Accounting localization in Odoo

Accounting localization in Odoo refers to bringing the program into compliance with the unique financial laws and customs of a given nation. In essence, it's an Odoo feature that customizes the accounting process based on your region. Odoo provides localization modules for different nations. Odoo installs the appropriate localization module automatically when you install the accounting module and select the country of your business.

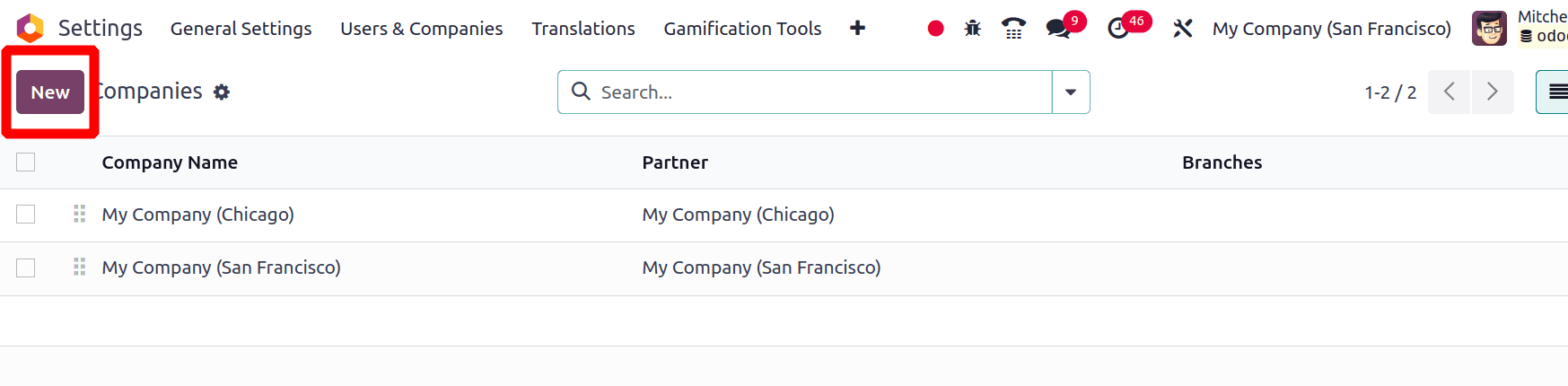

In this blog, we are going to discuss the accounting features of a company working in Latvia. For this, we need to create a new company from Latvia. In Odoo 17, we have the option to create a company from the General settings. Under the Users & Companies menu, there is a Companies sub-menu, and there we can find the list of companies that are already created there. We can create new companies from there by clicking the New button on this page.

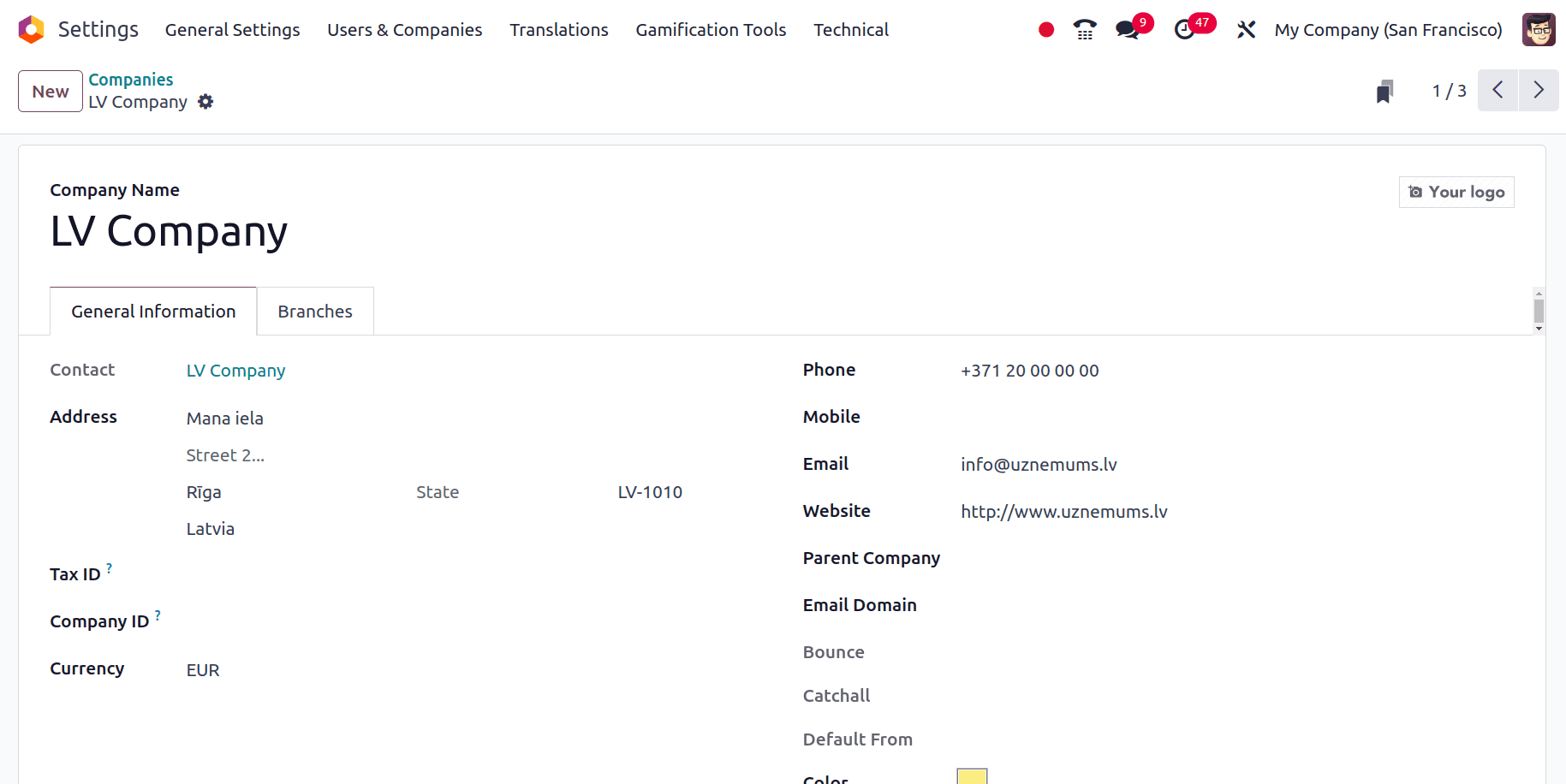

When we click the New button, a form will appear to fill up the details of the company. In that form, provide the name of the company, Address, the country to which the company belongs, etc.

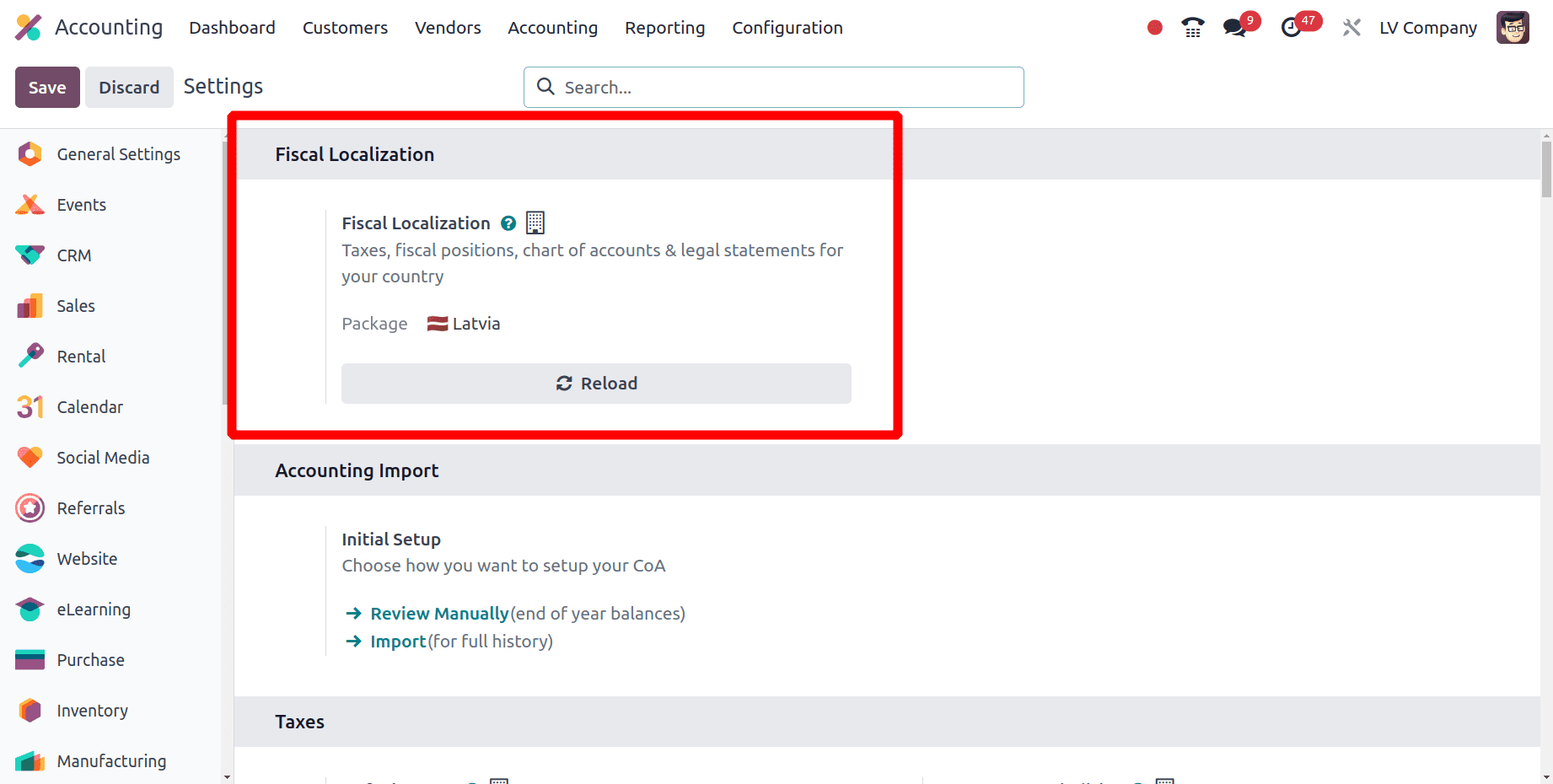

To get the country-specific features in Odoo for a company, we should need to set up the localization package for this company. To set the localization package, move to the Accounting application. In the Configuration > Settings of Accounting application, there is an option to set the localization package for the company.

For a company from Latvia, we can provide the package as Latvia itself, and the package has been configured properly, click the Save button to save the changes. Then let's look at the changes that form when the localization package is configured properly.

Changes that occur during the Configuration of the Latvian localization package

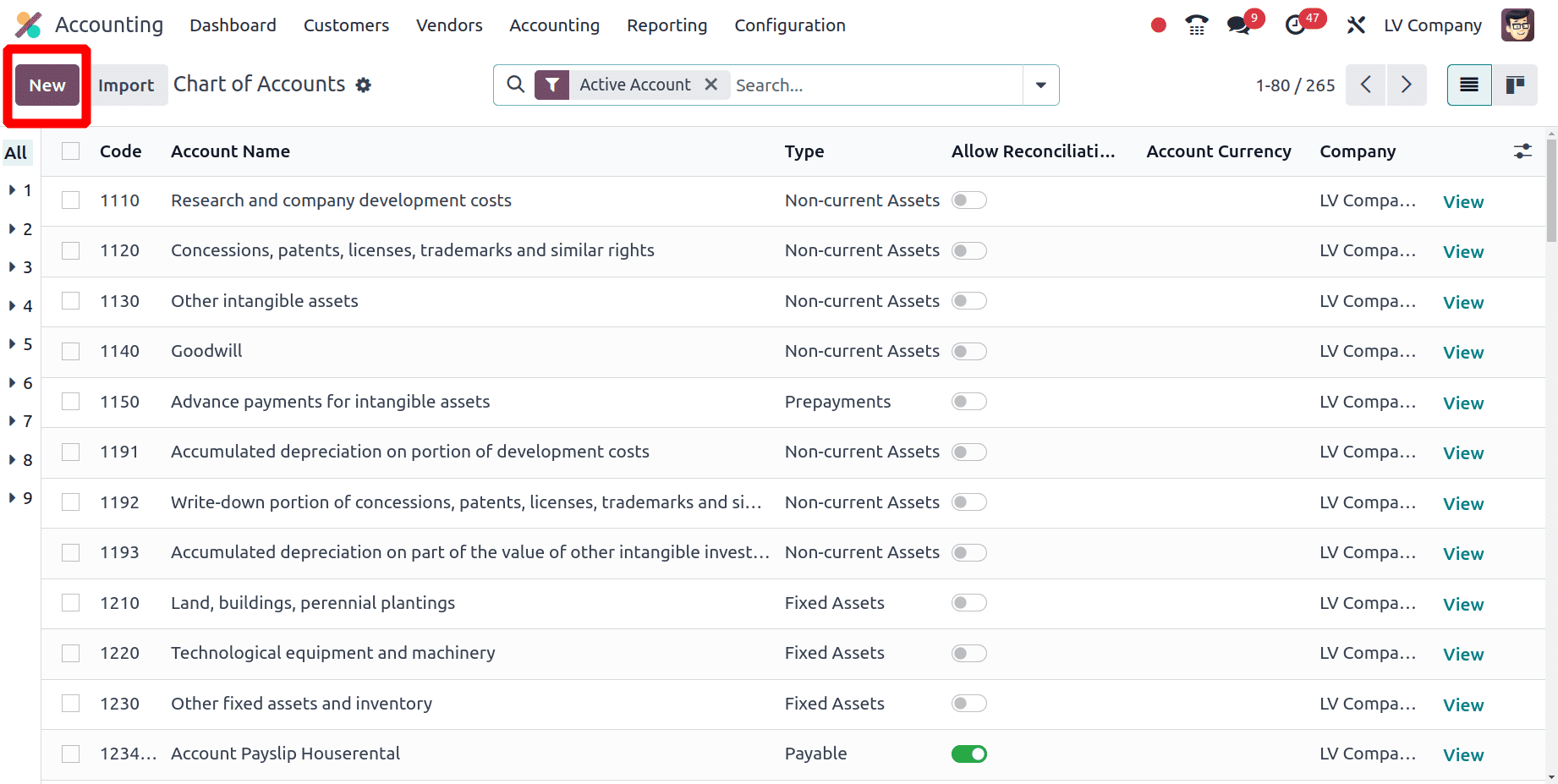

Chart of Accounts

Chart of Accounts is the major pillar of accounts of a company. It serves as an organized list of all the accounts that are utilized to document the financial transactions of your business. A chart of accounts from Odoo includes specific details such as the unique identification code of the account, Account name, Account type, Account currency, company, etc. Under the configuration menu, there is a Chart of Accounts sub-menu. When you click this Chart of Accounts sub-menu it will list all Chart of Accounts that are already configured for this company.

The code, Name, and Type of the accounts that are used by different countries for different purposes may vary. You can also create a Chart of Accounts for the company by clicking the New button.

Financial transactions are categorized by the organized system, which makes them simpler to locate and follow. This makes it easier to retrieve data for jobs like creating reports or doing in-depth financial analysis.

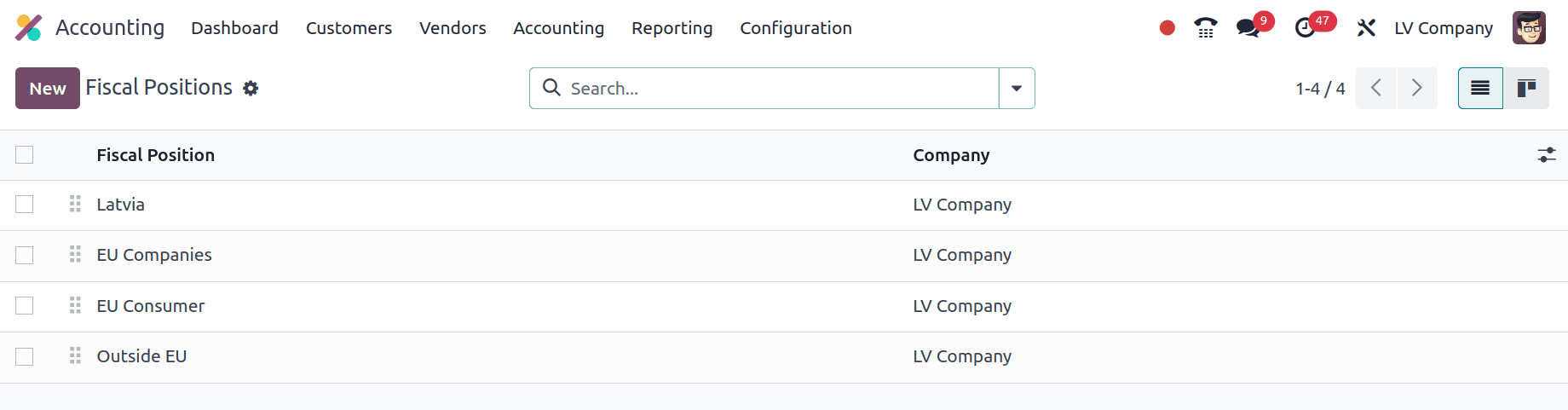

Fiscal Position

Fiscal positions are an effective tool in Odoo that lets you automate account mapping and tax computations depending on predefined parameters. Under the Configuration menu, there is a fiscal position sub-menu and you can find all the predefined fiscal positions for this company. You can also set up a new Fiscal position for this company by clicking the New button on this page.

Tax Mapping Defines how taxes are applied to transactions based on the fiscal position. You can replace default taxes with different ones or even remove them entirely. The Account mapping specifies which accounts to use for recording income and expenses based on the fiscal position. This ensures proper categorization of financial data. You are also able to set rules to automatically assign fiscal positions to transactions.

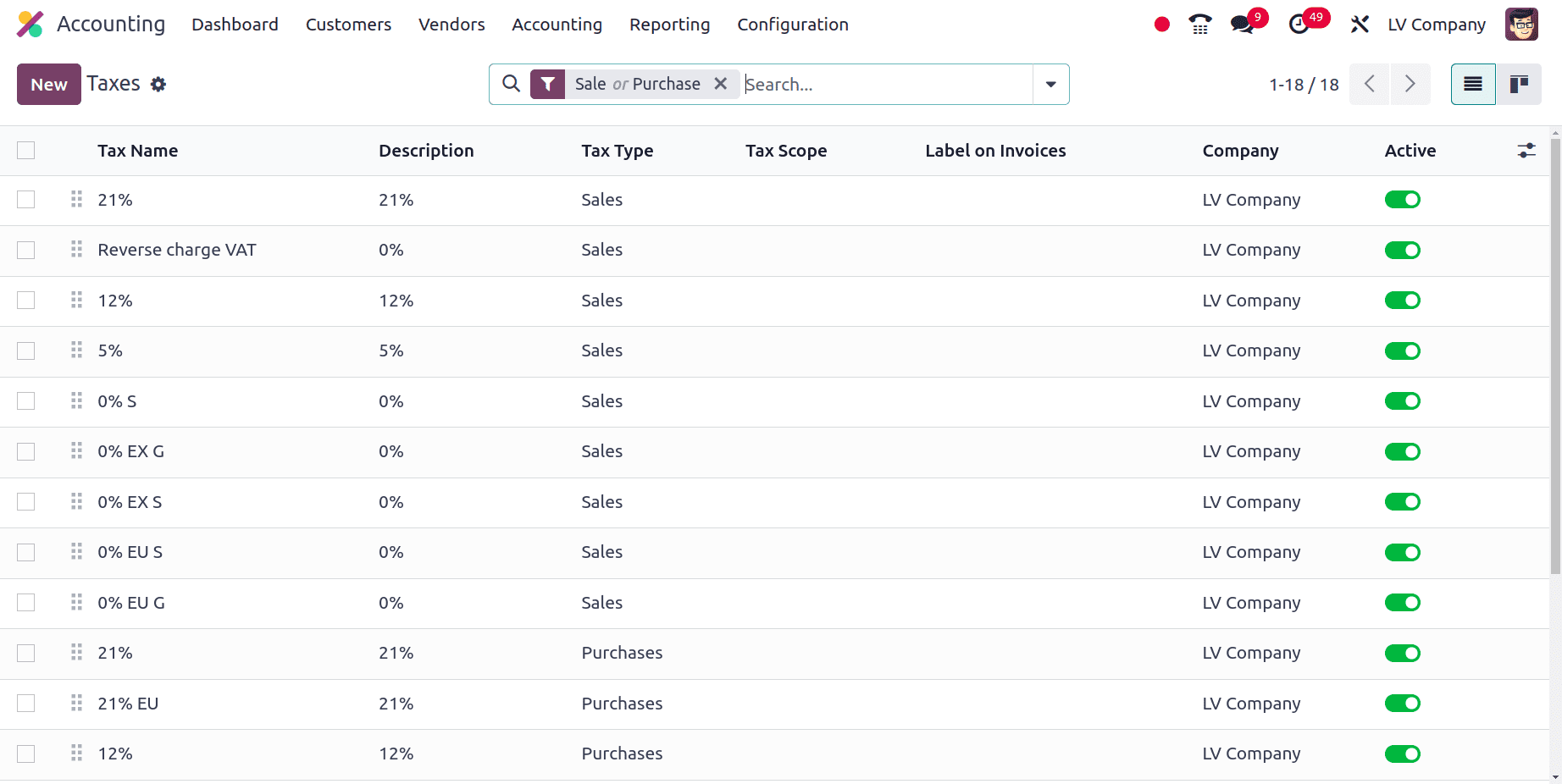

Taxes

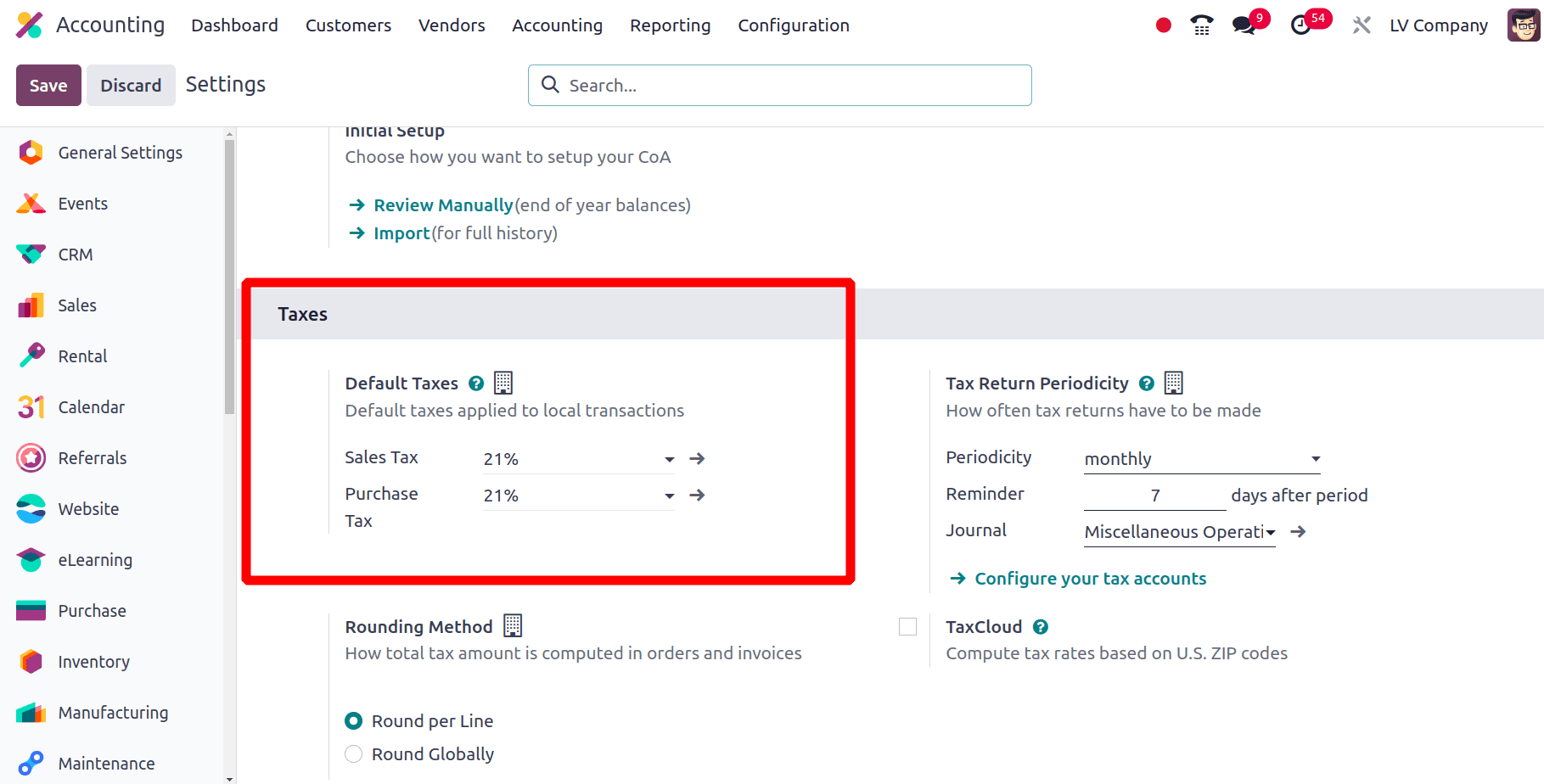

In accounting, taxes are important because they have an impact on many parts of the process of recording and reporting financial information. In Odoo, it's possible to apply default taxes and also specific taxes for different products. Under the Configuration menu, there is a Taxes sub-menu. There you can see all the taxes that are specially configured for the company from Latvia.

It is also possible to create new taxes here by clicking the New button. There are mainly two types of taxes, Sales taxes and Purchase taxes. Sales taxes are applied on products while they are sold, and purchase taxes are applied on products while they are purchased. In Odoo 17, it is possible to provide a default tax for every sale order and every purchase order separately. While selling or purchasing those products that don’t have any individual taxes, these default taxes will be applied.

In the Configuration > Settings under the Taxes section, there is an option to set the default tax for the company. But here, Odoo automatically updates the Default sales taxes and Default purchase taxes for the company when we set the localization package for the company.

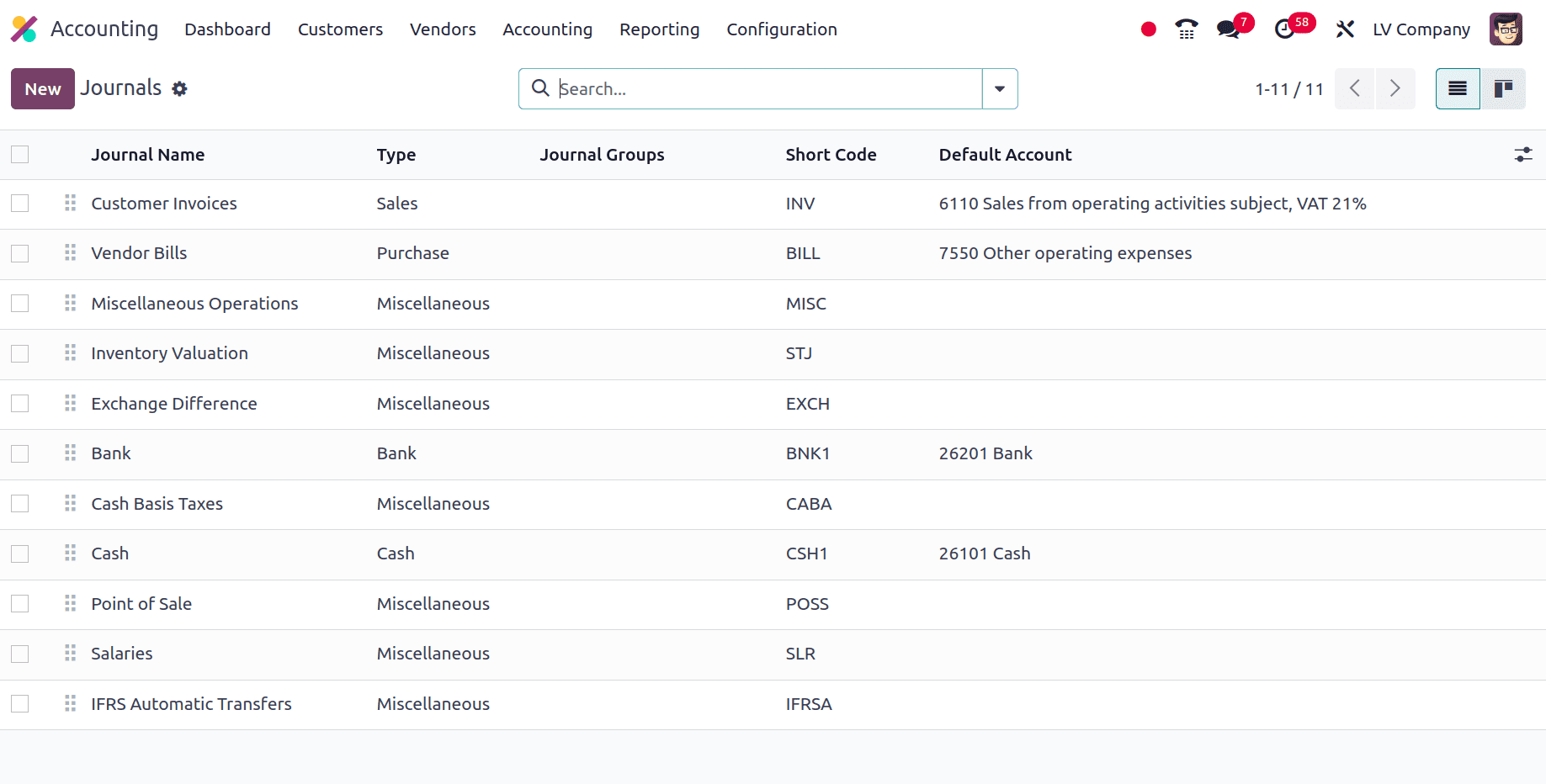

Journals

A journal is essentially the initial location in accounting where all of a company's financial activities are documented in a sequential manner. It functions as a kind of historical record of a business's financial transactions. Because these diaries record the first information about every transaction, they are also known as the Book of Original Entry.

Under Configuration > Settings, there is the Journals sub-menu. On clicking this journal, all the journals for this company, their type, short code, etc. will shown in a list.

By clicking the New button, you can create a new journal for this company. There are mainly five types of journals: Sales, Purchase, Cash, Bank, and Miscellaneous. The journal ensures that all transactions are accounted for, minimizing errors and enhancing financial transparency.

Under Configuration > Settings, there is a currency section, and in this section, we have the main currency. Either we can automatically set the main currency or Odoo will automatically set the main currency for the company as we set the Fiscal localization package for the company.

Financial Statements

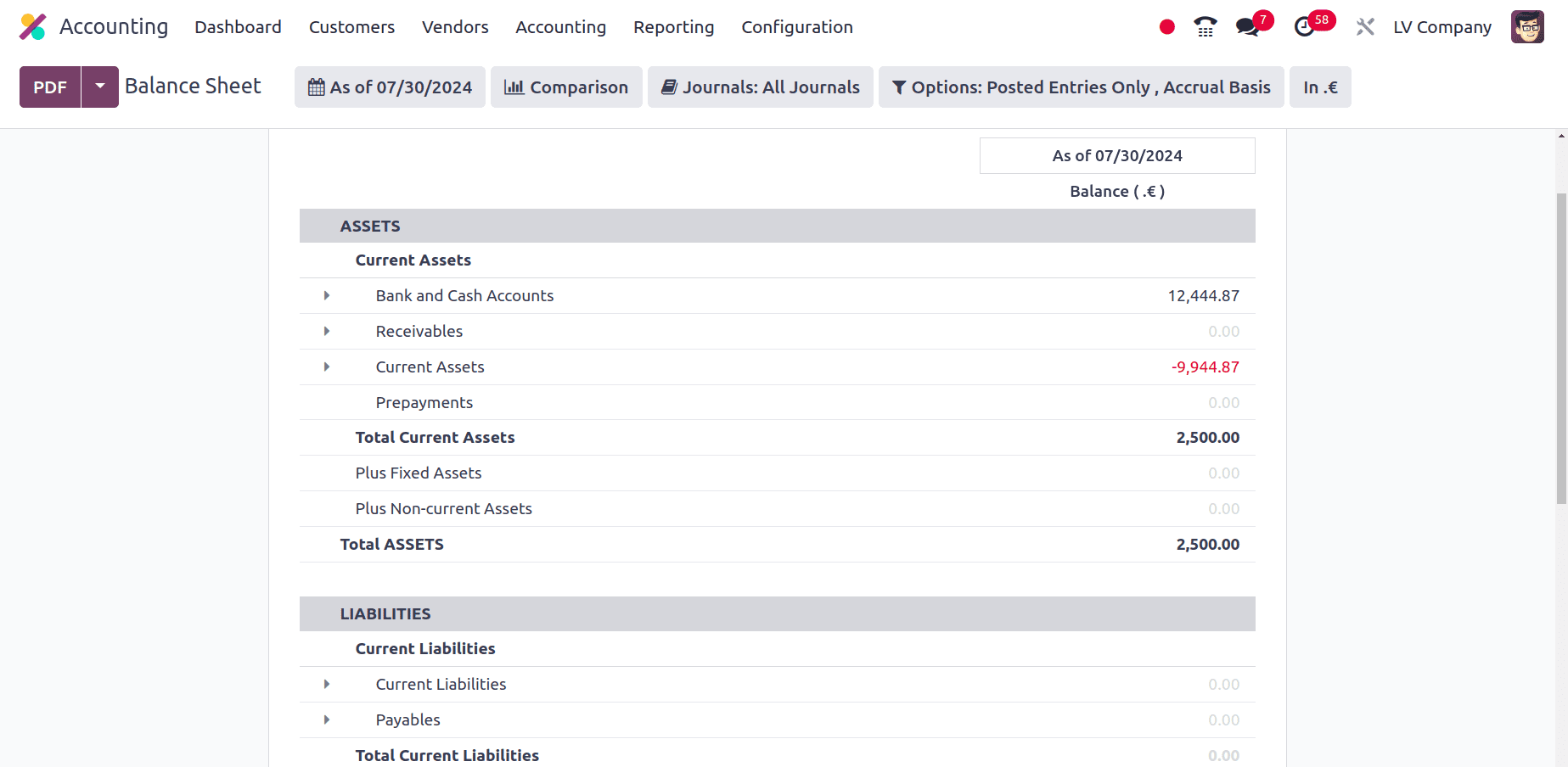

Next is the Balance sheet of the company. The balance sheet of the company from Latvia includes Assets, Liability, and Equity of the company. Under the reporting menu, we have the Balance Sheet sub-menu and we get the balance sheet of the company there.

An organization's resources that hold potential economic value are referred to as its assets. These are maintained and classified in Odoo to give a clear financial picture. The Current assets, Bank and Cash accounts, Receivables, Prepayments, Plus Fixed assets, Plus Non-Current assets, etc are included in this assets section. Liabilities represent the financial obligations a company owes to others. Current liabilities, Payables, Plus Non-current Liabilities, etc are included in the Liabilities of the company in the balance sheet. The owner's stake in a business is represented by equity. It is the asset value that remains after subtracting liabilities. Put more simply, it's the total amount of money that would go back to shareholders when all liabilities were settled, and all assets were liquidated. Allocated Earnings, Unallocated Earnings, Retained Earnings, etc are included in the Equity section of the Odoo Balance sheet.

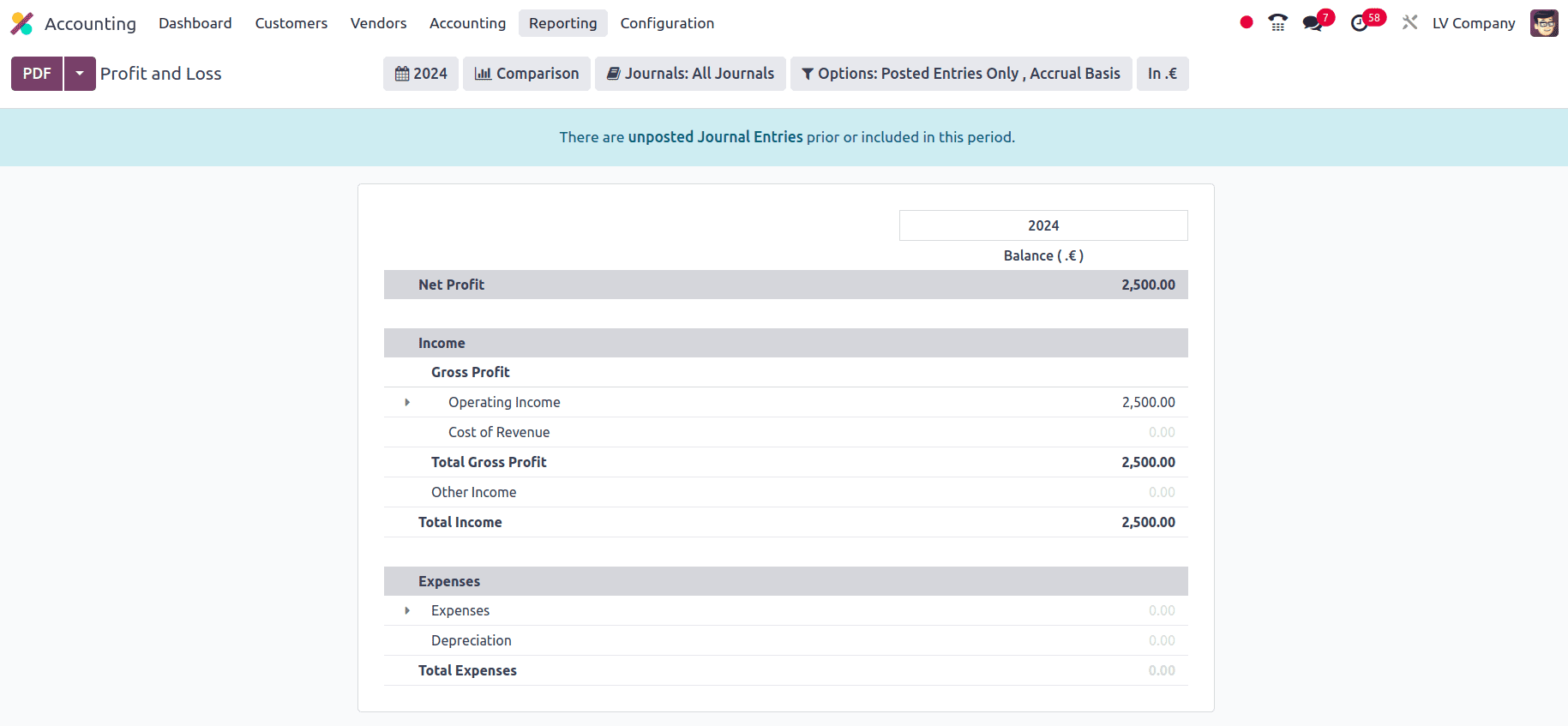

The Profit and Loss (P&L) report from Odoo offers a thorough summary of the financial performance of your company over a given time frame. It lists your earnings, outlays, and net profit or loss as a result. Under the Reporting menu, we have the Profit and loss report. The profit and loss report includes Net profit, Income, Expenses, etc. Operating income, cost of revenue, total gross profit, and other incomes, all are included under the income section, and the Expenses and depreciations are included in the Expense section.

The Odoo Profit and Loss (P&L) report provides insightful information about the financial condition of your company so that investors can make wise selections. aids in establishing financial targets and goals. finds areas that need budget cuts or more resources. and aid in evaluating possible financial hazards.

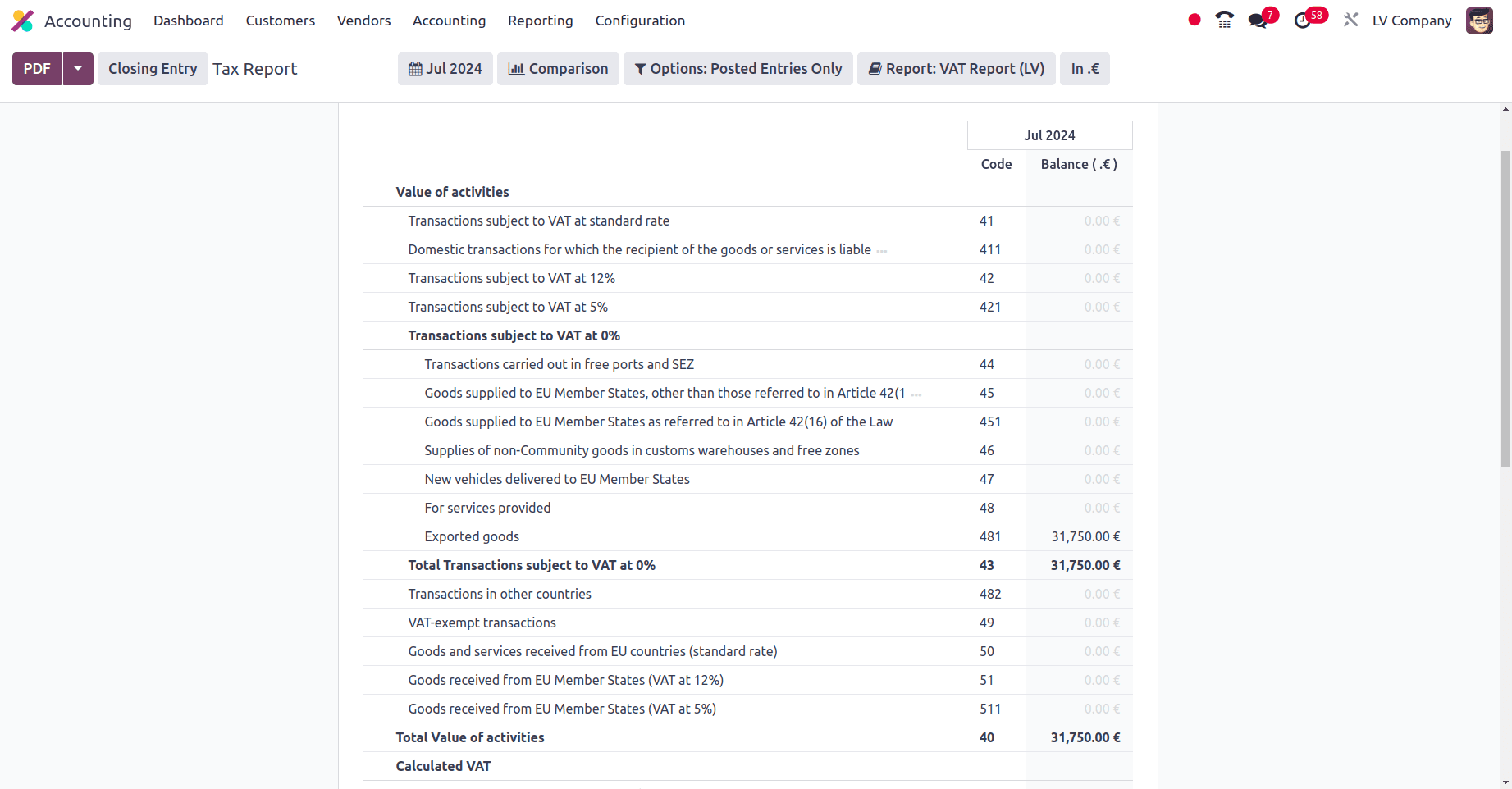

Next is the Tax report of the company. Under the Reporting menu, we have the Tax report of the company. Odoo offers a dedicated tax report feature that allows you to generate reports based on specific tax periods. You can also make customizations for the tax reports to satisfy your specific needs.

Value of activity, transaction subjected to VAT, calculated VAT, VAT paid for goods and services purchased, etc are included in the Tax report of the company.

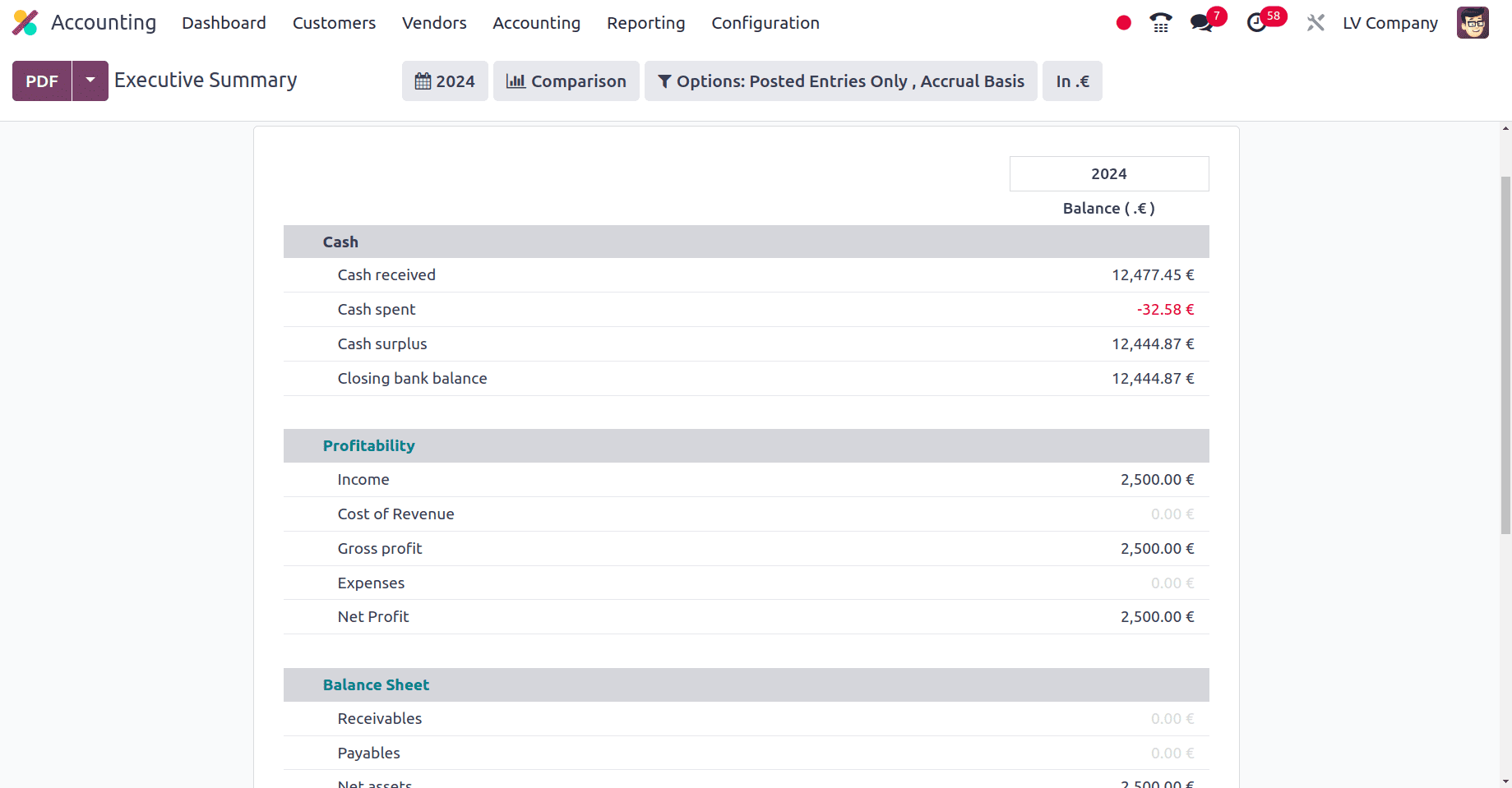

For each company, an executive summary will be created, and the executive summary report will be placed under the Reporting menu.

An executive summary usually offers a high-level synopsis of the financial performance of a corporation. You may use a variety of dashboards and reports in Odoo to gather the information you need and produce an executive summary that is specifically customized.

In this blog, we have discussed Accounting localization for a Latvian company. Odoo provides a useful tool for companies doing business in Latvia. By utilizing Odoo's features, businesses may generate accurate financial reports, simplify their accounting procedures, and adhere to local laws.

To read more about An Overview of Accounting Localization for Estonia in Odoo 17, refer to our blog An Overview of Accounting Localization for Estonia in Odoo 17.