Inventory management is an asset to your company and a crucial component of corporate operations. Depending on the product arrangement, the inventory value may fluctuate when a product enters or leaves your stock. New stock causes regular fluctuations in the inventory's value. The total benefit of revenue, net profit, and sold product price all have an impact on how inventory is calculated. Odoo 18 offers two main options for Inventory Valuation: Costing Methods and Inventory Valuation.

A basic accounting technique for figuring out the worth of stock on hand is inventory valuation. Once the inventory valuation amount has been established, the total value of the business is computed.

By default, Odoo 18 uses manual inventory value. This procedure states that the accounting team creates journal entries based on the company's actual physical inventory, while warehouse employees count what is in stock.

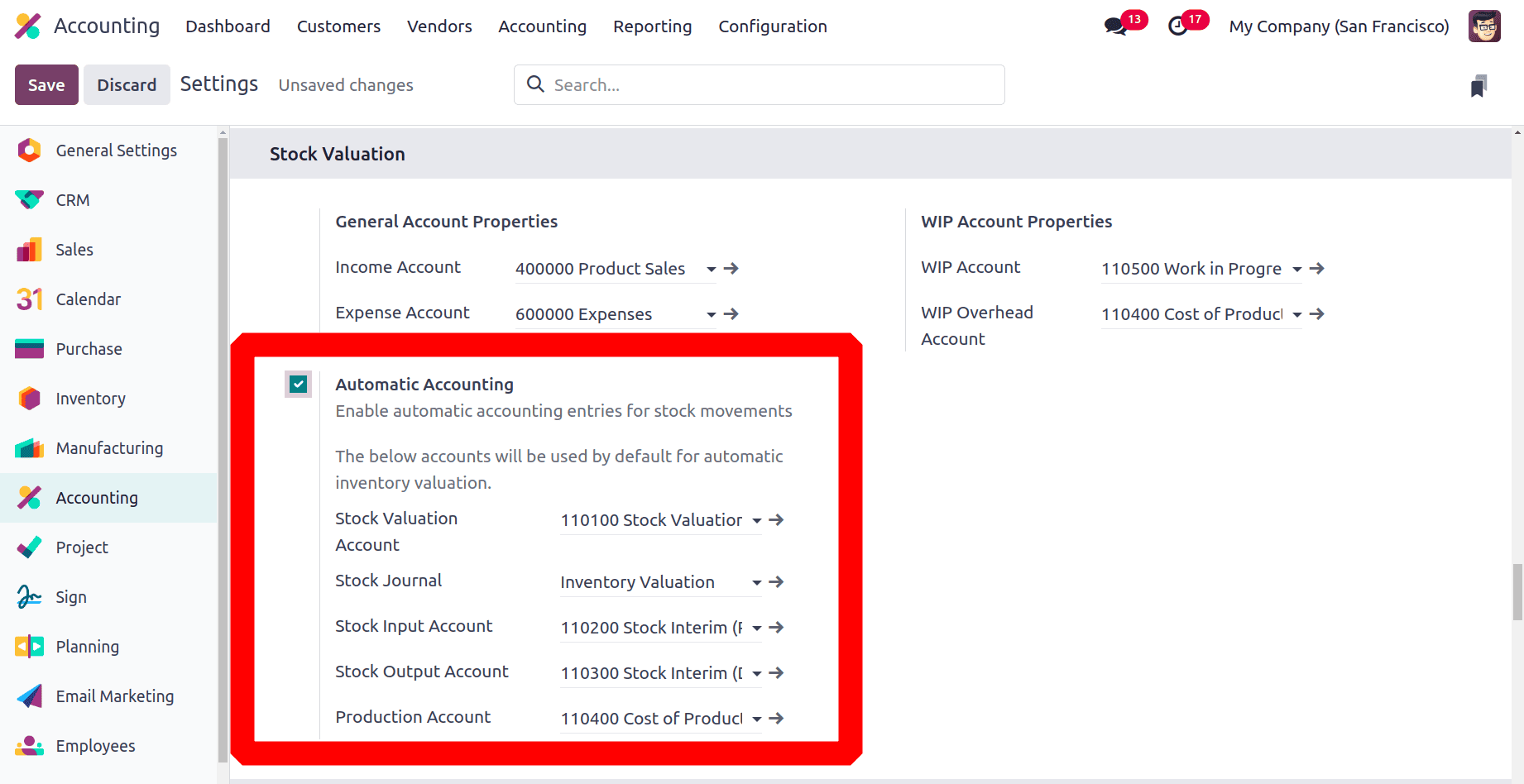

The Inventory valuation gets inside the Product Categories. To get the stock accounts inside the Product Categories, the user needs to enable Automatic Accounting from the Settings of the Accounting module.

: Configuration > Settings > Automatic Accounting

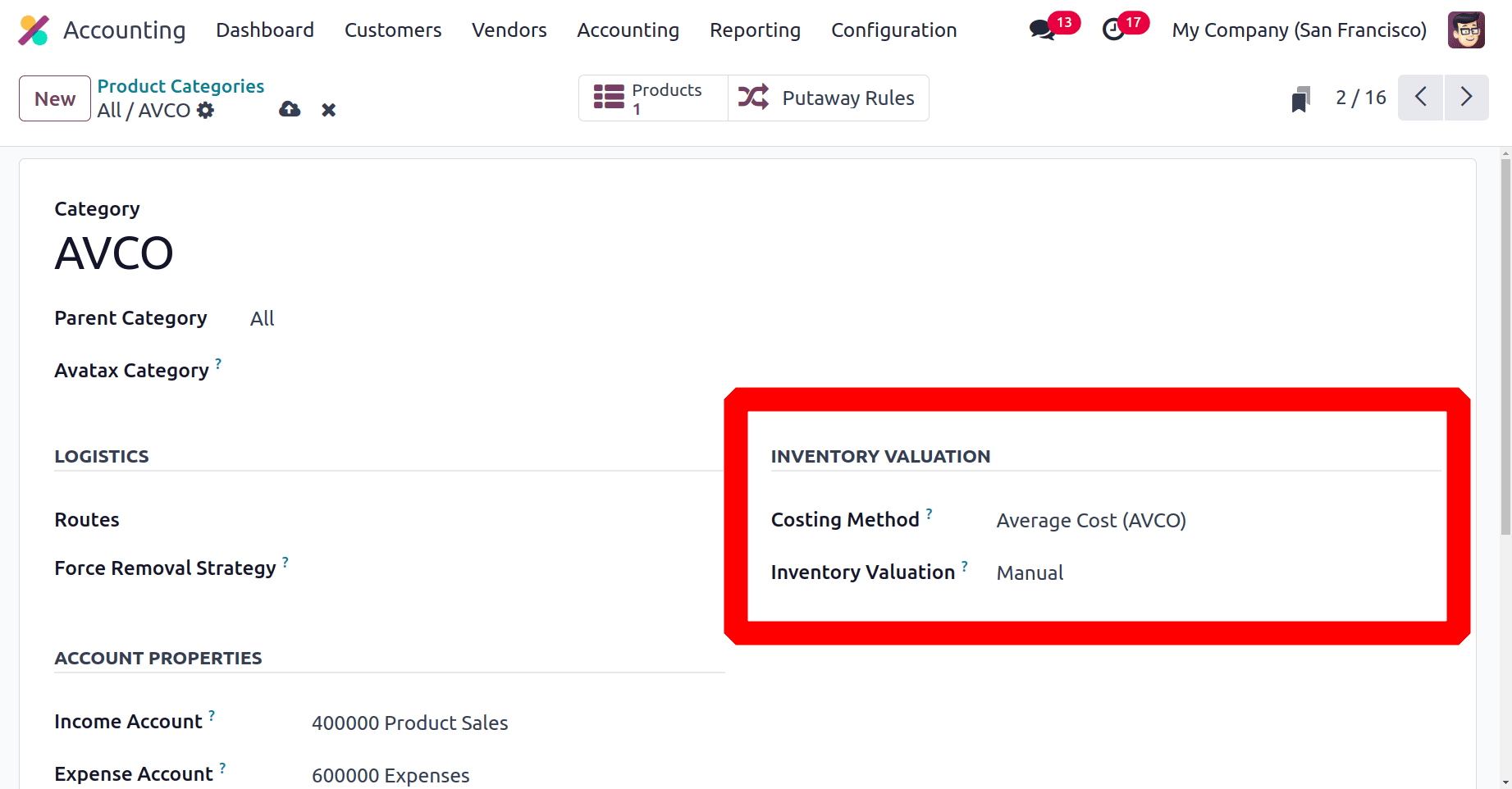

As shown below, Odoo 18 reflects this strategy by the Inventory Valuation field to Manual and the Costing Method field to Average Cost (AVCO) in each product category.

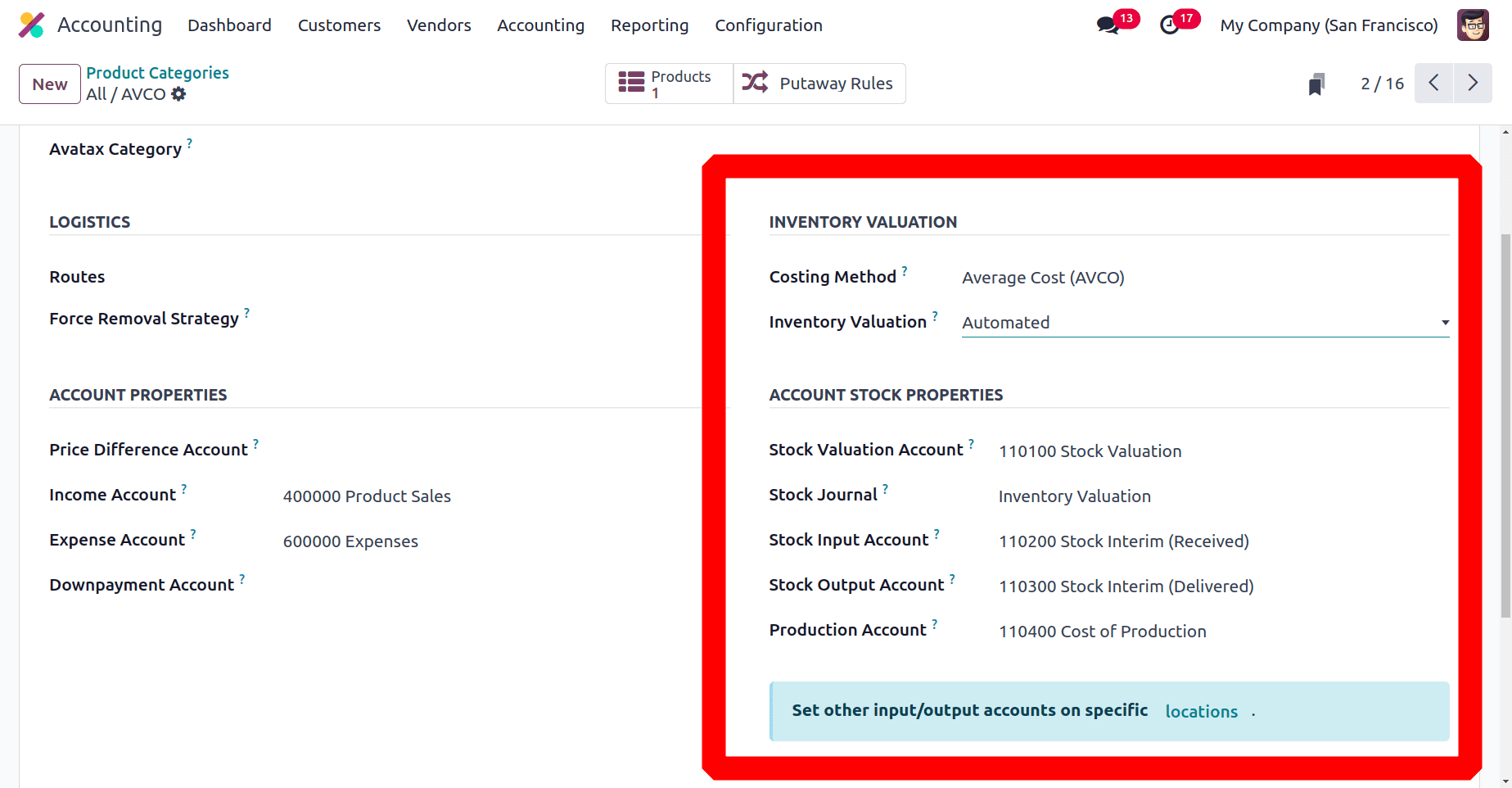

So let's check how the Automated Inventory Valuation works in Odoo 18. For that, change the Inventory Valuation to Automated and Costing Method as Average Cost (AVCO).

If the Inventory Valuation is set as Automated. Then the Stock Accounts and Stock Journals are shown there.

* Stock Valuation Account: This account will include the product's current value when automatic inventory valuation is enabled.

* Stock Journal: When processing stock moves, entries will be automatically posted in this accounting journal, which is used for automated inventory valuation.

* Stock Input Account: Unless there is a special valuation account, this account will be used to post the equivalent journal items for any incoming stock changes.

* Stock Output Account: This account will be used to post the corresponding journal items for all outgoing stock moves during automated inventory valuation. Unless the destination site has a specific valuation account set up. For every product in this category, this is the default value. Additionally, it is directly placed on every product.

* Production Account: For manufacturing orders, this account will serve as a valuation counterpart for both components and finished goods. After the production is finished, any workcenter or staff charges will still be reflected on the account.

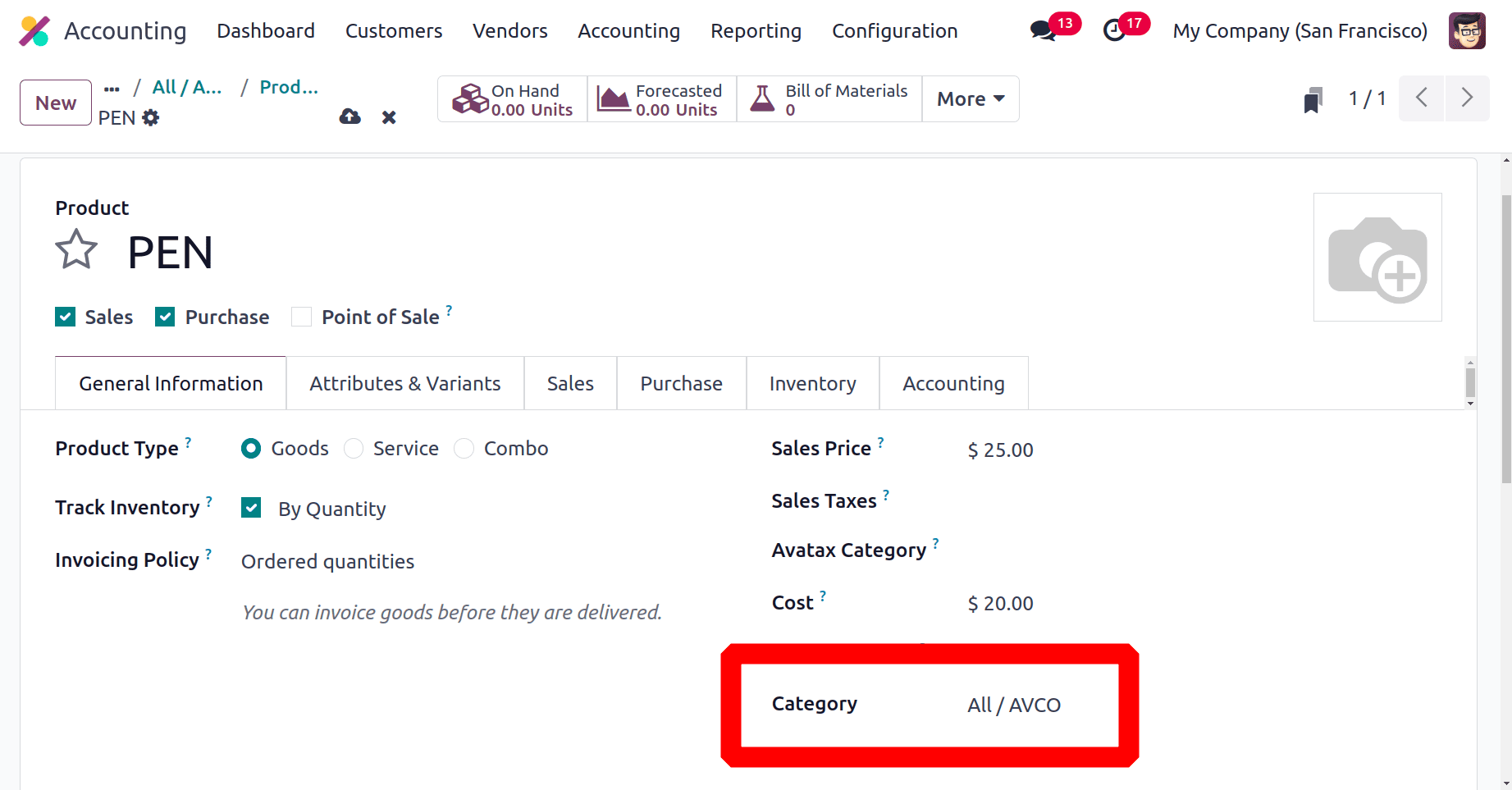

Moving items in and out of stock will help us grasp the fundamentals of Odoo 18 inventory valuation. Let's do that by creating a new product, the PEN, for which the category is likewise specified as indicated below.

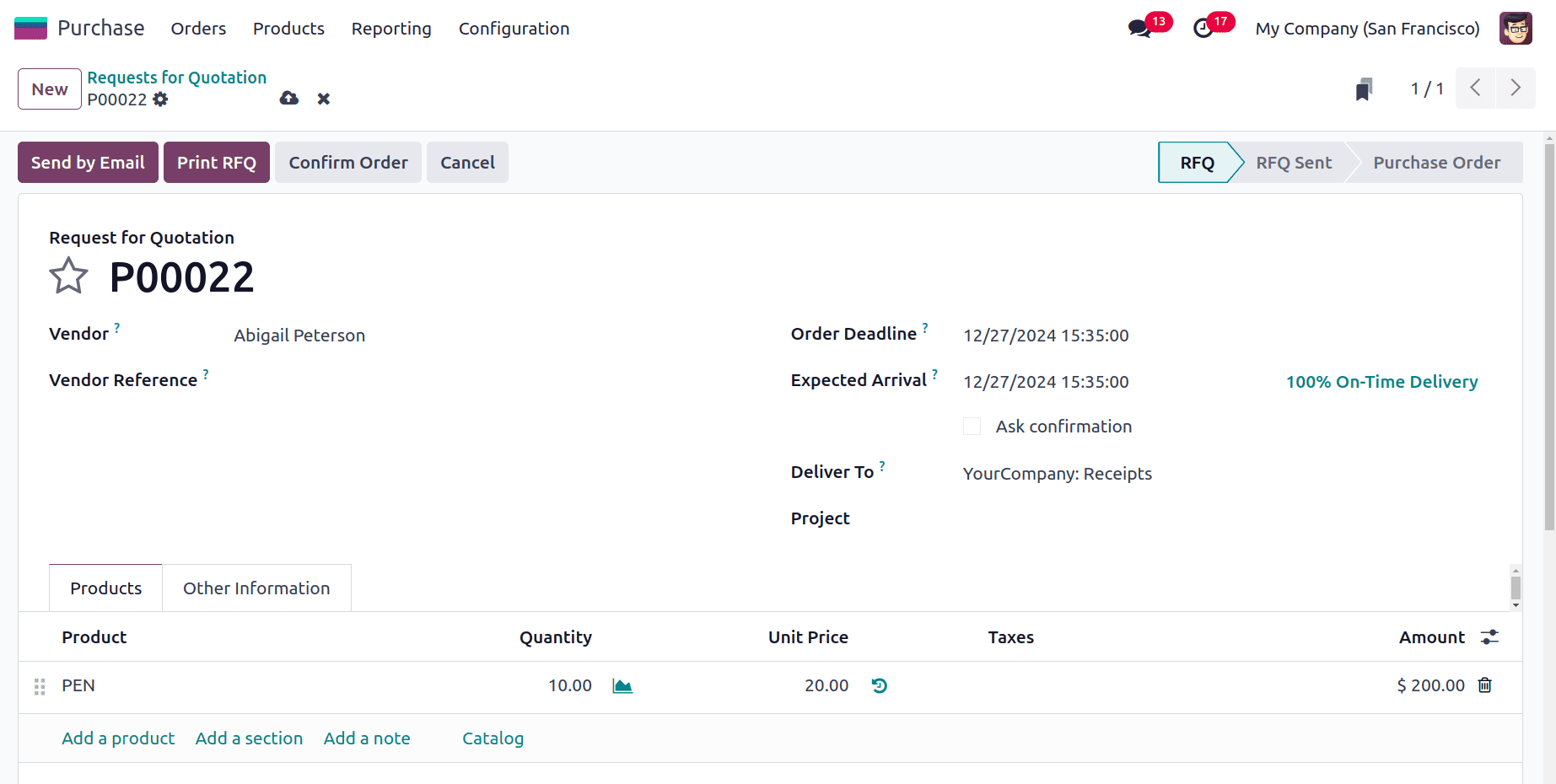

Let's now draft a buy order for ten of the products, each costing $20, and verify the order as indicated below. The customer is Abigail Peterson here.

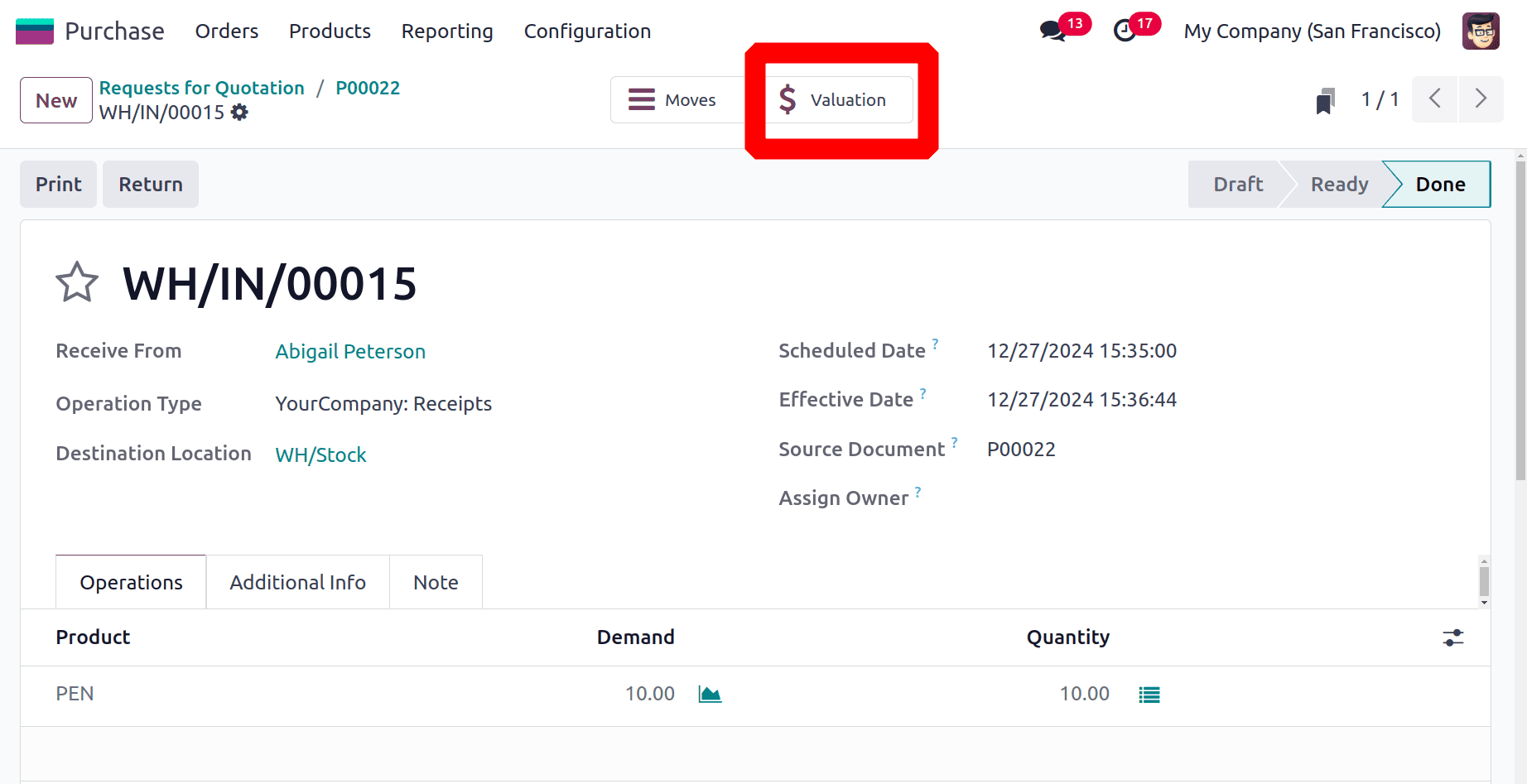

Once the order has been confirmed, verify the receipt and click the valuation button to see how the inventory value was affected inside the receipt form, as indicated below.

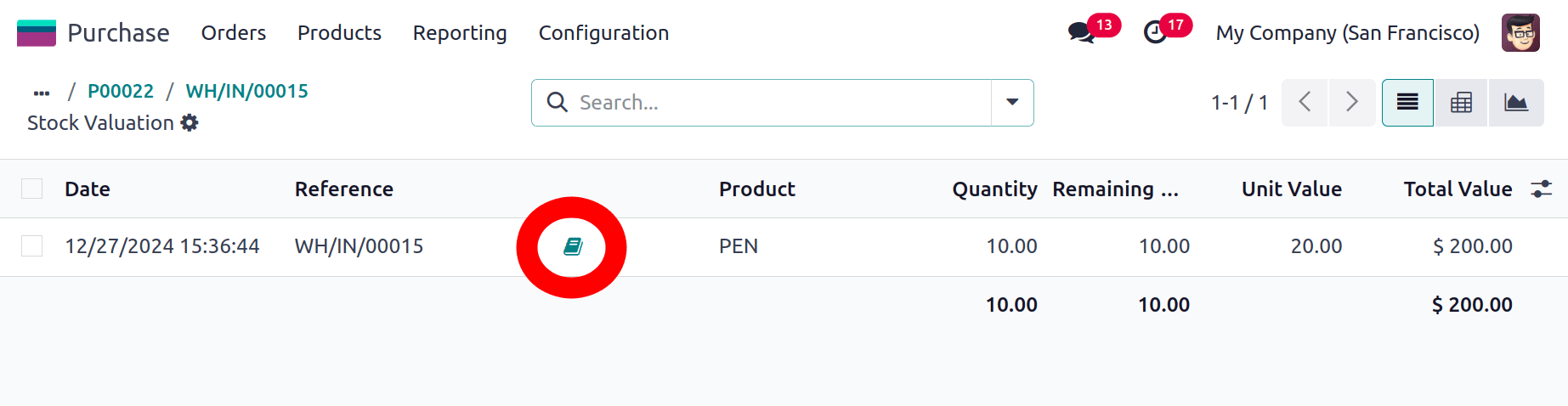

As can be seen below, the Valuation button offers information such as Date, Reference, Product, Moved Quantity, Unit value, UoM, and Total value. There shows a Book icon, click on it to view the stock journal entry.

The value of each product in the shipment, along with its quantity and valuation, is subsequently shown on the Stock Valuation dashboard. For instance, the dashboard's total Value column would display a calculated valuation of $200 if ten units of pens were purchased in the aforementioned PO at a unit price of $20.

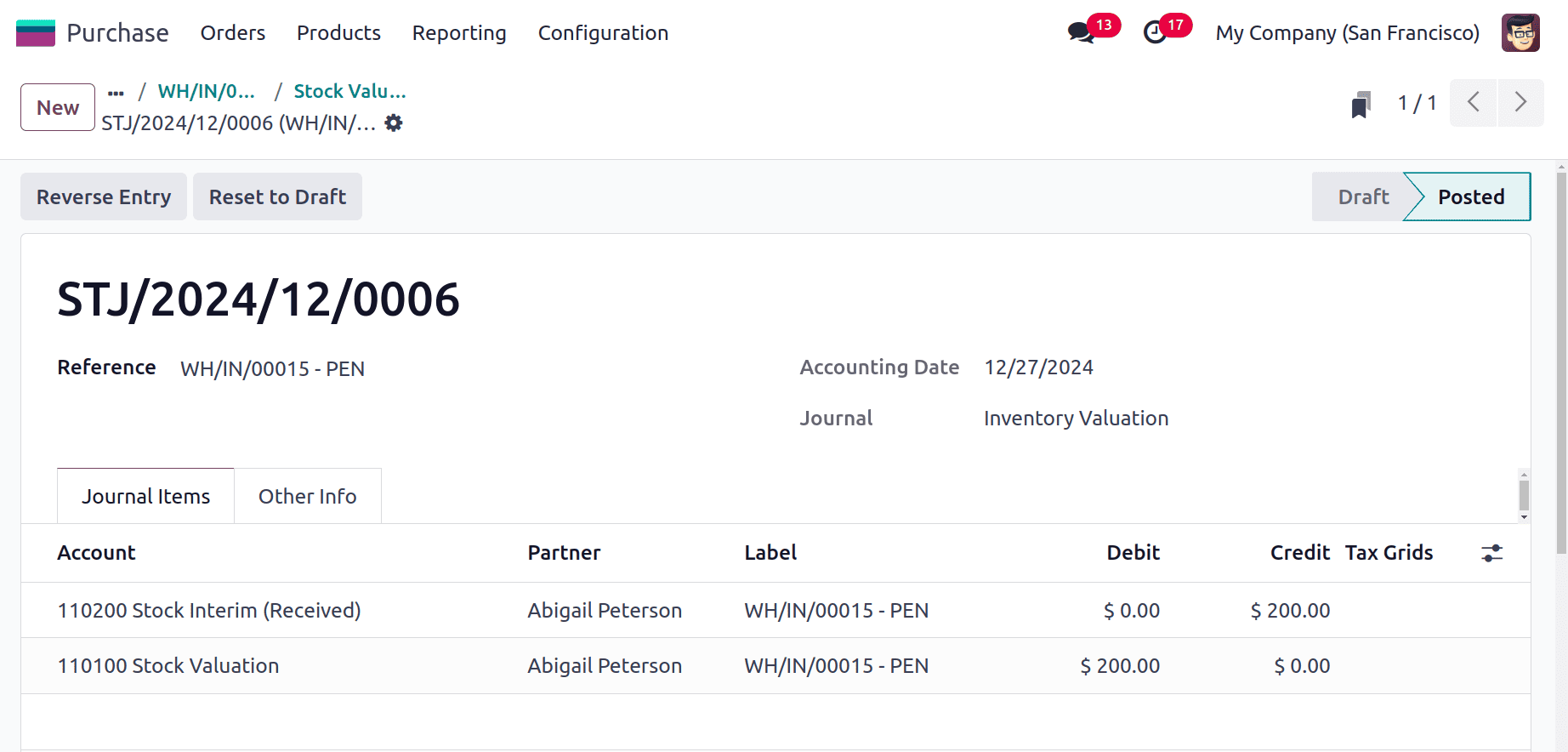

The Odoo Accounting software also stores data related to automatic inventory value. Look for inventory value entries with the STJ prefix in the Journal and Number columns, respectively.

Upon receiving the product, the Odoo18 platform's "Stock Valuation Account" and "Stock Input Account" are affected. The Stock Valuation Account is debited here because the asset will increase when a product is received to inventory stock. Here, the Stock Interim Account is credited because liability is also raised.

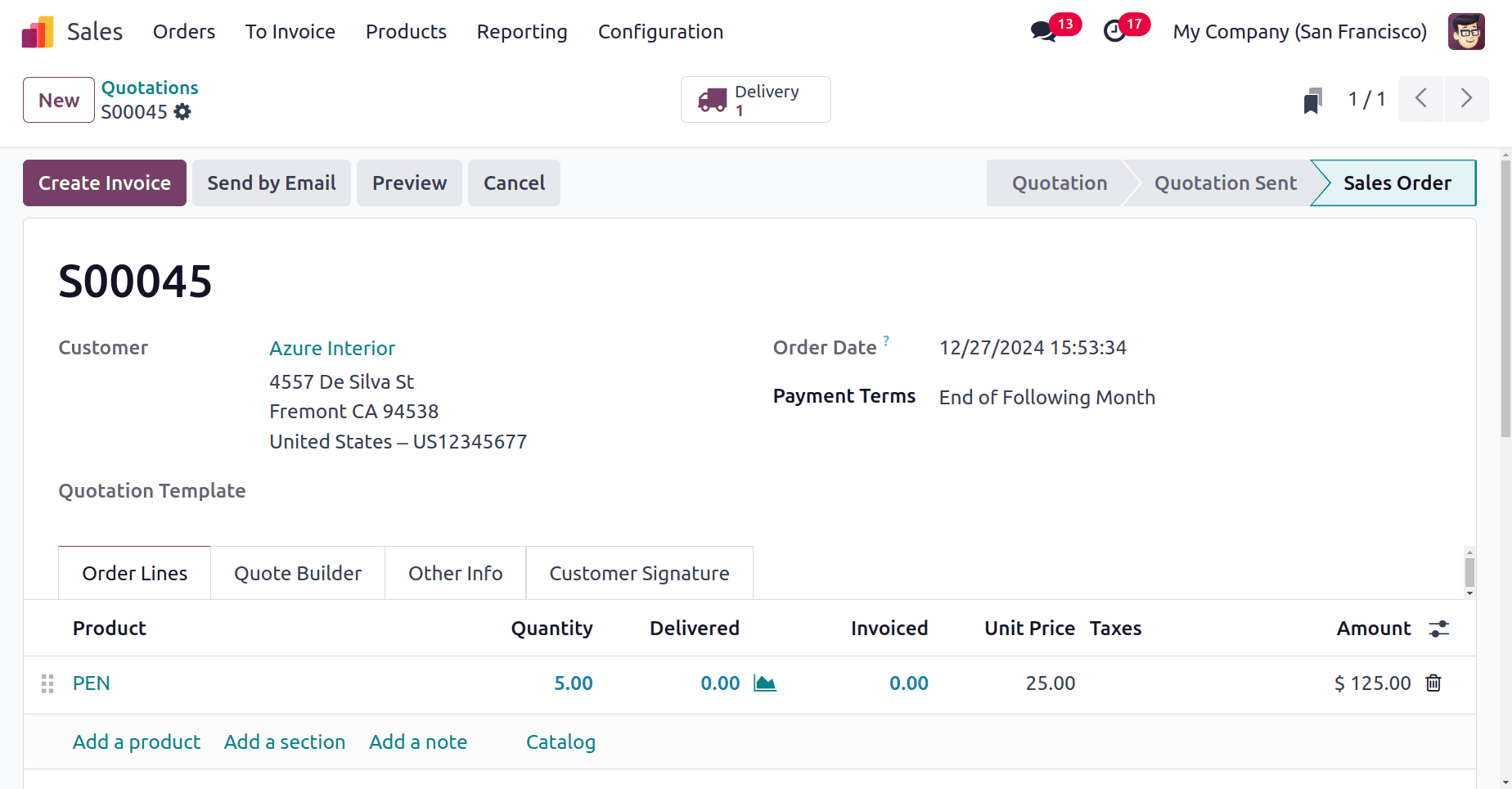

Let's now examine the situation while delivering a product to the clients. Let's make a sales order for that using the identical product. As indicated below, confirm the order by writing in the order line.

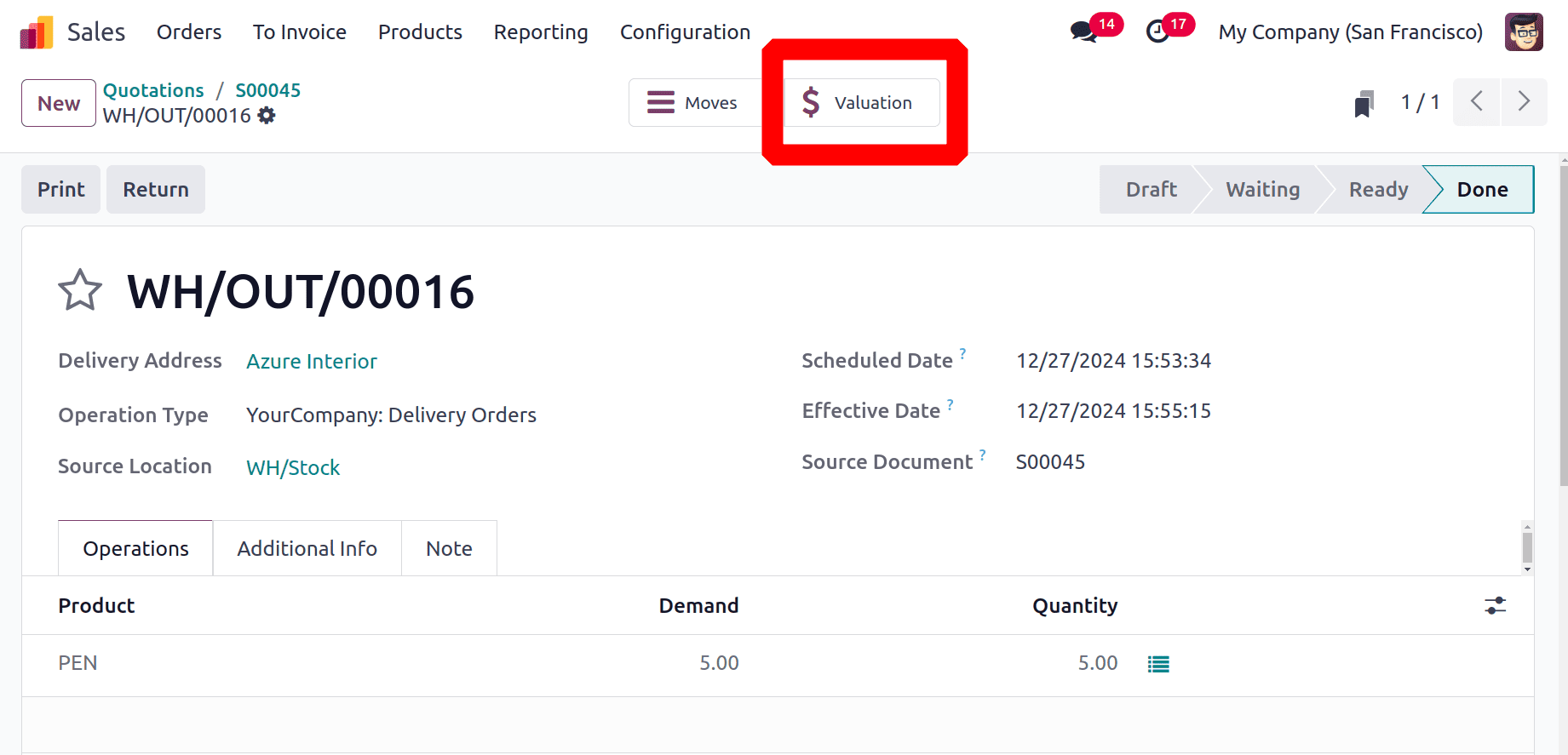

After confirming the sale order, it shows the Delivery. Then Validate the delivery transfer. After validation, the transfer shows a smart tab named Valuation.

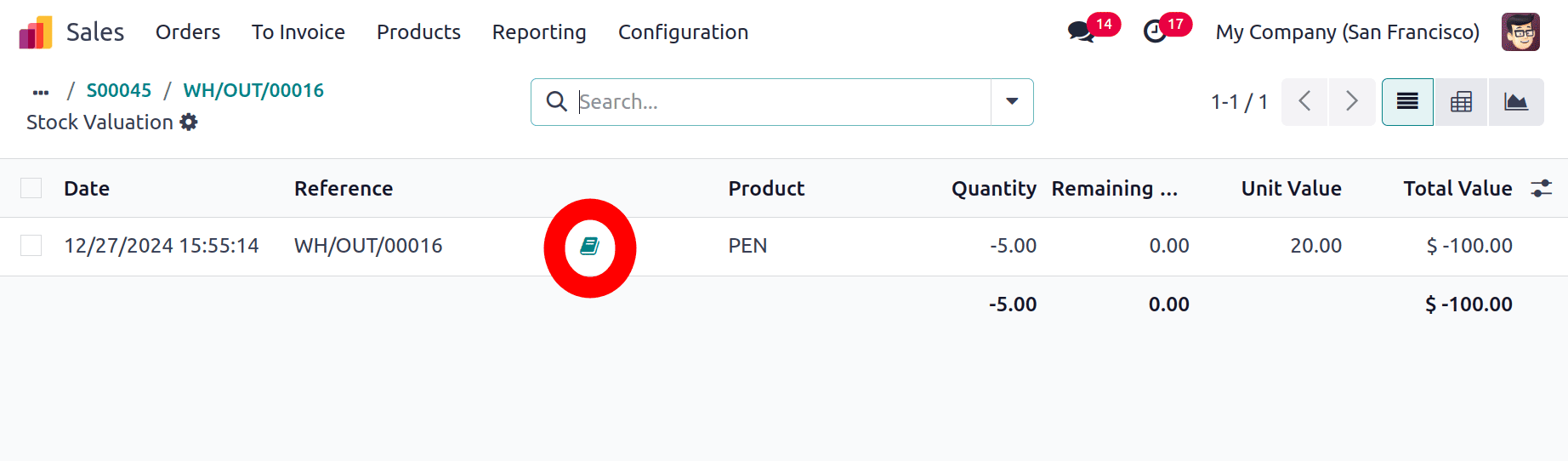

The Valuation shows the Date, Reference, Product, Quantity, Remaining Quantity, Unit Value, and Total Value are shown in the list. As said before while clicking on the Book icon users can view the stock journal entries.

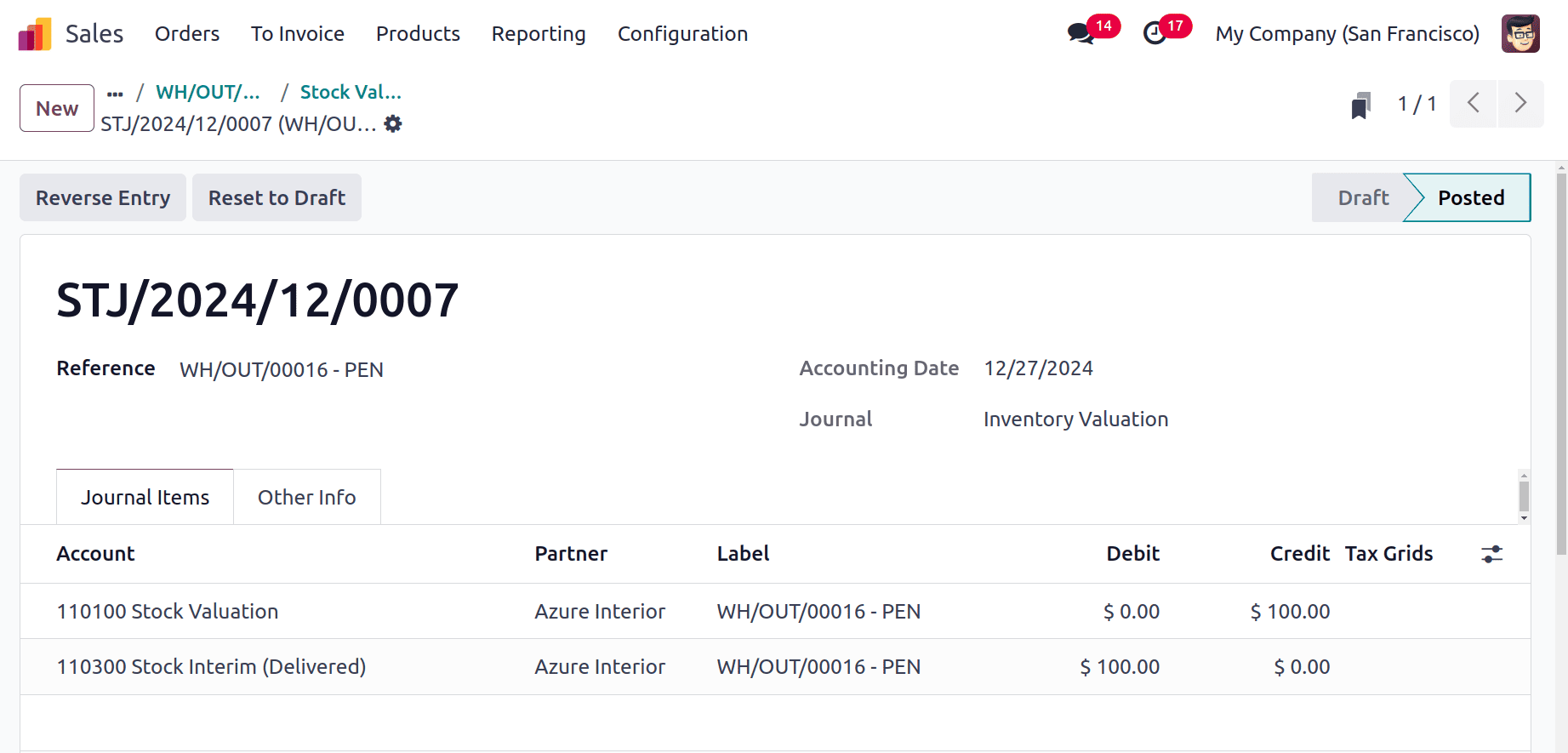

Upon delivering the product, the Odoo18 platform's "Stock Valuation Account" and "Stock Output Account" are affected. The Stock Valuation Account is Credited here because the asset will decrease when a product is delivered from inventory stock. Here, the Stock Interim Account is debited and liability is also reduced.

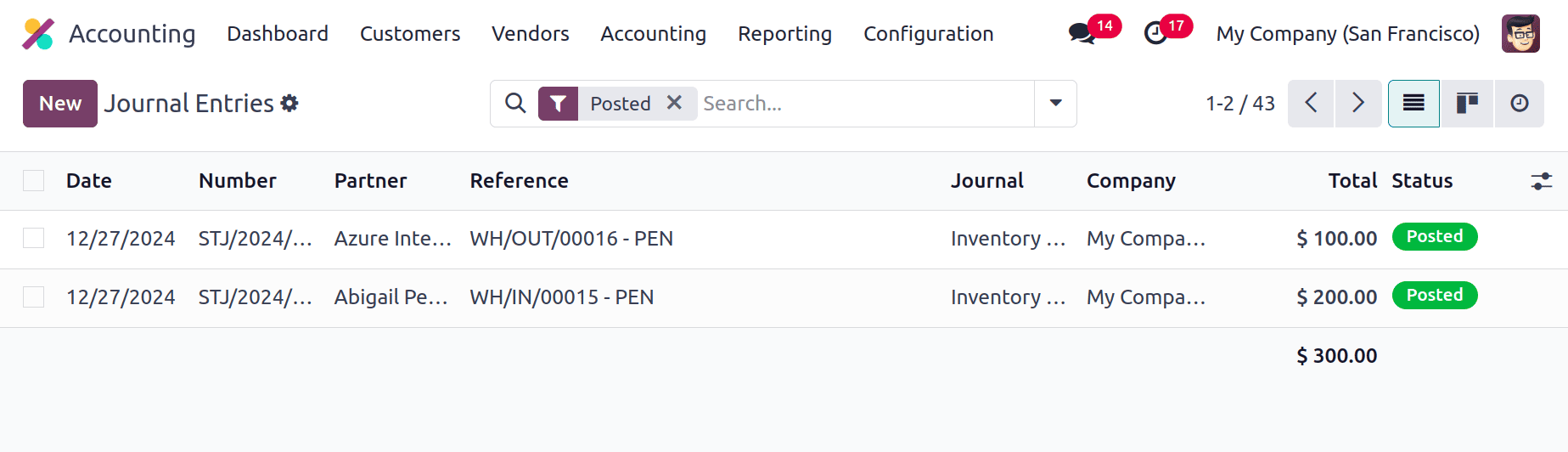

So the Journal Entries are also visible inside the Accounting module. To get that open the Accounting module and choose the Journal Entries from the Accounting menu.

: Accounting > Journal Entries

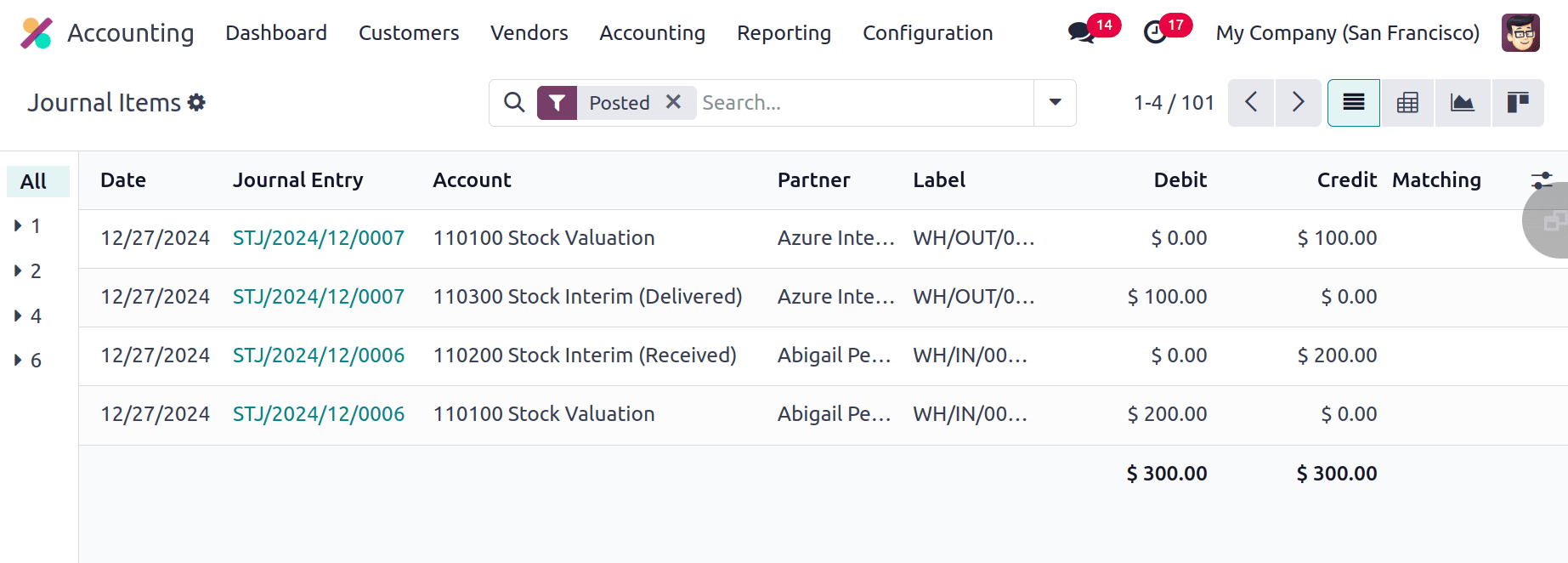

Each journal item can be viewed separately from the Accounting menu. For that users chose the Journal Items. So the list shows all the journal items for the receipt and delivery.

In Odoo 18 inventory management, inventory value is crucial in this way. Odoo 18's stock journals offer an organized method of documenting and monitoring every inventory transfer, guaranteeing accuracy and transparency in-stock operations. They facilitate smooth interaction with accounting procedures and improve inventory management efficiency by automating journal entries.

To read more about What is Inventory Valuation in Odoo 16 Inventory Module, refer to our blog What is Inventory Valuation in Odoo 16 Inventory Module.