There are differences between nations when it comes to tax legislation, accounting standards, legal reporting obligations, etc. Accounting localization is the process of adjusting the Odoo accounting modules to fit each nation's particular characteristics. The availability of "Fiscal Localisation Packages," which are accounting localization modules tailored to each country, is the main feature of Odoo 17. Odoo provides fiscal localization packages that comply with various tax laws, accounting standards, and legal reporting obligations of various nations. This guarantees that your accounting processes are acceptable, which reduces the likelihood of errors and penalties. Prepared elements that automate tax calculations and reporting, including fiscal events, accounts charts, and tax groups.

Following the local tax laws and accounting standards is crucial for companies doing business in Peru to ensure efficient and legal financial management. Odoo provides tools for accounting localization that are specifically suited to the Peruvian market. Businesses will be able to easily handle the intricacies of Peruvian financial legislation with this localization.

Essential tools and features that take into consideration local tax laws, accounting principles, and reporting needs are part of Odoo's accounting localization for Peru. Odoo is a comprehensive solution that caters to the specific requirements of businesses in Peru, ranging from setting up VAT rates and producing proper tax documents to customizing invoice forms and integrating with Peruvian banking institutions.

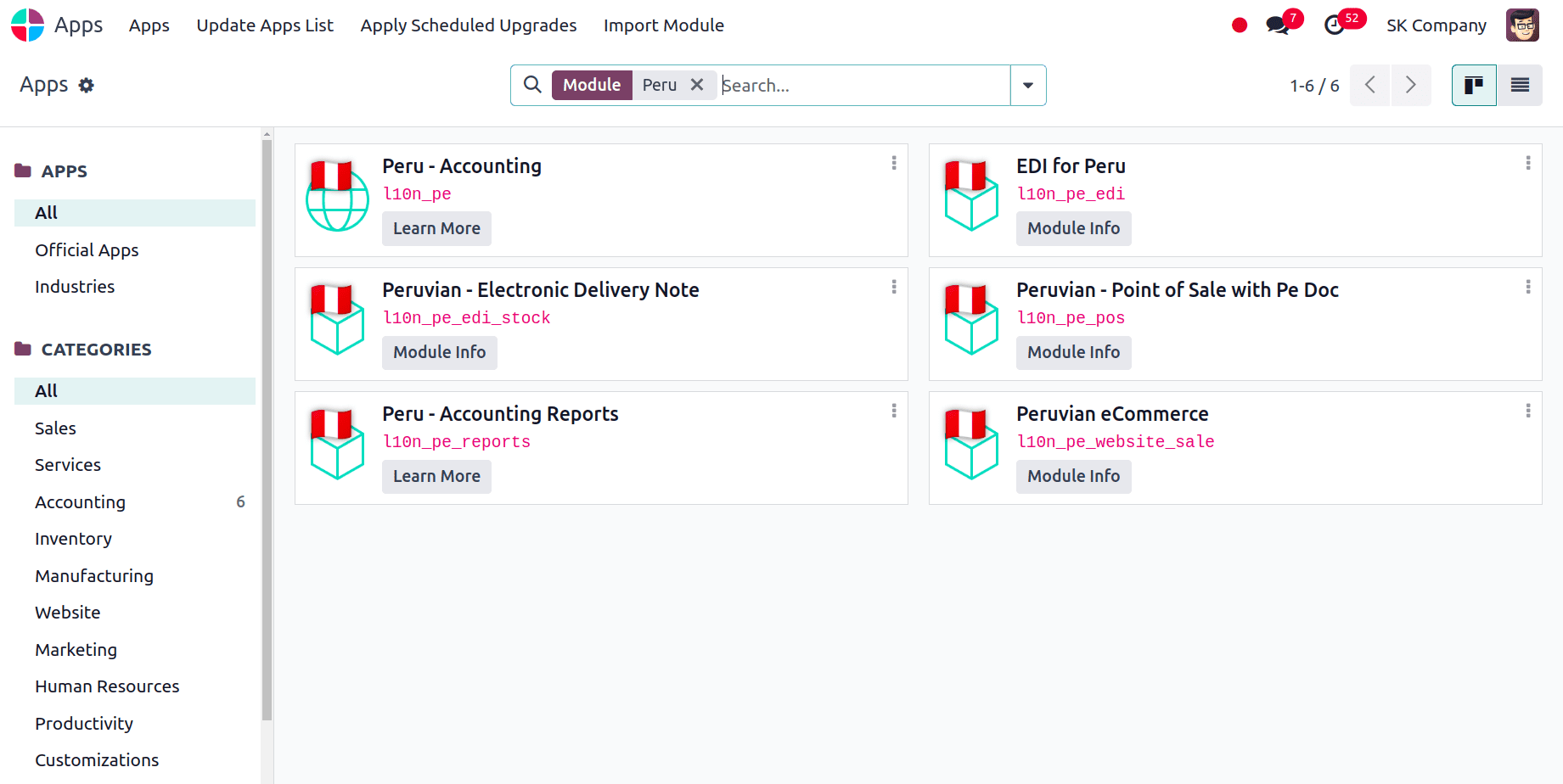

We can navigate to Apps and search for the localization modules for Peru. Install the modules to set up the Peru accounting localization.

Configuring the Company

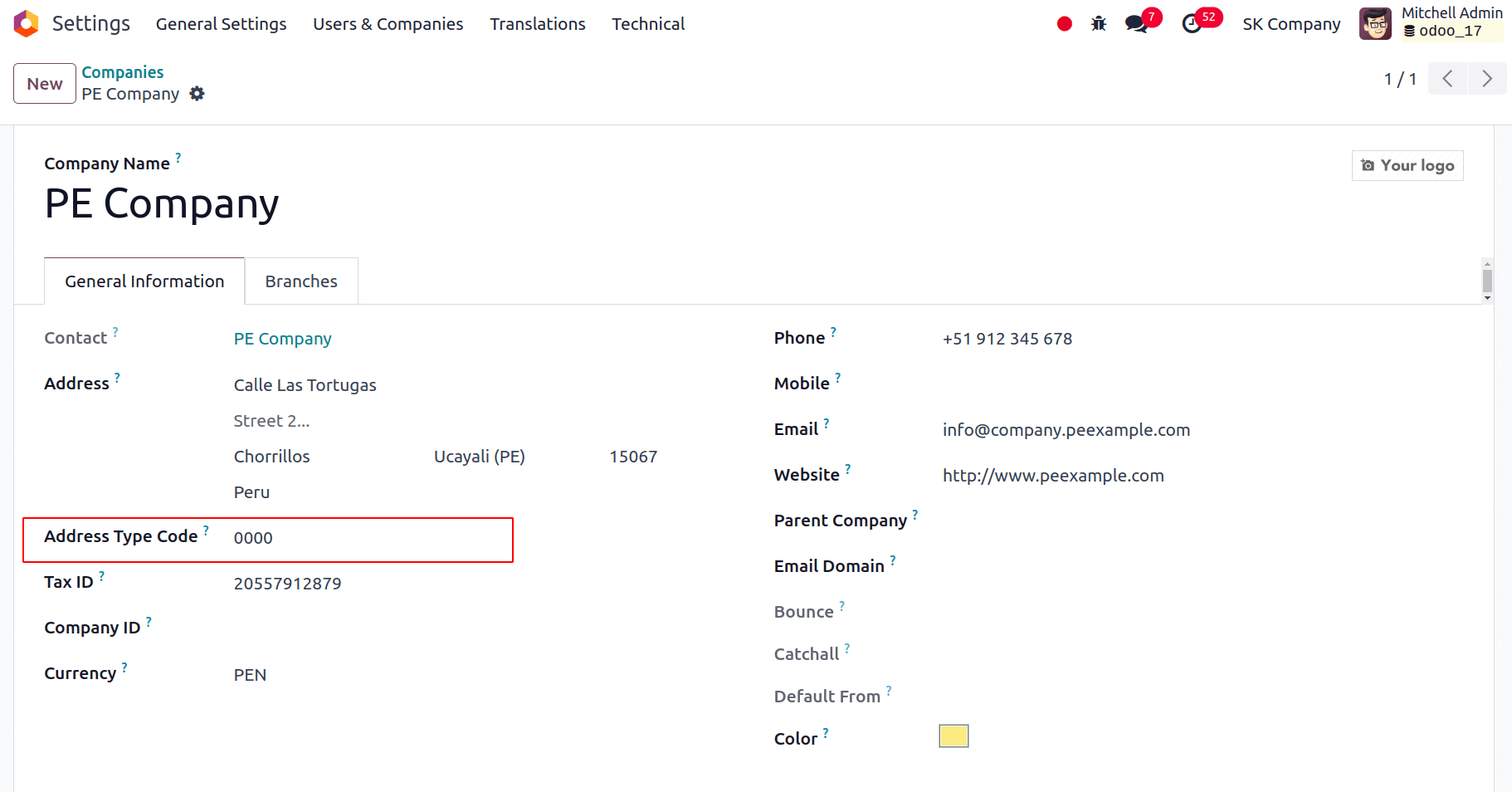

After installing the required modules or this particular localization now we have to make sure that the company configurations are set up accurately. We can go to Settings> Users and Companies> Companies, there we can see the list of companies and check the configurations for the required company.

In addition to the Company's basic data, we also need to choose Peru as the Country for the Electronic Invoice to work properly. Businesses include the establishment code supplied by the SUNAT in the Address Type Code area when registering their RUC (Unique Contributor Registration). You can set the Address type code to 0000, which is the default value, in the event that it is unknown. There may be issues in the electronic invoice validation if an inaccurate value is entered.

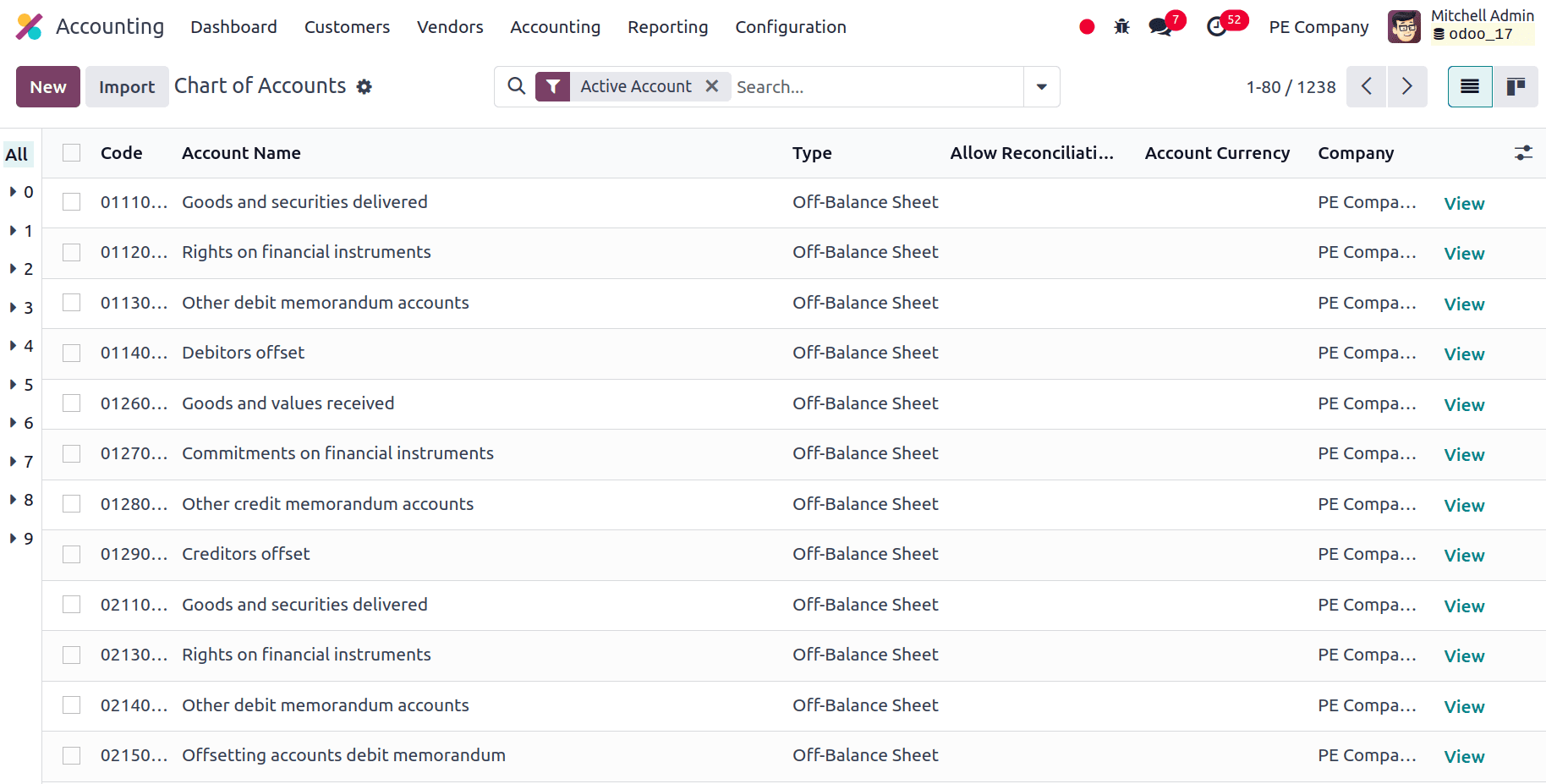

Chart of Accounts

When the localization module is installed, the chart of accounts for the company are pre-installed by default. The accounts are automatically mapped in Taxes, Default accounts payable, and accounts receivable via Default. Based on the most recent version of the PGCE, which is categorized and compliant with NIIF accounting, the Peruvian chart of accounts is divided into multiple groups.

We have the Off-Balance Sheet Chart of Account type in this localization. Accounts that are off-balance sheet are used to record financial transactions that do not show up on the balance sheet but may have an effect on the financial stability of the firm. These typically include items like leases, contingent liabilities, and certain types of financial guarantees.

Journals

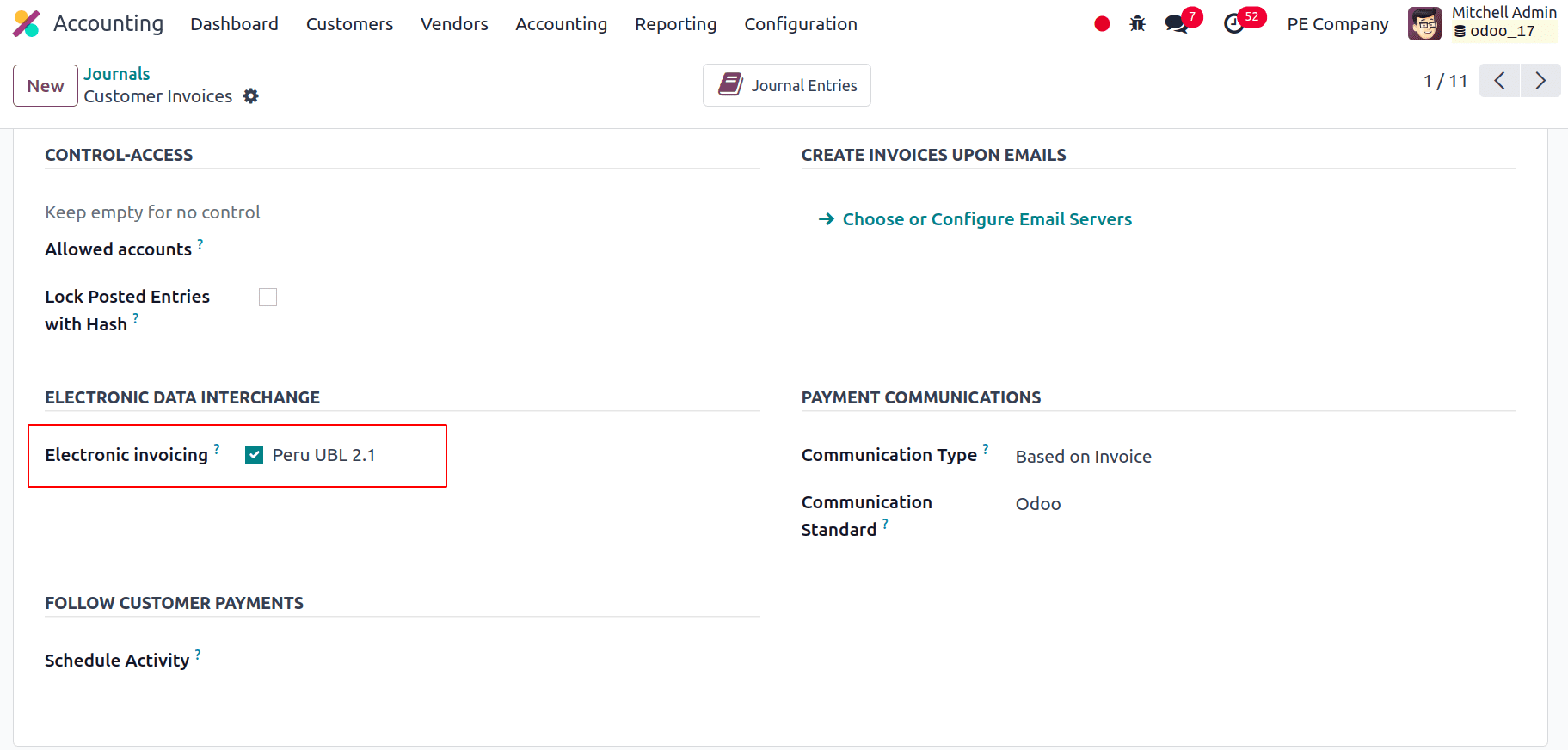

An essential part of the accounting system in Odoo is journals, which are the main means of keeping track of financial transactions. With the installation of this localization, we have to make sure to fill the Electronic Invoice field under the Electronic Data Interchange as Peru UBL 2.1 while creating the Sales journal.

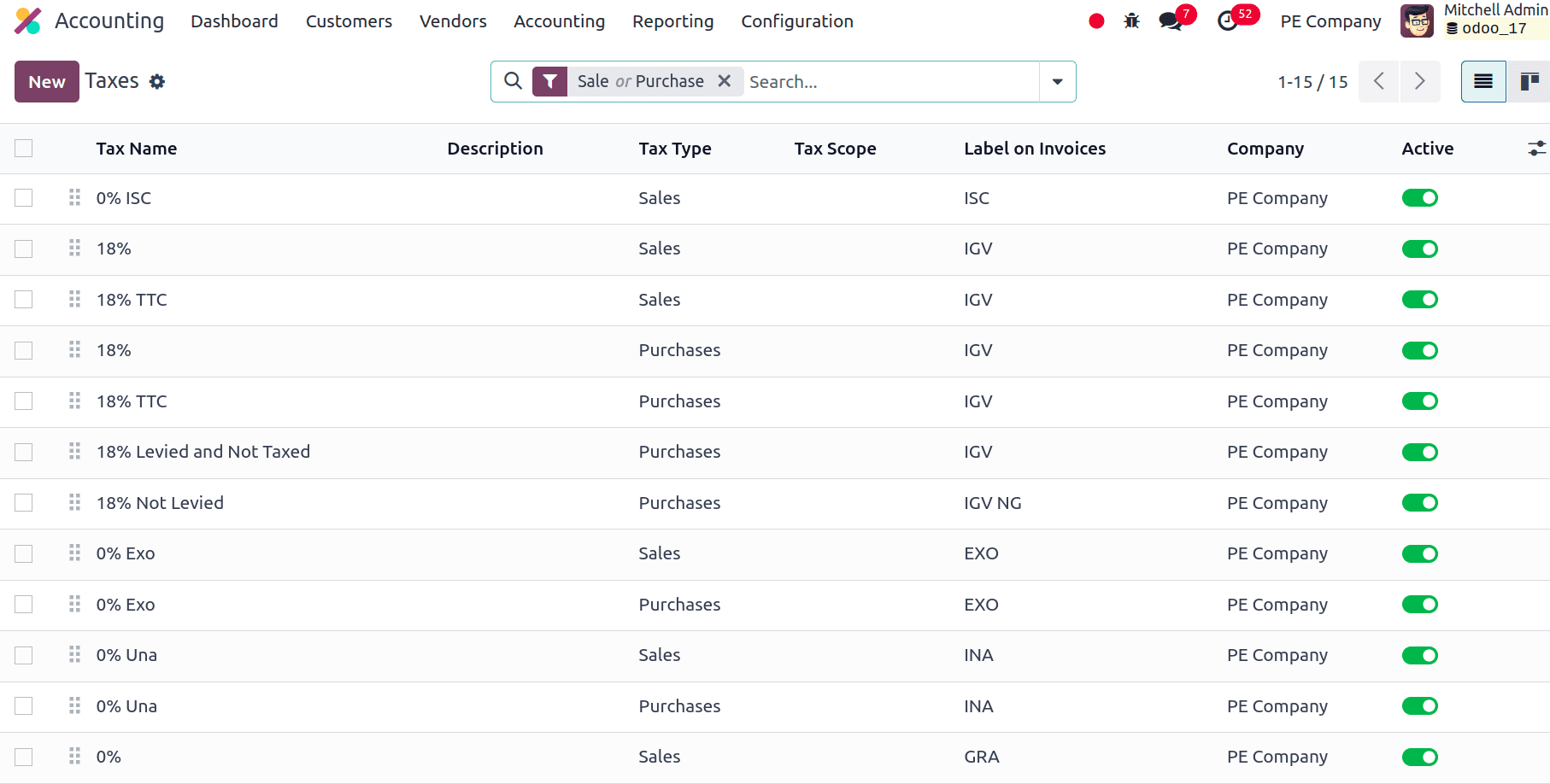

Taxes

Based on the settings chosen for various locations and transaction kinds, Odoo automates tax computations. Because of this automation, errors are reduced and manual labor is minimized when calculating taxes on sales, purchases, and other financial transactions.

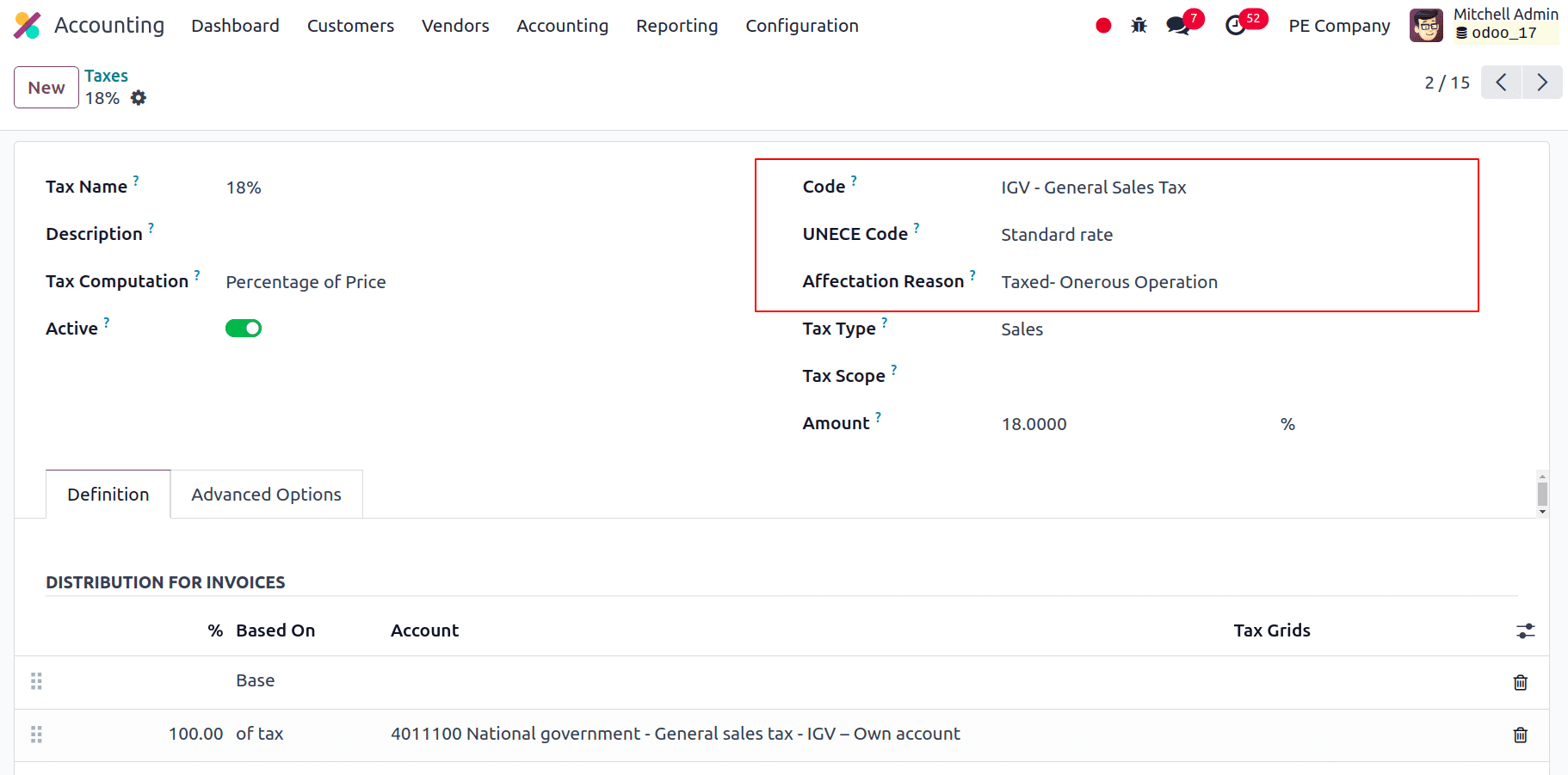

Three new fields are needed for an electronic invoice as part of the tax setup; this data is included in the taxes created, but if you create new taxes, be sure to fill these fields correctly.

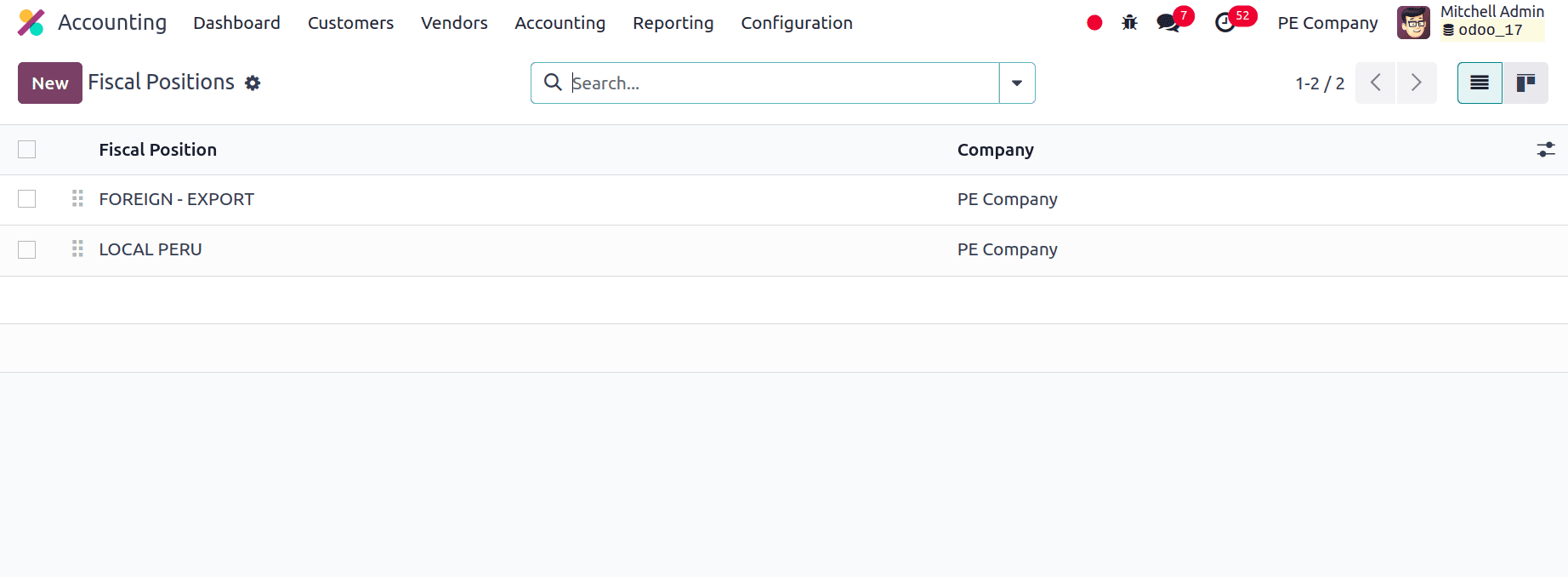

Fiscal Positions

A crucial component of Odoo that helps companies manage and adjust to various tax laws and regulations according to their operational requirements and geographic locations is fiscal positions. They offer an organized method for managing modifications linked to taxes and applying the proper tax laws for different situations. Installing the Peruvian localization includes two primary fiscal positions by default.

* Foreign - Export: This fiscal position is applied to customers with Exportation transactions

* Local Peru: This fiscal position is applied to local customers.

Document Types

Certain accounting transactions, such as vendor bills and invoices, are categorized in various Latin American countries, including Peru, according to document categories that are established by the government fiscal authorities—in this case, the SUNAT.

Each type of document in a journal may have a unique sequence assigned to it. As part of the localization process, the nation to which the document applies is included in the Document Type; the data is automatically created upon installation of the localization module.

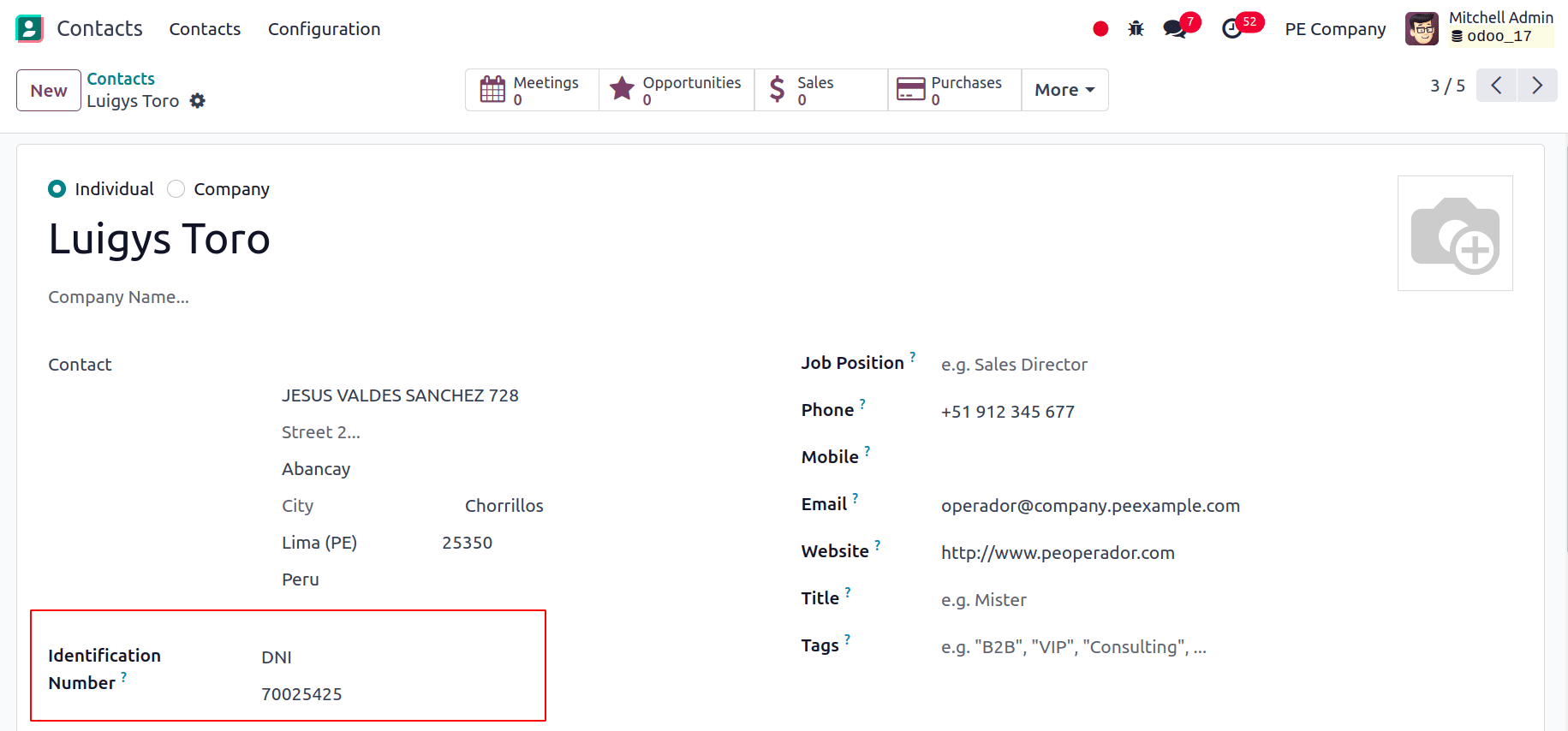

Partner

The Peruvian localization of the Partner form now includes the identifying categories provided by the SUNAT; be careful to keep a note of this information since it is required for the majority of transactions, both on the sender company's and also on the customer's end.

Electronic Invoicing

One of the main features in this localization is the Electronic invoicing. To make use of this feature first we must configure the components needed for an electronic invoice. Navigate to Accounting > Settings > Peruvian Electronic Invoicing to accomplish this.

There are some words that are crucial for Peruvian localization:

* The electronic invoice is referred to here as "EDI," or electronic data interchange.

* The agency in charge of enforcing taxes and customs in Peru is called SUNAT.

* OSE: Electronic Service Provider, as defined by OSE SUNAT.

* Certificate of receipt (Constancia de Recepción, or CDR).

* Sunat Operaciones en Línea is the SOL Credential. The SUNAT provides the user and password, which enable access to the Online Operations services.

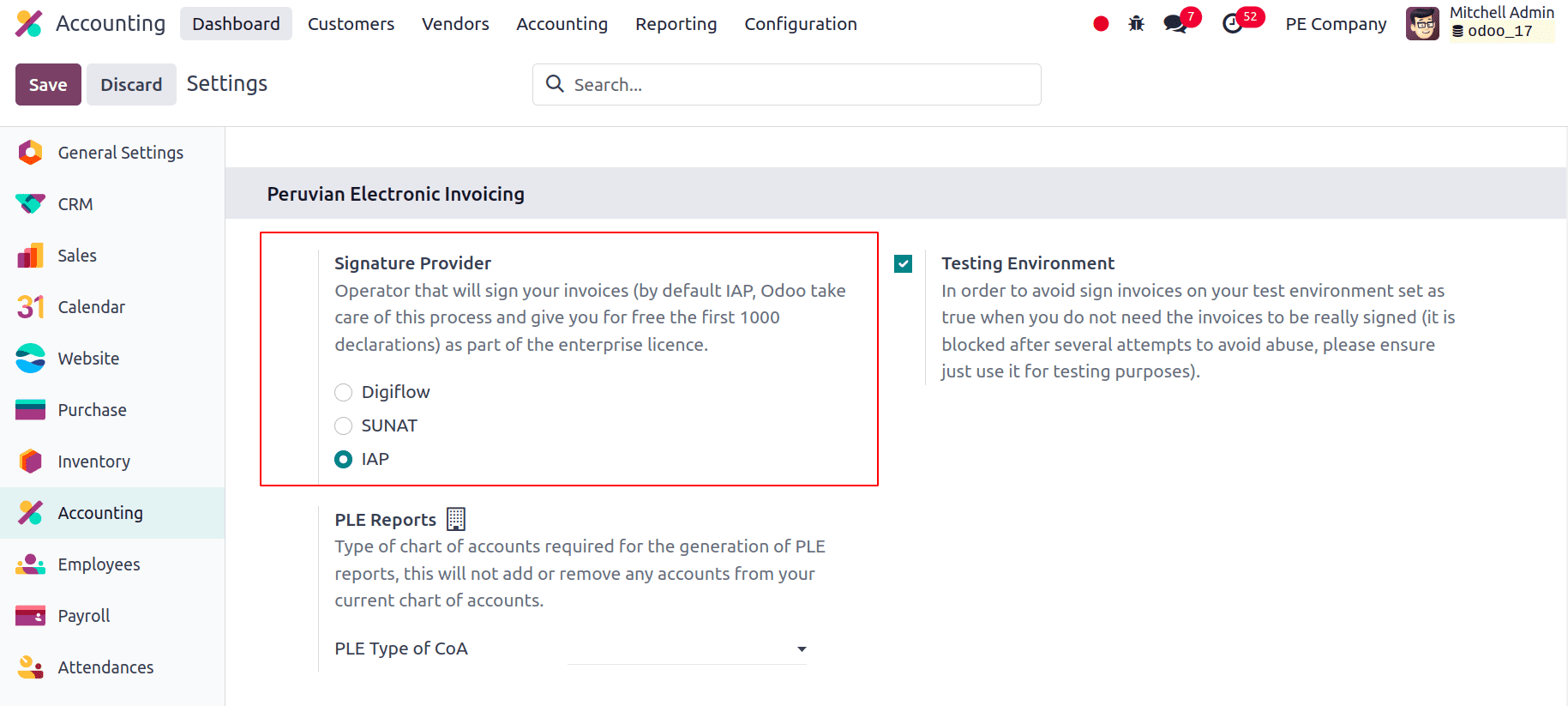

Now, we must choose a Signature Provider to handle the SUNAT validation response and document signing procedure as part of Peru's requirements for Electronic Invoices.

Odoo provides three choices:

1. Digiflow

2. SUNAT

3. IAP (Odoo in-app purchase)

Digiflow

Digiflow is a digital signature service designed to simplify the process of signing documents electronically. It offers a secure and compliant method for obtaining signatures, making it a valuable tool for businesses that require efficient and legally binding document approval. Digiflow integrates smoothly with Odoo, allowing us to send documents for signature directly from the system. This integration eliminates the need for separate signature management tools and provides a unified workflow within Odoo.

We can transmit the document validation straight to Digiflow and forego using the IAP services.

SUNAT

SUNAT (Superintendencia Nacional de Aduanas y de Administración Tributaria) is the Peruvian government agency responsible for tax administration and customs.SUNAT oversees digital signatures and electronic invoicing, making sure companies adhere to regional tax regulations and documentation specifications.

The SUNAT signature provider integration ensures that all electronic documents and signatures comply with Peruvian tax regulations. This integration helps businesses meet SUNAT's requirements for electronic invoicing and digital signatures.

IAP (Odoo in-app purchase)

The Odoo In-App Purchase Signature Provider is a feature within Odoo that facilitates secure and compliant electronic signatures for transactions processed through the platform. This service ensures that documents related to in-app purchases are validated and signed electronically, meeting legal and regulatory standards. The provider of in-app purchase signatures provides an easy-to-use interface that makes signing documents simpler. Users can easily initiate signature requests, track the status of documents, and receive notifications when signatures are completed, streamlining document management.

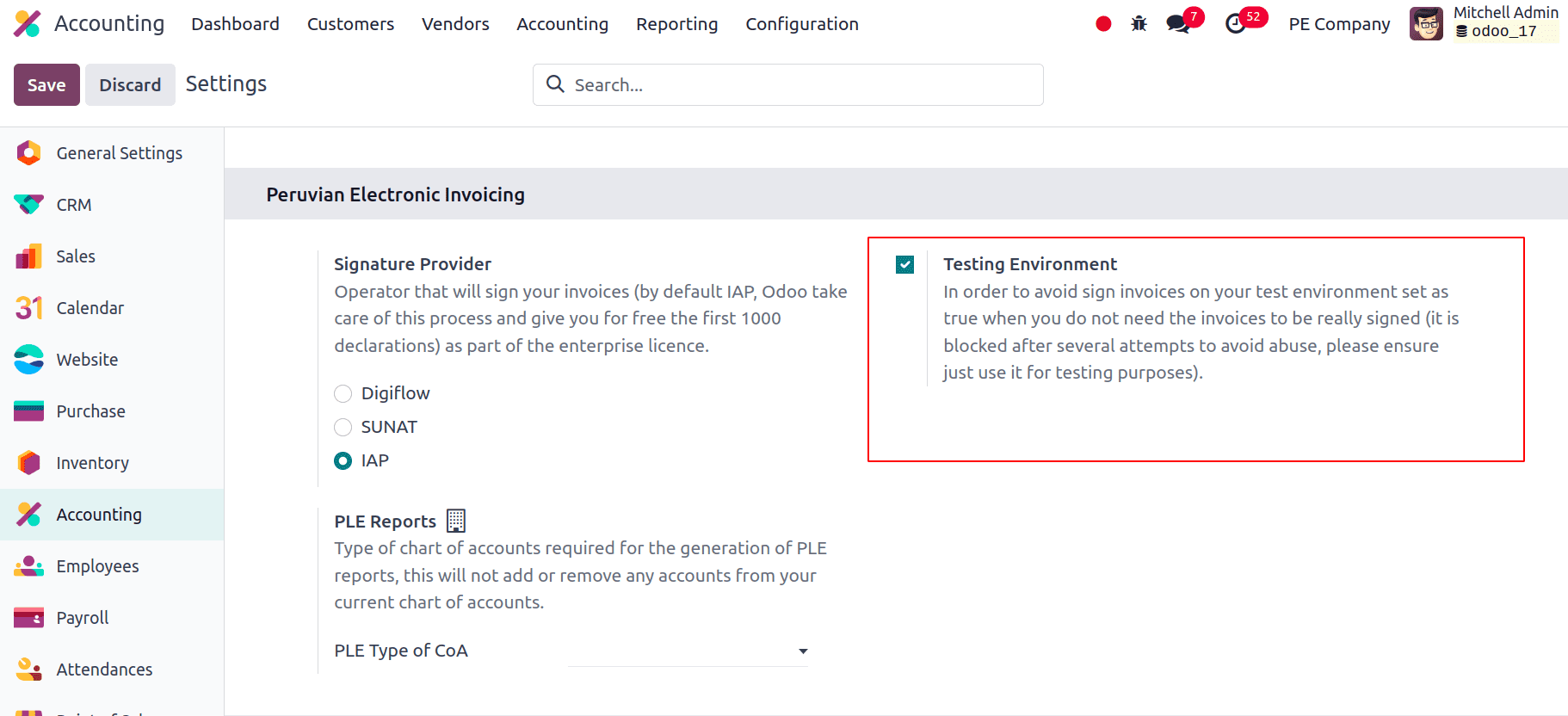

There is a testing environment available, and we can activate Odoo's testing environment before the business goes into production. We do not have to purchase testing credits for the transactions while using the testing environment and the IAP signature because they are all automatically validated. Generally, the databases are configured to operate in production, so we have to make sure to enable the testing mode when required.

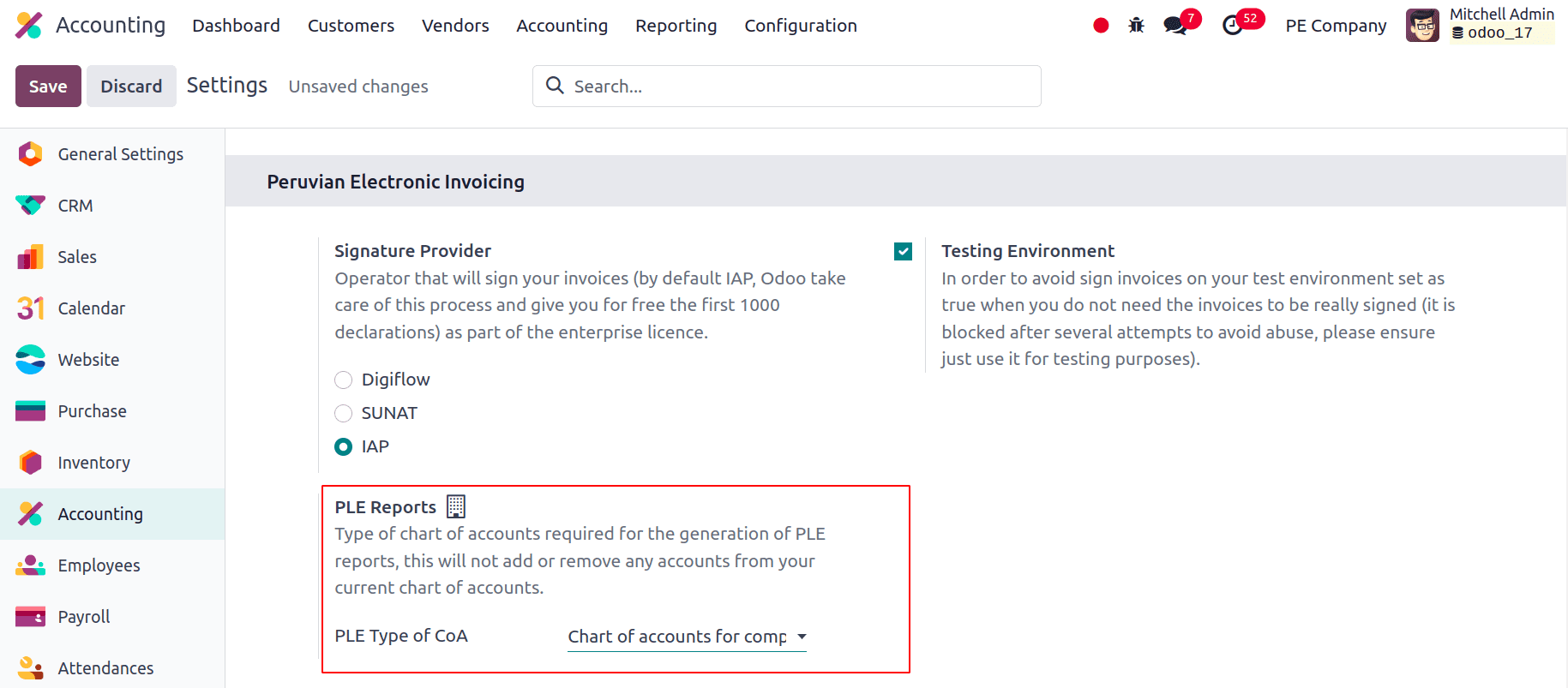

PLE reports are electronic records that businesses are required to submit to the Peruvian tax authorities, SUNAT. These reports include detailed information about a company's transactions, tax calculations, and other financial data essential for tax reporting and compliance. Here, we can choose a PLE Type of CoA.

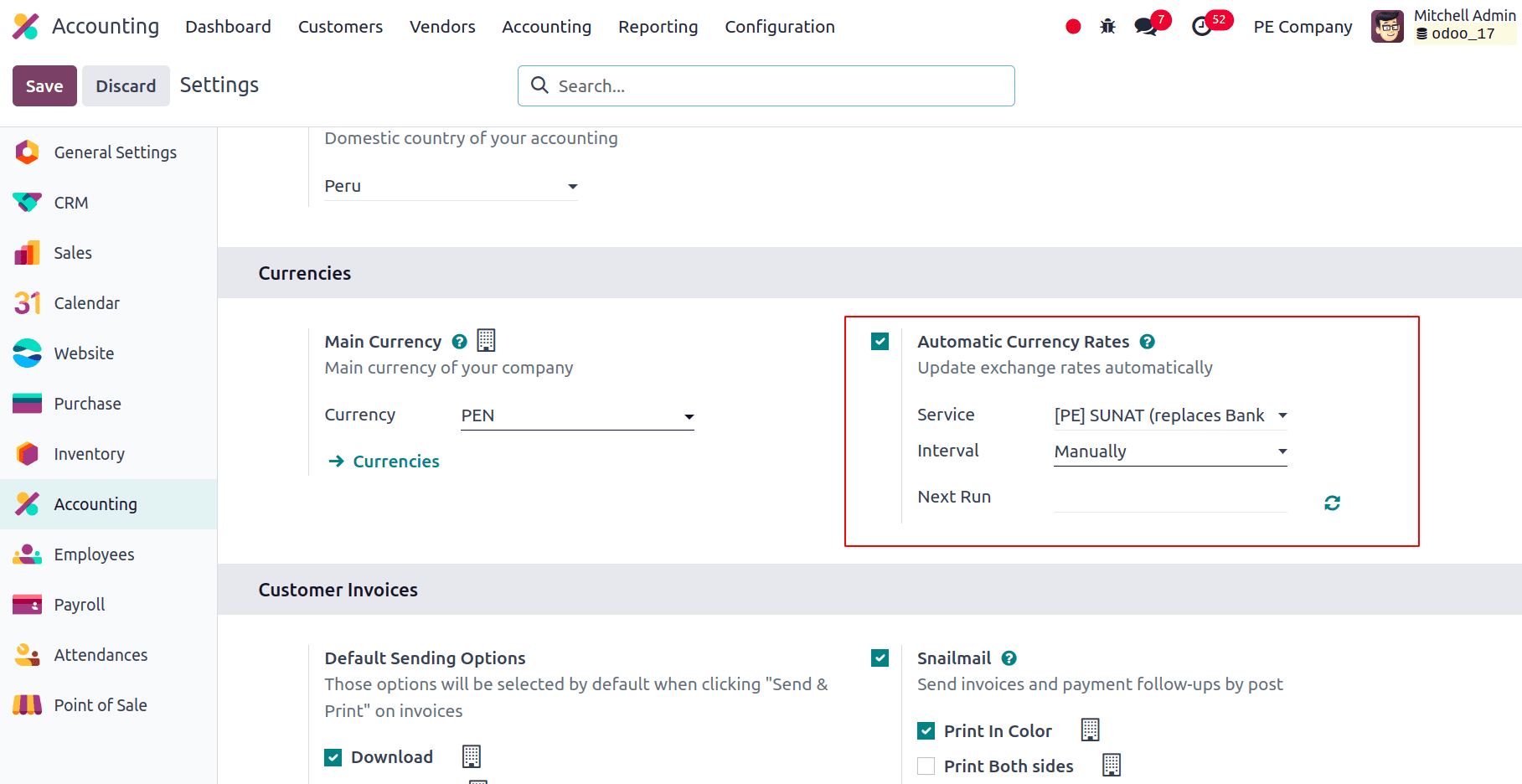

Currency

The official currency exchange rate in Peru is provided by the Bank. Odoo has the option to connect directly to its services and obtain the currency rate manually or automatically.

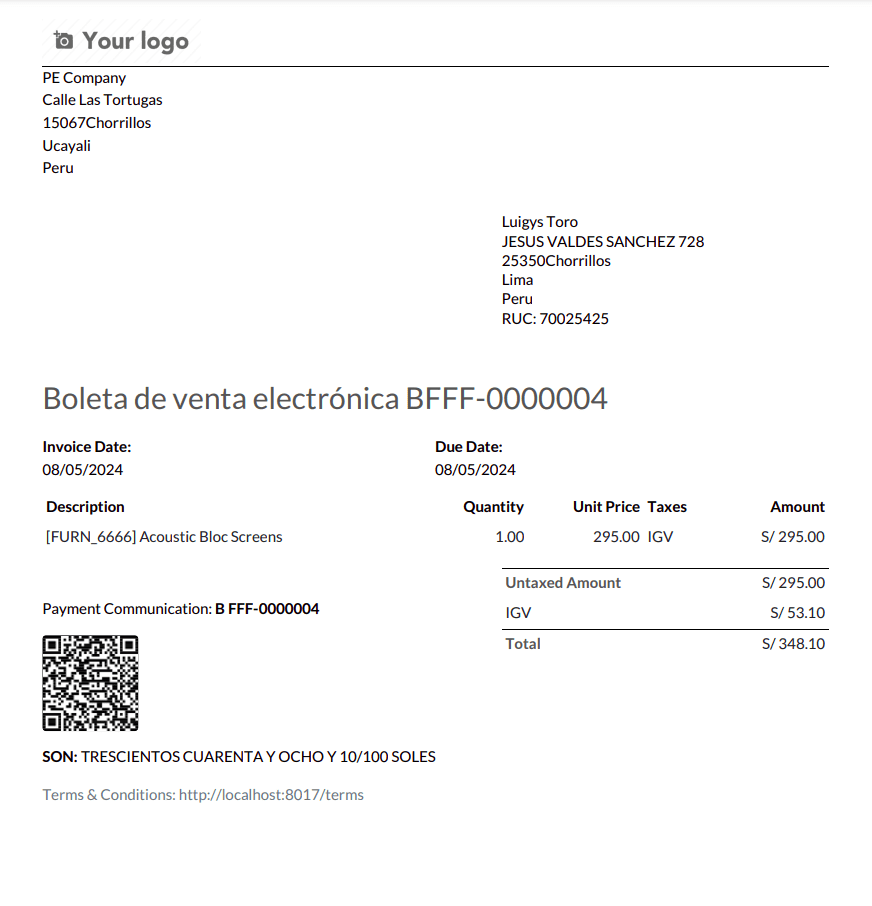

Once all the configurations have been made appropriately, let's create an invoice and see.

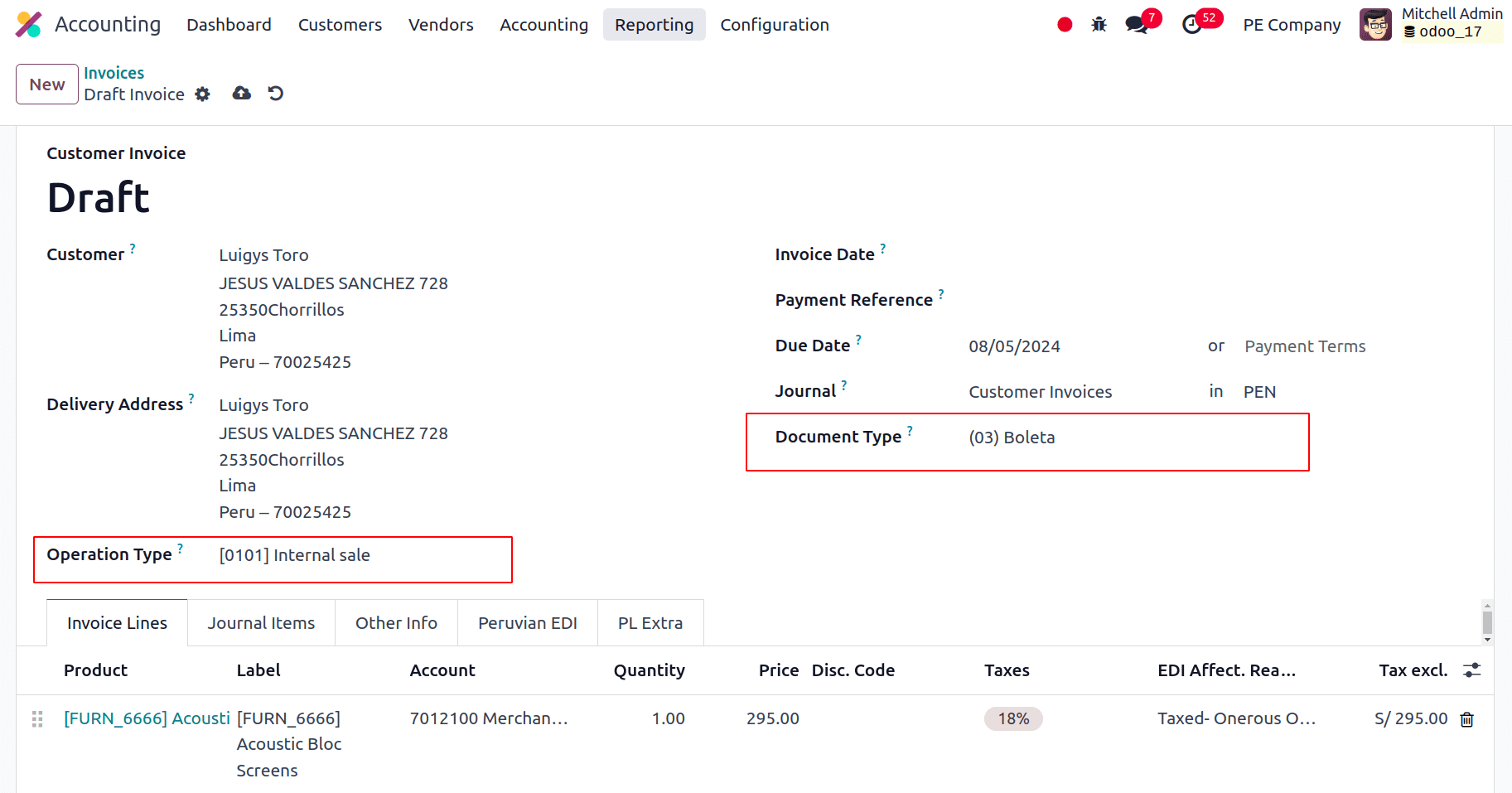

Goto Accounting > Customers > Invoices and click on the New button to create the invoice. There, we can see that we have to add the Operation Type and Document Type.

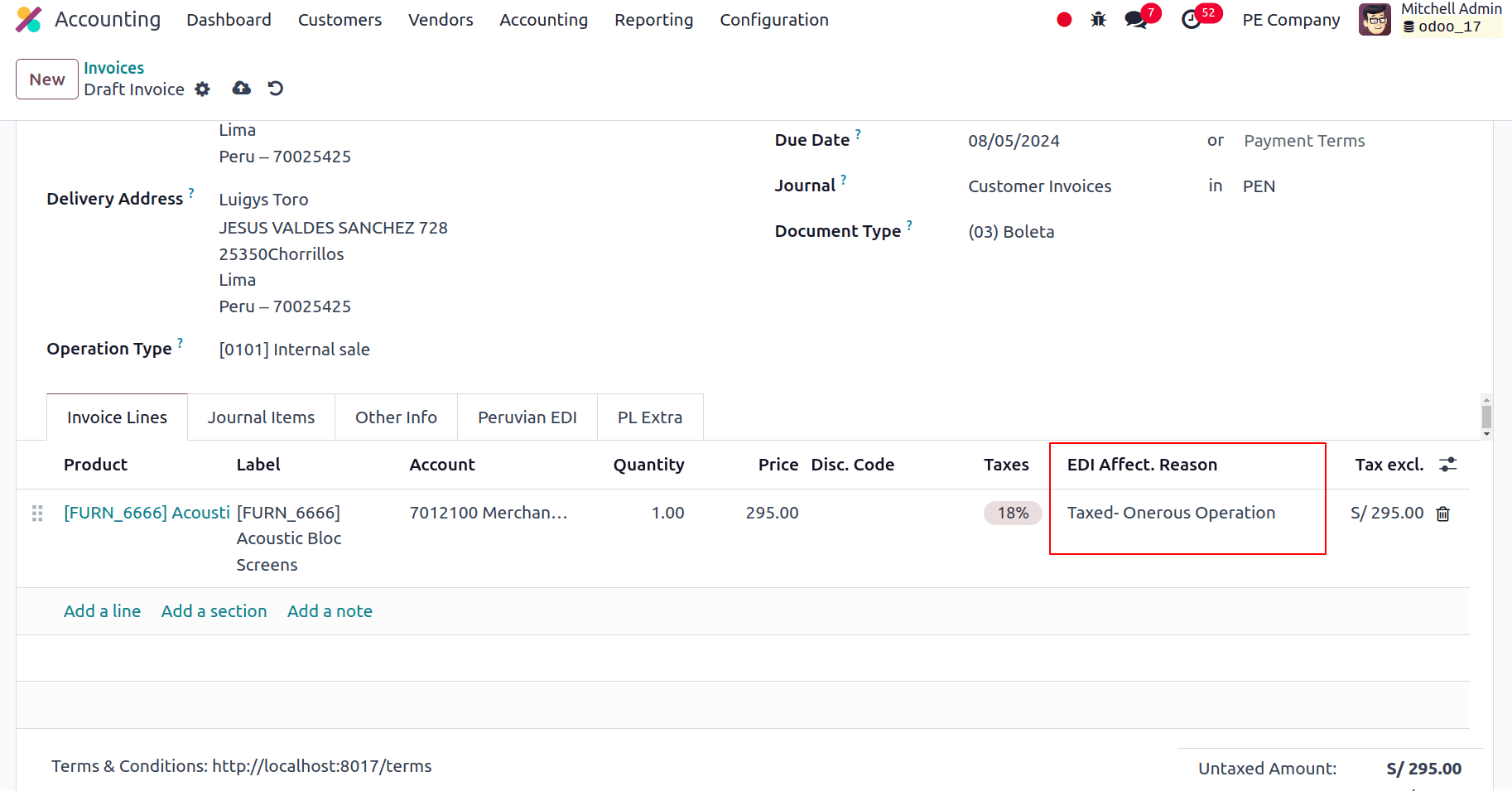

In addition to the tax, the invoice lines provide a column called "EDI Affectation Reason" that, when used in conjunction with the presented SUNAT list, establishes the tax scope. When constructing the invoice, you have the option to explicitly specify a different EDI affection reason if necessary. All taxes are imported by default with one default affection reason.

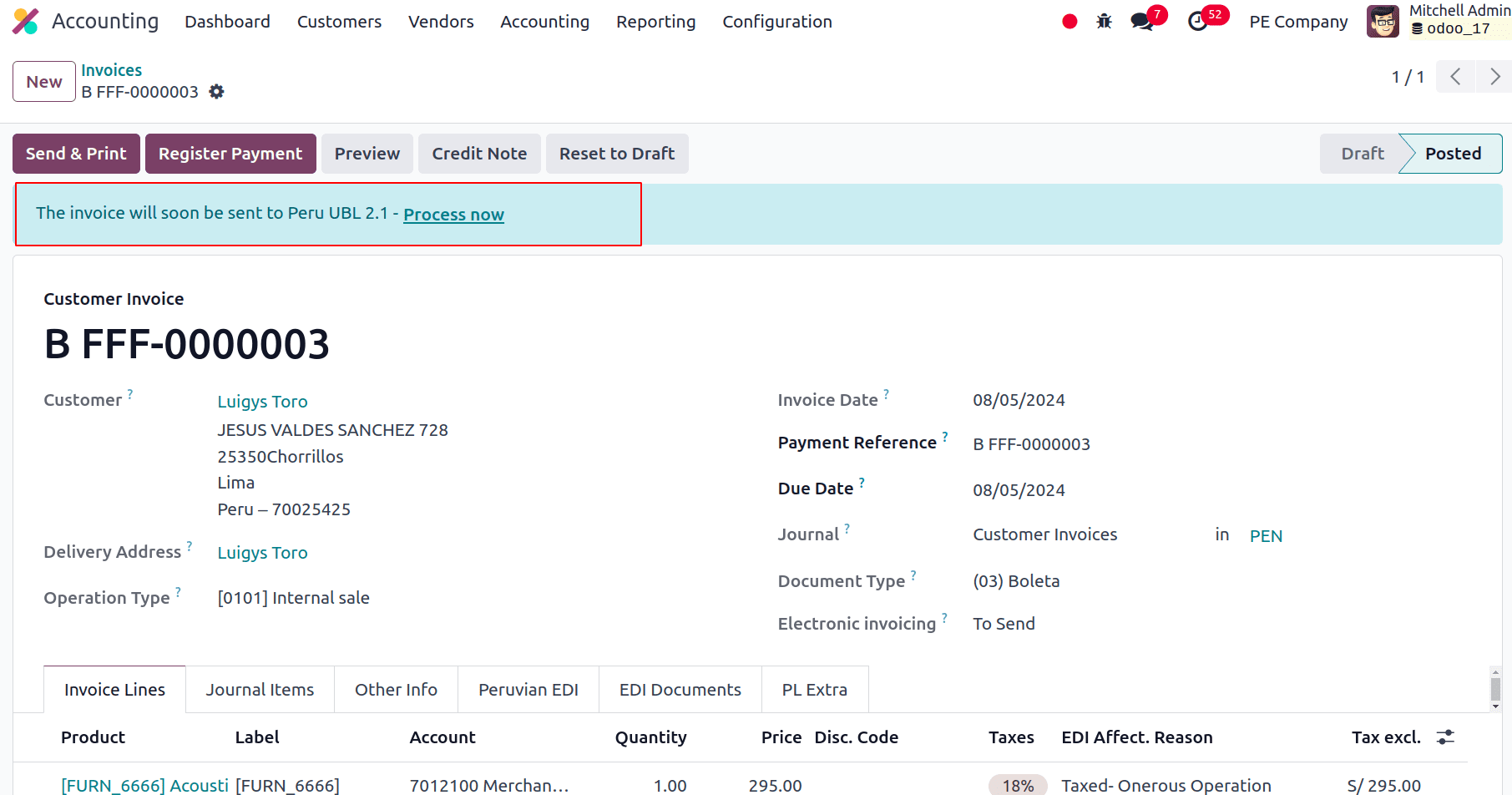

You can validate your invoice after you've made sure all the information is accurate. By registering the account move, this operation starts the electronic invoice workflow, which then sends the invoice to the SUNAT and the OSE. The following message can be seen at the top of the invoice.

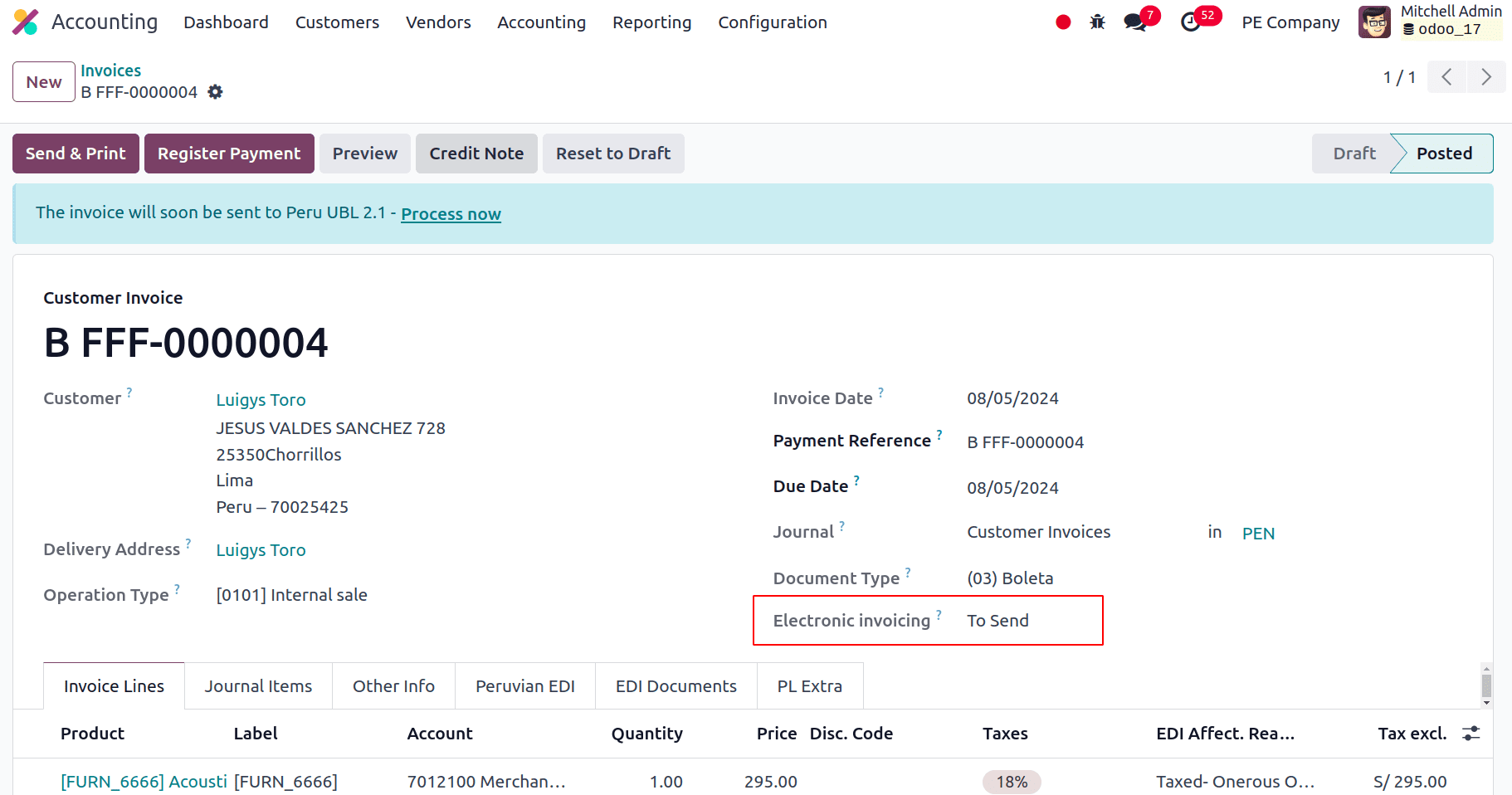

Now we can look into the status of the Electronic invoicing. It will be in either of the two following states.

* To be Sent: This shows that the file is ready to be forwarded to the OSE. This can be done automatically by Odoo using a cron that is set to run once per hour, or it can be sent right away by the user by using the "Process now" button.

* Sent: This indicates that the document was successfully validated after being transmitted to the OSE. A ZIP file is downloaded as part of the validation process, and a message stating the accurate government validation is noted in the conversation.

The electronic invoice status stays in "To be sent" in the event of a validation error, allowing for adjustments and subsequent submission of the invoice. After the invoice PDF report has been accepted and confirmed by the SUNAT, it can be printed. The invoice is a legitimate fiscal document, as shown by the QR code included in the report.

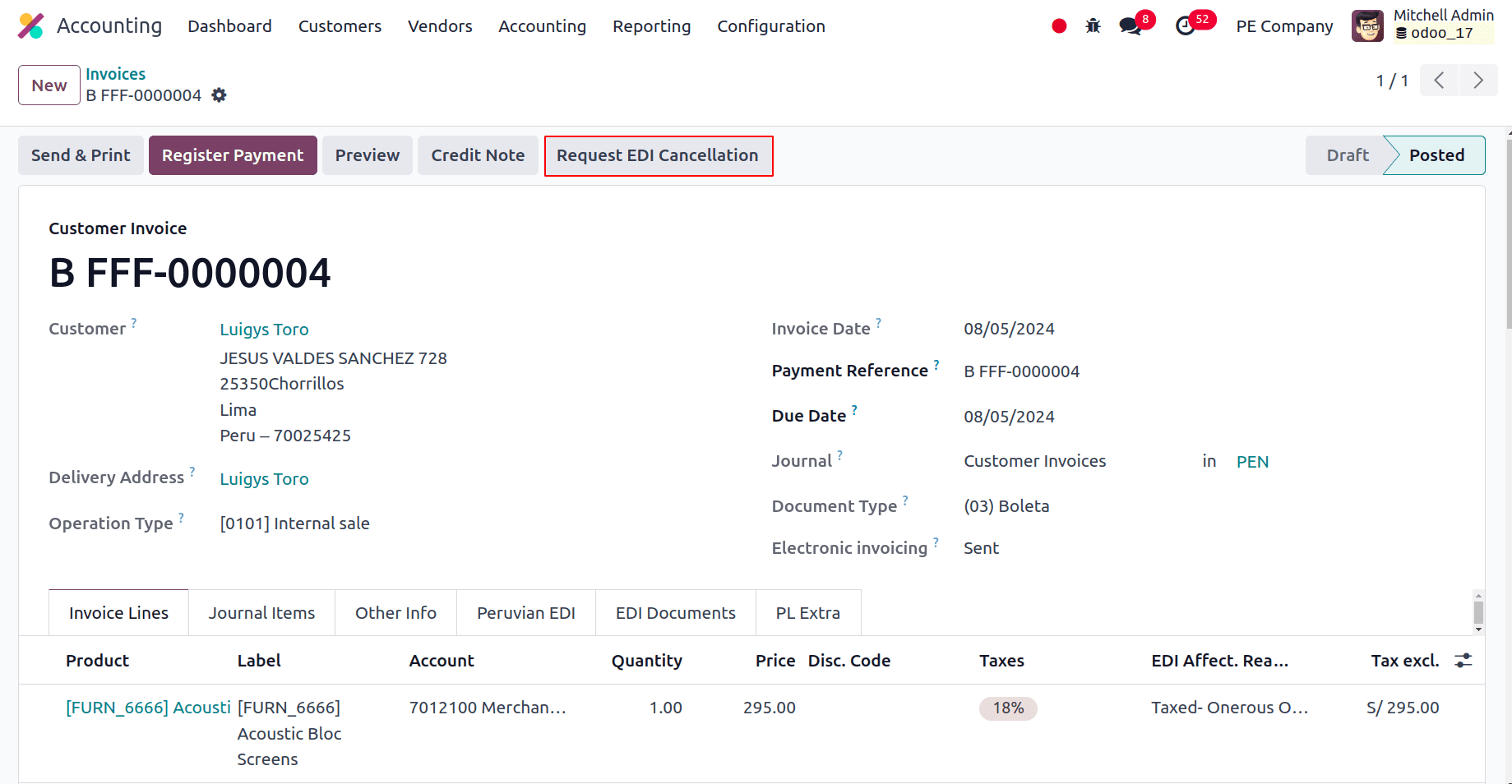

There are instances where cancelling an invoice is required, such as when it was created incorrectly. The appropriate course of action in the event that the invoice has already been received and approved by the SUNAT is to select the Request Cancellation button.

If you would like to cancel an invoice, please indicate why you are doing so.

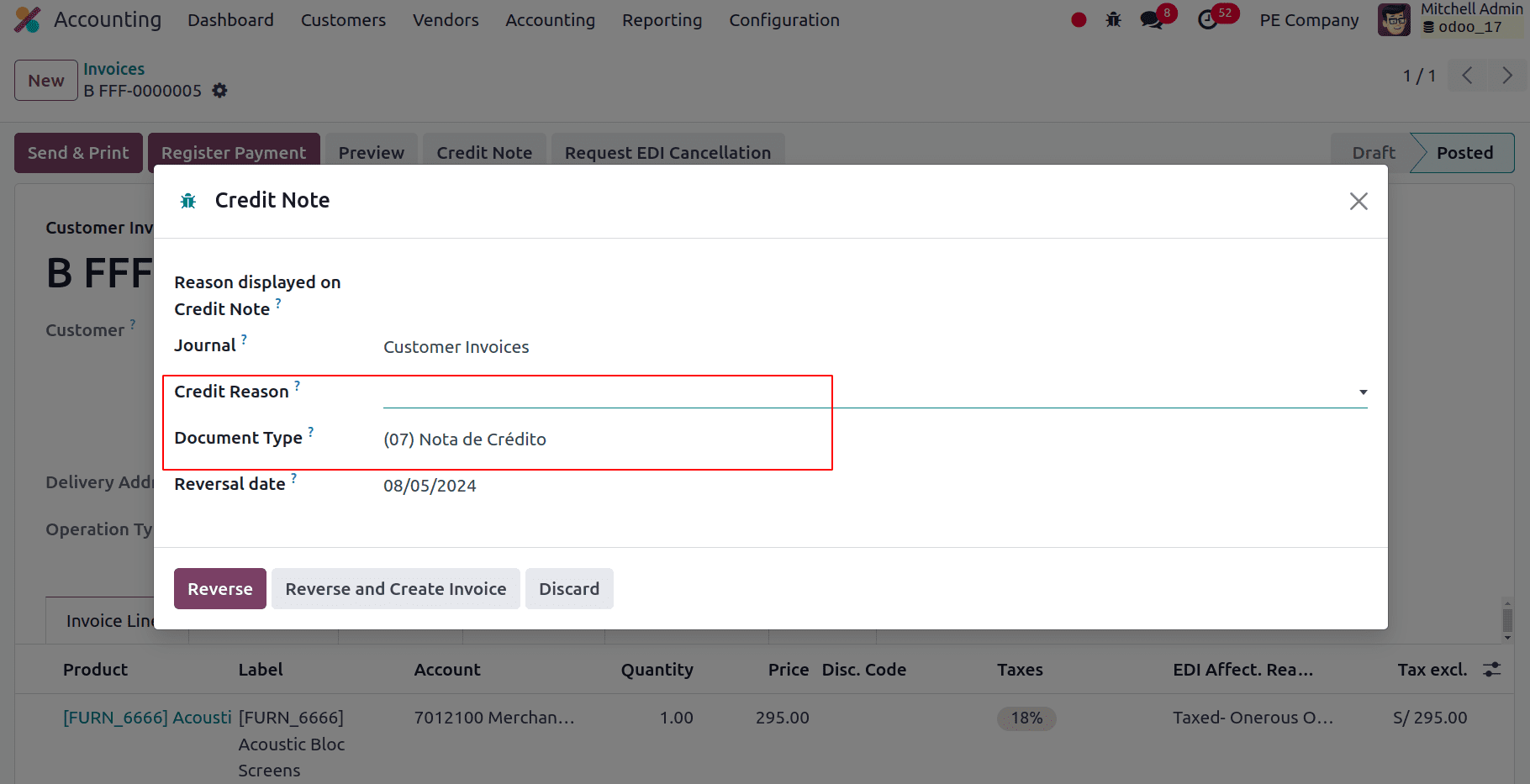

Credit Note

In the Peruvian localization, you must select one of the alternatives in the list to prove a credit reason when a correction or refund is required over a validated invoice. To make a credit note, simply click the "Add Credit Note" button. The Credit Note is, by default, set to the following document type.

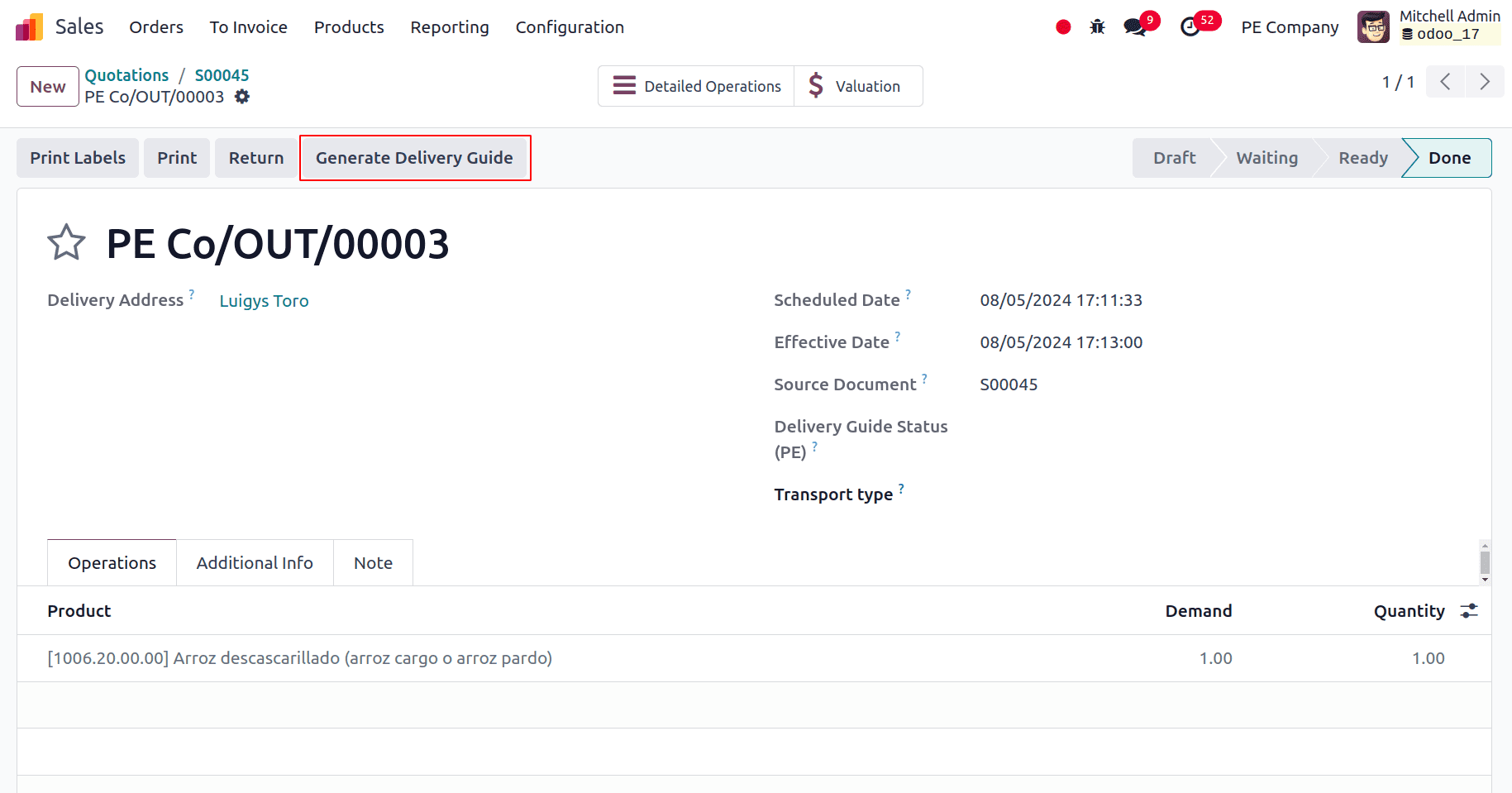

Electronic Delivery Guide 2.0

The Guía de Remisión Electrónica (GRE) is an electronic document that the shipper creates to make it easier to move or transfer things from one place to another, like a warehouse or facility. You must complete a few configuration tasks in Odoo before you can effectively use this functionality.

Except for taxpayers covered by the Single Simplified Regime (régimen único simplificado, or RUS), SUNAT requires the use of the guía de remisión electrónica electronic document for taxpayers who need to move their products.

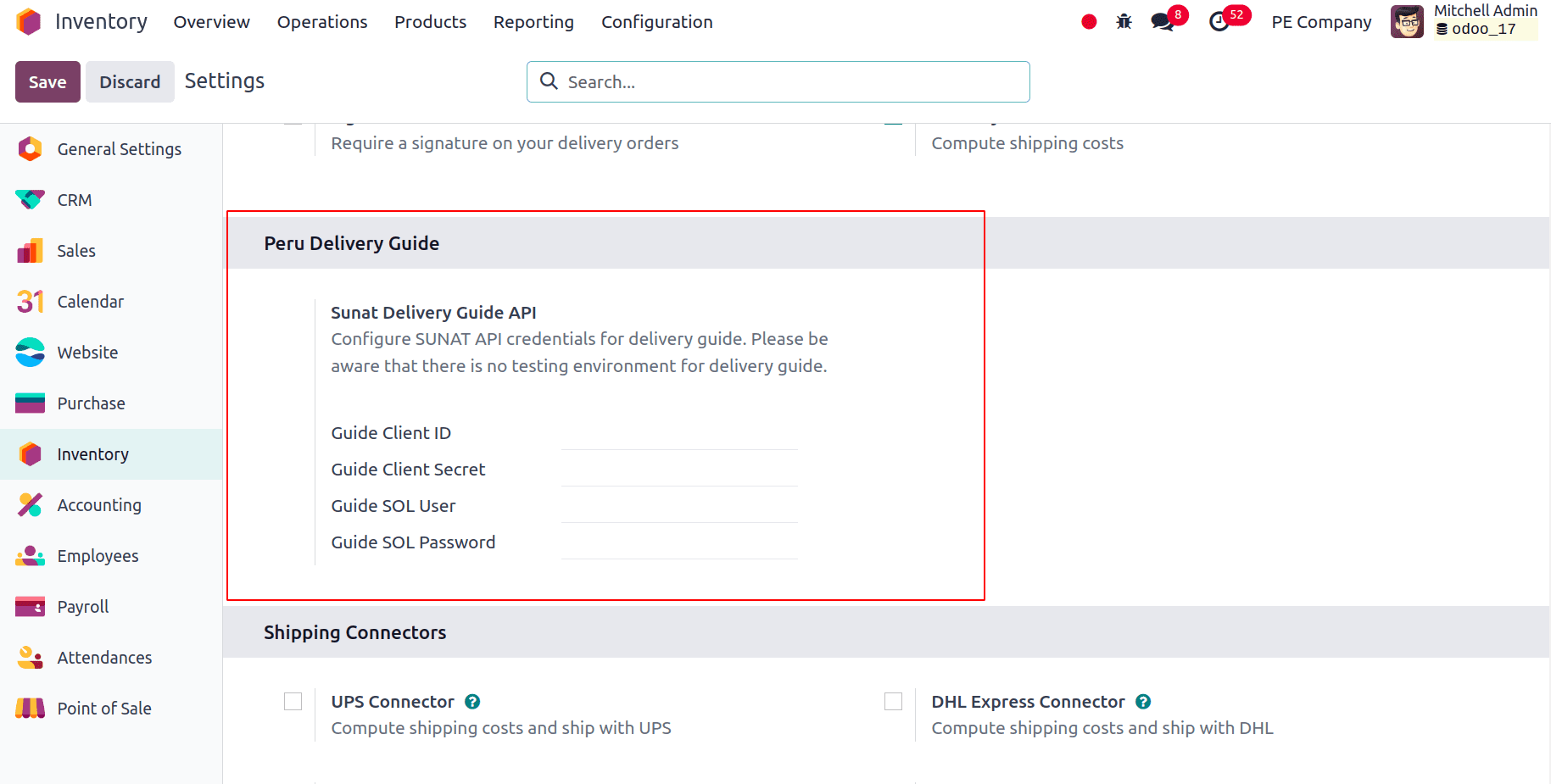

For this, we have to make certain configurations; for that navigate to Inventory > Configuration > Settings, and under the Peru Delivery Guide section we have to provide the following credentials.

When the delivery guide uses private transportation, the operator drives the vehicle.

Go to Contacts to add a new operator. Make the contact information and fill it out.

Choose Individual as the Company Type first. Next, add the Operator License to the contact form's Accounting tab. Verify that the following fields for the customer address are filled in:

* District

* Tax ID Number

* Tax ID (DNI/RUC)

When the delivery guide is made using public transportation, the carrier is used. To establish a fresh carrier, go to Contacts. Make the contact information and fill it out. Choose Company as the Company Type first. The Authorisation Number, Authorisation Issuing Entity, and MTC Registration Number should then be included.

Verify that the following fields for the company address are filled in:

* District

* Tax ID Number

* Tax ID (DNI/RUC)

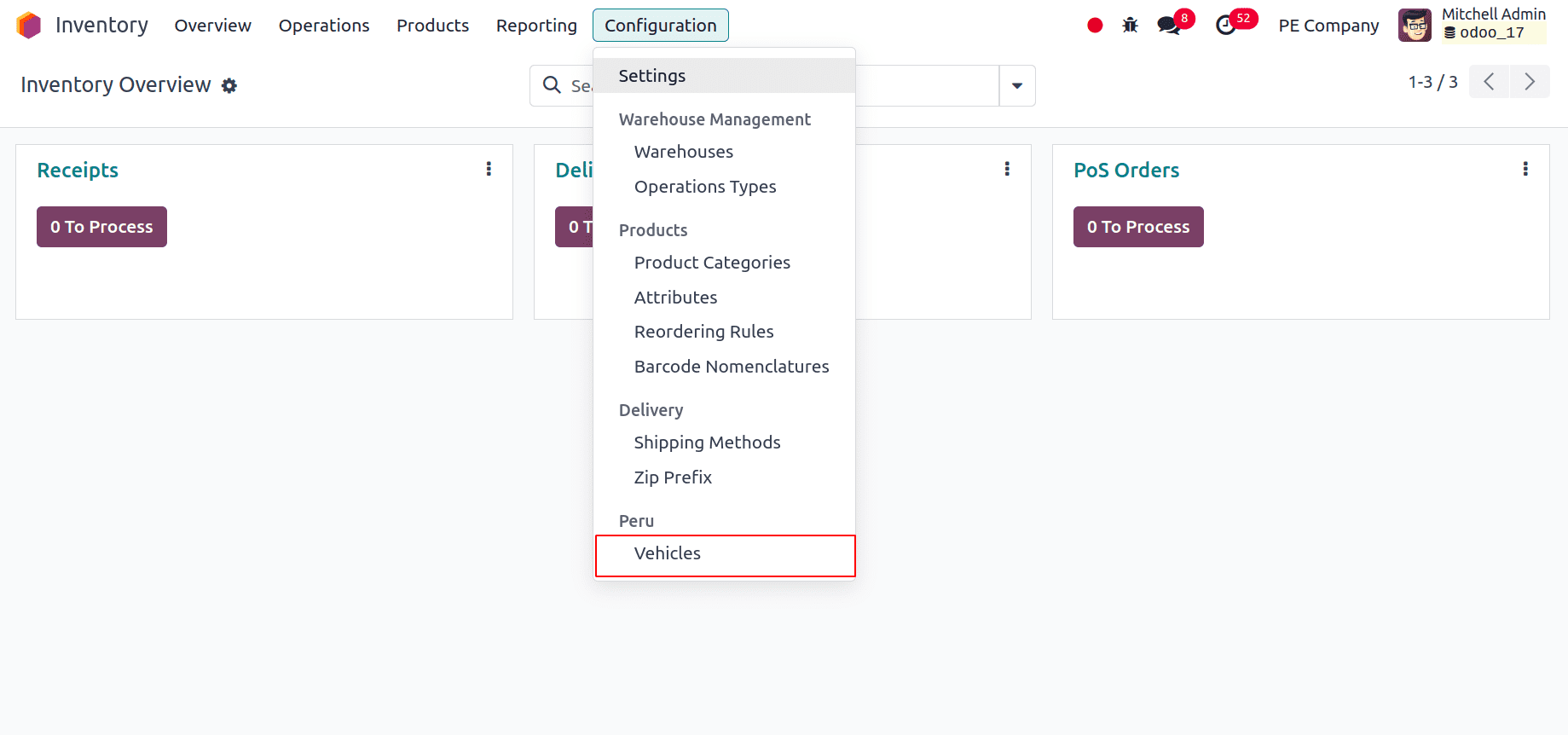

To customize the available vehicles, navigate to Inventory > Configuration > Vehicles and complete the vehicle form with the required data.

Given below is the vehicle form.

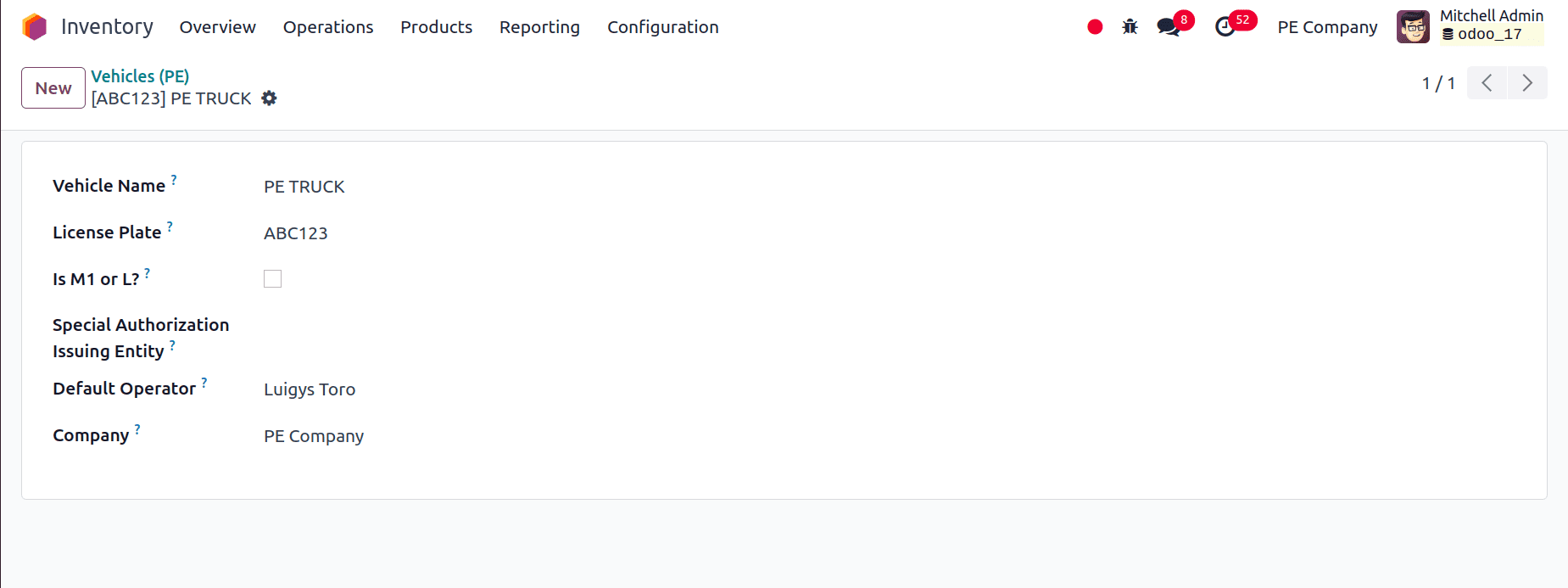

Products

For the products, we have to add the Tariff Fraction(PE). Tariff Fraction (PE) in the Peruvian customs system, is a number or classification utilized to identify products according to their tariff category. When importing or exporting items, this classification system aids in figuring out the appropriate tariffs, levies, and other customs-related regulations.

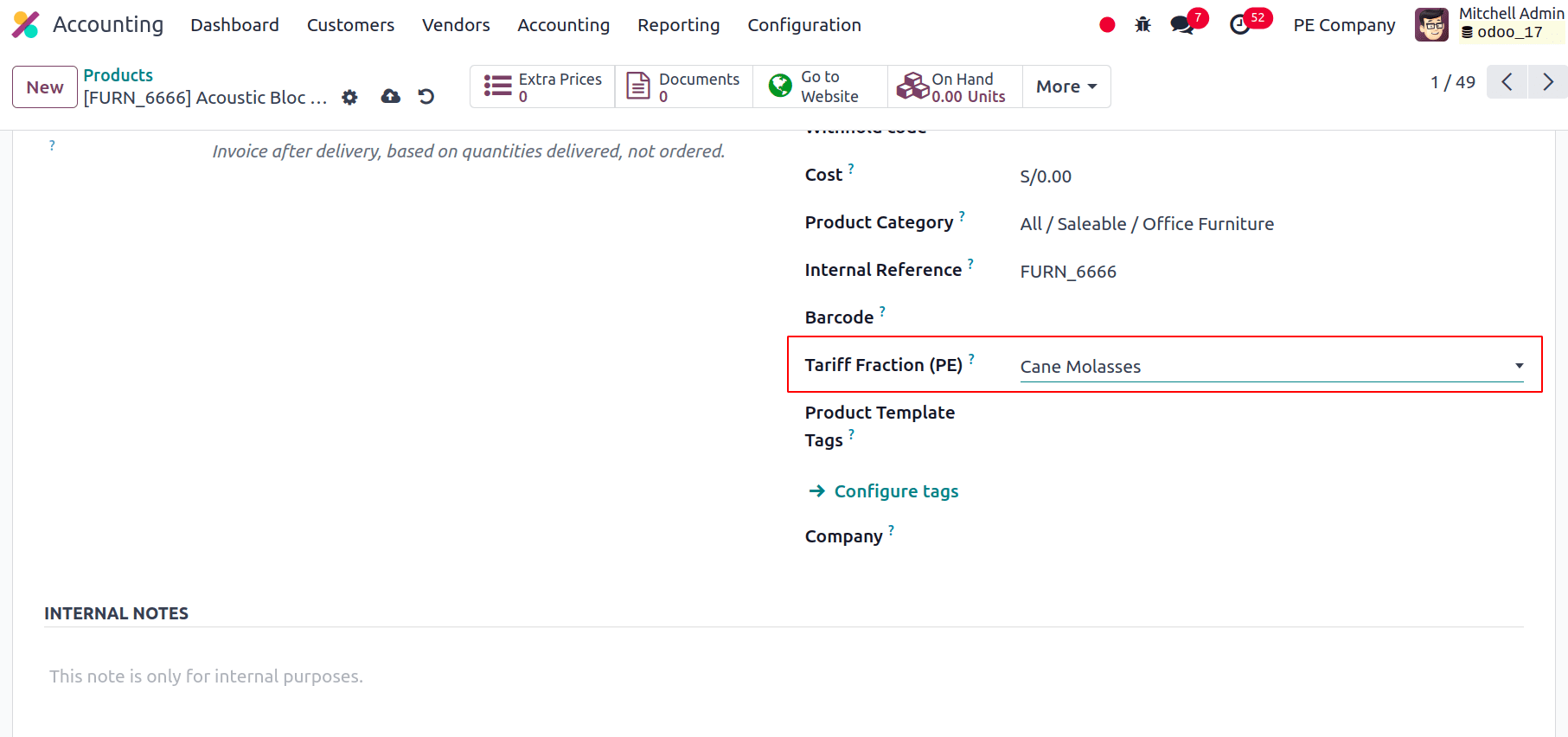

Generating a GRE

The Guía de Remisión Electrónica (GRE), an electronic delivery guide, is required by the SUNAT in Peru. It acts as evidence of the movement of goods, recording shipment information and guaranteeing that commodities are moved in compliance with legal regulations. It is necessary to issue the GRE online and submit it to SUNAT in order to adhere to customs and tax laws.

Make sure to fill out the GRE fields located in the upper-right side of the transfer form for the following fields when the delivery from inventory is created during the sales workflow:

* Transport Type

* Departure start date

* Reason for Transfer

Completing the Guia de Remission PE tab's Vehicle and Operator forms is also necessary.

The delivery transfer needs to be marked as Done in order for you to see the Generar Guia de Remission button on the left menu of the transfer form.

So we have seen in detail the accounting localisation for Peru in Odoo 17. The strong and complete solution provided by Odoo's accounting localization for Peru is designed to satisfy the unique operational and regulatory requirements of Peruvian organizations. Through the integration of tools like the Electronic Delivery Guide (Guía de Remisión Electrónica), adaptable tax management, and precise control of the fiscal situation, Odoo guarantees that enterprises can effortlessly negotiate Peru's intricate accounting regulations.

To read more about An Overview of Accounting Localization for United States in Odoo 17, refer to our blog An Overview of Accounting Localization for United States in Odoo 17.