Through accounting localization, Odoo, an open-source ERP program, provides accounting features that may be customized for particular nations. This means that Odoo 17 can modify its accounting functions to conform to local laws, tax laws, and reporting standards of a specific country. Here we are setting up the accounting localization for the country Algeria.

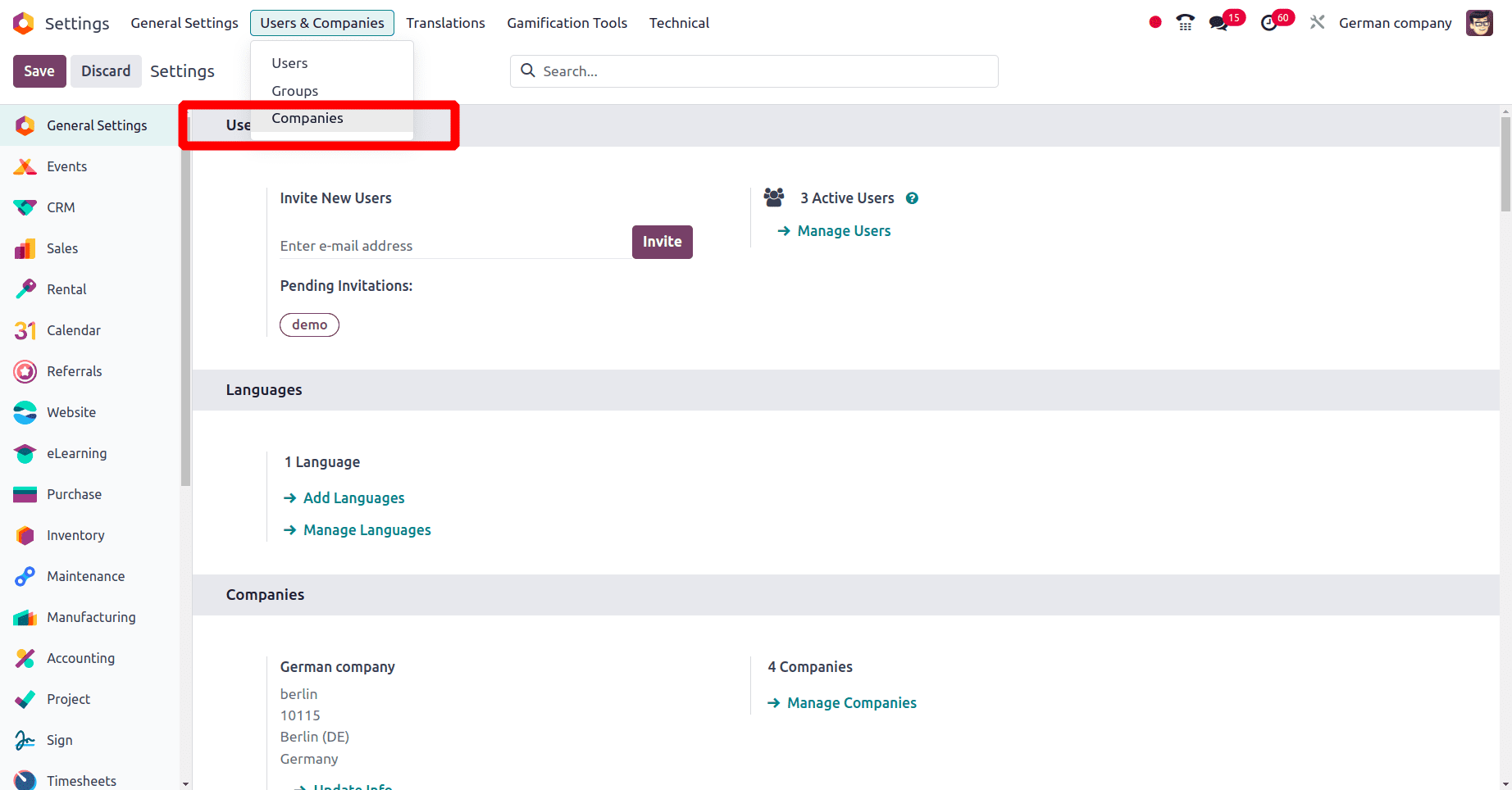

For setting up the country-specific localization for an Algerian company first of all we need to configure an Algerian company. To set up this we can move to the General settings application in Odoo and click the ‘Users & Companies’ menu. Under Users & Companies click the ‘Companies’ sub-menu.

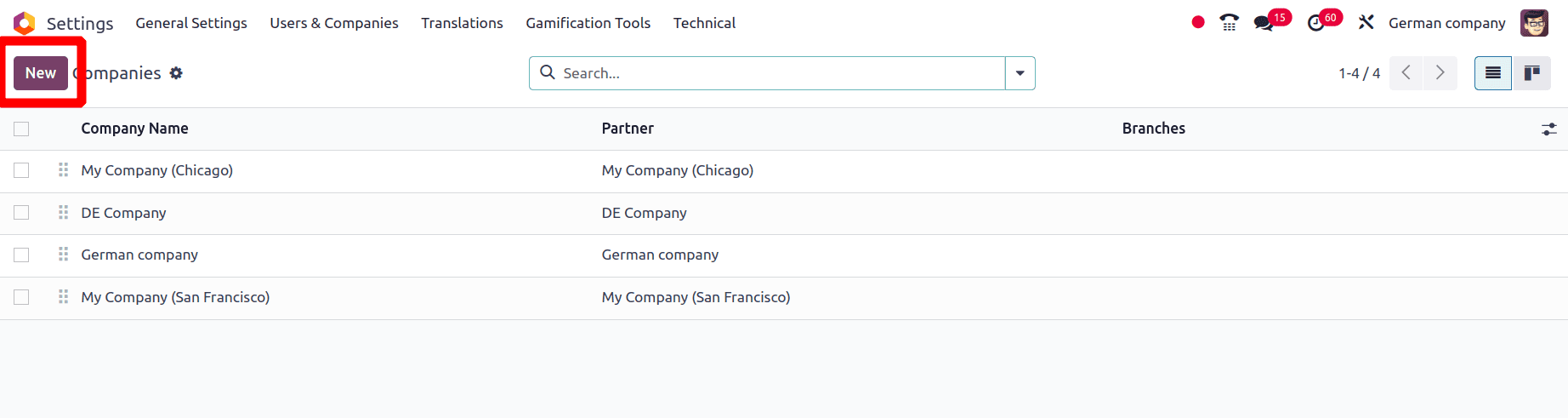

On clicking on the ‘Companies’ sub-menu, there will be a list of companies. To create a new company we can click the New button.

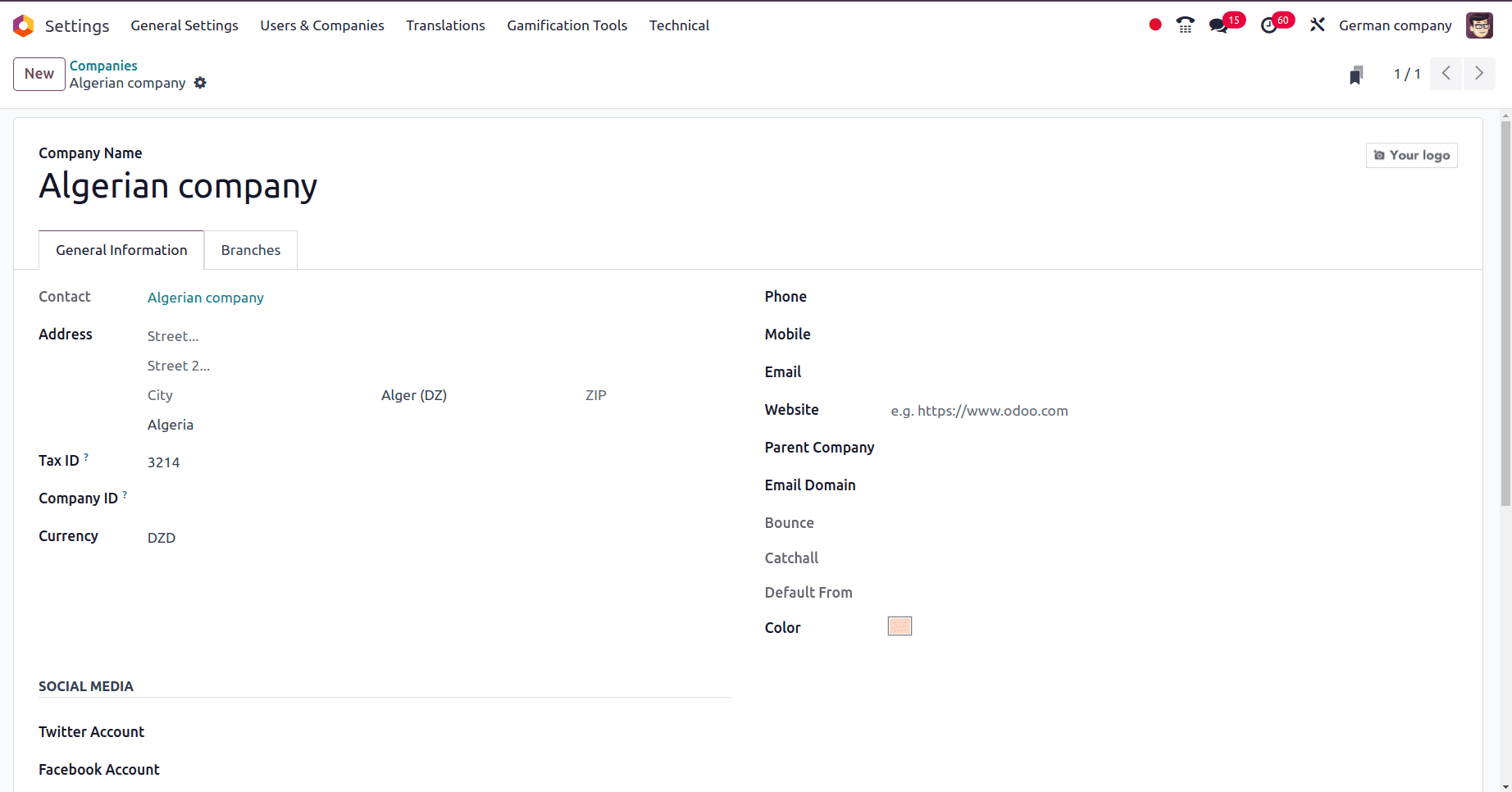

There we got a form to fill up the company details like the company name, company address, country to which the company belongs, currency of that country, tax ID, phone, email, website, etc.

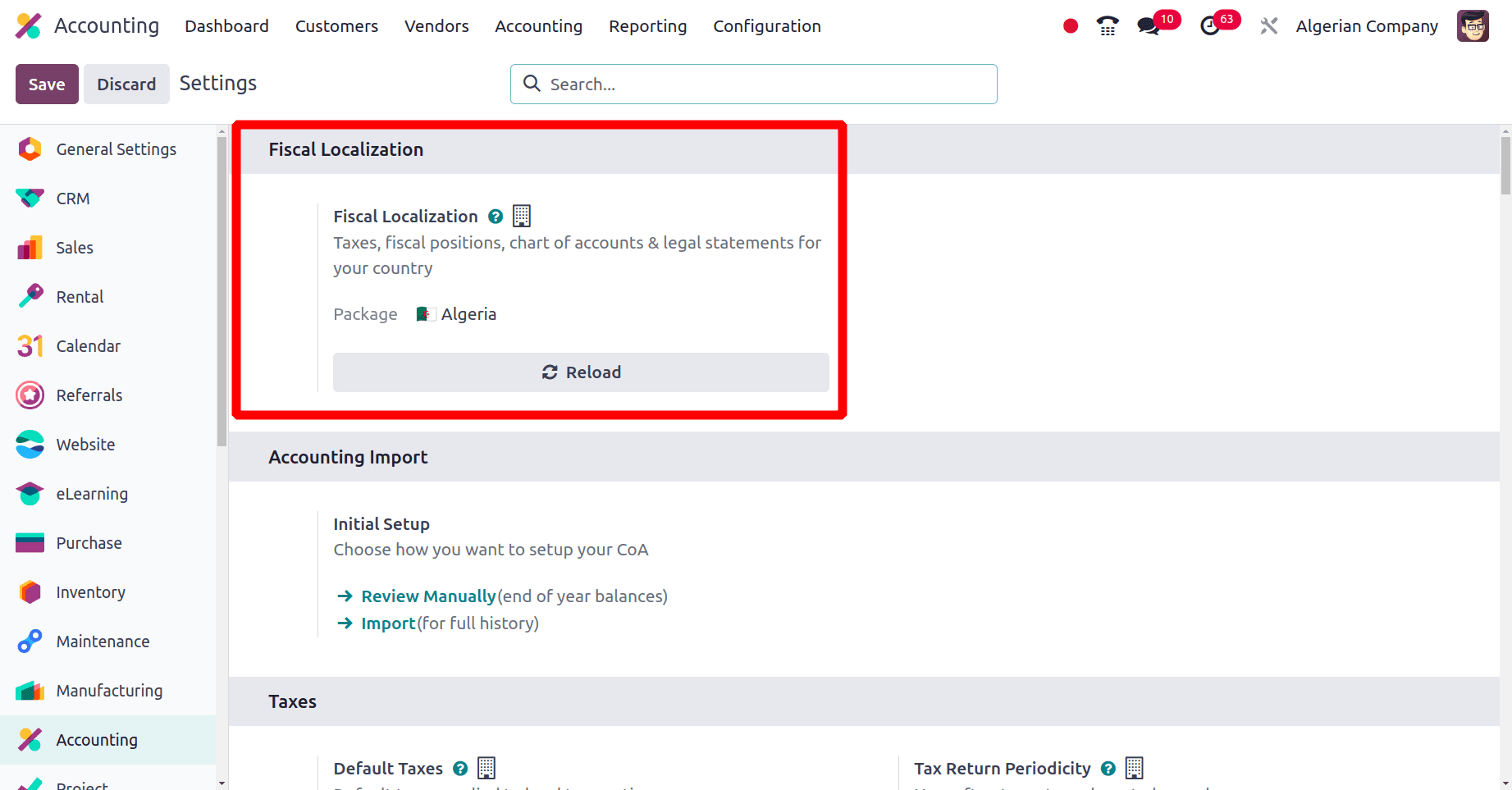

Then save the whole details of the company and get back. The next step is to set up the localization for Algeria. So to set up Algerian localization, we can move to the accounting application in Odoo. Then click on the Configuration > Settings sub-menu. Under the ‘Fiscal Localization’ section, we can set up the package for the country so that Tax, Fiscal position, chart of accounts, legal statements for the company, etc can be configured. For that in the packages field set the package as ‘Algeria’ and click the Save button to save the changes.

Changes formed when Algerian localization was configured in Odoo 17

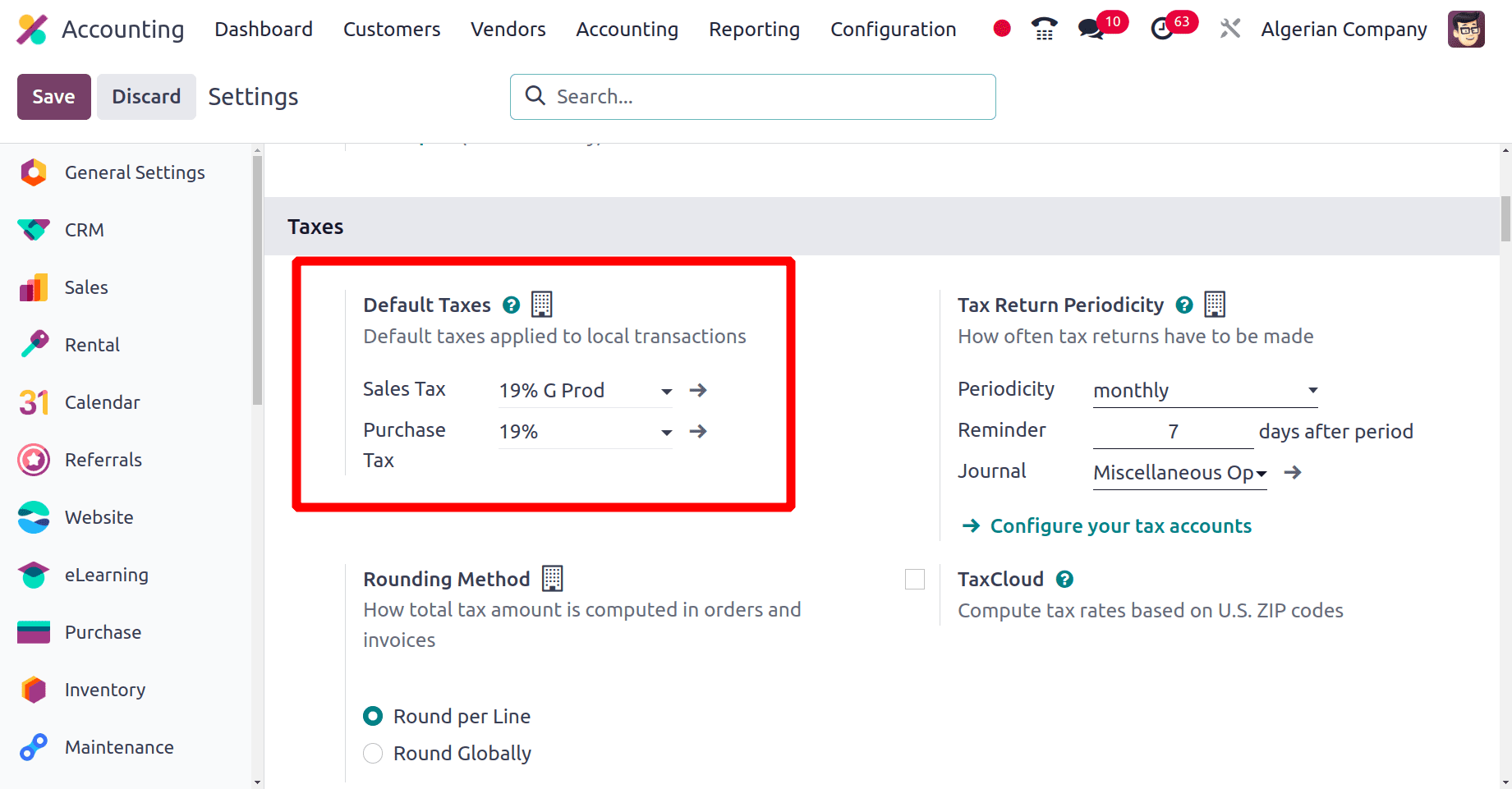

There will be lots of changes when an Algerian localization for a company has been configured. In the settings of the accounting application itself, we can notice that the default sales tax and purchase tax have been changed and a new tax was configured automatically with Odoo 17.

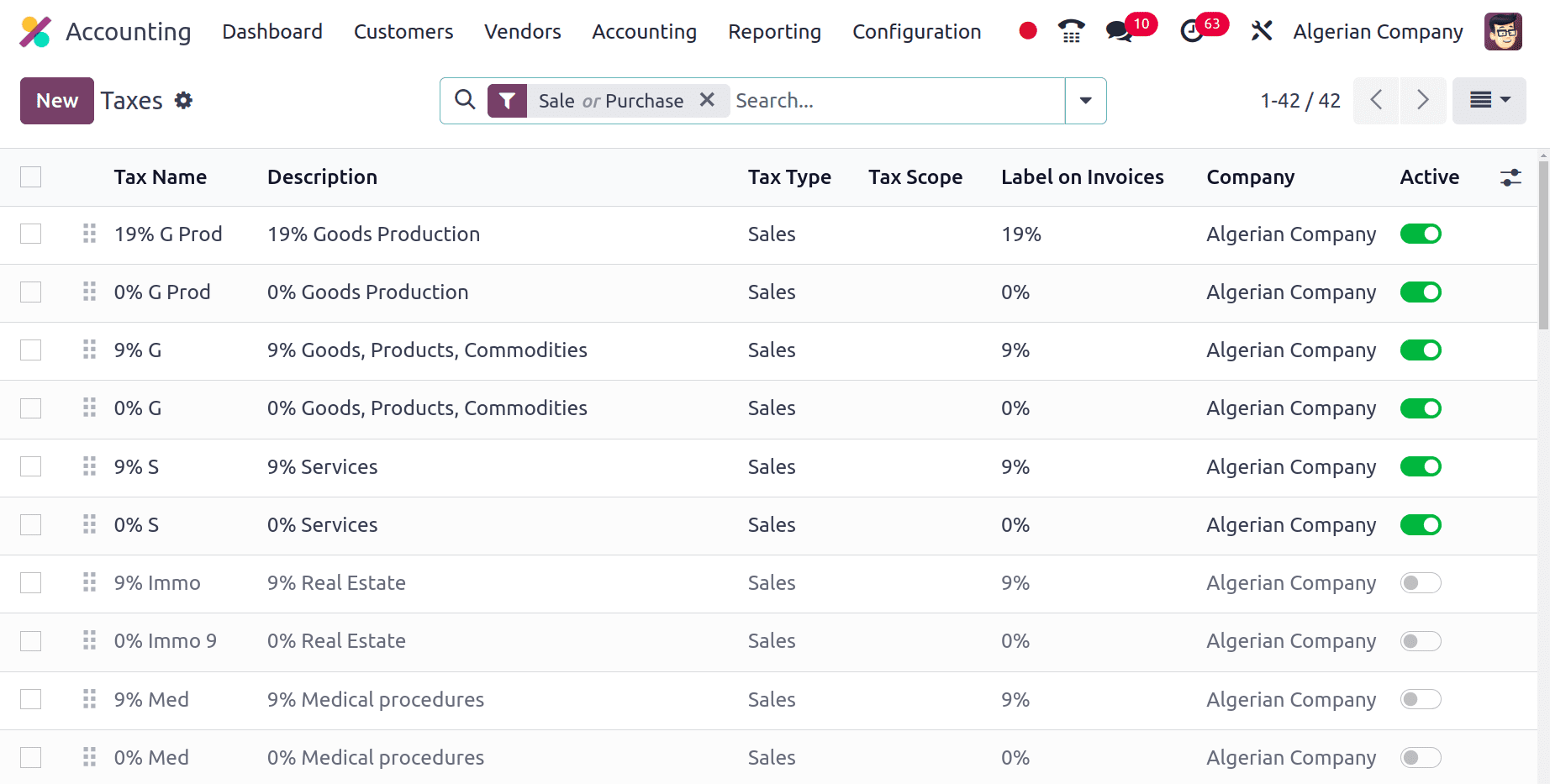

Next, we are moving to the tax configured for the Algerian company. For that choose the ‘Configurations’ menu and under that, there will be a ‘Taxes’ sub-menu. Click that taxes sub-menu and there we can see a list of taxes. These all are the taxes for which an Algerian company can use or the taxes for which the businesses in the country Algeria can configure.

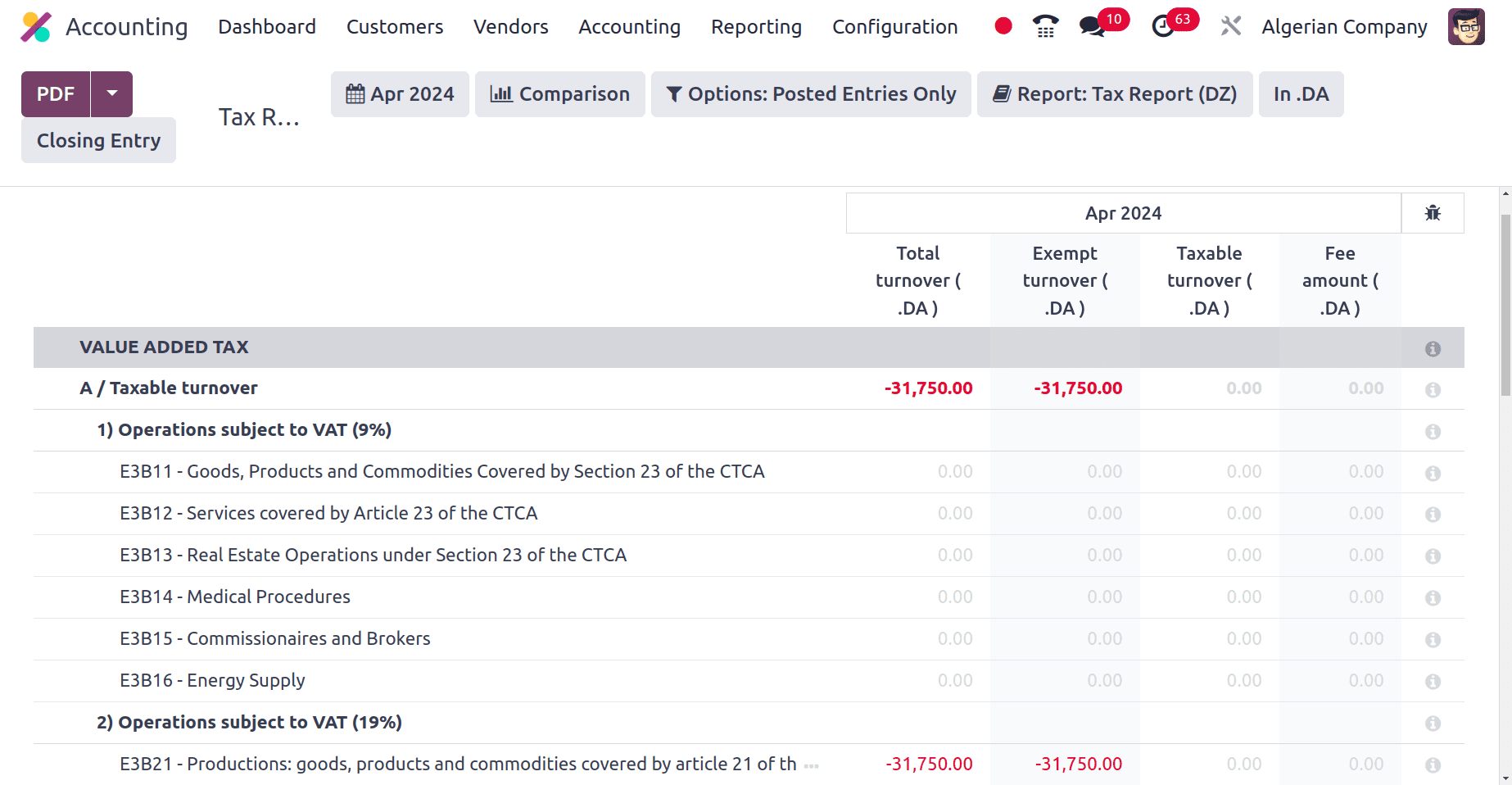

Now we can look at the Tax report of the company. There will be a Tax Report sub-menu under the reporting menu. When we go with the Tax Report, there will be Taxes used, with different names shown.

In the Tax Report, we can see that there are different types of taxes and tax amounts in that list. Taxable turnover, Operation subject to VAT, deduction to be made, total to be recalled, etc.

* Taxable turnover: which refers to the entire sum of money received from the sale of goods or services that are liable to taxes. In essence, it's the sales amount utilized to compute taxes such as VAT.

* Operation subject to VAT: The entire sum of money received from the sale of products or services that are liable to taxes. In essence, it's the sales amount utilized to compute taxes such as VAT.

* Deduction to be made: These are the costs that your company incurs and that the tax authorities permit you to deduct from your gross income. As a result, the amount of taxable income deducted from your taxes is decreased.

* Total to be recalled: Tax reports usually do not include "recalls," but rather concentrate on income and expenses that have an impact on your tax liability.

Here in the tax report, we can also see that, based on the tax grid that is provided in the tax, each and every tax report line is recorded.

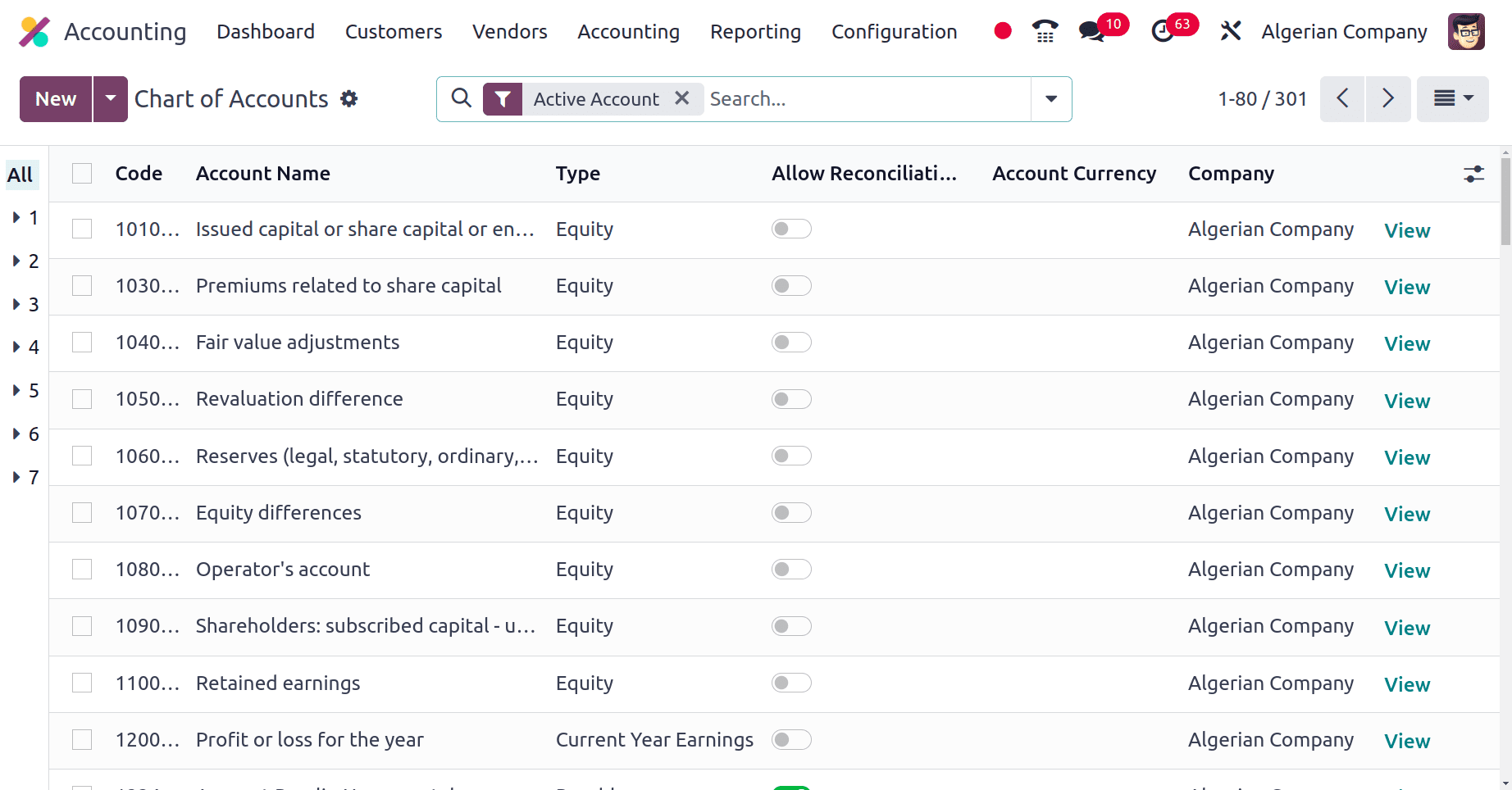

Then we can focus on the Charts of accounts used by all of the Algerian companies. There will be different types of accounts for which the different companies from different countries were used. Let us take a look at the Chart of Accounts of the Algerian company.

Here we can see that the names of the accounts are different from the Chart of Accounts of other companies from different countries. These are the accounts that are specially configured for the Algerian companies.

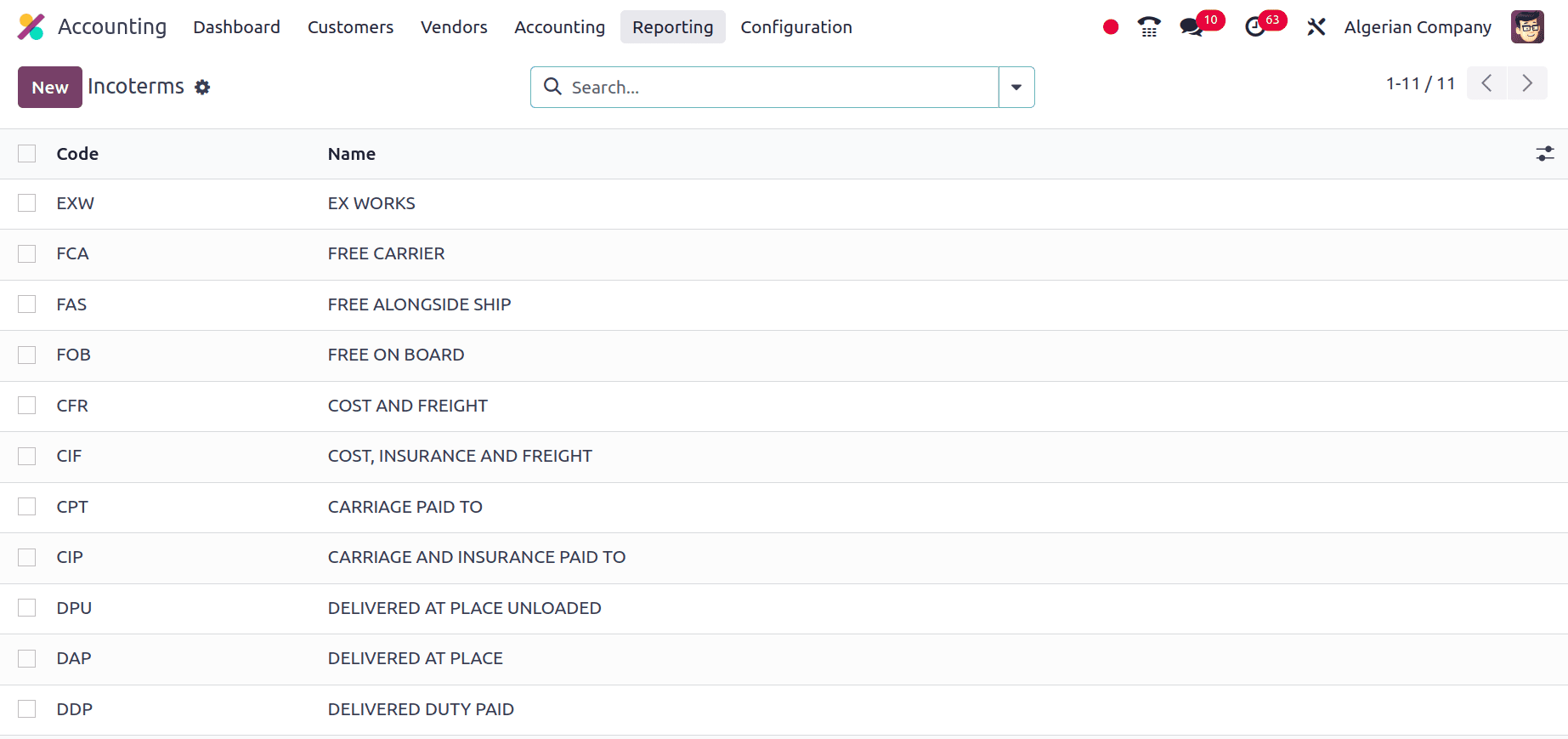

The next one is Incoterm. Incoterm is a uniform collection of guidelines that specify the obligations of both buyers and sellers in international trade transactions, published by the International Chamber of Commerce (ICC). We can find the Incoterm sub-menu under the Configuration menu. Click on the Incoterm and there we find the different Incoterms that are listed and the Algerian companies can use these Incoterms.

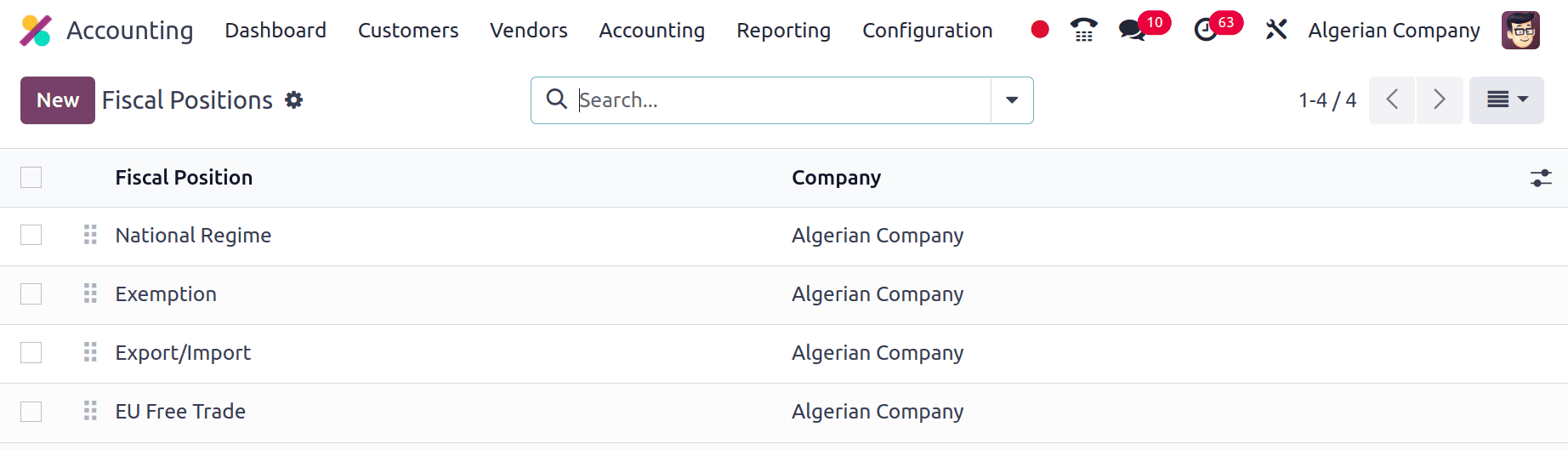

Under the Configuration menu we can see a Fiscal Position sub-menu, click on the Fiscal Position. The way taxes and accounting are applied to transactions is governed by the fiscal position. In essence, it assists you in adhering to the various accounting standards and tax laws that apply in various jurisdictions.

The above screenshot shows all of the Fiscal Positions configured for the Algerian companies. So Algerian companies can use these fiscal positions for their accounting operations.

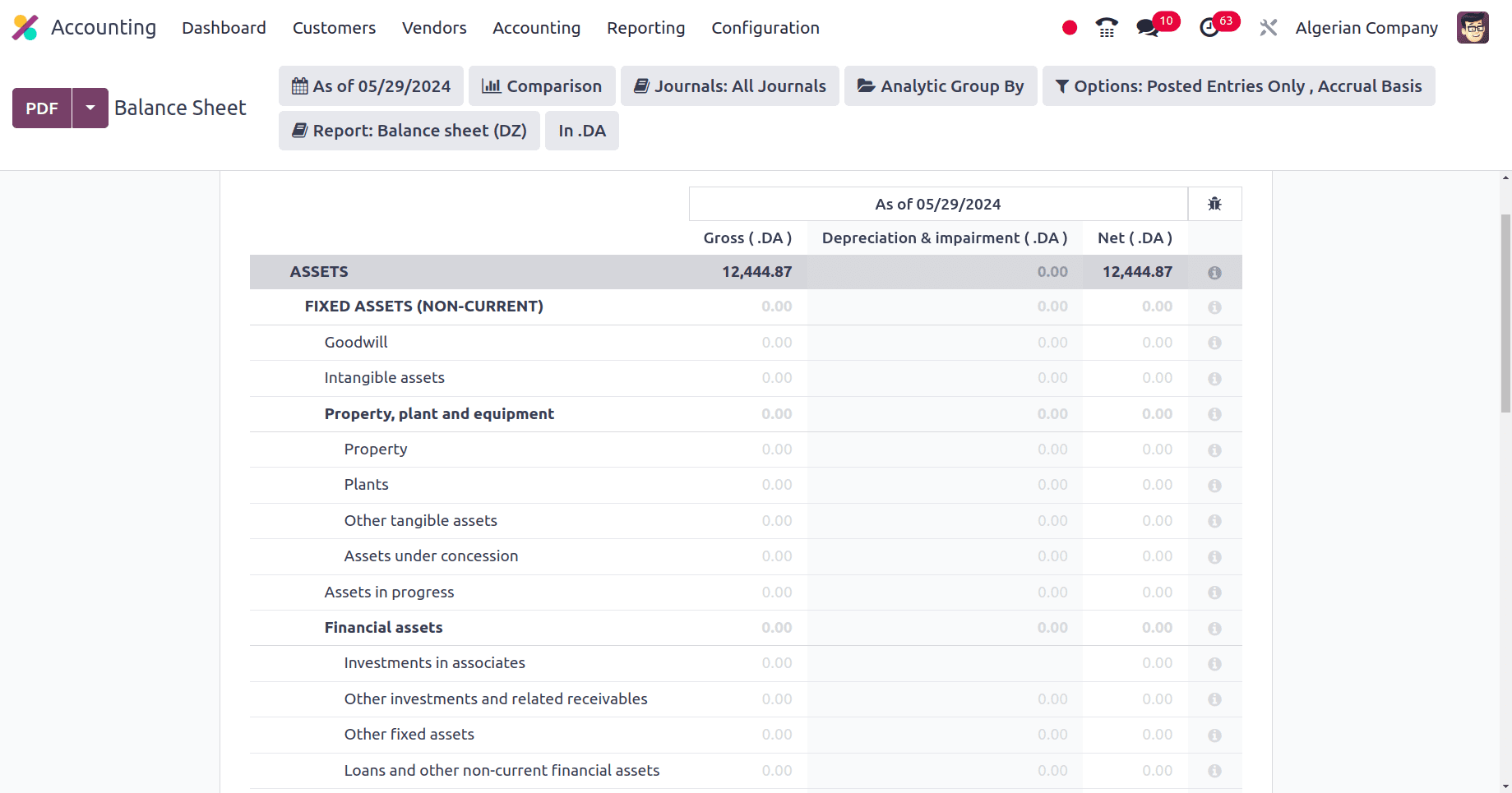

The major terms included in the Balance Sheet are Assets and liabilities. But for the Algerian companies, the Assets are again divided as, Goodwill, Intangible assets, Tangible assets Property, Plant and equipment assets, Financial assets, current assets, receivable and similar use, cash and cash equivalent, etc. The Balance sheets also include liabilities. Liabilities are again divided into Equity, Non-current liabilities, and current liabilities.

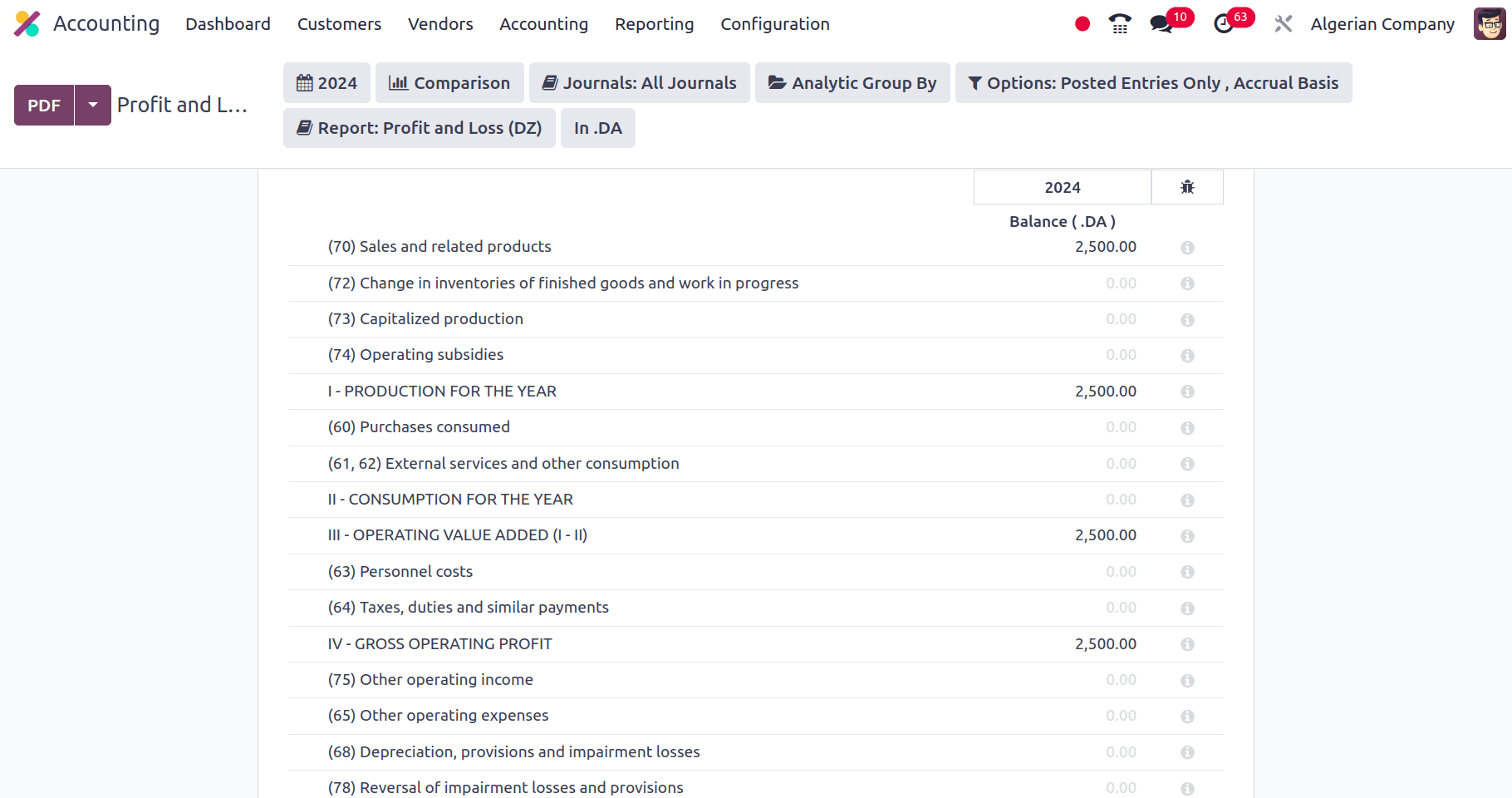

Then we can look at the profit and loss of the Algerian companies and all the profit and loss are considered using these lists of accounts. For representing different profits and losses different accounts are used.

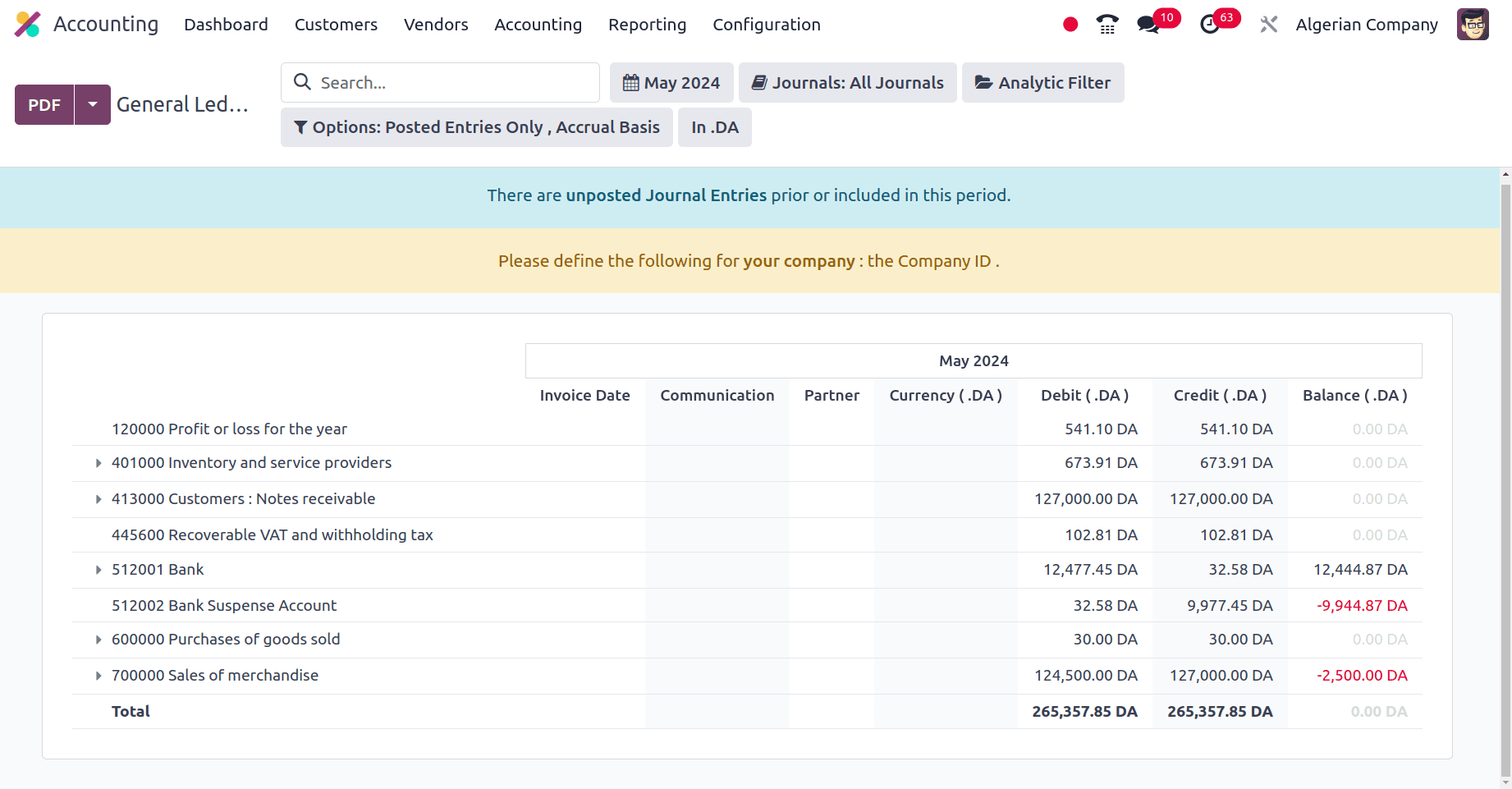

Now we can look at the General Ledger of the Algerian company by clicking the General Ledger sub-menu from the Reporting menu.

General Ledger acts as a central repository for all of your financial transactions, offering a thorough analysis of each financial activity that takes place within your business. Here the general ledgers that the businesses in Algeria can use are completely provided.

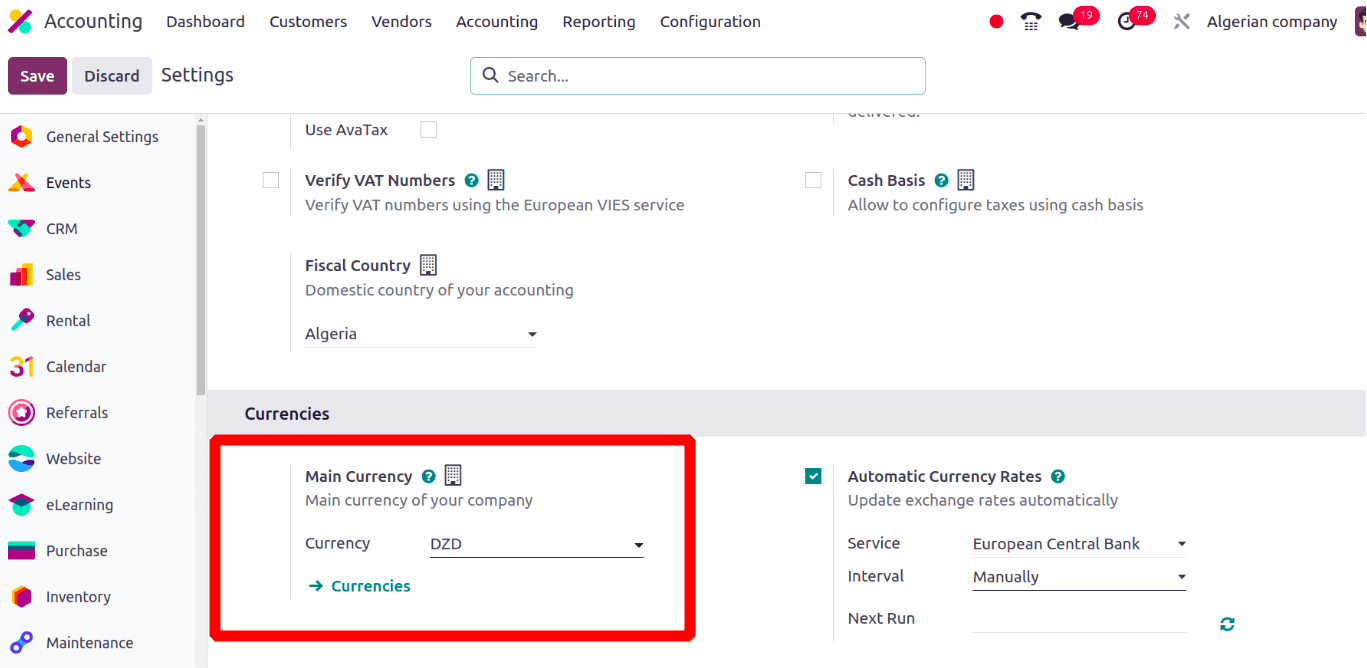

We know that the currency used in the country Algeria is the Algerian dinar which is abbreviated as DZD when we set the Algerian localization the main currency of the company should be the Algerian dinar.

When we reach the Currencies section in Configuration > Settings, we can see that Odoo 17 has configured the Algerian dinar (DZD) as its main currency.

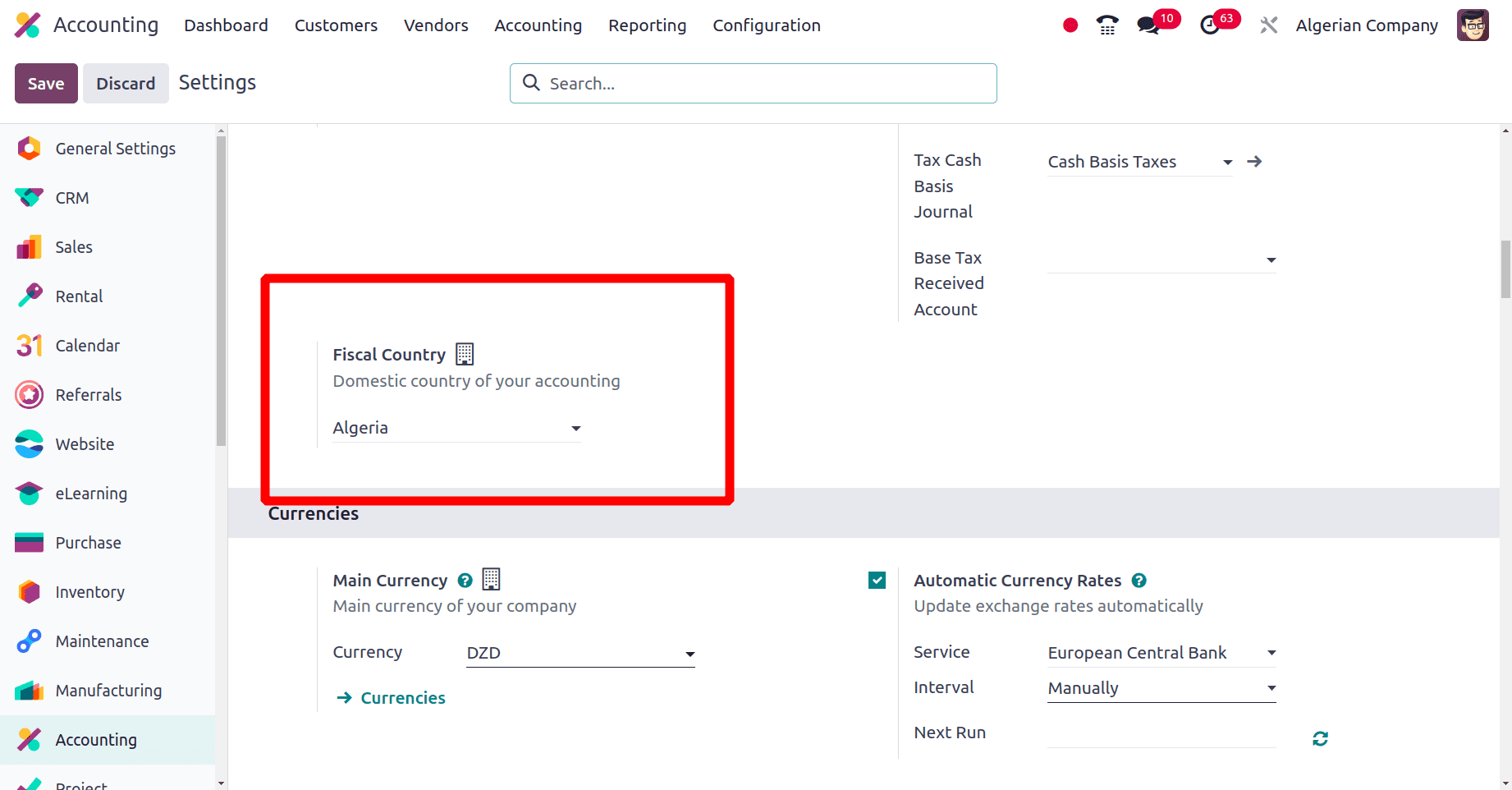

Here under the Taxes section, we found that the fiscal country is set as Algeria. The Fiscal country is configured by Odoo 17 automatically when we add the specific package. So in this case when we set the package as ‘Algeria’, Odoo 17 automatically set the fiscal country also as Algeria.

Odoo 17's localization feature for accounting procedures provides a comprehensive solution adapted to the unique requirements and laws of many locations. Businesses can improve reporting accuracy, increase compliance, and streamline financial operations with Odoo 17 by incorporating country-specific requirements. Businesses can comply with legal requirements, manage complicated tax systems, and have more insight into their financial performance through localization. Ultimately, Odoo 17's accounting localization enables businesses to function effectively in international marketplaces while guaranteeing conformance to regional financial rules, encouraging expansion and durability.

To read more about An Overview of Accounting Localization for Australia in Odoo 17, refer to our blog An Overview of Accounting Localization for Australia in Odoo 17.