Most countries have a tax system to support many national needs. So tax feature is a must-have in every accounting system.

In Odoo we can create different types of taxes. But you have to be an advisor level user to do this in Odoo. Other groups are accounting can only have the read access to this.

To create a new tax or list out all the taxes in your Odoo,

go to Accounting > Configuration > Accounting > Taxes

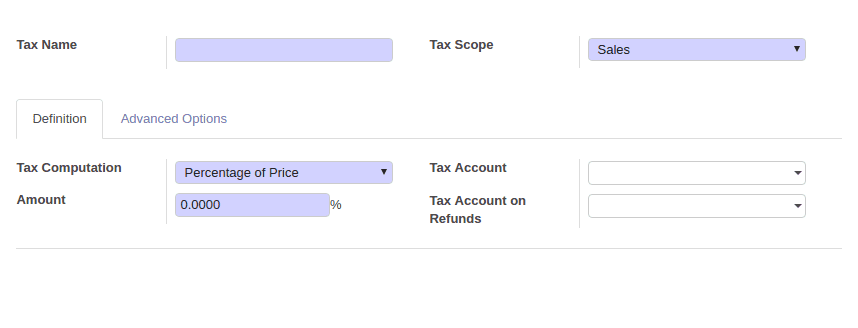

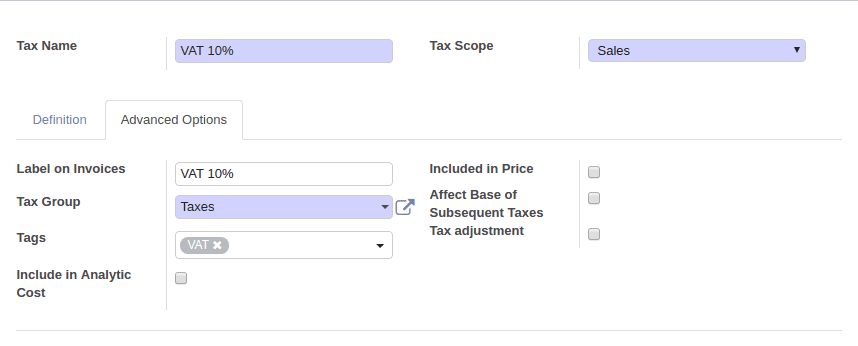

In the above picture, you can see the mandatory fields for a tax.

Tax Name

Name of the tax

Tax Scope

Where to use this tax. If you select ‘None’, you can only use this tax with other tax groups.

Tax computation

Odoo has four different types of tax computation

*Group of taxes

*Fixed

*Percentage of price

8Percentage of price tax included

Amount

Some other options are

Tax account

The account that will be used in the invoice tax lines later creates journal entries using this account. If we leave it empty, then Odoo will take the default debit/credit account of the Journal.

Tax account on refunds.

The account used in case of refund entry.

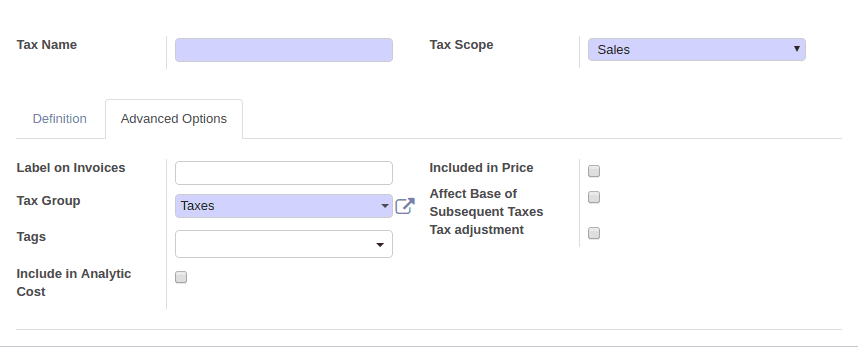

Label on Invoices

This is used on the invoice report to represent this tax.

Tax Group

Tags

We can add custom tags to create custom reports.

Include in the analytic cost

If we set this option, then the amount computed by this tax will assign to the same analytic account mentioned in the invoice line.

Included in price

Set this option if this tax is included in the unit price of the product/service.

Affect base of subsequent taxes

If you set this option, the Base amount of subsequent taxes will be the sum of the current base amount and tax amount of this tax.

Tax adjustment

Set this option if you want this tax to be used in a tax adjustment wizard.

Let's go detail with tax computation methods

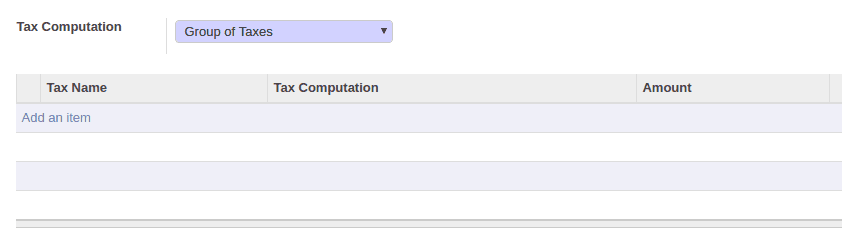

Group of taxes

This option lets us configure the tax as a collection of many child taxes.

Odoo will make visible the table to select the child taxes when you select this option as a tax computation method.

Fixed

You can give a fixed amount as a tax

Example:

Base amount: 1000

Tax rate (value of Amount field): 10

Amount of Tax: 1010

If you set ‘included in the price’

Real amount: 990

Tax: 10

Amount with Tax: 1000

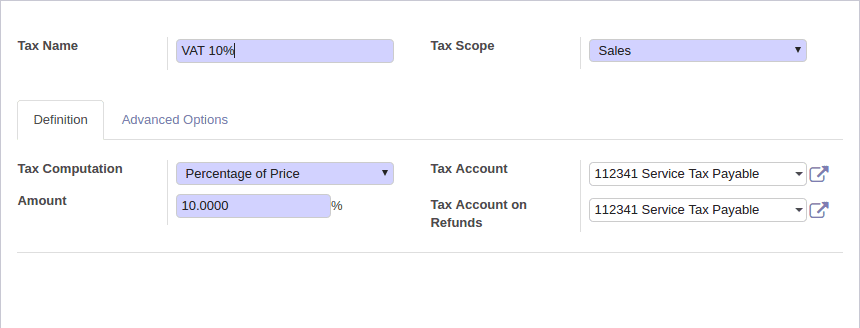

Percentage of price

This is the most common way of tax computation. Let’s us to mention tax as the percentage

Example:

Base amount: 1000

Tax rate (value of Amount field): 10%

Tax: 100

Amount of Tax: 1100

If you set ‘included in the price’

Real amount: 909.09

Tax: 90.91

Amount with Tax: 1000

Percentage of price tax included

This way of calculation is used when your tax is a percentage of the total price. This option is by default tax included on the price.

Example:

Base amount: 1000

Tax rate (value of Amount field): 10%

Tax: 100

Amount of Tax: 1000 (Tax is already included in price)

These all are the details we have to take care of when we configure a tax.

Now you can use these taxes in Product master or product category master as Customer Tax or Vendor tax. So that whenever you select this product in a Sale order/Purchase order/ invoice, Odoo will select this tax automatically for you.