What is Accounting localization?

Accounting localization is the process of modifying accounting software to meet the unique needs of a specific country. The laws and norms governing accounting differ greatly from country to country. Localization guarantees that your accounting program complies with these regional specifications. Accounting localization helps to obey local accounting and tax laws to prevent errors and fines, reduces manual labor and the possibility of errors by using pre-defined accounts and automating tax computations, and simplifies accounting procedures with features made to meet the unique needs of a nation.

In this blog, we can familiarize ourselves with the Accounting localization and the changes formed when we set localization for Chile.

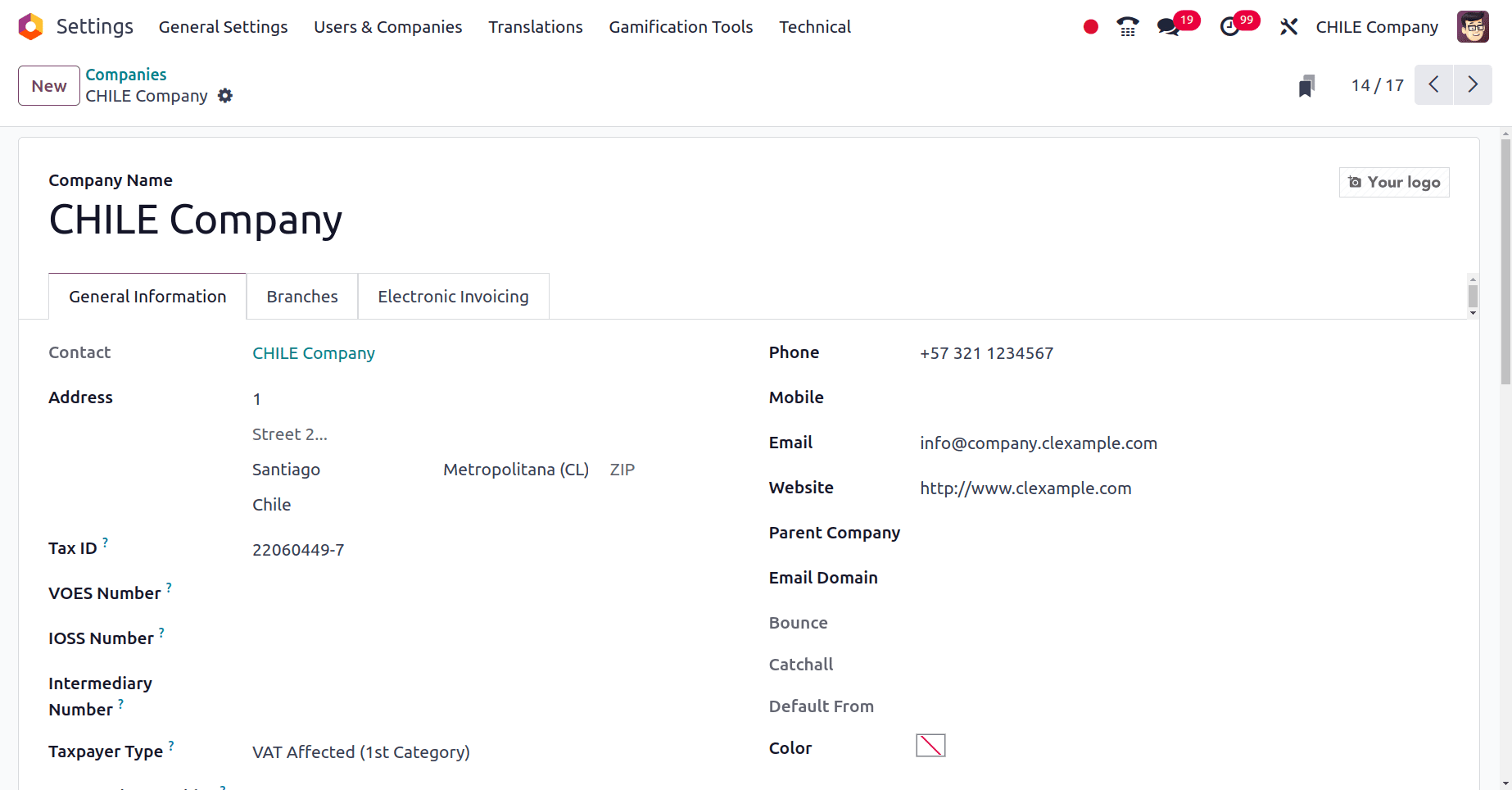

Before digging up the localization as Chile, we need to configure a new company from Chile. So go to the General settings of the Odoo application. Under the ‘Users & Companies’ menu, click the Companies sub-menu. At that time you will get a list of companies and you can create new companies from the same window by clicking the ‘New’ button.

Give the company address, country of the company, and all other details of the company like VOES Number, IOSS Number, Intermediary Number, Taxpayer Type, DTE Service Provider, LEI, etc.

* VOES Number: VOES Number is used by companies that are outside the European Union, and they want to make use of the Operation Support System (OSS).

* IOSS Number: The EU put in place this approach to make it easier for online retailers selling goods to EU customers for less than €150 to collect VAT. Businesses operating in the EU or those registered with IOSS are able to collect VAT at the point of sale rather than in the country of destination, which expedites the procedure.

* Intermediary Number: Utilized by businesses outside of the European Union who import goods into the EU through an intermediary in order to pay OSS tax.

* Taxpayer type: There are mainly four types of taxpayers in Chile, VAT-affected taxpayers, Fees receipt issuers, which are applied to the supplier who issues fee receipts, the End consumers, and foreigners.

* DTE Service Provider: In the context of Chilean accounting, DTE (Documento Tributario Electrónico) service providers are a collection of businesses that provide DTE (Electronic Document Certification) services. These DTE documents are necessary for a number of Chilean accounting and tax procedures.

* LIE: Legal Entity identifier, which uniquely identifies the entities worldwide and is used to improve transparency in financial transactions.

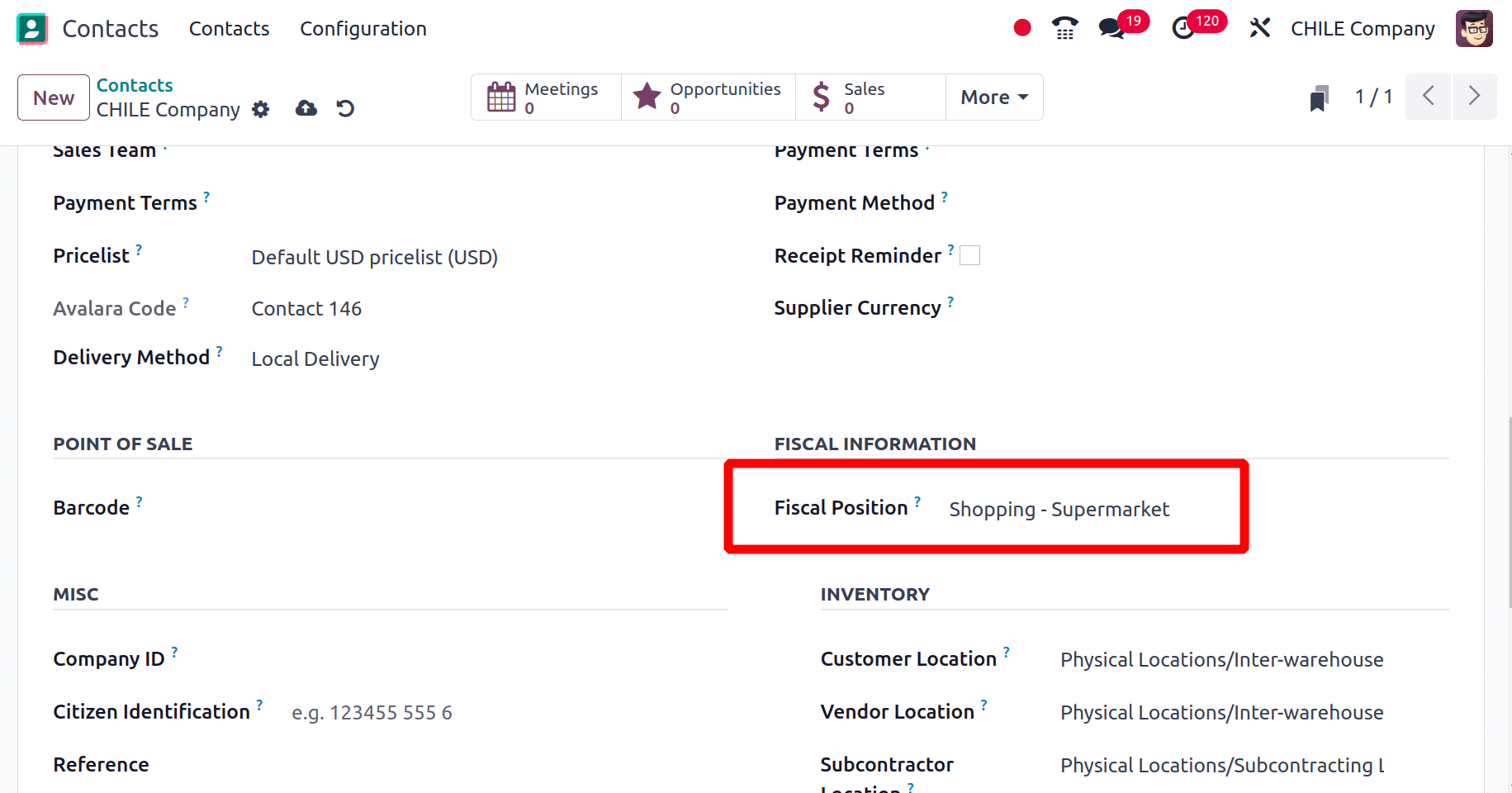

When a company has been created extra details can added from the contact application also. In the sales and purchase tab of the accounting application, you can provide the Fiscal position of the company.

There is one more extra tab, Electronic Invoicing, and there you can provide the DTE email which is the email ID used to send and receive the Electronic invoice. A delivery guide price field is also available there and it is used to select the price of the product which is to be shown in the delivery guide if any.

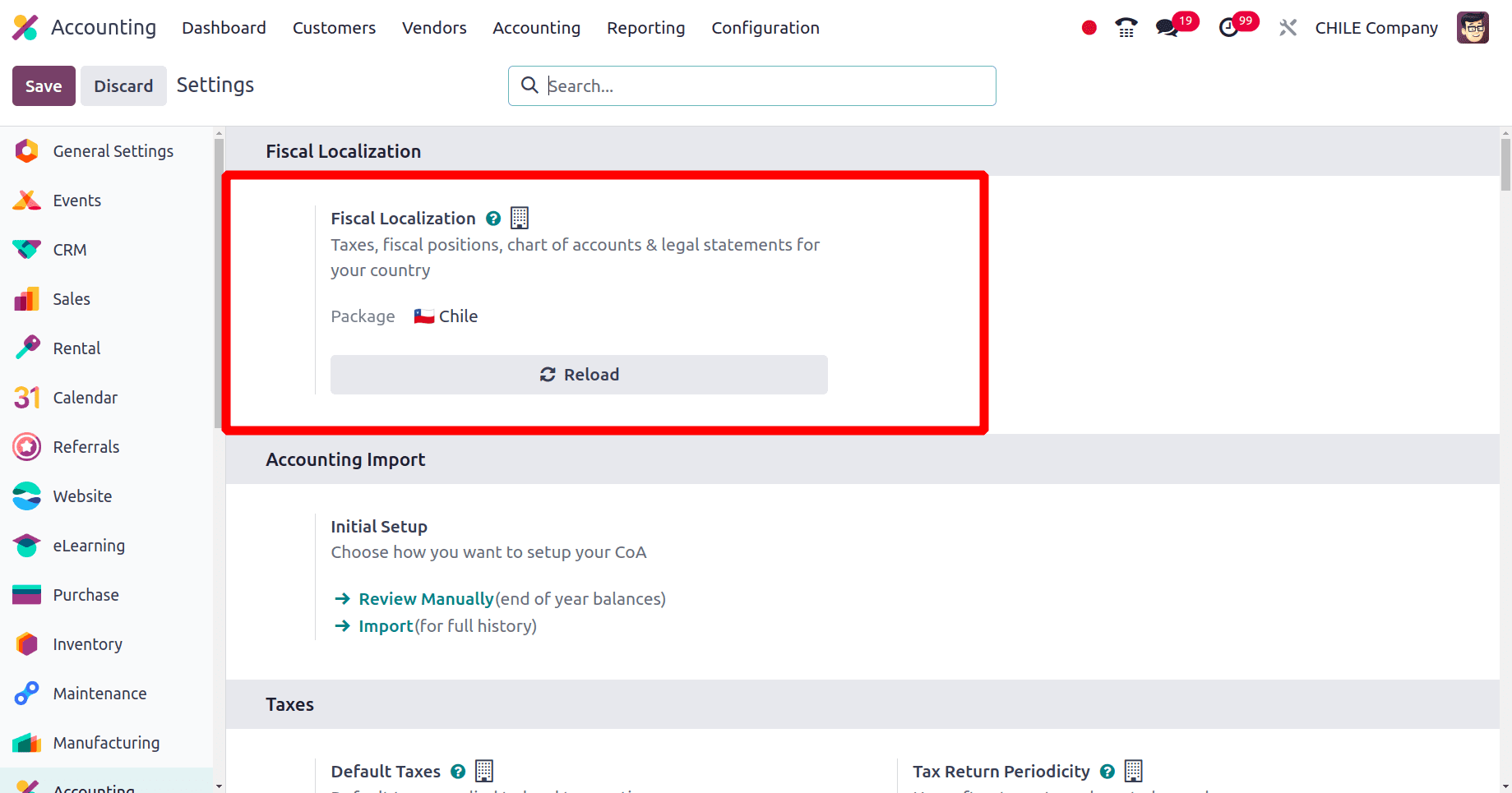

Then after the details have been successfully added to the database, go to the accounting application. You can configure a package for the country localization from the configuration > settings. Go to the configuration settings of the accounting application. Under the Fiscal Localization section, provide the package for the company as Chile.

Changes that occur when accounting localization for Chile is configured in Odoo 17

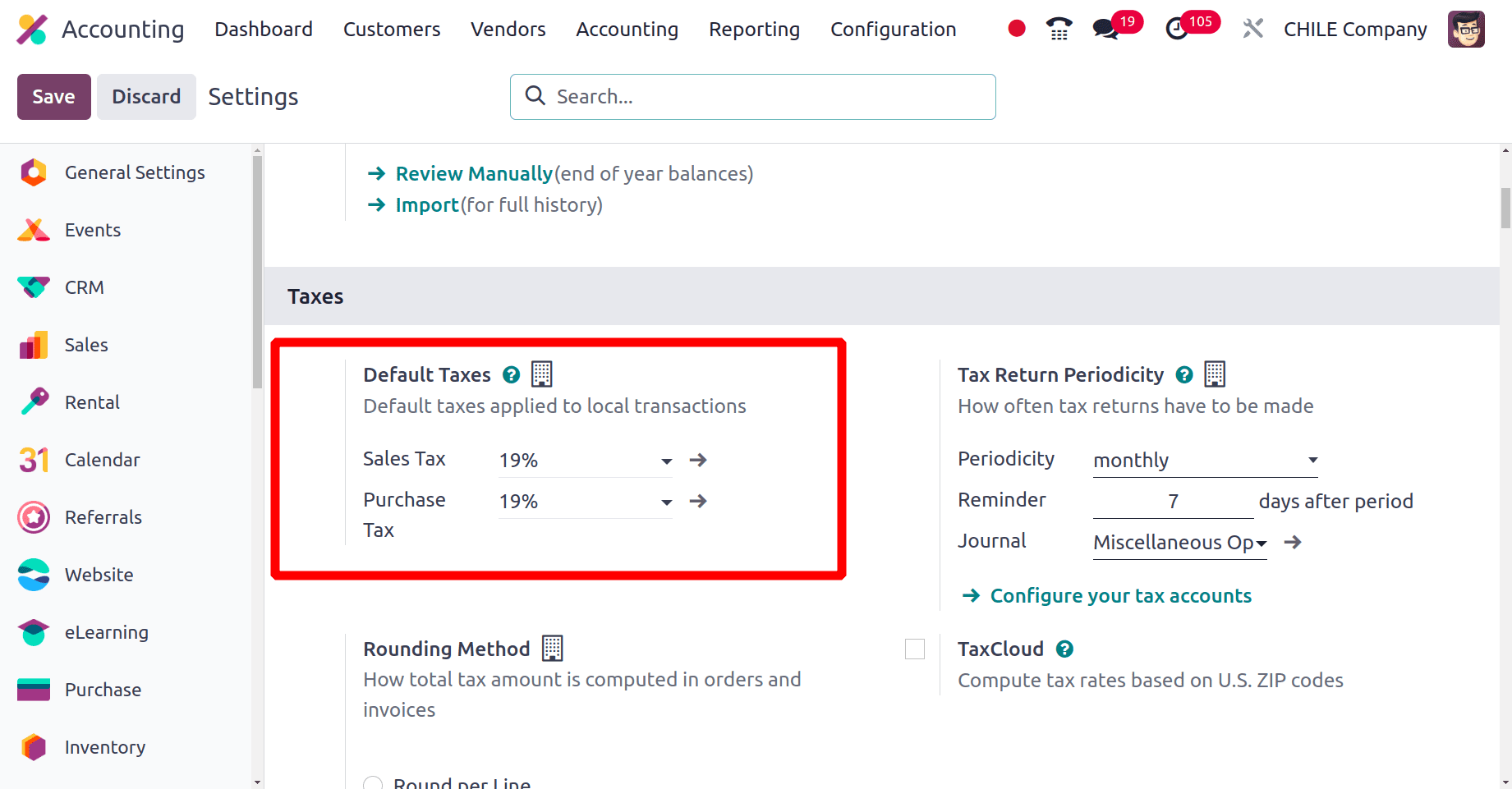

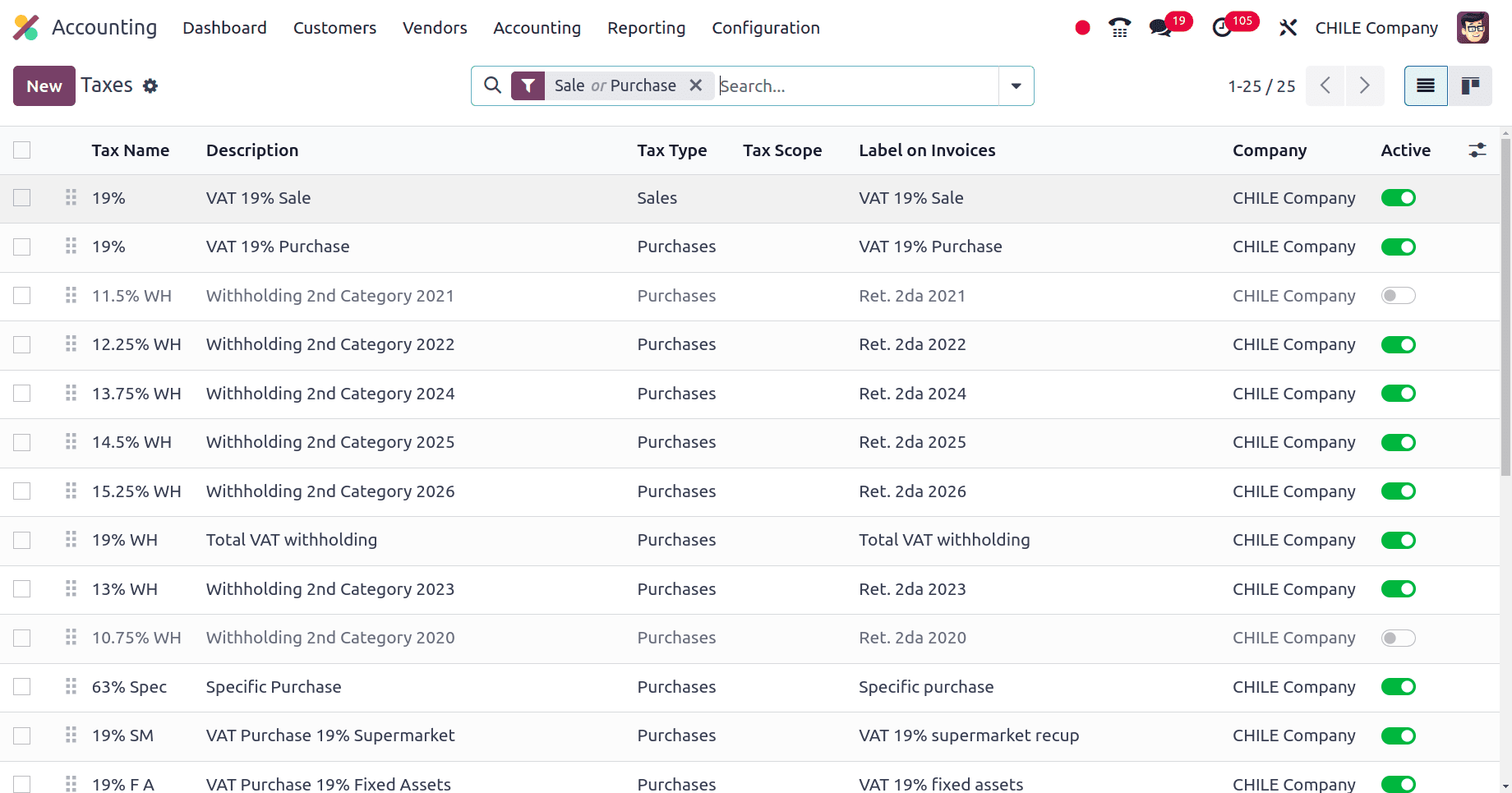

Then, when the package has been configured, the default tax for this company has been automatically added and is visible in the Configuration > settings under the Taxes section.

There you can see that the default tax for this company is configured by Odoo itself. 19% is the Default sales and purchase tax used by the companies in Chile.

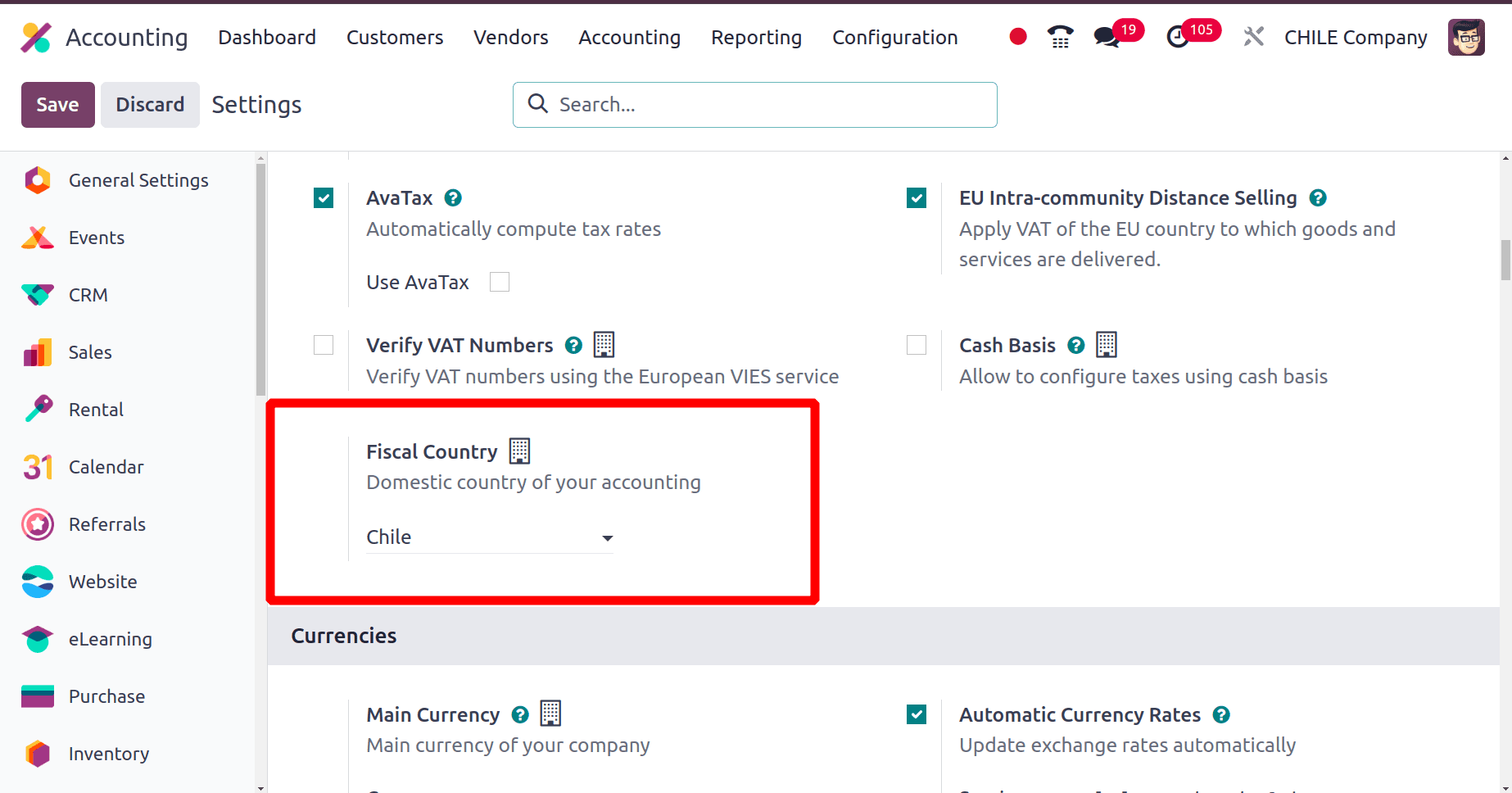

Under the Taxes section, there is a field called Fiscal Country. So if the package is set as Chile, Odoo also sets the Fiscal country as Chile.

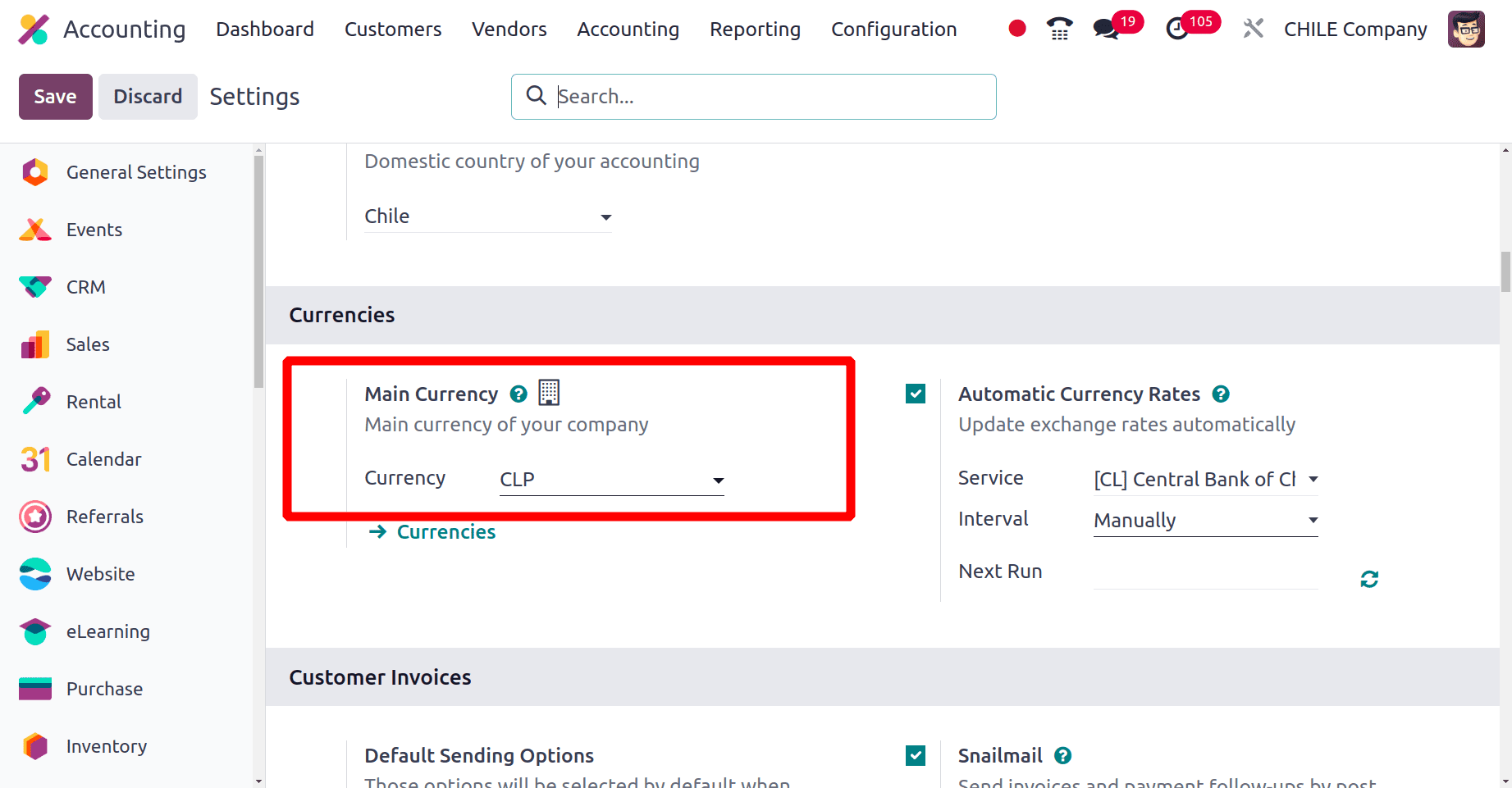

In addition, Odoo set the main currency for the company in accordance with the country of the company. The currency in Chile is the Chilean peso (CLP), so Odoo automatically configures the main currency as the Chilean peso (CLP) and it can be found under the Currencies section after the package for the company has been configured.

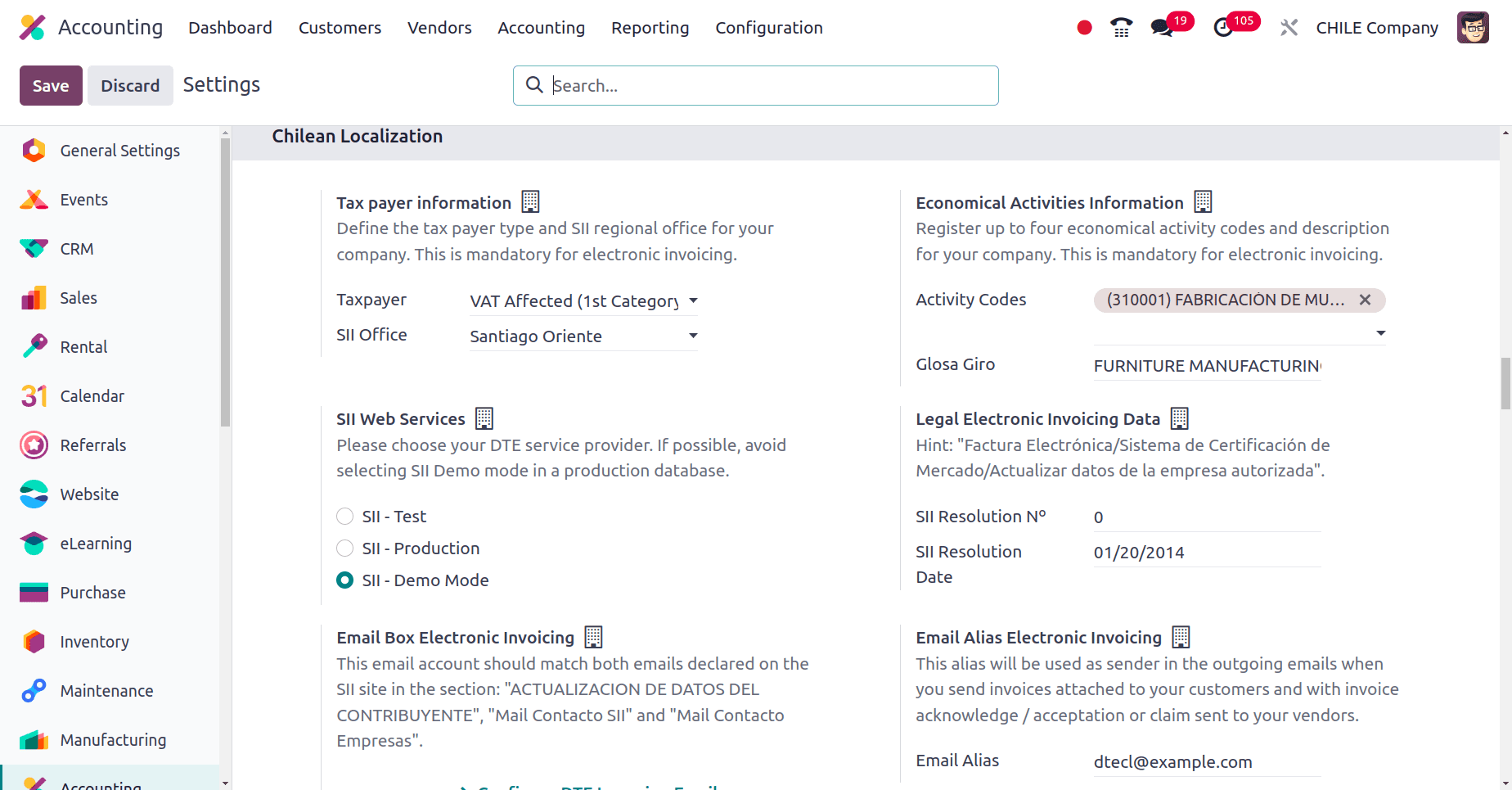

An extra section has been added to the Configuration > settings when the Chilian package is configured, which is Chilian Localization.

Here, under the Tax Payer information, you can provide the Tax Payer type and the SII Regional office for your company. The SII regional officer is the person, who works for the Chilean Internal Revenue Service as a tax accounting specialist. SII officer is essential to maintain your Odoo system's compliance with Chilean tax laws. The SII officer is required to have a comprehensive awareness of Chilean tax laws, rules, and the standards for electronic invoicing set forth by the SII. This includes keeping abreast of any modifications or additions to these rules.

The Internal Revenue Service of Chile offers the SII web service. In Chilean accounting, it is an essential instrument for electronic invoicing. It serves as a link between the SII and your accounting program. You can select the SII web service that you need from the list.

DTE incoming mail in Chilian localization is the system or email account that is specifically used to receive electronic invoicing (DTEs) from suppliers or other companies that you do business with. Under the field Email Box Electronic Invoicing, you can configure the DTE Incoming Email.

The signature certificate describes an electronic certificate that is used to sign digital tax papers, particularly the Electronic Invoices (DTEs) that the Internal Revenue Service of Chile requires (SII)

Accounting software uses the proportional factor as a tool to allocate costs or other sums proportionately over the course of the fiscal year. You can set the proportional factor under the Proportional Factor for the fiscal year field.

Financial Activities Information in Chilean accounting most likely refers to the information you set up to define your organization's business operations in Chile. For accurate tax filing and conformity with the Chilean Internal Revenue Service (SII), this information is essential. Under the Legal Electronic Invoicing Data, you can provide the SII resolution information.

Under the Email Alias Electronic Invoicing field, provide the email ID used to send the electronic invoice. PPM for the fiscal year denotes a configuration that establishes the projected month within the fiscal year that a supplier invoice is expected to be paid. The value for PMM can be provided under the field, PPM for the fiscal year.

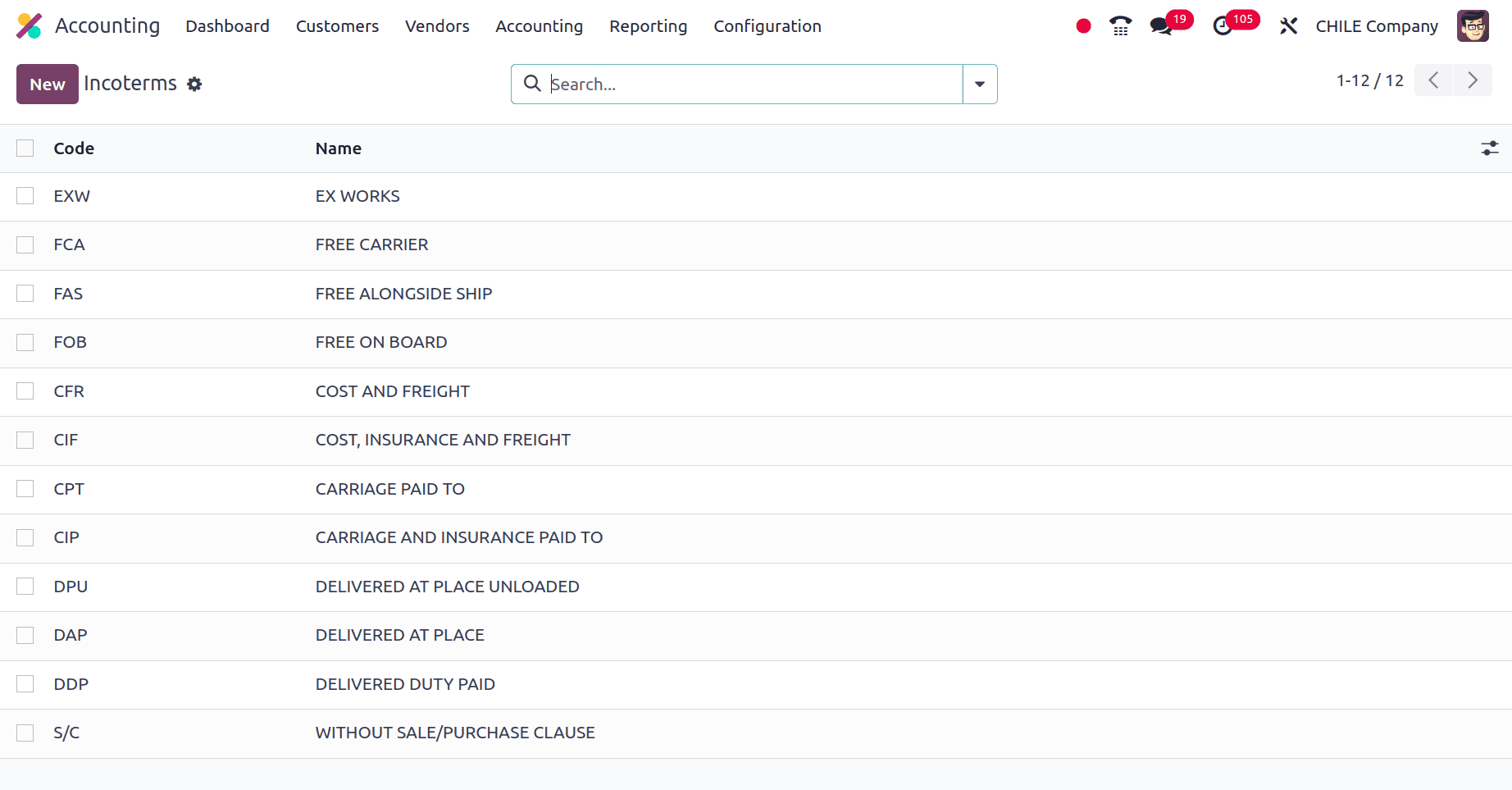

Look at the incoterm of the company by clicking the incoterm sub-menu under the configuration menu. There, you get the whole list of Incoterms that this company can use.

International Commercial Terms is what Incoterms stands for. These are a set of globally accepted standards that specify the obligations of buyers and sellers in cross-border commercial transactions, and they were released by the International Chamber of Commerce (ICC). The Chilean company can use those incoterms, which are seen in the screenshot above.

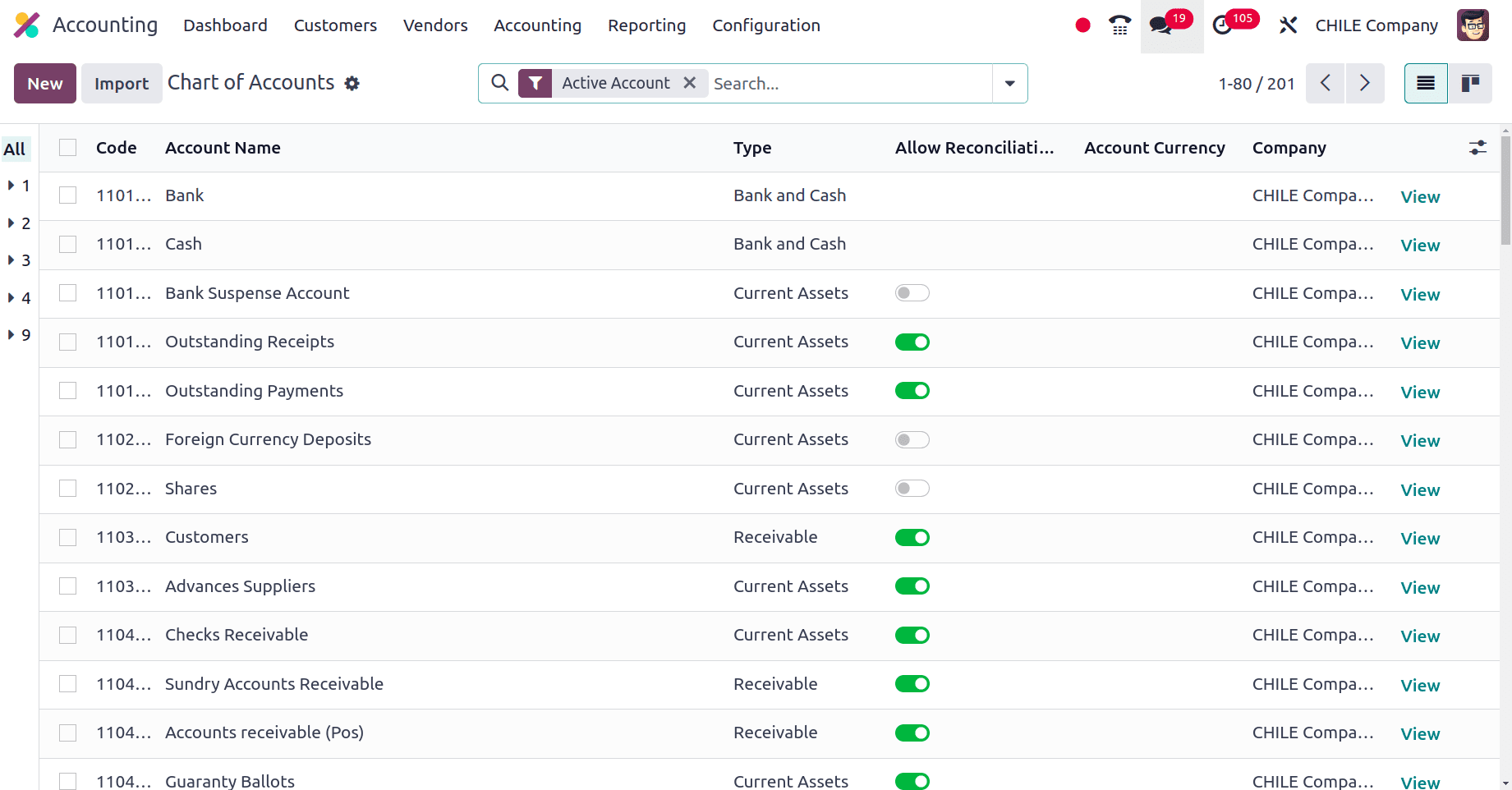

The next is the Chart of Accounts for the Chilean company. Chart of Accounts is a key component of the accounting module. It serves as a list that arranges all of the bank accounts that you use to keep track of your business dealings, It is essentially a detailed account of your income and expenses, showing where your money is coming from and going.

The names of the accounts along with their codes are listed and the Chilean company can use the accounts in the list for the different purposes of the different business activities.

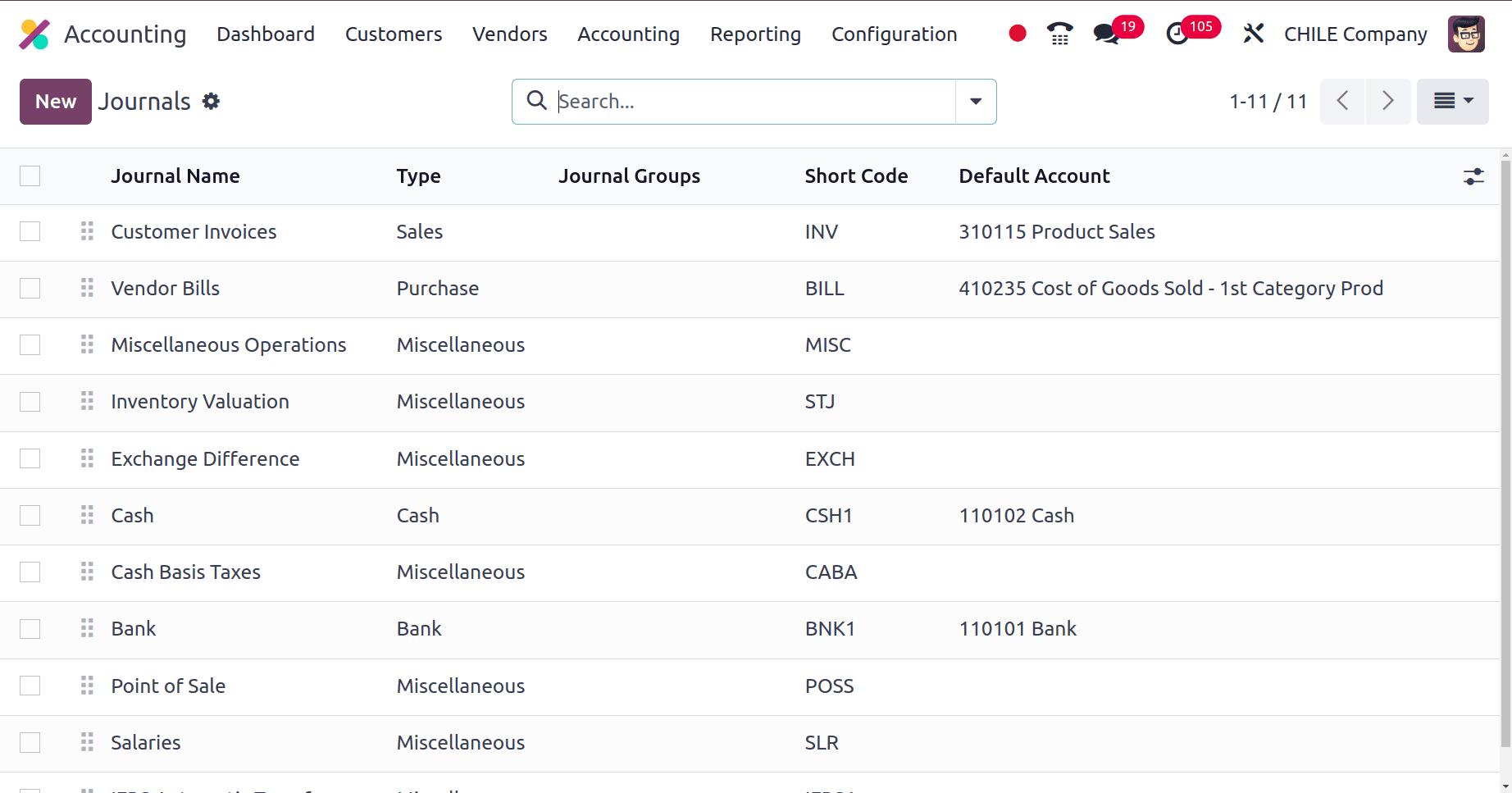

There is a ‘Journals’ sub-menu under the ‘Configuration’ menu of the Accounting application. On clicking on the Journals, there is a list of journals for which the Chilian company can use.

In the journal list, you can see that different journals which are used for different purposes.

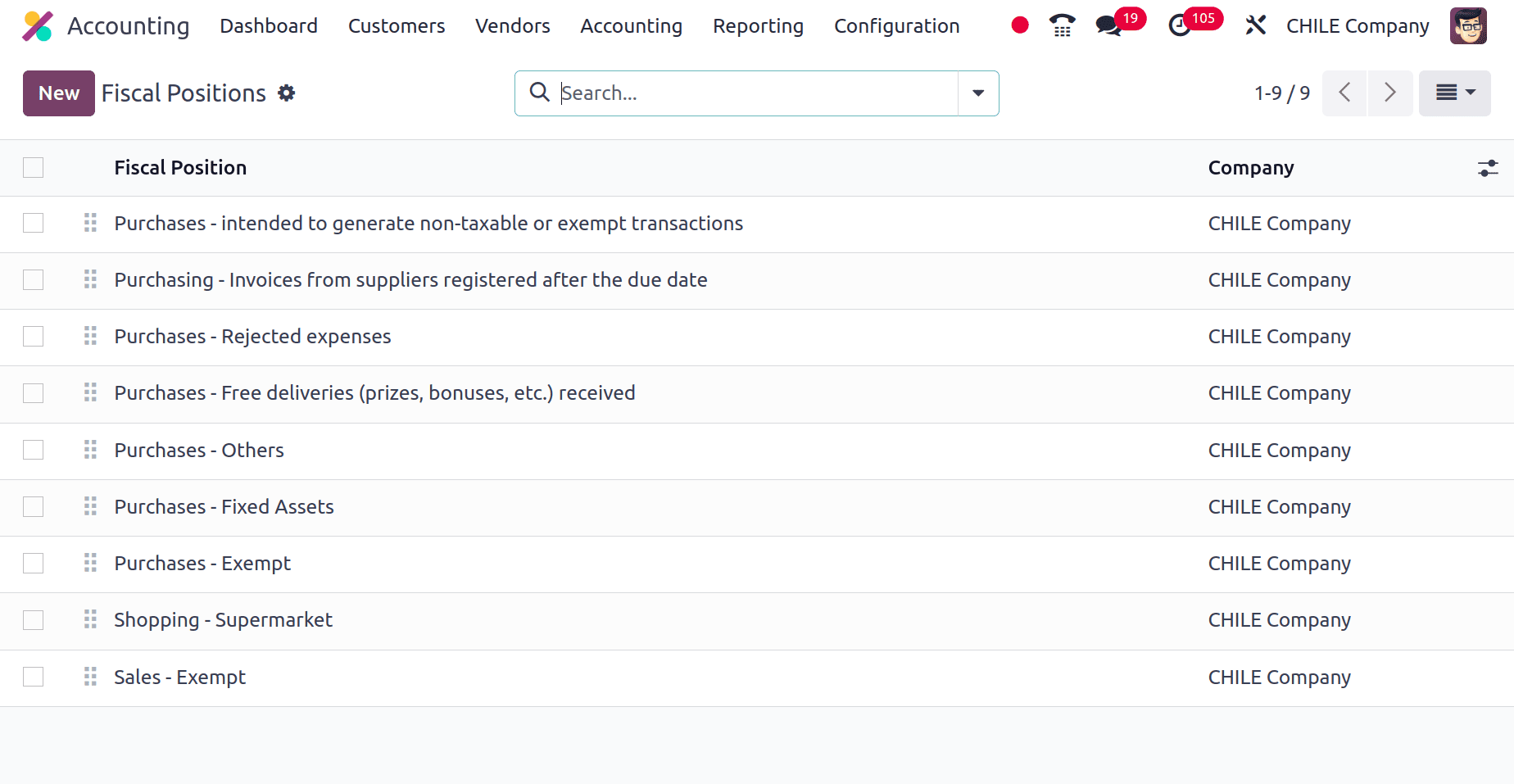

The fiscal position serves as a set of guidelines that specify how accounts and taxes are applied to particular activities. Click the ‘Fiscal Position’ sub-menu under the ‘Configuration’ menu. In essence, it lets you handle account mapping and tax consequences according to several parameters like product category, business type, and client location. The screenshot below shows the different positions that a Chilean company can use for their business needs.

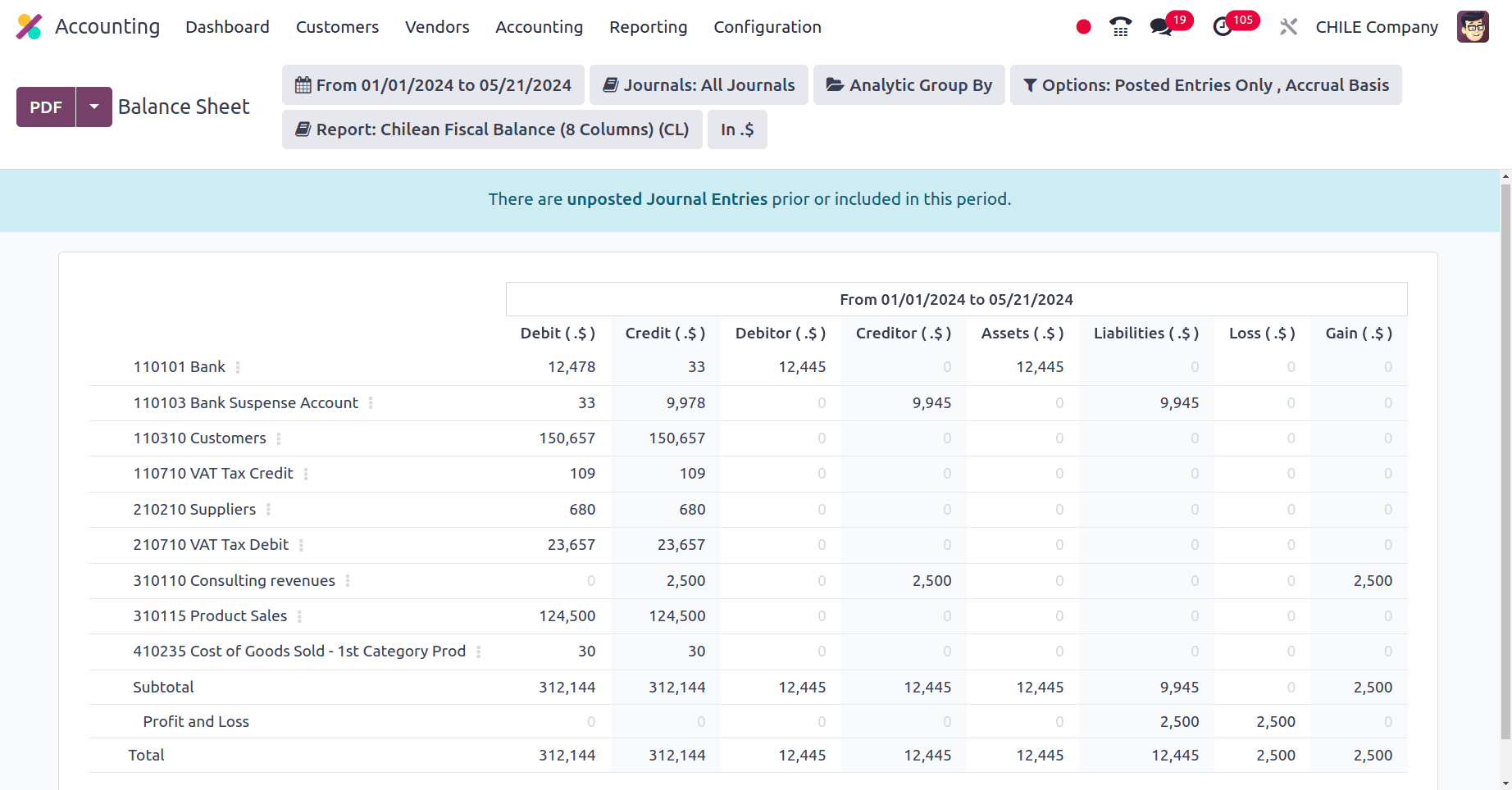

The Balance sheet in Odoo 17 is a type of financial report that you may create to see a quick overview of the financial situation of your business on a given date. It provides information about what your company owns (assets), owes (liabilities), and has as net value (equity) by summarising your assets, liabilities, and equity. Go to the ‘Balance Sheet’ sub-menu under the ‘Configuration’ menu.

The balance sheet of a company from Chile can include a Bank, Bank suspense account, VAT, VAT Tax Credit, Consulting revenues, etc

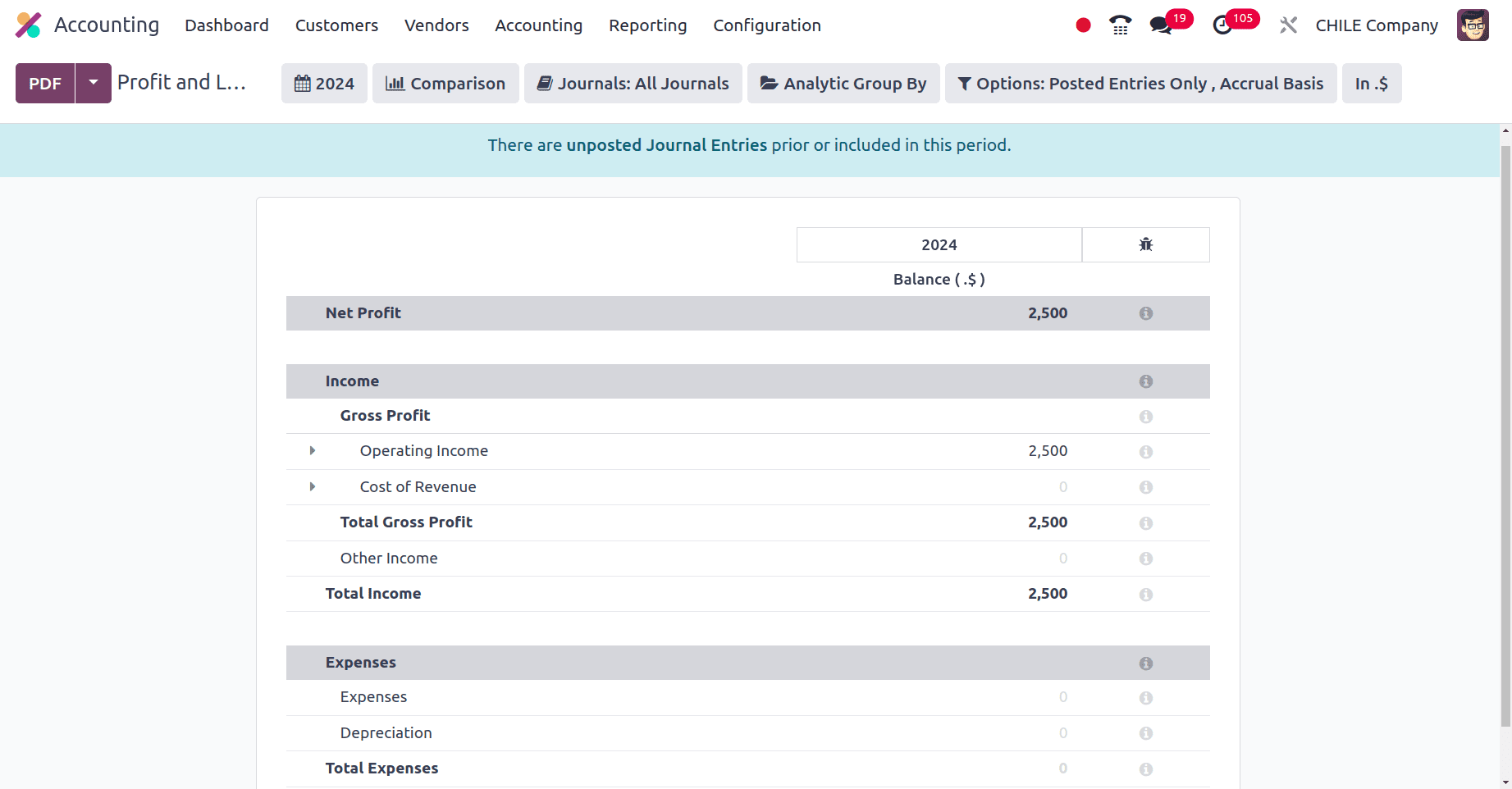

The next is the Profit and Loss report. Income, Expenses, and Net Profit are listed in the profit and loss report of the Chilean company.

Operating income, cost of revenue, other income, etc are included as income, and the Expense, Depreciation, etc are included as the Expenses of the company.

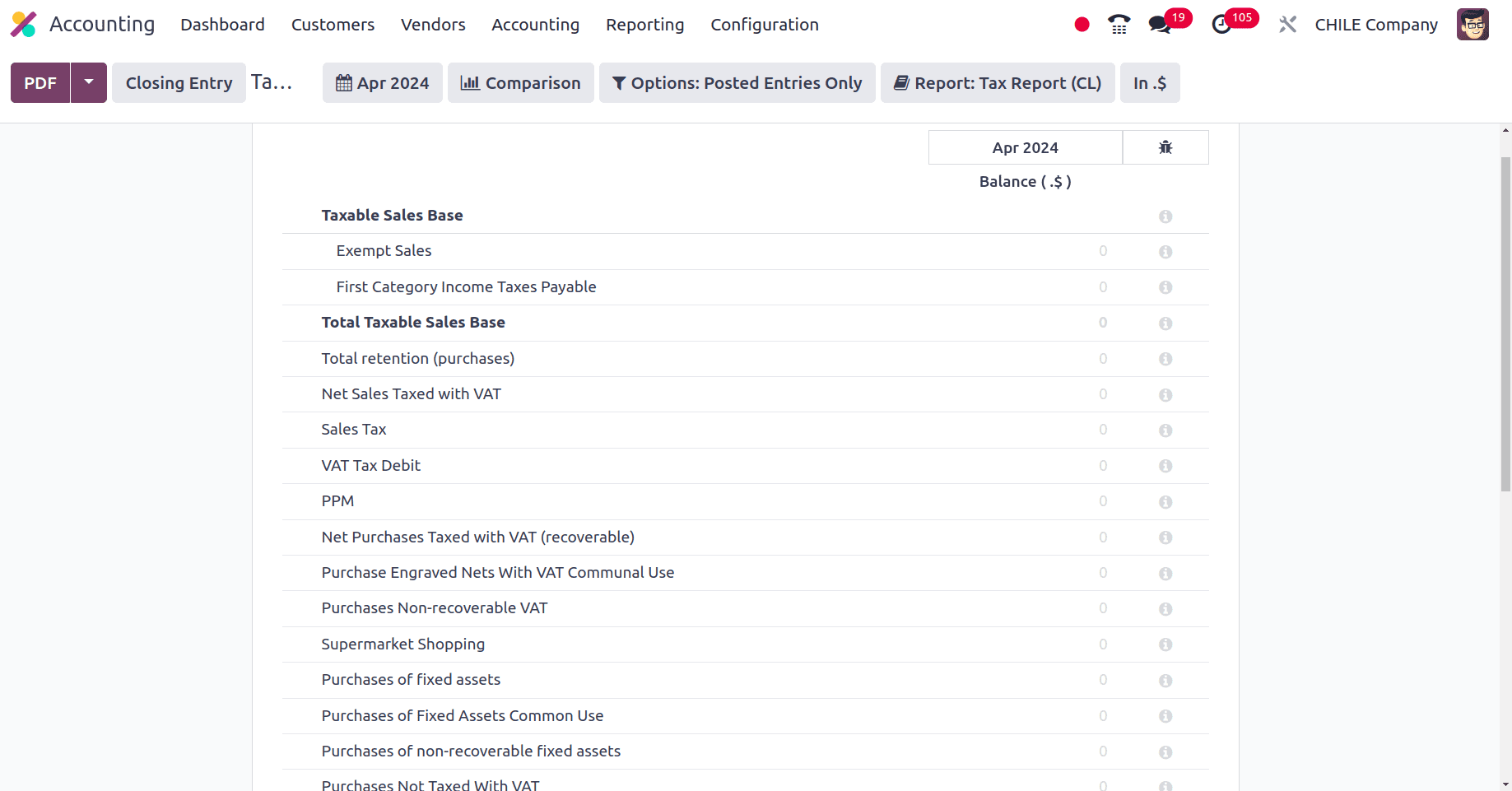

Next, move to this company's tax report. Different entries are added to the tax report.

* Exempt sales: This is used to describe transactions that are not subject to the Impuesto al Valour Agregado (IVA), often known as Chilean Value Added Tax (VAT).

* First category income tax payable: This is the estimated income tax that your business must pay to the Chilean Internal Revenue Service (SII) for the period that was reported, depending on your taxable income.

* Total retention (purchases): This is the total of all of these sums that have been deducted from your supplier bills for a given tax period (month, quarter, or year).

* ILA Withholding Base (sales): This describes the entire sales amount taken into account when determining how much ILA should be withheld.

These are some of the data that are used to represent the tax reports of the companies from Chile.

The Odoo Chilean localization highlights a number of distinct aspects. It includes all the amenities and features required to carry out and conduct business in Chile. In this blog, we have discussed localization for a Chilean corporation so that it may perform its accounting operations without any problems.

To read more about An Overview of Accounting Localization for Colombia in Odoo 17, refer to our blog An Overview of Accounting Localization for Colombia in Odoo 17