Odoo 17 The accounting technique known as "continental accounting" documents the cost of income at the time of purchase. Generally speaking, there will be costs associated with buying products or services. These costs will be recorded at the time the ledger's expenses are created. Despite adhering to GAAP accounting, the preset accounts allow one to select which account is credited or debited.

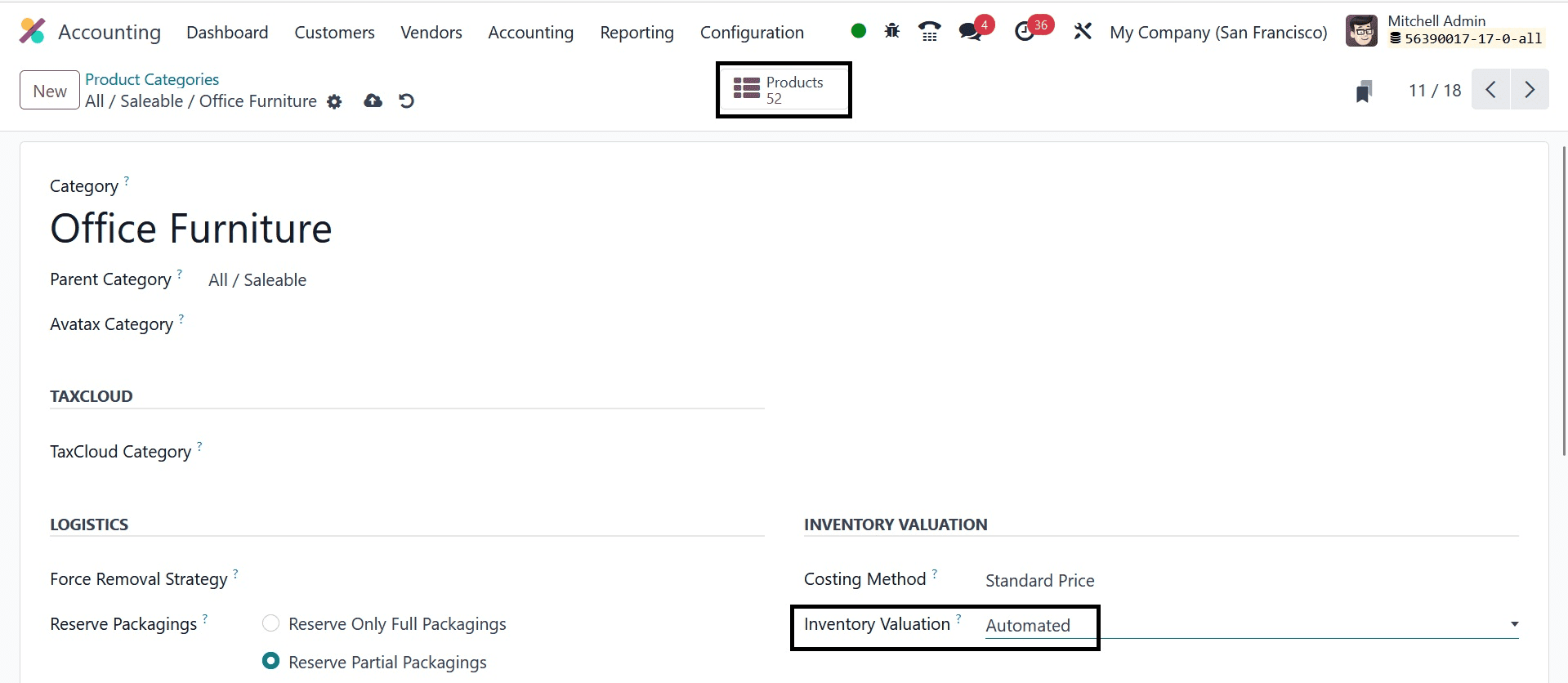

Let's now examine the impact of continental accounting on the ledgers. To examine the stock journal effects, let's look at a product category whose inventory valuation can be set to "Automated." Inventory valuation does not always need to be done automatically; manual methods are equally acceptable. This is solely predicated on how the business runs. Businesses occasionally updated their ERPs with quarterly or half-yearly stock value counts. When inventory valuation is done "automated," every stock entry is updated instantly after the transaction.

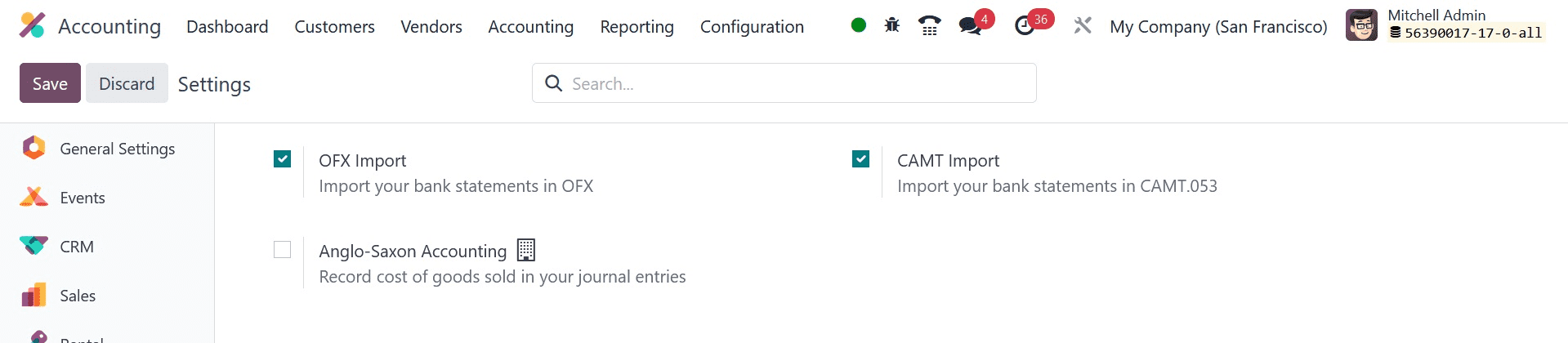

We must confirm whether we are in continental accounting mode before moving on to continental accounting. To do so, turn on developer mode, navigate to the accounting configuration options, and make sure "Anglo-Saxon Accounting" is turned off.

When "Anglo-Saxon" is disabled, it is regarded as being in continental accounting mode. Let's get started now. Take a look at the product category below, which includes 52 items and has automatic inventory valuation.

Adding the stock accounting characteristics is necessary because the inventory value is "Automated." The stock value of the incoming stock is recorded in the stock input account. The stock value that was removed from inventory is tracked in the stock output account. The difference between stock in and out, or the current stock value, will be retained in the stock valuation.

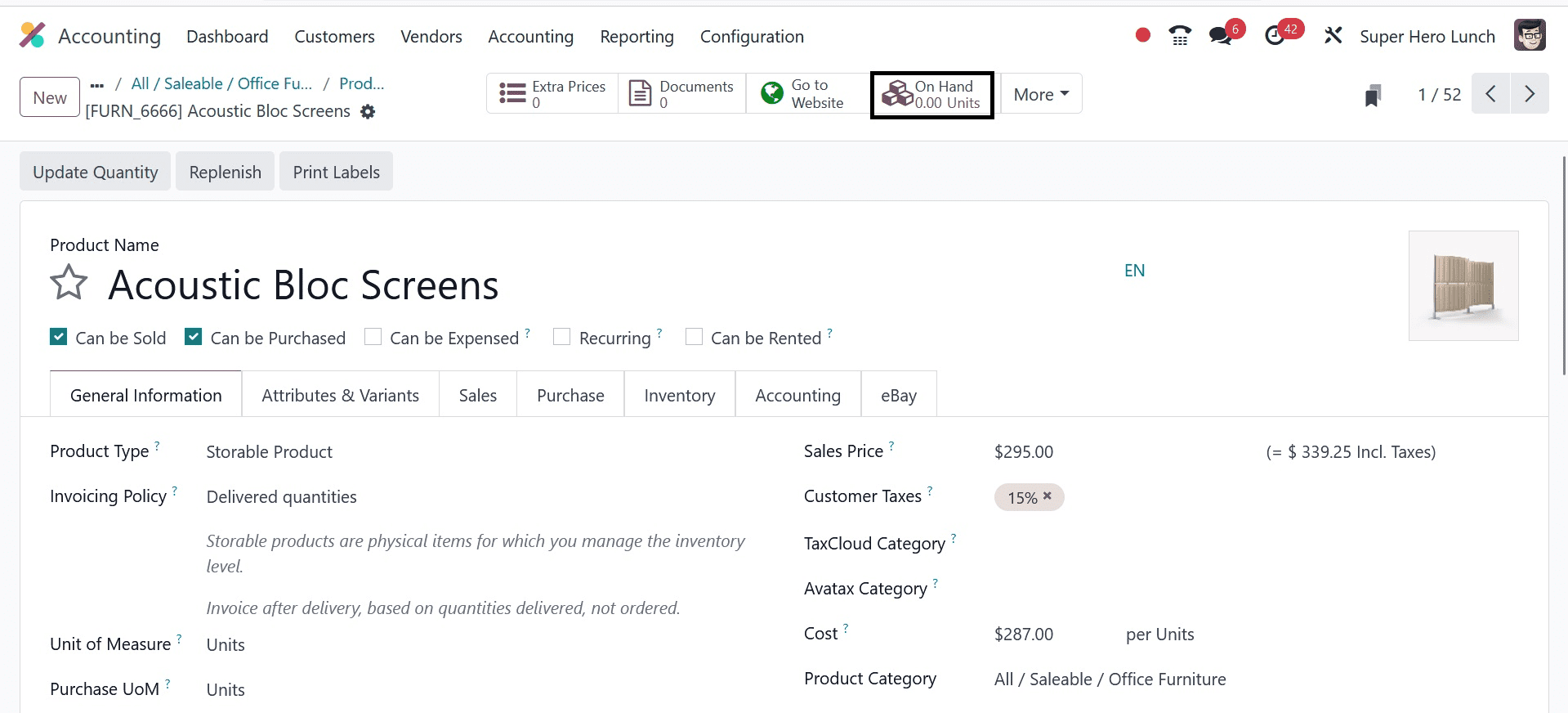

Standard, Average Cost (AVCO), or First In First Out (FIFO) costing techniques are available. Now consider a product to purchase from a merchant. At the beginning, there is no stock available.

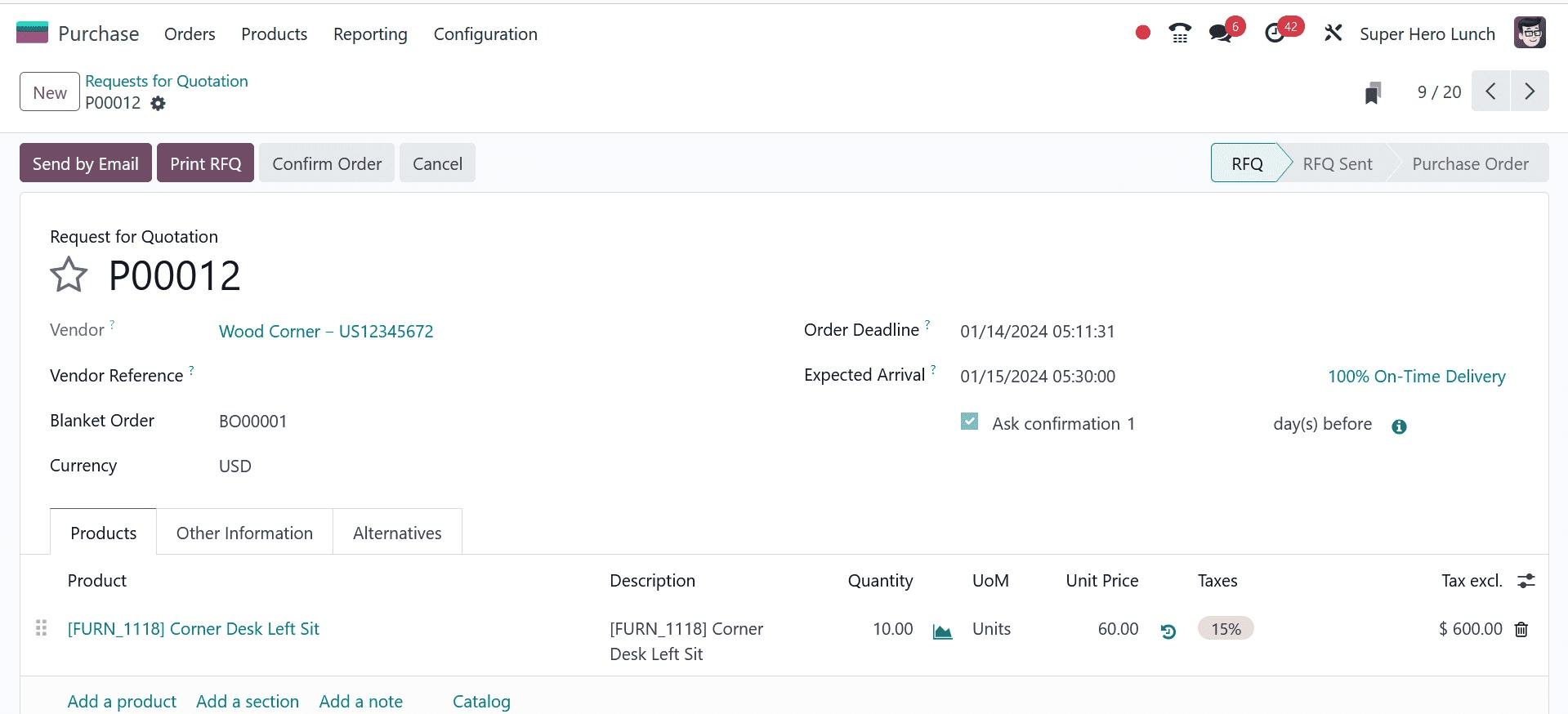

Let's now perform a product purchase procedure to observe how the ledgers impact continental accounting.

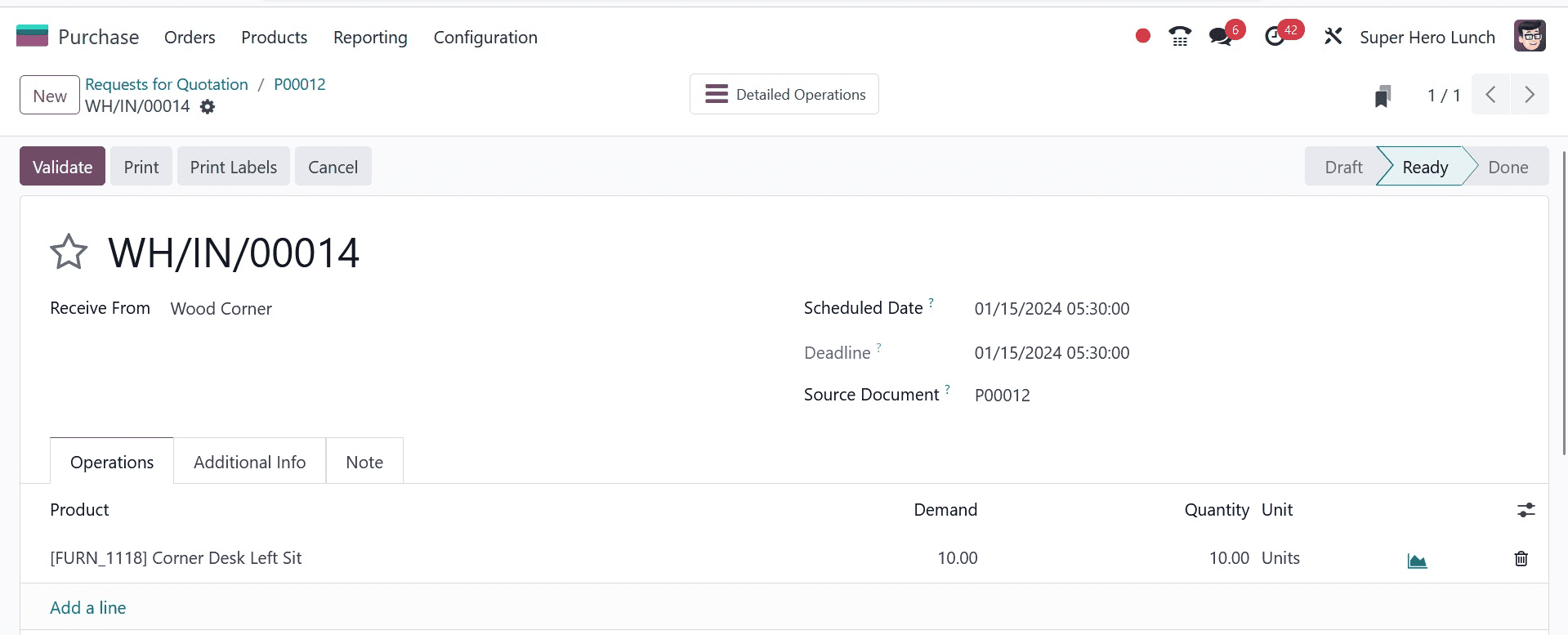

Purchase orders just produce a document that is appropriate for business; they have no bearing on accounts whatsoever. The purchase receipt is the next step. The stock accounts are impacted upon receiving products.

The value of the stock will be recorded by the input account upon receipt, increasing the value of the stock at that time as well. Let's now examine the stock notebook.

The receiving stock's characteristics are regarded as a liability. When the obligation rises, the account will be credited following the asset-liability chart. As a result, the stock valuation account is debited and the stock interim received account is credited. A stock valuation account maintains the asset's worth as of right now. Thus, the stock valuation account is debited as an asset appreciates.

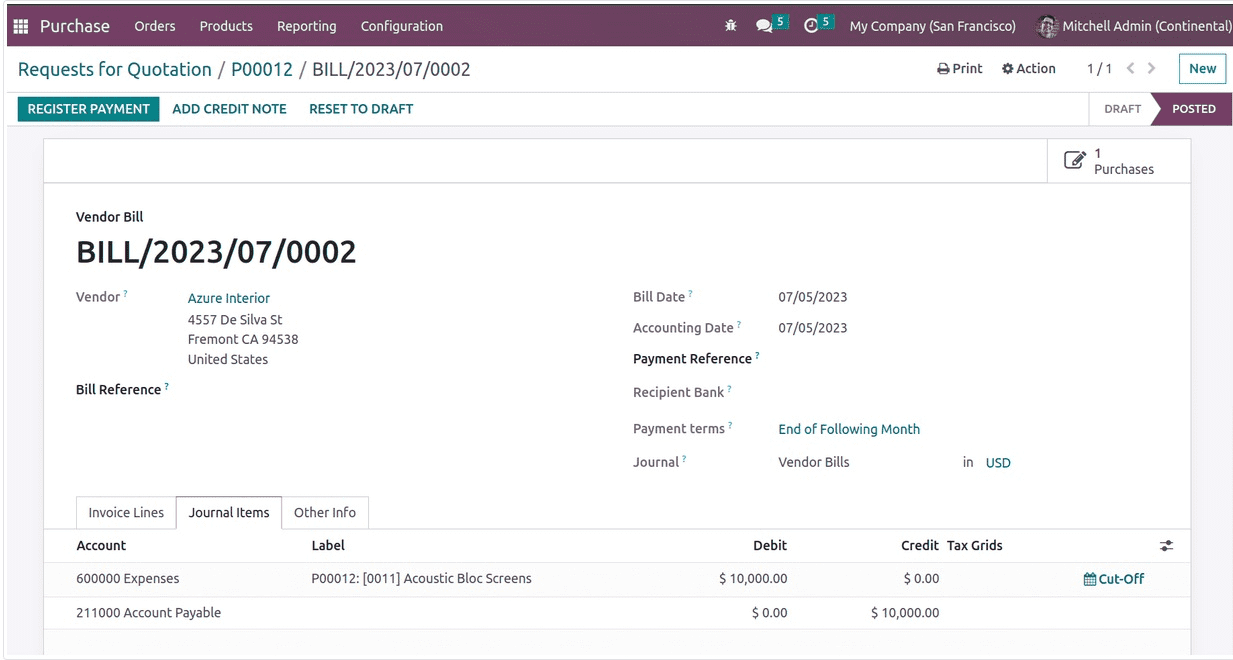

Note: The asset-liability chart shows when the rise in income and liability will be credited, and when the growth in assets and expenses will be deducted. The bill for the purchase order, which will have an impact on the accounting ledgers, must be created next.

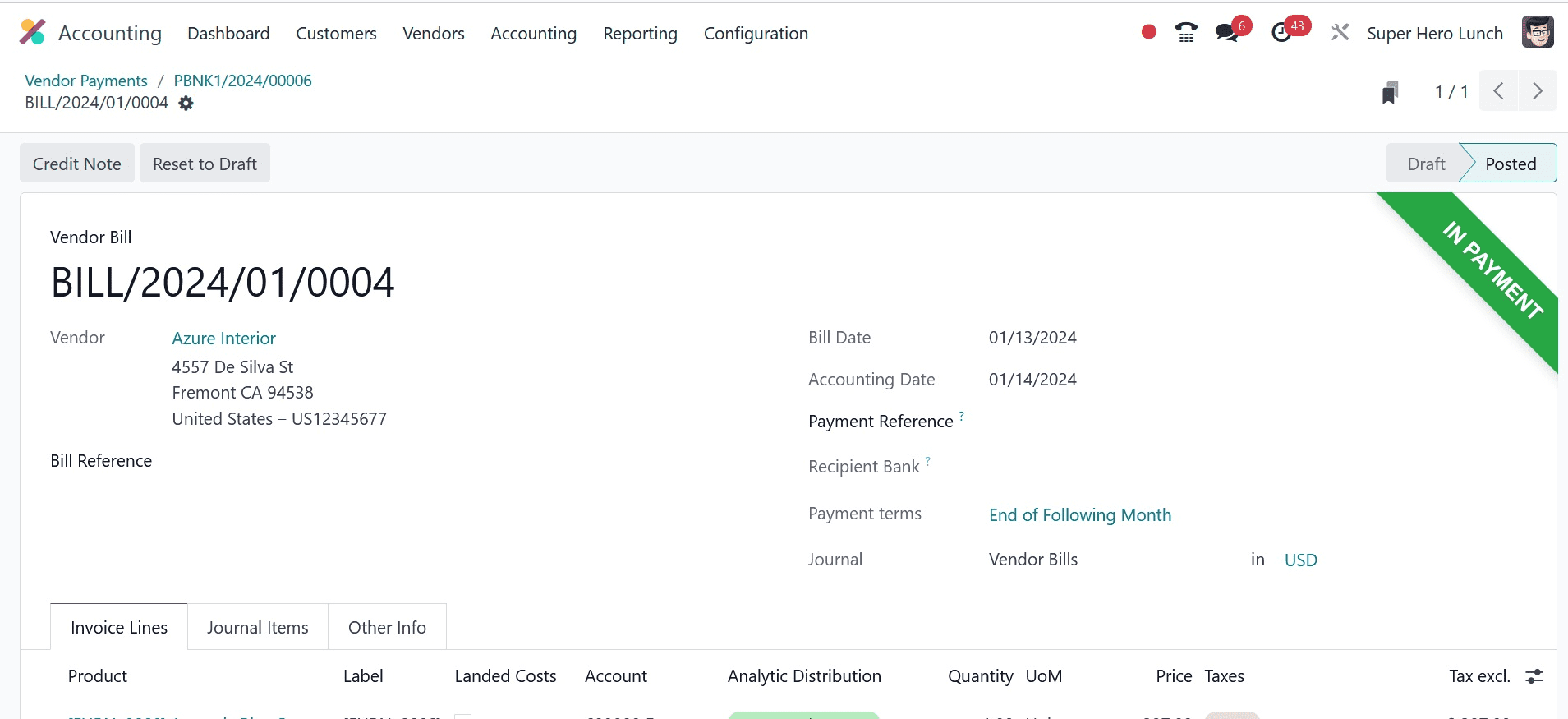

The ledger details, showing the debiting of the expense account and the crediting of the account payable, are visible under the journal items tab. In this instance, the business is responsible for paying the vendor—the account payable—while generating a bill. Account payable is by definition a liability, and the account is credited as the liability grows. An acquisition raises the business's expenses, which are noted in the expenditure account. As a result, expenses rise and the account is charged.

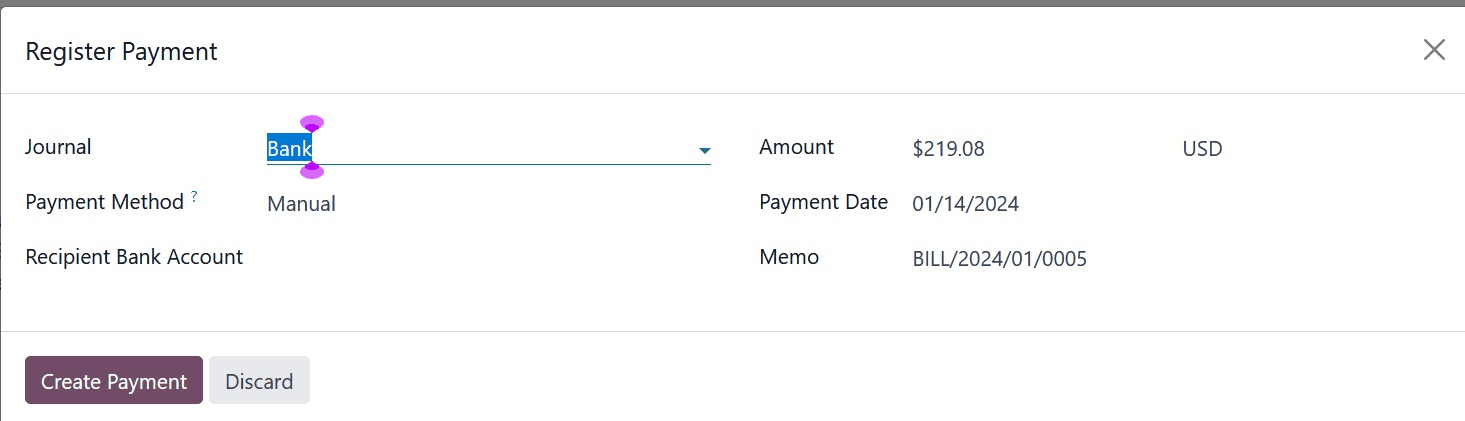

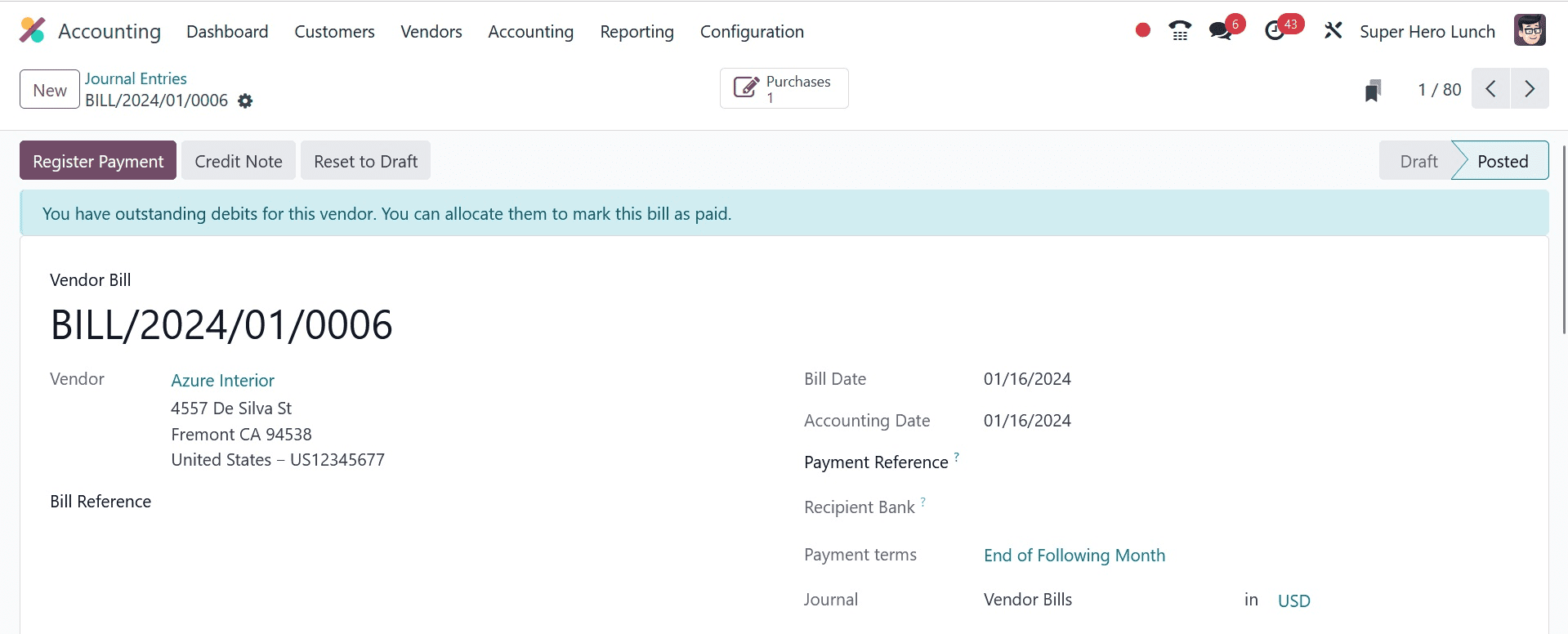

The payment of the vendor by registration payment is the current procedure. When you click "Register Payment," a pop-up window allowing you to select the payment journal and method will appear. The accounts payable and overdue payments are noted in the payment journal entry that is created upon creating the payment.

Check out the diary entry for the payment. In this case, unpaid receipts are credited and the account payable is debited.

The account payable account is debited once the payment has been made since the liability has decreased. This amount is then noted in the outstanding payments for reconciliation. The unreconciled transactions will therefore be noted in the account for unpaid payments.

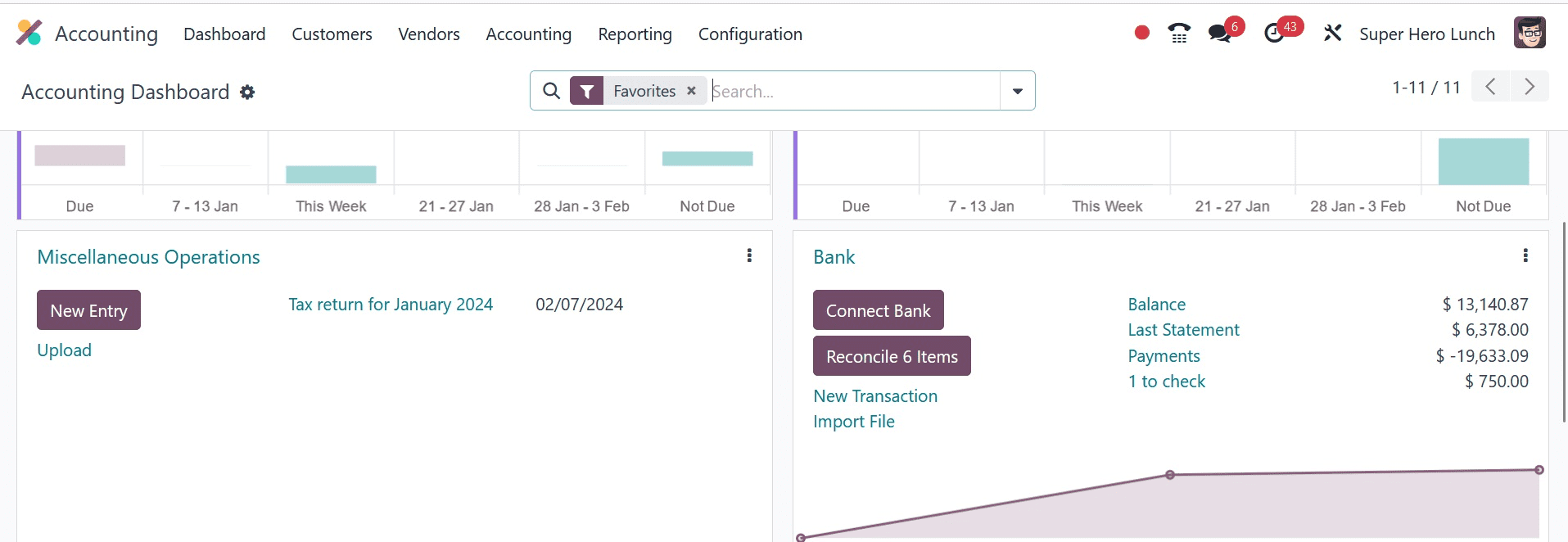

The outstanding payments in the bank journal are now visible on the accounting dashboard. It will be transferred to the bank and the Balance in GL will be updated after it has been reconciled with the bank statement.

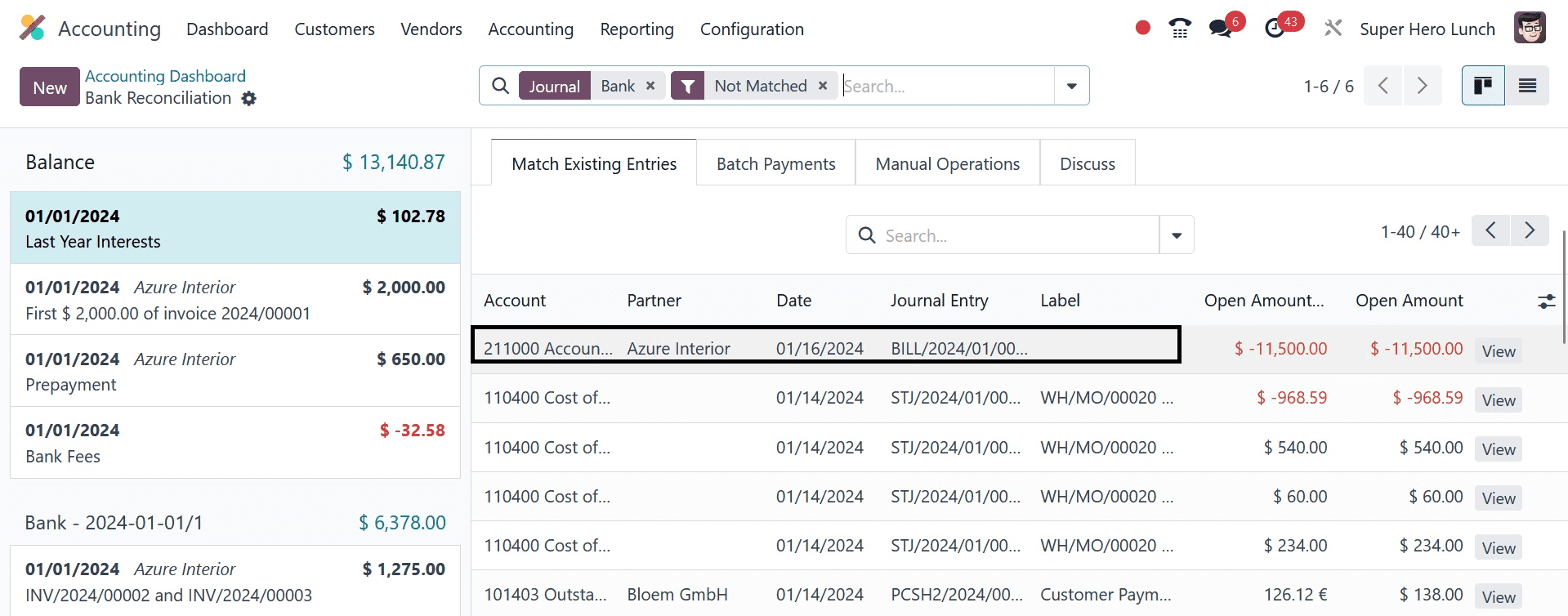

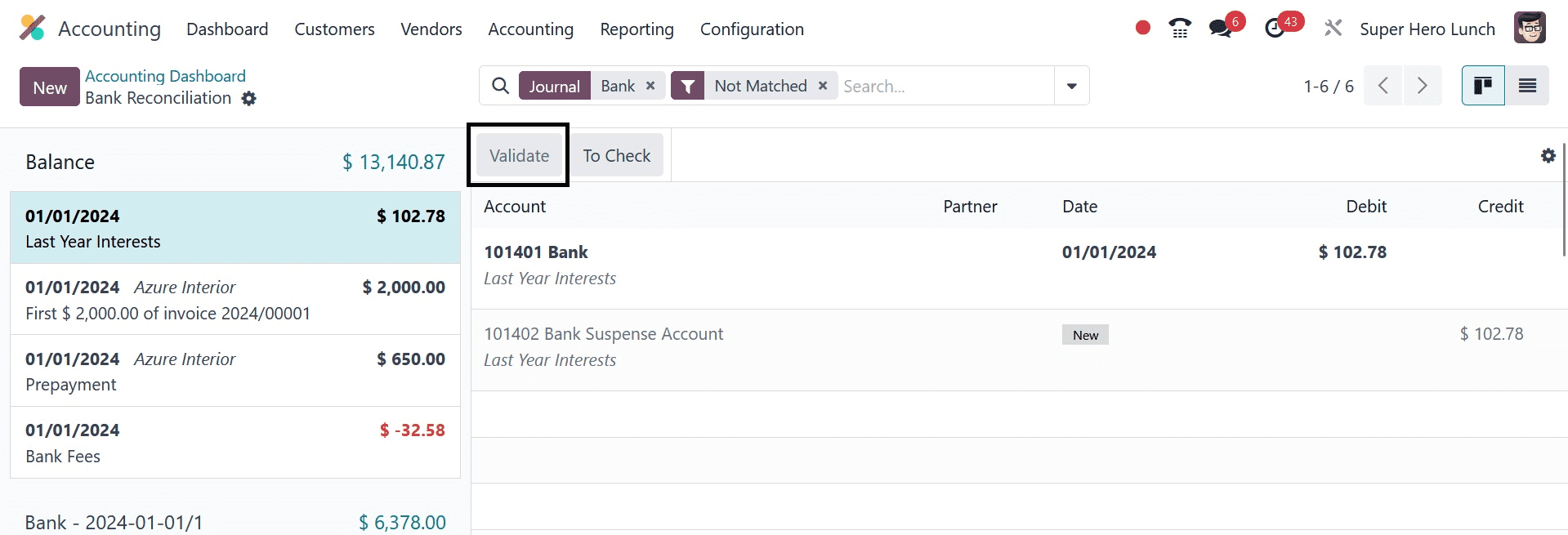

The bank statements that are retrieved must be compared against the payment. Another journal entry for bank accounts and bank suspense accounts is produced when bank statements are created. So let's update Odoo with a statement line.

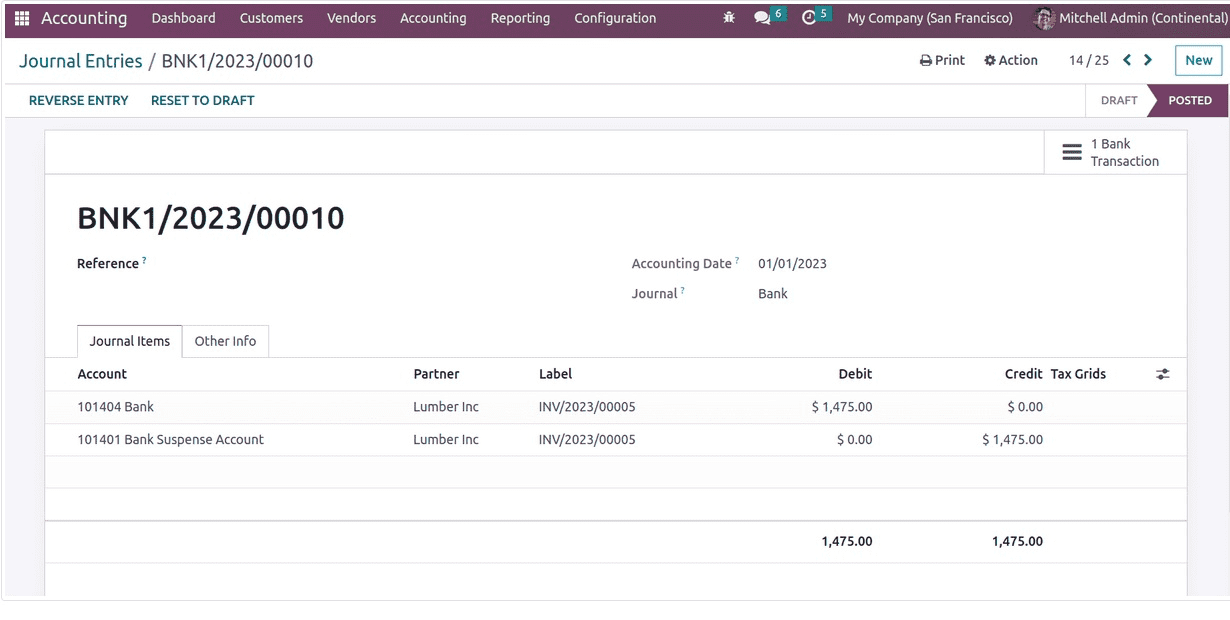

You can reconcile the entries by following the MATCH. Additionally, it holds the statement value for the bank suspense account until it locates the appropriate account to map with the bank. It therefore has a corresponding journal entry.

The Bank is credited while discussing the ledger posting. This indicates that the asset is declining in this instance as the vendor is being paid. The suspense account, which is debited, is the equivalent.

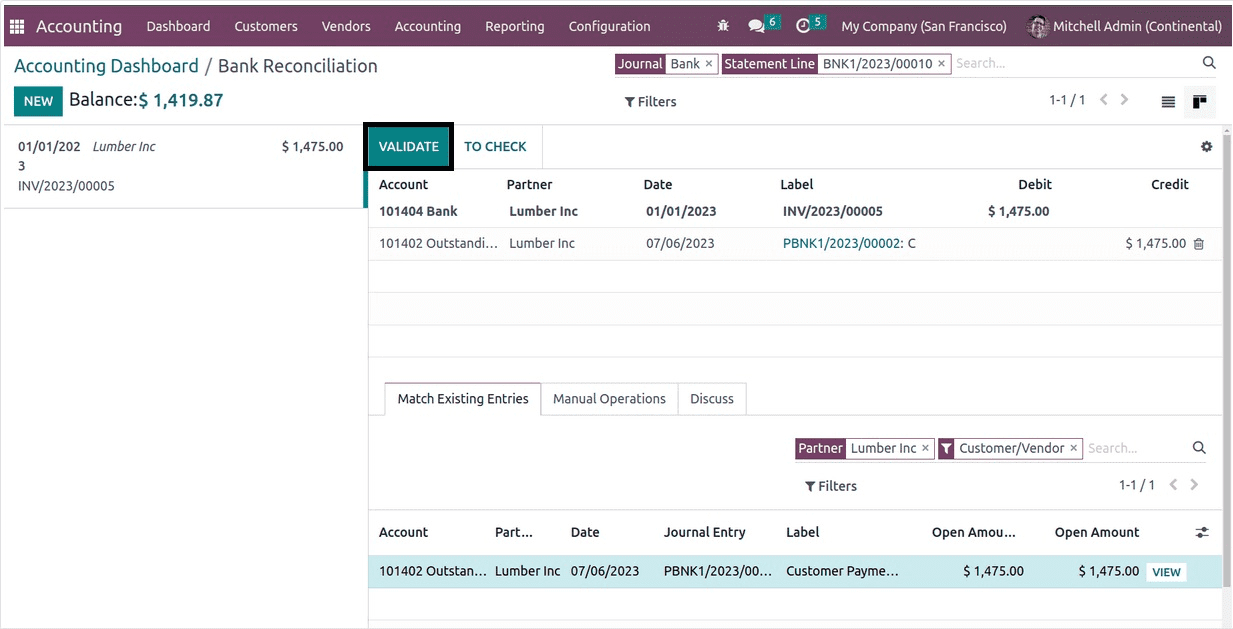

Let's now reconcile the payment and the line item on the bank statement. The corresponding items are verified by the VALIDATE option.

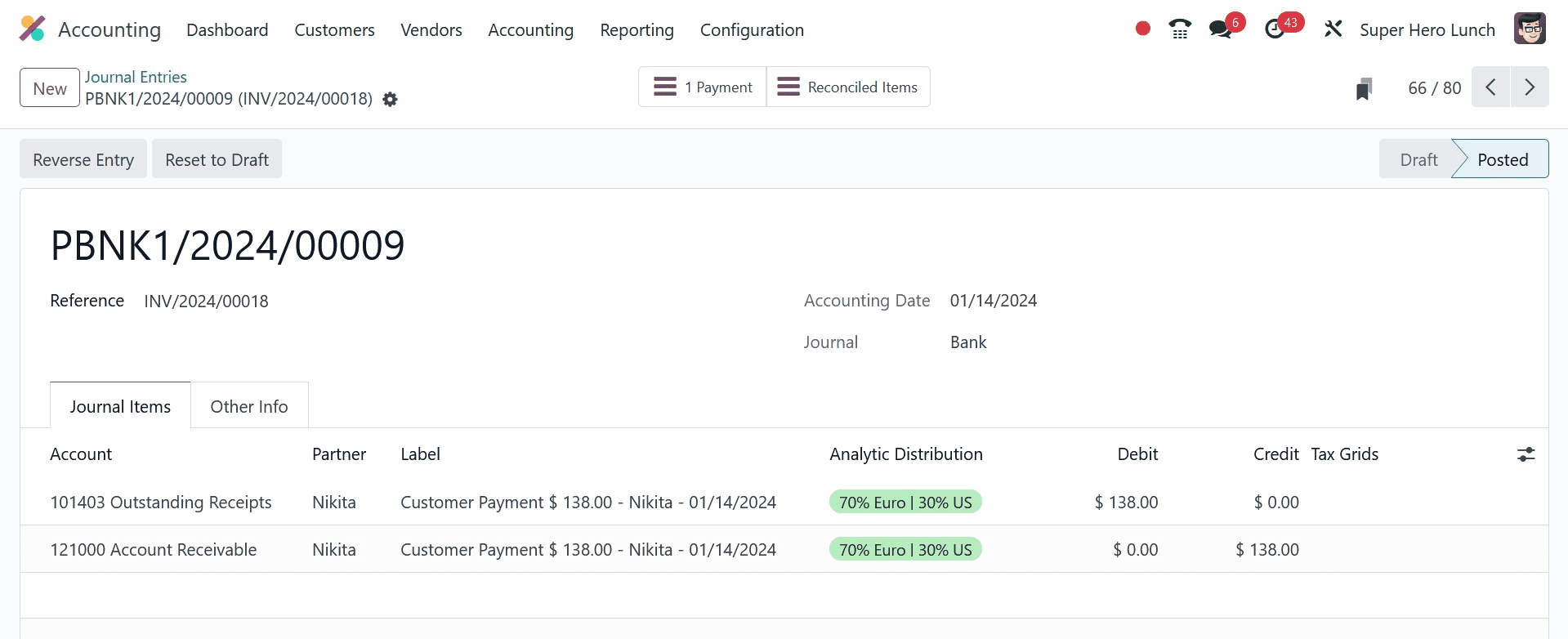

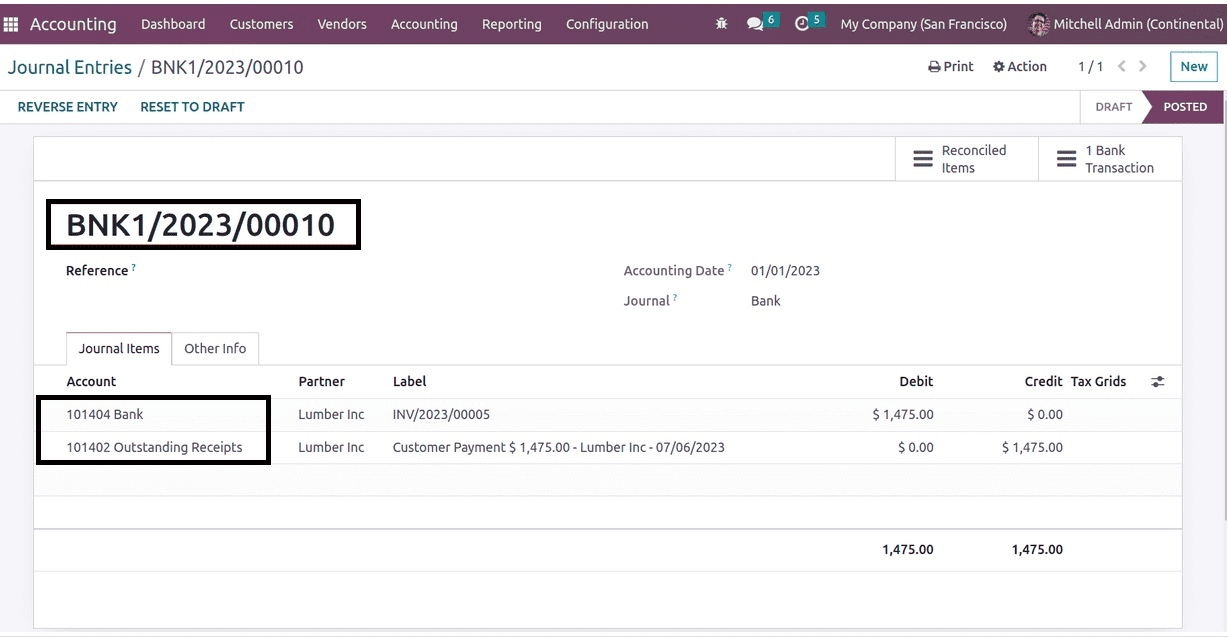

The money in the overdue payments appears to be transferred to the bank when reconciliation is completed. As a result, the bank suspense account and outstanding payments will once more be included in a journal entry.

You can see that the outstanding payments account has taken the place of the bank suspense account in this journal entry following reconciliation. The bill status then changed to PAID.

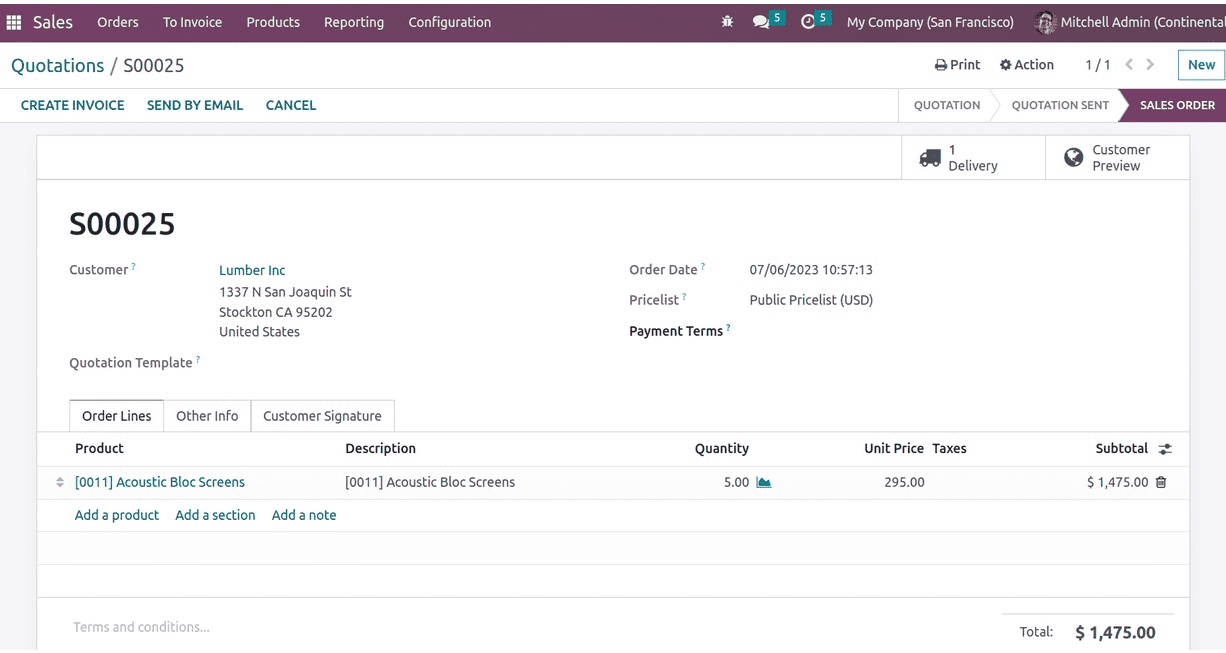

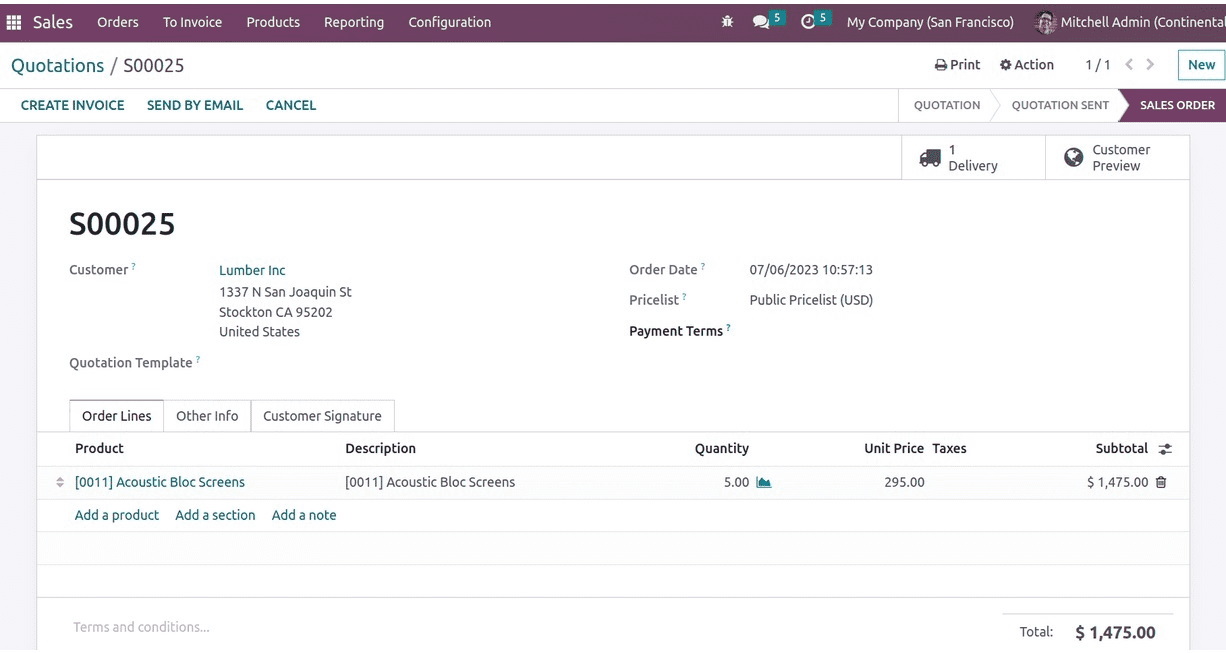

View the Sales operation now, where a portion of the acquired products are sold.

Sales orders are a significant document for business, unrelated to accounts, and they have no bearing on any ledgers. Delivering the requested items listed in the sales order is the following step.

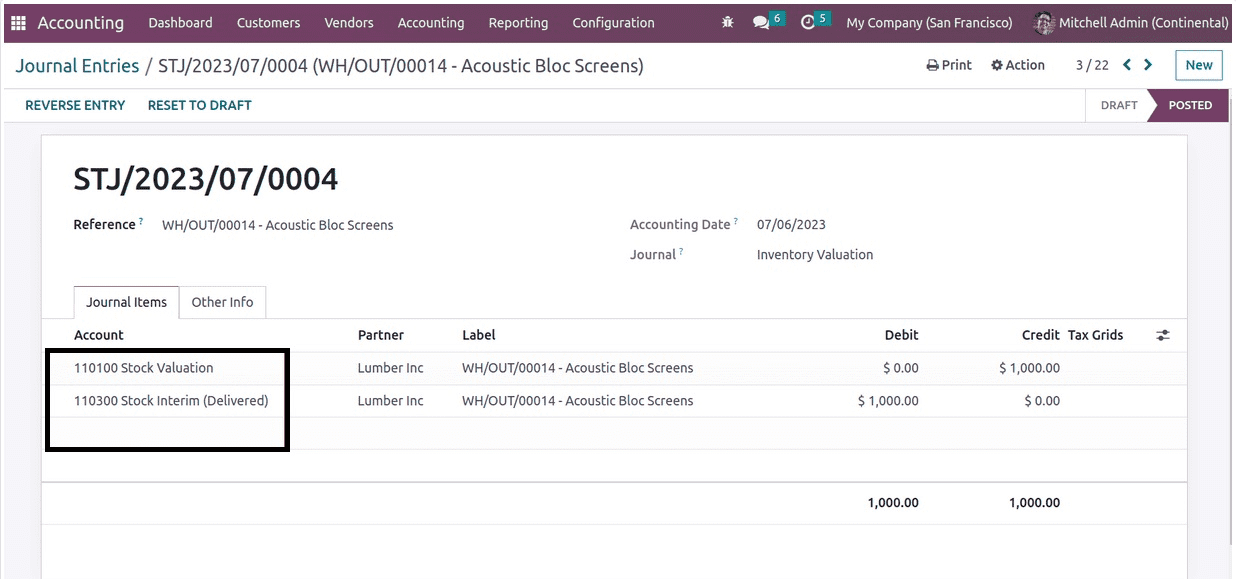

Delivery of goods affects stock, which in turn affects stock ledgers (since inventory valuation is computerized). When the goods are delivered, the value of the supplied stock is recorded in the stock output account by the stock result record, which also reduces the value of the current stock. We should view the stock journal at this time.

In this case, the lowering obligation results in a debit to the stock output account, while the decreasing asset results in a credit to the stock valuation account.

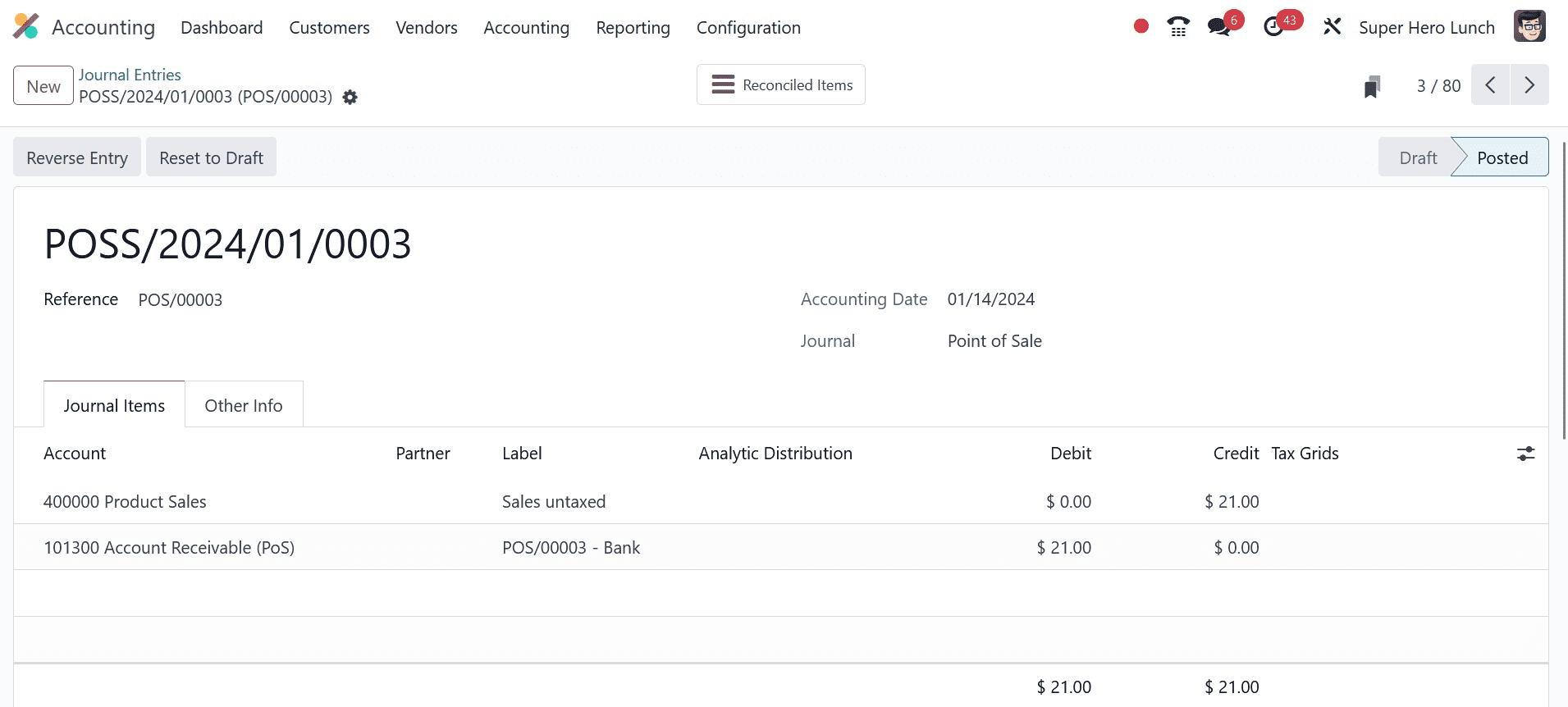

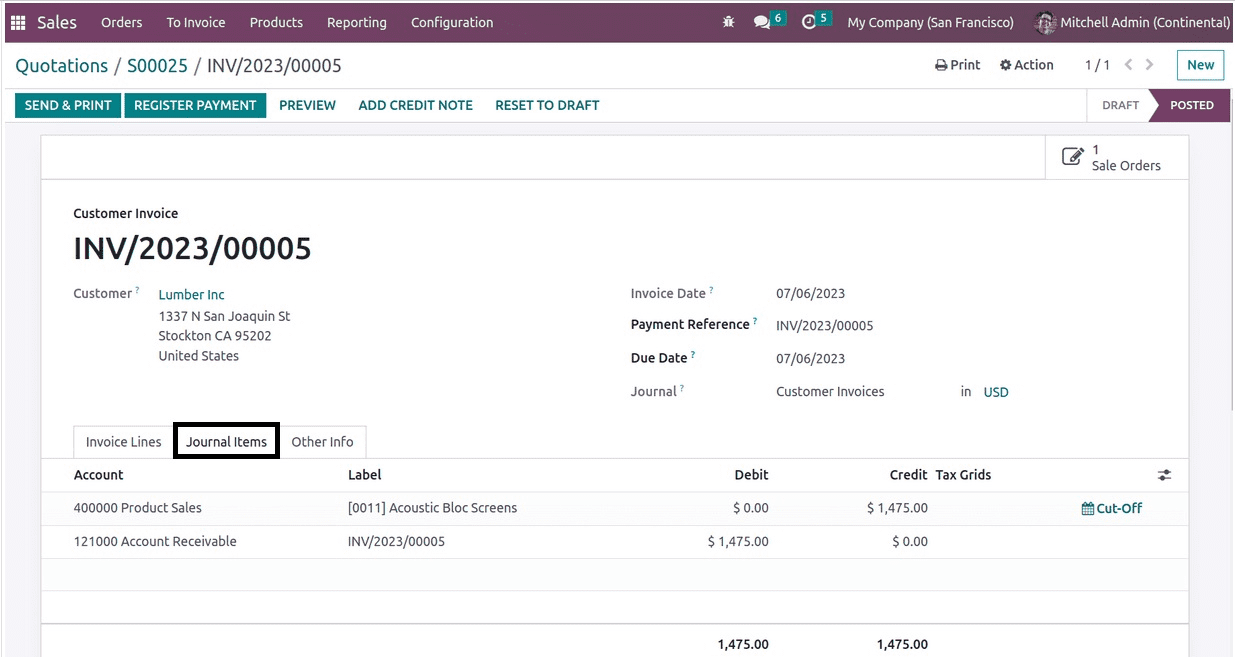

The following step is creating an invoice on which the revenue will be noted. The journal items tab displays the impacted ledgers.

This credit goes to the income account "Product Sales." An income account's nature is income, and it is credited as income rises during transactions. The money that should have been received from the consumer is kept in the account receivable, which comes next. In this case, the account receivable is treated as an asset and is debited when assets grow.

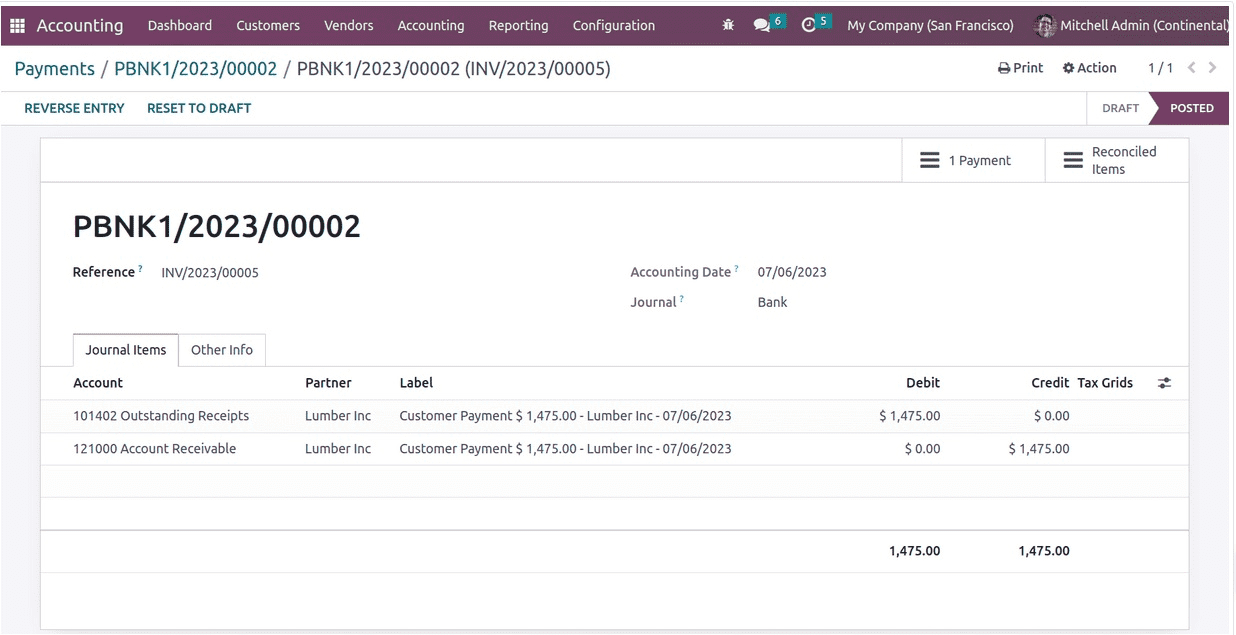

The cashier can add "register payment" in Odoo 17 after receiving money from the client. The received amount will be transferred to overdue receipts in the payment journal entry that is created as a result of this.

The amount owed will go down after payment is received. Account receivables are asset-based, and the account is credited when the assets decline. The funds until reconciliation, which is debited, will be the counterpart account "outstanding receipts."

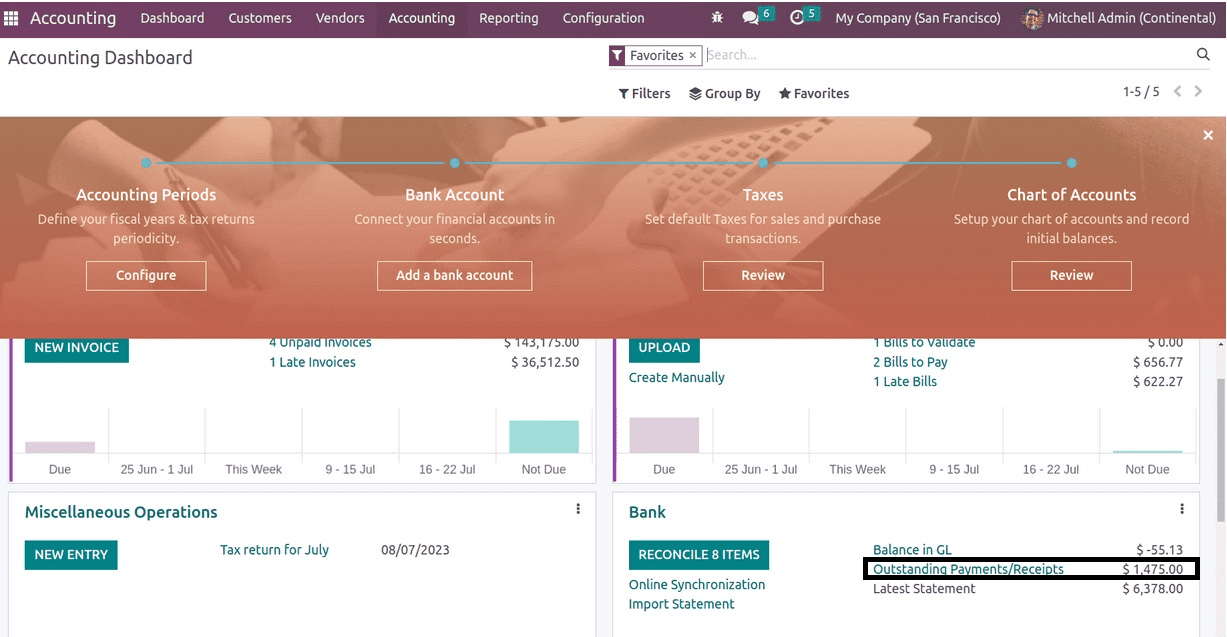

The following action is to either prepare and reconcile a bank statement or obtain one from the bank. Now let's take the accounting dashboard and construct a statement line. This time, the outstanding receipt amount will also be displayed under the bank journal on the accounting dashboard.

A corresponding journal entry is made between the bank account and the bank suspense account when a statement line is created.

Since the consumer has deposited money into the company's bank account, the bank account gets debited in this instance. As a result of the asset increasing and the account being debited, the amount in the bank account will rise.

Reconcile the Odoo payment log and the statement at this point. The statement is verified by clicking the validate button, and the reconciliation is finished.

Upon reviewing the journal item, you will notice that the overdue receipts account has taken the position of the bank suspense account.

As a result, the invoice status changed to PAID.

We have now covered the posting of ledgers at every stage of the purchase and sales process. This has shown us that the continental accounting expense is impacted either at the time the purchase bill is created or when the charge is recorded.

To read more about continental accounting in Odoo 16, refer to our blog An Overview of Continental Accounting in Odoo 16