Deferred expenses and prepayments are costs that have already occurred for products or services yet to be received, making them assets for the company. They cannot be reported on the current profit and loss statement or income statement as they will be expensed in the future. These future expenses must be deferred on the company's balance sheet until they can be recognized on the profit and loss statement.

The latest version of Odoo simplifies the management of deferred expenses by automating the process of creating and posting periodic journal entries, providing a user-friendly interface and robust tools for efficient scheduling, transparency, and detailed reporting. This feature is particularly useful for long-term contracts, prepaid services, or significant operational costs.

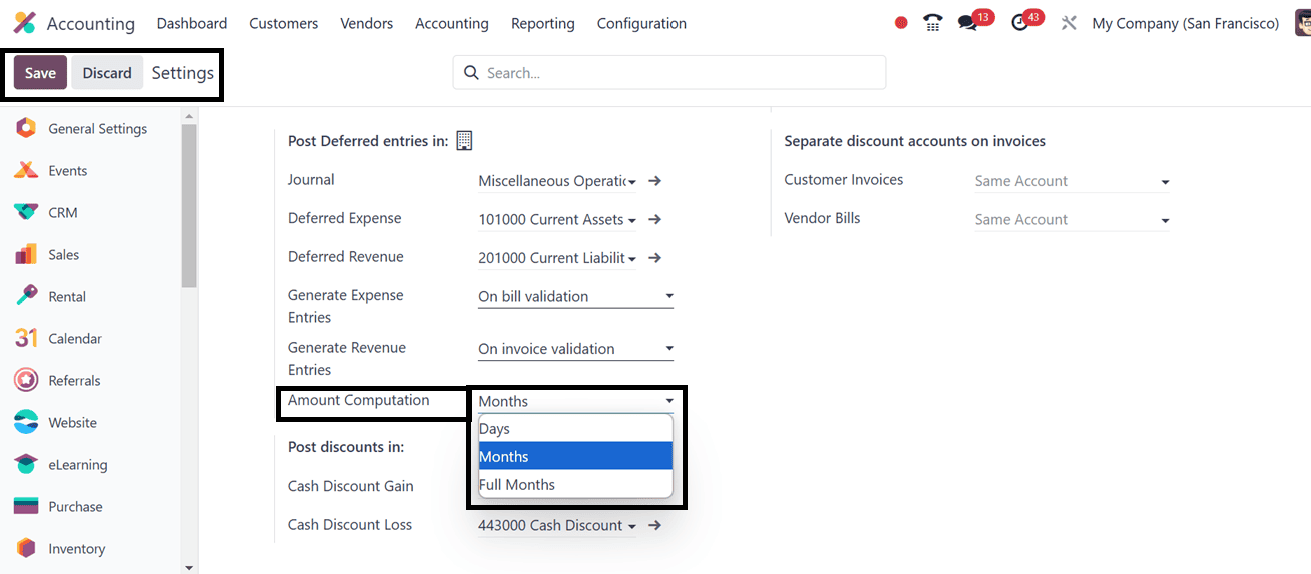

Configuring Post-Deferred Entries

Odoo provides detailed configuration features for the deferred expenses and revenue entries through its ‘Default Accounts’ tab in the ‘Settings’ window.

This configuration setting in Odoo allows users to specify default accounts for each journal, including Deferred Expense Account, Deferred Revenue Account, and Journal. These accounts record deferral entries, which are automatically generated when submitting a client invoice as illustrated in the screenshot below.

To check the Deferred Expenses and their computation functionality, configure the important settings options provided below;

* Journal: Record deferral entries.

* Deferred Expense Account: Deferred expenses on Current Assets until recognized.

* Deferred Revenue Account: Deferred revenues on current liability until acknowledged.

* Generate Entries: Odoo automatically generates deferral entries on bill validation when posting a vendor bill, but users can manually generate them by selecting the Manually & Grouped option.

* Account Computation: Invoice computation methods include Days, Months and Full Months computations. Here, we are choosing the computation method as ‘Months.’ So, the bill amount will be calculated on a monthly basis.

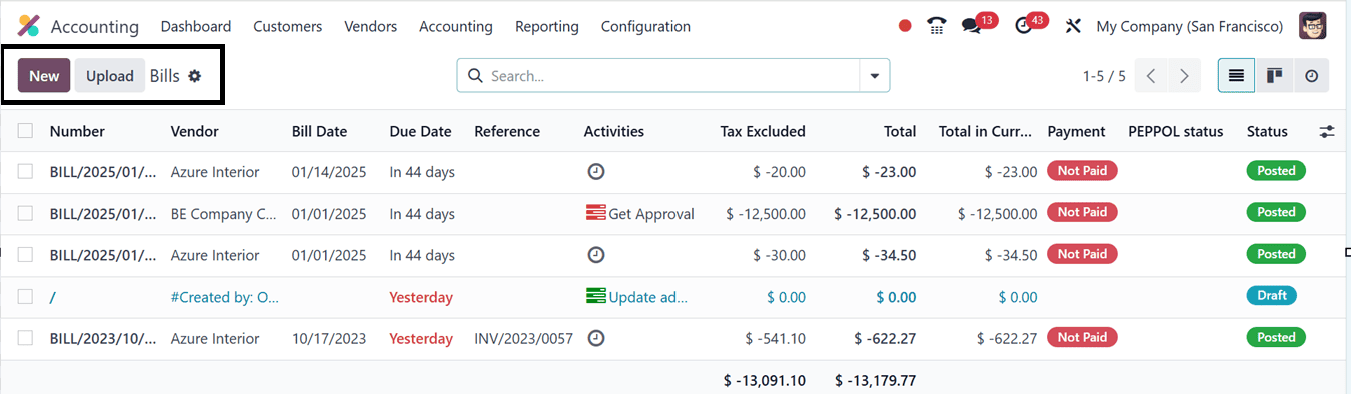

Save the settings after selecting the appropriate settings, then go to the next step. Therefore, creating a vendor or customer bill is the first step. Here, I'm making a new vendor bill for a three-month rental product with a deferred payment.

So, go to the ‘Bills’ sub-menu option from the ‘Vendors’ menu and upload a bill or create a new bill.

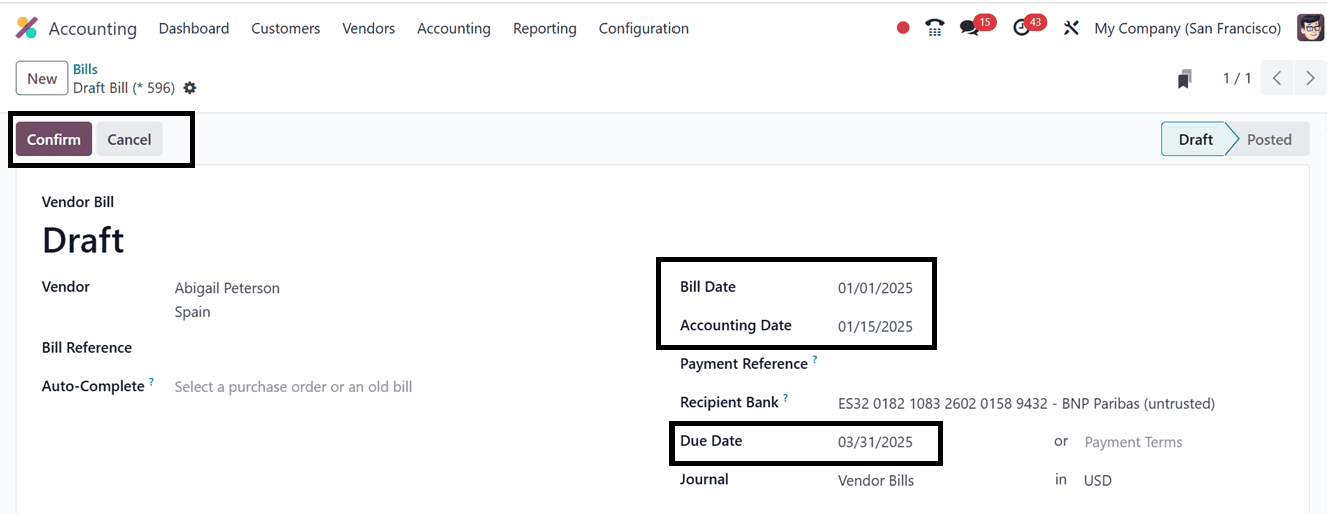

In this scenario, we are creating a new bill using the ‘New’ button. Inside the new bill configuration form, edit the details including the Vendor, Bill Reference, Bill Date, Accounting Date, Payment Reference, Recipient bank, Due Date, and Journal details as shown in the screenshot below.

Here, we are already paying the bill before the due date so, it has to be mentioned in the Bill Date and Accounting Date fields.

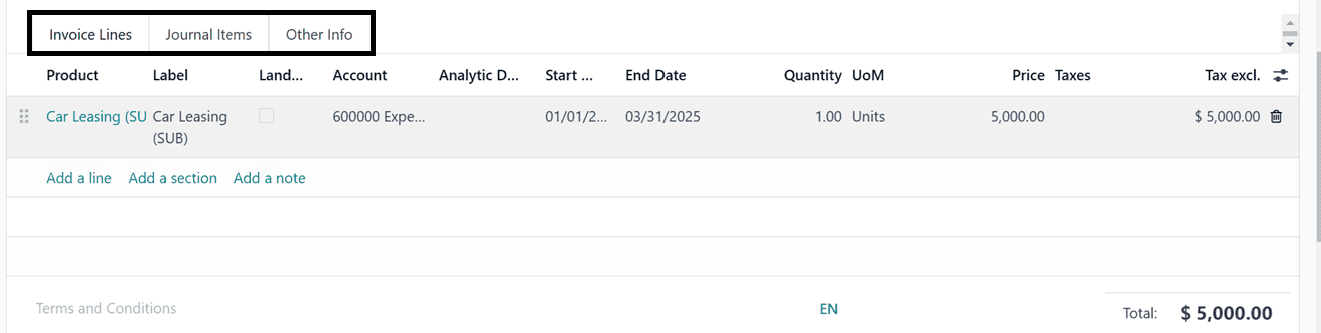

Invoice Lines Tab: To finalize an invoice, click on the ‘Add a line’ button provided in the Invoice Lines tab and Enter the ‘Product.’ ‘Start date' and 'End date,’ ‘Quantity,’ ‘Price,’ and ‘Taxes’ fields. Then the other related fields will be automatically filled.

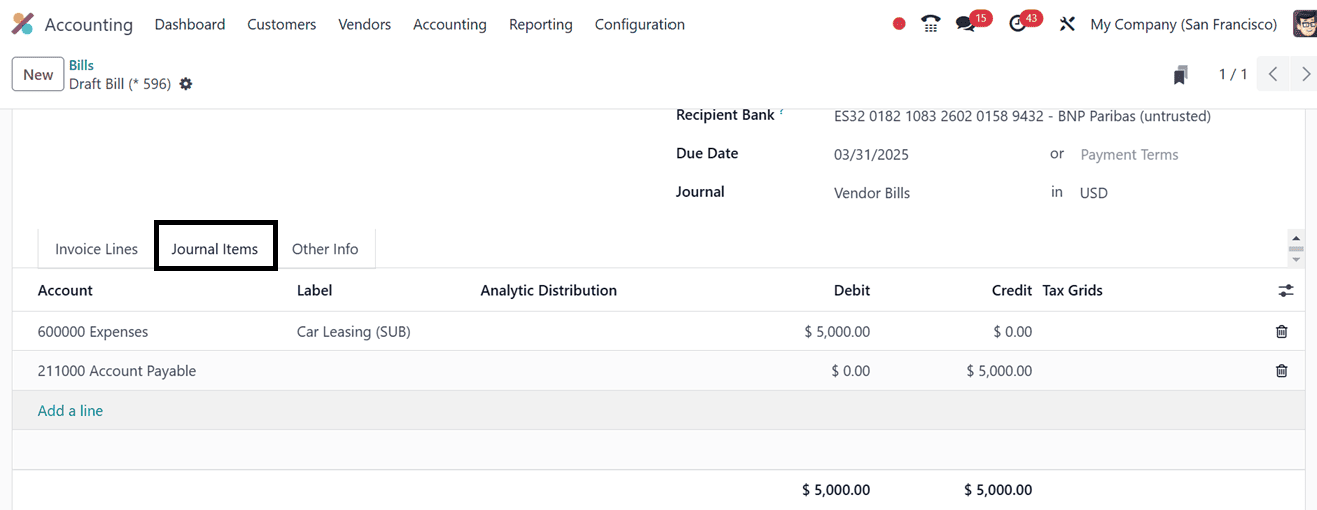

Journal Entries Tab: The ‘Journal Entries’ tab section will show the journal entries related to this vendor bill. The 'Debit' column in the 'Journal Items' tab displays the allocated expense amount, which is then recognized and credited to the deferred expense account in the ‘Credit’ column, as shown below.

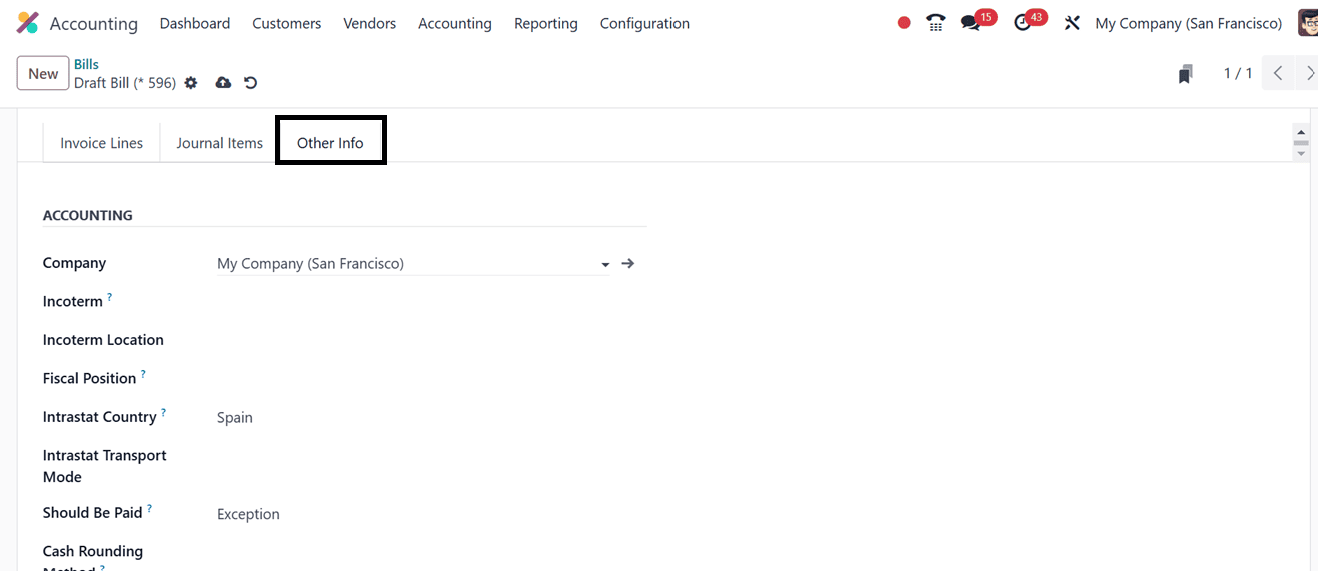

Other Info Tab: The ‘Other Info’ tab can be used to set the other invoice details including the Incoterm, Fiscal Position, Cash Rounding, and other accounting-related features as shown below.

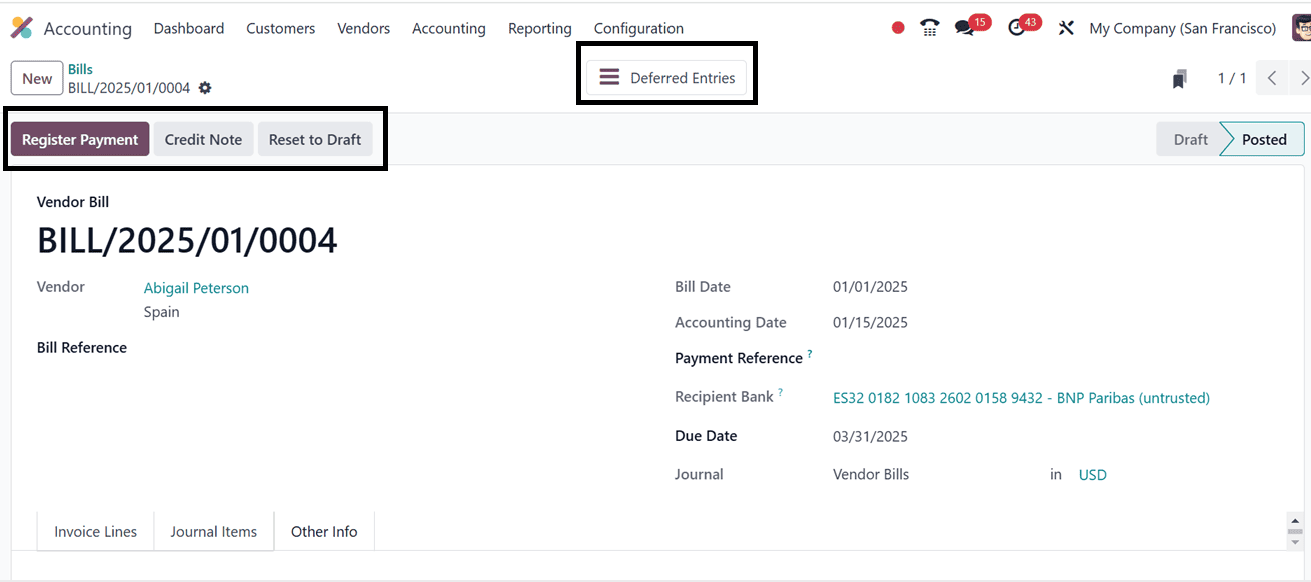

After editing all the bill details, save the data using the ‘Save’ icon. So this will display a ‘Confirm’ button that can be used to confirm the vendor bill. After confirming the bill, the invoice amounts will be transferred from the Deferred Account to the Income Account on the same day as the invoice, with future deferral entries moving the invoice amounts monthly to recognize revenue.

Earlier, we had configured the “Generate Entries” to “On invoice/bill” validation in the settings. So this will activate a ‘Deferral Entries’ smart button after the confirmation.

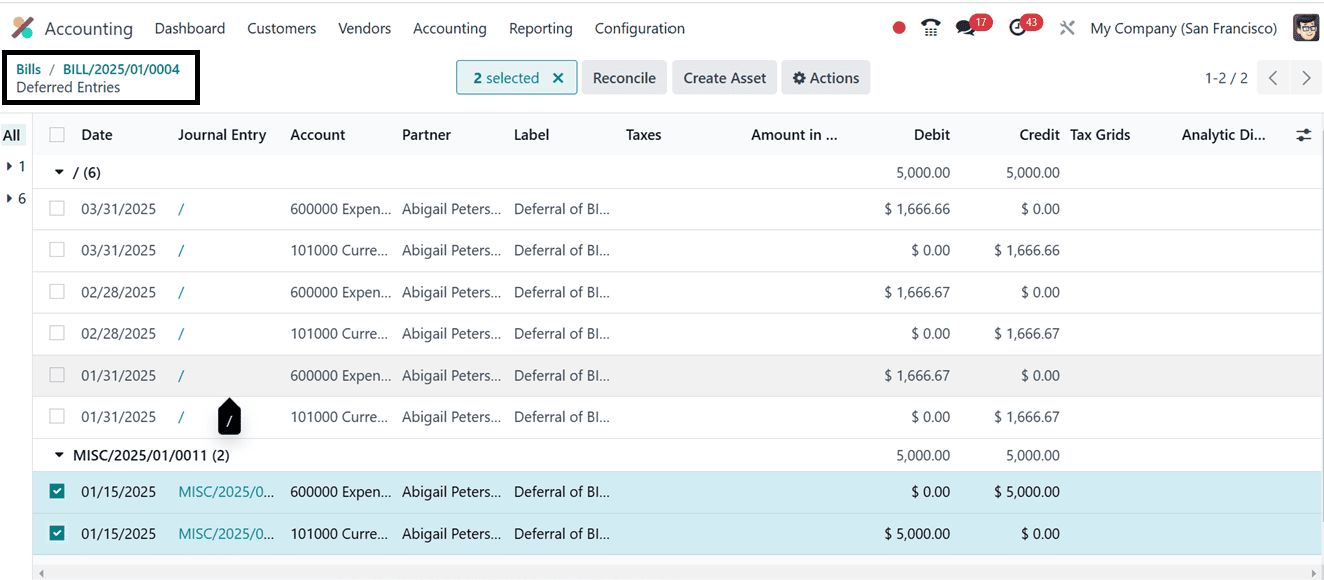

By opening the ‘Deferred Entries’ smart button, we can check the deferred entries available in the accounting database. The newly created entries will be automatically added to the list as shown below.

The deferred expenses and expenses will be added to the ledgers. But this has to be distributed in the given time period. So, in the next entries which are in draft, you can find the assets and expenses distributed over 3 months. Thus for each month, 5000/3 = 1666.667 will be the asset (decreases) and expense (increases)

After choosing the journal entries, you can reconcile the entries, and create assets using the Reconcile and Create Asset buttons. The ‘Action’ menu can be used to Export, Delete, Move to Account, Unreconcile, and Create Assets using the journal entries.

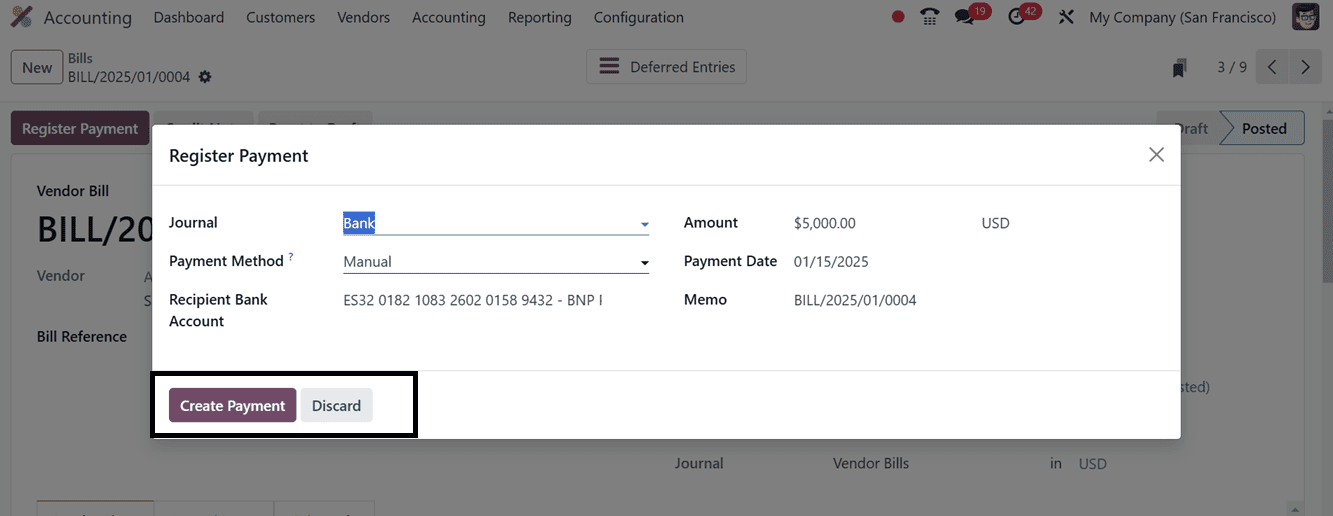

Then, go back to the vendor bill configuration form and make the payment using the ‘Register Payment’ button. This will open a payment confirmation window, where you can edit the Journal, Payment Method, Recipient Bank Account, Amount, Payment Date, and Memo as illustrated in the screenshot below.

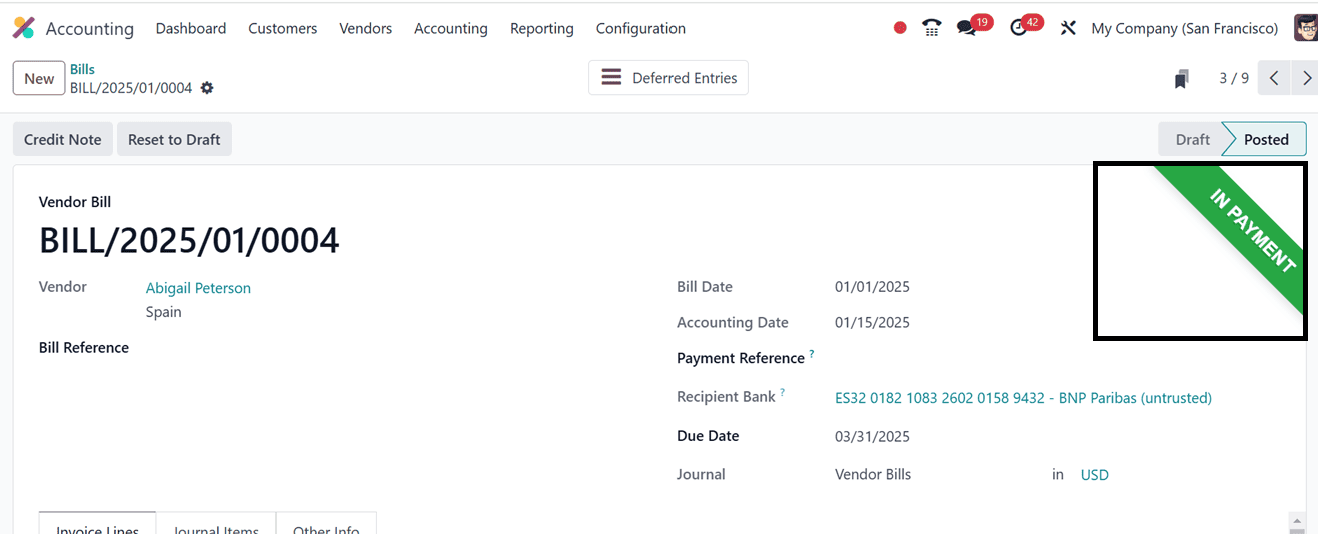

Finally, click on the ‘Create Payment’ button to confirm the payment process. Then an ‘IN PAYMENT' ribbon will appear on the upper right side of the bill as shown below.

Deferred Expense Reports

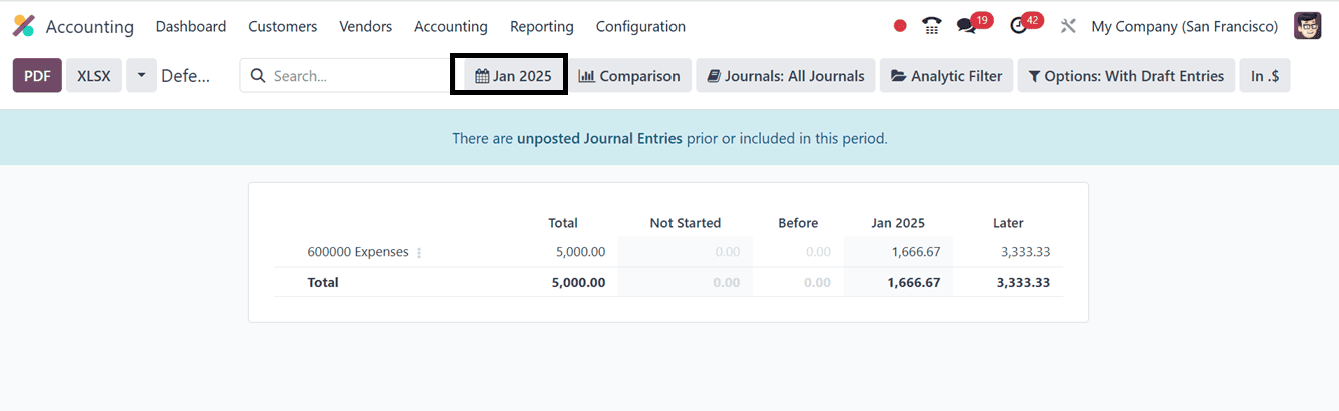

Odoo offers various reporting tools, including profit and loss statements, to analyze the impact of deferred expenses on financials. To access detailed analysis, navigate to the 'Deferred Expenses' section in the Odoo 17 Accounting Module’s ‘Reporting’ menu. This reporting window helps regularly review and adjust deferred expense entries for accurate financial reporting, especially if expenditure timing changes.

According to the report, the entire sum for a three-month rental period is 5000/- which is shown under the ‘Total’ area. Next, the entire amount of the vendor bill will be divided by the deferred payment of 1666.67/-for the first month of January, which has already been paid. Finally, the upcoming bill amount is displayed under the 'Later' area using the Deferred expenses computation method.

Based on Last Month, Last Quarter, Last Financial Year, This Month, This Quarter, and This Financial Year, we can generate the Deferred Expenses analysis. We can also adjust the reporting as necessary by using the various filter options at the top of the page, such as Date and Time Range, Comparison, Journals, Analytic Filters, Options with/without Draft Entries, and Amounts. This is especially useful if the expected delivery date of the goods or services changes.

Odoo 17's accounting module simplifies deferred expense management, ensuring accurate and honest financial record keeping. By following the guide, businesses can accurately reflect incurred expenses' timing in their financial reports, leading to better decision-making and financial management. The module offers seamless tools for businesses.