As salary management is an essential part of any company, the employer requires an efficient salary management system to meet all requirements. Odoo Payroll comes to the rescue of an organization at this juncture. This helps the organization and especially its human resources and accounting wings to easily manage payroll.

The salary of the employees of an organization or a company varies based on their job position, experience, and skills. Management of the payroll of a firm becomes tougher as the salary scale of different employees is different. Salary categorizations are made based on different factors including experience, expertise, and position. Manual management of salary is very difficult for human resources. If an organization is depending on the Odoo Payroll management system this herculean task can be converted into a cool game.

In this blog, we can discuss how to set up salary structure and Salary rules for an organization using Odoo Payroll.

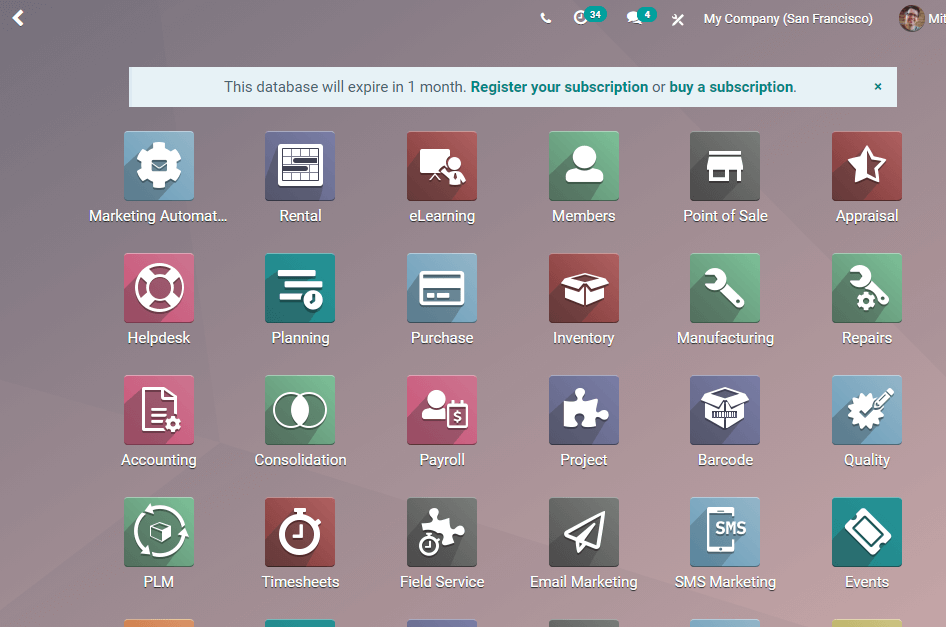

What you have to do to make use of this facility is to install Payroll from the Odoo Apps.

Set up Salary Rule

Odoo Payroll gives easy assistance to create salary rules. Salary rules are the basic conditions required for fixing the salary of an employee. As the salary of an employee and worker may vary it requires a specific set of rules. With Odoo Payroll we can create Salary rules.

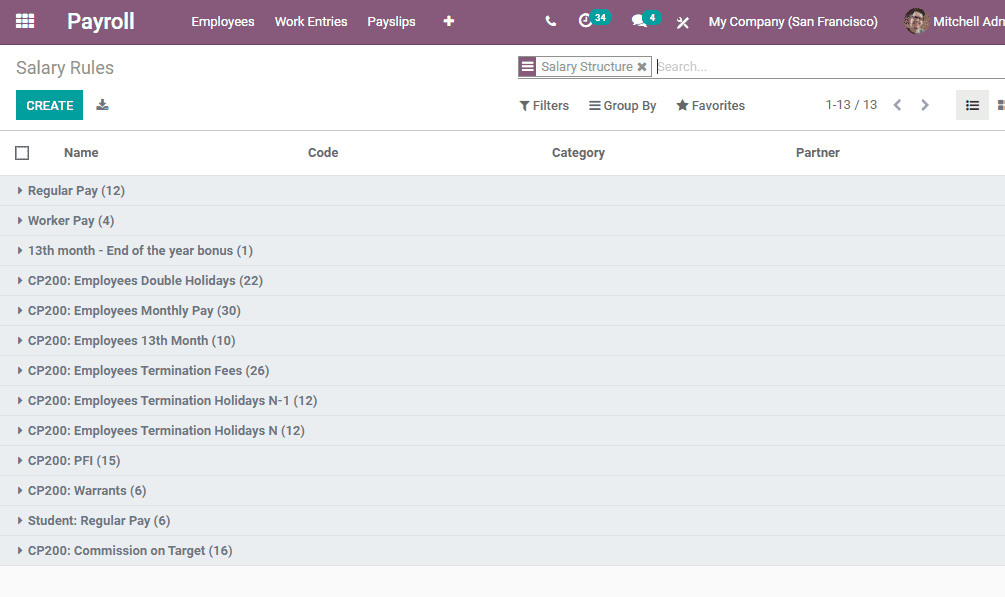

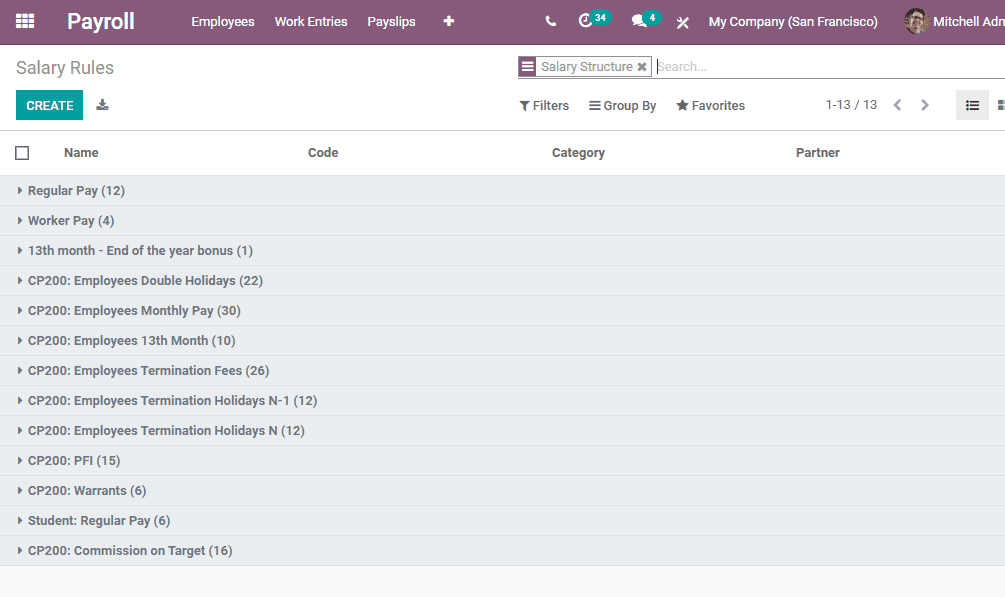

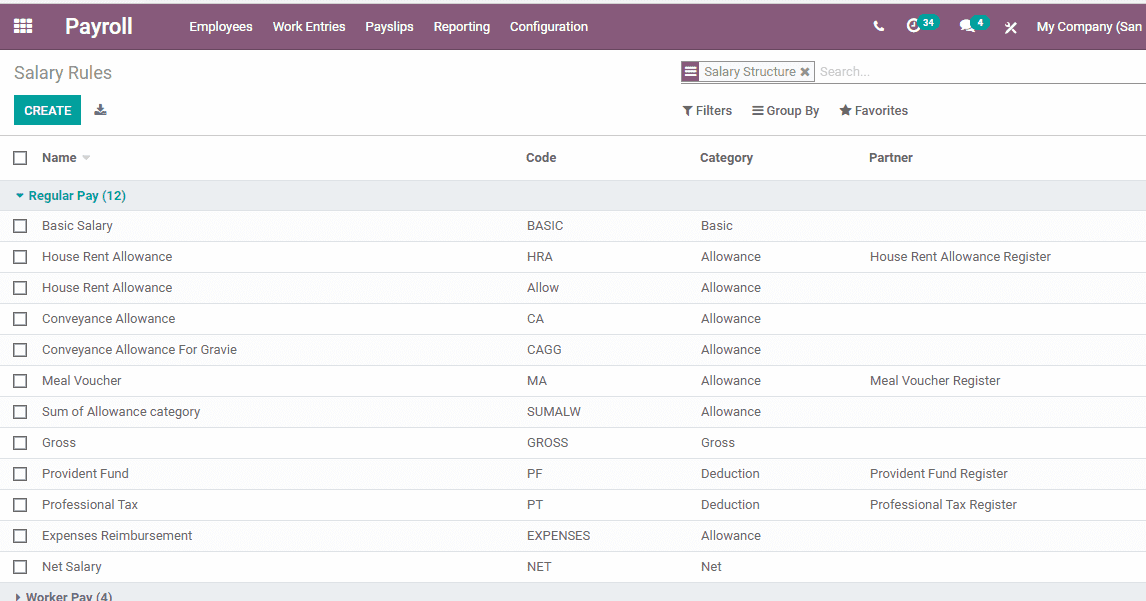

To avail of this feature Go to Payroll -> Configuration -> Salary -> Rules

On entering the page, the user can find the Create button. Here, we can find a few rules listed below as we have already created a few rules. Now, we can click on the Create button to create a new rule.

As we know, a salary structure is prepared based on various salary rules. A salary structure will have different fractions including basic pay, various allowances, and gross pay, and so on.

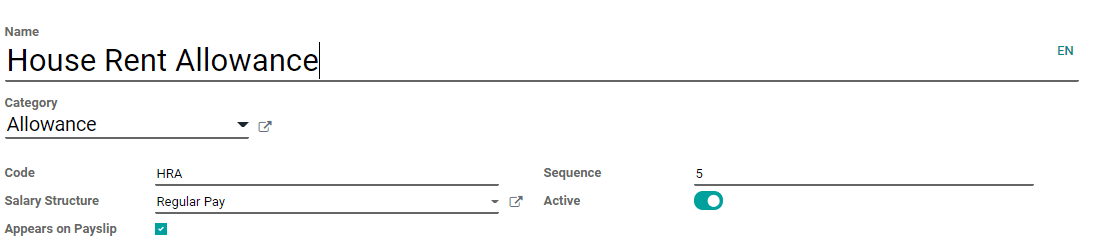

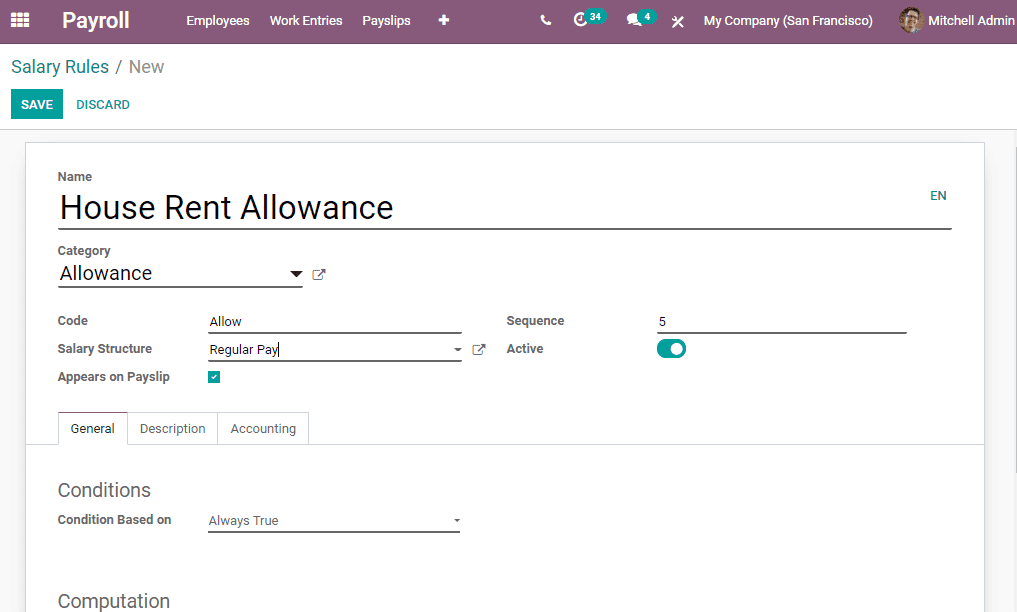

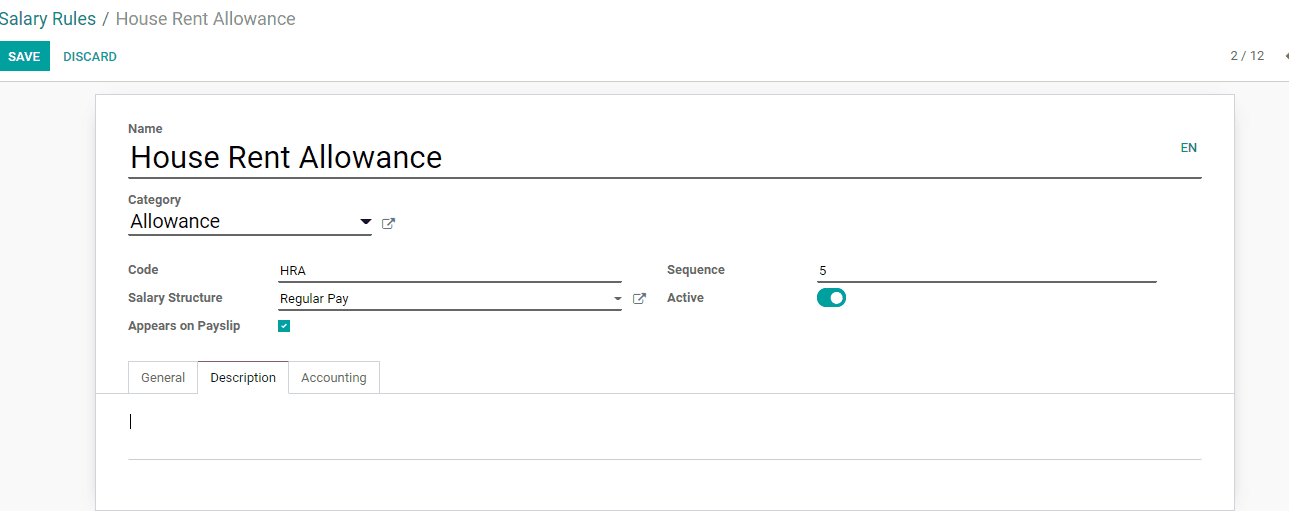

In the above given create form we have different fields as given below

Name: Name of the pay

Category: Category of the pay. It could be basic, allowance or bonus

Other details, including code, sequence, and salary structure can also be provided. These categories will later appear on the payslip

In the Create Form, we have to fill information under the tabs - General, description, and accounting

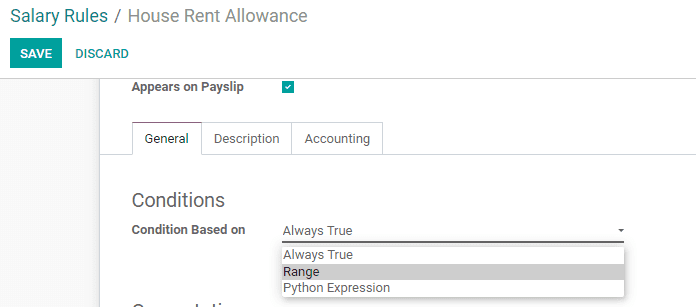

General Information

Conditions based on: Here the user will have to choose the condition from these- Always True, Range, and Python expressions.

Always true - When we use this option it makes sure that this particular rule is available in each individual salary computation.

Range - When you select this option you can see you will get some additional fields also.

Range-based on: This will be used to compute the percentage field value. This particular range is set on the basis of the employee wage by default.

Minimum range: The minimum amount applied to this rule.

Maximum range: The maximum amount applied to this rule.

Python Expression: In this field, some comment lines can be seen here which helps to create python conditions. The equation footed on the result is provided by Odoo as default.

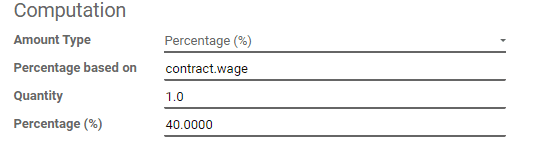

Computation

The salary calculation will be made based on a few factors including Percentage, Fixed amount, Python code

Fixed Amount: Using this option the salary can be provided in a fixed amount.

Percentage(%): The variable required to compute the percentage is provided here.

Python code: Can mention code to calculate the amount.

Company Contribution

Description Tab

Give any description if required

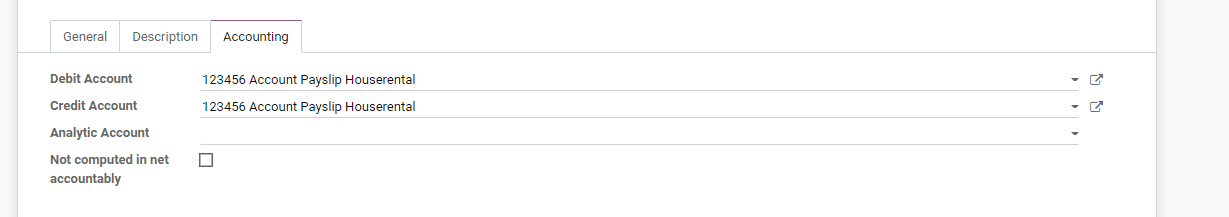

Accounting Tab

Give various information including debit and credit amount for the preparation of salary rules and a boolean field named Not computed in net accountably, when enabled it allows to delete the value of this rule in the net salary rule at the accounting level to explicitly display the value of this rule in the accounting the. This info can ease salary management.

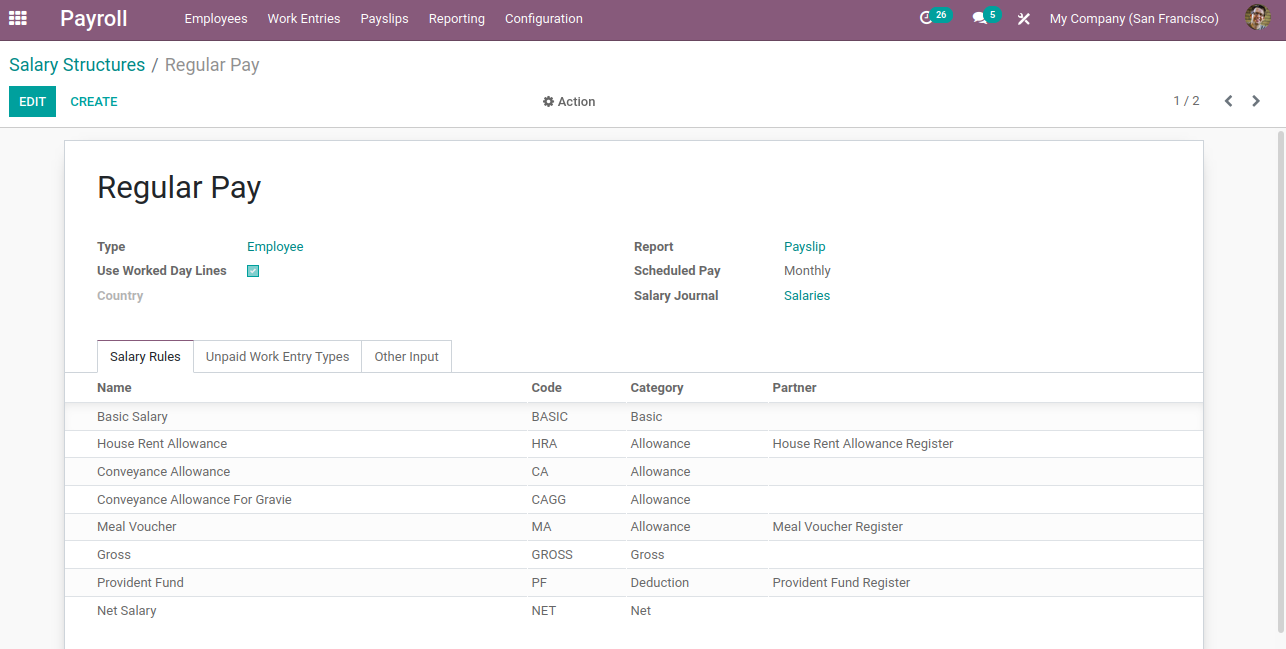

Salary Structure

Now, let us look into the Salary Structure. It is a mandatory factor that is required for computing the salary of an employee and for preparing a payslip for the employee. We make use of the already set salary rules to prepare the salary structure as shown below.

Where you can find an option like :

Type - In this field one can mention the salary structure type.

Use worked day lines - Worked days won't be computed/displayed in the payslips.

Report - This field will allow you to generate reports for the payslip.

Scheduled Pay - It defines the frequency of the wage payment.

Salary Journal - This field defines the journal to record the values.

With this one can also mention the unpaid work entries type too. The created salary structure can be defined within the contract of the employee or can be manually entered while generating the payslip for the employee.

In an organization, the job position of the employee, contract type, and the experience of the employee is taken into account while preparing the salary structure. Or else, we can say that the salary structure is a combination of different salary categories such as basic pay, gross pay, net pay, and allowances.

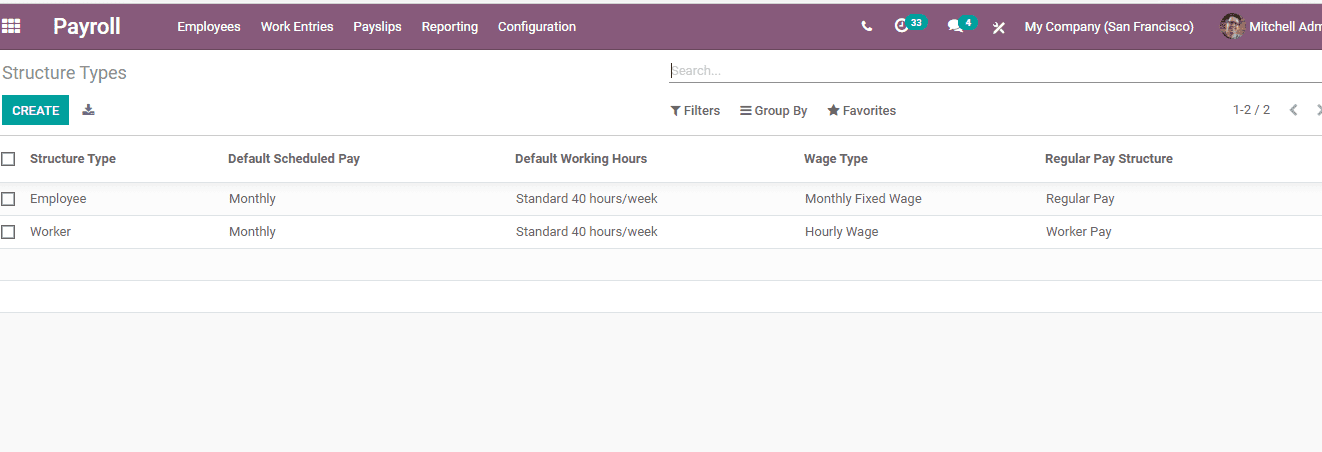

Salary Structure Type

Every organization maintains different salary structures for their employees so in order to deal with that in Odoo we have the option of salary structure type. The below-given image will give an idea about the type.

The type of employment and the experience are considered to prepare salary structure type.

This is how the salary structure is configured using Odoo 14