The wages holding back from employees' total earnings for paying taxes or other benefits refers to payroll deductions. As per the applicable tax laws, it is generally processed on each pay period. The note given to employees at the end of the week or month that shows their earned money is a payslip. Most firms provide payslips for their employees, and the compensation is a complicated process. Payroll operation in the US is complex compared to other countries. After installing Odoo ERP software, you can quickly configure payroll for an Employee working in the US based on deductions.

This blog provides you with the steps of US Payroll deductions for employees in a salary slip using Odoo 16 Payroll.

The Payroll module of Odoo 16 is beneficial for managing employee contracts, payslips, and work entries. Payroll management of an employee becomes easy once defining various salary rules in a payslip. We can formulate payslips for employees in a company using Odoo 16 Payroll module.

Analysis of US Payroll Deductions for Users

The payroll deductions in the US cover post-tax deductions, pre-tax deductions, federal tax, and state or local taxes. Medicare and social security taxes exist inside the Federal Insurance Contributions Taxes Act. A medicare tax of 1.45% and social security tax of 6.2% pay by an employee for the government. Moreover, employees whose wages are above $200000 must pay additional medicare of 0.9%. Under the pre-tax deductions, medical benefits, 401 k retirement plans, federal tax, and other income tax of employees takes place. The taxable income reduces through pre-tax deductions of employees.

After withholding all required taxes of an employee, post-tax deductions takes from their checks. Union dues, wage garnishments, disability insurance, and more came under post-tax deductions. According to a specific place of an employee, local and state taxes varies. Each state has different tax rates, which apply to the employee payslip.

How to Define a Payroll Structure in the Odoo 16?

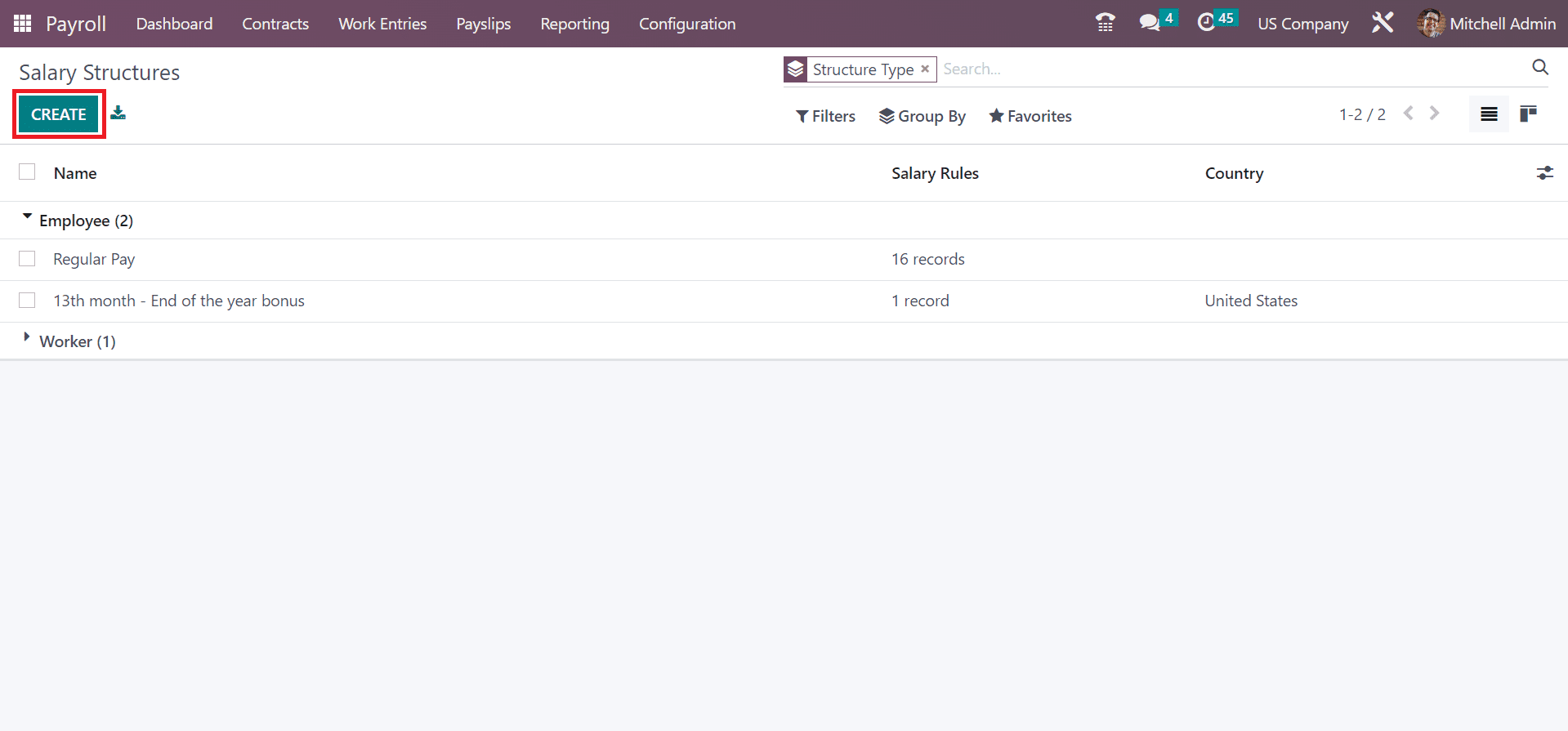

You can obtain the Structures menu from the Configuration tab, and records of all created structures are visible. Details of each salary structure, including Name, Country, and Salary Rules, are viewable to a user. Select the CREATE button to generate a new structure for a US Employee.

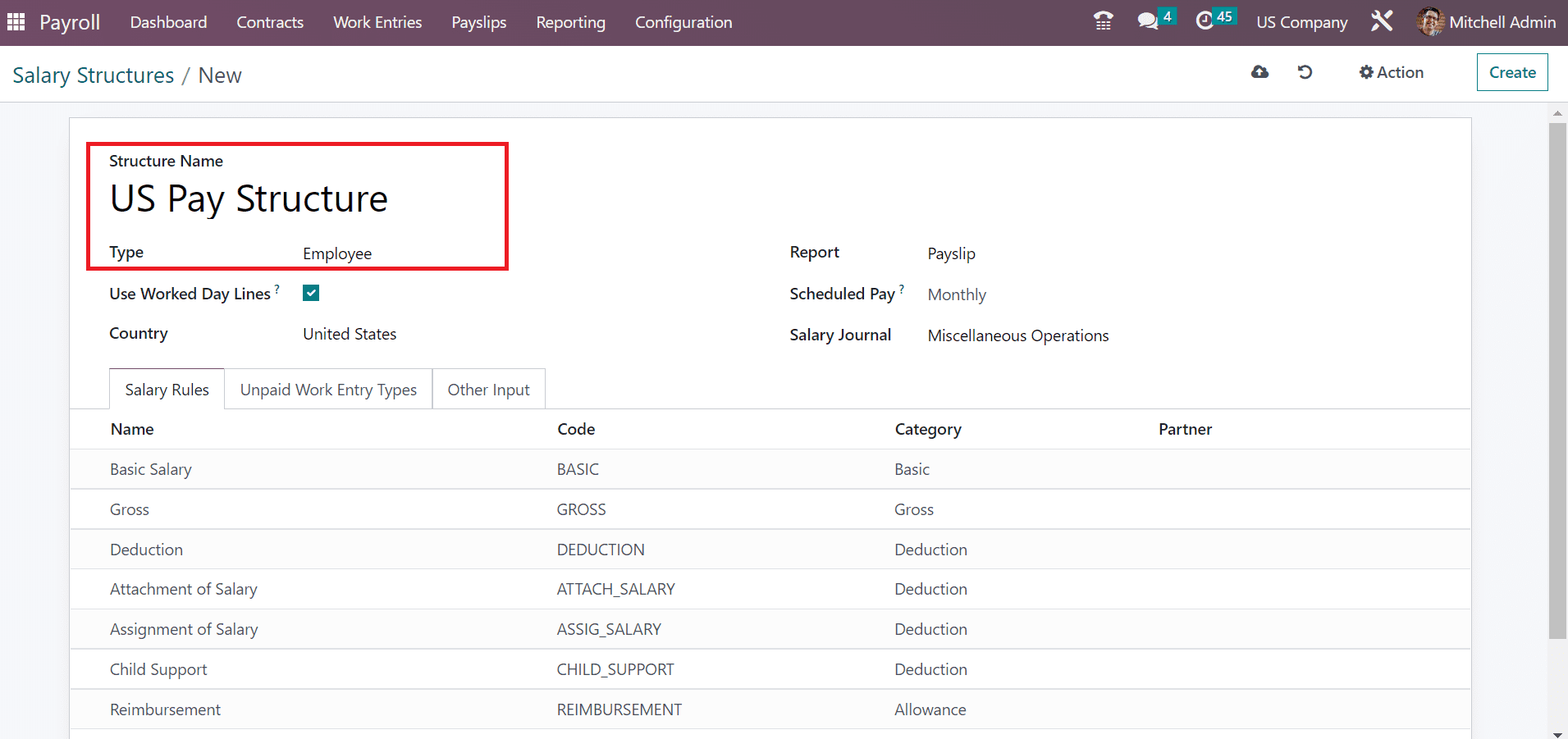

On the open page, enter US Pay Structure in the Structure Name field. Next, we can mention the structure category as Employee or Worker in the Type field. Add the Employee option inside the type field, as marked in the screenshot below.

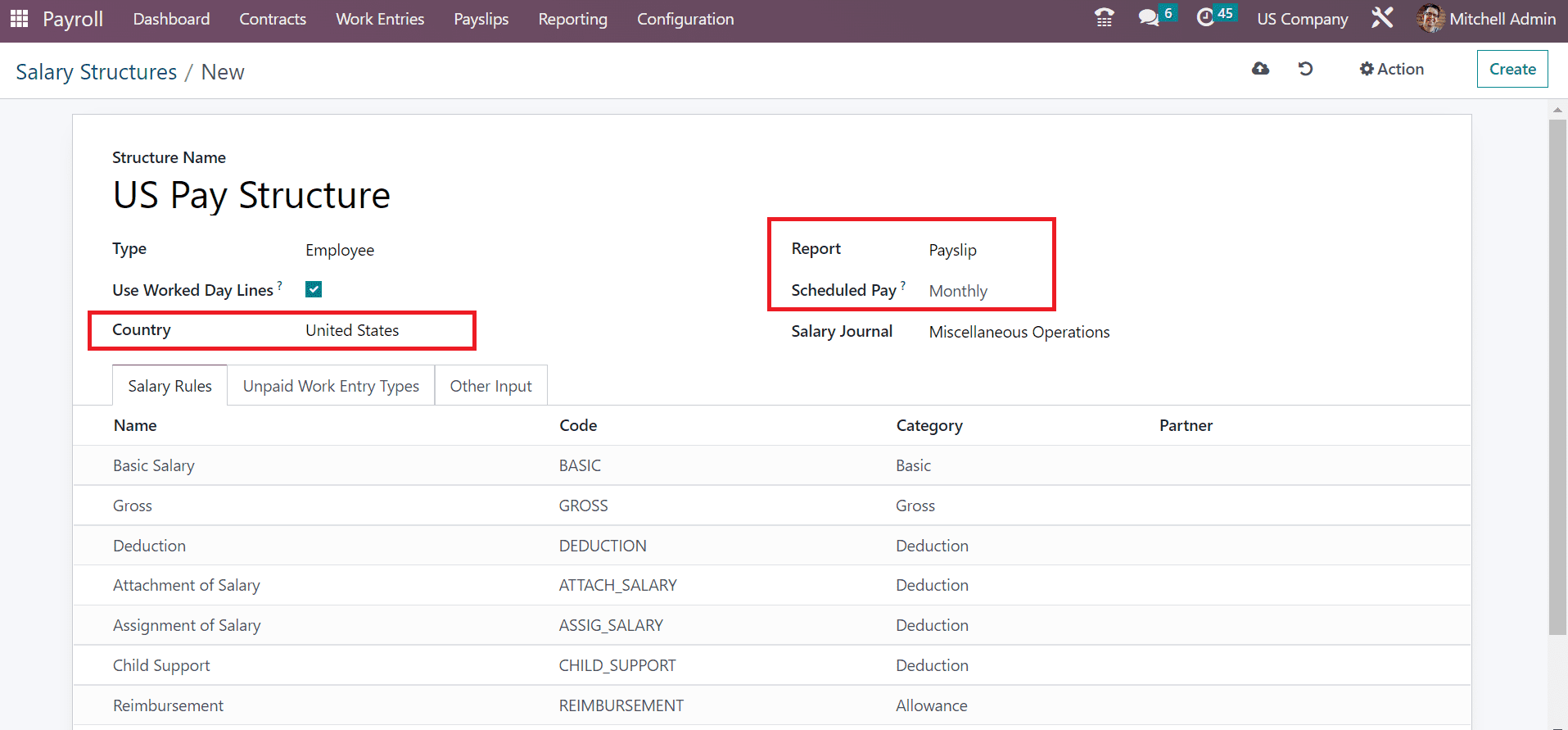

We can select the Country as the United States because of a US employee's payslip generation. Pick the Payslip option as your Report, and it is possible to mention the frequency of wage payment. This frequency is classified as Monthly, Weekly, Annually, Bi-weekly, and more. We selected the Monthly option for the scheduled pay of employees as defined in the screenshot below.

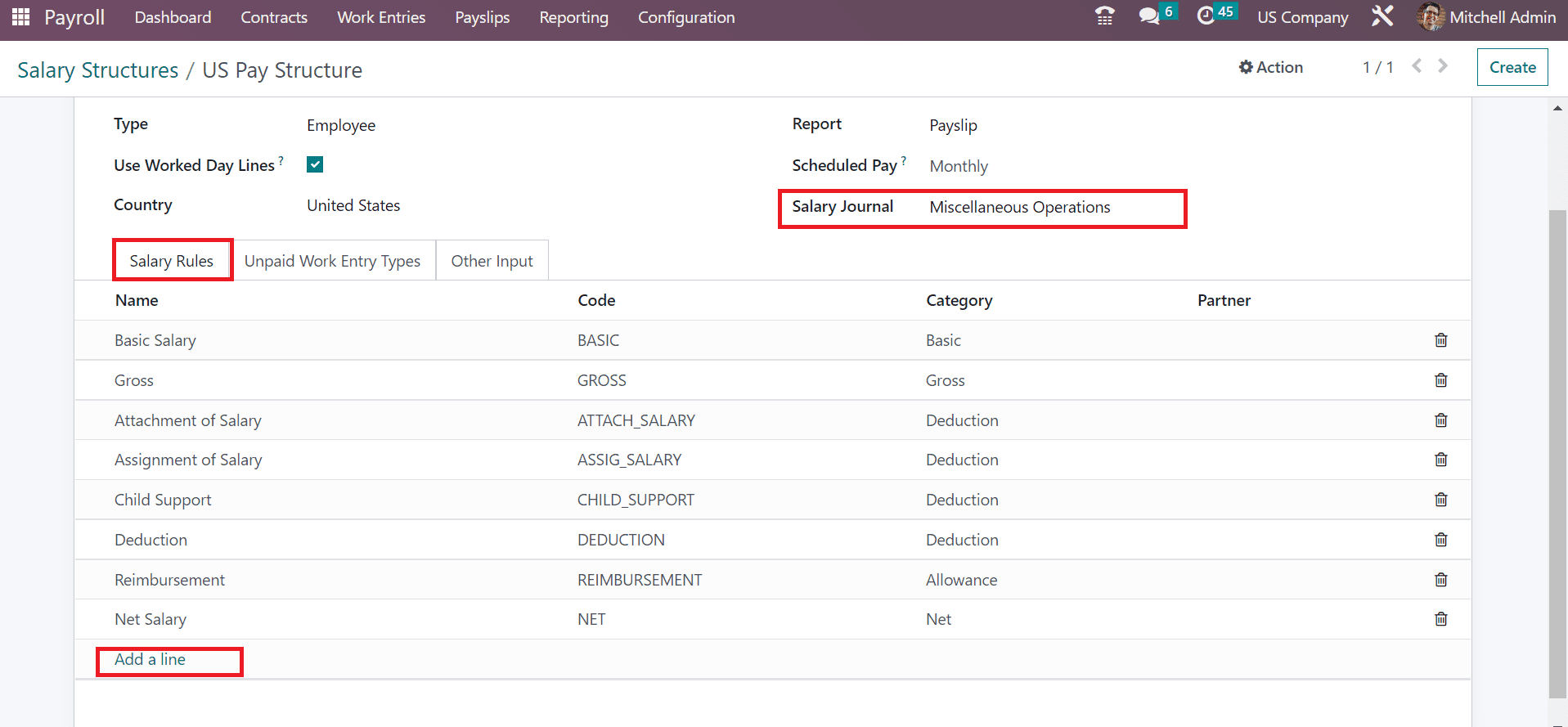

It is easy to choose your journal for salary as Miscellaneous Operations in the Salary Journal field. Users can add various salary rules inside after pressing the Add a line option, as mentioned in the screenshot below.

Next, we can view the process of US payroll deductions as a salary rule for employees.

To Set US Payroll Deductions for an Employee as a Salary Rule in Odoo 16

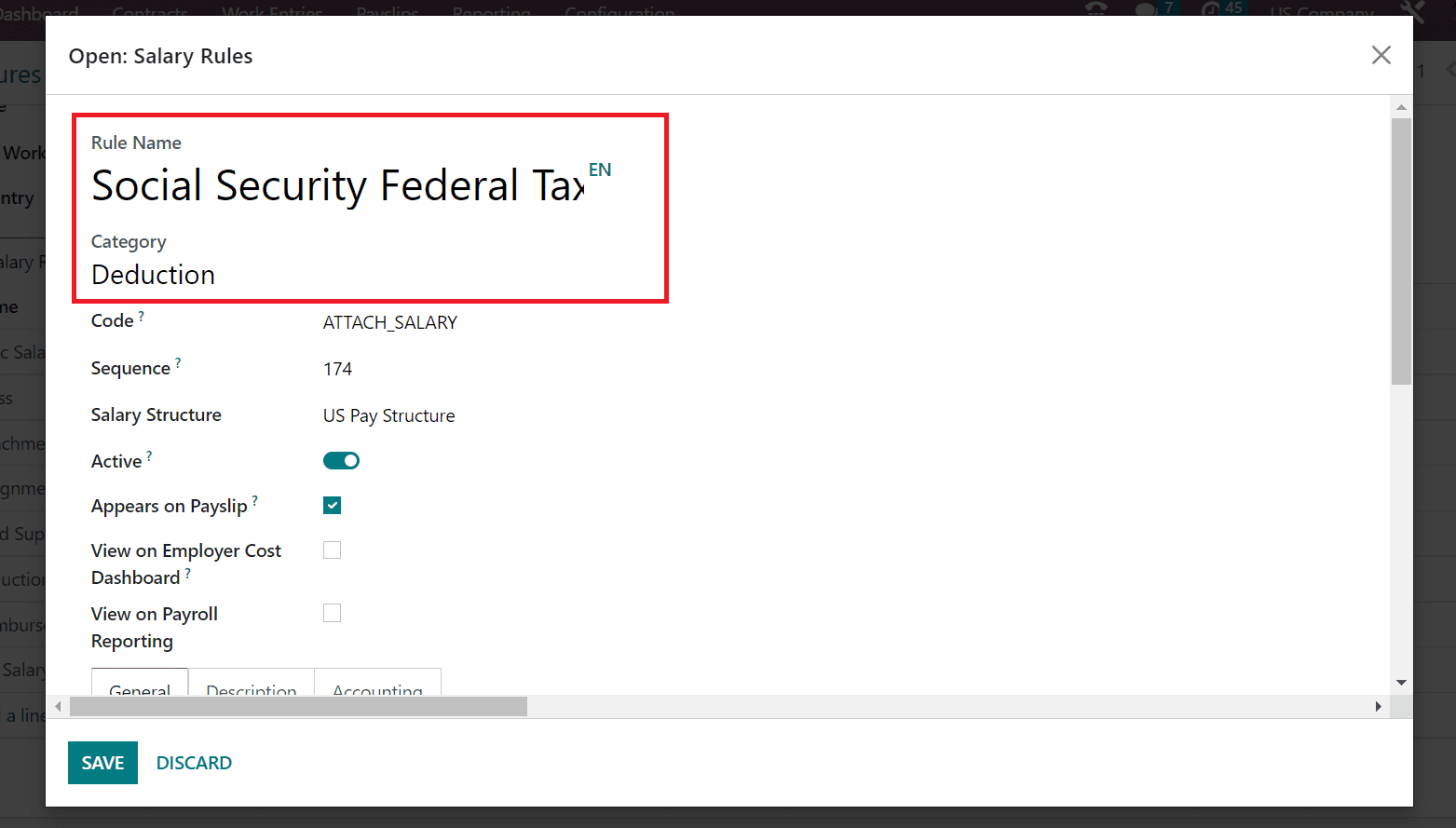

Users can click the Add a line option under the Salary Rules tab to mention a US employee's deductions. A new window appears before the user specifies details of deductions. Add the Rule Name as Social Security Federal Tax and set Deduction within the Category field as denoted in the screenshot below.

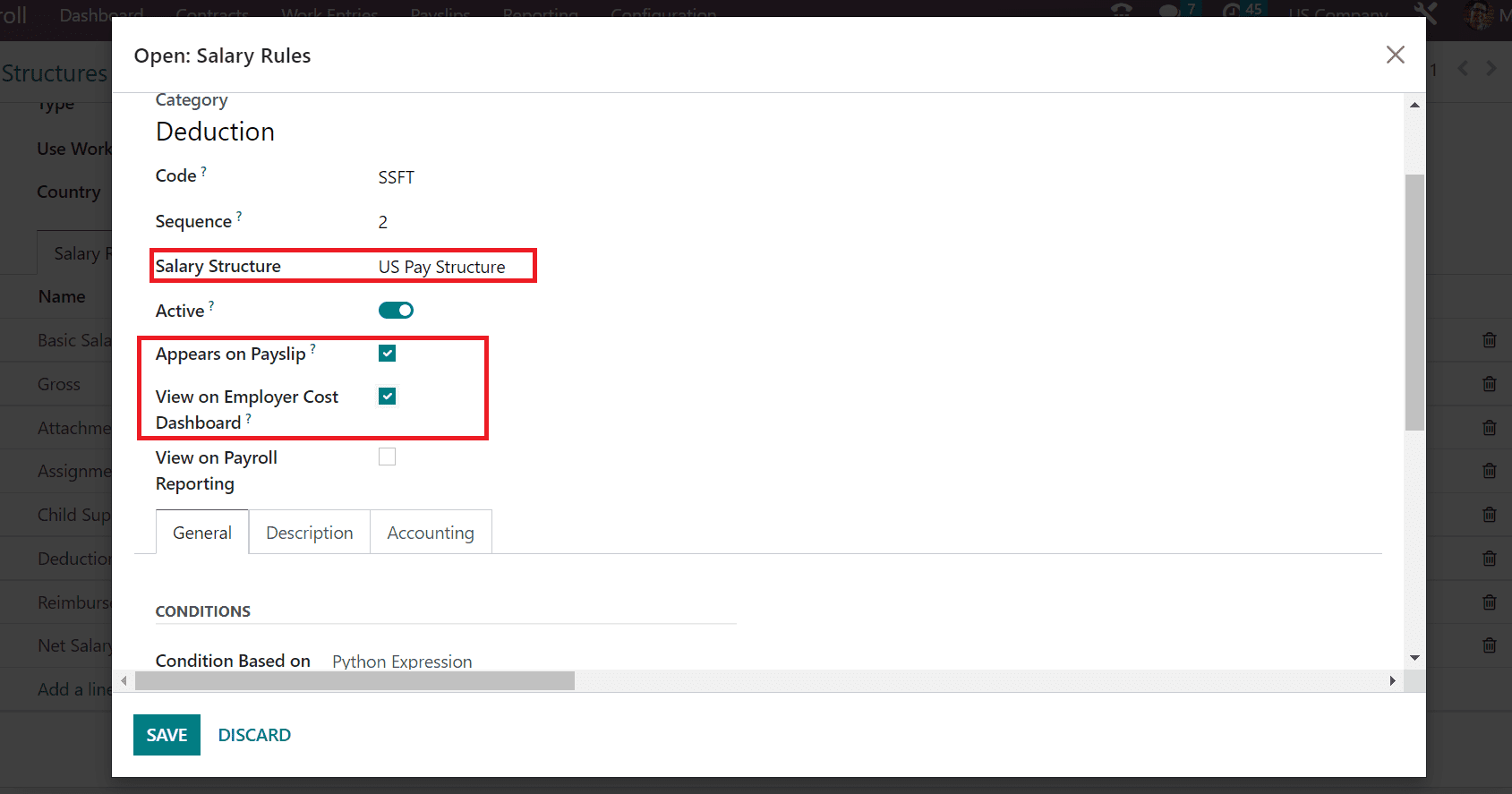

Add reference for computation of a rule in the Code field as SSFT for Social Security Federal Tax. Moreover, choose your US Pay Structure option in Salary Structure and enable the Appears on Payslip option to activate specific rules on your payslip. To display the employer cost dashboard rule, you must activate the View on Employer Cost Dashboard field.

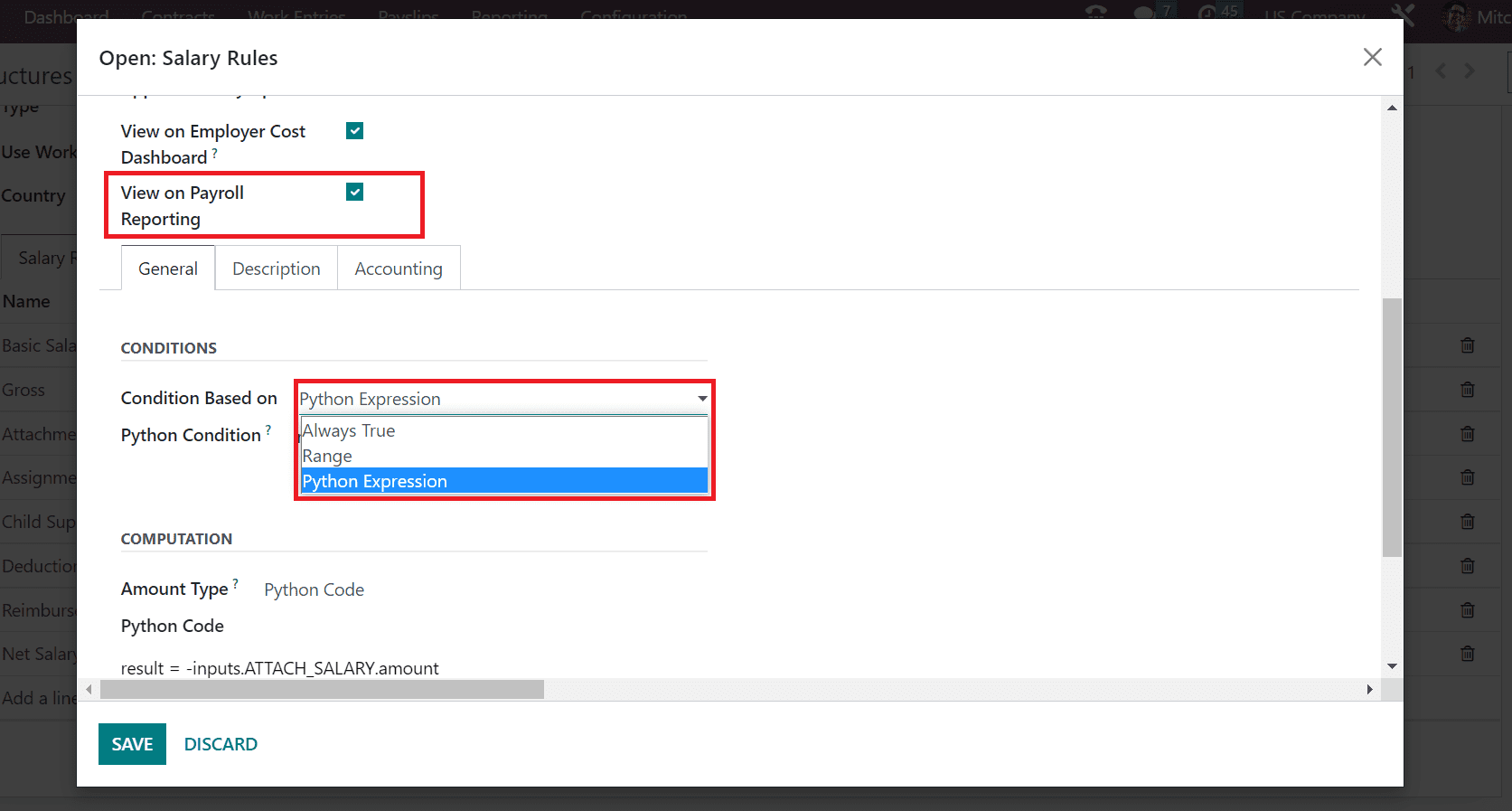

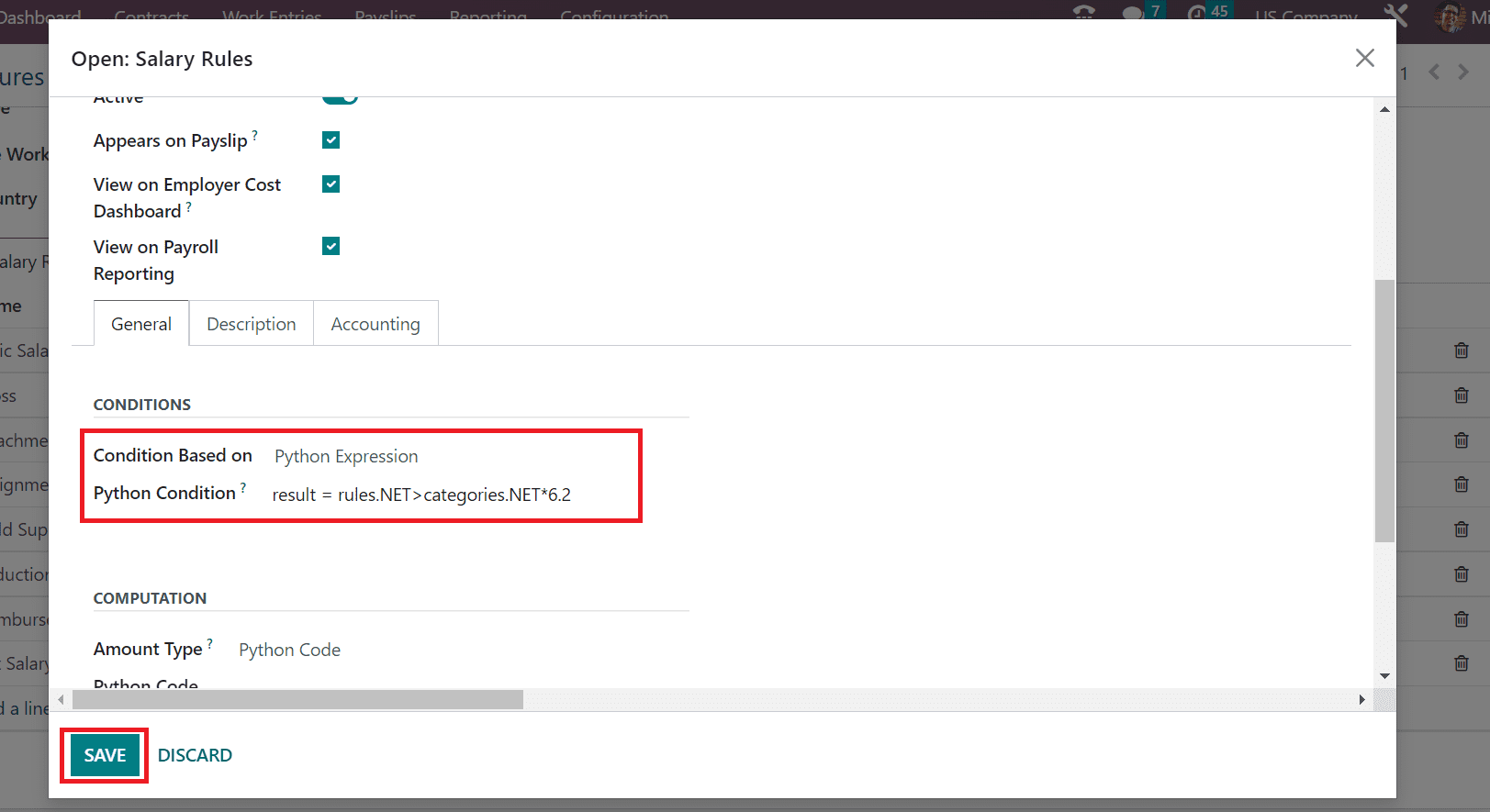

It is possible to access the social security federal tax rule on reporting once enabling the View on Payroll Reporting option. Below the General tab, we can set conditions for the specific rule. Specifying requirements as per Range, Python Expression, and more are accessible as defined in the screenshot below.

A Python Condition field appears before the user once selecting the Python Expression option as the condition. As specified in the screenshot below, we can add the necessity for social security federal tax with a 6.2% tax rate.

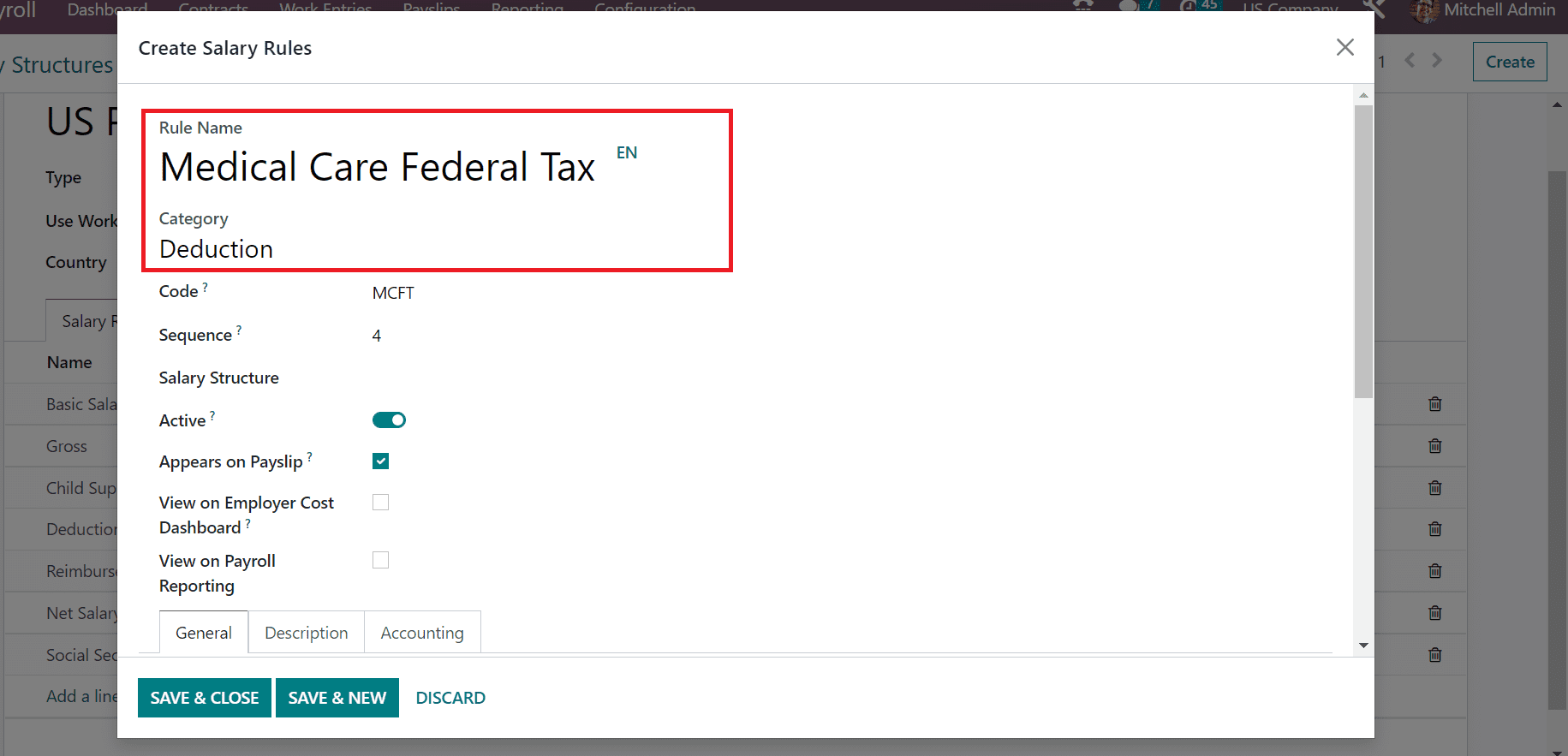

Choose the SAVE icon after entering the salary rule details related to social security federal tax. Next, we can apply the federal tax for medical care as a salary rule. In the Create Salary Rules window, enter Medical Care Federal tax as Rule Name and choose Deduction as the category.

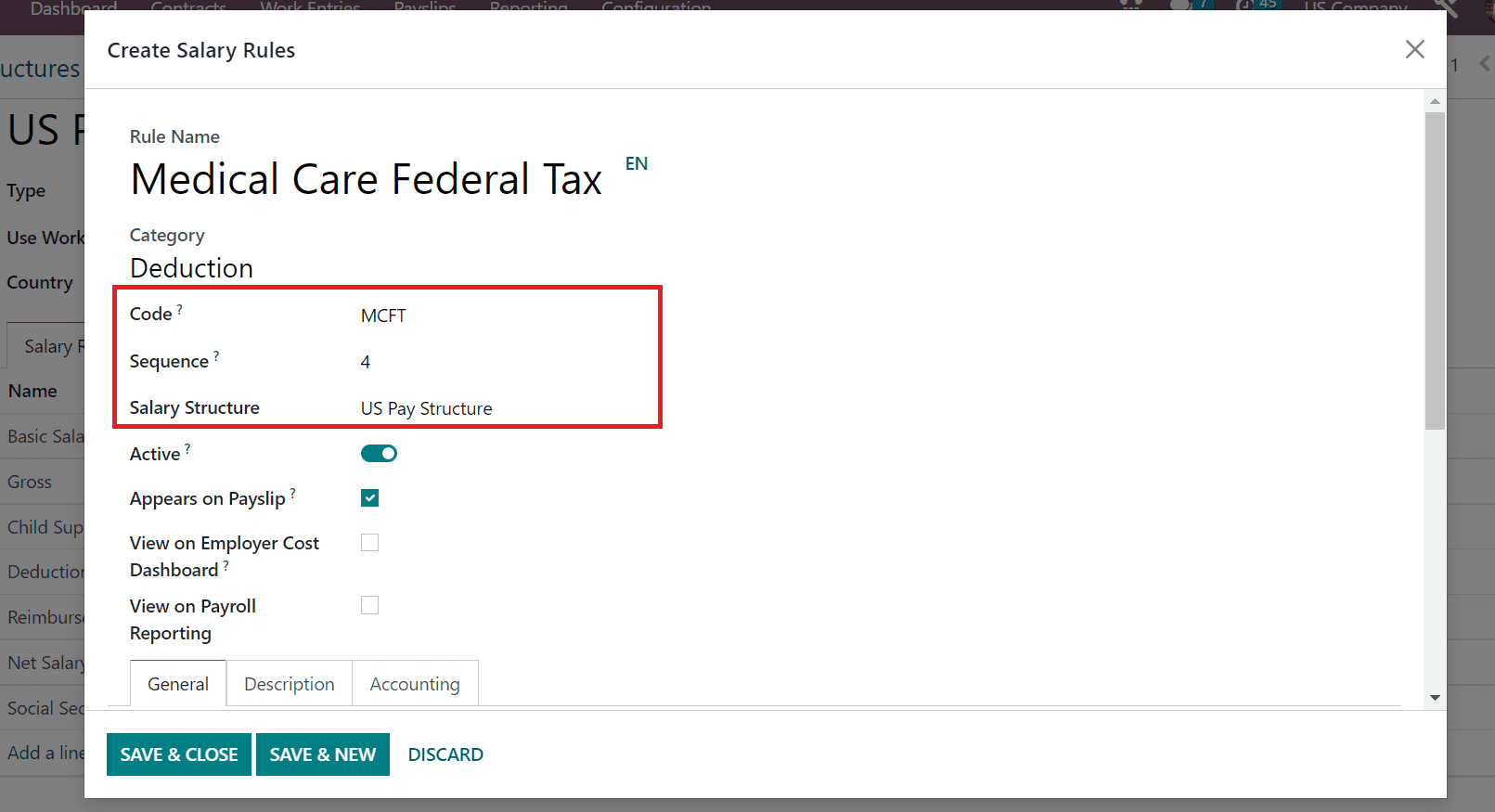

You can mention the code for your salary rule as MCFT in the Code option. Afterward, add a calculation sequence number for your rule as 4. Furthermore, choose your Salary Structure as US Pay Structure as portrayed in the screenshot below.

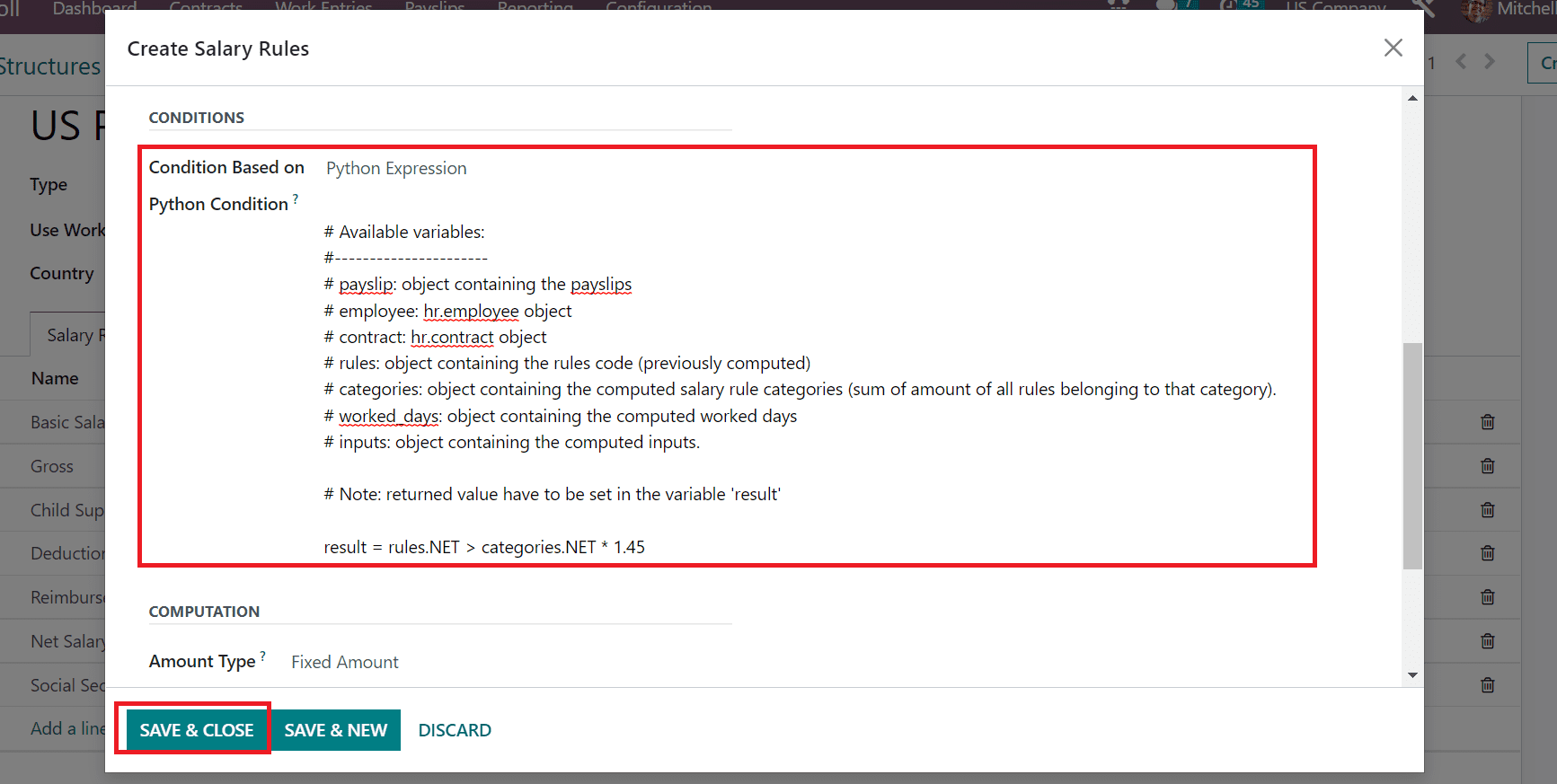

Now, we can specify conditions for the Medical Care Federal Tax rule. We set the Python Expression as the condition in the CONDITIONS section under the General section. The computation of your salary rule occurs as per the python expression condition. As noted in the screenshot below, you must apply the 1.45% of medical care federal tax provided to US employees in the Python Condition field.

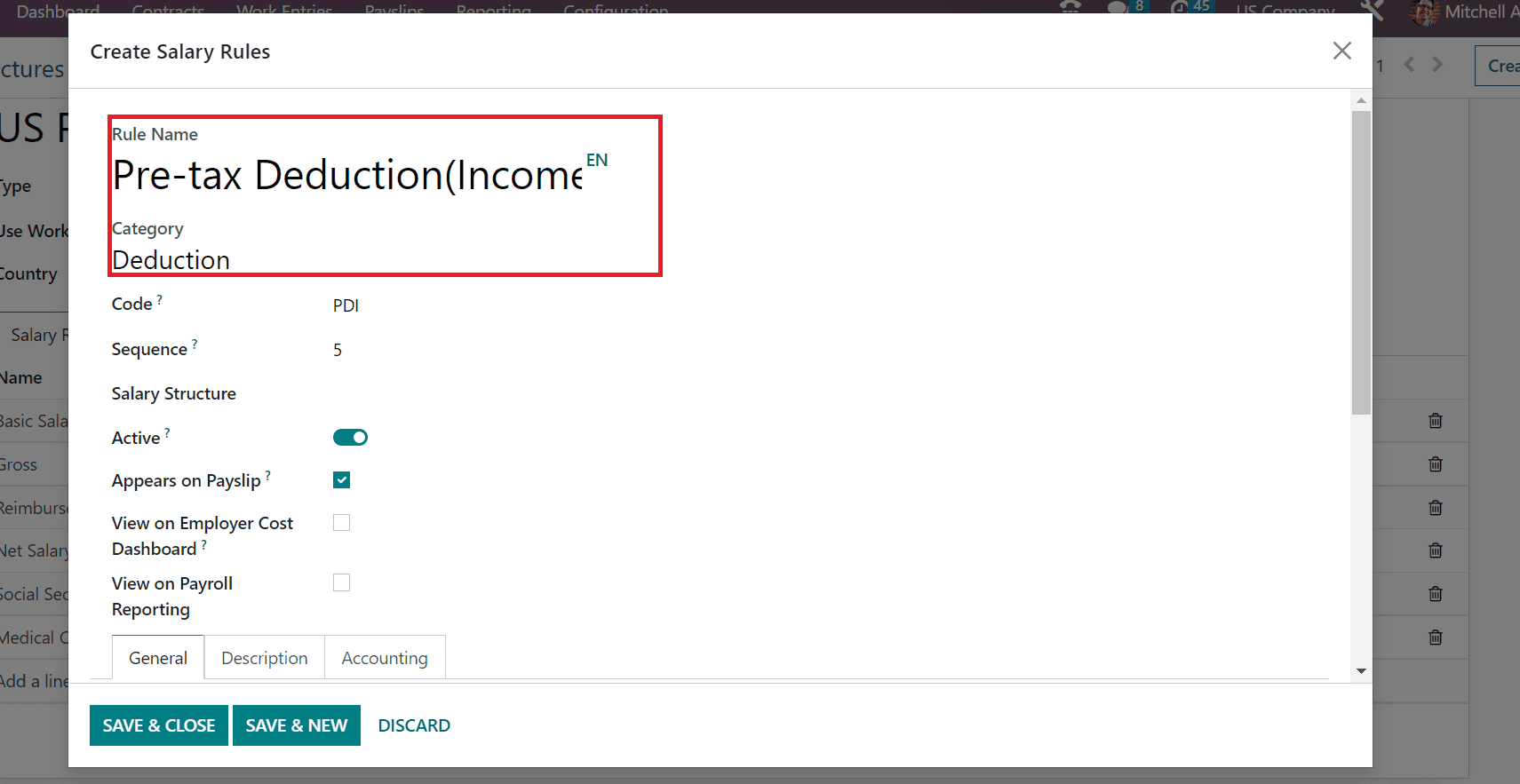

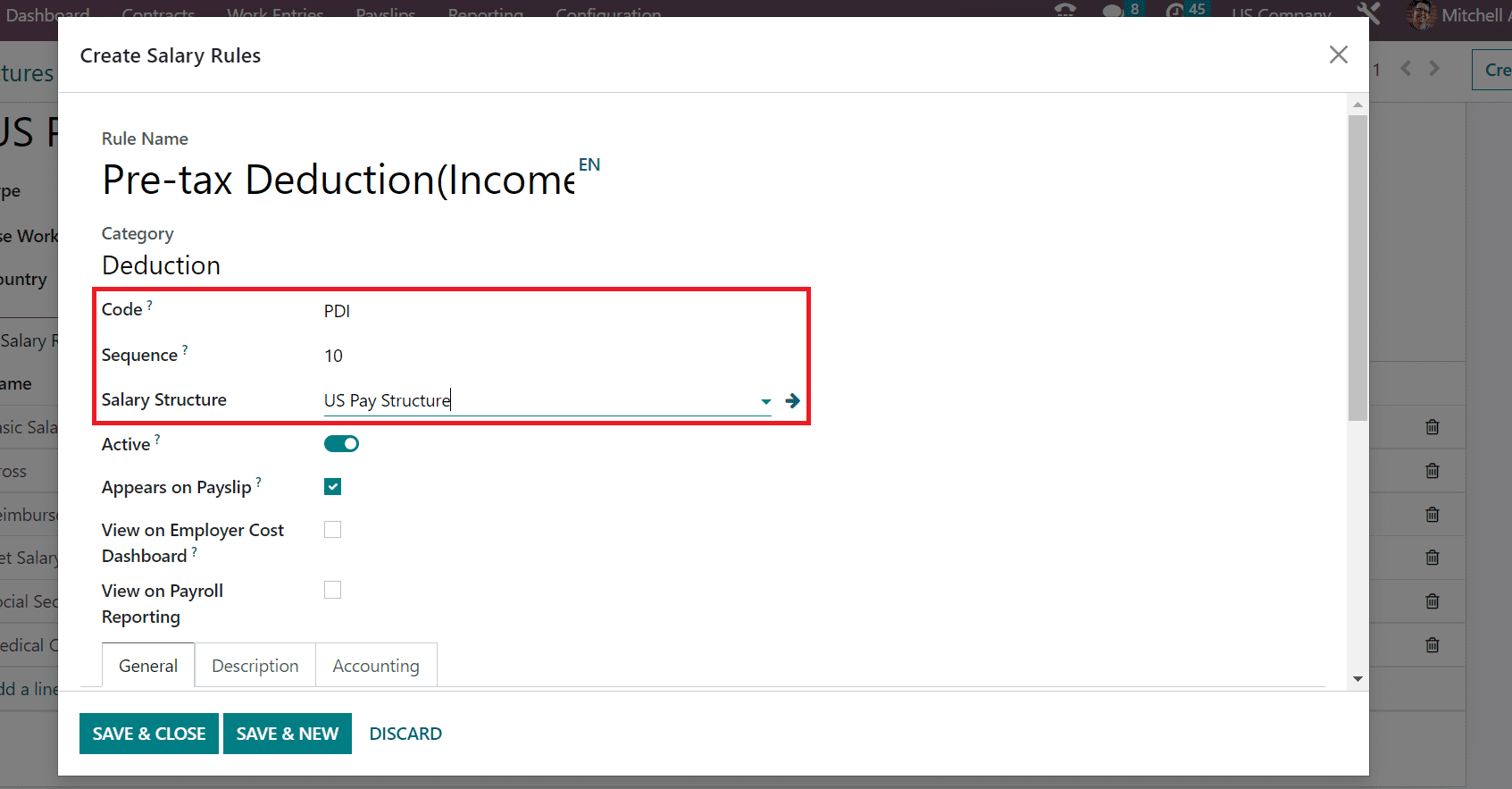

Press the SAVE & CLOSE icon to save the Medical Care Federal Tax rule in the salary structure of employees. Next, we can add Pre and Post-tax deductions for employees as salary rules. In the Create Salary Rules page, we applied Pre-tax Deduction(Income Tax) as the Rule Name and set Deduction as the category for your rule.

Enter PDI as the Code for your Pre-tax Deduction (Income Tax) and apply sequence number 10. You need to select US Pay Structure as the Salary Structure for your rule.

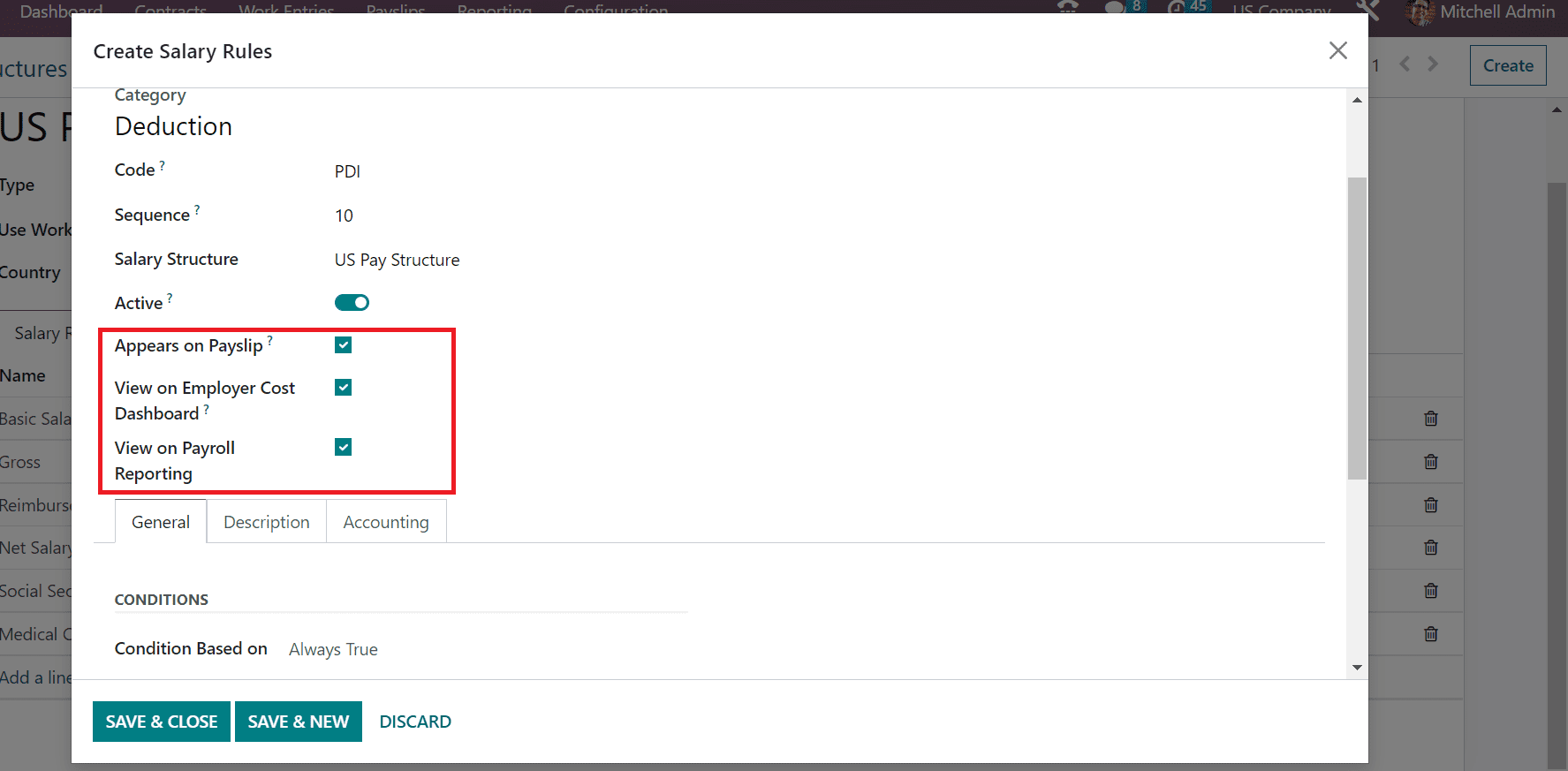

To access the salary rule on the payslip, activate the Appears on Payslip option. Similarly, the user can view the payroll reporting rule once the View on Payroll Reporting field is activated. It is easy to see the pre-tax deduction rule on the employer cost dashboard after enabling the View on Employer Cost Dashboard field.

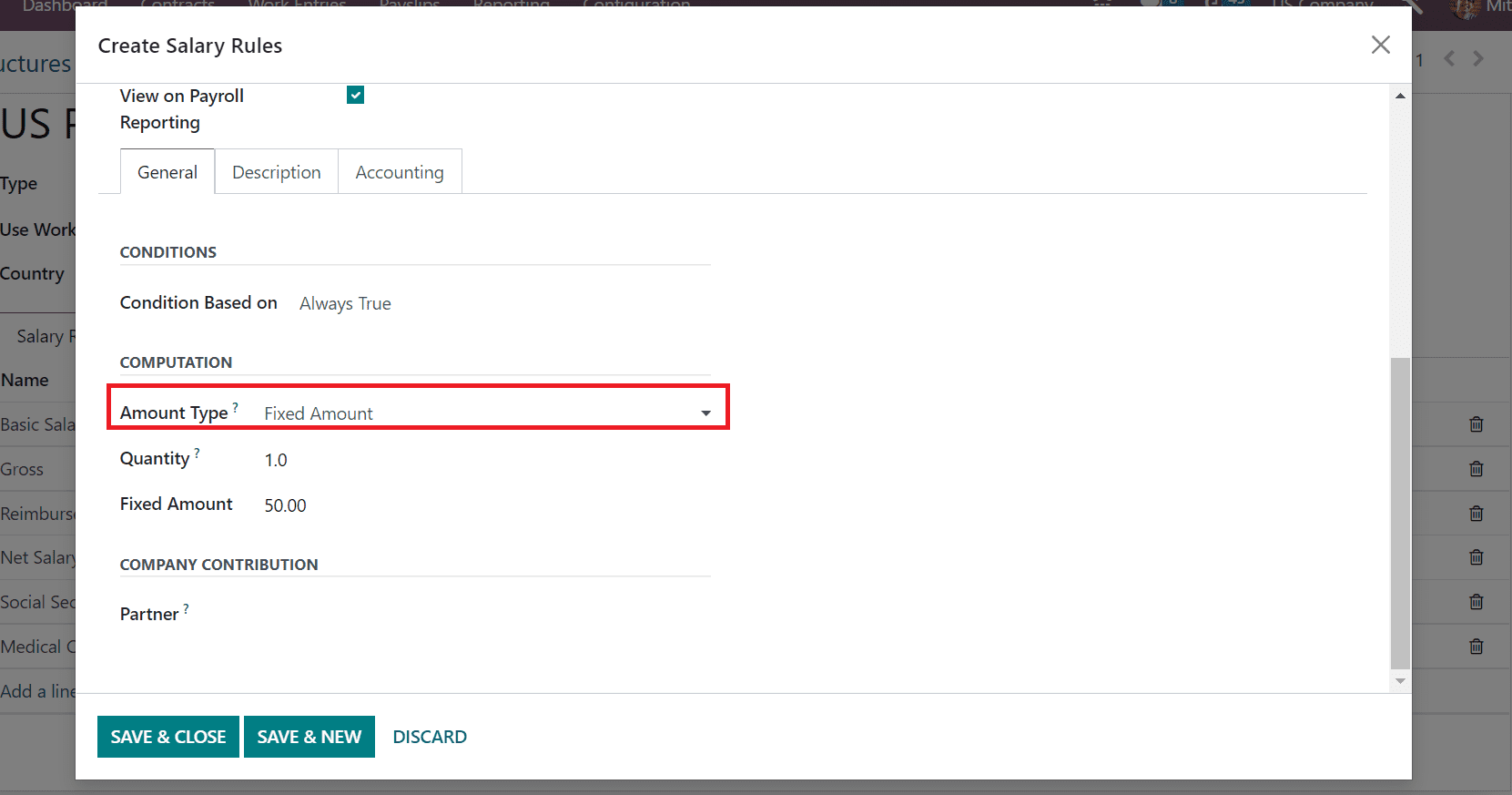

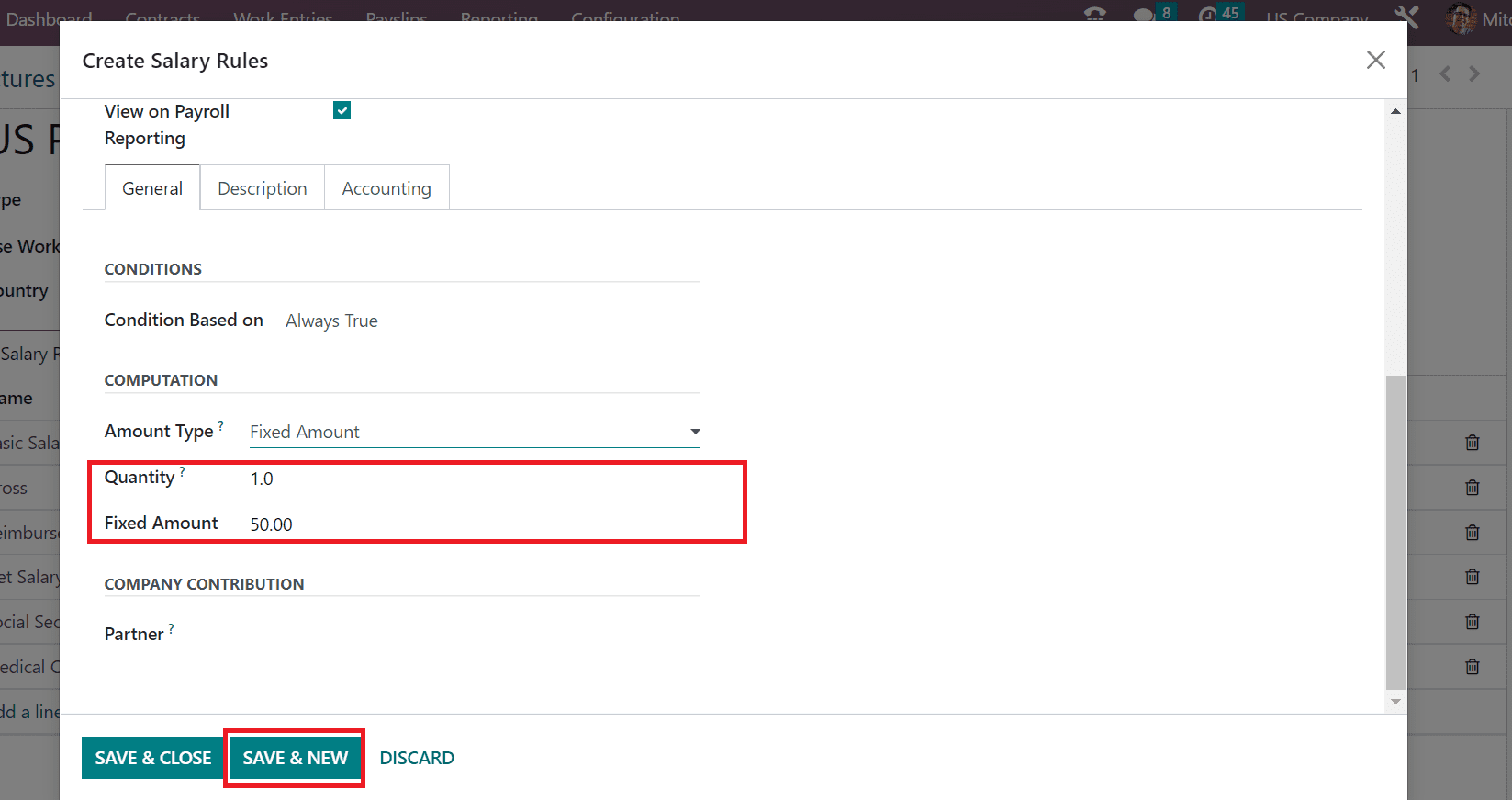

Next, we set the condition Based on Always True below the CONDITIONS section. After setting that condition, we can elaborate on the computation method for your salary rule. The computation method for a rule is divided into Percentage, Python Code, and Fixed Amount. A Quantity and Fixed Amount fields appear before the user once choosing the Fixed Amount as an Amount Type under the COMPUTATION section.

The quantity is applicable for the computation of a fixed amount, and we added one quantity. Later, enter the total price based on your quantity in the Fixed Amount option. After mentioning the necessary data, click the SAVE & NEW icon, as illustrated in the screenshot below.

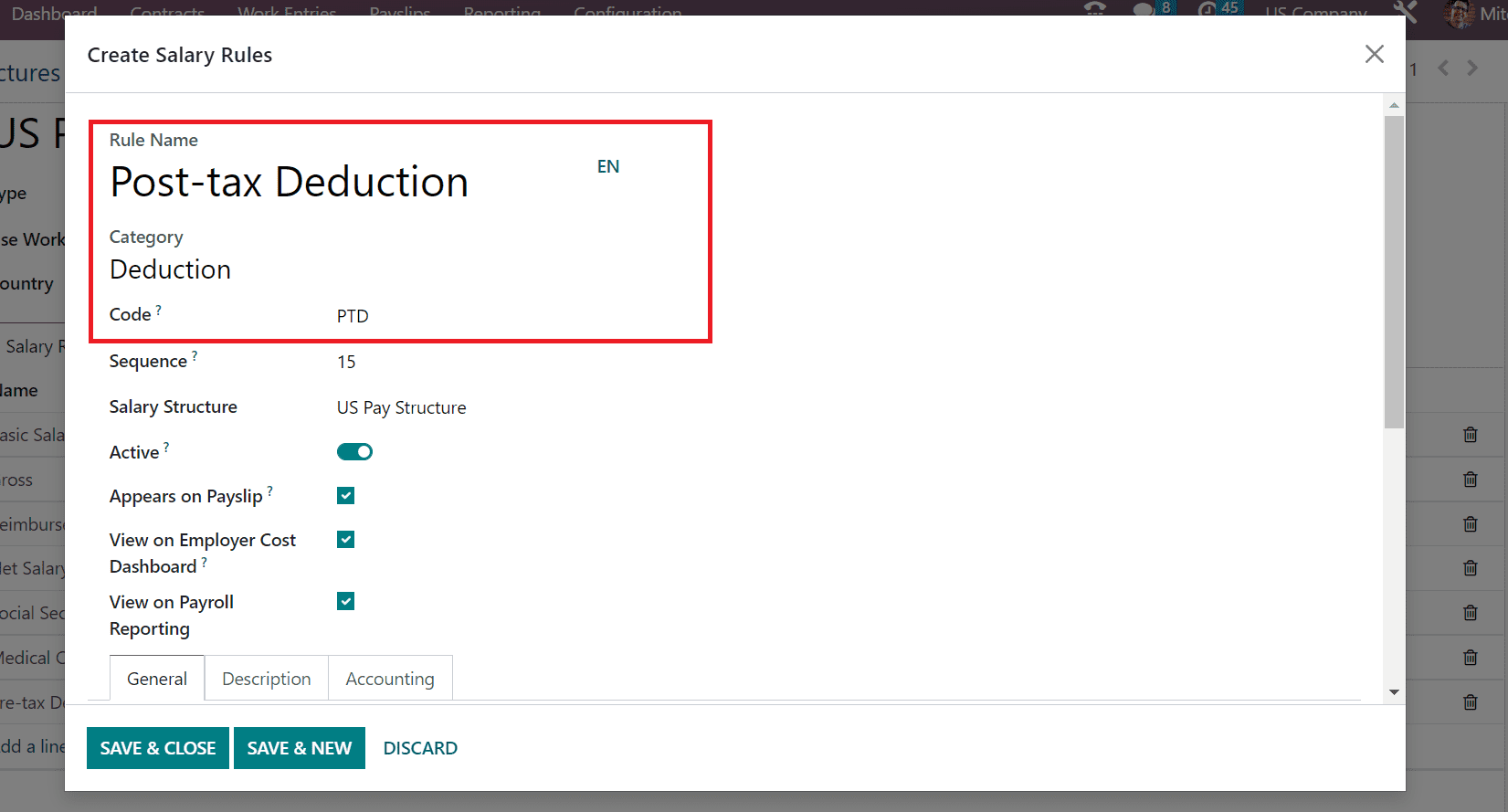

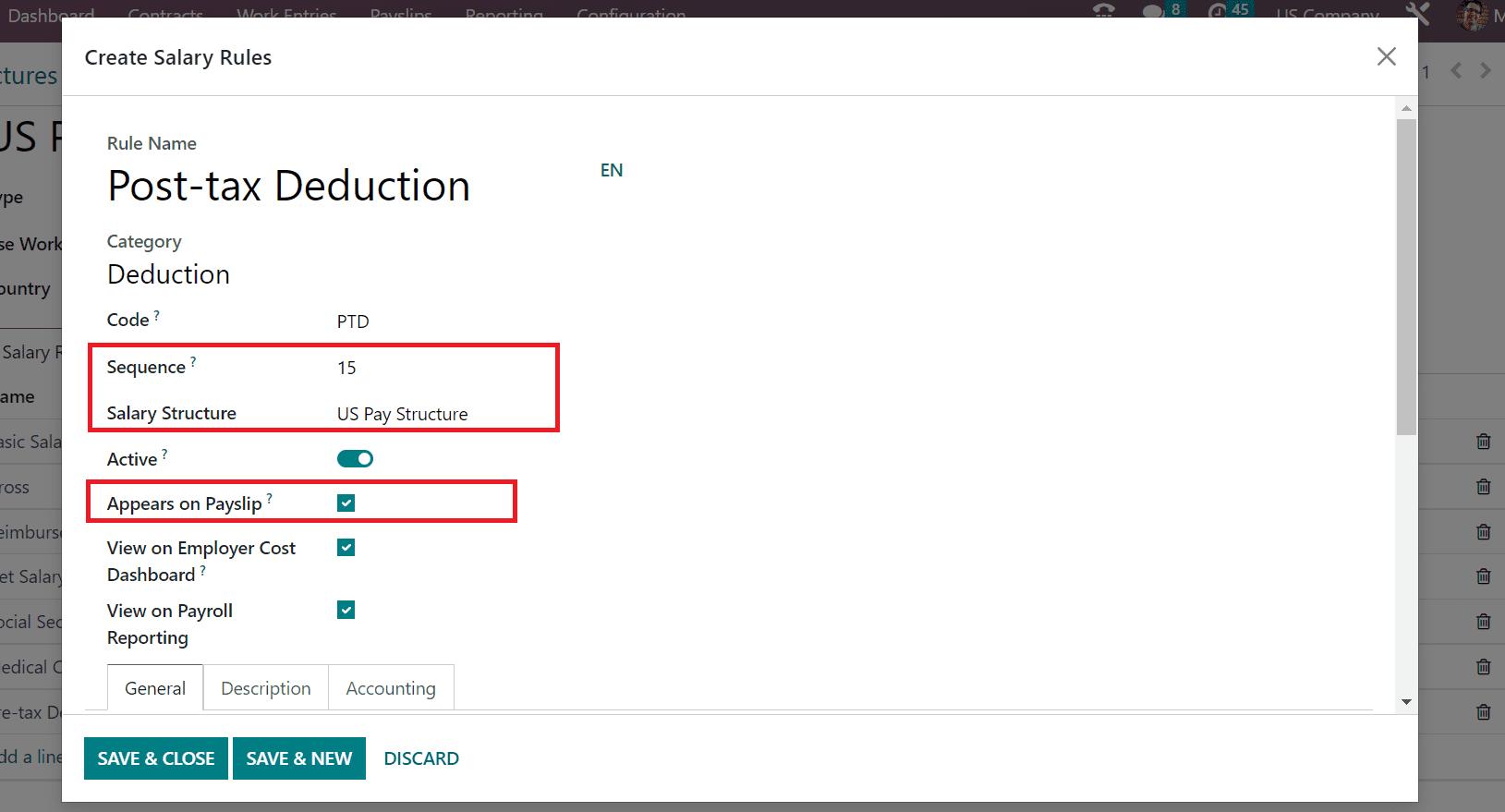

In the open screen, enter Post-tax deductions in the Rule Name option. Also, set a Deduction for the category of your salary rule and add PTD as the code.

Users must apply for a sequence number and pick US Pay Structure in the Salary Structure option. Later, enable the Appears on Payslip option to view the Post-tax deduction salary rule on an employee payslip.

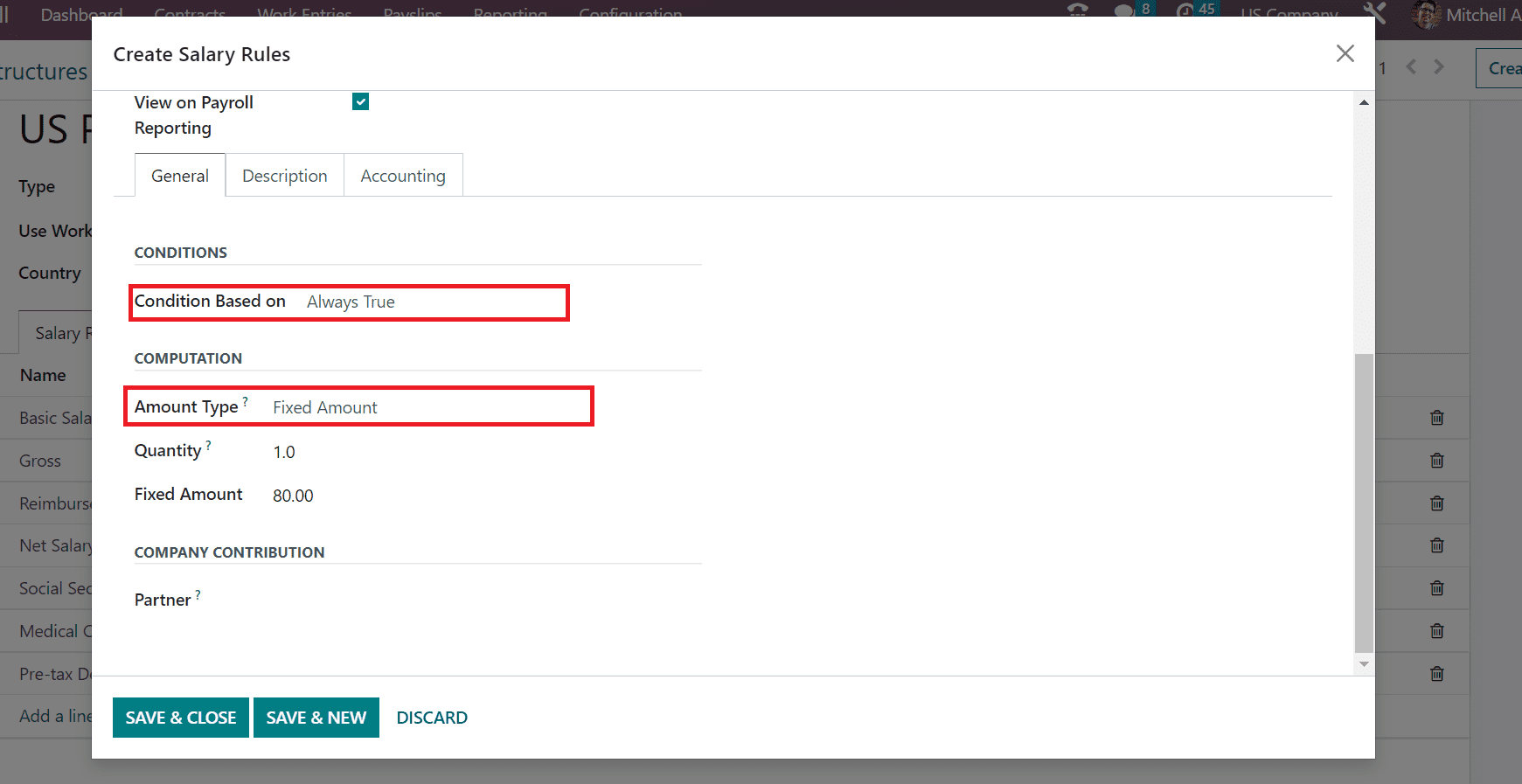

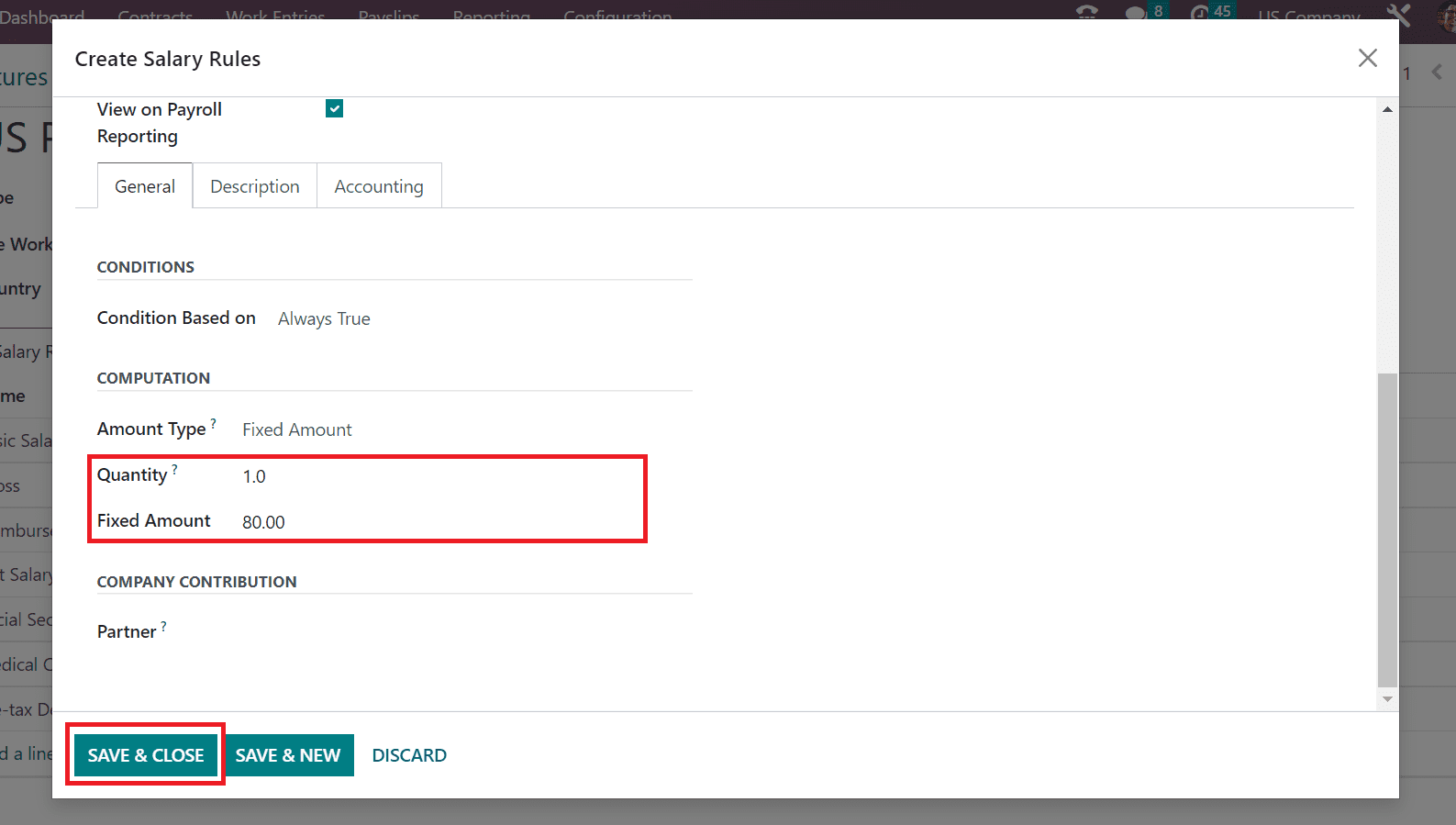

Set the condition for the rule as Always True in the condition Based on the field. Moreover, enter the calculation method for the rule amount as Fixed Amount in the Amount Type field.

Below the COMPUTATION section, we added one quantity and a Fixed Amount of $80. After specifying your amount, press the SAVE & CLOSE icon in the Salary Rule window.

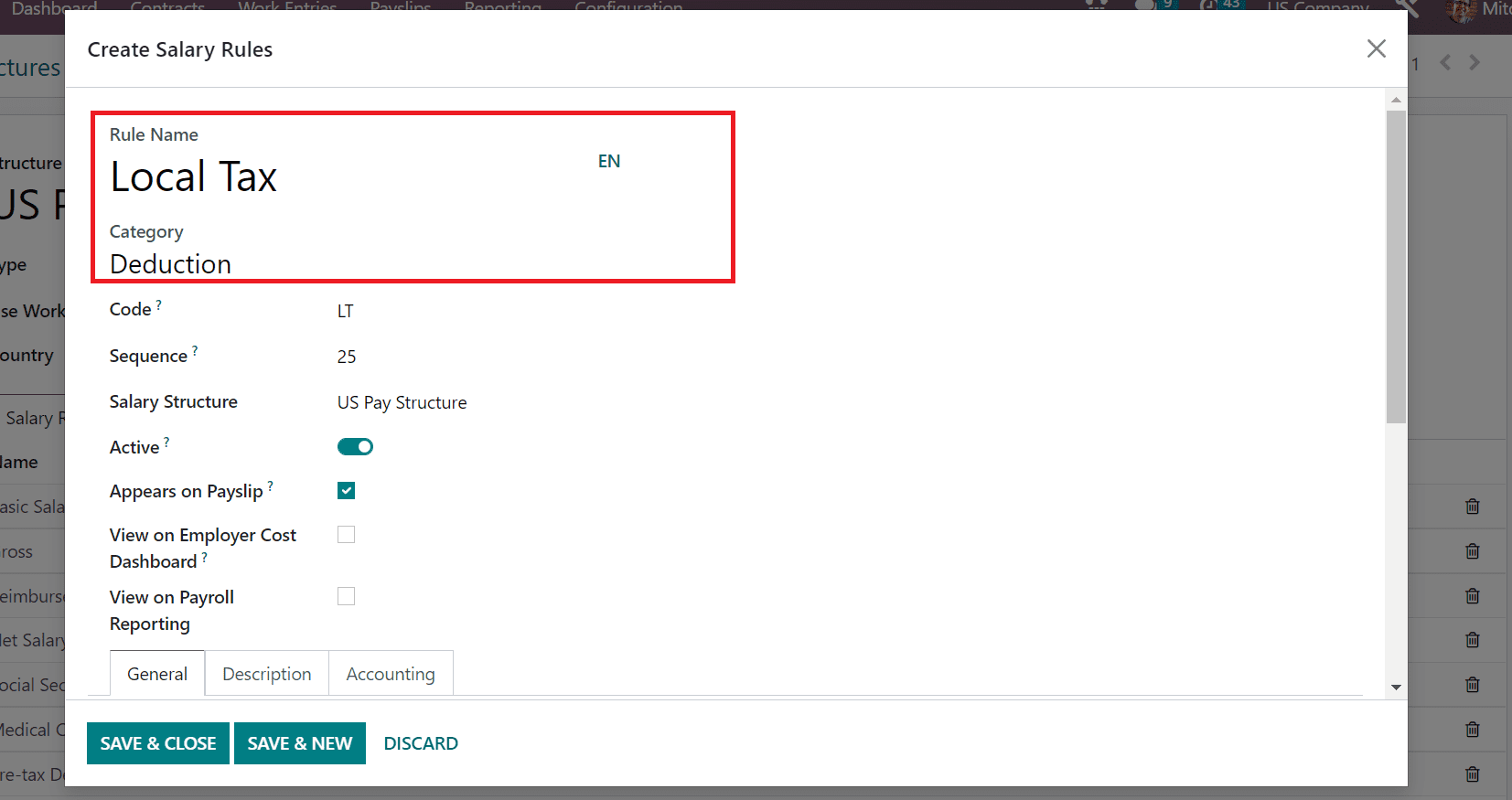

Finally, we can mention the Local tax as the salary rule for the US Pay Structure of an employee. Add Local Tax in the Rule Name and select Deduction Category.

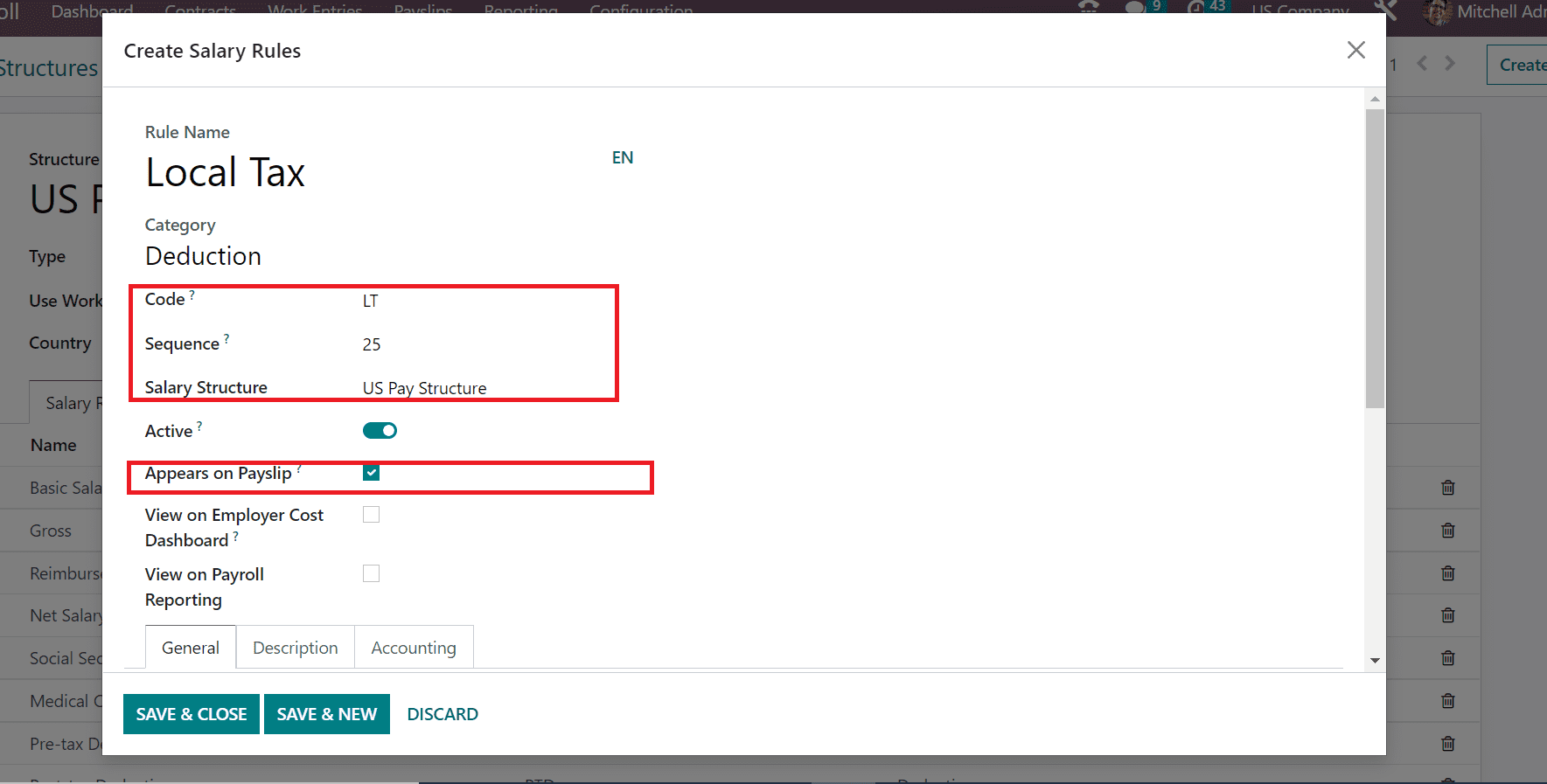

Later, we can apply Code as LT and enter a sequence number for your salary rule. Moreover, pick US Pay Structure within the Salary Structure option and activate the Appears on Payslip option as specified in the screenshot below.

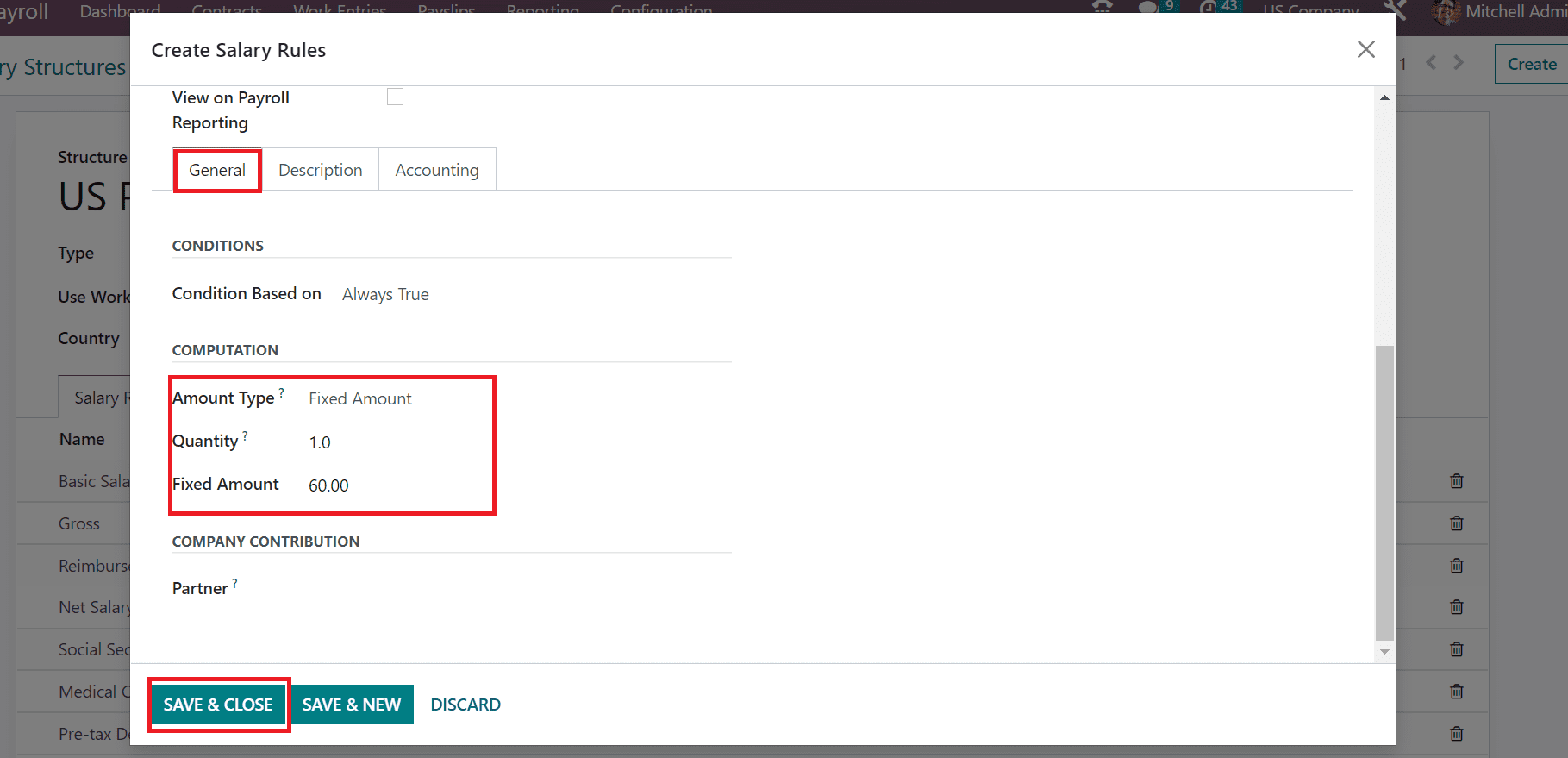

In the COMPUTATION section of the General tab, we set Fixed Amount as the Amount Type. We can calculate the fixed amount per quantity and add your amount for the required quantity, as illustrated in the screenshot below.

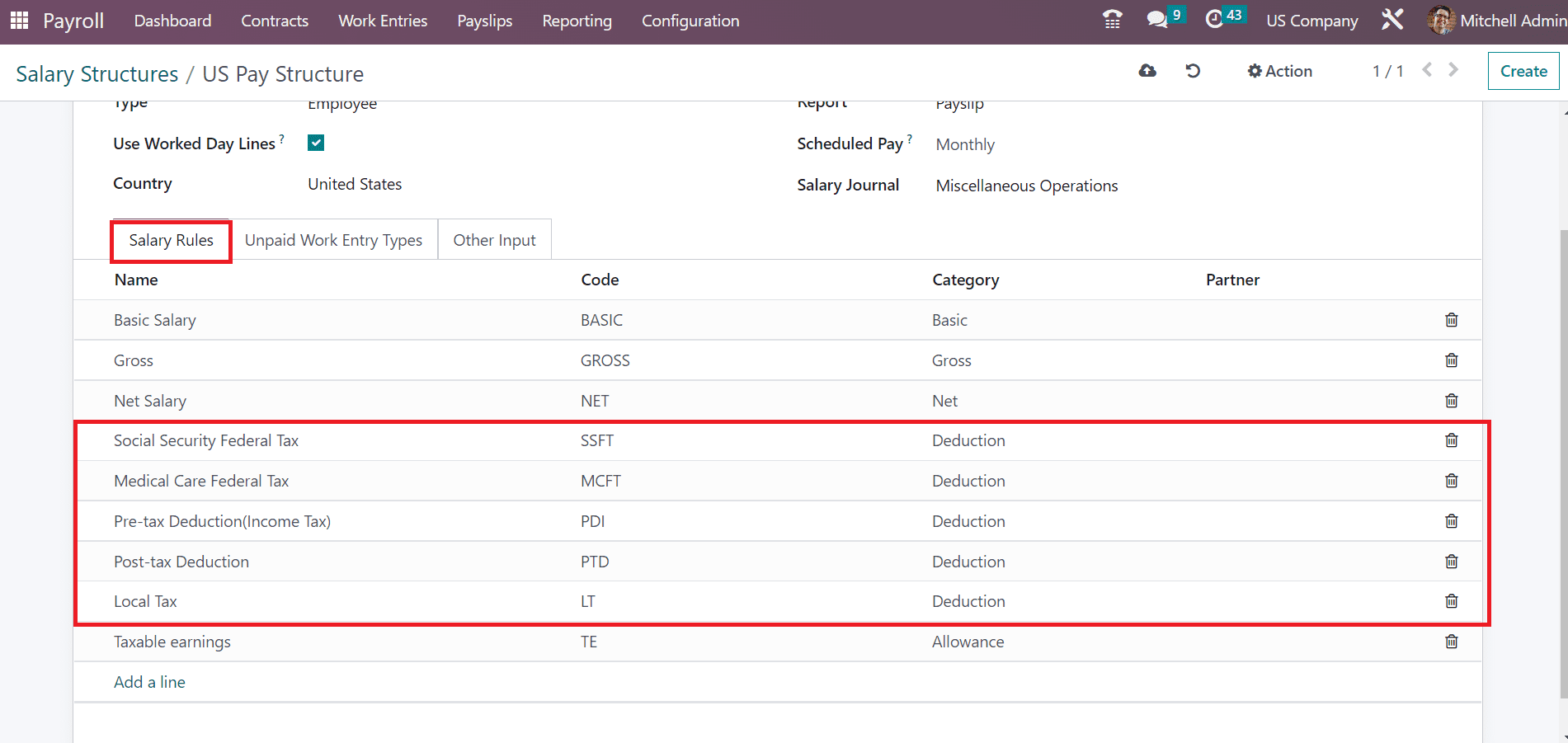

After applying vital data, press the SAVE & CLOSE icon, as shown in the screenshot above. All your developed salary rules under the deduction category are visible in the Salary Rules section.

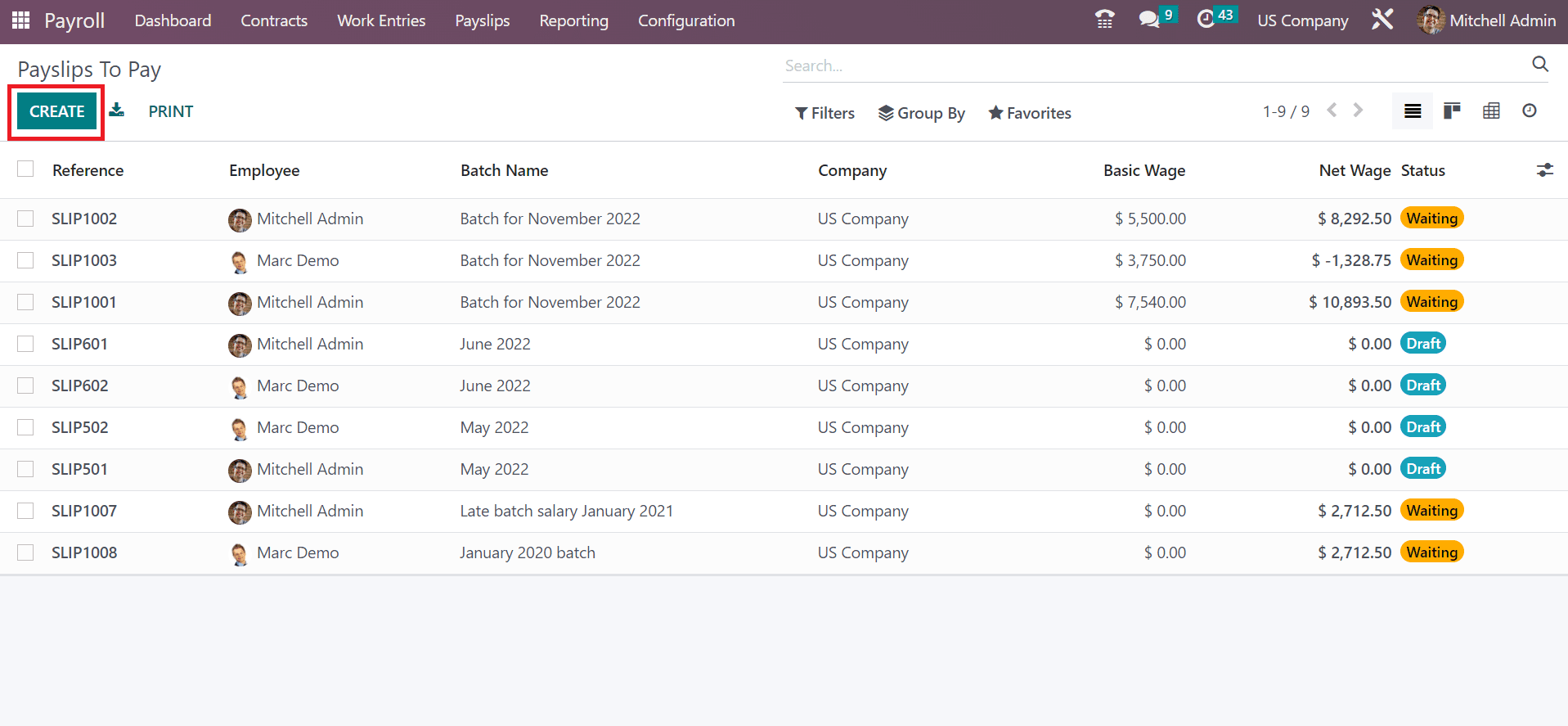

After saving the data manually, let's create a payslip for the employee. You can acquire the To Pay option under the Payslips tab and click the CREATE button.

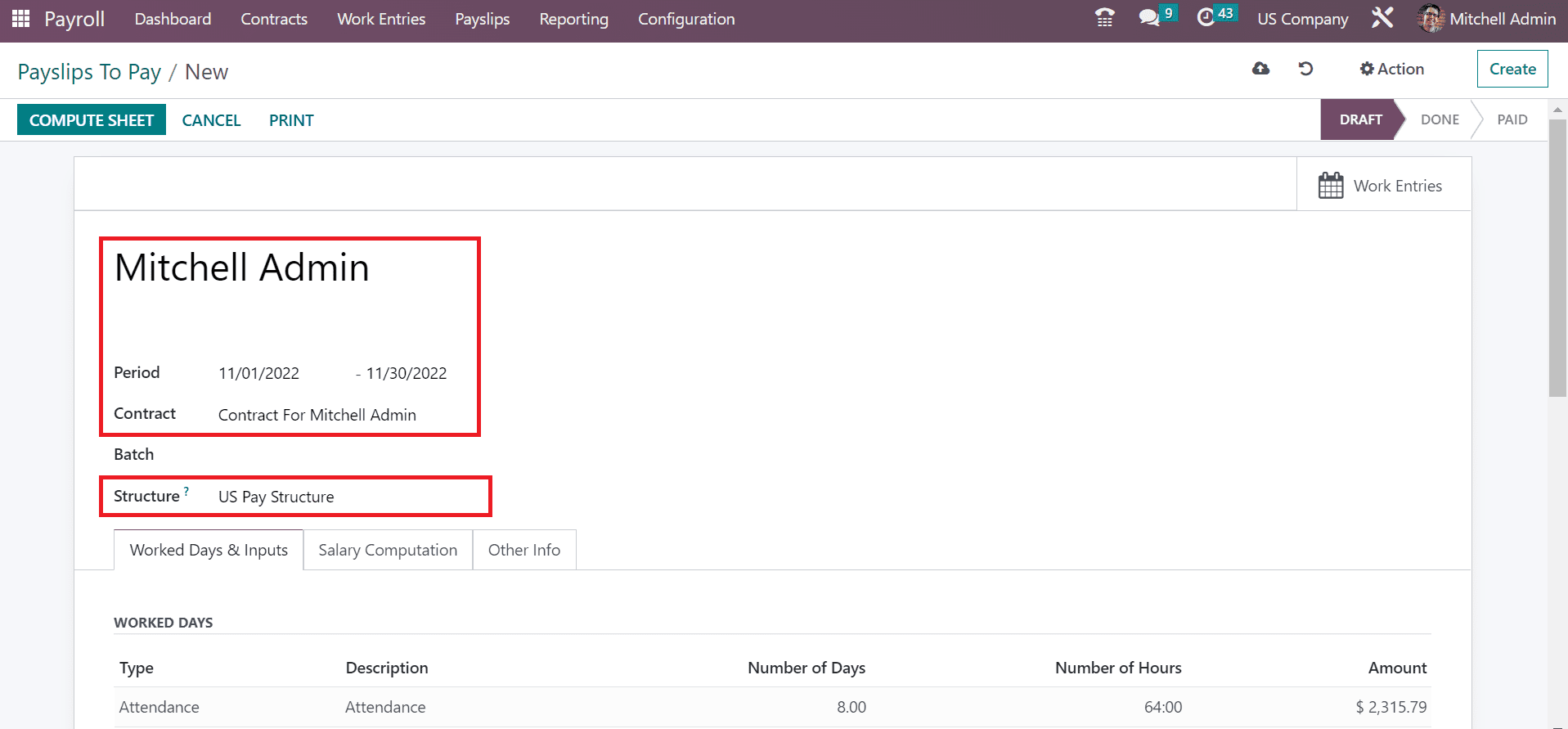

In the open screen, enter Employee Name and duration of employment in the Period field. Select US Pay Structure once selected the contract for your employee in the Payslips to Pay window.

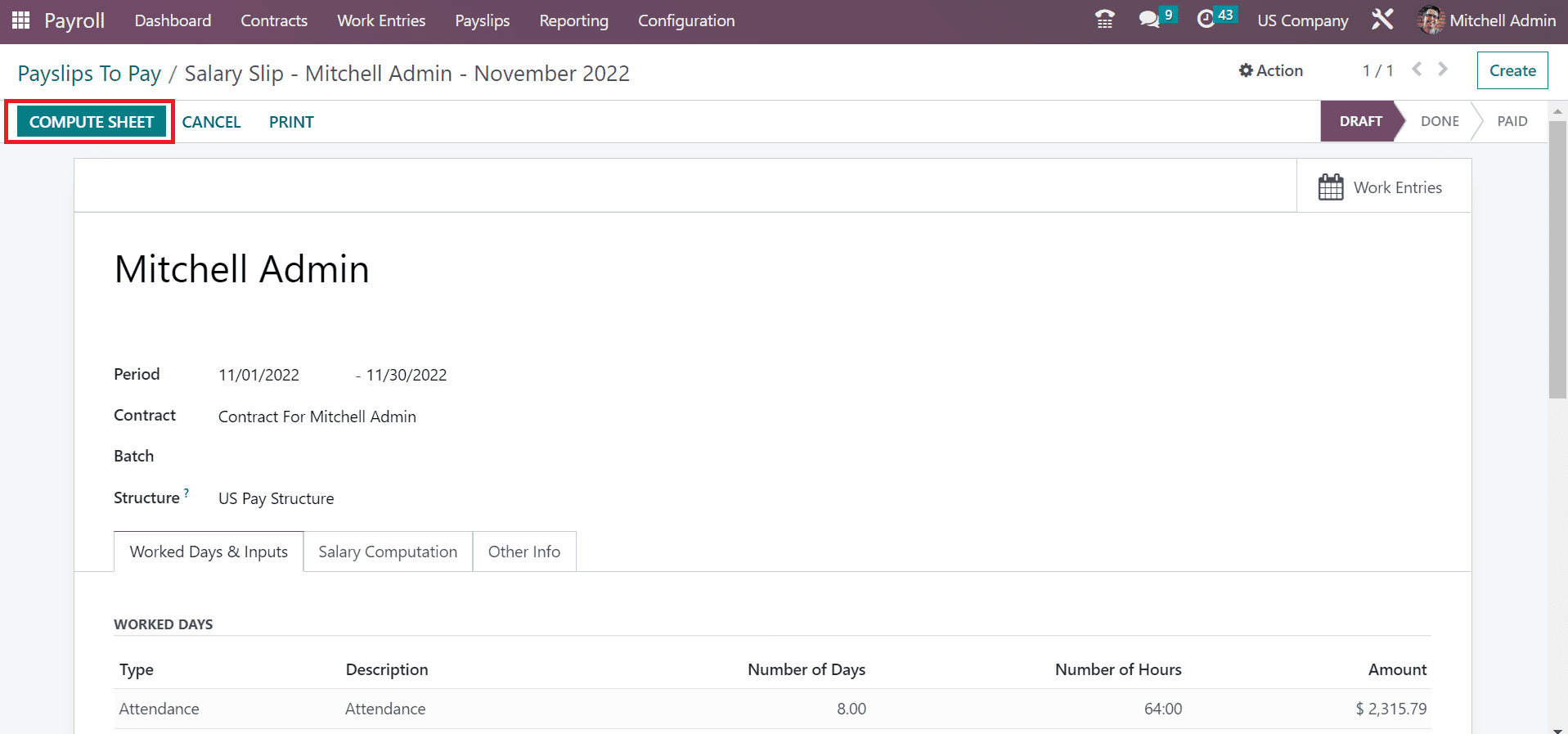

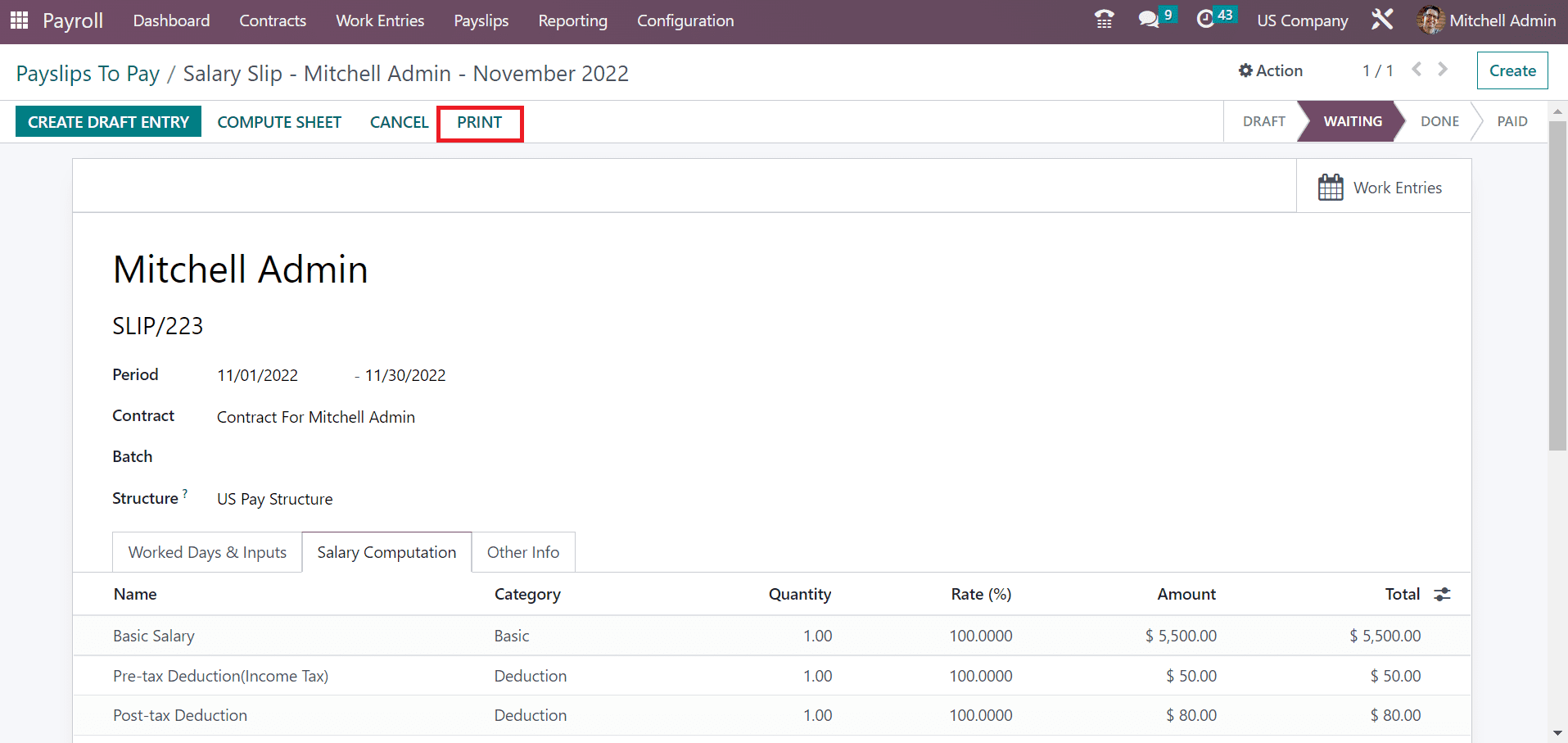

Now, we can compute the sheet after clicking on the COMPUTE SHEET icon in the Payslips to Pay window.

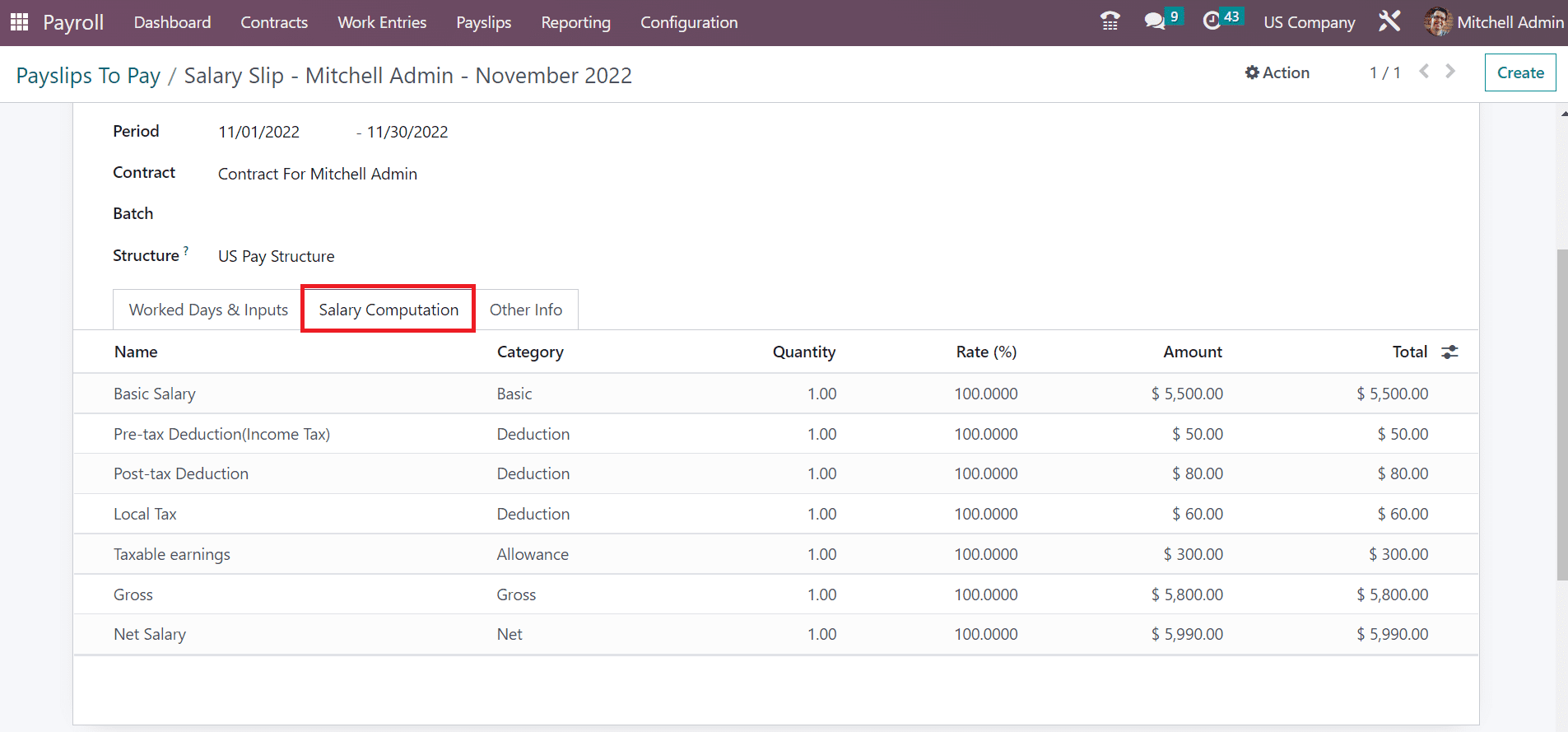

Inside the Salary Computation section, the user can view the necessary salary rules computation of employees.

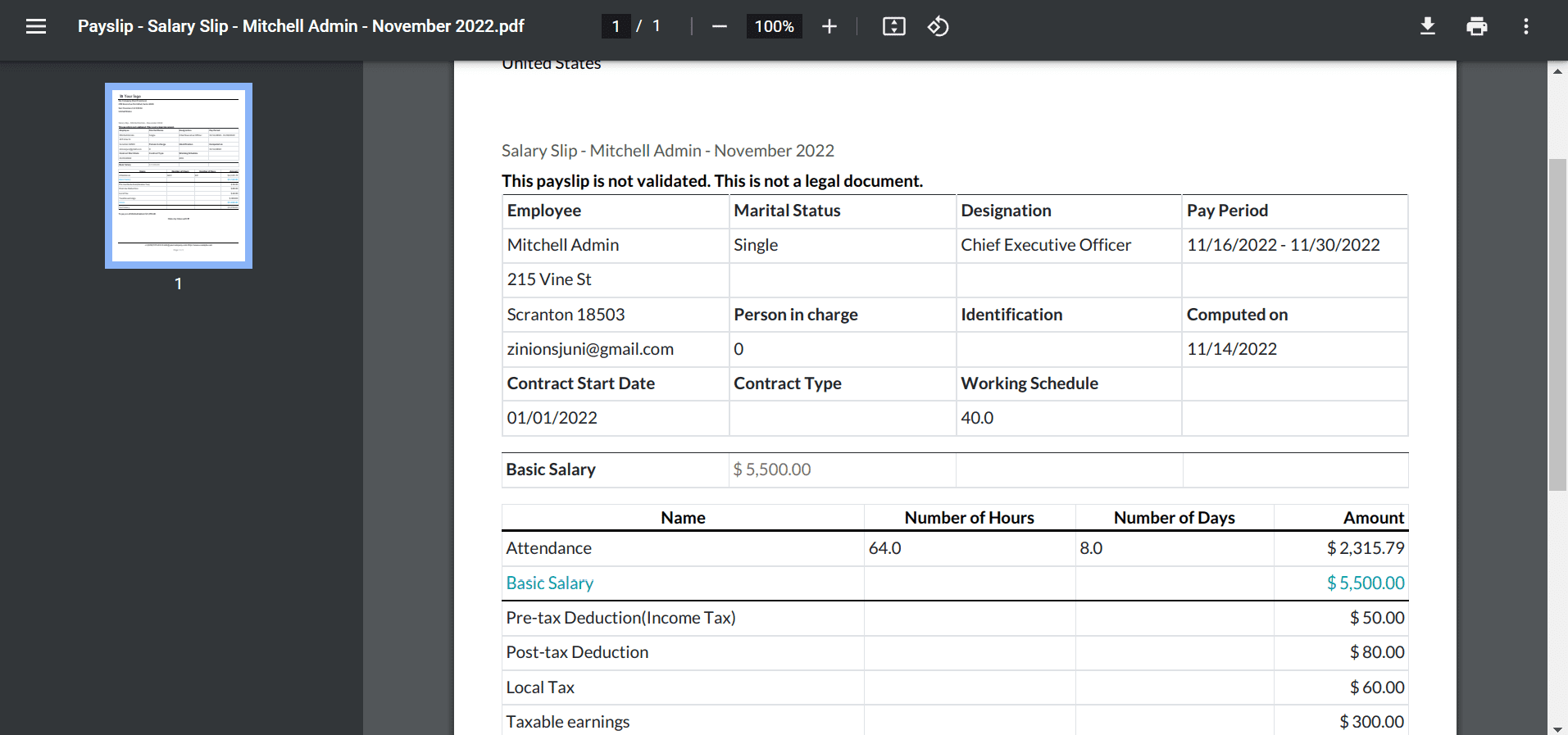

By choosing the PRINT button, we get a copy of the payslip for the employee Mitchell Admin.

So, it is easy to develop a payslip, and the salary slip of employees is attached below.

A company quickly creates salary rules under the deduction category inside a payslip using Odoo 16 Accounting module. So, a US company's payroll management for an employee becomes easy through Odoo ERP support.