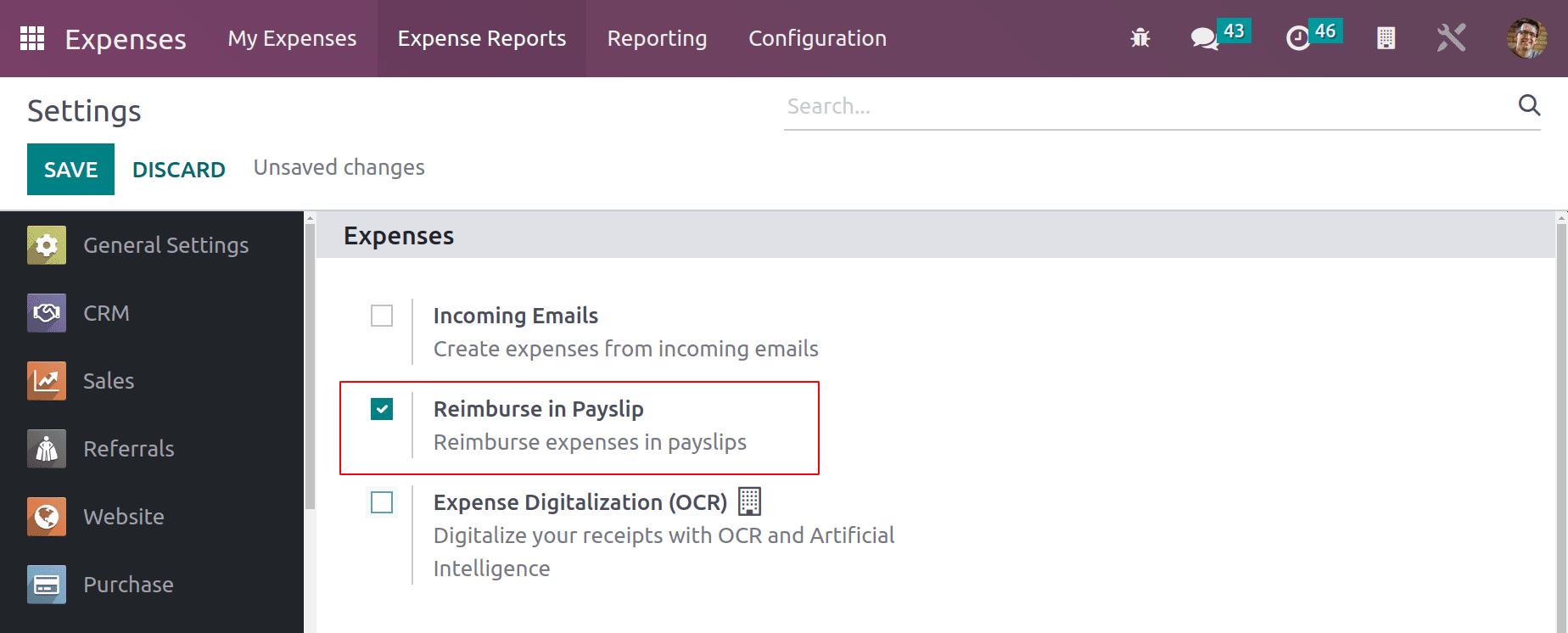

To reimburse the expense spent by the employee to his next payslip, the user must configure it from settings. From the settings option, enable the Reimburse in Payslip.

Configuration > Settings > Reimburse in Payslip > Save

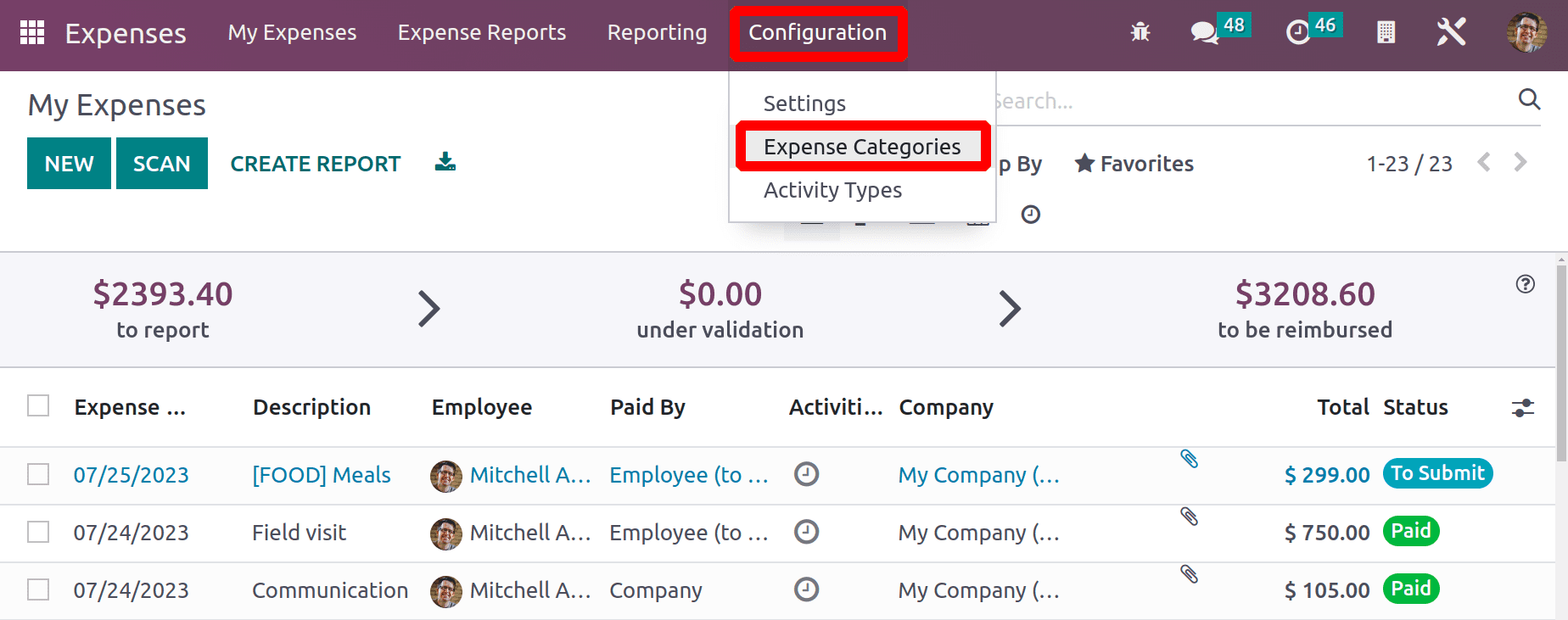

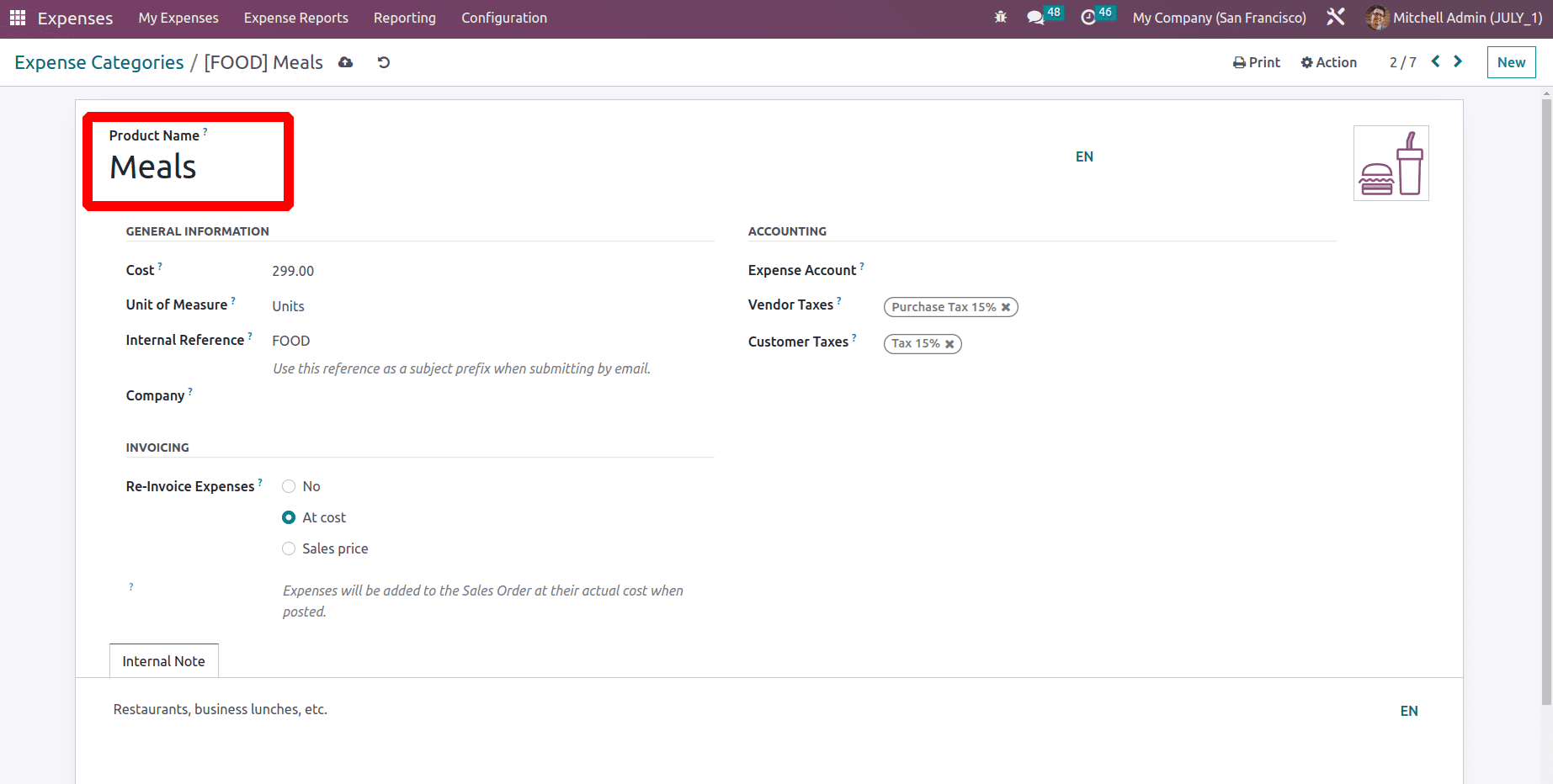

Configuring Expense Category

It is simple to set up a new expense category in the Odoo expense module. A classification of an employee's numerous expenses, such as travel, food, and communication costs, is known as an expense category. To view through and add a new category choose the Expense Categories option under the configuration tab.

Configuration > Expense Categories > NEW

Here, Meals is the newly introduced expense category. Details such as Price, Unit of Measurement, Internal Reference, and Taxes are included. Either the Cost or the Sales Price might be used to re-invoice the client for the expense, the Cost is picked here. There was also an internal note inserted. A category should be saved for later use.

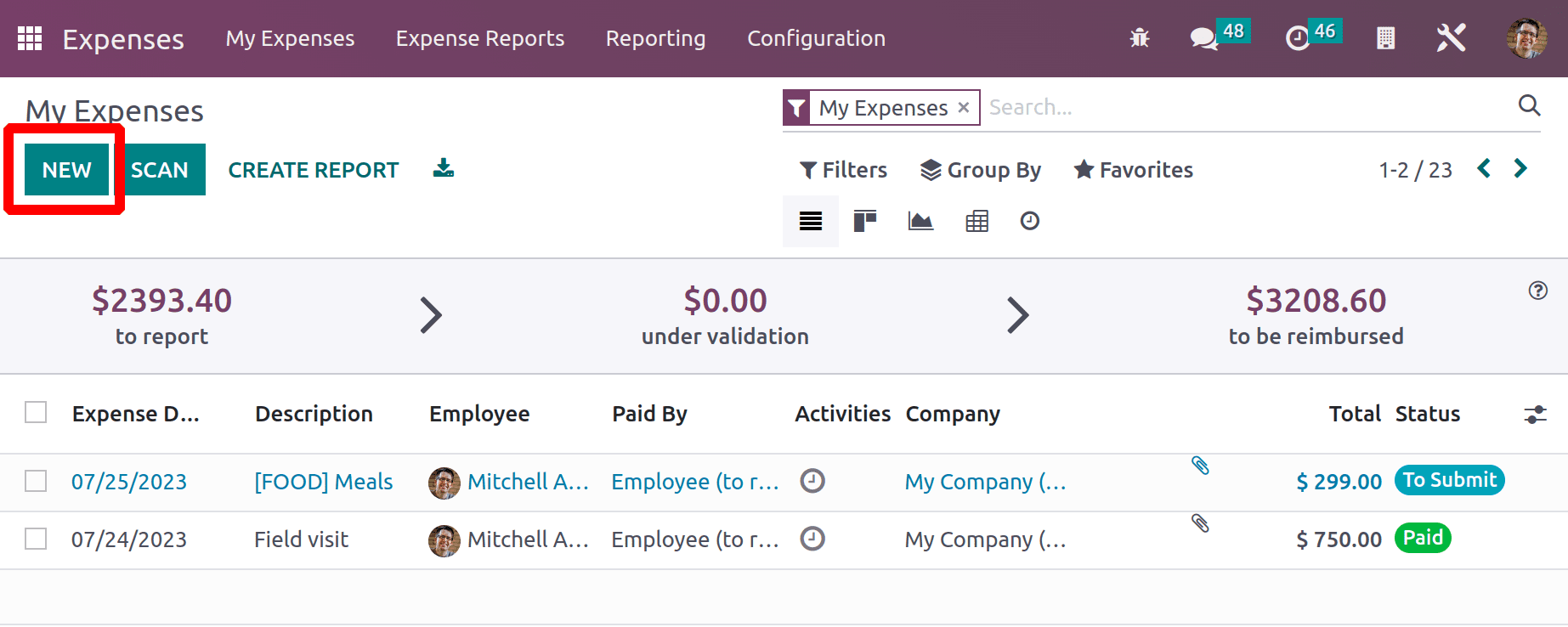

Creating Expenses for Employee

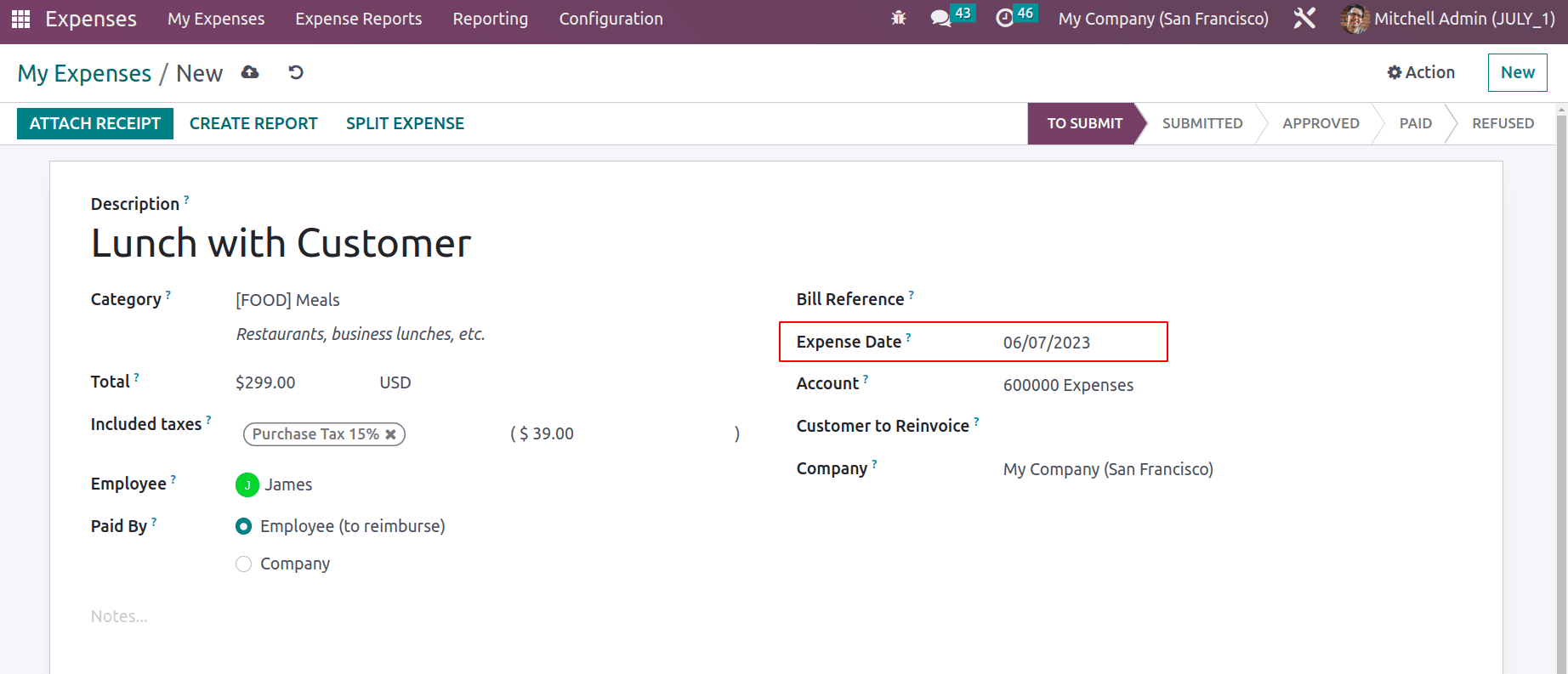

Create a new expense for the employee. To add a new expense go to the My Expense and create a new one.

My Expense > NEW

Here, James, the employee, is the one who creates the expense. The money is used for lunch with the client. Meals have been picked as the category and $299 has been spent in total. James, one of the employees, covered the cost. The cost date in this case is June 7. Therefore, the expense will be paid in the payslip in July.

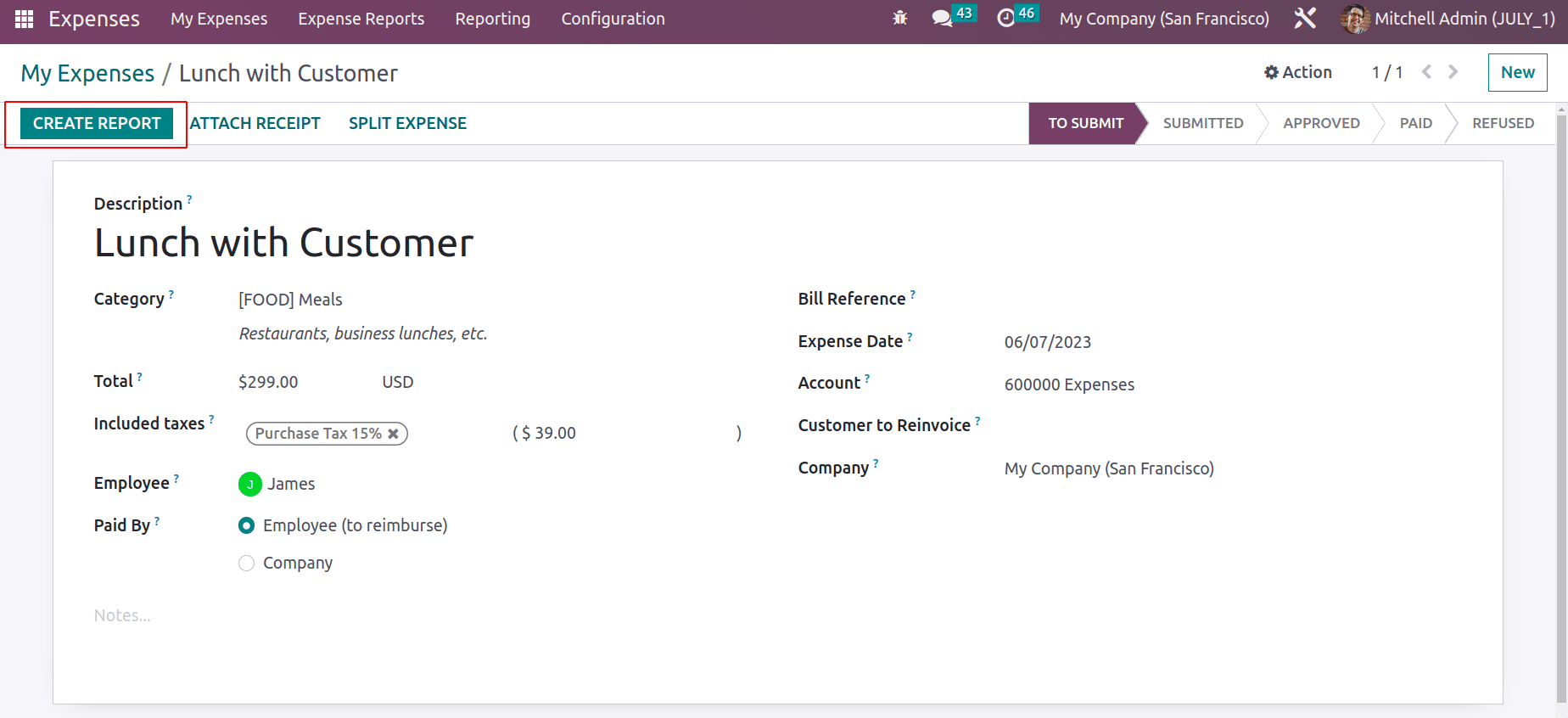

If any receipt or bill needs to be attached with the expense this can be done by using the ATTACH RECEIPT button. Then click on the CREATE REPORT to create the Expense report.

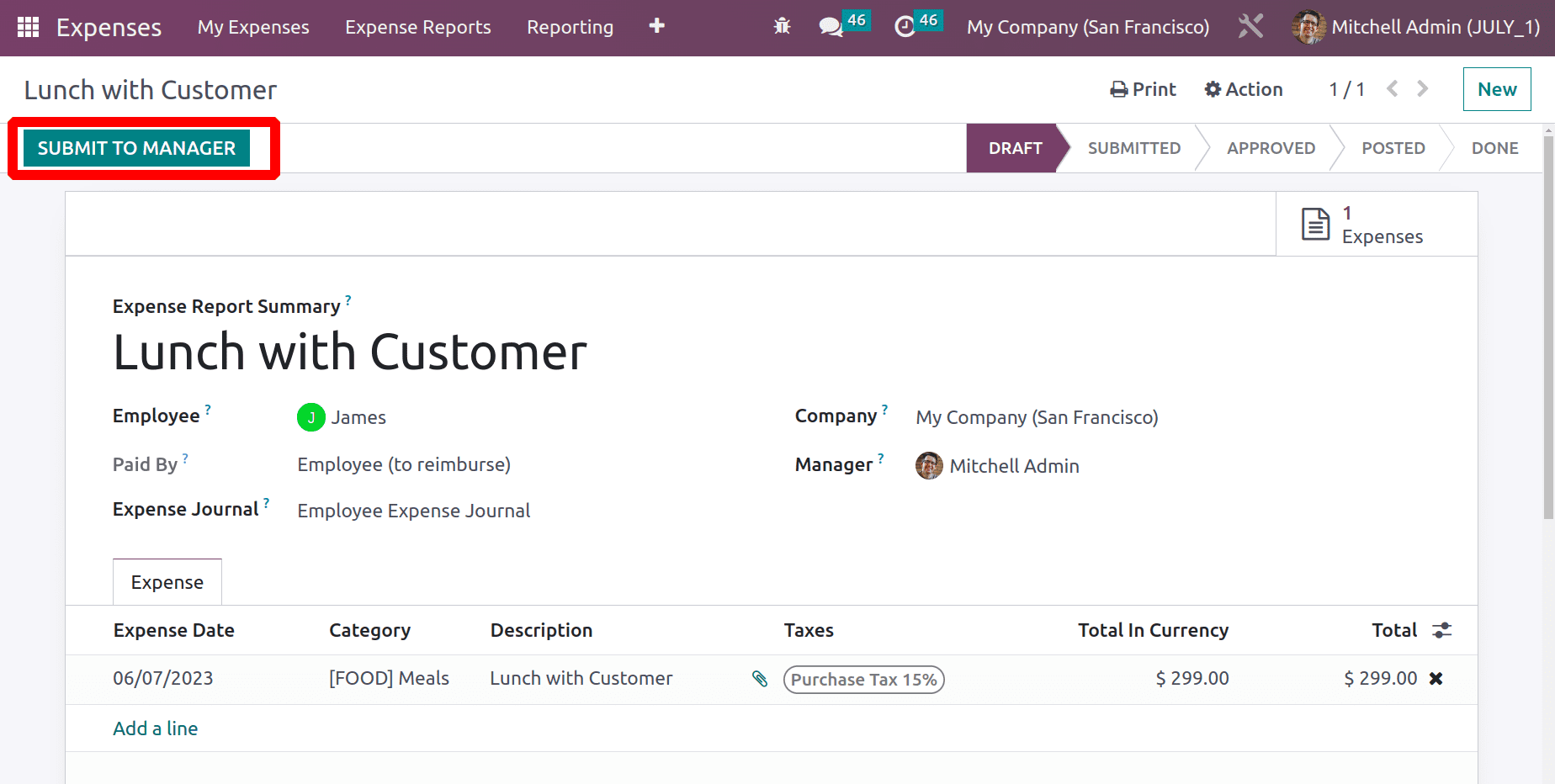

All expenses spent by the employer can't be refunded by the company. So the refund only happened after checking the credibility of the expense. For that, the expense report wants to submit to the Manger.

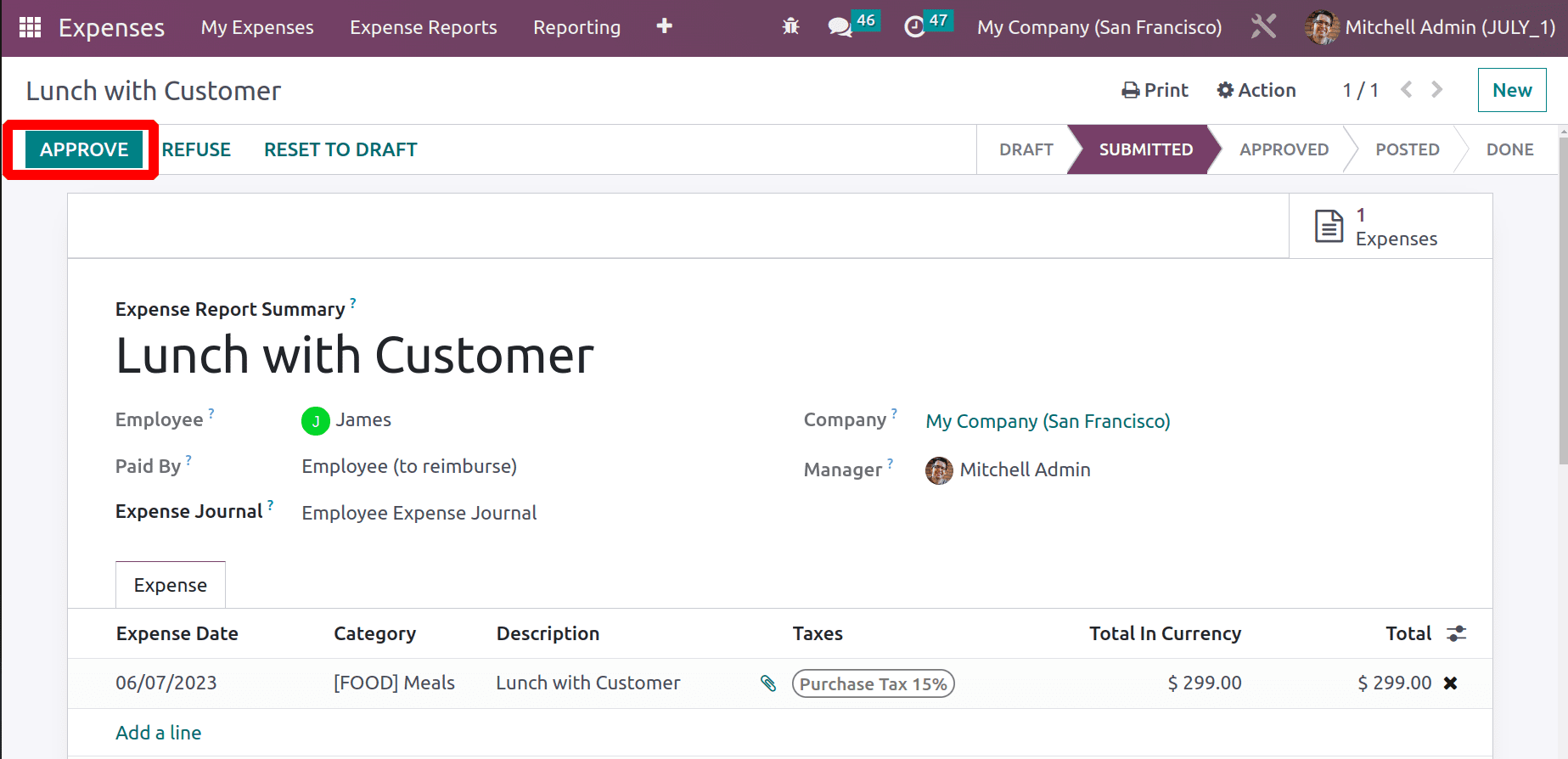

When the report is submitted for managers' approval, the manager will either approve or refuse the expense report.

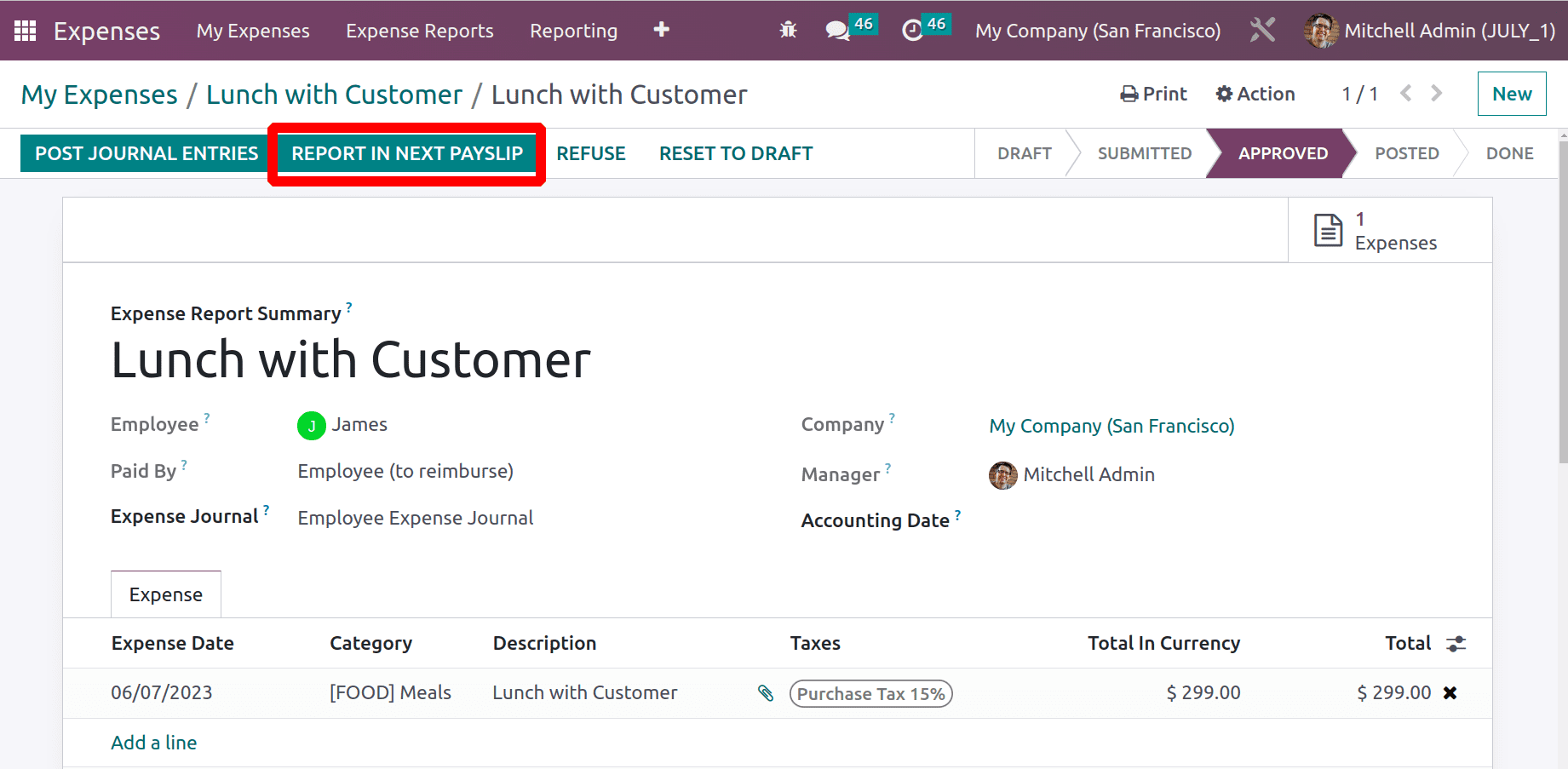

After adding approval the manager has two options. One is to Post the journal entries and the second one is to report the expense into the next payslip.

Here is an approved expense report for the employee James. The expense will be refunded through his payslip. So let's go to the Payroll module to create a new payslip for the employee James.

Creating Payslips for the Employee

The employee payslip is a thorough record that includes information about the employee's salary, deductions, allowances, and other earnings for a particular period. This also includes information such as the employee contract, the pay structure, etc. Let's check how the Employee Payslip is configured in Odoo.

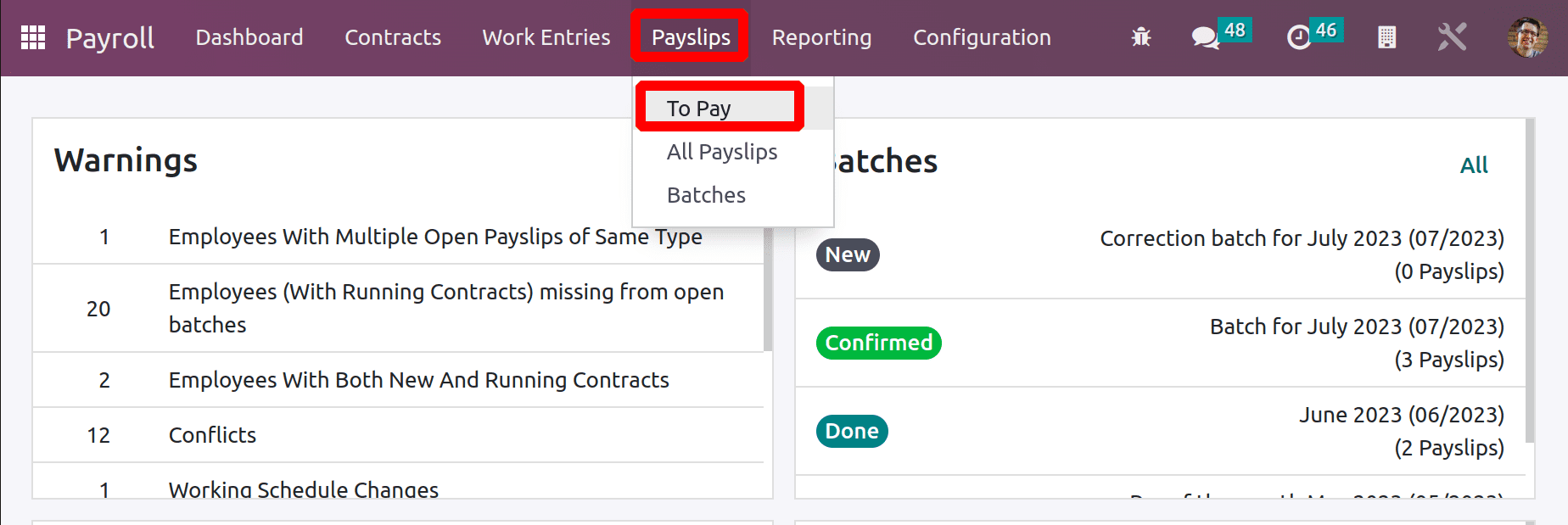

To create a new payslip go to the Payslip tab and choose the To Pay menu.

There shows a list of created payslips. So click the NEW button to create a payslip for employee James.

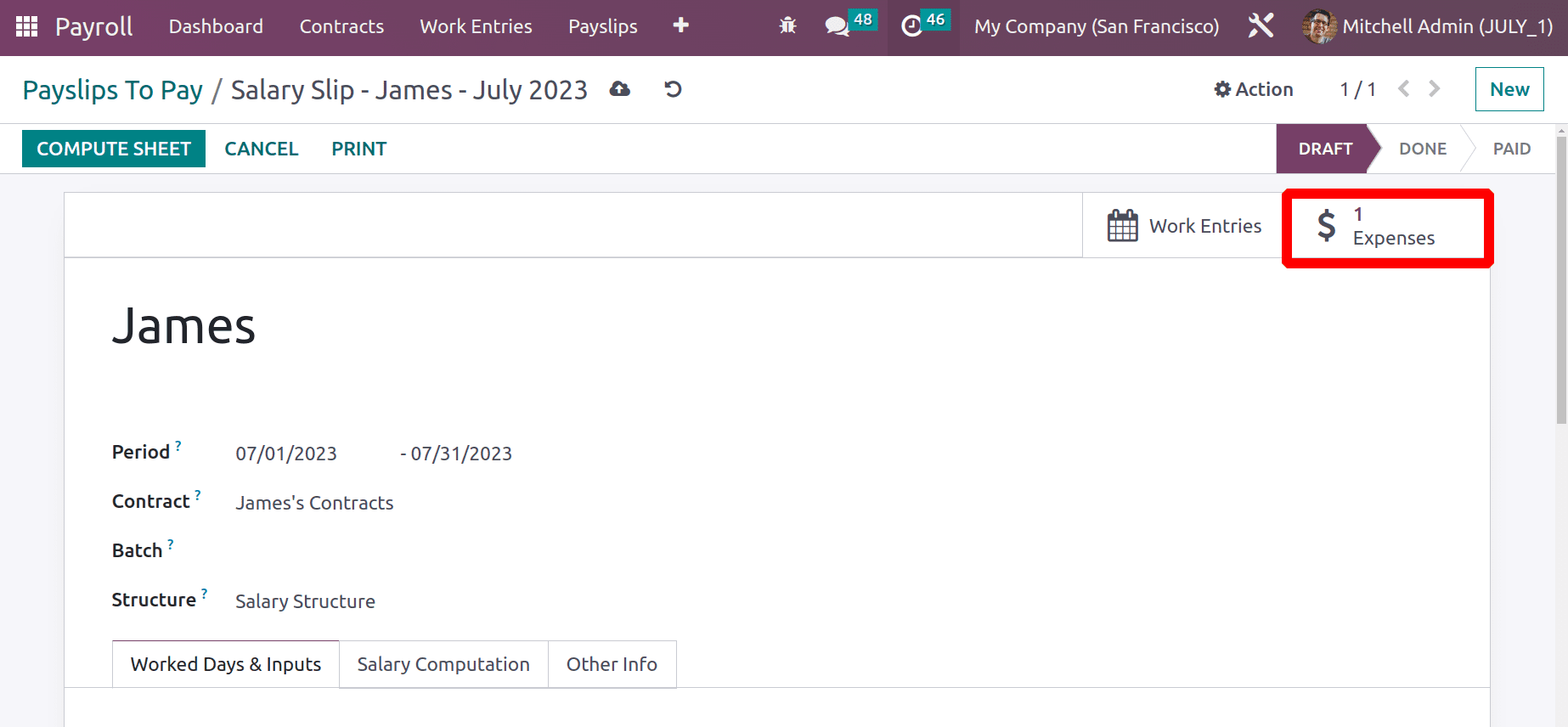

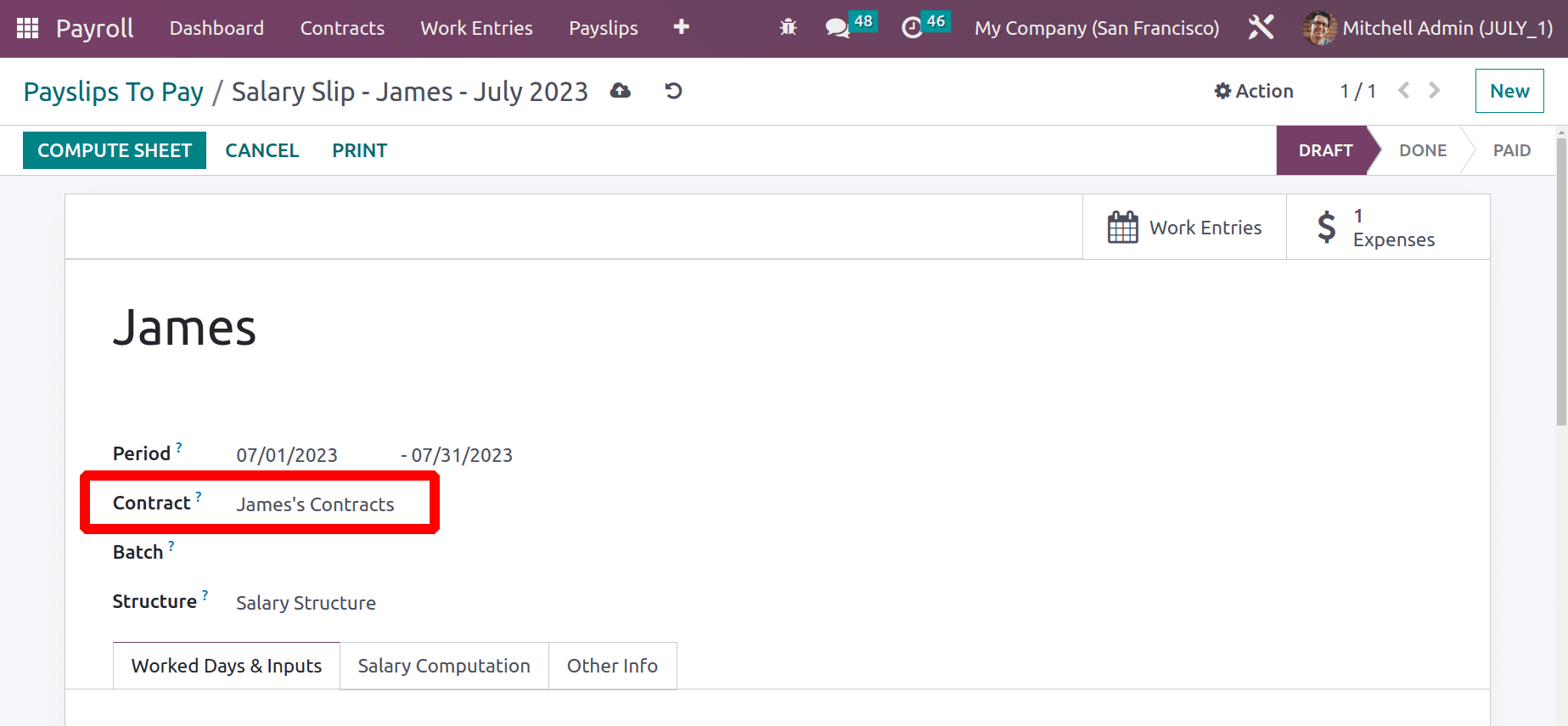

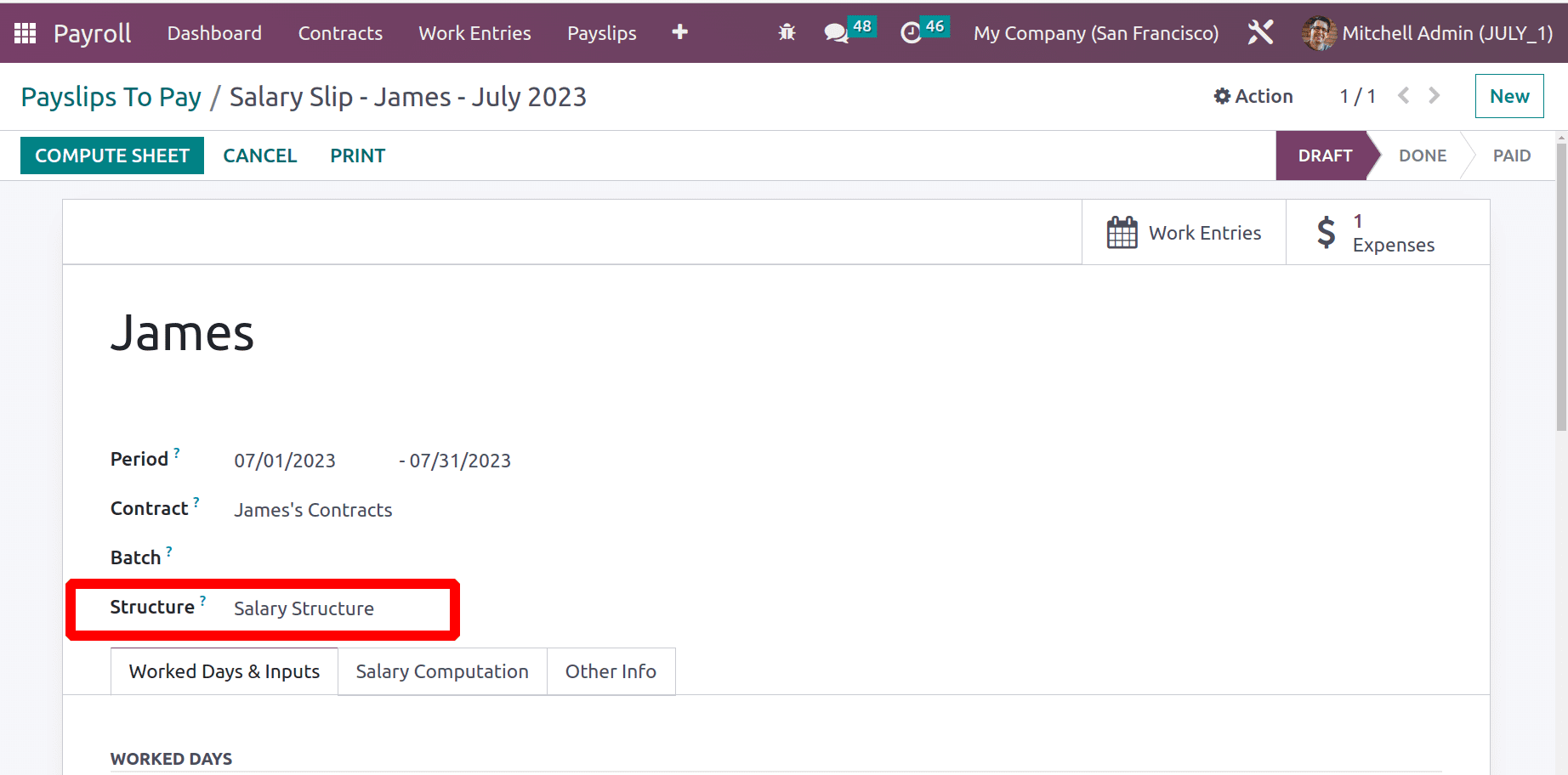

Choose the employee, James, then the contract added inside the employee will automatically be chosen there. The period and Salary Structure can be updated inside the payslip. A smart tab named expense is added, which is the expense that was created just now.

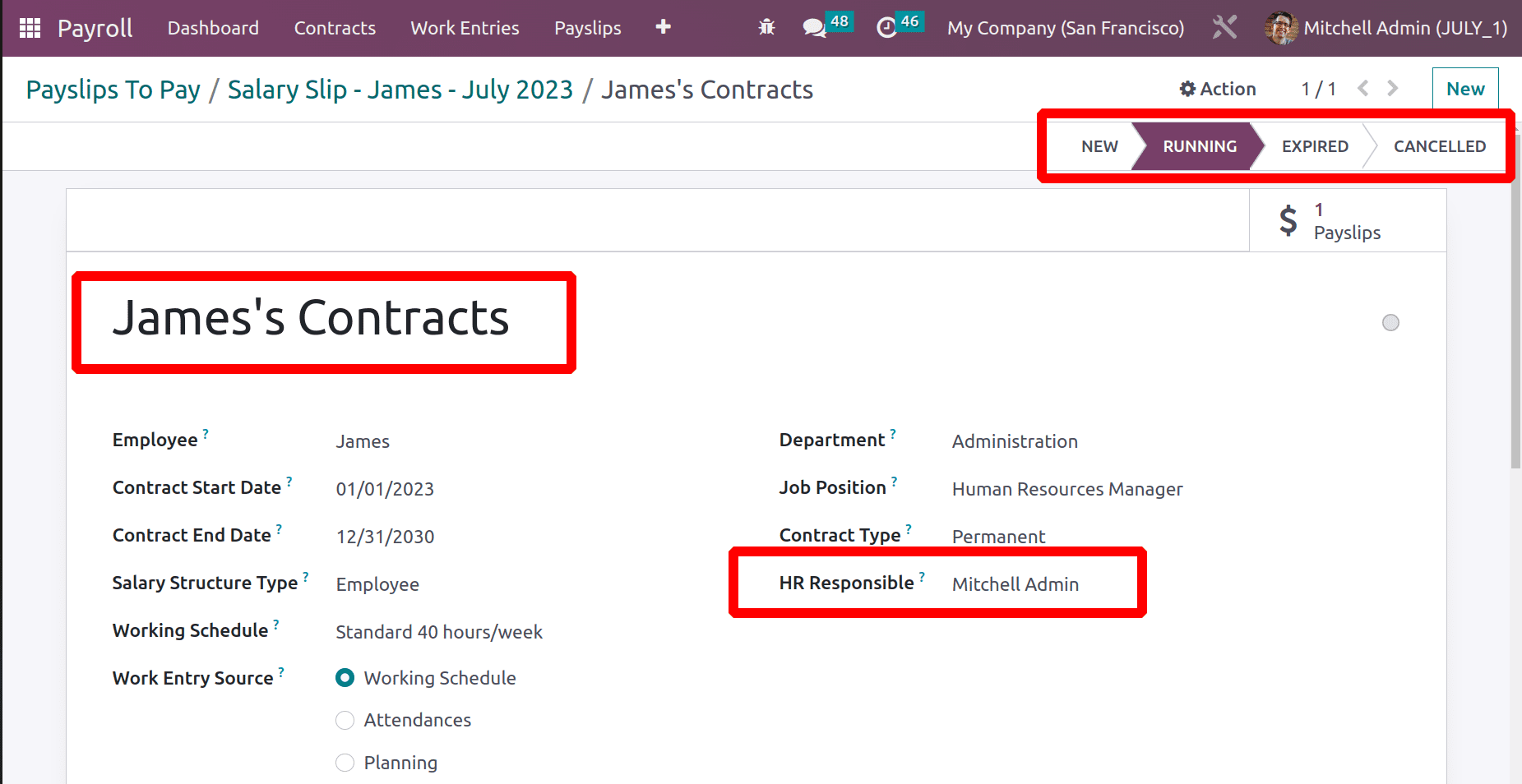

To compute a payslip for an employee the employee must have a running contract. To view the contract open through the external link of the contract.

The contract contains the details like the Start date and End date of the contract, Salary Structure, Department and Job position of that employee, Contract type, and HR Responsible are added here. Make sure the contract is in the Running stage.

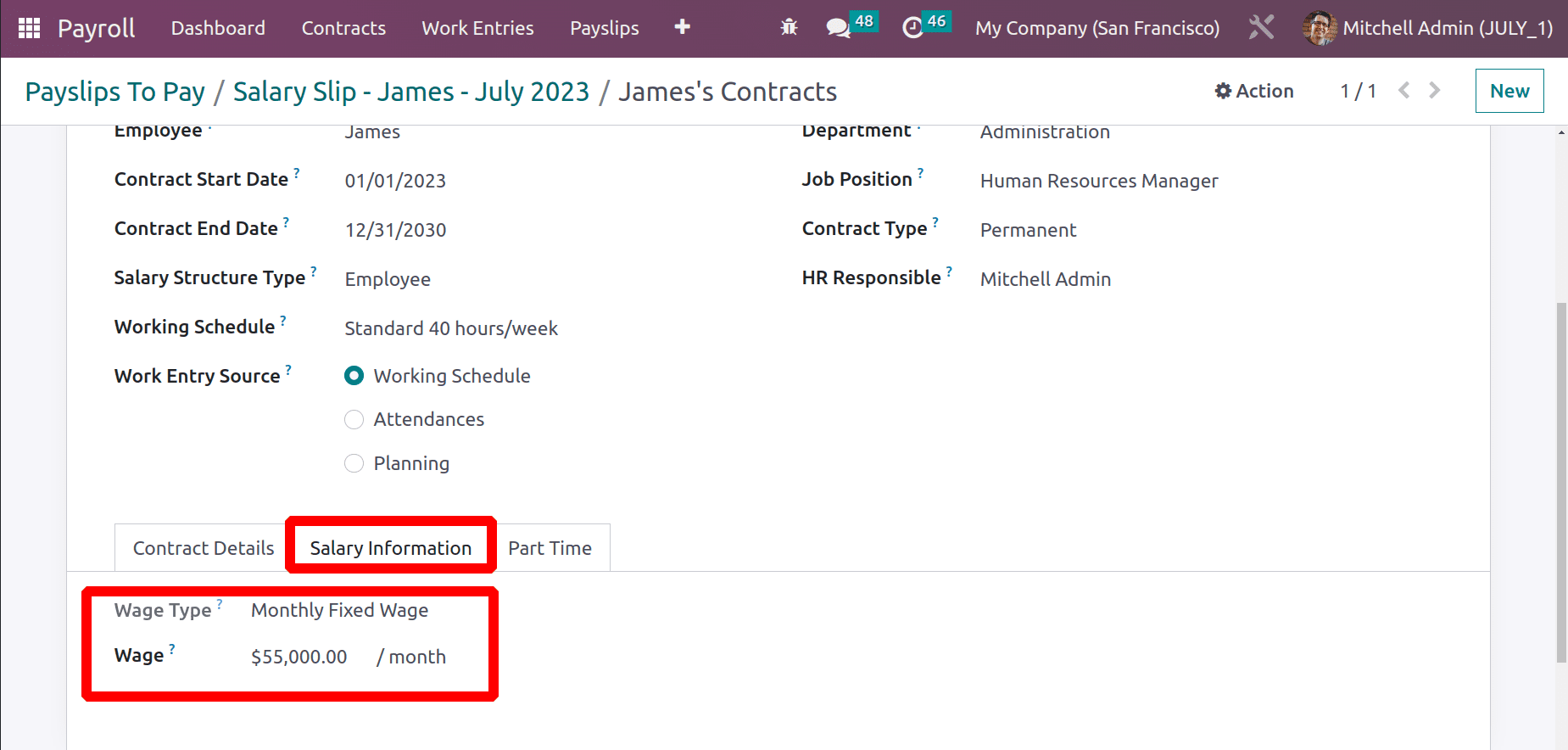

The Salary Information tab of the contract contains the monthly wage of the employee.

Return to the Payslip after that. The user wishes to make sure the necessary rule to include the expense in the payslip is added to the structure before computing the payslip. To do it, click the Salary Structure external link.

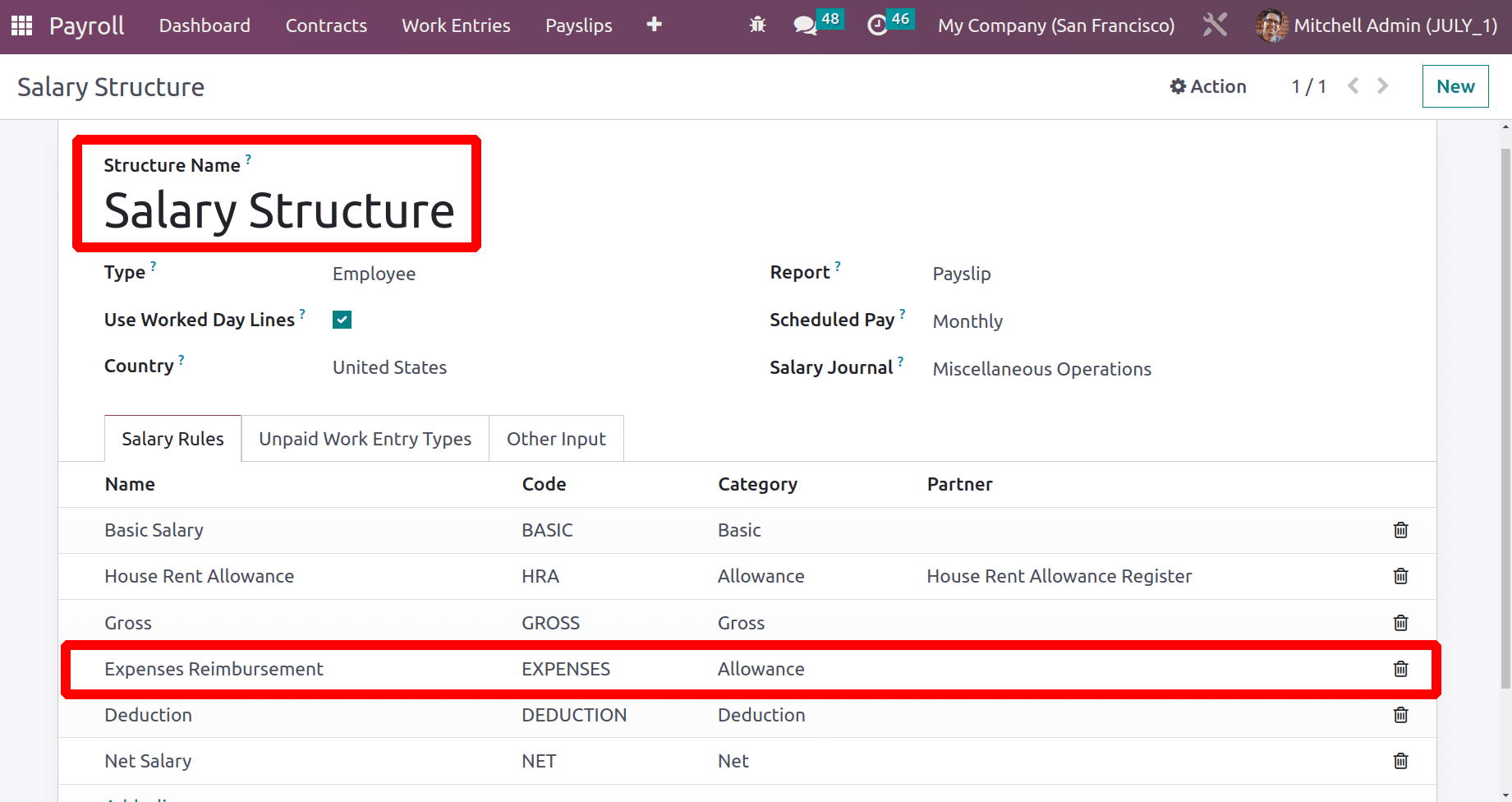

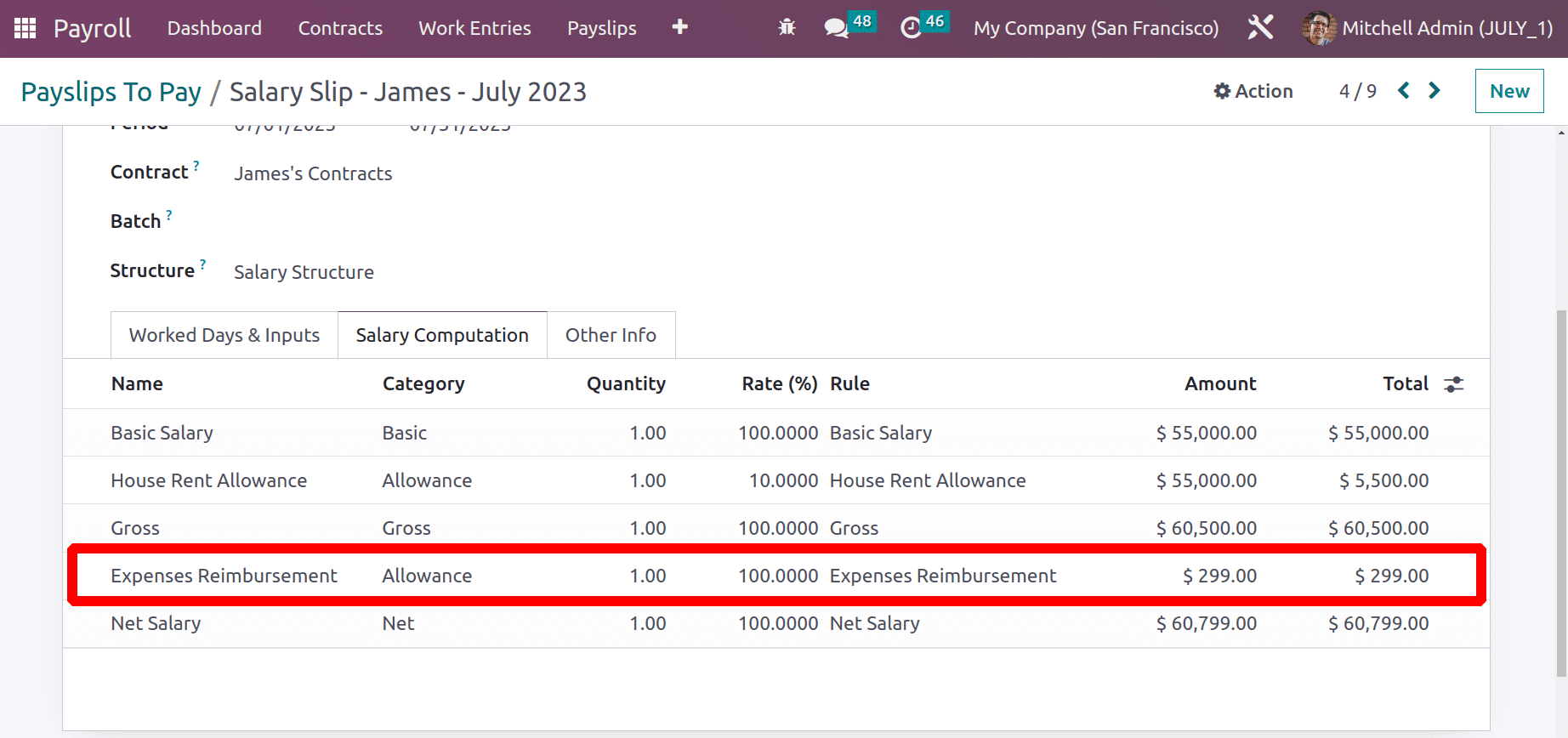

The view of all the additional rules is provided when the Salary structure is opened. This set of guidelines will be used to calculate a payslip. To add an expense to the payslip, there is a rule called Expense Reimbursement. Only this rule is contained inside the structure, and it will add the expense to the payslip.

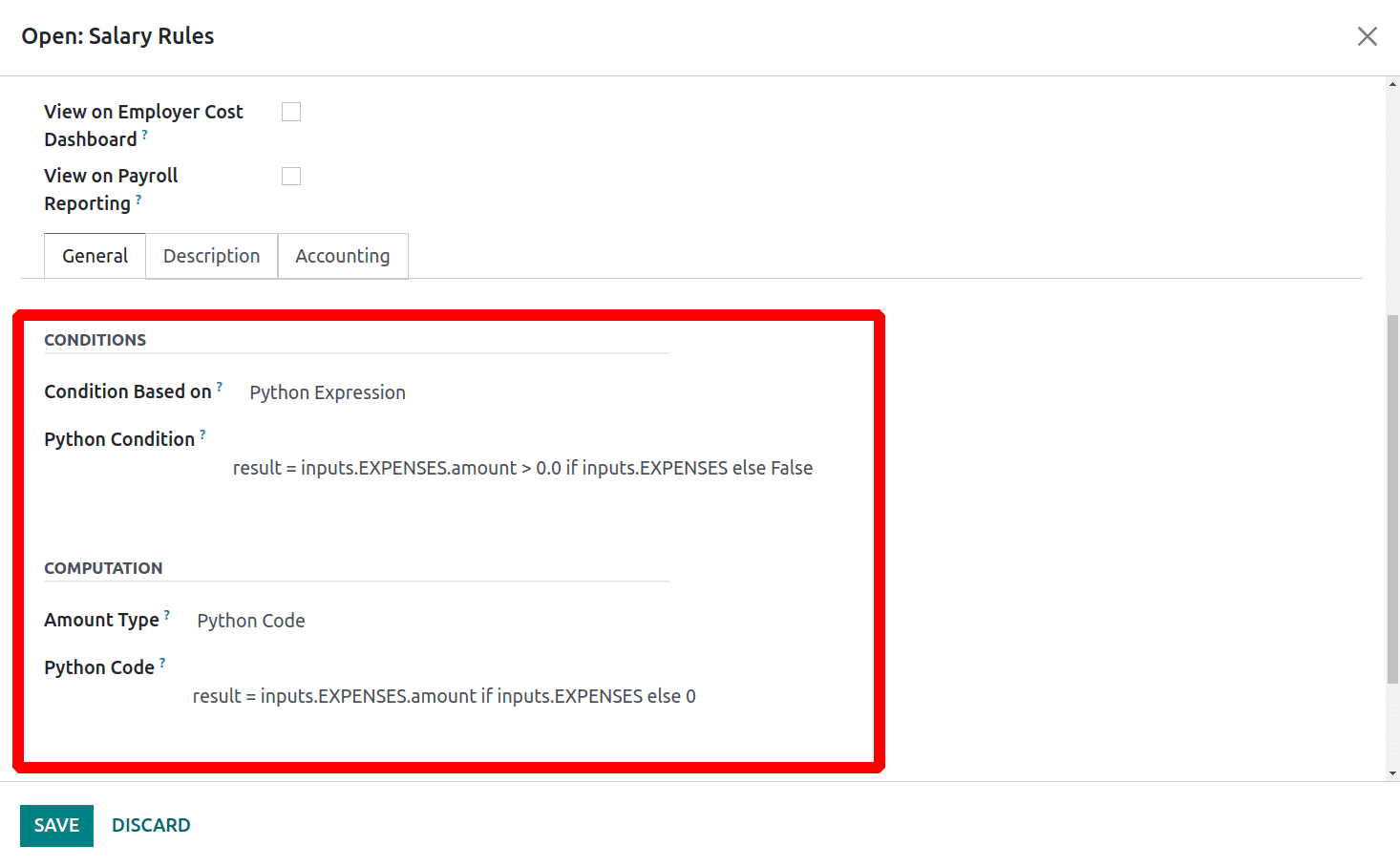

Open the rule to check the condition added inside the rule. Here the condition and computation are added based on Python code.

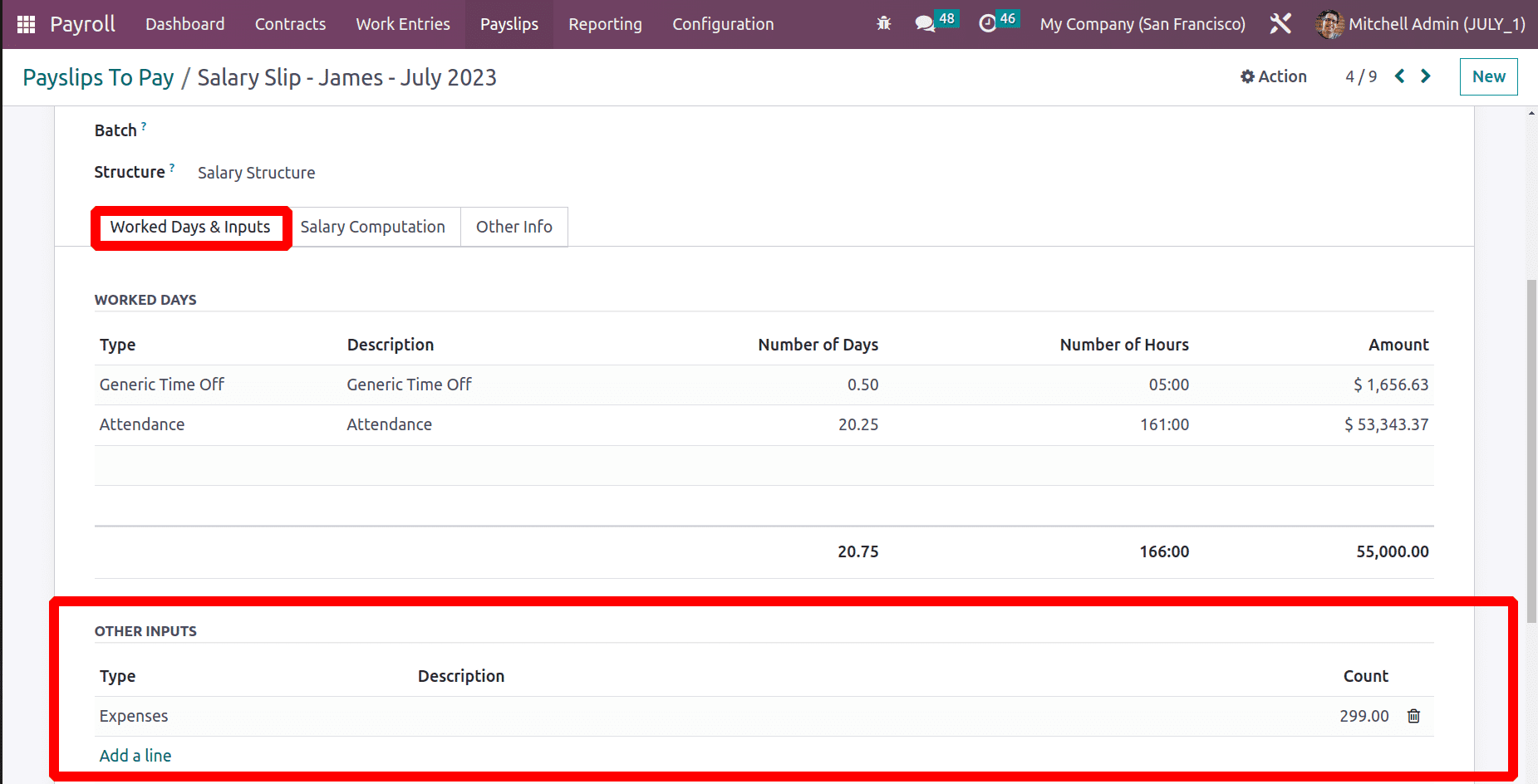

Then go back to the Payslip. Inside the payslip, there is a tab named Worked Days & Inputs. The employee's attendance details and other inputs like expense, Child support are added in this tab. While checking here the Expense is automatically added here as an Input.

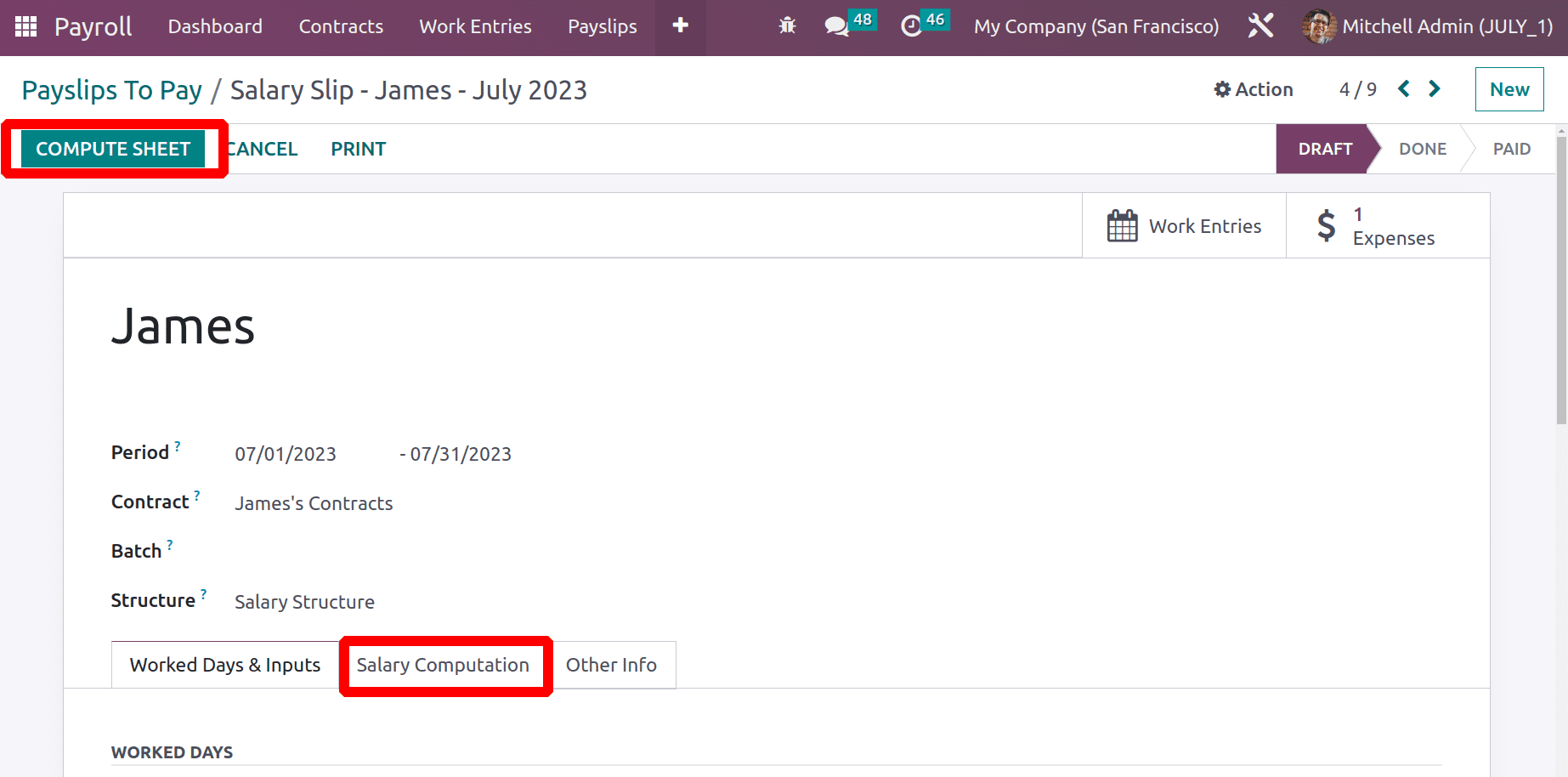

Then click on the COMPUTE SHEET button. Then check the Salary Computation tab to view the computed salary.

Inside this, the Expense Reimbursement rule added an allowance of $299, which is the expense amount spent by the employee in the previous month.

This means that the Expense spent by the employee is refunded through the next month's payslip of the employee.

This simplified approach ensures accuracy and compliance and increases employee pleasure by offering a simple, transparent reimbursement process that is linked to their paycheck. By utilizing the cutting-edge capabilities of Odoo 16, businesses may successfully optimize their spending management, enabling increased efficiency and financial control. The configuration of the employee expense and the method of reimbursement via payslip are described in full here.

To read more about employee expense management, refer to our blog Employee Expense Management With the Odoo 15 Expenses