Following regional accounting guidelines and standards is necessary for efficient financial management in New Zealand. Odoo's accounting localization for New Zealand is specially made to meet these objectives by adding features that are relevant to the nation's financial processes. This localization guarantees adherence to accounting standards, financial reporting obligations, and tax legislation in New Zealand. Through the integration of features like GST management, precise tax reporting, and improved financial procedures, Odoo assists New Zealand-based firms in effectively managing their accounting duties while adhering to regional laws. This tailored strategy improves operational effectiveness while streamlining compliance, giving companies a strong foundation to manage their financial operations in New Zealand.

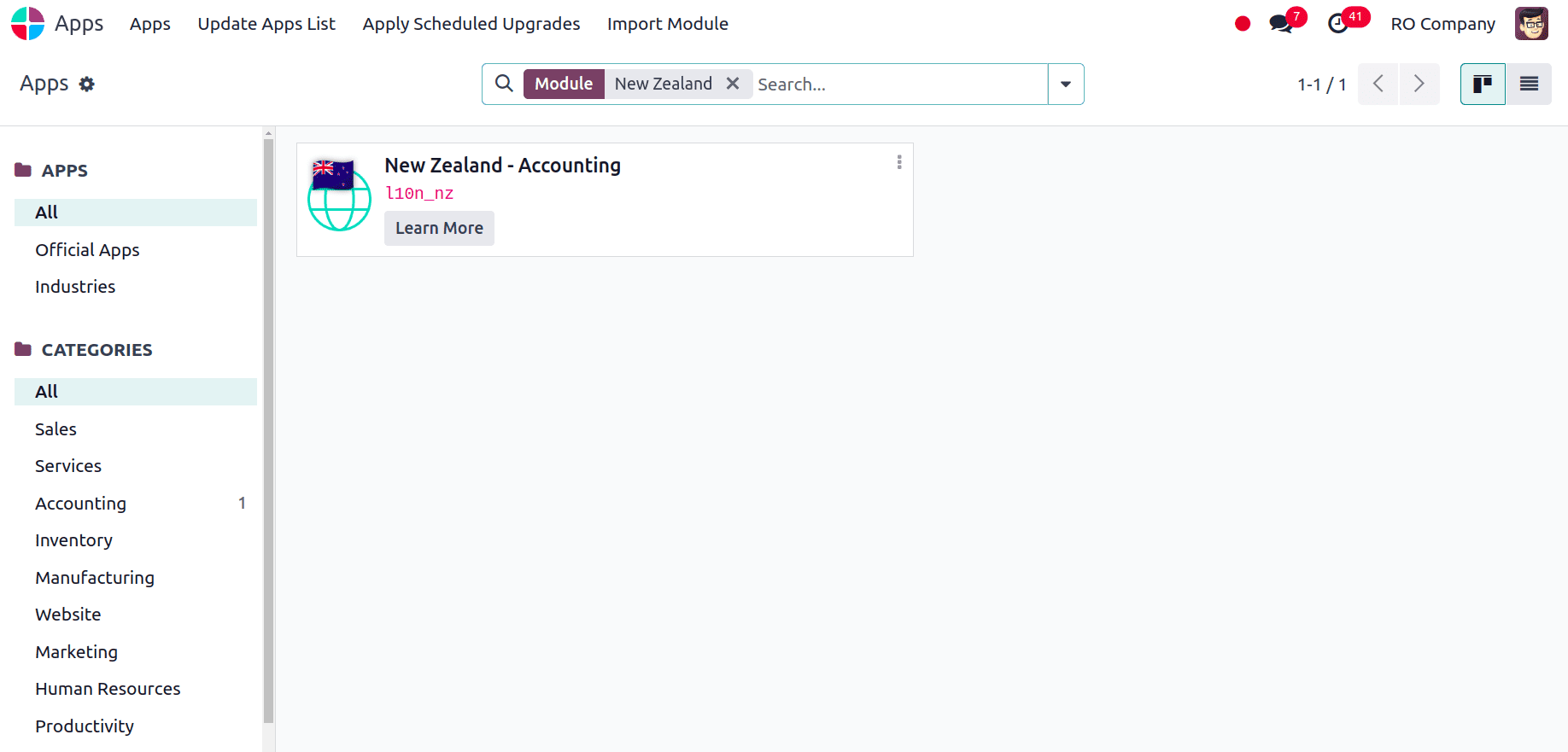

First, we have to install the New Zealand Accounting localization module, for that navigate to Apps and install the modules.

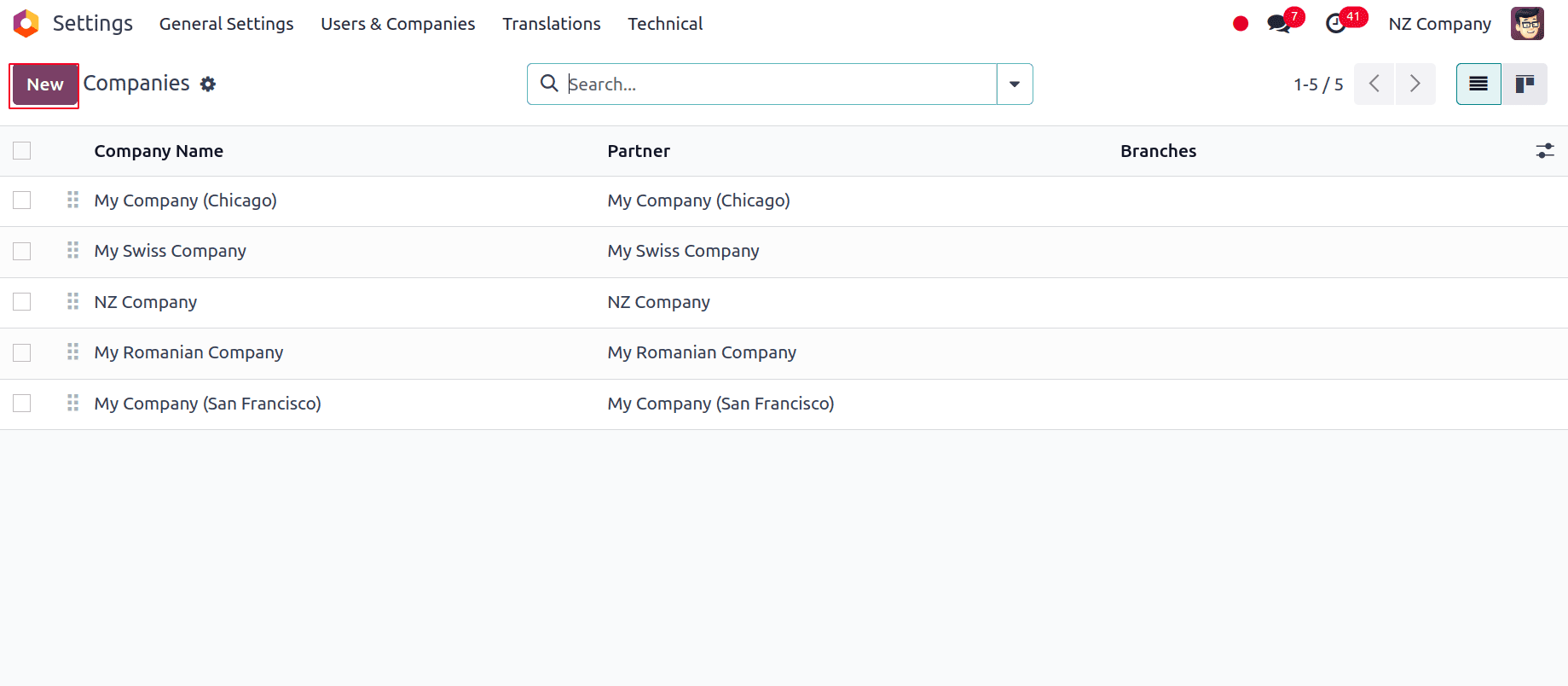

Then we have to check whether the company configuration is correct or we can create a new company with the correct details by clicking on the New button. Navigate to Settings > Users and Companies> Companies, and a list of all the already configured companies appears.

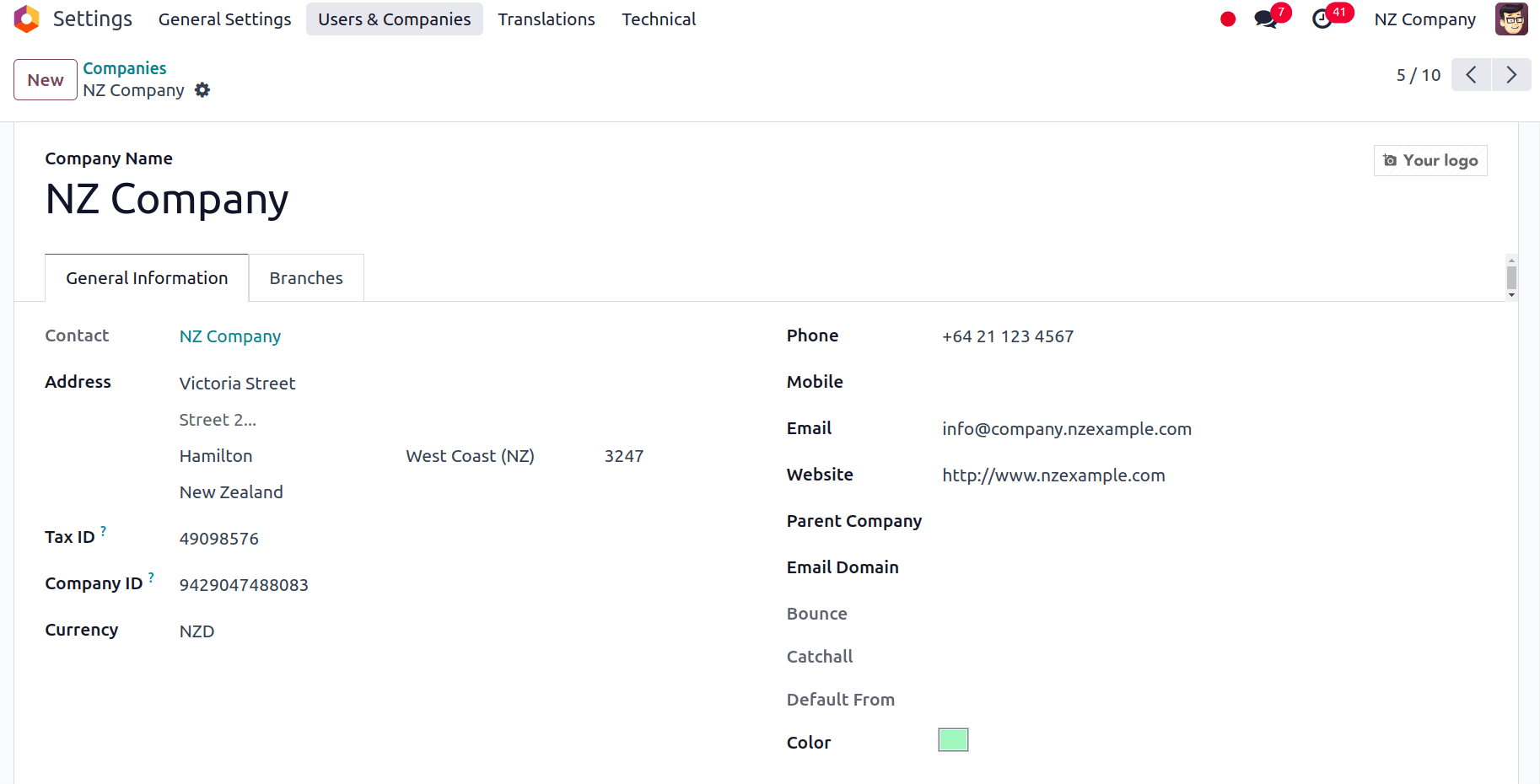

Select the company for which we want to check the company configuration like the Tax ID, Company ID, Address etc, and ensure it is properly set up.

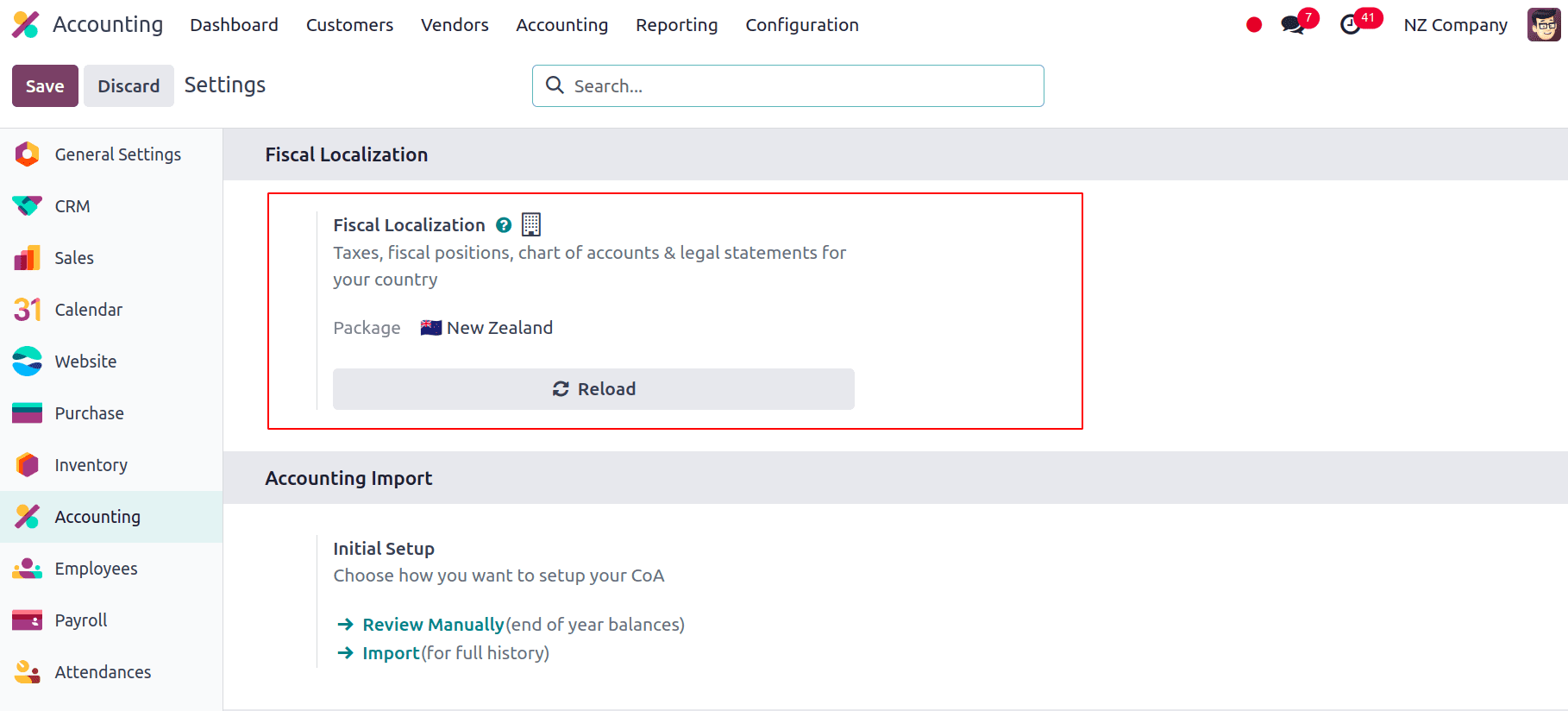

With the installation of the localization, the Fiscal localization will be set to New Zealand in the configuration settings of the Accounting module.

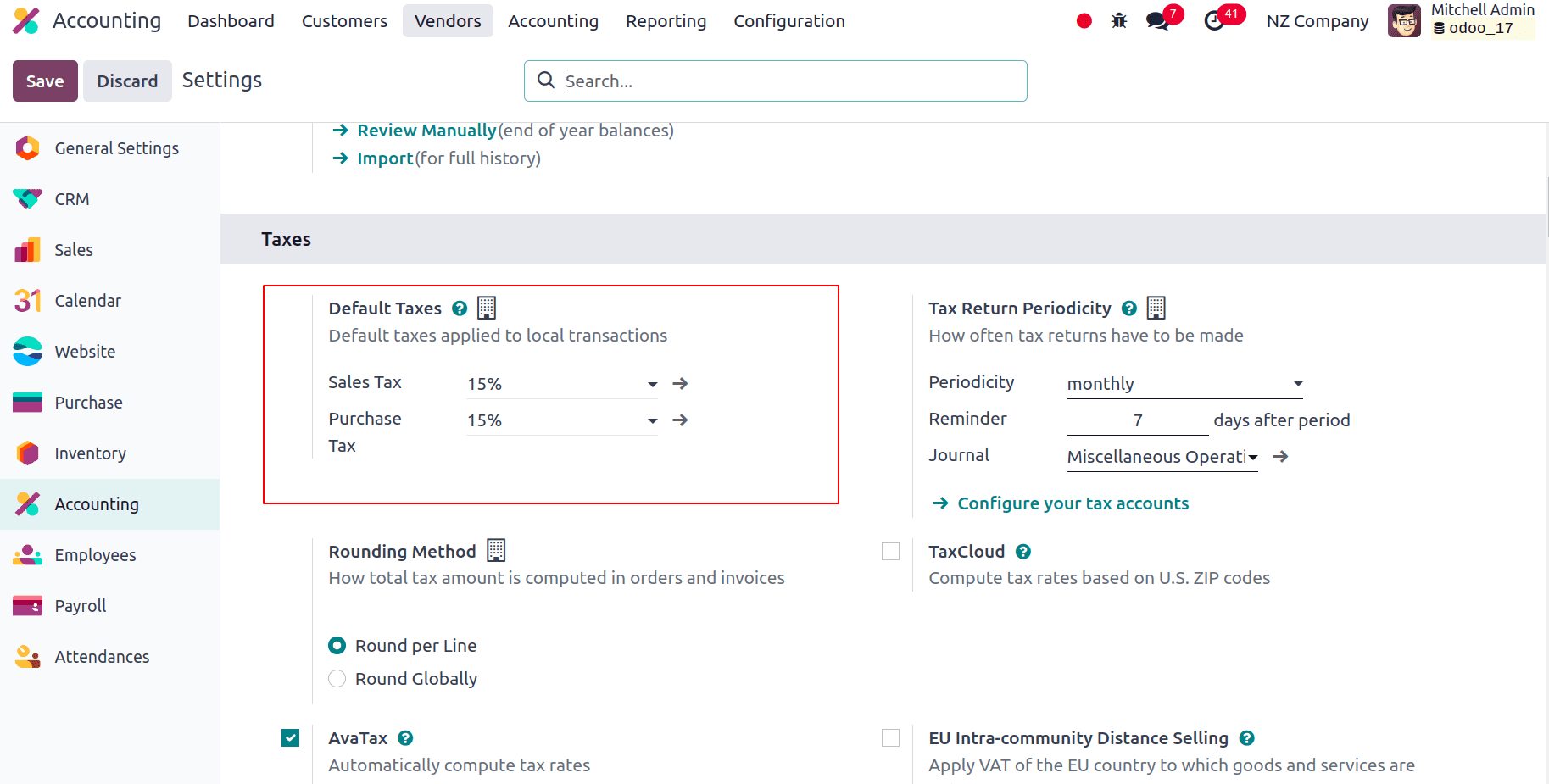

Now, we can check the default taxes and the main currency set for this localization. Default Taxes are the pre-established tax settings that, in accordance with the relevant tax laws, apply to transactions automatically. Since the right tax rates are applied regularly to invoices and purchase orders, these default taxes make accounting easier. Here, we can see the Sales Tax and Purchase Tax under the default taxes. Sales taxes are the taxes applied to the sale of goods and services, which are calculated and recorded during the invoicing process. Here, they are configured to 15%. Purchase taxes are the taxes applied to the receipt of goods and services, recorded during the purchase process, and are configured as 15%.

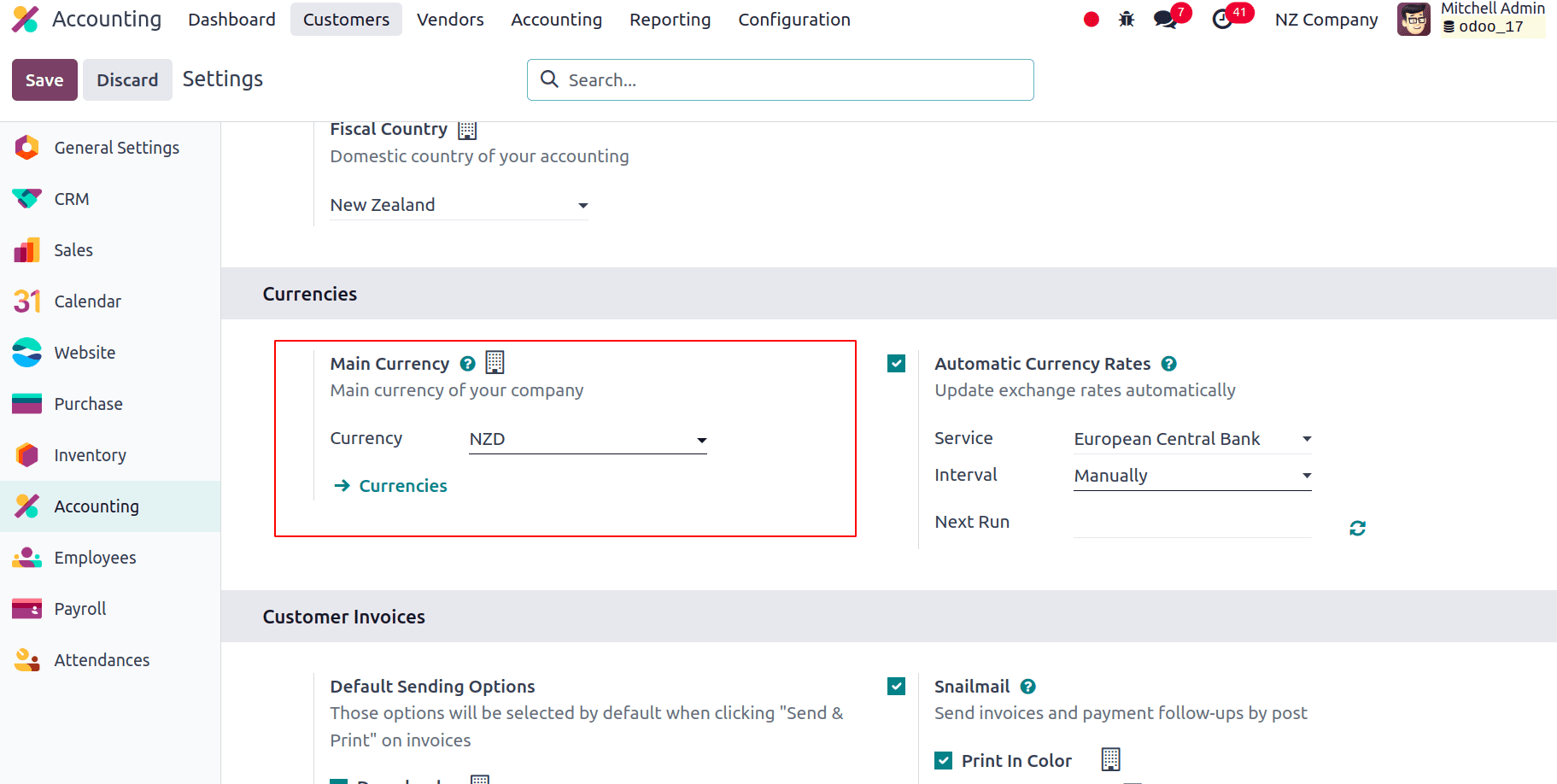

The Main Currency for this localization is set to New Zealand dollar (NZD) which is the official currency of the country.

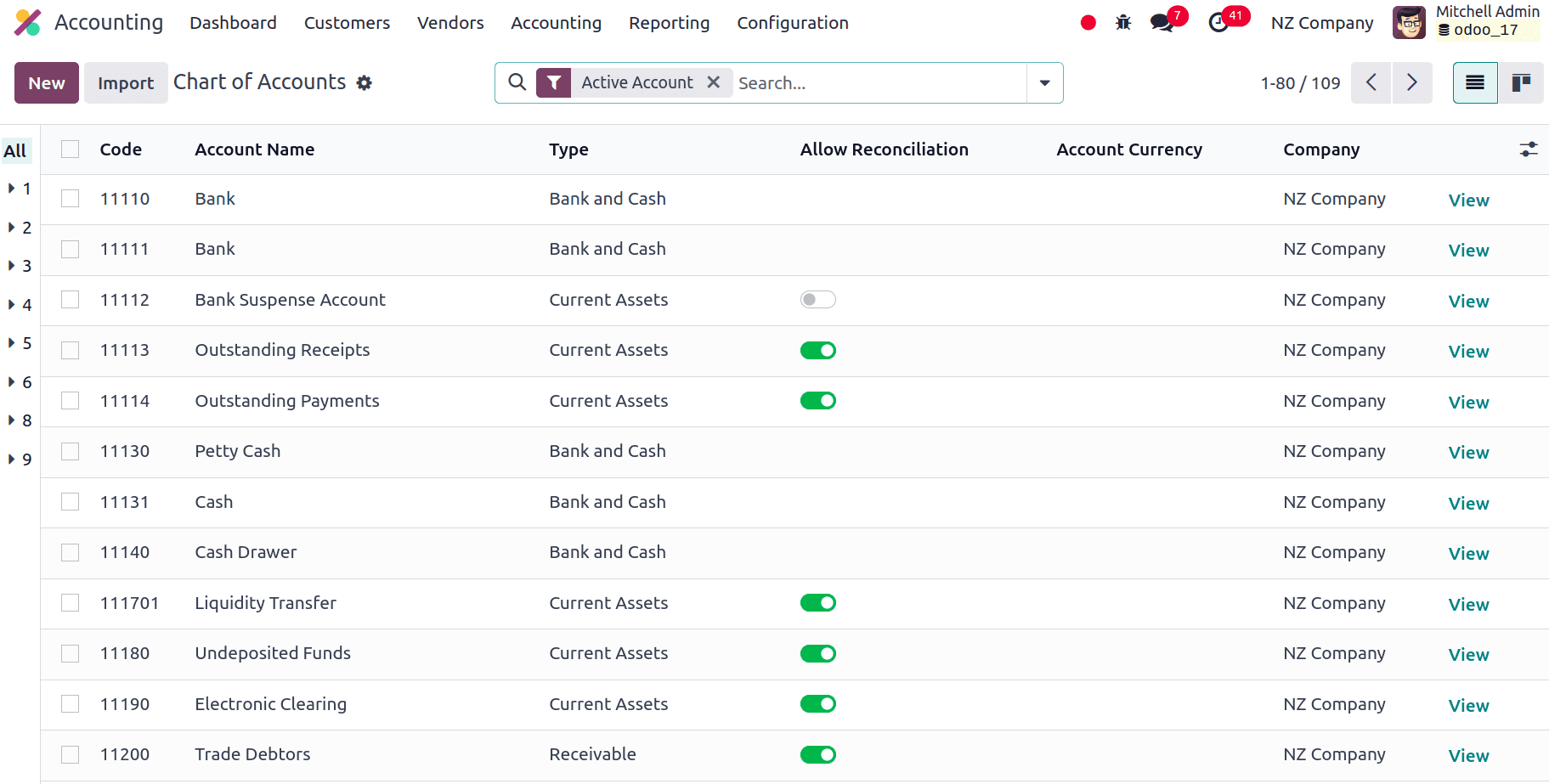

Chart of Accounts

In Odoo, the Chart of Accounts provides an orderly framework for classifying and arranging financial transactions. It offers an exhaustive inventory of every account—including revenue, expenses, equity, liabilities, and assets—that is utilized in the accounting system. A distinct code and description are issued to every account, making it easier to accurately track and report financial activity. By customizing the Chart of Accounts to fit specific business needs, Odoo ensures streamlined financial management and compliance with accounting standards, helping businesses maintain clear and organized financial records.

Some of the Chart of Accounts included for this localization include :

* Less Provision for Doubtful Debts account, which is used to record allowances made for accounts receivable that are expected to become uncollectible. It represents a reduction in the total value of receivables, reflecting an estimation of potential losses due to customer defaults. By setting aside a provision for doubtful debts, businesses can more accurately present their financial position and manage credit risk. This account helps ensure that financial statements provide a realistic view of expected cash flows and helps maintain prudent financial practices.

* The Goods Shipped Not Invoiced account tracks the value of goods that have been dispatched to customers but for which invoices have not yet been issued. It acts as a temporary holding area, recording the revenue from shipped goods until the formal invoicing process is completed. By maintaining this account, businesses can manage and monitor sales transactions more effectively, ensuring that revenue is accurately recognized and aligned with shipping activities.

* The Freight Paid account in Odoo is used to record expenses related to the transportation of goods. This account captures costs incurred for shipping, delivery, or handling of products, reflecting them as part of the company's operational expenses. By tracking these expenses, businesses can better manage their logistics costs, analyze the impact on overall profitability, and ensure accurate financial reporting. This account helps maintain clear visibility over freight expenditures and supports effective cost management within the financial system.

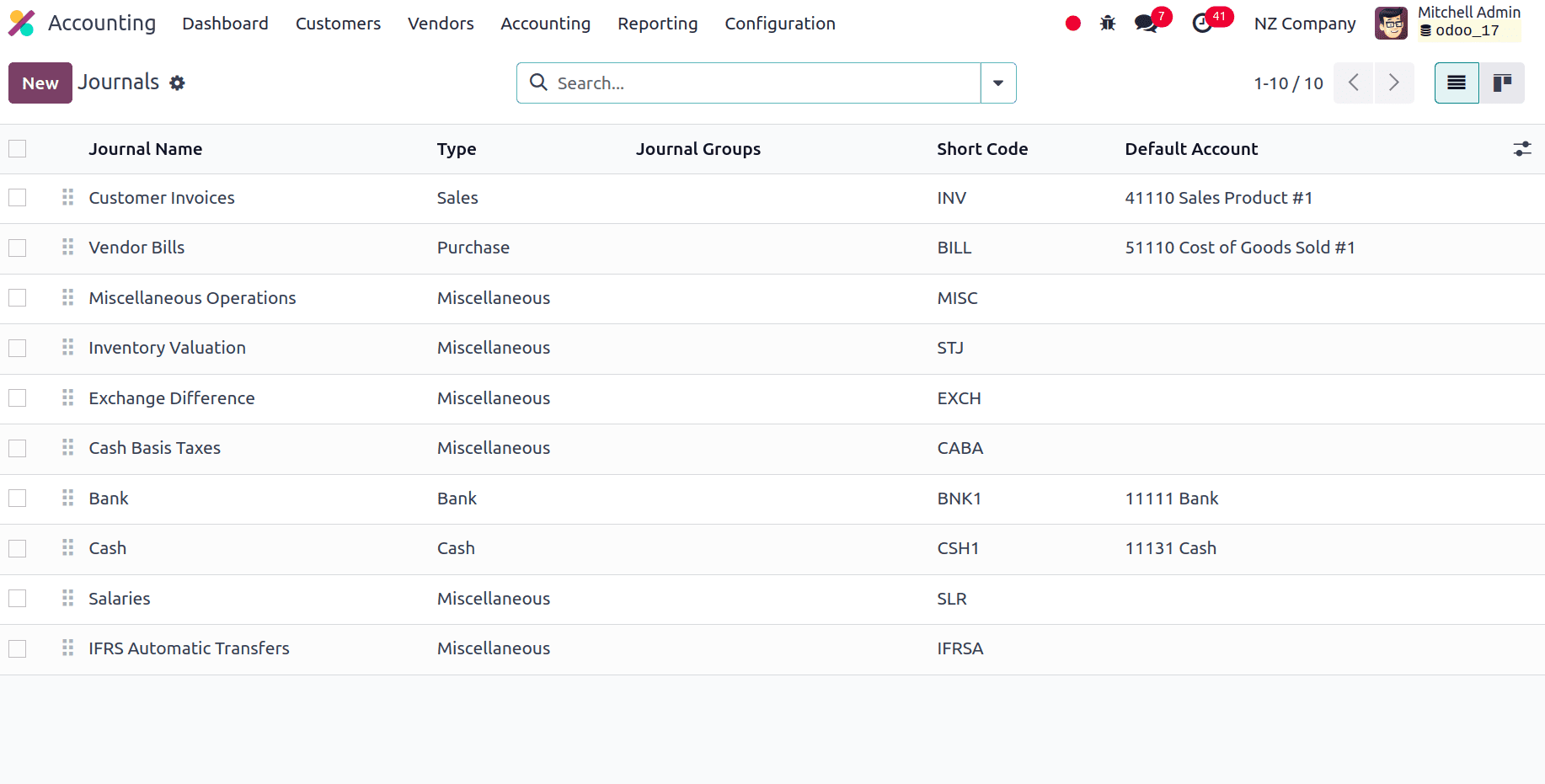

Journals

Journals are fundamental components used to record and manage various types of financial transactions. They serve as detailed records where all accounting entries are logged, ensuring organized and accurate tracking of financial activities. Each journal in Odoo corresponds to a specific category of transactions, such as sales, purchases, bank transactions, and general entries. Accounting localization for New Zealand includes all the fundamental journals required for smooth accounting operations in the country, like Customer invoices, Vendor Bills, Bank, Cash, etc, and also the Exchange difference journal, which tracks the Currency exchange rate fluctuations on foreign currency balances and transactions. This diary records the profits or losses resulting from fluctuations in currency rates from the moment a transaction is recorded until its settlement or revaluation.

The IFRS Automatic Transfers journal in Odoo allows users to set up rules that specify when and how balances should be transferred between accounts. It enhances efficiency in financial operations by streamlining the process of applying IFRS standards to financial data.

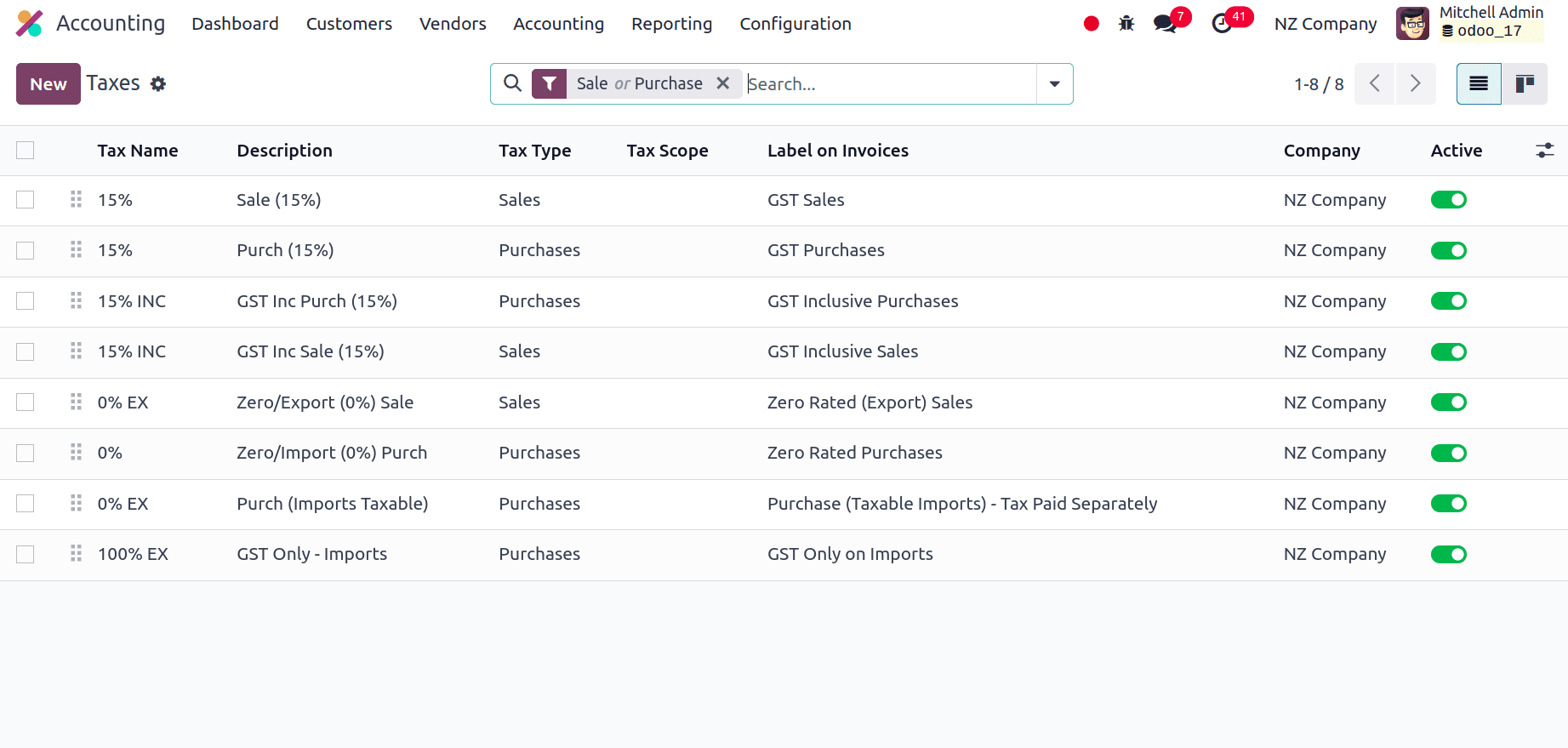

Taxes

Taxes in Odoo with New Zealand Accounting Localization include:

1. GST (Goods and Services Tax):

* New Zealand's primary consumption tax is GST, currently set at 15%.

* Odoo allows businesses to configure and manage GST settings easily. This includes defining GST rates for different types of goods and services, applying GST to sales transactions, and ensuring accurate calculation of GST amounts on invoices and purchases.

2. GST Reporting:

* Odoo provides robust tools for generating GST reports tailored to New Zealand's requirements.

* Businesses can generate GST returns periodically (e.g., monthly, bi-monthly, or six-monthly) directly from Odoo.

* The reports include details such as total sales, GST collected, GST paid on purchases, and the net GST liability or refund due to the tax authority.

Odoo allows customization of tax codes and configurations to align with specific business needs and New Zealand's tax regulations. Taxes are automatically applied based on predefined tax rules and configurations, minimizing manual errors and saving time for accounting teams.

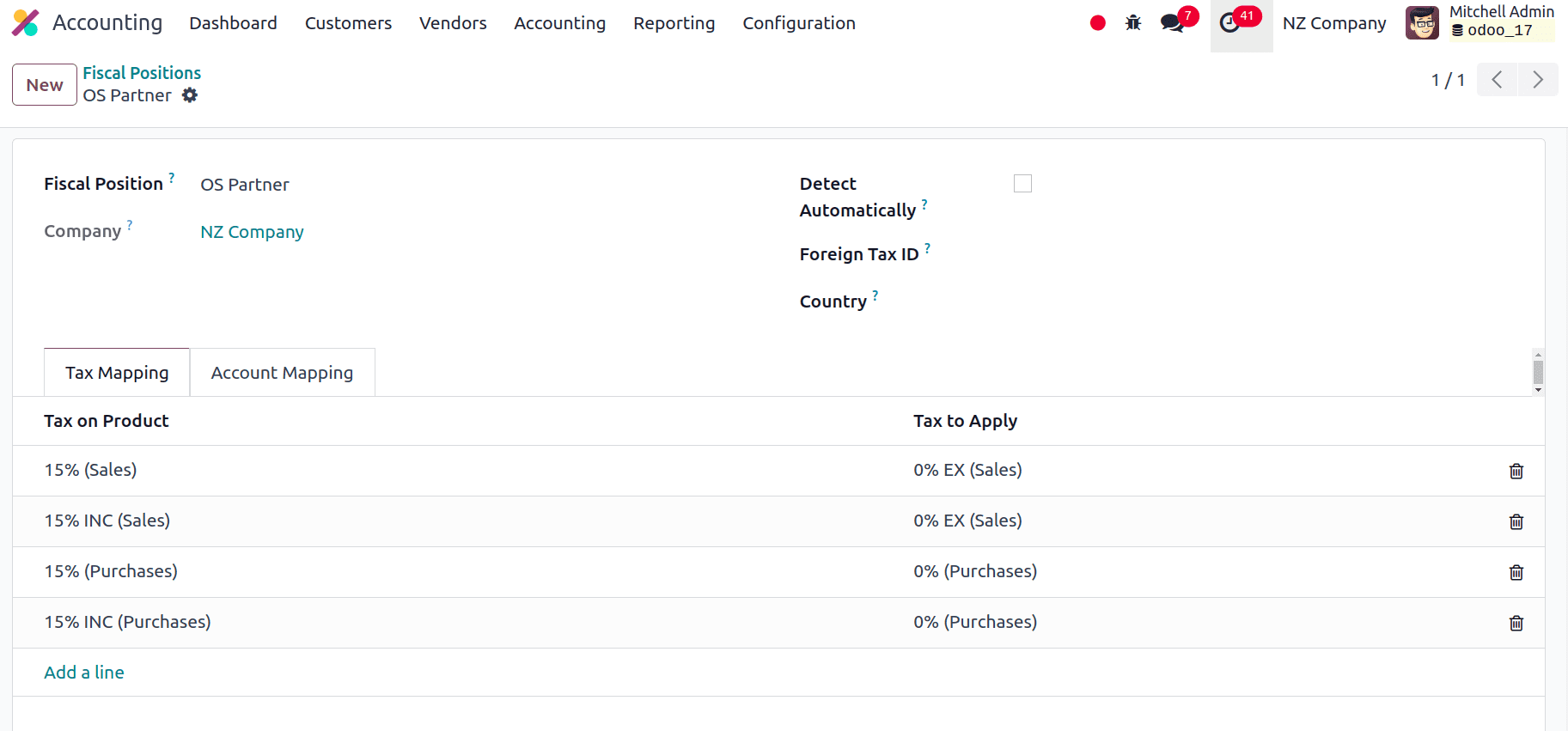

Fiscal Positions

In Odoo, a Fiscal Position defines the mapping between customer or supplier accounts and specific taxes based on their location or other criteria. It allows businesses to apply different tax rules and accounts automatically based on predefined conditions. With Fiscal Positions, businesses can map different tax rules and rates to specific customers or suppliers. Fiscal Positions in Odoo’s New Zealand accounting localization provide businesses with a structured approach to managing tax implications based on customer or supplier profiles. Odoo assists with proper financial reporting and agreement while boosting tax administration efficiency by automating tax computations and guaranteeing conformity with regulatory standards.

Partner Fiscal Position refers to the configuration that links customers or suppliers to predefined tax rules and accounting settings. It allows businesses to apply different tax treatments, such as GST rates or exemptions, based on the partner’s location, type of business, or other criteria.

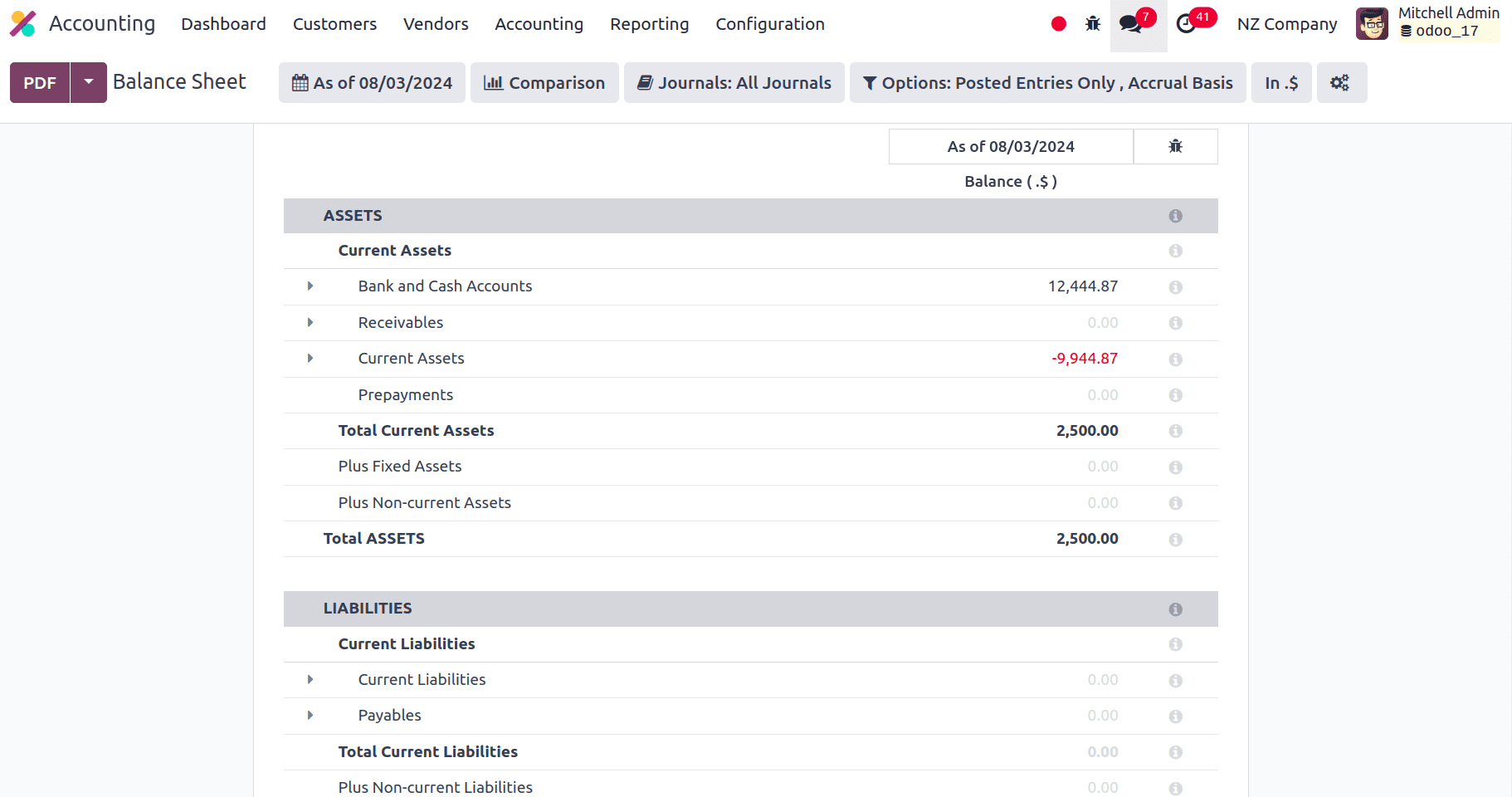

Balance Sheet

The Odoo balance sheet provides an overview of a company's assets, liabilities, and equity as of a specific date, usually the conclusion of a reporting period (month, quarter, year, etc.).

Assets: All of the company's assets are listed in this area, including cash, inventories, accounts receivable, and fixed assets like real estate, machinery, and equipment.

Liabilities: These include all debts that the business has, including loans, accounts payable, and accumulated charges.

Equity: Following the deduction of its liabilities, equity is the remaining stake in the company's assets. Retained earnings, common shares, and additional elements like contributed capital are all included.

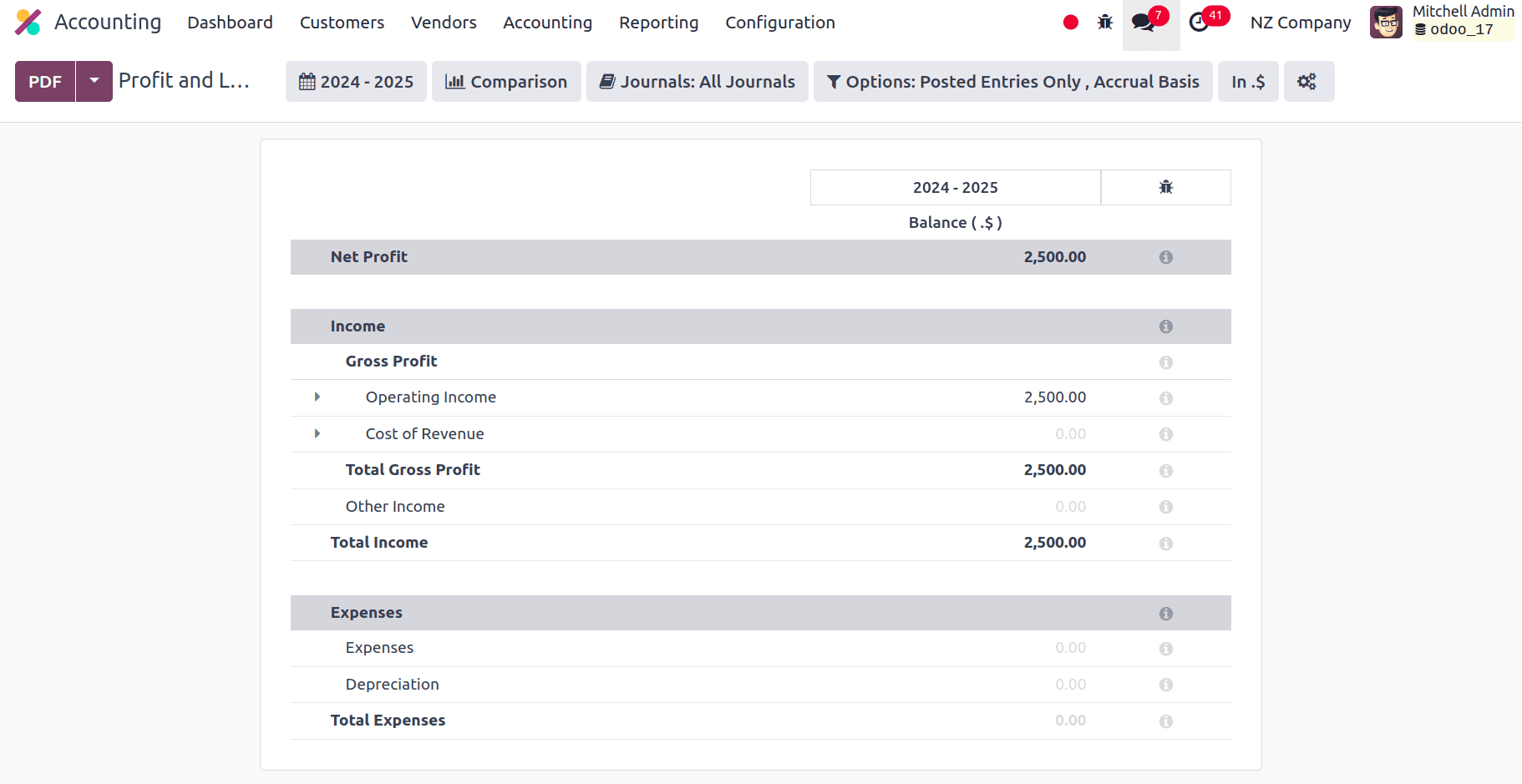

Profit and Loss Report

A company's earnings, costs, and net profit or loss for a given time period—such as a month, quarter, or year—are compiled in the Profit and Loss Report. The primary purpose of the P&L report in Odoo is to assess the profitability of the business operations during the reporting period. It facilitates stakeholder understanding of whether the company's primary business operations resulted in a profit or a loss. Odoo’s Profit and Loss report with New Zealand accounting localization serves as a vital tool for businesses to monitor financial performance, evaluate profitability, and support informed decision-making. Its automated features, real-time updates, and integration capabilities enhance efficiency in financial reporting and analysis, contributing to overall business success. We can view the Net Profit, Income, and Expenses in the report. Under Income, we can view the Gross Profit, Total Gross Profit, and Total Income. Total Expenses can be viewed under the Expenses section.

Tax Report

The Tax Report's main purpose is to help firms meet their tax compliance obligations. It ensures proper tax calculations and reporting to governmental authorities by offering a consolidated picture of all taxable transactions. It consolidates and presents detailed information on taxes collected (output tax) and taxes paid (input tax) within a specified reporting period. It is designed to facilitate accurate tax reporting and compliance with New Zealand tax regulations, particularly GST.

Strong features and functions designed to satisfy the unique demands of the nation's accounting standards and tax laws are provided by Odoo's accounting localization for New Zealand. Some of the key features of this localization include automated calculation and reporting of GST on transactions, enabling businesses to accurately track and comply with GST obligations. Accurately generate financial statements such as balance sheets and profit and loss reports on an accrual basis. Tools for defining tax rules based on partner attributes and locations, facilitating precise tax application and reporting. Through the utilization of Odoo's accounting localization for New Zealand, enterprises may optimize their overall efficiency and foster sustainable growth in the New Zealand market by streamlining their financial operations, improving reporting accuracy, and adhering to local accounting standards.

To read more about An Overview of Accounting Localization for Australia in Odoo 17, refer to our blog An Overview of Accounting Localization for Australia in Odoo 17.