In the new Odoo 16 Accounting module, you can effortlessly automate the creation and validation of assets. This will make the management of assets much easier and more efficient. With this new asset automation feature, Odoo will automatically create and validate the asset once you confirm the vendor bill of the respective product. There is no need to create assets and validate them separately as Odoo offers a single platform to manage all these operations.

This blog will help you to get to know more about the automation of asset management in the Odoo 16 Accounting module.

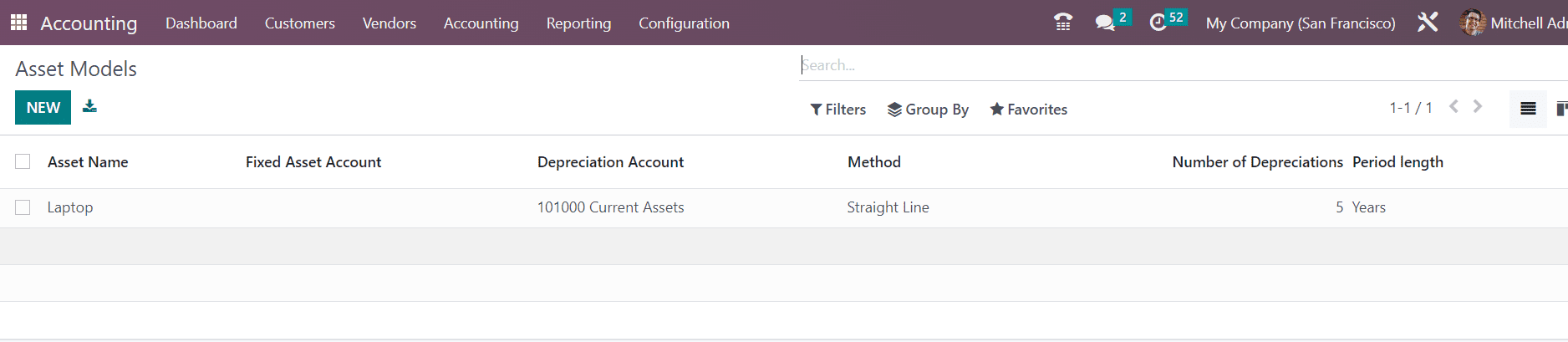

To manage any asset of your company, you need to configure the corresponding asset model in the Accounting module. You can select the Accounting module from the Odoo dashboard. Now, let’s create a new asset model in the Accounting module by selecting the Asset Models from the Configuration menu. When you click on the Asset Models option, Odoo will open a new window with the list of already configured asset models. As you can see in the image below, the preview of the list includes the Asset Name, Fixed Asset Account, Depreciation Account, Method, Number of Depreciation, and Period Length.

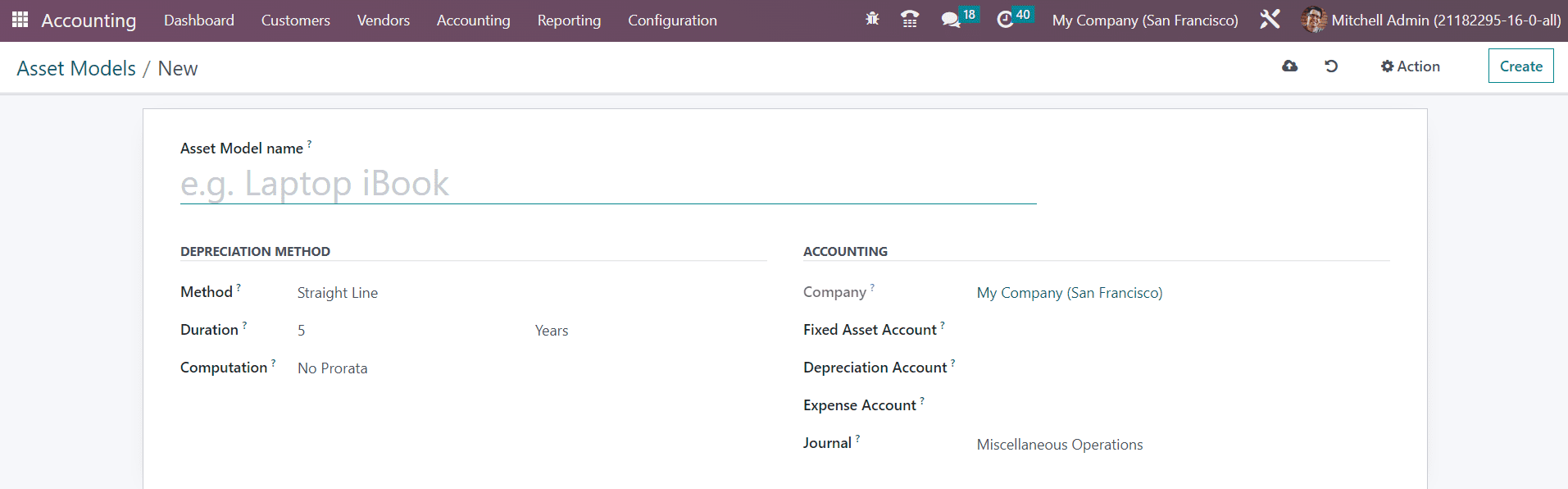

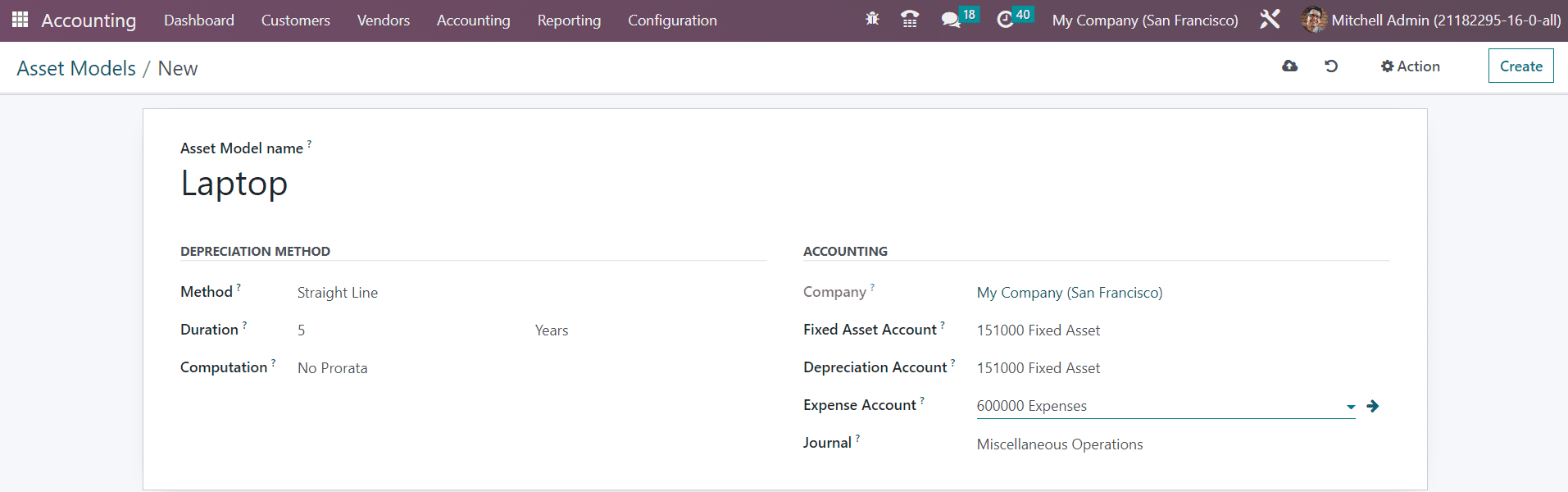

We are going to create a new Asset Model with the help of the New button. Clicking on this button will open a new form view as shown below.

You can mention the name of this particular asset model in the Asset Model Name field. The Depreciation Method will define the method to compute the amount of depreciation lines. You can set the method as Straight Line, Declining, or Declining then Straight Line.

Straight Line: It is a commonly used depreciation method which is easier to calculate compared to the other two methods. You can find the amount of the depreciation line by dividing the gross value by duration.

Declining: You can set a declining factor in this method and the depreciation value is calculated by multiplying the residual value with this declining factor.

Declining then Straight Line: This is a combination of Straight Line and Declining. This method works like the Declining method but with a minimum depreciation value equal to the Straight Line value.

The total depreciation required to depreciate your asset can be specified in the Duration field. The duration can be mentioned in Months or Years. In the Computation field, you can select the computation method from the given options which are No Prorata, Constant Periods, Based on days per period. The name of your Company will be available in the respective field in the form view. The account to keep track of the purchase of the asset and its original price can be specified in the Fixed Asset Account field.

The account used in the depreciation entries to decrease the asset value can be specified in the Depreciation Account field. In the configuration of the Depreciation Account, you will get the option to automate asset management. You can use the internal link available here to make changes to the configuration. Or else, you can edit the configuration by selecting the corresponding depreciation account from the chart of accounts in Odoo once you complete the creation of the asset model.

In the Expense Account field, you can add the account used in the periodical entries to record a part of the asset as an expense. Once you mention the Journal for recording the accounting entries of this asset model, the configuration of the new asset model is complete.

Now, let’s check how to automate asset management.

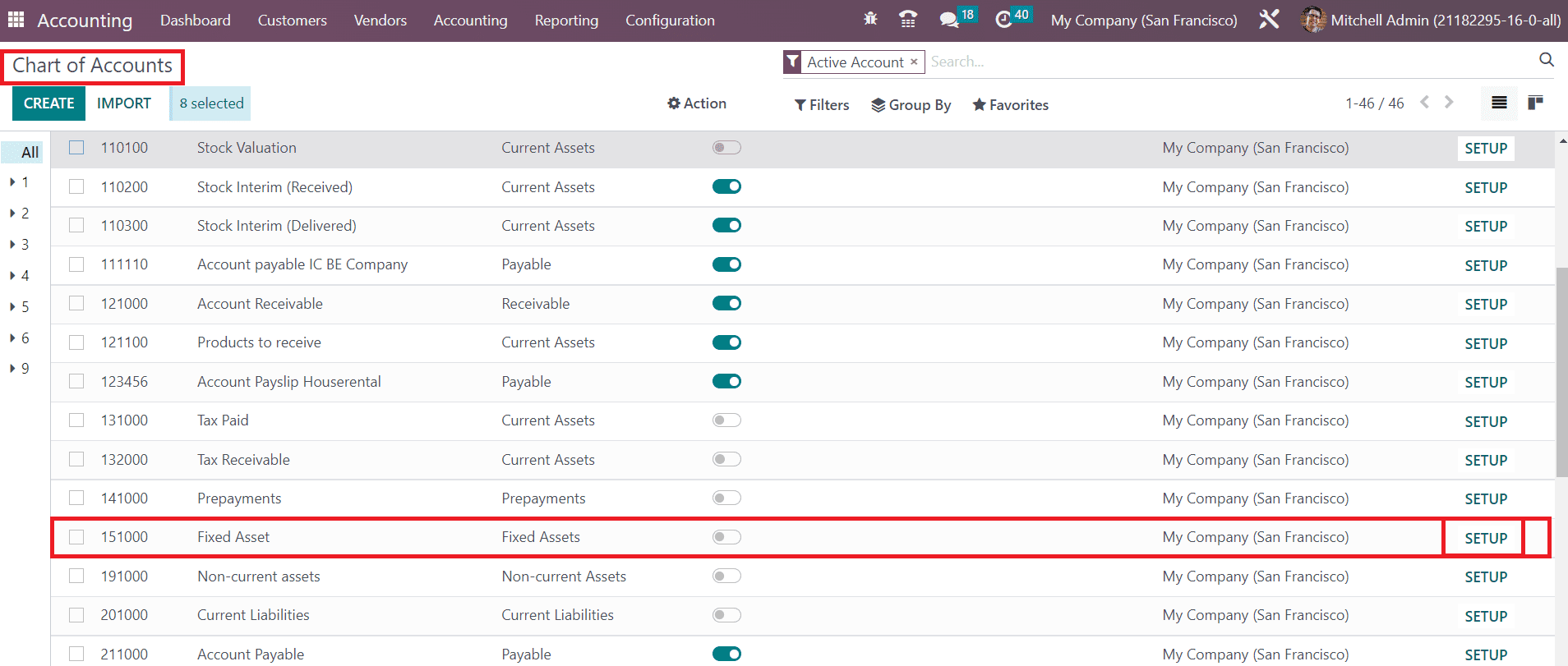

In order to automate the assets, you can go to the Configuration menu and select the Chart of Accounts.

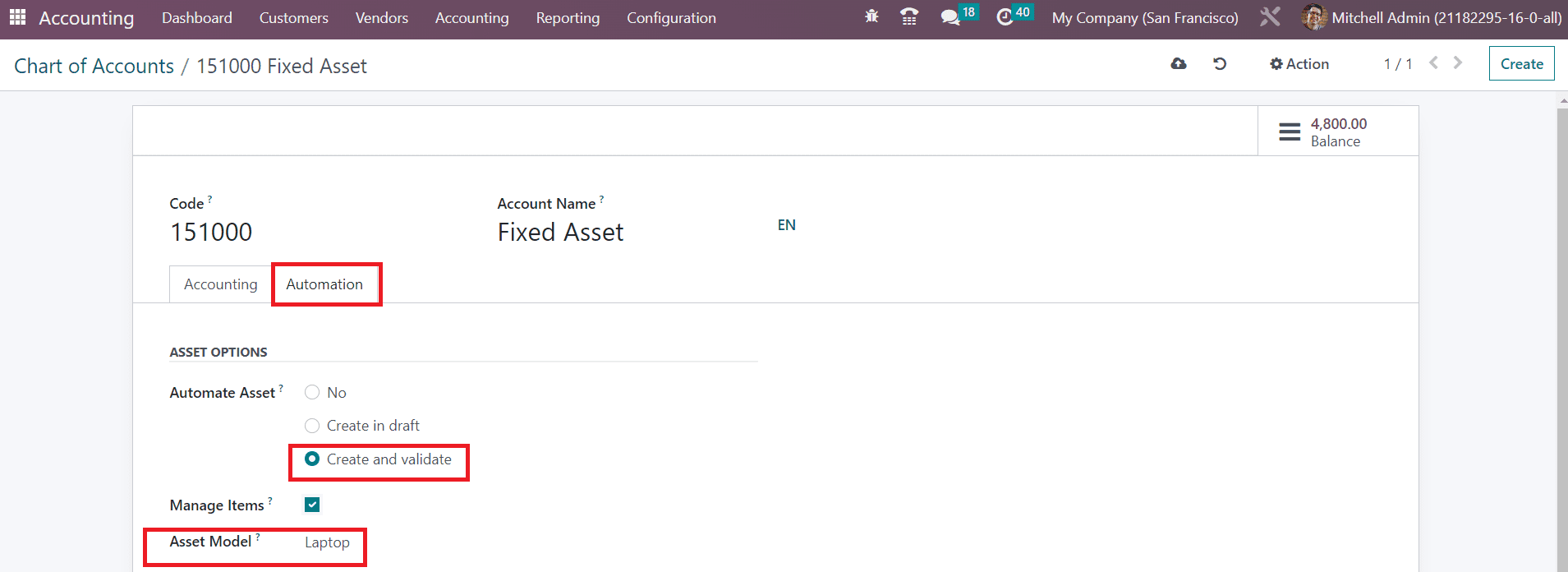

From the given list, you can select the depreciation account you mentioned in the asset model. We are going to edit the configuration of this particular account that you selected as the depreciation account. For this, you can click the Setup button.

As soon as you click on the Setup button, Odoo will lead you to the edit window of the particular account. Here, you can find the Asset Options under the Automation tab. The Automate Asset feature will help you to automate asset management. You can set it as No, if you don’t want to create and validate assets automatically. Selecting the Create in Draft option will create a draft asset automatically as soon as you validate the bill. Later, you can validate the draft asset manually. Odoo will automatically create and validate assets when you select the Create and Validate option. The asset will be in the Running state once you confirm the bill. Enabling the Manage Items will let you manage multiple quantities of assets at the same time. The Asset Model you selected will be available in the respective field.

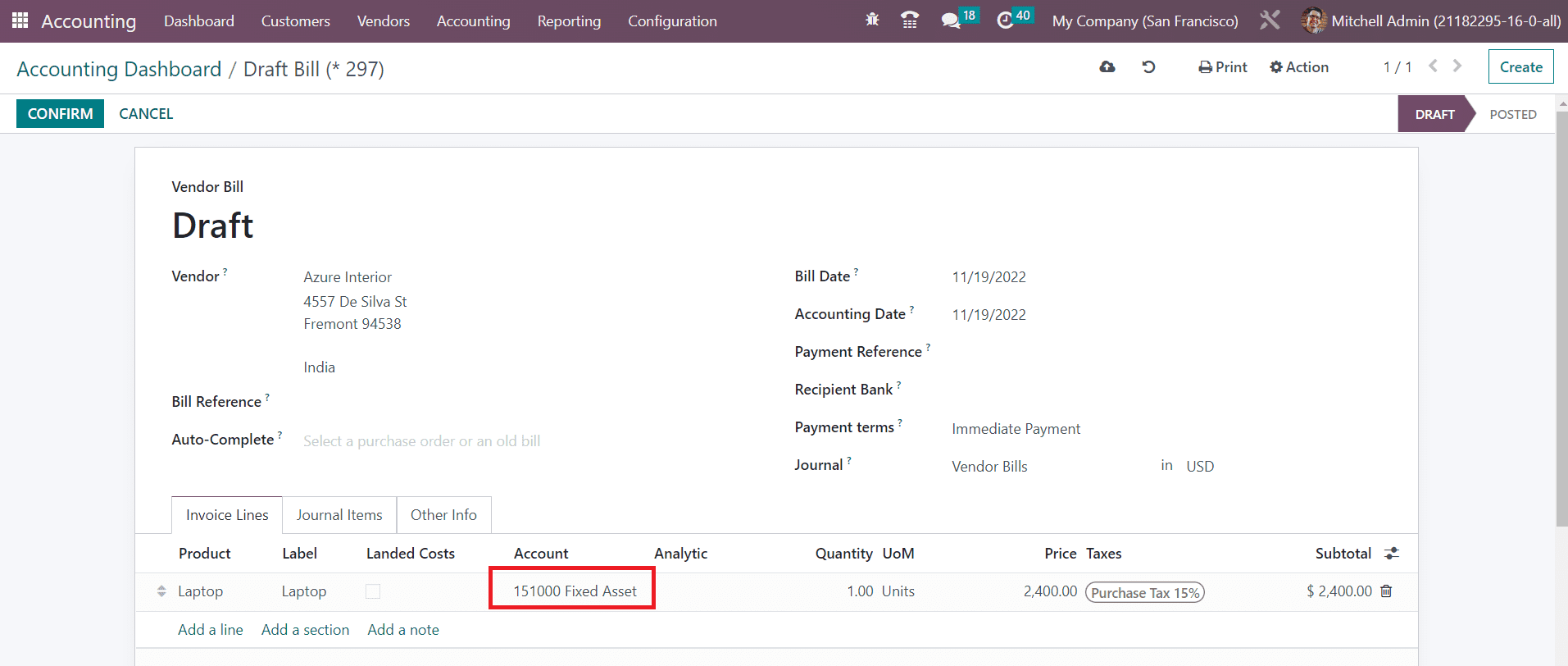

Here, we selected the Create and Validate option in the Automate Asset field. Let’s take a look at how Odoo automatically creates and validates assets when confirming bills. For this, you can generate a vendor bill for the purchased asset. While mentioning the details in the Invoice Line of the vendor bill, make sure to select the account as the same as that of the asset model.

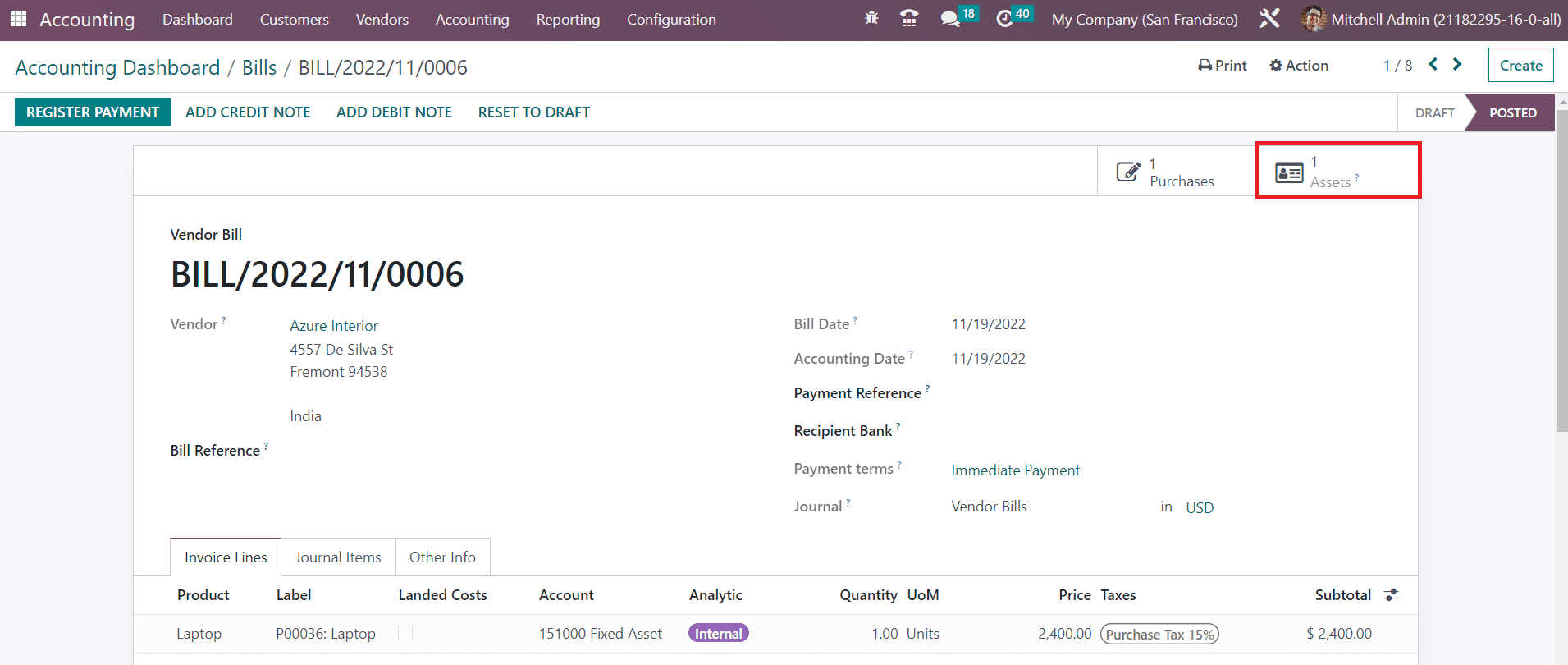

Click on the Confirm button to confirm the vendor bill. The screen will show a new smart button named Assets as soon as you validate the bill. If the bill has been generated for multiple quantities, the smart button will show assets for each quantity separately.

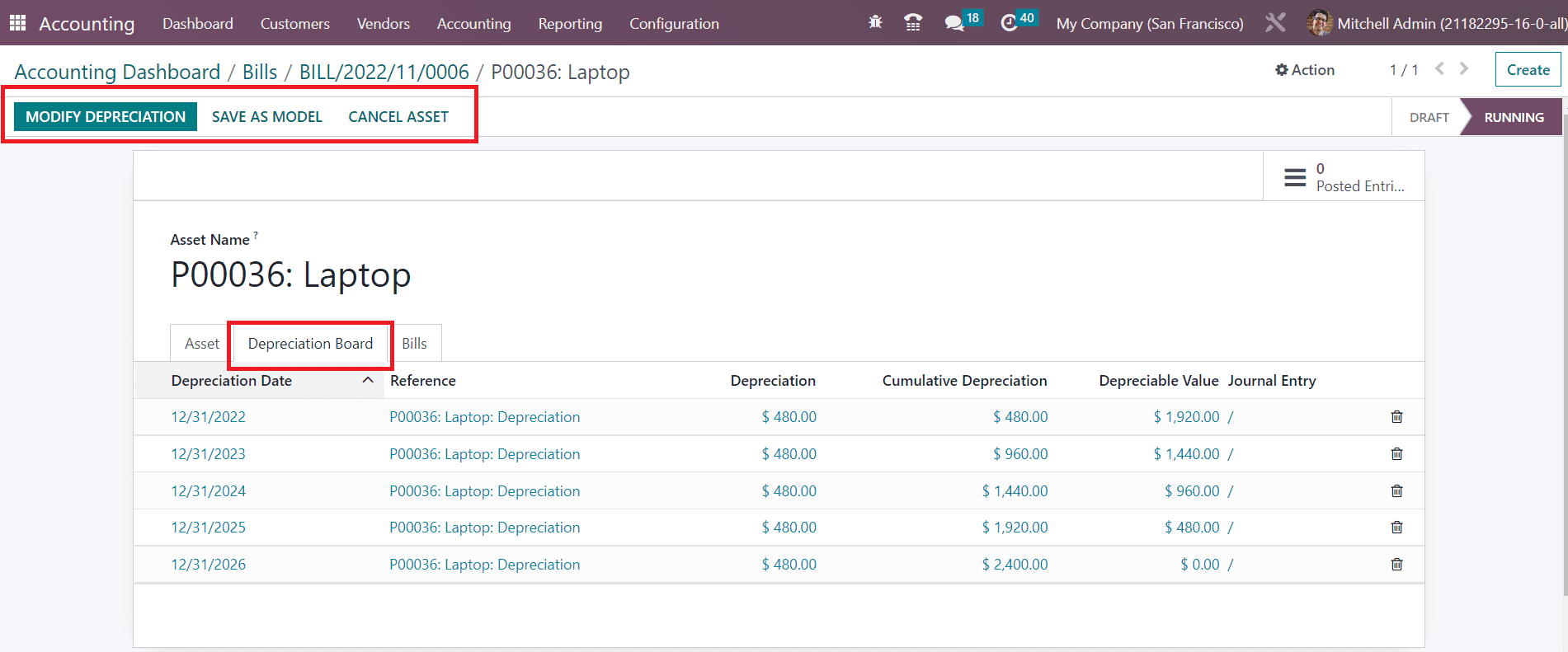

Clicking on this button will lead you to a new window where you can observe the automatically created assets.

As you can see in the screenshot, the asset is in the Running stage, which indicates that Odoo automatically created and validated the new asset. In the Depreciation Board tab, you will get the details of the upcoming depreciations. By clicking on the Modify Depreciation button, you can modify the current depreciation. The new automatic asset creation and validation feature streamlined the asset management process in the Odoo 16 Accounting.