Different countries have various distinct tax laws, accounting standards, legal reporting requirements, etc. The process of changing the accounting modules in Odoo to match the particular characteristics of each nation is known as accounting localization. The primary characteristic of Odoo 17 is the availability of "Fiscal Localisation Packages," which are nation-specific accounting localization modules. Odoo offers fiscal localization packages that are designed to adhere to the many countries' distinct tax laws, accounting systems, and legal reporting requirements. This guarantees that your accounting processes are compliant, which reduces the likelihood of errors and penalties. Fiscal events, charts of accounts, and tax groups are examples of prepared components that automate tax computations and reporting.

Odoo's accounting localization for Poland includes a number of features that make it easier to follow the Polish tax laws, accounting standards, and reporting requirements. With the ability to customize invoice forms, integrate with local banking systems, set tax rates, and generate obligatory reports, Odoo's localization features enable businesses to function smoothly within the Polish regulatory framework.

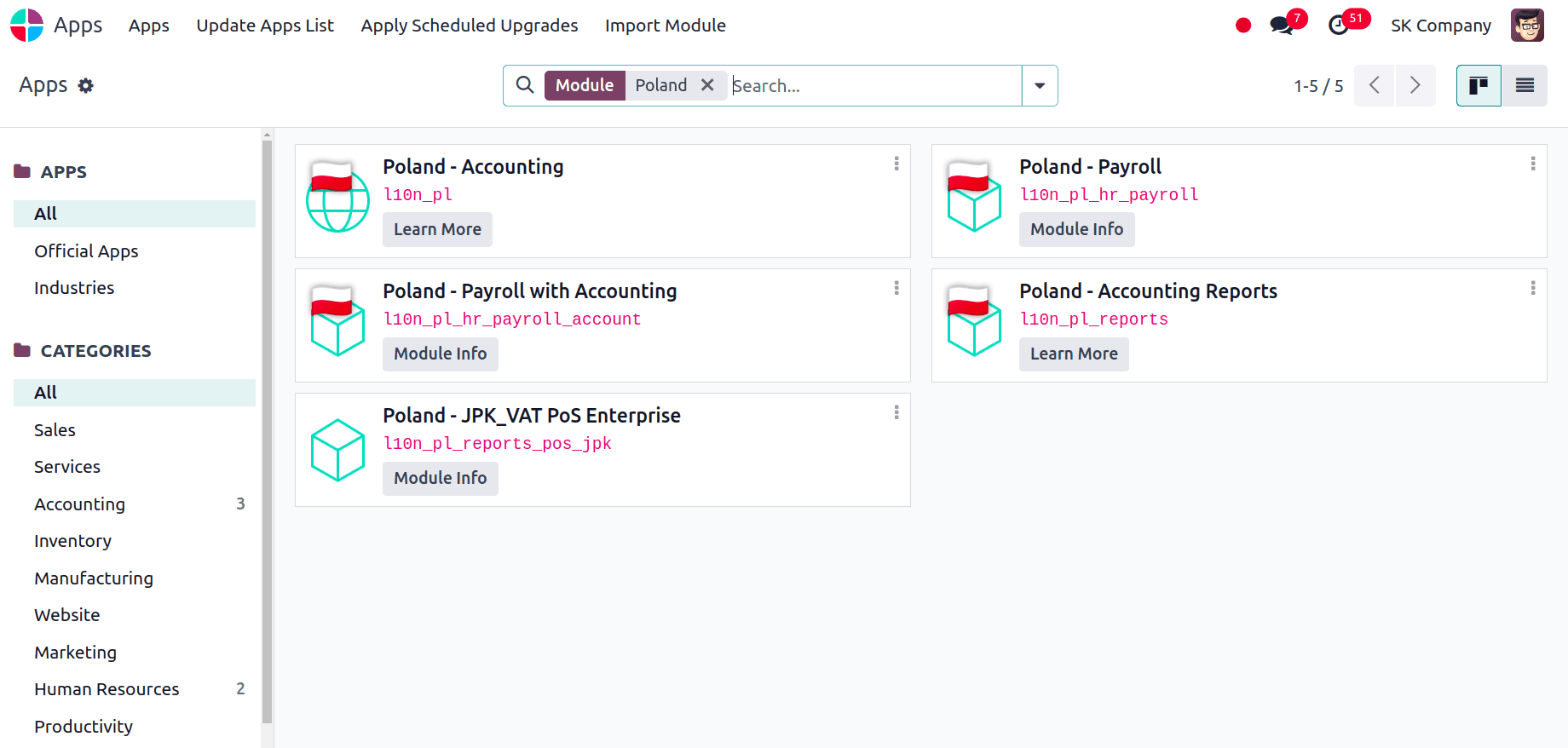

Setting up the accounting localization for Poland starts with installing the Poalnd localization. To accomplish this, go to Apps and install the modules required to configure the Poland accounting localization.

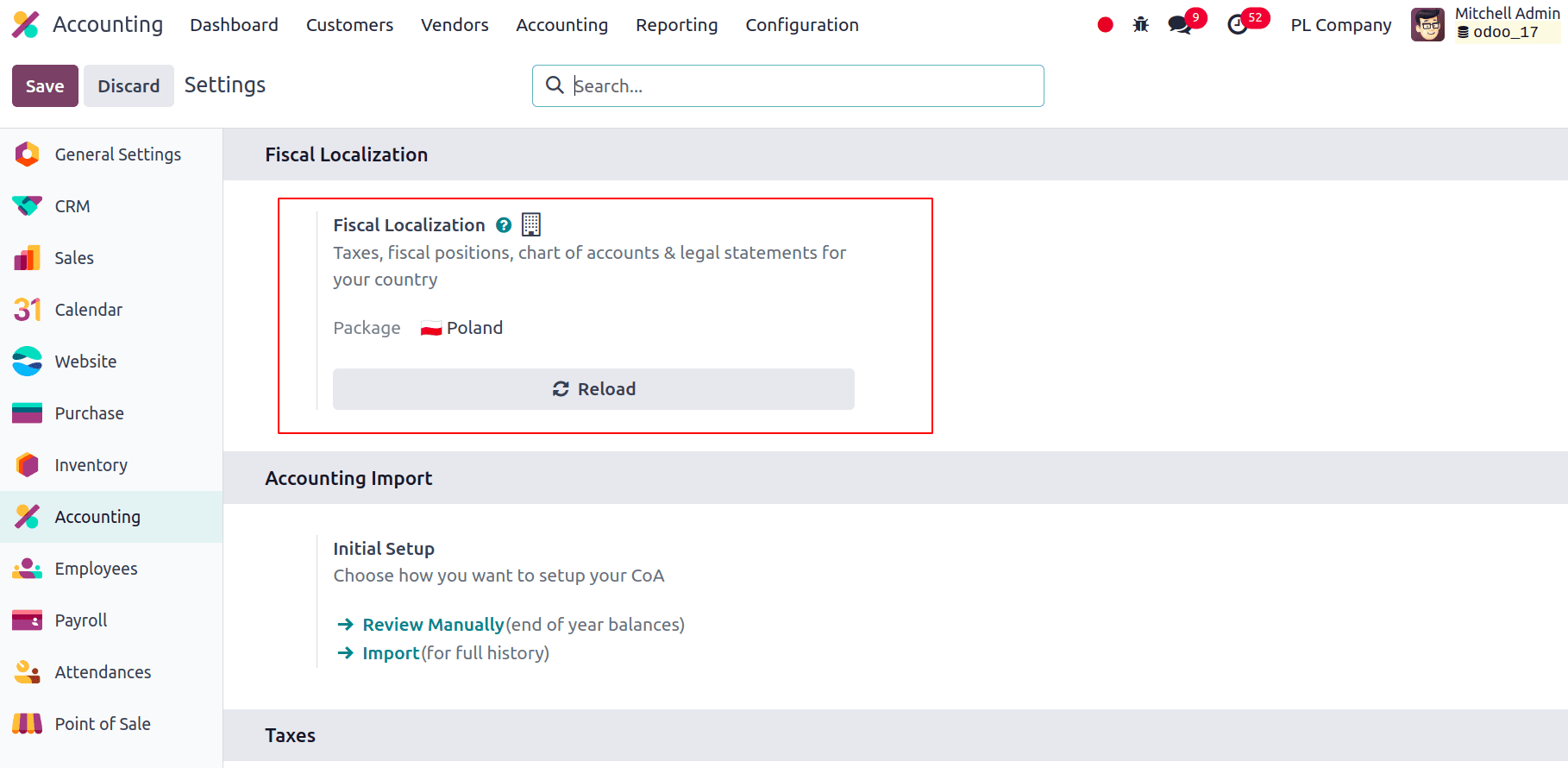

Now we can look into the changes in the Fiscal Localization, default taxes and currency. For that navigate to Accounting > Configuration > Settings, we can see that the Fiscal Localization will be set to Poland.

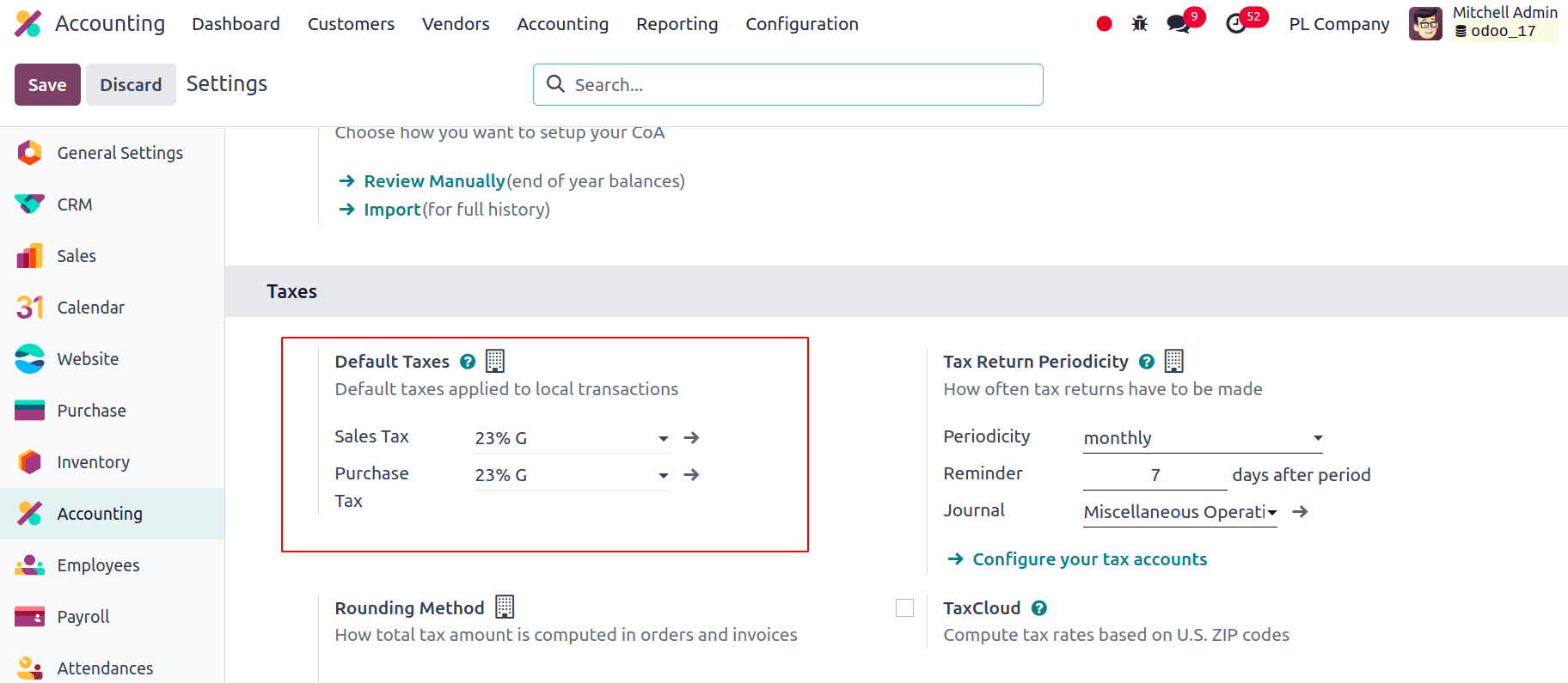

And the default taxes, Sales Tax, and Purchase Tax will be set to 23% G which will be applied to all the transactions by default.

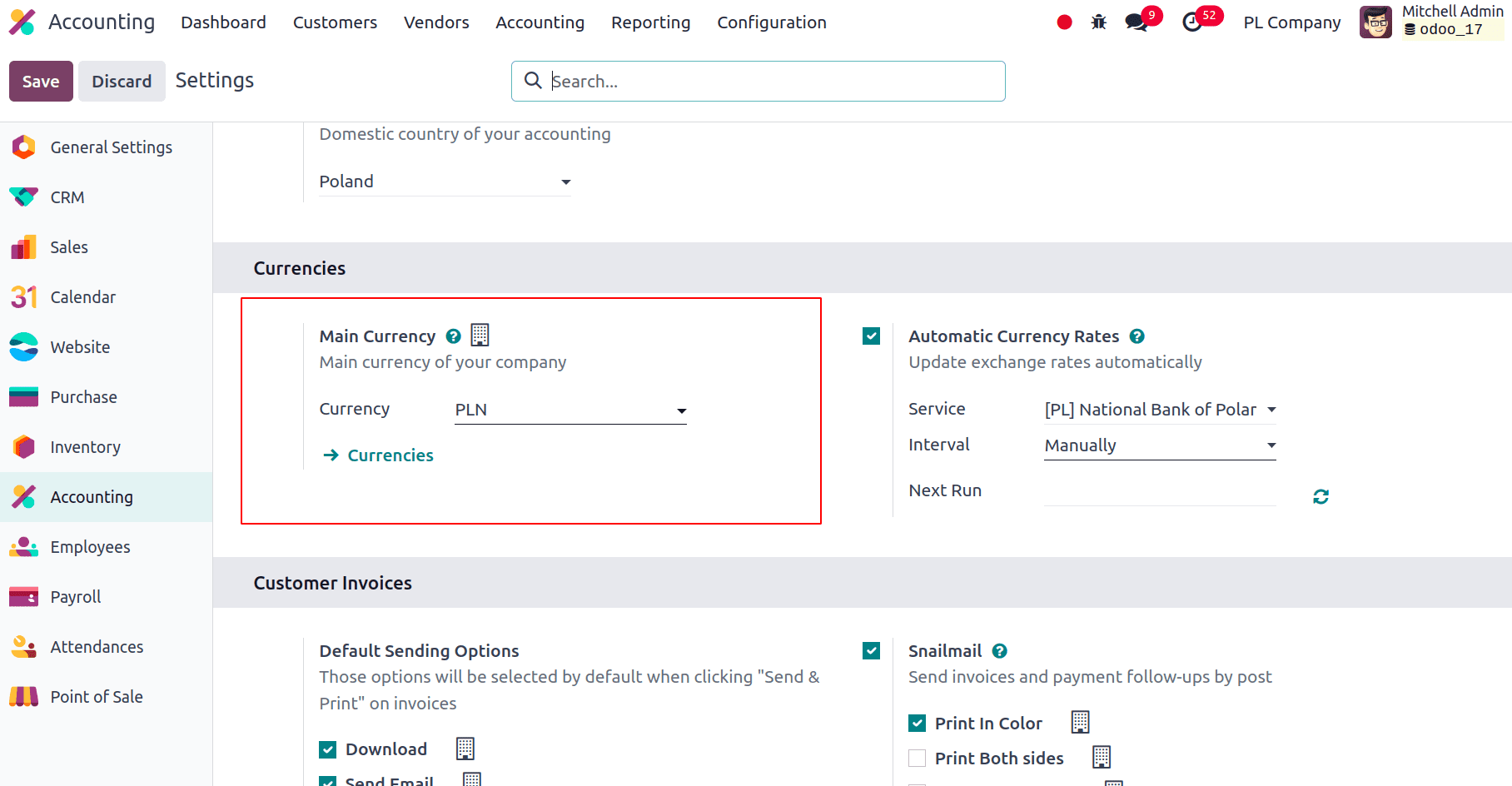

The main currency is set to the official currency of Poland which is Polish zloty (PLN) and all the transactions takes place in that.

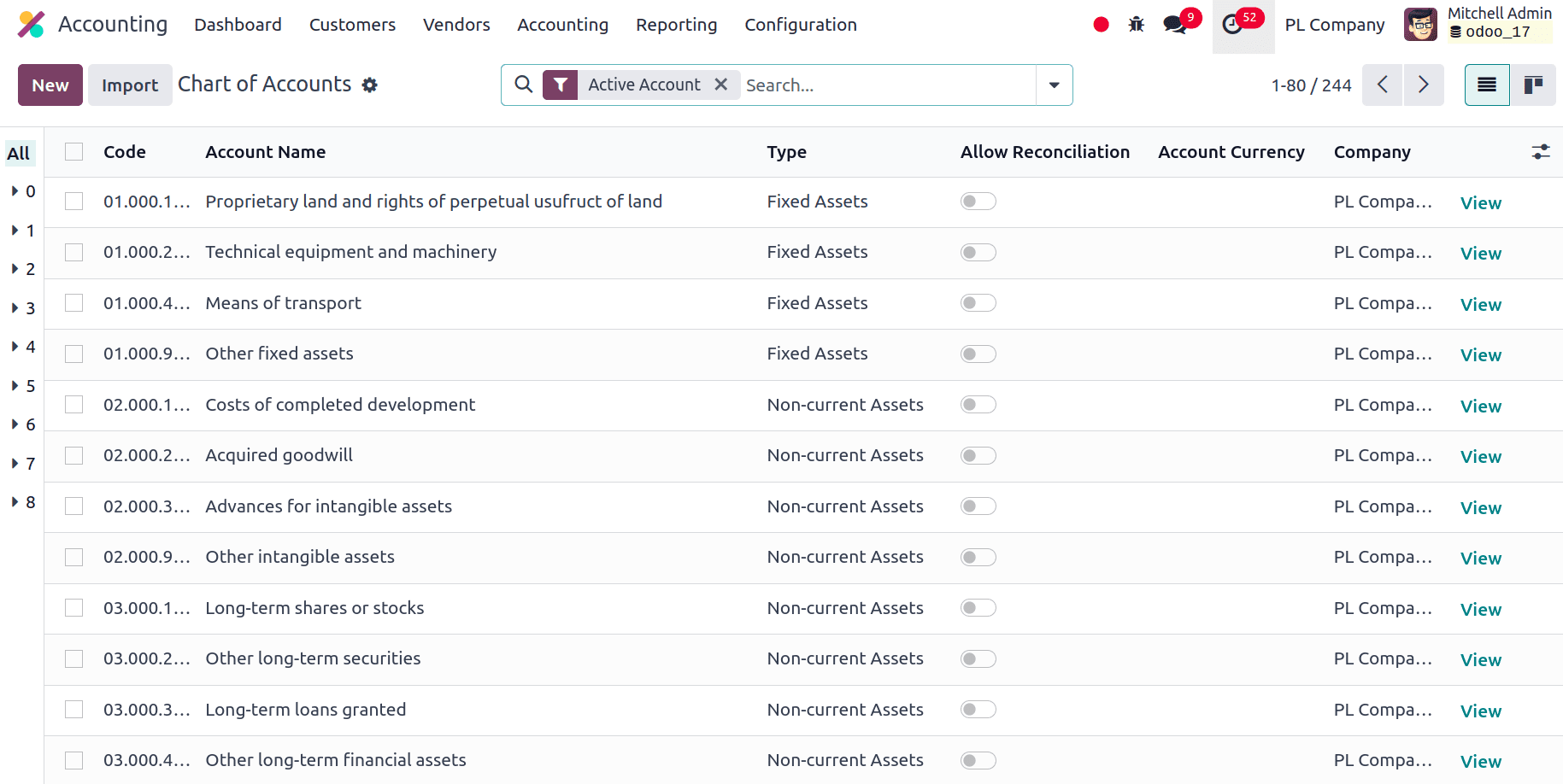

Now, we can look into the Chart of Accounts in this localization. Chart of Accounts classifies and organizes all the company's financial transactions. All of the accounts that a business uses, including those for assets, liabilities, income, and expenses, are listed in an organized manner. This configuration guarantees accurate financial reporting and efficient account management. Effective tracking and analysis of financial data is made possible by Odoo's adaptable Chart of Accounts, which can be tailored to unique business requirements. This feature assists companies in keeping transparent and legally acceptable financial records and supports a number of accounting procedures.

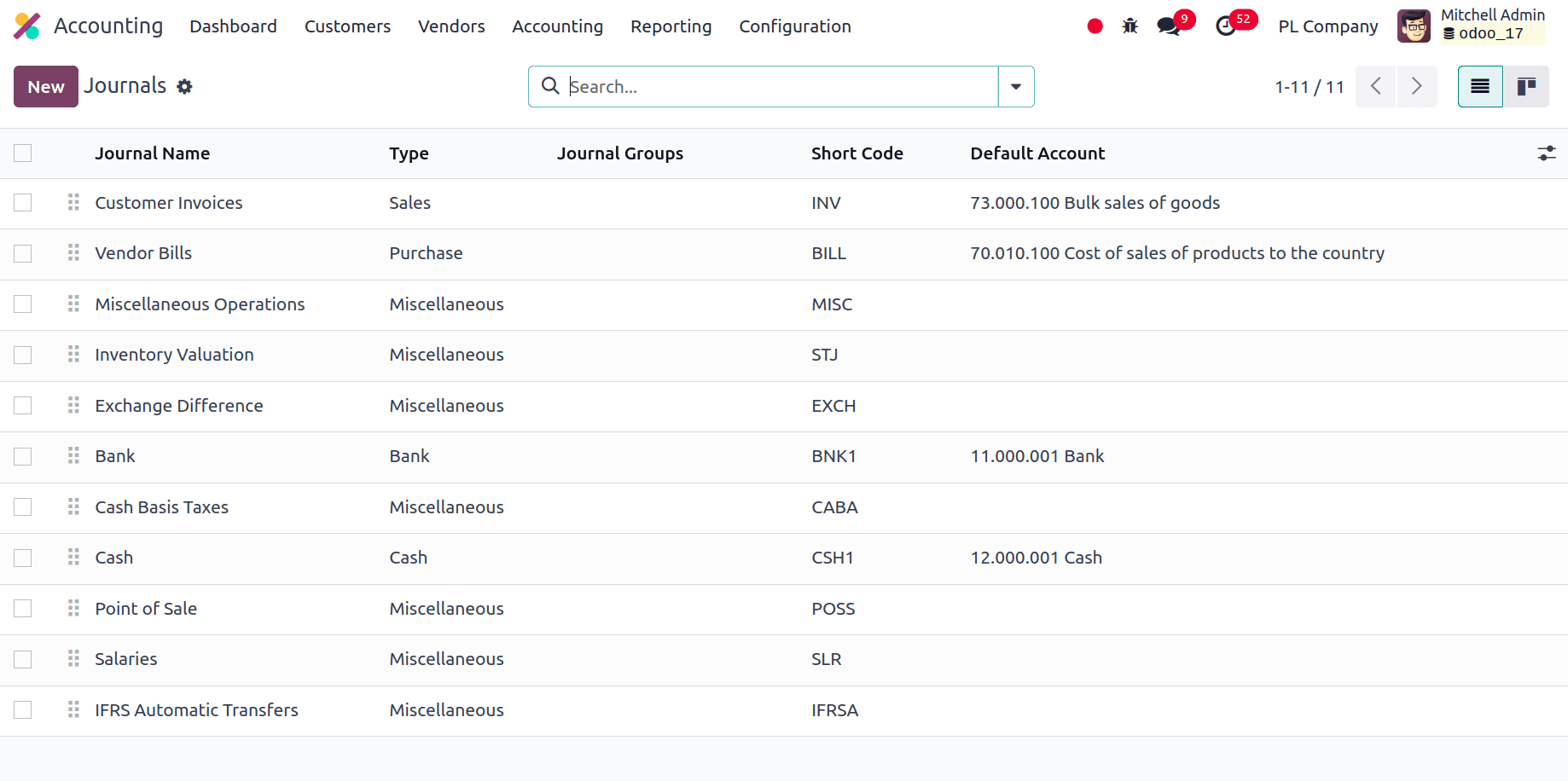

Journals are vital elements in Odoo accounting that are used to document and monitor financial activities. Like managing sales, purchases, or bank transactions, each journal has a distinct function. Assuring accurate and effective financial management, they methodically arrange transactions. The journals in Odoo provide customized entries, automated postings, and thorough tracking, so offering a transparent audit trail and streamlining the reconciliation procedure. Effective use of journals allows companies to expedite their accounting processes and keep well-organized data.

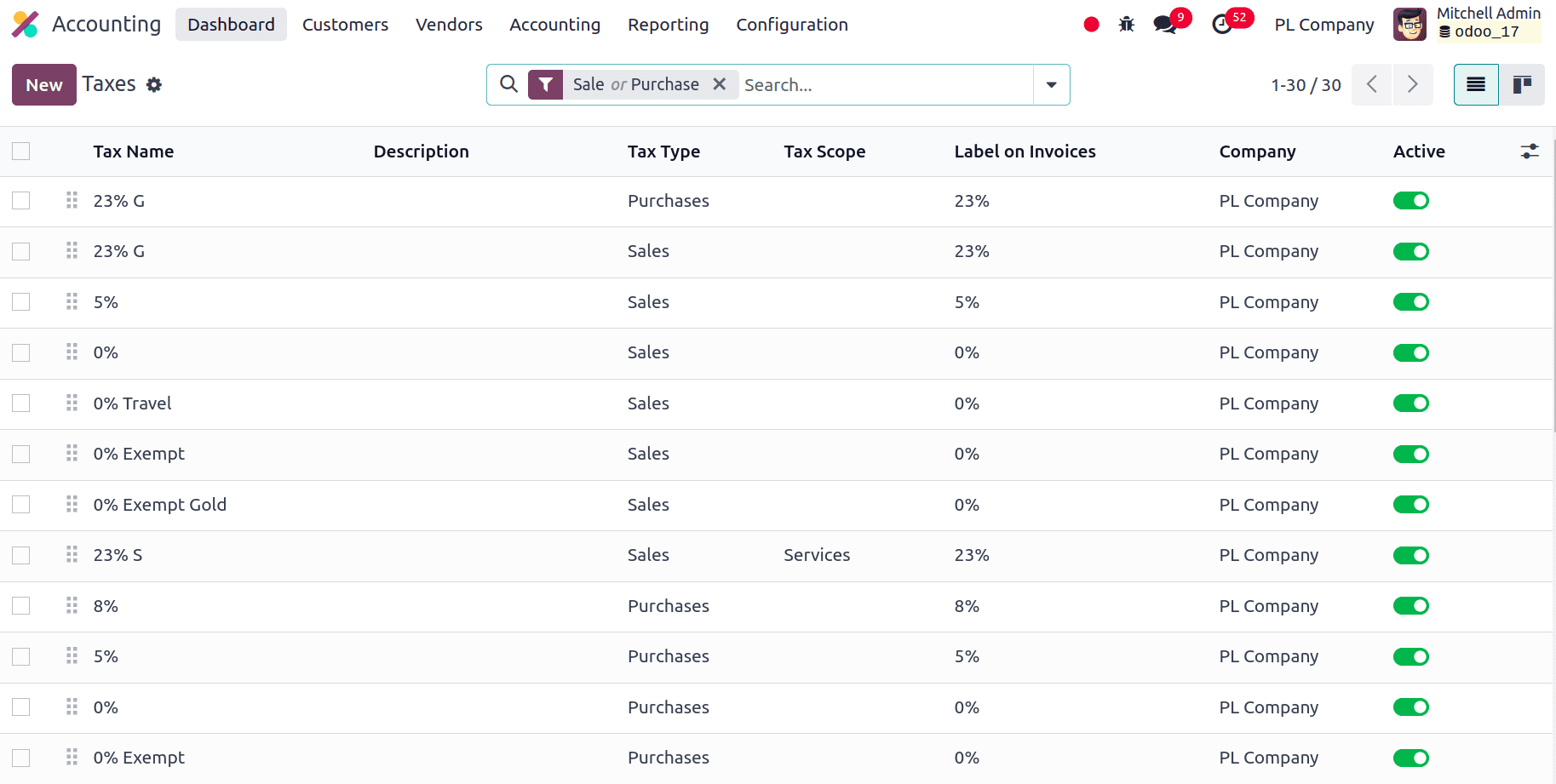

The Taxes in Odoo 17 ensures the precise application of tax rates and automates tax calculations, making it easier to handle varied tax rules. In order to provide comprehensive assistance for compliance with local and international tax legislation, firms are able to create and customize tax rules for various areas and transaction types. Efficient reporting, documentation, and regulatory compliance are made possible by Odoo's seamless integration of tax management with other accounting features. In Odoo, with Poland's accounting localization, tax management is designed to handle local tax regulations efficiently. The system supports various Polish tax requirements, including VAT, and allows businesses to configure tax rates and rules specific to Poland. Odoo automates tax calculations, ensures compliance with Polish tax laws, and facilitates accurate reporting and documentation.

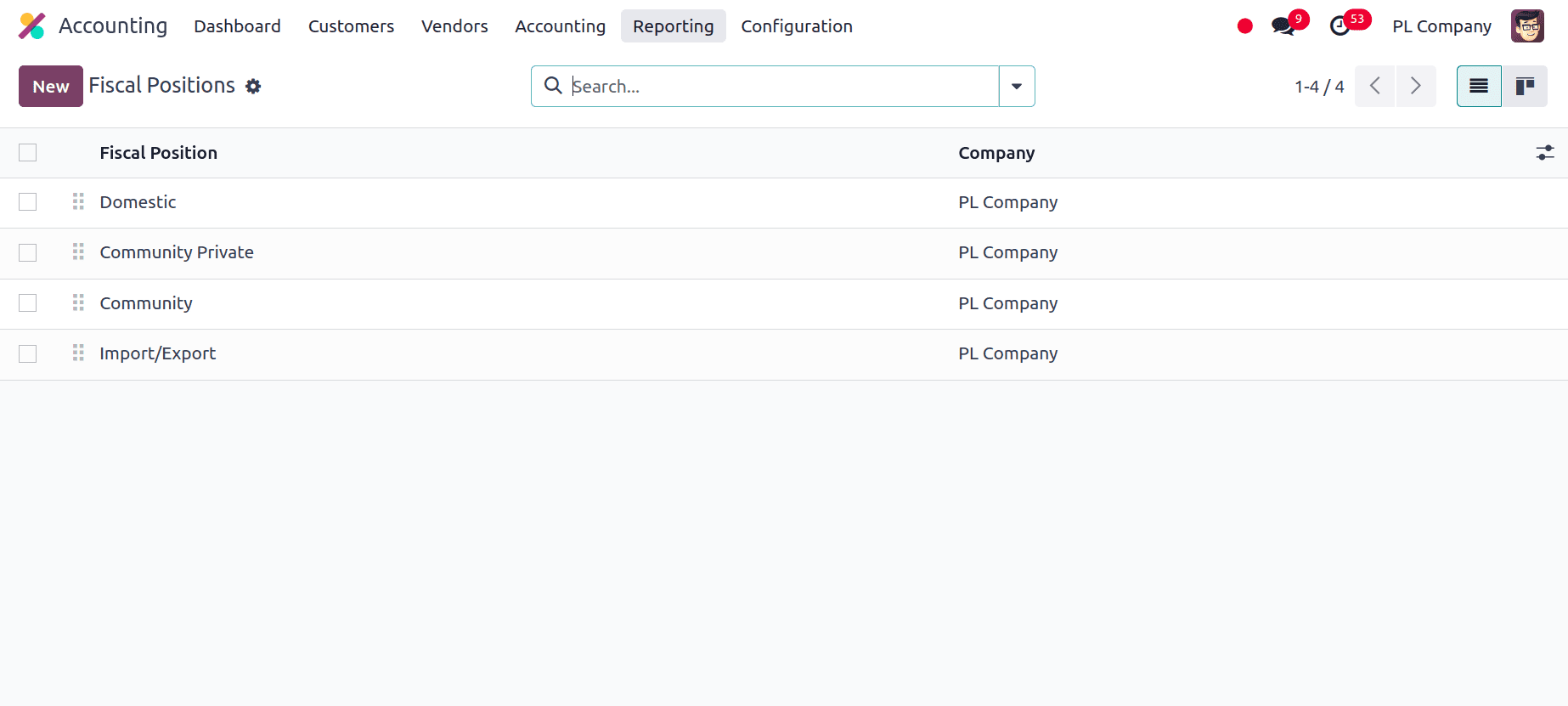

Fiscal Positions

Completely tailored to meet the unique tax and financial reporting needs of the Polish market, Odoo's fiscal localization for Poland manages a wide range of activities, including import/export, community private transactions, intra-community transactions, and domestic transactions.

* Domestic: This helps businesses accurately record and report domestic financial activities, aligning with Polish tax laws.

* Community Private: Odoo handles the VAT regulations unique to community private transactions, which are transactions involving private persons or companies within the EU. It guarantees that, in accordance with the specifics of the transaction and the rules that apply to community private sales, VAT is appropriately computed and submitted.

* Community: Odoo makes it easier for Polish companies doing business with other EU members to comply with intra-community VAT laws. It is in favor of handling VAT exemptions and reporting obligations for cross-border trade in goods and services in an appropriate manner. This entails producing the required reports and making sure that VAT is administered correctly in compliance with intracommunity regulations.

* Import/Export: It manages customs duties and VAT associated with the import of products into Poland. In order to guarantee proper reporting and adherence to Polish import laws, it automates the computation of import VAT and integrates it into the accounting system. Odoo helps with managing VAT exemptions and reporting requirements for exporting goods outside of Poland. It makes sure that export transactions are accurately documented and that VAT is handled in accordance with international trade agreements and Polish export regulations.

Balance Sheet

The Balance Sheet in Odoo's Poland accounting module is designed to satisfy Small PL and Micro PL businesses' reporting requirements. These balance sheets give smaller enterprises a clear financial picture while complying with Polish accounting regulations.

* Small PL Balance Sheet: In compliance with Polish law, this format provides a comprehensive overview of assets, liabilities, and equity and is appropriate for small firms. It has every necessary financial category to guarantee thorough reporting.

* Micro PL Balance Sheet: The reporting requirements have been simplified in this version, which is optimized for micro firms. Concisely summarising the financial position, it adheres to Poland's particular reporting requirements for microentities.

The balance sheet features of Odoo guarantee that these reports are produced automatically and precisely.

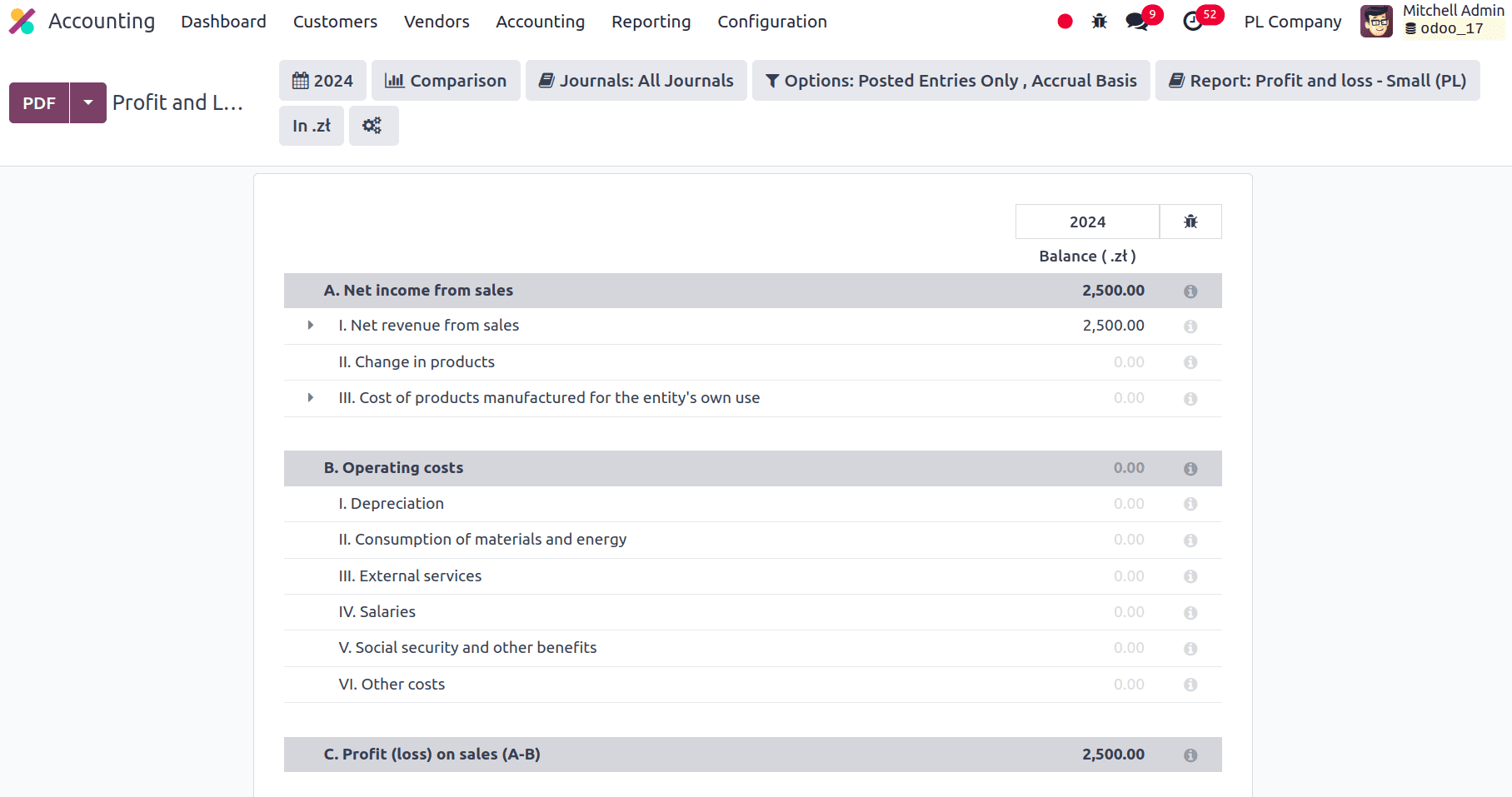

Profit and Loss Report

The Tax Report function in Odoo's accounting module for Poland is created to simplify adherence to Polish tax laws. It creates full reports that include a summary of all tax-related transactions, including VAT and other relevant levies. The report guarantees correct and timely submissions to tax authorities by giving a clear summary of tax liabilities and credits. Odoo's integrated tax reporting features enable automated data extraction and aggregation from the larger accounting system. Businesses may more effectively handle their tax responsibilities and stay in compliance with regulations thanks to this connectivity.

Tax reporting for Small PL and Micro PL firms is available in Odoo's Poland accounting module to satisfy particular legislative needs.

* Small PL Tax Report: Specifically tailored for small enterprises, this report offers an in-depth analysis of VAT and other tax obligations while guaranteeing compliance with Polish tax laws. It facilitates correct and timely tax submissions by providing comprehensive breakdowns of tax calculations and credits.

* Micro-Level Tax Report: This report, which is specifically designed for small businesses, streamlines the tax reporting procedure by emphasizing the crucial tax data needed for compliance. It gives a simplified picture of tax responsibilities, which makes it simpler for micro businesses to effectively handle their tax responsibilities.

The profitability gained from sales activities is thoroughly analyzed in the Net Income from Sales Report. The net income in this report is determined by deducting sales-related costs and expenses from the total amount of revenue earned. Keeping thorough track of and reporting on costs related to day-to-day business operations is necessary to control operating costs in Odoo's accounting module for Poland. We can also view the Profit (loss) on sales (A-B), which computes the difference between sales revenue and related costs to give a clear picture of the financial result of sales activities.

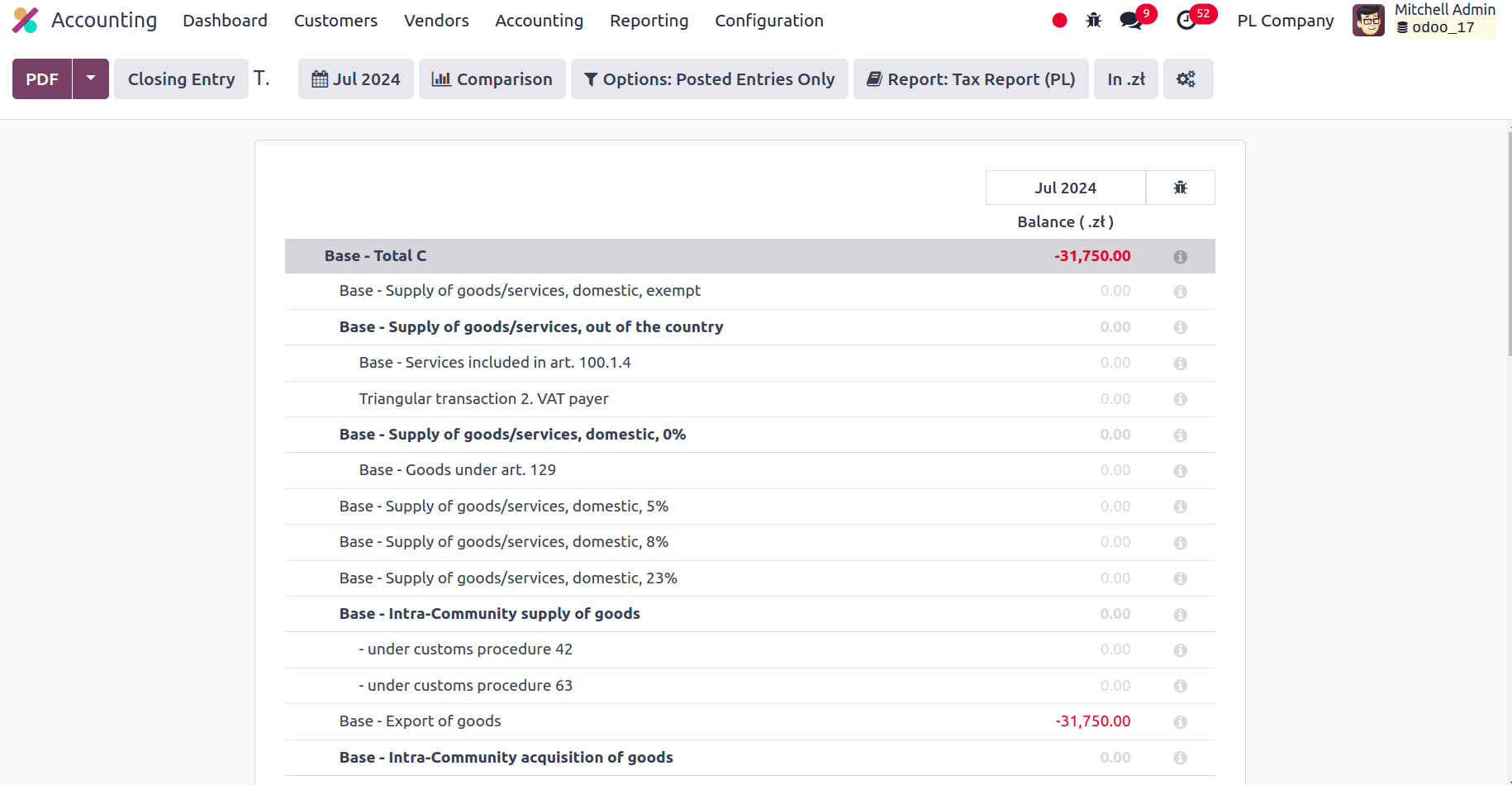

Tax Report

A tax report is a financial record that offers a thorough overview of all tax-related transactions for a given time period for a business. It contains details about sales taxes received, purchase taxes paid, and any changes or credits made. The section of the report that deals with the value of products delivered between EU member states is referred to as the Base - Intra-Community Supply of products. The value of transactions involving the supply of goods or services to entities outside the domestic country is reported in the Base - Supply of Goods/Services, Out of the Country section, The transactions where products or services are supplied within the home country but are subject to a zero-percent VAT rate are detailed in the Base - Supply of Products/Services, home, 0% section.

The Poland accounting localization for Odoo provides a customized solution made to satisfy the particular financial and legal needs of Polish firms. Businesses may effectively manage their accounting procedures in accordance with Polish standards thanks to Odoo's extensive functionality for handling local tax rules, VAT compliance, and specific reporting demands.

To read more about An Overview of Accounting Localization for Romania in Odoo 17, refer to our blog An Overview of Accounting Localization for Romania in Odoo 17.