In accounting, deferred release is the sum of money that a business receives from clients in advice for any goods or services that are sold but have not yet been delivered or finished. We are unable to record this amount in the company income account since the money has not yet been learned and is still being received. The status of this revenue or income cannon be altered until the delivery or service is finished. After declaring the sum as a liability in accounting, it would be feasible.

Let's examine the Odoo 18 Accounting module's handling of referred income.

From the Odoo 18 main dashboard, you may choose the Odoo 18 Accounting module. The option to manage the deferred release is located under the Settings of the module when you check it out.

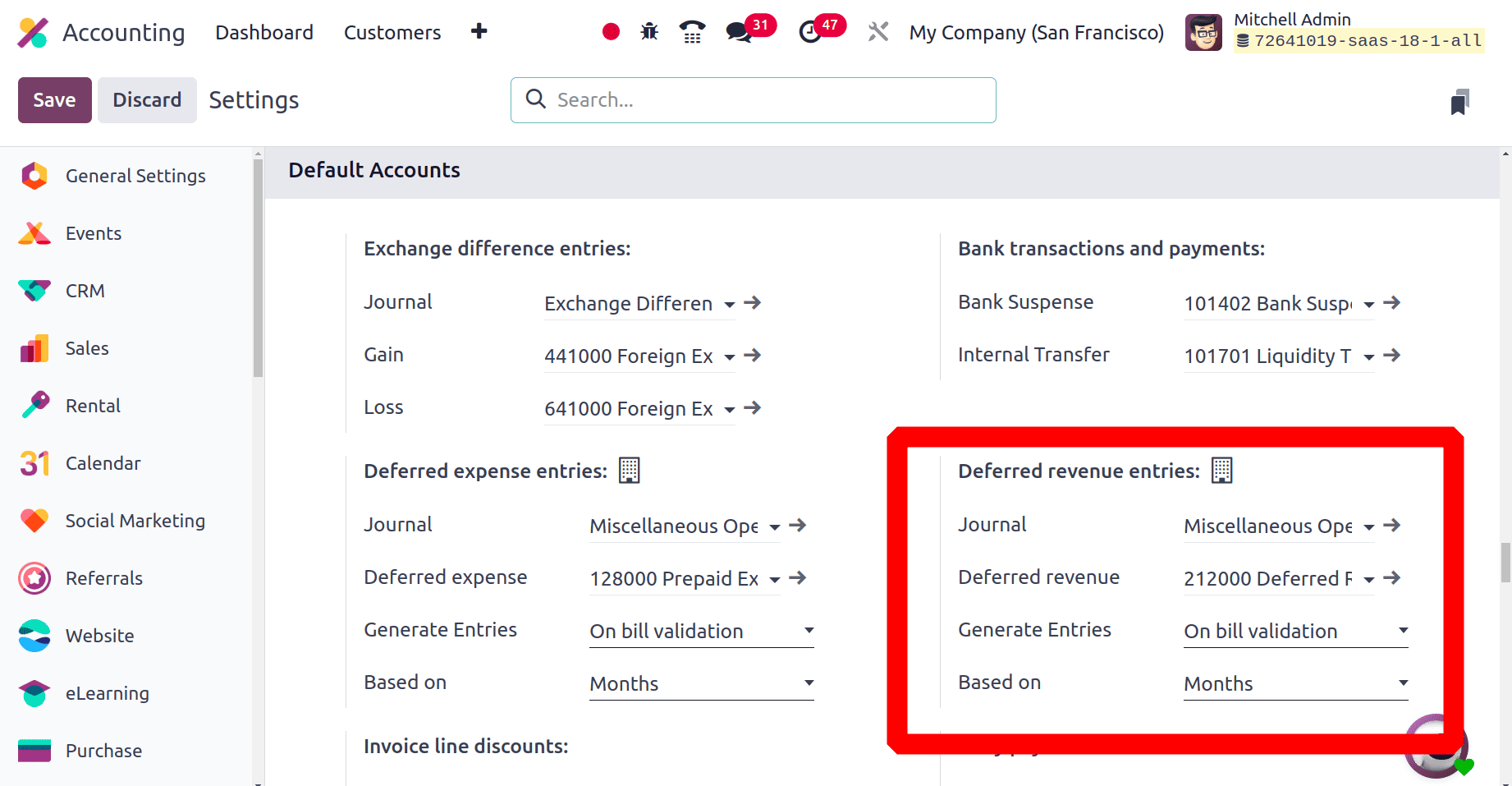

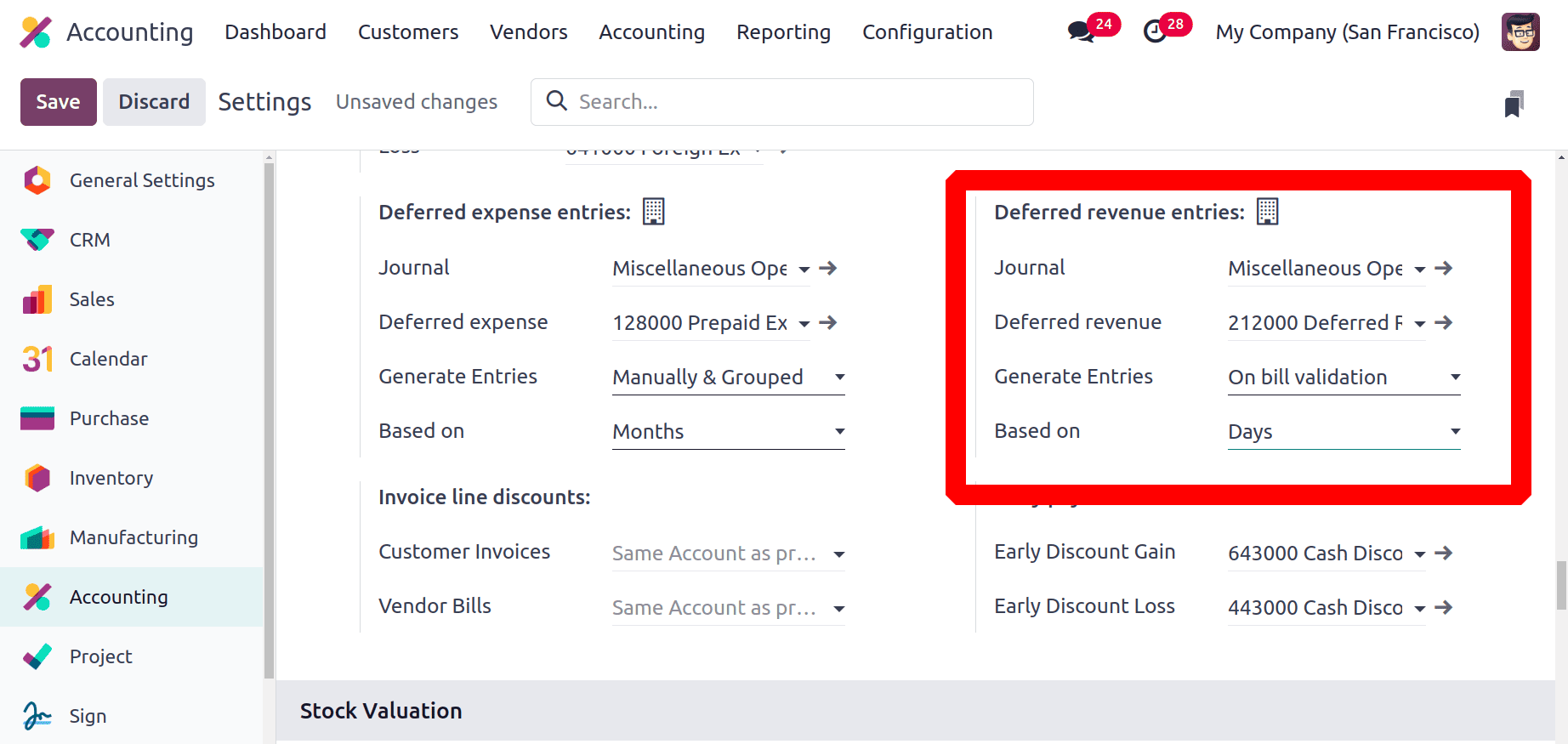

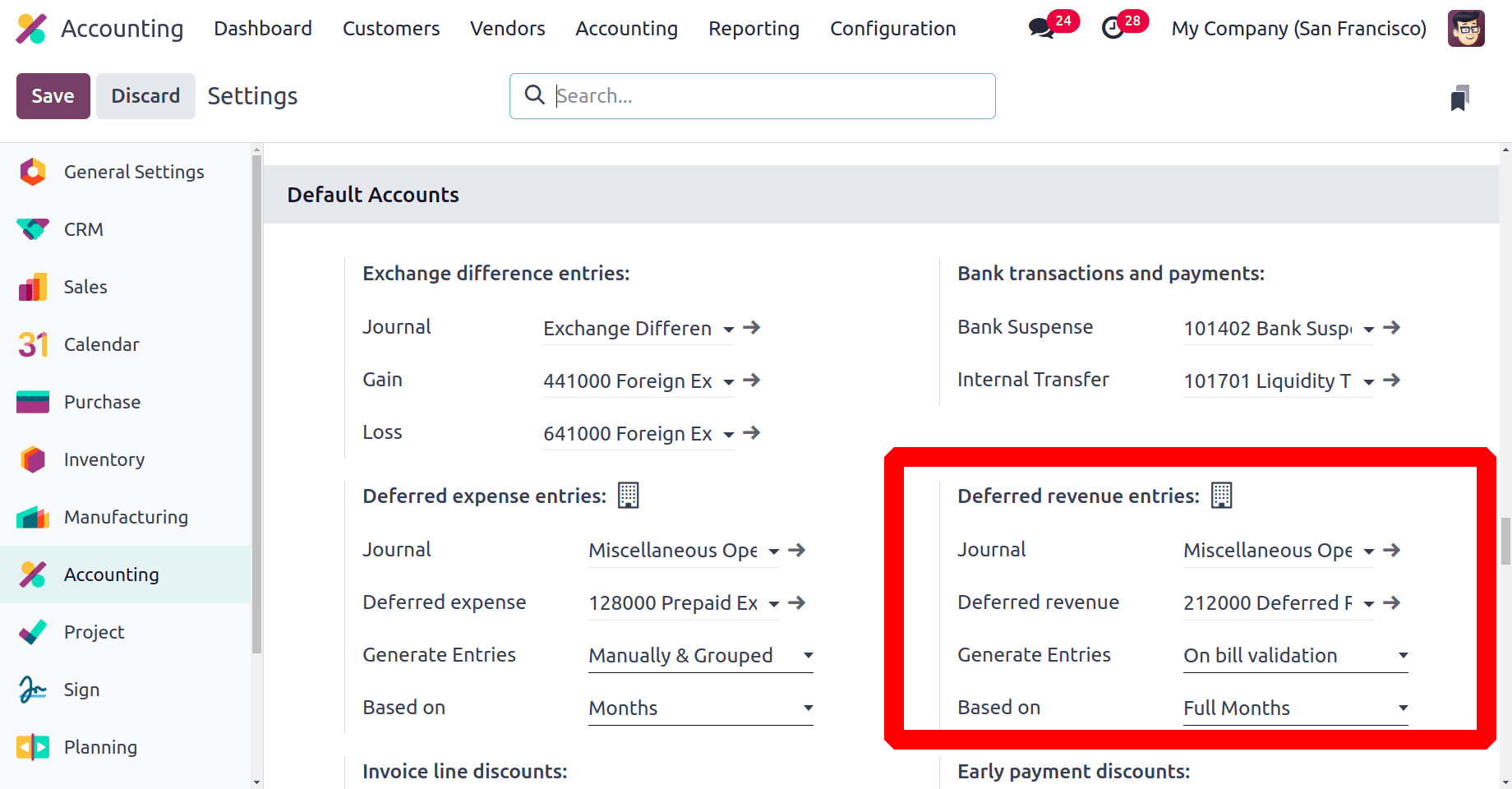

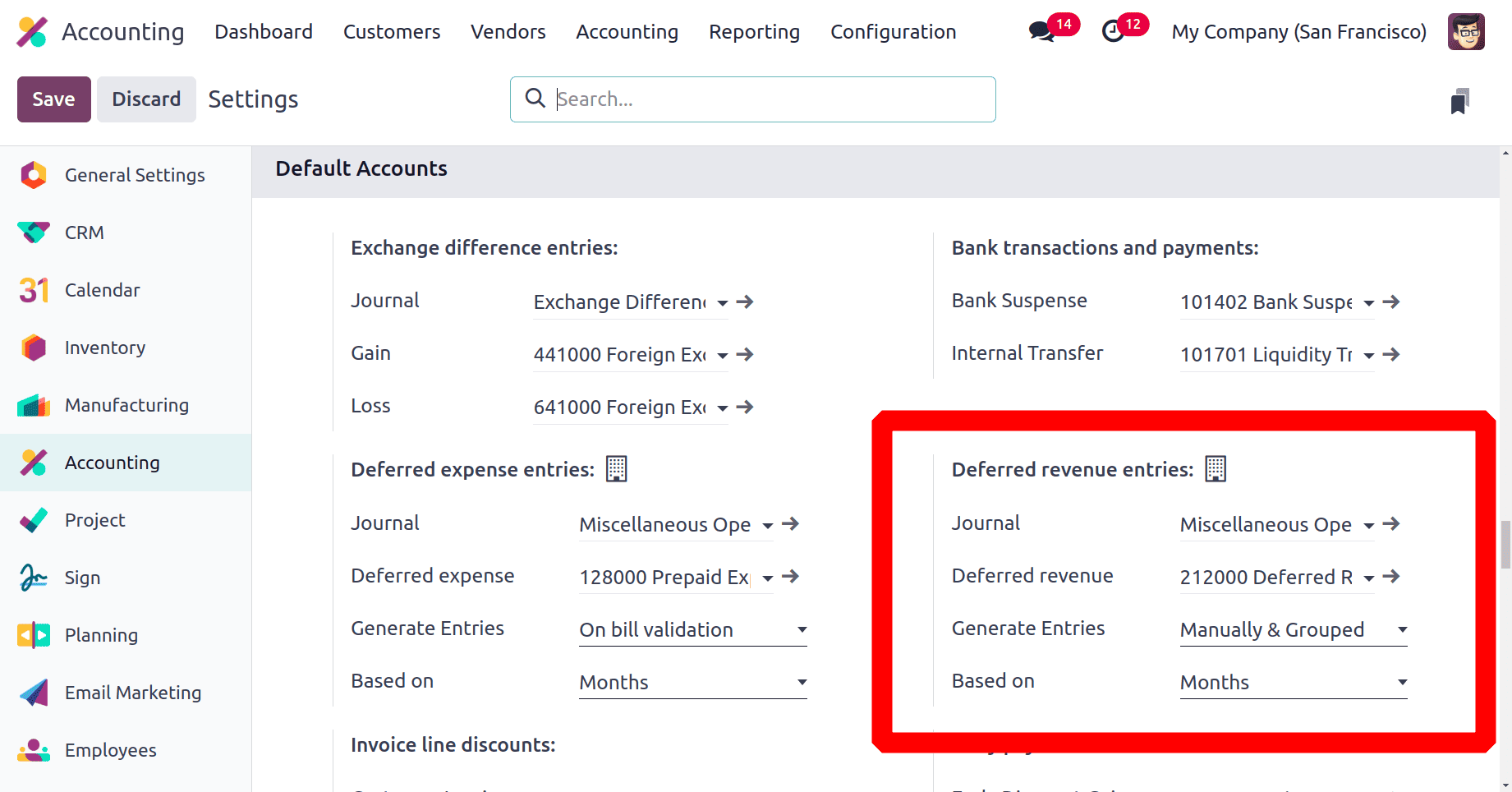

In Accounting Settings, there is a section called Default Accounts. In this section, all the default company accounts are show. The Deferred revenue entries are shown as seen in the screenshot bellow.

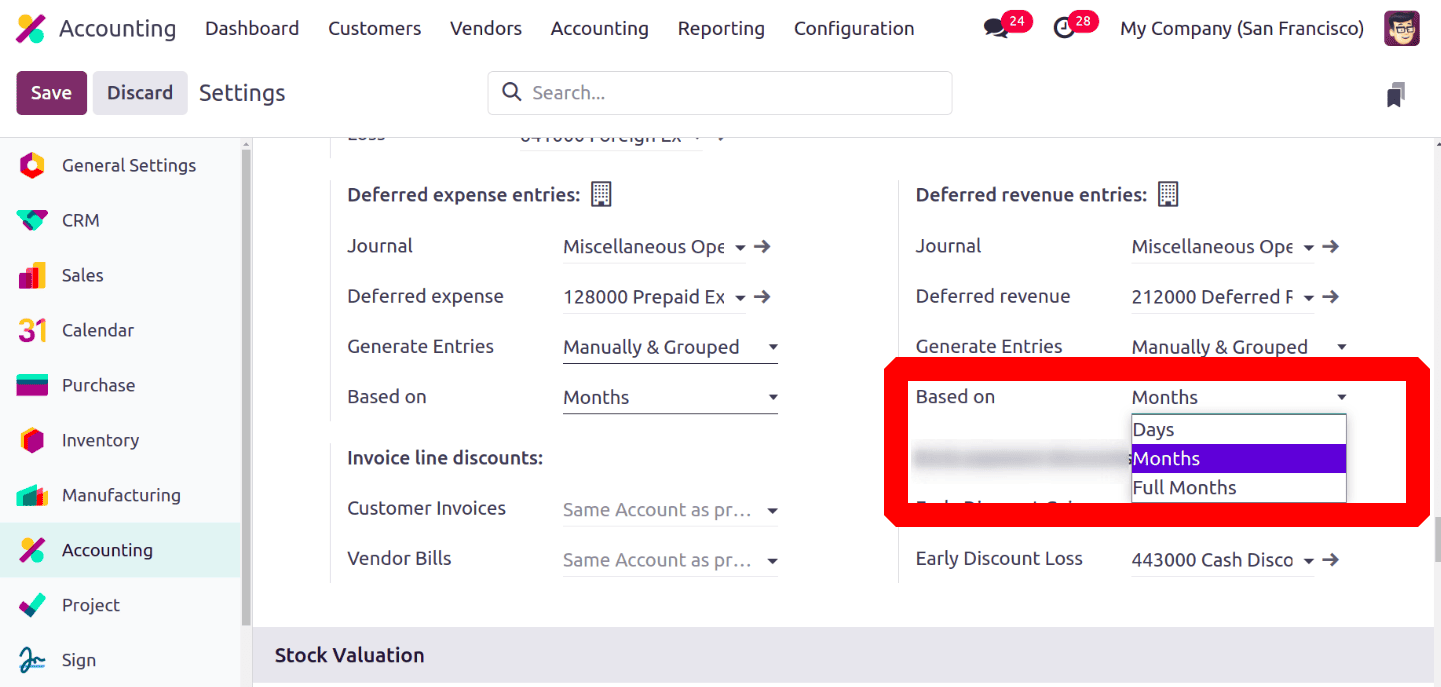

The journal for deferred entry and Deferred Revenue account are given there. Deferred entries can be generated either on bill verification or Manually & Grouped. Entries can be calculated based on Days, Months, and Full Months.

Generate Entries On bill verification

While the deferred entries generate entries as Bill validation, the deferred entries will automatically generate on the confirmation of a bill.

* Based on Months

Let's consider we have a customer who takes a subscription plan from the company. So let's create a new invoice. To add a new invoice, choose the Invoice from the Customer menu. A list of invoices with details like reference, Customer, Invoice Date, Tax Excluded, Total, and Status. Click the New button to add a new one.

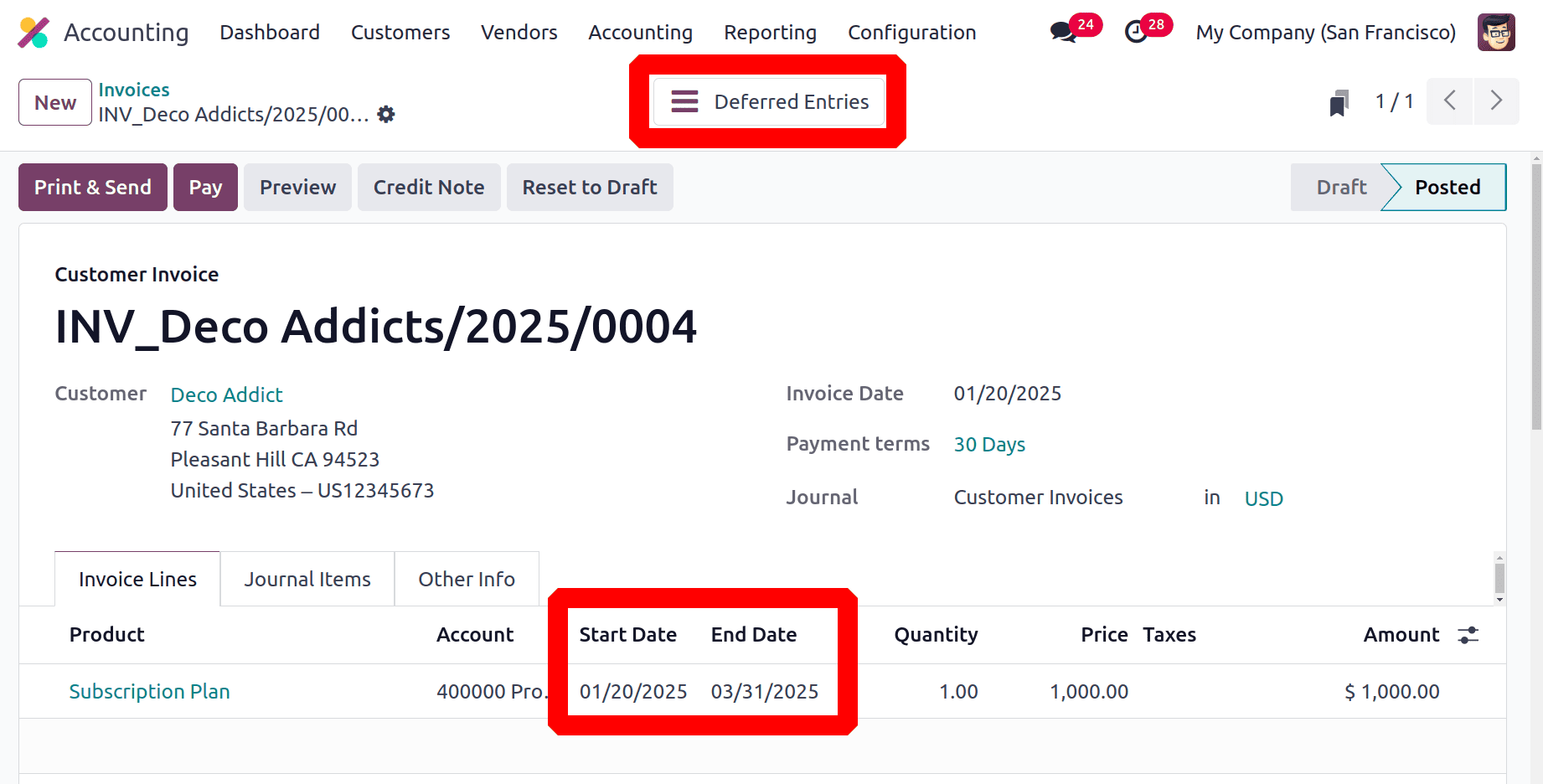

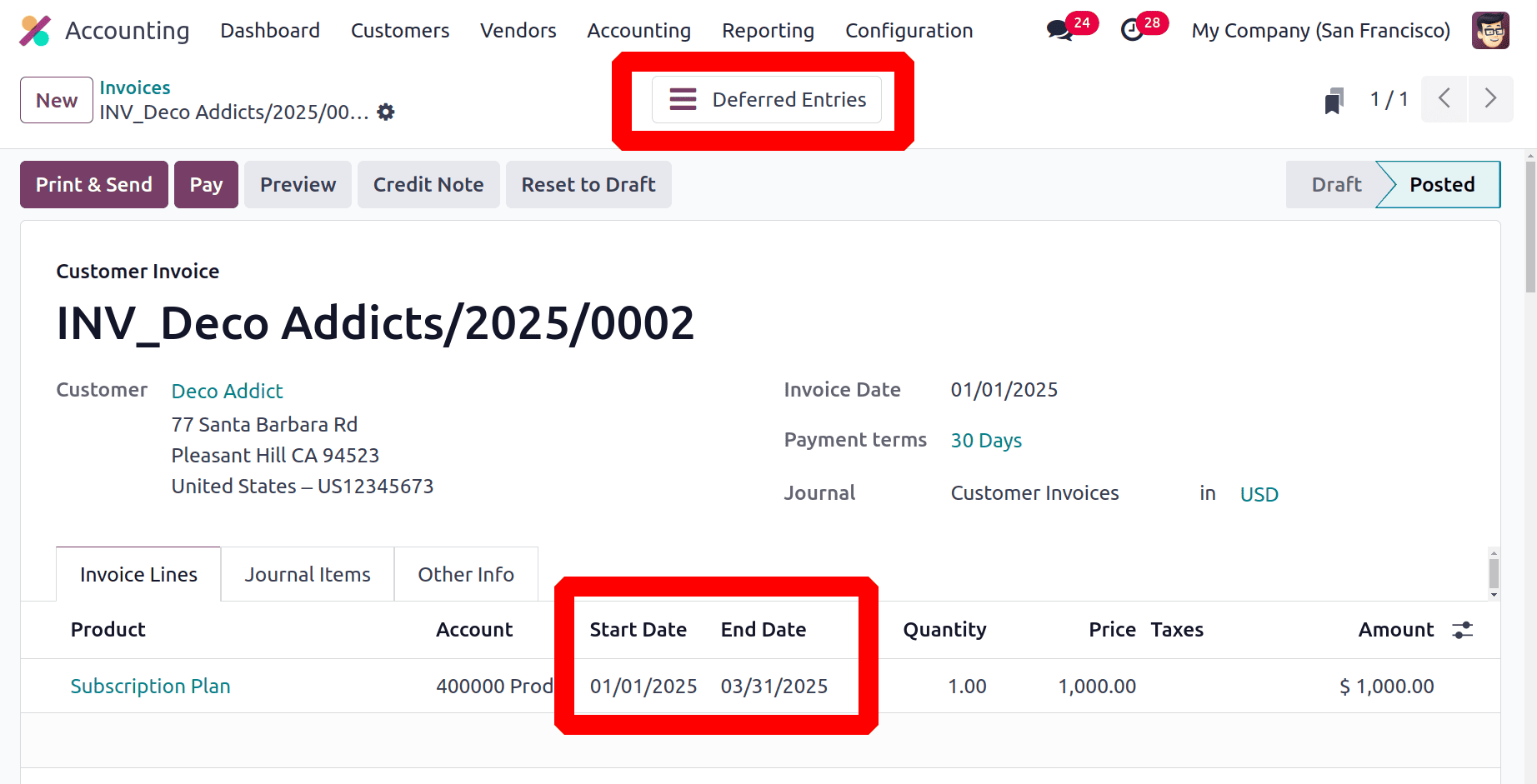

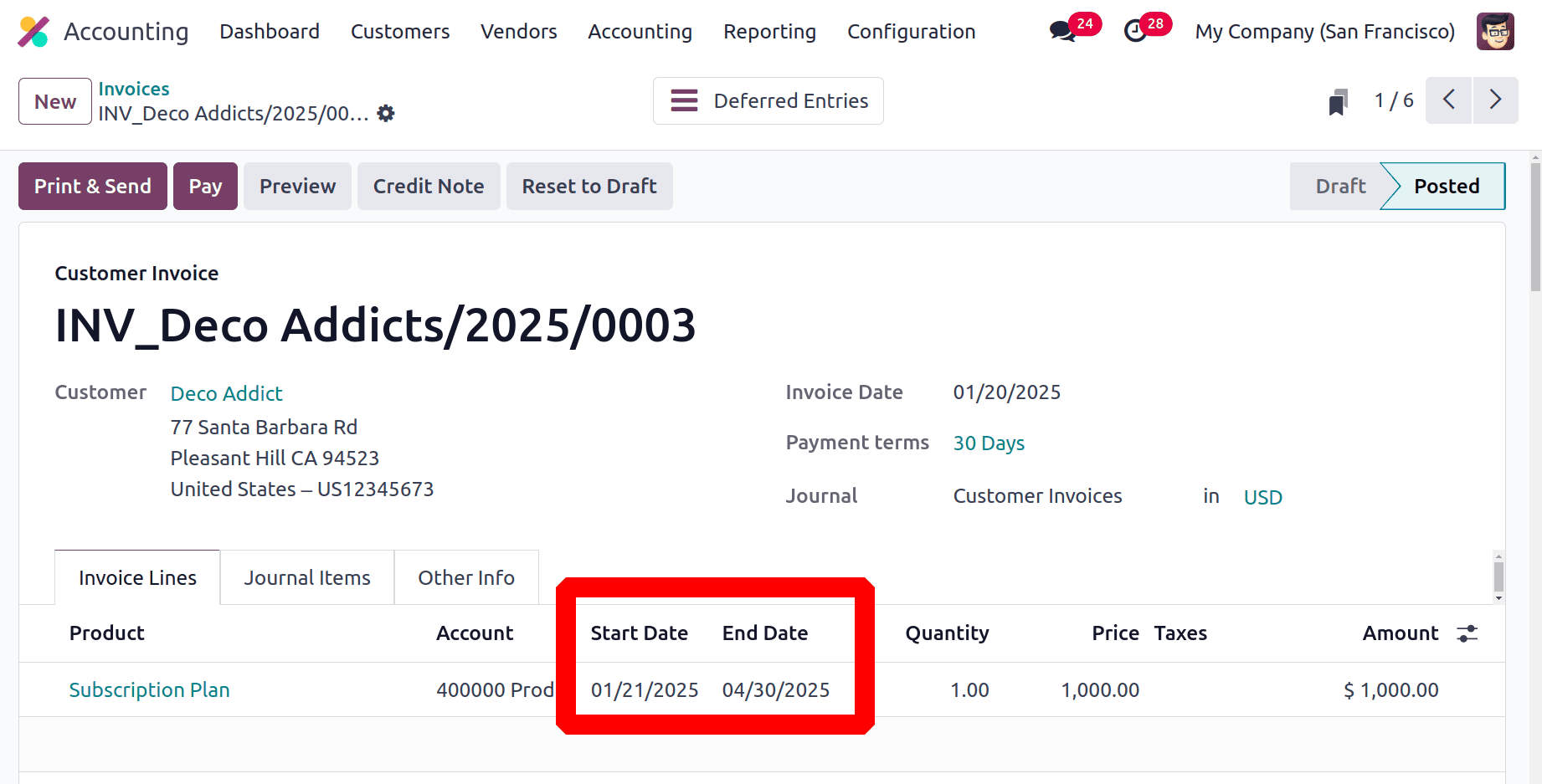

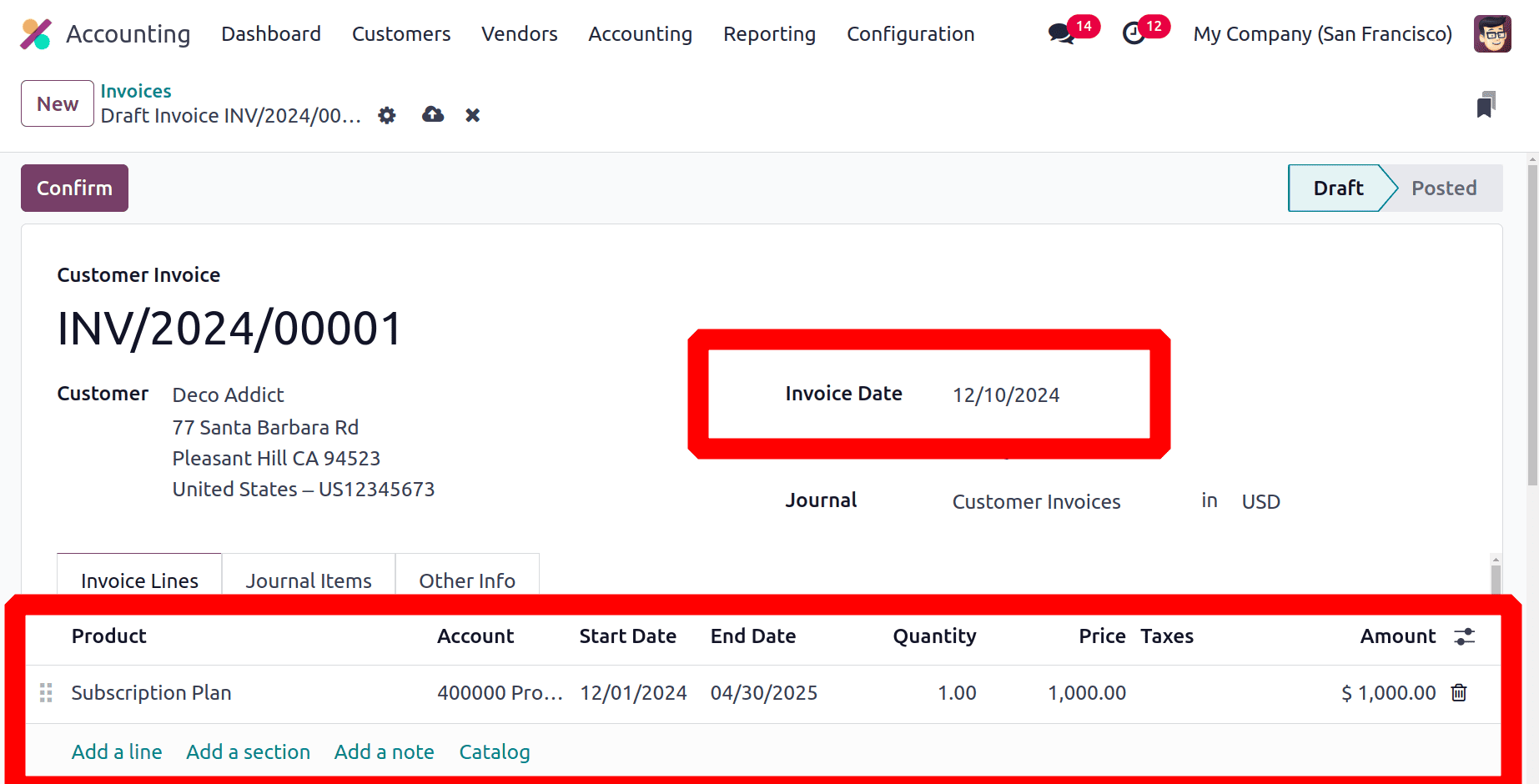

Add the customer name first, then add the invoice date, payment terms, Journal, etc., the invoice line used to add the product with quantities. Also, the Invoice line contains two fields named as Start Date and End Date. That start date and end date show the dates of the referred entry.

The screenshot below shows that the customer Deco Addicts store the service product Subscription Plan. The date is from 01/20/2025 to 03/31/2025. So let's confirm the invoice to view the entries.

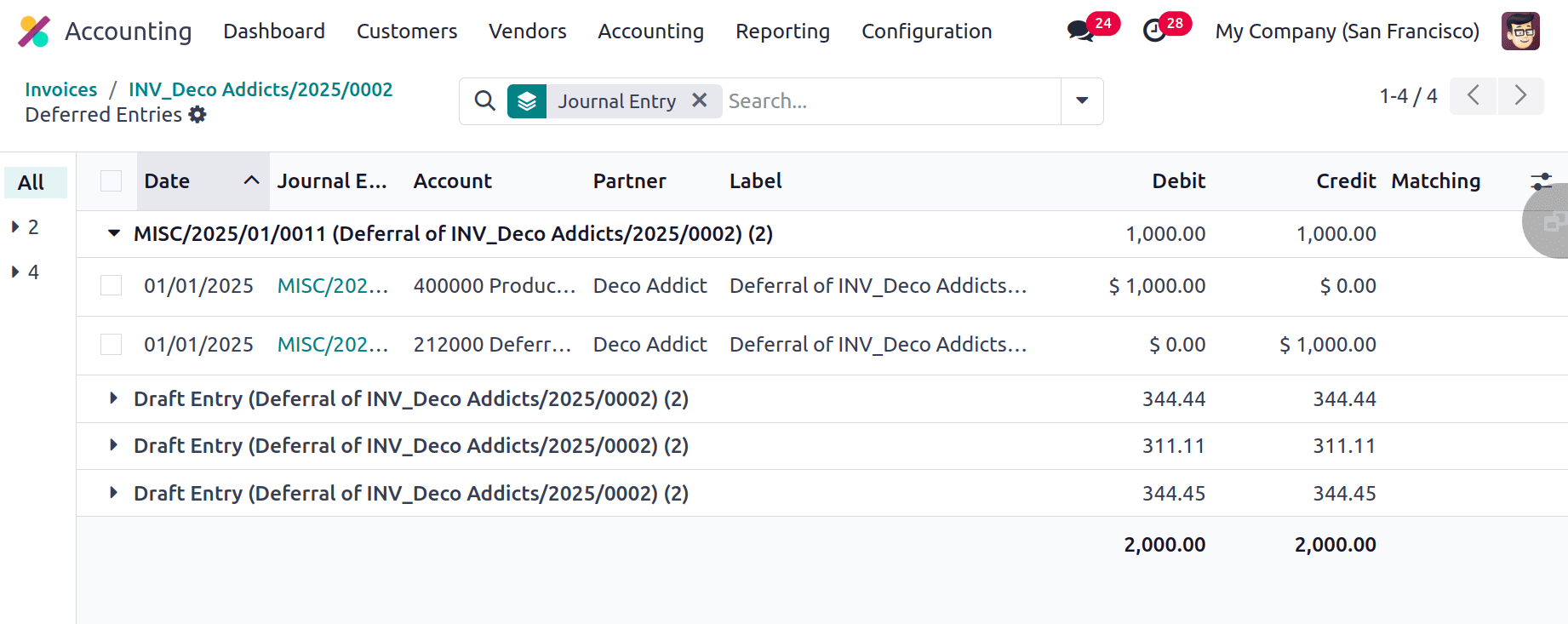

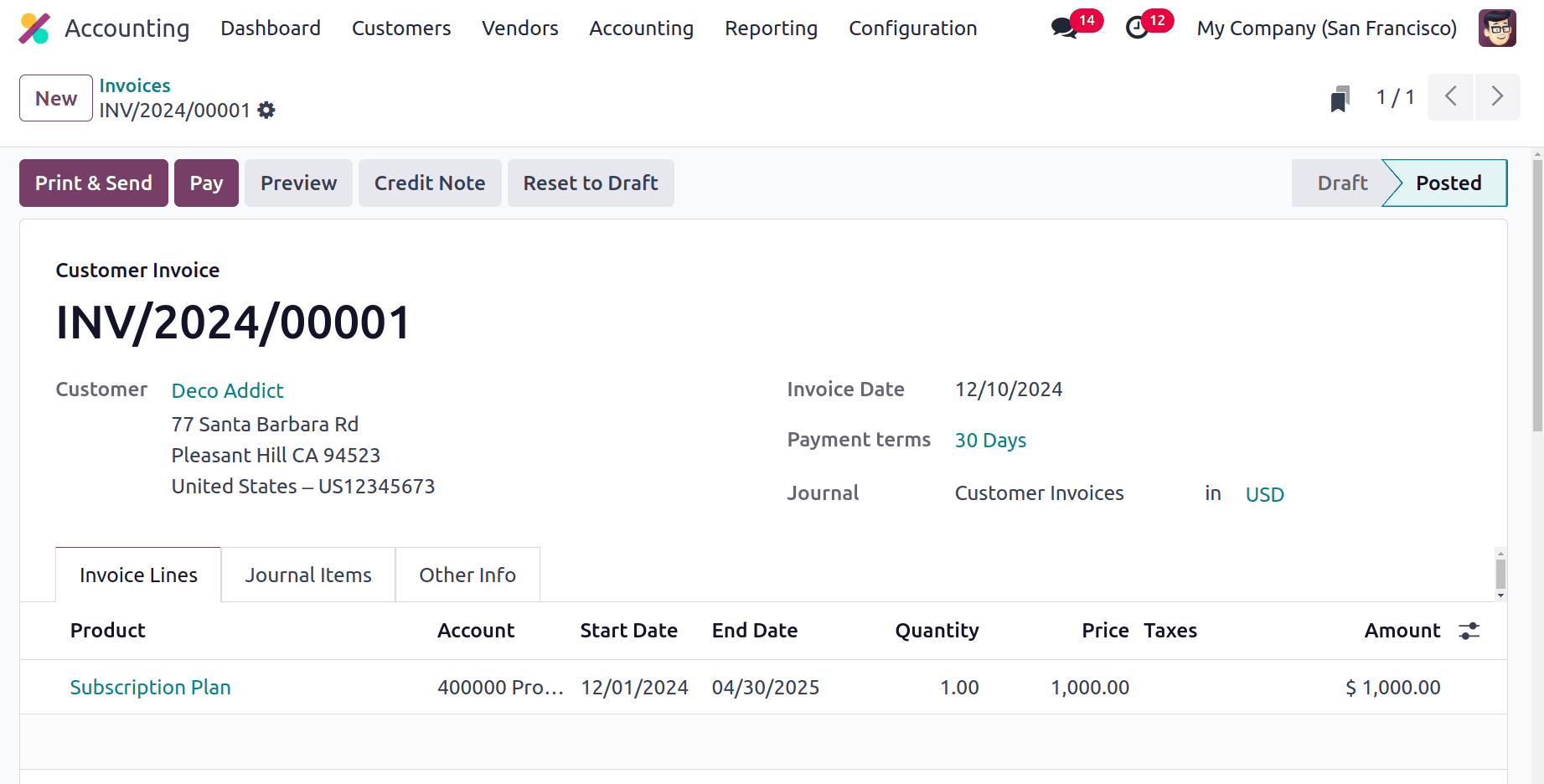

After the confirmation of the invoice, it shows a new smart tab named Deferred Entries, as show above. To view the deferred entries, click on the smart tab.

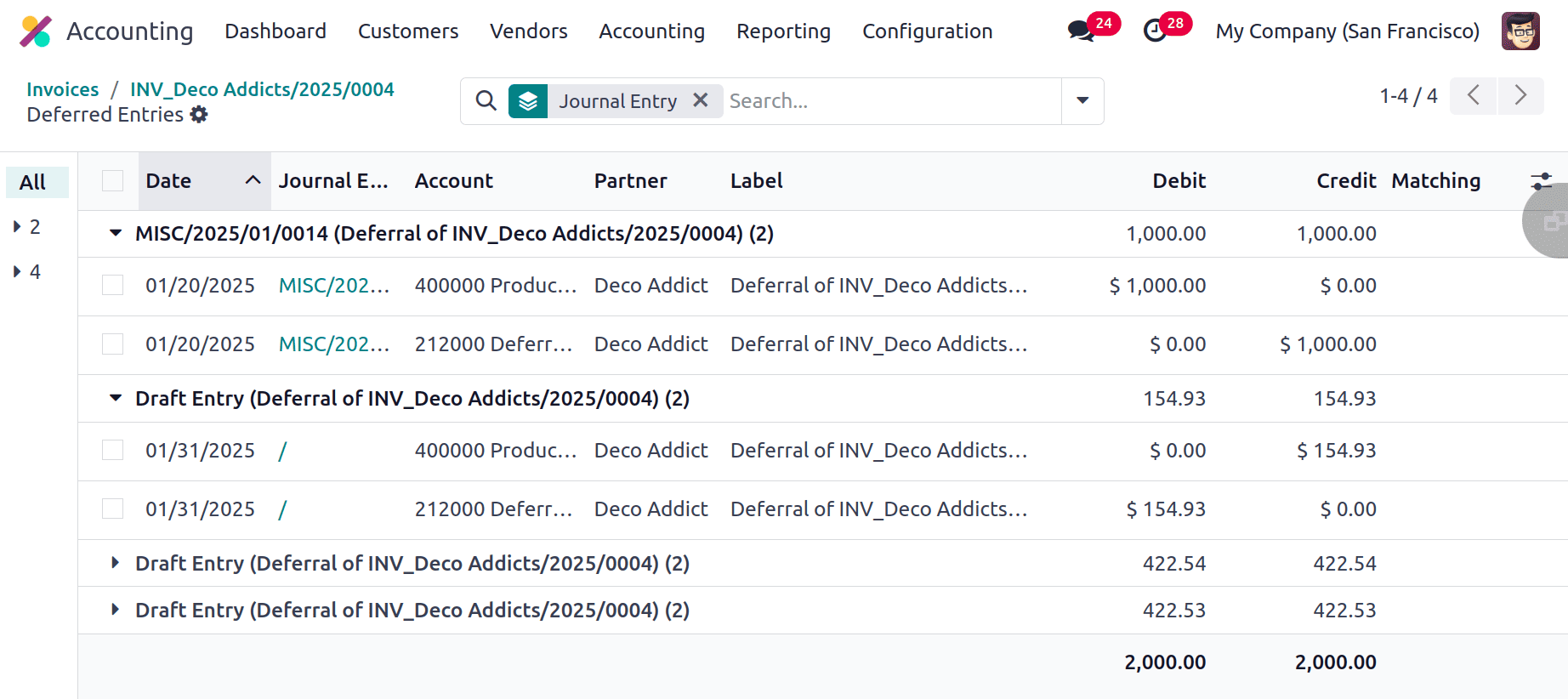

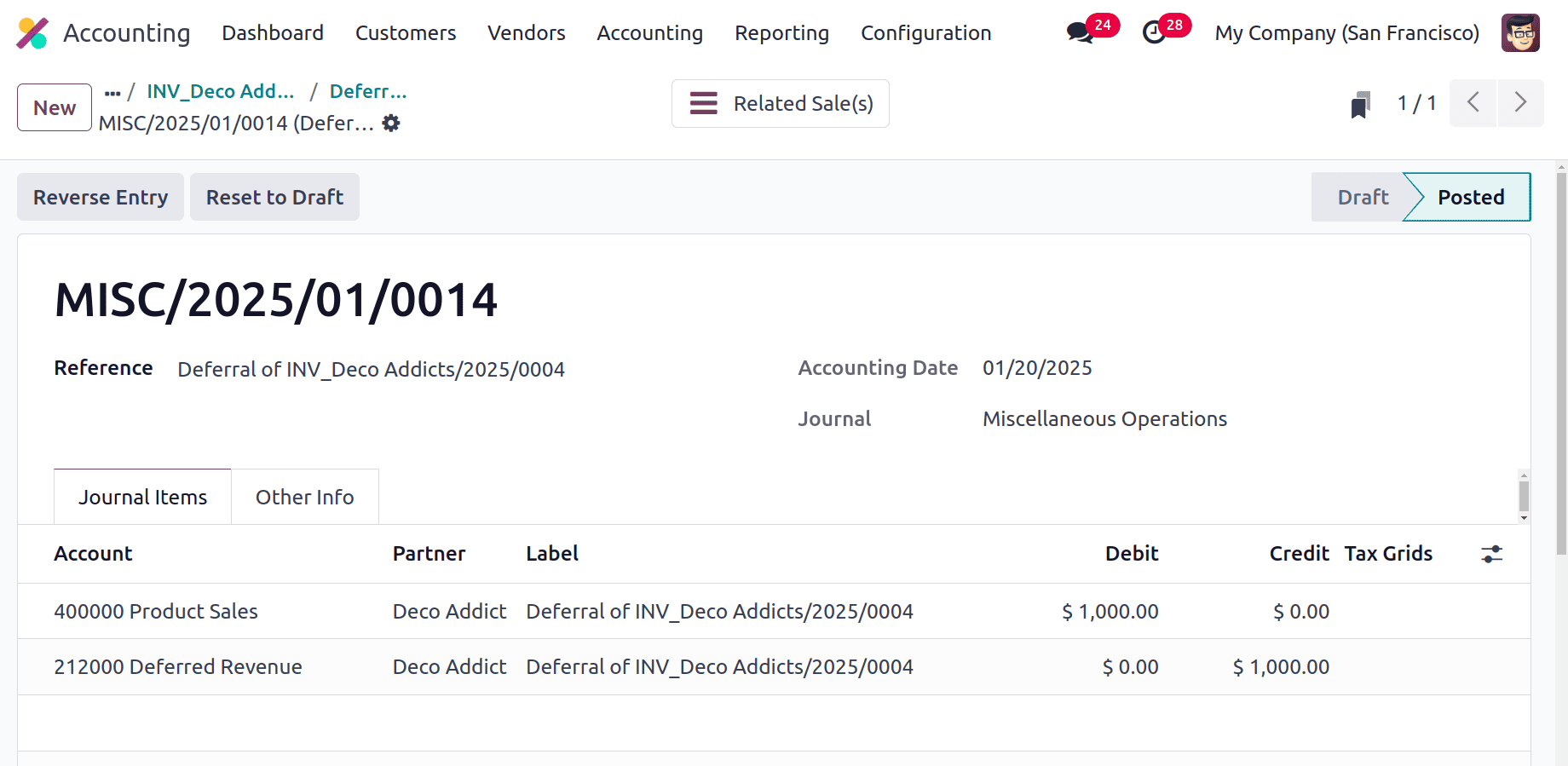

The first entry shows two accounts. The first one is Product Sales, which is an income account. In the case of deferred release, the Income is decreased, so the Income account is Debited with the total amount. Deferred Revenue account is Current Liability, here the liability increases, so the account is credited.

Here, the Deferred Revenue is created for 3 months (January to March) and considers 30 days as a month. The total amount is $1000. But the start date is set as January 20th. So the number of days in January is 11, which means that 11/30 = 0.36666667 months. So from the start date to the end date, there are 2.36666667 months.

Deferred Revenue per month = 1000/2.36666667= 422.535211208.

So each month $422.54 depreciated.

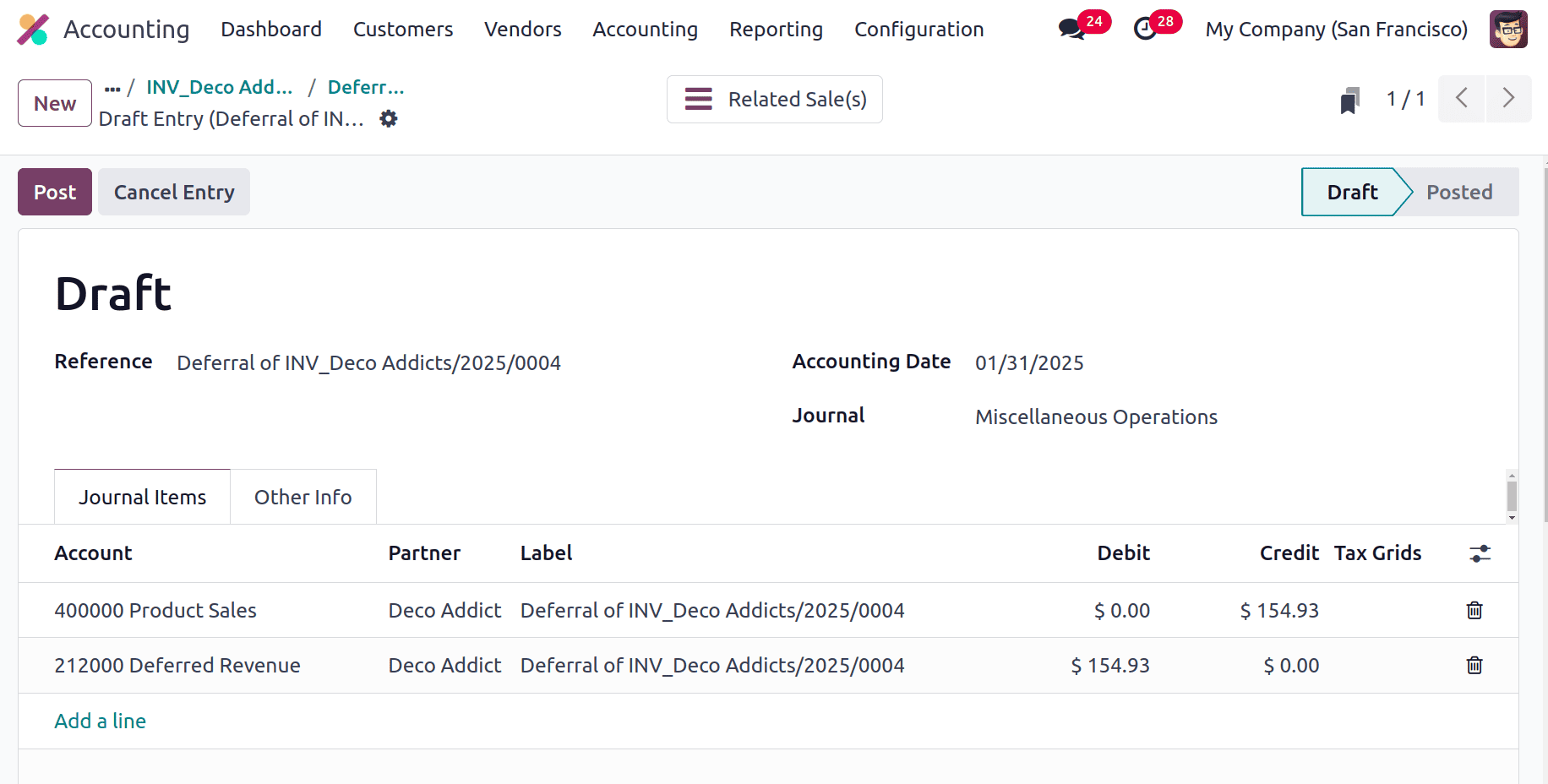

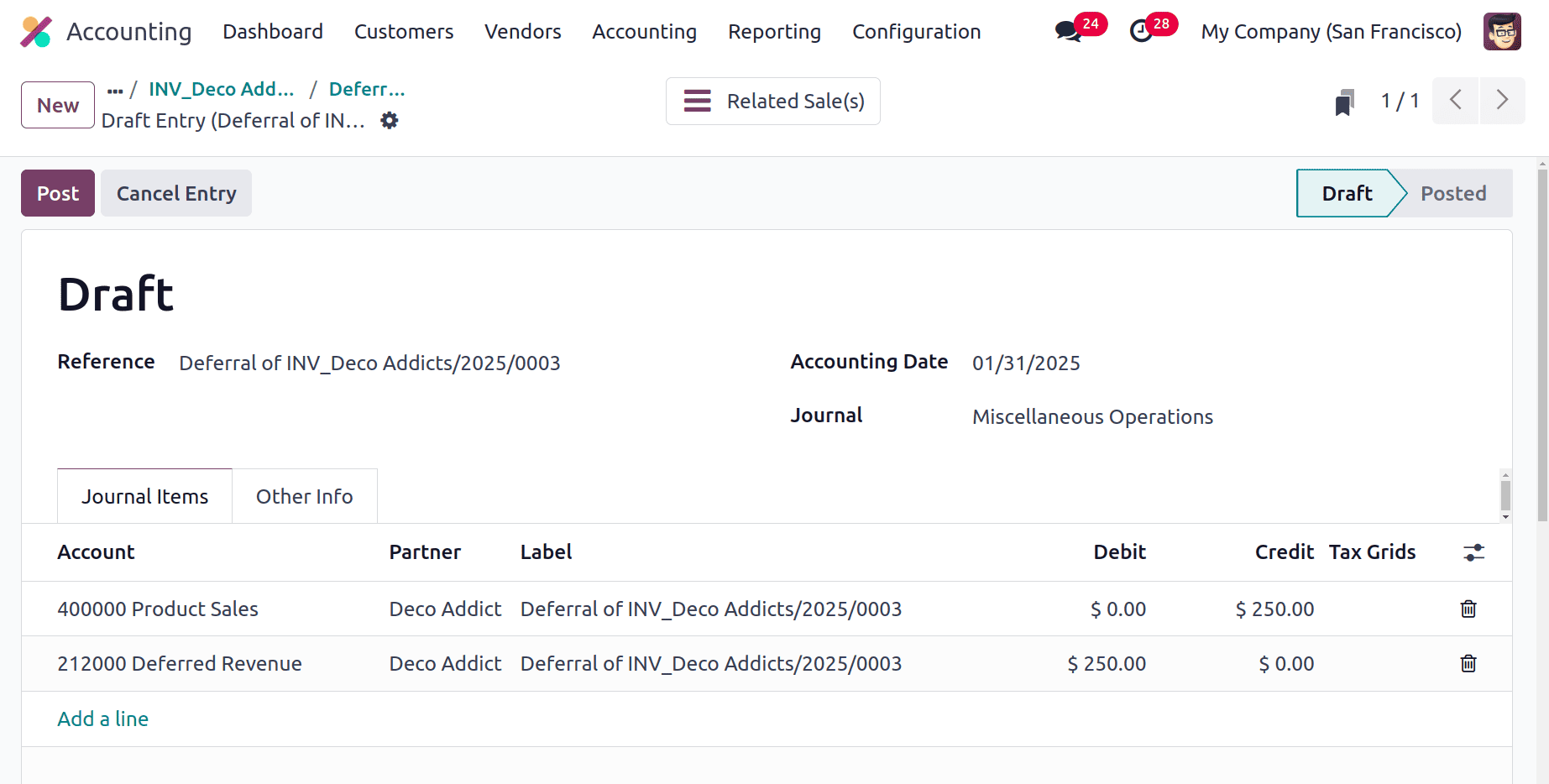

Let's check the journal entry. Here is the referred journal entry for January. The start date is set as January 20th. So the remaining number of days in January is just 11 days.

Deferred Revenue for January= (11/30) * 422.535211208 = 154.93.

January 31st is listed as the accounting date. The income rises and the liability falls each month. Thus, the sum was debited from the Deferred Revenue account and credit to the Product Sales account.

* Based on Days

While the deferred revenue is calculated based on Days, the calculation of entries will change. First, change the configuration as show below.

Then again create a new invoice. The customer is Deco Addicts and requested the same Subscription product. Add the start date and end date. The start date is set as 01/01/2025 and the end date as 03/31/2025. Confirm the invoice.

After confirmation, a smart tab named Deferred Entries will show in the upper portion of the invoice. Here the calculator happy on the basis of Days.

Deferred entries based on Days = Total Invoked amount / Total Number of Days.

Deferred entry for one day = 1000/90 = 11.111.

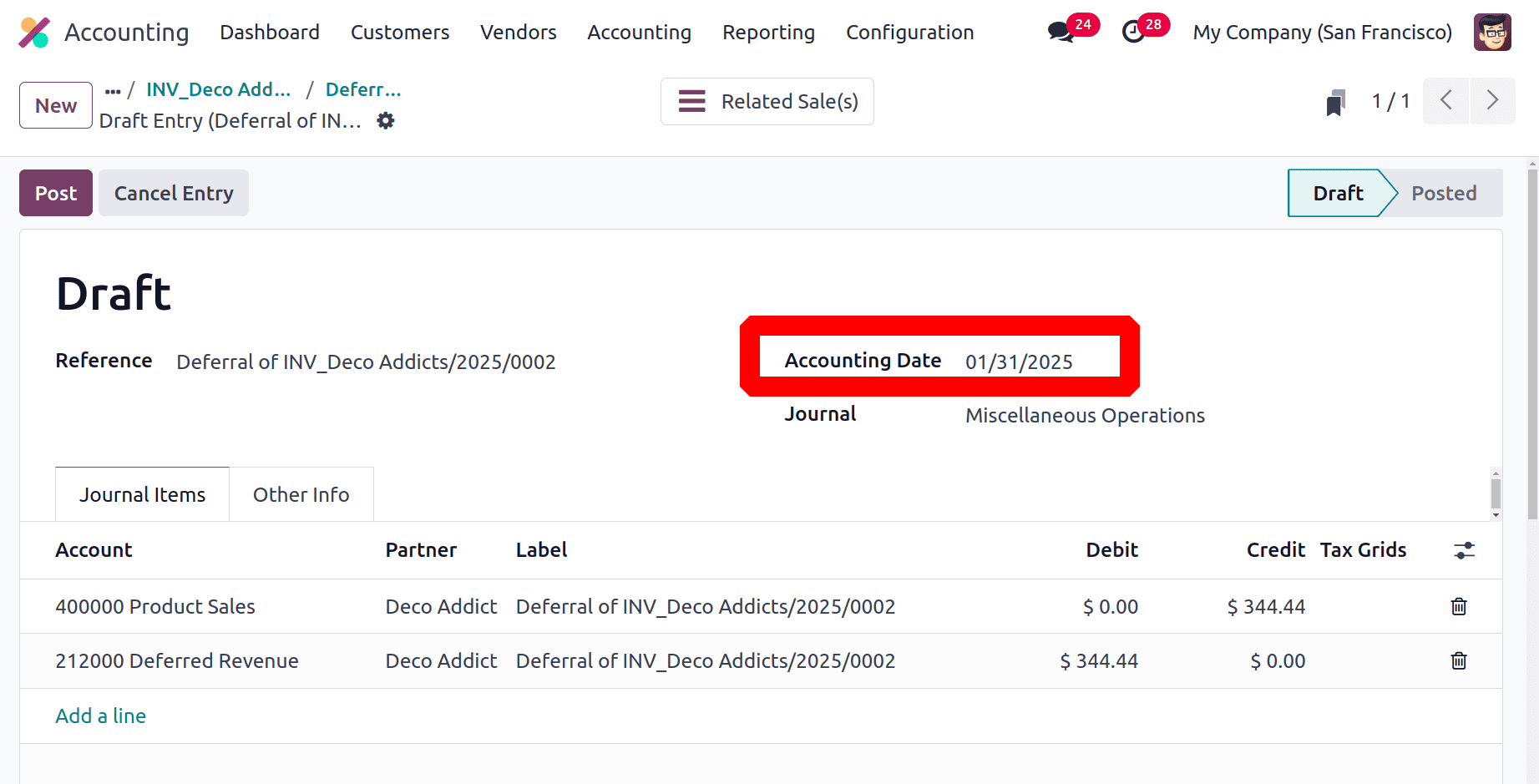

Open the entry created for the month of January. In January there are 31 days.

Deferred entry for January = 11.111*31 = 344.44.

So the deferred revenue amount for the month is debited on the Deferred Revenue. Click on the Post button to post the journal entry.

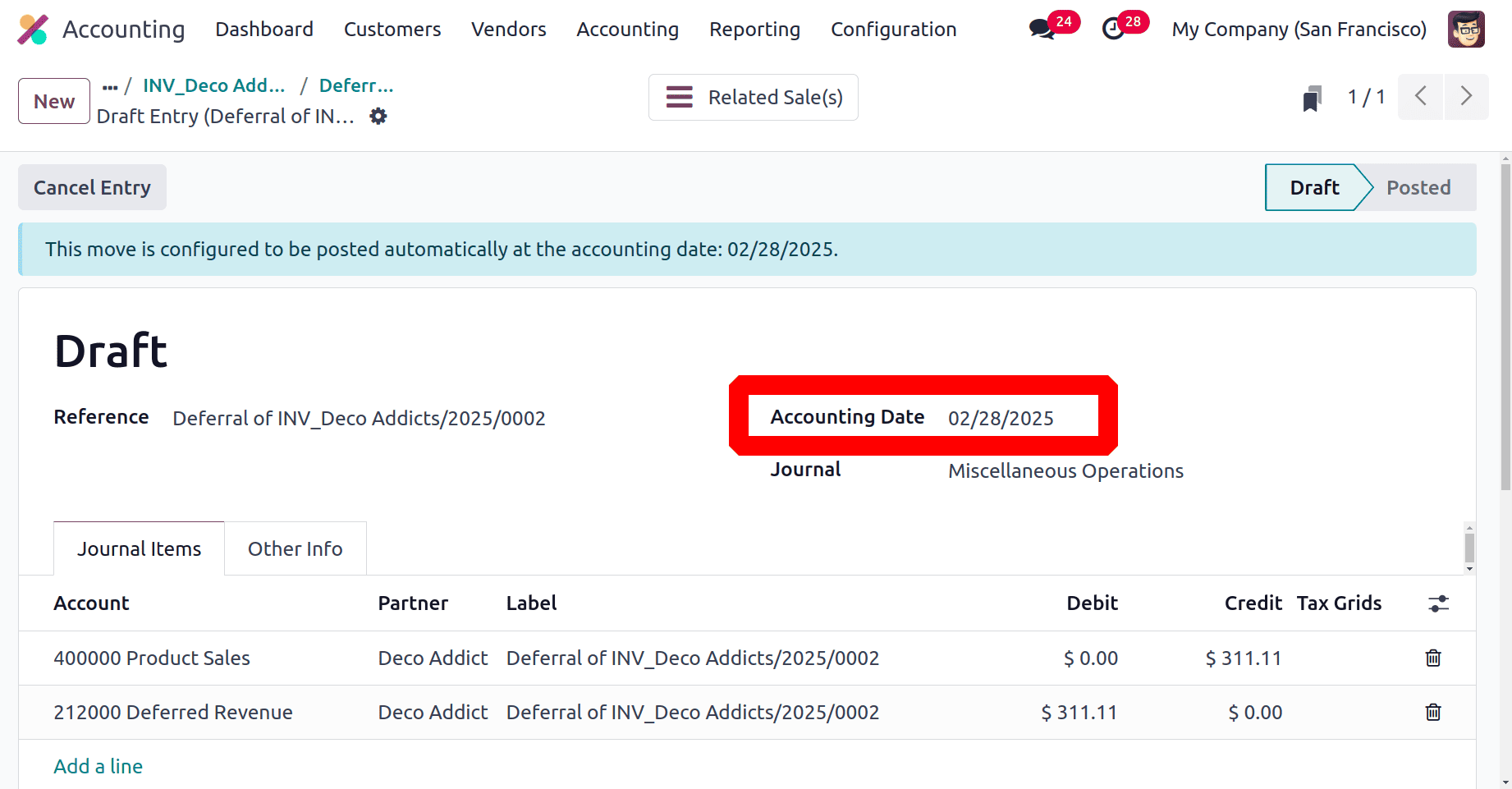

Then the next journal entry was created for February. There are 28 days in February.

Deferred entry for February = 11.111*28= 311.11.

The journal entry will automatically be posted on the accounting date.

This is how the deferred release journal entries are calculated.

* Based on Full Months

The next calculation is Based on Full Months, which works equally splitting the total amount among the months. Change the configuration first.

Then create a new invoice for a customer. The start date is 01/21/2025 and the end date is 04/30/2025. The product Subscription Plan with the price of $1000 added. Confirm the invoice.

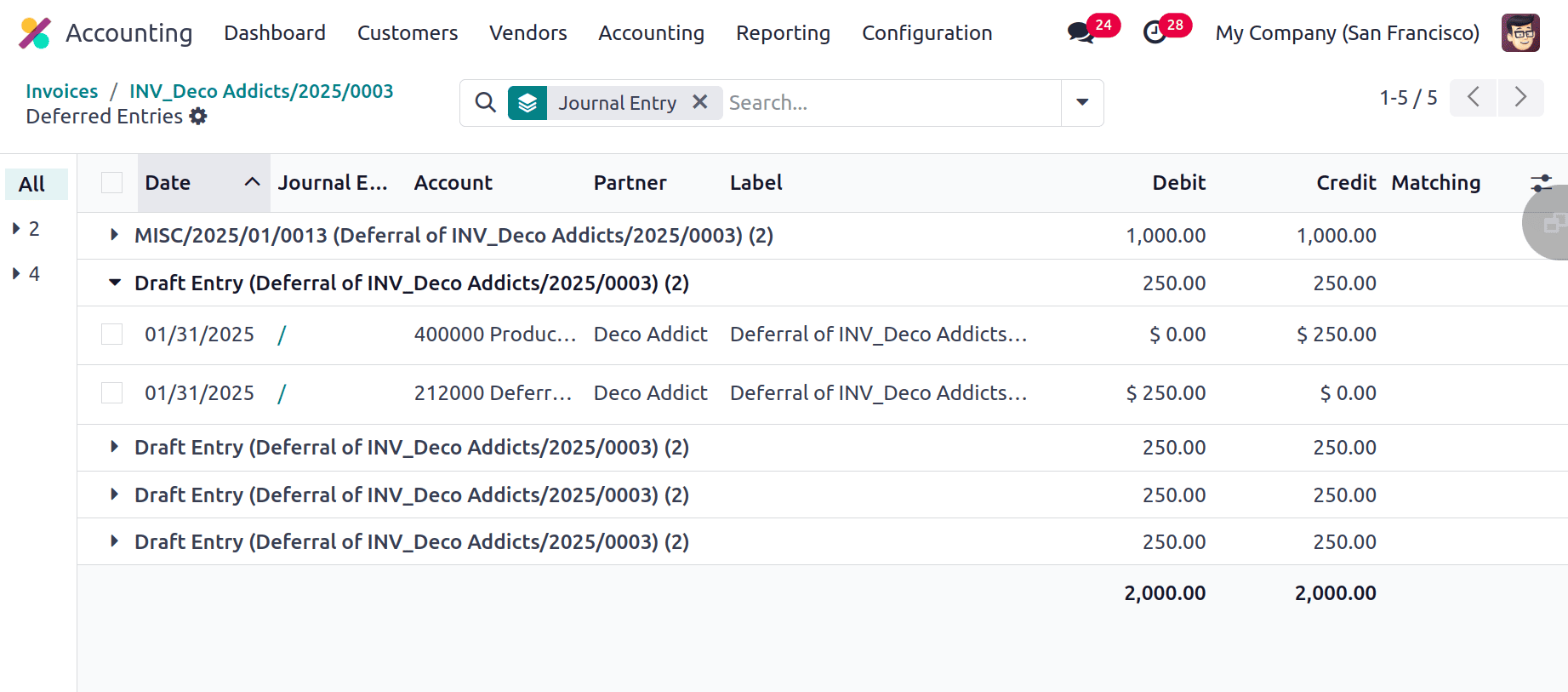

Open the smart tab Deferred Entries. All the entries created will be shown there. The depreciation entry for all months is the same here.

Total release is $1000 for 4 months.

So to find the Deferred Revenue for one month = Total Invoice amount / Total number of months.

Deferred Revenue for one month = 1000/4 = 250.

Generate Entries Manually & Grouped

The second method for generating deferred entries is Manually & Grouped. During this method, the journal entries are not automatically created. So the user needs to generate the entry for each month separately. First, the user needs to change the settings, so choose the Deferred Entries from the Accounting Settings. Then change the field Generate Entries to Manually & Grouped.

After saving, create a new invoice. The same customer Dec Addicts was chosen as a customer. Inside the invoice line, the same Product Subscription Plan is added. Start date and end date for the referred entry is set as 12/01/2024 to 04/31/2025. The invoice date is also set as December 12th. Confirm the invoice.

After confirmation, as said before, the referred entries are created there automatically. So the user needs to generate the journal entry.

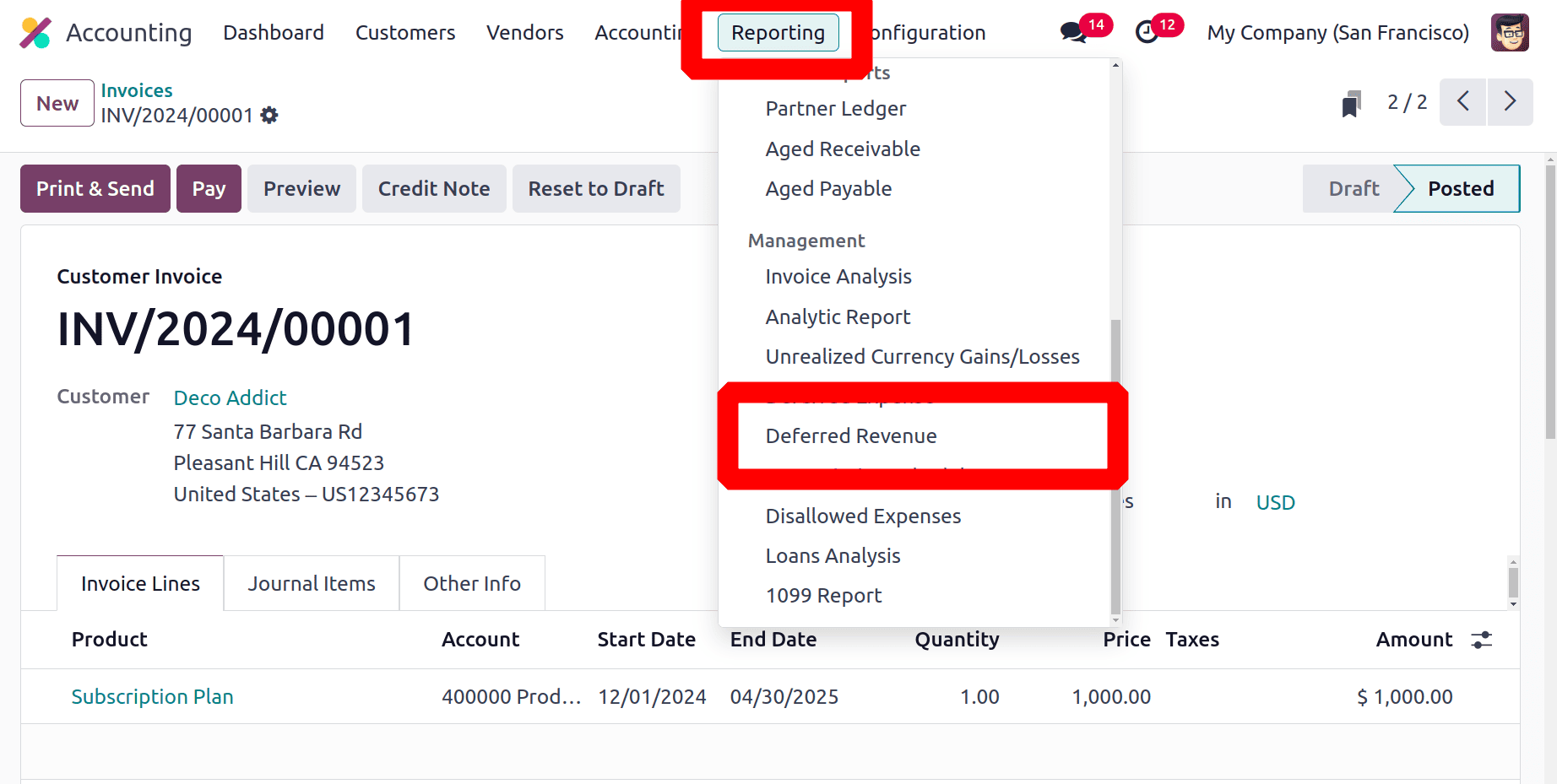

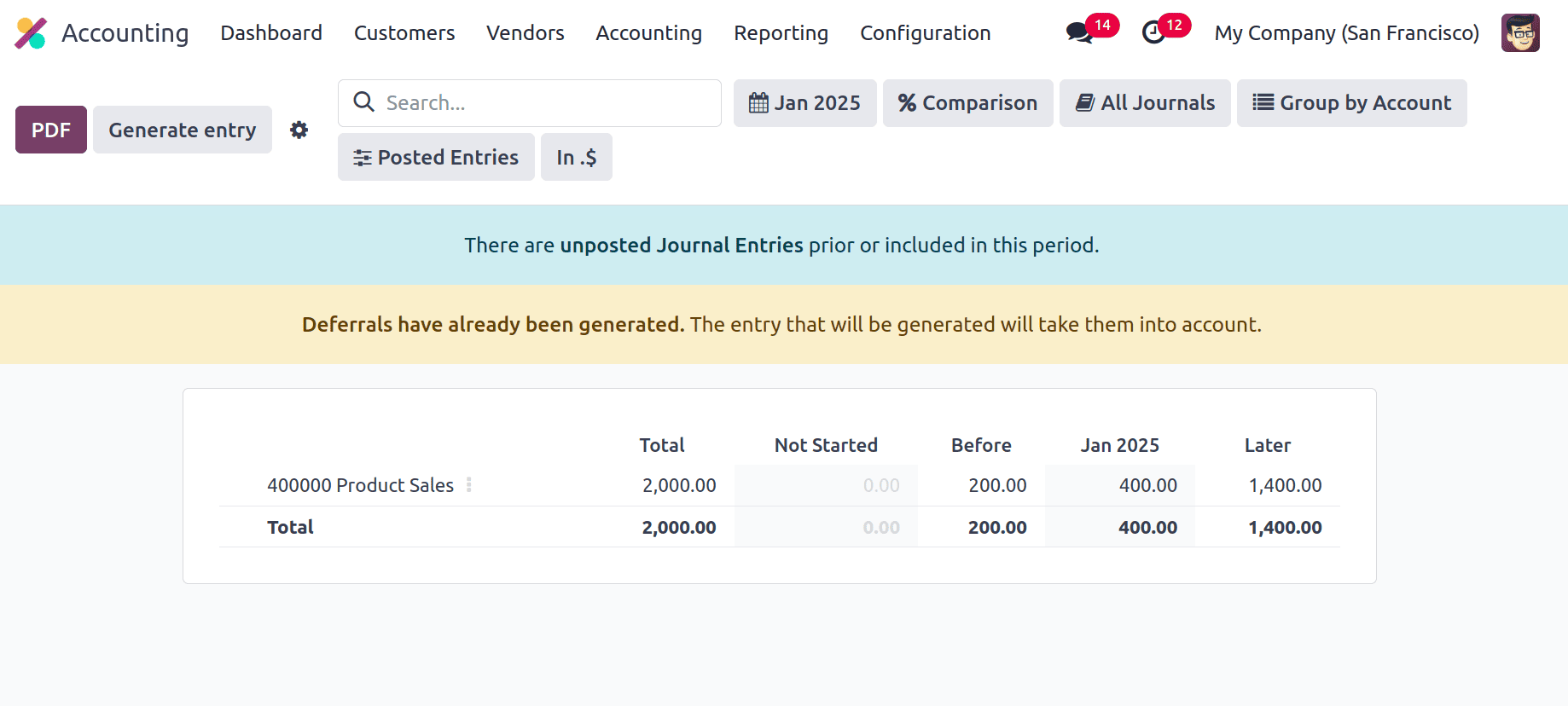

To generate and view the deferred entries, Odoo added a Deferred Revenue Report. The report is included under the Management Reports. So, choose the Deferred Revenue Report from the Reporting menu.

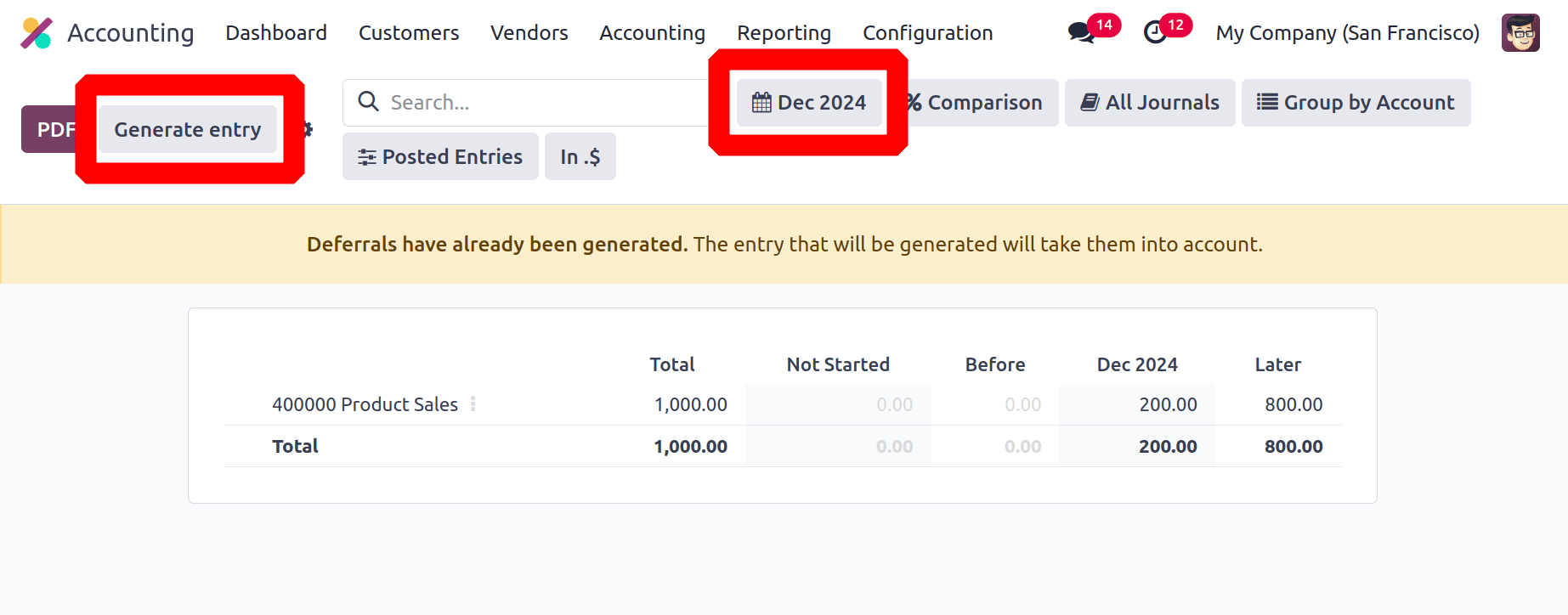

The report is show below. So choose the appropriate month from the filter first, then there is a new button on the upper left side of the screen named as Generate entry.

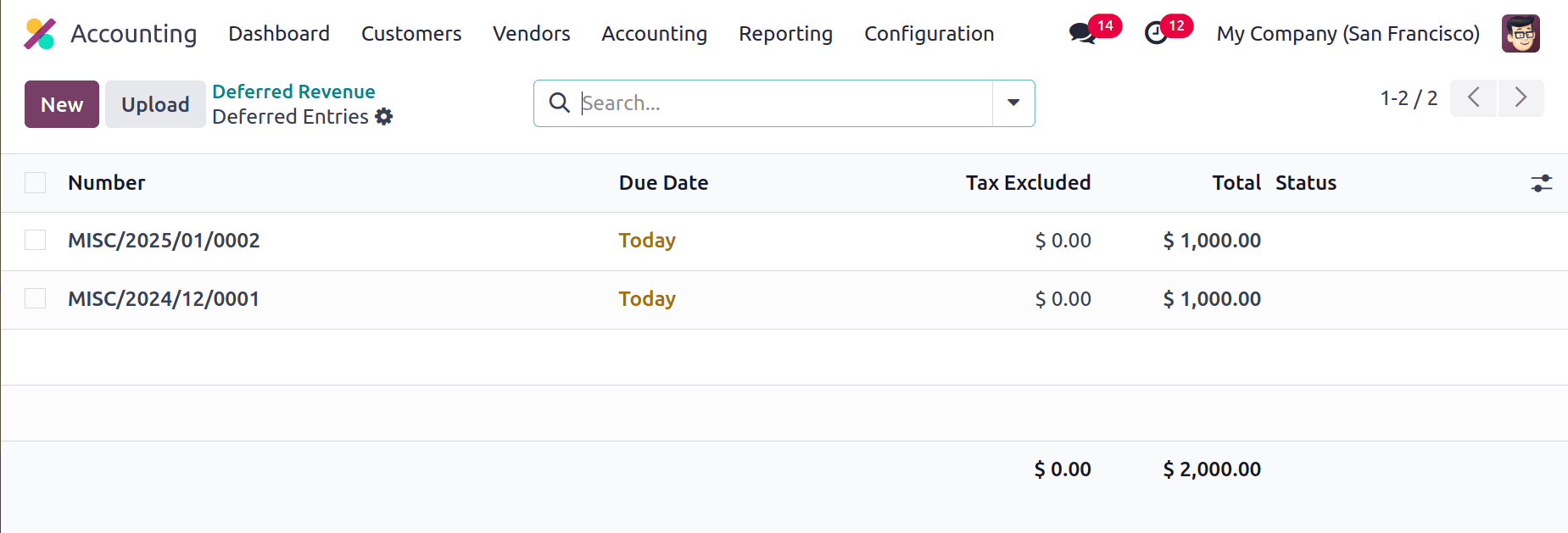

Click on it to generate the journal entry. Then two journal entries are created for the month of December, as show below. Open each one.

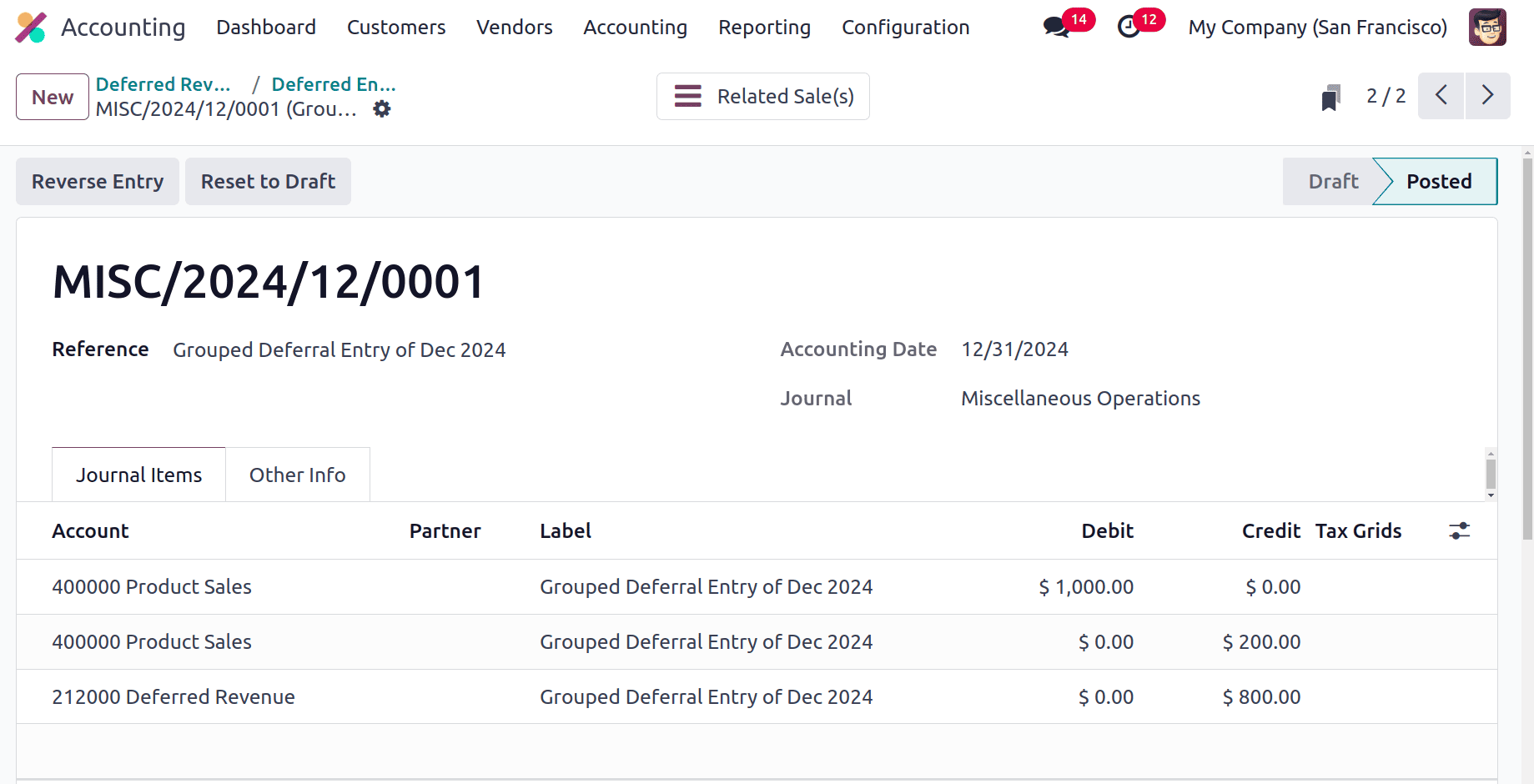

First journal entry is Grouped Deferral Entry of Dec 2024. The total revenue is $1000. but it's a referred revenue, so the revenue belongs to 5 months. The straightline method is used for depreciation. So each month $200 will be depressed.

Here the total amount is debited on the Product Sales account. As said the revenue for the month December is only $200. So the $200 are credited to the Income account, and the balance amount is recorded to the Deferred Revenue account.

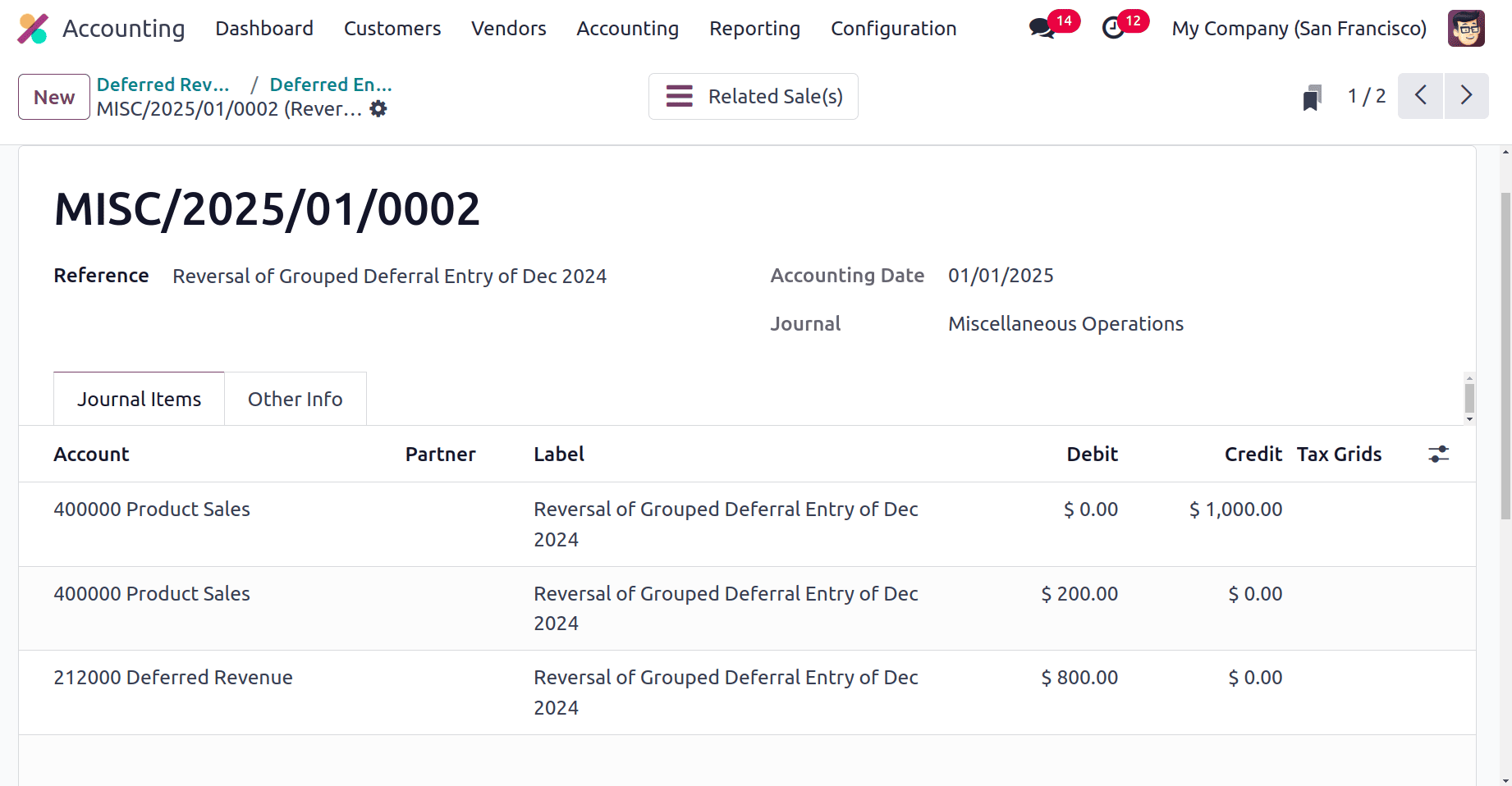

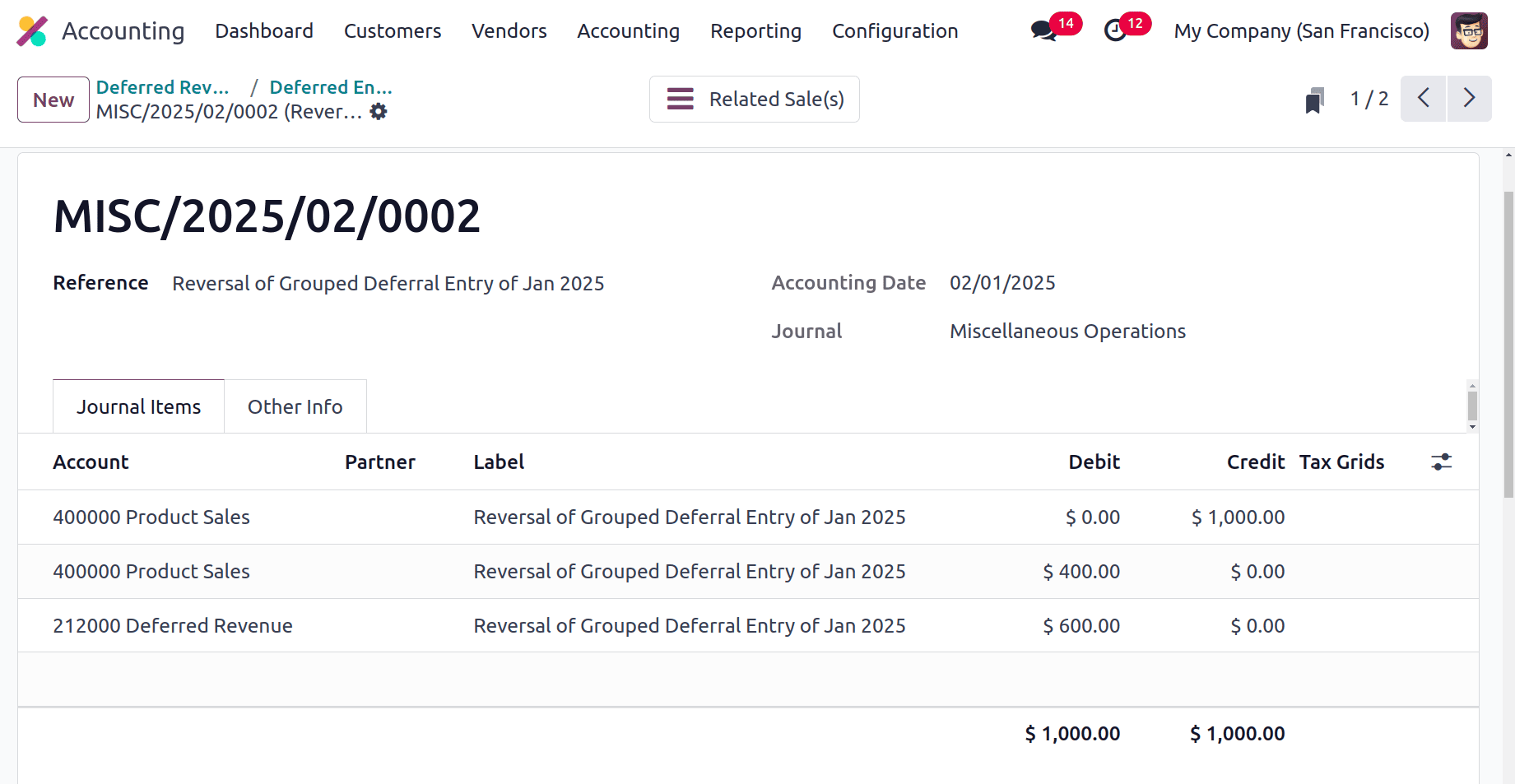

The second journal entry is a Reversal of the Grouped Deferral Entry of Dec 2024. All the entries on the previous one are reversed here, which will be posted on the next month's i.e., on 01/01/2025.

Product Sales is Credited with $1000. Then the Product Sales and Deferred Revenue accounts are Debited with $200 and $800 respectfully. Post both entries first.

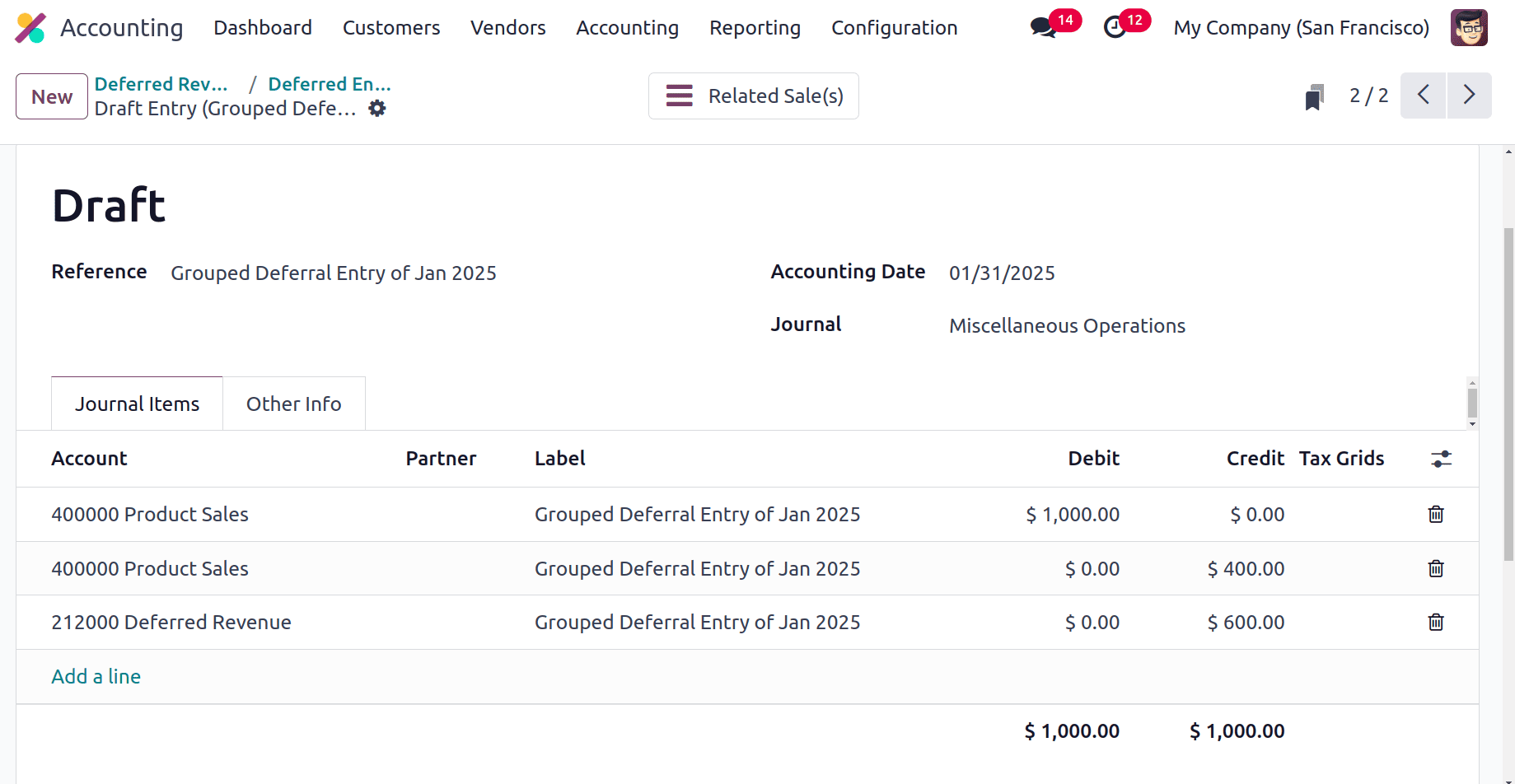

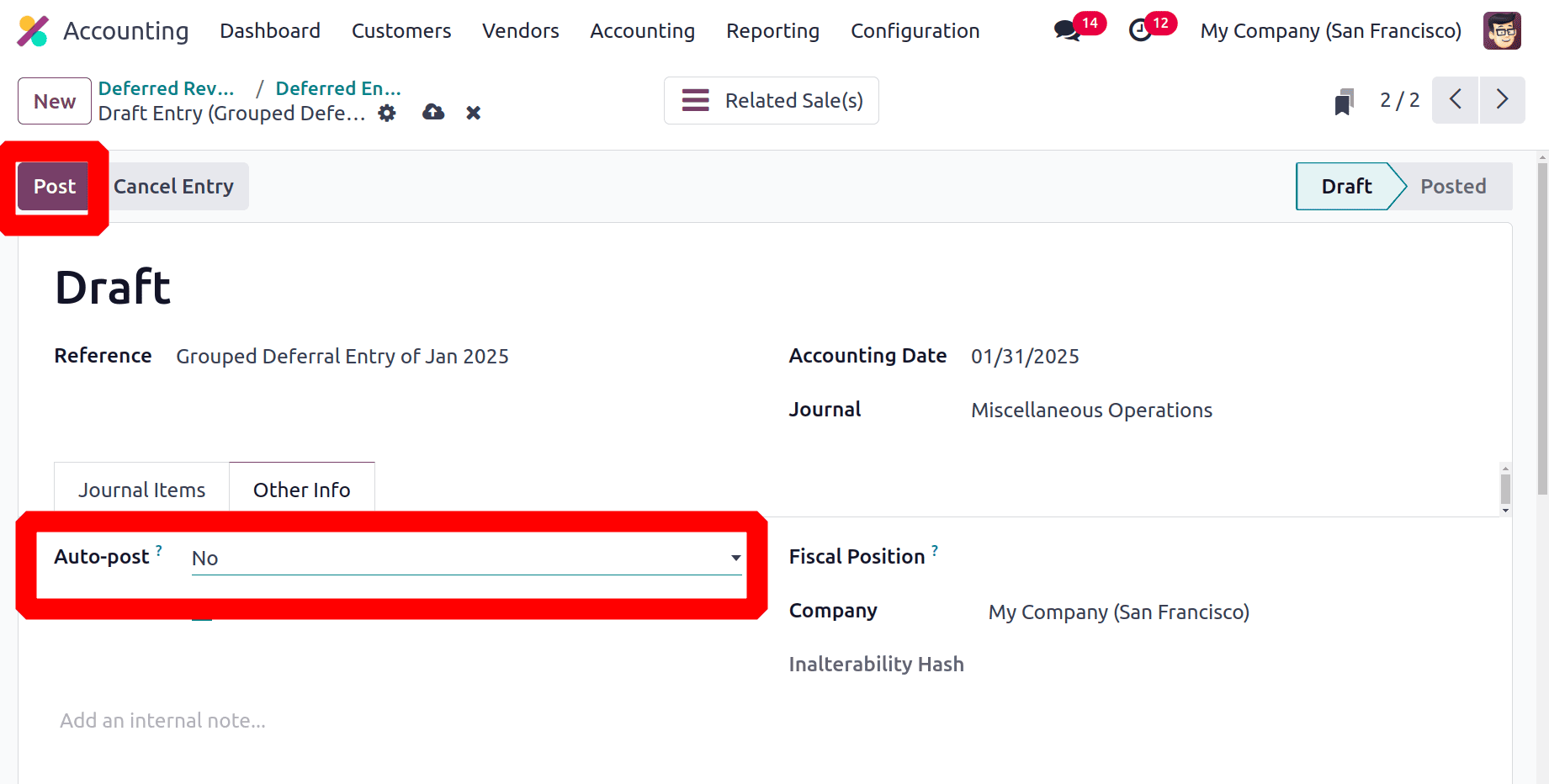

Then go back to the report and change the filter to next month again. Click on the Generate entry button. As said before, two journal entries will be be generated there. One is Grouped Deferral Entry of Jan 2025 and the second one is Reversal of Grouped Deferral Entry of Jan 2025.

In the ‘Grouped Deferral Entry of Jan 2025 ’, the Product Sales account is again debited with the full amount that is $1000. Then the total revenue for the second month is $400, which is creditited in the product Sales account. And the remaining amount is credited in the Deferred Revenue account also.

The entry is still in the draft stage, and will auto-post on the accounting date. If the user wants to post the entry, change the Auto Post Option to No, from the Other Info tab. Then click on the Post button.

The reversal of the previous entry is the next one, as shut in the image below. This will be posted on only 02/02/2025.

Recording to the posted entries, the values on the report will change.

Effective handling of delayed income is essential to maintaining account financial records and adhering to accounting regulations. The accounting module of Odoo 18 simplifies this procedure and gives companies the resources they request to manage referred income effectively. Businesses can improve decision-making and financial management by ensuring that their financial reports accurately depict their income situation by following the procedure.

To read more about How to Manage Deferred Expenses in Odoo 18 Accounting, refer to our blog How to Manage Deferred Expenses in Odoo 18 Accounting.