Odoo accounting localization is essential for coordinating financial management with local business procedures and legal needs. It guarantees that the accounting system complies with local currency restrictions, reporting requirements, and tax laws, all of which are critical for the accuracy and smooth running of the company. Odoo assists companies in streamlining their accounting procedures, lowering errors, and preserving transparency by integrating localized elements such as particular tax computations, reporting formats, and regulatory needs. This customized strategy streamlines financial operations and facilitates strategic planning and well-informed decision-making while adhering to local regulations.

Understanding and following local financial rules is crucial for businesses in different markets. Odoo’s accounting localization for Romania offers a specialized solution to meet the country's unique accounting and tax requirements. This localization integrates Romanian financial standards directly into Odoo's ERP system, providing businesses with tools for accurate VAT calculations and compliant financial reporting, as well as following local accounting practices. By customizing features to align with Romanian regulatory frameworks, Odoo enhances operational efficiency, simplifies financial management, and ensures that businesses remain compliant with Romanian financial laws and standards.

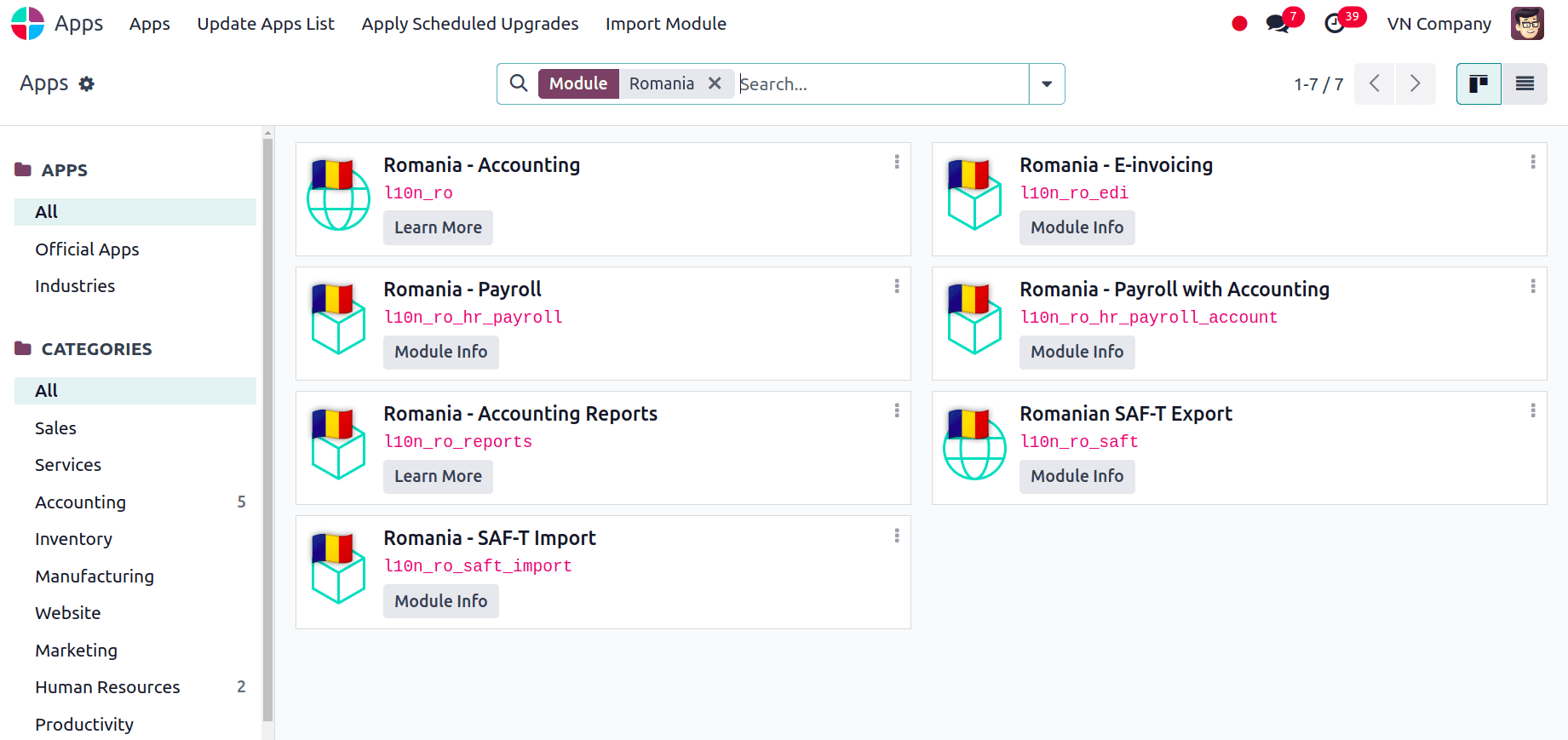

Installation of the localization

We can get the Romania accounting localization in Odoo 17 in two ways: either install the accounting localization modules or choose Romania as the country when creating the database. To install the modules for Romania localization, go to Apps, search for the Romania localization modules, and install the required modules.

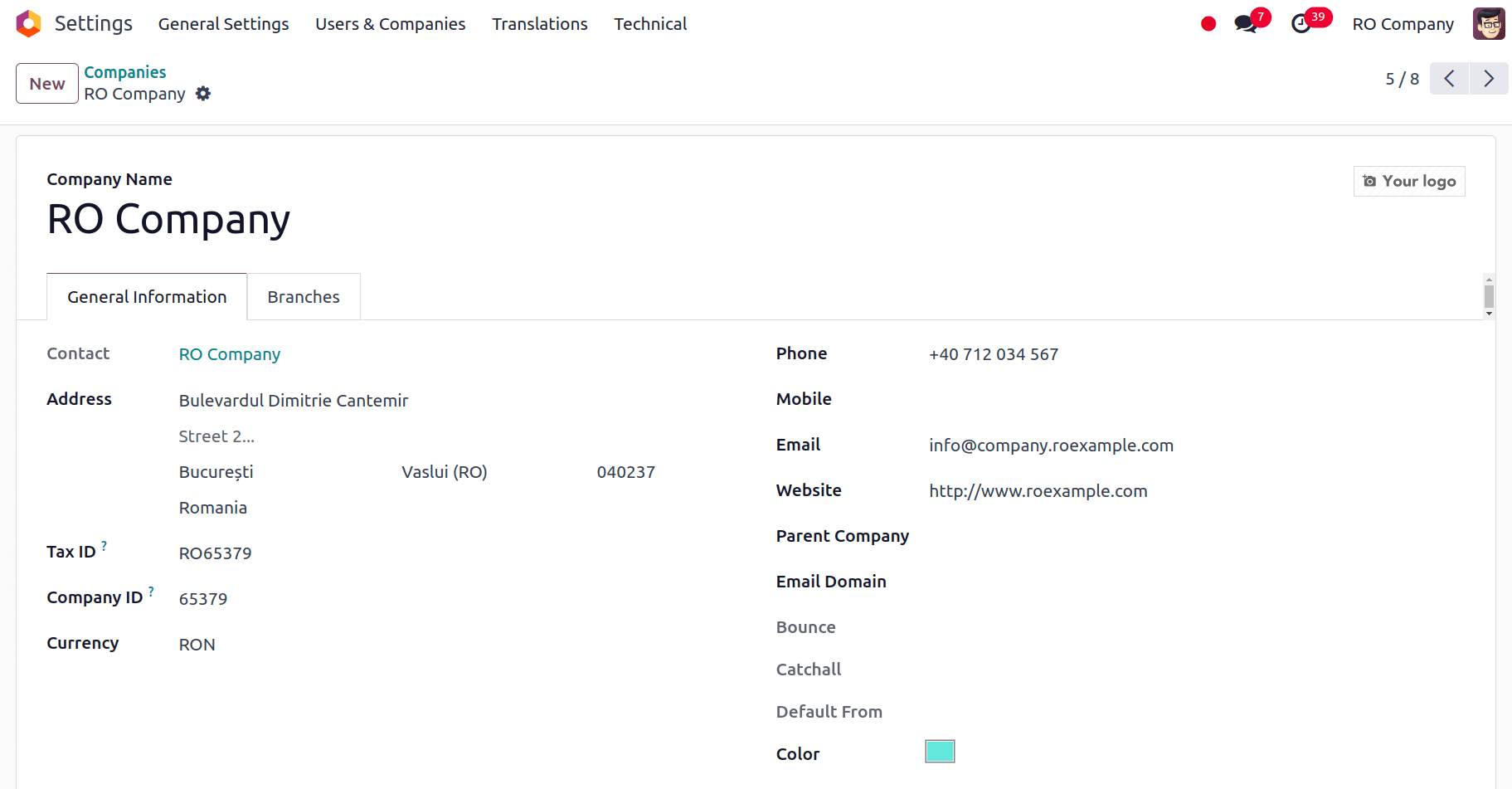

Configuring the Company

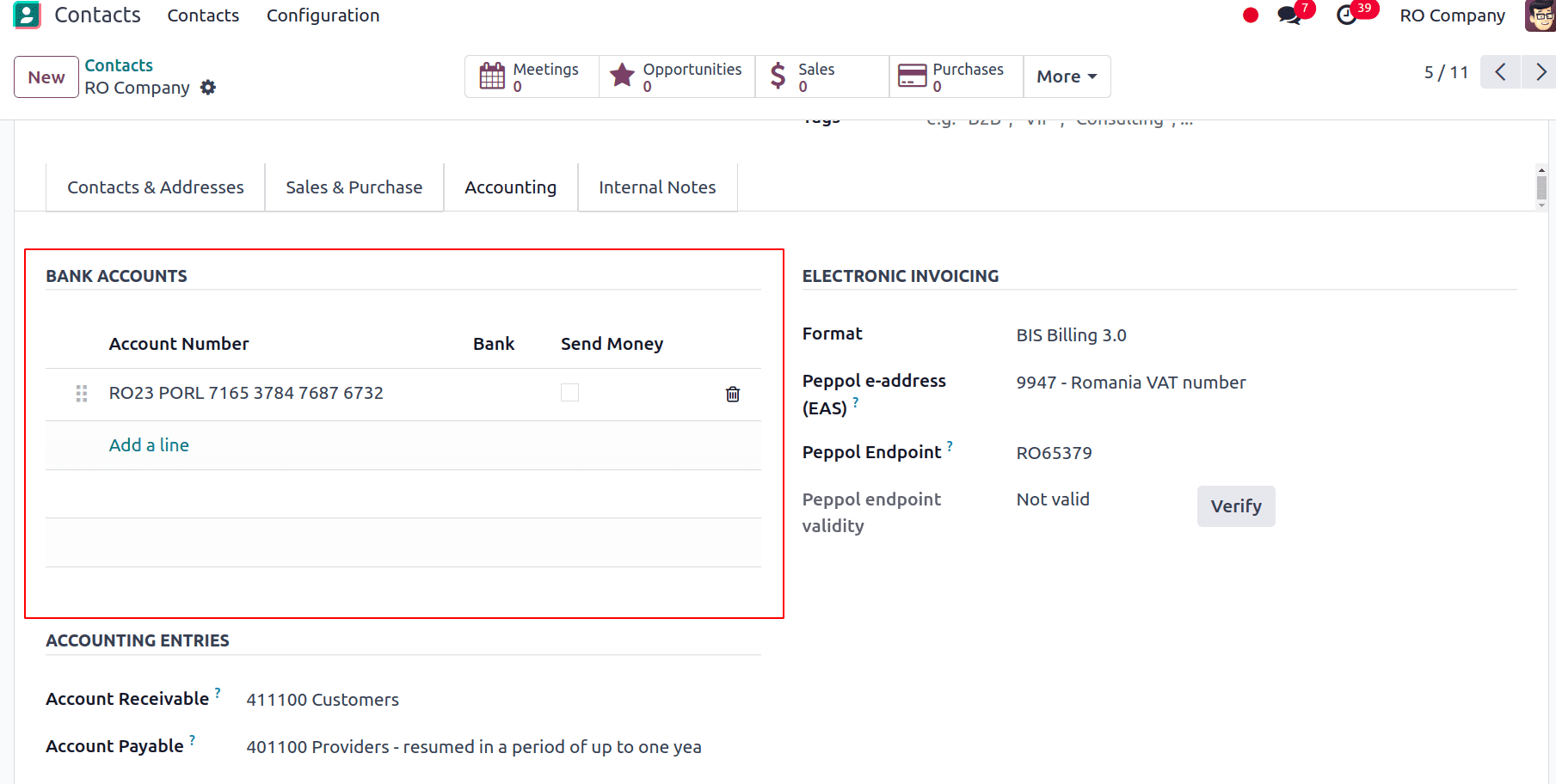

After installing the modules, we have to check whether the company configuration is proper, for that go to Settings > Users and Companies > Companies. Select the company and check the configuration. Check the Country, City, and Telephone Number and in the Company ID section, enter your company's CUI number (or, for overseas corporations, CIF number) without the RO prefix (e.g., 18547290).

Provide the Tax ID number (e.g., RO18547290) in the Tax ID field if your company is registered for VAT in Romania. You do not need to enter the Tax ID area if the company is not registered for VAT in Romania. And also set the Bank Account Number for the Contact of the company from the Contacts module in the accounting tab.

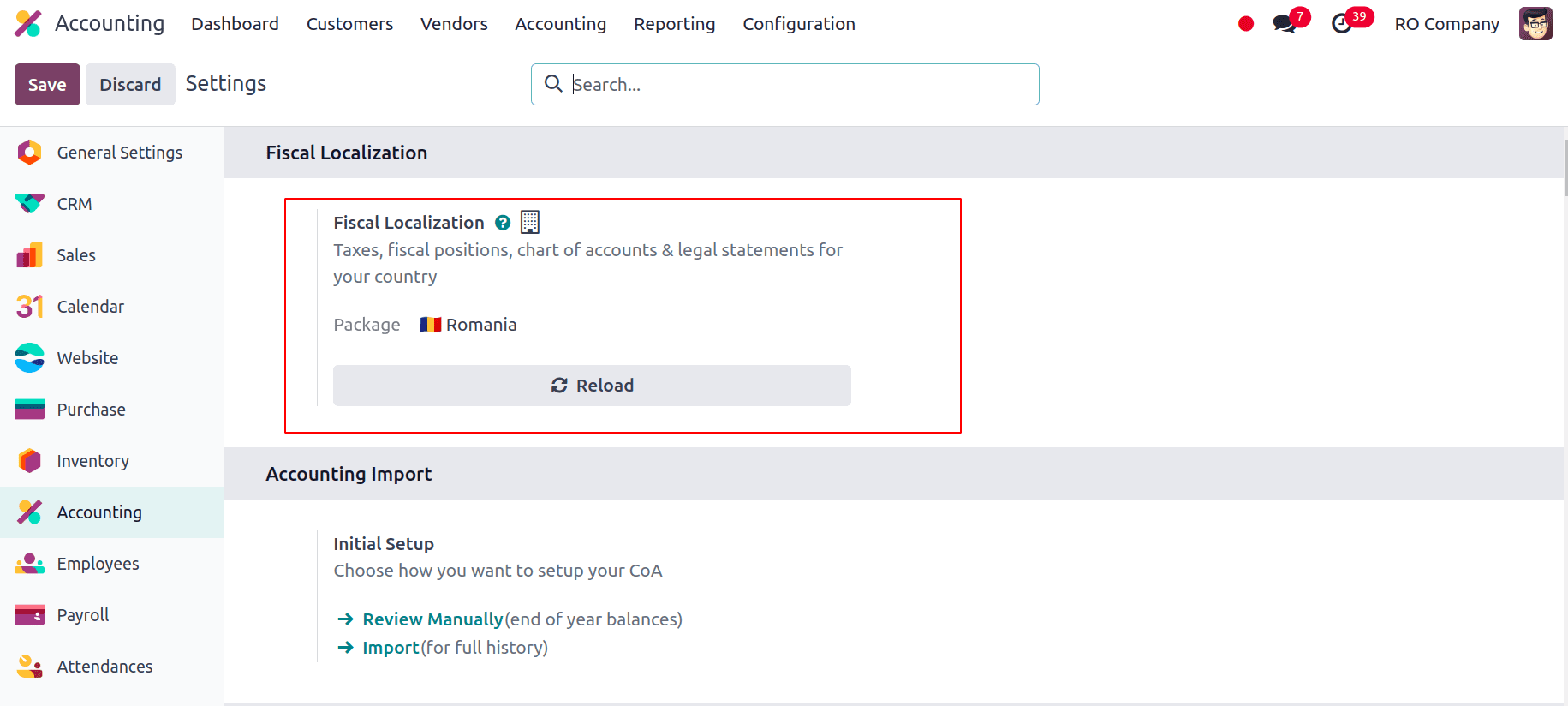

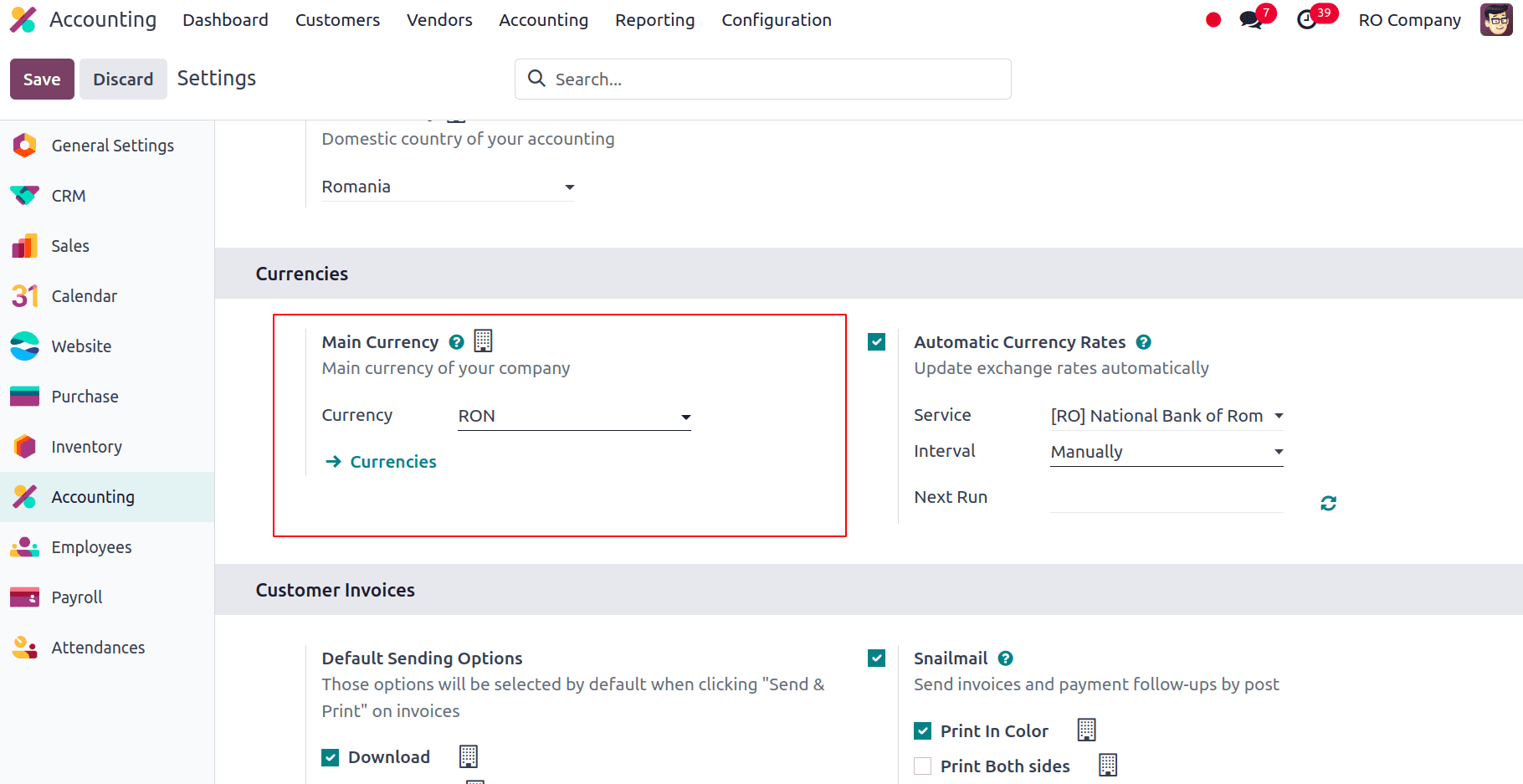

After ensuring that the company is set up properly, we can go to Accounting > Configuration > Settings and check the Fiscal localization that is set for this localization. It will be set in Romania.

The main currency will be the Romanian leu (RON), which is Romania's official currency.

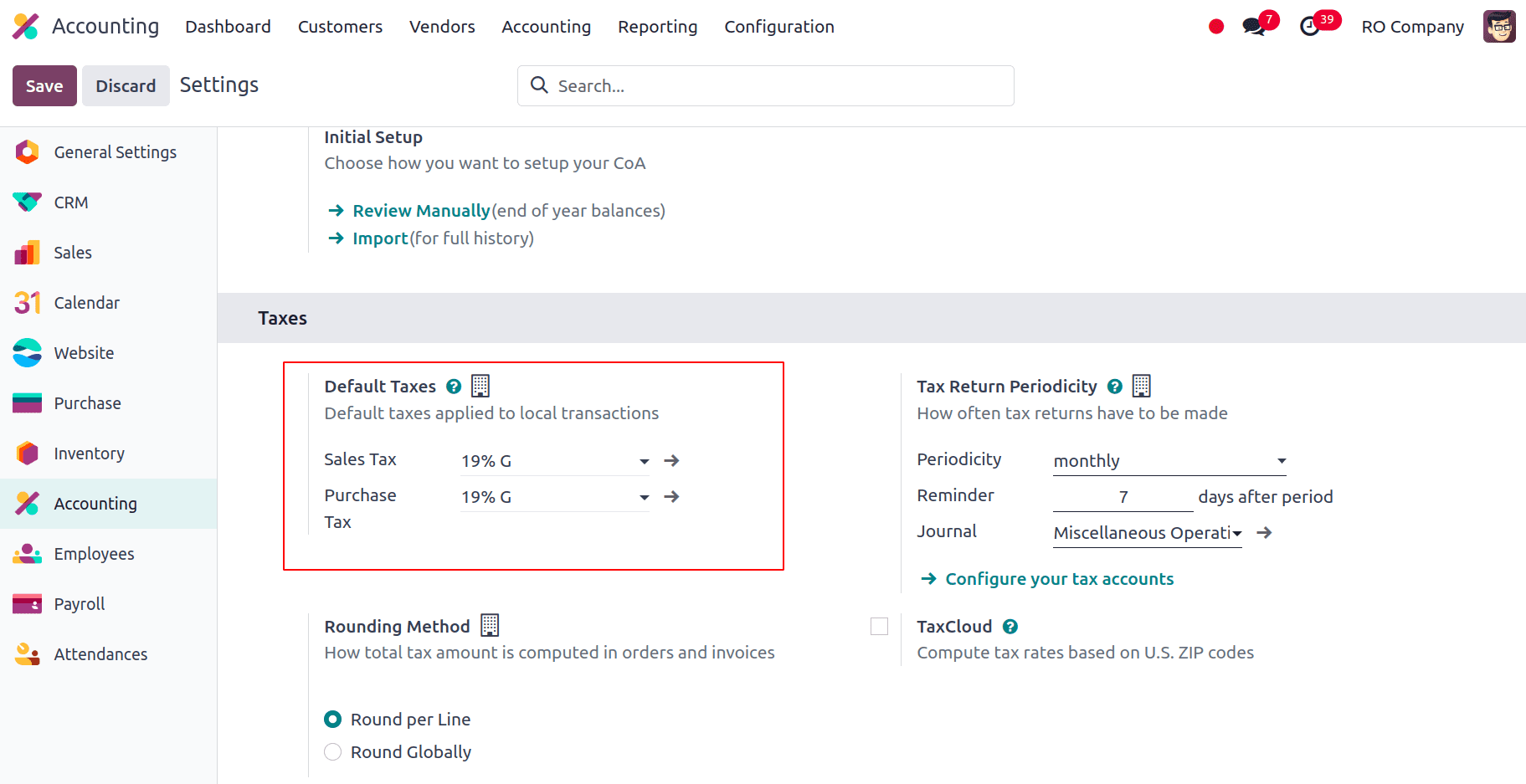

When we install the Romania Localisation, the default tax in the configuration settings of the accounting module will be set so that correct tax rates are automatically applied to transactions, reducing the risk of manual errors and ensuring consistency. Default taxes help streamline the invoicing process by pre-configuring tax codes for various products and services, which enhances accuracy in financial reporting and tax calculations. Here, it is set to 19% G for Sales and Purchase Tax.

Chart of Accounts

The Chart of Accounts in Odoo accounting is a structured framework that arranges all of the financial accounts that a company uses. It simplifies the recording and reporting of financial transactions by classifying accounts into several types, including assets, liabilities, equity, revenues, and expenses. In the Chart of Accounts, we have the Merger/Division premiums in the Chart of Accounts which is used to track the premiums or adjustments associated with corporate mergers or divisions. These premiums are often recorded in accounts designated for extraordinary gains or losses resulting from such restructuring activities. Then, we have the Provisions for Litigation, which is an account designed to track estimated costs associated with legal disputes, such as lawsuits or legal claims against the company. This provision is a liability recognized to anticipate and account for potential financial outflows resulting from legal matters. Similarly, several accounts were added to the Chart of Accounts when we installed the Romania Localisation.

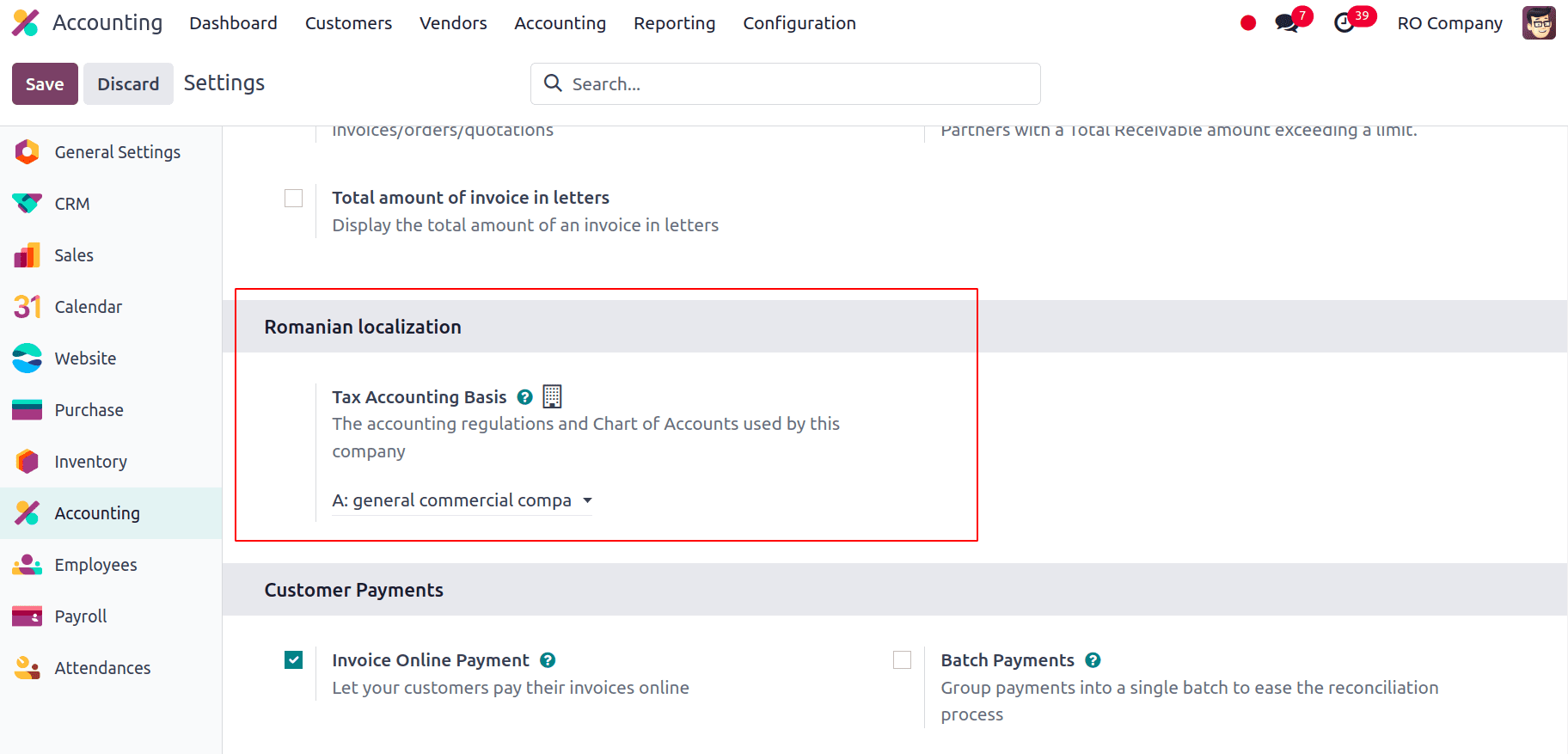

The chart of accounts cannot differ from an official chart of accounts in order for the Romanian Tax Agency to create a file receivable with the Romania accounting localization. In the Romanian localization area of Settings –> Accounting, adjust the Tax Accounting Basis to align with the company's Chart of Accounts and accounting guidelines.

We have to set the Tax Accounting Basis which is under the Romanian Localization in the configuration settings of the accounting module so that the accounting basics and the Chart of Accounts Used by the company are reflected.

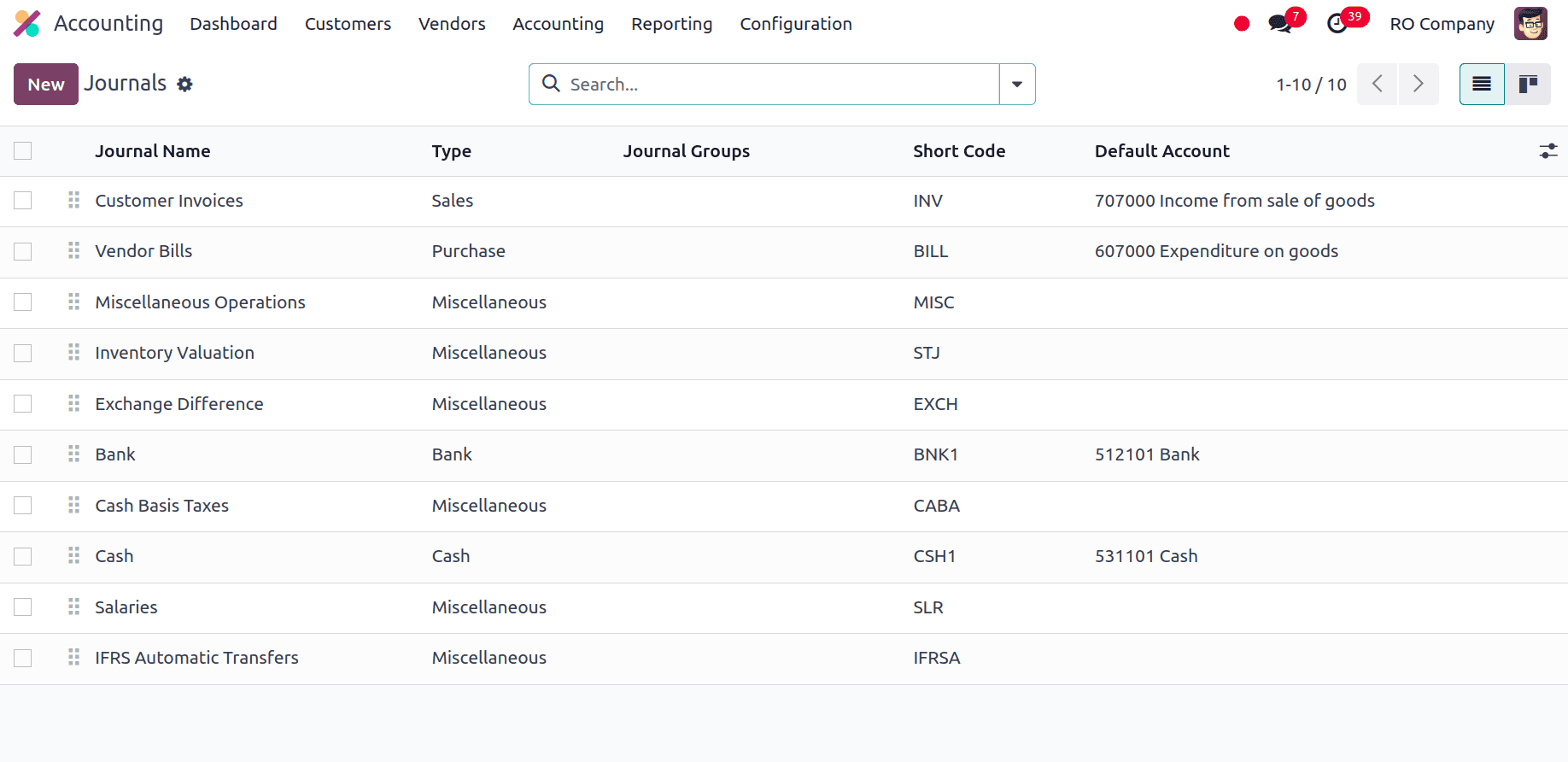

Journals

Journals record and organize financial transactions. They function as detailed logs where transactions are entered, categorized, and tracked, such as sales, purchases, bank, and cash. Each journal in Odoo can be customized to fit specific transaction types and accounting needs, ensuring accurate financial data management. Journals help maintain a clear audit trail, streamline reconciliation processes, and support comprehensive financial reporting, making them a key component in maintaining organized and compliant accounting records. With the installation of the Romania accounting localization, along with all the basic journals, Exchange Difference and IFRS Automatic Transfers have also been added. Exchange difference journal monitors and records the effects of exchange rate fluctuations on financial transactions and balances. It helps to keep accurate accounting records, makes it easier to comply with financial reporting rules, and offers insights into the financial effects of currency volatility by recording exchange rate discrepancies.

Users can create rules that dictate when and how balances should be moved between accounts using Odoo's IFRS Automatic Transfers journal. This automation minimizes the possibility of errors in financial transactions and cuts down on manual labor. By making the process of applying IFRS standards to financial data more efficient, it improves the efficiency of financial operations.

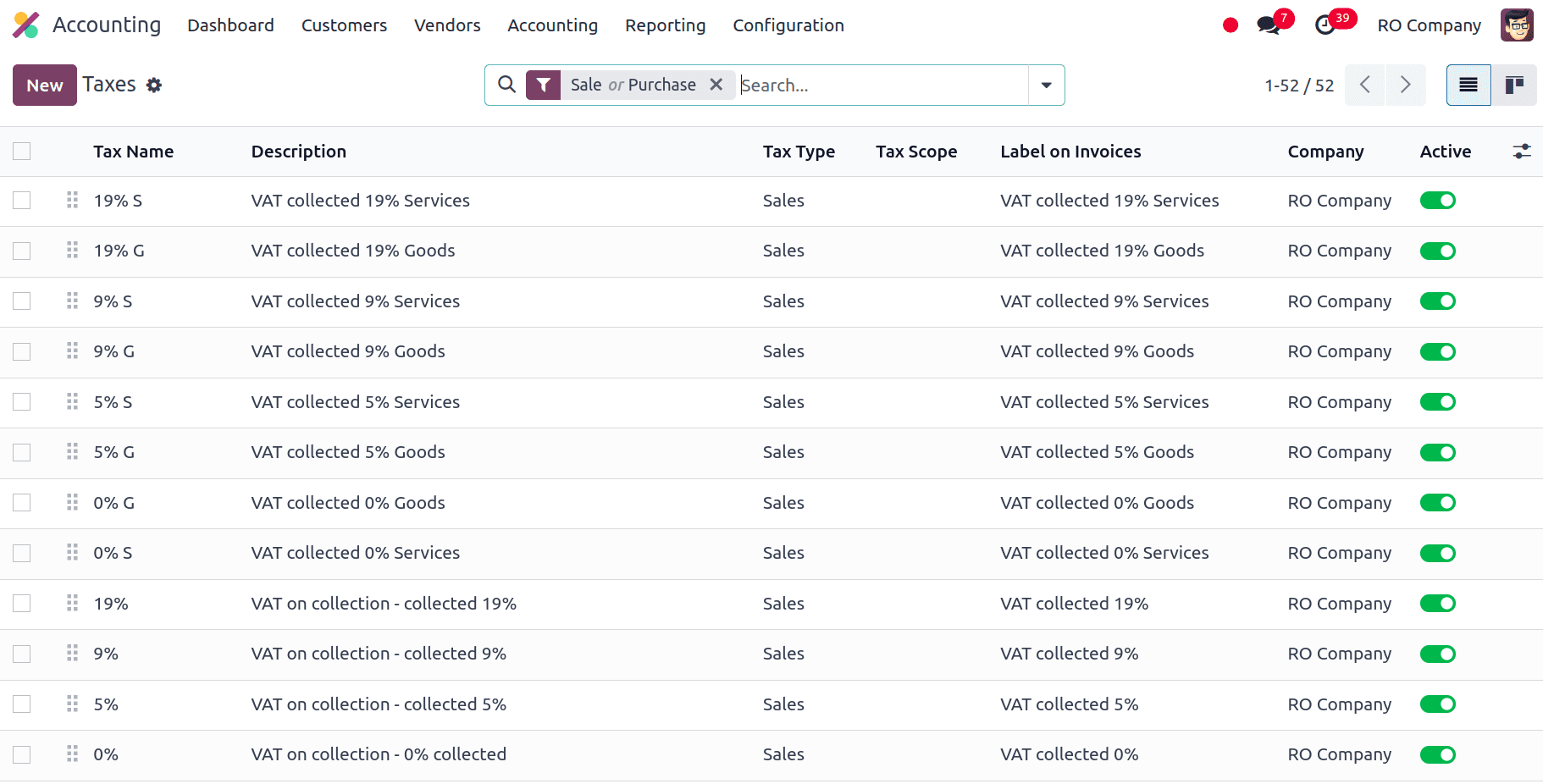

Taxes

In Odoo, the taxes streamline the management and calculation of taxes for various transactions. It automates tax calculations based on predefined tax rates and rules, ensuring accurate application of taxes on sales and purchases. On every tax you use, you have to write the Romanian SAF-T Tax Code (6-digit number) and Romanian SAF-T Tax Type (3-digit number). This is already completed for the taxes that are present in Odoo by default. To accomplish this, navigate to Accounting > Configuration > Taxes, choose the tax to be changed, click the Advanced Options tab, and then enter the tax code and tax type.

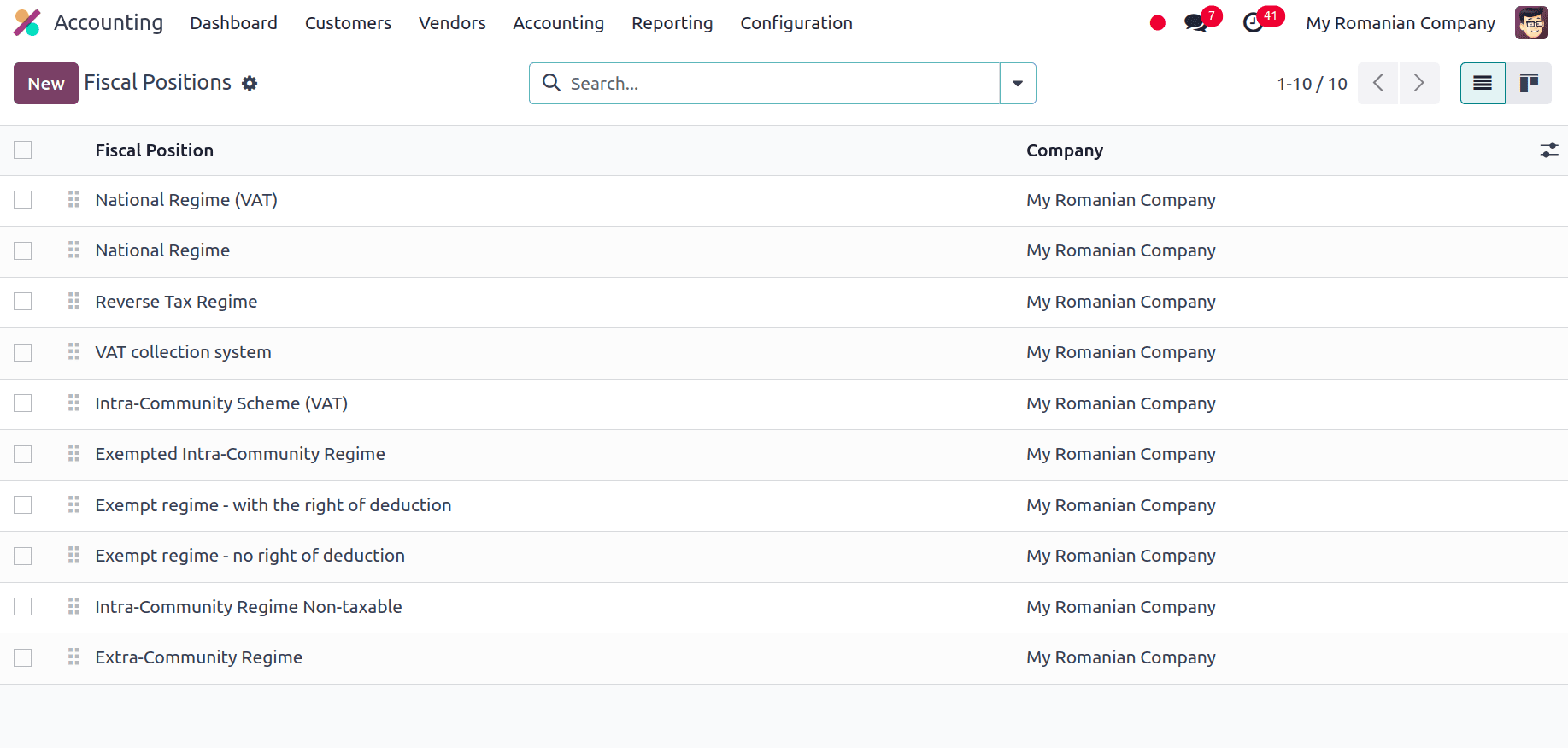

Fiscal Positions

The fiscal position function in Odoo's Romanian localization is essential for handling taxes and financial transactions in compliance with regional laws. Using the appropriate tax rates and accounting guidelines depending on the customer's region or the kind of good or service being sold is made easier with the aid of fiscal positions in Odoo. When creating or editing fiscal positions, users can map taxes from one fiscal position to another. This ensures that invoices and sales orders reflect the accurate VAT rates required by Romanian tax law.

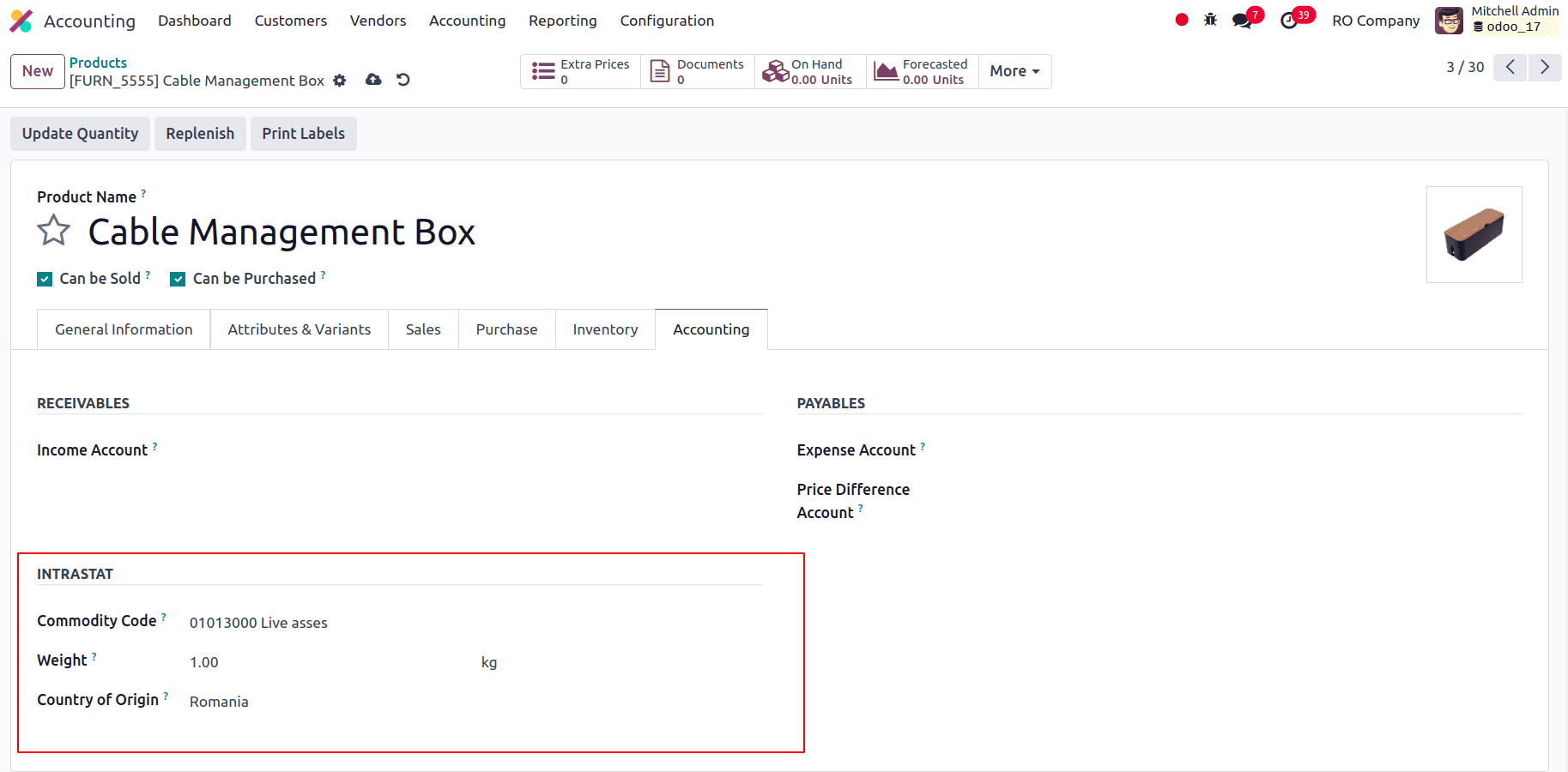

Products

According to Romanian law, the Intrastat Code (Cod NC) needs to be set up on the product for certain kinds of goods transactions like transactions involving import and export, purchases and deliveries of food items that are liable to a lower VAT rate, Intrastat reporting is applied to intracommunity movements, purchases and supplies susceptible to a reversed VAT charge at the municipal level, based on the Code of NC and transactions involving products that are subject to excise duties, which are established in accordance with the Cod NC. A non-service product will utilize the default code "0" if the Intrastat Code is not given. Go to Accounting > Customers > Products, choose a product, and then select a commodity code in the Accounting tab to configure the Intrastat Codes.

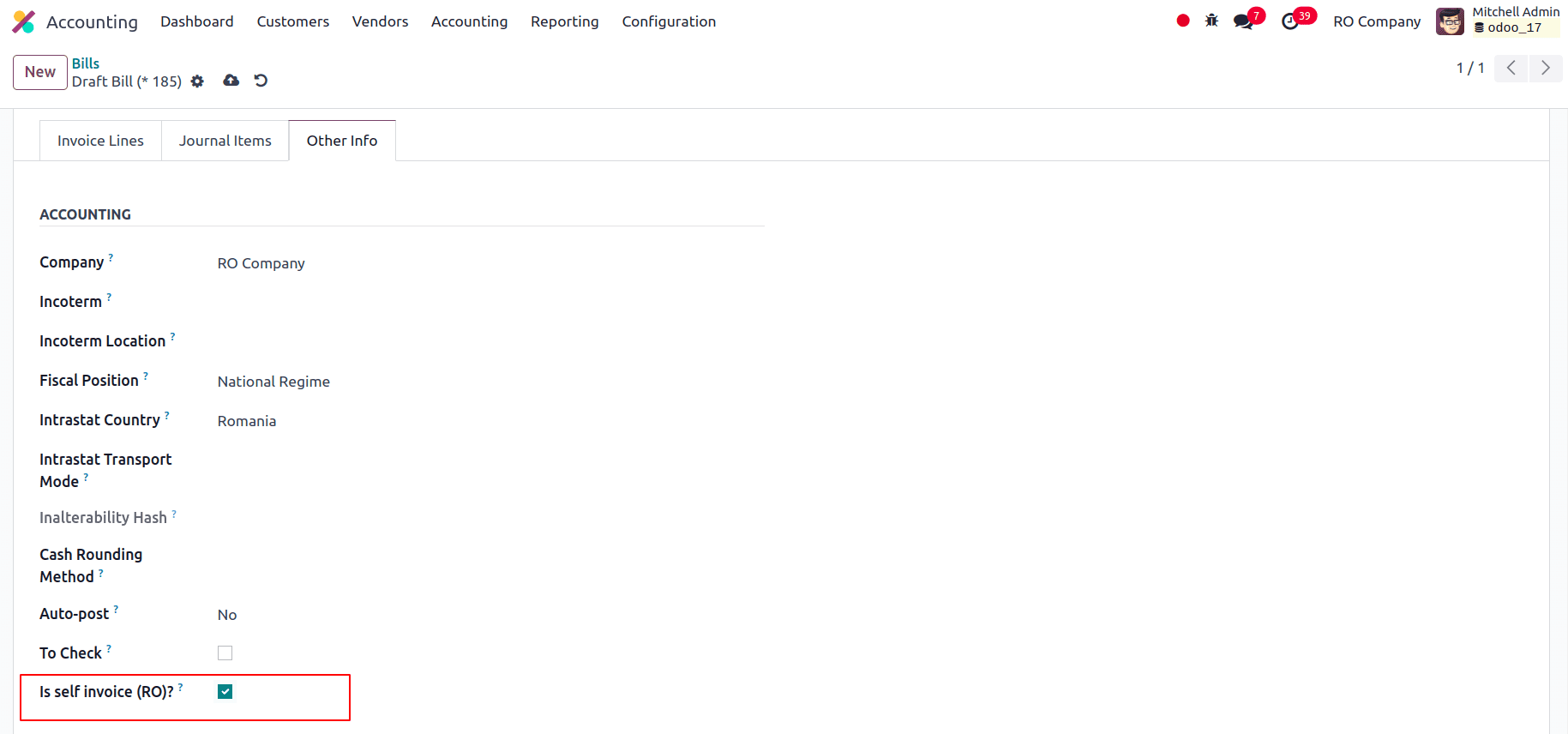

Vendor Bill

For every vendor bill that is a self-invoice (i.e.,in the absence of an invoice document received from a supplier we can issue a vendor bill ourself), you must check the Is self-invoice (RO)? Checkbox in the Other Info tab.

D.406 declaration

To export the XML for the D.406 declaration in Odoo, follow these steps:

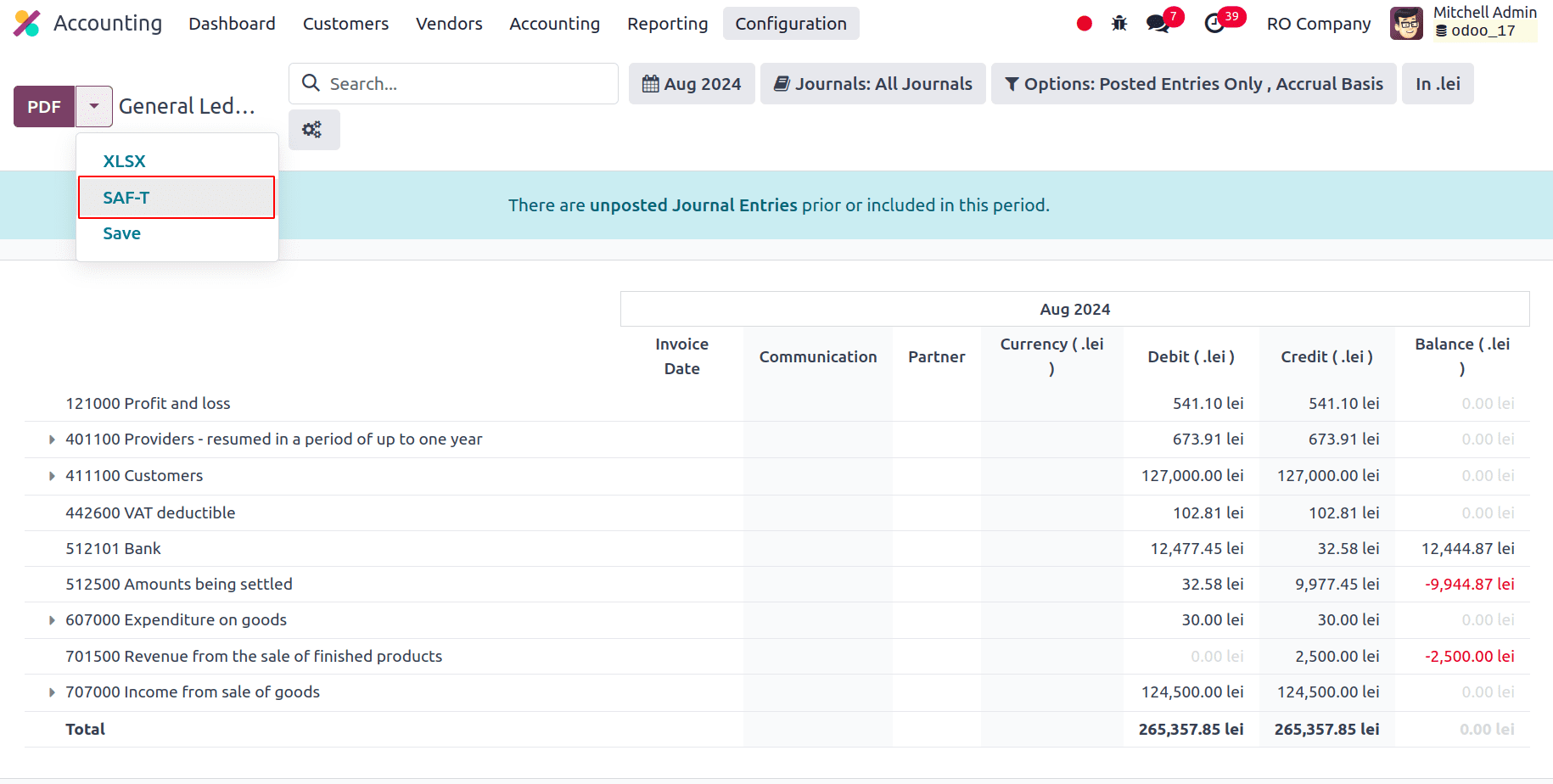

1. Export XML:

* Go to Accounting > Reports > General Ledger.

* Click on SAF-T to export the D.406 XML declaration.

2. Validate and Sign XML:

* Download and install the DUKIntegrator validation software from the Romanian Tax Agency's website.

* Open DUKIntegrator, select the generated XML file and choose Validare + creare PDF to create an unsigned PDF or Validare + creare PDF semnat to create a signed PDF.

3. Error Handling:

* If DUKIntegrator detects errors in the XML file, an error report will be generated. Correct these issues before submitting the report to the Romanian Tax Agency.

This process ensures compliance with Romanian tax reporting requirements by validating and signing the XML declaration file.

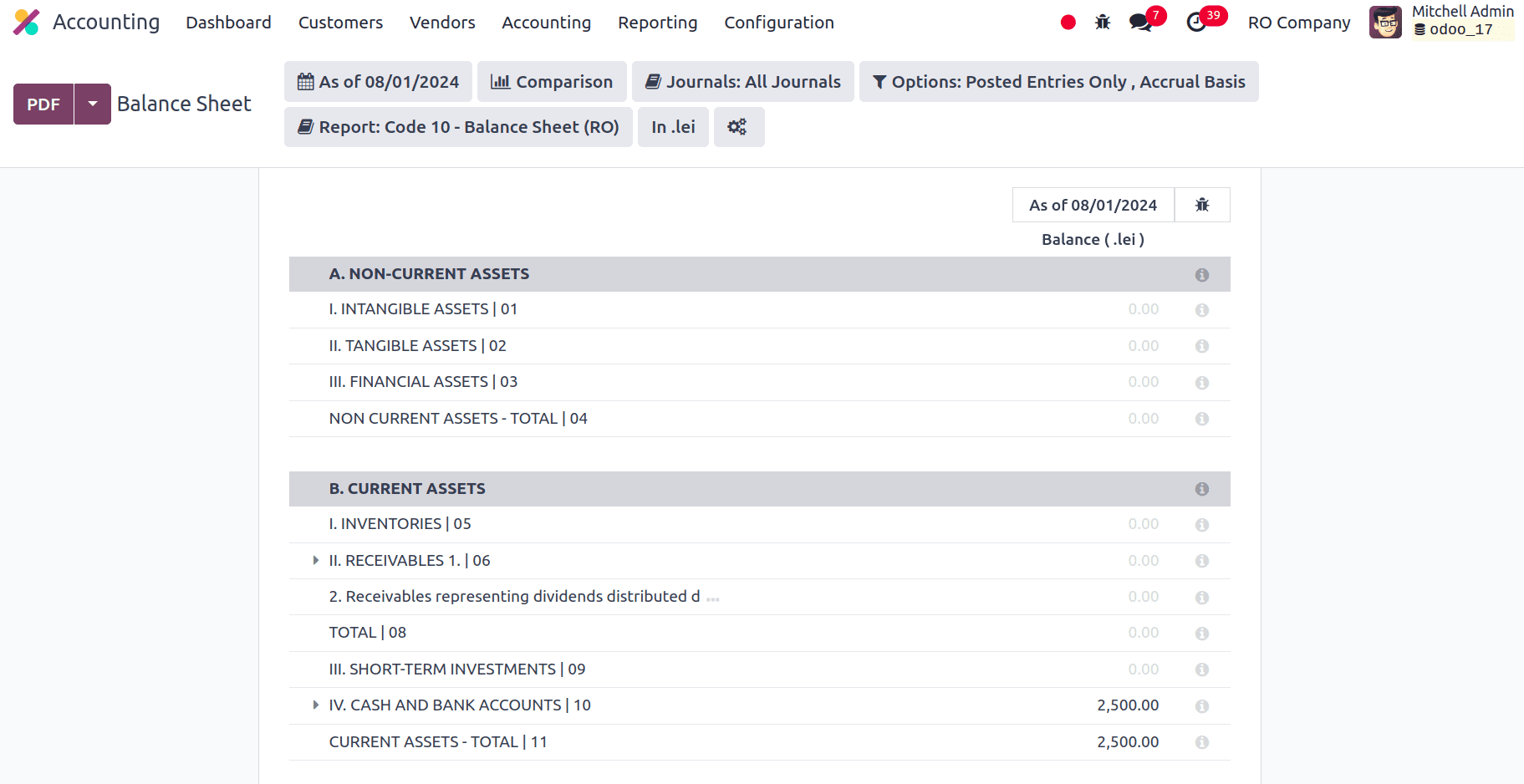

Balance Sheet

A complete picture of a company's financial situation at any one time can be found on the balance sheet. It compiles data on equity, liabilities, and assets to give owners a comprehensive image of the company's holdings and debts as well as its remaining worth. Assessing financial soundness, assisting in decision-making, and guaranteeing accurate financial reporting all depend on this report. By automating the creation of balance sheets and guaranteeing that the data is up to date-and compliant with accounting standards, Odoo makes effective financial management and compliance possible. The balance sheet in Odoo with Romania localization provides a thorough summary of a business's financial situation and is adjusted to meet Romanian accounting requirements. It presents the company's equity, liabilities, and assets at a certain moment in time, indicating the state of its finances.

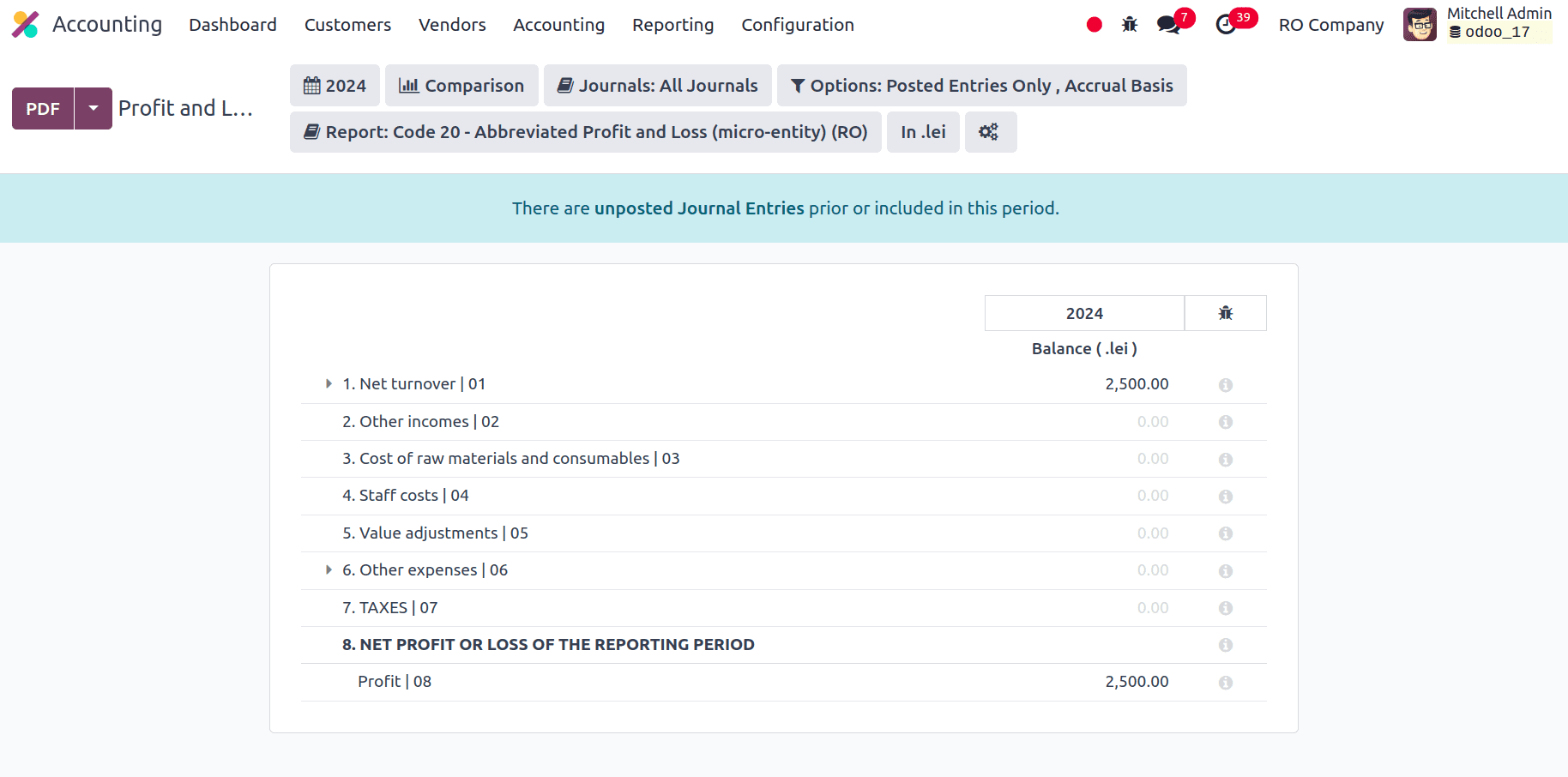

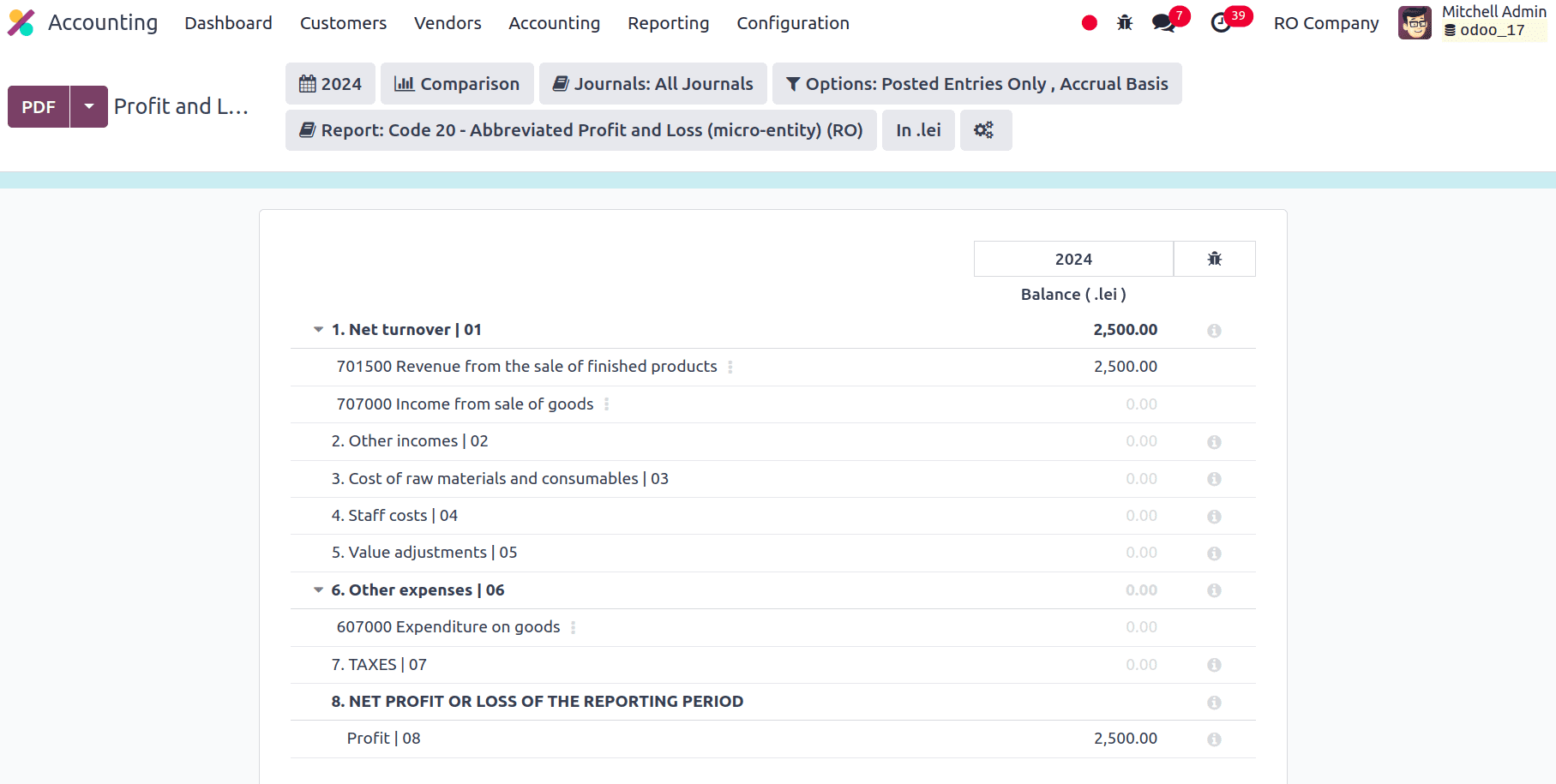

Profit and Loss Report

According to Romanian accounting rules, the Profit and Loss report in Odoo with Romania localization provides a thorough overview of a company's financial performance over a given period. The summary of revenues, expenses, and net income offers valuable information on the profitability of the company. This localized report presents precise and pertinent financial data while guaranteeing compliance with Romanian financial reporting regulations. In order to facilitate efficient financial analysis and decision-making, Odoo integrates local tax and accounting regulations and automates the creation of the profit and loss report.

Tax Report

In Odoo's Profit and Loss report, net turnover represents the total revenue generated from core business activities, excluding returns, allowances, and discounts. It provides a clear measure of the company's actual sales performance, reflecting income earned from primary operations. This metric is crucial for evaluating business performance and profitability, as it highlights the revenue that directly contributes to the company's financial results. Odoo calculates net turnover automatically, ensuring accuracy and alignment with financial reporting standards.

The Romanian localization of Odoo's accounting offers a complete solution that complies with regional financial and legal regulations. Through the integration of tax laws, reporting requirements, and Romanian accounting standards, Odoo streamlines financial administration and guarantees regulation. By streamlining procedures like financial reporting, regulatory filings, and VAT handling, the localization features enable enterprises to function effectively within the confines of Romanian accounting standards. Odoo improves accuracy and operational performance with automated tools and customized functionalities, assisting organizations in upholding financial integrity and making wise judgments.

To read more about An Overview of Accounting Localization for Kazakhstan in Odoo 17, refer to our blog An Overview of Accounting Localization for Kazakhstan in Odoo 17.