Deferred revenue is the money that is received in advance. The status of this money is received but not earned. It is not yet the income or revenue and thus it is not reported in the income account. It is rather reported as a liability. This will not be changed unless and until the service is rendered.

For example, if you want to sell a 5 months service contract for 5000 rupees, starting from next month. Its duration is 5 months. When you validate the invoice, the amount of 5000 is reported in the deferred revenue account. It is received but nor earned. Now, the next month onwards you will be reducing 1000 Rs each for 5 months. Eventually, you will receive 5000 at the end of 5 months.

Let’s see its configuration.

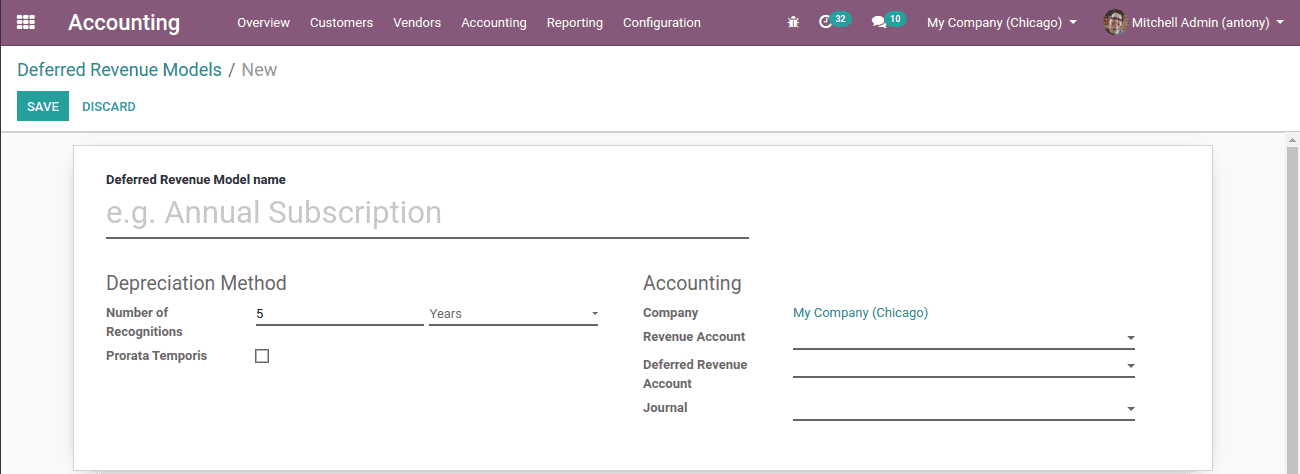

First of all, we need to set the deferred revenue model. For that go to accounting -> configuration -> deferred revenue model.

Create a new deferred revenue model by clicking the “Create” button.

Fill all the necessary fields like model name, number of recognition, revenue account, deferred revenue account, journal and so on.

The account type of deferred revenue is a current liability because it contains the money that has to be earned in the future.

Let’s create a deferred revenue manually.

For that go to Accounting -> Accounting -> Deferred revenue.

Here fill the form with all the necessary details. Here we are calculating the deferred revenue of the sum 5000, we mentioned in the example above.

Once the original value is set we can see that the residual value is automatically set as same as the original value.

We also have to mention the number of recognitions.

After having filled the details, save and confirm it. You can also click “Compute revenue”. Then the board of revenue will be generated.

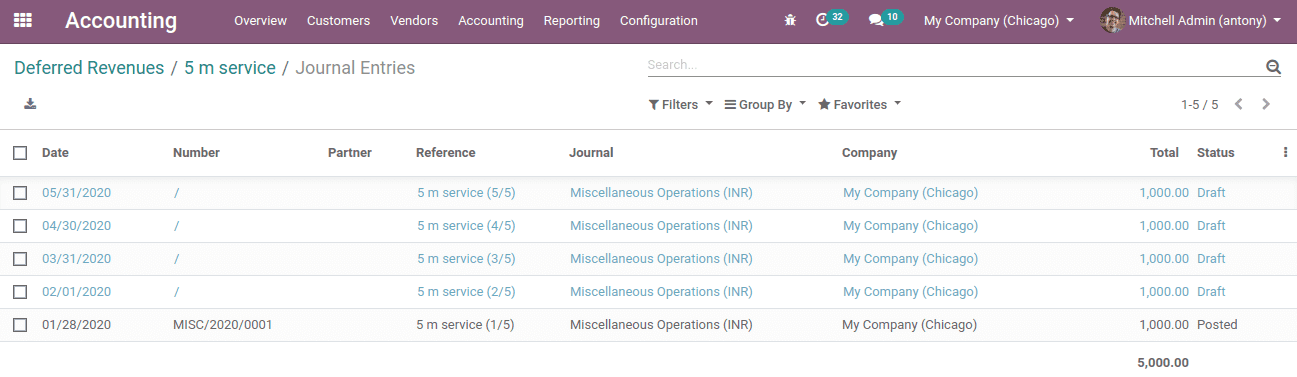

Here we can see the deferred revenue 1000 Rs for each month. Here 1000 Rs is deducted for 5 months from the deferred revenue account and posted in the revenue account.

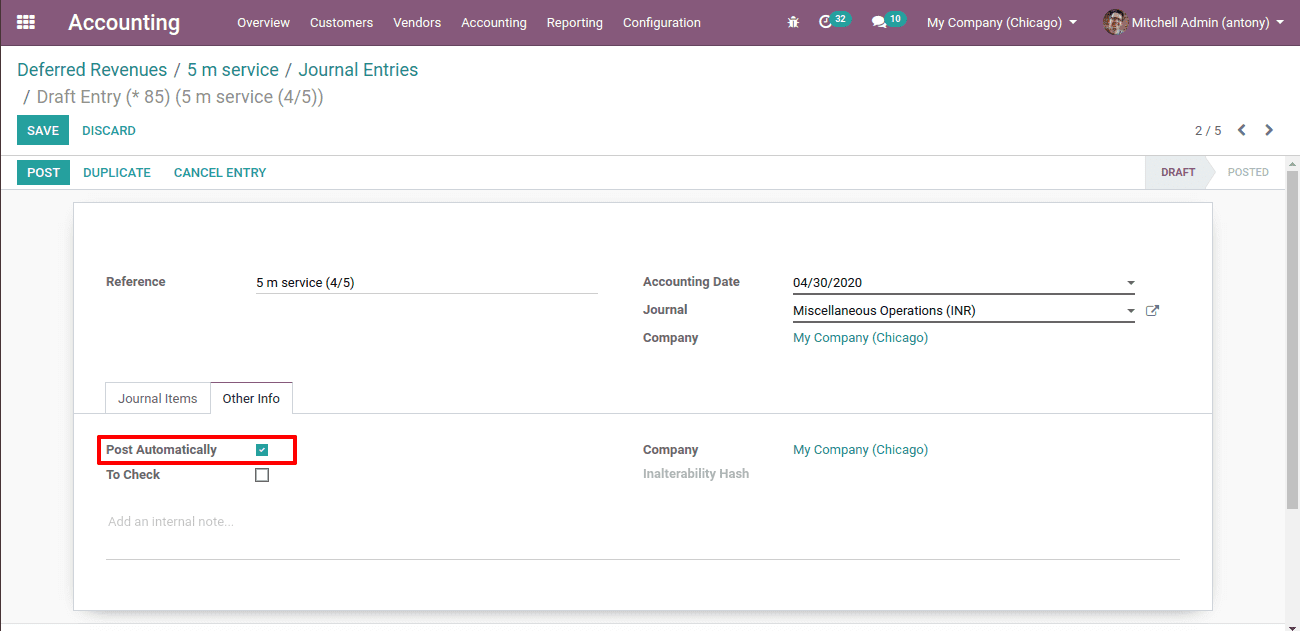

You cannot manually post each deferred revenue before the date if you tick the post automatically. But after the date of posting, if it is not posted, you can manually post it. Otherwise, if we want to post it manually we need to uncheck the “post automatically” from the other info.

Here we can see the status of each deferred revenue. Here one is posted and others are draft.

Here is the journal entry of the posted deferred revenue.

How to Modify the Deferred Revenue?

In order to modify the existing deferred revenue, we shall click on “Modify revenue”. Then a popup window will appear.

There we shall give the reason. We can change the number of depreciation as we wish. Now click on “Modify”. Then a new revenue board will be computed as per the number of depreciation we mentioned.

So this is all about the Deferred Revenue and its computation.

Odoo Blogs Odoo Development Tutorials Odoo Accounting Apps