Switzerland is renowned for its complex financial regulations and multilingual environment, which can pose significant challenges for businesses. Odoo 17, a leading ERP platform, has tailored its accounting functionalities to meet these specific needs. We can look into how Odoo 17 addresses Swiss accounting standards, including compliance with local VAT regulations, adherence to Swiss GAAP, and other key requirements unique to the Swiss market. By leveraging the tools and features designed for Switzerland, businesses can ensure accurate financial reporting and manage operations efficiently.

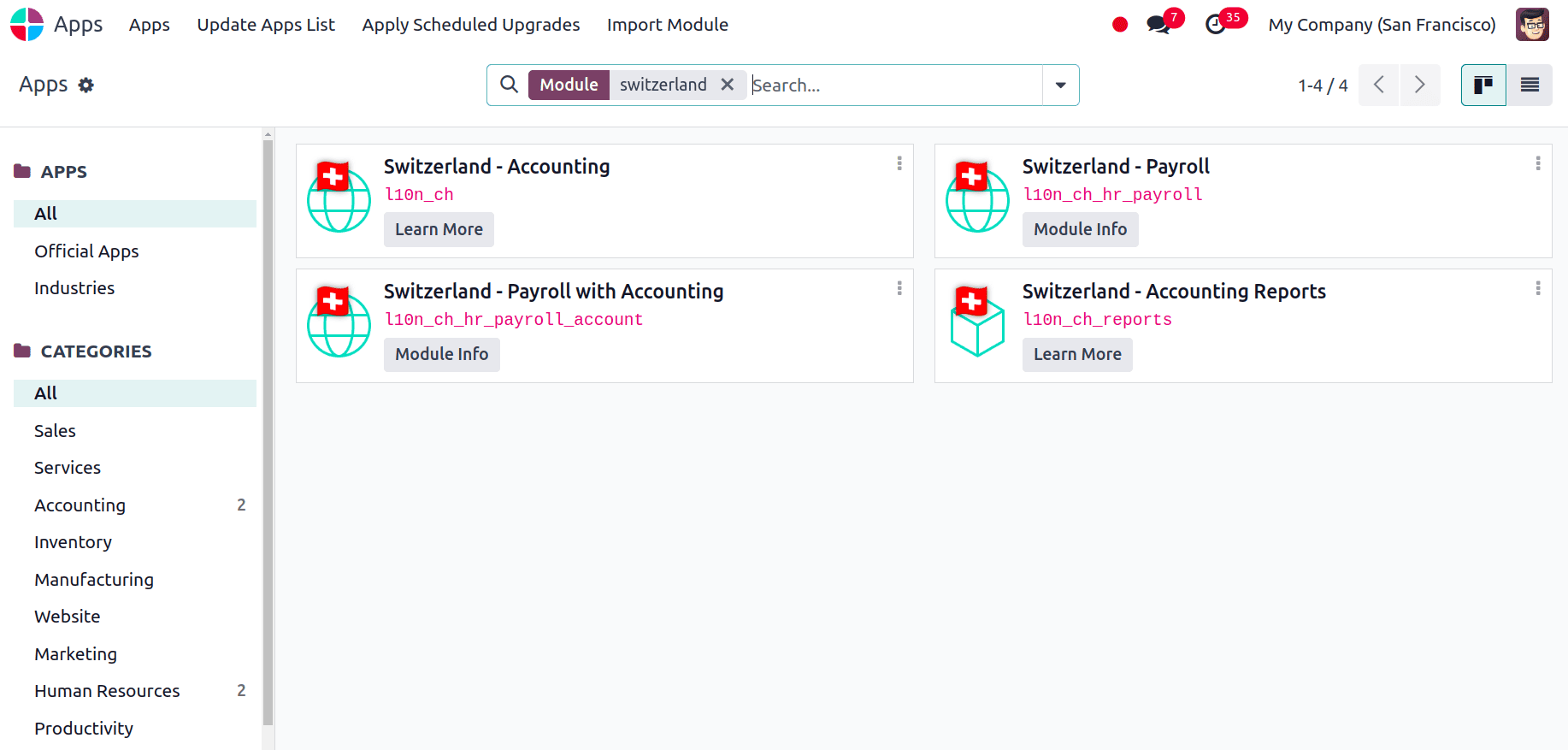

To get the Switzerland accounting localization in Odoo 17, either we can select the Country as Switzerland when we create the database or we can install the accounting localization modules. For that, navigate to Apps and search for the required localization modules.

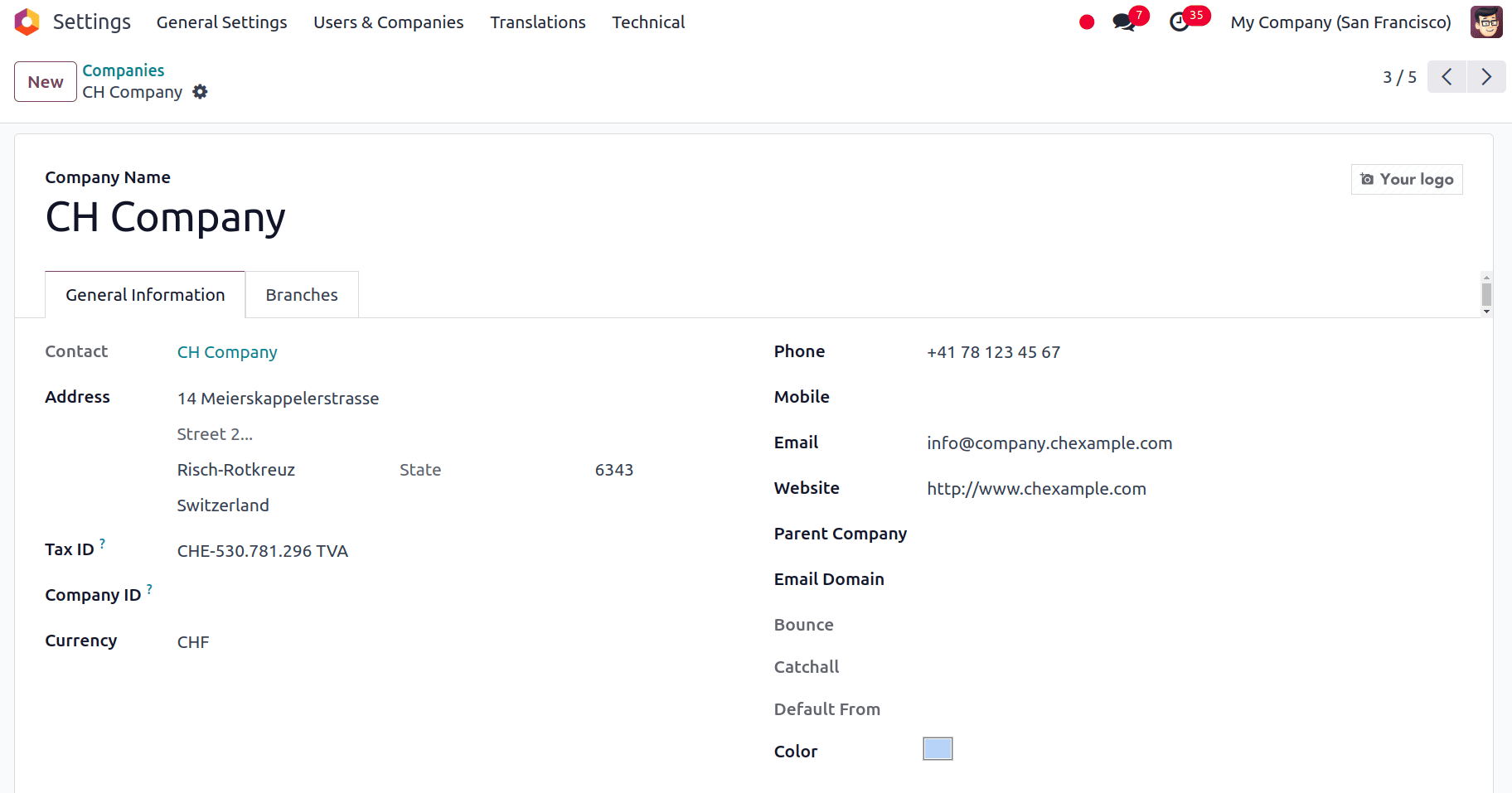

In order to ensure correct data and functionality in Odoo, it is essential to confirm the current company setup, or we can create a new company with the correct details if required. Important information about your company is established by this setting. Navigate to Settings > Users and Companies > Companies, and select the company for which we want to check the configuration from the list of companies.

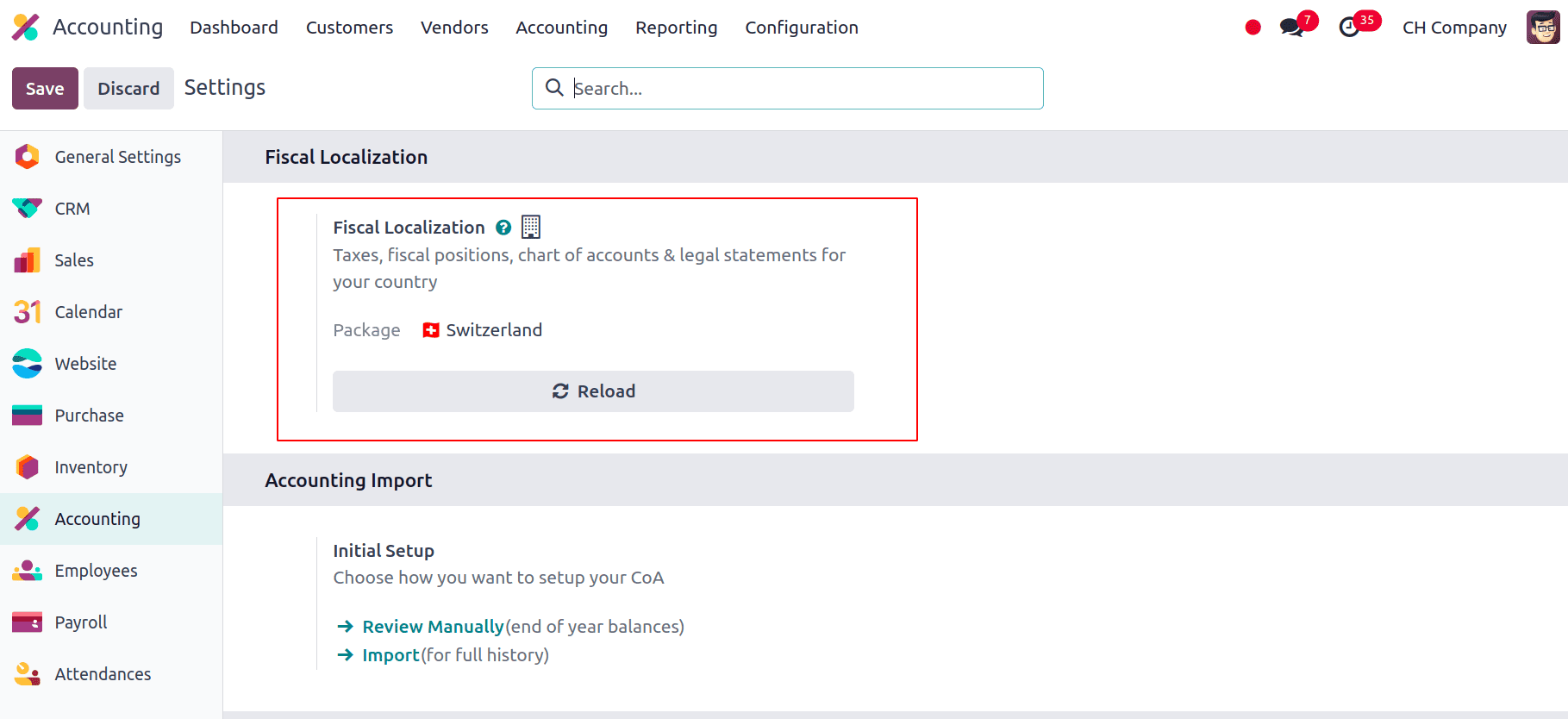

After installing the Switzerland localization and ensuring the correct company details, we can go to the configuration to view the changes for this localization. Navigate to Accounting > Configuration > Settings, and we can see that the fiscal localization will be set to Switzerland.

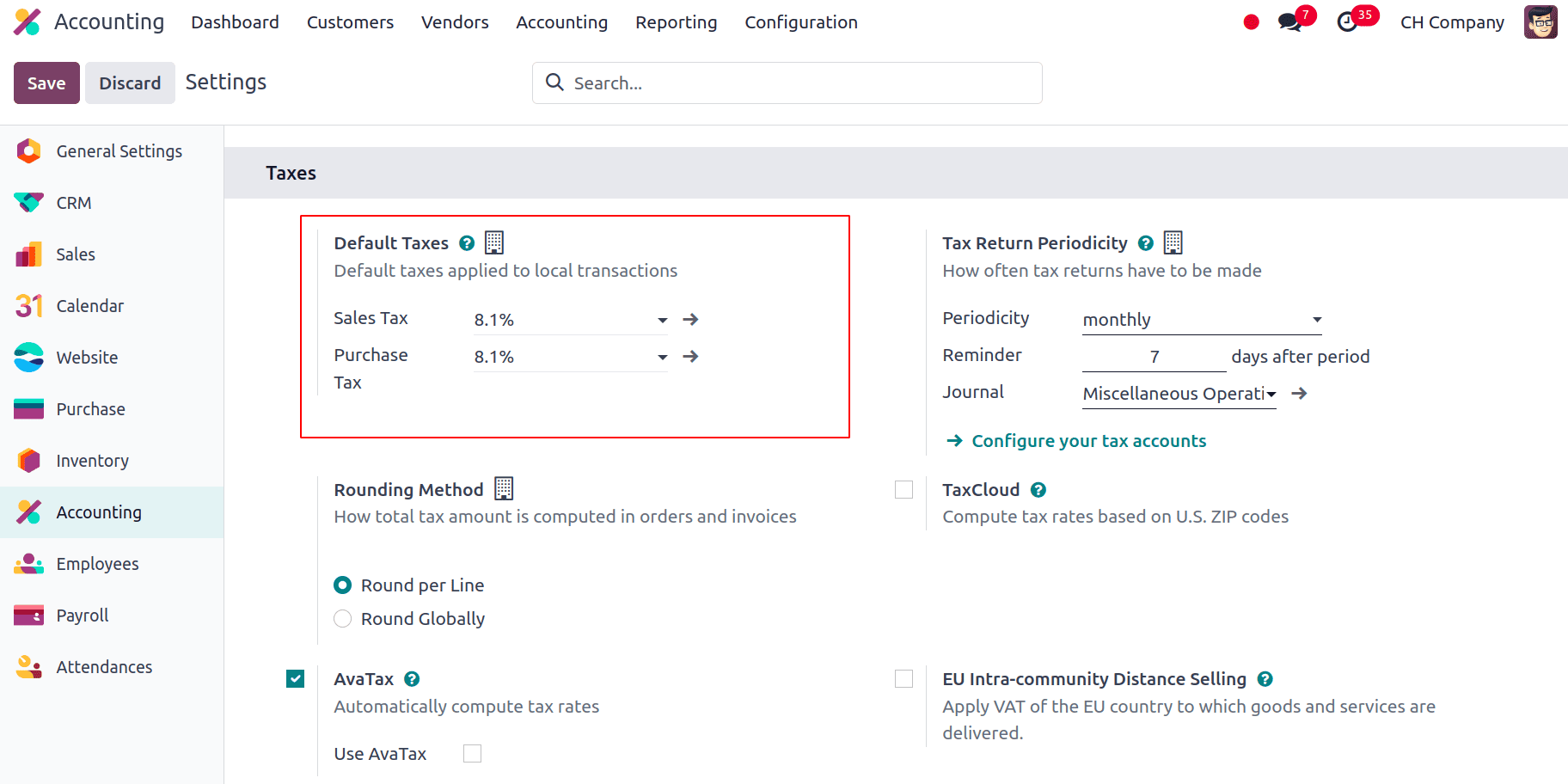

And under the Taxes section, we can see the Default Taxes. Default taxes are predefined tax settings that are automatically assigned to transactions based on the selected tax category. These settings help ensure accurate tax calculations and simplify the invoicing process by applying the correct tax rates according to predefined rules. So when we install the Switzerland Accounting Localization, the default tax will be set according to the country’s localization. Here it is set as 8.1% for the Sales and Purchase Tax, which will be applied for all the transactions by default.

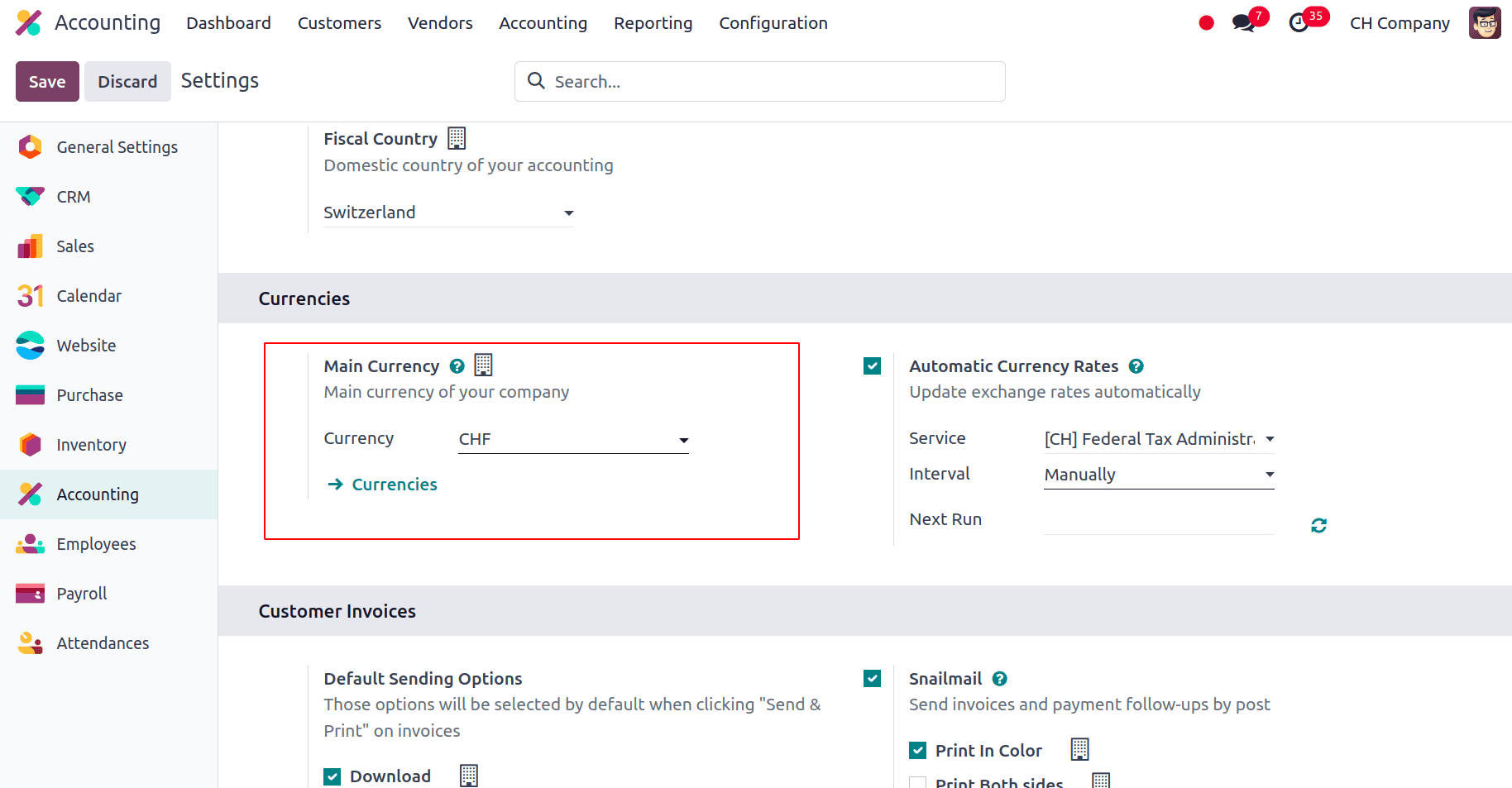

Also, under the Currencies section, the Main Currency by which all the transaction takes place for the company will be set to Swiss franc (CHF) which is the official currency of Switzerland.

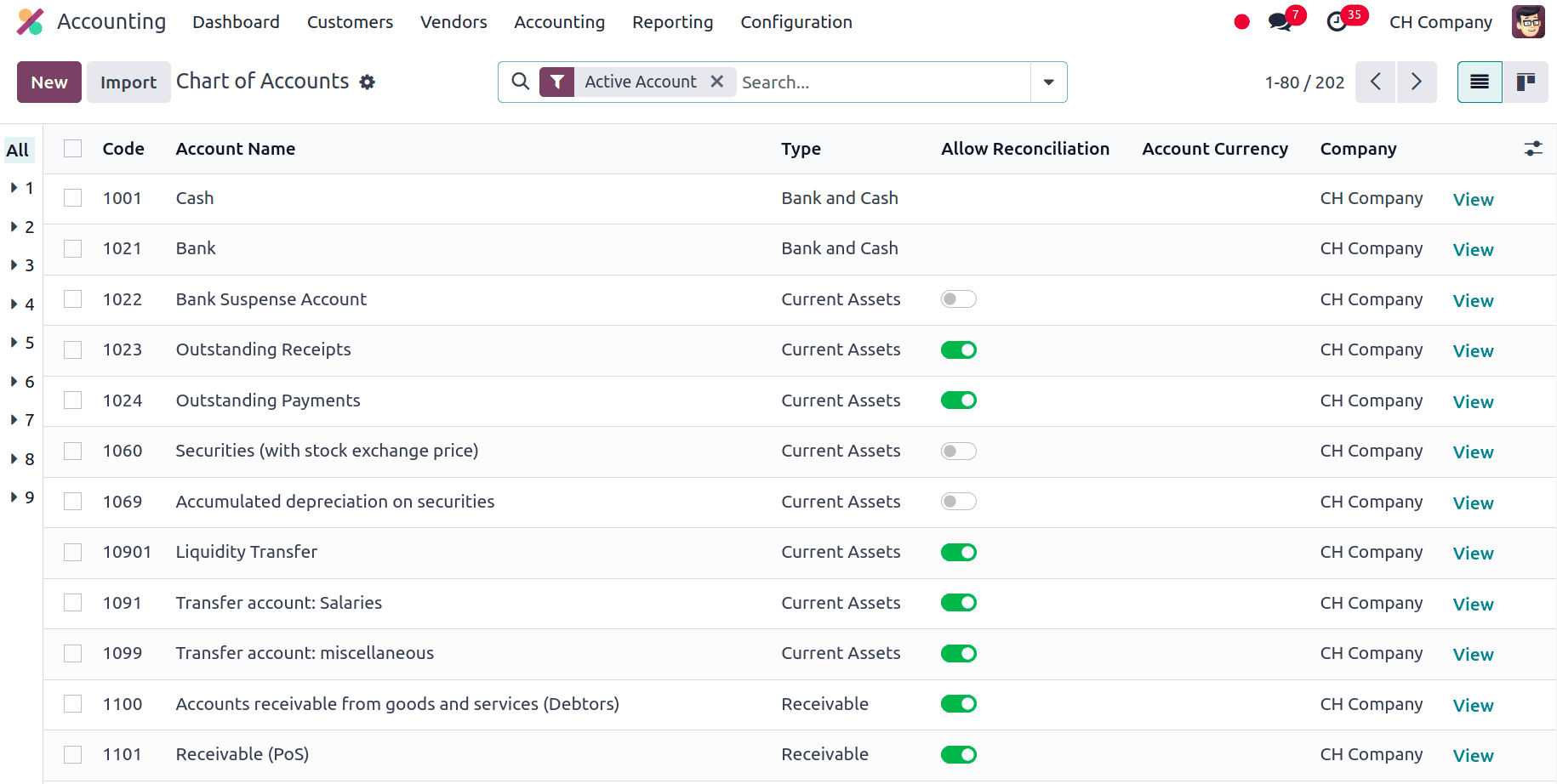

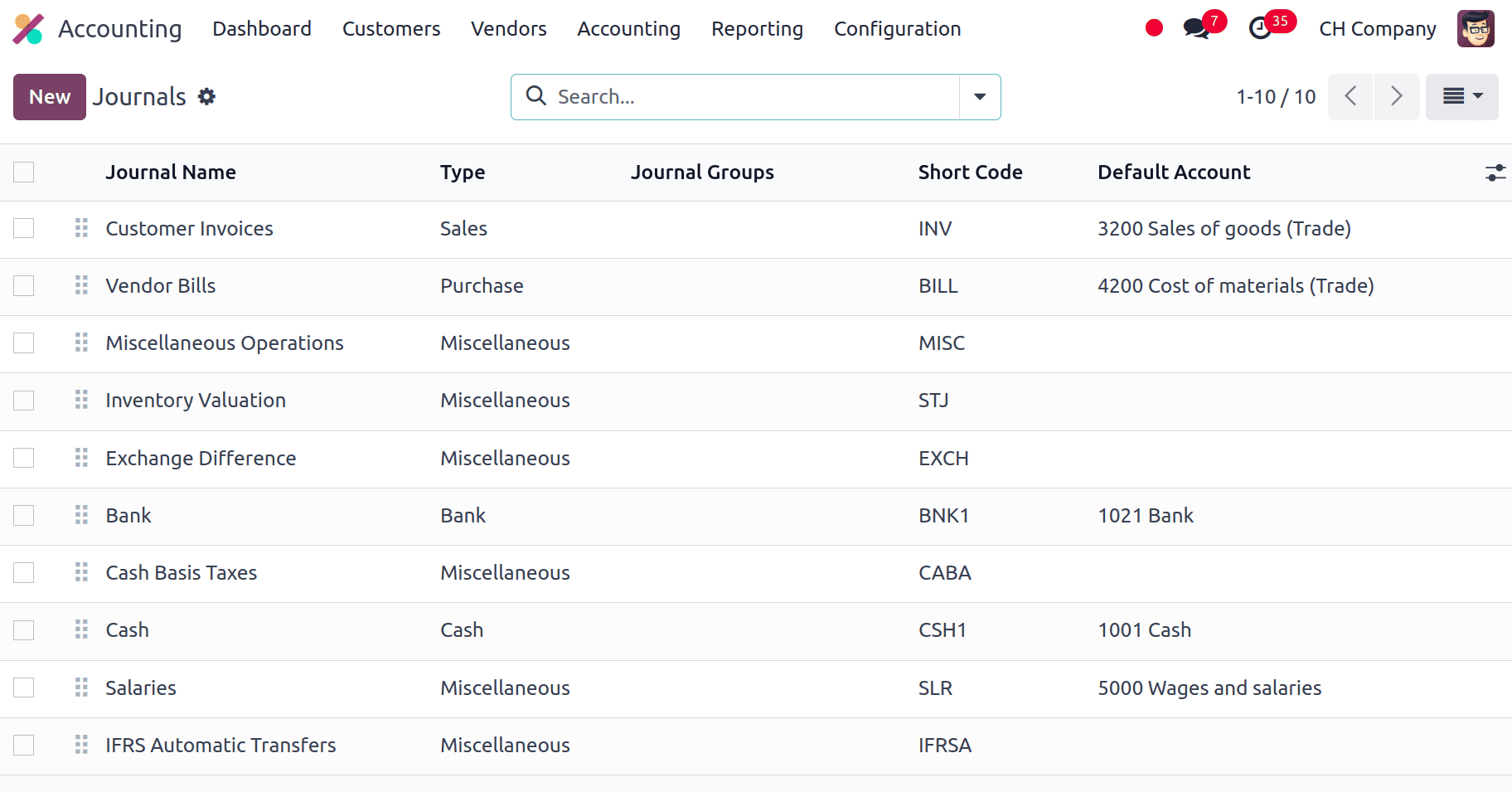

We can look into the Chart of Accounts and Journals that is set with the installation of Switzerland Accounting localization

* Chart of Accounts: Chart of Accounts is basically a structured list of all financial accounts used by a business to record transactions. It organizes accounts into categories such as assets, liabilities, income, and expenses, providing a framework for systematic financial reporting and management. Here all the basic Chart of Accounts are included along with some of the accounts tailored for performing the Accounting transactions of Switzerland easily like Input Tax (VAT) receivable on investments, other operating expenses. It is the VAT that a company pays on its purchases or expenses as receivable, and it may be able to recover this VAT from the tax authorities. This account keeps track of VAT on purchases made for business purposes, including investments and running costs. Payments made in advance for raw materials prior to their receipt or invoicing are tracked using the Downpayment on Raw Material account in the Chart of Accounts. In the procurement process, this account is essential for tracking and managing prepayments and there are many other such accounts too.

* Journals: In Odoo, journals are records used to categorize and track financial transactions. They organize entries into specific types, such as sales, purchases, or bank transactions, ensuring accurate and systematic accounting within the system. In the Journals we have the Salaries Journals, the Salaries Journal is a specialized journal used to record and manage all transactions related to employee salaries. This journal helps ensure that payroll entries are accurately documented and compliant with Swiss accounting standards. IFRS Automatic Transfers Journal which is used to manage and automate the process of transferring financial data and adjustments in accordance with International Financial Reporting Standards (IFRS). This journal is particularly useful for businesses that need to ensure compliance with IFRS accounting principles, which are applicable internationally and in Switzerland for certain entities.

Key Features of Odoo 17 for Swiss Accounting

Efficient Management of ISR Payment Slips

In Switzerland, ISR (In-payment Slip with Reference number) payment slips are widely used for processing payments. Odoo 17 simplifies this process by allowing you to print ISR slips directly from customer invoices. Here’s how it works:

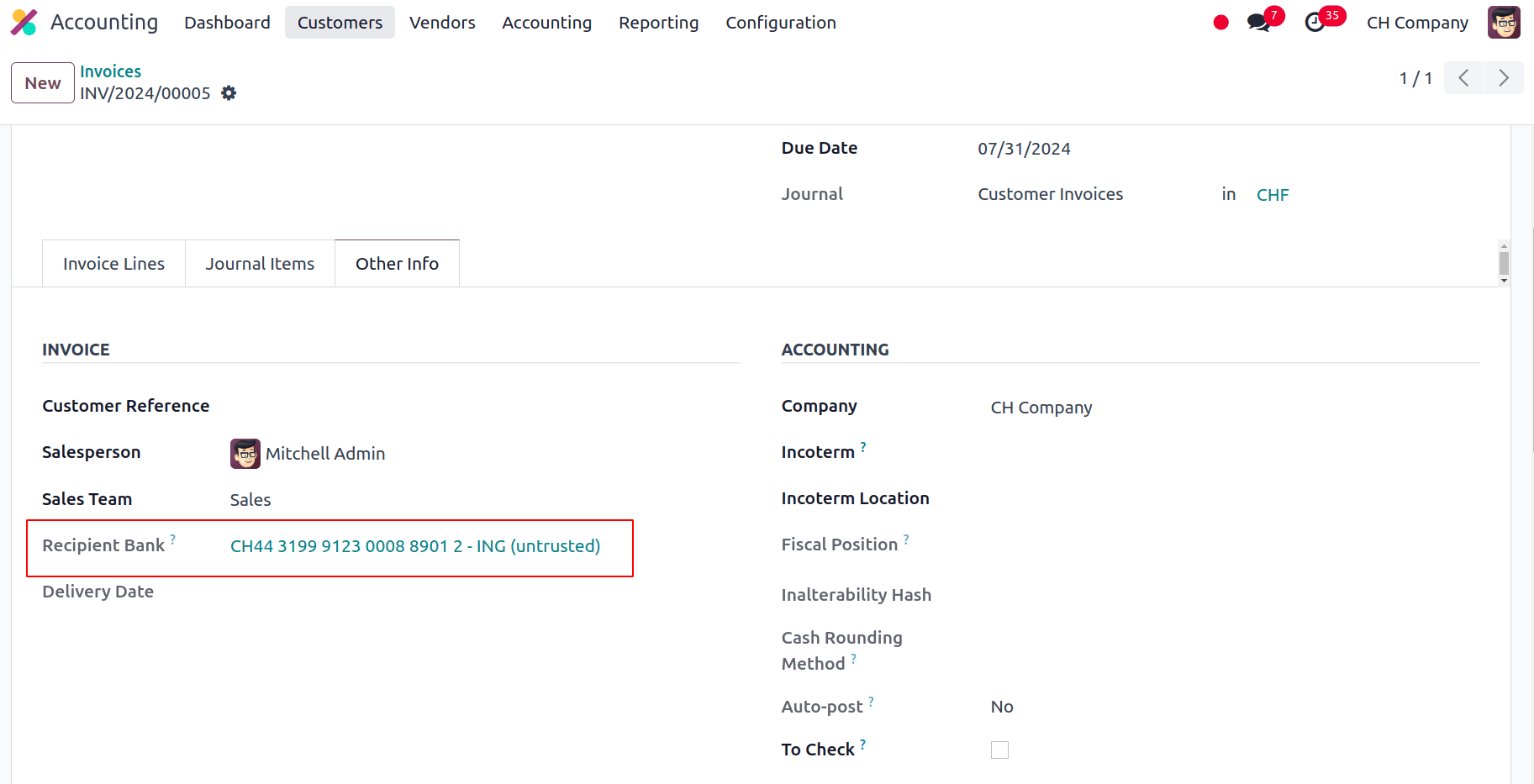

* Printing ISR Slips: On the customer invoices, there is a button labeled "Print ISR." This feature enables us to generate ISR slips for easy payment processing. This button will only appear if a bank account is specified on the invoice.

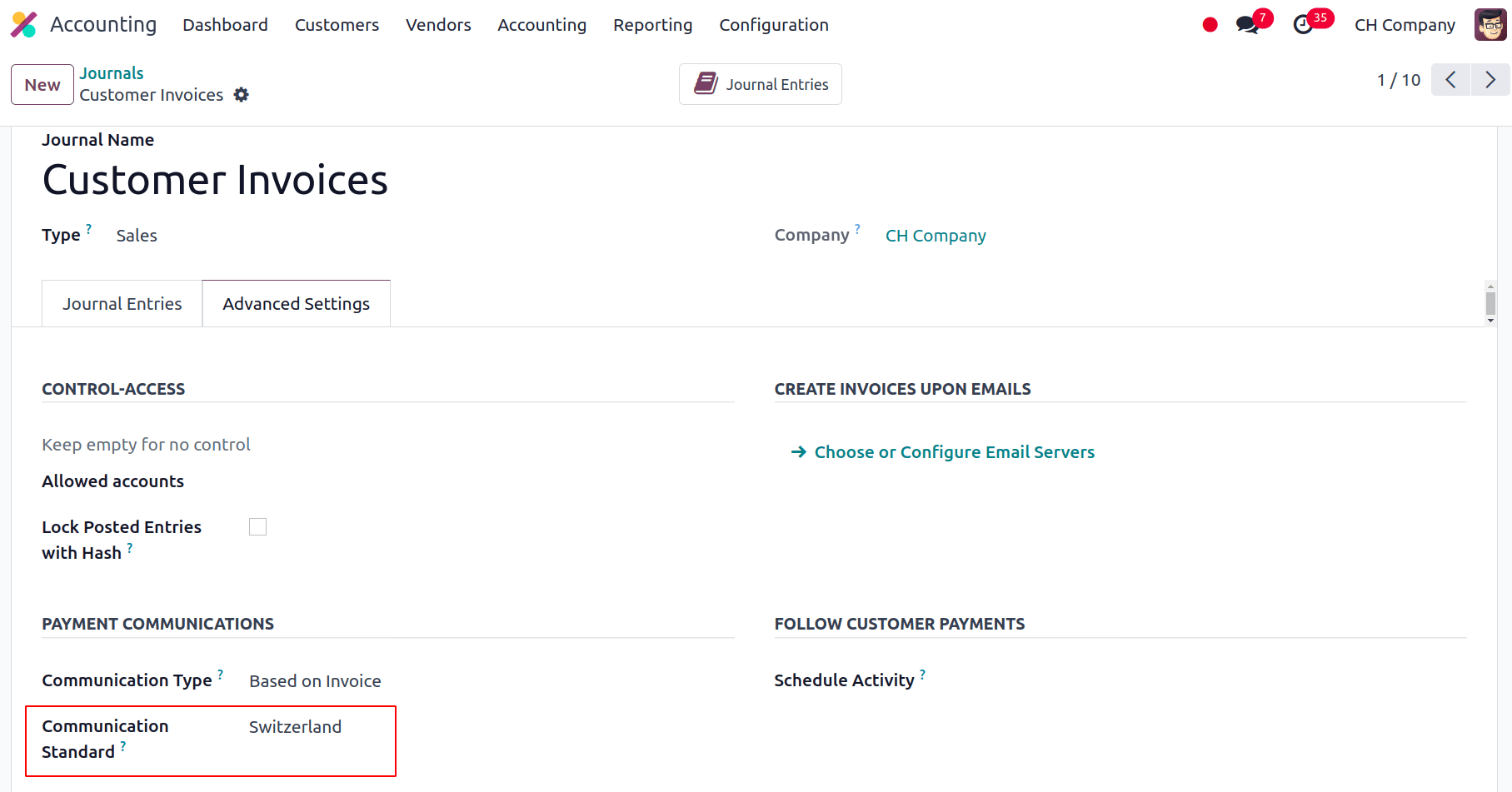

* Adding ISR References: To facilitate easier reconciliation, we can include our ISR reference as a payment reference on invoices. Configure this by navigating to Accounting > Configuration > Journals, select Customer Invoices, and there we can edit it. Under the Advanced Settings tab, set the Communication Standard field to "Switzerland" and save the changes.

Currency Rate Updates and VAT Adjustments

1. Currency Rate Updates:

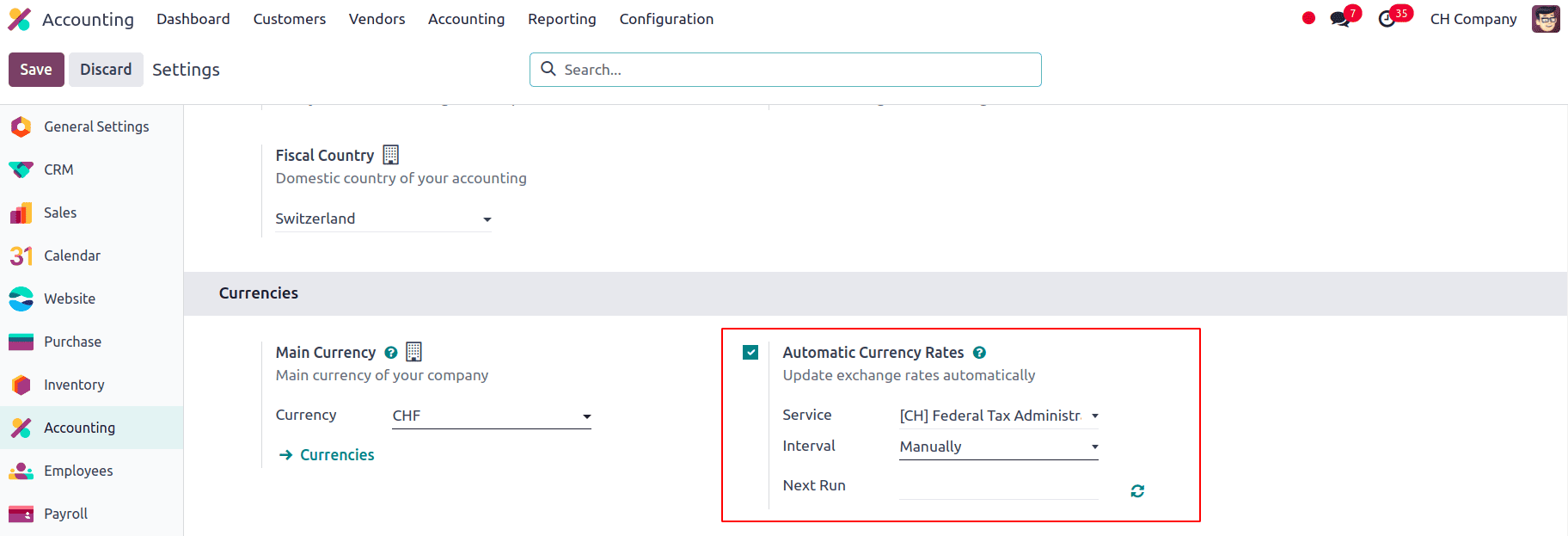

To keep your currency rates up-to-date, Odoo 17 integrates with the Federal Tax Administration of Switzerland. Navigate to Accounting > Settings, and under Currencies, we can select the preferred update service to ensure accurate currency conversions.

2. VAT Rate Changes:

As of January 1, 2018, Switzerland implemented new VAT rates:

* Standard VAT Rate: Reduced from 8.0% to 7.7%.

* Reduced VAT Rate for Hotel Sector: Adjusted from 3.8% to 3.7%.

These changes affect how businesses record VAT on sales and purchases, and it's essential to update our Odoo system accordingly to reflect these new rates.

* Check Your Odoo Version: Ensure you are using Odoo 17 or later. For users on version 11.1 or higher, the VAT rate updates may already be integrated into your system.

* Update the Relevant Module: For earlier versions, you need to update the "Switzerland - Accounting Reports" module to incorporate the new VAT rates.

* Create New Tax Entries: Instead of modifying or deleting existing tax rates, create new tax entries for the updated VAT rates. This ensures that historical transactions remain accurate and compliant.

1. Purchase Taxes: Duplicate existing tax entries and adjust the rate to 7.7% for the standard rate and 3.7% for the reduced rate. Update the labels and tax groups accordingly.

2. Sale Taxes: Similarly, create new sale tax entries for the updated rates. Ensure that the tax labels and VAT form tags are correctly assigned.

Example Tax Configurations:

* TVA 7.7% sur achat B&S (TN): 7.7%, Label: 7.7% achat, Tax Group: TVA 7.7%, Scope: Purchases

* TVA 3.7% sur achat B&S (TS): 3.7%, Label: 3.7% achat, Tax Group: TVA 3.7%, Scope: Purchases

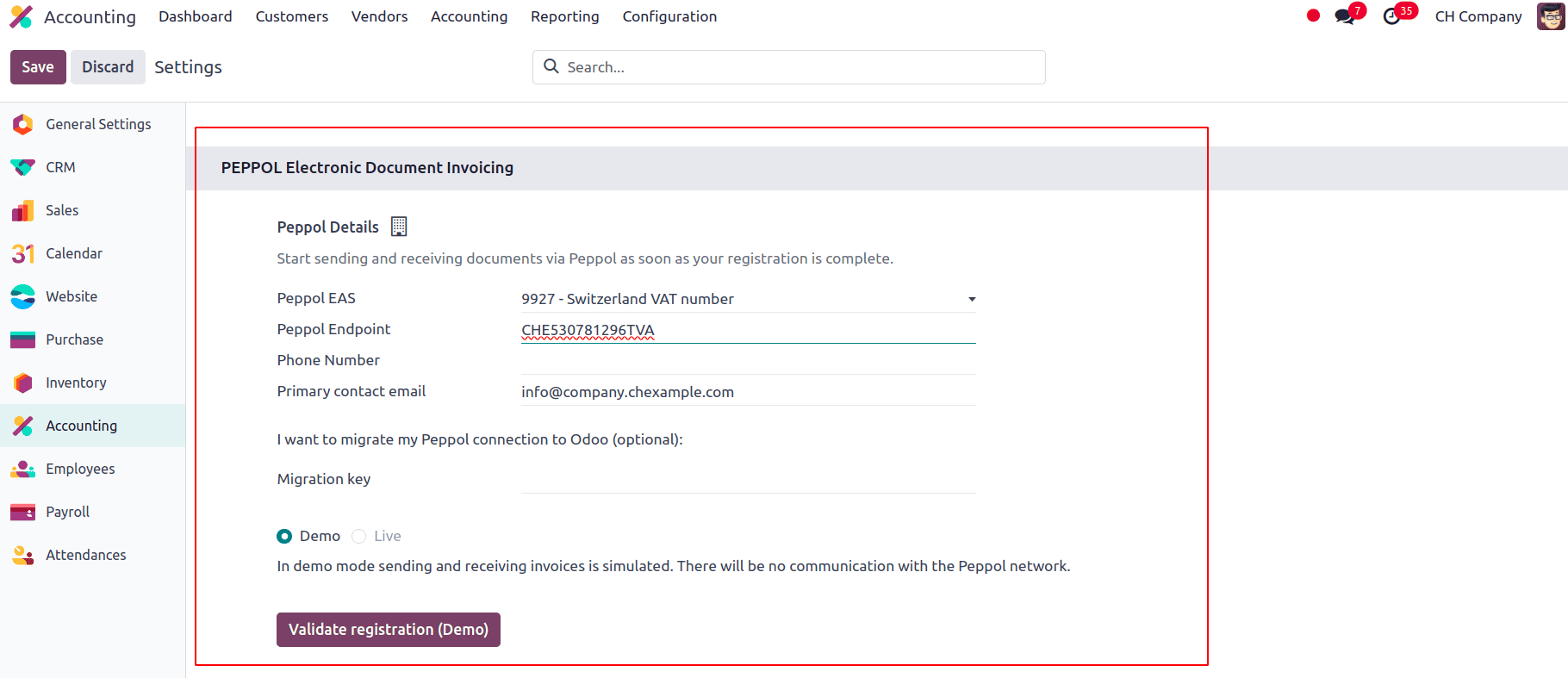

PEPPOL Electronic Document Invoicing

PEPPOL Electronic Document Invoicing in Swiss localization streamlines the invoicing process by integrating the PEPPOL framework, which facilitates seamless electronic document exchange between businesses and authorities. In Switzerland, this system ensures compliance with local regulations by adhering to the Swiss-specific requirements for invoicing and document handling. By leveraging PEPPOL, Odoo accounting software enables businesses to automate the invoicing process, reducing manual errors and processing time. This integration not only supports efficient transaction management but also aligns with Switzerland's standards for digital document exchange, promoting accuracy and transparency in financial operations. We can configure it by navigating to Accounting > Configuration > Settings, and there we have a section for PEPPOL Electronic Document Invoicing where we can register by filling in the Peppol details and validating the registration.

* Peppol EAS: The electronic "address book" for Peppol participants is the Peppol Electronic Address Scheme. Each Peppol EAS identification is specific to each member of the network.

* Poppol Endpoint: Peppol is a global network that enables businesses to send secure electronic invoices. Each endpoint on the Peppol network uniquely identifies each member. This endpoint serves as an address and allows other Peppol participants to locate and send invoices electronically.

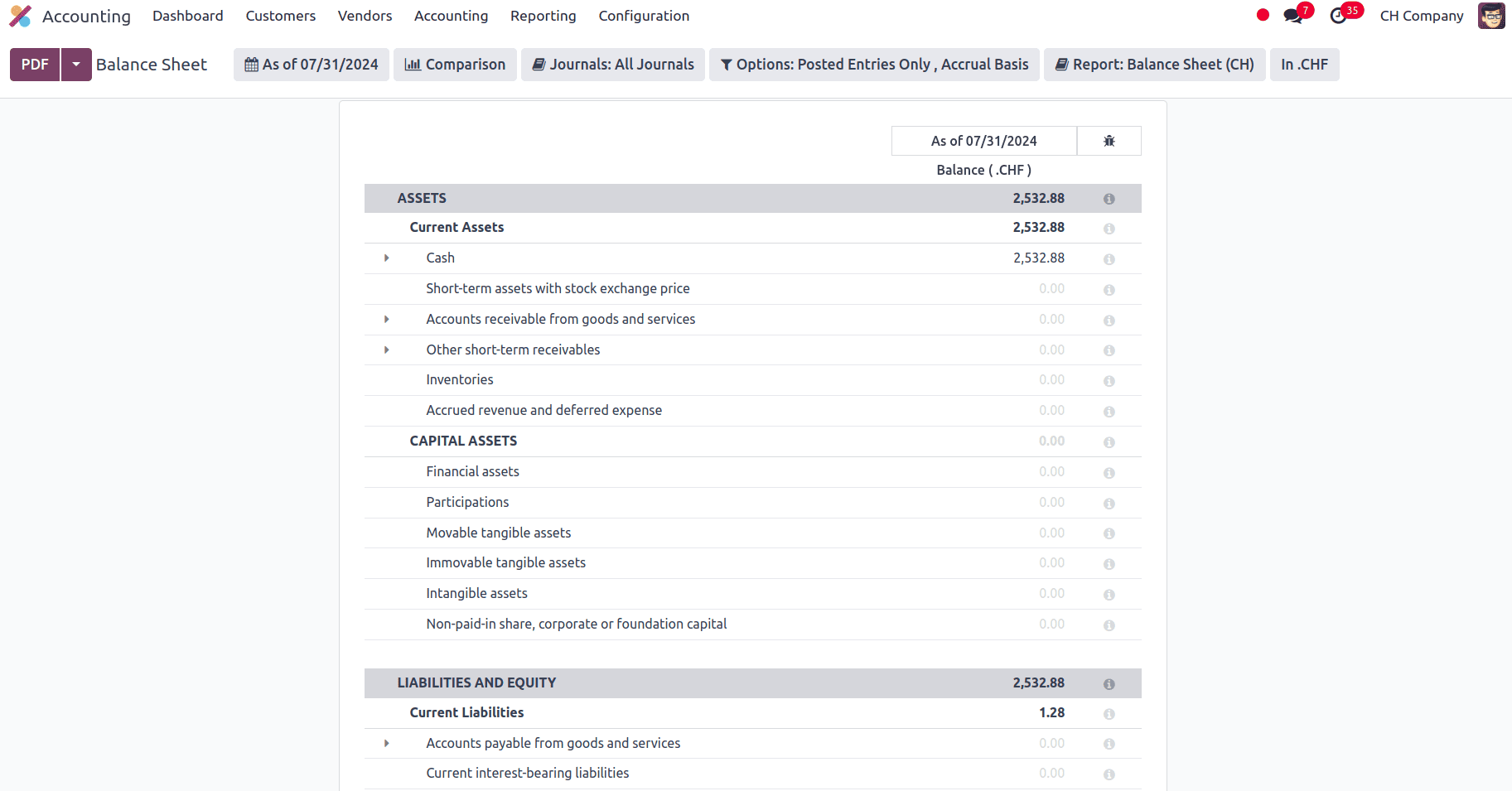

Balance Sheet

A balance sheet is a type of financial statement that shows the assets, liabilities, and equity of a business at a certain moment in time. Its arrangement demonstrates the company's assets, liabilities, and equity—the remaining stake held by the owners. The balance sheet ensures that the business's financial status is appropriately recorded and balanced by using the basic accounting equation. In Odoo with Switzerland accounting localization, the balance sheet is tailored to meet Swiss financial reporting requirements, ensuring accuracy and compliance. This localization adjusts the standard balance sheet format to reflect local accounting practices, such as specific asset and liability classifications and valuation rules. Odoo’s Swiss localization supports the detailed tracking of assets, liabilities, and equity, providing businesses with a clear, accurate view of their financial position. It incorporates local regulatory standards, including particular requirements for depreciation and financial disclosures, ensuring that the balance sheet aligns with Swiss statutory regulations.

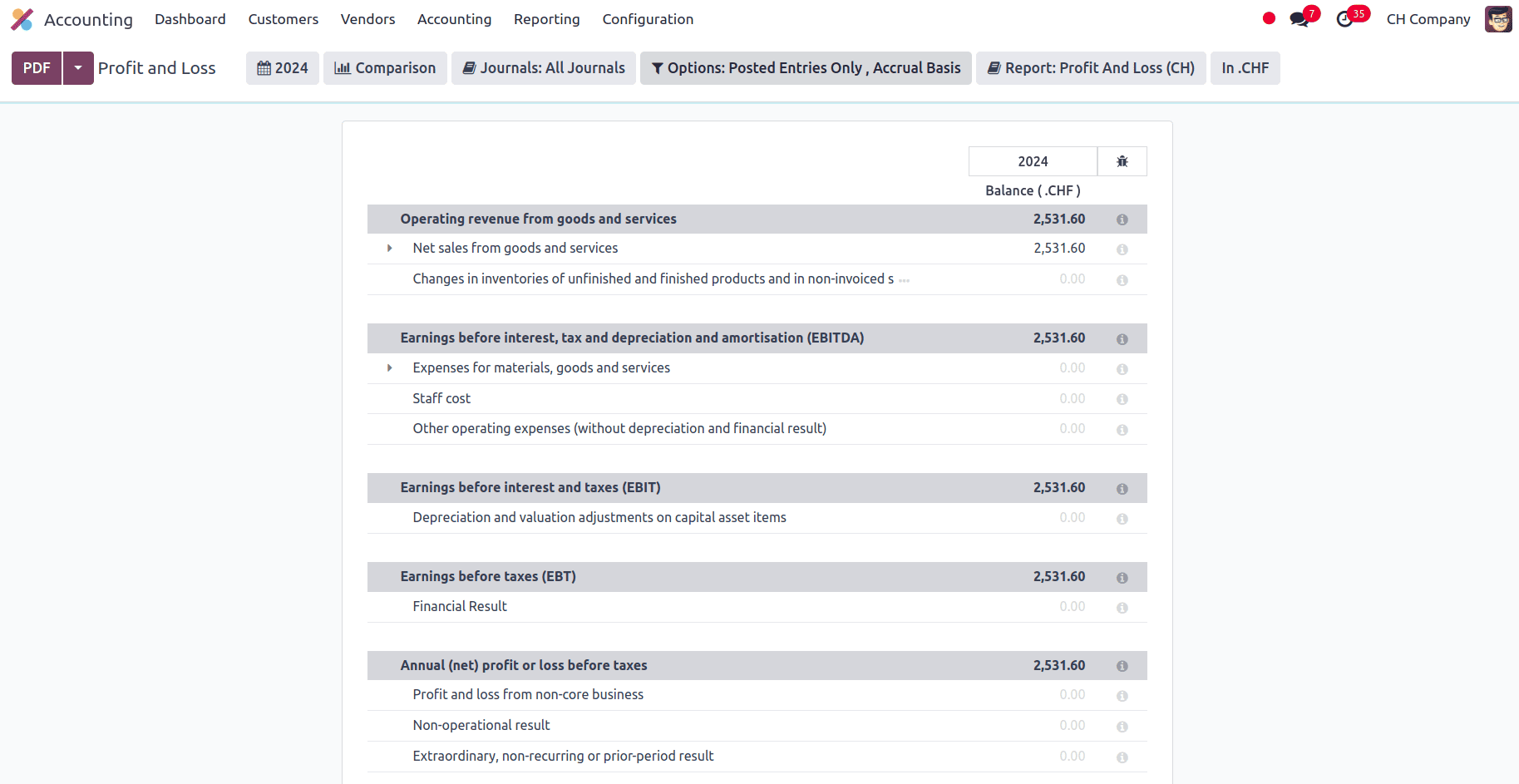

Profit and Loss Report

We may find the company's profit and loss report under the Reporting Menu. A company's payments, expenses, and net earnings or losses for a specific time period are listed in a report called the profit and loss. It provides a summary of the company's financial performance during that period and is essential for figuring out how profitable the company is. In Switzerland, Operating revenue from goods and services represents the income generated from a company’s primary business activities. This revenue is crucial for understanding a company’s financial health and performance. Accurate accounting of this revenue is essential for compliance with Swiss financial regulations and for providing stakeholders with reliable financial information. And we can also view the Earnings before interest, tax and depreciation and amortisation (EBITDA), Earnings before interest and taxes (EBIT), Earnings before taxes (EBT), Annual (net) profit or loss before taxes in the profit and loss report.

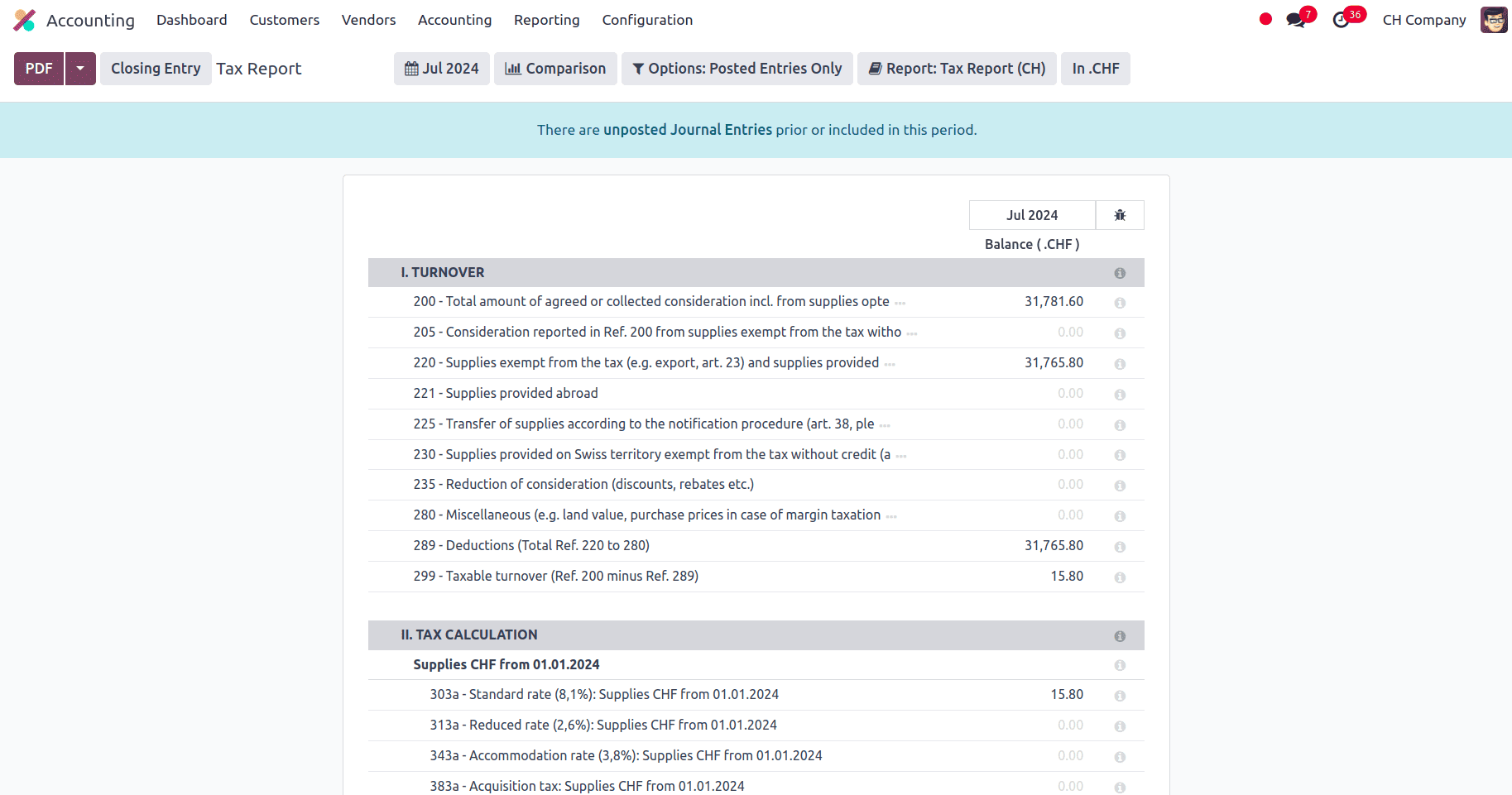

Tax Report

In Odoo Accounting, a tax report is a specialized financial document designed to provide a detailed overview of a company’s tax obligations and compliance status. This report consolidates information about taxes collected on sales and paid on purchases, reflecting the company's tax position within a specific reporting period. The tax report shows the Turnover which is the total revenue generated by a business from its core operations over a specific period. This figure represents the total income earned from sales of goods or services before deducting any expenses, taxes, or other cost. Tax Calculation, which is the detailed process of determining the amount of tax a business or individual owes based on various financial figures and tax rules. This section of the report breaks down the methodology used to calculate the tax liabilities and Other Cash Flows.

In conclusion, the Switzerland accounting localization in Odoo provides a robust framework to meet the unique financial and regulatory requirements of Swiss businesses. By integrating features such as precise VAT calculations, comprehensive tax reporting, and compliance with local accounting standards, Odoo streamlines the financial management process for Swiss companies. The localization ensures accurate handling of transactions, simplifies tax filings, and maintains adherence to Swiss accounting laws, ultimately enhancing operational efficiency and financial transparency. With these capabilities, businesses can effectively navigate the complexities of Swiss accounting while leveraging Odoo’s powerful ERP functionalities to support growth and compliance.

To read more about An Overview of Accounting Localization for Germany in Odoo 17, refer to our blog An Overview of Accounting Localization for Germany in Odoo 17.