In Odoo 15, the cut-off in Accounting is a brand-new feature. This was introduced in Odoo 14 version. Let’s now jumbo to understand how The cut-off operations are being conducted with the Odoo Accounting module. Due to some unpayable invoices or bills, there may be some matches on the Profit and Loss Report at the end of a specific period. To recognize the exact income statement for a period, we'll need to make some adjustments. We can easily manage this change in Odoo 15 by utilizing the cut-off.

Through an example, we will discuss the use of cut-off. Here making an invoice for a customer named “Tom customer “ right now.

An invoice is a business record that includes information on the product or service supplied to the client and the amount of money that the client owes the company. This includes product information, client information, and payment information.

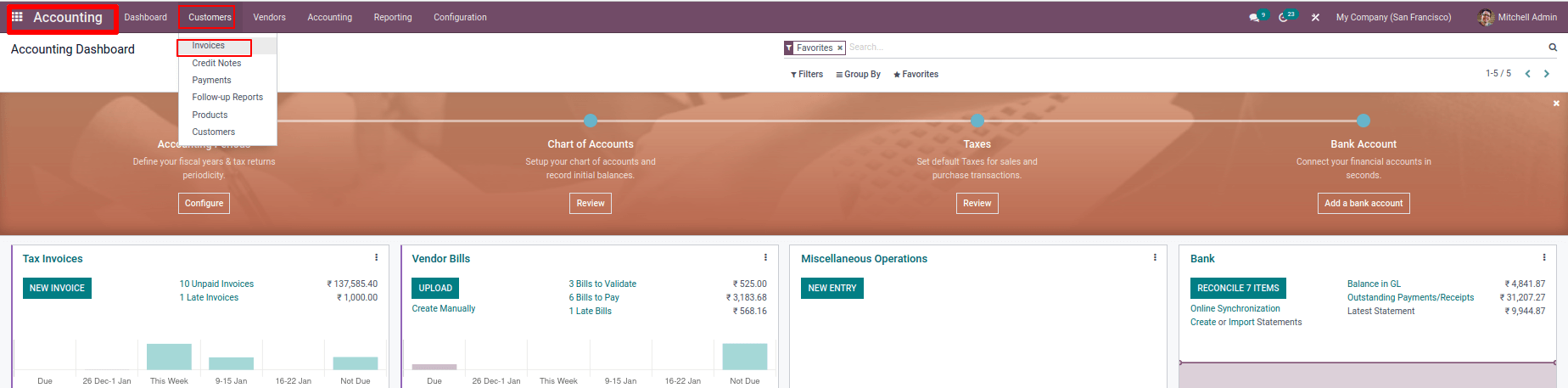

Go to the Customer tab in the Accounting module and select the Invoice tab to create an invoice. There is a pay-only list of previously created invoices. We can create a new one by clicking the Create button.

Go to Customer > Invoices > Create

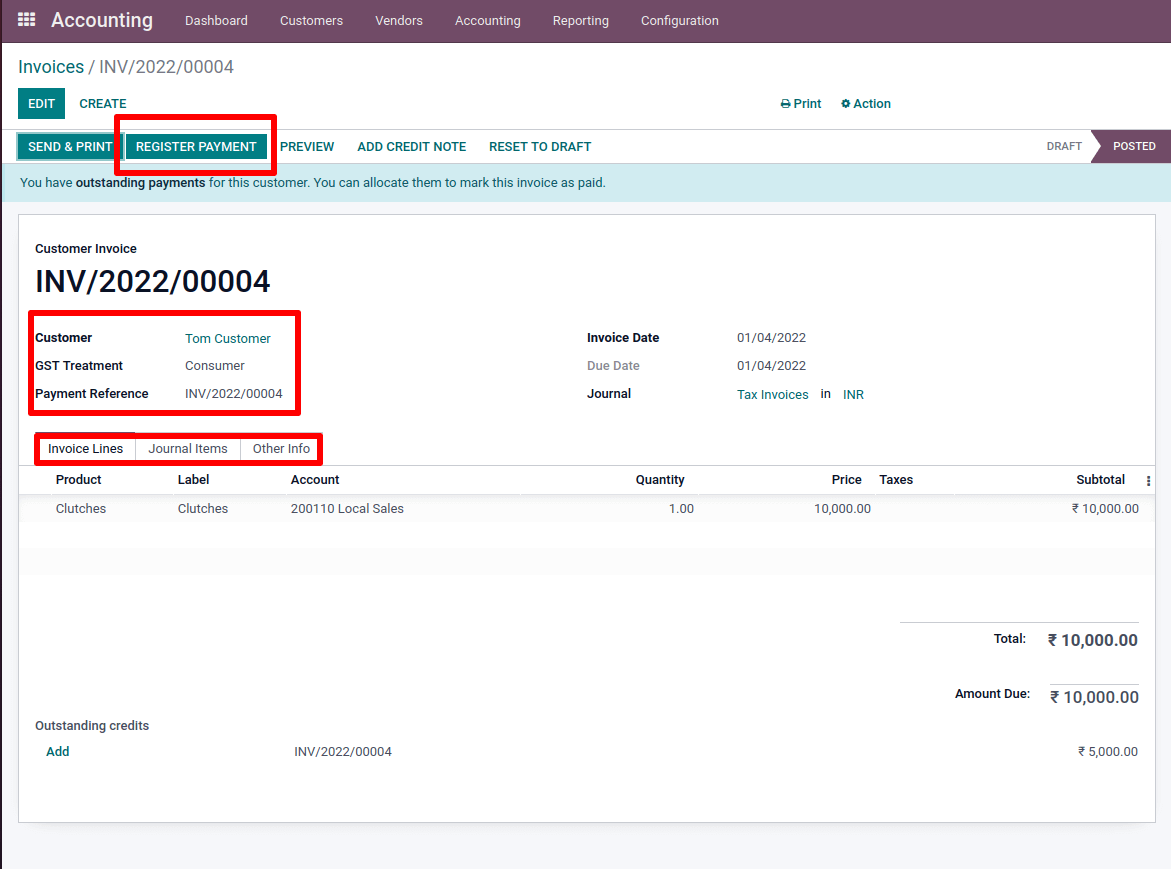

Add the customer's name to whom the goods were sold. Payment Reference can be added to a journal item. The invoice date is when the invoice was created. The due date is a date that indicates ill when a payment is due. We can add products to be billed in the invoice line. After confirming the invoice, we get the prepared journal entries from the journal entry tab. We can add invoice details such as Customer Reference, Salesperson, Sales Team, Recipient Bank, and Accounting details like Company, Incoterm, Fiscal Position, and so on to the Other Info tab. If we enable Post Automatically, the invoice will be automatically posted on the accounting date. Set the invoice date, due date, and other product details. Create an invoice worth 10000 here. Save it when you've filled in all of the details. The invoice can then be confirmed. Then we can add a payment to the created invoice. To add a payment, click Register payment.

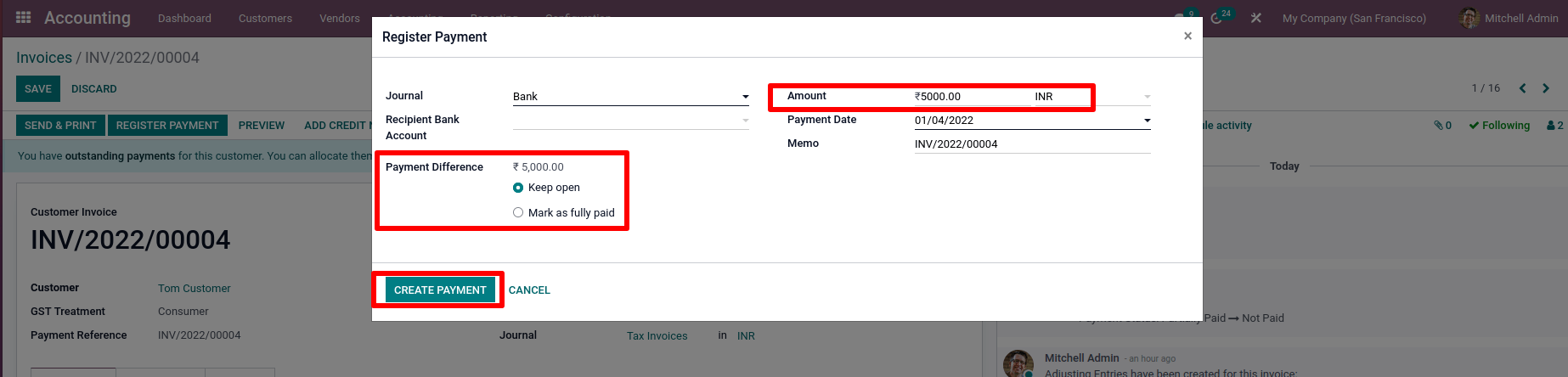

In rare cases, the customer pays only a a portion of the total due to unforeseen circumstances. As a result, the Demo client is only paying half of his invoiced amount. We can observe the payment difference and keep it open.

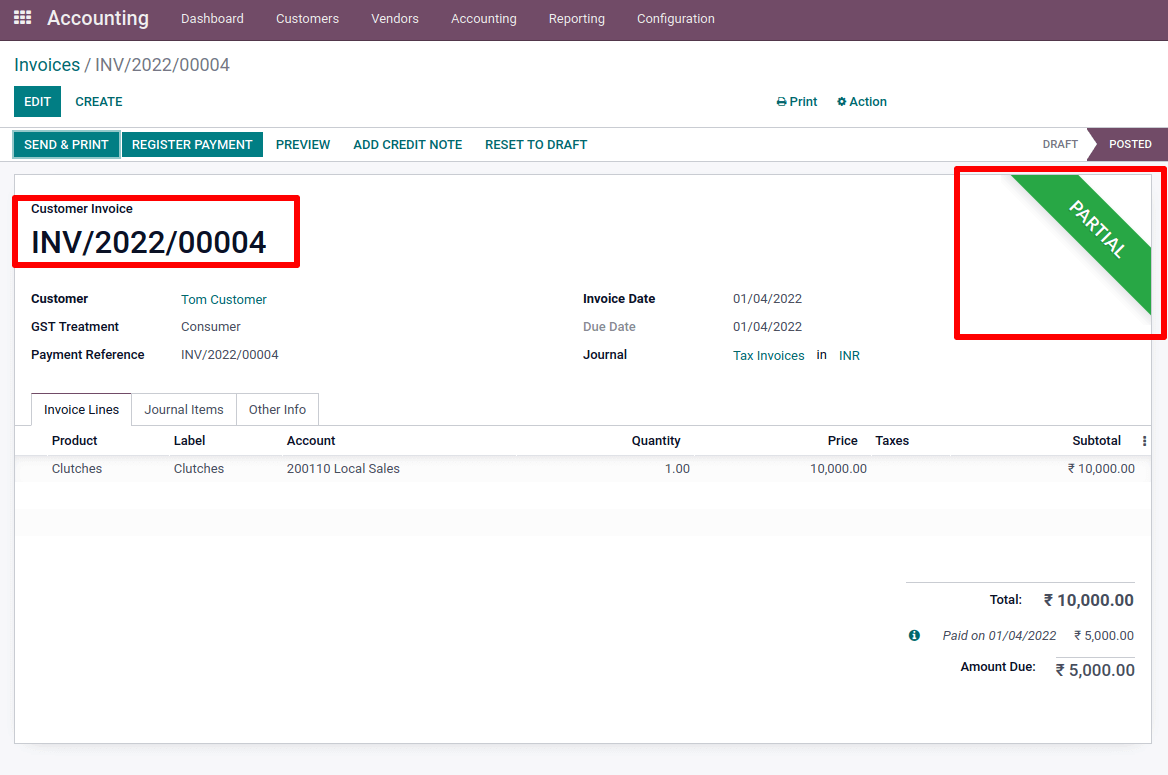

Then the Invoice is depicted as partially paid.

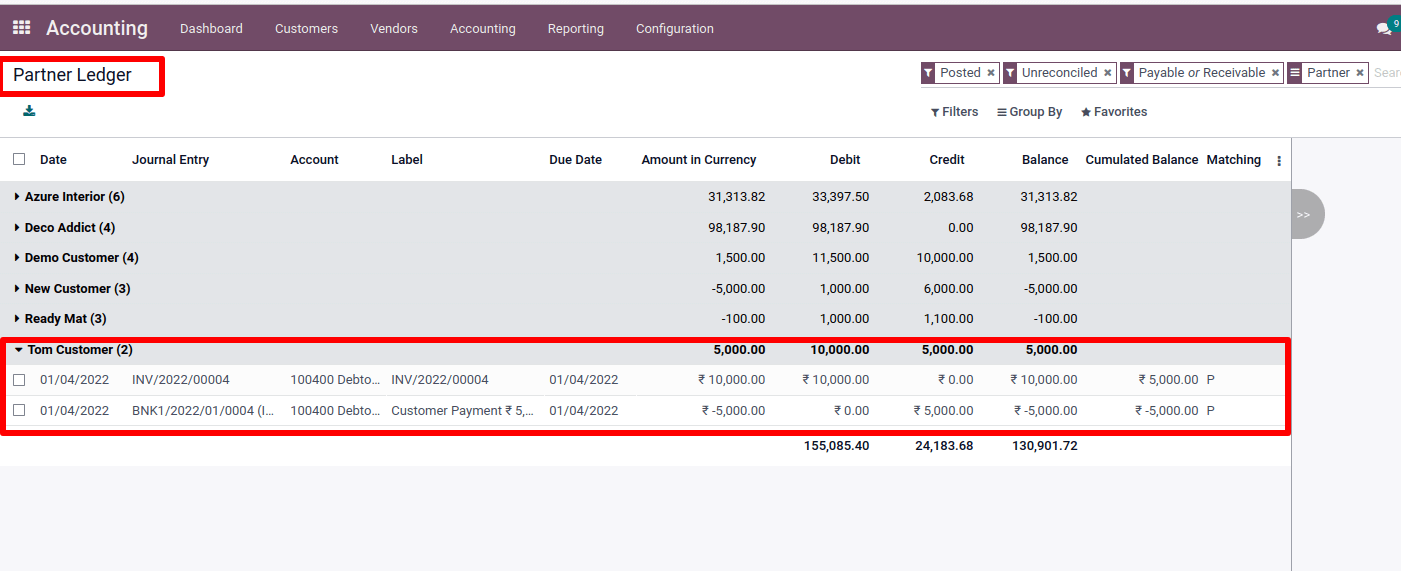

Let us check the Partner Ledger under the Accounting tab.

Now go to Accounting > Partner Ledger

We can see the customer when we examine his transactions, we can see that the debit is 10000, and the credit is 5000 and-5000 is the balance. This means that we created a 10000 rupee invoice, but he only paid 5000, leaving a 5000 rupee balance. The Partner Ledger statement shows this as Pay only to debit, credit, and balance.INV/2022/0004 Shows the Invoice details, and BNK1/2022/0004 shows the bank payment.

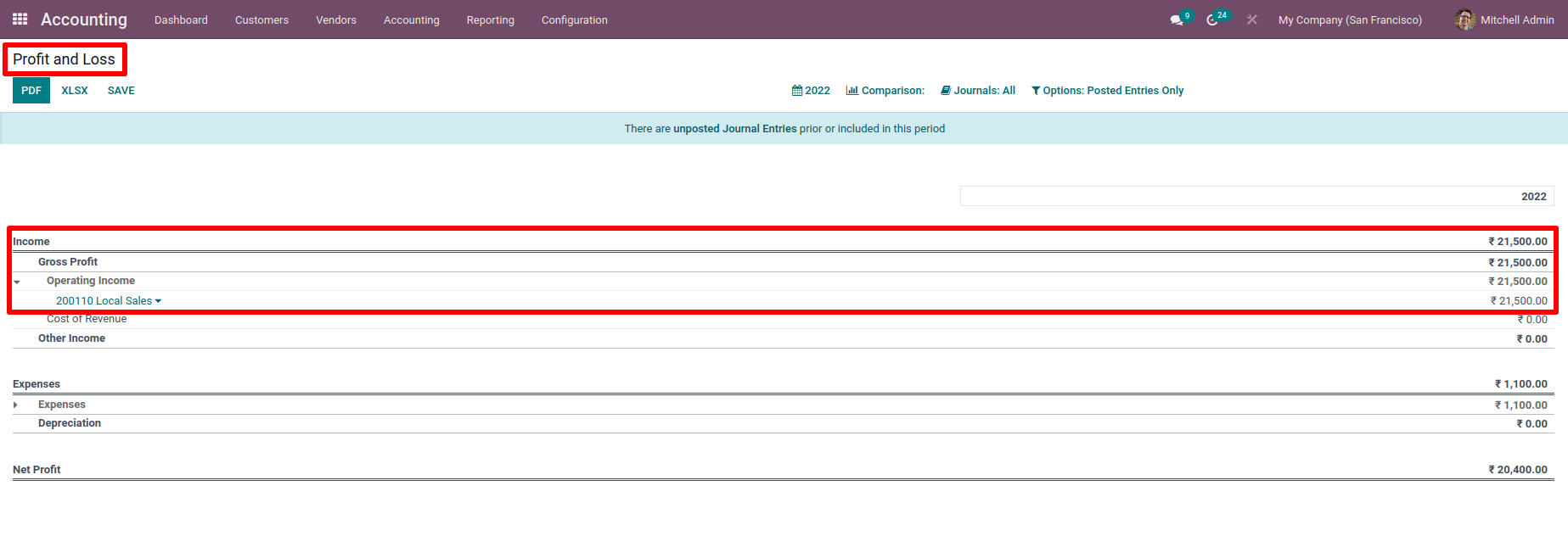

We can check the profit and loss report to know about the company income by choosing it from the reporting tab while looking at the profit and loss report.

Go to Reporting > Profit and Loss.

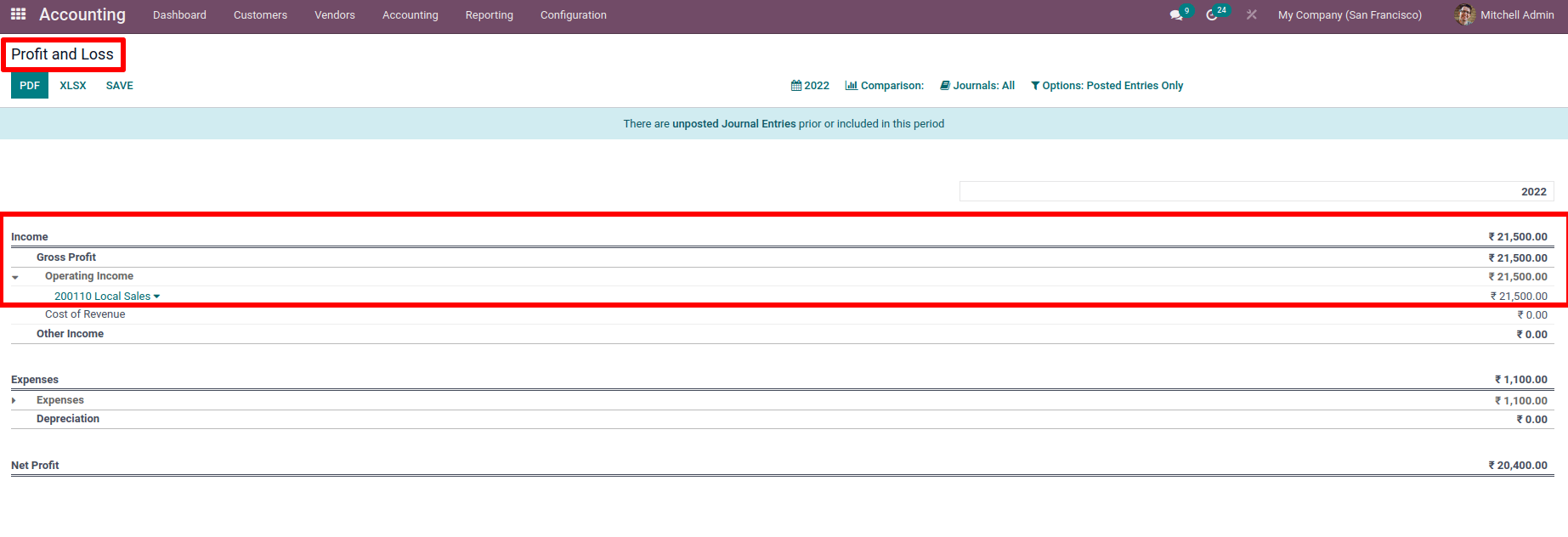

We can see that the company's overall operating income is now 21500 rupees. The total income of a company is its overall operating income.

Here, we prepared a 10,000rupee invoice for the customer. However, he only paid a portion of the bill. That is, he only paid a total of 5000rupees. As a result, this 5,000 rupees is included in the total income.

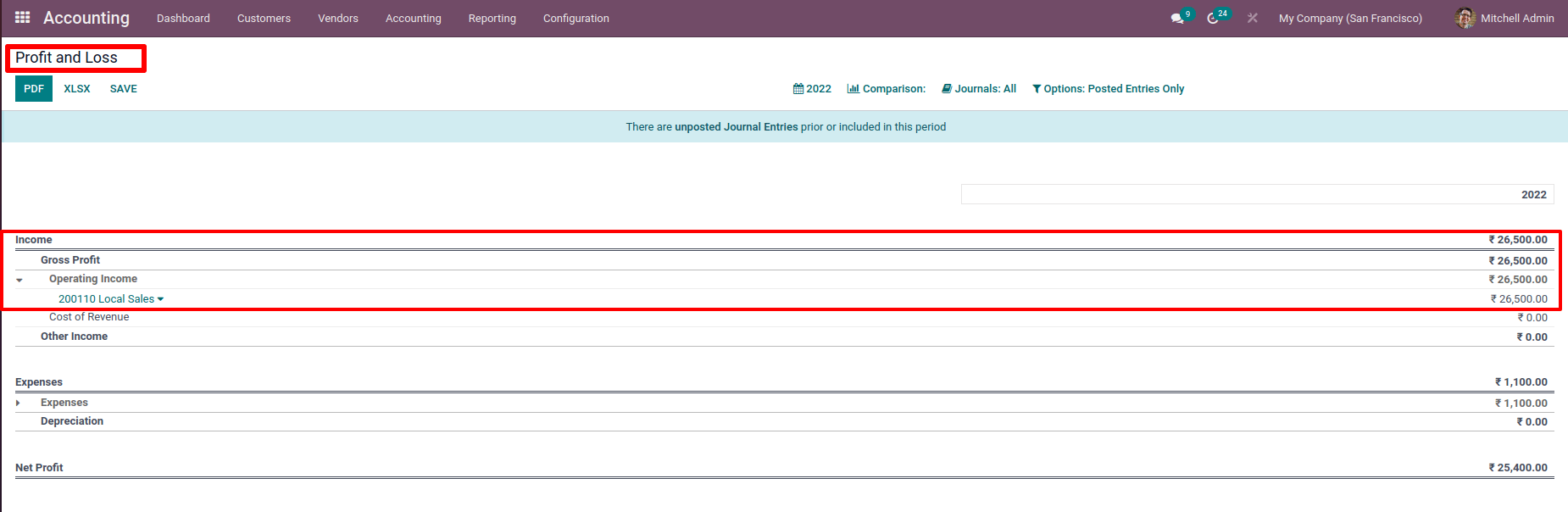

We made a 10000 rupee invoice here. However, only half of the invoiced amount was paid, i.e., 5,000 rupees. In this scenario, the company's actual income is 26,500rupees, including a 10,000 rupees invoiced amount. However, only 21500 rupees are recorded when checking the profit and loss report because of the partially paid invoice. We may change this by applying a cut-off. We create an adjustment entry in cut-off and add the balance of 5000 rupees to an accrued account. And select including a specific date; the journal entry will only be posted on that day. The profit and loss report reflects the actual total income, which is 26500rupees, while we establish a cut-off till that date. As a result, we receive the right report by using a cut-off.

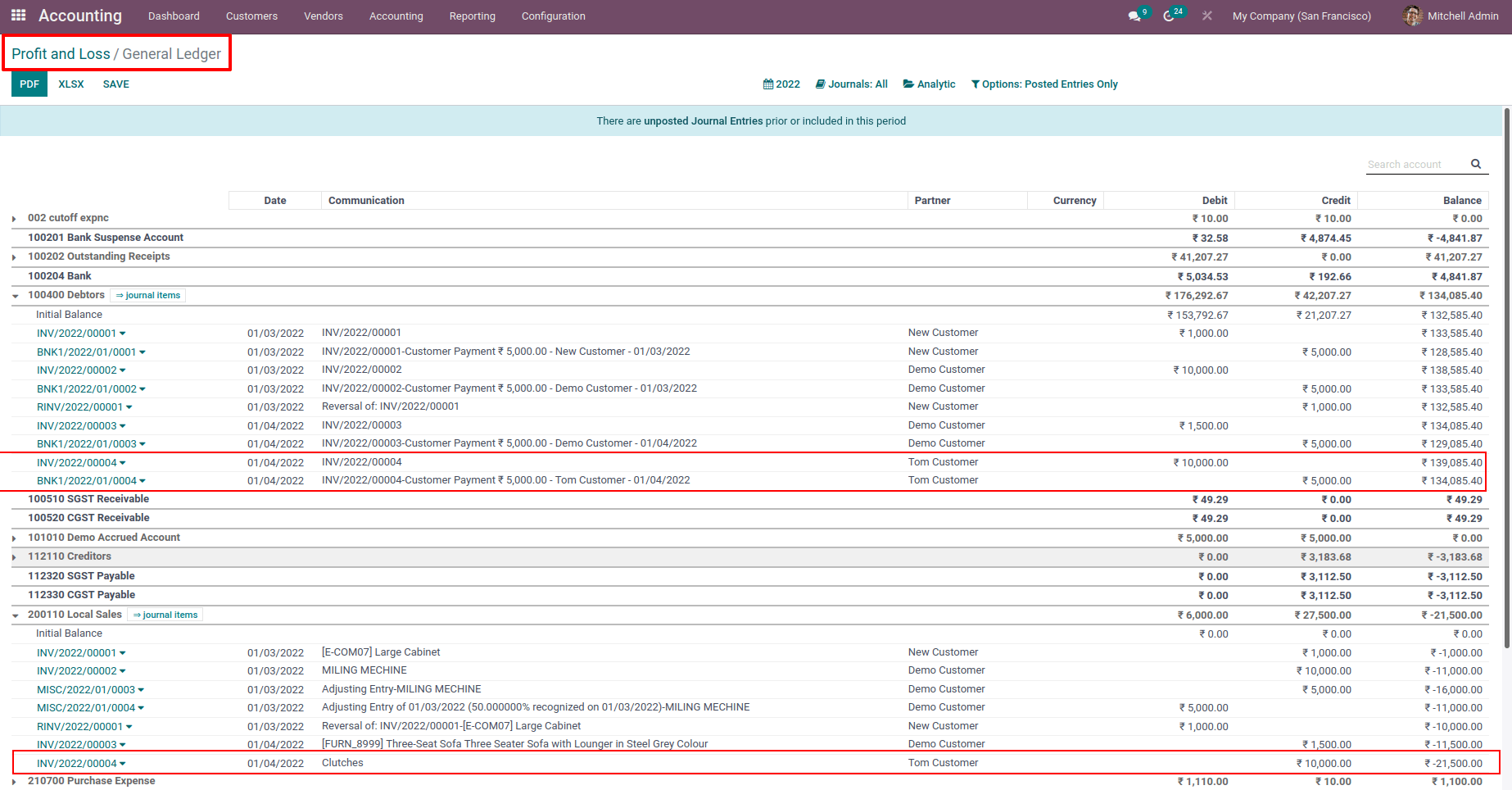

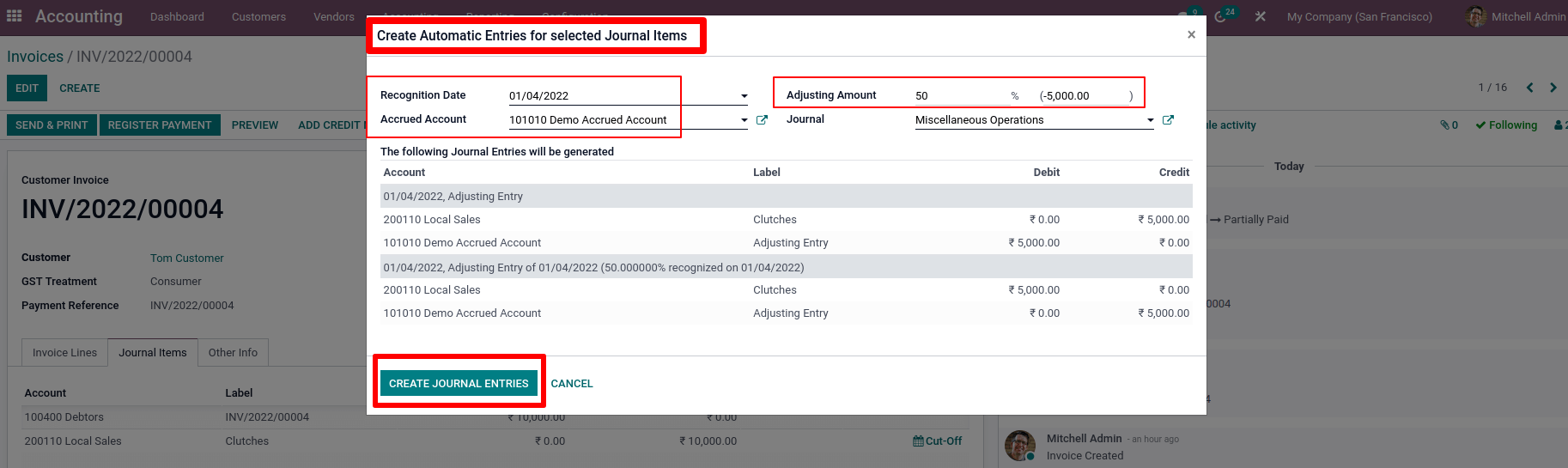

When we look at that specific invoice we created, we can find the cut-off option under the journal items tab. To create an adjustment entry, click on Cut-off. We can see a window for Automatic Entries for selected Journal Items when clicking the cut-off option. We can fill in the details of the adjustment entry there.

The date on which this adjustment entry is recognized in the profit and loss report is the set in Recognition Date; this date of the journal entry will automatically post. The adjustment amount is stored, a current asset acc in out in the Accrued Account. The entire amount affected by the automatic entry is the Adjusting Amount.

Because this is a partially paid invoice, we set the balance to 50% or 5,000 rupees.

Then, to generate these entries, click on Create Journal Entries.

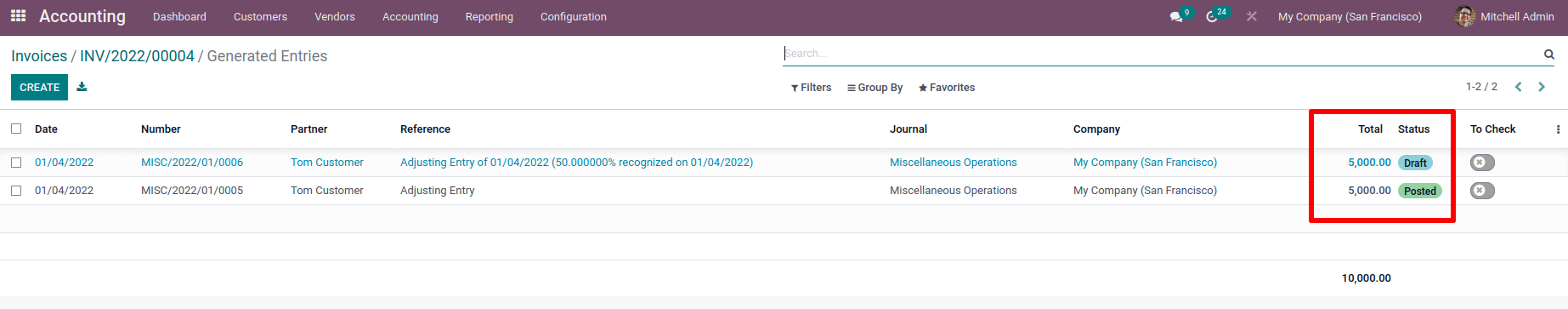

We can see there are two journal entries created. The first one is the created adjustment journal entry in the draft stage. And the second one is in the posted state

While reviewing the profit and loss report, we notice that the entire operating income has increased by 5000 rupees, bringing it to 26,500rupees. Because here we invoiced for an amount of 10000 but paid only 5000. so this balance of 5000 is added to overall income for getting accurate data.

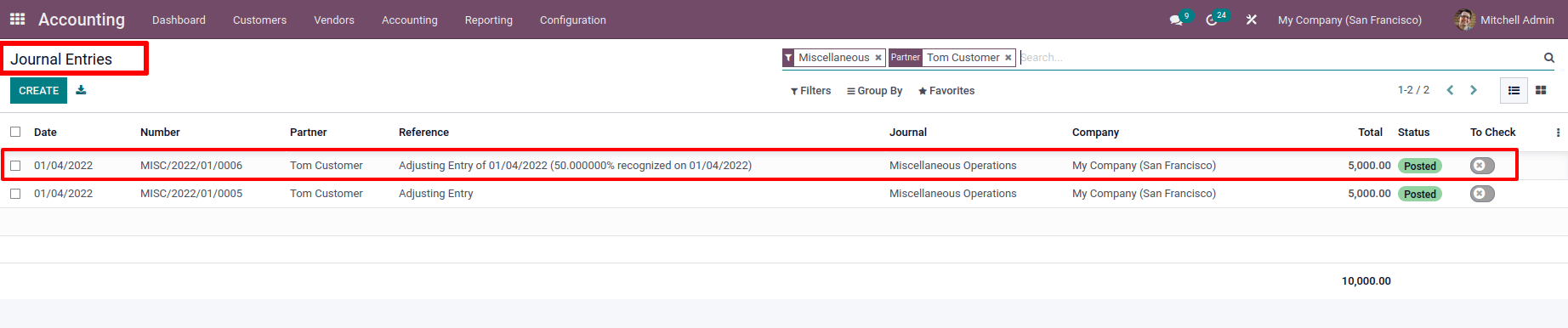

The created journal entries can be found in the journal entries under the Accounting tab.

From there, post the adjustment journal entry. Both journal entries have now been published.

Check the profit and loss report after posting the adjustment journal item to notice that the overall operating income has been reduced to the previous level of 21500 rupees. After posting the entry, we can see the difference of 5000 rupees in the total amount, which will be reflected in the Profit and Loss report.

In Odoo, the cut-off journal is a handy feature pay. We're adjusting outstanding amounts to an accrued account; therefore, data on handy featurely posts on the day we specified in the recognition date. We can see our company's exact revenue by applying a cut-off.