What is meant by accounting localization?

Accounting localization means changing how you do accounting to fit the rules and customs of a specific country or region. It involves adapting your financial practices to match local laws, currency, and language so your financial reports are correct and meet local requirements. This is important for businesses operating in different countries to stay compliant and avoid issues.

What are the advantages of Odoo 17 Accounting localization?

The localization capabilities of Odoo 17 assist in making sure that accounting procedures adhere to the unique rules and legislation of various nations, lowering the possibility of legal problems and penalties. By automatically applying local tax laws and rates, it makes tax computations simpler and aids in proper tax filing and reporting. Businesses can manage transactions and reports in the local currency and language of each location thanks to Odoo 17's support for multiple currencies and languages. It makes financial information easier to examine and transmit as required by local authorities by generating financial reports that adhere to local reporting standards and formats.

How to set up localization packages in Odoo?

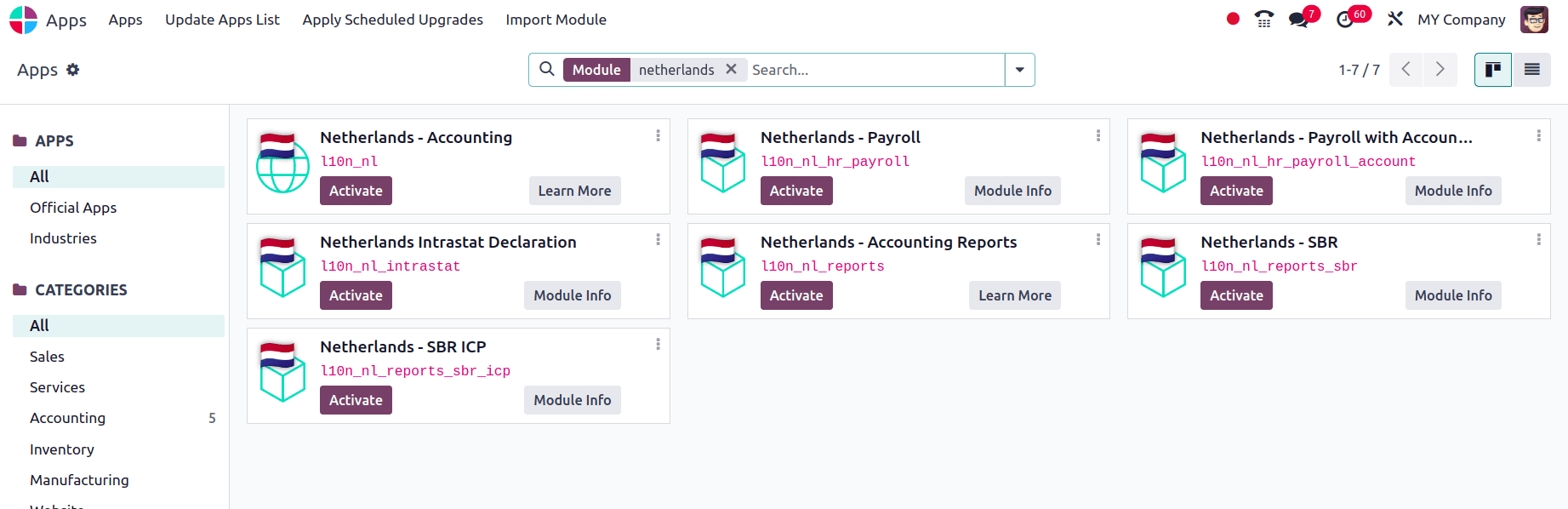

When you move to Odoo apps and remove the ‘apps’ filter you can find the packages that are needed to set the localization package for the country Netherlands.

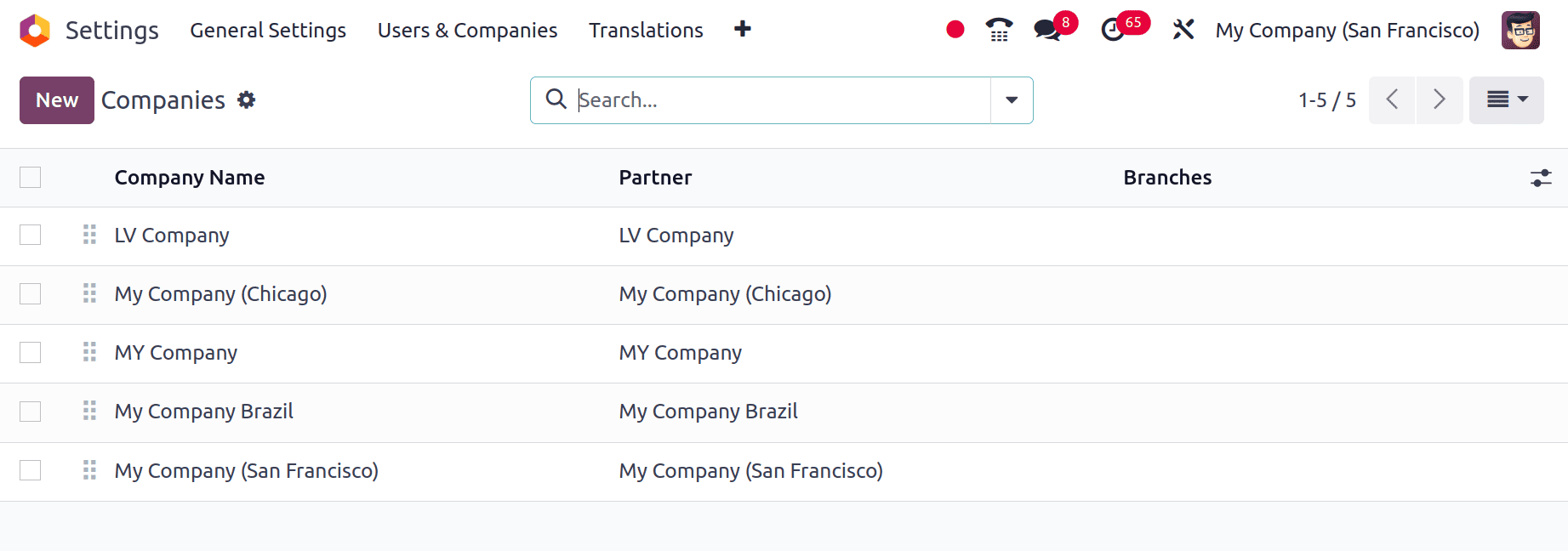

Just activate all these modules and move to Odoo's general settings to create a new company from the Netherlands. So move to General > Settings and you can find a Users & Companies menu there. Under this Users & Companies menu, there is a Companies sub-menu. when you click the Companies sub-menu, the list of companies that are pre-created can be seen there. By clicking the New button you can create a new company here.

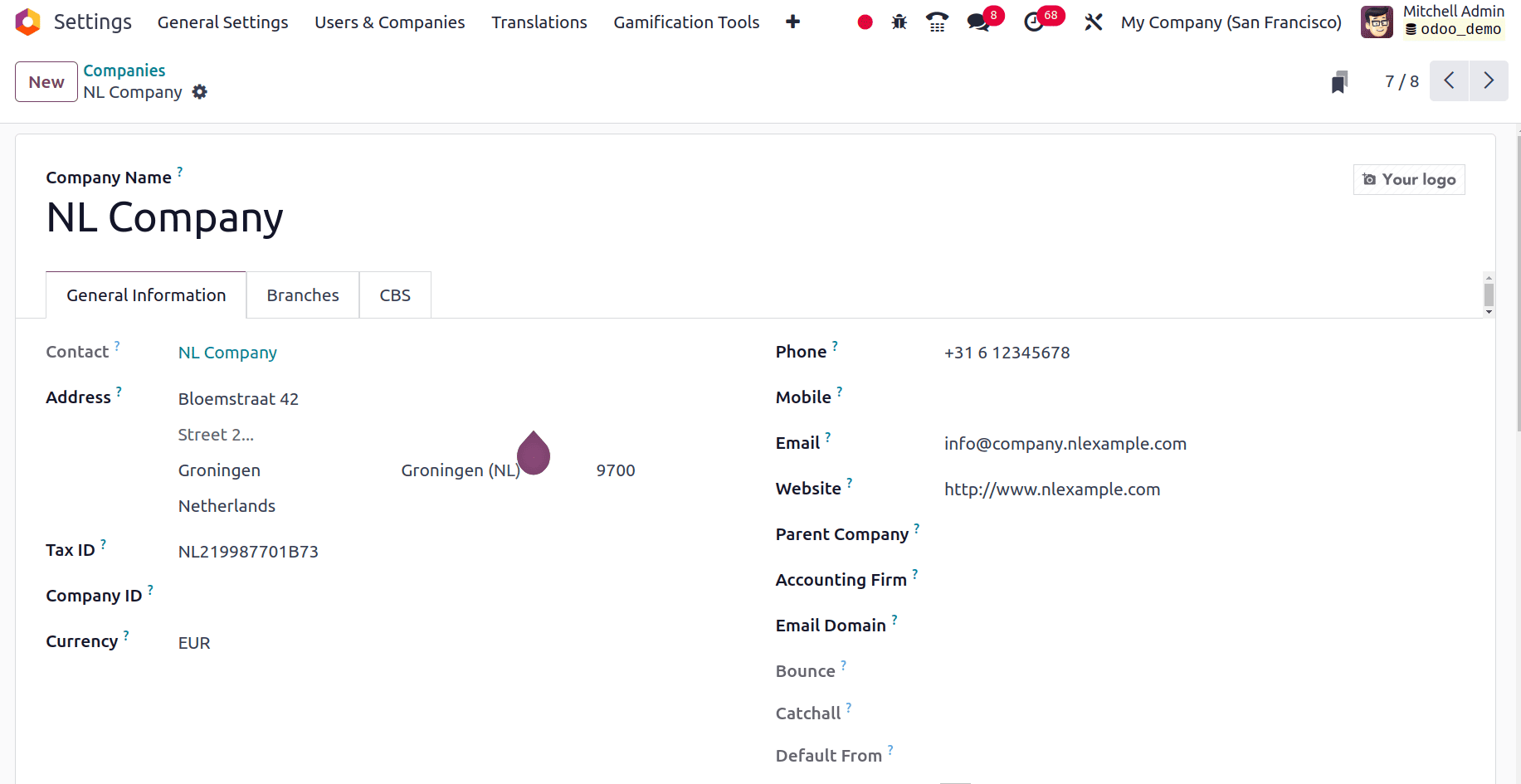

There you will get a form to provide the details of the company. In this form, you can give the name of the company, address, Tax ID, country to which this company belongs, etc. When we set the country here, then odoo automatically adds the official currency of the country to the form.

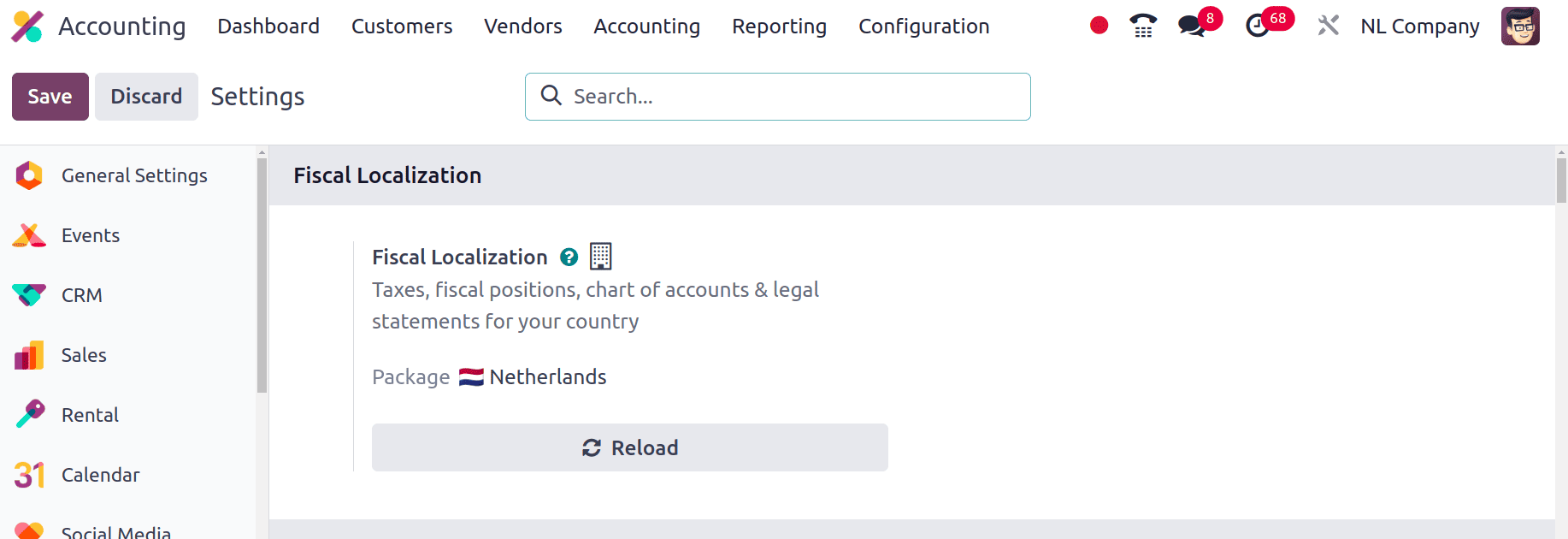

To familiarize the features of accounting localization for the Netherlands first we need to configure the Fiscal localization package for this company. For that move to the Accounting application and in Configuration > Settings there is a Fiscal localization section.

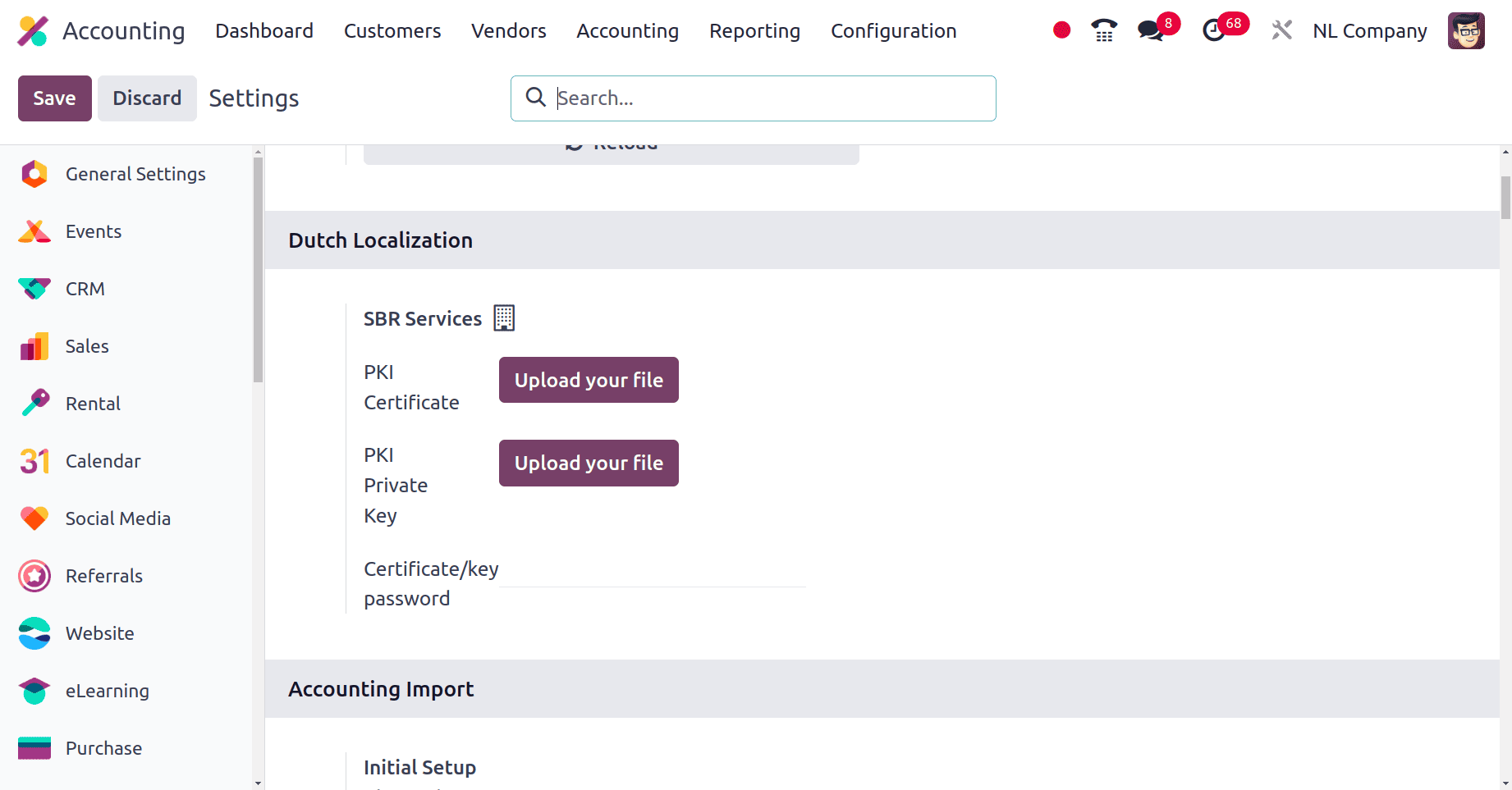

In this Fiscal localization section, we can provide the Package as the Netherlands and click the save button to save the changes. Next in the settings after setting the Fiscal localization package, an extra field Dutch localization section is added to the Configuration > settings.

There we can see the option to upload the PKI certificate file, the PKI private key, and the Certificate/key password. SBR Services refers to the Standard business reporting services which is a platform used for the electronic communication between business and government agencies. PKI means the Public key infrastructure, which is mainly used for ensuring data privacy and integrity and also used to protect sensitive email content. The PKI private key is the foundation of security in the PKI. It's the secret component that allows for secure communication and data protection.

Some of the main features of odoo accounting localization are the automatic configuration of the Chart of Accounts, Journals, Fiscal positions, and Taxes.

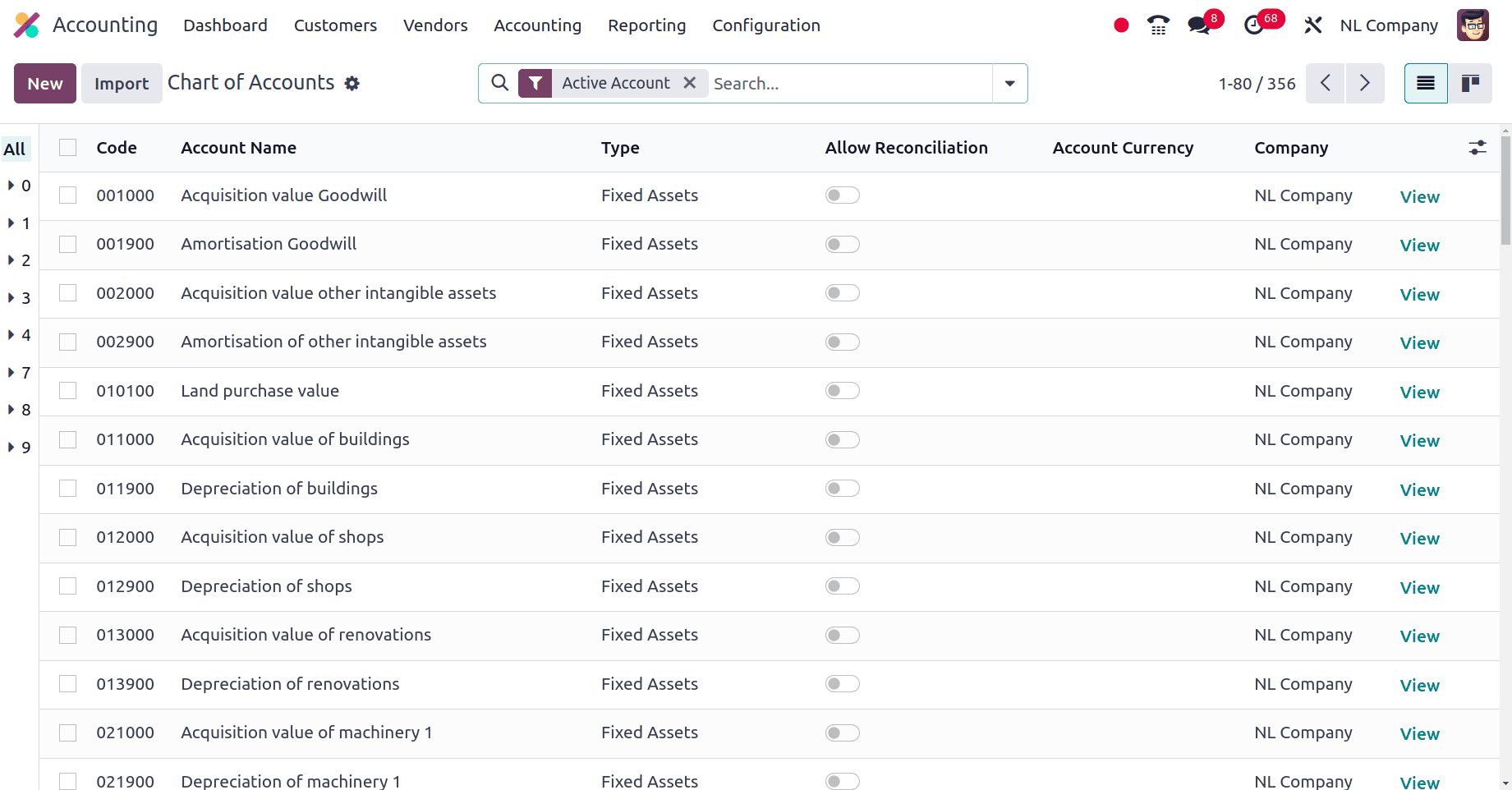

Chart of accounts

Odoo offers a pre-configured chart of accounts specifically designed for businesses operating in the Netherlands. This chart of accounts adheres to Dutch accounting standards and regulations. Under the Configuration menu, we have the Chart of Accounts sub-menu. There we can find the preconfigured chart of accounts for the company from the Netherlands.

The chart of accounts used in different countries may vary depending on the country's specifications. The chart is designed to align with local tax regulations, ensuring correct VAT or GST calculations. It incorporates necessary accounts and structures to meet local financial reporting standards. If you need any more chart of accounts to satisfy the needs of your business you can create a new account by clicking the New button.

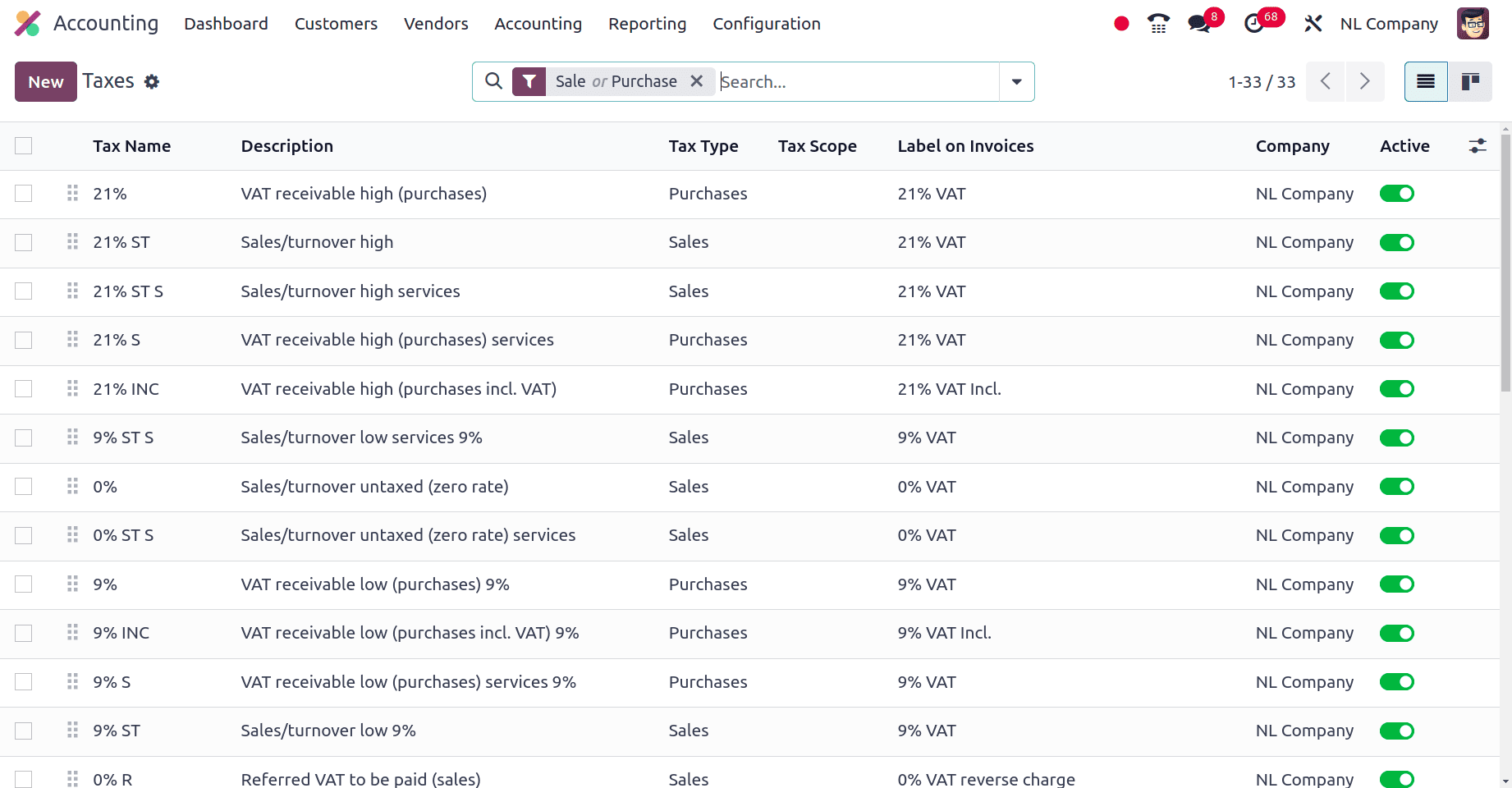

Taxes

Netherlands companies impose the value-added tax (VAT) in the transfer of goods and services. Odoo Supports multiple VAT rates applicable in the Netherlands. Mainly there are two different types of taxes, sales and purchase taxes.

Under Configuration > Settings we have a Taxes sub-menu. When we choose that taxes sub-menu you will obtain a list of taxes that are already configured.

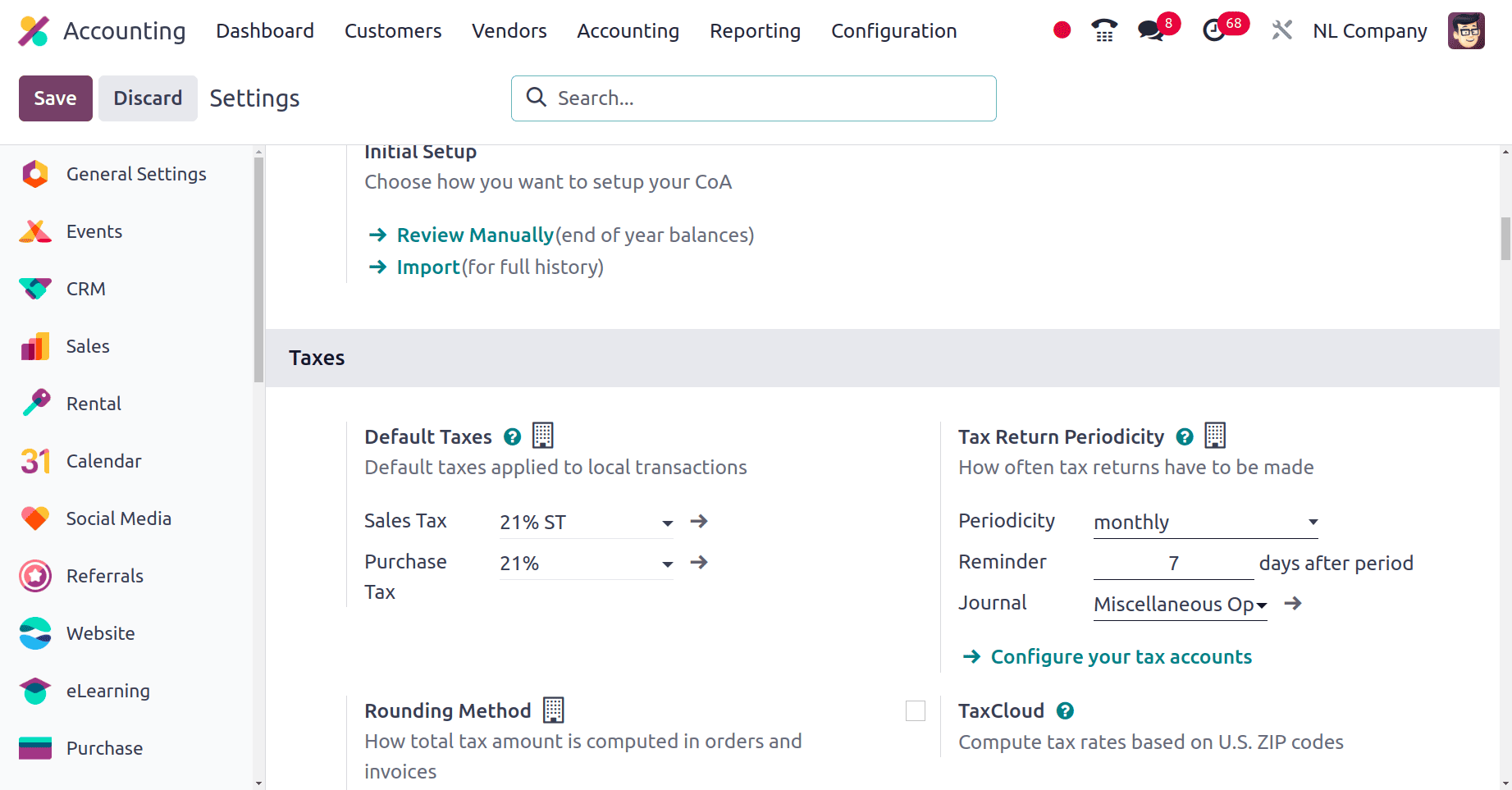

Here we have found the already-created taxes that the company can use for its needs. But Odoo automatically adds taxes on products while selling and purchasing them and these taxes are called Default taxes of the country. In Configuration > Settings we can find a section named Default taxes and in that section, you can set two different taxes Default sales tax and Default purchase tax for the company.

From the above screenshot, we can see that one Sales tax and One purchase tax are added by Odoo when the localization package is configured and saved. All companies from the Netherlands may use these taxes as the default tax for the transfers.

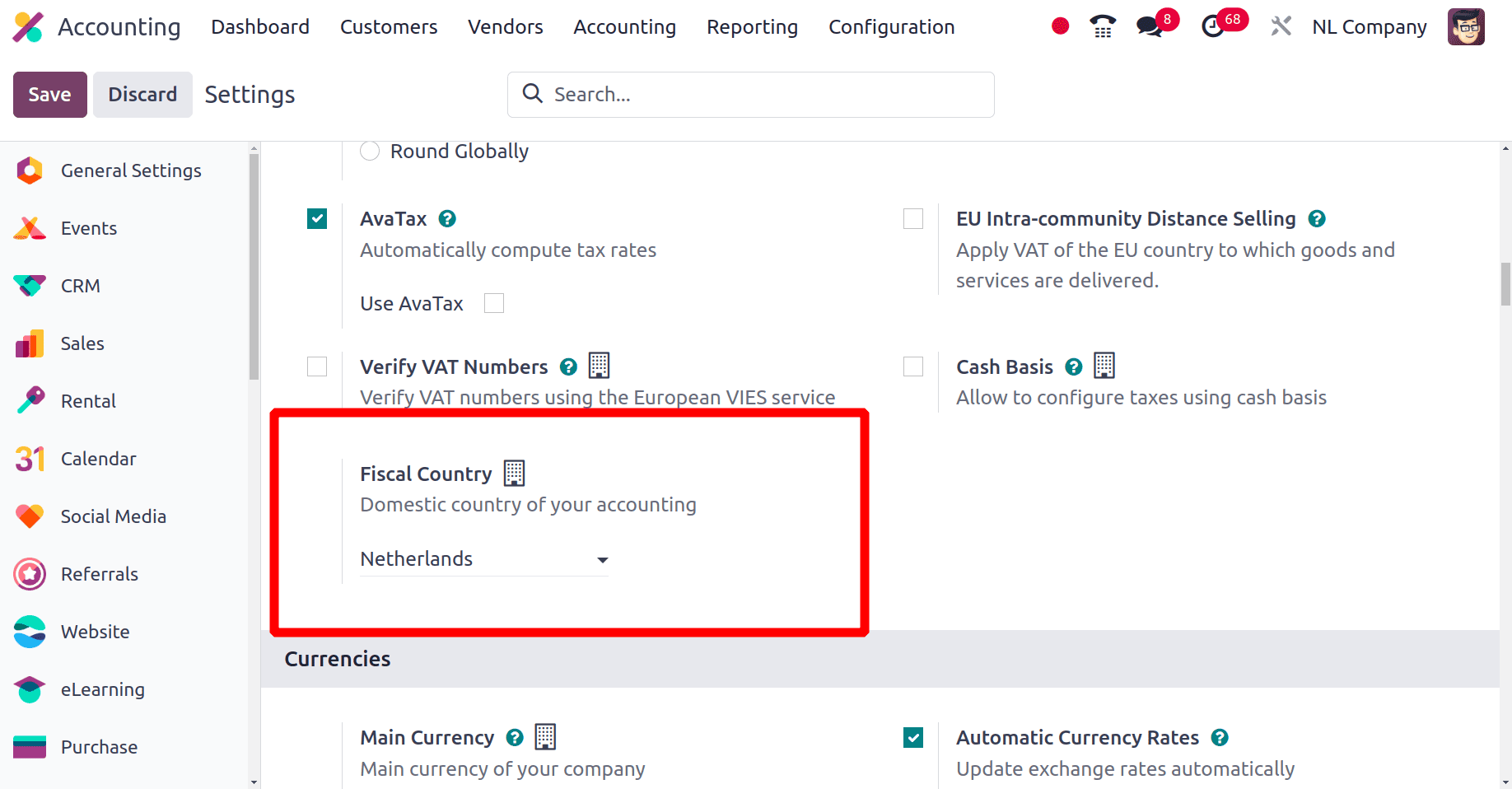

In the Taxes section in the configuration > Settings there we can find a field to provide the fiscal country for the company. We are allowed to set the Fiscal country for the company here.

But we can see that here Odoo automatically sets the Fiscal country for the company as the Netherlands when the localization package for the company is configured and saved.

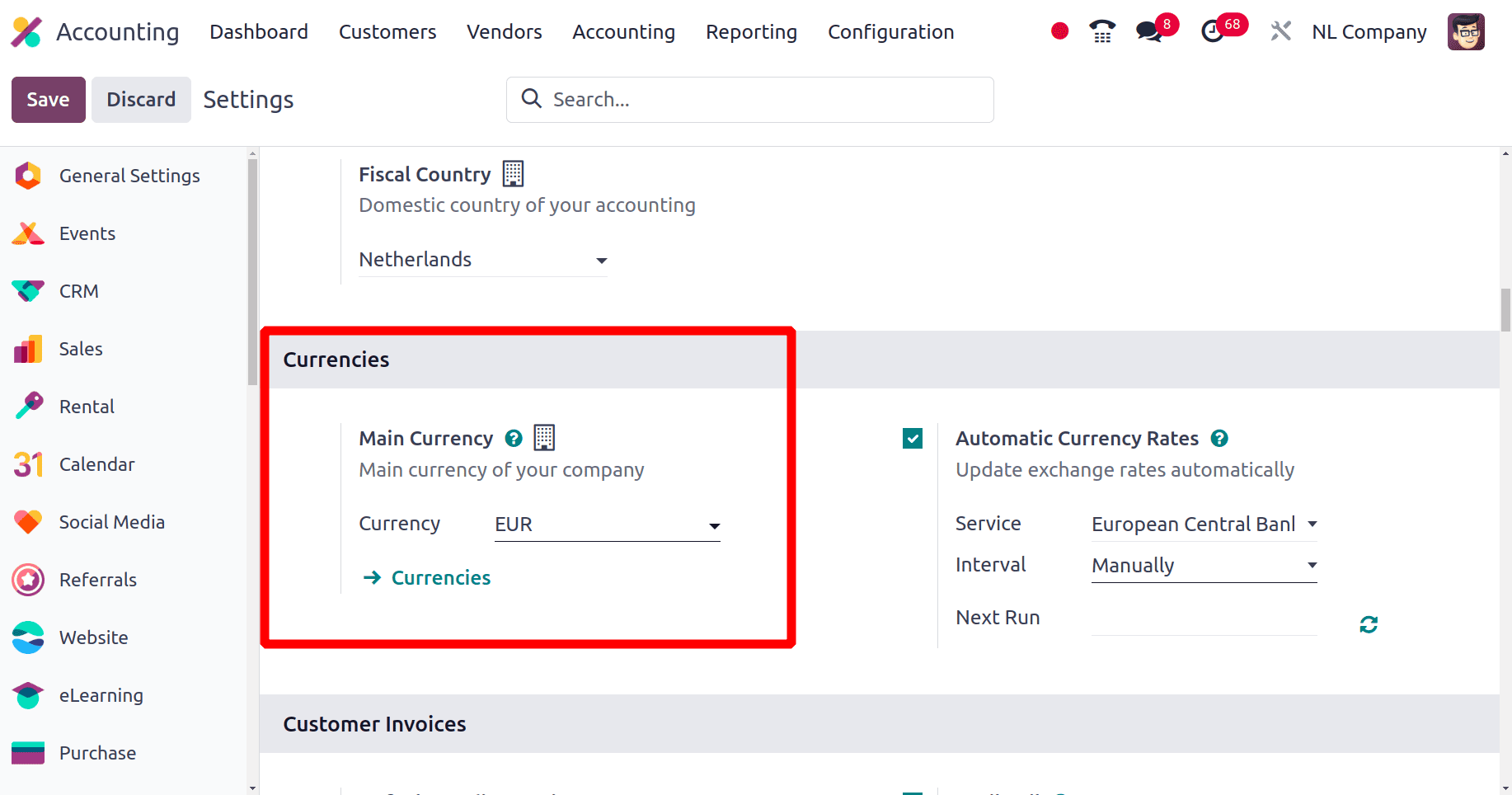

The next is the Currencies section in the Configuration > Settings. We know that the official currency in the Netherlands is Euro (EUR) and on configuring the localization package odoo automatically saves the main currency for the company as Euro (EUR)

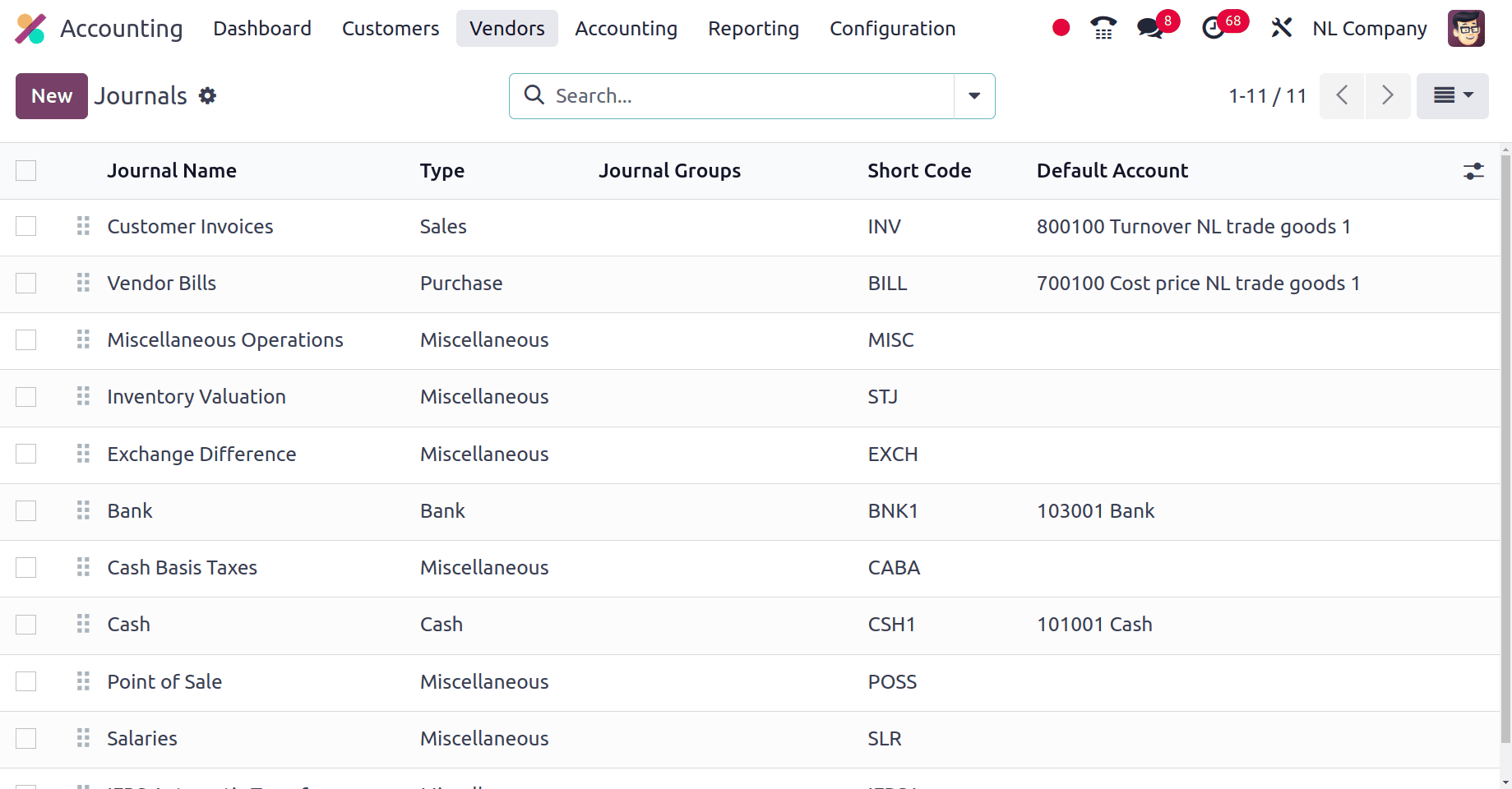

Journals

Journals are essentially records of financial transactions arranged by date. They serve as the foundation for your accounting system, capturing all the financial activities of your business. Under the configuration menu, we have a journals sub-menu and on clicking the Journals we will get all the journals that are already configured for the accounting entries.

There are mainly five types of Journals, Sales, Purchase, Bank, Cash, and Miscellaneous journals. You can configure a new journal for the company by clicking the New button. Journals help categorize and organize financial transactions for better management, By segregating transactions, it helps in maintaining accurate financial records.

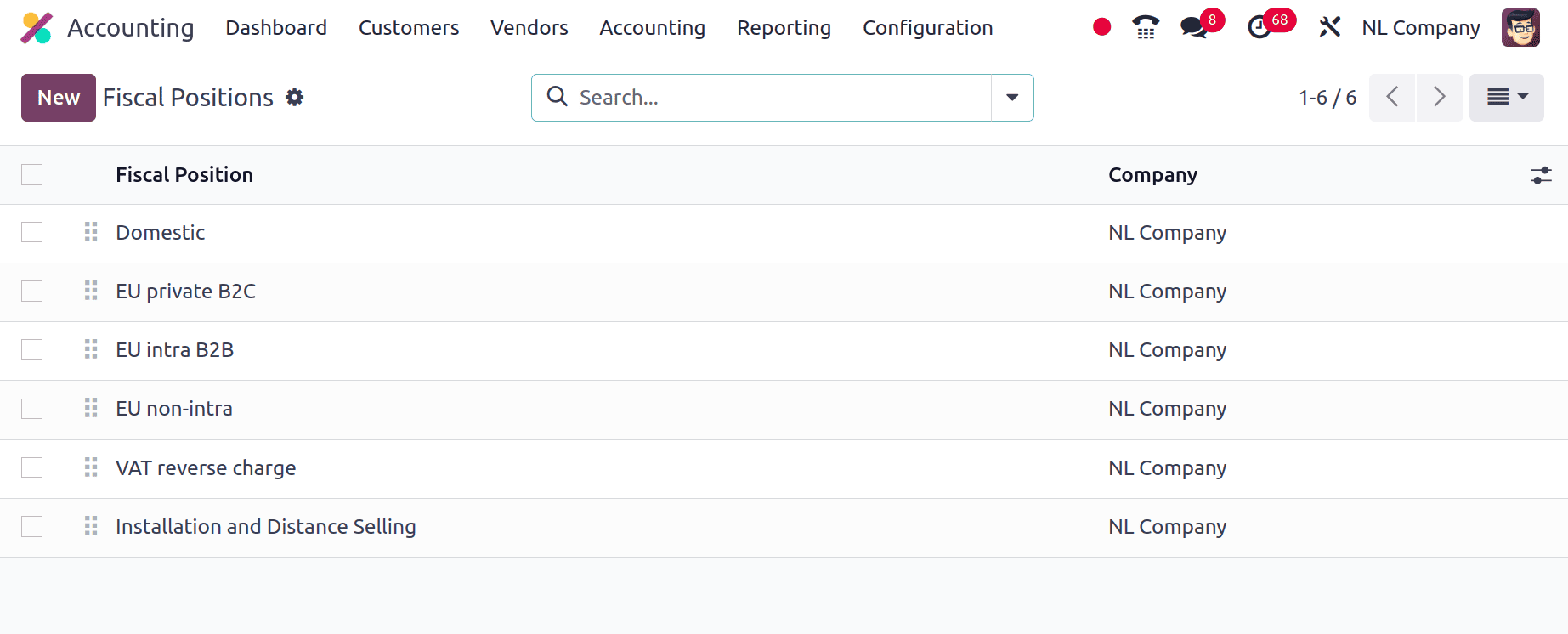

Fiscal position

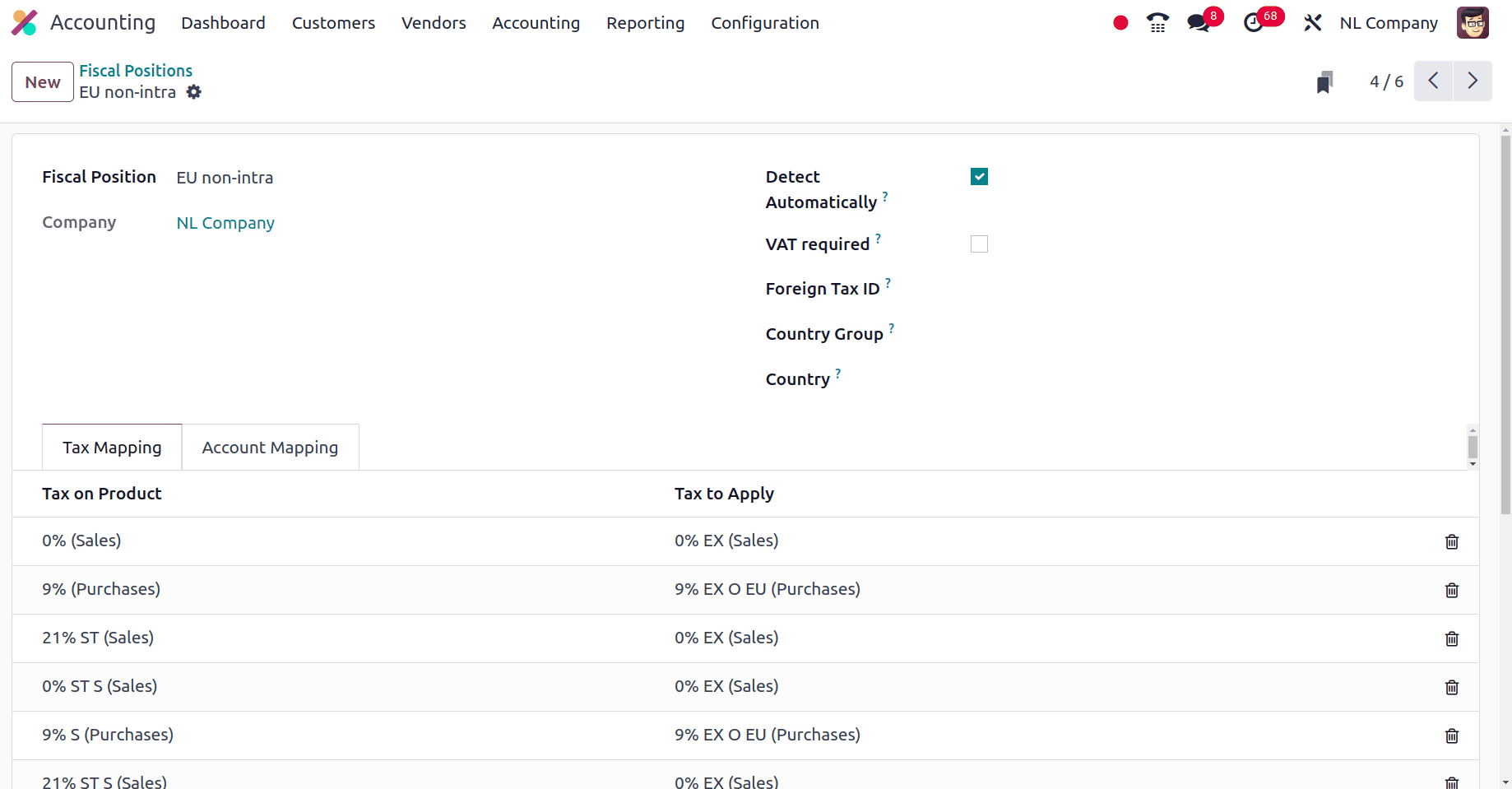

A fiscal position in Odoo is a configuration that defines how taxes are applied to various types of transactions. It determines the tax computation, including input tax recovery and output tax calculation. Under the Configuration > Settings of the accounting application we have the fiscal position sub-menu. When we click that Fiscal position sub-menu a list of fiscal positions that are preconfigured for the companies from the Netherlands can be found here.

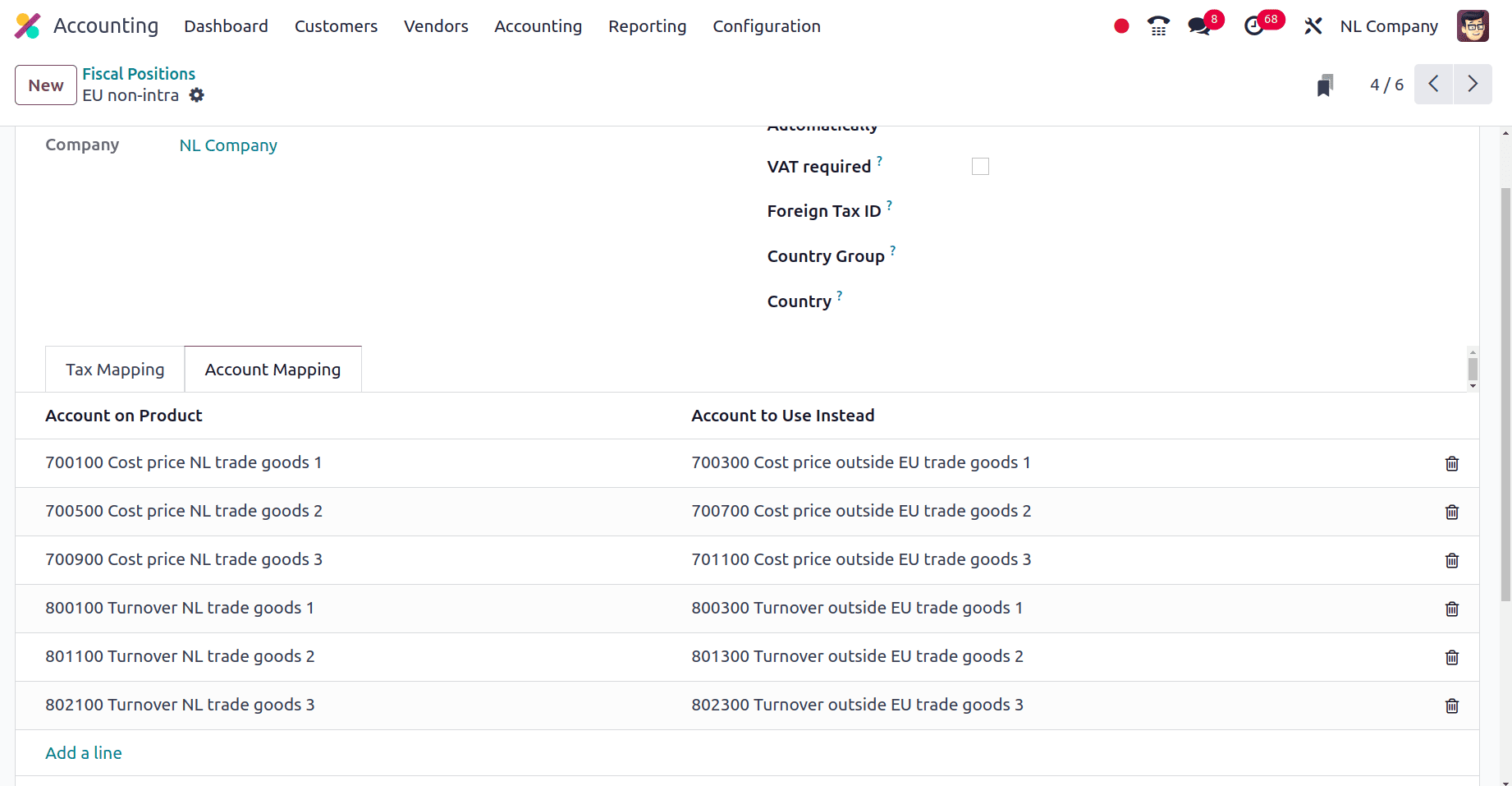

On choosing one of the fiscal positions from here we can see the mapped taxes and the mapped accounts under each fiscal position.

Here in the above screenshot, we can see that under the Tax Mapping tab, all the mapped taxes are listed.

On moving to the account mapping tab we can find the list of all mapped accounts, from which account to which accounts the accounts have been mapped are shown there.

The PEPPOL Electronic Document Invoicing option is available for every company from the Netherlands when we configure a localization package for the company. Pan-European Public Procurement Online. In Configuration > Settings we have the option to enable the PEPPOL. That is when the PEPPOL option is enabled, odoo allows us to send and receive invoices through the PEPPOL network.

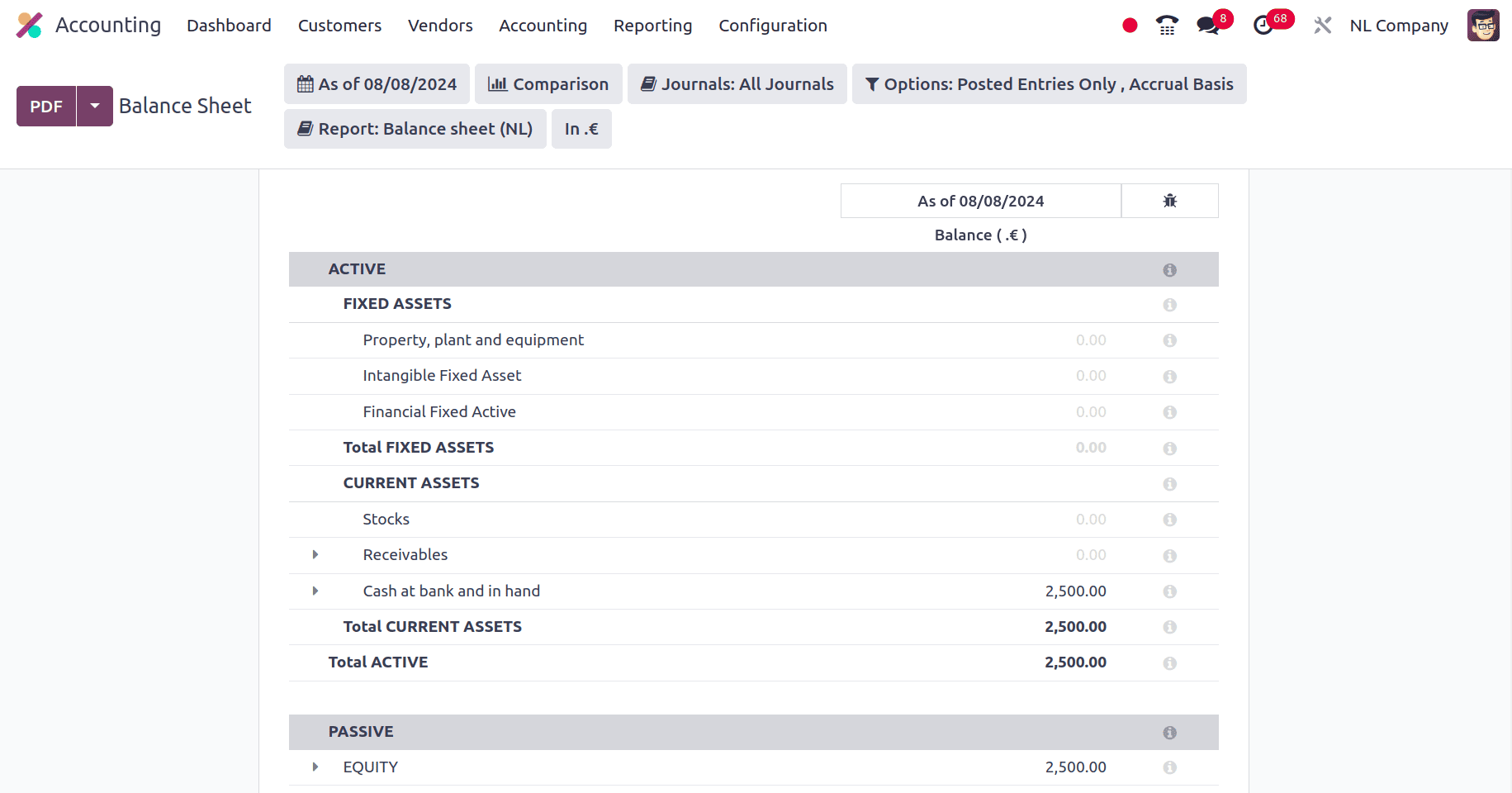

On moving to the Reporting menu we have the Balance sheet, Profit and loss report, cash flow statement, Tax report of the company, etc which helps to assess the growth of the company.

The balance sheet of the company provide Odoo's balance sheet provides a comprehensive overview of a company's financial position at a specific point in time. It presents a snapshot of the company's assets, liabilities, and equity.

The balance sheet of the companies from the Netherlands is mainly divided into two, Active and Passive. Fixed assets, Current assets, Stocks, Receivables, etc are included in the Active section, and the Equity, Claims, provisions, Long-term liabilities, Creditors, etc are included in the Passive section of the balance sheet.

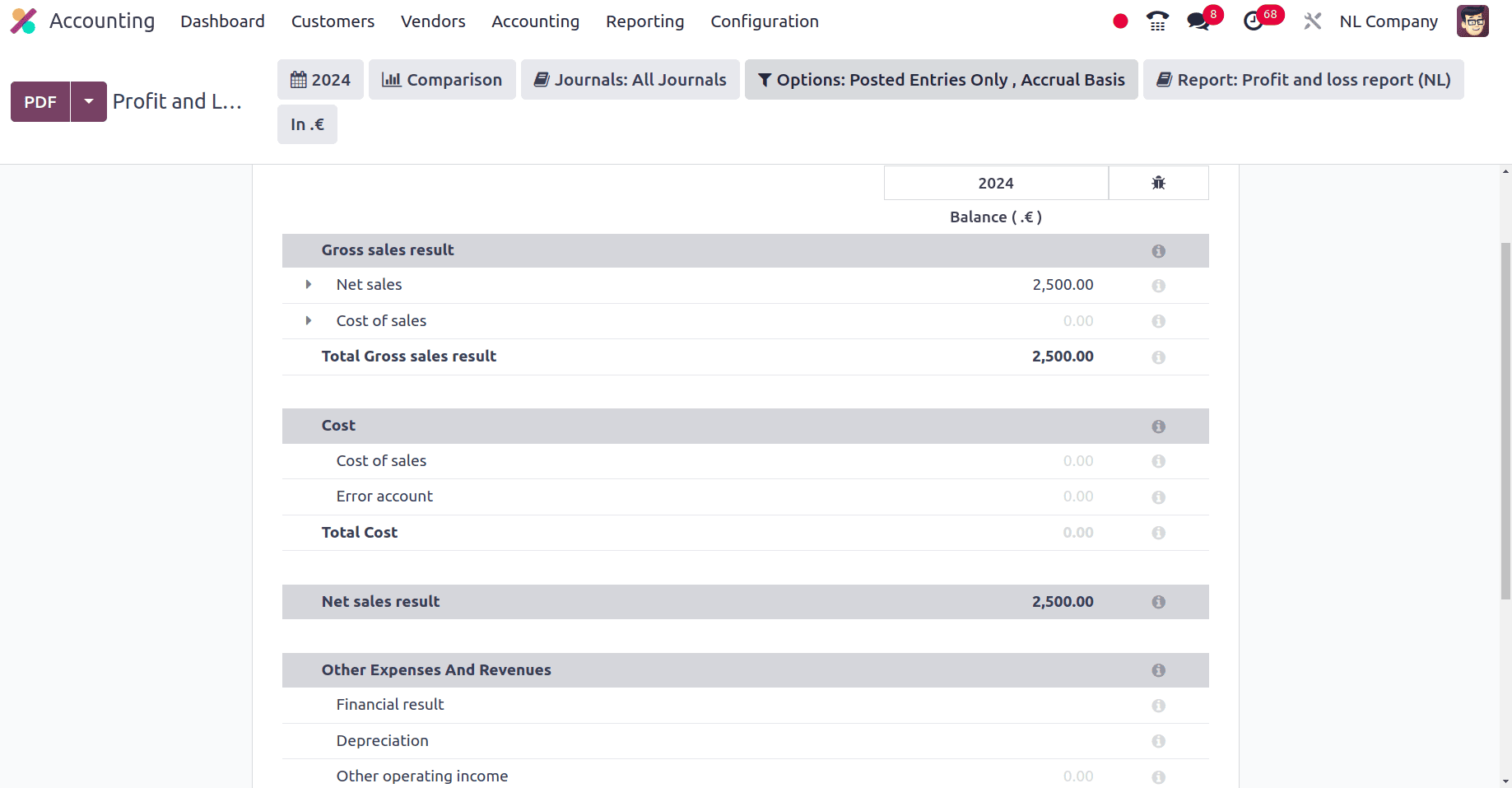

Next is the Profit and Loss report of the company. Under the reporting menu, we have the profit and loss report of the company.

Gross sales result, Net sales, Cost of sales, Net sale result, Other expenses and revenues, depreciations, other operating incomes, Taxes, etc are included in the Odoo profit and loss report.

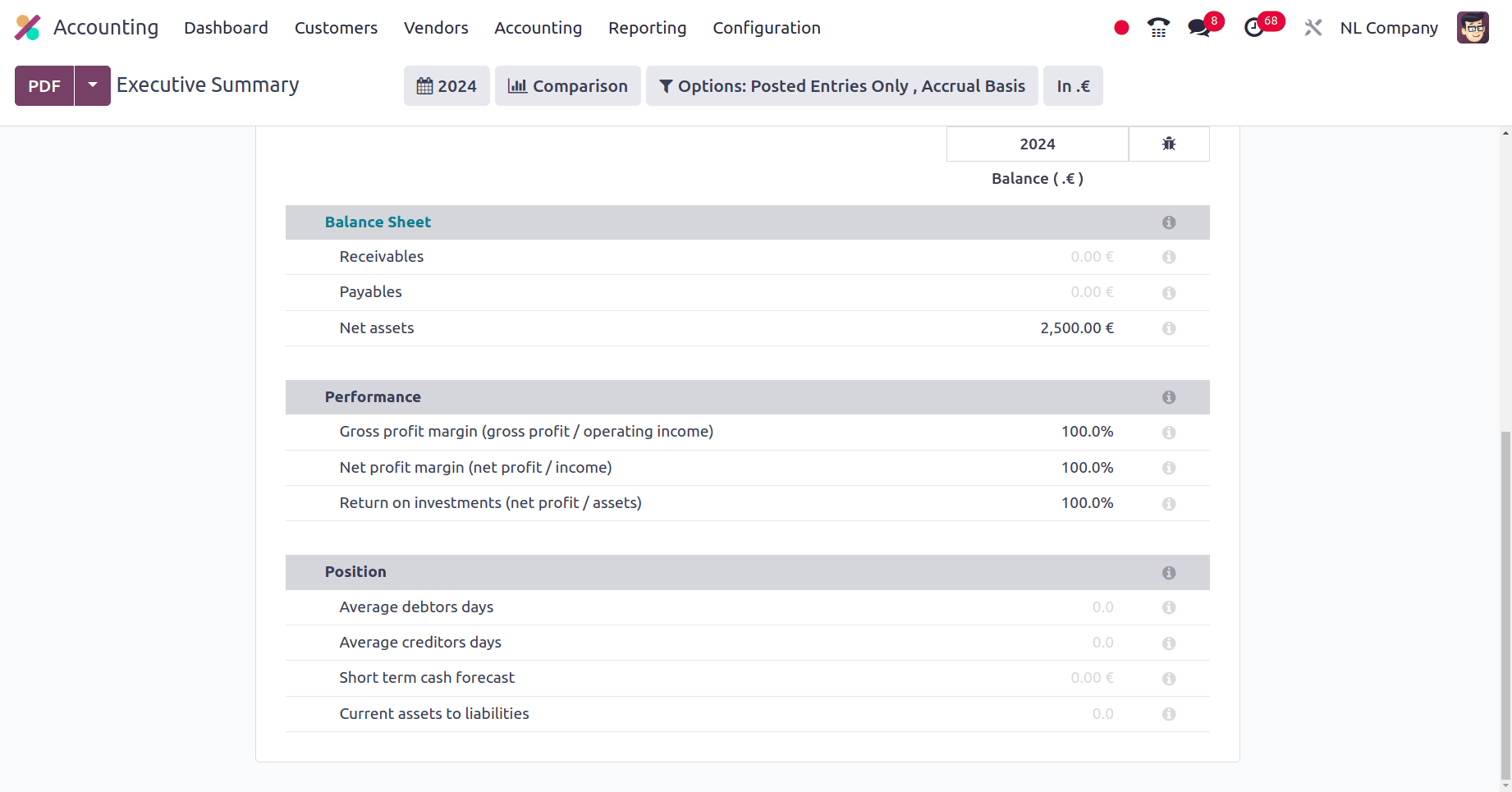

In conclusion, Odoo also provides an Executive summary.

Executive Summary report is a powerful tool designed to provide a high-level overview of a company's financial performance. It consolidates key financial metrics into a single, easily digestible format, making it invaluable for decision-makers. which the Executive summary includes the total reports of Cash, Profitability, Balance sheet, Performance, Position, etc.

The Netherlands accounting localization for Odoo 17 provides a strong and all-inclusive solution for companies doing business in the Netherlands. Through its smooth integration with the nation's complex tax and accounting laws, Odoo enables businesses to optimize their financial processes, increase productivity, and guarantee adherence to rules. Based on precise and up-to-date financial data, Odoo's customizable features and simple interface enable businesses to make well-informed decisions. Businesses can gain a competitive edge and concentrate on their main strengths while leaving financial administration in expert hands by implementing Odoo for Netherlands accounting.

To read more about An Overview of Accounting Localization for Denmark in Odoo 17, refer to our blog An Overview of Accounting Localization for Denmark in Odoo 17.