The tax that applies to several goods and services is the sales tax rate. Each state government uses unique tariffs in the United States. Some tax exemptions are visible in the raw materials, resold items, medicines, and more. Besides state sales tax, local governments also levy taxes in the US. Typically, the sales tax rate ranges from 5 to 9% in Louisiana, Tennessee, Arkansas, etc. Management of sales tax in an organization is the most laborious task based on each location. By installing ERP software, users can configure sales tax rates in their business. Odoo 16 Accounting application is a suitable way to direct all accounting operations in a company.

This blog pointed out the Configuration of Louisiana(US) sales tax in Odoo 16 Accounting.

We can administer deferred revenues, analytic items, assets, payment terms, currencies, product categories, and more in the Odoo 16. Furthermore, management of vendors, customers, accounting, and banks is made easy through the Accounting application of Odoo 16. Next, let’s access the steps to configure Louisiana(US) Sales Tax inside the Odoo 16 Accounting.

Basis of Louisiana Sales Tax for Users

The introductory state sales tax rate of Louisiana is 4.45%. Depending upon the parish and city, the local sales tax rate ranges up to 7%. The maximum sales tax rate is 12.95% in towns like Sterlington and Monroe combined with state sales tax. Also, the sales tax rate is applied for tangible personal property, furnishing of printing, laundry, telecommunication services, and more. Moreover, general state sales tax is payable to consumers, users, and lessees. Physical and Economic nexus are the two methods that sellers are tied to a state.

Physical products sold to the customer contain a sales tax in Louisiana. Meals prepared for businesses and restaurants are subjected to the sales tax rate. The Louisiana Revenue Department site helps to register your sales tax license. Before registering for a sales tax permit, you must aware of some accurate information. It includes a business description, business identification info, and a NAICS code.

Louisiana(US) Company Layout in the Odoo 16

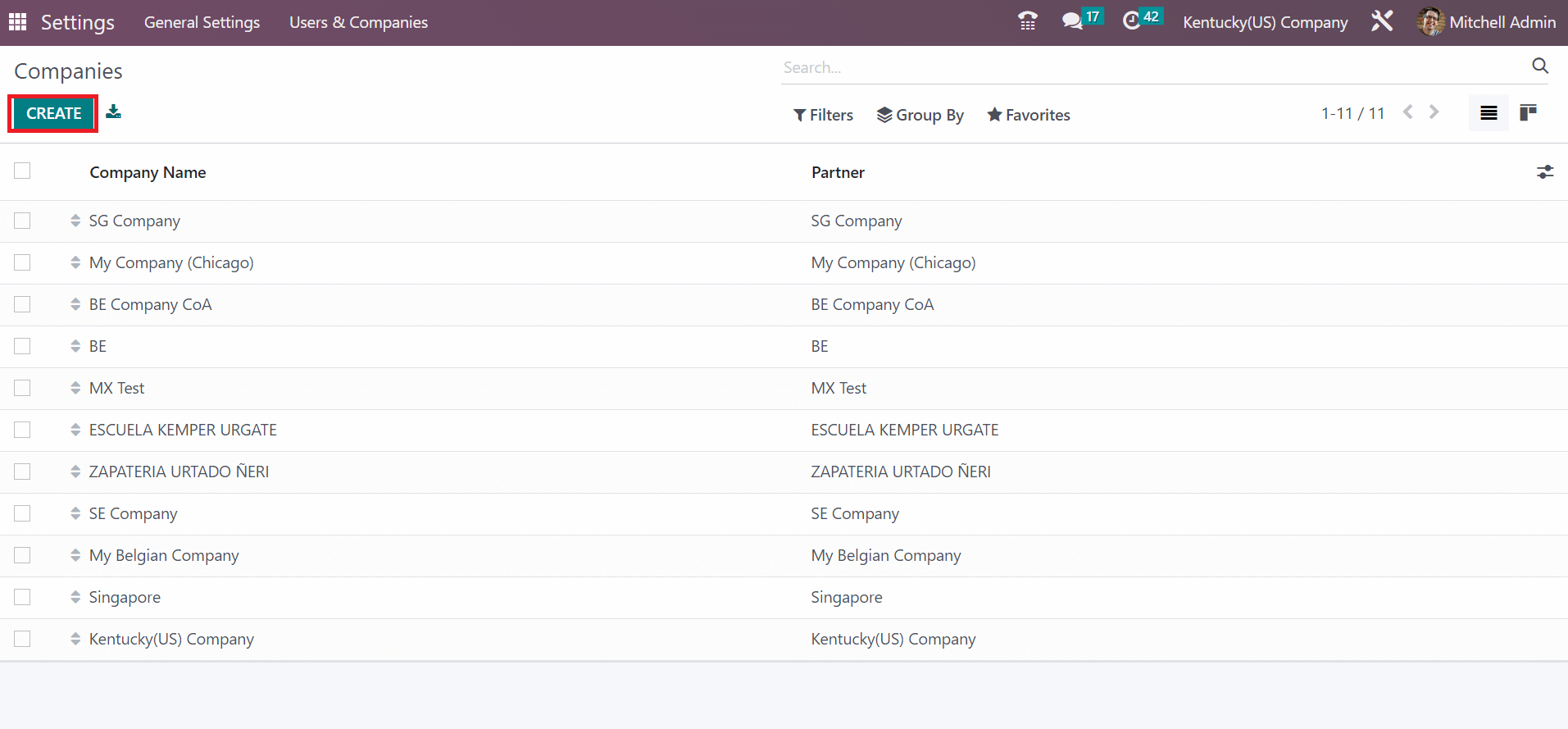

You can choose the Companies menu from Odoo 16 Settings for prospering company information. In the List view of Companies window, we can see Partner and Company Name separately. To generate recent firm data, pick the CREATE button in the Companies window, as signified in the screenshot below.

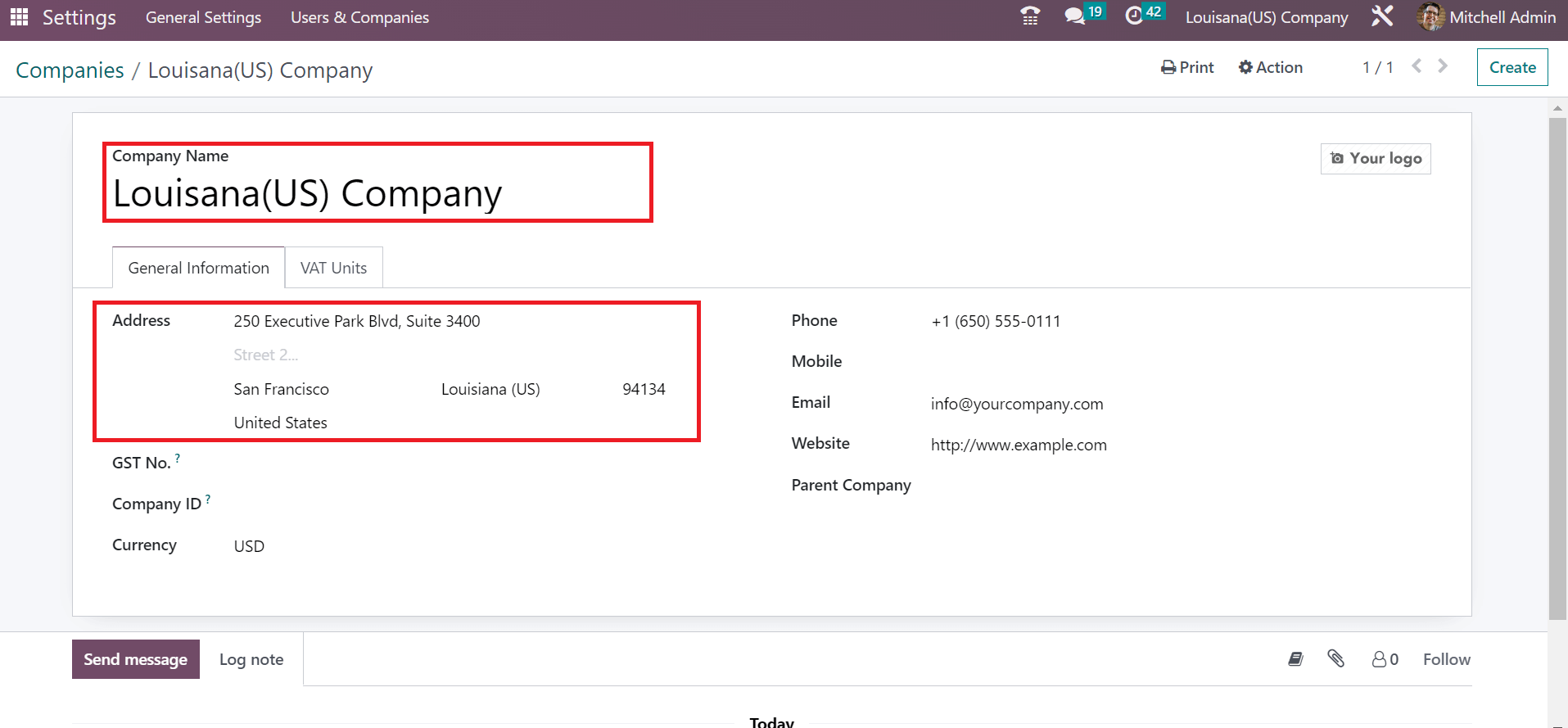

In the open screen, put on the Louisiana(US) Company in the Company Name field. Moreover, apply the street names, Pincode, Country, and state in the Address option.

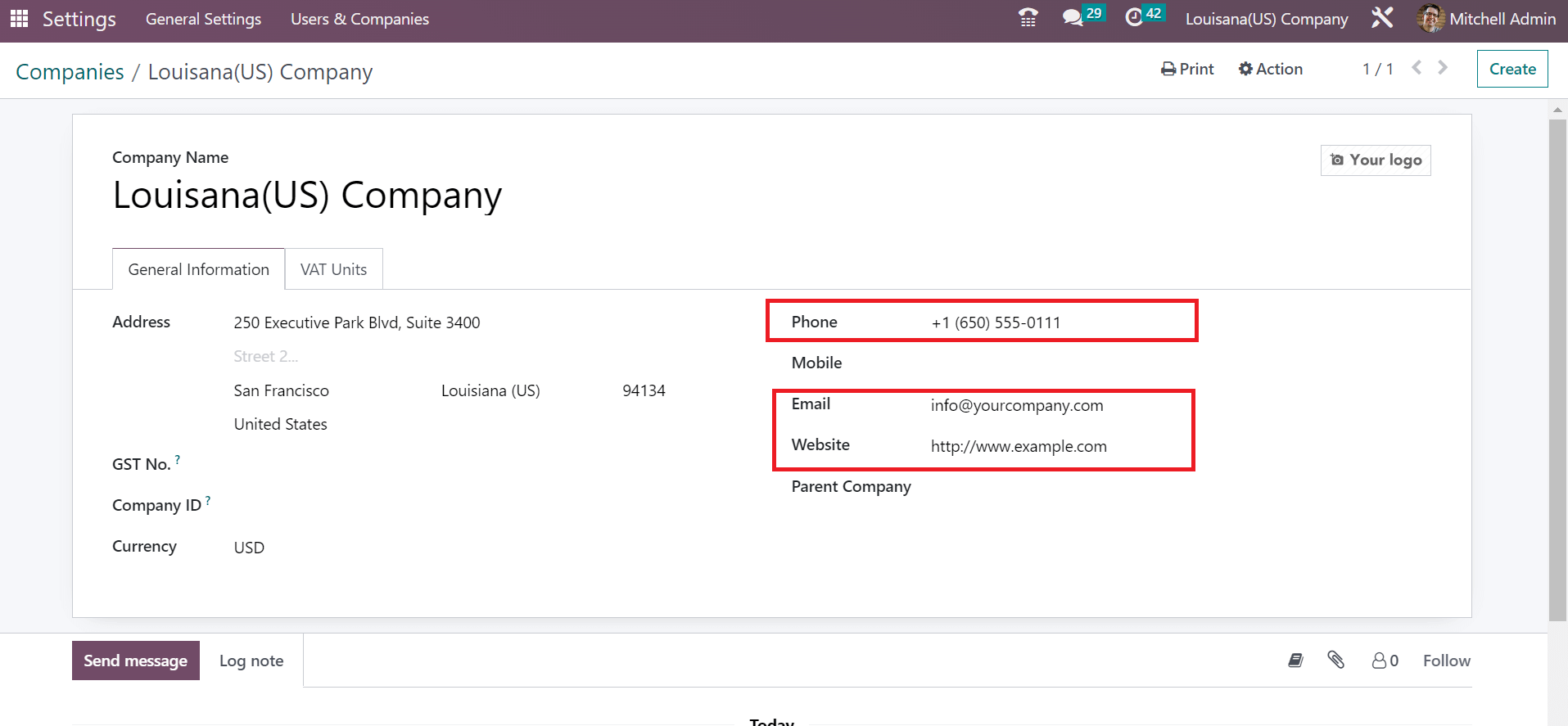

You must enter Louisiana(US) in the state option and the United States in the Country. Add the company phone number, website, and email address under General Information, as indicated in the screenshot below.

Details of your company are saved automatically in the Odoo 16. Next, let’s produce the sales tax of Louisiana in the Odoo 16 Accounting.

How to Configure Sales Tax of Louisiana(US) in the Odoo 16 Accounting?

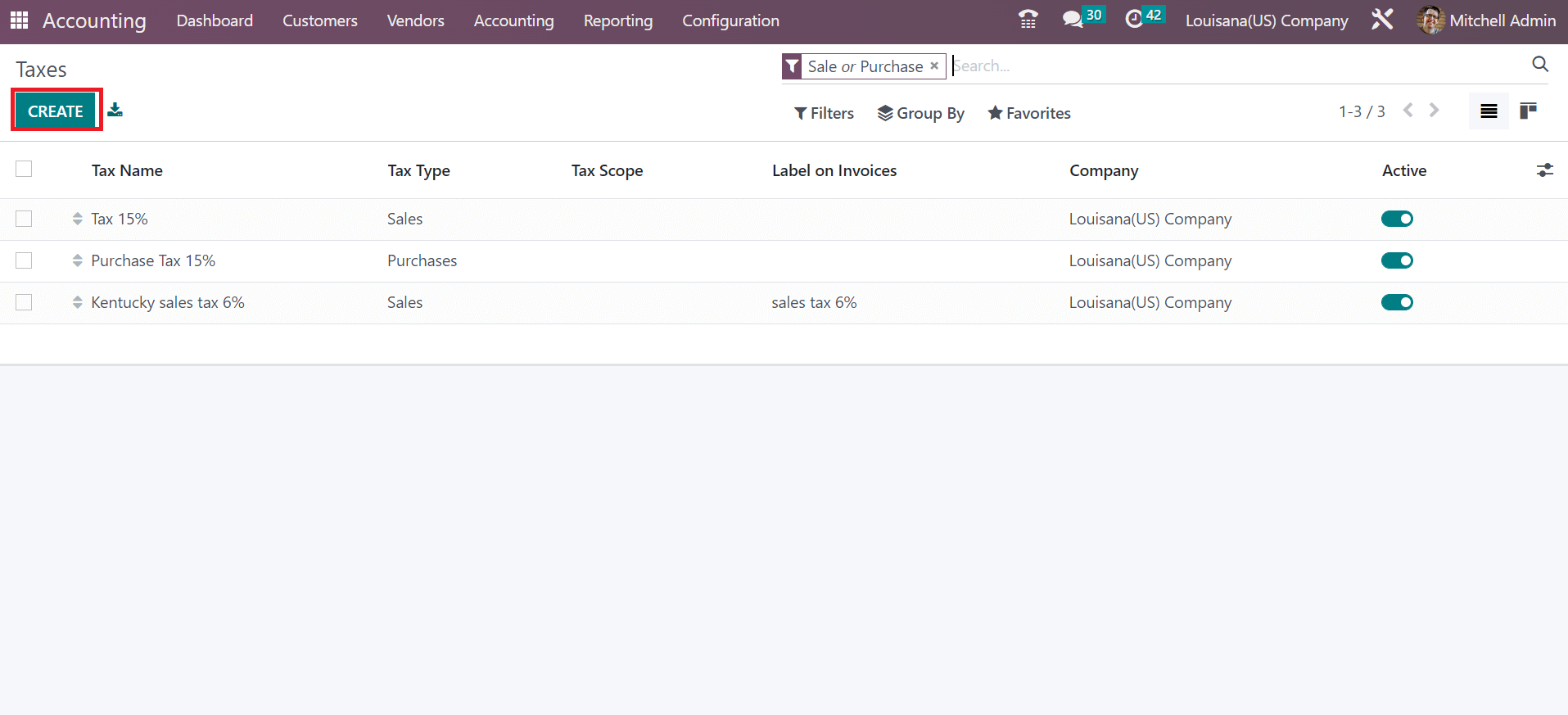

Below the Accounting section of ConfigurationConfiguration, click the Taxes menu to generate a sales tax. The Taxes window shows different types of purchase and sales tax percentages with company details. By clicking on CREATE icon, it is easy to develop a recent sales tax for your company, as specified in the screenshot below.

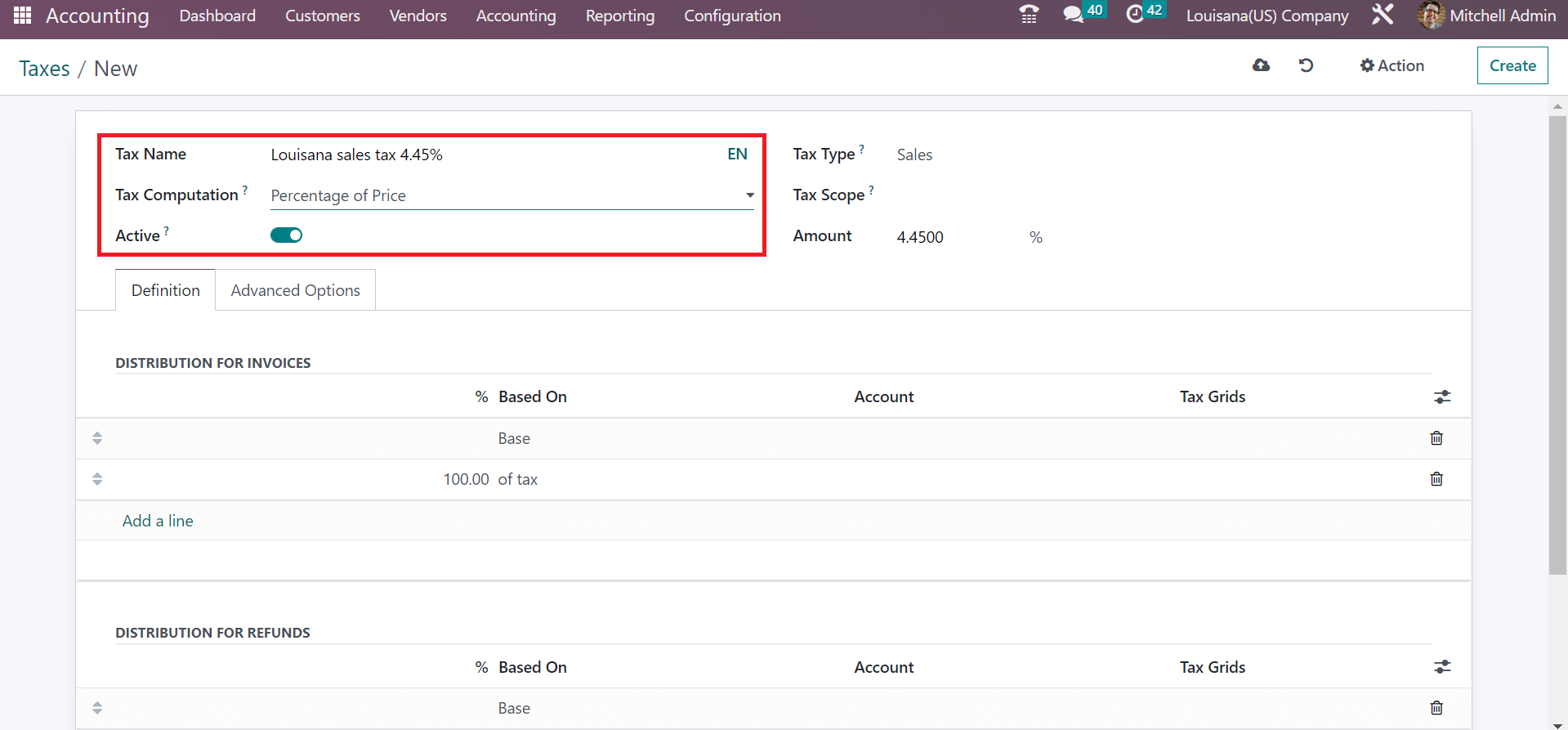

Mention Louisiana Sales Tax 4.45% in the Tax Name field. Later, the user can pick a computation method that includes Python code, Fixed, etc. Select your required tax compassion for the Louisiana sales tax of 4.45%, as defined in the screenshot below.

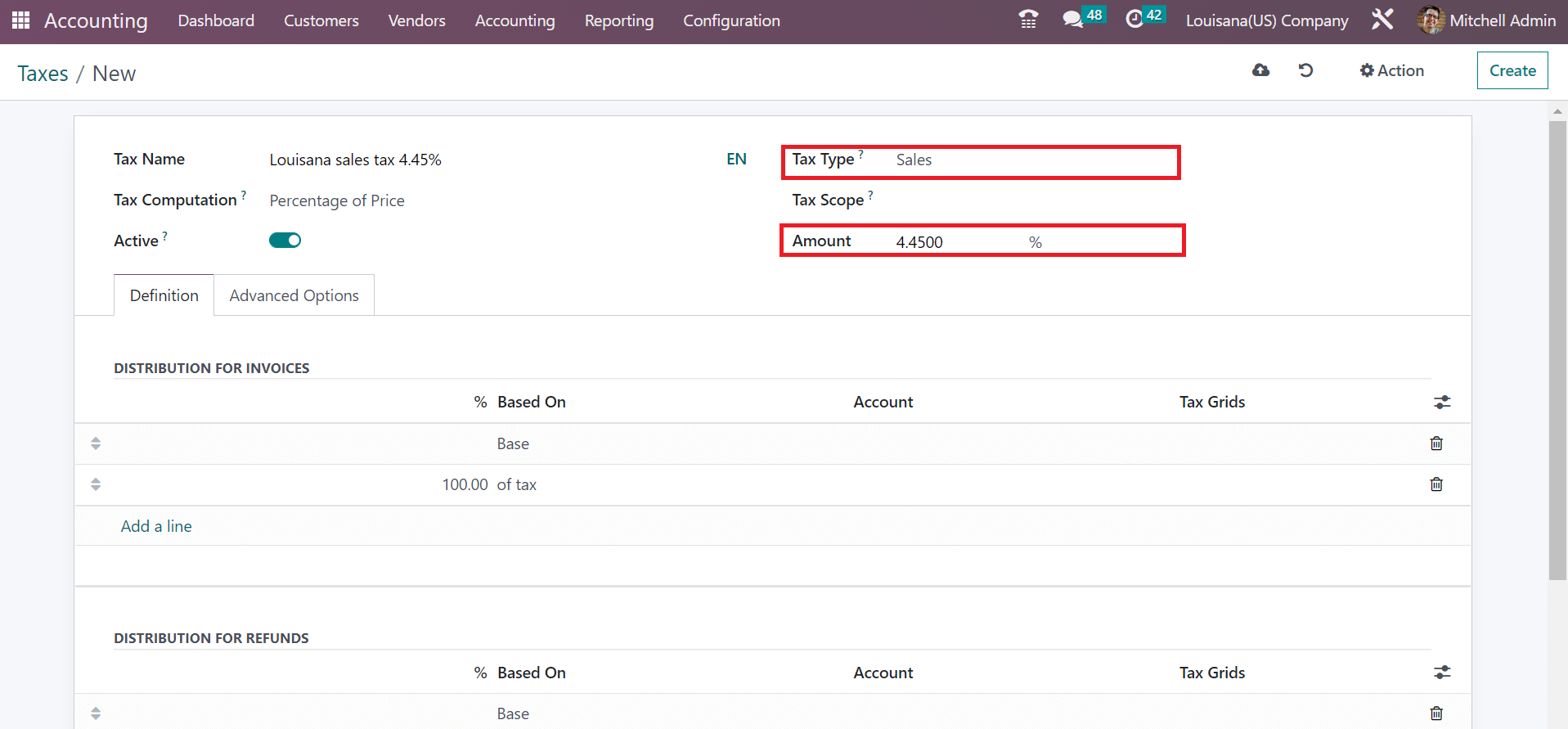

You must enable the Active field in the Taxes window to run this specific tax. Furthermore, the user must determine the tax category as Sales or Purchases. After setting Sales as Tax Type, add the tax Amount as 4.45% in the Taxes window.

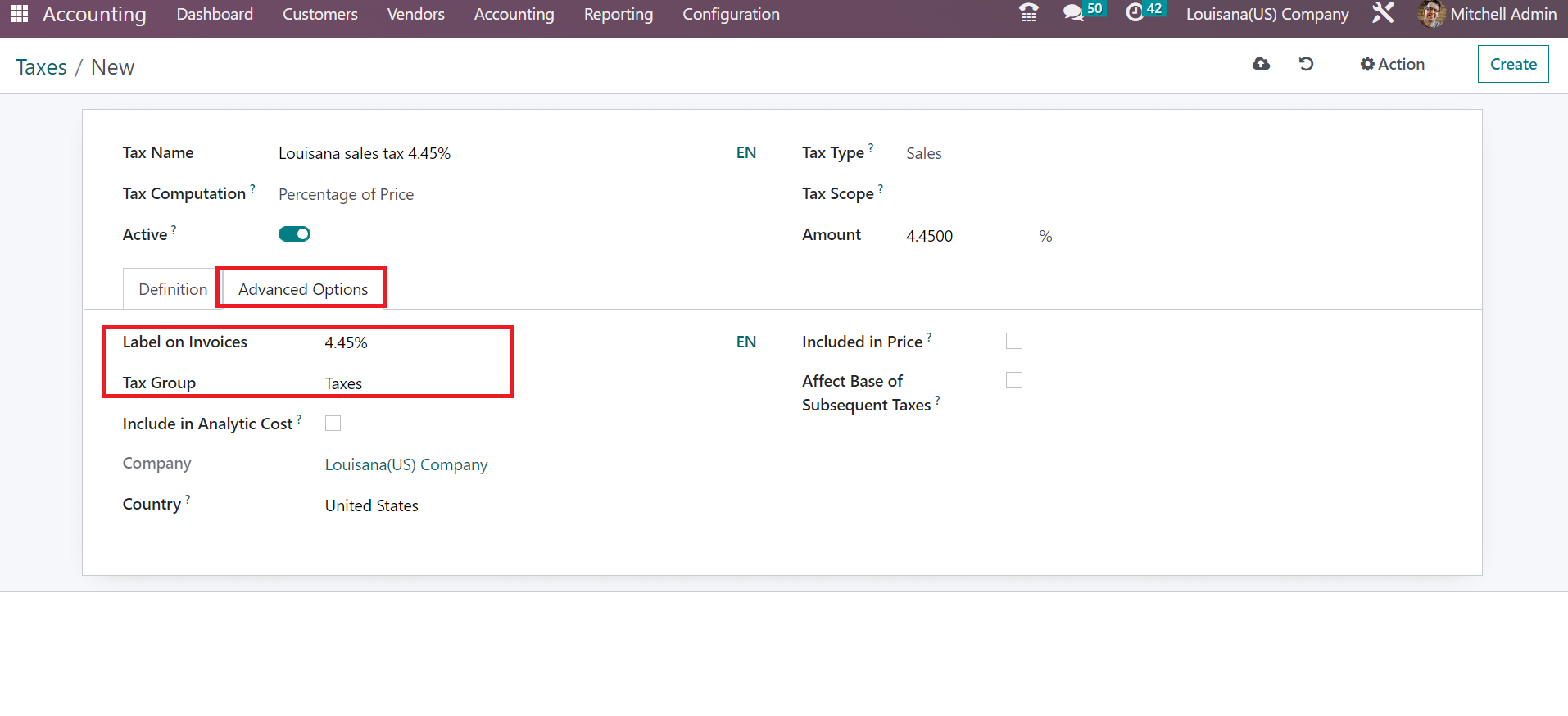

You can select Add a line option if you want to split taxes for refunds and invoices. Below the Advanced Options section, you can enter the text visible on invoices in the Label on Invoices field. Also, choose the group of your tax in the Tax Group option as Taxes.

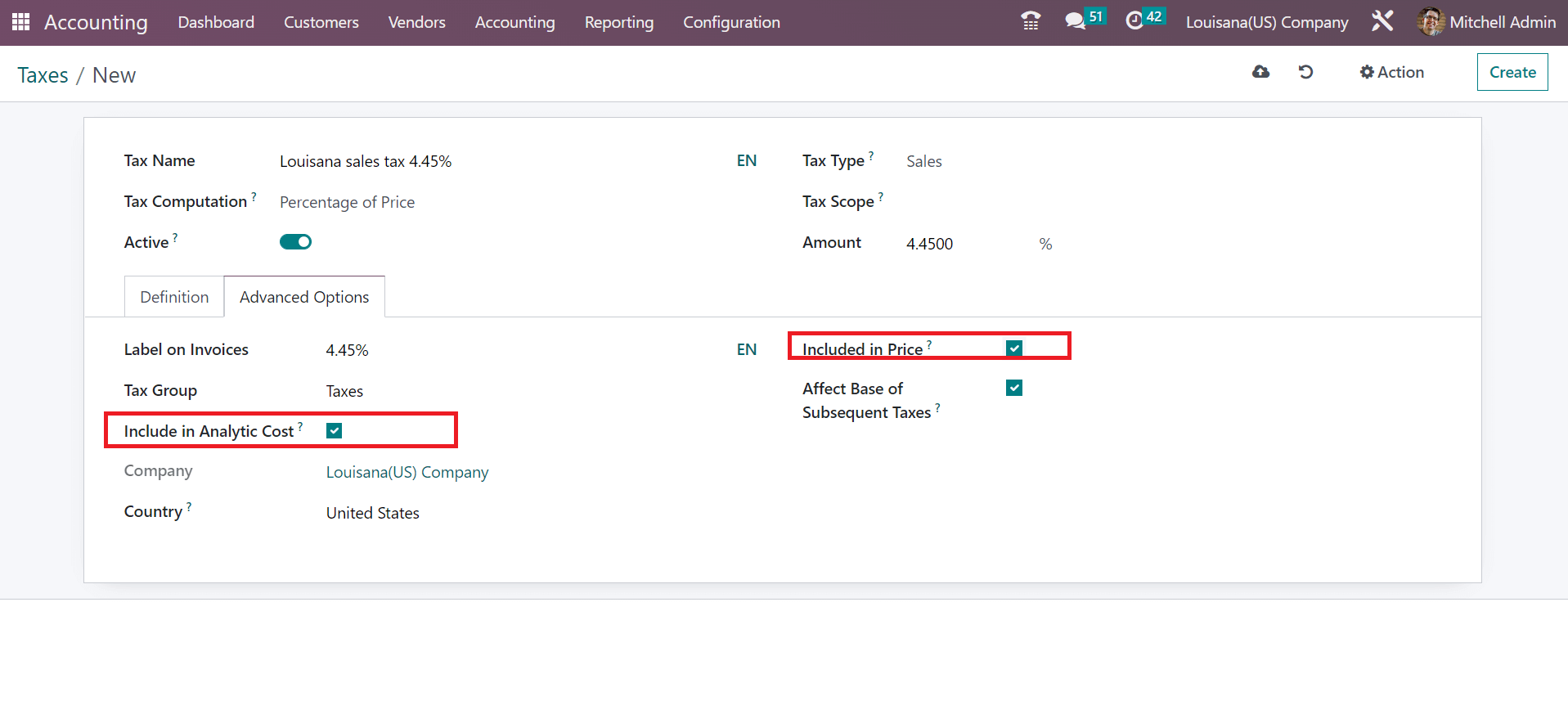

You can activate the Include in Analytic Cost option if you want to see the tax in the analytic cost section. Similarly, it is possible to attach the price along with tax after enabling the Included in Price option.

Users can save the Louisiana sales tax details manually in Odoo 16.

Louisiana Sales Tax Application on a Customer Invoice

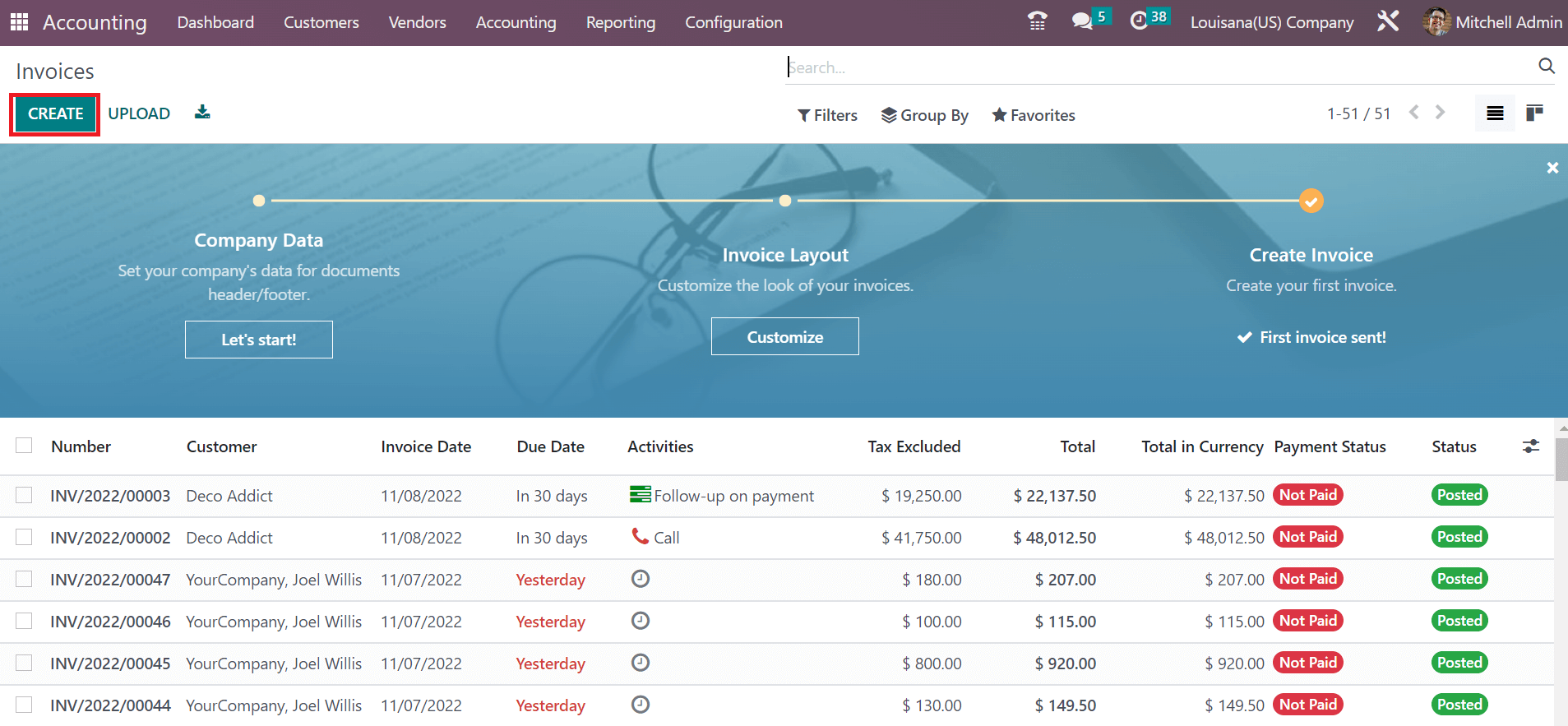

The invoices menu is visible to a user inside the Customers tab of the Accounting module. The record of each invoice contains details including Invoice Date, Total, Number, Status, etc. By choosing the CREATE option, the user can produce a recent invoice for the customer, as portrayed in the screenshot below.

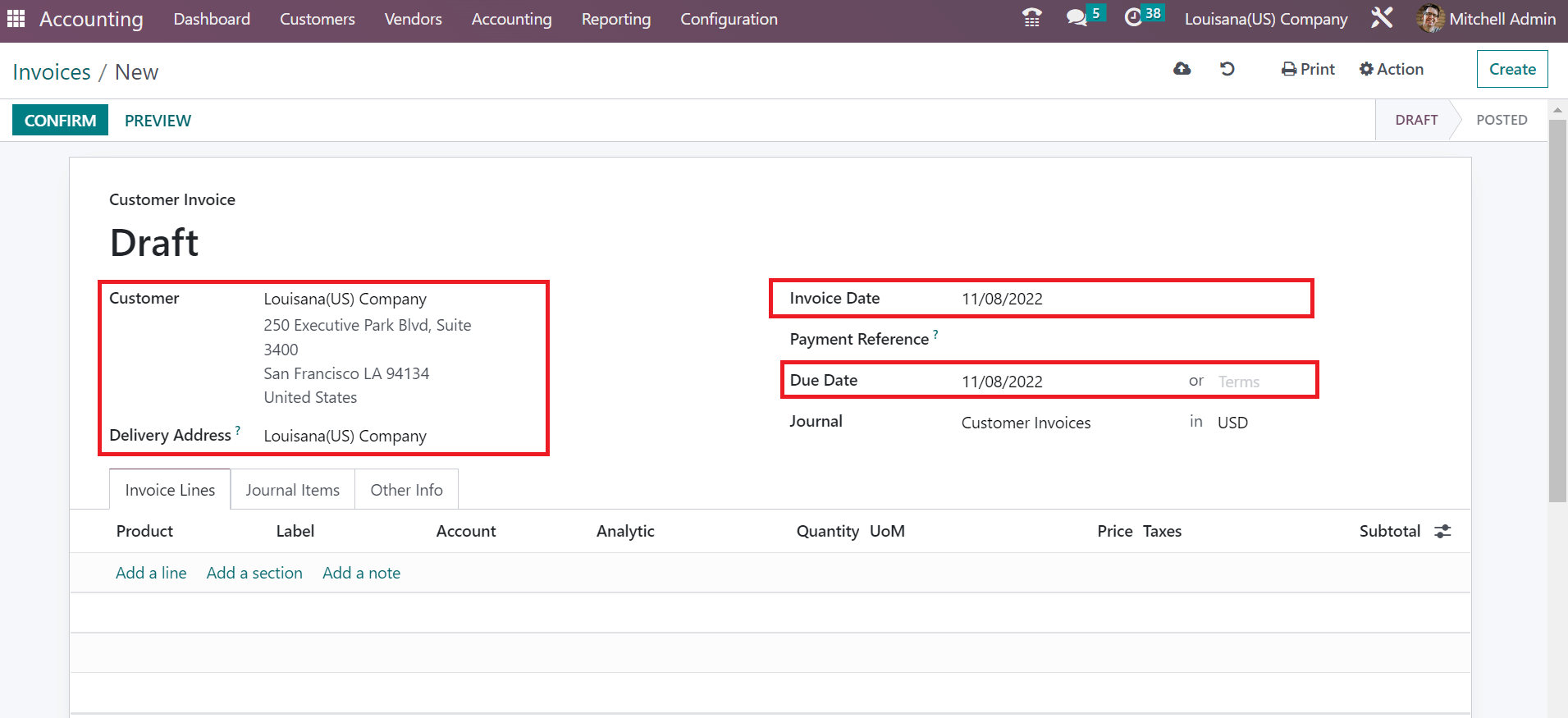

Choose Louisiana(US) Company as your partner in the Customer field. The address for your latest invoice for the customer is accessible within the Delivery Address field. Additionally, we can add the Invoice and Due Date of the customer invoice, as illustrated in the screenshot below.

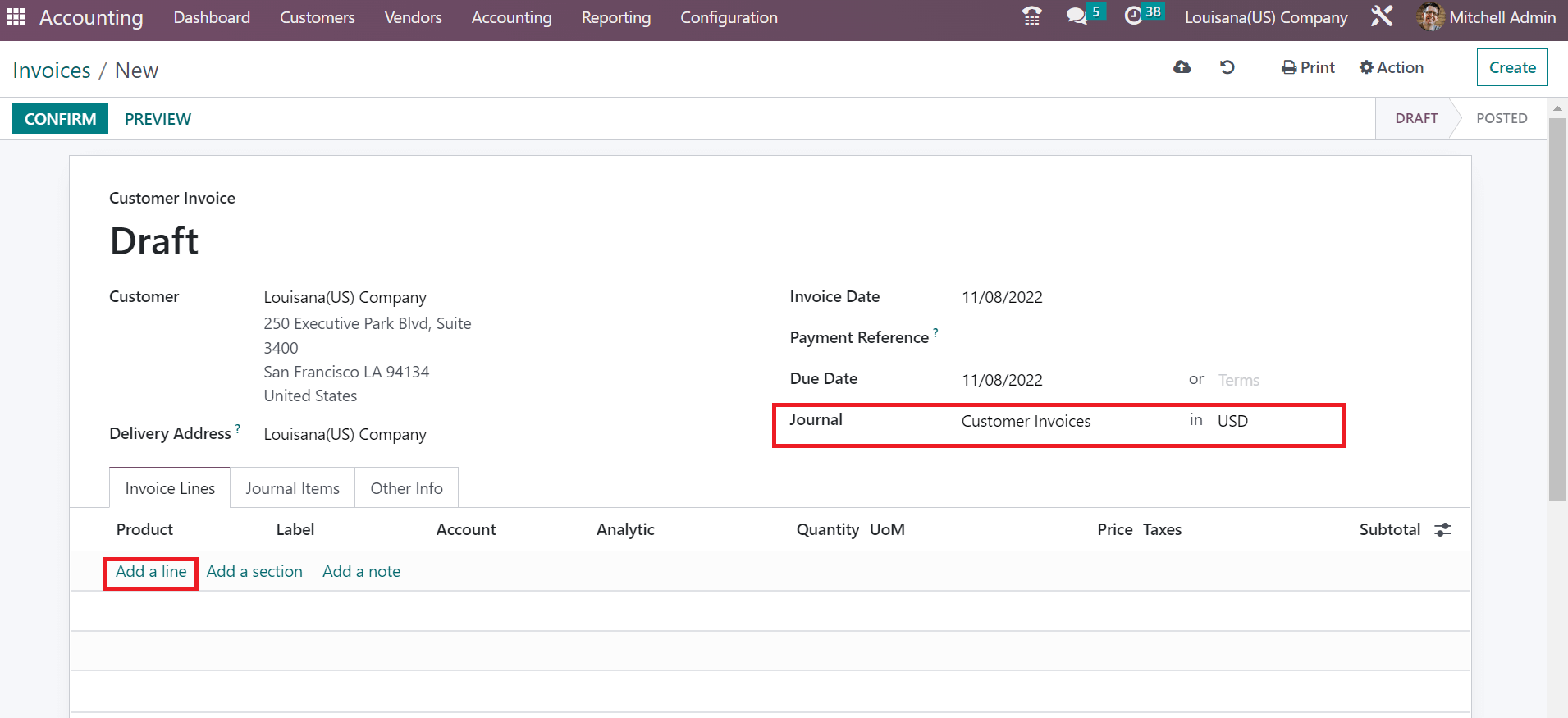

It is possible to pick the Journal for your invoice in the Journal option. To specify the item for the customer invoice, click the Add a line below Invoice Lines as indicated in the screenshot below.

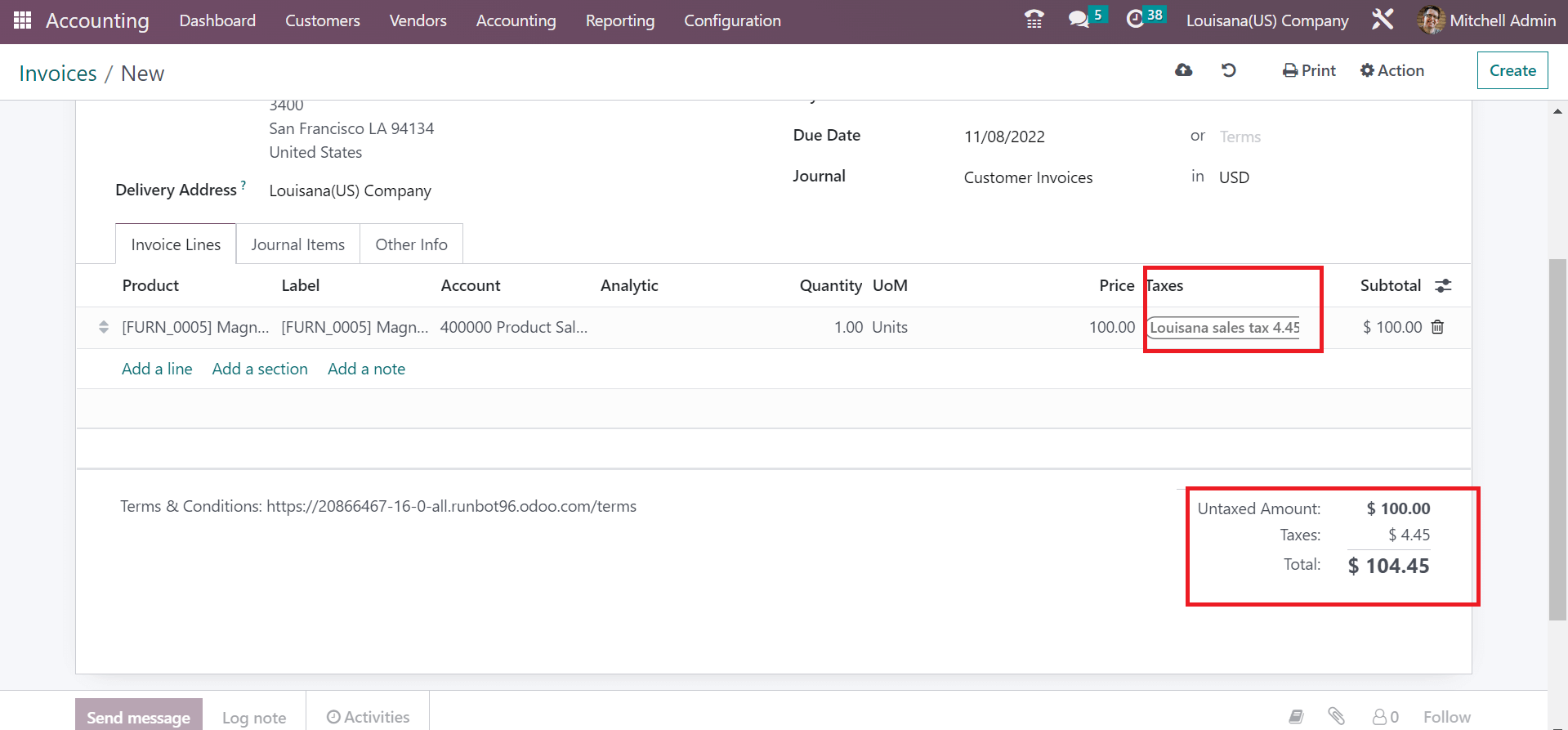

Users can easily pick the product and select the Louisiana sales tax of 4.45% under the Taxes section. After applying the taxes, the Total cost of a commodity is obtainable at the right end.

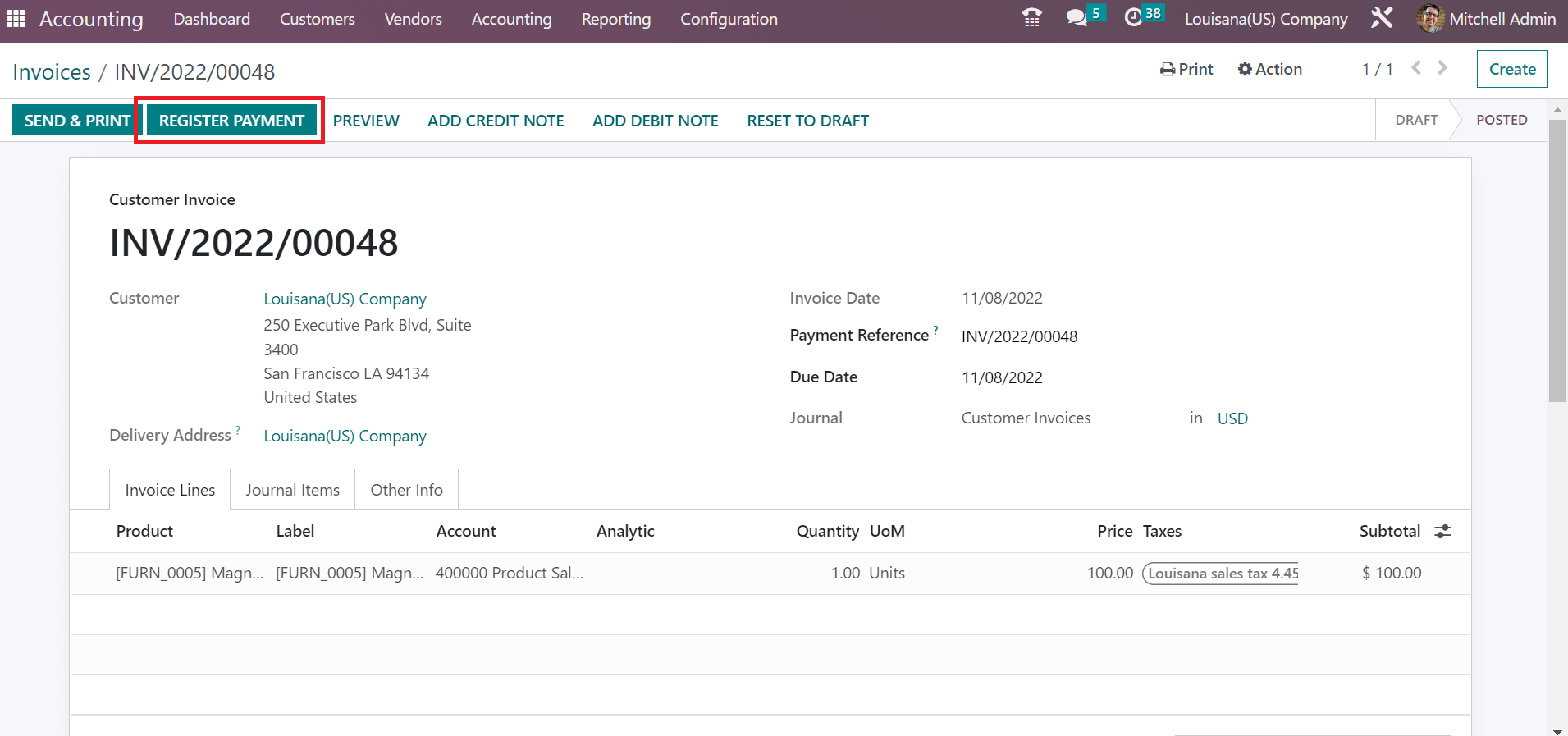

We can confirm the invoice and make further payments to the customer. Click the REGISTER PAYMENT icon to pay with a customer, as denoted in the screenshot below.

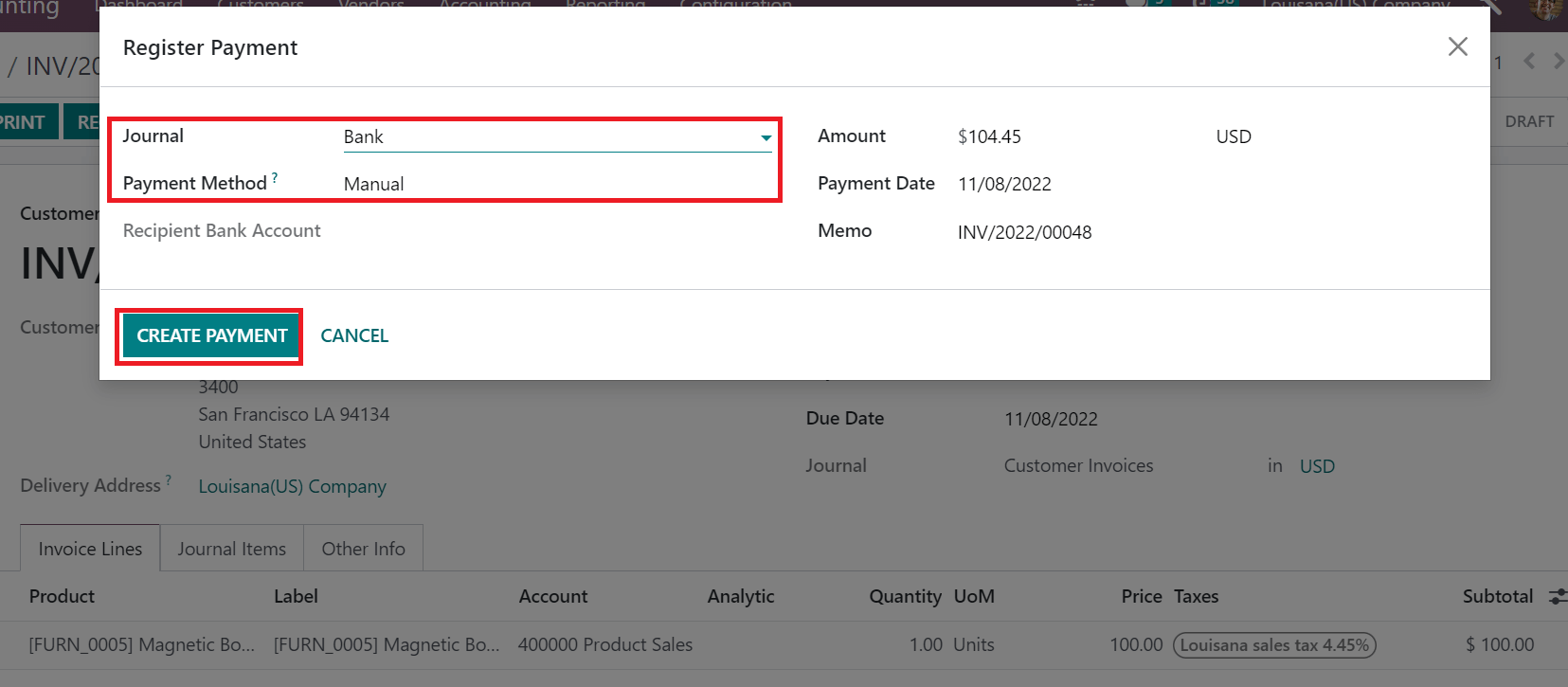

In the Register Payment window, pick your Journal and set a payment method. We select the Manual option in the Payment Method field for invoice payment.

Information about the Payment Date, Memo, and Amount is manually visible to the user. After managing the data, click the CREATE PAYMENT button, as revealed in the screenshot above. So, it is easy to handle payments for customer invoices in the Odoo 16.

Accounting functions of a company manage easily with the Odoo 16 Accounting. Tax configuration becomes simple in your firm by downloading ERP software to your system. Check out the below link to learn about Colorado(US) tax setup in Odoo 16