A specific tax for final sales of goods or services means a sales tax. Business owners must collect taxes from customers and pay them back to the state monthly or yearly. In the United States, each state covers different taxes rates for businesses and customers. Sales tax administration for a company is arduous according to the specific branch in other countries. Installation of ERP software to the business assists in configuring taxes in various states per your requirements. Odoo 16 Accounting application is the best way to calculate your sales tax according to a particular country.

This blog highlight the Configuration of Florida(US) Sales Tax in the Odoo 16 Accounting.

Updation of account reports, asset models, batch payments, journal audits, and more configures easily within the Odoo 16 Accounting application. It is possible to manage localization for several countries such as Brazil, Austria, Germany, Belgium, Indonesia, and more within the Accounting module. We can view the procedure of calculating Sales Tax in Florida(US) in Odoo 16.

Florida(US) Sales Tax Information

Florida has a sales tax rate of 6% and a local option of sales tax of up to 1.5% collected by the local government. Each rental, admission, sale, and storage in Florida is taxable; however, the transaction is exempt. Sales tax is charged for the cost of taxable services or goods and collected from the purchaser at sales time. We can view some exceptions for sales tax rates in retail sales of mobile homes, electricity, commercial real property, rental, and machine receipts. Most Florida countries contain discretionary sales surtax applicable for transaction subjects related to sales tax charged to taxable services or items delivered into a surtax-applied country.

A due on the use of taxable goods or services once sales tax is not paid at the time of purchase is referred to as Use tax. For example, a use tax is owned by you if you did not pay sales tax after buying a taxable item. Apart from use tax and sales surtax, the state imposes local rental taxes for accommodation leases, home parks, apartments, hotels, etc. Some essential details to register for sales tax in Florida include business name, social security number, business activities description, employment information, dates, and more.

Florida(US) Company setup in Odoo 16

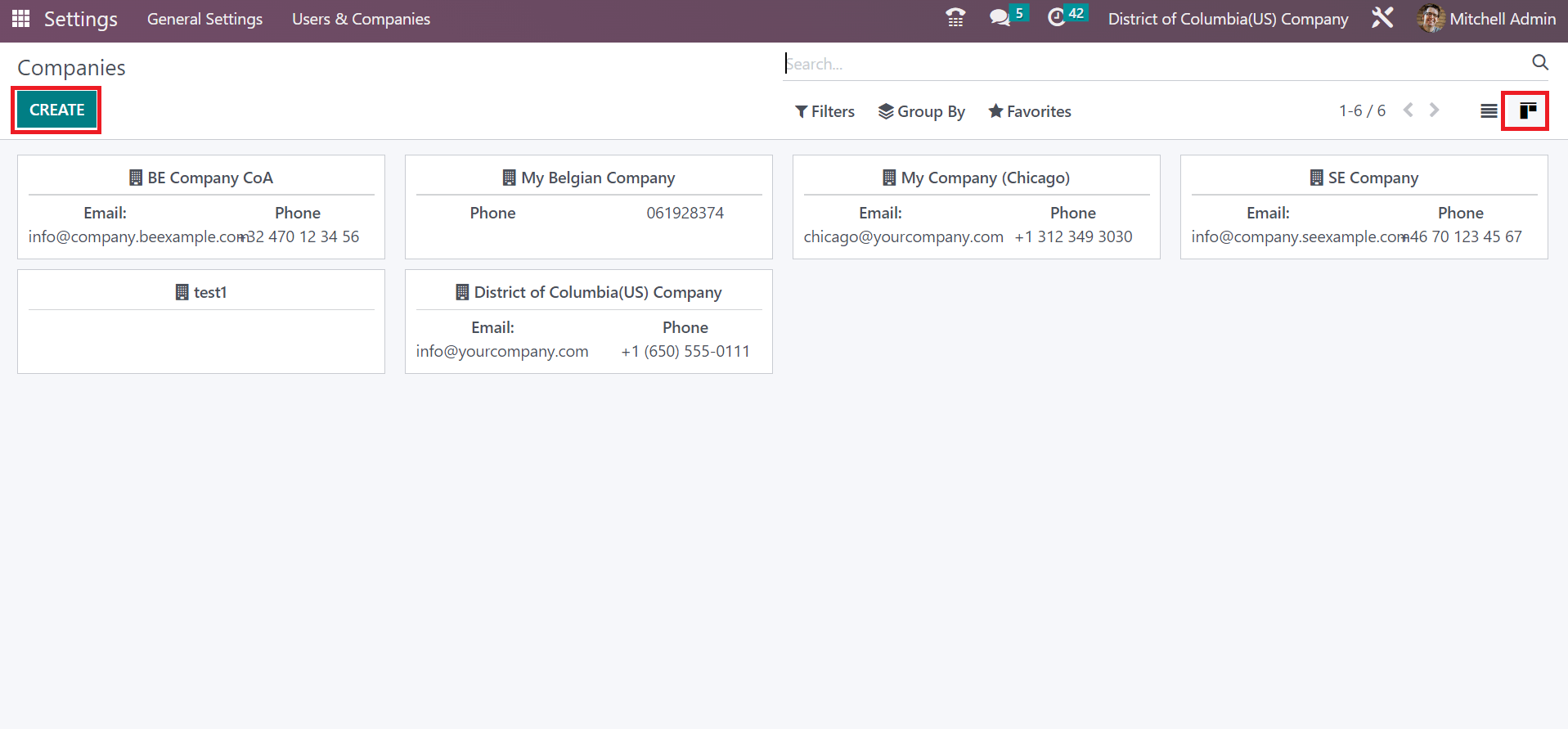

It is vital to create your Florida company information in Odoo 16 before configuring the taxes. You can reach the Companies menu from the User & Companies tab in the Odoo 16 Settings. In the Kanban view, we can find facts about each company, including Company name, Email, phone number, and more, in the Companies window. Choose the CREATE button to compose a Florida company information in Odoo 16, as marked in the screenshot below.

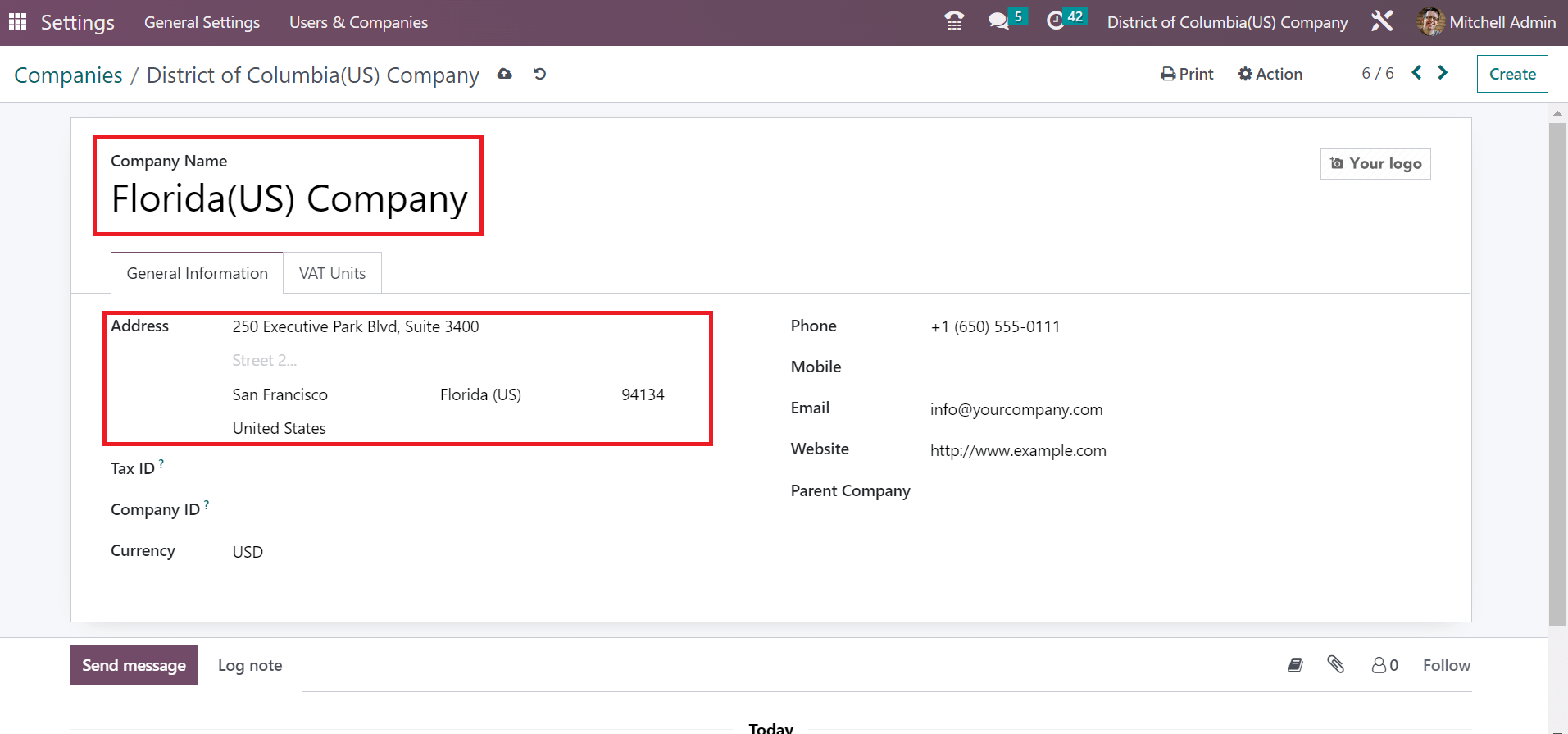

Users can put the Company Name as Florida(US) Company in the Companies window. Later, enter your company's address information, such as street name, state, city, Pincode, country, and more, in the Address field. Make sure to mention State as Florida(US) and the United States in the Country field as defined in the screenshot below.

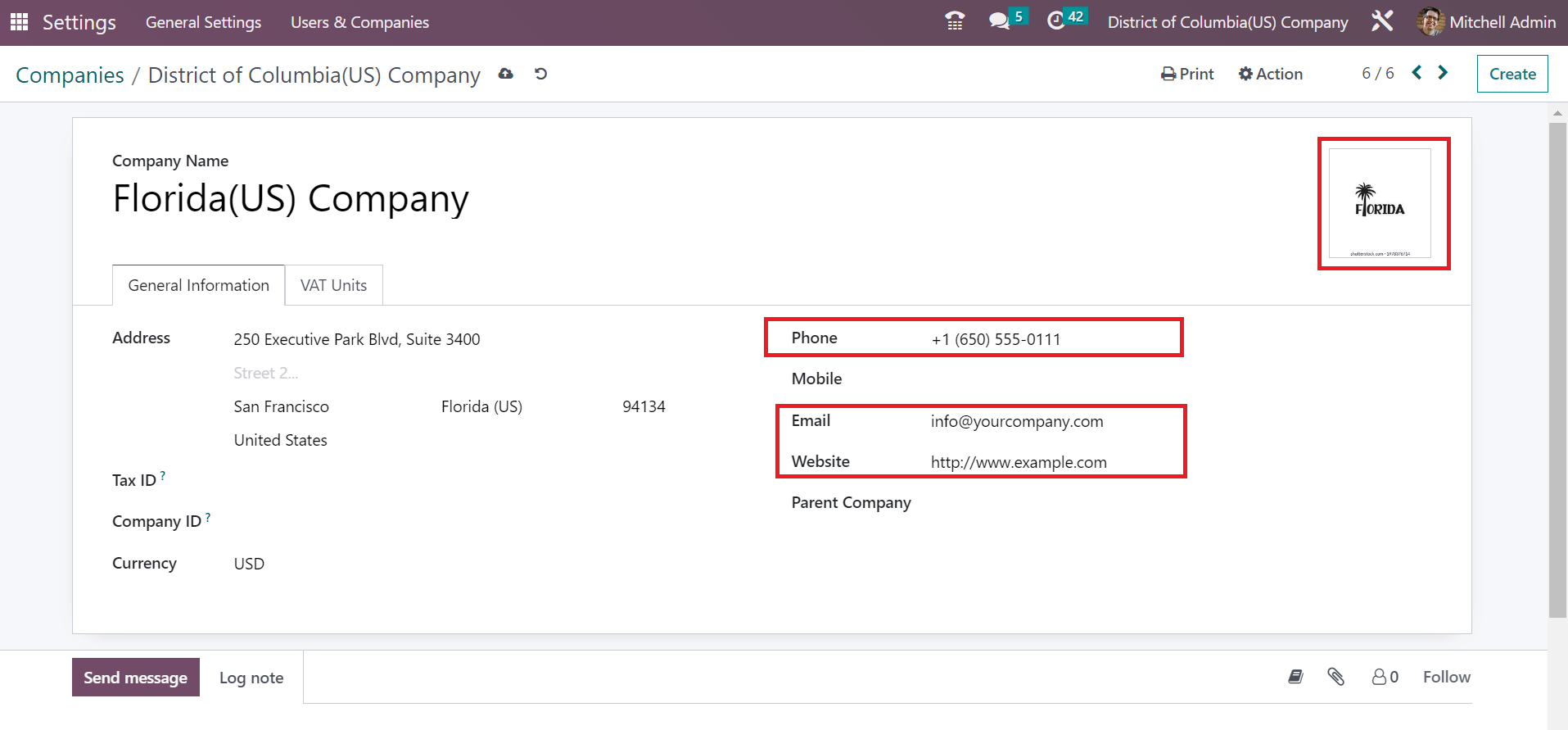

You can also upload the company logo on the right side of the window. Moreover, you can enter the company's phone, Email, and Website data, as noted in the screenshot below.

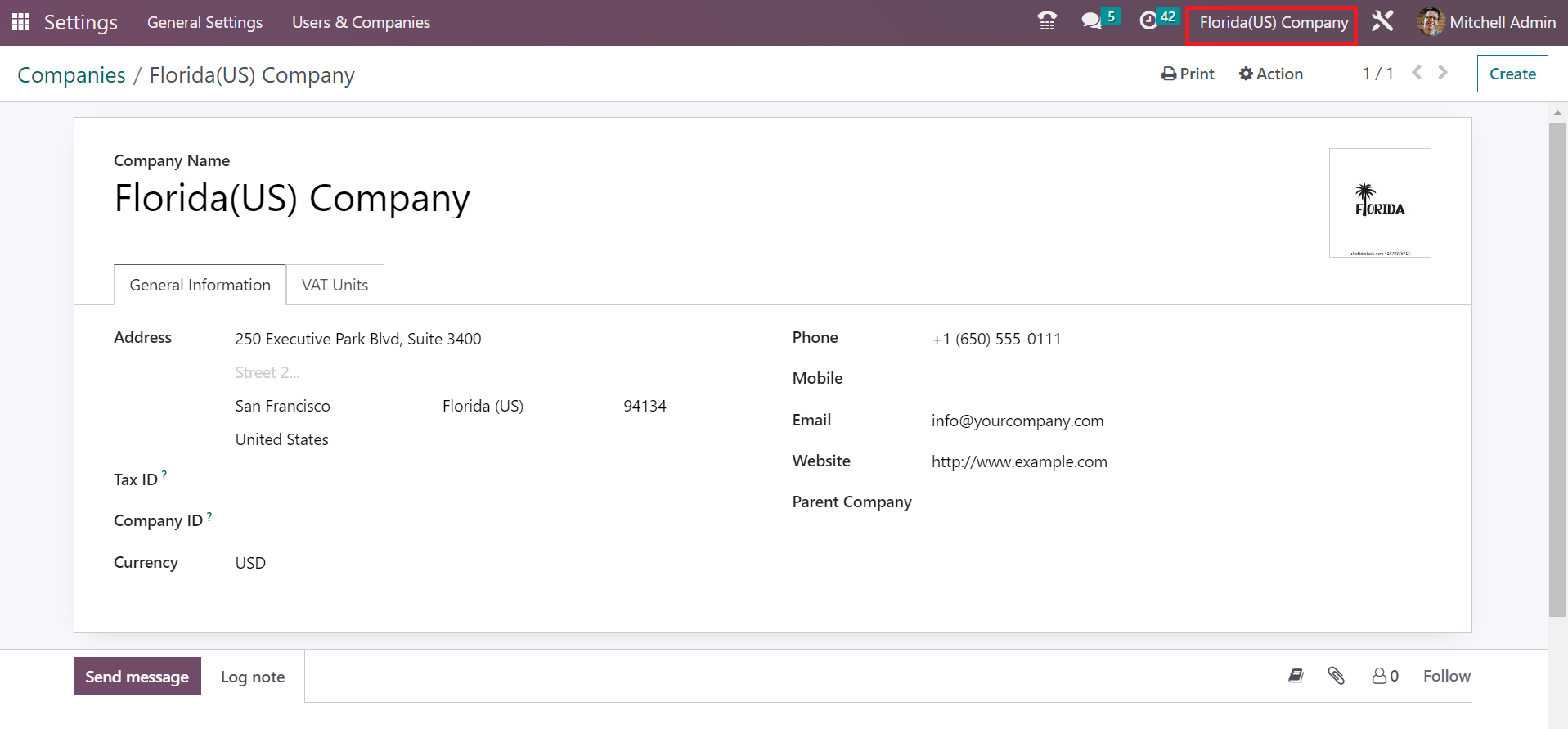

After saving the data manually, you can see the created company name at the top right of Odoo 16, as marked in the screenshot below.

To Set up Sales Tax for Florida(US) Company in Odoo 16 Accounting

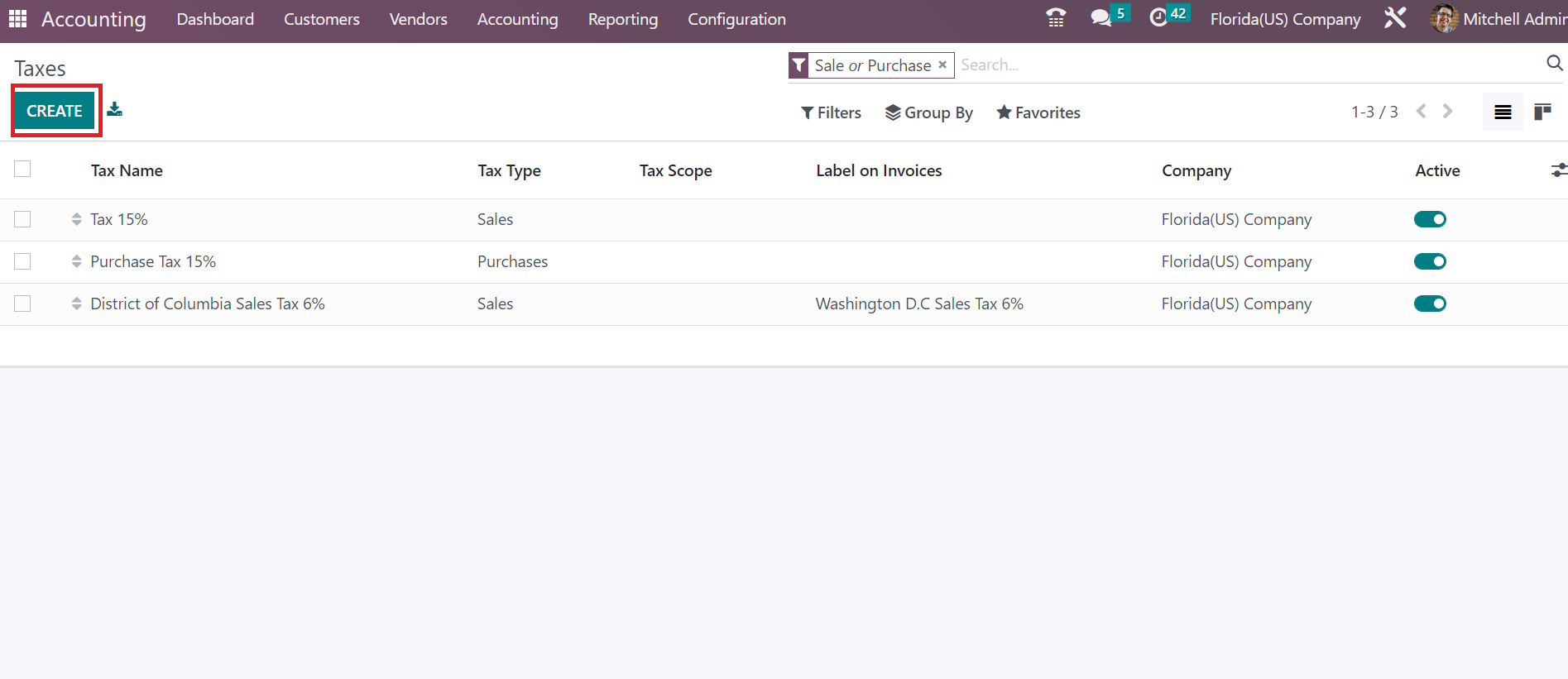

Move to the Accounting module in Odoo 16 to create a new sales tax. Users can acquire the Taxes menu below the Accounting section of Configuration. In the Taxes window, a record of all completed taxes consisting of Labels on invoices, active, tax name, company, tax scope, and more are visible to the user. Click the CREATE button to generate a sales tax for Florida(US) company, as demonstrated in the screenshot below.

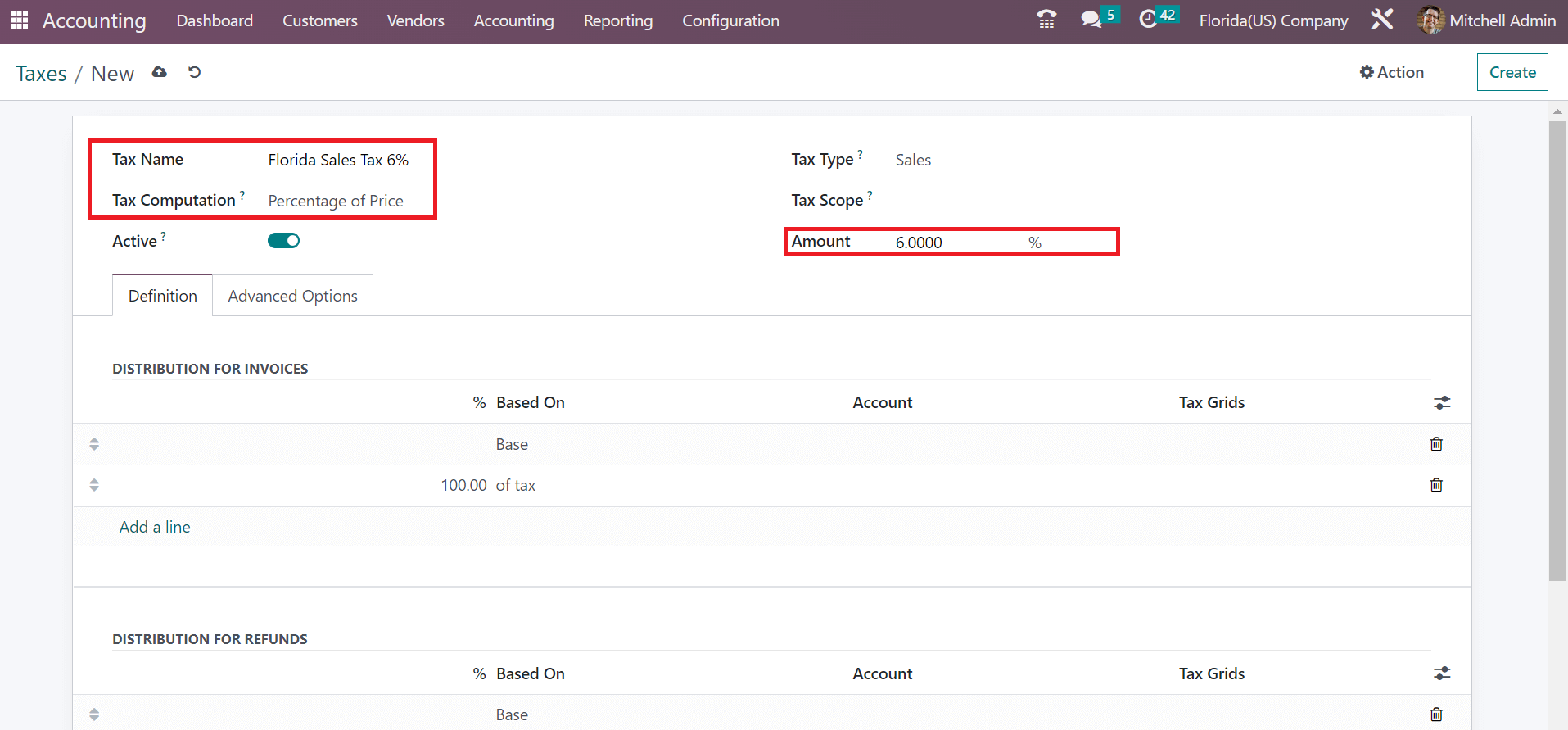

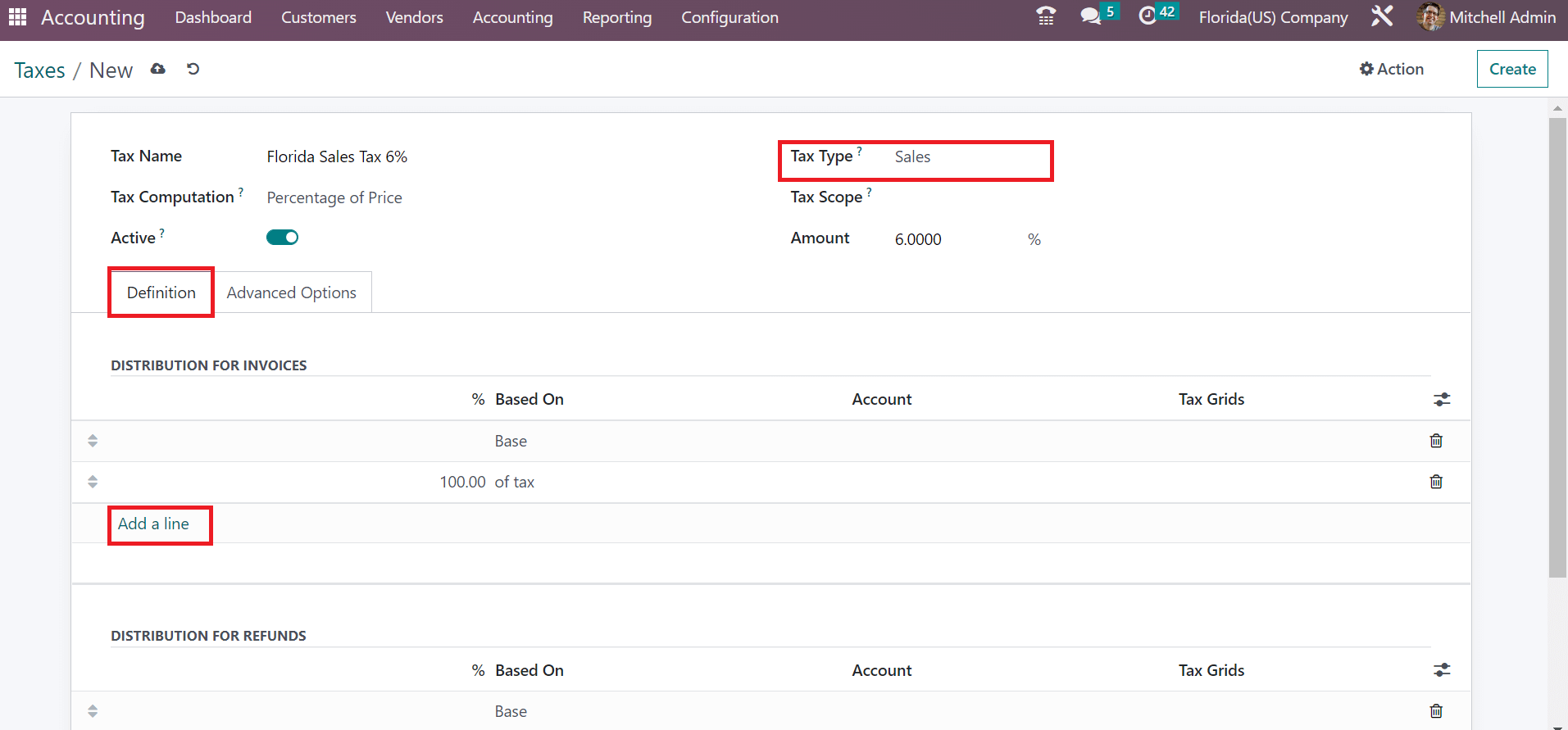

The new page specifies the Tax Name as Florida Sales Tax 6%. Also, you can pick a computation method for sales tax in the Tax Computation option. We selected the Percentage of Price option, as represented in the screenshot below.

Enter the total percentage of sales tax in Florida within the Amount field. As shown in the screenshot above, we applied a sales tax of 6% in the Amount field. By choosing the tax type, the user can determine whether it is taxable or not. Select the Sales option in the Tax Type field because we are applying the sales tax of Florida(US). Afterward, it is possible to describe the tax distribution on refunds and invoices by choosing the Add a line button under the Definition tab.

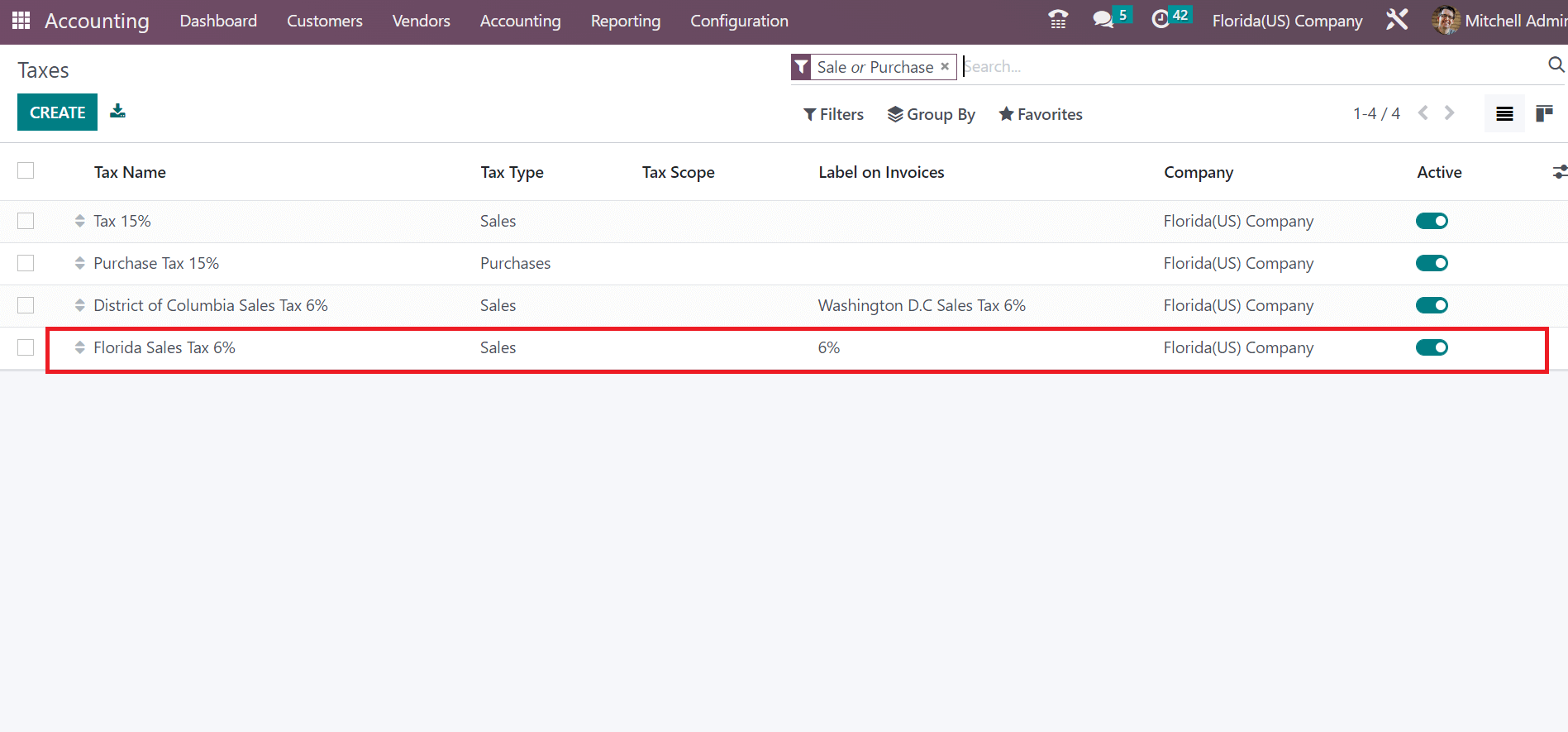

After saving the data manually, we can see the created tax name in the main Taxes window.

Next, let's produce the customer invoice for Florida Sales Tax of 6% in Odoo 16.

How to Generate Customer Invoice with Florida(US) Sales Tax in Odoo 16?

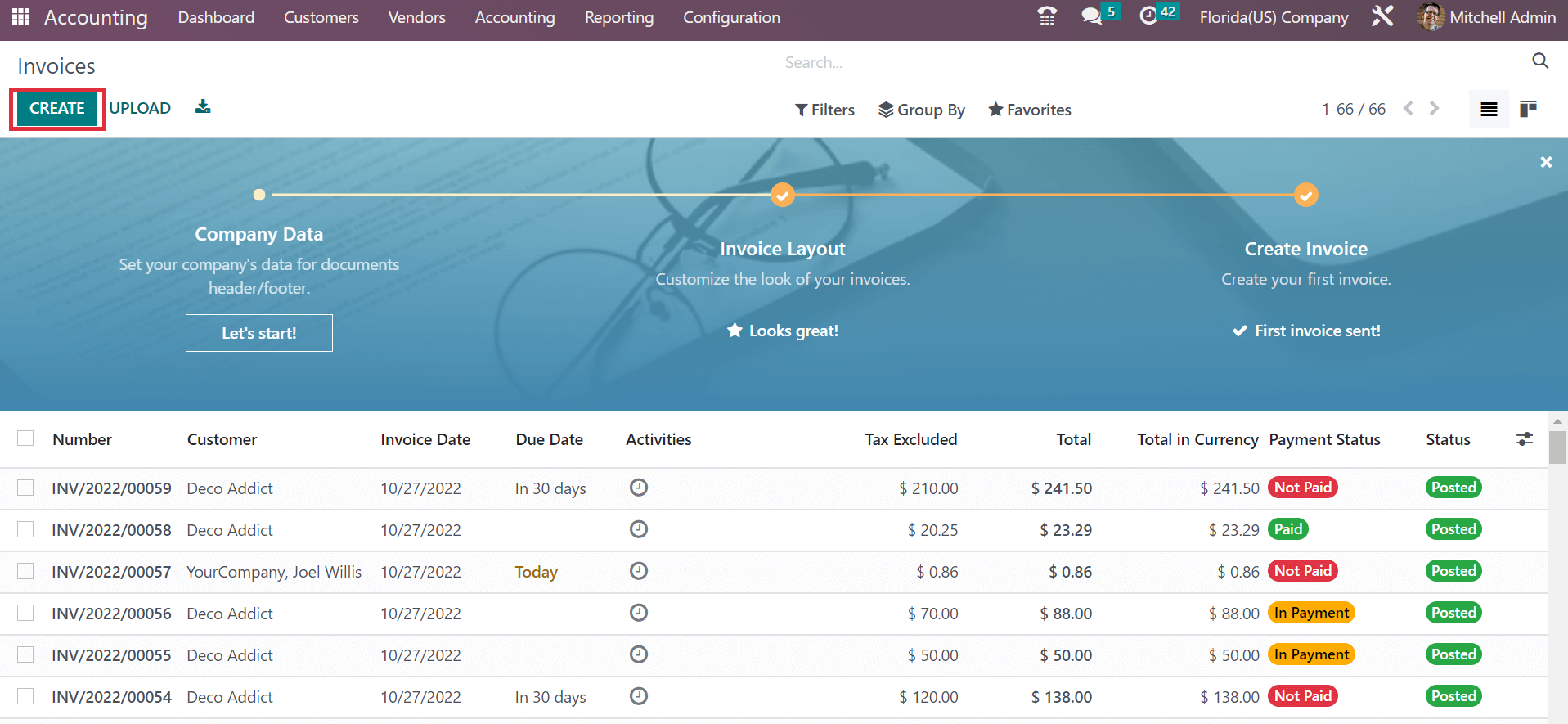

All the lists of created invoices are accessible by choosing the Invoices menu in the Customers tab. Users can view the data related to every invoice, such as Total in Currency, Status, Invoice Date, Customer, and more, within the Invoices window. Select the CREATE icon to develop a new invoice with a Florida(US) sales tax, as presented in the screenshot below.

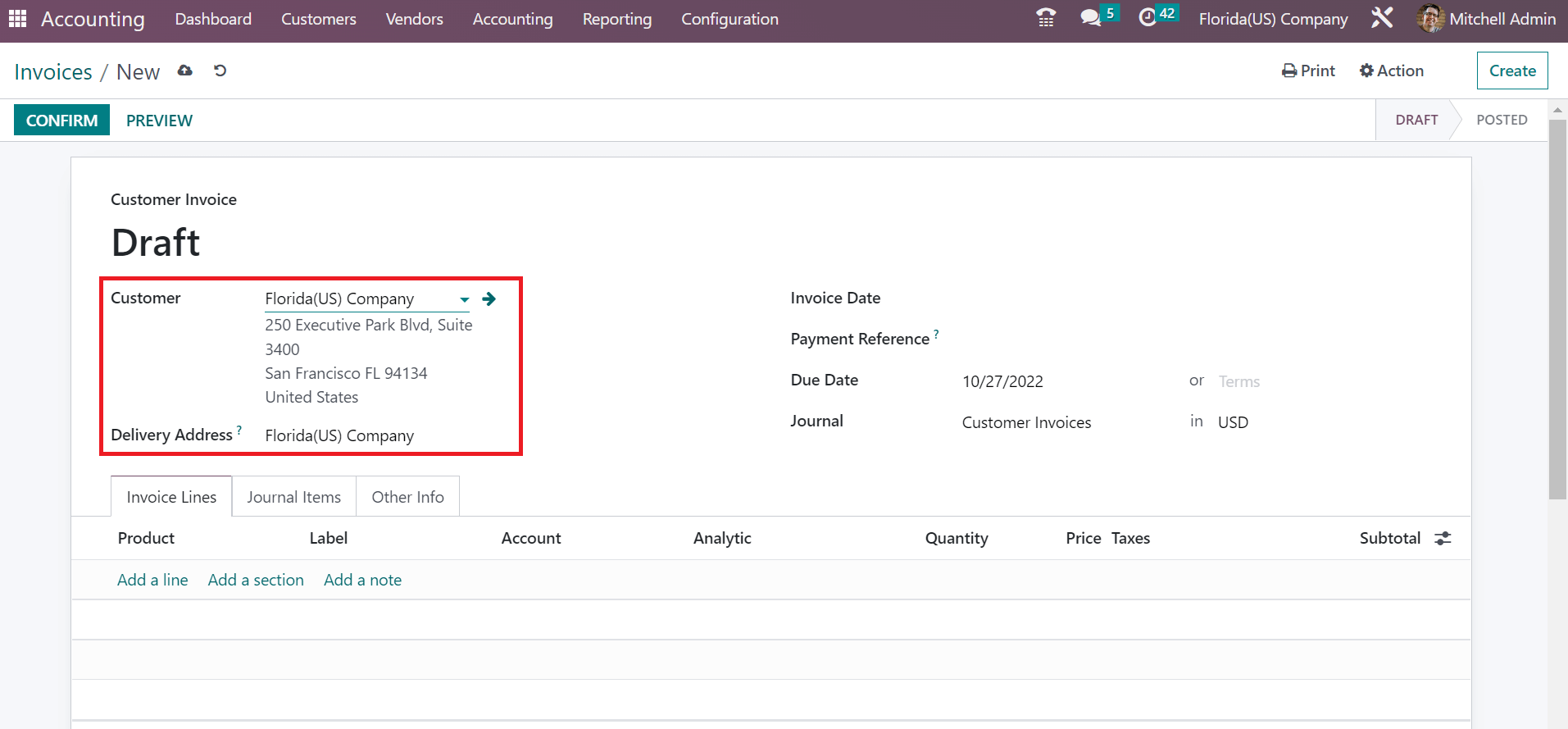

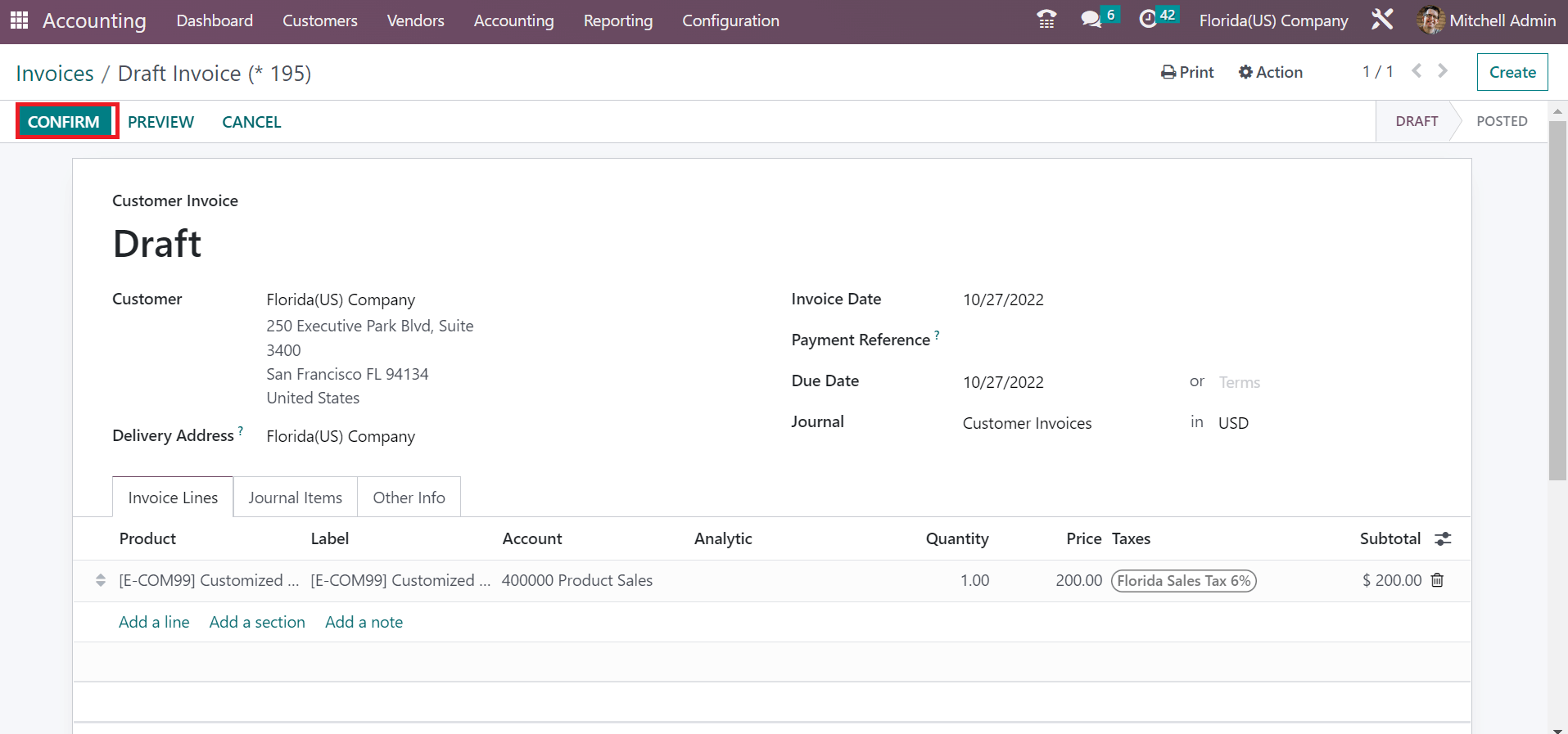

Choose Florida(US) Company as the Customer on the Draft Invoice page. After picking your Customer, the address linked with the Florida company is automatically accessible, as portrayed in the screenshot below.

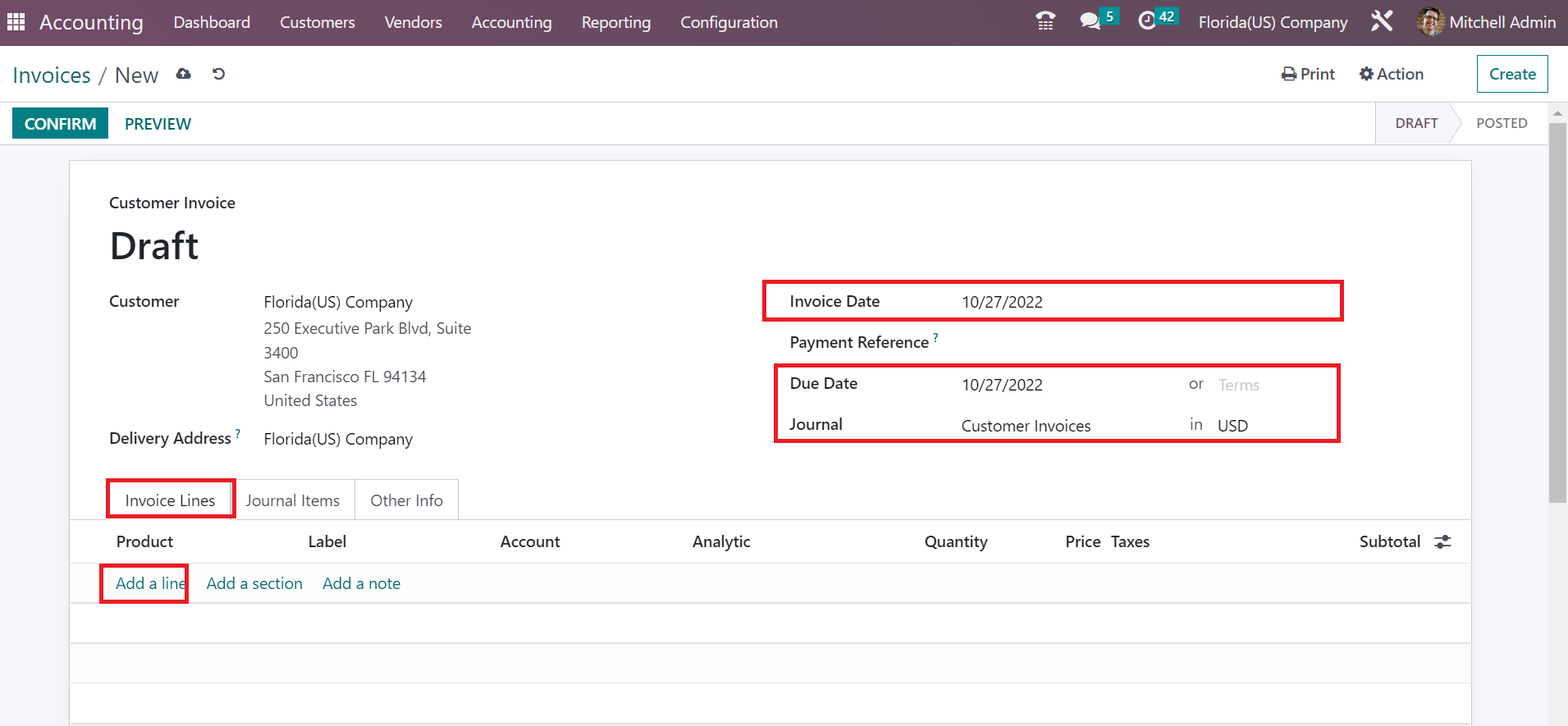

Specify the date on which goods have been billed in the Invoice Date field. Later, enter the payment completed date for the invoice in the Due Date field. In the Journal field, you can select a journal related to customer invoices in the currency, as cited in the screenshot below.

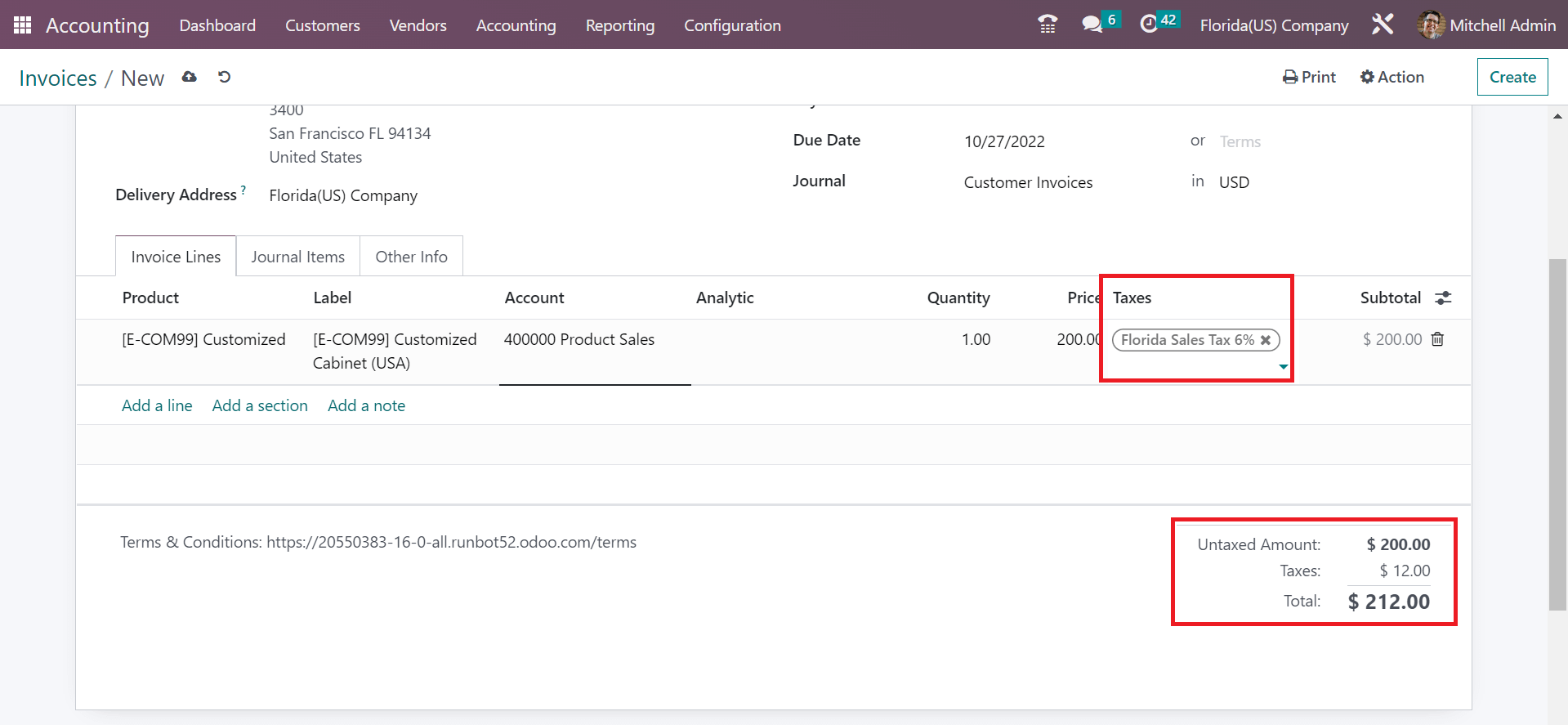

Users can add commodity quantity for customers below the Invoice Lines tab after selecting the Add a line. Choose one customized amount of cabinet in the open space and apply Florida(US) Sales Tax 6% under the Taxes section as illustrated in the screenshot below.

As noted in the above screenshot, we can identify the specified tax rate along with the product price at the right end. Each data about the invoice is manually saved in Odoo. You can verify the order by clicking on the CONFIRM button in the Invoices window.

After confirmation, it is easy to make further payments for customer invoices. So, we can quickly manage customer invoices per a state's sales tax.

Sales or Purchase tax calculations of a company as per customers' needs are defined easily within the Odoo ERP support. Users can set up customized company locations, create sales tax, and add a customer invoice through Odoo 16 Accounting module. By running an Odoo ERP, better customer relationships impact your business.