A customer invoice is an official record issued by a seller to a buyer. that details the products or services provided, their corresponding prices, and the total amount due. It functions as a formal request for payment and a record of the transaction for both parties.

Creating a customer invoice in Odoo 18 Accounting is an important step towards effectively managing company finances. Odoo's user-friendly design and strong features make it simple to create accurate invoices that optimize your billing process, increase your income, and ensure smooth interactions with your clients.

Customer invoice creation

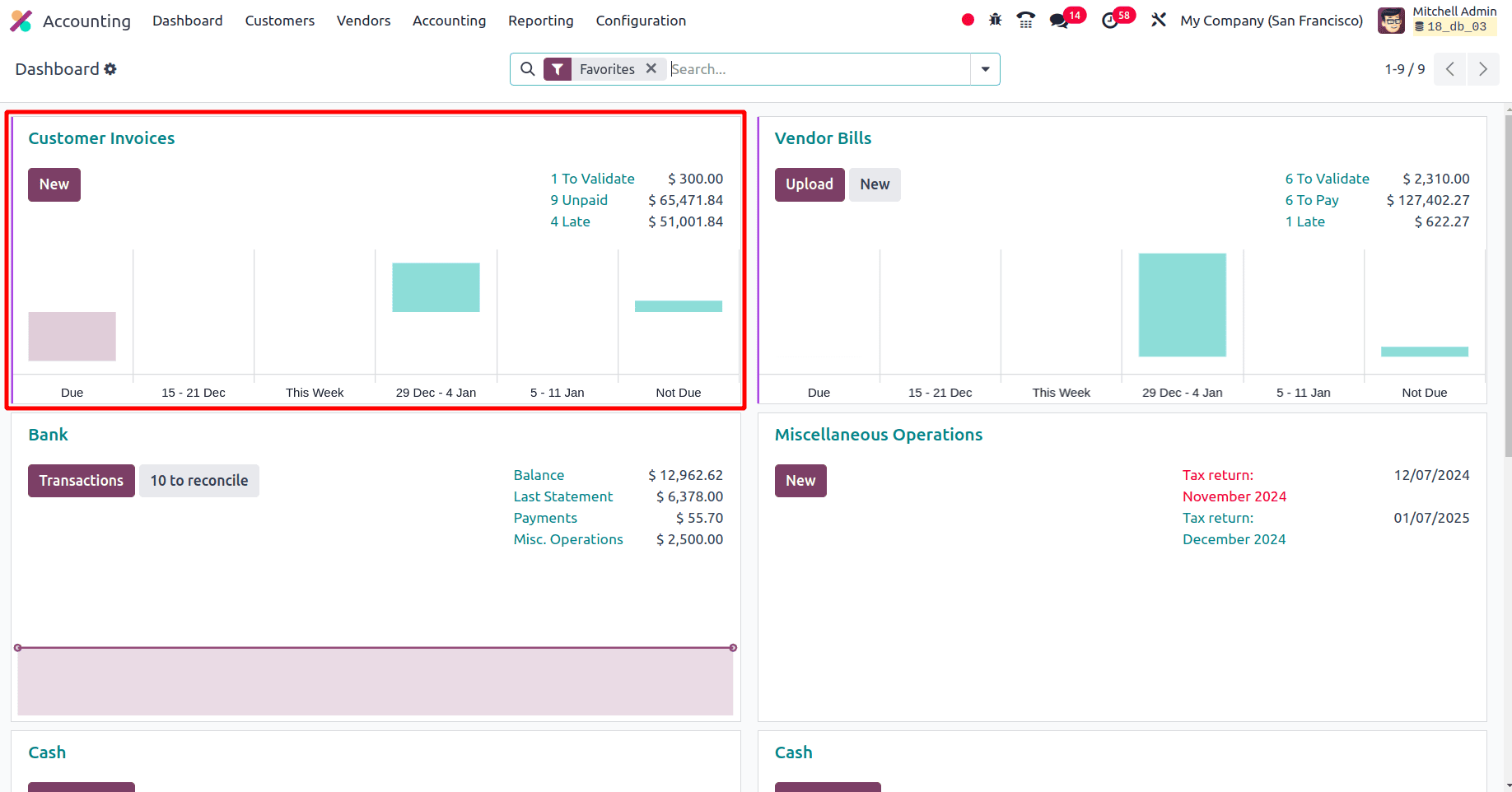

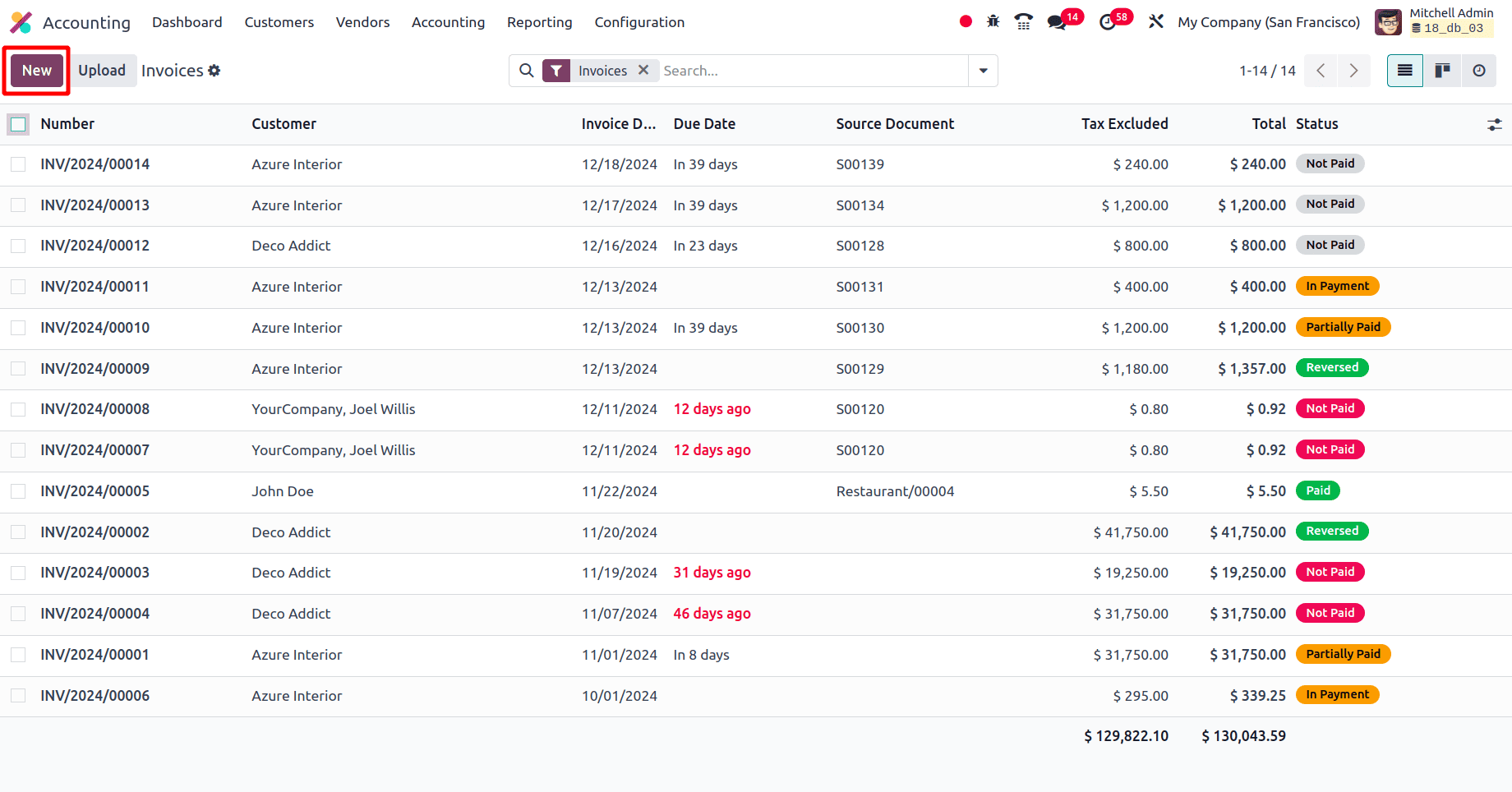

From the Odoo 18 Accounting application, one can easily create an invoice for a customer. Move to the accounting application and in the dashboard of the accounting, there will be the journals displayed. On clicking the new button corresponding to each journal, one can create an entry to that journal.

Here as displayed in the above screenshot, by clicking the New button in the customer invoice section it is possible to create a new customer invoice. Or under the Customers menu, there is an ‘Invoice’ sub-menu. On clicking the invoice all the invoices will be displayed. To create a new invoice, click the ‘New’ button.

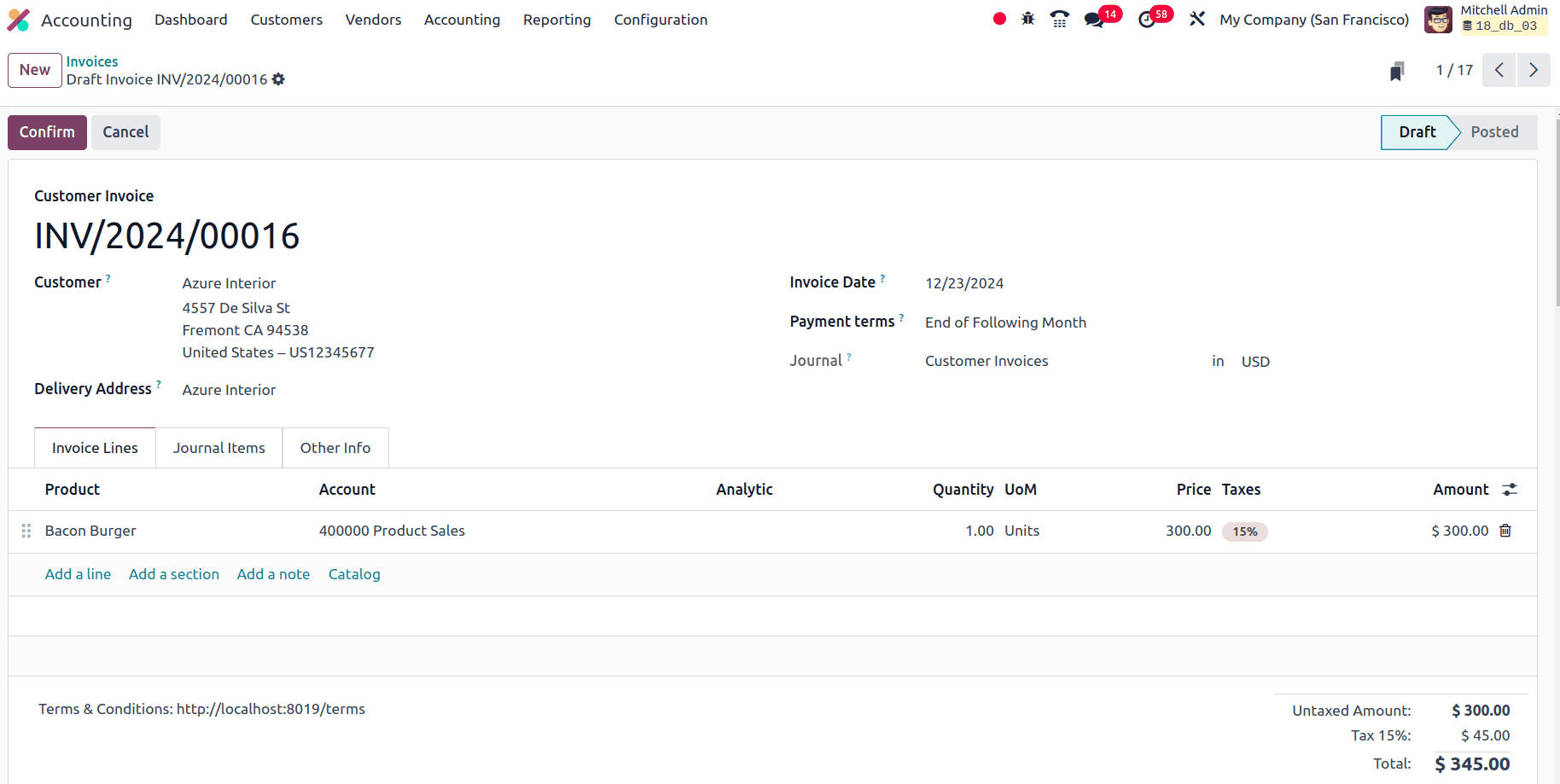

On clicking the New button a form to create the invoice will be given by Odoo. there will be different fields to fill like the Customer, Delivery Address, Invoice date, Payment terms, Journal, etc.

* Customer: The name of the customer to which the invoices are created.

* Delivery Address: The delivery address of the customer. Sometimes the delivery address varies from the customer's contact address.

* Invoice Date: It represents the date on which the invoice is issued to the customer

* Payment Terms: The terms and contentions on the due amount are added to the payment terms.

* Journal: It determines how the invoice transactions are recorded in your accounting books. Once the journal is added, the option to choose the currency in the invoice is provided. All the activated invoices will be there.

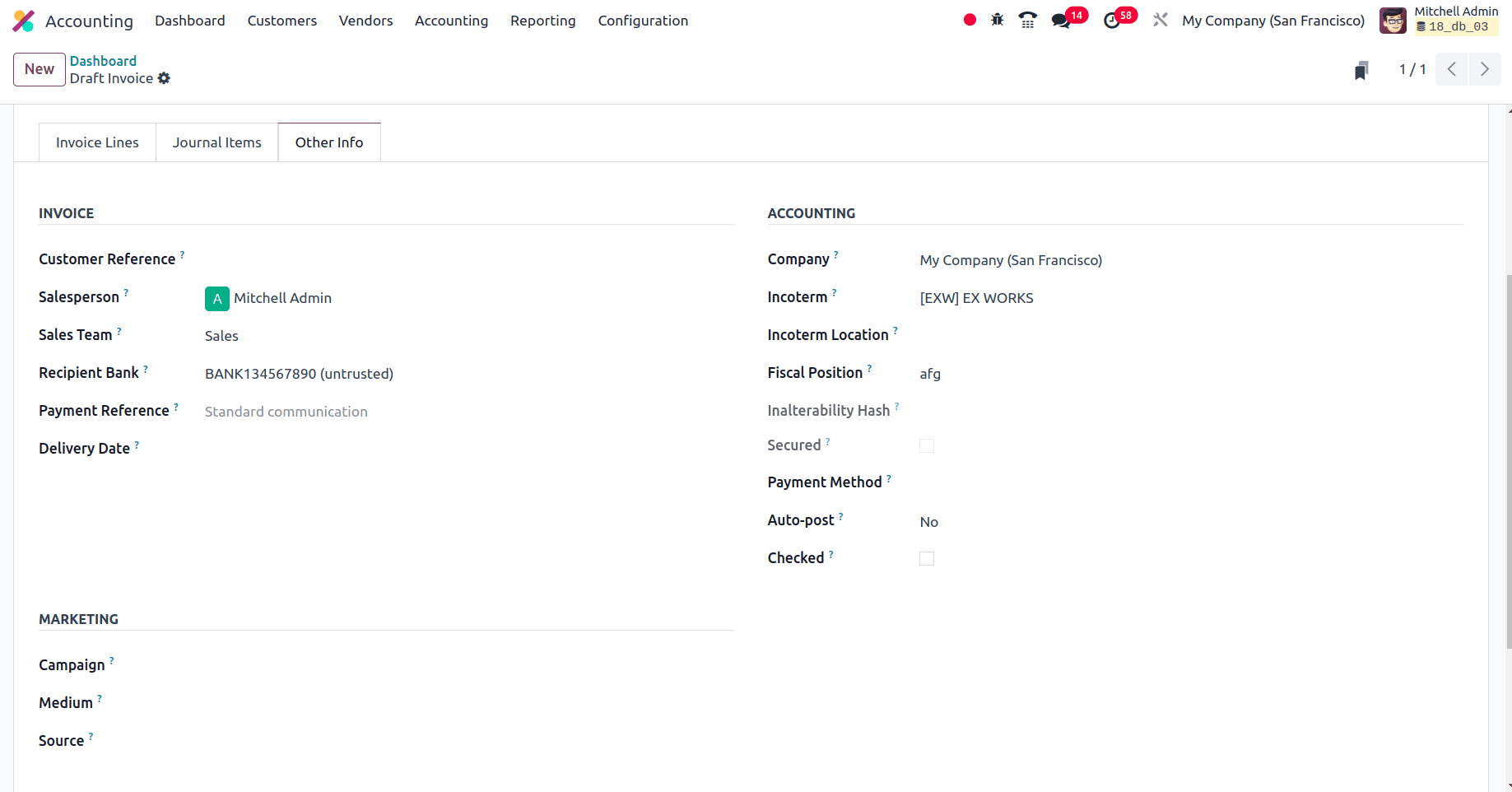

In the form, there are two more tabs, Journal items, and other info tabs. The journal items tab will show the journal entry in the order. Then move to the other info tab and there will be different fields like Customer Reference, Sales Person, Sales Team, Recipient Bank, Payment Reference, Recipient Bank, and Delivery Date under the Invoice section. Under the Accounting section, there will be fields like Company, Incoterm, Incoterm location, Payment location, Fiscal

Position, Payment method, Auto-post, Checked.

* Customer Reference: Used to capture an external reference or identifier provided by the customer.

* Sales Person: Used to associate the invoice with a specific salesperson or sales representative within your organization.

* Sales Team: Used to associate the invoice with a specific sales team in the organization.

* Recipient Bank: The bank account number where the invoice will be paid. If it's a customer invoice or a vendor credit note, use your company's bank account. Otherwise a partner bank account number.

* Payment Reference: The payment reference to set in journal items.

* Delivery Date: Used to specify the date when goods or services are expected to be delivered to the customer.

* Company: A company from which the customer invoices are created.

* Incoterm: International Commercial Terms, this area describes the delivery terms agreed upon by the customer and supplier. It outlines the roles and risks of both parties in cross-border transactions.

* Incoterm location: This specifies the geographic location related to the Incoterm.

* Payment Method: Defines the method used to settle the vendor bill, such as through bank transfer, credit card, or cash.

* Fiscal position: specify whether this entry is posted automatically on its accounting date and any similar recurring invoices.

* Payment Method: It defines the method used to settle the vendor bill, such as through bank transfer, credit card, or cash.

* Auto-post: Fiscal positions are used to adjust taxes and accounts for specific customers or sales orders/invoices.

* Checked: If this checkbox is not ticked, it indicates that the user was unsure of all of the related information when creating the move and that the move should be examined again.

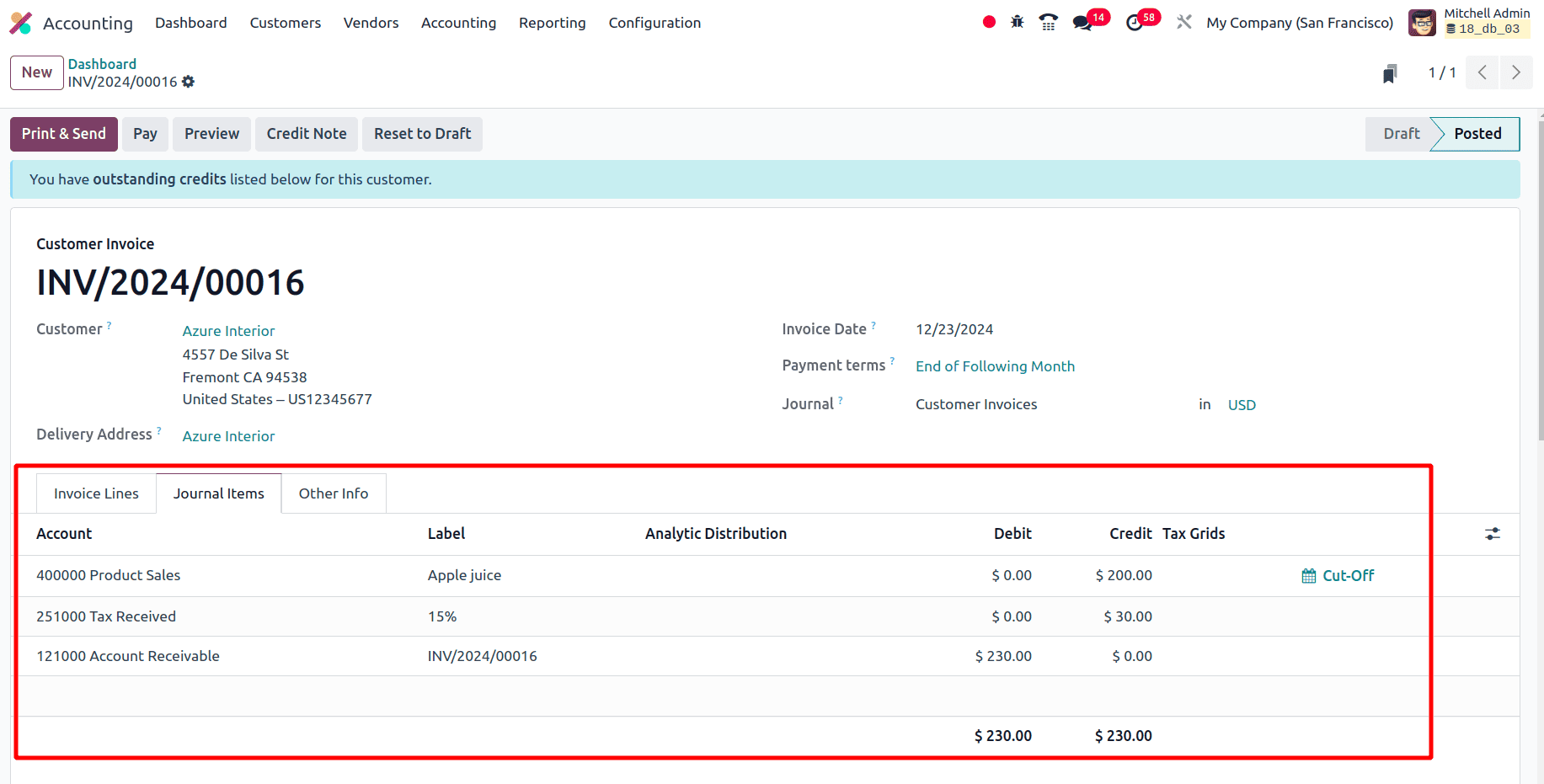

Once these fields are filled properly, click the Confirm button then the invoice will move from draft state to posted state. Then the journal entries were created corresponding to the invoice. On moving to the Journal item tab, the journal items will be displayed.

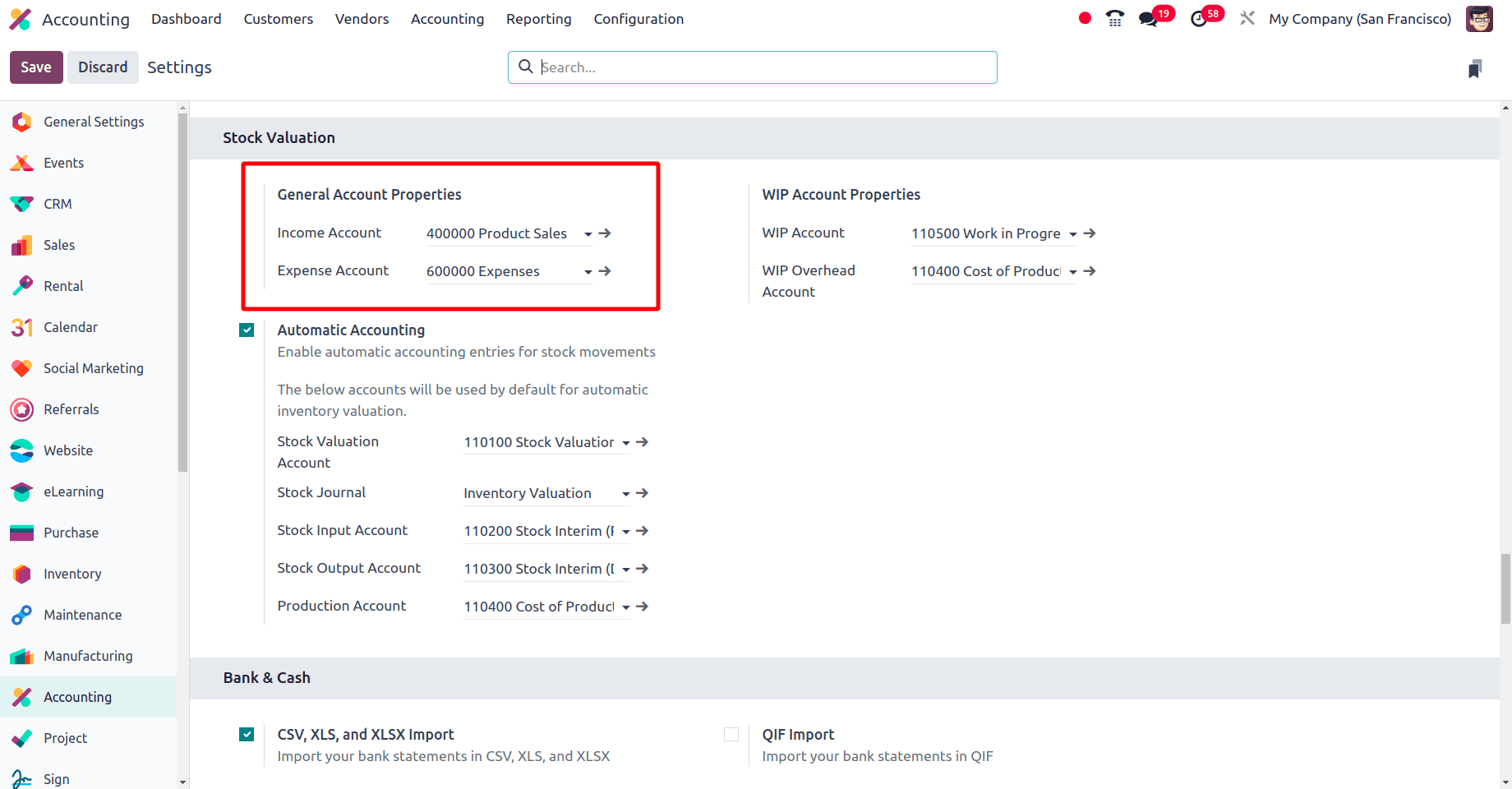

Here, three accounts are affected, Product sales, Tax Received, and Account Receivable. The product sale account and the tax-received accounts are credited, and the Account Receivable account is debited. The product sale account is an income account and in the Configuration Settings, it's possible to set the default income account. Under the Stock Valuation section, one can set the default income account and the Expense account. Also, the income account can also be set in the product level, product category level, and sales journal. The product sale account is an income account, and the increase in the income provides the account with a credit balance.

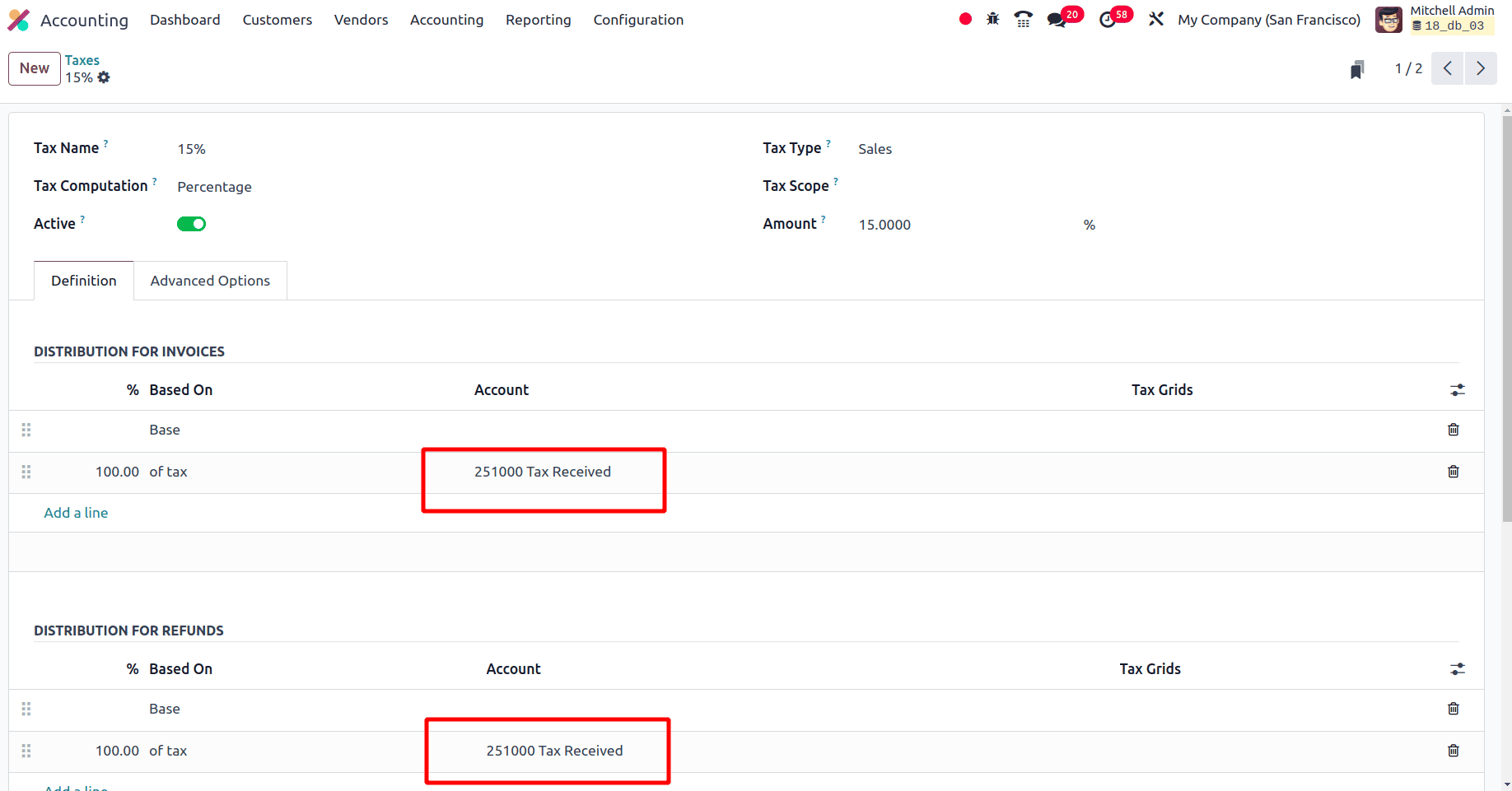

The next is the ‘Tax Received account’, A =Tax Received account is a liability in nature. Here as a result of an increase in liability, the account gets credited. Under the configuration menu, there is a Taxes sub-menu. All the taxes were listed there. On selecting each tax, the account to post the tax distribution was correctly mentioned there.

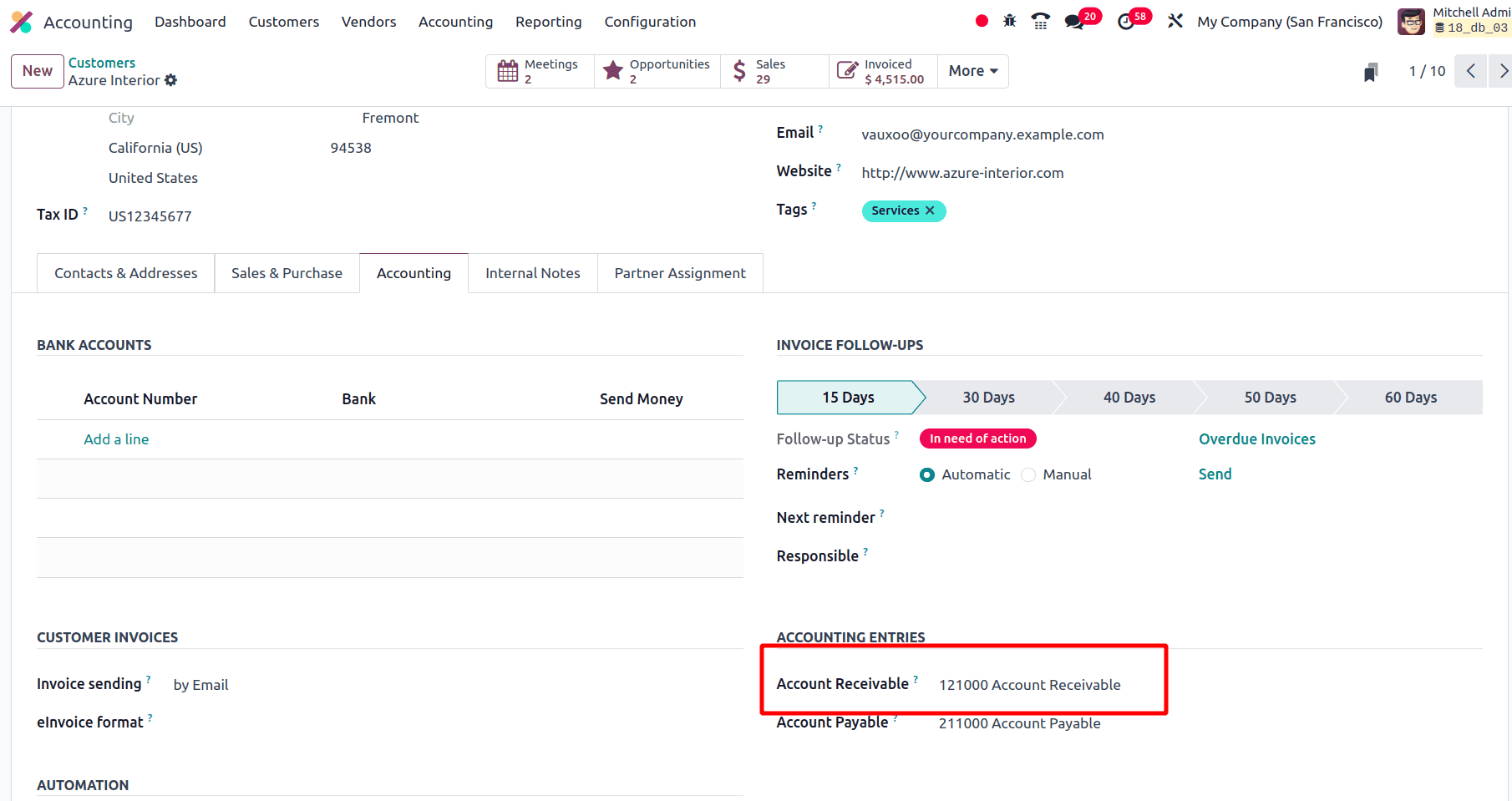

At last, the Account Receivable account is a receivable account whose nature is an asset. The increase in the Assets increases the debit amount of the account. When moving to the Customers template, under the Accounting tab, there is an Accounting Entries section. The default Account Receivable account is configured here.

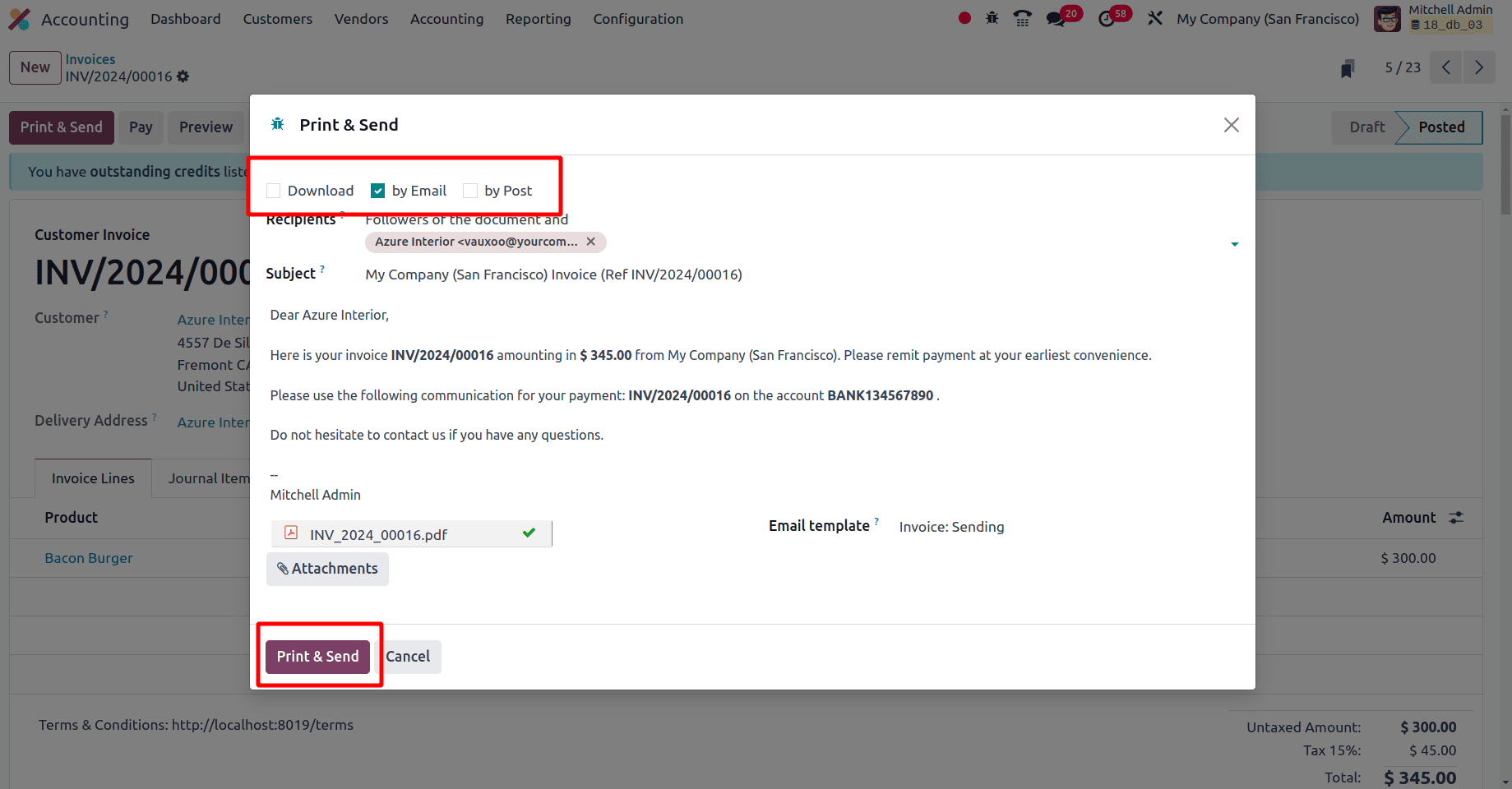

On clicking the Print & Send button, the invoice will be sent to the customer via email. Once the invoice is confirmed, there will be a Print and Send button. On clicking the Print & Send button a pop-up window will be given and then click the Print & Send button. If the booleans near the download and By Post options are enabled, this document will be downloaded and also sent to the customer by post.

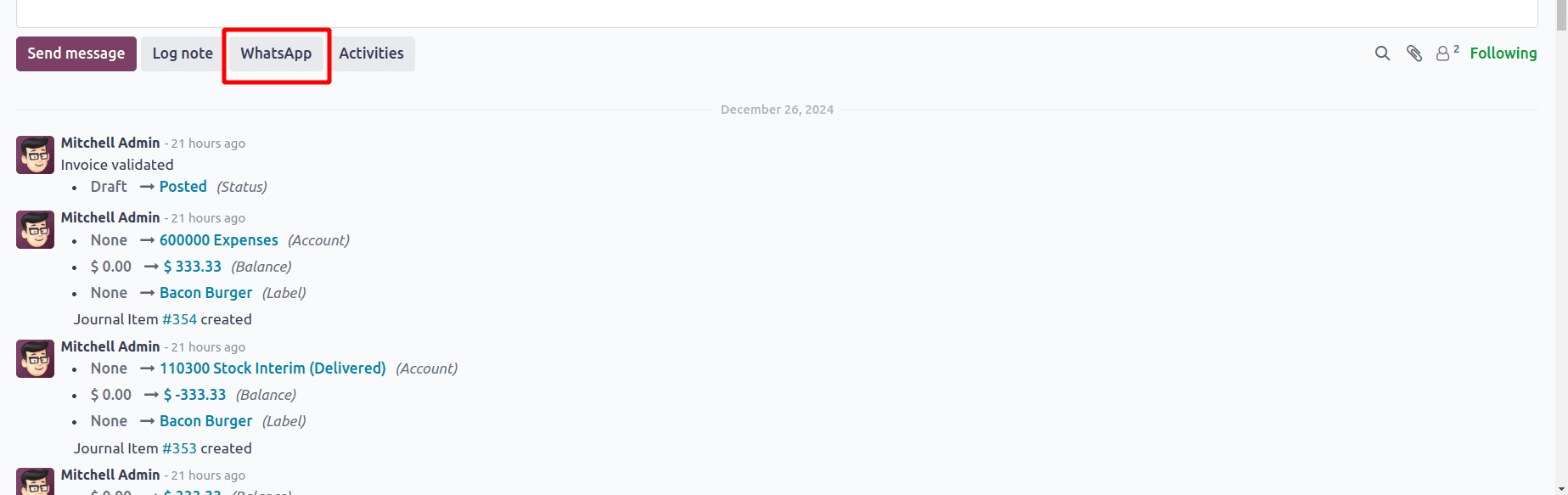

Then the next step is to make the payment for the invoice. For that click the Pay button at the top and select the payment method and then click the Create Payment button. Then the invoice will have an in-payment ribbon. When moving to the chatter section on the same page of the invoice there is the WhatsApp button.

On clicking that WhatsApp button the template for sending the invoice will be visible. Once the template gets approved, the company can send this invoice template to the customer through WhatsApp.

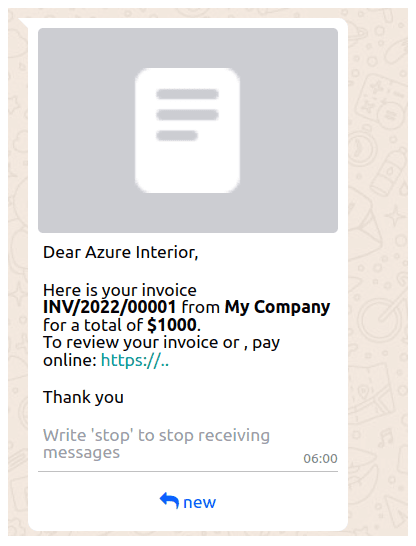

This is the preview of the invoice template created by Odoo for sending the invoice through WhatsApp, Provided WhatsApp integration must be done and templates should be approved.

These customer invoices contain critical information, such as the items sold, quantities, prices, and payment terms, which help businesses keep track of the sales transactions made to their customers. By generating invoices, businesses can track the revenue generated from sales over time.

To read more about Customer Invoice & Payments Management With Odoo 17 Accounting Module, refer to our blog Customer Invoice & Payments Management With Odoo 17 Accounting Module.