There are some aspects that make Odoo distinct from all other ERP Accounting applications. All bookkeeping transactions are relevant to clients or vendors, like client reports, revenue, receivables/payables, etc can be recorded. So while recording, all the transactions should balance. That is, the sum of credits will be the same as that sum of debits.

Odoo supports information on both the accrual and the cash basis accounting. This helps the end-user to record revenue/cost at the time of transaction. The difference between them is the timing of recording the transaction.

Accrual basis accounting

In Accrual basis accounting the expense or cost are recorded at the time a bill is created, that is, it will record the transaction before a cash transaction happens in hand. The two types of accrual accounting include Expense accrual and Revenue accrual.

In Expense accrual reports, the expense associated with any purchase does not record the transaction in cash. For instance, if a purchase is done and the payment is not done, it comes under expense accrual.

In the case of Revenue accrual, the revenue associated is recorded and the transaction of cash in hand is not. If a sale order is processed and the stock is moved from the warehouse, and still payment transaction is not done. They can be defined under revenue accrual.

Cash basis accounting

In Cash basis accounting the expense or cost are recorded only after the customer is paid or supplier has received the cash in hand. That is only after the money transaction happens.

Firstly enable cash basis in the accounting configuration settings. Go to, Accounting module -> Configuration -> Settings & enable Cash Basis and save changes.

Now configure a tax, go to Accounting module -> Configuration -> Taxes. Create a tax.

In the advanced options, tab check-in for ‘Based on Payment’ and add ‘cash basis transition account’ and save changes.

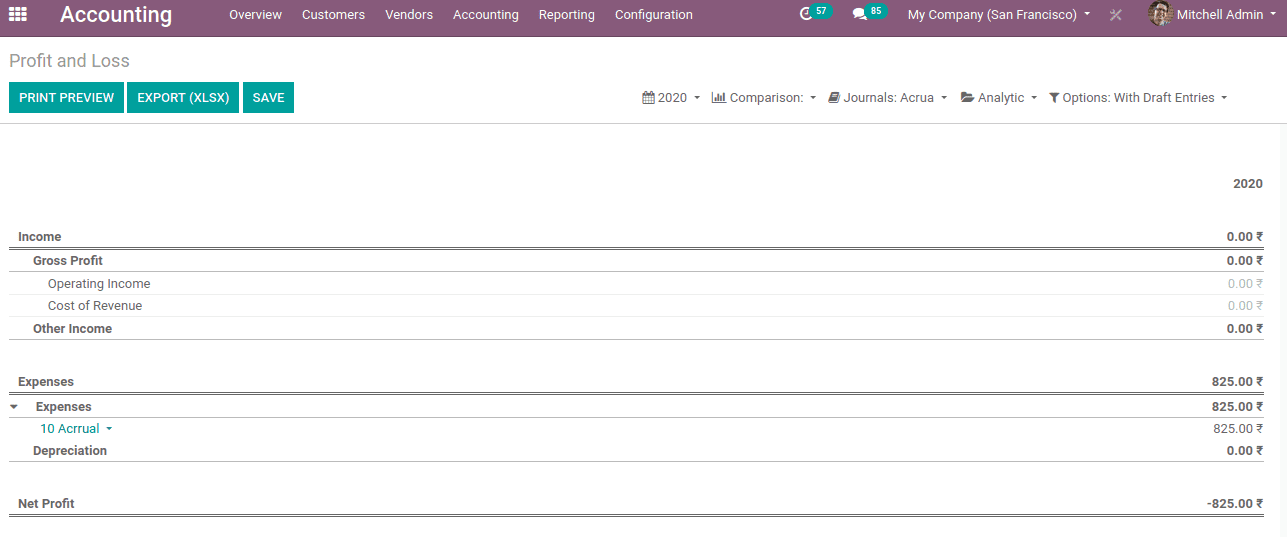

You can find the cash basis accounting in Accounting -> Reporting -> Profit and Loss.

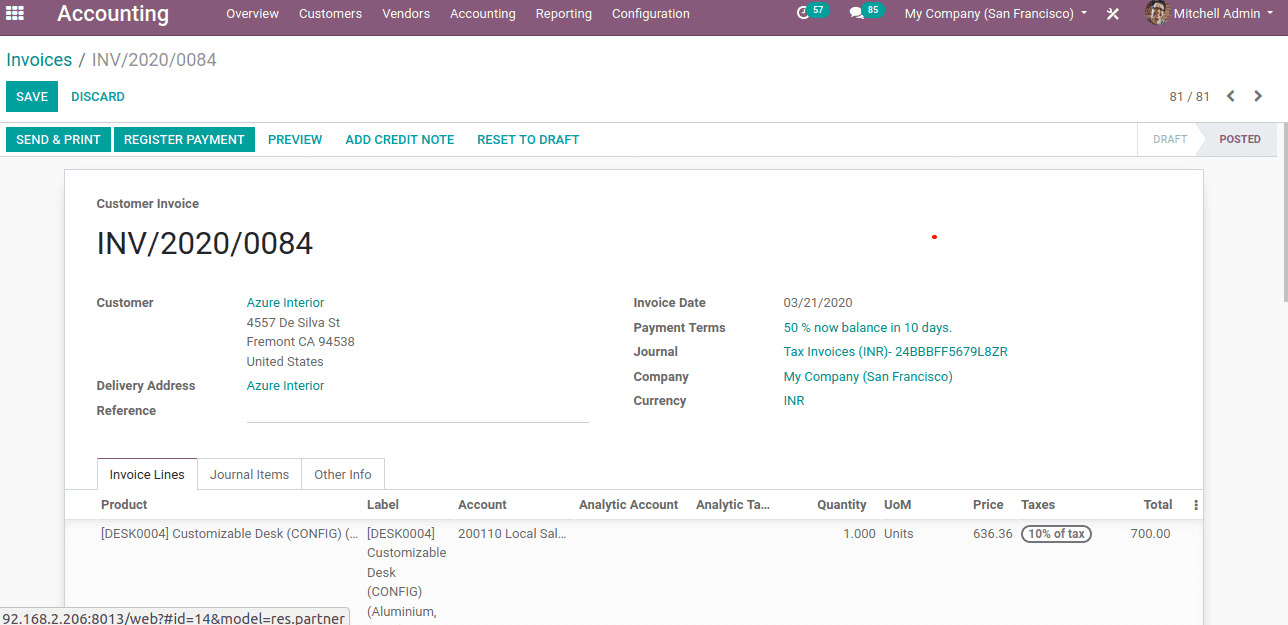

Now create a customer invoice and select the product and tax. If you choose ‘Tax Due‘ as ‘Based Payment’, then the tax report updates the tax amount after registering the payment. For ‘Tax Due’ as ‘Based on invoice’, the tax report updates the tax amount when the invoice is validated.

Here the tax ‘10% of tax’ is created and ‘tax Due’ is based on payment. So make payment and check the tax report.

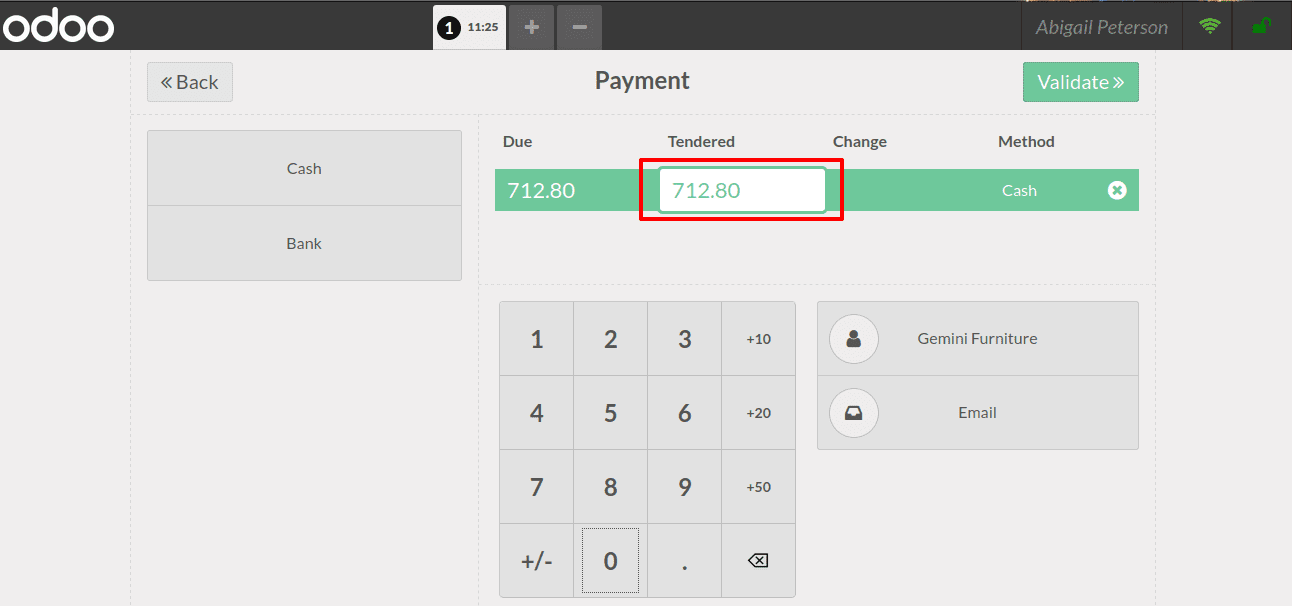

Consider another instance, in which the sales are done through a point of sale.

Here the payment is done for the purchase.

Now check the cash basis account for the point of the sale transaction. Thus the journal point of sale is chosen along with the Cash Basis Accounting.

Thus on a cash basis, the transactions are recorded after the money exchanges have been done from the customer or vendor.

In both cases, i.e in cash basis accounting and accrual basis accounting transactions are recorded but the difference is in the timing of recording the transaction.