Taxes are an unavoidable factor while running a business, as the governing bodies are implementing new versions day by day the organizations should keep and cope up with it. The tax allocations of the various governmental needs should be effectively implemented in the business and the returns are to be filed mandatorily. With the implementation of environment and luxury taxes, the countries are in a run to gather funds for projects from the various organizations for their profits. Taxes are also being implemented based on the occurrence of natural calamity to illustrate various countries have implemented flood cess and taxes on the products and services available to obtain funds for the budget of rehousing, building of barriers and bridges, etc. The import and export taxes are unavoidable in the case of international business countries of destination and pick would charge the companies and consumers on the same basis.

Implementing all these options and taxing methodologies into a business is atiredsom task and managing as well as monitoring each may take a toll on the employee's working hours. With the change in time companies tried to automate their business management for effective and efficient operation which reduced the load on the management. Enterprise and resource planning software(ERPs) seemed to do a good job in this scenario. This led to the boom of various Erp's development to manage all the operations of a company. Many lacked the advantage of adaptability and flexibility to existing business methodologies. Moreover, the affordability and reliability factors of these seemed to be not up to the mark and standards.

Odoo is one of the best ERPs available in the market these days seemed to have an edge of advantage over its competitors. Odoo is often responded as the one-stop solution for all the business needs. Since Odoo operates from a single platform the operations can be unified and managed from a single system. Furthermore to the advantage, the platform has the feature of customizability held high allowing various business organizations and methodologies to be implemented in Odoo. In addition, the platform allows third-party source integrations which permit the use of existing systems and equipment in business with Odoo. The cost of implementation and the maintenance charges of the Odoo platform is a much more affordable company to its competitors in the market.

Extra taxes in Odoo

Taxes being an unavoidable part and parcel of any business they should be effectively managed and monitored to cope up with the governmental needs of the organization. Odoo platform allows the users to create taxes of any norms irrespective of the country or the region but it should be compatible with the governmental regulations. Taxes such as environmental, luxury, and another natural calamity cess can be added to the platform and managed effectively. The payable and receivable tax amounts and details are recorded separately in the database of the Odoo software, therefore, helping the users at the instance of filing taxes to the concerned authorities. Each tax can be allocated separately to the products at the instance of entering them into the database. The exception of taxes can also be made on the platform.

Create a tax in Odoo

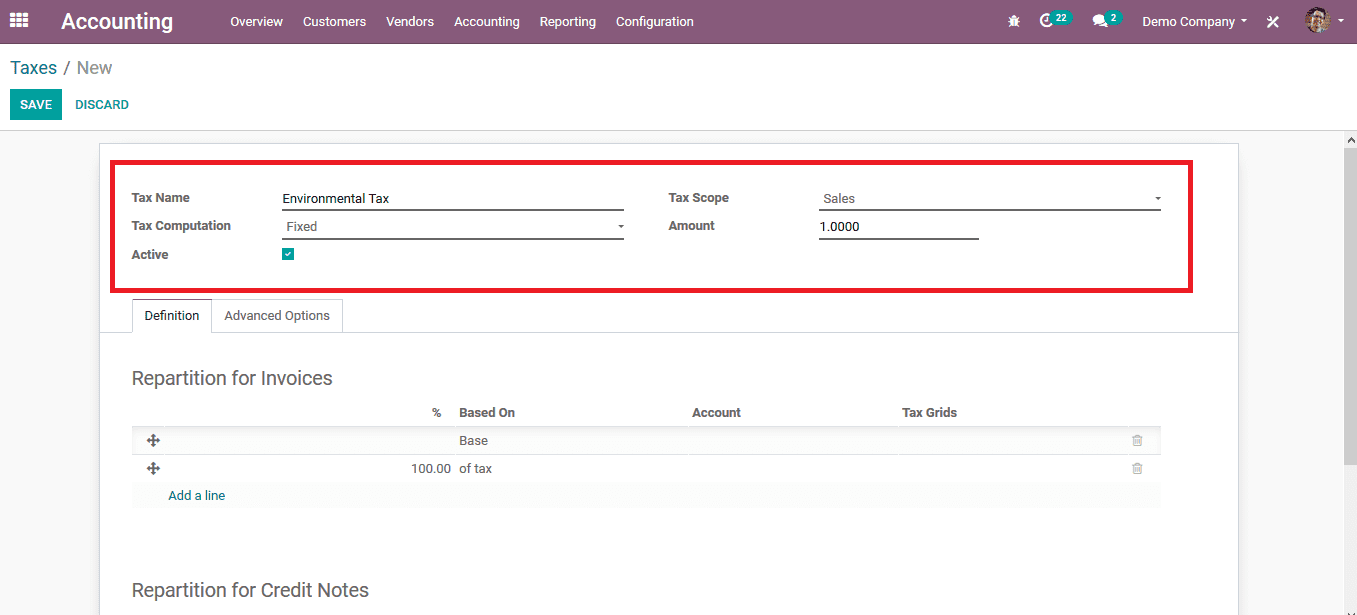

To create a tax in Odoo the user can navigate to the accounting module of the database and select the tax menu available in the configuration dashboard. The user can now view all the taxes available in the database while in the taxes menu. He/ she can choose to edit the existing one or can create a new one by selecting the create option available. On choosing to create a new one the user will be depicted with the window as shown in the below image.

Create a tax name and provide the computation details along with the amount of the tax if chosen fixed. To activate the tax in the database enable the active option available.

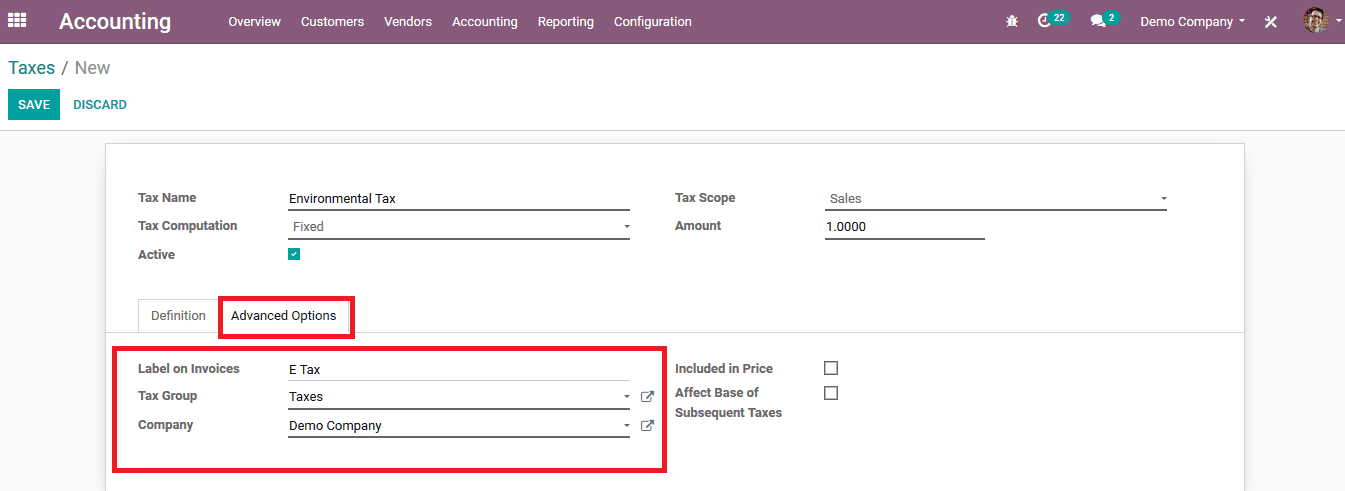

In the advanced options menu, the user can provide a label for the respective tax and allocate the Odoo taxes group.

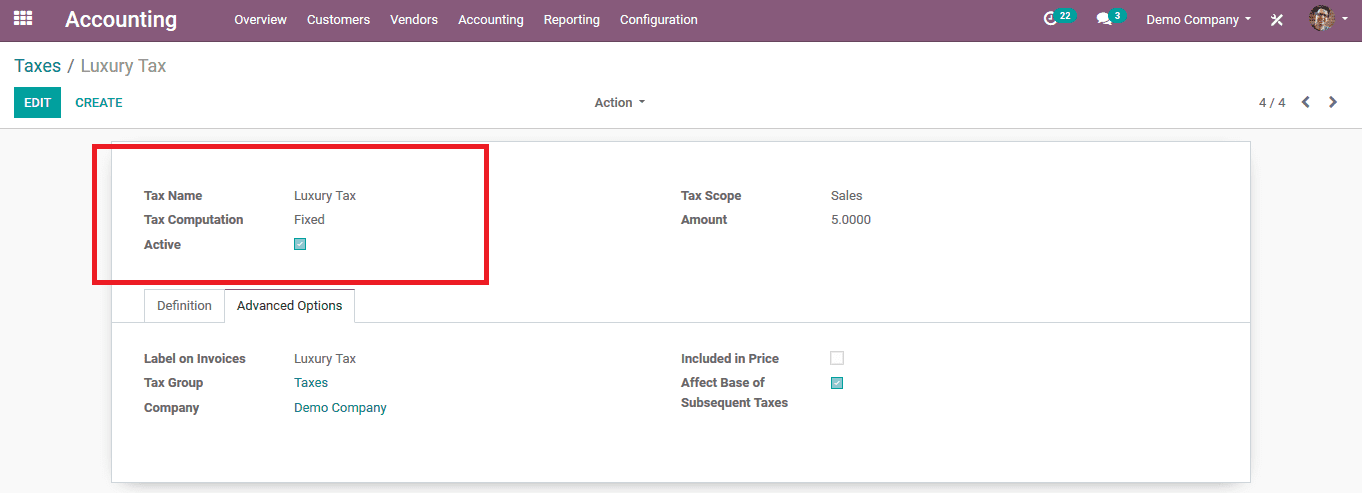

To illustrate how the operation of taxes works in Odoo another tax is created with the same methodology.

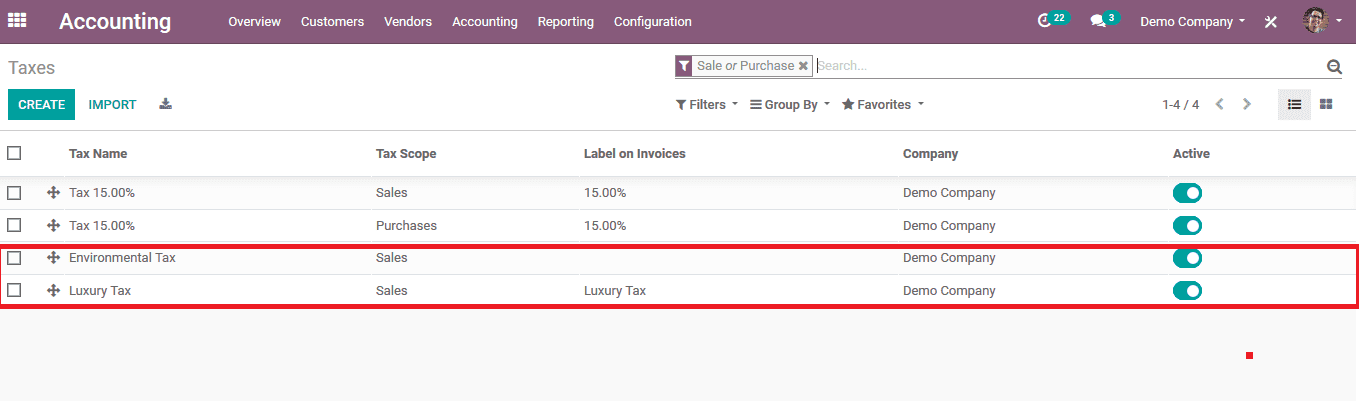

Back in the taxes menu, the user can view all the taxes allocated with the platform. It is to be considered that the order in which the taxes are calculated based on the listing available on their menu. The user can change the order of the listing by dragging them in the menu and positioning them in the respective order in which it's required.

Allocate taxes for a product

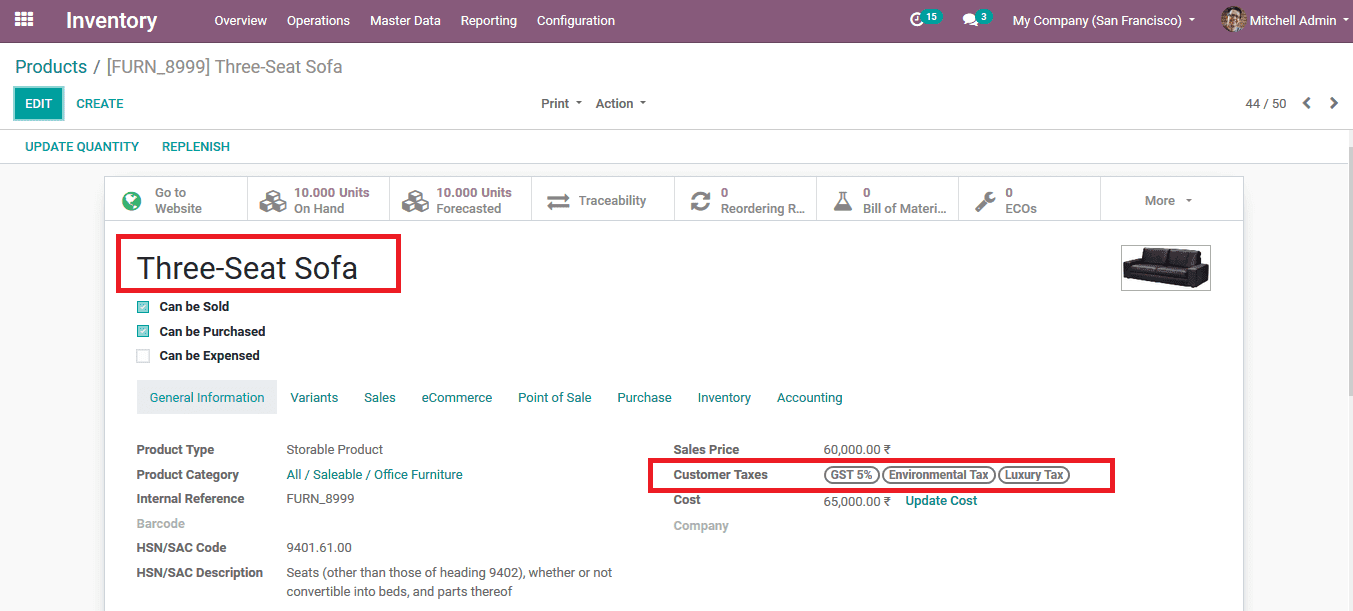

As the taxes are being described in the platform it can be allocated to the respective products in the product menu. In the inventory, the module selects the products menu from the master data dashboard. The user will be depicted with all the products available on the platform of the company. Select the product available or create a new one by selecting the create option available. Allocate the taxes to the product in the customer tax option available in the general information menu. On providing the details the user should save the product description.

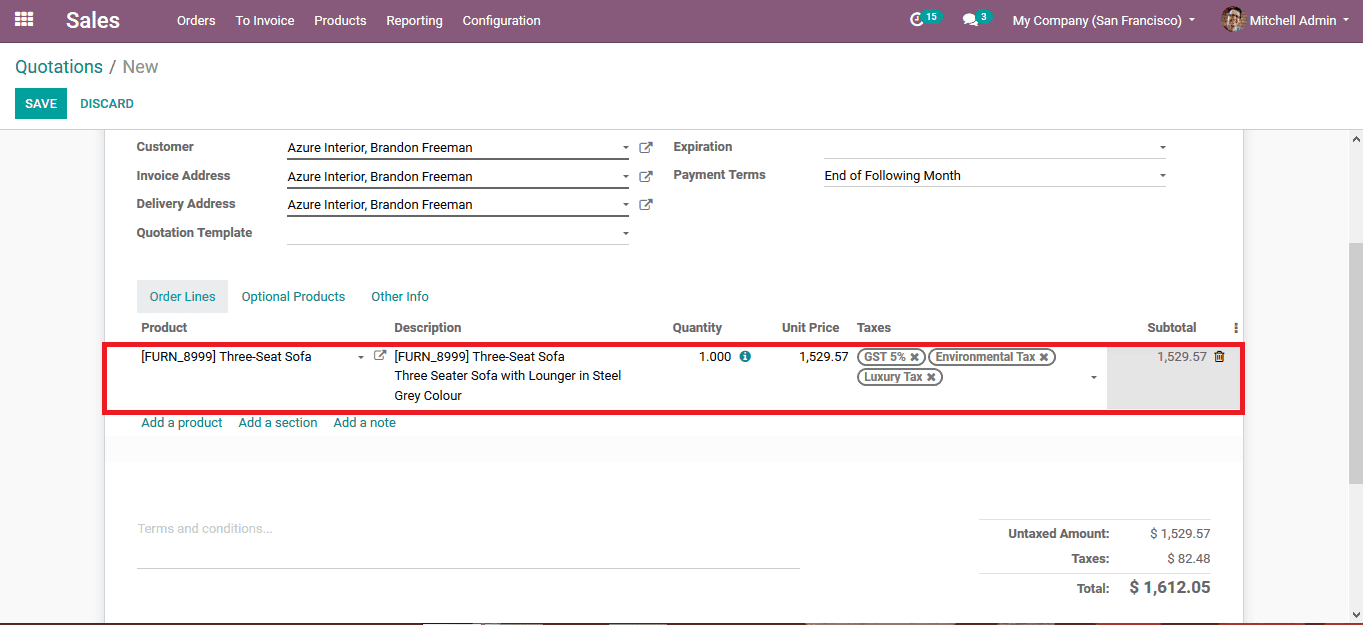

To showcase how the taxes are being indicated let's create a new sales quotation in the sales module. Provide the customer details and allocate the respective product to the quotation on which the taxes allocated will be listed out under the tax icon available in the order lines description. The taxes allocated will also be calculated and the amount of taxes will be illustrated along with the total amount of the quotation.

The provision to add taxes in Odoo allows the users to standardize the costing methods based on the regional governmental protocols and helps the users at the instance of filing them to the authorities.