You may control prices with Odoo 17 PoS in some ways, including included and excluded prices for taxes. This allows you to select the price strategy that best fits your company's requirements. The importance of price management is further highlighted by Odoo 17 PoS's ability to control pricing with tax included or removed.

Prices that include the relevant taxes are known as tax-included prices. In many nations, this pricing strategy is the most used. Regardless of the customer's tax rate, the total cost of an order will always be the same when tax-included pricing is used.

Prices that do not include the relevant taxes are known as tax-excluded prices. Although less widespread, this pricing strategy has its uses.

You have the option to utilize tax-included or tax-excluded prices for each product in Odoo 17 PoS. Additionally, you can assign several pricing strategies to certain clients. This allows you the freedom to customize your pricing plan to meet the unique demands of your company.

In Odoo 17 PoS, tax-excluded (B2B) and tax-included (B2C) pricing are popular methods of managing prices. This is because it enables you to distinguish between pricing for consumers (B2C) and businesses (B2B). You might use tax-excluded prices for B2B clients. This is a result of the fact that companies usually feel more at ease doing their own tax calculations and payments. You can also negotiate rates with businesses more flexibly if you use tax-excluded prices.

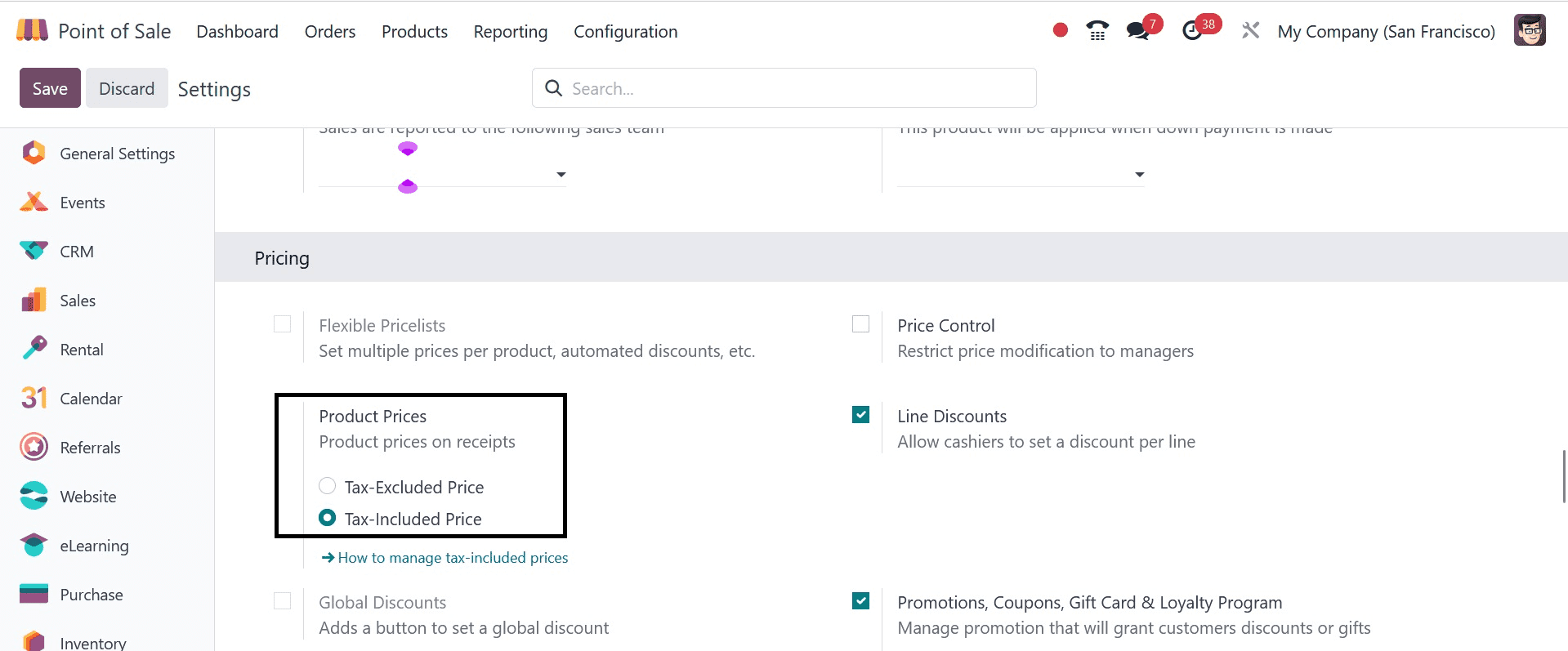

You can select whether or not the product price will include the tax amount when displayed in the PoS from the PoS module's configuration settings.

This is where you may customize the PoS to display the product pricing in the desired manner.

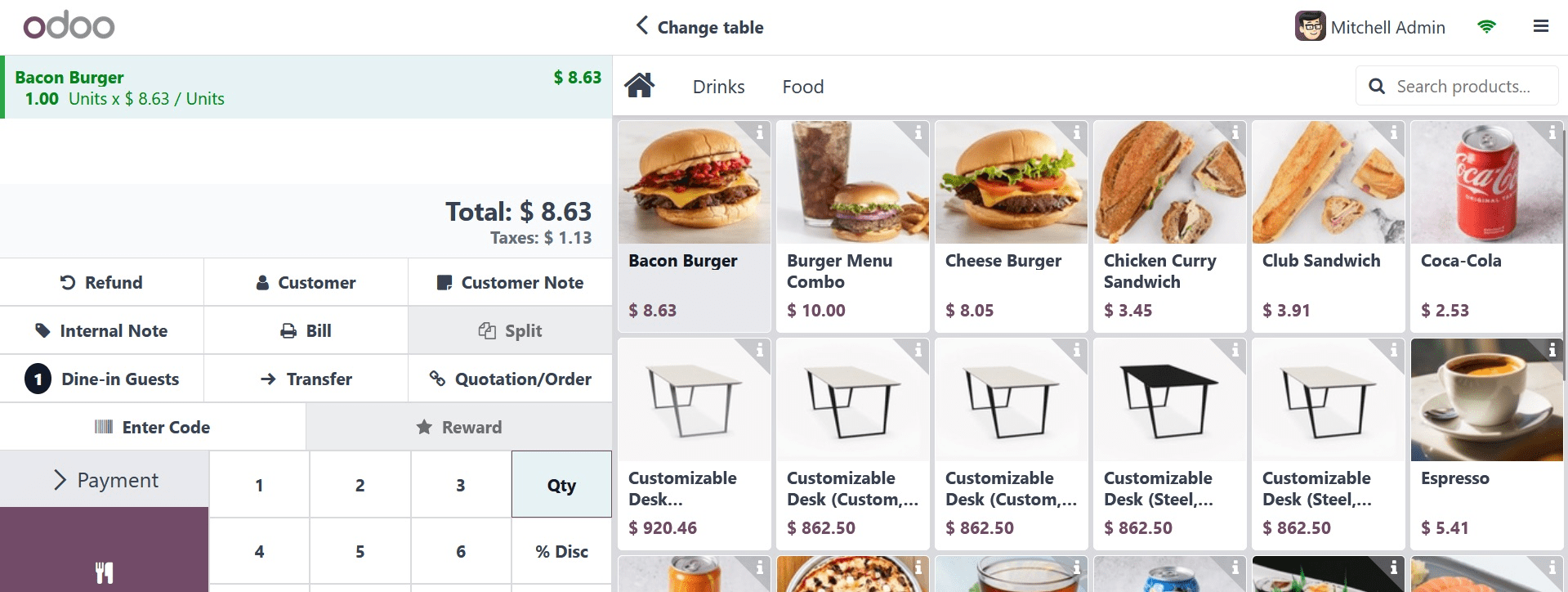

When you choose it as the tax-excluded price, the price of the product will show without the tax amount. Tax will be added to the total amount, and the customer can easily identify the product price without the tax amount.

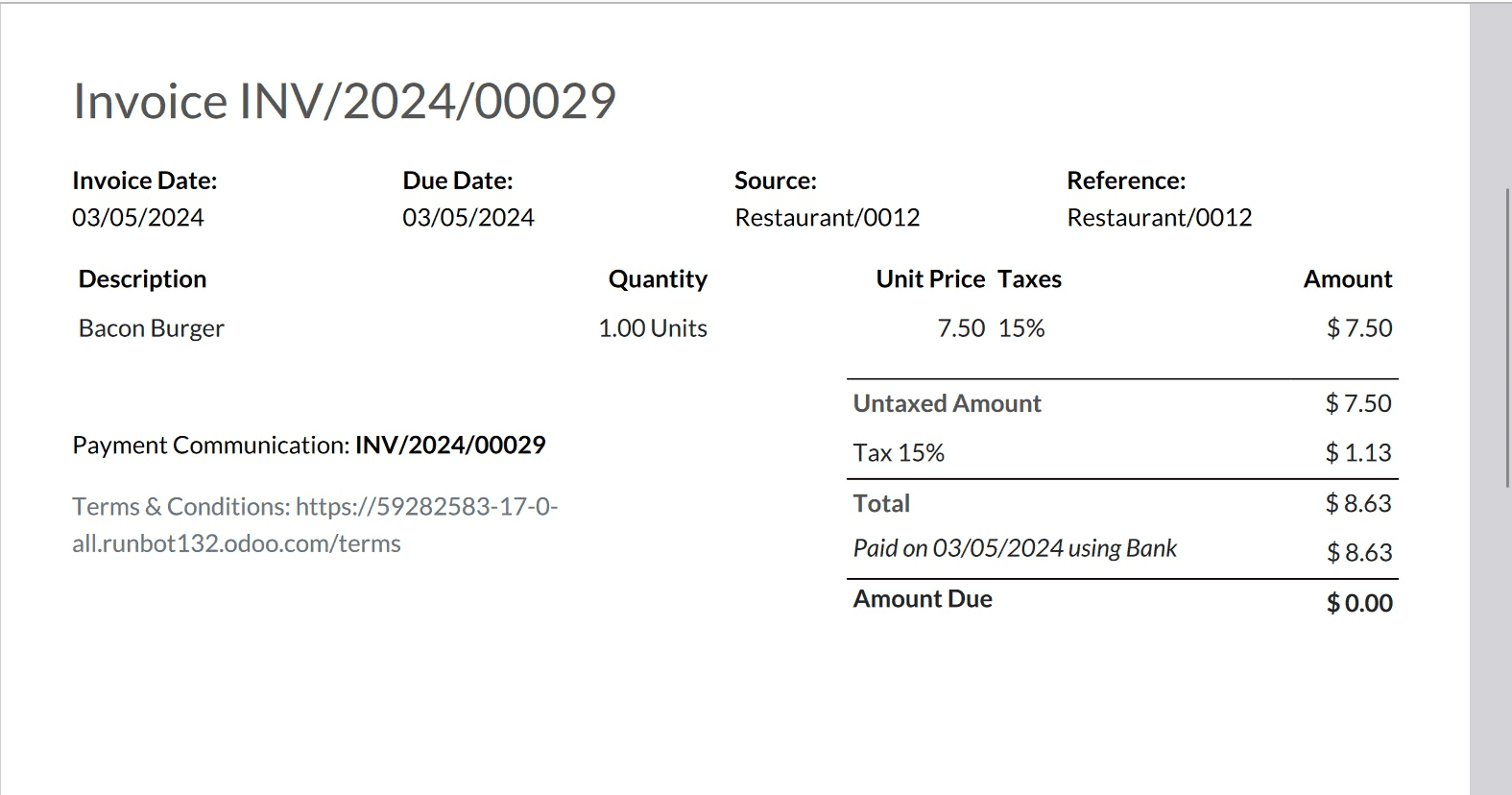

The customer can check the amount on the receipt in a similar manner.

The computation of an order's total cost is made simpler when tax prices are displayed individually. By doing this, mistakes can be avoided and consumers can be protected from being overcharged. Additionally, clients may view the precise amount of tax they are paying, which can promote openness and confidence in your company.

Let's now see how the tax-inclusive price appears in the PoS orders. Remember to specify the configuration price options to incorporate taxes.

You may view the entire amount, including the tax amount, on the receipts. Presenting tax costs, which include VAT, might assist you in adhering to legal requirements. It is mandatory in several nations to display tax prices, even on receipts. You might use tax-included prices for B2C clients. This is a result of the general discomfort that consumers have when handling their own tax calculations and payments. Additionally, consumers may find it simpler to evaluate rates offered by various companies when tax-included pricing is used.

The optimal pricing strategy for your company will ultimately rely on your unique requirements. In case you are seeking clarity and ease of use, prices that incorporate taxes can be your best bet. Tax-excluded prices might be a preferable option if you require greater precision and flexibility.

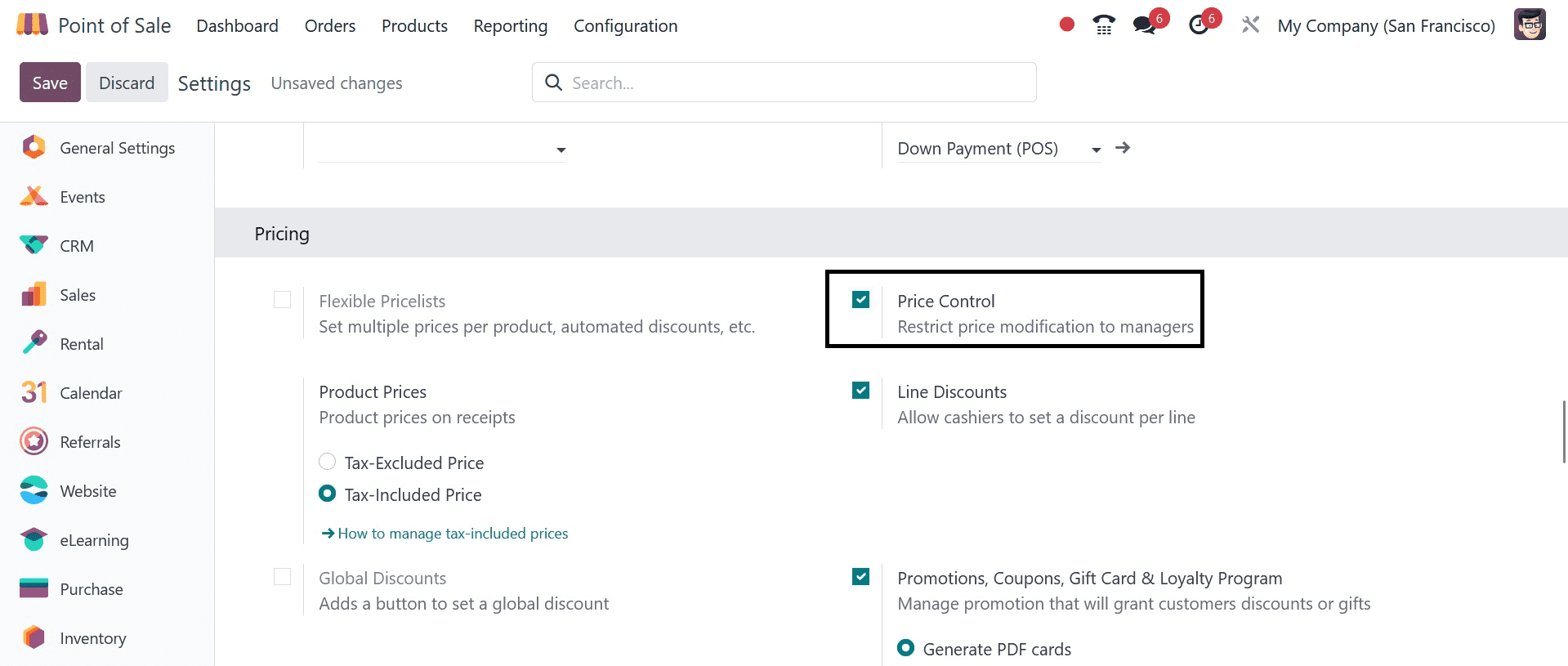

By turning on the Price control functionality, the Odoo 17 PoS module now provides the opportunity to restrict price adjustment. You can limit pricing changes to managers exclusively with it. This implies that normal users won't be able to alter the POS's product prices. Businesses that wish to stop employees from unintentionally or purposely adjusting prices may find this helpful.

Therefore, once this feature is activated, Odoo will stop workers from altering the prices of products. The only people who can change the product prices are the management. Let's begin the meeting with several staff members.

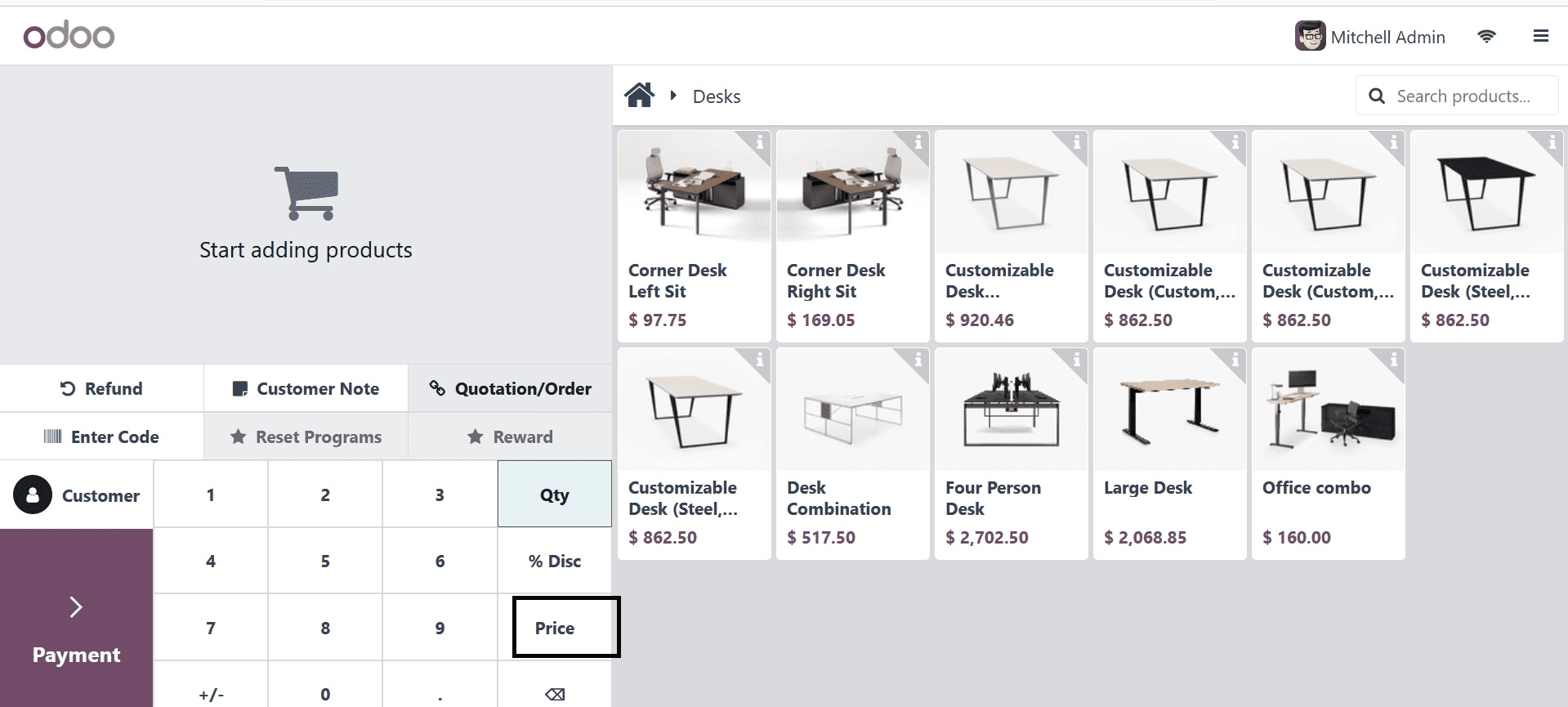

Anita Oliver is the user that is now logged in, as you can see. The price modification button is therefore displayed as disabled. By clicking on the price button, the manager who made the login can change the product price.

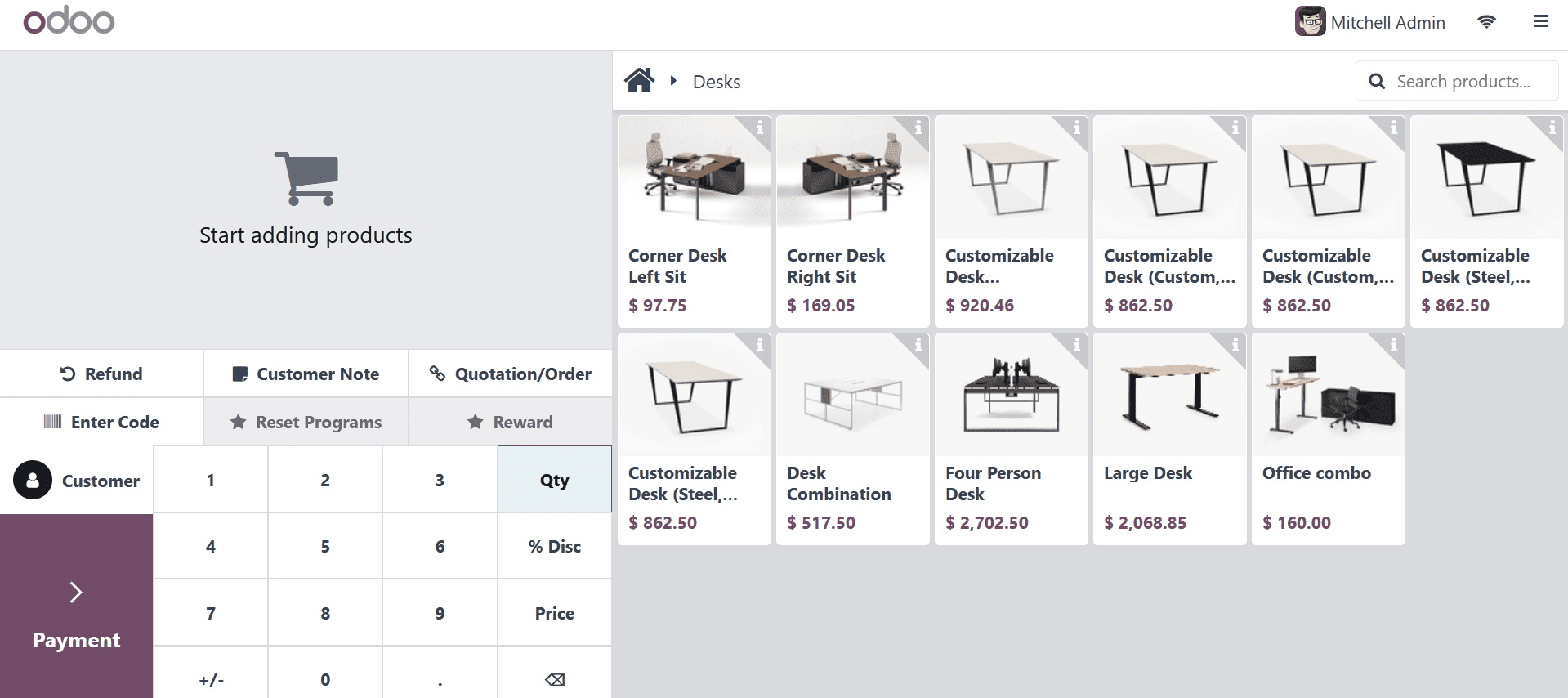

After logging in as the Mitchel Admin, you can see that the price button is active here because his access rights are administrator-level.

In this manner, you can use the PoS module to manage your product pricing. This guarantees that only authorized individuals, including managers, can alter prices. Errors are less likely to occur when price changes are limited to managers. By doing this, you can make sure that your prices reflect reality and that your profits are optimized.