The accounting localization feature of Odoo guarantees compliance with national and international tax laws and accounting standards. This lowers the possibility of fines or legal problems for firms by assisting them in adhering to local financial regulations. Odoo guarantees correct financial reporting by taking into account nation-specific regulations. More accurate financial accounts and analyses are the outcome of this. Features like localized charts of accounts, tax structures, and reporting formats are included. Accounting procedures are streamlined through localization, which automates regionally relevant operations. Accounting teams may now concentrate on more strategically oriented tasks as a result of the decrease in manual intervention, reduction of errors, and time savings.

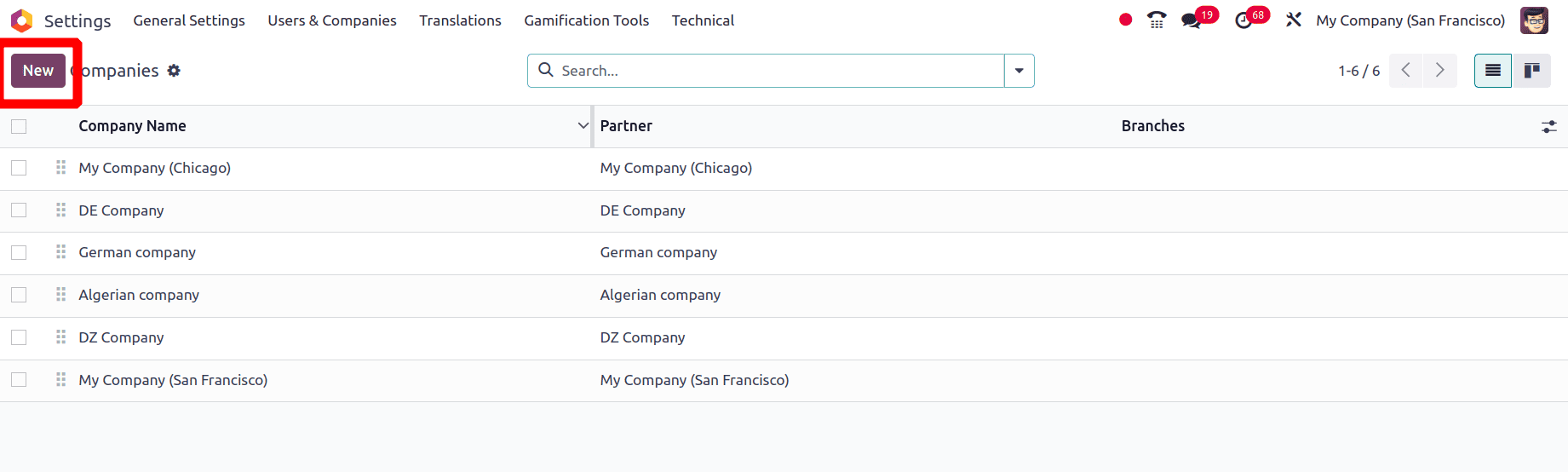

First, we want to set up a Brazilian company. So that goes to the general settings of Odoo and clicks on the Users & Companies menu. Here, we want to create a new company, so click on the company's sub-menu. There we can see all the companies that are pre-created and a New button. To create a new company, click the New button.

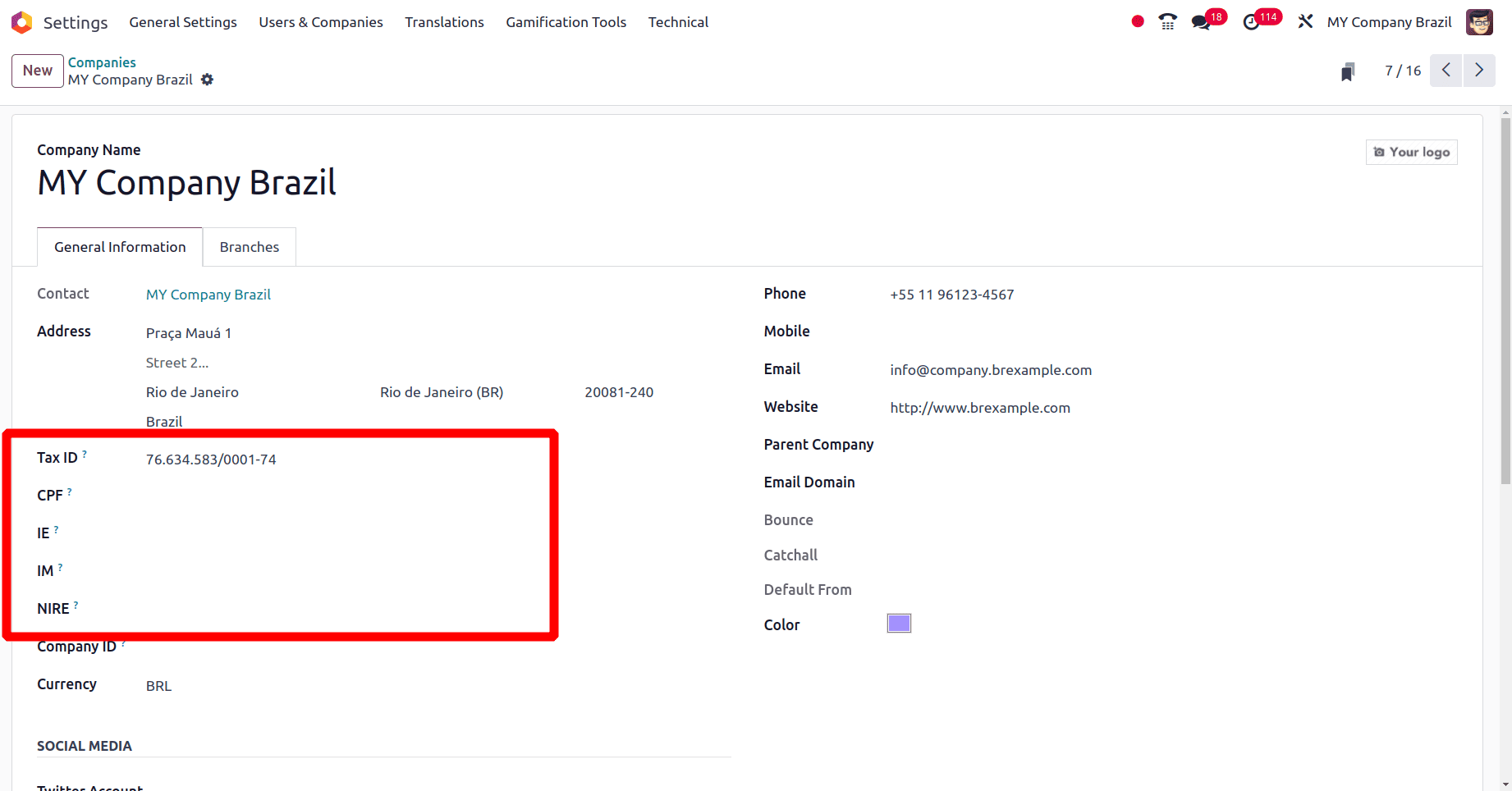

On clicking the New button there is a Form view for providing the whole details. Give the details for the creating company, like country, name of the company, address of the company, etc, and save the data by clicking the save icon.

In the form to fill out the company details, there will be a few extra fields to fill in, CPF, IE, IM, NIRE, etc

* CPF: Which is Cadastro de Pessoa Física which translates to Individual Taxpayer Registry in English. It's a unique identification number assigned to every Brazilian citizen and resident

* IE: Refer to Inscrição Estadual. This is a state-level tax identification number required for Brazilian companies involved in the trade, industry, or interstate/inter-municipal transport sectors.

* IM: Municipal tax identification number

* NIRE: State commercial identification number

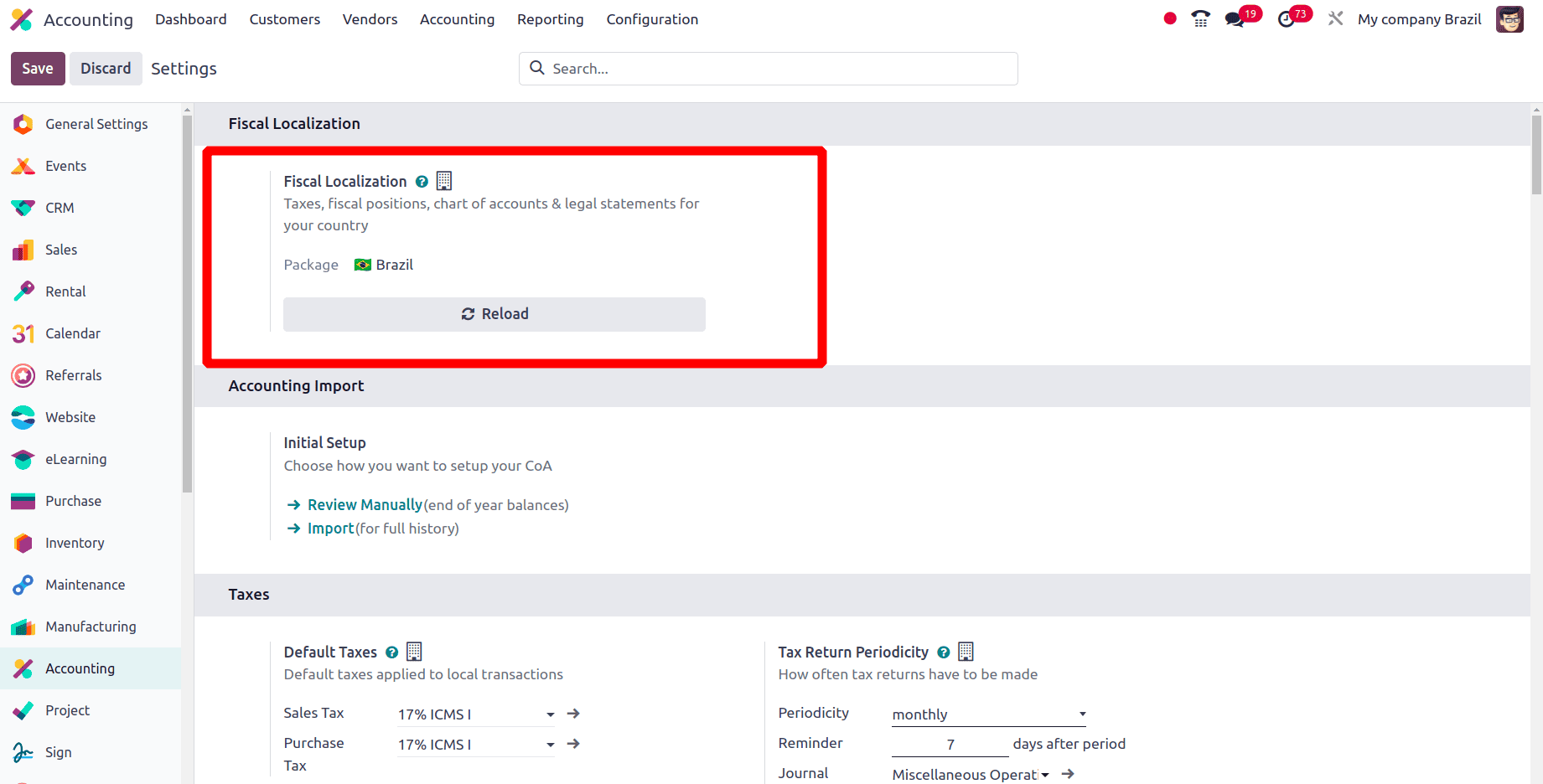

The next step is that we want to set up the localization for the Brazilian company. To set the localization for this company, go to Odoo's accounting application. move to the configuration settings.

Under the Fiscal localization section, we have the option to choose the package for the company. As the company that we created is a Brazilian company, select the package as Brazil and save the changes by clicking the save button in the configuration settings.

Changes happened when Brazilian localization was set up

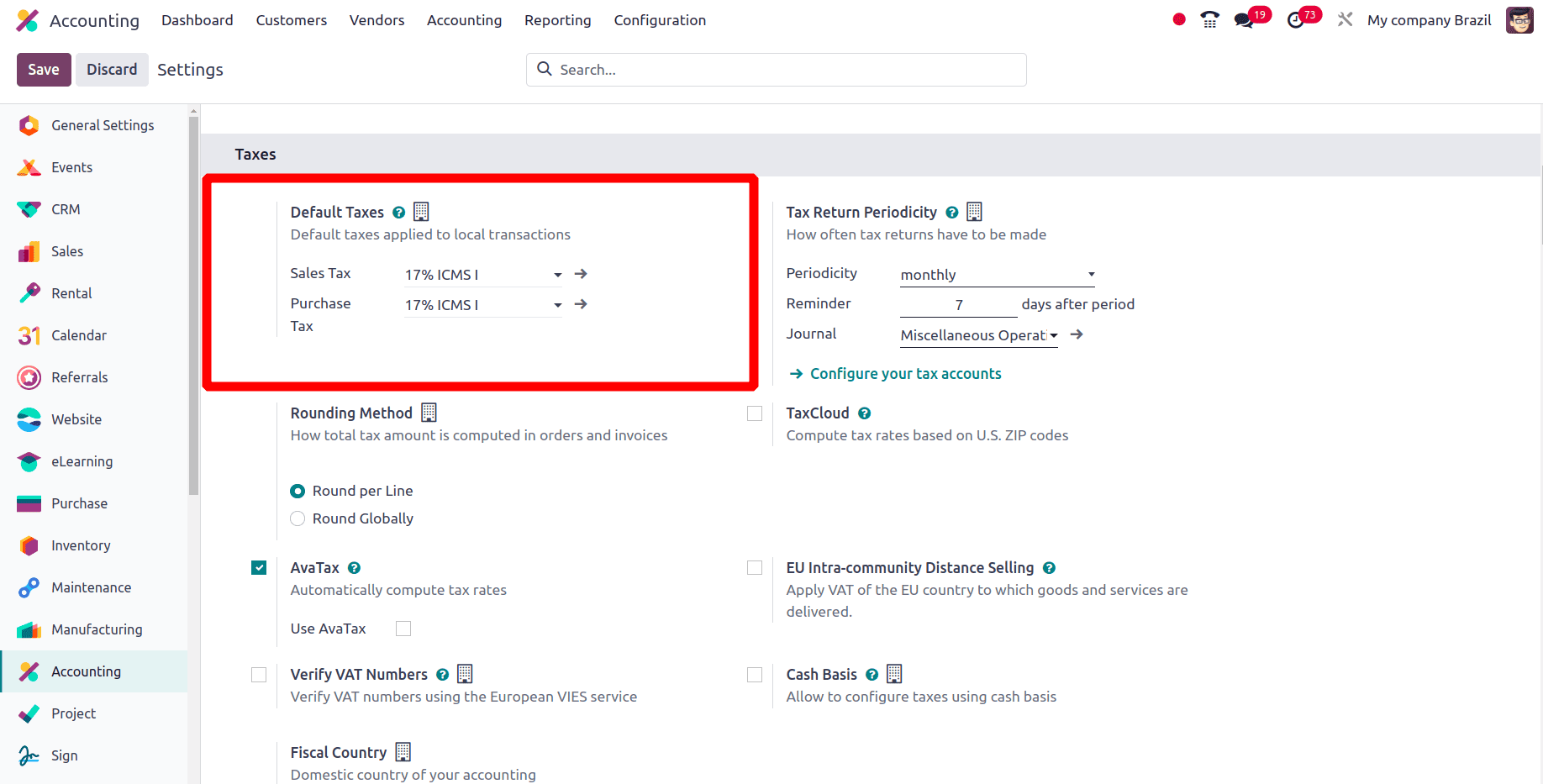

There will be lots of visible changes when we set up a country localization for a company. The Default Taxes are visible in the Taxes section of the accounting application's Configuration settings. The tax rate that is applied to every transaction is known as the default tax.

It is evident from the screenshot above that Brazil's default tax was distinct from that of other nations. So this tax amount will be applied to each transaction that takes place under this company.

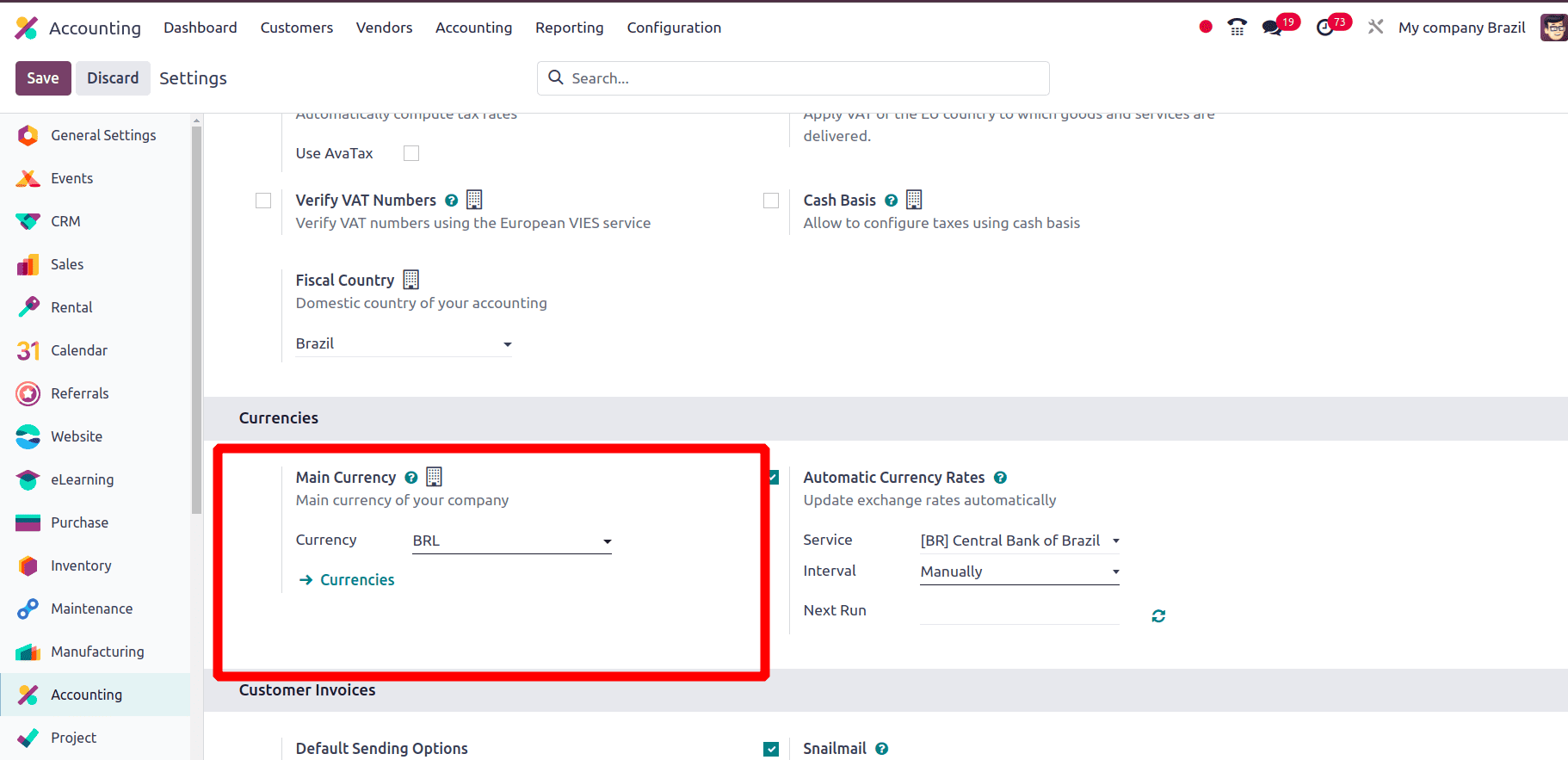

We know that the currency in Brazil is the Brazilian Real, which is abbreviated as (BRL), so when we reach the Currencies section in the configuration settings, the main currency configured for this company is also the Brazilian Real (BRL).

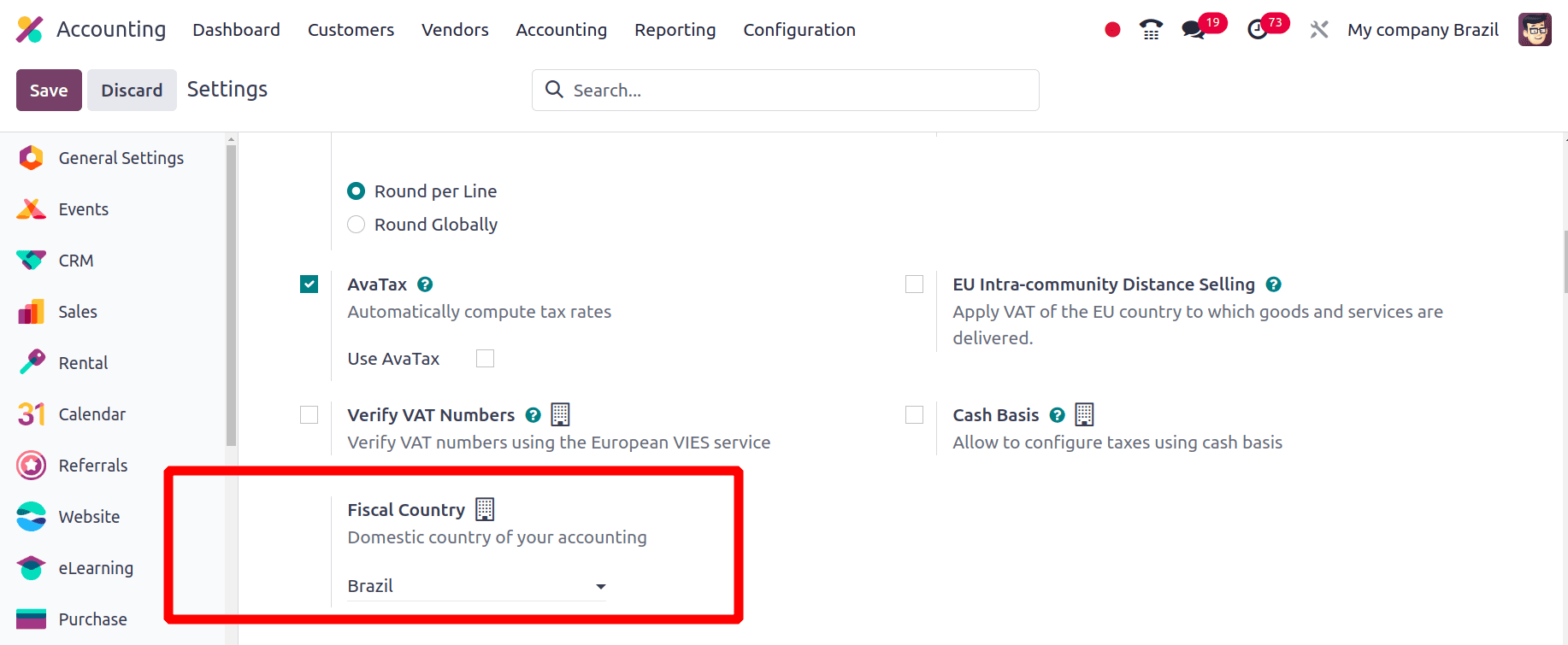

The fiscal country of this company should be Brazil. So, Odoo automatically configures the fiscal country as Brazil when the package for Brazil has been configured.

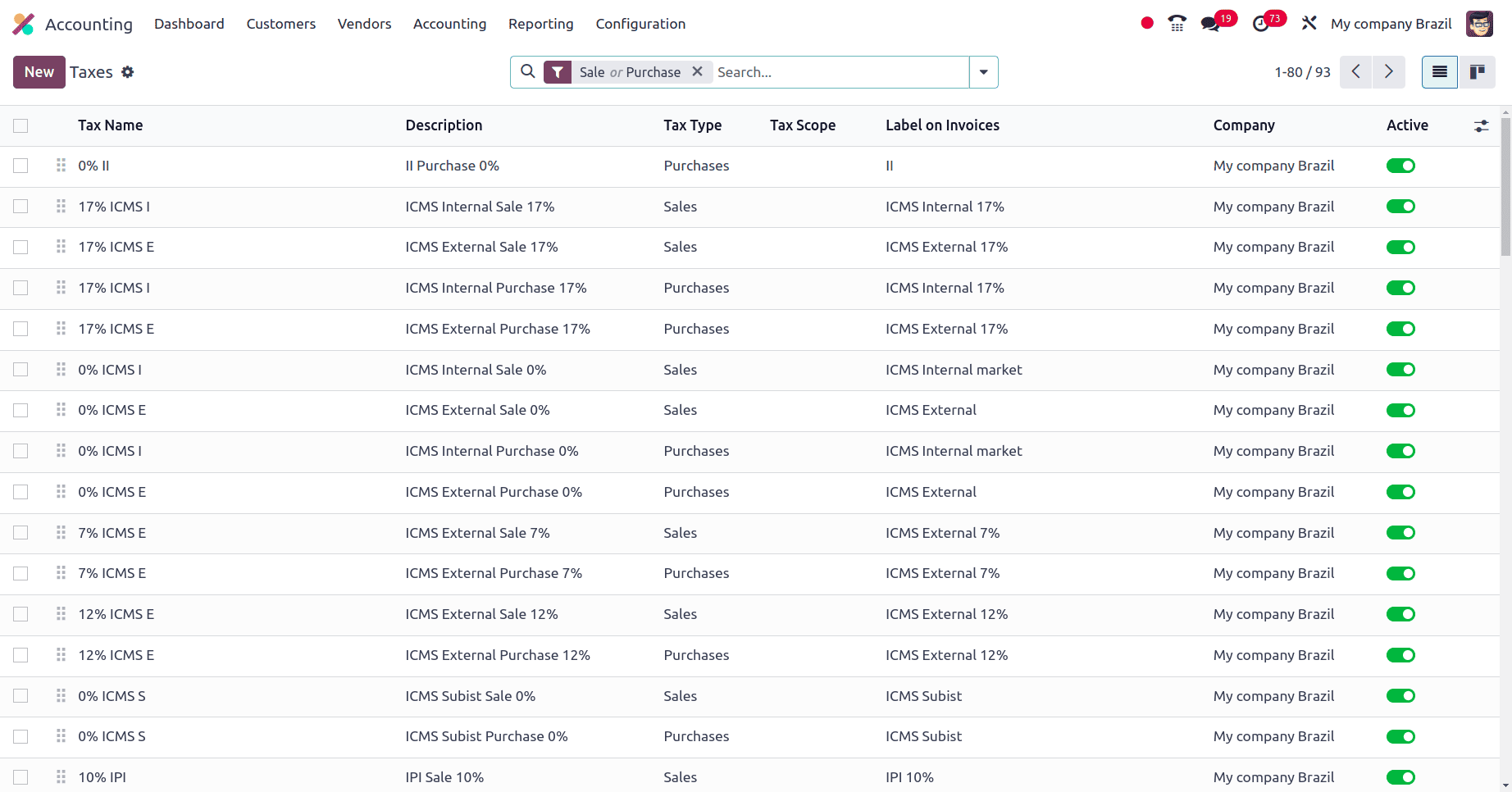

Under the configuration menu, we can see the Taxes sub-menu. Click the taxes sub-menu and we get a list of taxes.

All the businesses from Brazil can use all the taxes that are included in the list or these are the taxes that a Brazilian company can use.

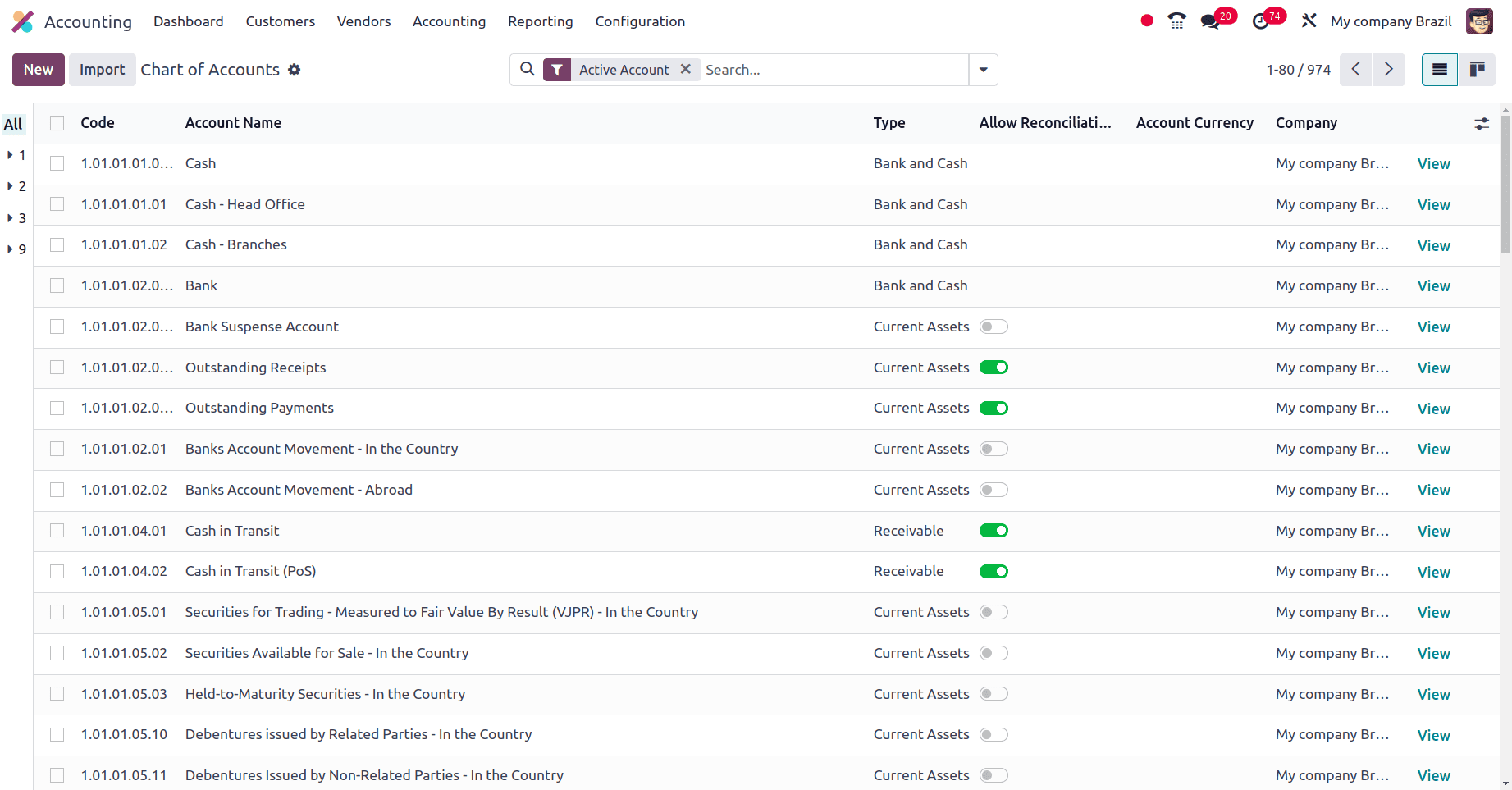

A chart of accounts is used to describe an organized list of all the general ledger accounts that a business uses. Chart of Accounts used by different countries may differ. There may be differences in the name, code, and use case too.

From the above screenshot, we can see that the code of the accounts, and names used by the Brazilian companies are different from the chart of accounts of other countries.

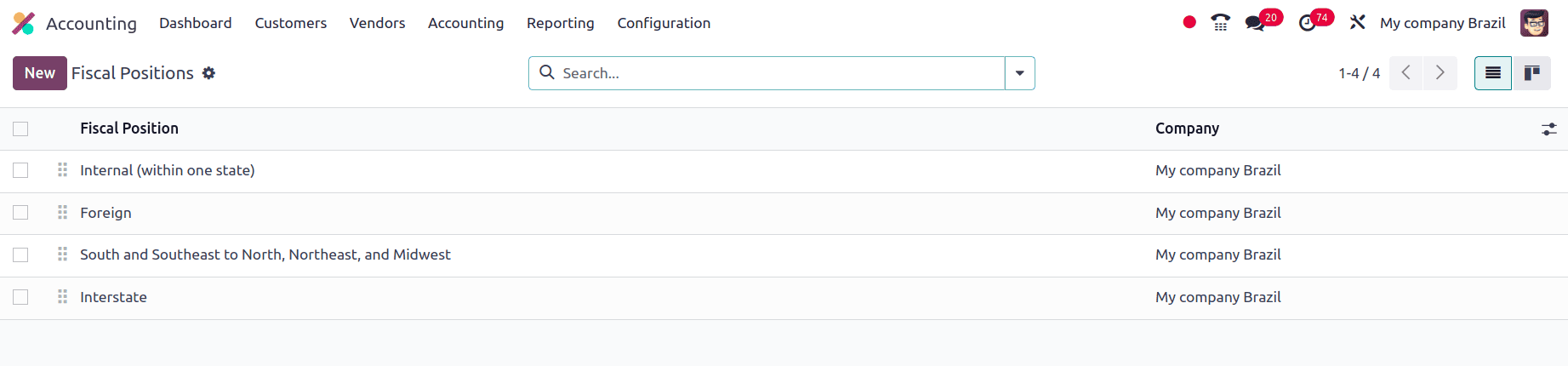

Take a look at the Fiscal position of the companies in Brazil. The fiscal position is used to describe an organized list of all the general ledger accounts that a business uses.

The fiscal position used by businesses in the country of Brazil is shown in the above screenshot. When we go to the Reporting tab of the accounting application there is a Tax report, Balance sheet, Cash flow statement, Profit and loss, etc.

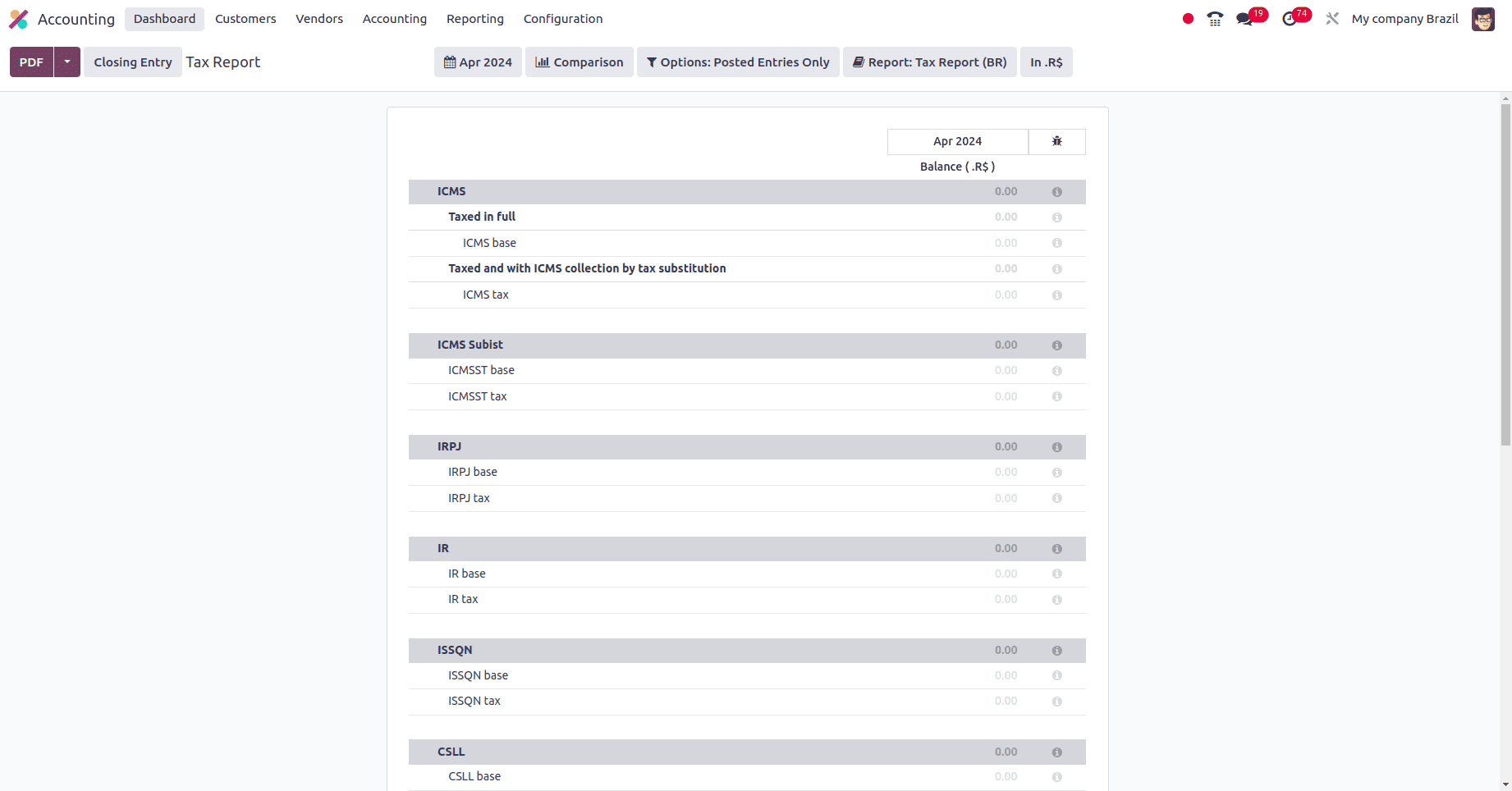

First, move to the Tax Report, and in the Tax report of the Brazilian company, variant taxes, and tax amounts are listed.

In this Report, we can see

* ICMS: which is the state tax on the flow of goods, information, electricity, etc.,

* IRPJ: which is used to refer to the corporate income tax in Brazil,

* IR: which is the federal income tax

* ISSQN: This is the tax on service of any nature.

* CSLL: Social contribution on net income. Legal organizations are typically charged a 9% CSLL.

* PIS: This is the program of social integration.

* COFFIN: Contribution for the financing of social security.

* IPI: This is an excise tax imposed by the federal government on items manufactured and imported into Brazil.

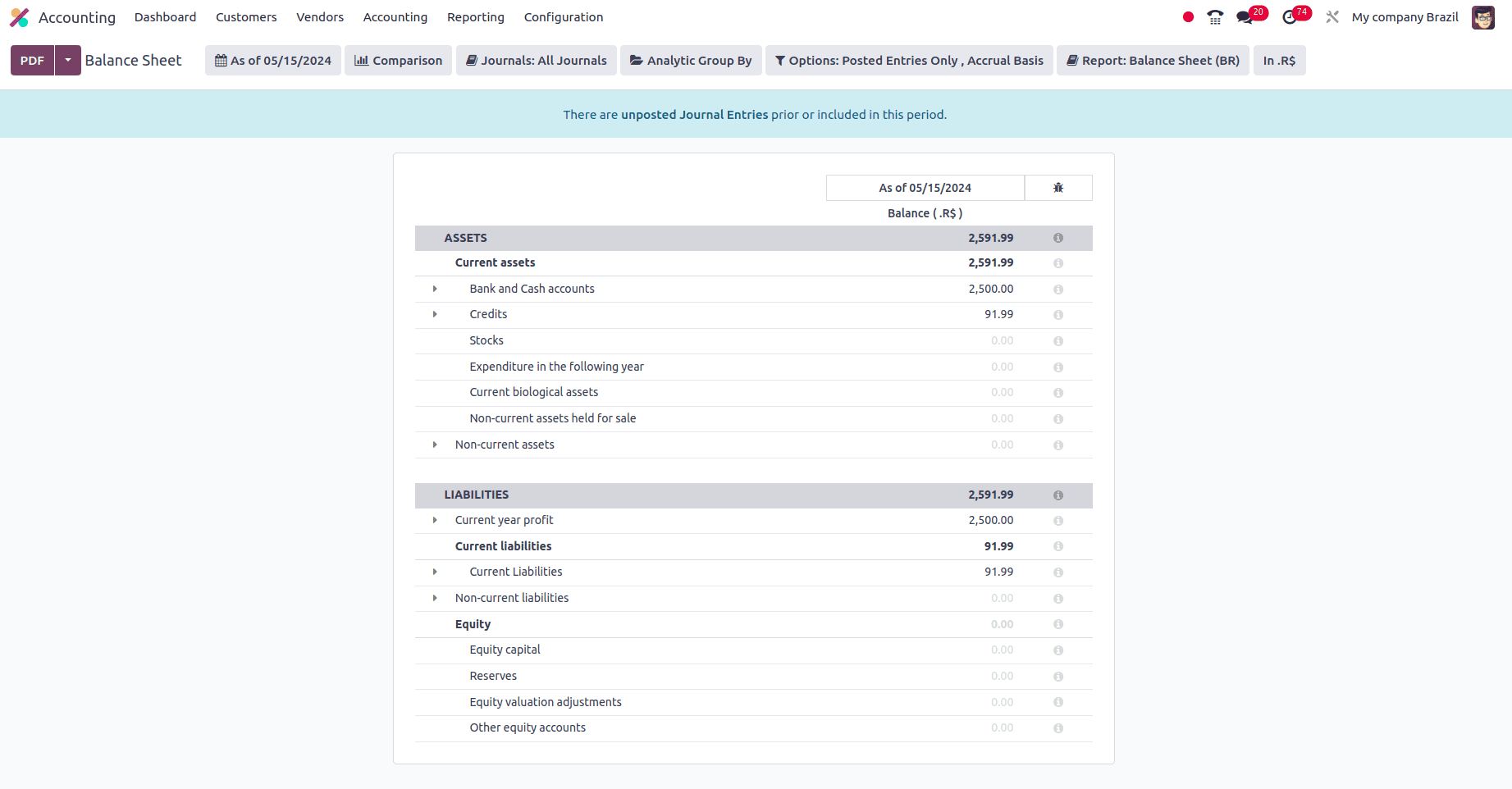

Now we can look at the balance sheet which is designed for Brazilian companies. Since it provides essential financial information on the assets, liabilities, and equity of a business at a specific point in time, the balance sheet is an essential instrument for tax reporting. This is how tax reporting uses it. Here in the tax report, we can also observe that every single tax report line is recorded, according to the tax grid that is provided in the tax.

The major terms included in the balance sheet are assets and liabilities. Current assets, non-current assets, stocks, credits, etc, are included under assets. Current year profit, current liability, current in liability, etc, are included under liability.

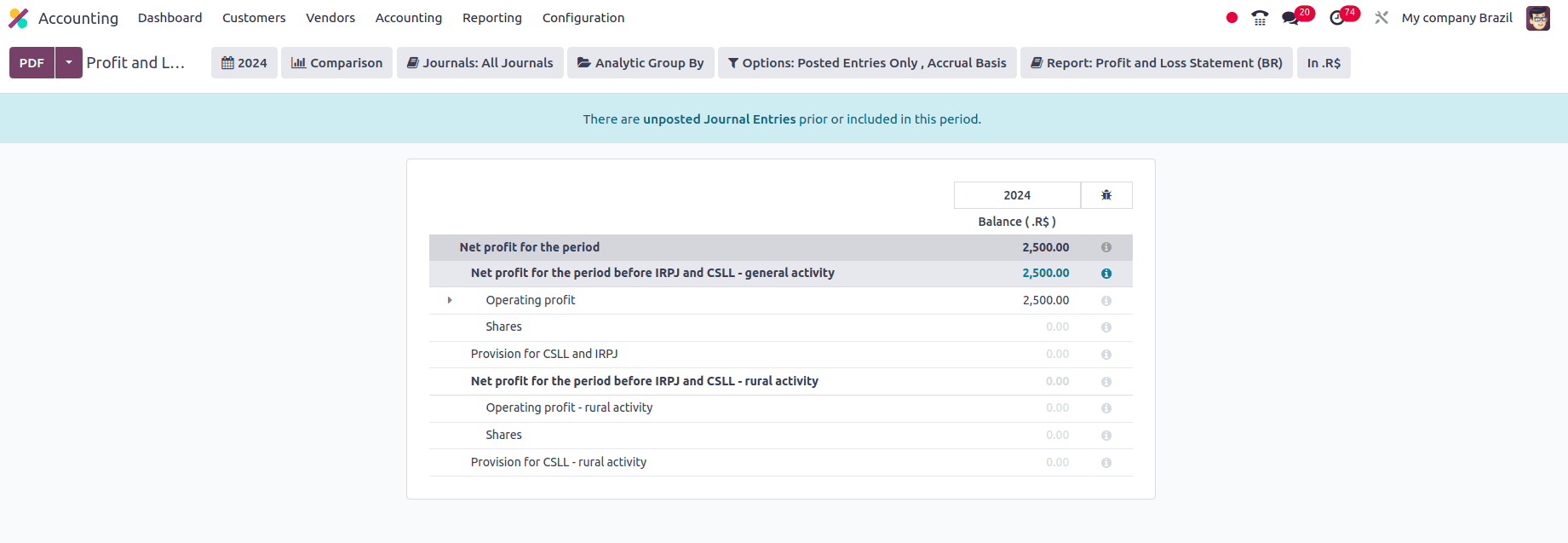

When we look at the profit and loss of the Brazilian companies, the net profit of the period is shown, and the net profit compared with different types of taxes are also provided.

So we can say that when we create a company and set the accounting localization for that company, it will allow smooth circumstances for the working of the company. It also contributes to the company's increased productivity and decrease in errors.

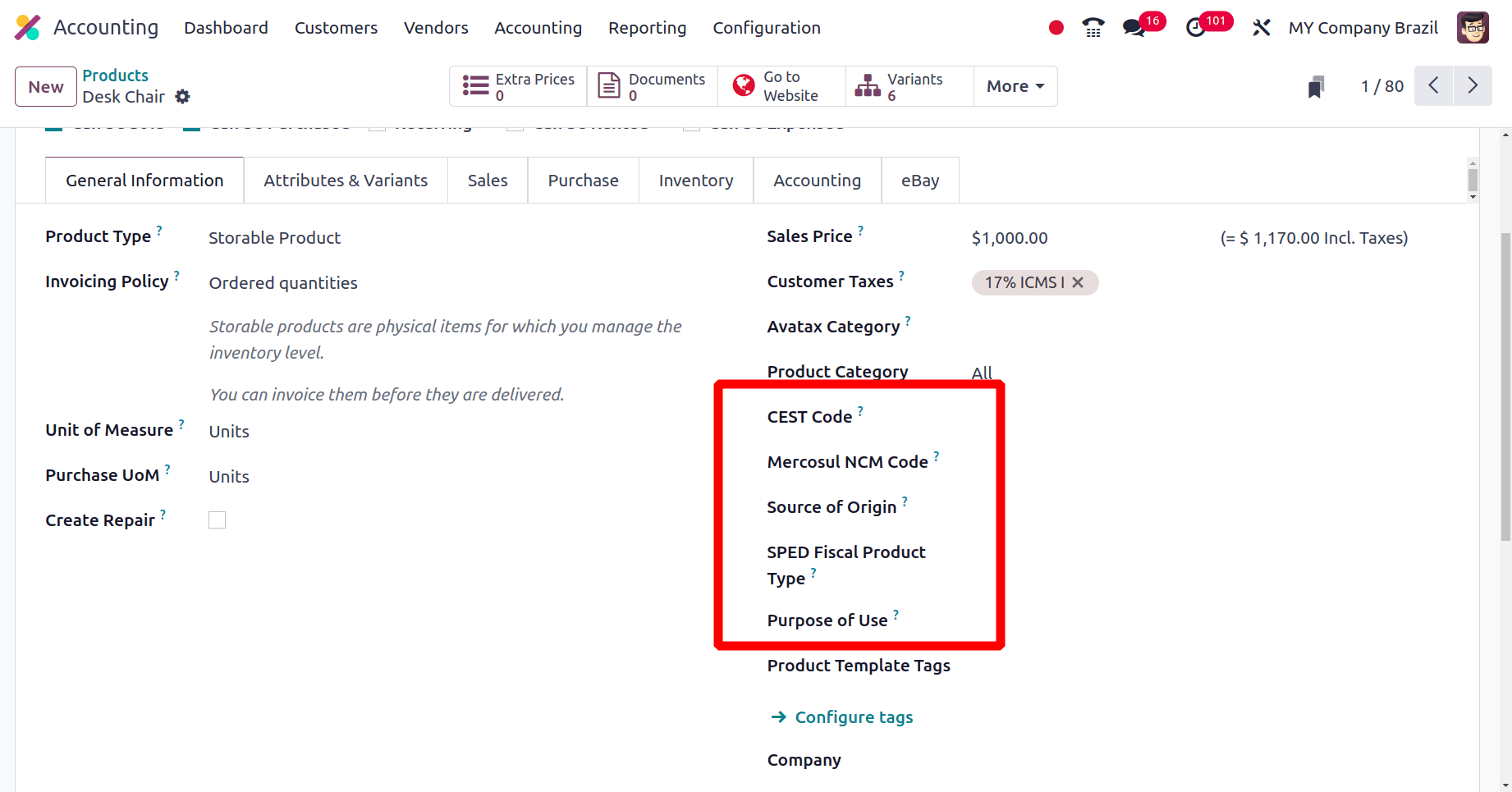

When we look at the product form, we can see that some extra fields have been added.

Under the general information tab of the product form, CEST Code, Mercosul NCM Code, Source of Origin, SPED Fiscal Product Type, and Purpose of Use are also added.

* CEST Code: A tax classification code used to identify goods and products subject to tax substitution under ICMS regulation. It helps to determine the applicable tax treatment and procedure for a specific item

* Mercosul NCM Code: Brazil: NCM (Nomenclatura comun do Mercosul) code from the Mercosur List

* Source of Origin: Product source of origin indicates if the product has a foreign or national origin with different variations and characteristics depending on the product use case.

* SPED Fiscal Product Type: fiscal product type according to SPED list table.

* Purpose of Use: Indicate what is the usage purpose of this product.

Businesses operating in Brazil can effectively manage their financial operations with the help of Odoo's powerful platform thanks to its localization into Portuguese. With all-inclusive capabilities including fiscal document generation, tax compliance, and connectivity with local payment gateways, Odoo 17 enables businesses to concentrate on expansion while streamlining their accounting operations.

To read more about An Overview of Accounting Localization for Vietnam in Odoo 17, refer to our blog An Overview of Accounting Localization for Vietnam in Odoo 17.