Payslip is an essential asset for an employee detailed about total wages from the company. Some vital heads mentioned in a salary slip include gross pay, net pay, allowances, earnings, deductions, and more. Management of all these inside an employee payslip can sometimes be difficult. Additionally, the income tax rates will vary based on each state of a country. Each form contains unique state or local tax rates in the United States. Configuring these taxes into a payslip is challenging for US companies. Odoo 16 Payroll module enables you to manage Alabama(Income Tax) as a salary rule within a payslip.

This blog highlighted the steps to apply Alabama(US) Income Tax in a Payslip within the Odoo 16 Payroll.

Analysis of work entries, contracts, templates, salary attachments, and more are accessible within the Odoo 16 Payroll module. In the salary structure, it is simple to add details of state and local tax rates as salary rules. Let's see the process of applying Alabama(US) Income Tax on the Odoo 16 Payslip module.

Brief of State Income Tax in the US

One mandatory field applied for workers' wages is a State Income Tax(SIT). It is reduced from the employee's salary and given to the concerned state tax agency. It may be either flat or progress according to the difference in each state. A flat-rated tax structure is imposed on particular employees in each state. Before working in a business, an individual must fill out a state W-4 form and gather information about each worker separately. Each state has a different W-4 record based on income tax rates. It is eays to begin the payroll running once completed the collection from a new hire is.

Most state income taxes are used for education, healthcare, and more. Few states in the US are exempted from the Income Tax rates. A flat income tax rate of 2%-5% is charged in Alabama for the salary wage between $500 to $3001 in US companies. Your applied Alabama Income Tax rate is deducted from the employee payslip. It becomes more accessible with Odoo 16 Payroll in your business.

To Apply Alabama(US) Income Tax as a Salary Rule in the Odoo 16 Payroll

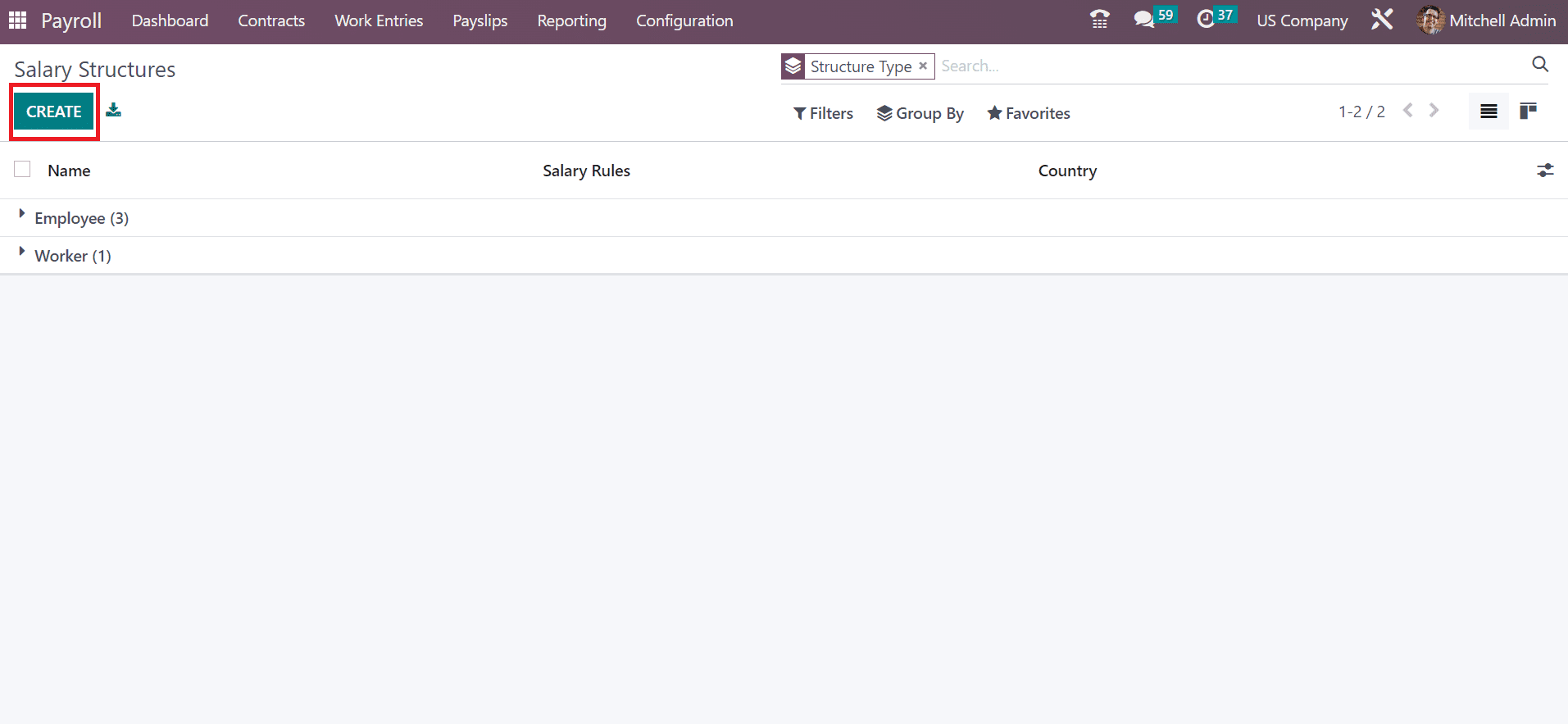

We can develop many salary structures by clicking on the Structures menu under Configuration. In the Salary Structure window, we can view two types related to both employee and worker. To develop a new salary structure, click the CREATE button, as exemplified in the screenshot below.

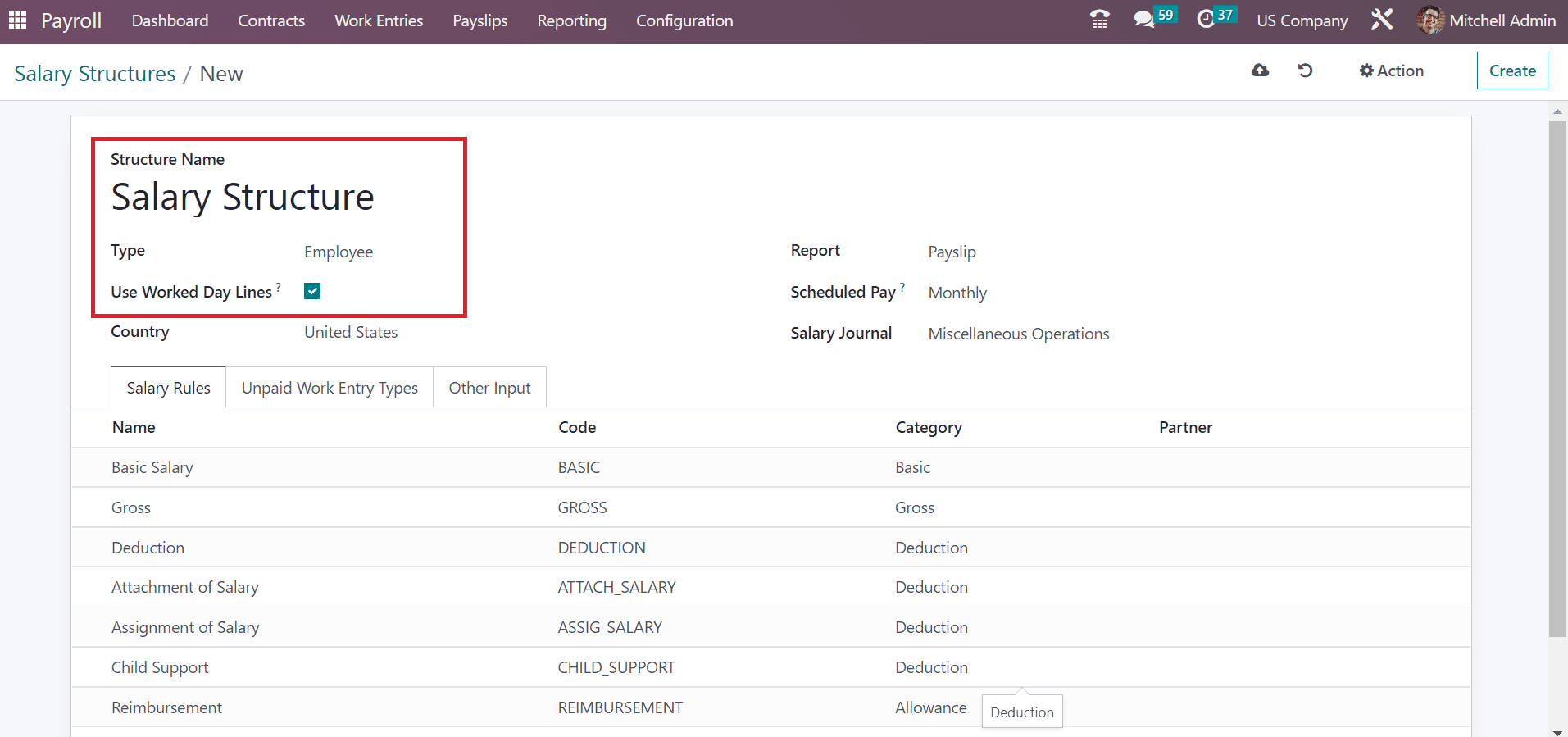

Enter the name as Salary Structure in the Structure Name field and choose the Type as Employee. Later, activate the Use Worked Day Lines option to display salary rules in a payslip, as portrayed in the screenshot below.

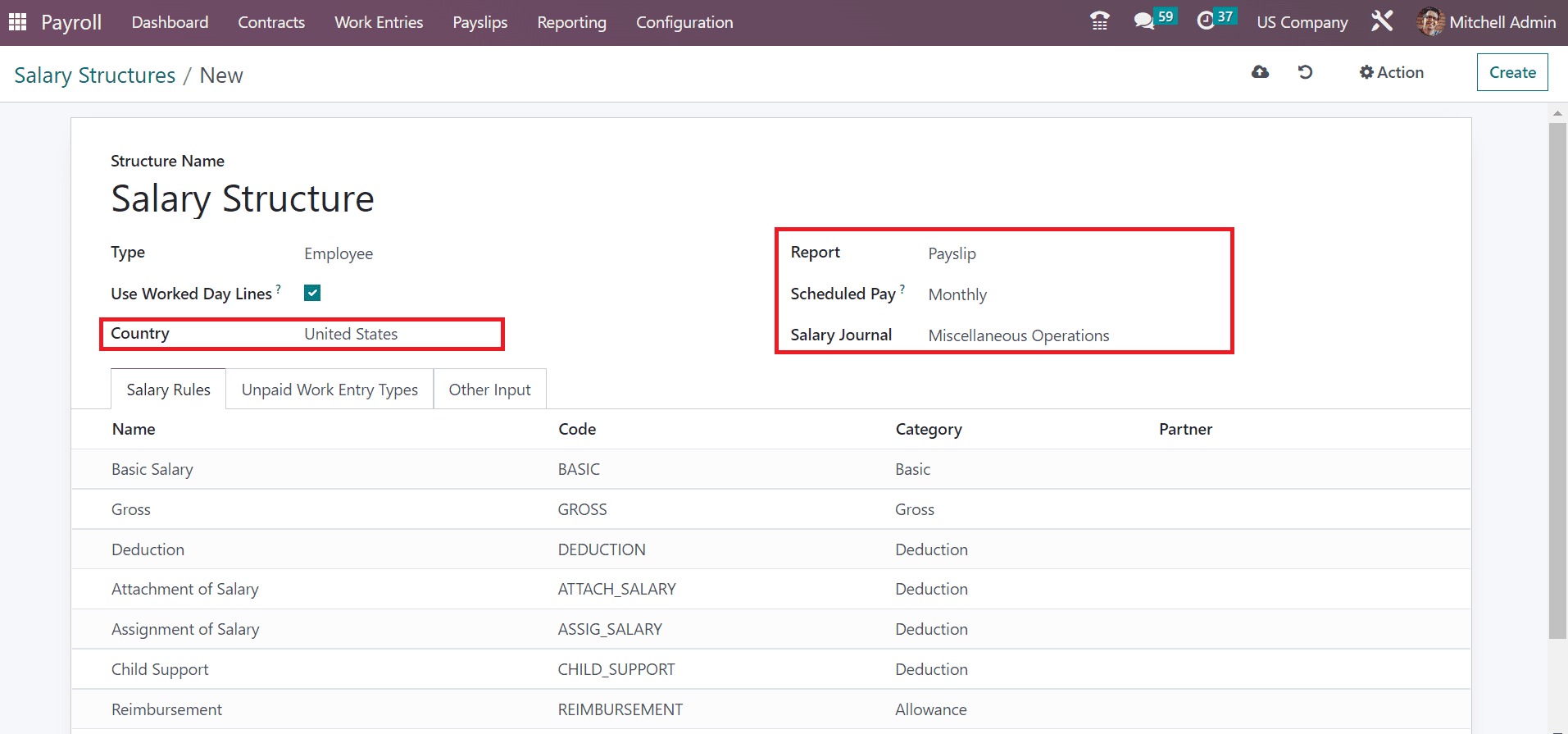

Set your Country as the United States and pick the Report as Payslip. In the Scheduled Pay section, we can make payment methods for employees yearly, monthly, and more. Also, choose Miscellaneous Operations in the Salary Journal field, as pointed out in the screenshot below.

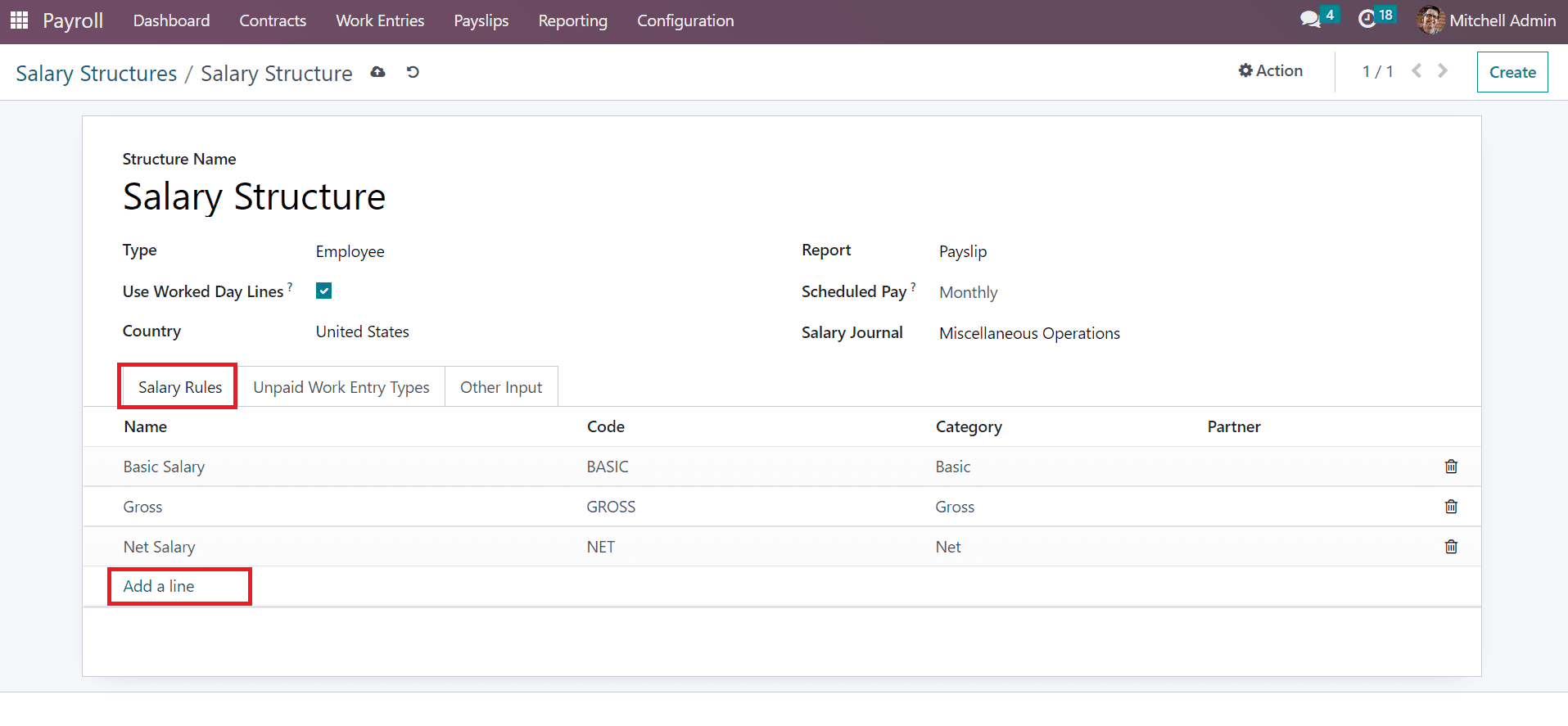

Next, we can apply Alabama Income Tax as a salary rule for employees once choosing the Add a line option under the Salary Rules tab.

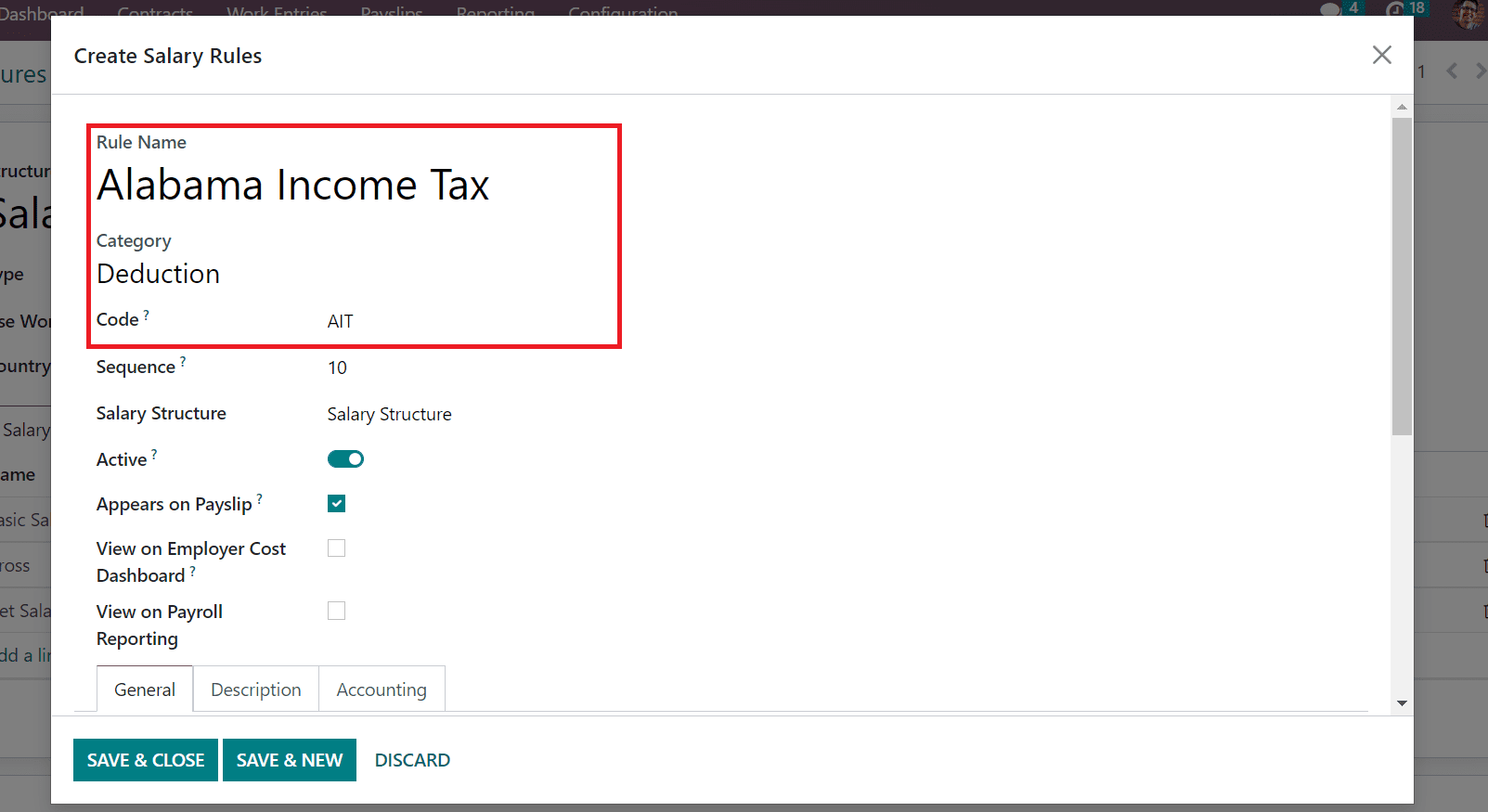

Enter the Rule Name as Alabama Income Tax and set Deduction as a category. Most of the state taxes are deducted from employees' wages. In the Code option, we added AIT for the Alabama Income Tax, as described in the screenshot below.

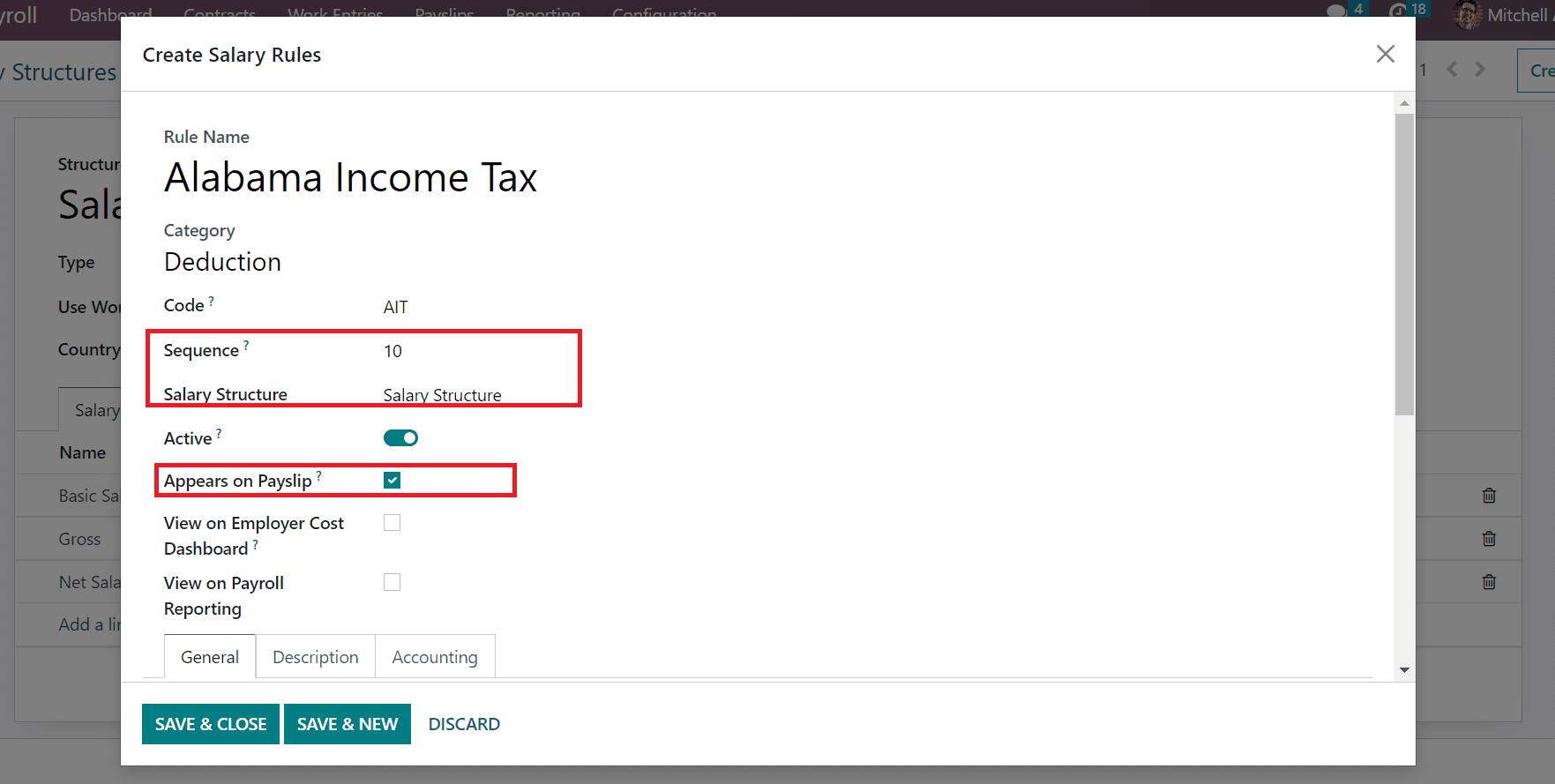

You can mention a sequence number for the salary rule and pick your created Salary Structure. Afterward, you can enable Appears on Paylsip option for the accessibility of the salary rules on a salary slip.

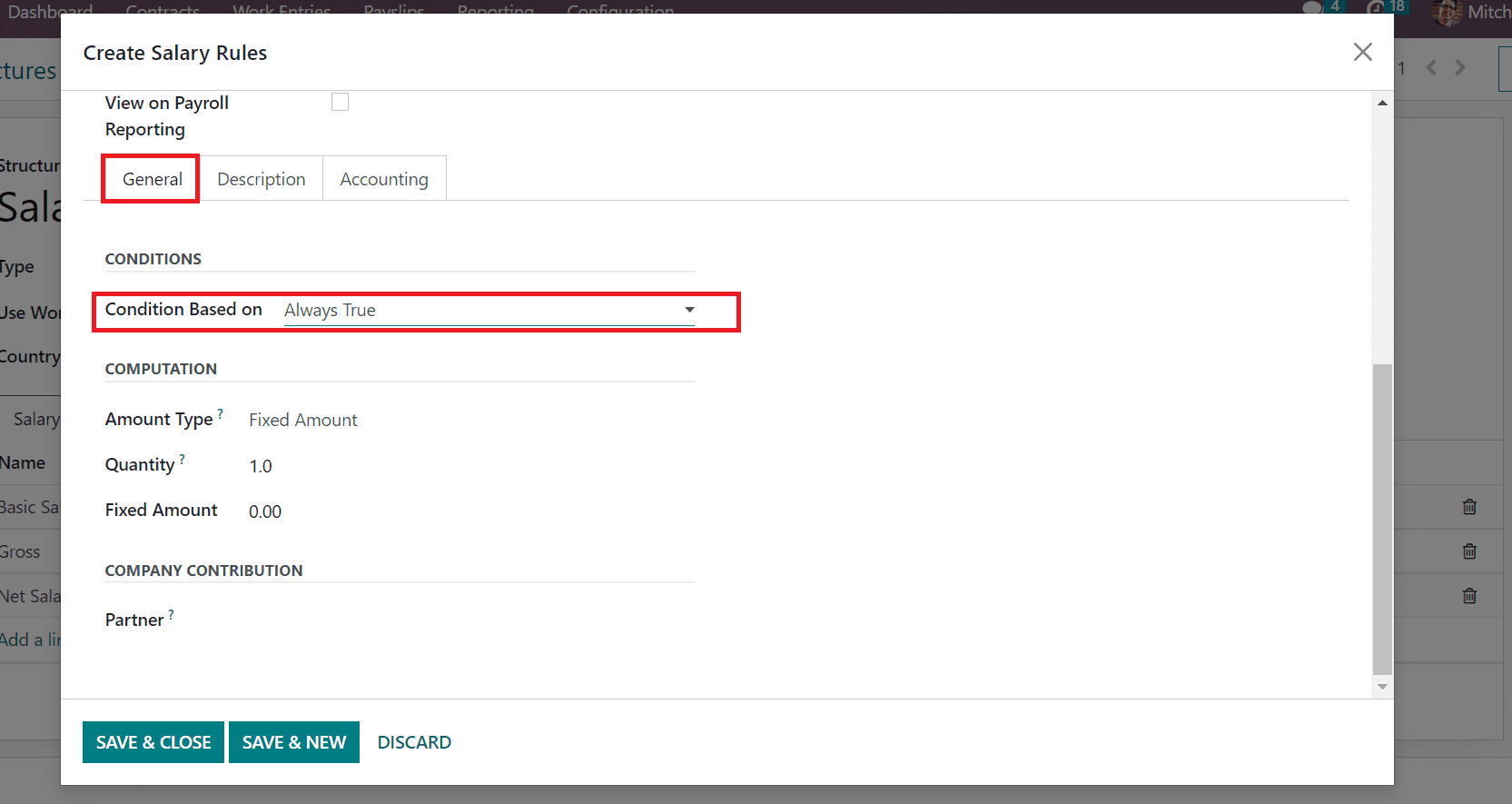

We can set a condition for the created salary rule inside the General tab. It is possible to add conditions according to Python expression, range, and always accurate. We selected the Always True condition for the Alabama Income Tax salary rule, as demonstrated in the screenshot below.

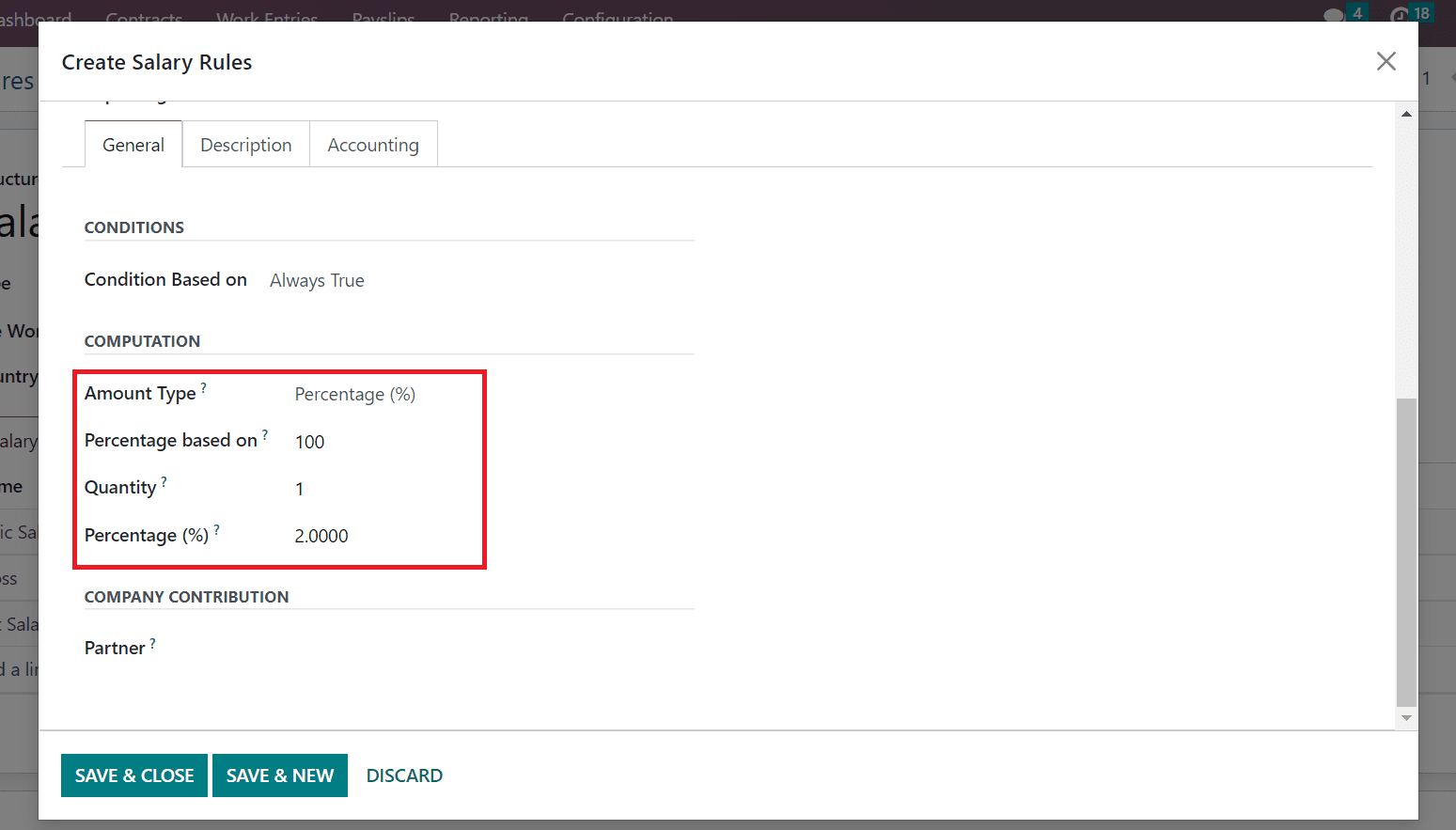

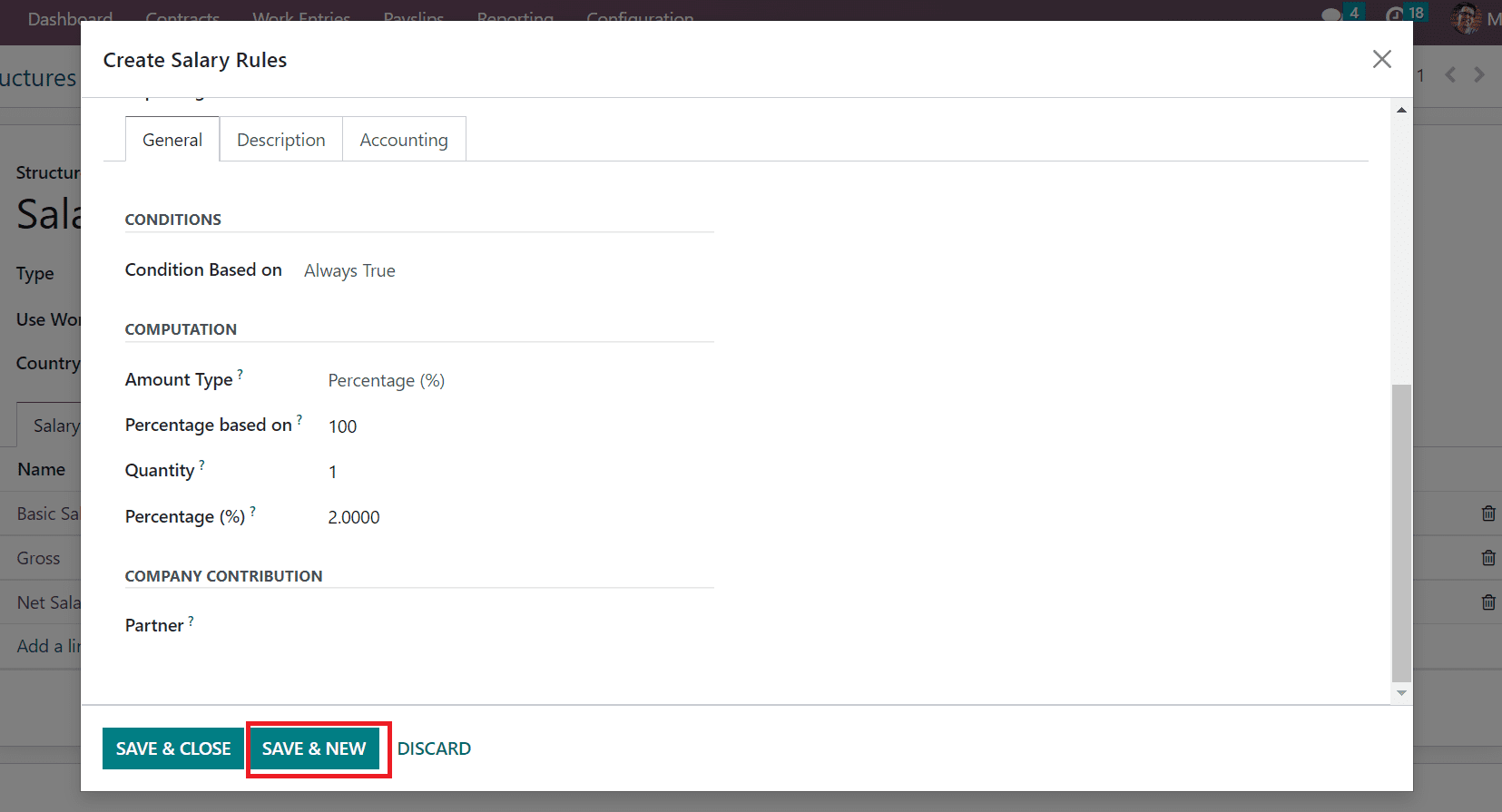

Below the COMPUTATION section, we can compute the Alabama Income Tax as per python code, fixed amount, and percentage. Let's apply the computation for the salary rule as per the percenatge. So, choose the Percentage option in the Amount Type field and enter the percentage based on the amount for the variable result. Also, you can apply quantity for the percentage computation of the salary rule in the Quantity field. Applying the percentage of your salary rule in the Percentage field is easy.

Here, we apply a 2% percentage for calculation due to the Alabama Income Tax ranges from 2 to 5% for employees. After entering all details, click the SAVE & NEW button in Create Salary Rule window, as cited in the screenshot below.

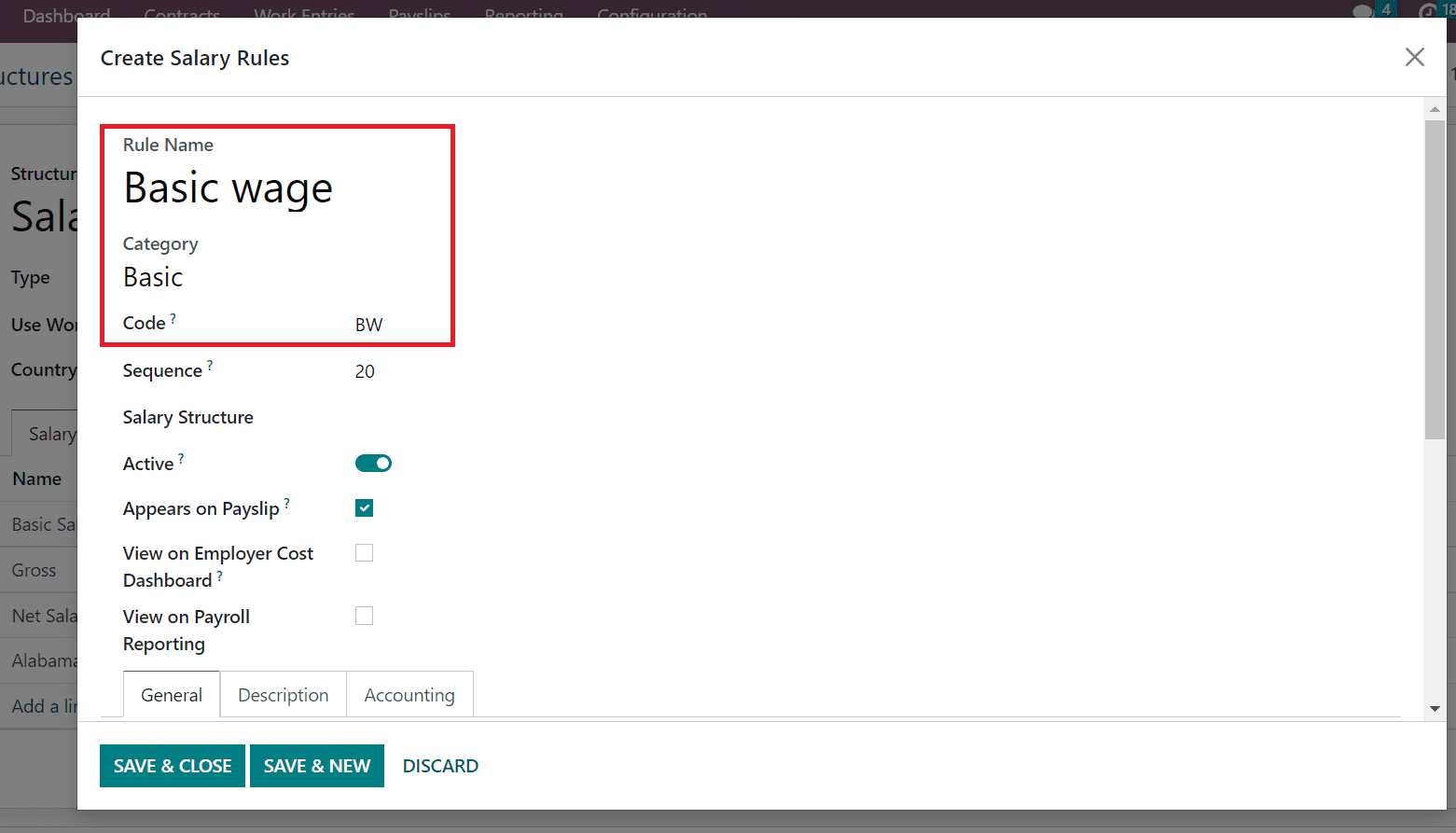

Now, we can apply employees' basic wages as a salary rule. Add Basic wage as a rule in the open window and pick the Category as Basic. Users can allow the reference of salary rule computation in the Code field as BW for Basic Wage, as specified in the screenshot below.

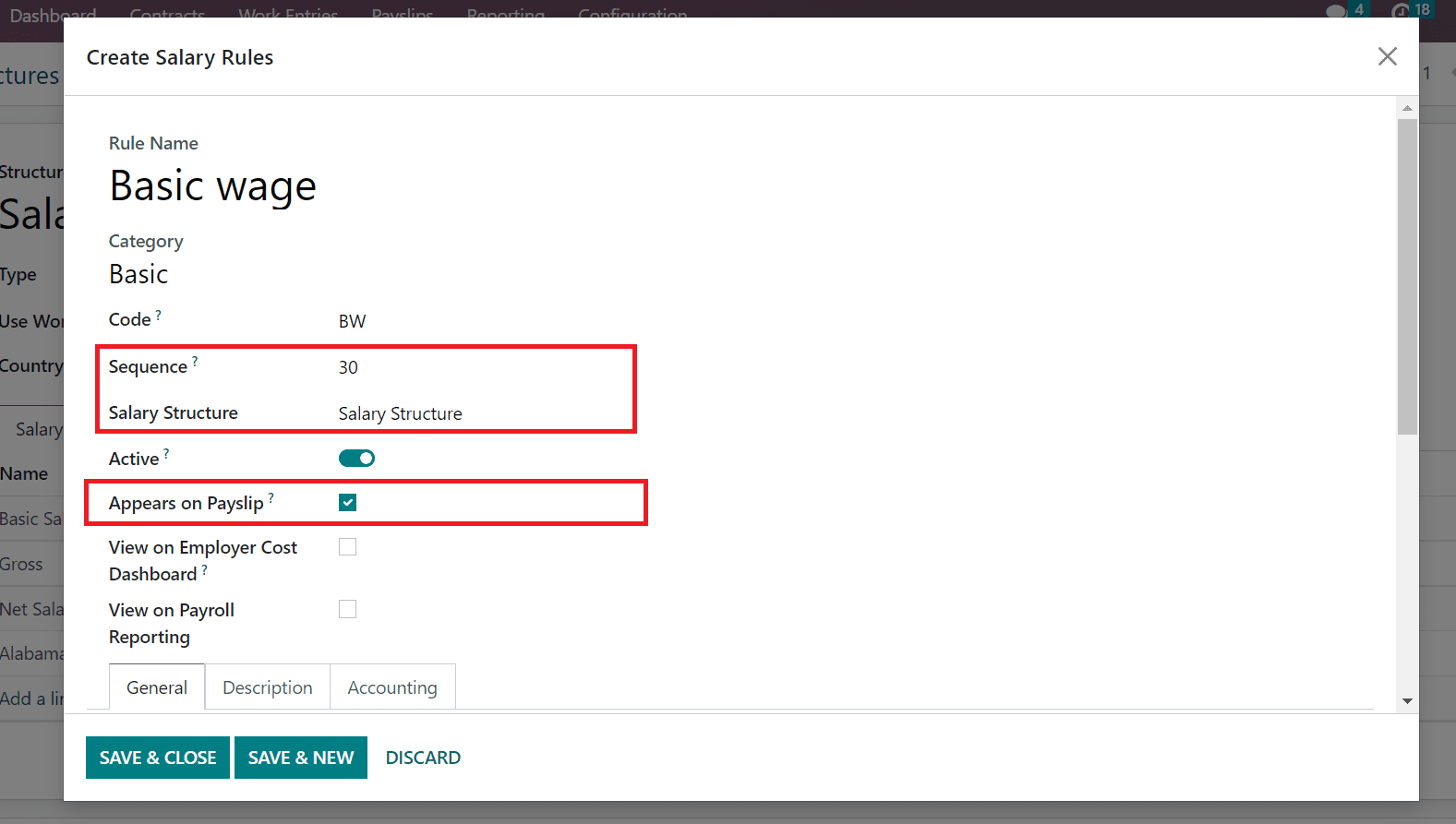

Later, mention the sequence number and your salary structure for the Basic wage salary rule. After enabling the Appears on Payslip option, your salary rule is viewable on the employee salary slip.

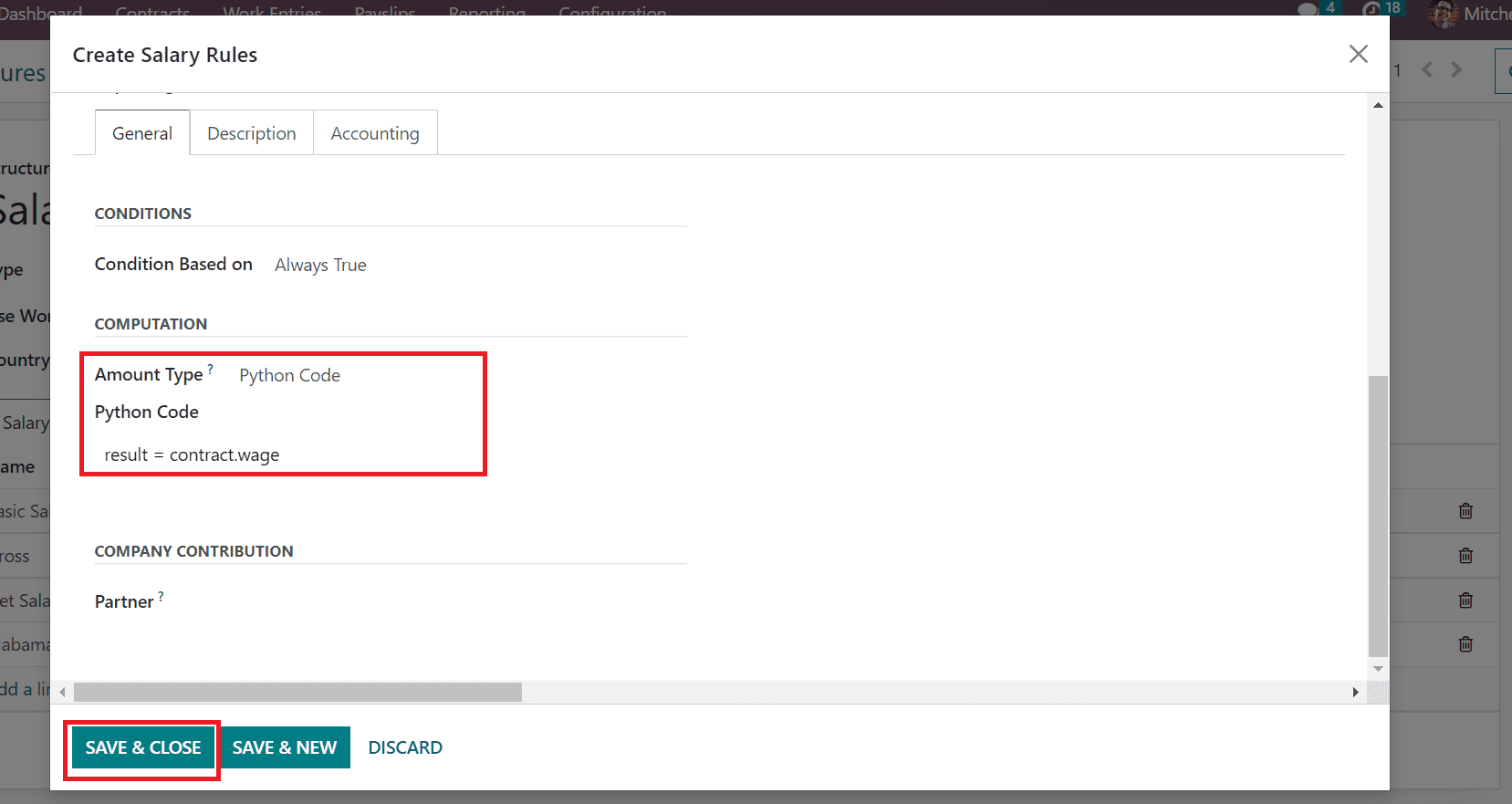

Next, we can set the computation for a worker's basic wage. For that, select Python Code as Amount Type and enter the code related to salary rule computation. Click the SAVE & CLOSE button after managing the complete details of the salary rule as defined in the screenshot below.

Similarly, we can mention the gross wage, net, and allowances related to employees as salary rules. All the information is saved automatically in the salary structure window. After developing all regulations, we can generate employee payslips in a company.

How to Generate Salary Slips for an Employee in Odoo 16?

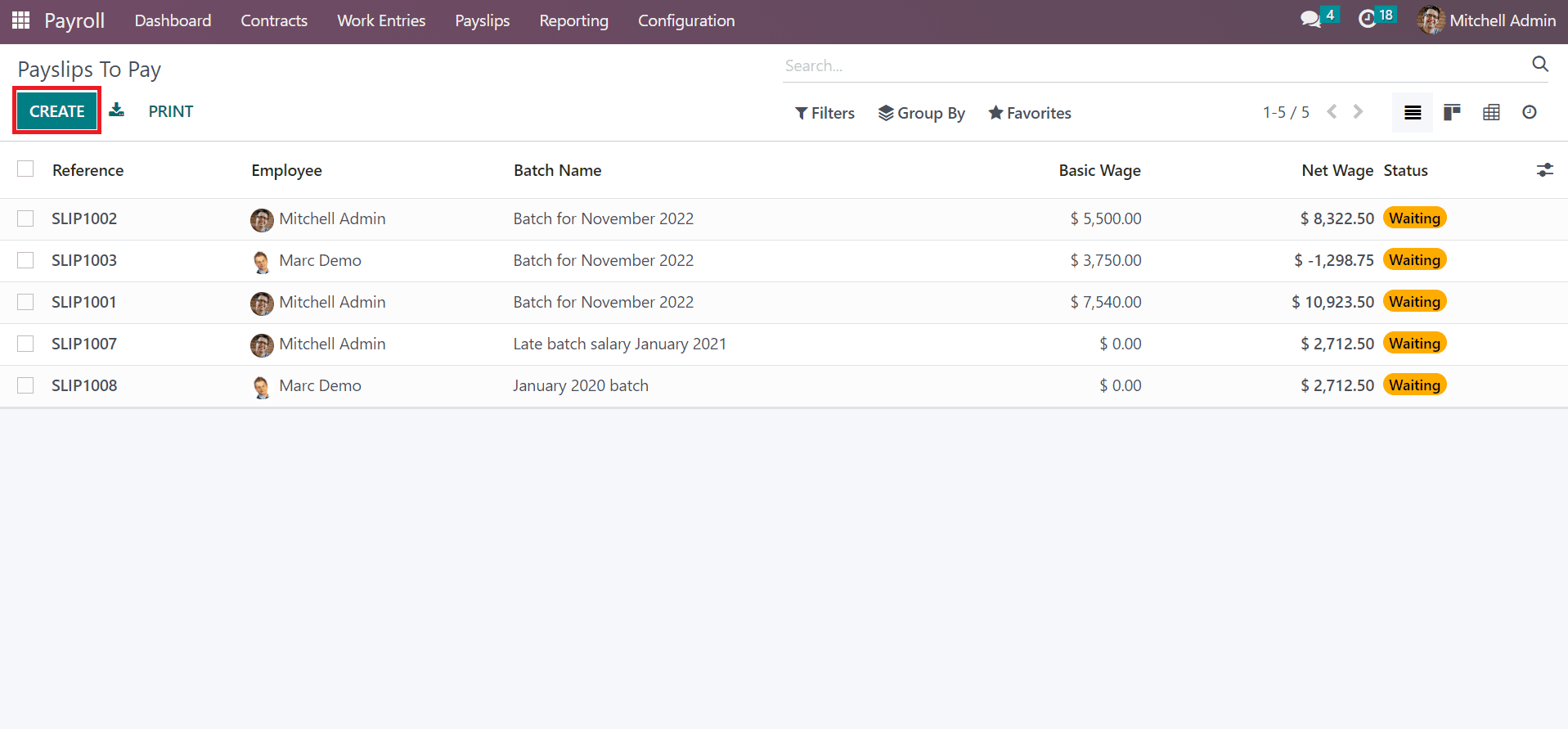

By clicking on the Payslips tab, we can create a salary slip for laborers by selecting the To Pay menu. The user can access the history of all developed payslips and click the CREATE icon, as noted in the screenshot below.

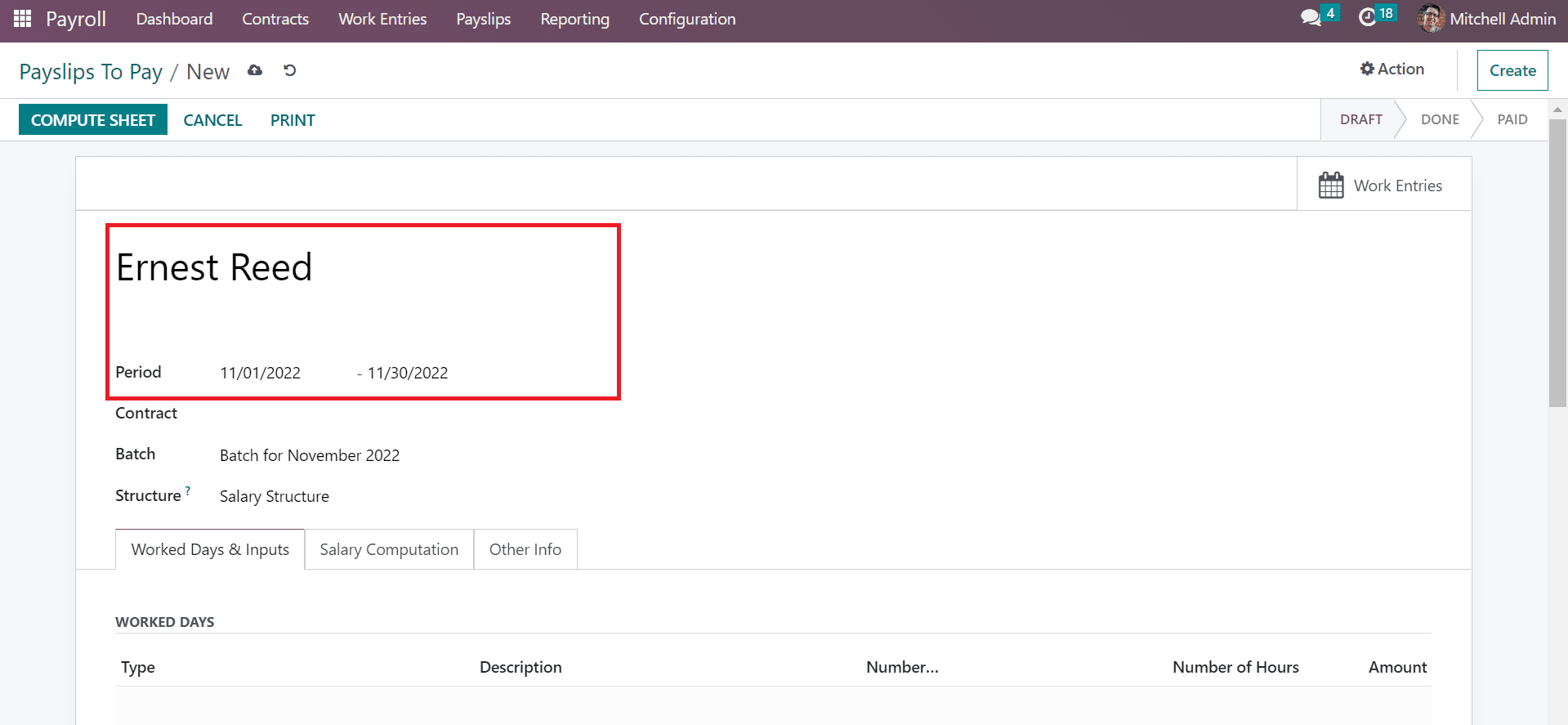

In the New screen, add the Employee name as Ernest Reed and choose the span of payslip in the Period option.

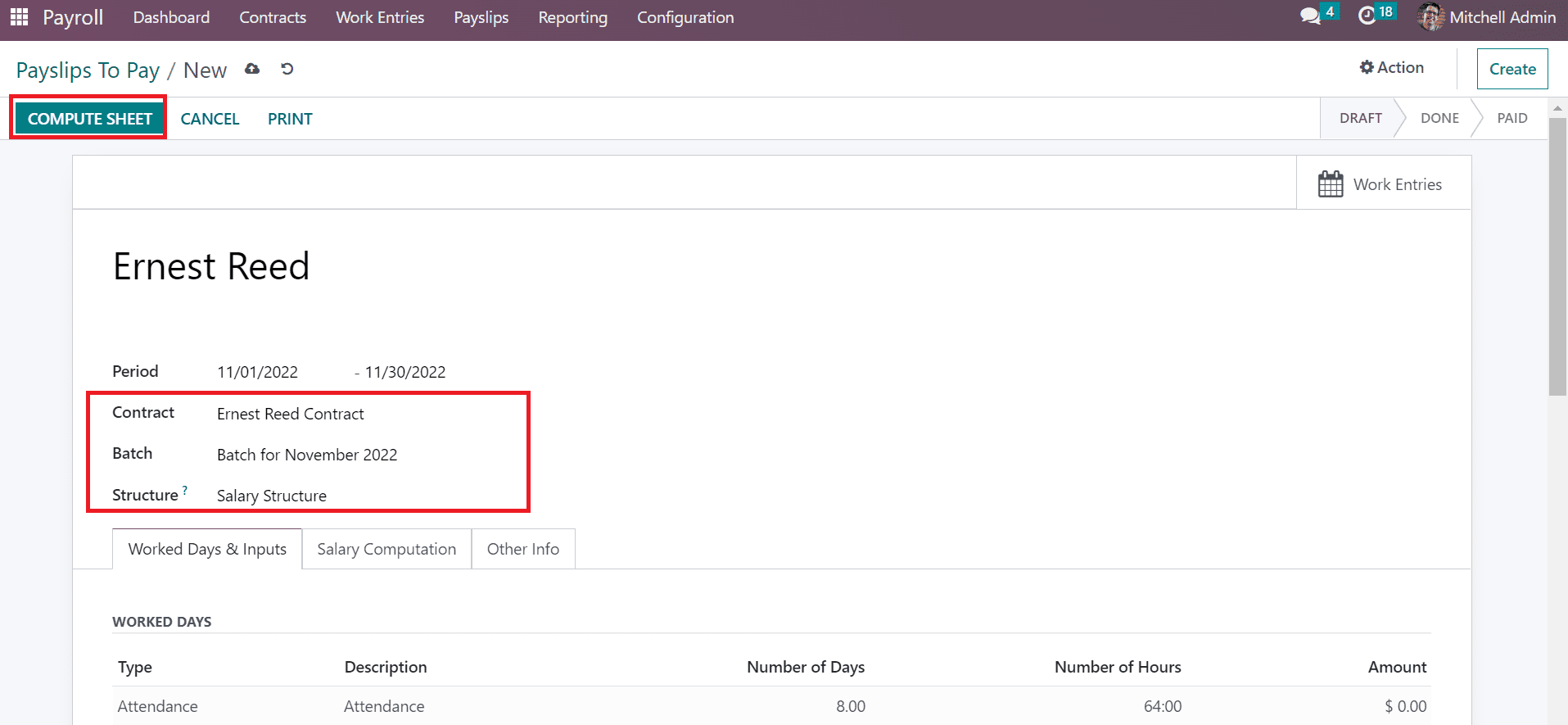

Later, we must add your employee's contract in the Contract field. Moreover, choose the particular month batch within the Batch field and add Structure as the Salary structure that is created before contains an employee's salary.

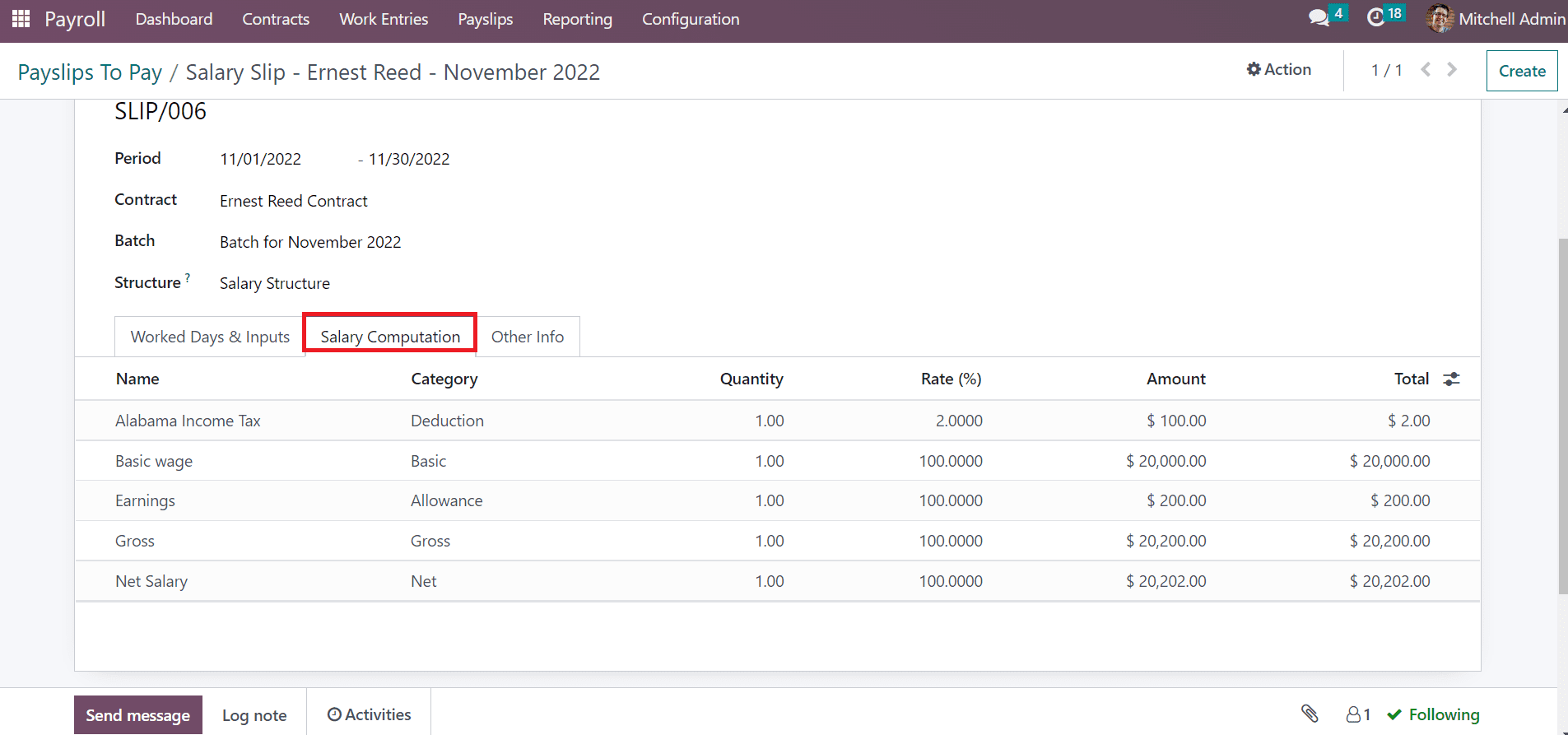

Press the COMPUTE SHEET button once managing the details of the payslip. After the calculation, we can see the computation of each salary rule separately under the Salary Computation field.

You can select the PRINT icon in the Payslip to Pay window to get a draft of your payslip. The pdf document will be transferred into your system and easy to send to the laborer.

Calculating Alabama(US) Income Tax in an employee payslip becomes an easy process using the Odoo 16 Payroll module. So, the computation of each salary rule in a payslip becomes a more straightforward process for most companies.