What is accounting localization in Odoo 17?

The process of modifying the Odoo 17 accounting module to conform to the unique tax laws, accounting standards, and reporting needs of a particular nation is known as accounting localization. Odoo 17 uses fiscal localization packages for this. Localization packages provide predefined elements such as fiscal positions, tax groups, and charts of accounts that adhere to your country's accounting standards. Odoo 17 can compute taxes automatically by applying the established tax laws, doing away with the requirement for human labor and the potential for error. Localization programs often include templates to help you create reports that meet the legal requirements of your country.

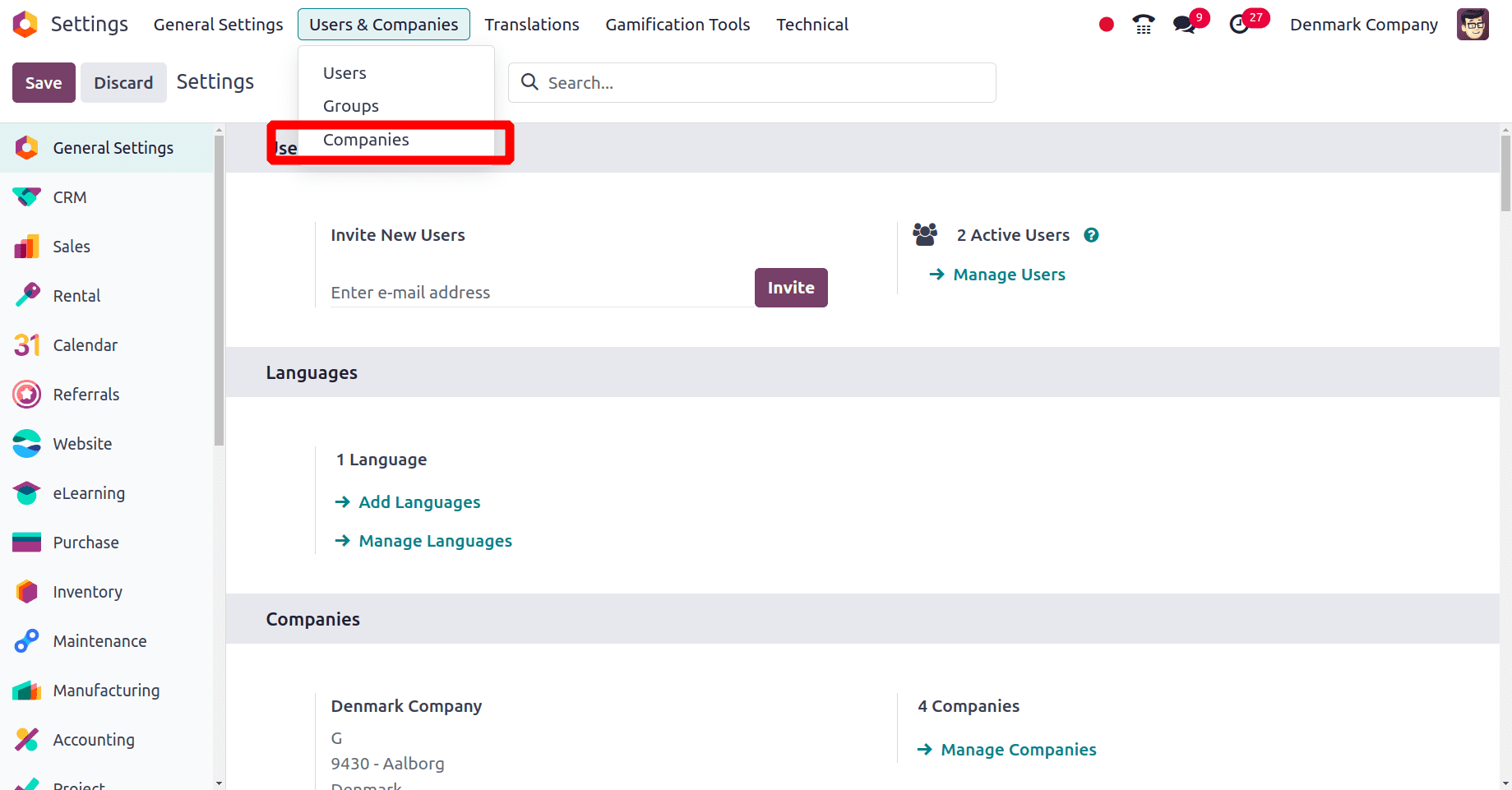

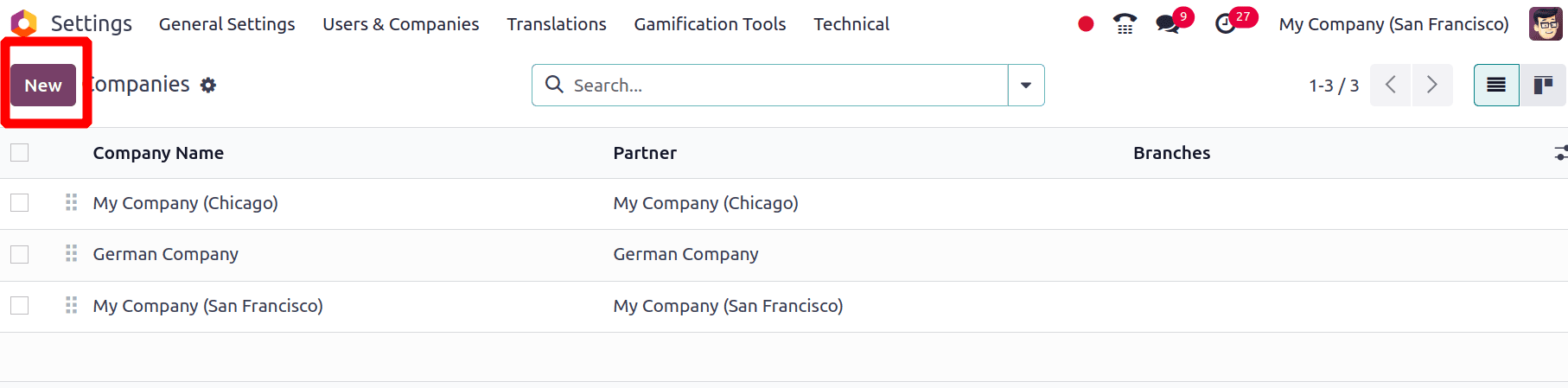

On clicking the Companies sub-menu you will get a list of companies which are already created. Click the ‘New’ button to create a new company.

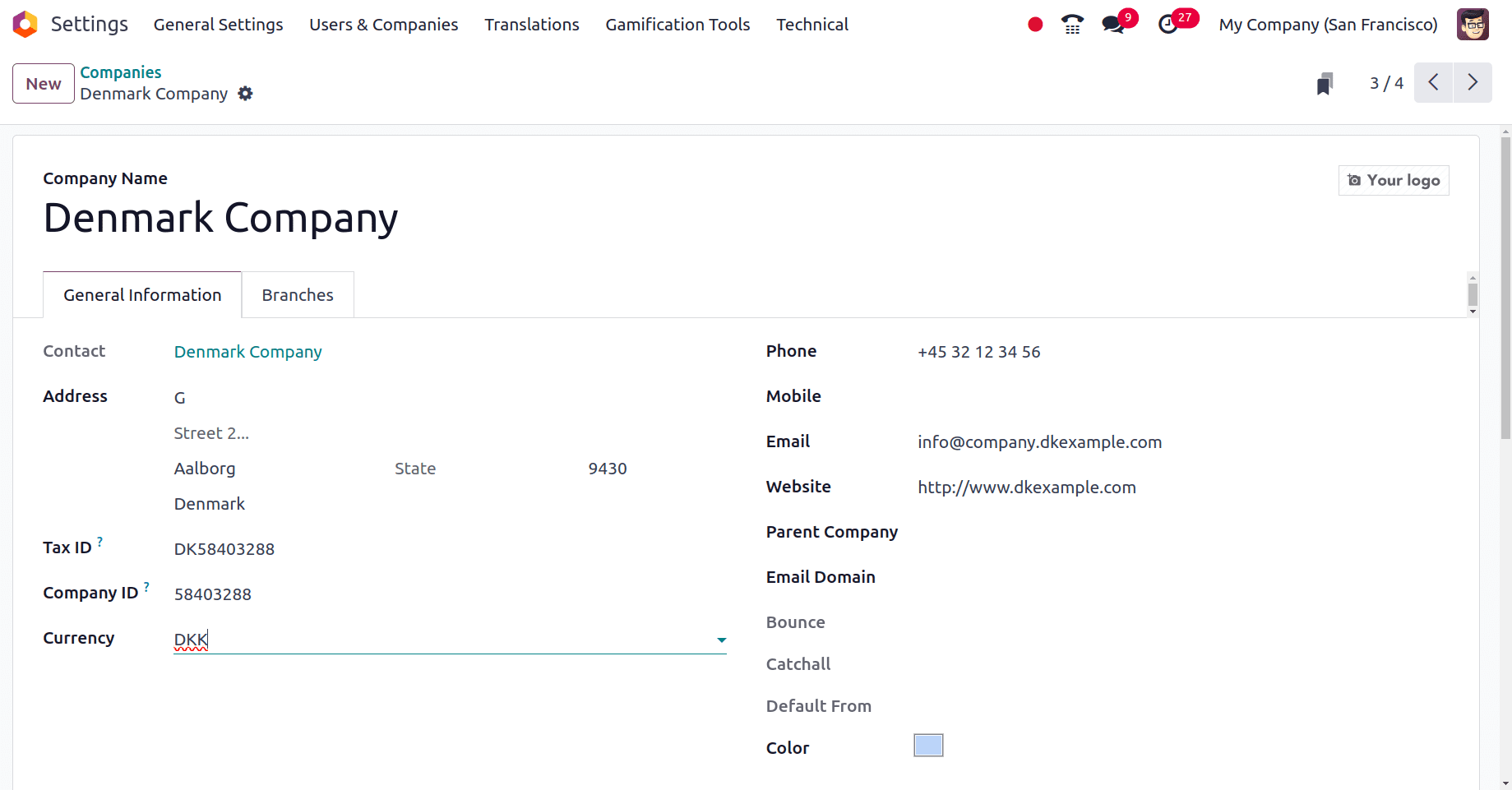

On clicking the New button, you will get a form to fill out the details of the company which you are going to create. Provide the Name of the company, address, country of the company, etc. but when the country is provided in that form, the currency of the company will be automatically configured by Odoo 17.

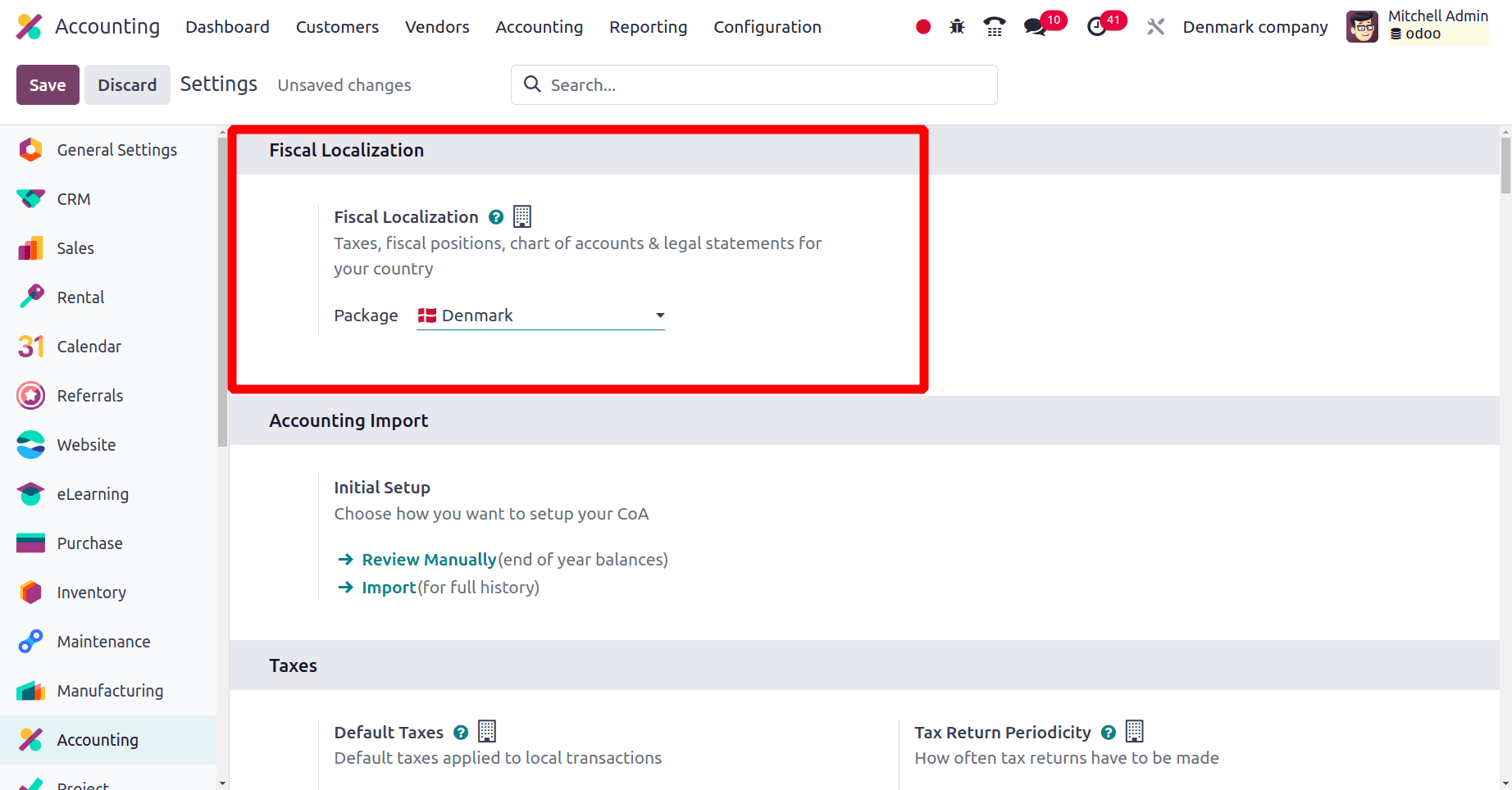

After saving the company details, you need to set up the localization package for the company. So to set up the localization package for the company, move to the accounting module of Odoo 17. In the Configuration > settings, under the Fiscal localization section, you have the option to configure the localization package for the company. Select the package as Denmark, because you have created a Denmark-based company.

After the package has been chosen, click the save button to save the changes you have made.

Peculiarities of Denmark localized businesses.

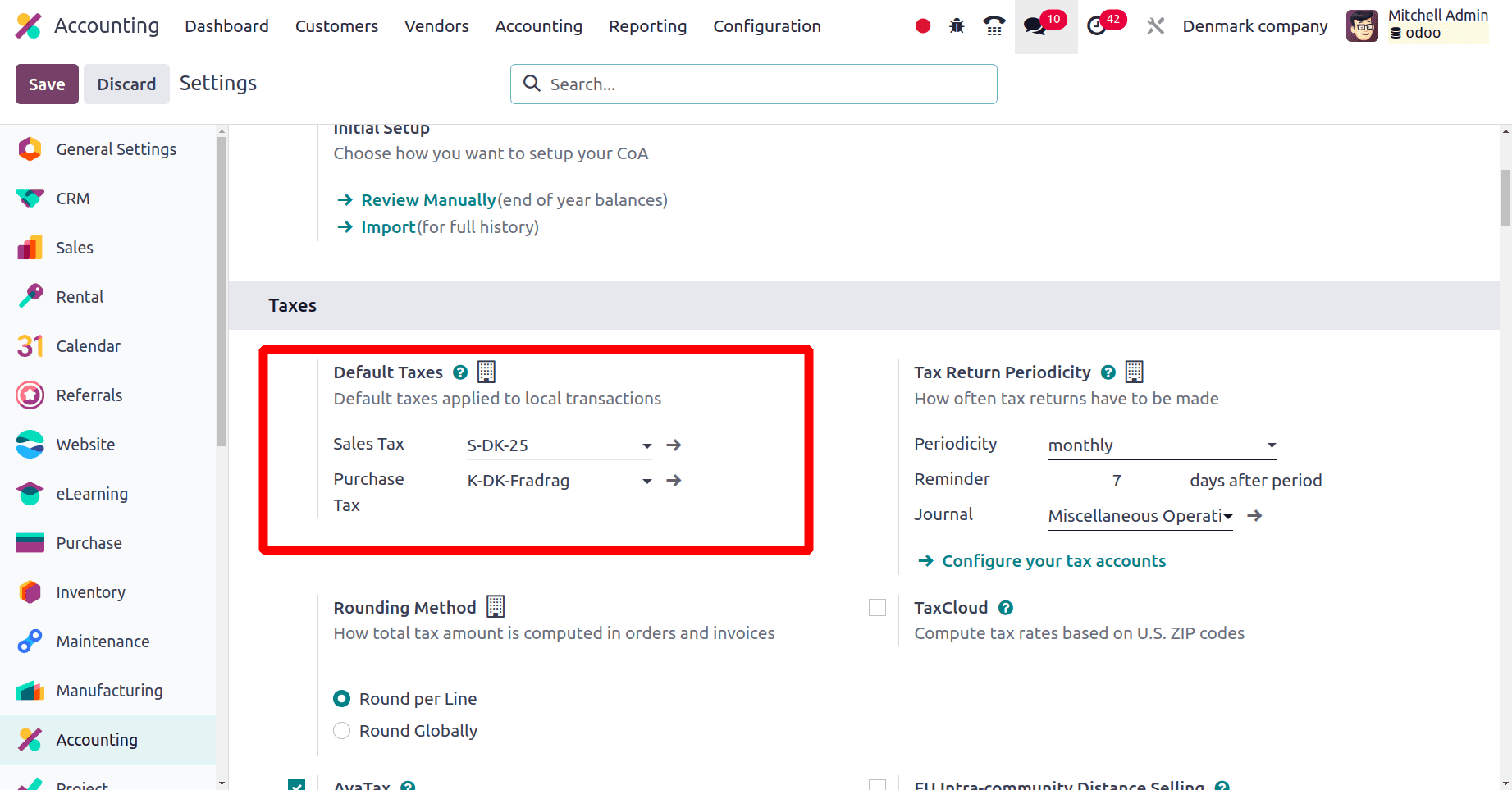

Move to the taxes section under Configuration > Settings. There, you can see the default tax for the company has been configured automatically.

From the above screenshot, you can identify the Default sales tax and the Default purchase tax used by this company are, S-DK-25 and K-DK-Fradrag.

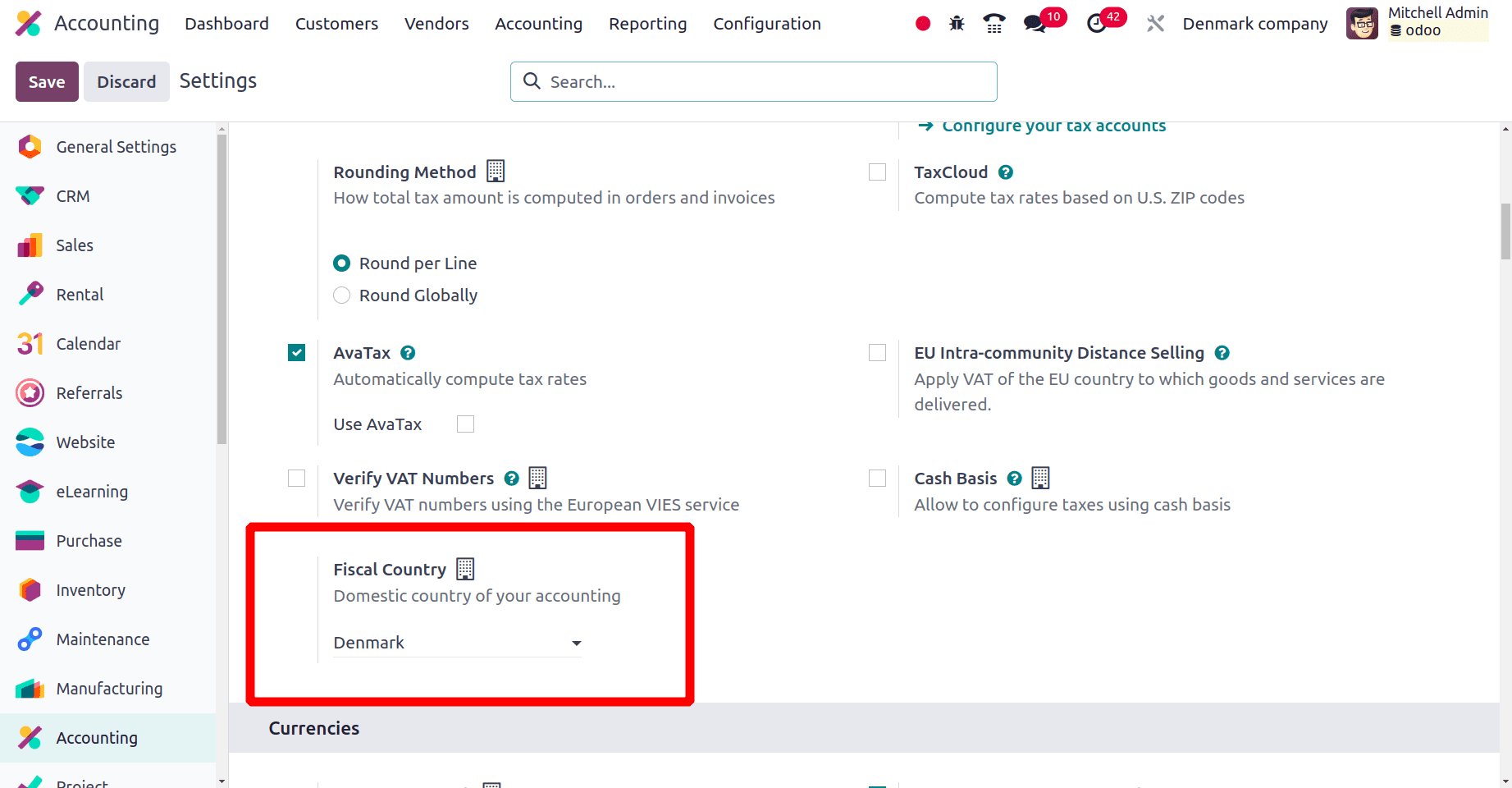

There is a Fiscal country filed under the taxes section. You can provide the fiscal country for this company, but in this case, when the package has been saved, Odo 17 automatically sets the Fiscal Country as Denmark.

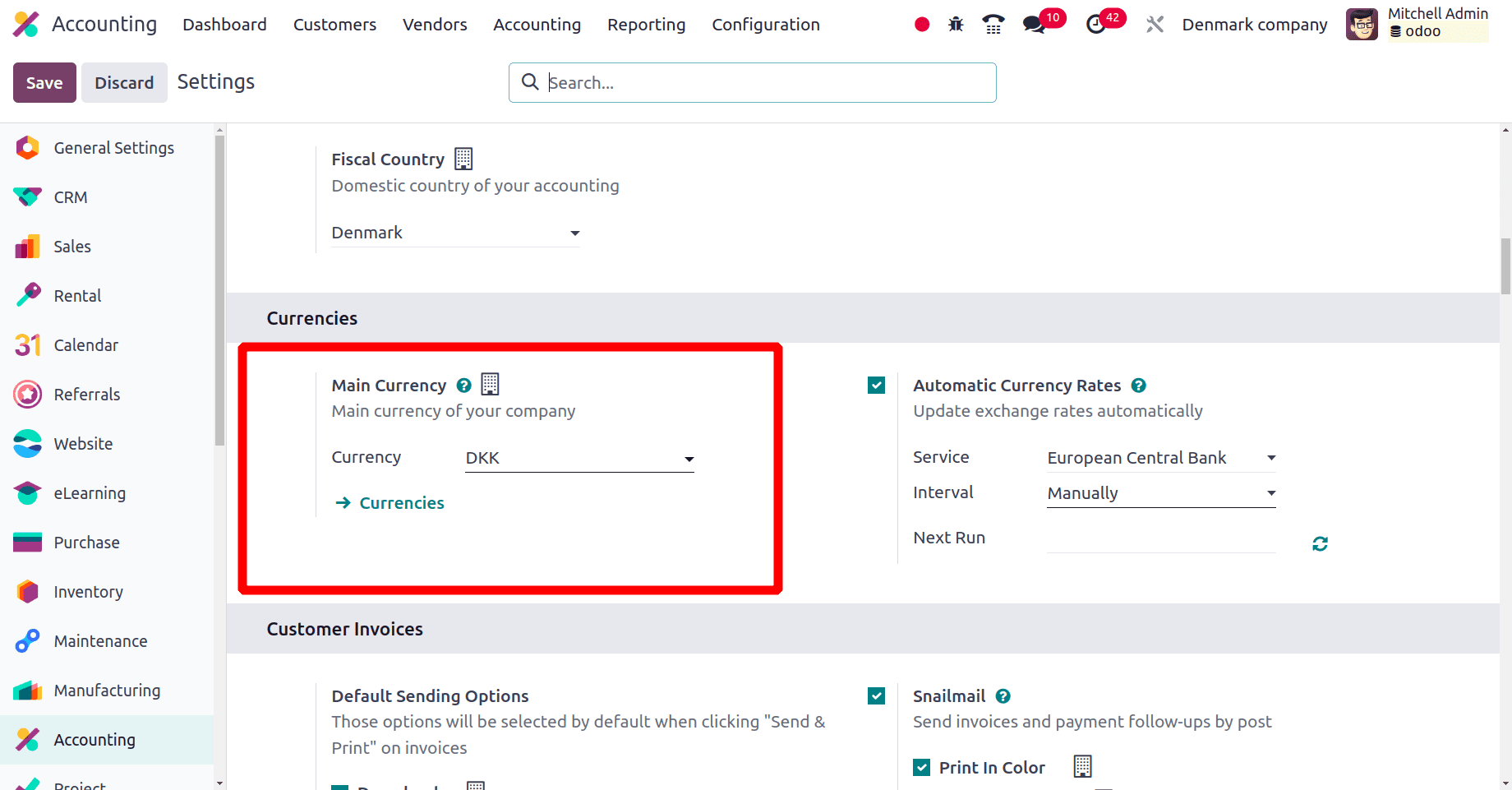

Next is the currency of the company. You know that the currency in Denmark is the Danish krone which is denoted as DKK. Here you can see that Odoo automatically sets up the main currency for the company as Danish krone (DKK).

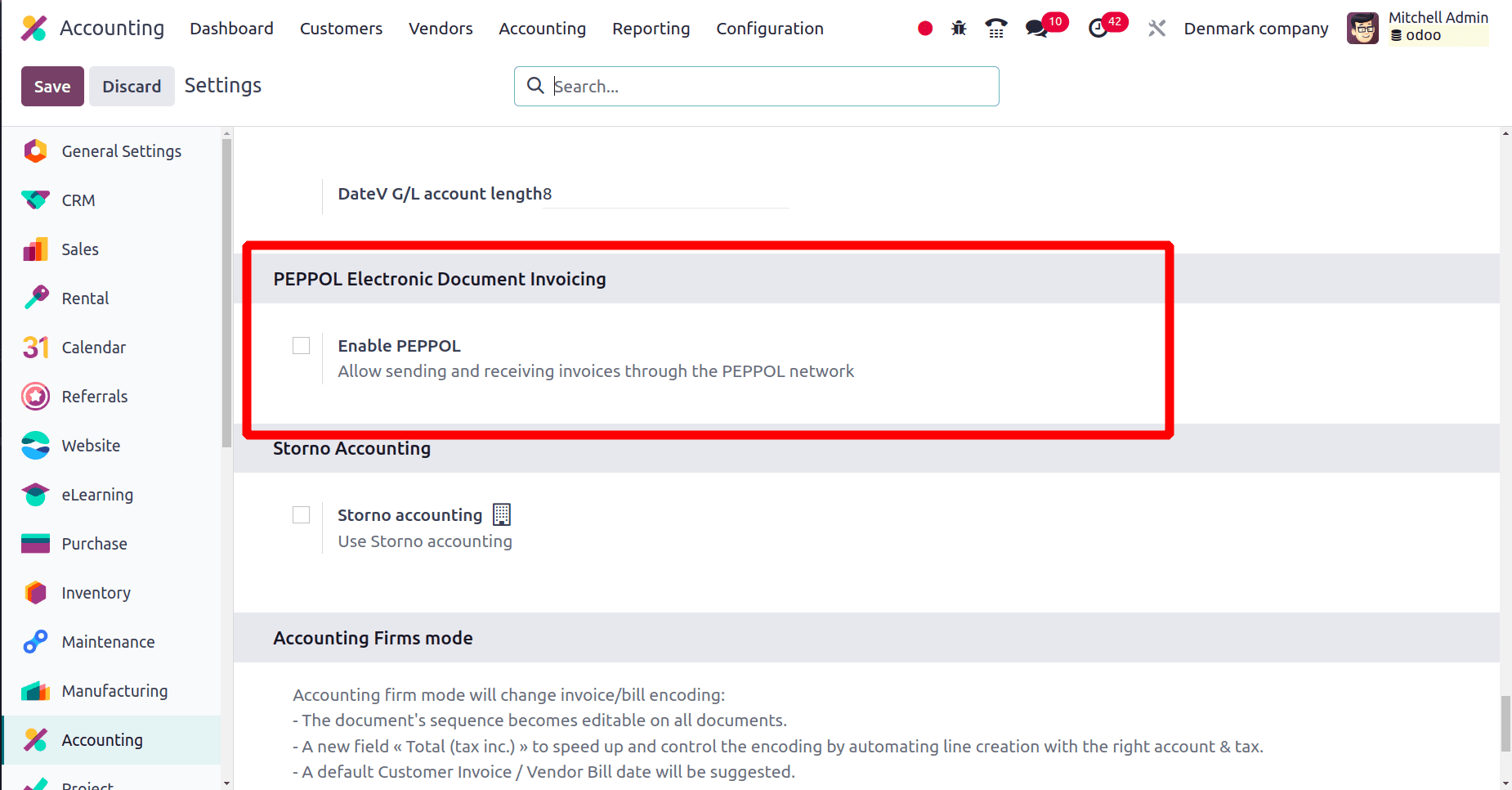

An extra section is added to the Configuration > Settings of the accounting application which is PEPPOL Electronic Document Invoicing. PEPPOL is a standardized network called Pan-European Public Procurement Online that makes cross-border e-invoicing safe and effective for enterprises. It guarantees smooth document sharing independent of the accounting program that each party uses. Through the PEPPOL network, automate the sending and receiving of invoices, get rid of the possibility of errors and laborious data entry that come with traditional paper bills, etc. Next, we can move to the Reporting menu of the Accounting application.

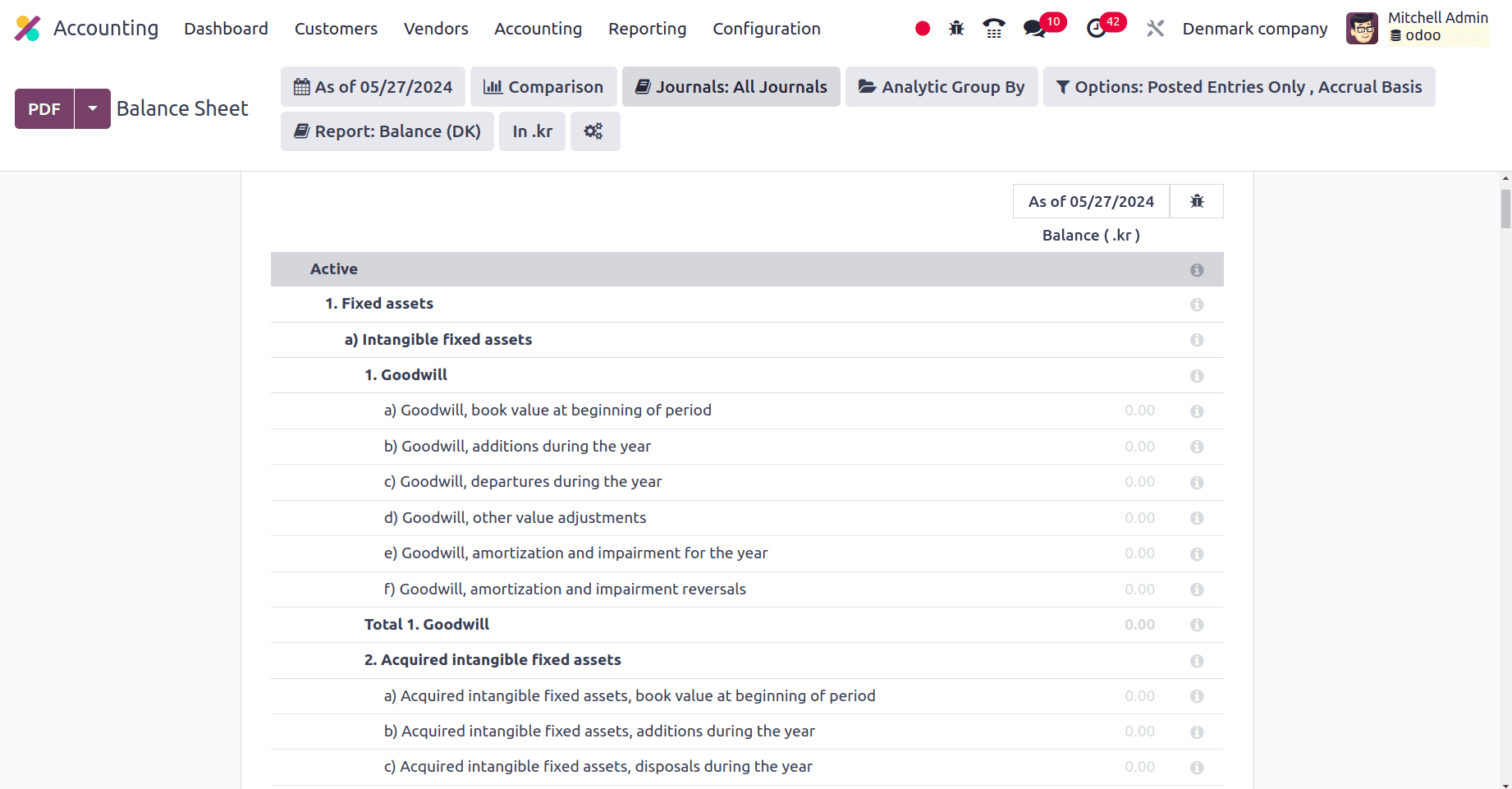

A financial statement that provides an overview of a company's financial situation as of a particular date is the balance sheet. It gives an overview of the company's current assets, liabilities, and equity (ownership stake) at that specific moment. The balance sheet of this company includes Intangible fixed assets, Goodwill, Acquired intangible fixed assets, tangible fixed assets, Investment properties, Land and buildings, etc. Like this, all the assets, liabilities, and equities are added to the Balance Sheet of the company.

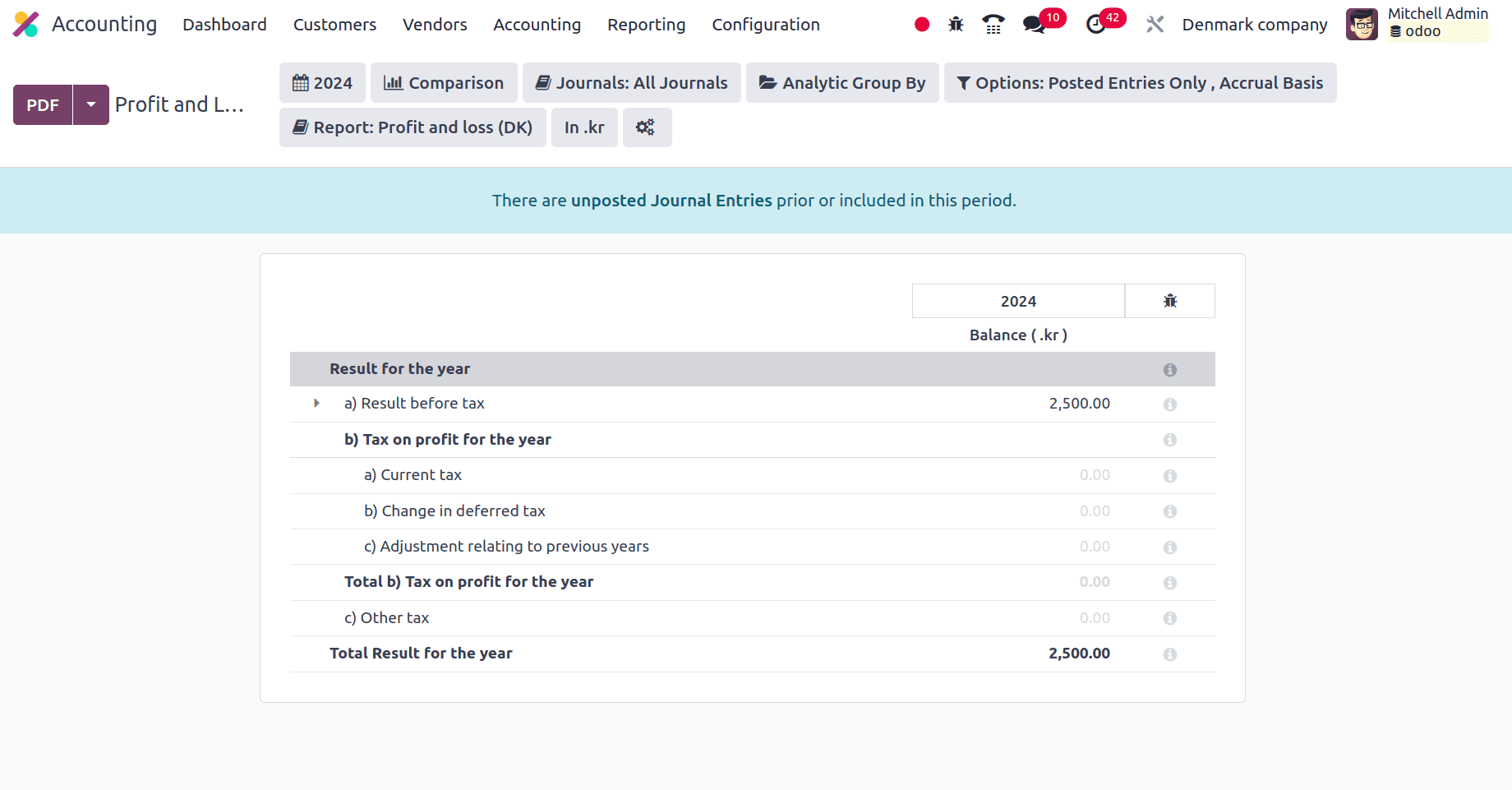

Next is the profit and loss report of the company. To get the profit and loss report of the company, choose the Profit and Loss sub-menu under the Reporting menu. It is an essential financial report that provides an overview of a business's profitability over a given time frame. It presents the net profit or loss after breaking down the amount of money made (revenue) and outgoings throughout that period of time. The profit and loss report of the company include Current tax, Change in deferred tax, adjustment relating to the previous year, Other taxes, etc.

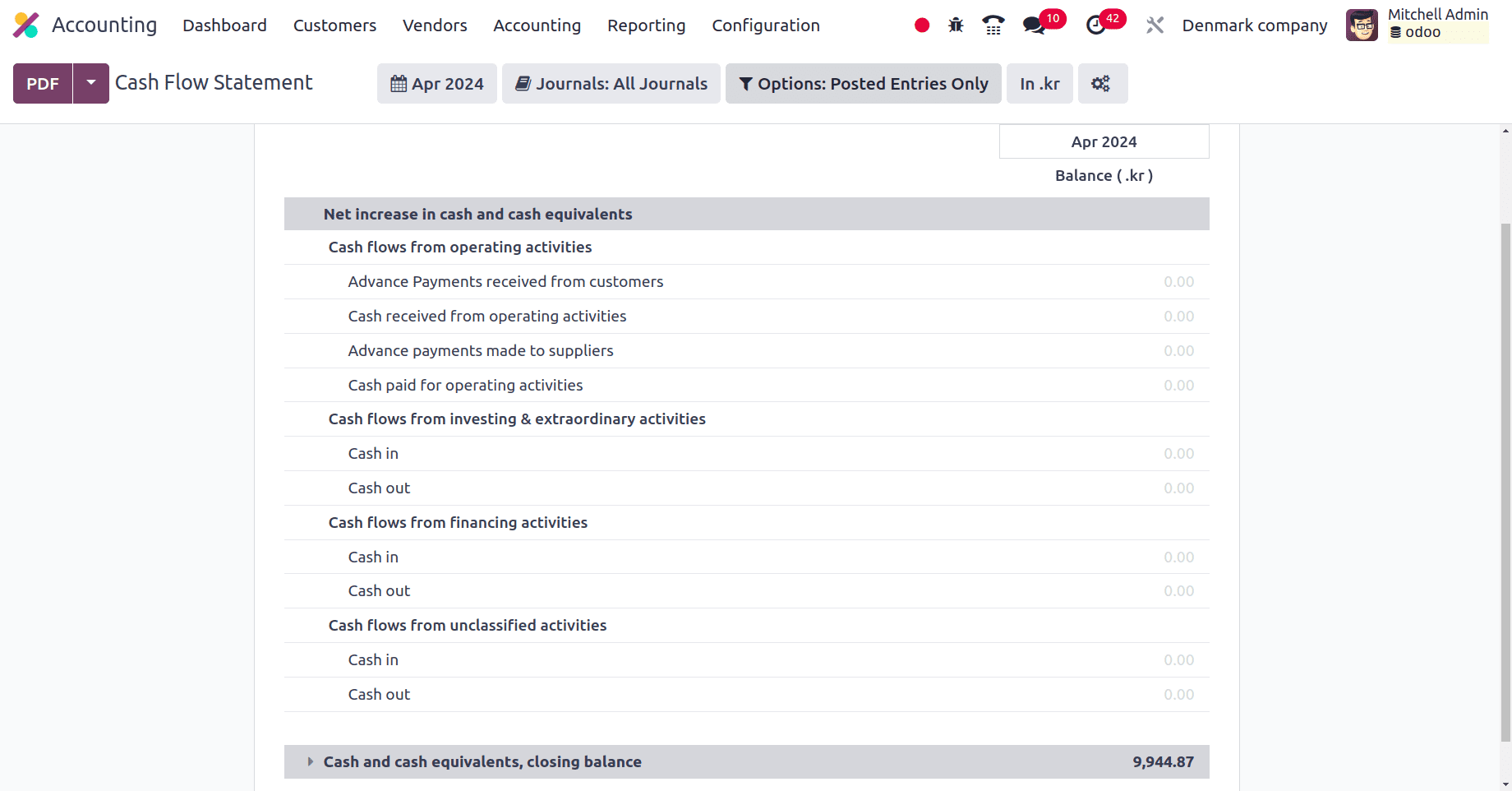

The Cash Flow Statement of a company is an Odoo 17 financial report that provides insight into a company's cash inflows and outflows over a given time frame. It aids in determining how well a business produces and uses cash to pay its debts. The cash flow statement of the company includes, Cash flows from operating activities, Cash flows from investing & extraordinary activities, Cash flows from financing activities, Cash flows from unclassified activities, etc.

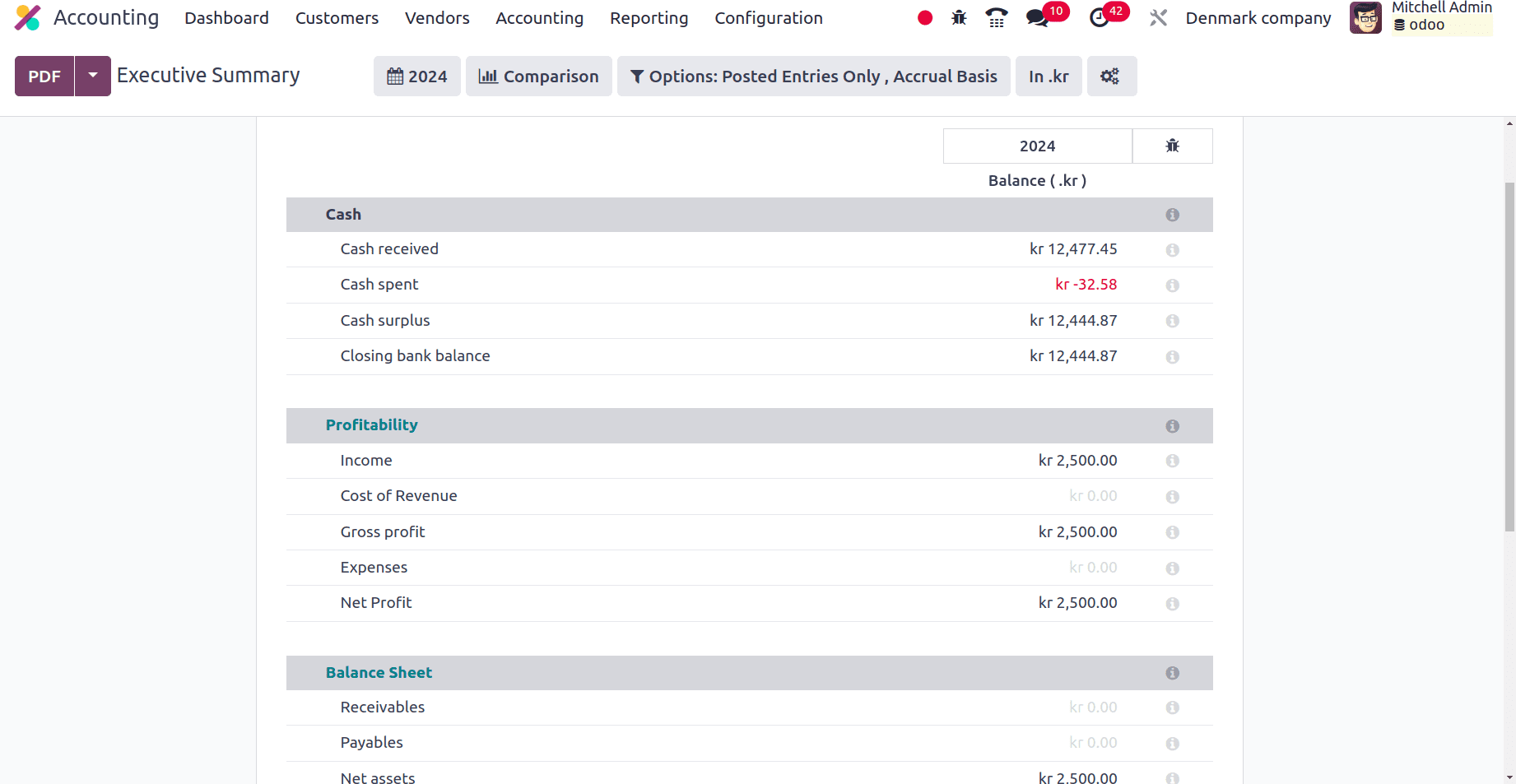

The executive summary is a management-level report that offers a brief overview of the most important financial data for your business. Without diving into detailed reports, it assists executives and decision-makers in gaining a broad overview of the company's financial performance. The executive summary of this company provides a brief overview of Cash, Profitability, Balance Sheet, Performance, Position, etc., and different supplementary information also.

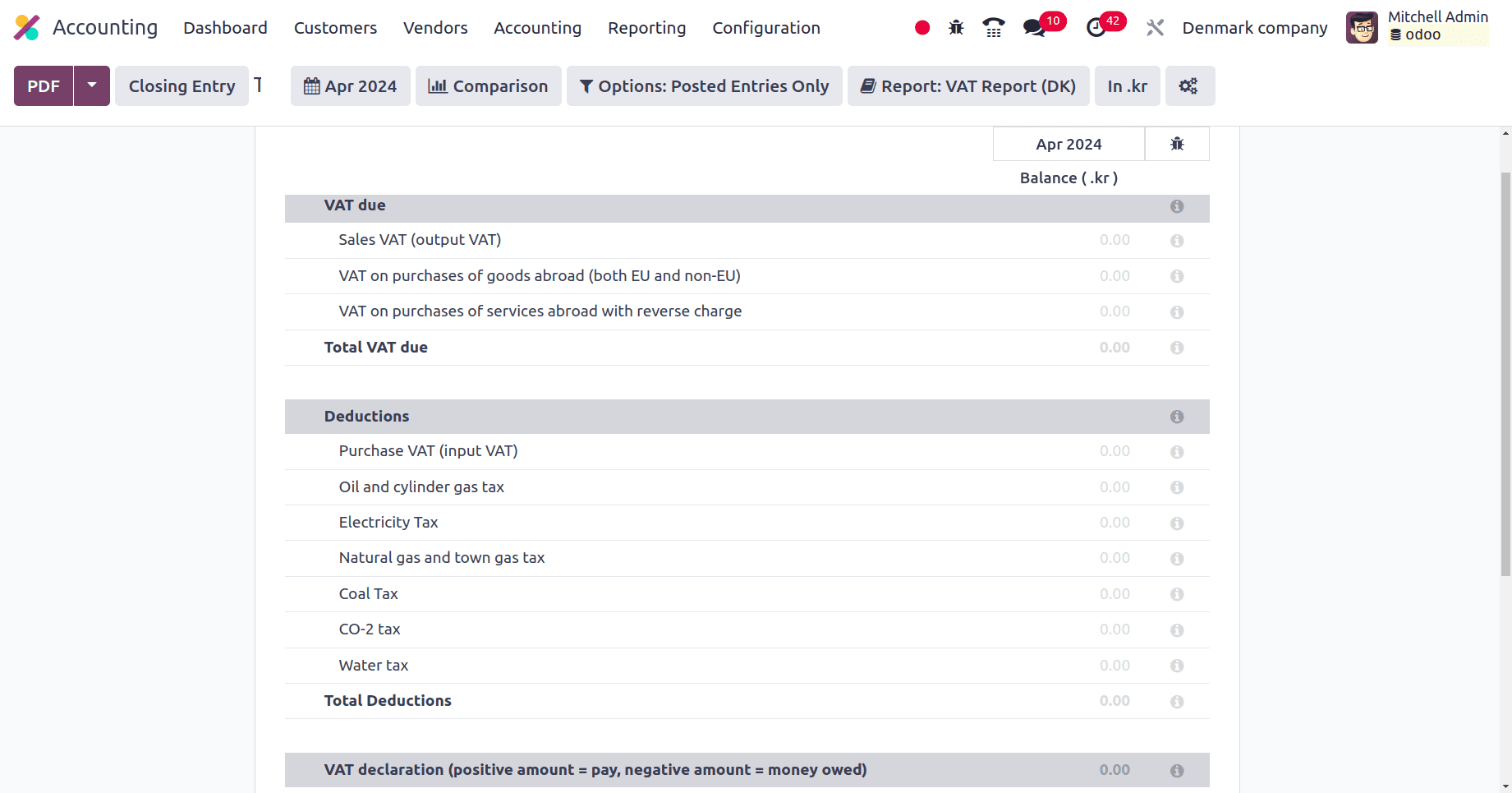

A tax report is an essential document for completing your taxes with the appropriate authorities. It allows you to calculate your tax obligations and make sure you are in accordance with tax legislation by providing an overview of your company's tax information for a given time. The tax reports of the businesses in Denmark include VAT dues, different deductions like electricity tax, Water tax, Coal tax, etc.,

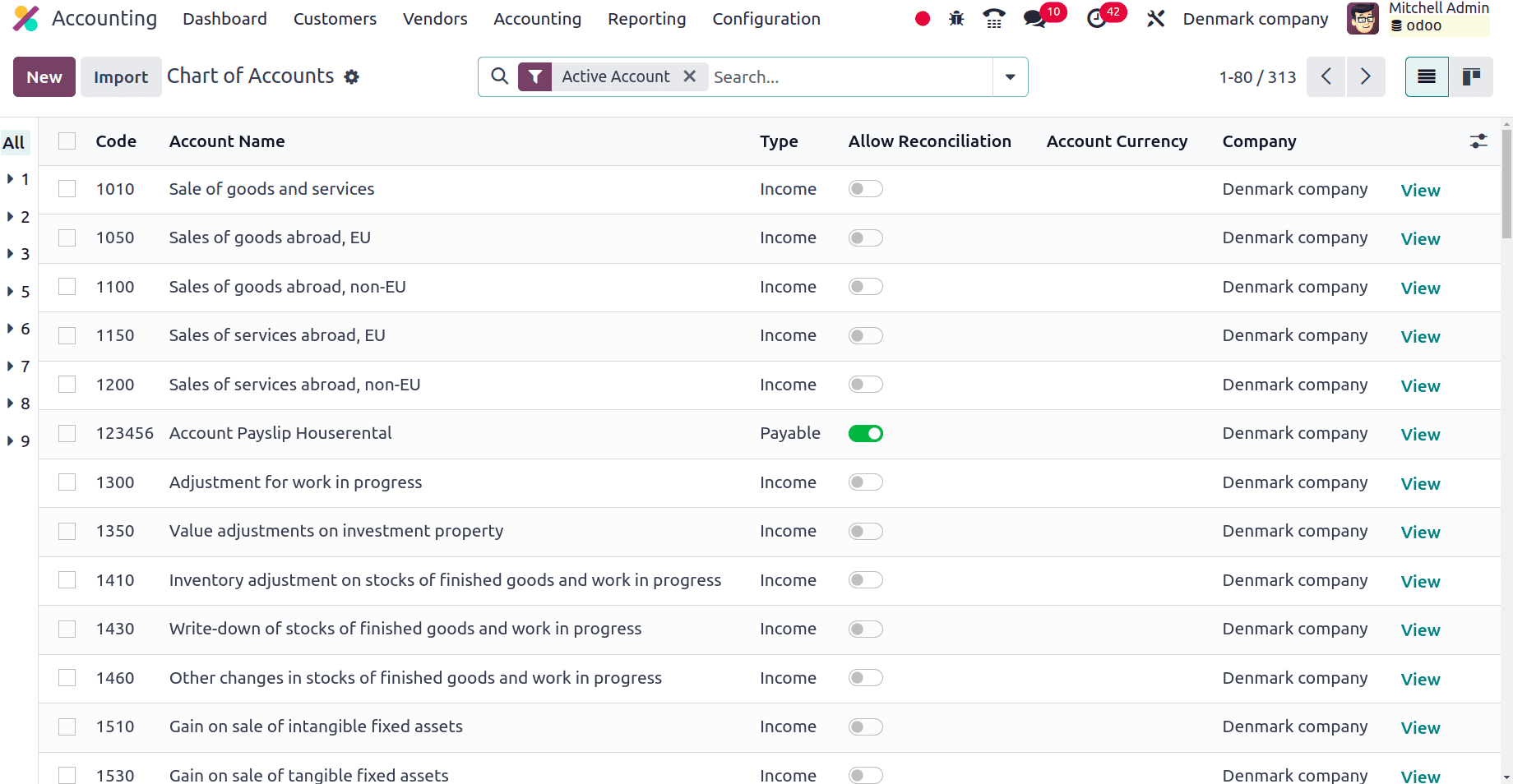

The chart of accounts in Odoo 17 is the list of all the accounts that are utilized in an organization's general ledger to record financial transactions. Through efficient use of Odoo 17's chart of accounts, your company can lay a solid basis for precise financial record-keeping, perceptive reporting, and knowledgeable financial management. The different accounts used by different businesses in Denmark are listed in the above screenshot. So they can use different accounts for different uses.

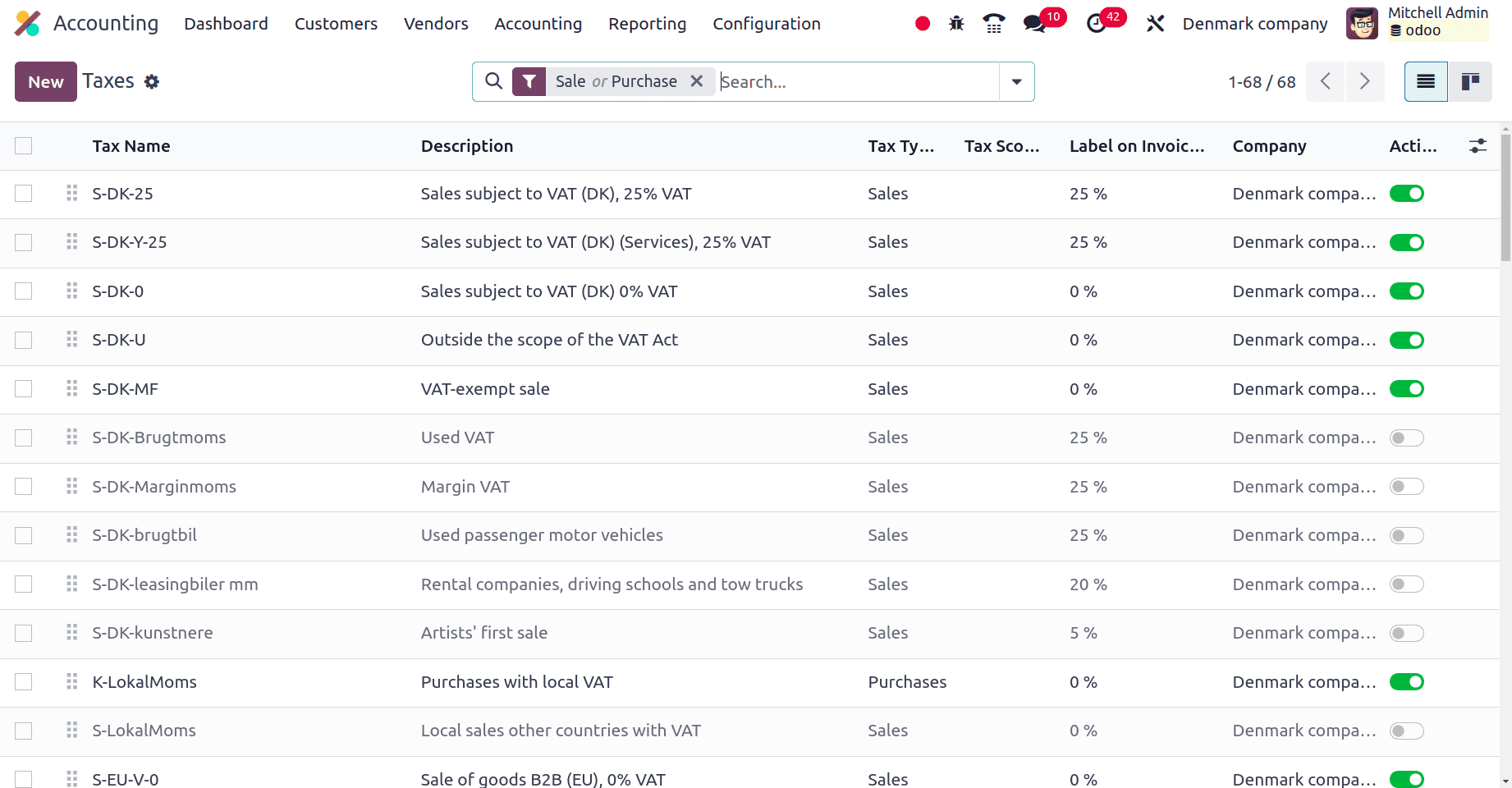

The taxes used by different countries may differ. A tax is a required financial duty owed by people or companies to a governing authority, usually the federal or state government. Numerous social programs and public services are funded in part by these taxes. S-DK-5, S-DK-Y-25, S-DK-U, S-DK-O, etc are some of the taxes used by companies in Denmark for different purposes.

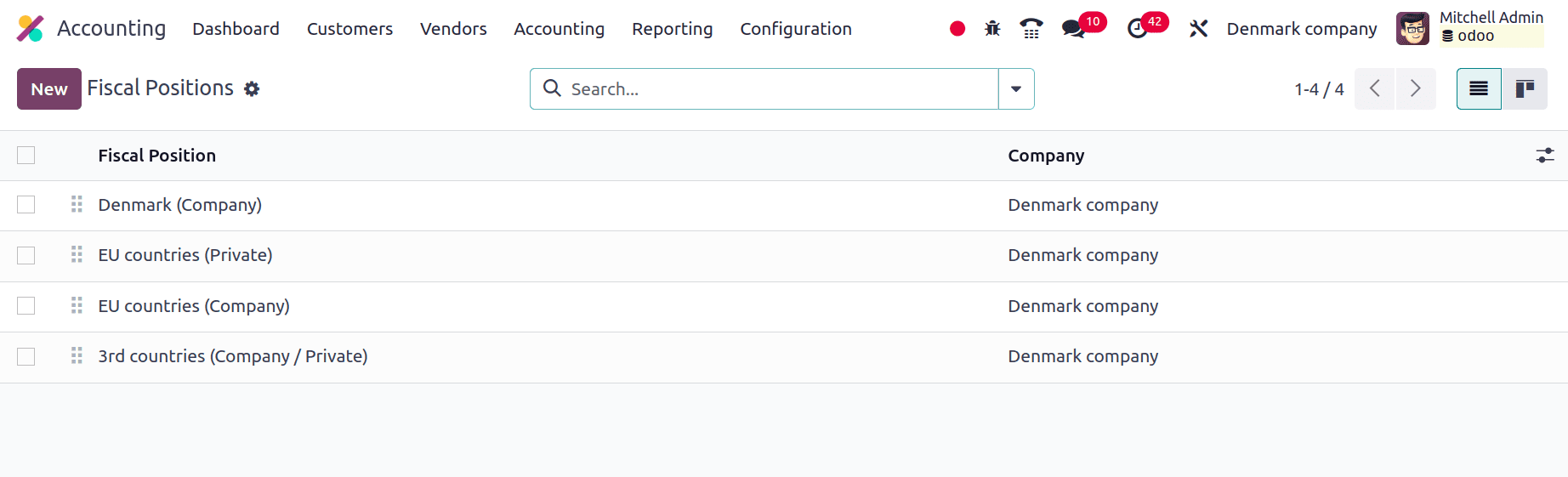

The different fiscal mapping used by the companies in Denmark is shown in the above screenshot. Under the Fiscal positions provided, some of the rules are created and saved to map the accounts that are used by the company. All these accounts will be automatically mapped by Odoo 17. So these are the major peculiarities and changes which are found for a Denmark-based company.

So with Odoo 17 accounting localization features designed with Denmark in consideration, Odoo 17 provides Danish firms with a host of benefits. Odoo 17 offers an accounts chart that complies with regulatory requirements and Danish accounting standards. This guarantees that you classify your financial transactions in accordance with Danish standards. Odoo 17's computations take into account Danish tax laws and regulations. This reduces errors and streamlines tax filing by ensuring proper calculation of VAT (Value Added Tax) and other taxes applicable in Denmark.

To read more about An Overview of Accounting Localization for Argentina in Odoo 17, refer to our blog An Overview of Accounting Localization for Argentina in Odoo 17.