Functional of Accounting

Generation of customer invoices and the conversion of this invoice to payment are part of every business. Only a professionally prepared invoice will be able to convince the customer about the price and the extra charges. It is taking this important role of invoicing and payment management that Odoo developed a well-equipped customer invoice and payment features.

The accounting module of the Odoo is suitable to prepare invoice and make payment. Odoo helps the user to automate customer invoice generation based on the business model and the applications used. With the help of Odoo Accounting, draft invoices are made based on a fixed framework. This frame work helps the user to make use of different factors like sale order and contacts. With Odoo, a user can automate invoice generation and payment registration. After this, the account will be responsible only to approve or validate the draft invoices. He will also have to send the documents in batch with the help of customary mail or email.

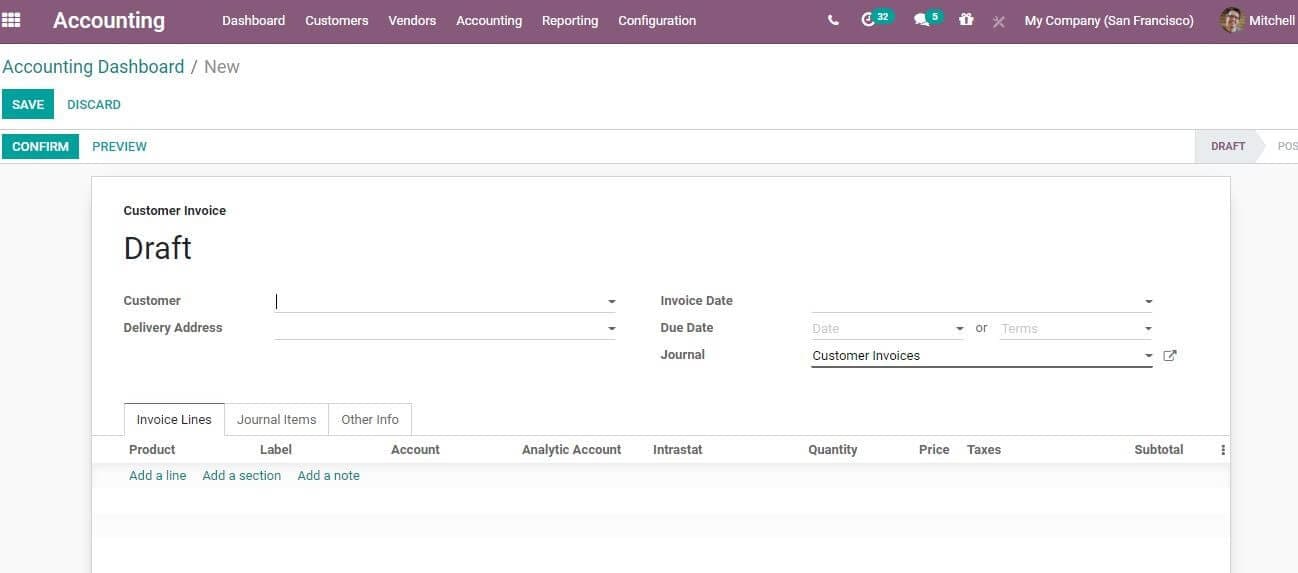

With the help of Odoo Accounting module, a user will be able to create a customer invoice from the dashboard itself. For this the user will just have to click on New Invoice button. Select INVOICE option which is available in the customer section.

Now, let us check how to make use of NEW INVOICE button. Move to the next window with the help of the button. The user will get a creation window on clicking the button.

In the above given form you can find the following fields.

Customer: Name of the customer along with TIN, Email or Internal Reference.

Delivery Address: Address to deliver the product

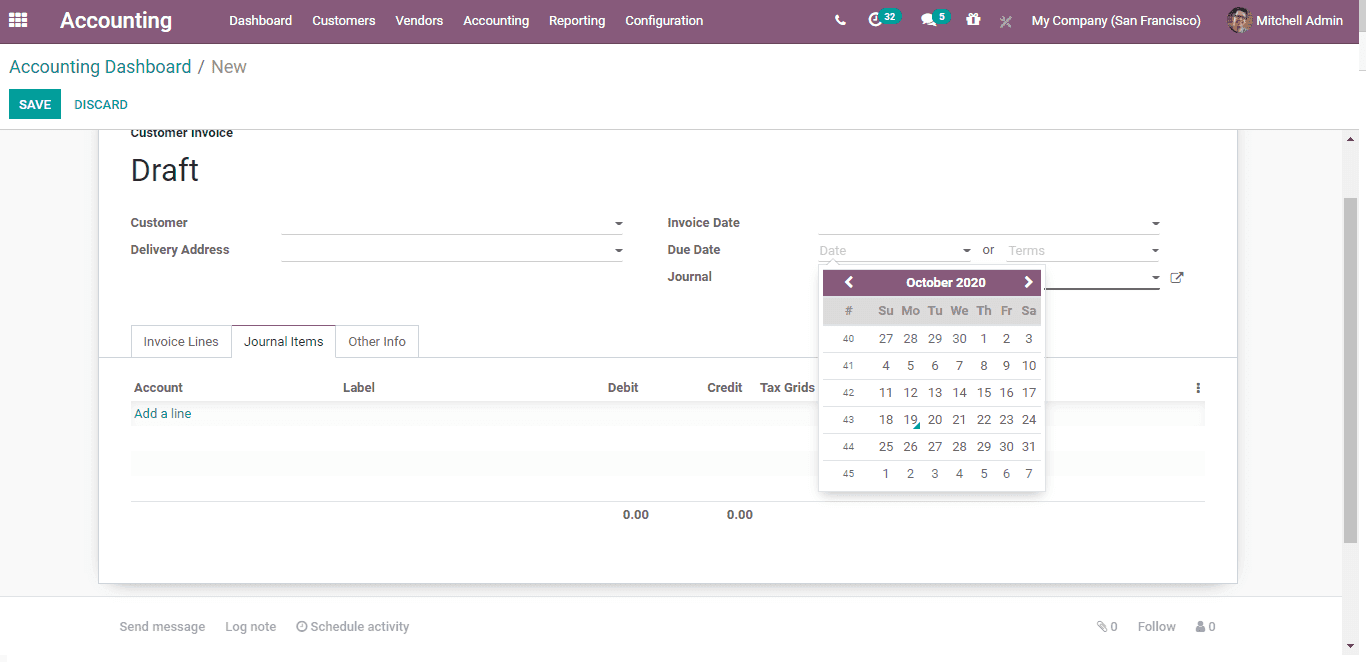

Payment Due Date or Terms: There may be customers using payment terms this can be added here. You can automate the calculation of due date here when creating account entries. Here, is an option to leave the payment terms and due date columns empty. In such cases payment can be made directly. With the payment terms the user will be able to compute the amount with several due dates.

With Odoo accounting a user can set the Payment terms by defining a date.

Invoice date: Want to use the current date for invoicing, leave the date empty. Otherwise, the user can fill in the box with required date. Sales Person: Name of the sales person authorized for the deal.

Journal: The Journal in which the entry will be made.

Company: Give the company name.

Currency: Name of the currency used.

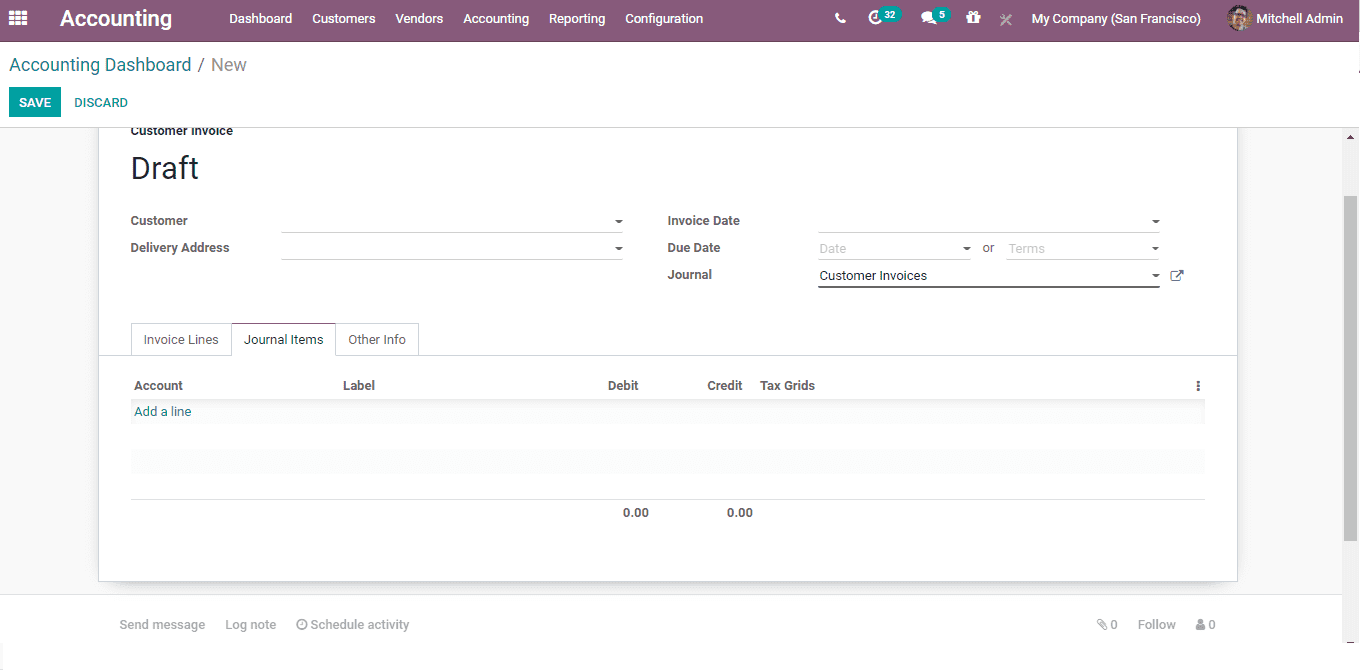

Under Invoice Tab

Add the details of the product that a customer wishes to purchase.

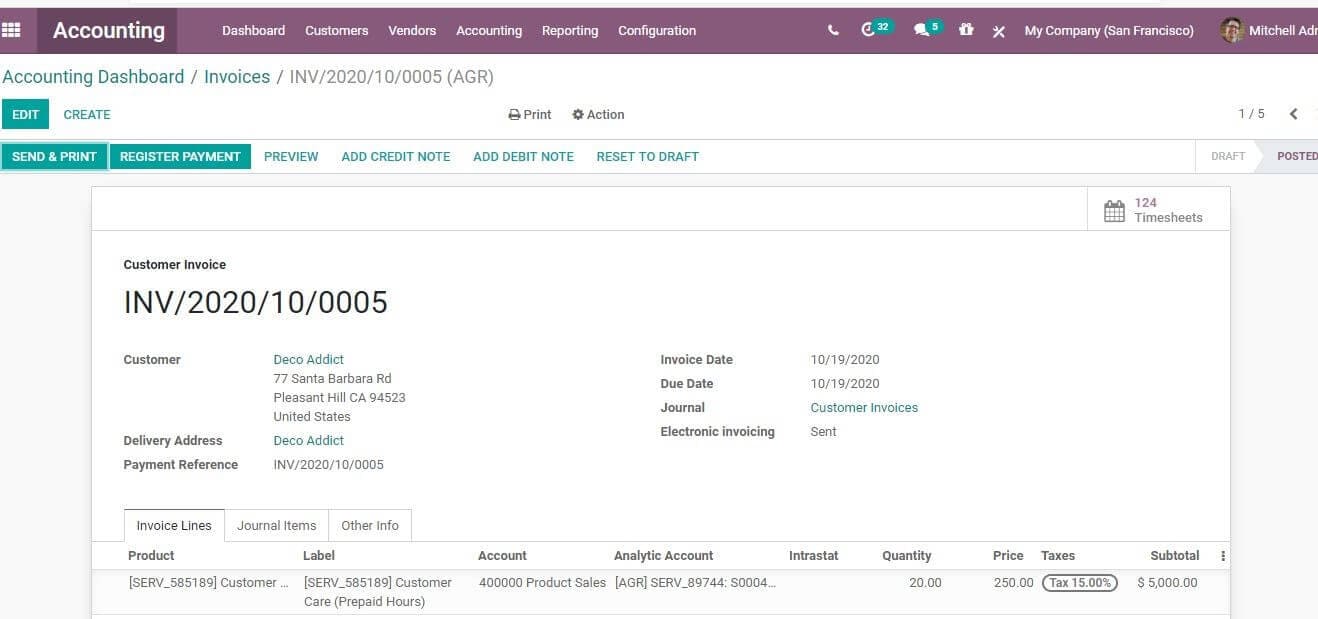

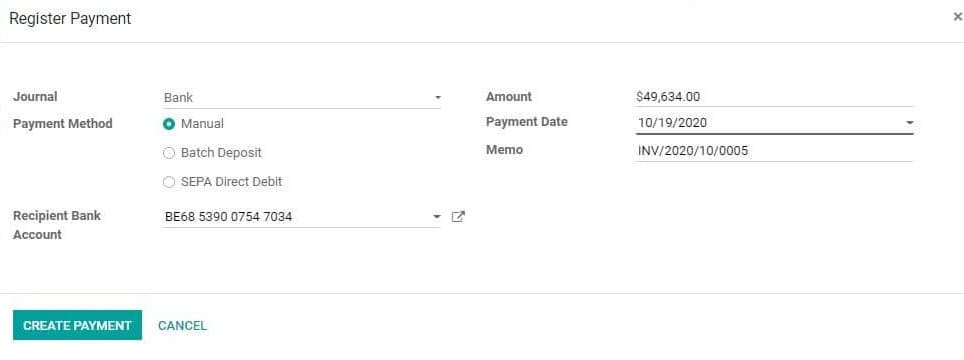

Register payment by clicking Create button

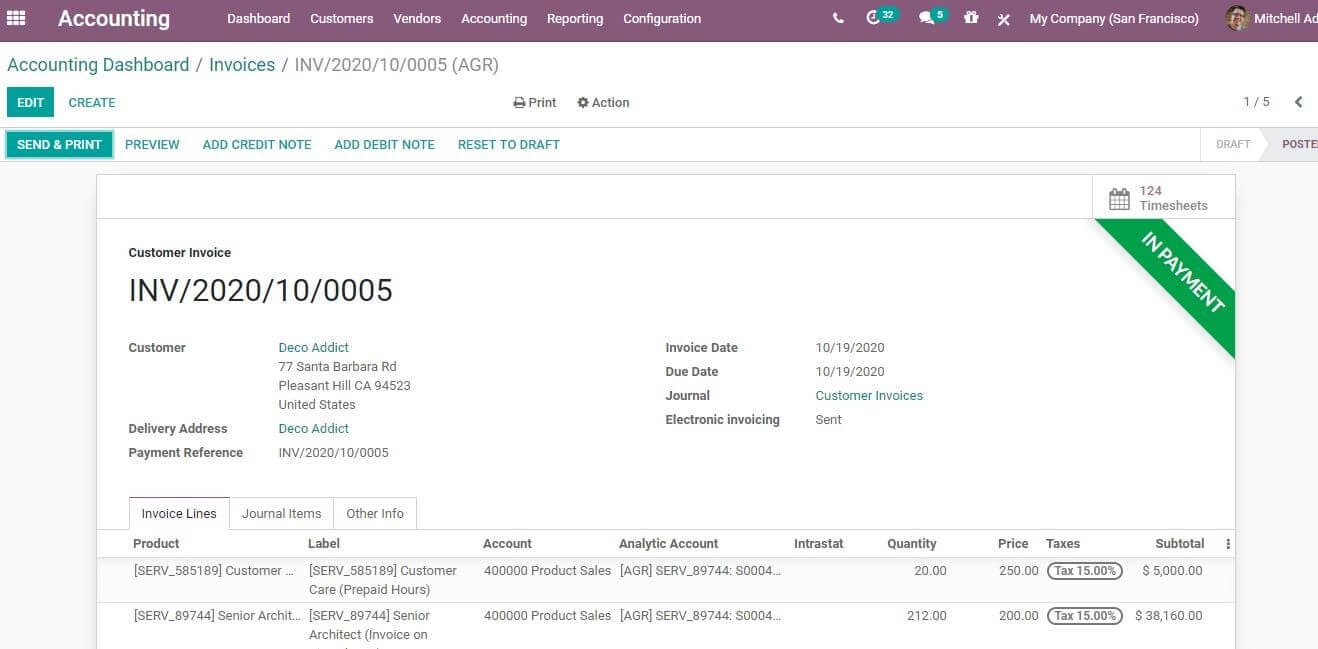

Click VALIDATE button. The invoice status changes into In Payment.

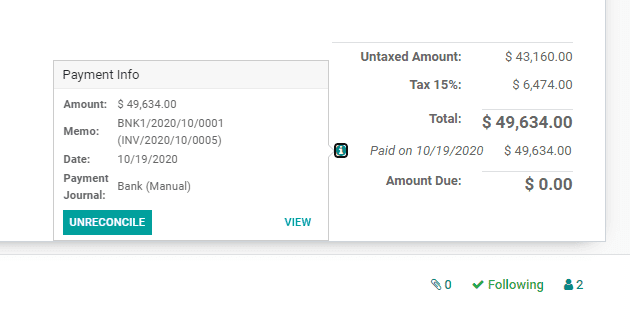

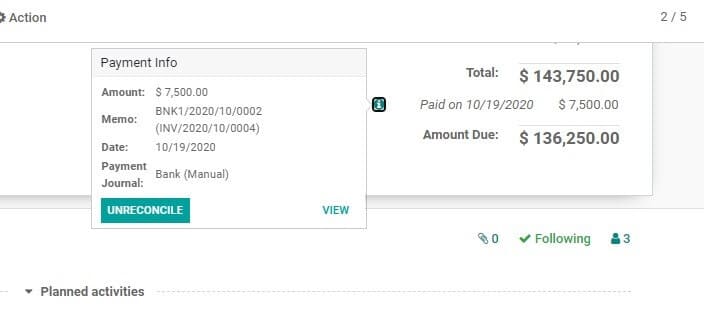

Now the user can reconcile the invoice. For this, click on the small green icon near the paid on date. You can find the reconciliation status here. It indicates that the payment process is over and reconciliation has been completed. In case the user want to unreconcile it, this process can be completed by clicking UNRECONCILE.

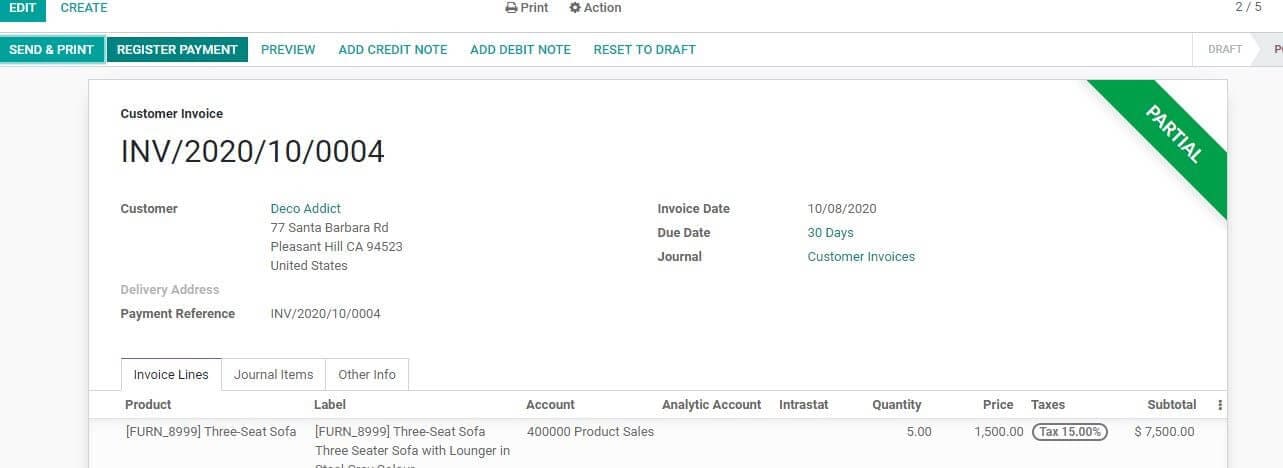

If the invoice payment is partial, the user will get the payment information along with the details of the amount due.

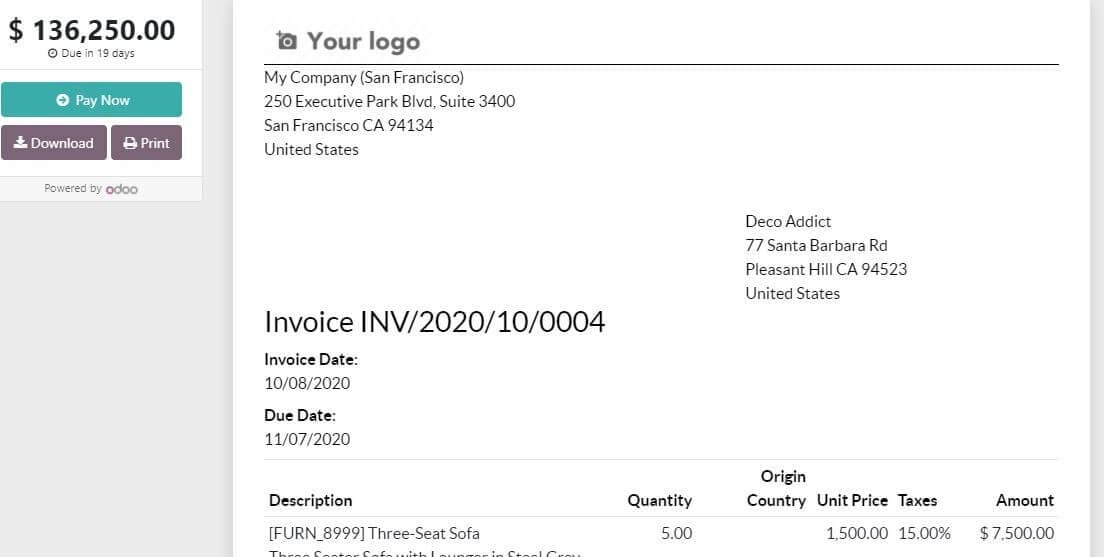

Odoo also helps the user to get a preview of the invoice. You can use the PREVIEW button for this. It helps to get a website view of the invoice.

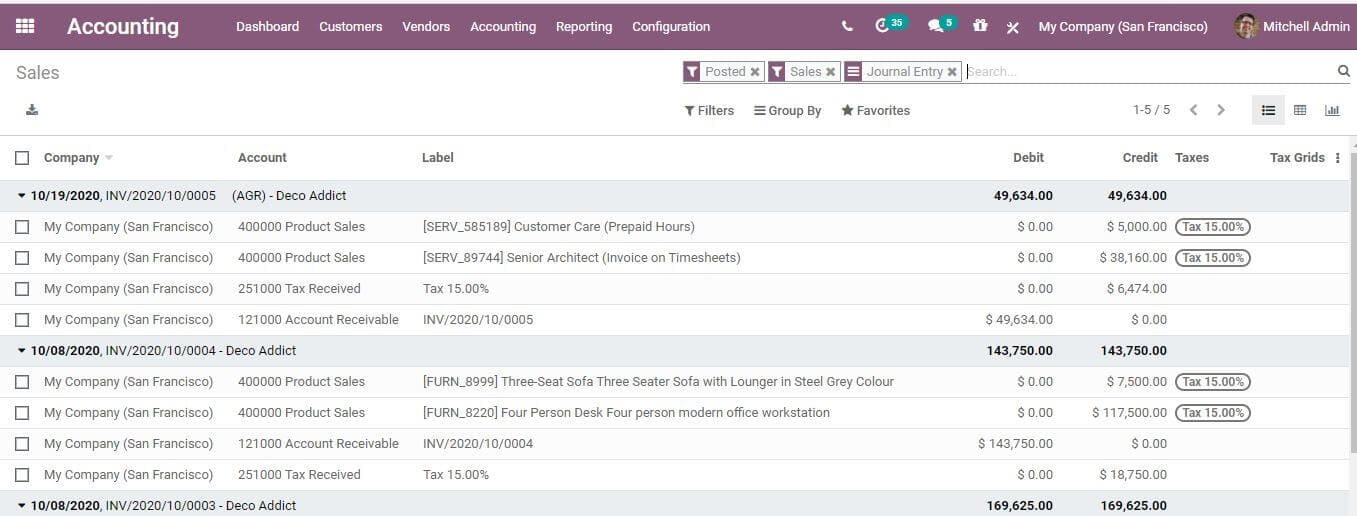

Now, go to Accounting> Journals> Sales. The user can view the journal entry that was automatically created for the invoice in the below given window.

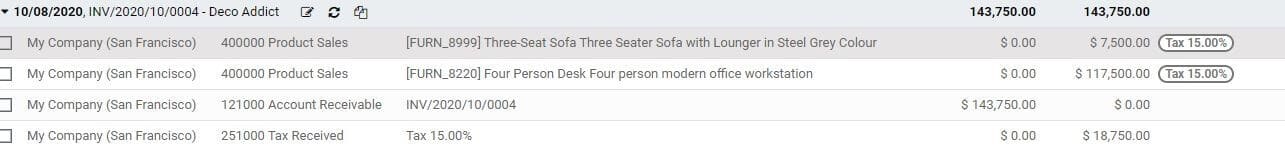

IF you click on any entry then you to access journal entry with debit and credit balanced.

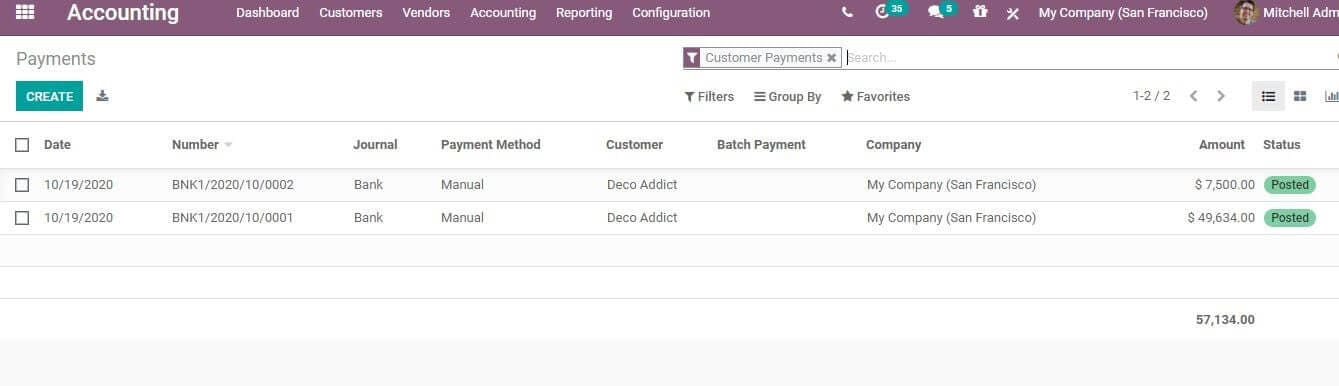

Go to Customers> Payments

This feature helps the user to view the Invoice Payment details. You can access different details as in the below given image.

From this stage, a user can access related journal items and the invoices.

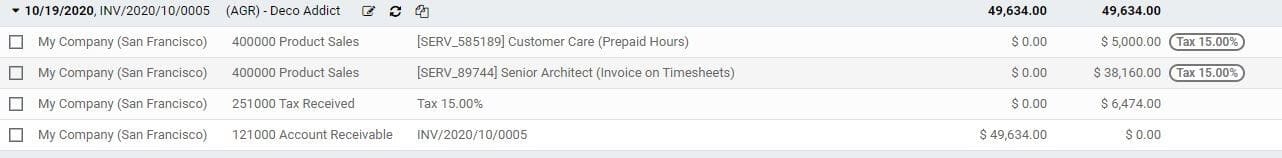

Want to get the details of the payment made by a client? Just click on the journal entry. Here, a user can view both the debited amount and the credited amount. Odoo accounting also helps the user can to access receivable details.

You get a clear view of the difference between credited and debited amount with a click here.

Odoo Accounting helps the user to manage Customer Invoice to Payments through the above given steps.