Anglo-Saxon is another accounting practice in Odoo 16, where the cost of revenue record on the product is sold out. Generally, only a small community uses Anglo-Saxon accounting around the world. And Anglo-Saxon accounting is only available in the enterprise edition.

Consider a scenario where the purchase of items is made in bulk orders. Say as an example that the manufacturing company purchases its raw materials in bulk. So if we record all the expenses in the income statement, it shows that the company is in loss. To rectify this, Anglo-Saxon accounting is the ideal solution. In Anglo-Saxon, the cost of revenue of an item will be recorded only if the purchased items are consumed for production or sold out, depending on the business.

In this blog, we will be discussing anglo saxon accounting and its ledger posting.

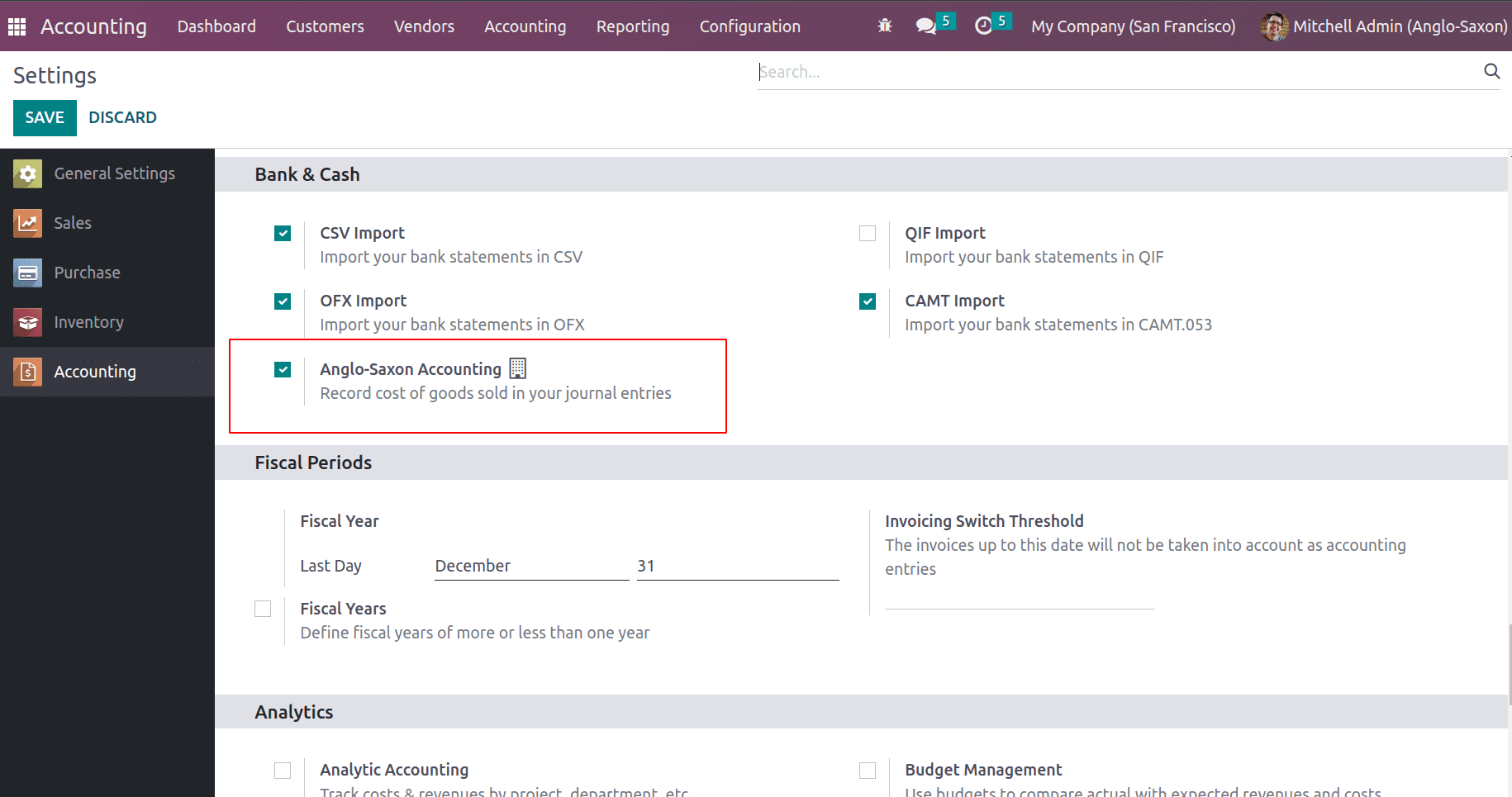

Firstly enable developer mode and ensure that Anglo-Saxon accounting is enabled from the configuration settings of the Odoo accounting module.

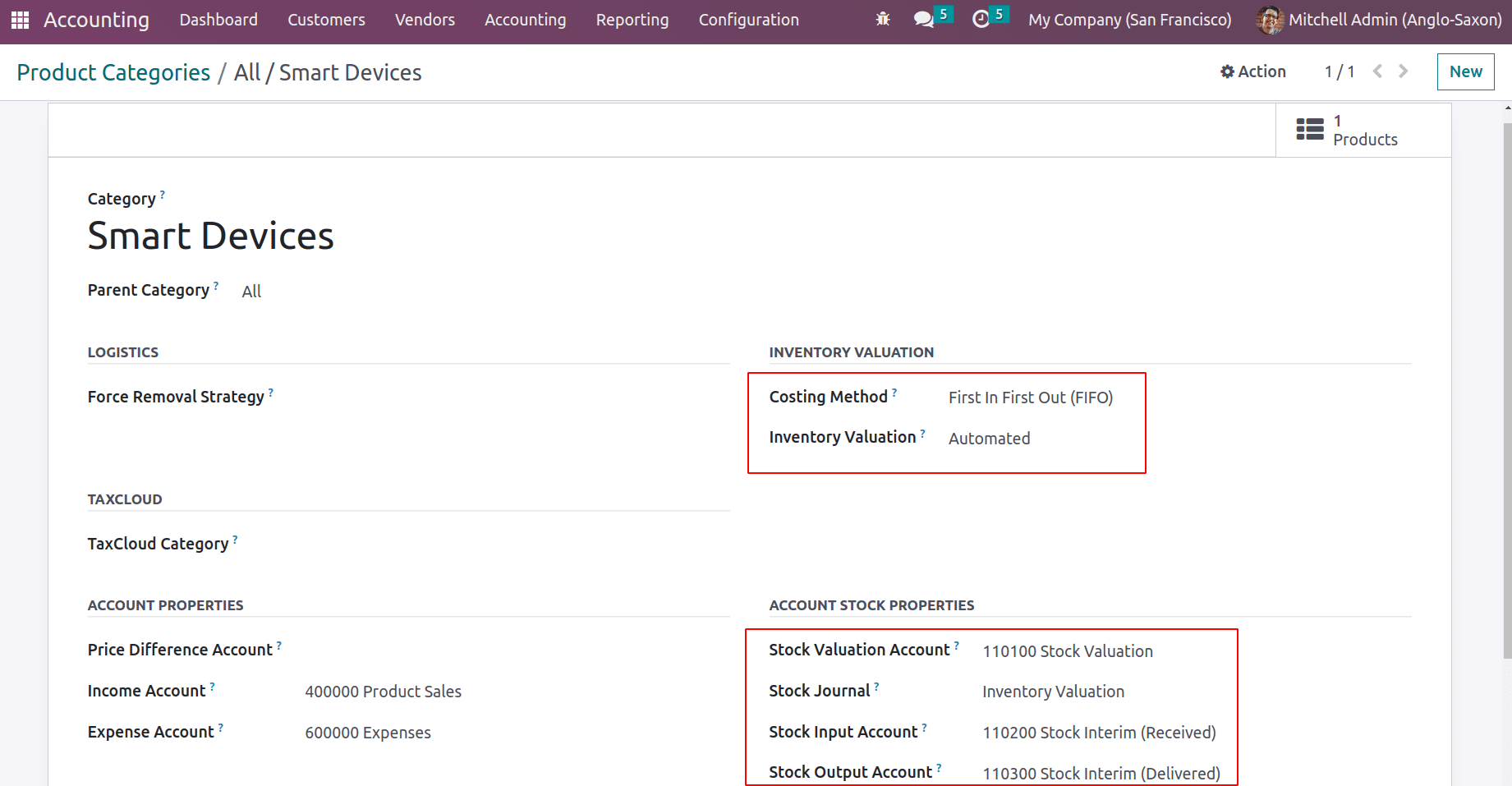

As previously mentioned, in anglo saxon accounting, expenses will be recorded only when the purchased item is sold. While the items are purchased, they are considered as the assets. Thus in this configuration, the inventory valuation must be automated. Go to the product category where you can find the inventory valuation as Automated.

Also, the costing method should be either First in First Out (FIFO) or Average Cost (AVCO).

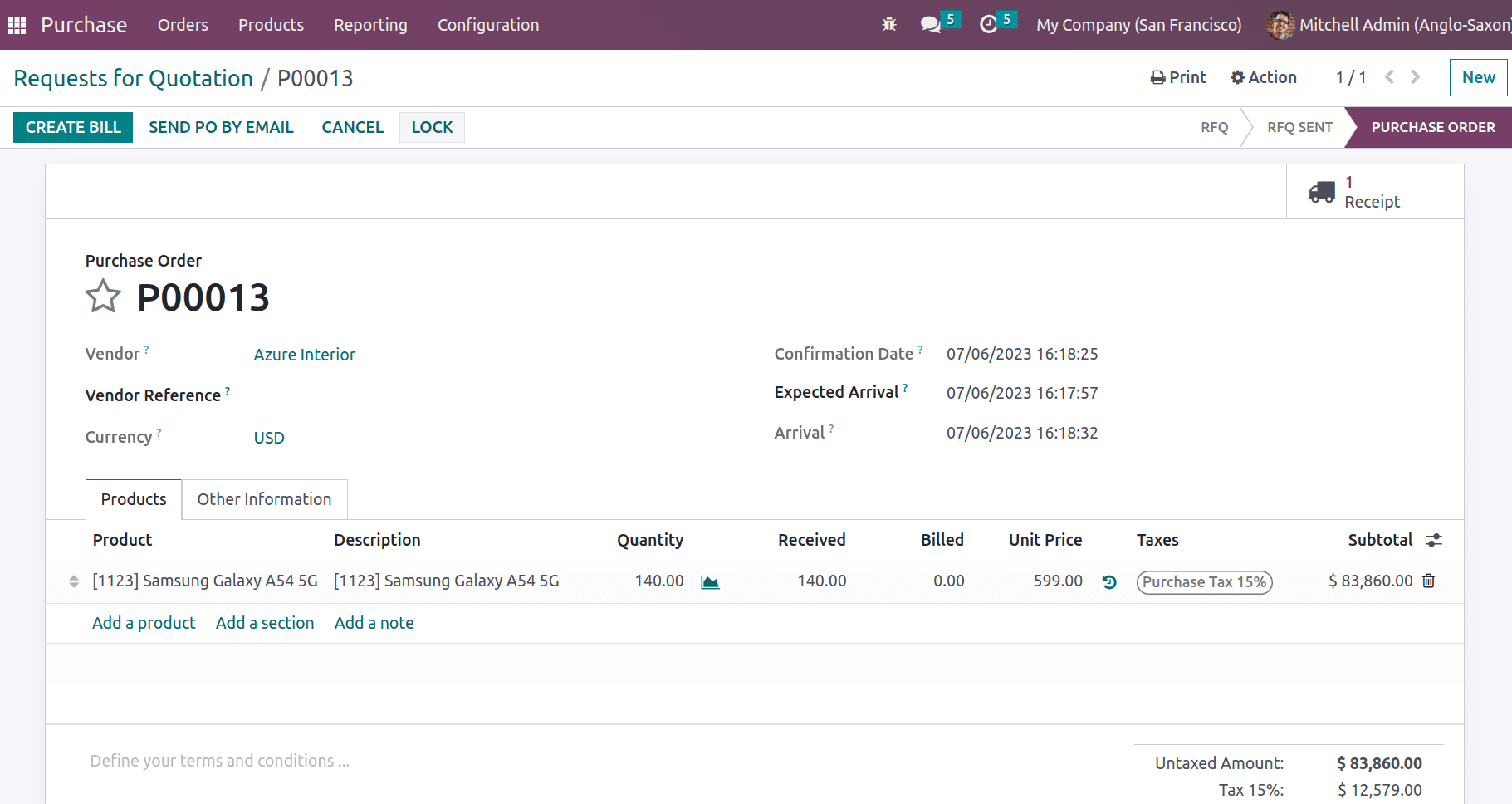

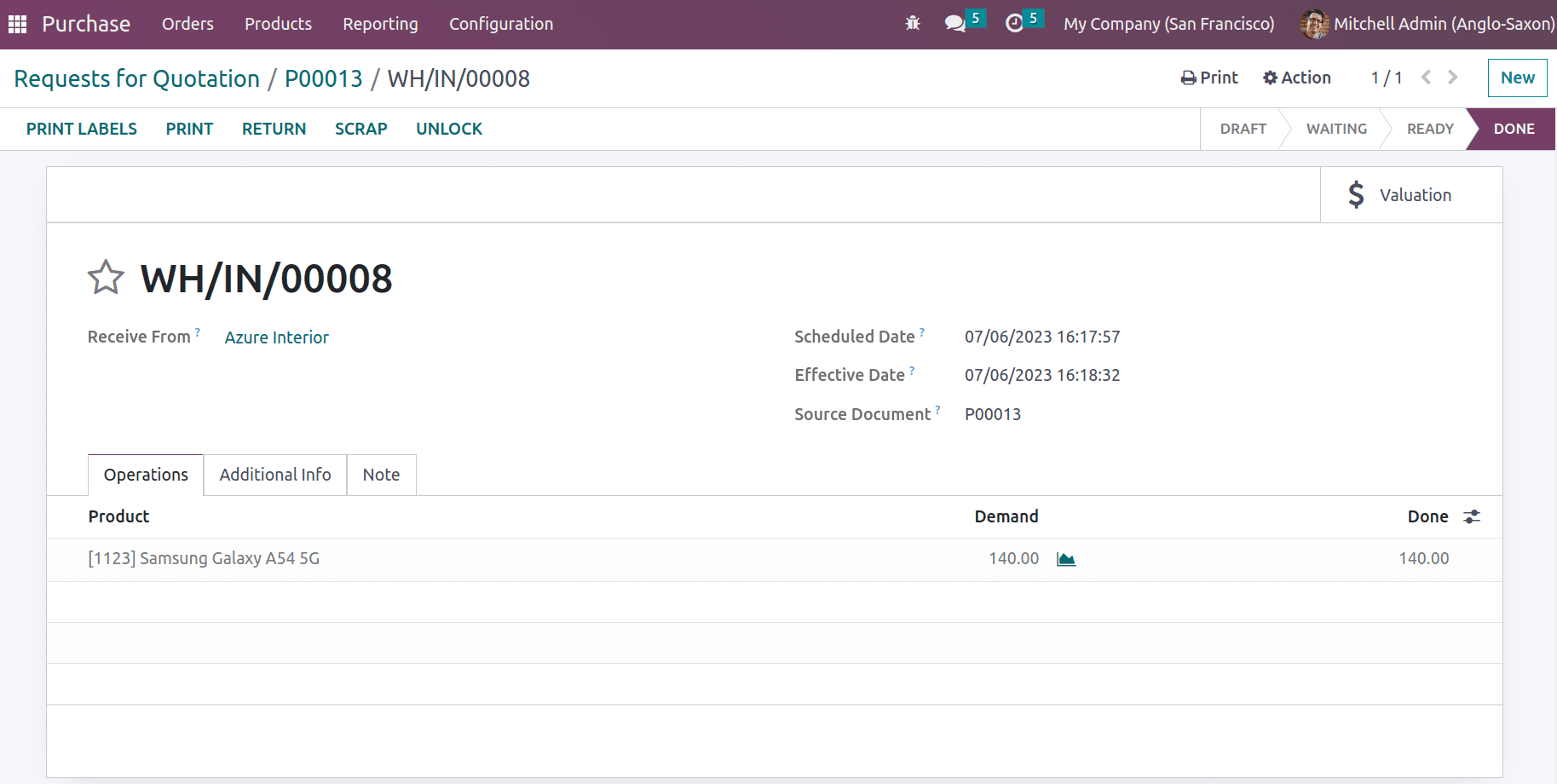

Now let's purchase a product that belongs to this category. The PO creation doesn’t affect the accounts. But when items are received to stock, stock journal entries will be posted.

Creating a PO is for documenting the business transaction ‘buy’ from the vendor. The value of the received stock will be recorded in the ‘stock input account’ upon delivery, also increasing the value of the existing stock as a result.

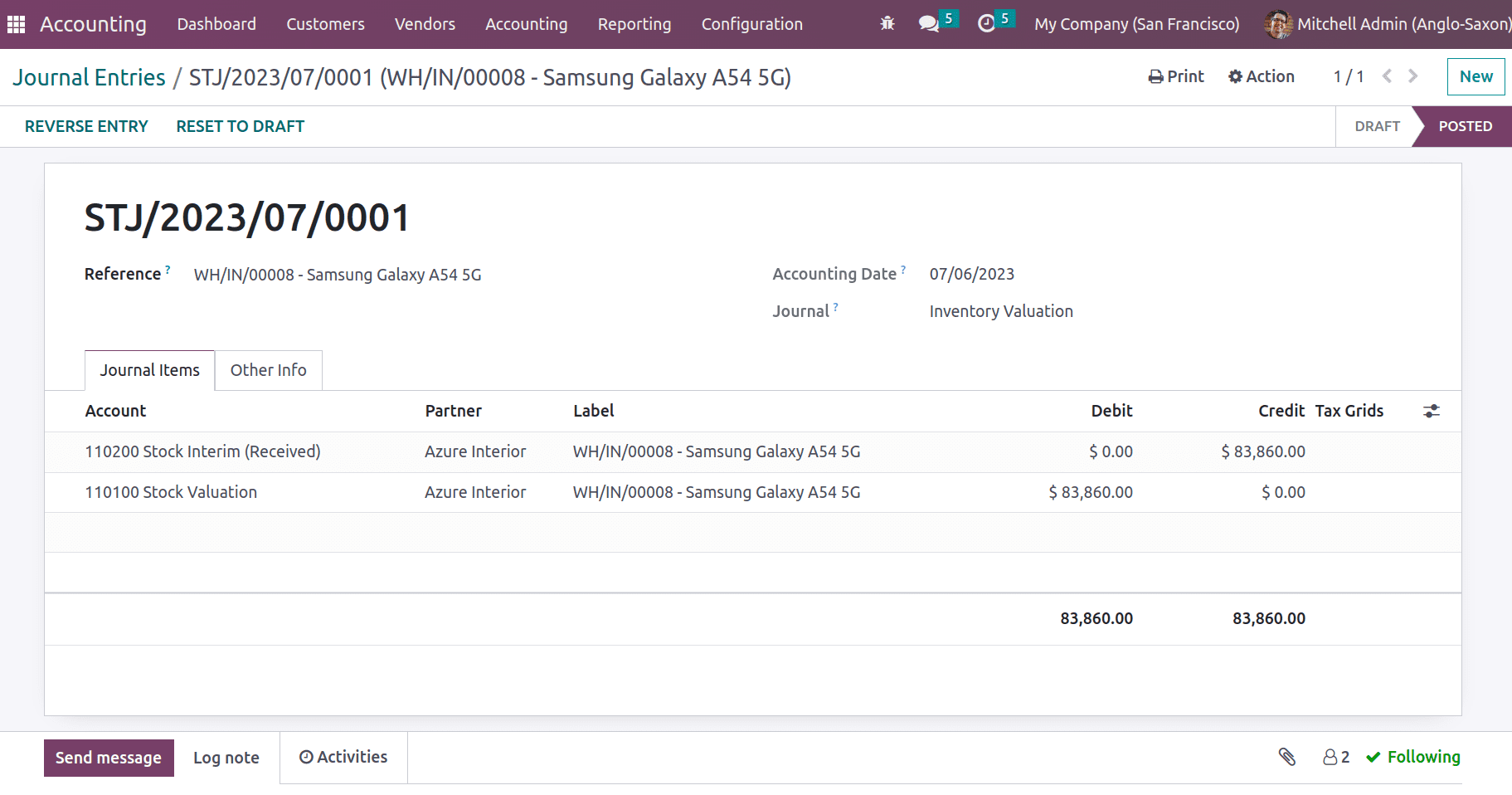

Let's now examine the stock journal.

The stock's nature is regarded as a liability. When the asset increases, the account will be credited in accordance with the asset-liability chart. As a result, the stock valuation account is debited, and the stock interim received account is credited. An account for stock valuation retains the current asset value. Therefore, the stock valuation account is debited when an asset increases.

Note: As per the asset-liability chart, When LIABILITY and INCOME increase account will be CREDITED, and when the ASSET and EXPENSE increase account will be DEBITED.

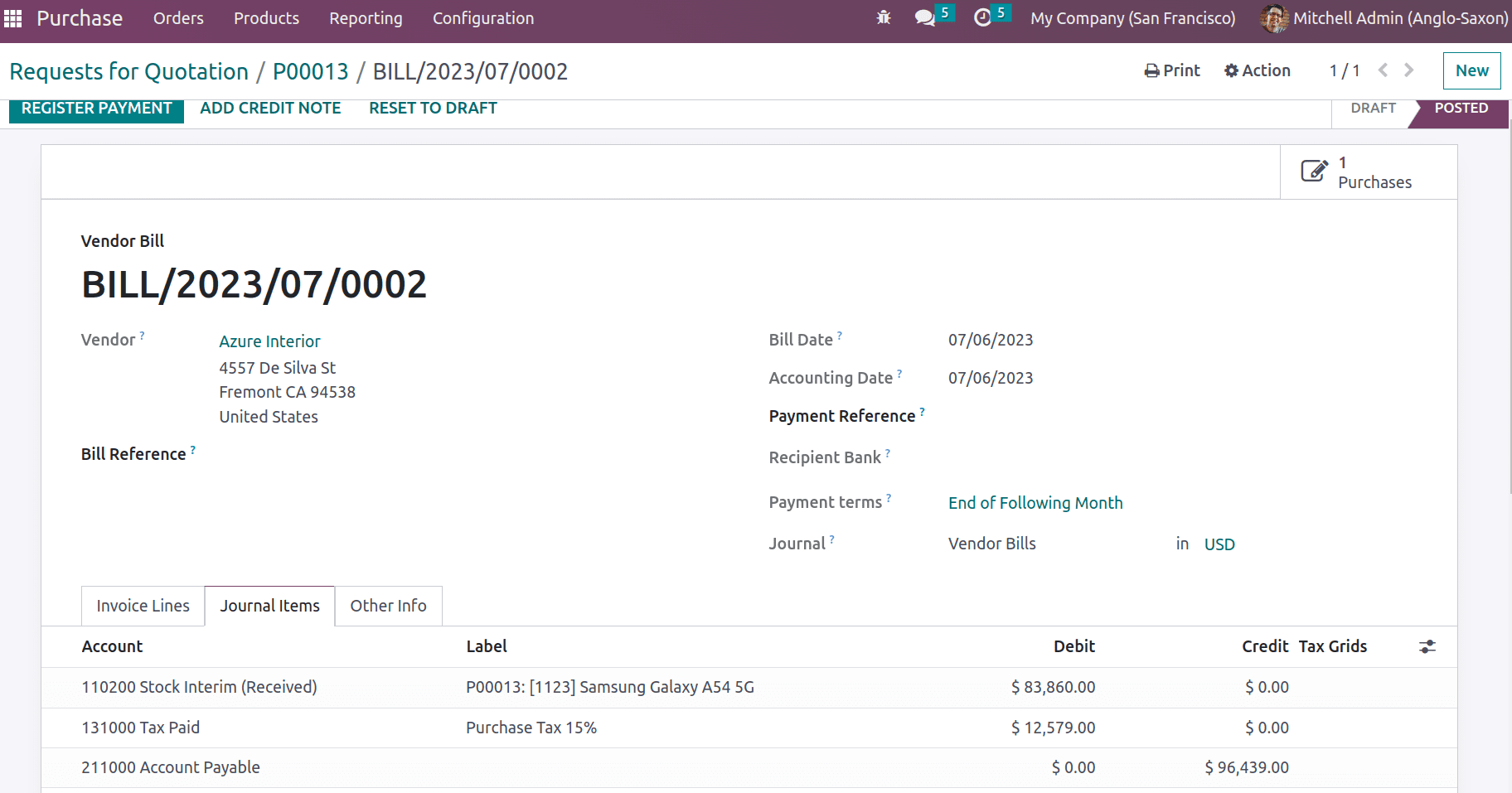

The bill creation for the purchase order is the next step, which will have an impact on the accounting ledgers.

Here is the main difference when it comes to the anglo saxon accounting. Here, the stock interim received account is debited instead of expense. This is because the expense of the purchased item is not recorded in the ledger, instead of it is treated as an asset.

As the asset increases stock interim received account is debited and the tax paid is also debited. The account payable records the amount that needs to be paid to the vendor. Thus it’s a liability and as liability increases account payable is credited.

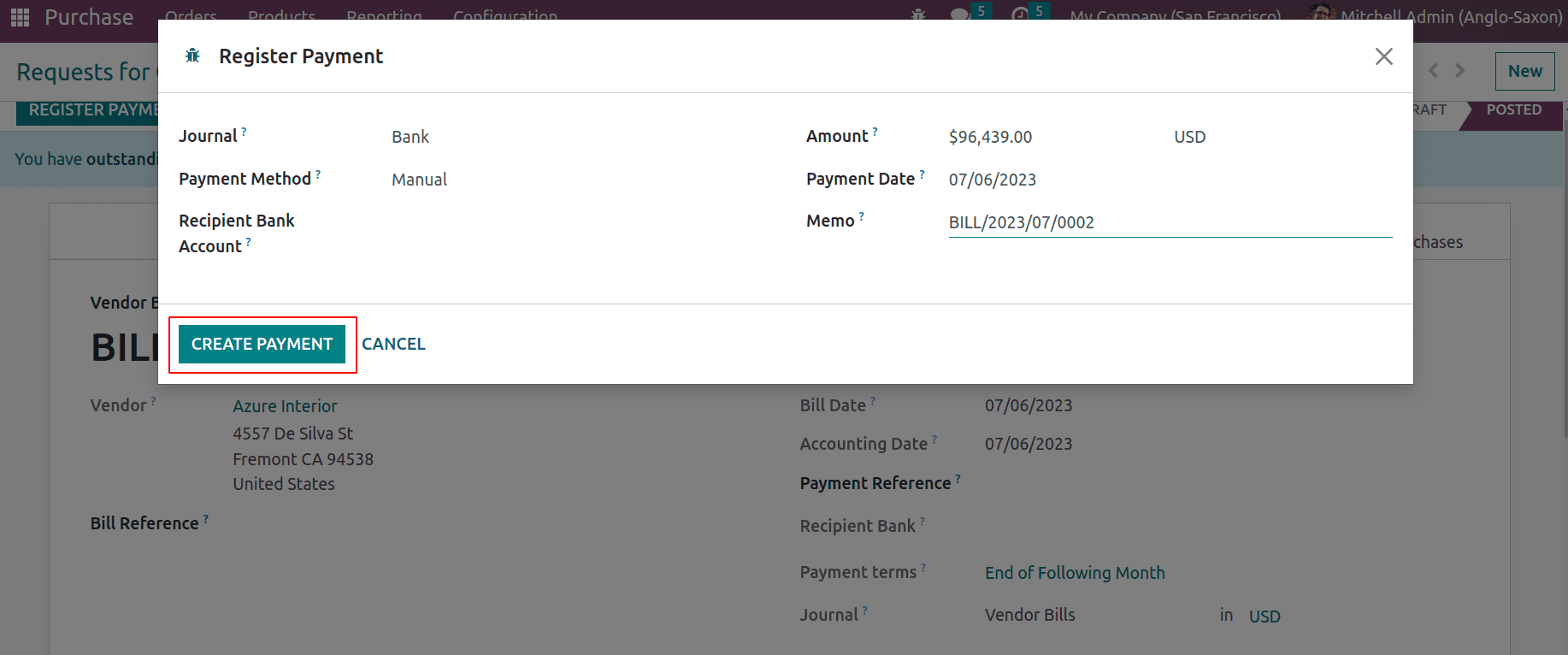

Next is registering payment and the bill status will move to ‘In Payment.

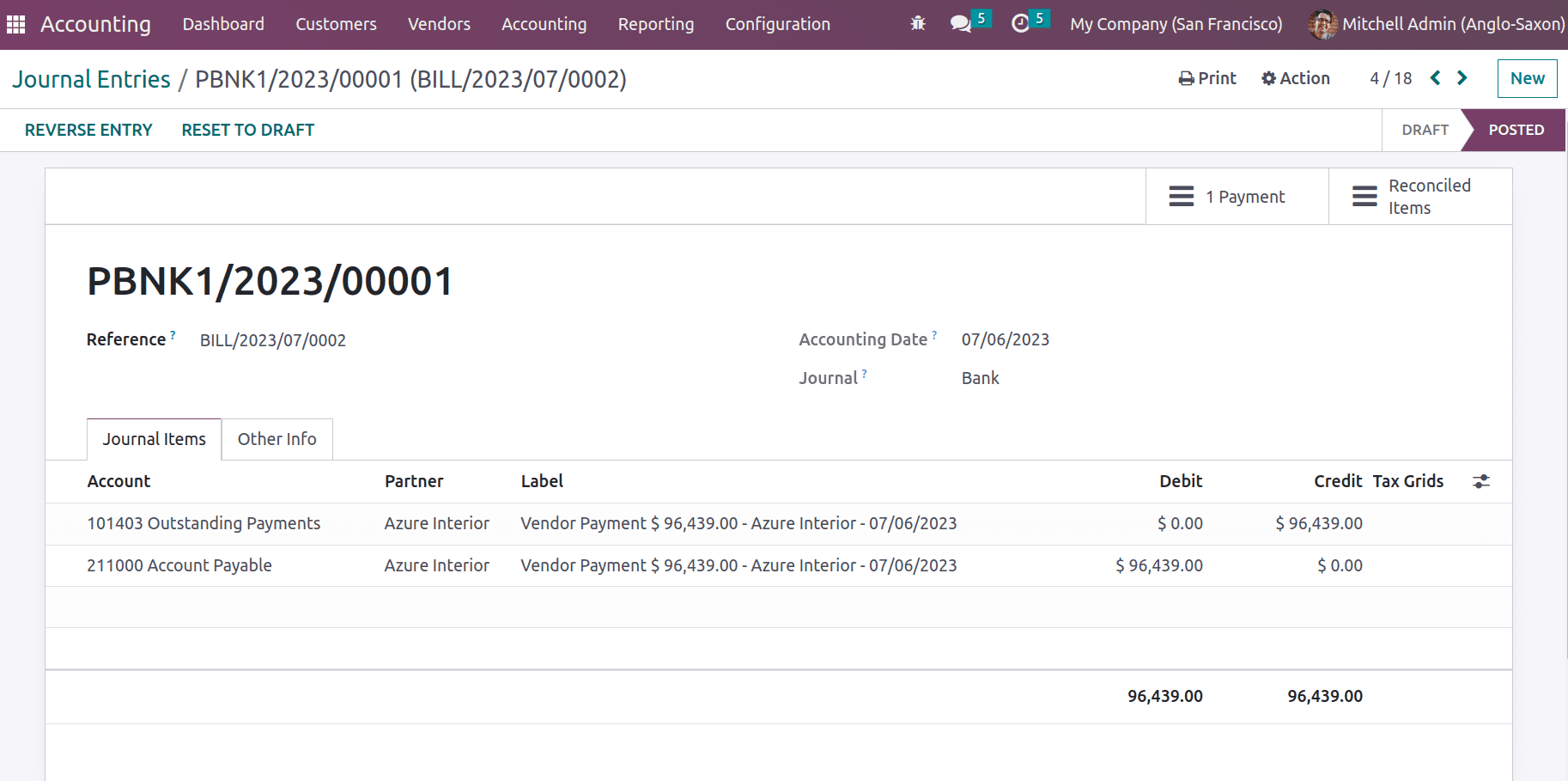

The payment journal entry will be recorded as follows, where the account payable is debited (as liability decreases) and the outstanding payment is credited.

Later this payment can be reconciled with the bank statement. The statement creation, ledger posting, and reconciliation are the same as we discussed in the blog ‘Continental Acocunting in odoo 16’.

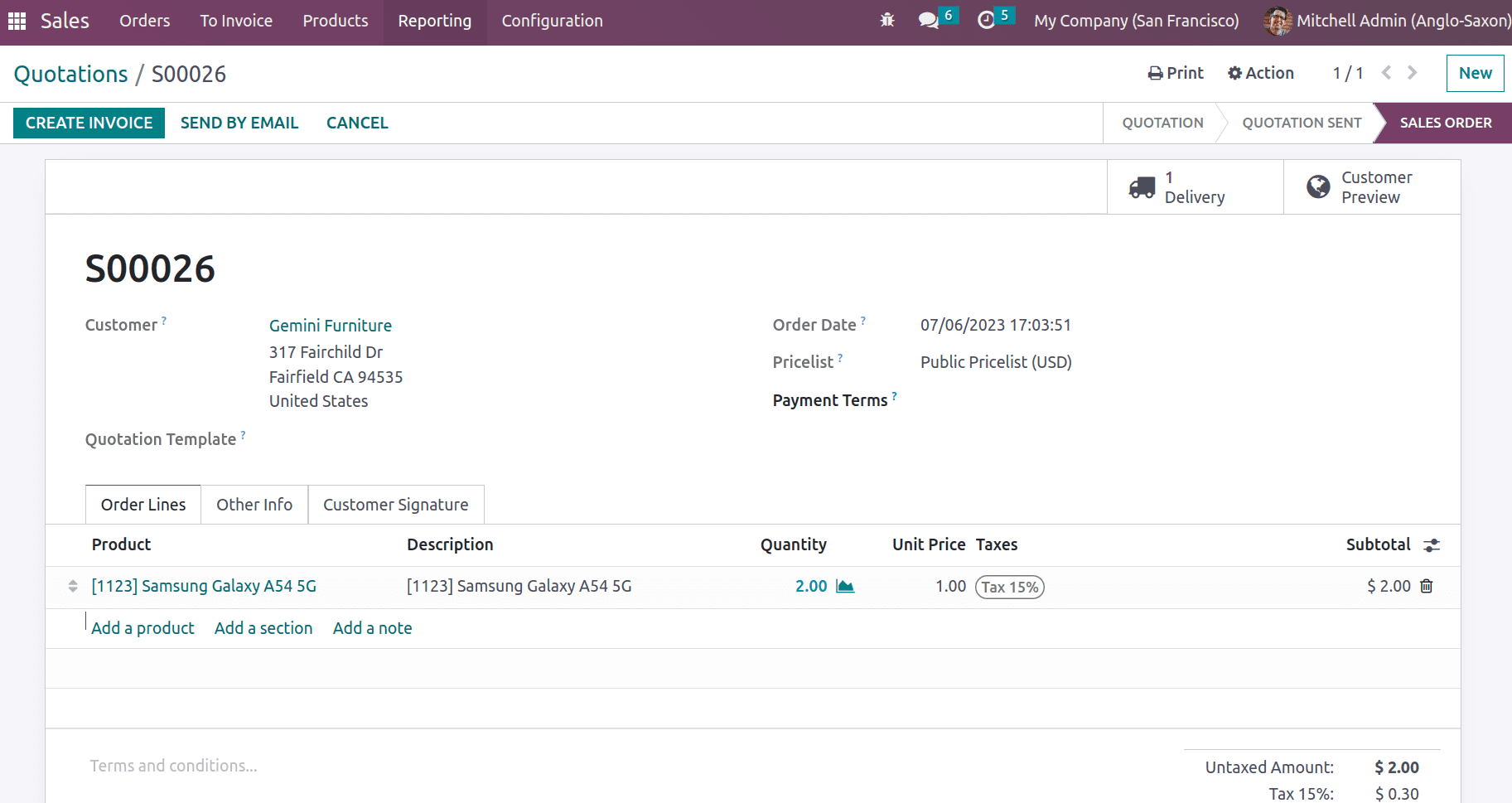

Now let's move to a sales operation for which some items from the purchased goods are sold. Initially, we purchased 140 quantities for $599. Thus it doesn't record the expense, instead, it is kept as a stock worth a total of $96,439. Now 2 quantities are sold.

Creating a sale order is also a document creation, where no accounts are affected.

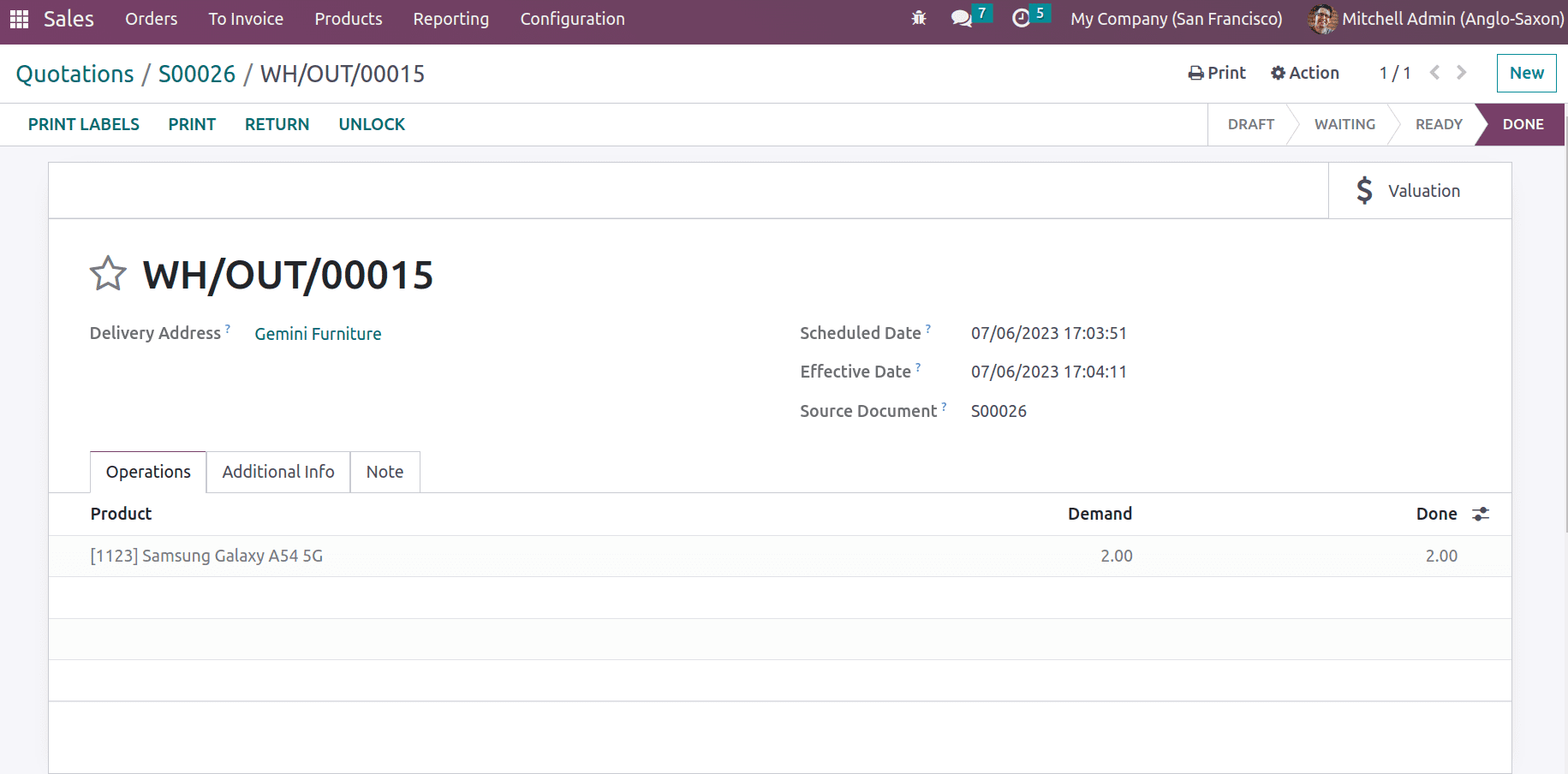

Once the delivery is validated, stock accounts will be affected.

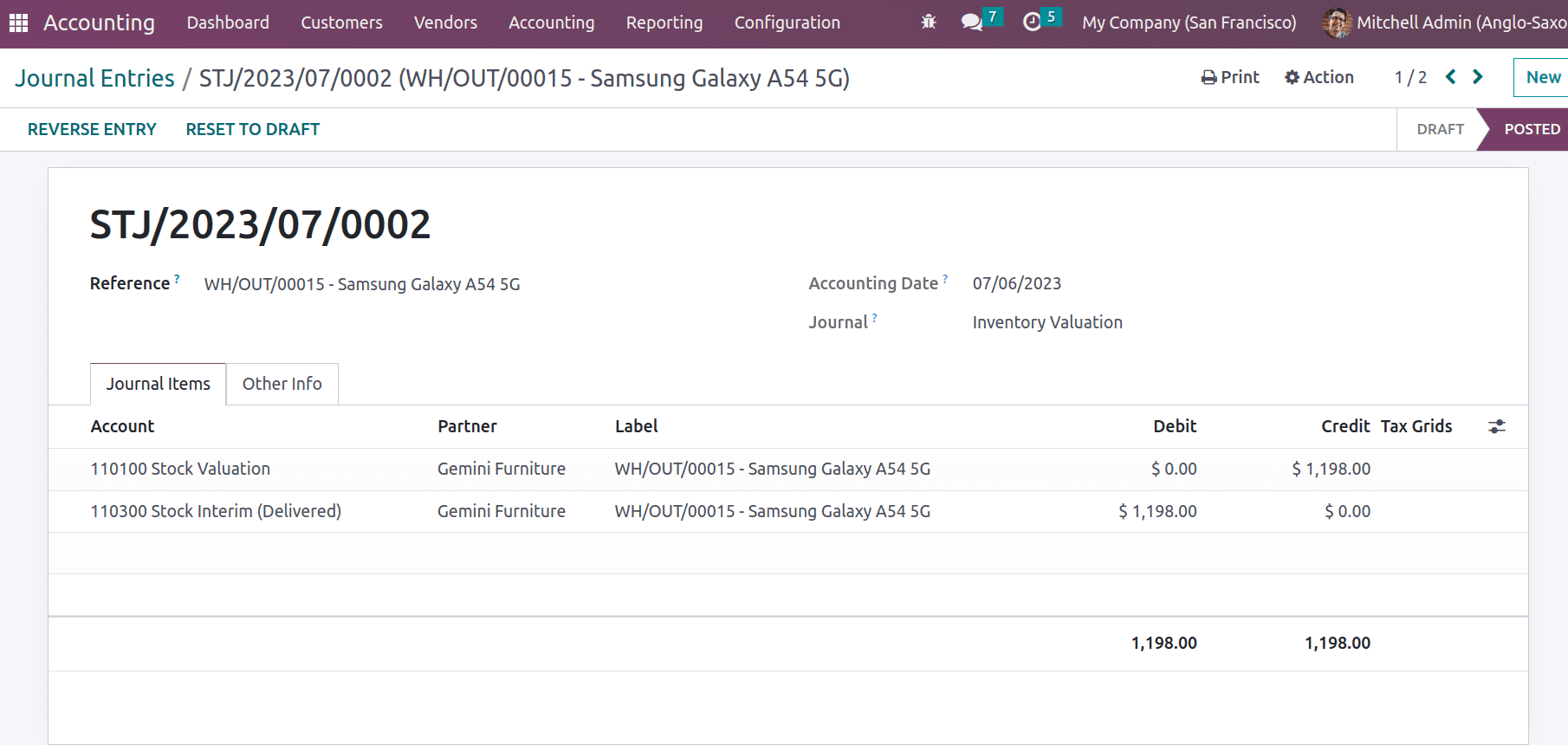

Now let's check the stock journal, where the stock interim delivered account is debited. On a sale operation, the liability is sold out and as liability decreases the account is debited. The stock valuation account whose nature is an asset. If products are sold out current stock value decreases, which means the asset decreases and hence the account will be credited.

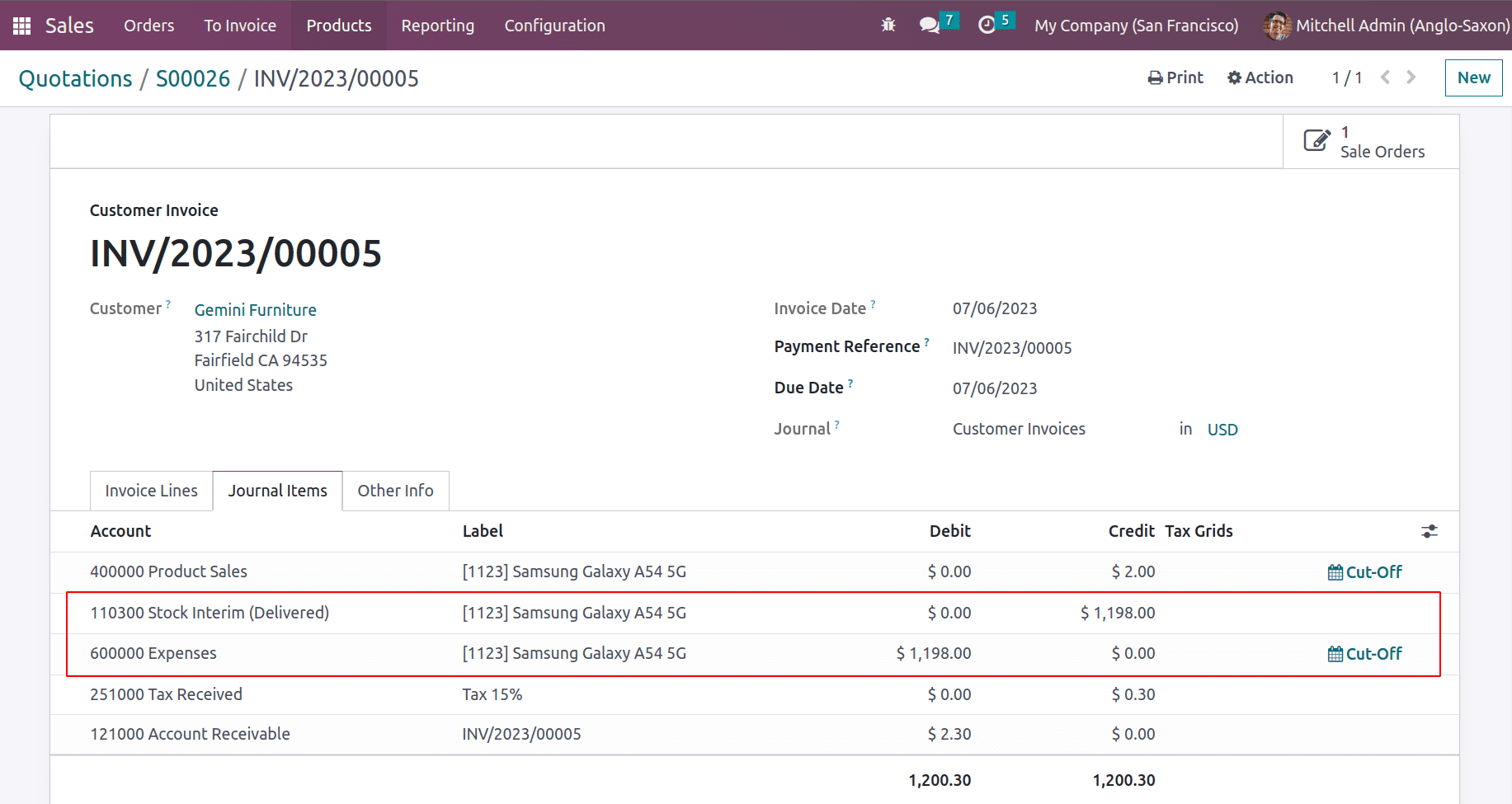

Here the sold items are only worth $1198. Now create an invoice for the order and on posting the invoice, you can find the expense will be recorded in the ‘Expenses’ ledger.

Here ‘Product Sales’ is the income account, and as income increases, it is credited. Then comes the stock interim delivered. This time the stock out is shown and it is taken as expenses. That’s why stock interim delivered is credited and expense is debited (expense increases). Here at this point, the expense is recorded in the anglo saxon accounting.

The ‘tax received’ is also credited since the liability increases. Then the account receivable, which is an asset, and as the asset increases, it is debited. Later this invoice can be paid and reconciled. The remaining process and ledger posting are similar to that explained in continental accounting. You can refer to the blog.

This is how Anglo-Saxon Accounting works in Odoo 16 accounting module. It records the purchased item as assets and when the product is sold out or consumed, then only the expense is affected.