What is accounting localization in Odoo?

In Odoo, accounting localization is the process of modifying and setting up accounting functionality to adhere to the unique legal and regulatory requirements of other nations. As an adaptable ERP system, Odoo offers capabilities that may be customized to match the particular requirements of different geographical areas.

Localization for Kenya in Odoo 17

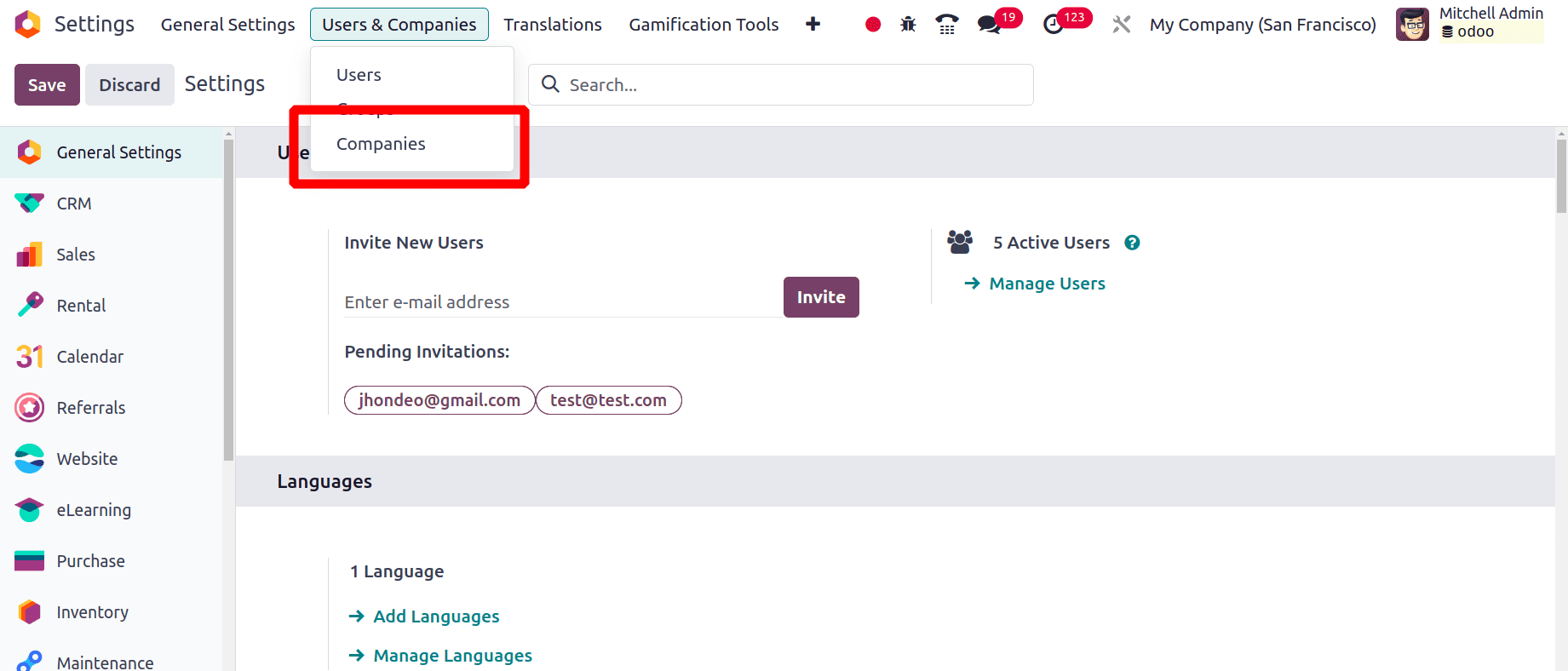

We need to set up a Kenyan company in Odoo in order to set up the localization for Kenya. So to create a new company, move to the General > Settings of the Odoo application. Then choose the Companies sub-menu under the Users and Companies menu.

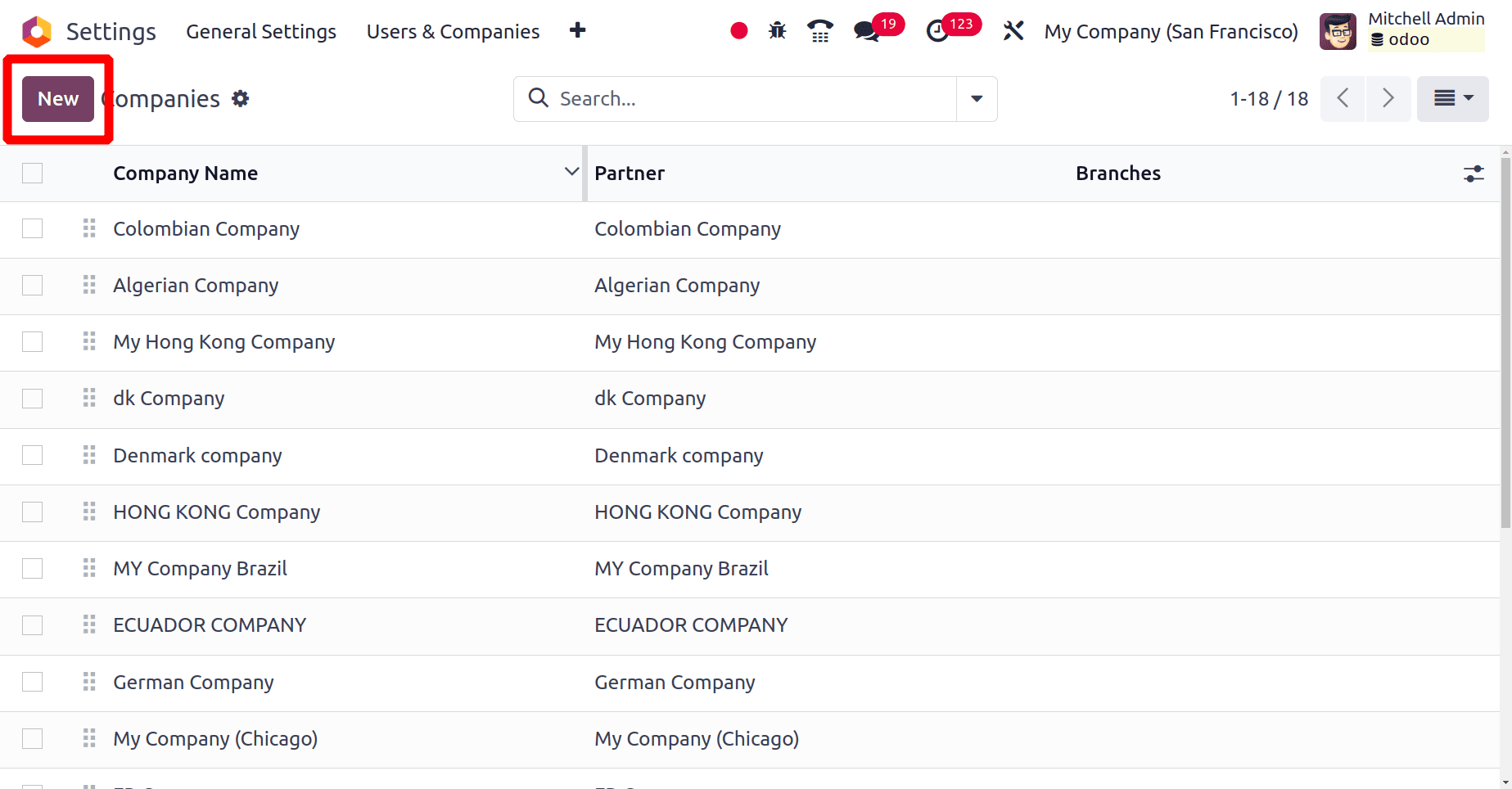

There we can see all the pre-created companies in the Odoo application. By clicking the New button, we can create a new company here.

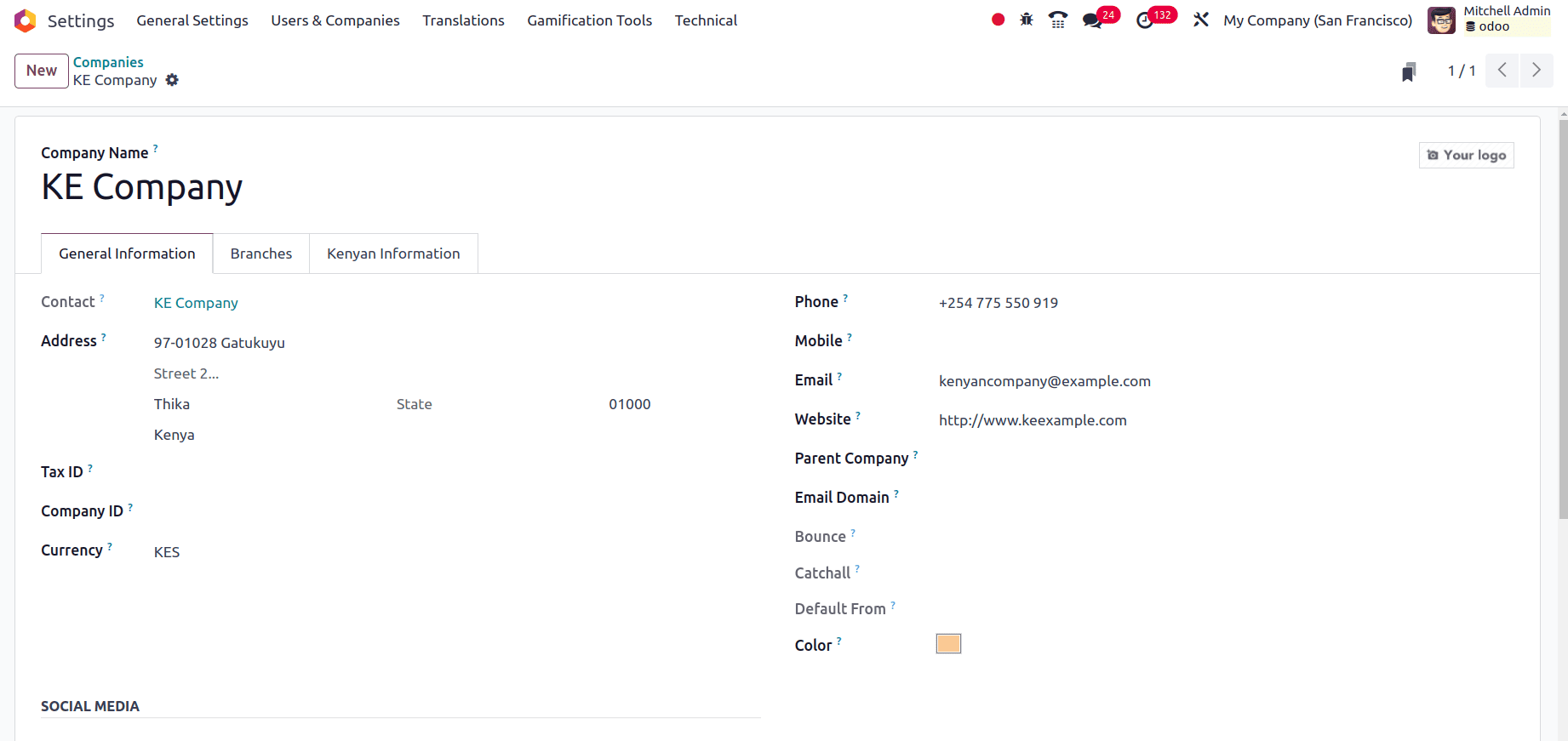

Upon selecting the "new" button, a form will appear for us to complete with all of the information about the company we are starting.

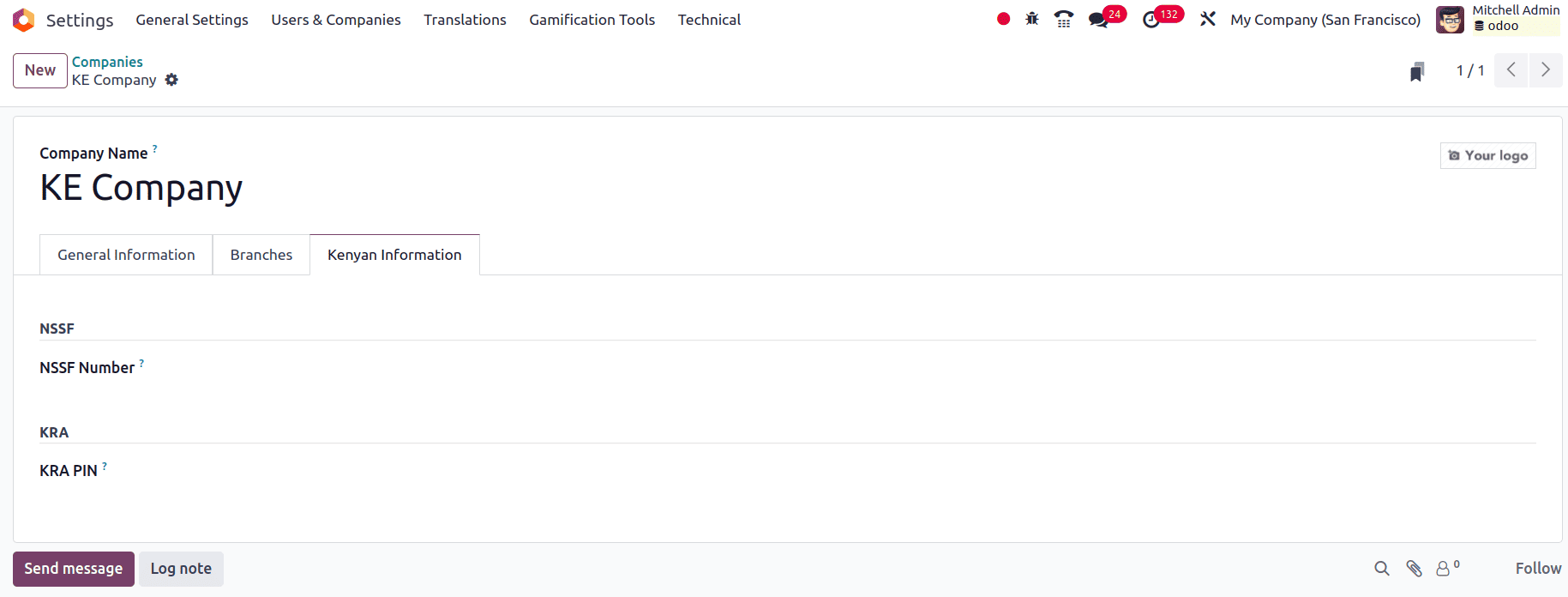

Fill in the company details correctly, and one extra tab Kenyan Information is added here. When you click that Kenyan information tab, you can fill in some extra details about your company.

* NSSF Number: The NSSF number in Kenyan accounting refers to the National Social Security Fund number assigned to an employee. In Kenya, retirement benefits and other forms of social security are provided to employees through this mandated social security program.

* KRA PIN: Stands for Kenya Revenue Authority PIN. It's a unique identifier assigned to taxpayers in Kenya by the Kenya Revenue Authority (KRA). For both individuals and businesses filing their income tax returns electronically via the iTax platform, they need to utilize their KRA PIN.

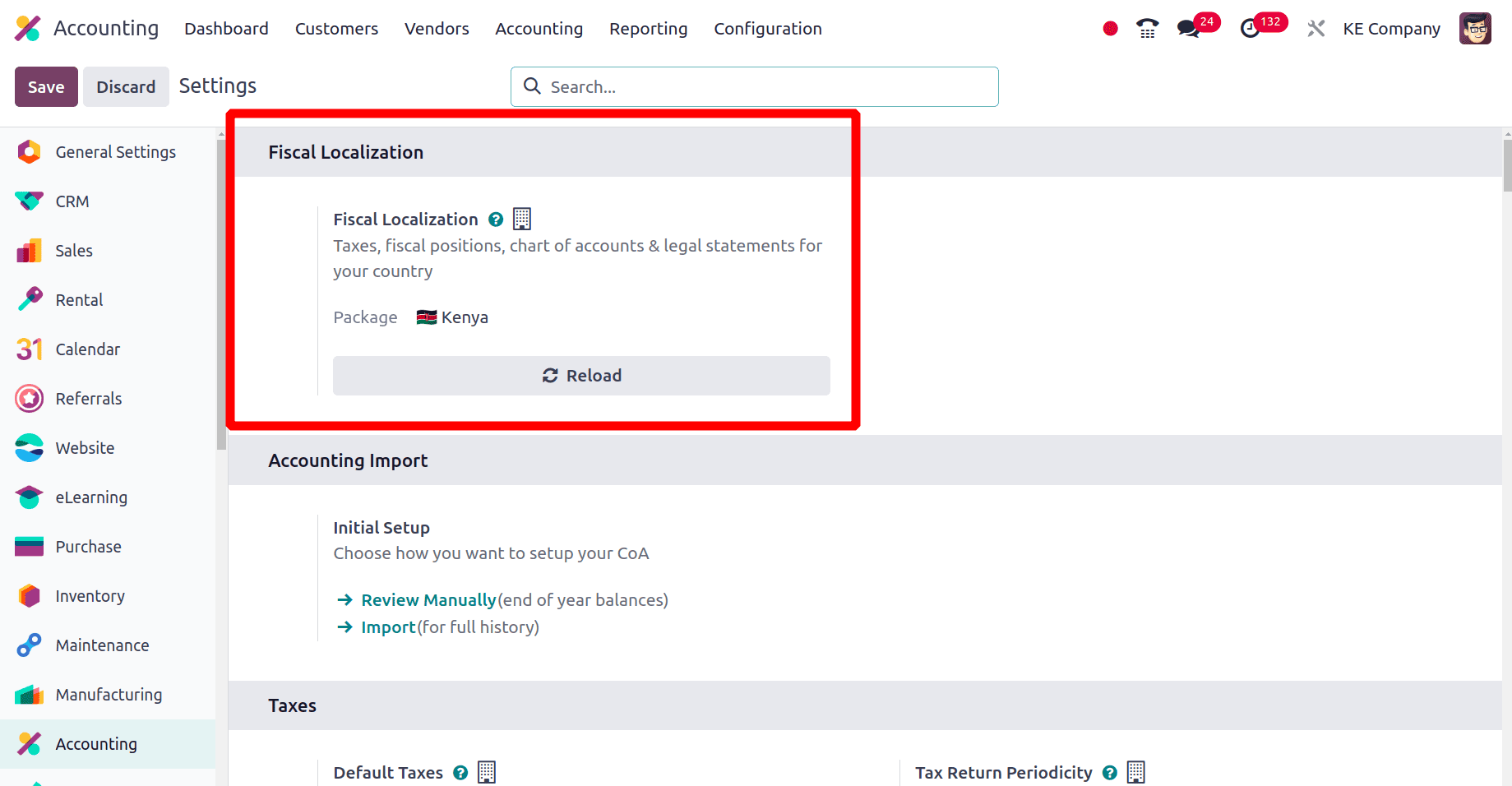

We found that while creating the company, we had the option to set the country for the company. So when we set the country for the company, Odoo automatically sets the currency for the company as Kenyan shilling (KES). Next, we need to set the localization package for this company. Move to the accounting application and select the Configuration > Settings. Under the fiscal localization section, we have the option to set the localization package for this company. Here we have created a Kenyan company so that we can set the localization package as Kenya.

Then click the Save button to save this package for this company as Kenya. So when we save this package, all the properties of the Kenyan accounts will be fetched to the accounts of this newly created company.

Modifications brought about by configuring Kenyan localization

When Kenyan localization was configured, a lot of changes were visible for the accounts of this Kenyan company from other companies in another country. Some of the changes may include the Fiscal position of this country, Charts of Accounts, Taxes, journals, etc. so let's discuss those changes for the accounts of this Kenyan company.

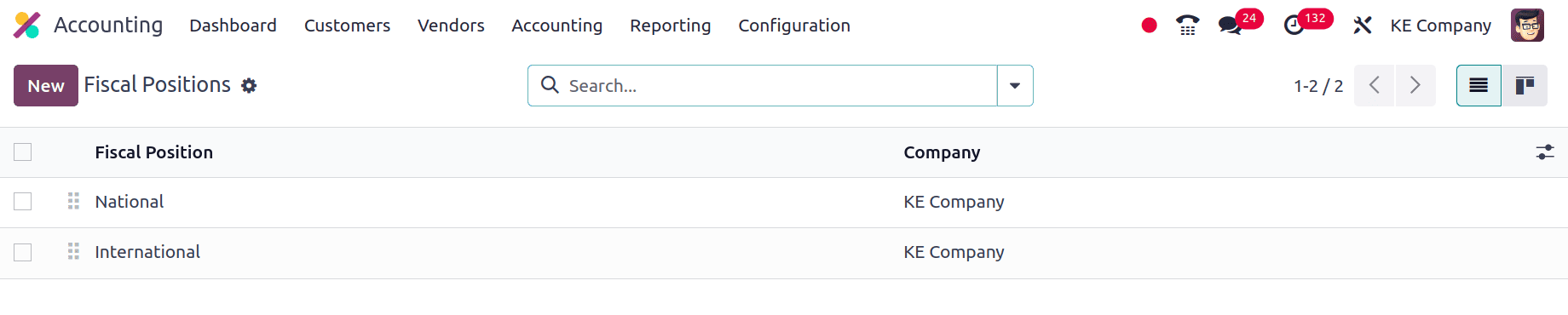

Fiscal position

A fiscal position in Odoo is a collection of guidelines that specify how taxes and accounting are applied to transactions depending on a variety of factors, including the product type, the location of the client, and the nature of the business. In simple terms, it assists in addressing the accounting and tax issues brought on by different countries.

We can see that the main two fiscal positions used by the companies from Kenya are shown in the above screenshot. Both of these were used for different purposes.

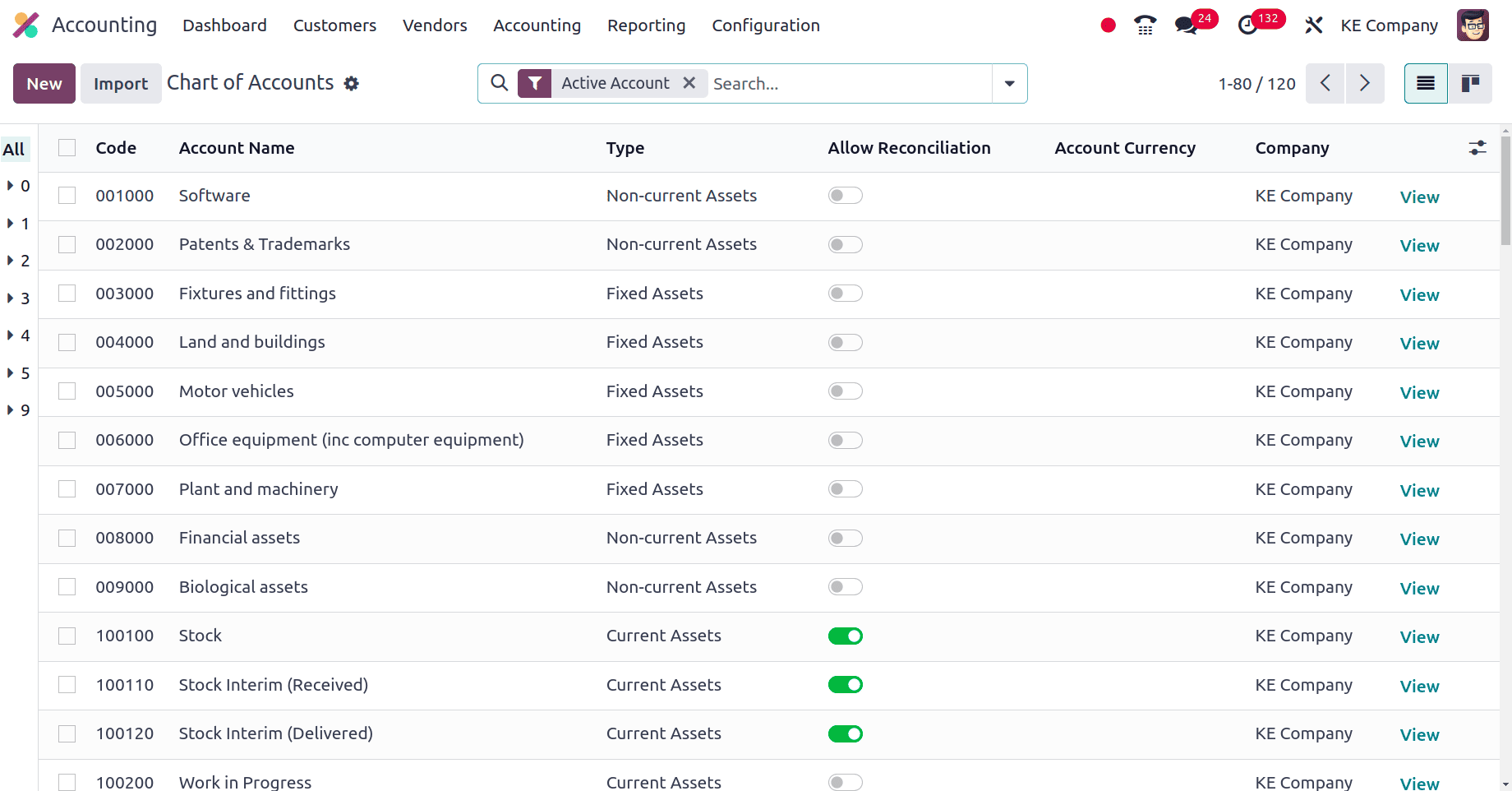

Chart of Accounts

One important part of Odoo17 accounting module is the chart of accounts. It essentially serves as a list of all the accounts you use to keep an eye on the financial transactions of your business. Different countries' companies could employ different charts of accounts.

The common Chart of Accounts that the companies from Kenya can use is shown in the above screenshot. You are also able to create new accounts for this company by clicking the New button.

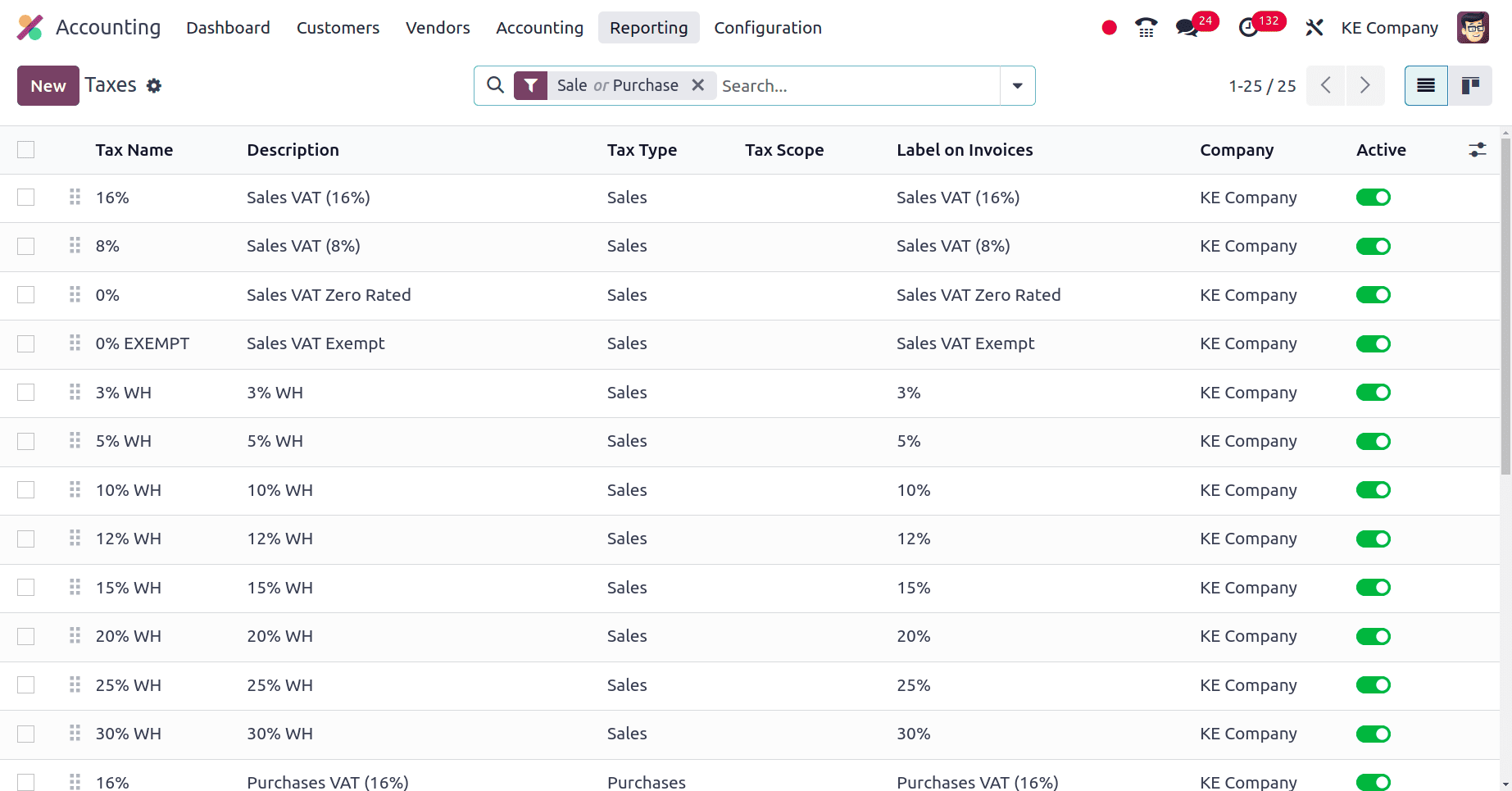

Taxes

Taxes are fees charged on numerous aspects of a commercial transaction. You can manage tax compliance, automate tax computations, and ensure correct financial reporting with Odoo's tax features. You can build many tax kinds in Odoo, such as sales and purchase taxes, along with the corresponding rates and requirements. When issuing purchase orders or invoices, Odoo automatically determines the necessary taxes based on the location of the vendor and the items or services that are being purchased or sold. We have the Taxes sub-menu under the Configuration menu of the Accounting application.

When we select this Taxes sub-menu, it will list all of the taxes that the companies from Kenya can use for their accounting activities. If more taxes are needed for this company they are also able to create new taxes by clicking the New button seen in the above screenshot. Sales taxes and purchase taxes are the two main categories of taxes that are evident here. Sales taxes are levied on goods or services during the sale to consumers, and purchase taxes are levied on goods or services during the purchase from a vendor.

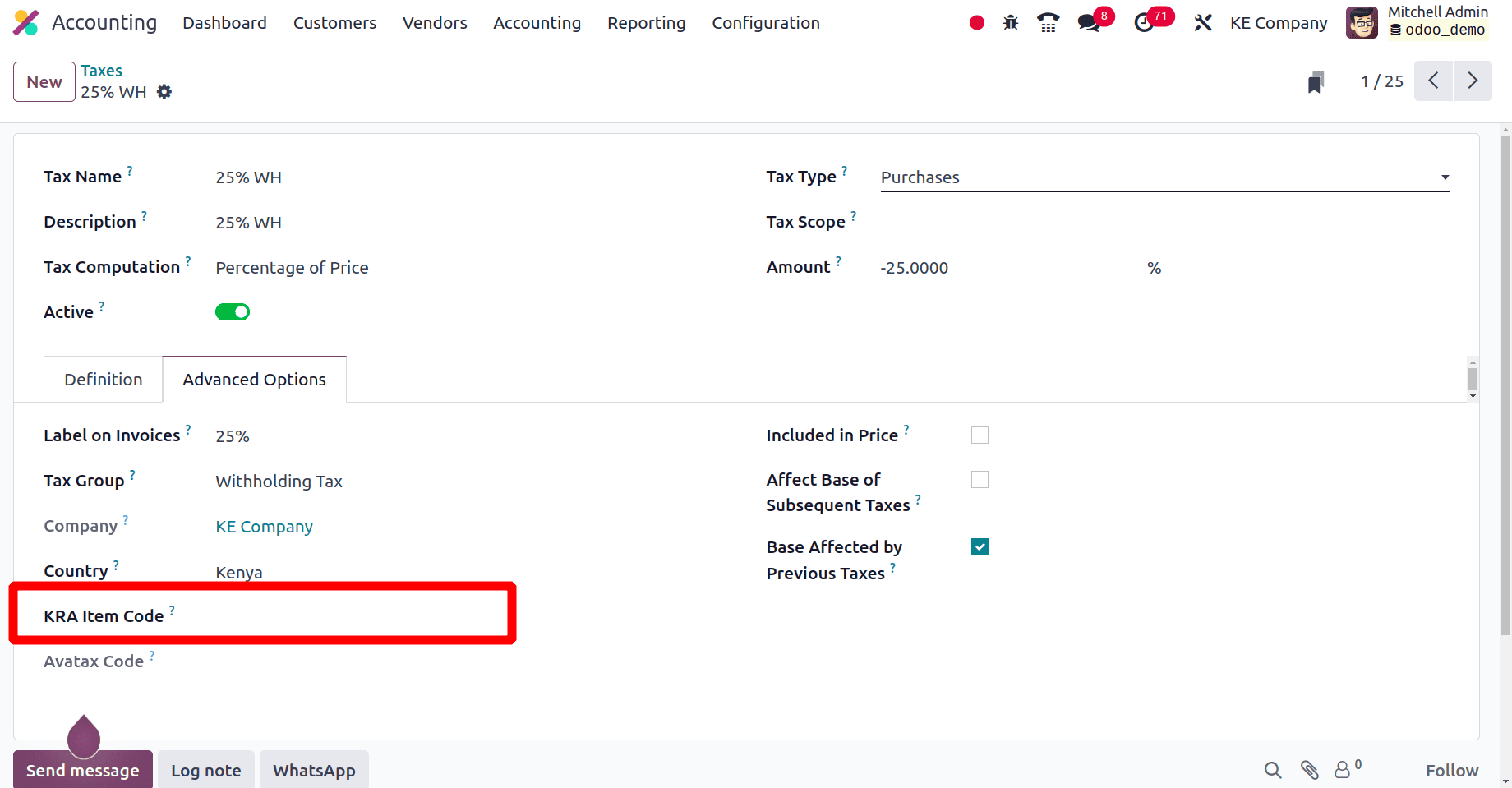

Select one of the taxes and on moving to the Advanced Settings tab and there you can find a field to add the KRA item code. KRA item code that describes a tax rate or exemption on a specific product or service.

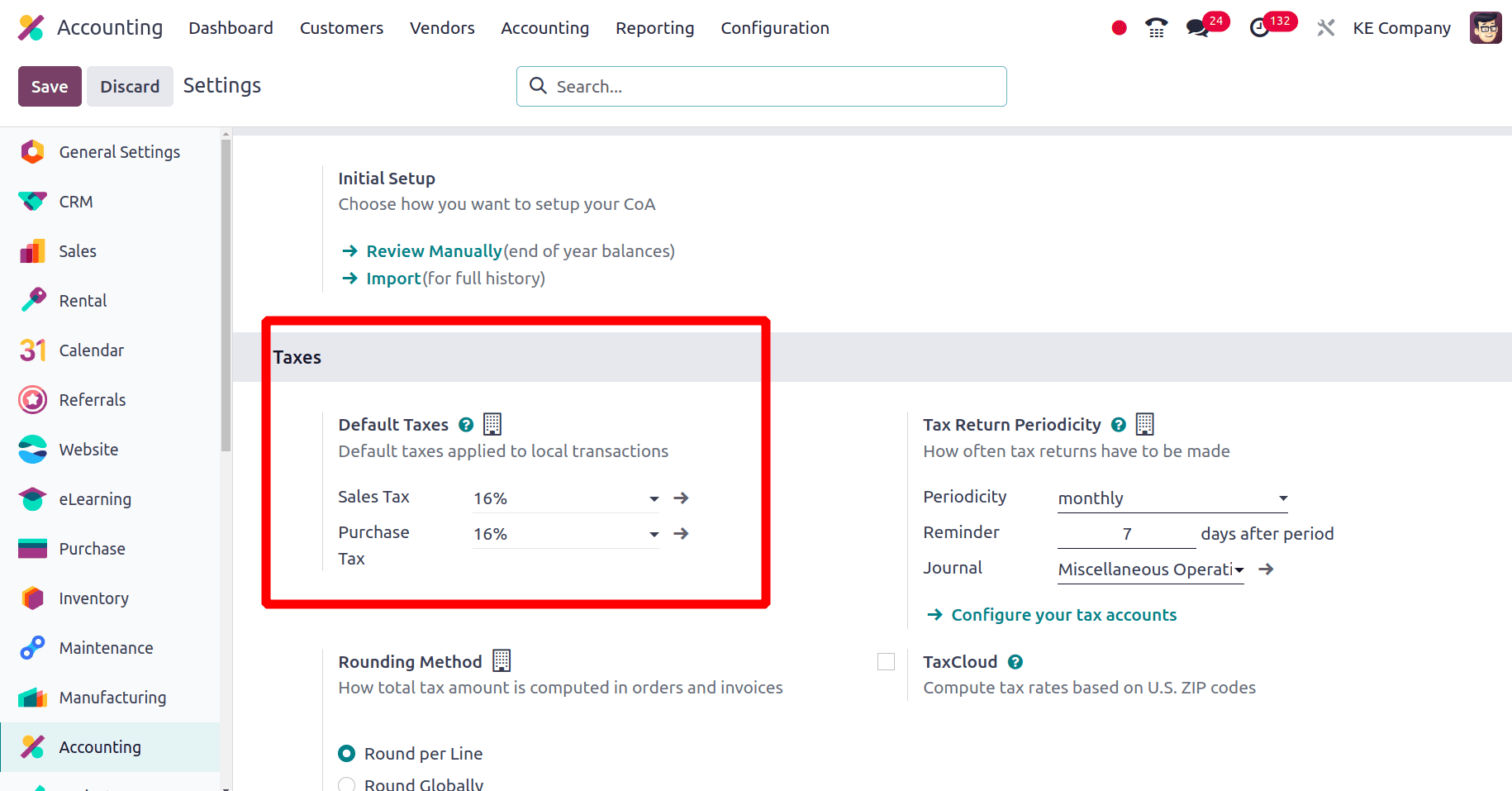

We can set the company's default taxes in the Taxes section when we navigate to Configuration > Settings. We can choose to manually set this or have Odoo set it for us automatically. Here, Odoo will automatically configure the company's Default Taxes when we select Kenya as the Localization Package.

The default sales taxes and the Default purchase Taxes are mentioned here for this company. These can be identified from the above screenshot, that is 16 % of sales taxes and 16 % of purchase taxes are used by this company on their transactions.

Journals

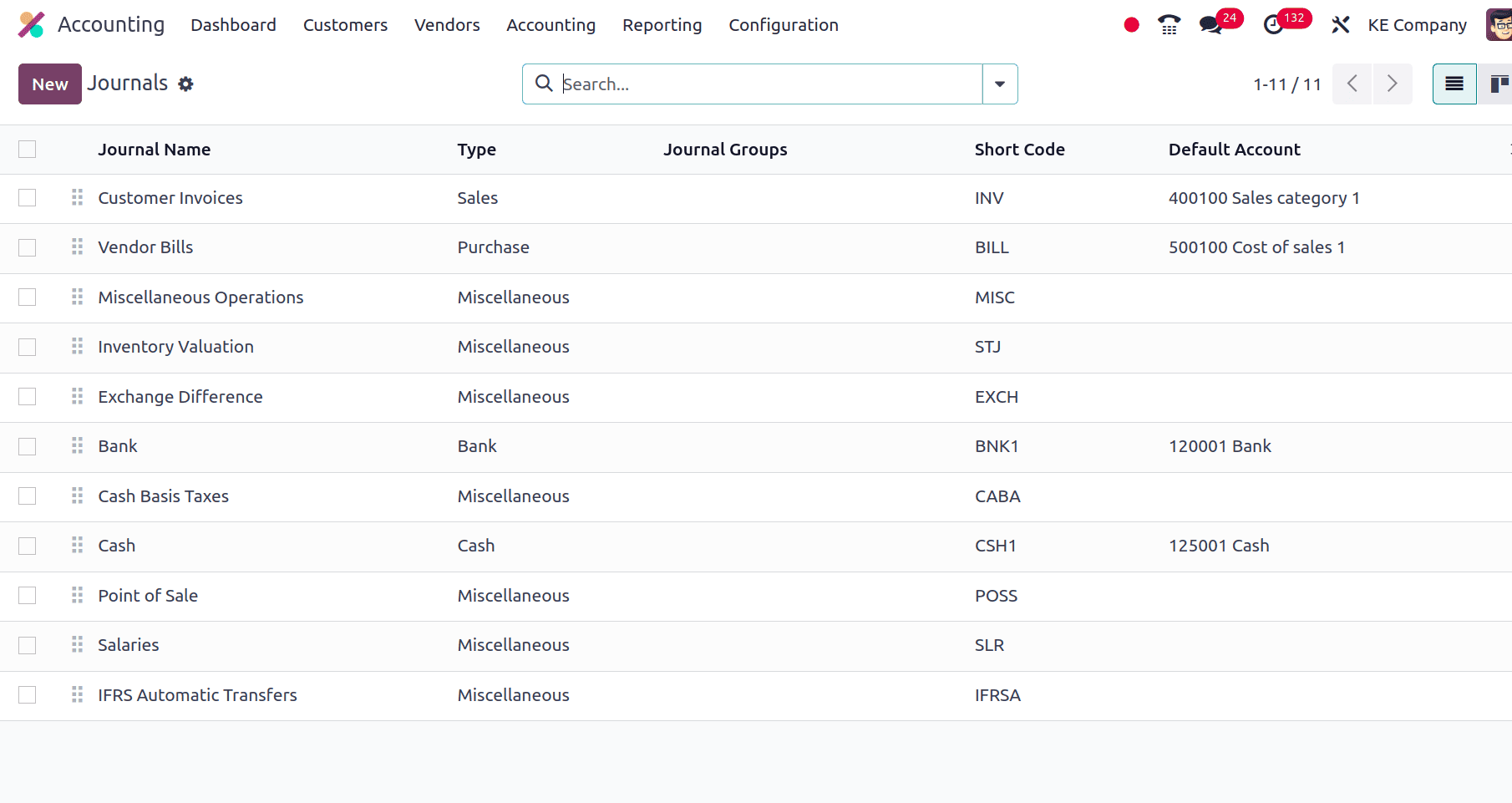

Journals are used by the accounts of an organization to document its financial transactions. With Odoo, you can create different kinds of journals to manage and arrange different parts of your accounting system. Every journal in Odoo can have several configurations and settings applied to it, such as default accounts, journal types (such as sales, purchases, banks, etc.), sequence settings, and access privileges. These choices help in precisely capturing and categorizing financial activity within your Odoo instance.

Here the several journals used by the companies from Kenya are listed. Odoo mainly provides five types of journals, sales, Purchase, Bank, Cash, and Miscellaneous.

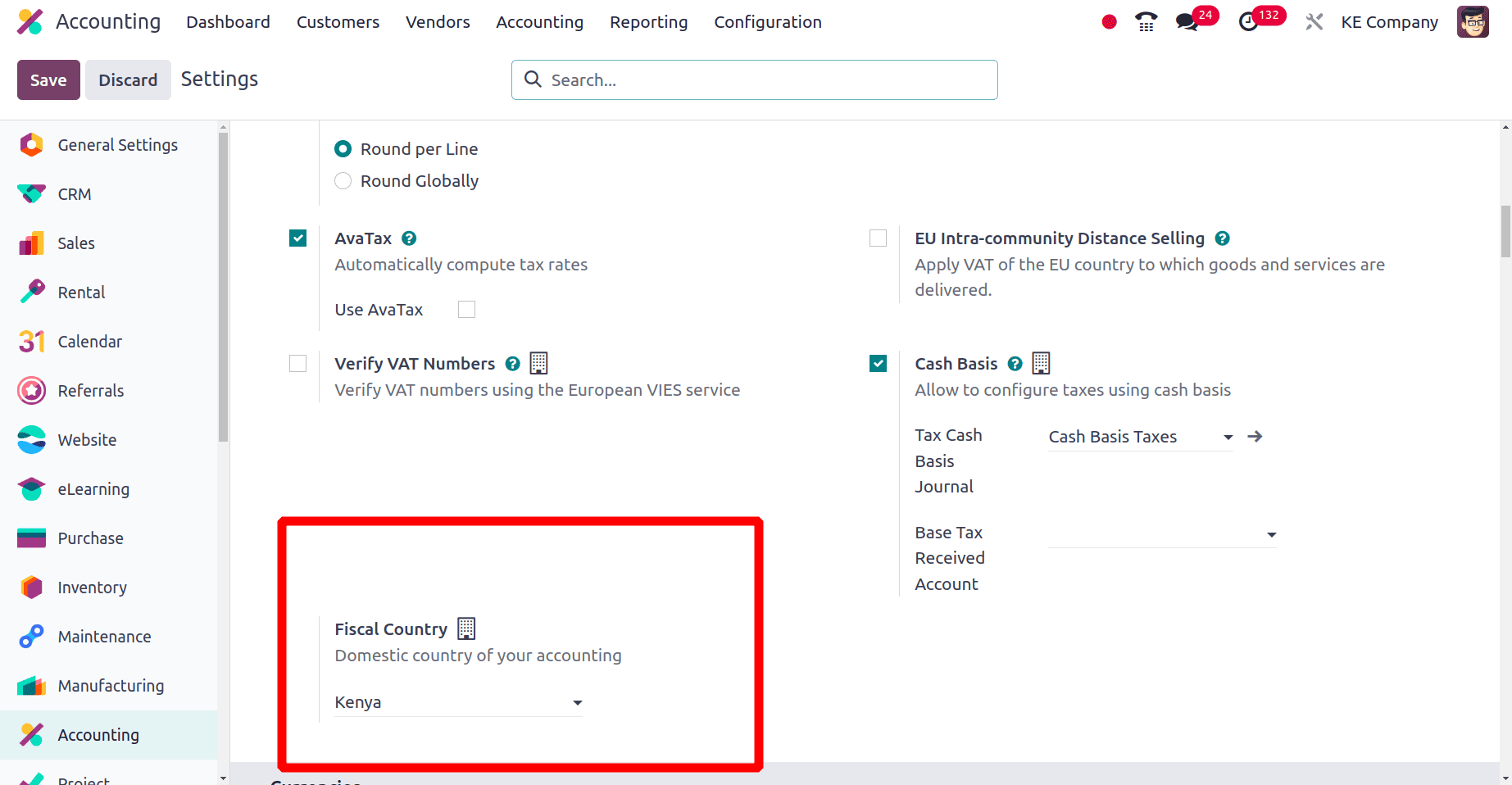

In Odoo, there is a feature to add the Fiscal country for a company. When we move to the configuration settings, under the Taxes section we have the option to set the Fiscal country for the company. Fiscal country means the legal country for which the business is registered for tax purposes.

Here we can see that the Fiscal country is set as Kenya by odoo directly when we configure the localization package for the country as Kenya

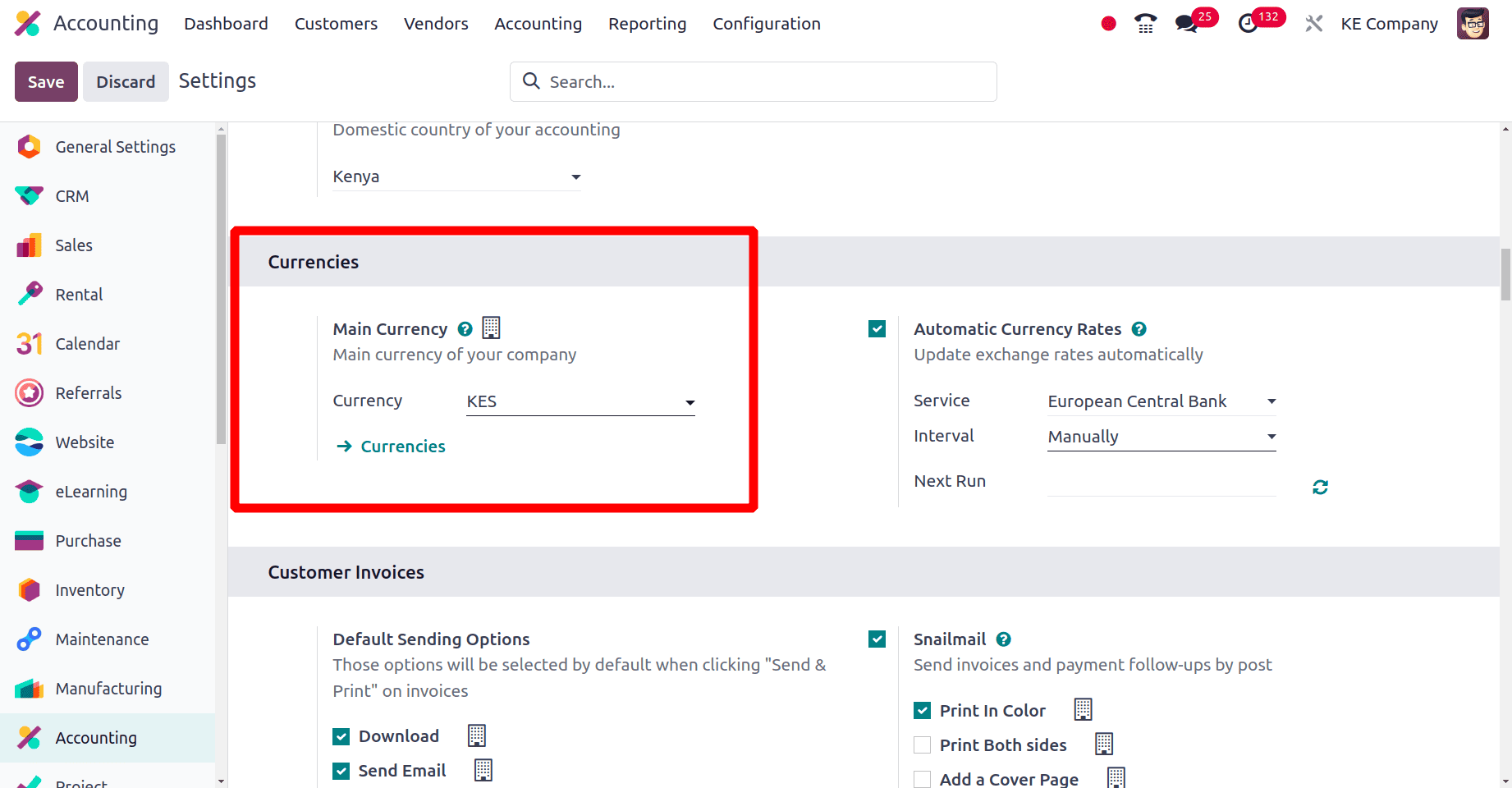

We know the official currency in Kenya is Kenyan Shilling (KES). under the taxes section, we have a Taxes section in the configuration settings. There we have the option to set the main currency for this company.

Here Odoo automatically sets the main currency for the company as Kenyan shilling when we set the localization package as Kenya.

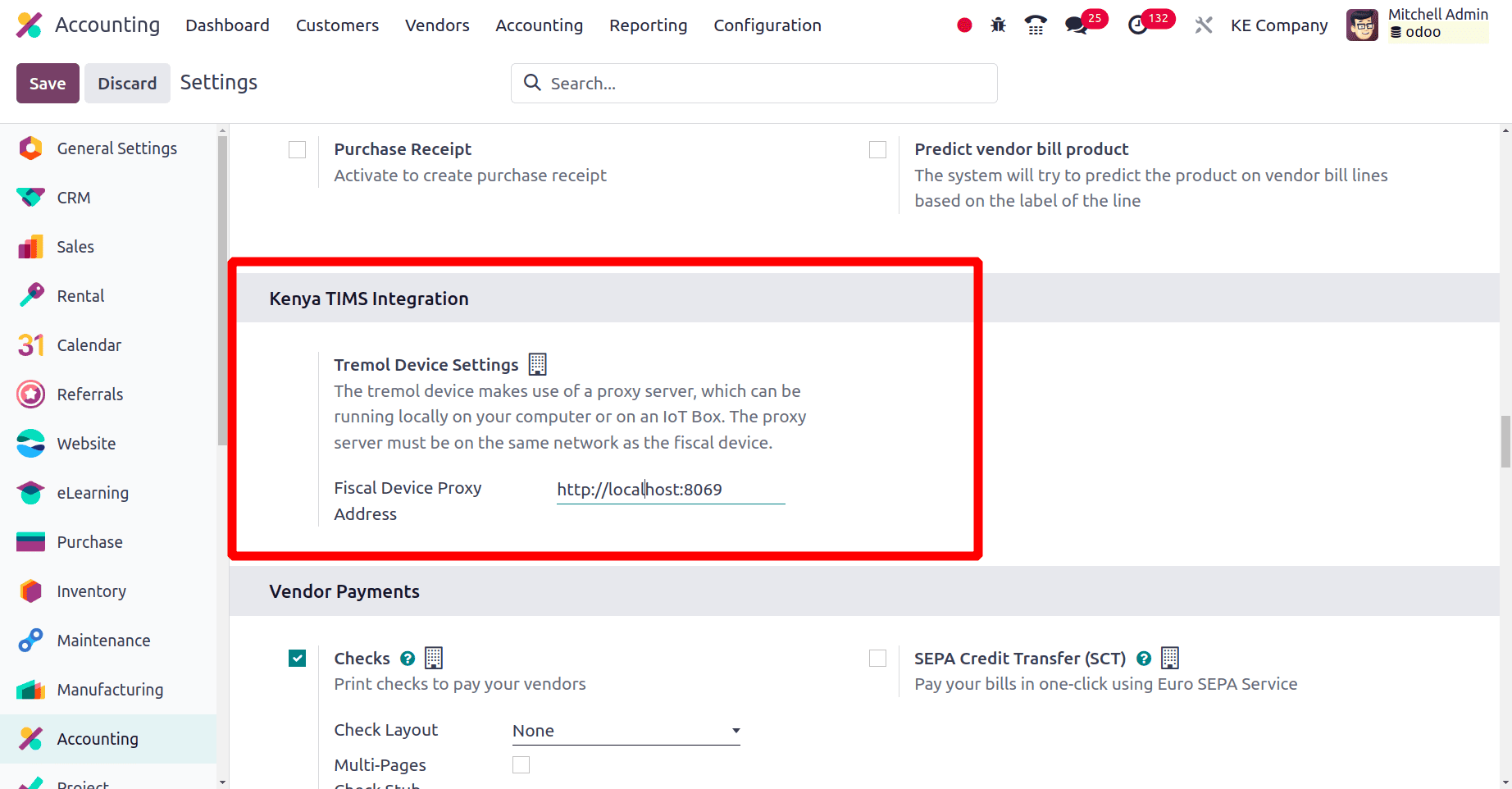

In the Configuration > Settings of the accounting application, an extra section Kenya TIMS Integration is added especially for Kenyan companies.

Kenya TIMS Integration: Kenya’s Tax Invoice Management System integration is mandatory for all businesses operating in Kenya. It assures that invoices are generated and sent electronically via the Kenya Revenue Authority (KRA) system. In this section, there is an option for setting the Fiscal Device Proxy Address. Here the Proxy server is used by the Tremol device which can be running locally on your computer or on an IoT box. The fiscal device and the proxy server need to be connected to the same network. Tremol devices are electronic cash registers with fiscal memory. In Kenyan companies, it is mainly used for recording and reporting sales transactions.

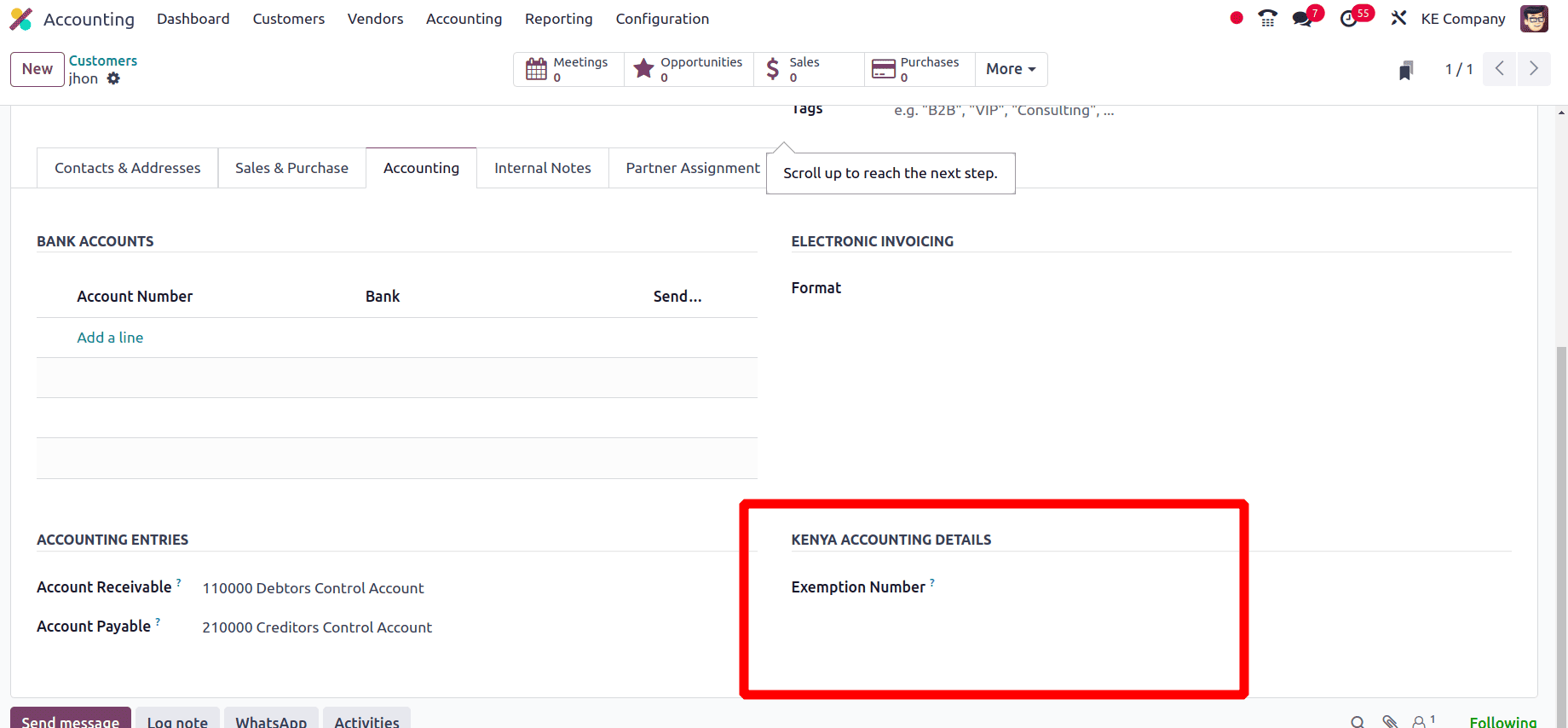

On moving to the partner form and creating a new customer from Kenya we can see an accounting tab that's to provide the accounting information of the customer. There is an extra field for the partners only from Kenya. There we can provide the Exemption Number of the partner there.

An exemption number in Kenya is a unique identifier issued by the Kenya Revenue Authority (KRA) to individuals or entities that have been granted tax exemptions.

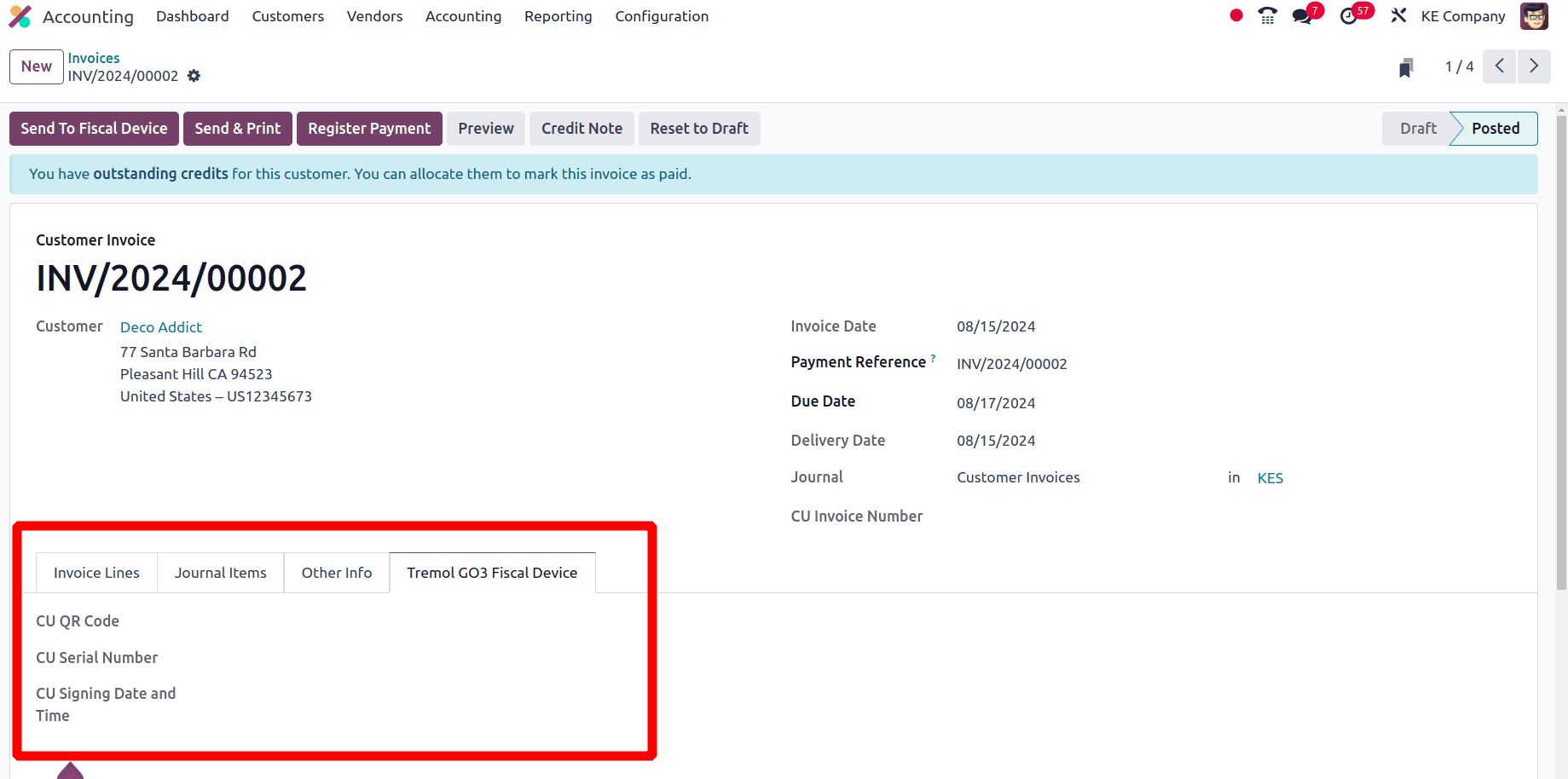

On creating a new invoice for a customer, an extra tab “Tremol GO3 Fiscal Device” will be there. The Tremol G03 Fiscal Device is a hardware component used in Odoo's accounting localization for Kenya to comply with the country's tax regulations.

* CU QR Code: A unique QR code generated by the KRA portal.

* CU Serial Number: The unique identifier of the Tremol G03 device.

* CU Signing Date and Time: Timestamp of when the invoice was sent to the KRA.

Financial Statements

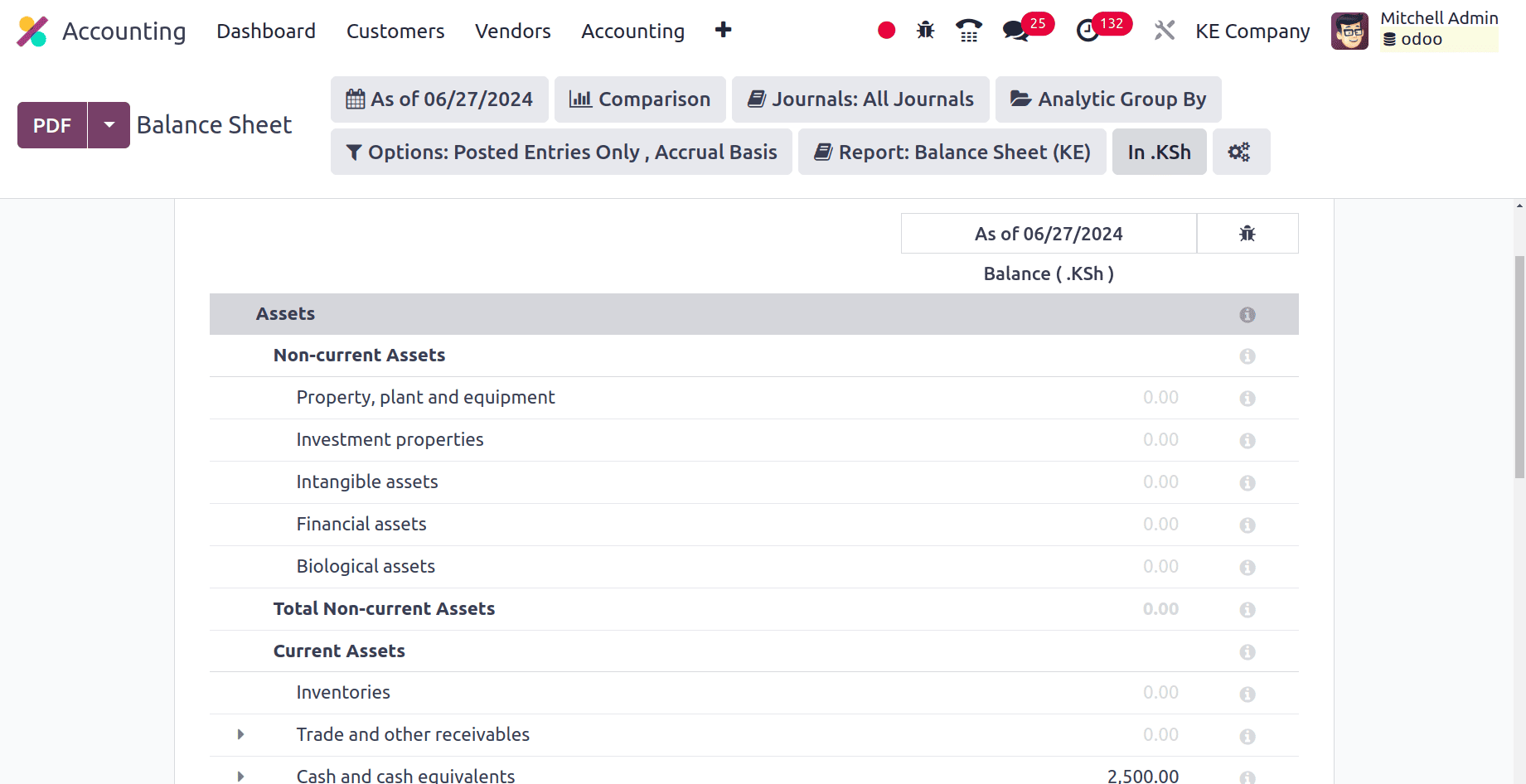

A balance sheet displays the assets, liabilities, and equity of a business, providing a concise overview of the business's financial situation.

* Assets: Assets are resources that belong to a business or an individual that are valued from a commercial standpoint and are anticipated to generate benefits down the road. Asset classification, a basic concept in financial accounting, frequently takes into account an asset's type and role within an organization.

* Liabilities: Liabilities are obligations a business has to its creditors or other third parties. Items on the balance sheet called liabilities represent the amounts owed by the business to suppliers, creditors, lenders, and other organizations.

* Equity: Equity is the amount of a company's assets that is left over after subtracting its debts. It is a crucial area of the balance sheet that shows the ownership position of the shareholders as well as information about the entity's financial situation and performance.

property, plant, and equipment, investment properties, Intangible Assets, Financial Assets, Biological Assets, Inventories, Trade, and Other receivables, cash and Cash Equivalents, capital, unappropriated Profit, reserves, Trade, and Other Payables, Other Financial Liabilities, etc are included in Odoo 17 Balance Sheet.

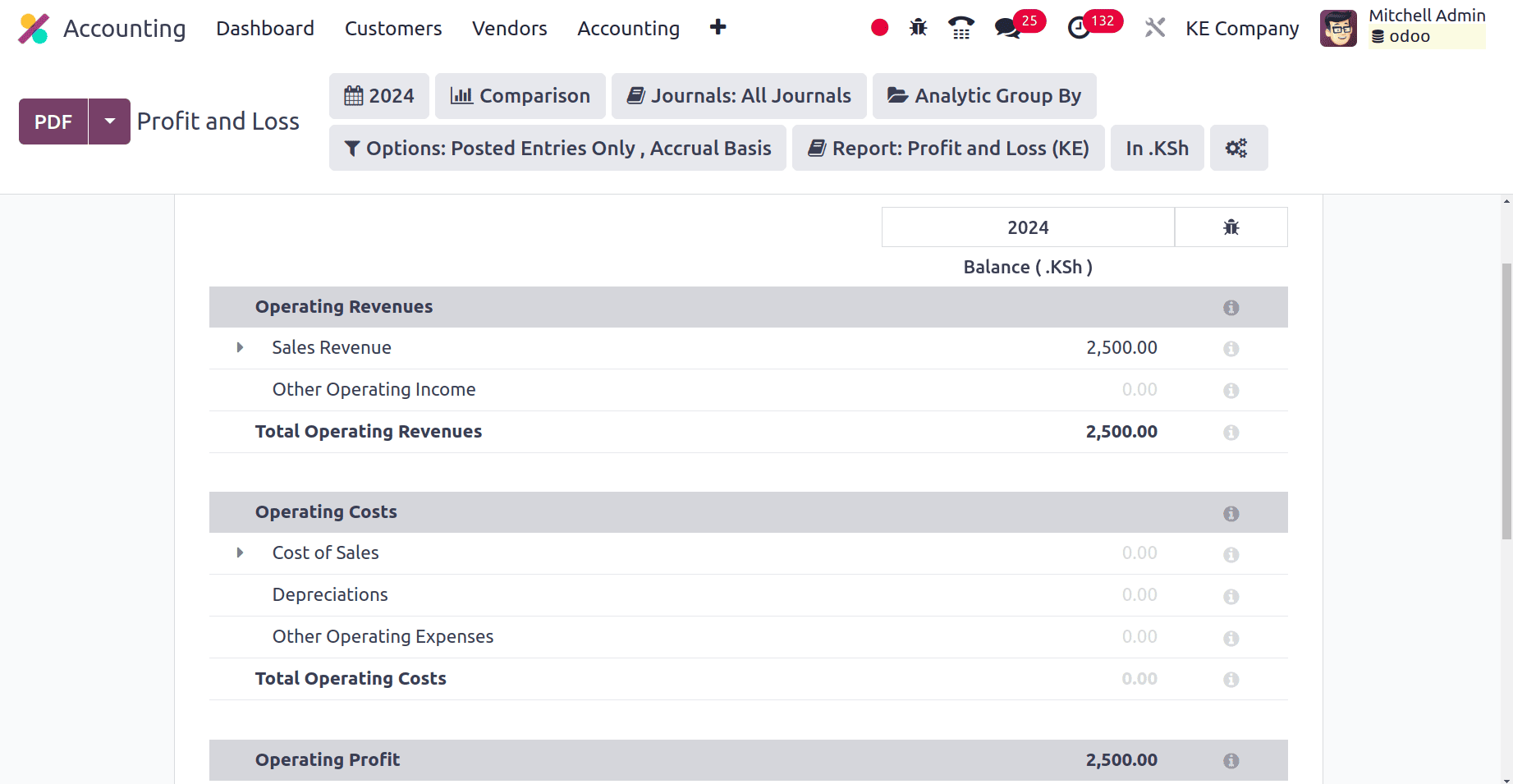

When we choose the Profit and Loss sub-menu under the Reporting menu, the company's Profit and Loss report will be displayed there.

A report known as the profit and loss statement details a company's payments, costs, and net earnings or losses for a given time period. It provides a summary of the company's financial performance during that period and is essential for figuring out how profitable the company is. The profit and loss report of the company from Kenya contains, Sales Revenue, Other Operating Income, Cost of sale, Depreciation, Other Operating Expenses, Financial Income, Financial income, Financial Expenses, Corporation tax Expenses, etc.

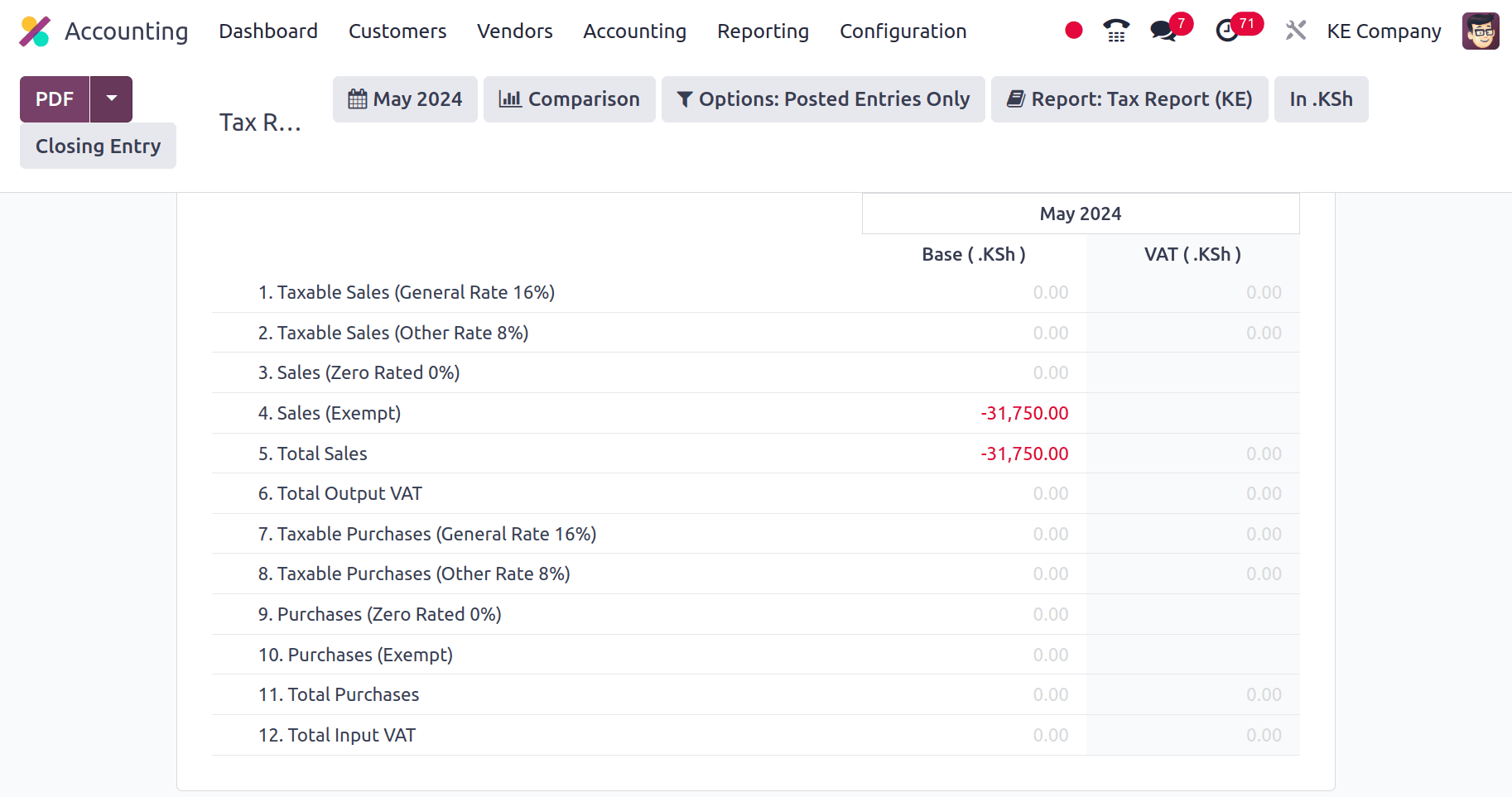

The Tax Report summarizes the tax information of a company. This report shows details on sales and purchase taxes within a specified date range. In the Accounting application, under the reporting menu, we have the Tax Report sub-menu. Select the Tax Report and thus odoo provide the tax report of this company.

The Tax Report of this company shows the Taxable sales, taxable Purchases, Total Sales, Total Purchases, Total Output VAT, Total Input VAT, etc. These tax reports help to ensure your tax liabilities are calculated correctly, reducing the risk of errors and penalties. It also helps to save time by automatically generating the report instead of manually compiling data from invoices and other financial records.

Thus, we have now covered all of the capabilities that are available while setting up Odoo 17's Kenyan Accounting localization. It is now evident that the Kenyan version of Odoo 17 ensures compliance with complex tax rules in Kenya. This makes it possible for us to produce financial reports that are clear and compliant with national regulations for Kenyan financial institutions and stakeholders. All things considered, Odoo 17's accounting localization for Keneya offers businesses operating there a comprehensive solution. It guarantees adherence to regulations, streamlines procedures, enhances precision and allows more accurate financial decision-making.

To read more about An Overview of Accounting Localization for Argentina in Odoo 17, refer to our blog An Overview of Accounting Localization for Argentina in Odoo 17.