Odoo 16 Payroll Module

Payroll management is used to manage the employees' salaries in a working organization. The management includes timely issuance of wages, employee benefits/ allowances, deducting employee loan amounts, and so on. The Odoo community doesn’t have a payroll module. Only enterprises have it. So, this module helps to work with the community version.

Features

* Salary Rules

* Salary Structure

* Employee Pay Slips

In this blog, let’s define the need for the Odoo 16 Payroll module.

Salary Rules

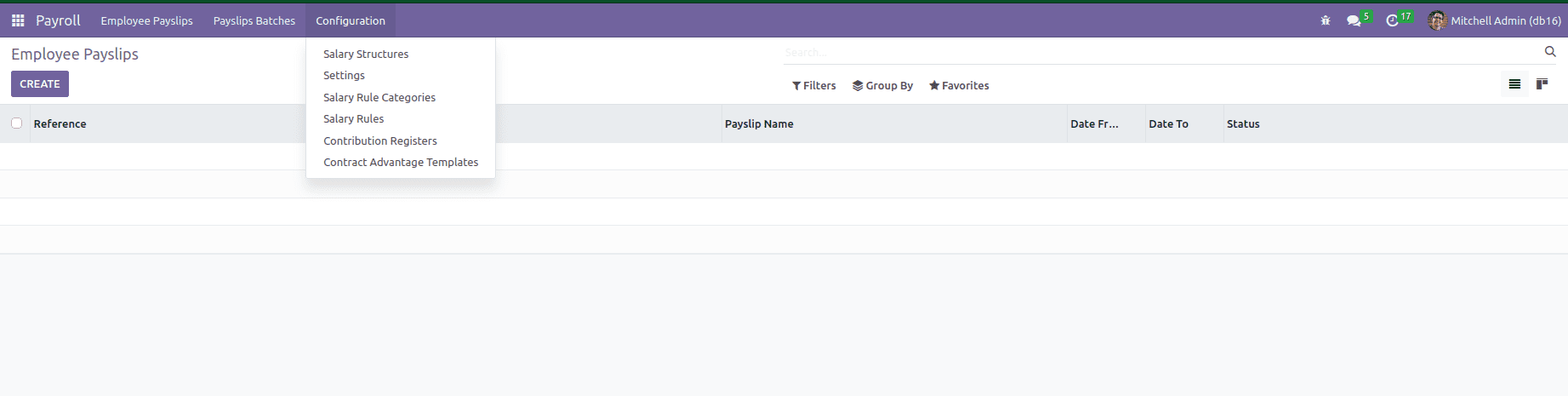

Under the Configuration menu, we can see the salary rules, salary categories, etc.

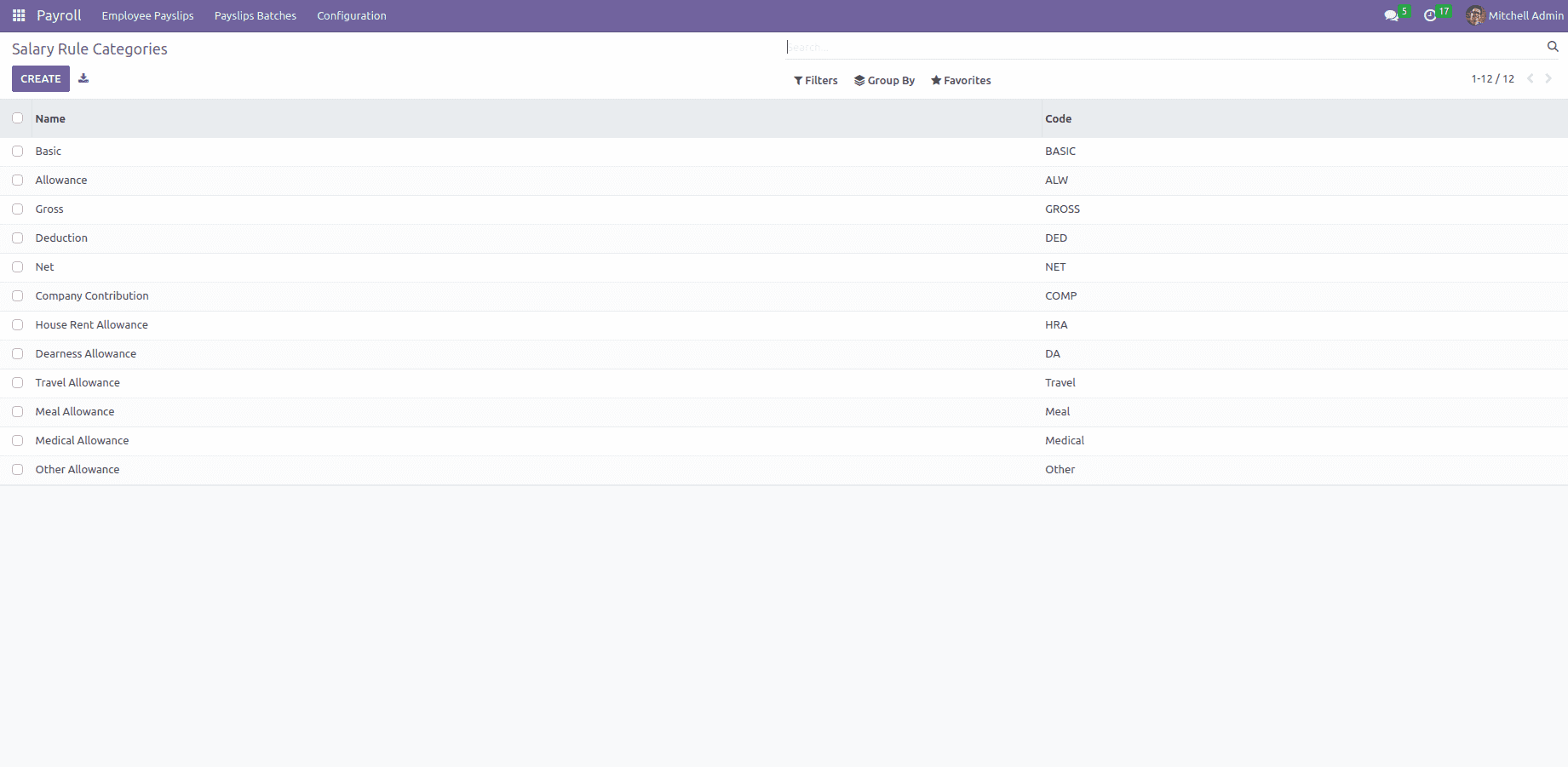

Configuration -> Salary Categories

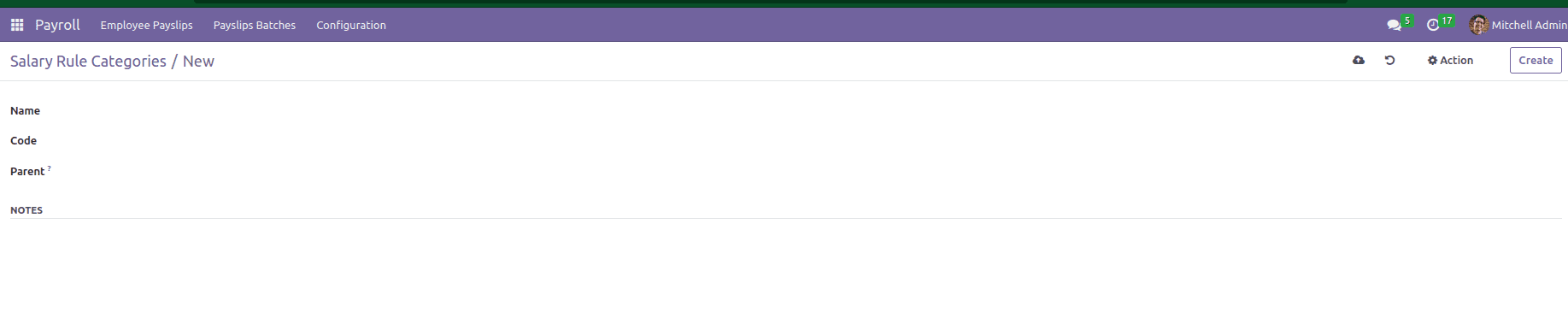

Here, different kinds of salary rule categories are displayed. From here, we can create a new salary rule category also. The basic allowance, gross amount, net amount, etc, are the parameters used. Each parameter needs a name and unique code so that you can define in this field

Name: Name of the Category.

Code: Code is given for the category to be identified. It should be defined as a unique code.

Parent: Here, linking the salary category to its corresponding parent. It is used only for reporting purposes.

Notes: Any notes that can be mentioned in this field.

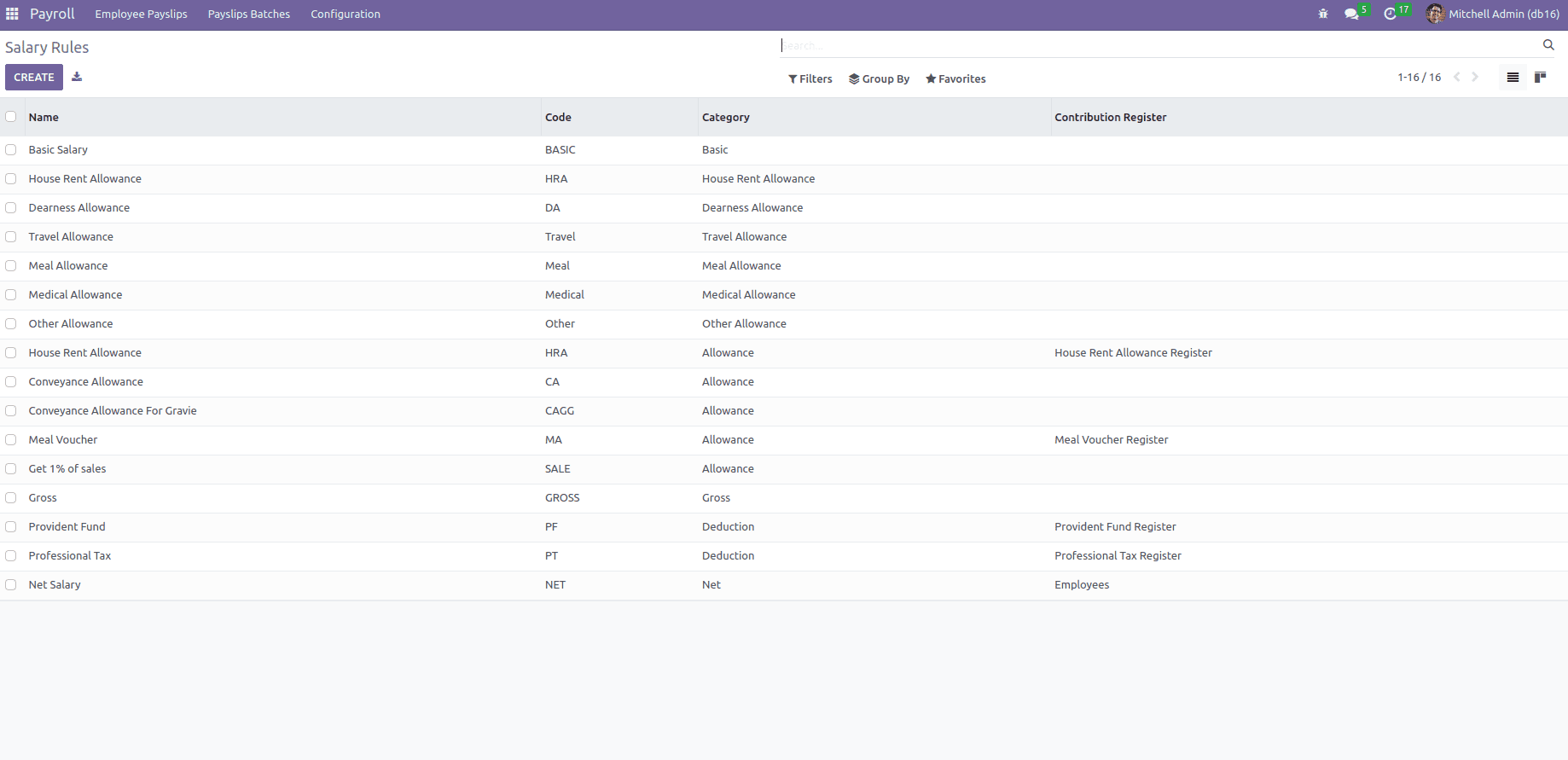

Configuration -> Salary Rules

Here, already existing/created rules are listed.

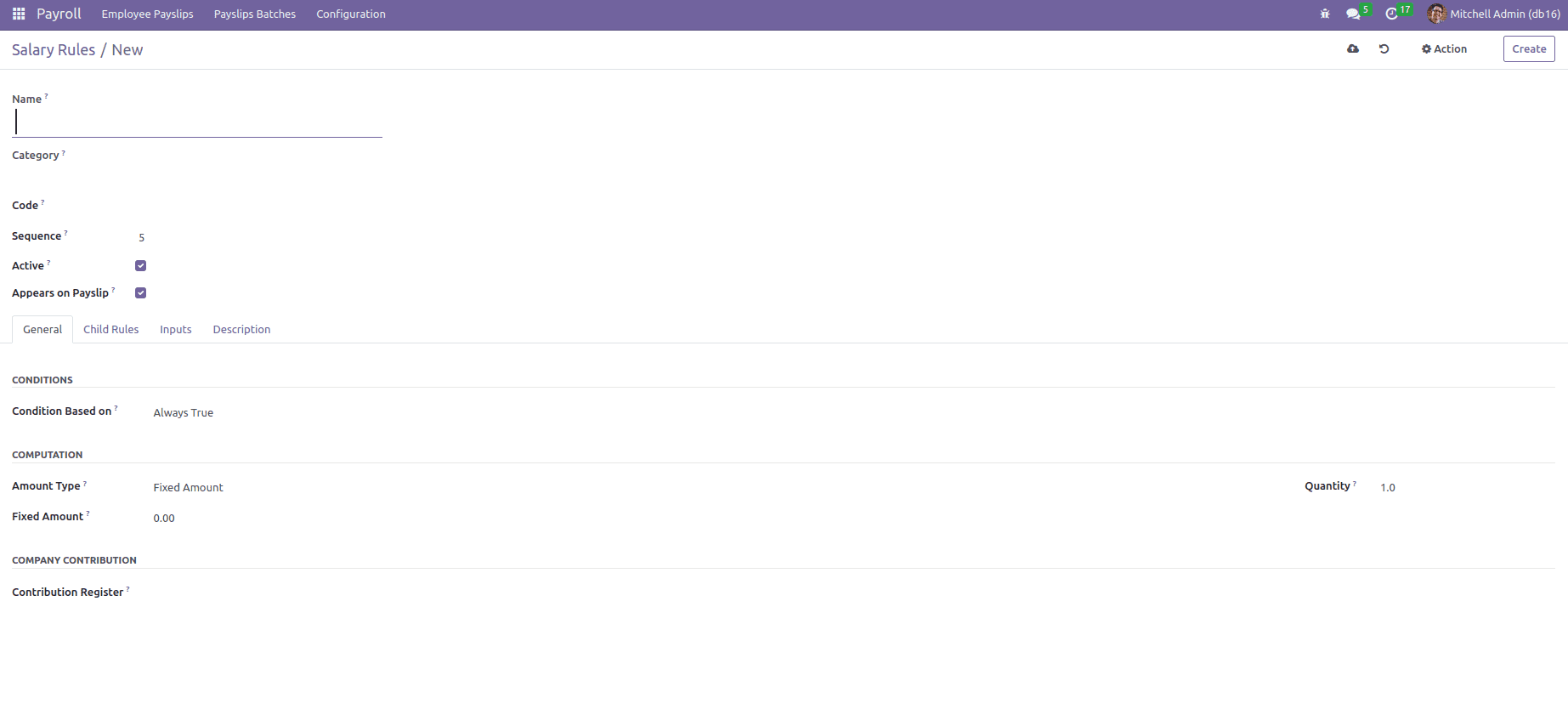

Salary Rules consist of different kinds of allowances and deductions. Salary Rules are defined under salary structure because of the easy computation of monthly salary. While creating a new salary rule should open a form like this.

Name: Name of the rule.

Category: Choose the salary rule category.

Code: It is used as a reference line in the computation of other rules under salary.Iit is case-sensitive.

Sequence: Here, it will arrange a calculation sequence in salary.

Active: It is a boolean field. If it is not true means false; hide the salary rule, not removing it.

Appears on Payslip: Used to display the salary rule on a payslip.

Under these fields, there are some tabs like General, Child rules, Inputs, and Description.

The General tab mainly deals with conditions regarding the calculation of salary rules.

Condition Based on: Choose the condition that is applied to the rule. Here, three options are available.

* Always True -Default one

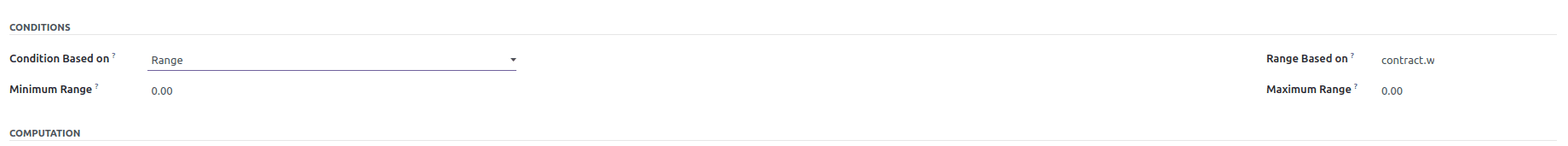

* Range

Minimum Range: The minimum amount that applies for this rule

Maximum Range: The peak value or maximum limiting amount applicable for this rule

Range Based on: This will compute the % fields values; for general cases, it is basic. Use categories code fields in lowercase as variable names and the variable basic.

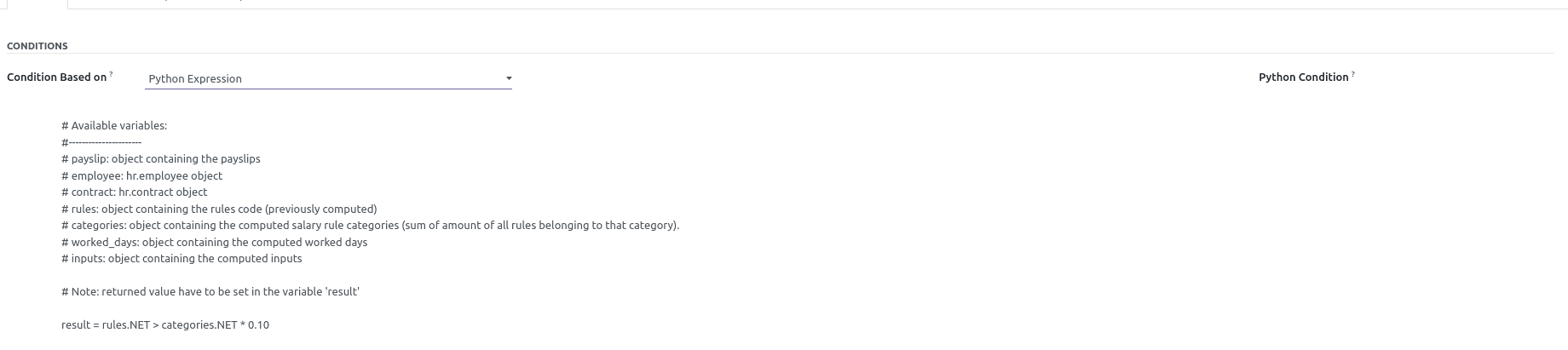

* Python Expression

Python Condition: Applied this rule-based calculation if the conditions are true. Here you can specify all conditions like basic > 1000.

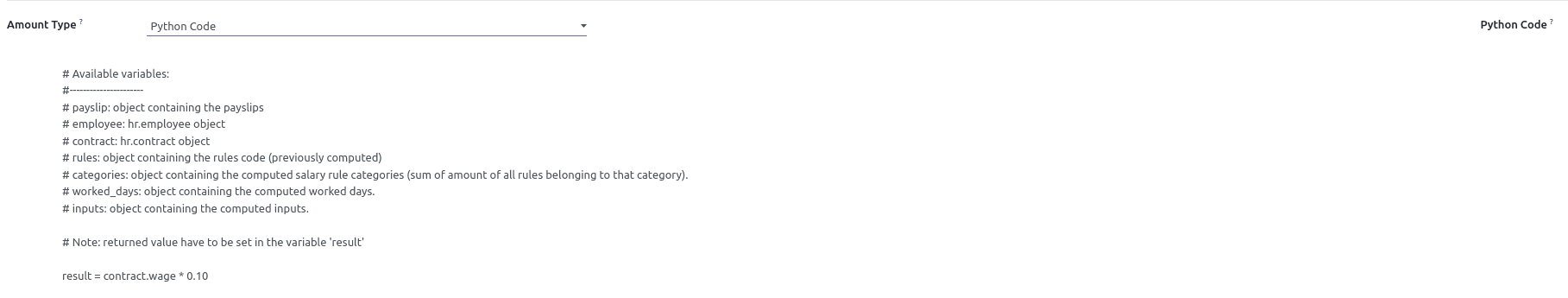

Amount Type: This is a computation method for the rule amount. Here three options(Percentage (%),Fixed Amount,Python Code)are available.

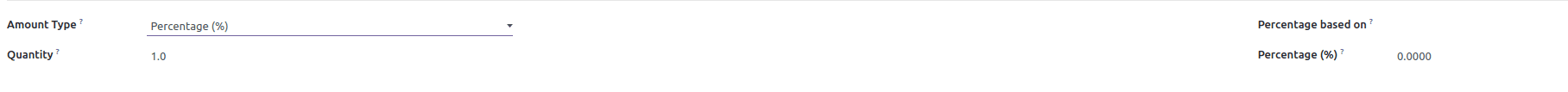

* Percentage (%)

Quantity: It is used in computation for percentages and fixed amounts. That is worked_days.WORK100.number_of_days.

Percentage based on: Result will be affected by a variable.

Percentage(%): Apply percentage. For example, 50%

* Fixed Amount

* Python Code

Contribution Register: Third-party involvement in the salary payment of the employees.

Inside the Child Rules tab, we can create the data of children.

Below the Inputs tab, you can add descriptions and code.

In Description, add any description regarding this rule.

Salary Structures

Salary structure is a combination of rules and some parameters.It helps the company to calculate the allowance of each employee separately in an efficient manner. Also defined as a salary structure is a detailed description or, in another way, total salary package of an employee.

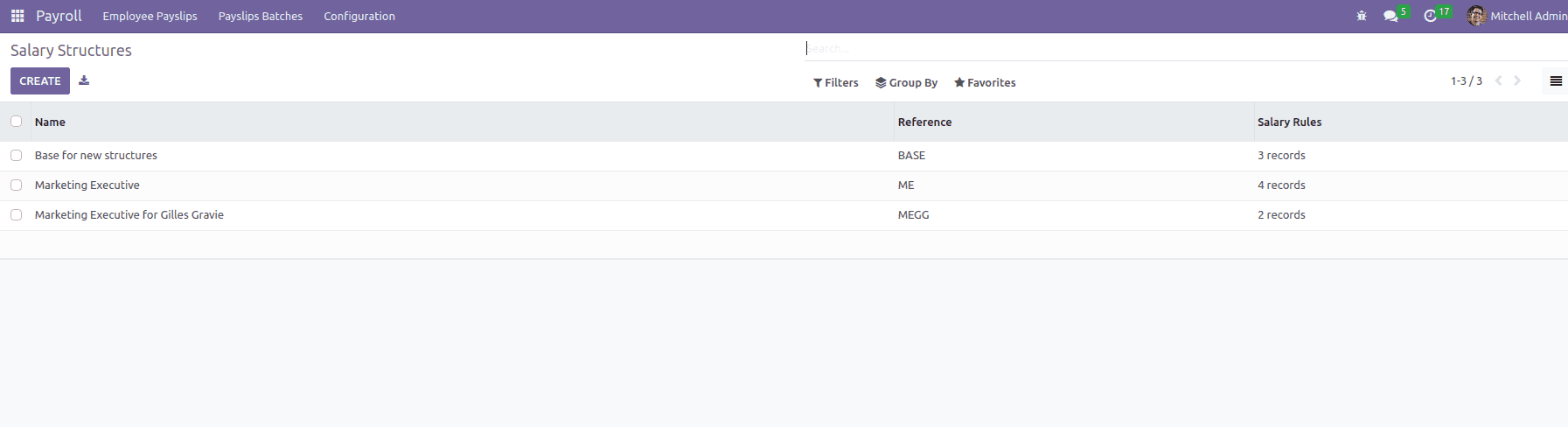

Go to Configuration -> Salary Structures

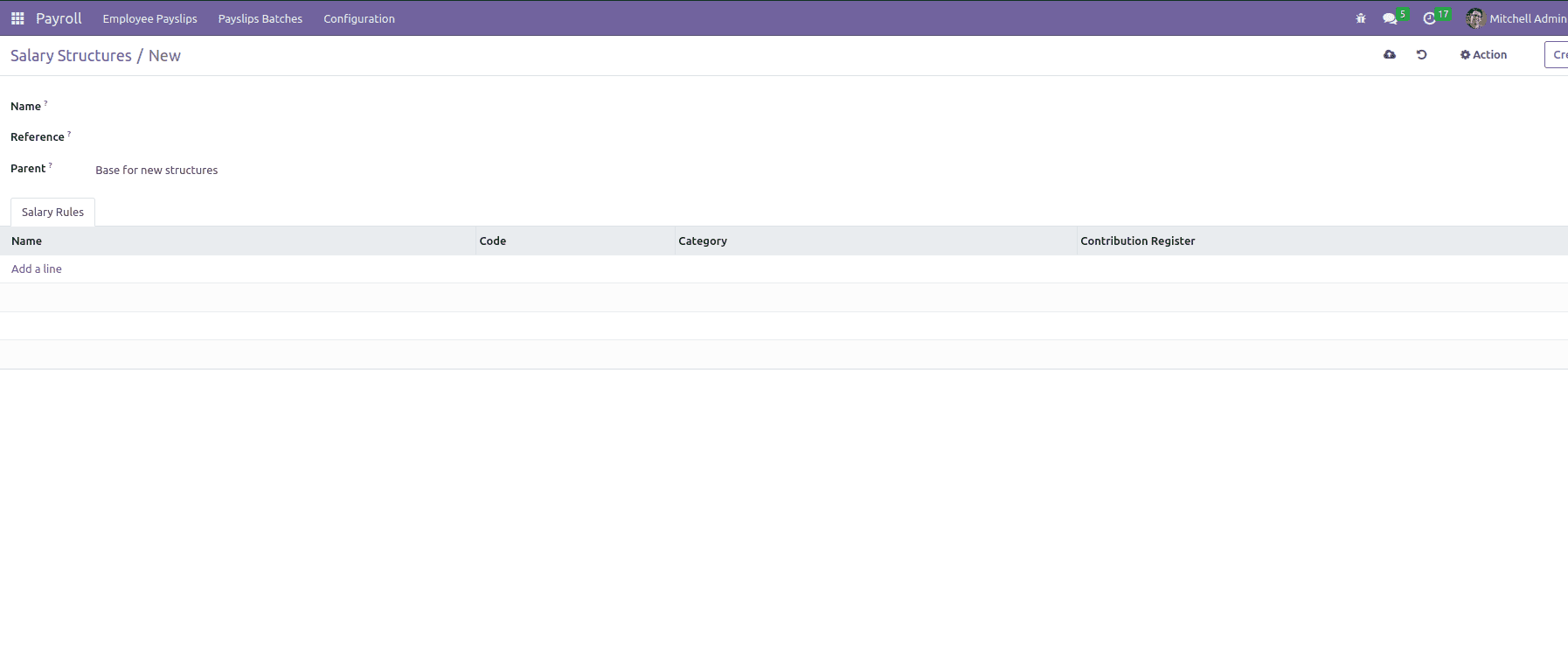

Here, create a new salary structure,

Name: Name of the salary structure will be mentioned here.

Reference: it depicts the code.

Parent: Choose the corresponding parent structure.

So the rule will be created on the tab by adding proper details.

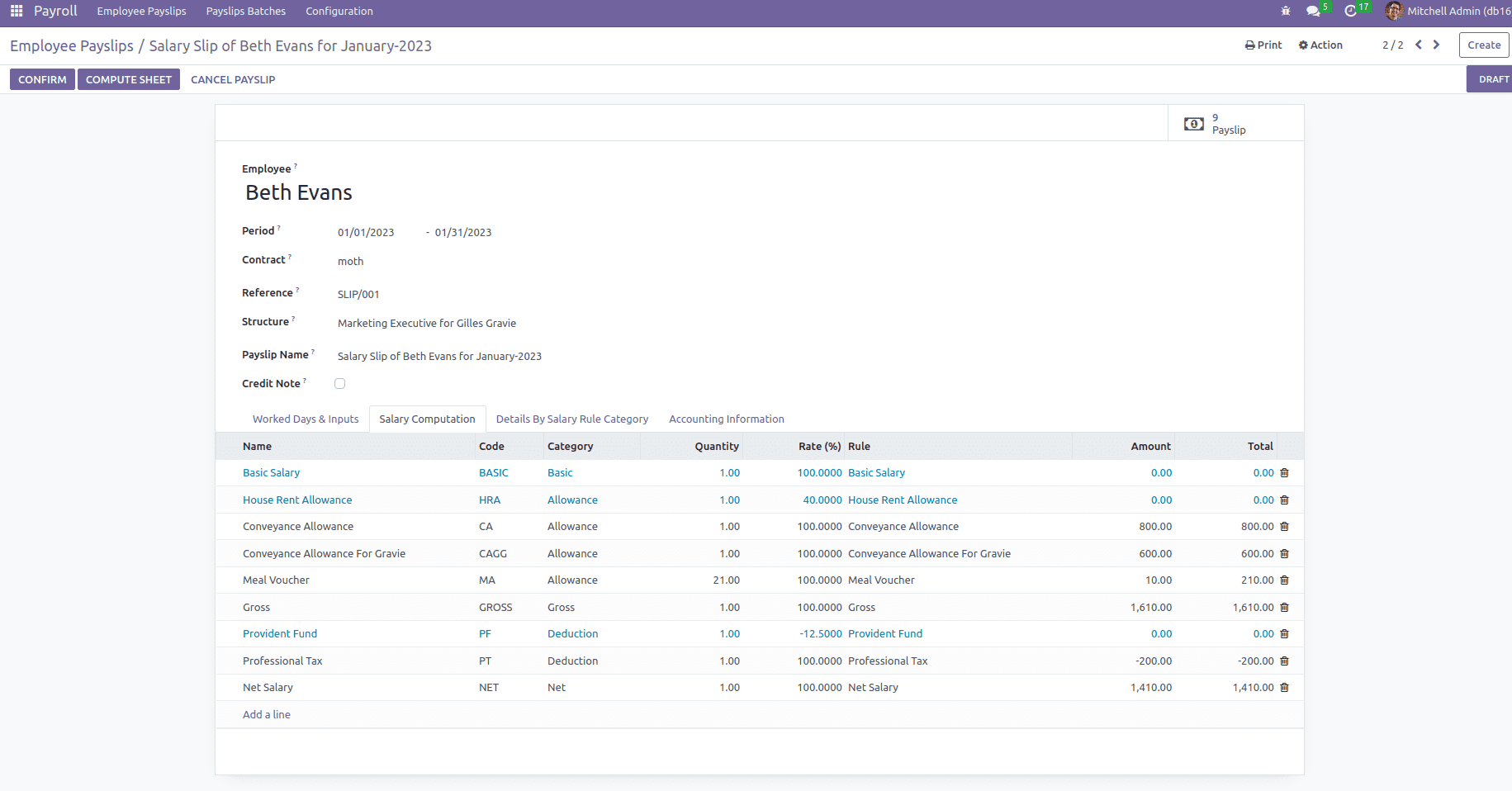

Employee Payslip

Select the menu Employee Payslip which shows all the payslips of the employees.

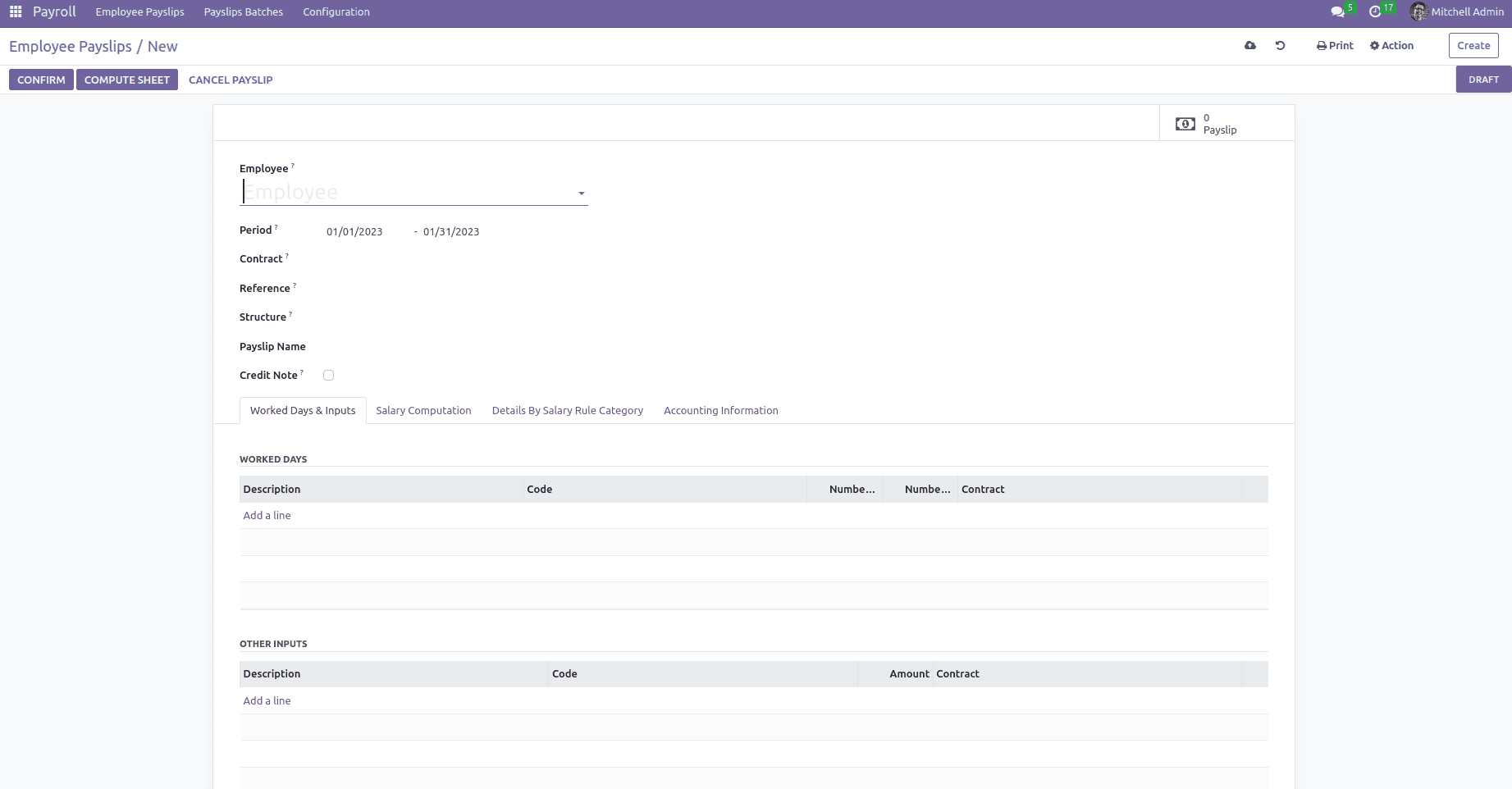

Now check how to create an employee payslip. Click the Create button.

Employee: Select the Employee.

Period: Choose the period to and from for the payslip.

Contract: Select the contract.

Reference: Add reference number.

Structure: Defines the rules to apply to this payslip according to the chosen contract. If the field is empty, it is not mandatory anymore. The rules that will be set on the structure of all employee contracts' expiry period date for the given selected period.

Payslip name: Name of payslip.

Credit note: Indicates this payslip has a refund of another

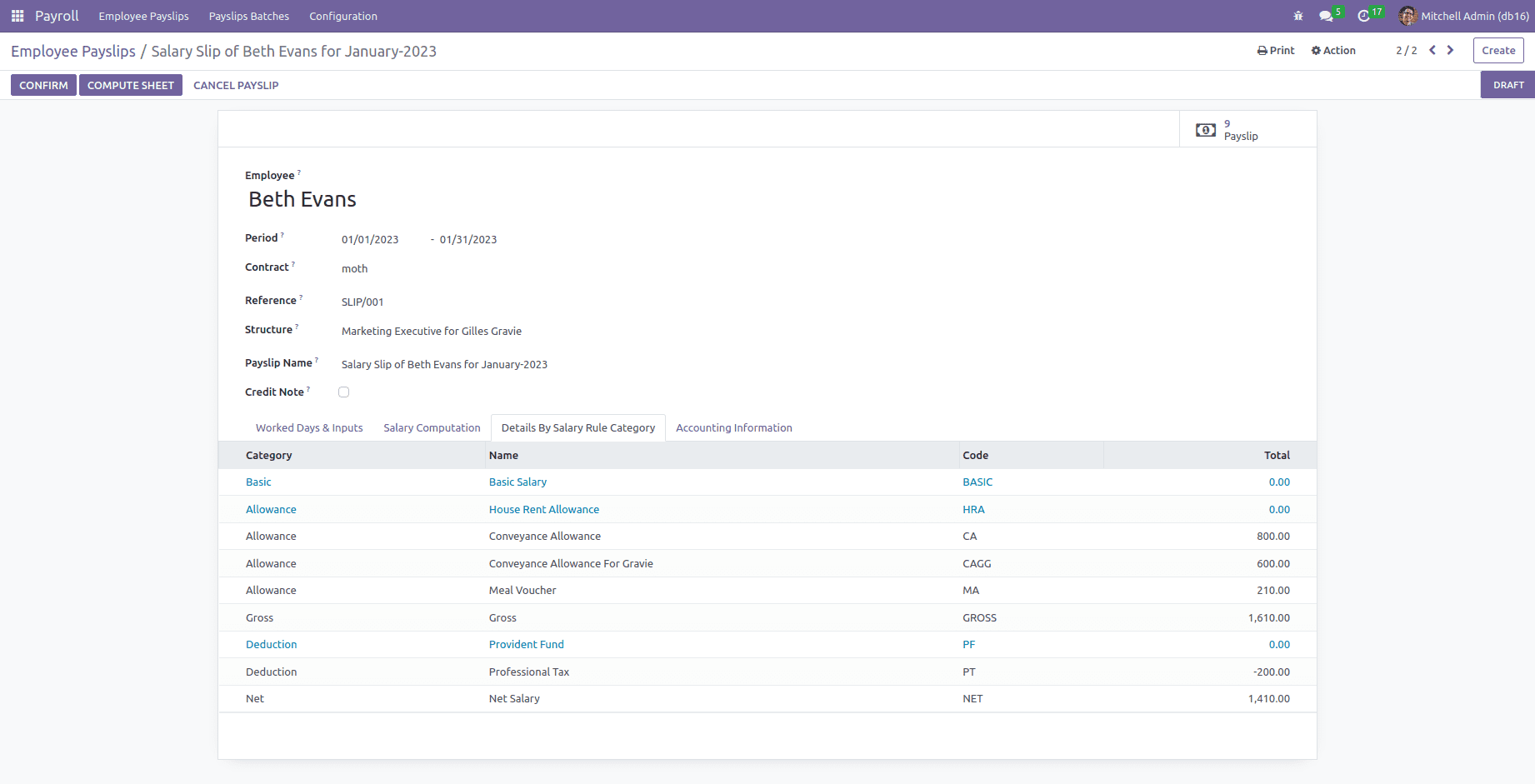

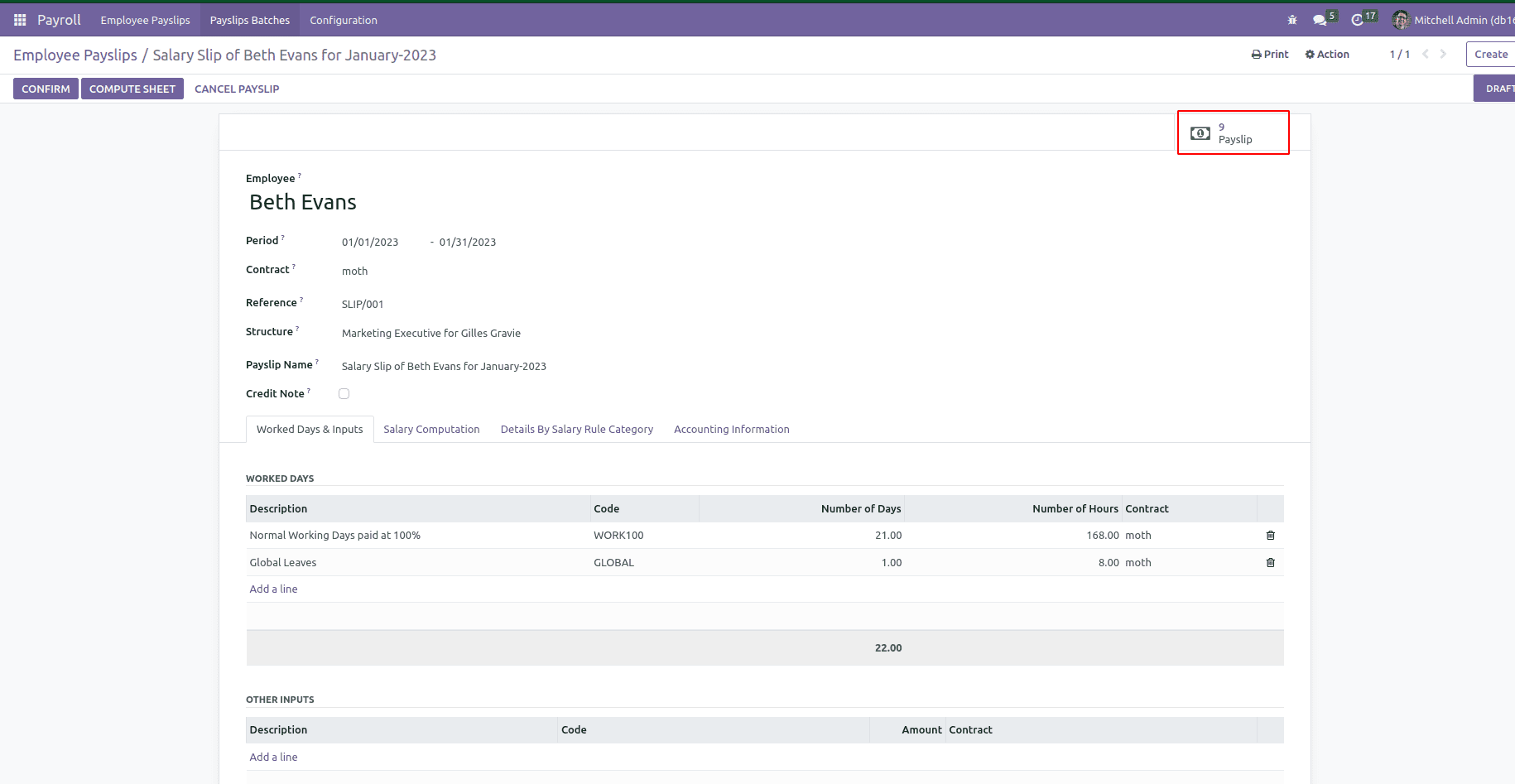

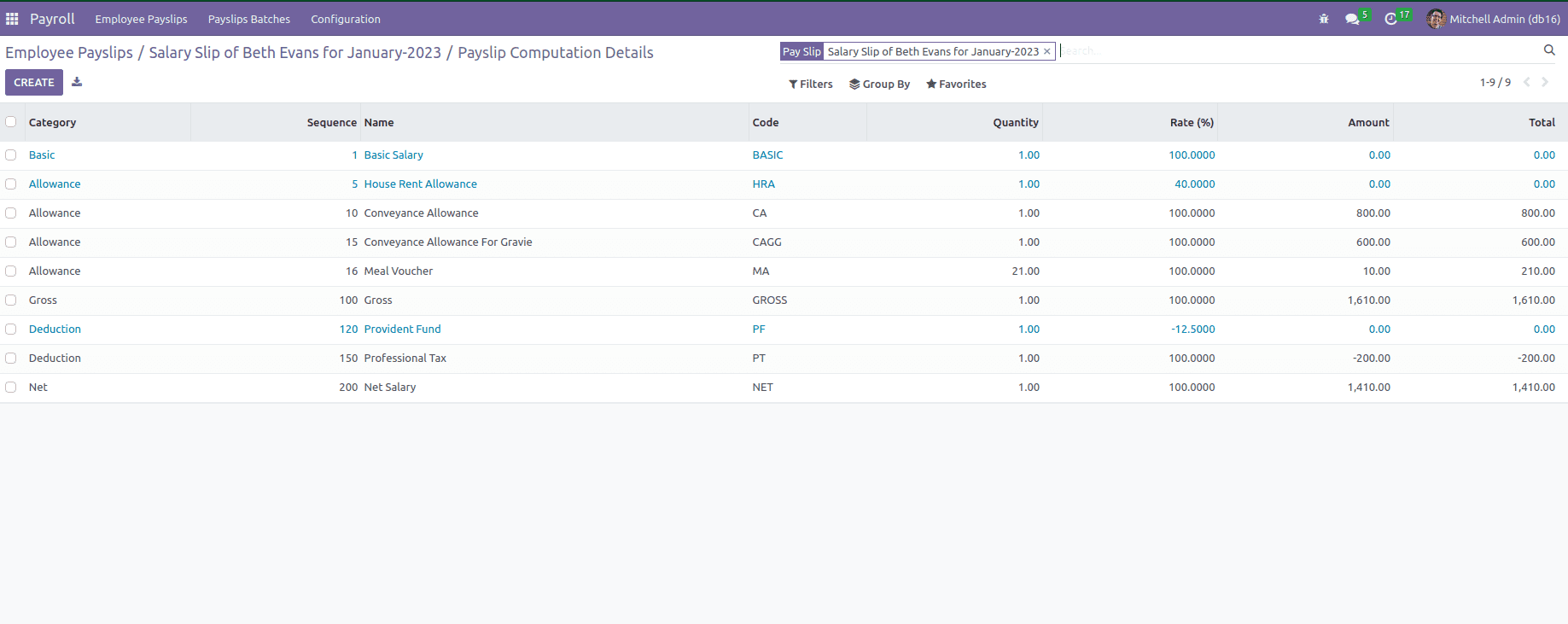

Under these fields, there are various tabs Worked days & input, Salary computation, Detailed by salary rule category, and accounting information are included here.

In Worked Days & Input, automatically adds details based on selected structure. By clicking the button computes sheet, the salary computation will be calculated in the Salary Computation tab, and the Detailed by salary rule category displays rules. These details as shown below.

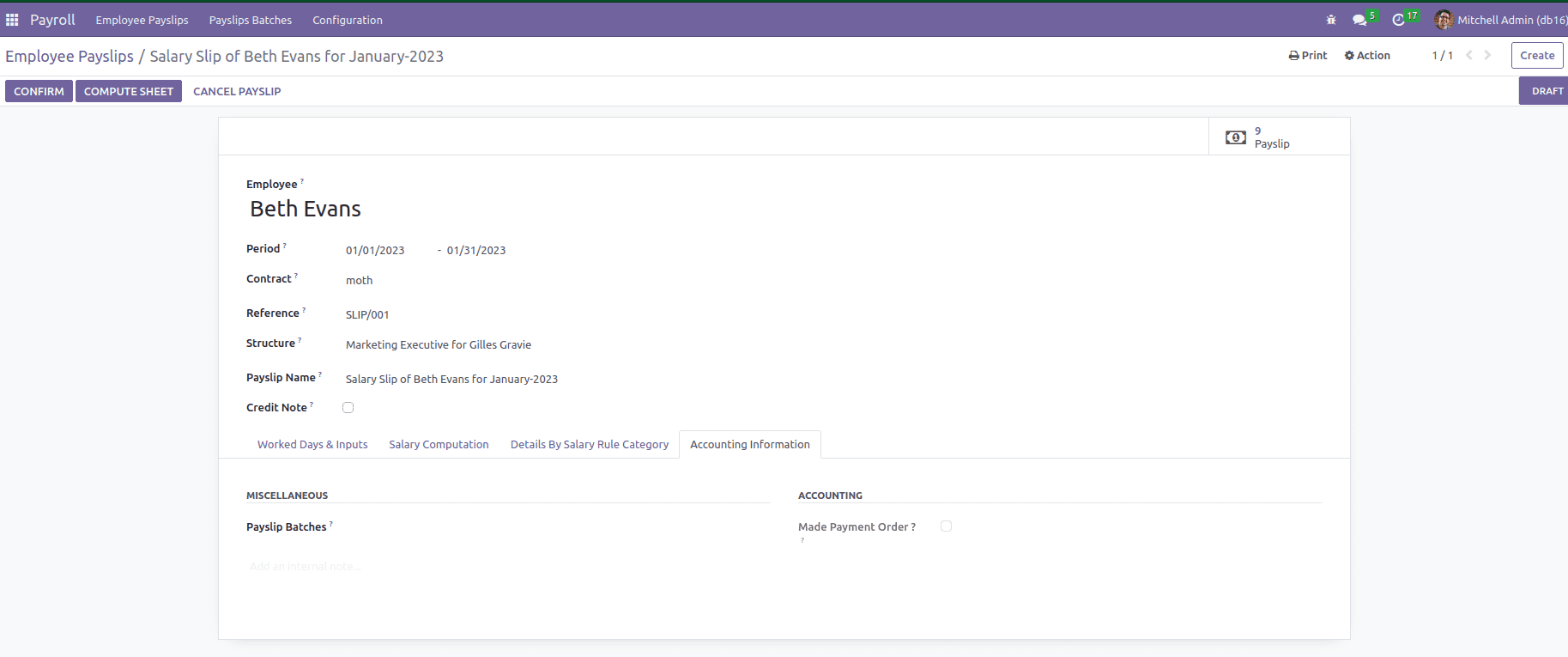

In the Accounting Information tab, add the payslip batches and accounting to make a payment order or not.

Go to smart button payslip and see all payslips corresponding to this employee.

Payroll management has an essential role in the working environment. It will help the growth of the management of employee salaries in an organization. With proper payroll management, compensation and other allowance will stay the same.