Accounting localization is a crucial aspect of managing financial operations in any business, as it ensures that accounting practices align with local regulations, standards, and tax laws. The accounting localization features of Odoo are made to give companies the resources they need to ensure correct financial management, expedite tax filing, and conform to local accounting regulations. Whether a company is operating in one nation or several, Odoo's country-specific customizations and capabilities help them effectively negotiate the complicated regulatory environments that they face.

In Slovakia, accurate financial management is vital for businesses. Odoo’s accounting localization features cater specifically to these needs by adapting its ERP system to Slovakian accounting standards. This blog will cover how Odoo helps streamline financial processes in Slovakia, from following the VAT regulations and financial reporting requirements to automating tax calculations. By leveraging Odoo’s tailored tools, businesses can enhance accuracy, efficiency, and compliance in their financial operations.

Slovakia Accounting With Odoo 17

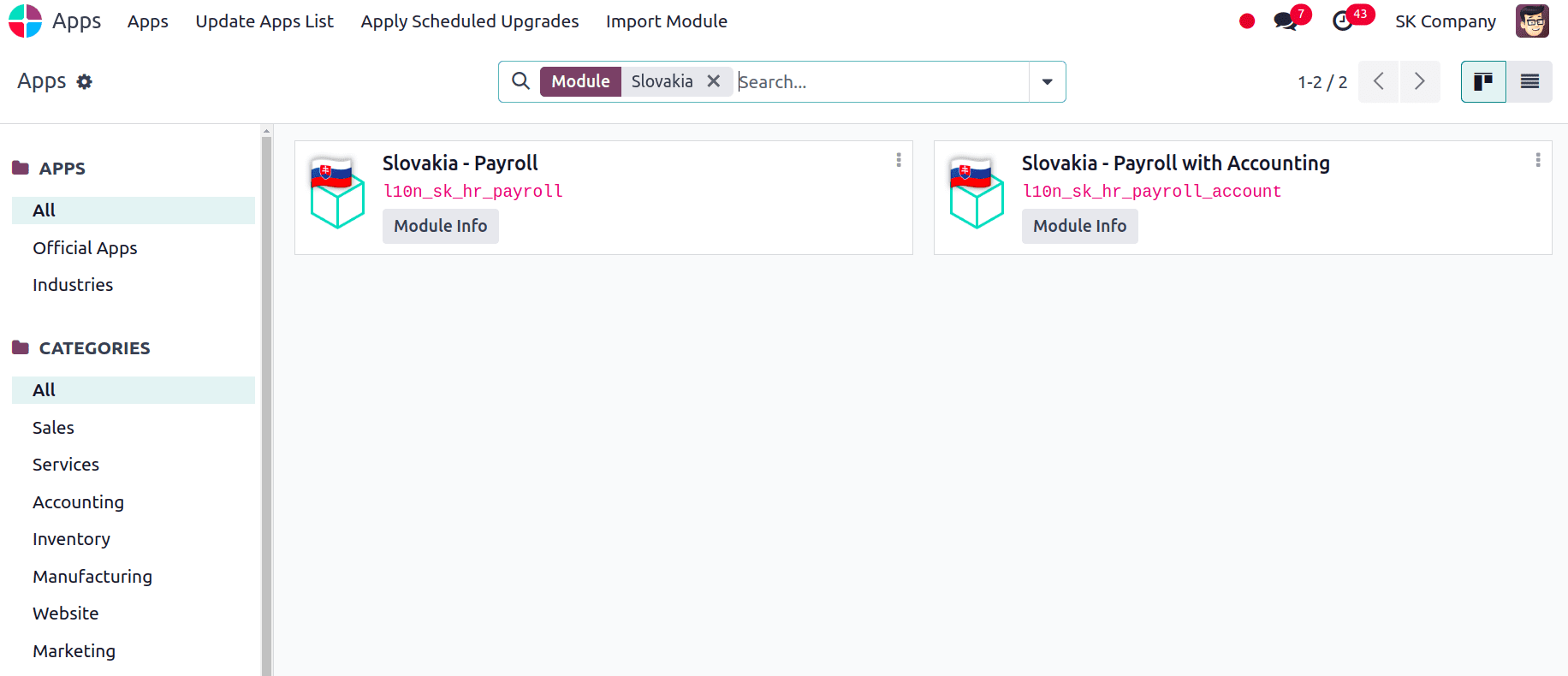

Following the local tax regulations and accounting norms is made simple with Odoo 17's Slovakia localization module. The first step in setting up the accounting localization for Slovakia is to install the Philippine translation. Install the modules required to set up the accounting localization for the Slovakia by navigating to Apps.

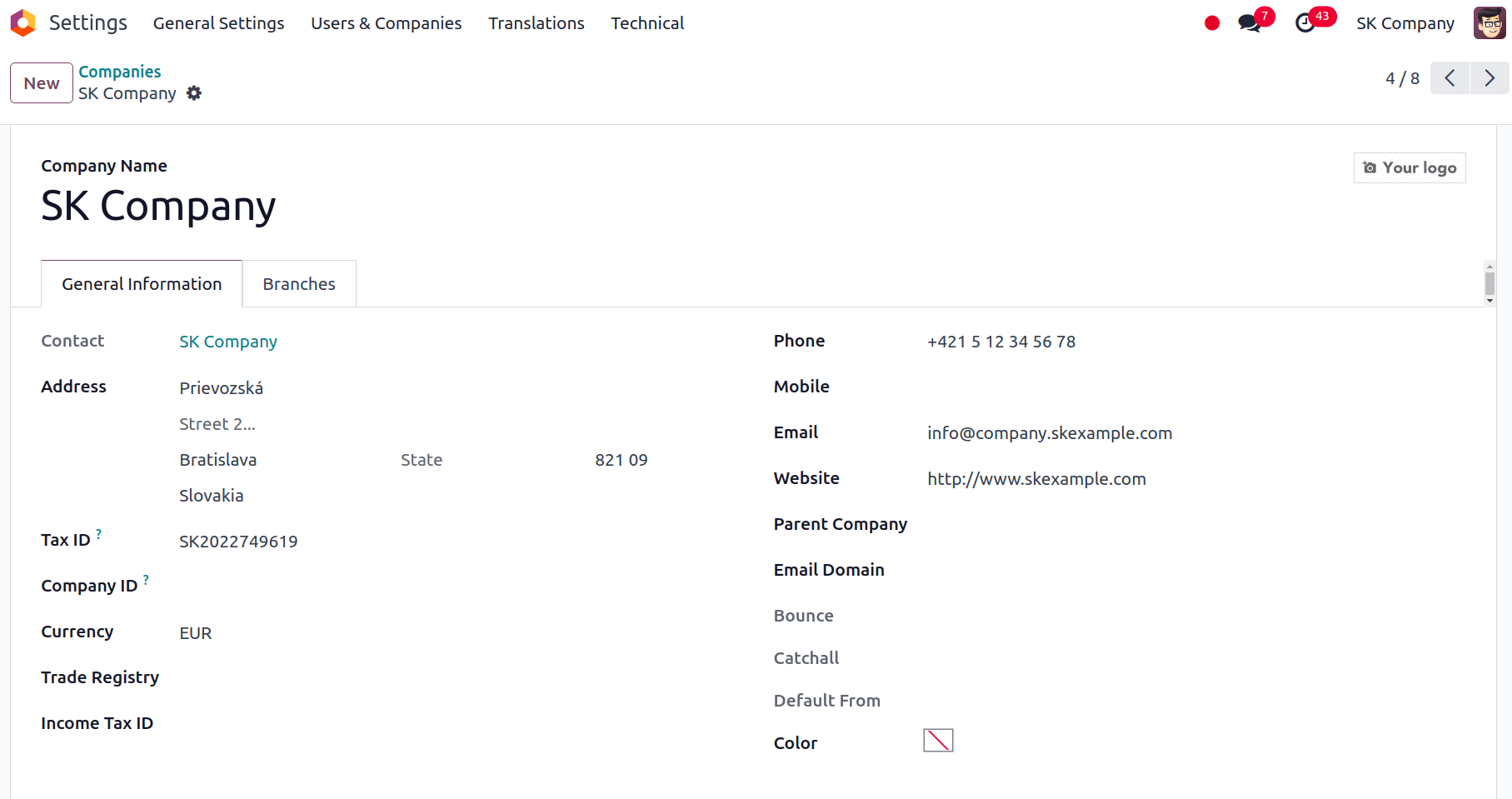

We can verify that the company is configured appropriately or create a new company with the necessary configurations after installing the modules needed for Slovakia localization. To accomplish that, go to Settings > Users and Companies > Companies. Click the New button to create a new company or select the company for which we want to check from the list of companies that appear.

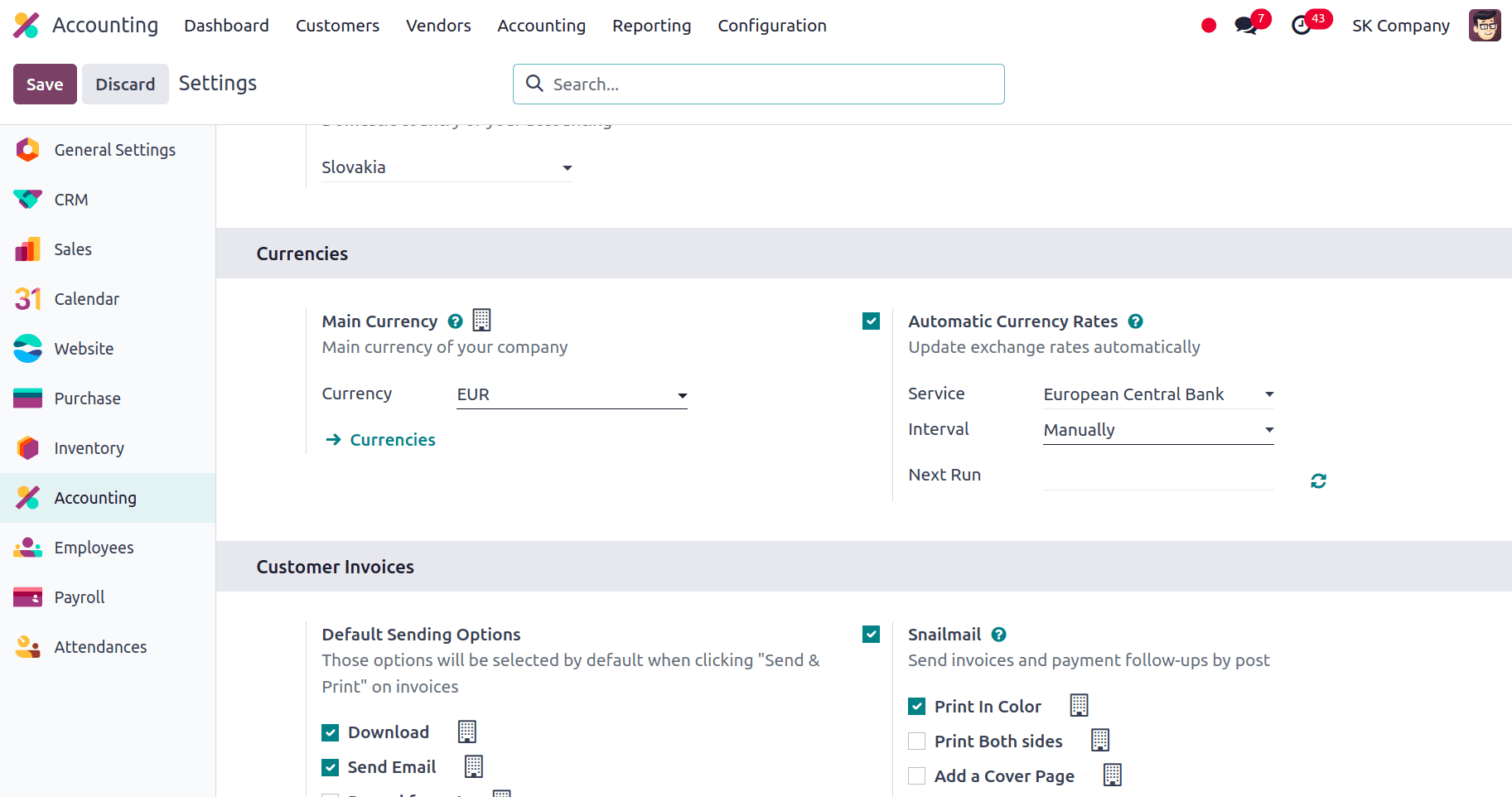

After reviewing the company configurations, we can examine the fiscal localization, which will be set to Slovakia in the accounting module configuration settings. We can also view the default taxes and the main currency for this localization.

Default Taxes are pre-specified as 20% Sales and Purchase tax in the settings that are automatically applied to invoices and sales orders. Because the right tax rates and regulations are applied according to the product, service, or region, these default tax configurations simplify the invoicing process. This feature makes tax management and compliance easier by preserving accuracy and consistency in tax calculations across a range of transactions. We can see that the main currency is set to Euro (EUR), Slovakia's official currency.

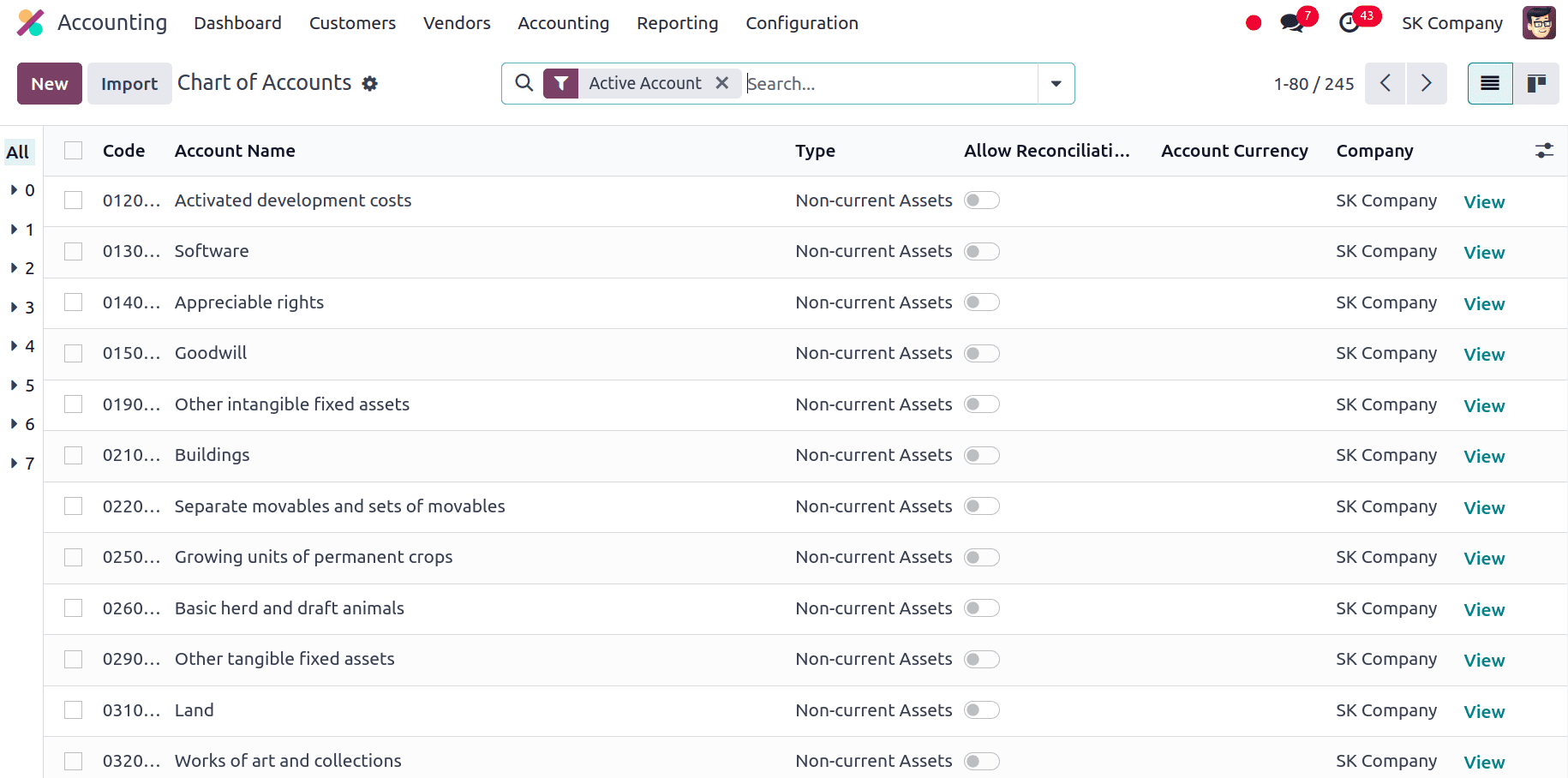

In Odoo’s Slovakia accounting localization, the Chart of Accounts is an organized framework designed to satisfy regional financial reporting and compliance standards. It provides a comprehensive list of accounts that categorize financial transactions according to Slovakian accounting standards and regulations. This localized Chart of Accounts ensures that businesses can accurately record and manage their financial data, from assets and liabilities to income and expenses, in alignment with Slovakian accounting practices. By integrating these localized account structures, Odoo facilitates accurate financial reporting, smooth tax processing, and effective adherence to Slovakian regulatory requirements.

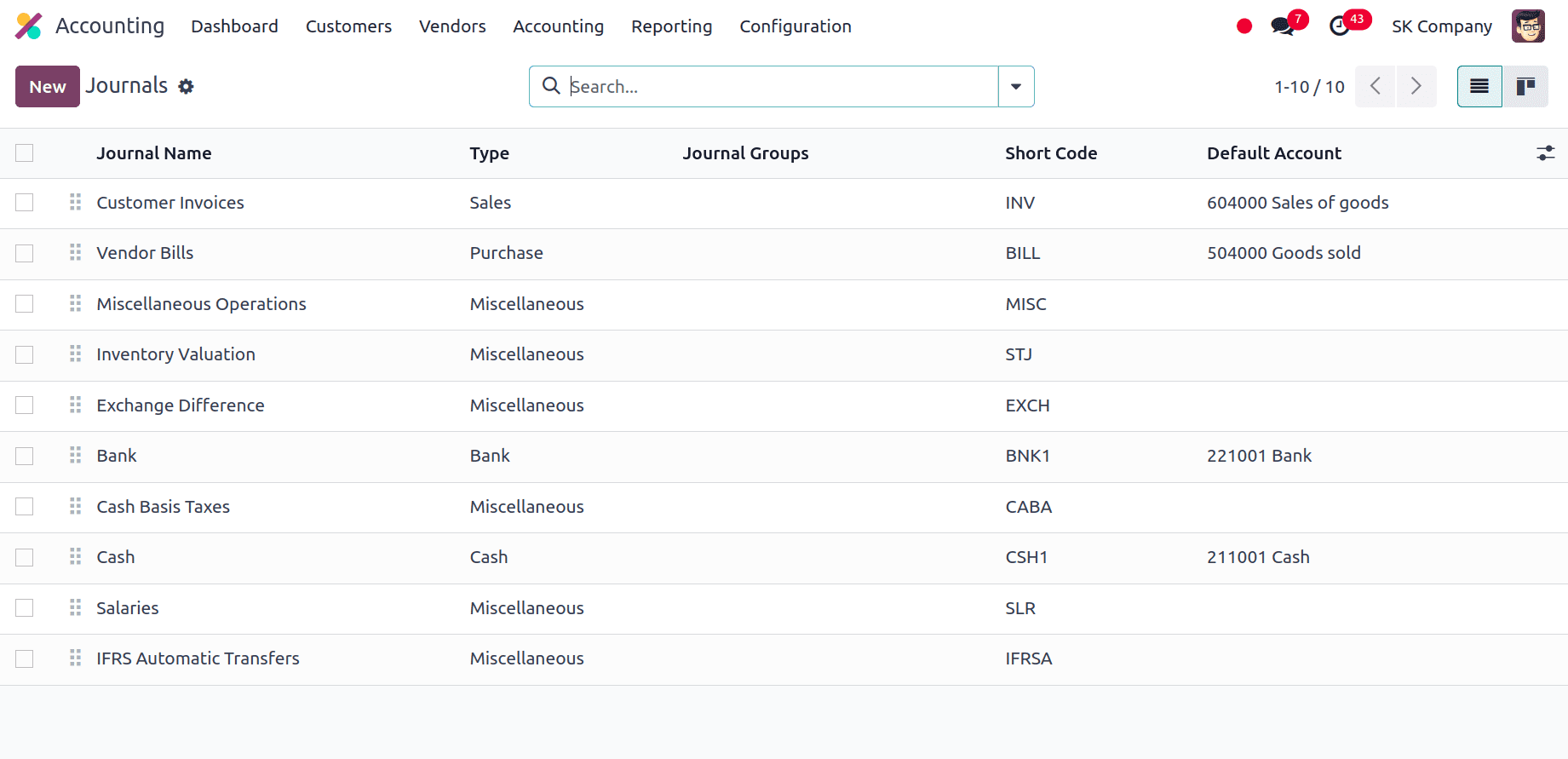

Journals are crucial tools for organizing and managing financial transactions in Odoo's Slovakia accounting localization. Every journal in Odoo is set up to comply with Slovakian accounting standards and procedures and reflects a certain category of transactions, such as purchases, sales, or bank operations. This localization makes sure that every entry is correctly classified and complies with local laws, which makes financial tracking and reporting more effective. Businesses can keep well-organized records, expedite their accounting procedures, and guarantee compliance with Slovakian financial requirements by utilizing these localized journals.

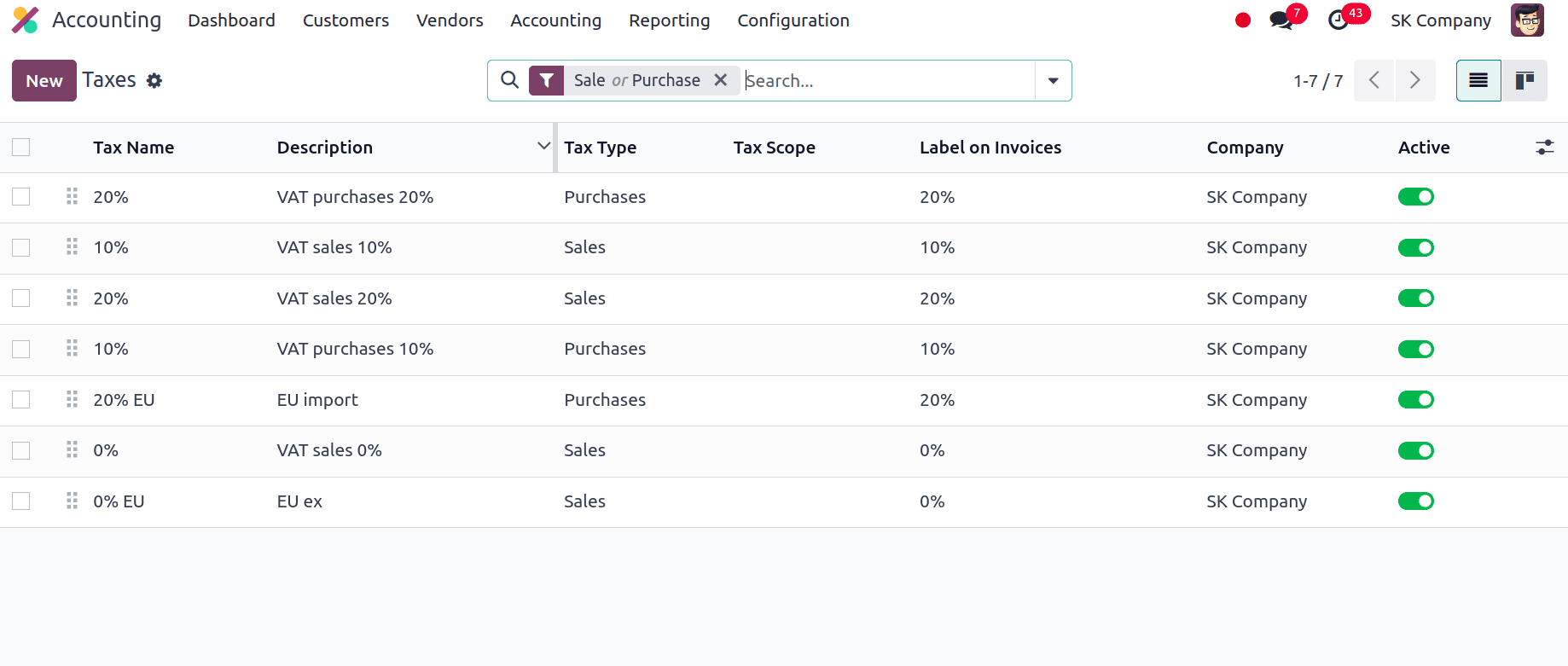

In Odoo’s Slovakia accounting localization, Taxes are configured to align with Slovakian tax regulations, ensuring accurate and compliant financial operations. The system allows for the setup of various tax rates and rules, including VAT and other local tax requirements, which are automatically applied to transactions such as invoices and sales orders. This localization feature simplifies tax management by automating calculations and ensuring that all tax-related processes conform to Slovakian standards, facilitating seamless tax reporting and compliance.

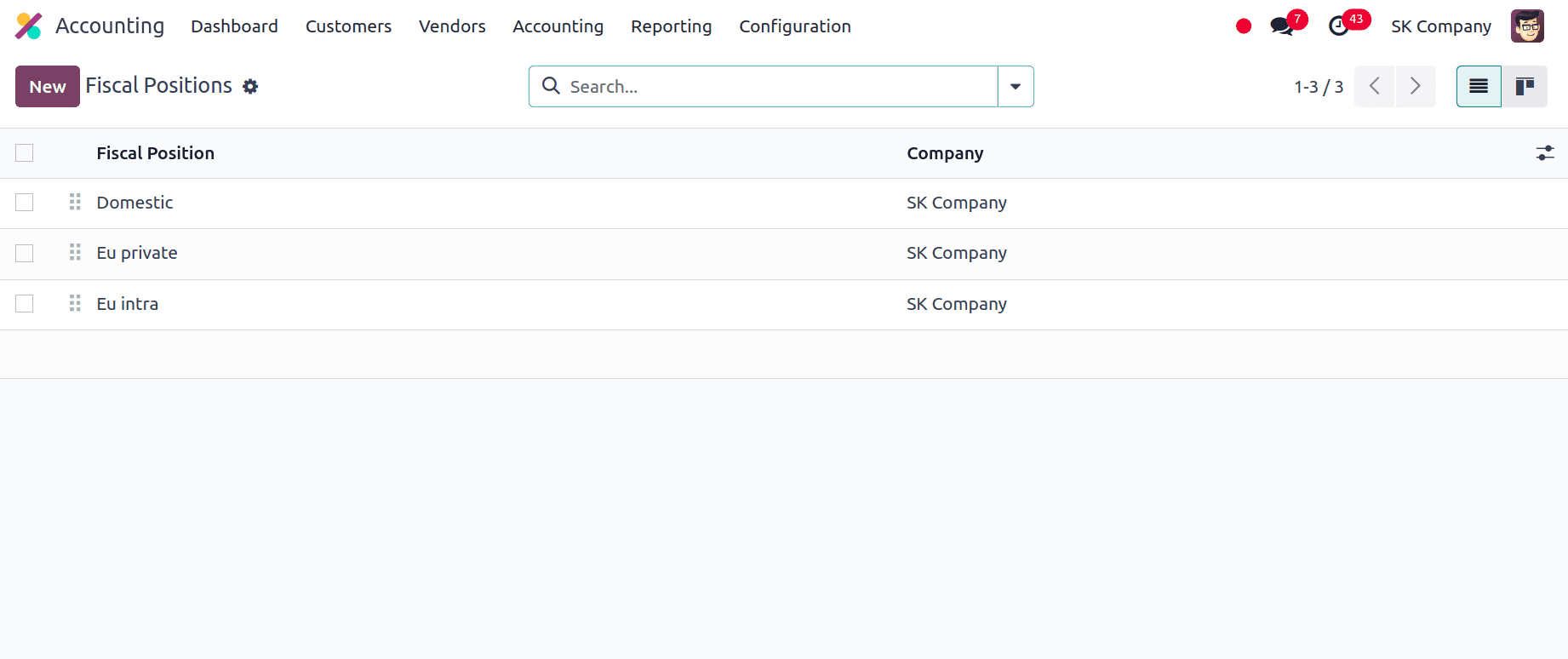

Fiscal Positions are a versatile tool used to manage and apply the appropriate tax rules and accounting practices based on specific transaction scenarios. Fiscal positions ensure that the correct Slovak VAT rates are applied automatically to transactions based on factors such as customer location, product type, or service category. This helps maintain accuracy in tax calculations with Slovakian tax laws.

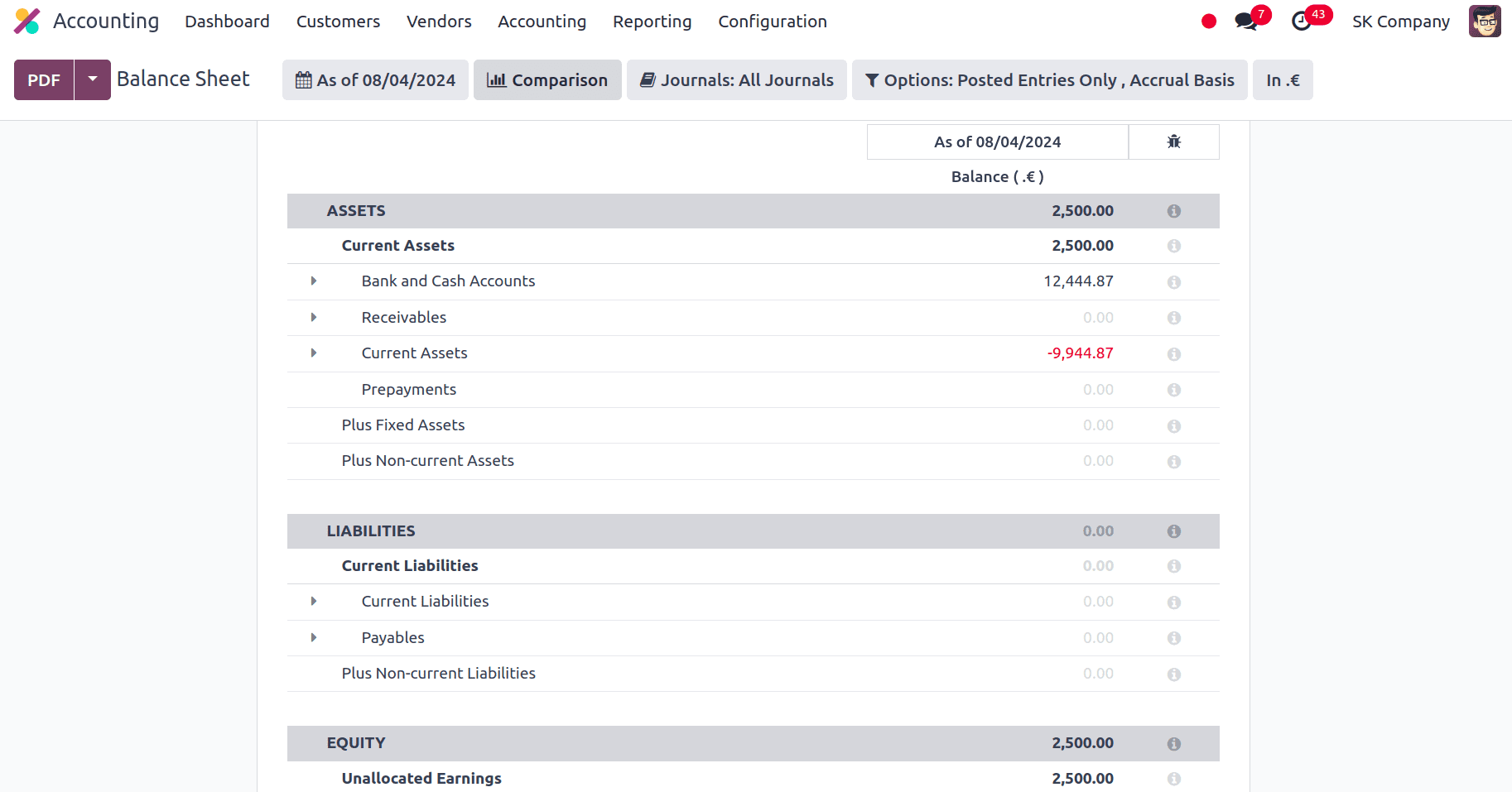

Balance Sheet

The Balance Sheet helps businesses evaluate their financial health by presenting a detailed view of assets, liabilities, and equity. This is essential for understanding the company's stability and financial structure, ensuring it aligns with Slovakian accounting standards. The Balance Sheet created in Odoo guarantees compliance with Slovakian reporting obligations by following local accounting regulations. This makes it easier to comply with legal requirements and makes accurate financial reporting possible.

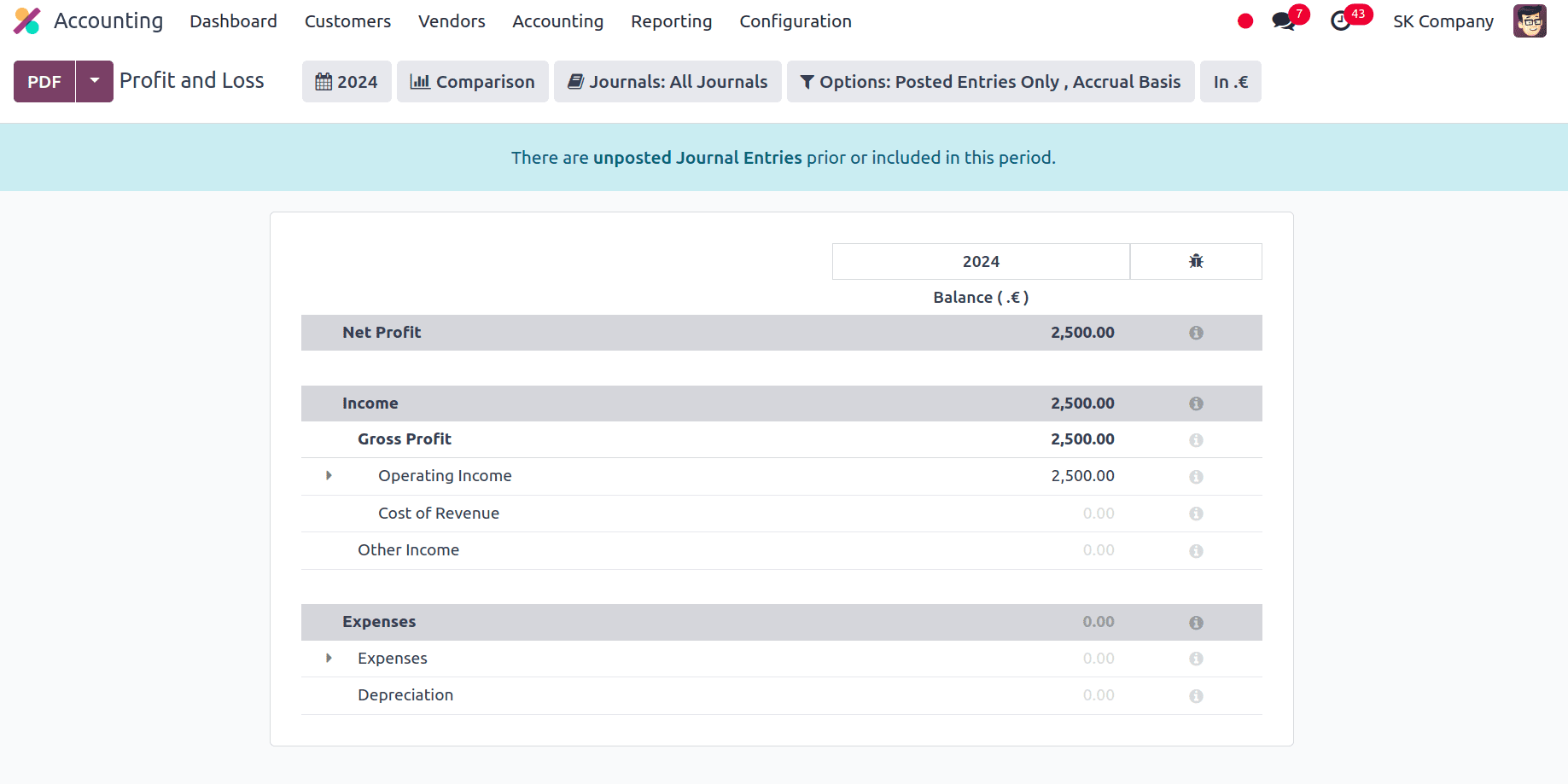

Profit and Loss Report

By outlining income and expenses, the profit and loss statement gives a clear picture of a business's financial status. This aids companies in evaluating their operational effectiveness and profitability in accordance with Slovakian accounting norms. Precise financial reporting depends on the Profit and Loss statement adhering to Slovakian accounting standards. The localization tools in Odoo make it easier to prepare P&L reports that comply with regional legal requirements, which promotes compliance.

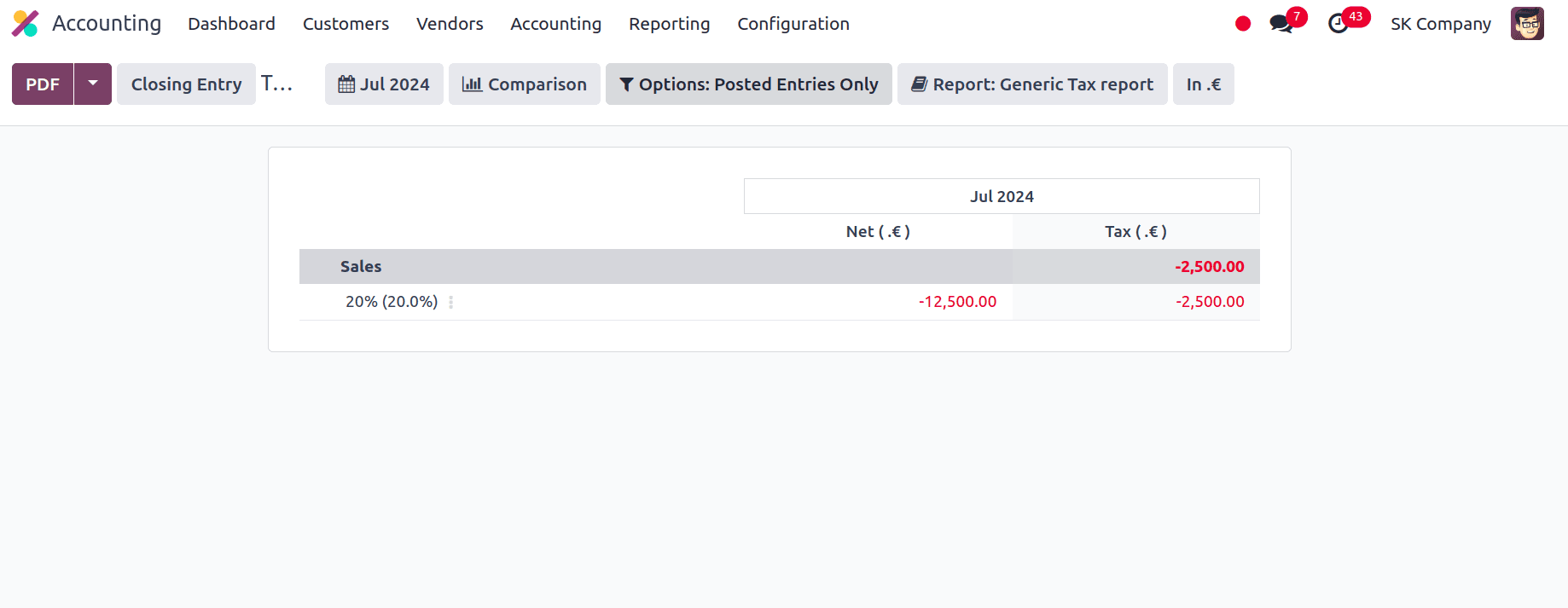

Tax Report

Tax reports, which provide precise information on VAT and other taxes received and paid, help firms comply with Slovakian tax laws. By doing this, one can follow the legal reporting obligations and stay out of trouble. Odoo makes the process of preparing and filing tax returns easier by producing comprehensive tax reports. The tax-related data is consolidated in these reports, which facilitates the proper and timely filing of VAT returns and other tax papers. The tax reporting capabilities of Odoo are updated frequently to take into account modifications to Slovakian tax laws and regulations. This guarantees that companies maintain compliance with the most recent regulations and modify their tax reporting procedures accordingly.

The accounting localization of Odoo for Slovakia offers a strong framework that is tailored to meet the particular financial and regulatory requirements of companies doing business there. By integrating Slovakian-specific features such as localized Charts of Accounts, fiscal positions, tax configurations, and compliance reports, Odoo ensures that businesses can manage their financial operations with accuracy and efficiency. Localization improves overall financial management by simplifying processes and providing thorough reporting while also making regional tax and accounting regulations easier. Businesses in Slovakia can easily traverse the accounting with Odoo, maximizing financial performance and assisting in strategic decision-making. Ultimately, businesses are given the resources they require to prosper in a constantly changing regulatory landscape with Odoo's Slovakia accounting localization.

To read more about An Overview of Accounting Localization for Spain in Odoo 17, refer to our blog An Overview of Accounting Localization for Spain in Odoo 17.