What's Storno Accounting?

It's a way to fix mistakes or reverse transactions in the accounting system. Imagine if there was an error in the money going in or out, or if you need to return something and get your money back. Storno Accounting helps sort out these situations.

The cool thing about Storno is that it prevents having the same numbers appear twice in the books. People who do the accounting often use red ink to mark these Storno entries, so sometimes it's called "Red Storno." When you look at the financial reports, items fixed with Storno will be in red, making them easy to spot. This way, everything stays organized, and it's clear what changes were made.

Storno accounting in Odoo refers to the process of reversing or canceling a previously recorded journal entry. In the context of accounting in Odoo, Storno functionality allows users to correct errors or undo transactions that were posted incorrectly.

Here's how Storno accounting typically works in Odoo

* Identification of Incorrect Entry: Users identify a journal entry that needs correction due to errors or omissions. This could include mistakes in amounts, accounts, or dates.

* Access the Journal Entry: In the Odoo accounting module, users can locate and access the specific journal entry that requires correction.

* Initiate the Storno Process: Odoo provides a Storno feature that allows users to initiate the reversal of a selected journal entry. This process generates a new entry that is essentially the opposite of the original entry, thereby correcting the error.

* Review the Reversed Entry: After initiating the Storno process, users can review the newly generated entry. This reversed entry should have inverted values compared to the original entry to rectify the mistake.

* Verification of Financial Impact: Odoo recalculates balances to ensure that the corrected entry aligns with the financial records. Users should verify the financial impact to confirm that the reversal has been accurately executed.

* Audit Trail: Odoo maintains a clear audit trail by linking the reversed entry to its original counterpart. This traceability is crucial for compliance, transparency, and internal control purposes.

* Reporting Accuracy: It's essential to check that financial reports, such as balance sheets and income statements, reflect the corrected information after the Storno process. Odoo's reporting capabilities assist in this verification.

Storno accounting in Odoo provides a systematic way to correct errors and maintain accurate financial records, contributing to the overall reliability and integrity of the accounting system. Many countries in Eastern Europe, including China, the Czech Republic, Croatia, Poland, Romania, Russia, Serbia, Slovakia, and Ukraine, widely use the Storno Accounting method for managing their financial records.

Let's see how the storno accounting is managed in Odoo 17 Accounting with an example.

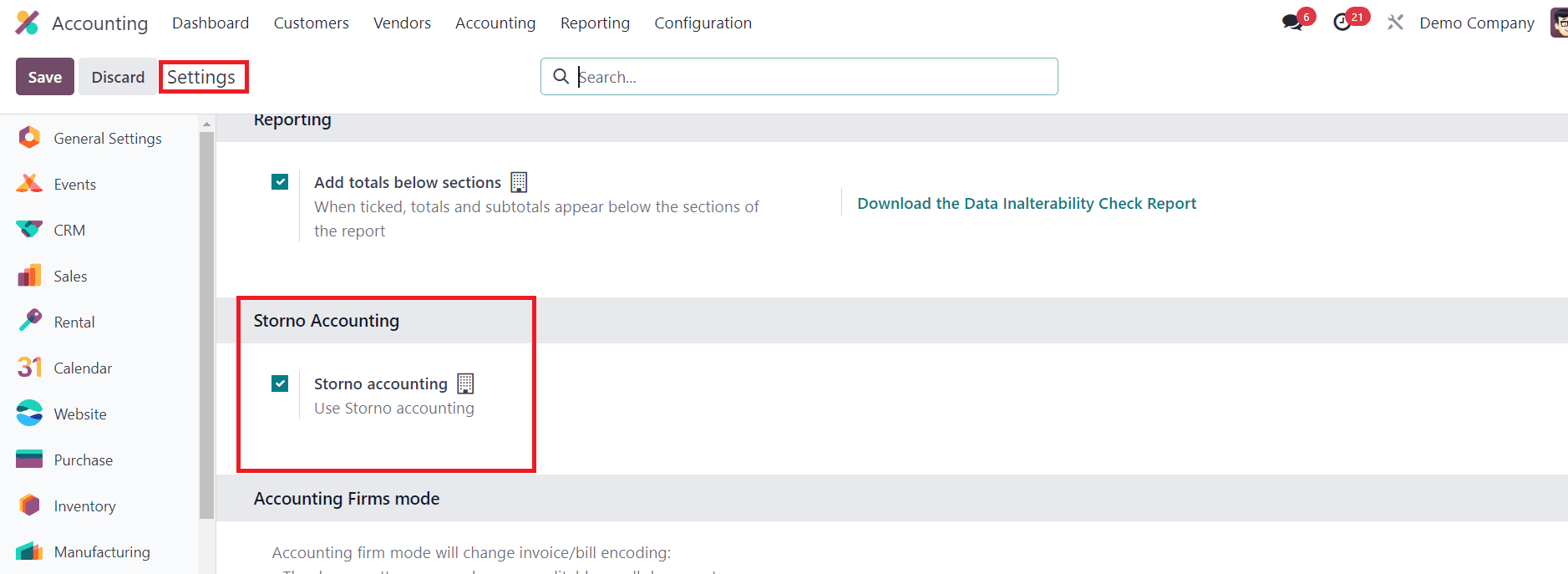

First, it is important to activate the Storno Accounting feature in your database. For this, you can go to the Settings menu of the Accounting module and navigate to the Storno Accounting tab, as shown in the screenshot below.

Activating this feature will allow you to use storno accounting in Odoo. This accounting approach employs negative credit or debit amounts within your account to counterbalance initial journal entries. This method helps fix mistakes in accounting records. If there's an error in a file with the wrong money information, you can cancel it. After canceling, you need to put in the correct details to make sure everything is right. If you use Storno accounting in Odoo, the system copies the original entry. In the copied entry, the amount is shown as negative, indicating it's a reversal.

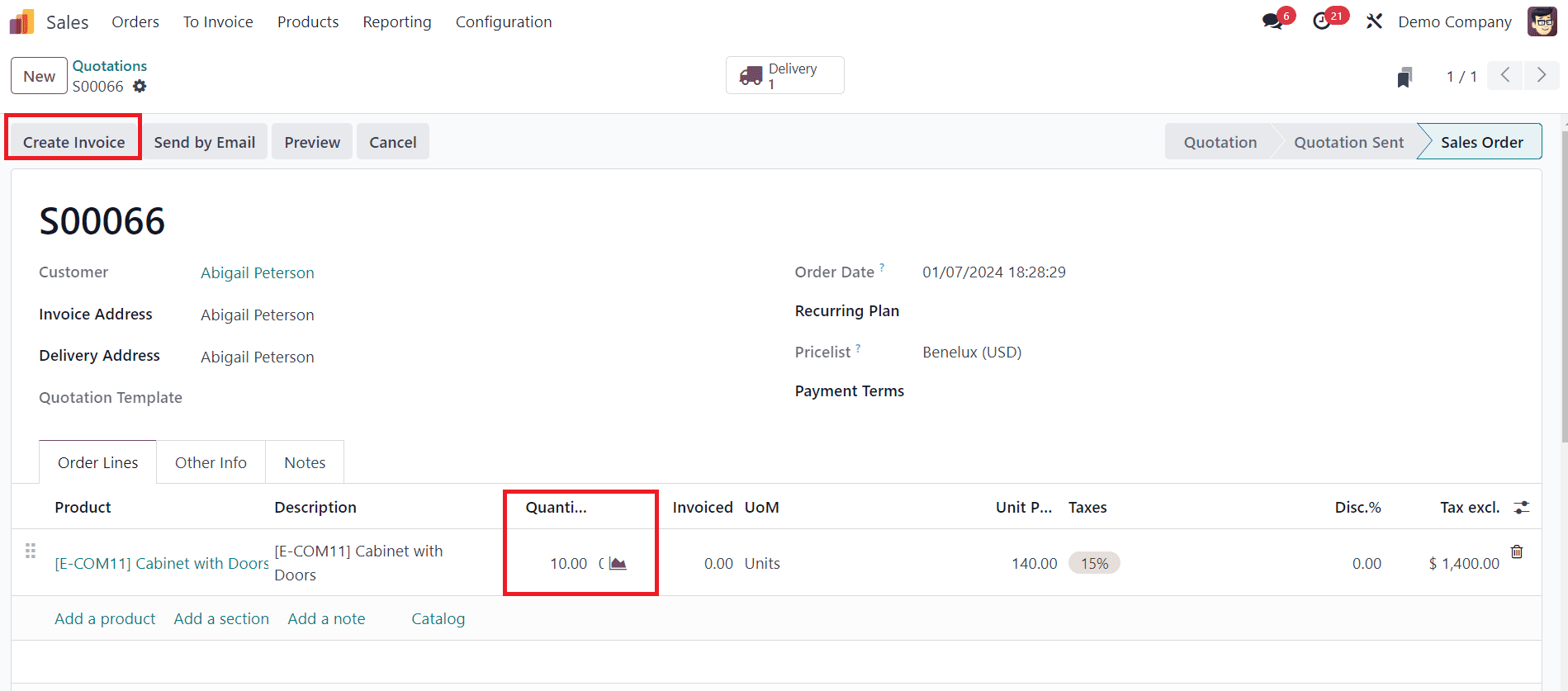

Now, let’s begin by generating a sales order for a specific product in response to a customer request for the purchase of 10 quantities. We can create a new sales order from the Sales module in Odoo.

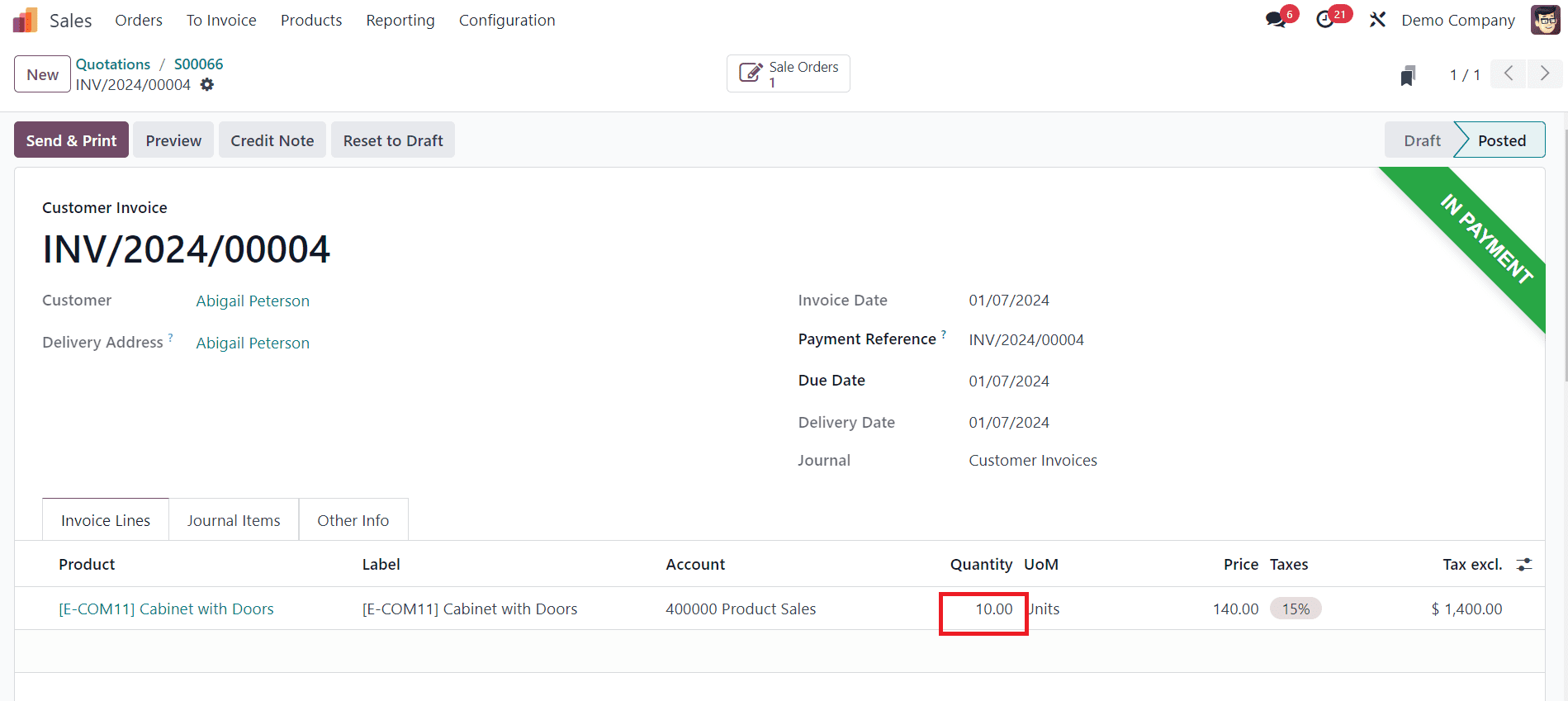

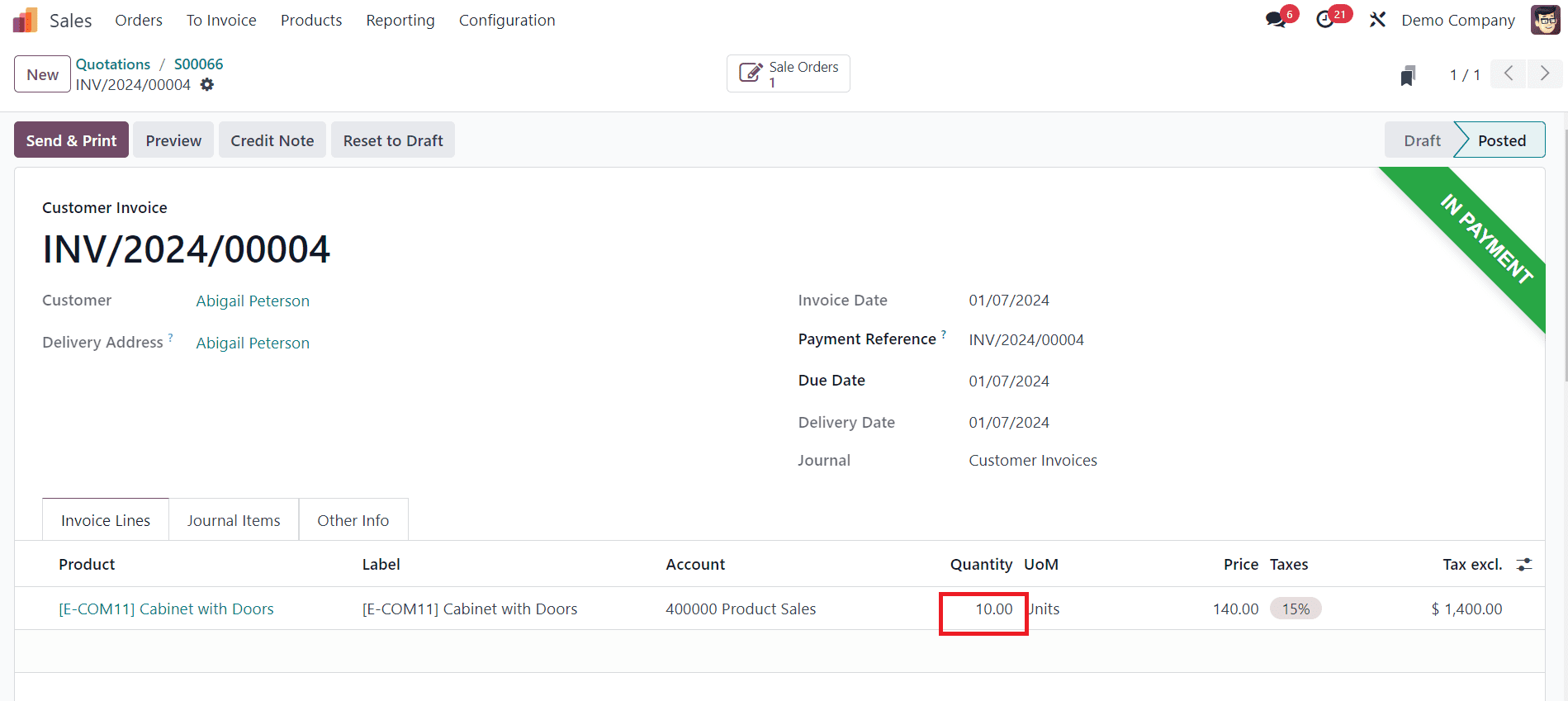

After confirming the order, we are going to create an invoice for this order. Here, take into account that the customer has already completed the payment.

The ledger posting to the corresponding accounts is visible under the Journal Items tab, as shown below.

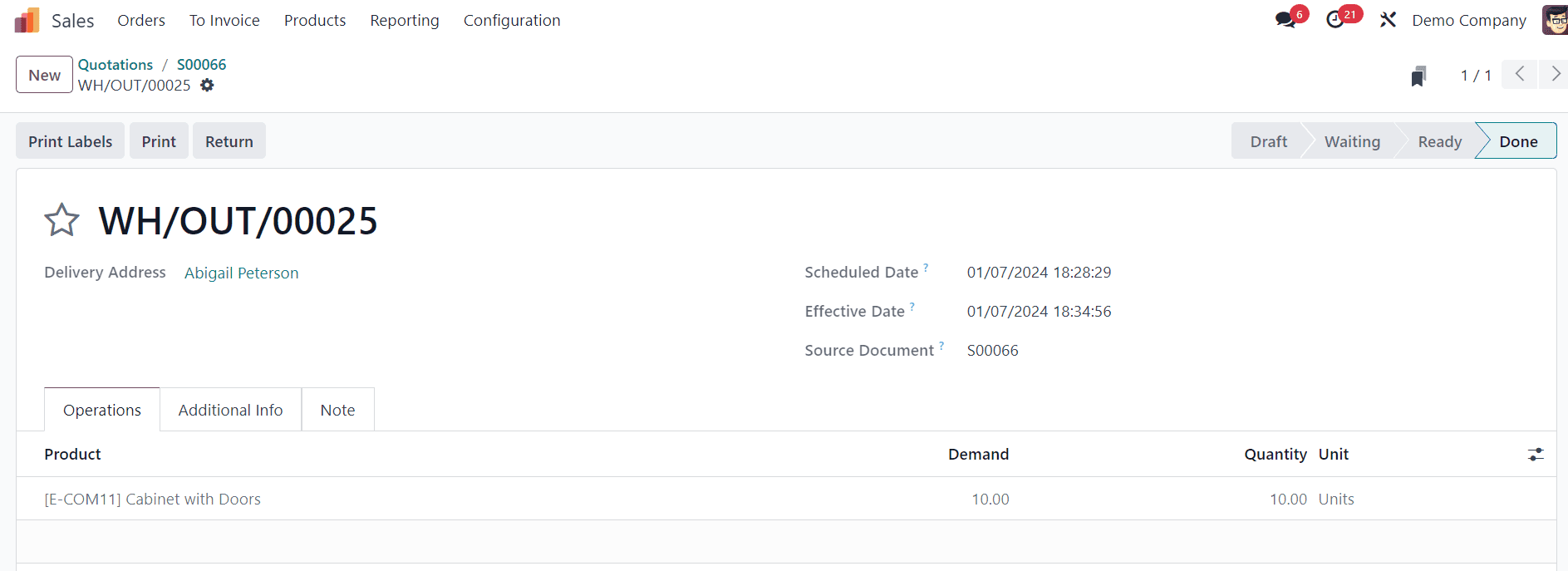

After completing the payment processes, you can complete the delivery by validating the transfer.

Upon validation of the transfer, the status is updated to DONE, signifying that the product will transition from stock to the customer. Completion of product delivery may take a few days, contingent on the customer's lead time.

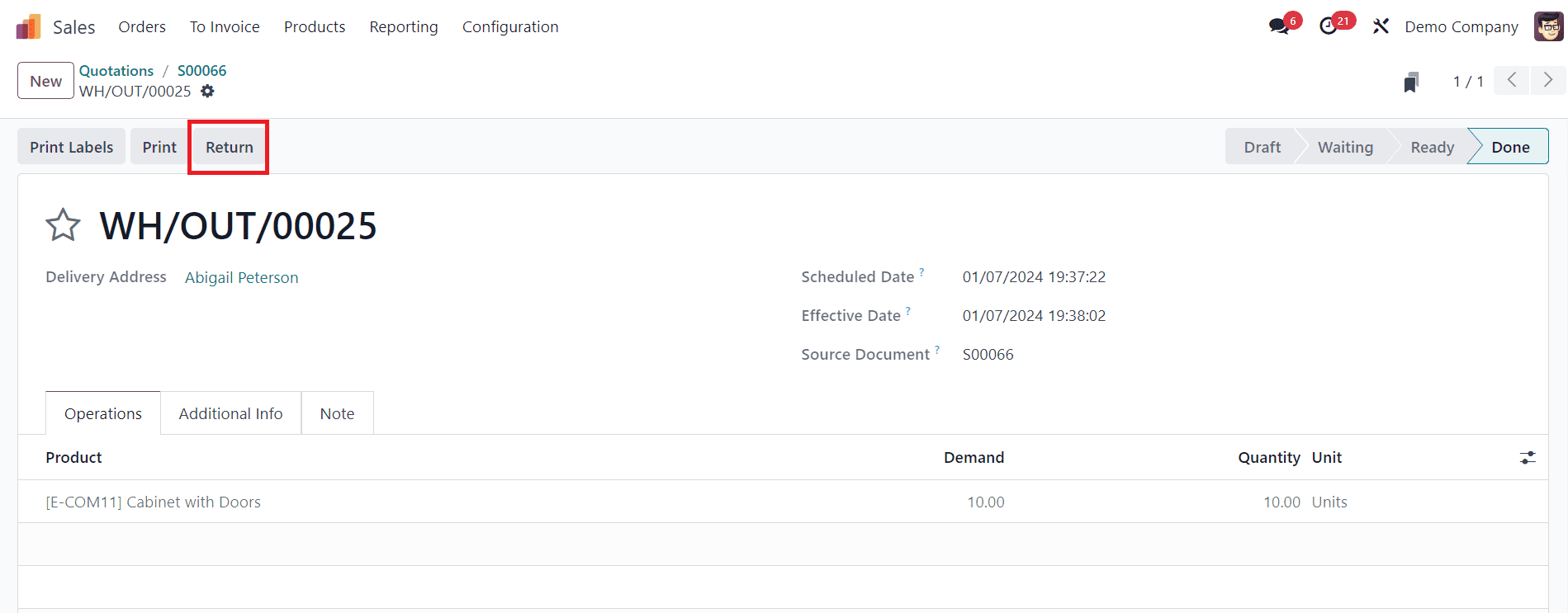

If the customer discovers that two units of the delivered products are not functioning, they have the option to return the defective products to the company. For recording the return of the product, you can select the respective Sales Order from the Sales module and select the Return button as shown below.

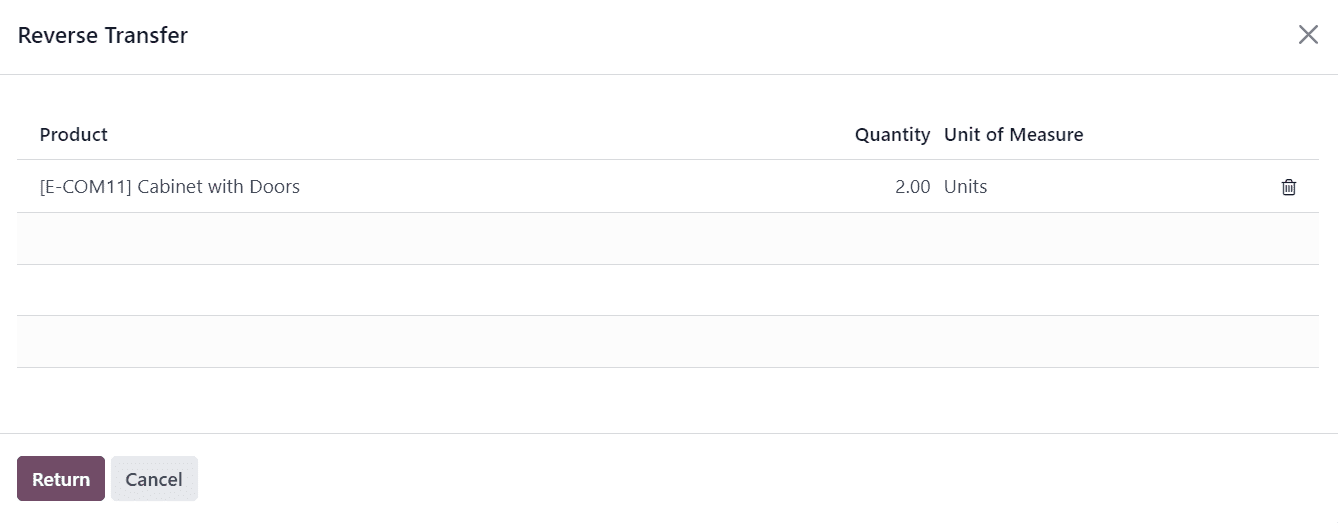

Clicking on this button will open a new pop-up window where you can mention the quantity that the customer wants to return.

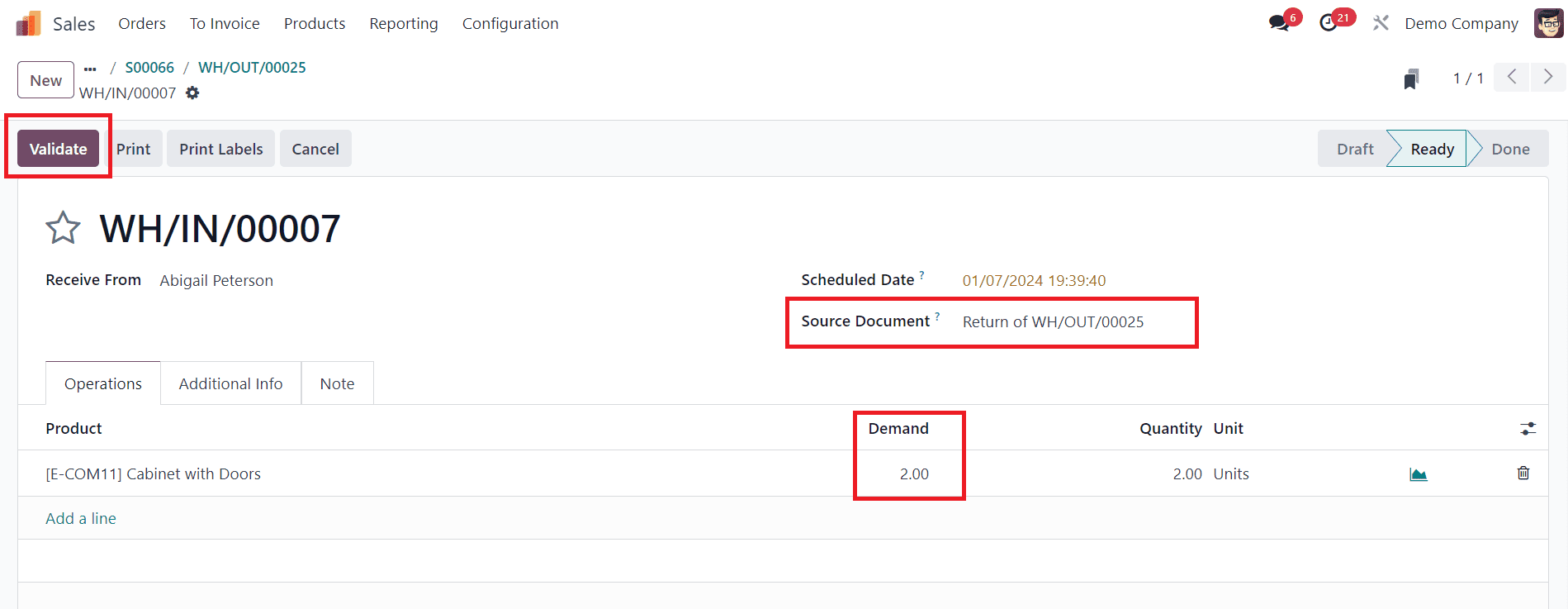

Now, click on the Validate button to confirm the return transfer.

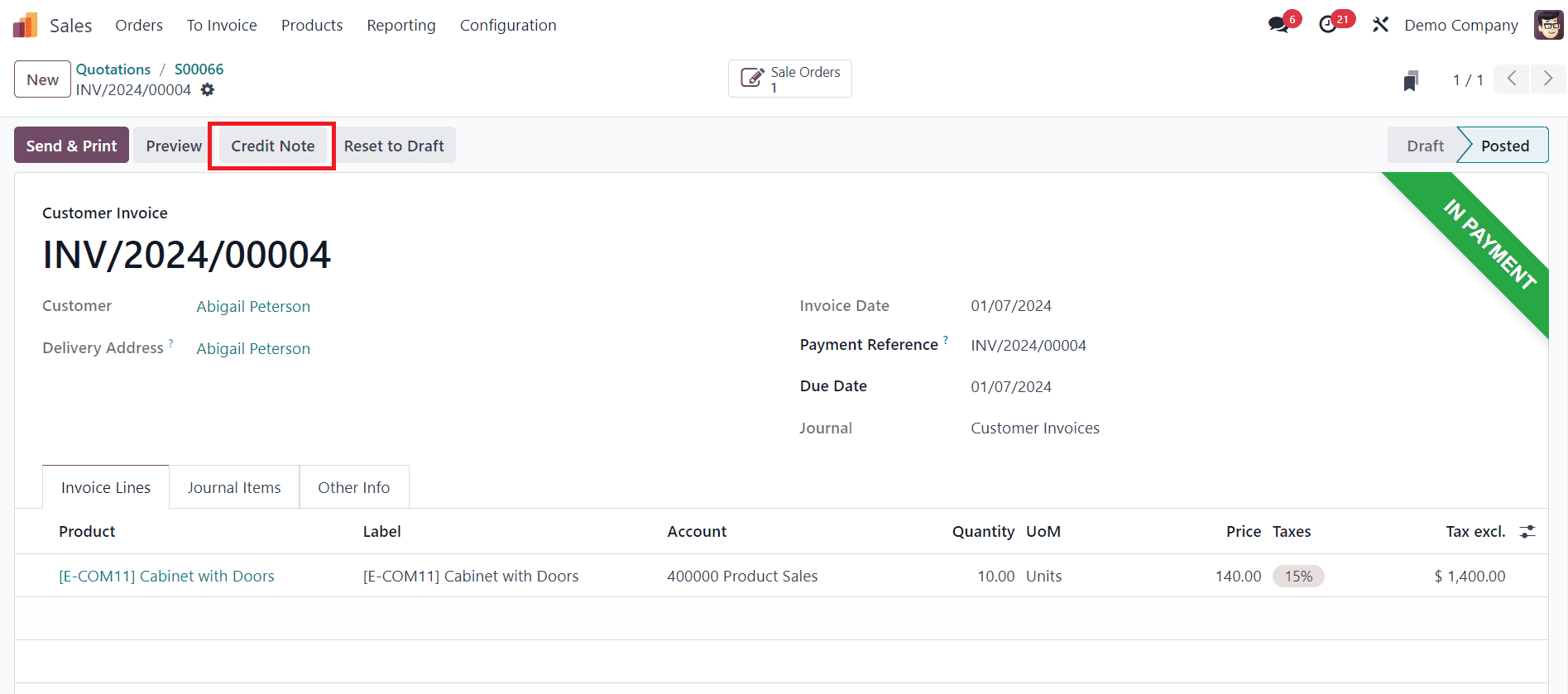

After confirming the return, the company must refund the customer by generating a credit note.

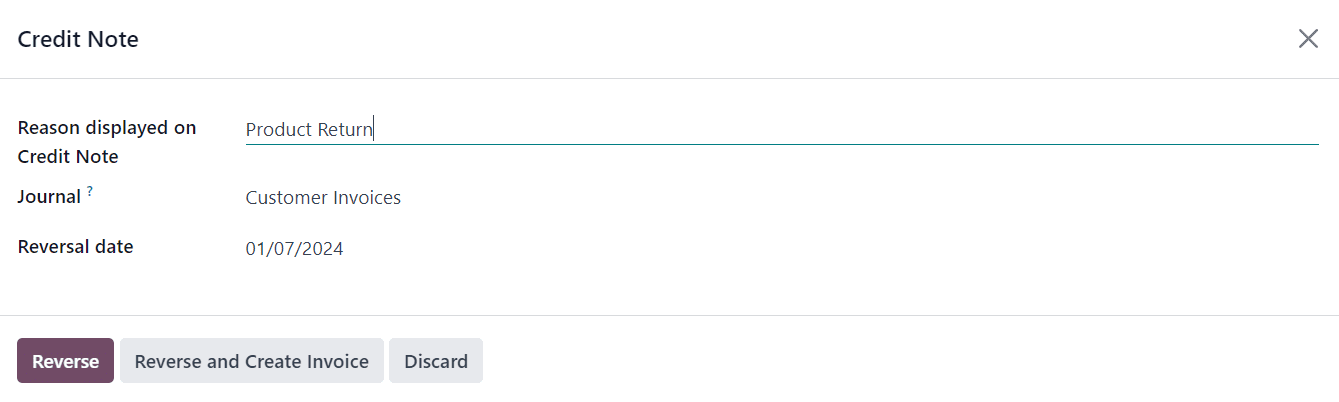

Click the Credit Note button from the customer invoice. You will get a new pop-up window, as shown below.

Specify the reason for the credit note in the given space. Now, click the Reverse button.

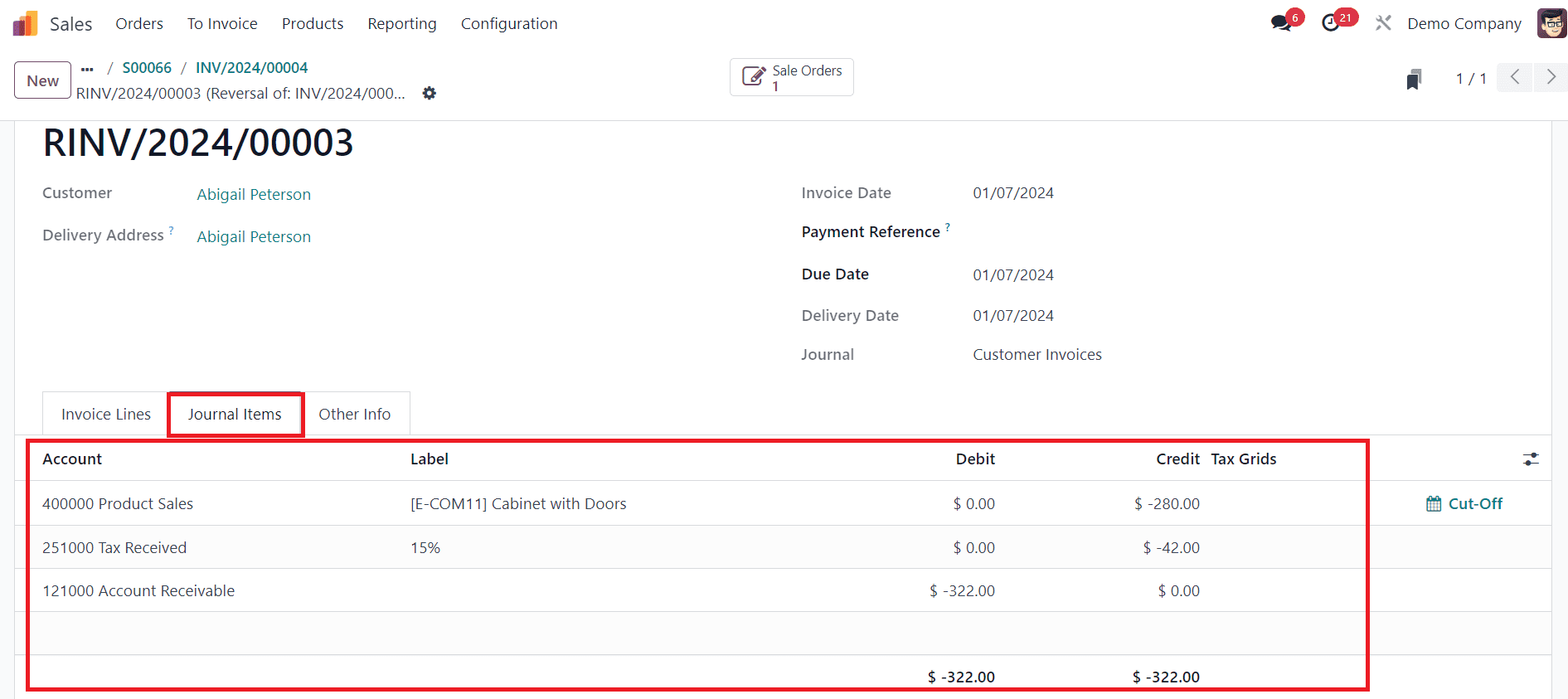

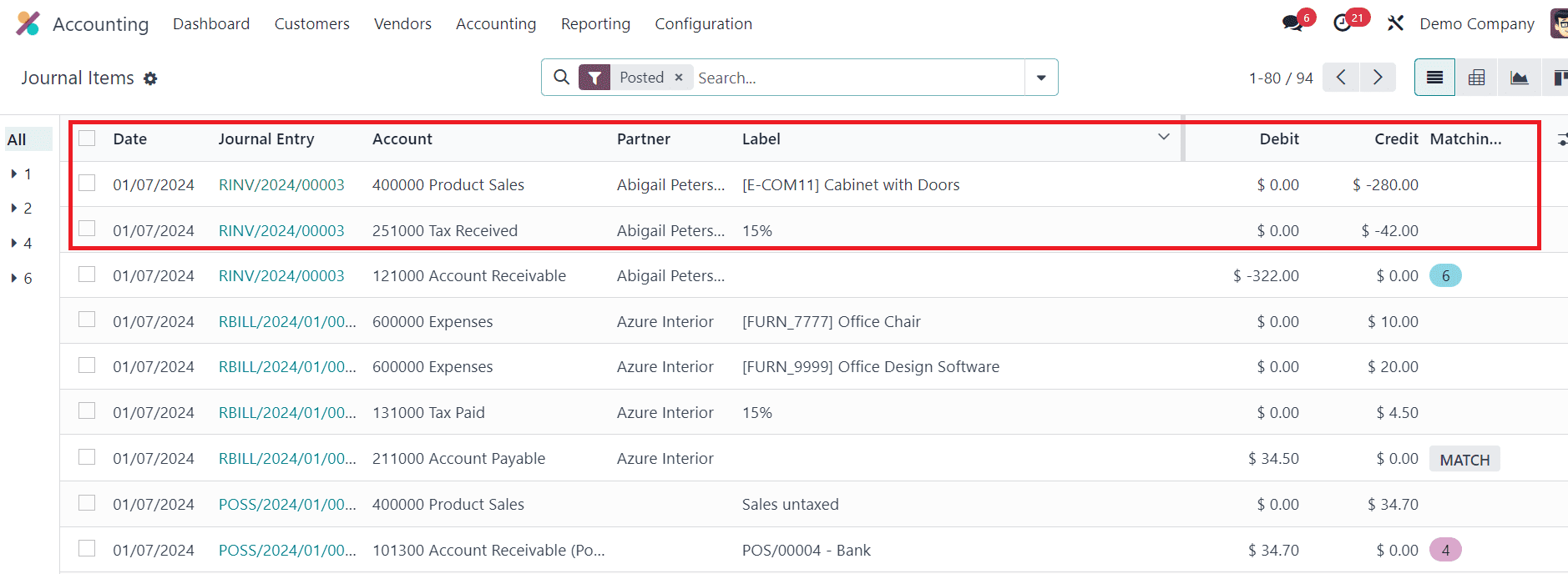

When you check the ledgers of the reverse invoice, you can see the income account is -(Credit) instead of debit, and all others are depicted as negative.

In storno accounting, the reverse entries are shown in negative to identify such entries easily, as shown in the image above.

Effectively managing Storno accounting in Odoo 17 is crucial for maintaining accurate financial records. By following these steps, businesses can streamline the process of reversing journal entries, correct errors promptly, and uphold the integrity of their financial data. Odoo's user-friendly interface and comprehensive features make it a reliable choice for businesses seeking efficient accounting solutions.