The business management aspects have been modernized today where most of the businesses needed dedicated tools of functioning to deal with most of the operations which have been defined. Out of all the operational needs which companies face in this modernized era, the aspects of financial management are one of the vital aspects which most businesses should take into real consideration. This is because the complete and effective Accounting and the management of finches will root for the direct profits and be able to show the business with the right return on investment. In this modernized digital era with faster communication, internet facilities, and a higher number of parameters and constrain of functioning the accounting operations, the old ways of ledger bookkeeping and bills and invoices in paper will not be helpful for the companies.

Businesses must shift to a digital platform for the management of operations. Enterprise and resource planning solutions have paved the way for the effective management of business operations all from the same platform. Available as a dedicated tool that is application-specific in running certain aspects of the business and tools that add up to the complete management of the business operation all from the same platform. The Enterprise and Resource Planning software solutions have modernized the way the business is being managed. Odoo is one of the complete business management solutions which falls under the category of ERP-based tools offering full and effective management of the operations all from the same platform with the help of the dedicated modules of functioning. The modular approach of the Odoo platform makes sure that the business has dedicated applications specific modules of operations that will pave the way for effective business management.

The complete and effective Accounting management module of the Odoo platform helps the business's ineffective financial management operations. Moreover, with dedicated menus and well-defined functioning tools, the Odoo Accounting module will act as the complete and efficient financial management solution that most businesses need. However, most businesses will need localization elements to function to run the business based on the concepts, traditions, and parameters of the local governing bodies. The Odoo platform also supports this with the region-based localization tools, which is one of the platform's best features.

This blog will provide insight into Accounting Localization for Argentina using the Odoo 15 platform.

The Odoo supports the aspects of localization of the accounting aspects which will allow the business to define the taxes, chart of accounts, payment terms, payment acquirers, invoicing formats, and all the aspects regarding the financial management of a company with regards to the norms and regulations imposed by the governing bodies. Regarding the Argentinean localization for a business, the Odoo platform has specific supporting modules which should be installed and configured to run the business based on the respective region. Before moving on to understand the definitive modules and their configuration, let's initially create a company that operates and functions in Argentina in your Odoo platform.

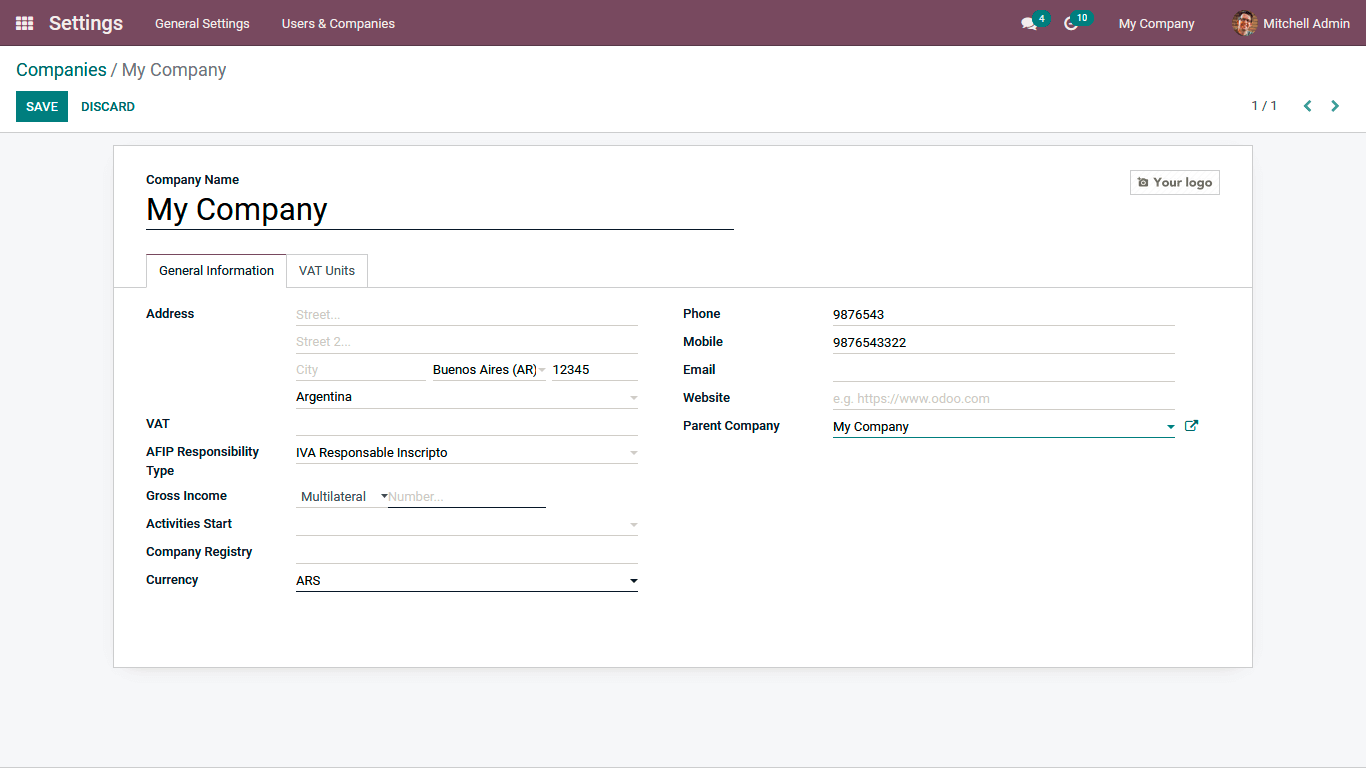

To define a new company, you can select the Settings module and then the ‘Users and Companies’ menu. You will be depicted with the List of companies in operation defined. To create a new Company in the process, you can choose the Create option available, which will direct you to the company creation form as depicted in the following screenshot. Here initially, the Company Name should be defined further under the General Information tab you need to provide in the Address of the company operation. As we are dealing with Argentinian localization, we have selected the country of operation as Argentina for the company we are creating now.

Additional contact information such as Phone number, Mobile Number, Email address, Website, and the Parent Company should be defined.

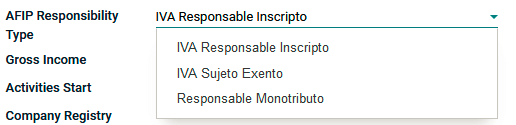

As its Organization is working under the Argentina region, the user should define the AFIP Responsibility Type. The AFIP Responsibility Type establishes the company's responsibility and the sure of functioning, assigning the responsibility that a person or a legal entity will have. Here, the AFIP Responsibility Type can be set as IVA Responsable Inscripto or IVA Sujeto Exento or Responsale Monotributo.

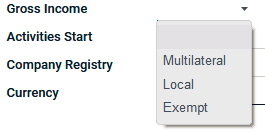

Next, the Gross Income for the company's Accounting operations can be defined as Multilateral, Local, or Exempt. Defining the Gross Income will help with the attributes while explaining the Invoices for the sales.

Further, the Activities Start date should be defined, which will determine the date of the start of the financial activities for the company. Moreover, this will be when the company starts operating regarding its finances. The Company Registry is where the company has been registered with the authority. The Currency of operation of the respective company can be defined. This will be the primary currency of operations, and if the company has a business run internationally, then multiple currencies options can be enabled and defined in Odoo.

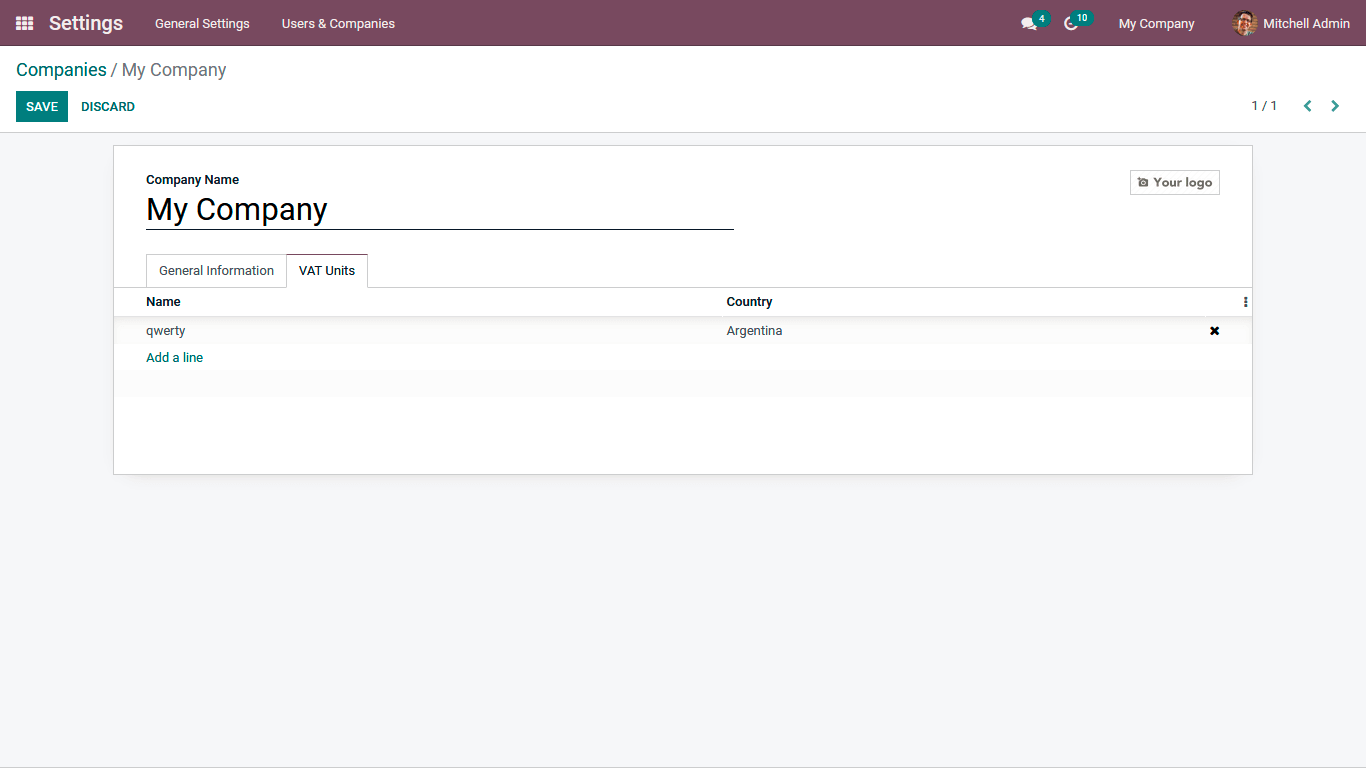

Under the VAT Units tab, the operation taxes to run the business in Argentina can be defined. All the VAT taxes of the company described will be depicted over here, and you can use the Add a line option available to define new ones.

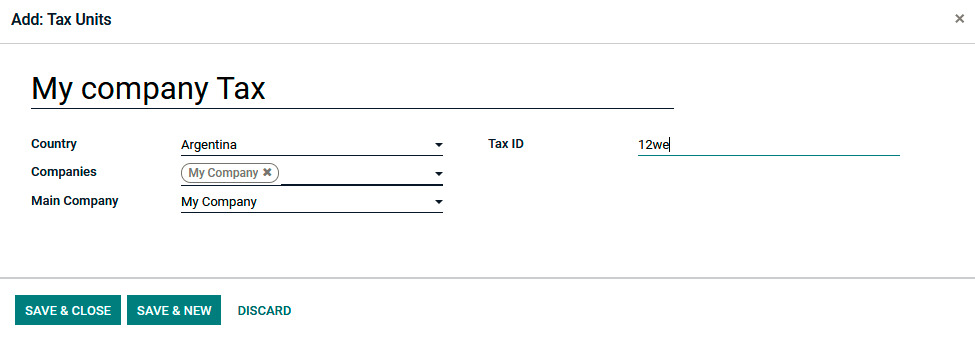

Upon selecting the Add: Tax Units option using the Add a line option, you will be depicted with the creation menu as shown in the following screenshot. Here the Tax name schedule is defined, and the Country will be auto allocated. Further, the Companies in which the respective tax is applicable can be specified along with the Main Company of its operation. The Tax ID should also be defined, which can be used while describing it during the accounting operations. You can select the Save & Close option, or else if you need to create a new Tax to be specified, the Save & New option can be chosen.

In this manner, multiple VAT taxes can be defined as in the Odoo platform. As the Odoo platform permits the operation and the management of various companies from the same platform, the business can use the same platform to run the operation with its sister firms. Moreover, once the region of operation of the company is specified, a certain percentage of information will be auto-filled, and the options will be modified accordingly, this on aspects of the localization feature which Odoo puts forward for the business operation and its management. As we have understood how the Companies can be defined based on the operations for the Argentinean region, let's now move on to the next section where the Argentinian Accounting localization aspect and configuration are described.

Configuration of Argentainain Accounting localization in Odoo.

The Odoo platform has distinctive modules of functioning which can be installed from the Applications module, which can be used for specific functions. Regarding Localization-based Accounting operation, specific country and region-specific modules can be installed for the Localization-based operations. Regarding the business process in Argentina, there are distinctive modules that will specify the Argentinian Localization aspects for the business operations.

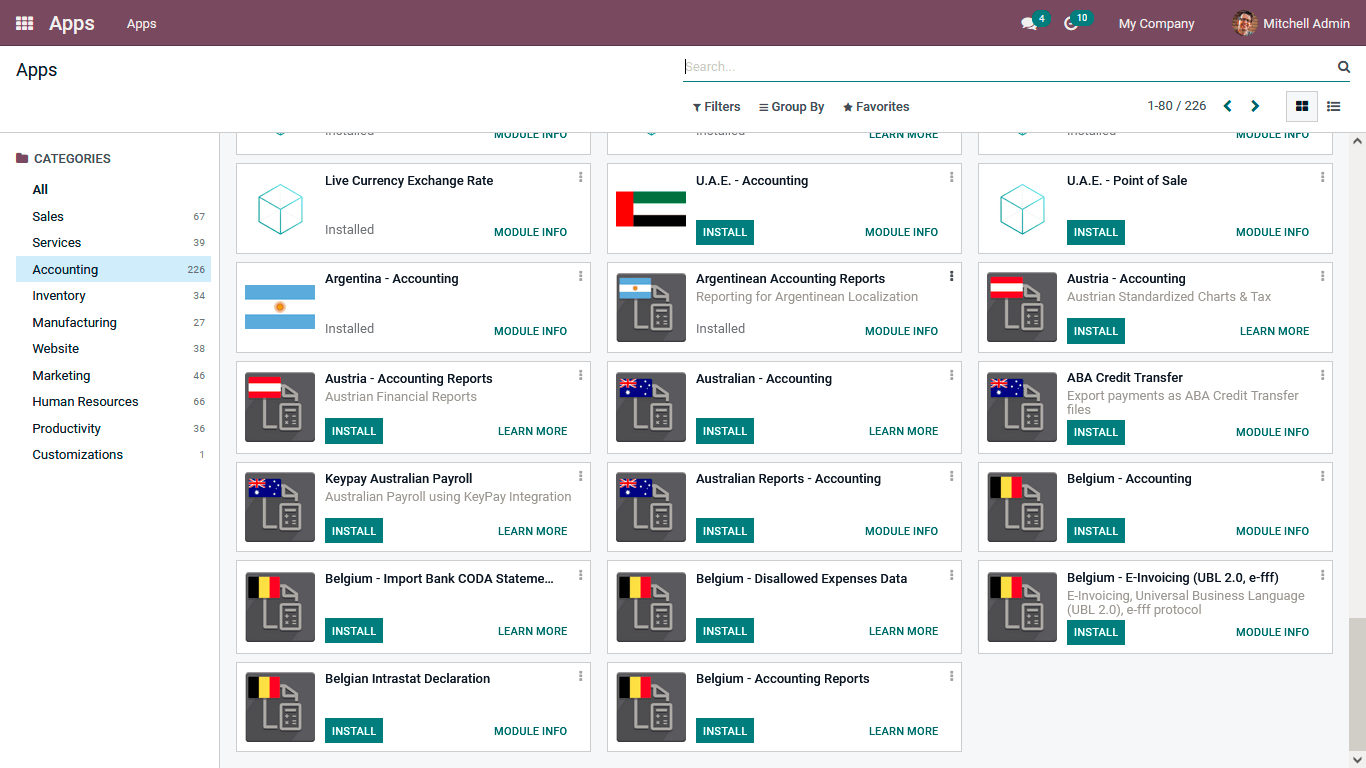

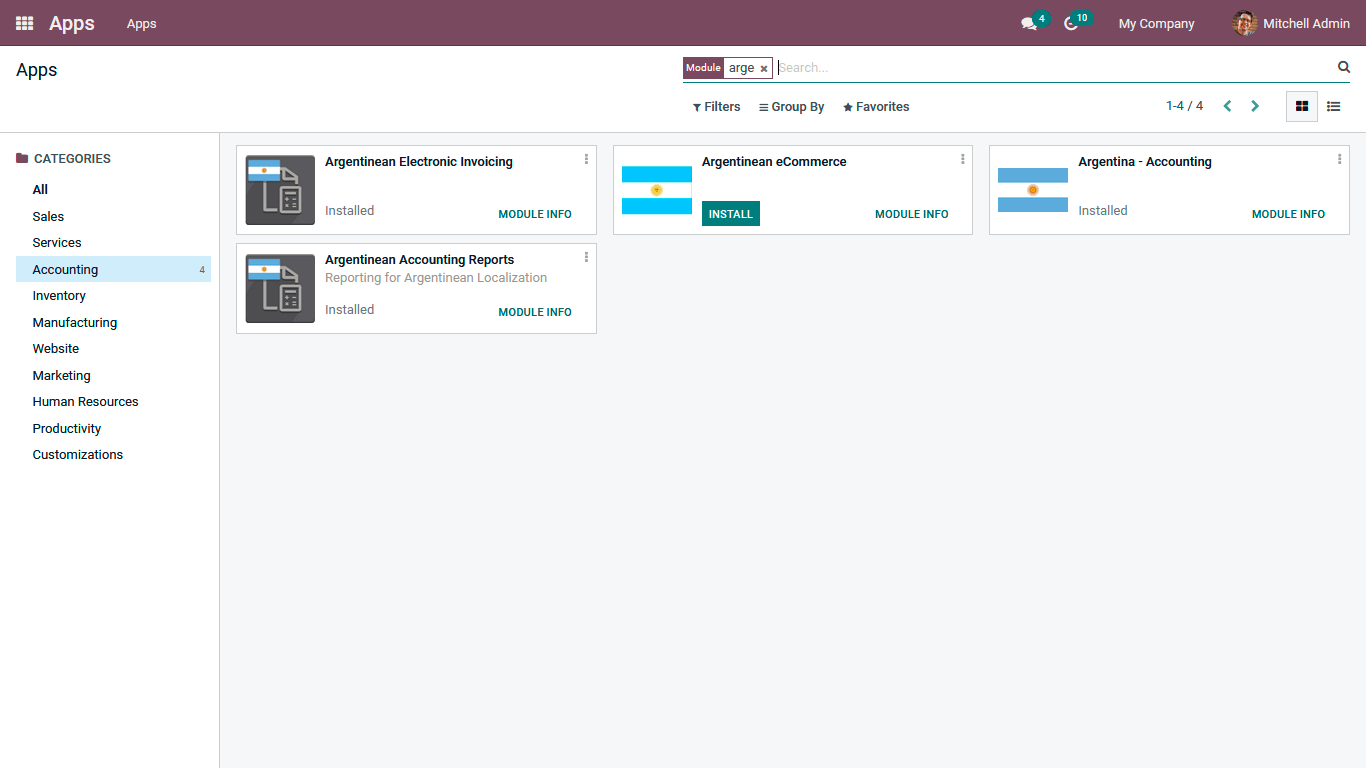

For running the business operation in Argentina with Odoo t, they can install the modules such as Argentinian Accounting, Argentinian eCommerce, Argentinian Accounting Reports, Argentinian Electronic Invoicing, and all other associative modules which will support the operation of the business in Argentina. The following screenshots depict the specific modules available in the Odoo Application menu, which will provide the capability of Localization Accounting and business management for the organizations.

You can also search Argentina in the Applications module after removing the Apps filter to depict you with all the supporting modules of the Odoo platform regarding Argentinian localization, just as shown in the following screenshot. You can install all the modules defined in the following screenshot, which will support you with Argentinian Localization.

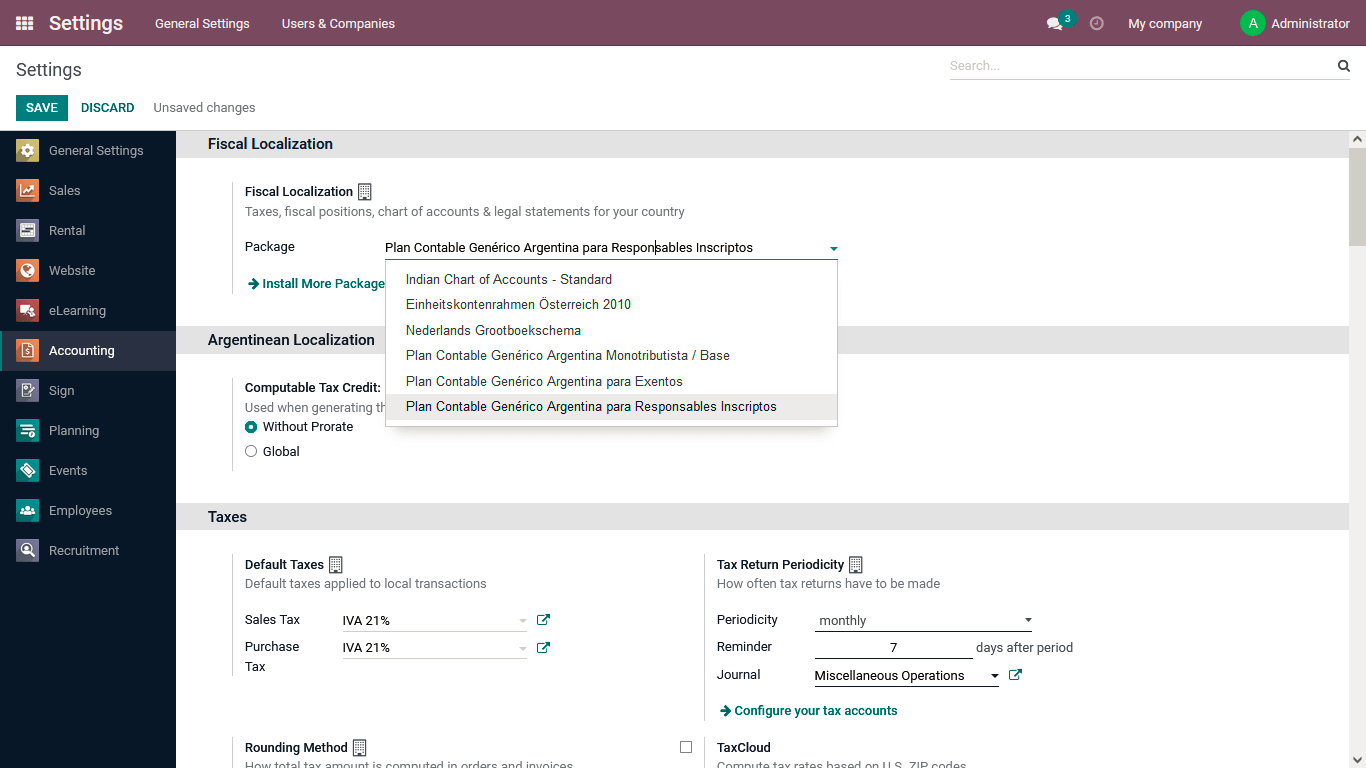

Next, you need to enable the Fiscal Localization Package for the Odoo platform to be operational. Once the Argentinean localization modules are installed in the Odoo platform under the Fiscal Localization section, the Packages of Argenitainan Localization will be visible. You need to choose the respective one of the operational needs.

Configuration of Chart of Accounts.

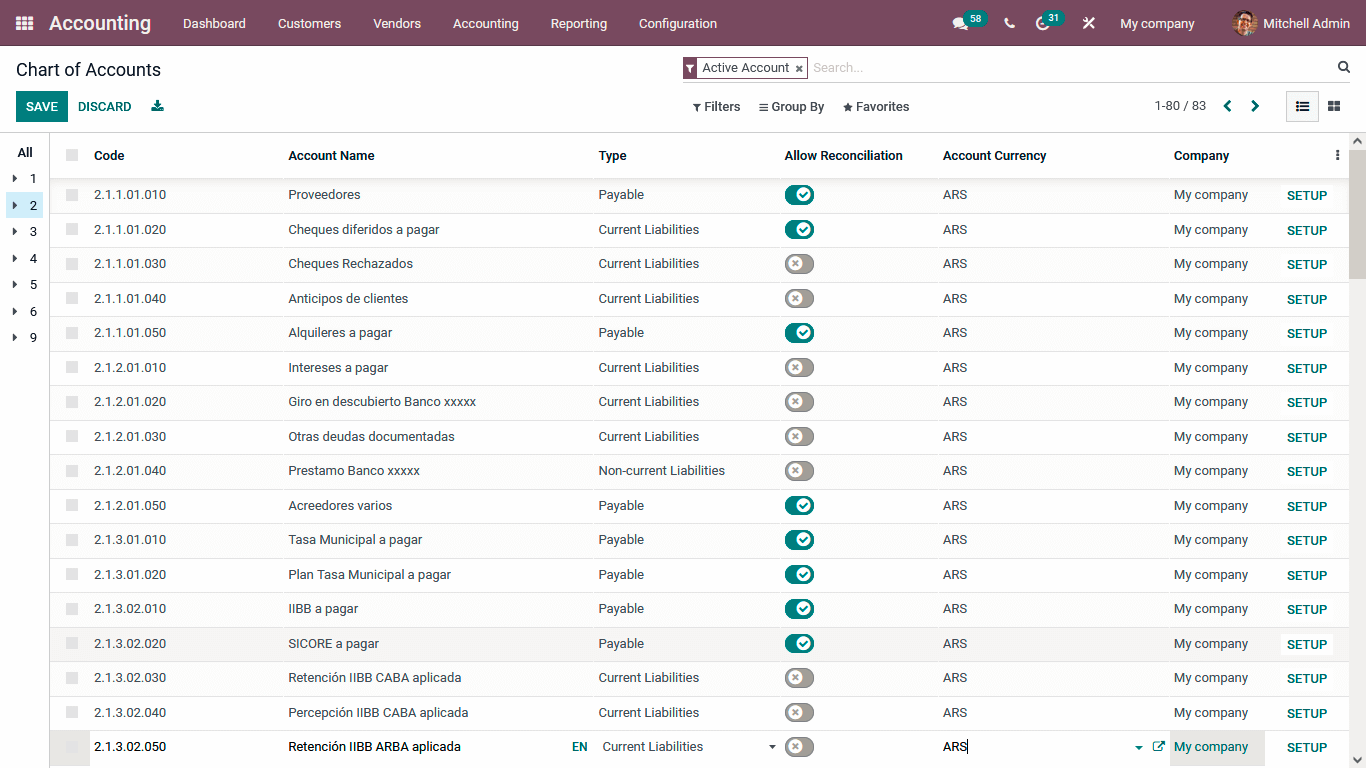

As the Odoo platform is operating for a company functioning in Argentina, the allied accounting aspects should also be configured as per the need. The Chart of Accounts is an essential aspect of the business's operations. Financial Management aspects will help define the respective Accounting Ledgers for the internal operational insight. Moreover, the Chart of Accounts menu of the Odoo platform can be accessed from the Configuration tab of the Odoo Accounting module, which will showcase all the Chart of Accounts that should be defined. The following screenshot depicts the Chart of Accounts menu where you can see that the Account Currency is set as Argentinian.

The Chart of Accounts menu will be helpful for the business with the effective management of the company's finances with the ease of Accountability and definition of each aspect of the Financial operations conducted in the company's process. Let's not move on to understand the Accounting Settings window where the Localization aspects have been configured.

Argentinian Localization Settings.

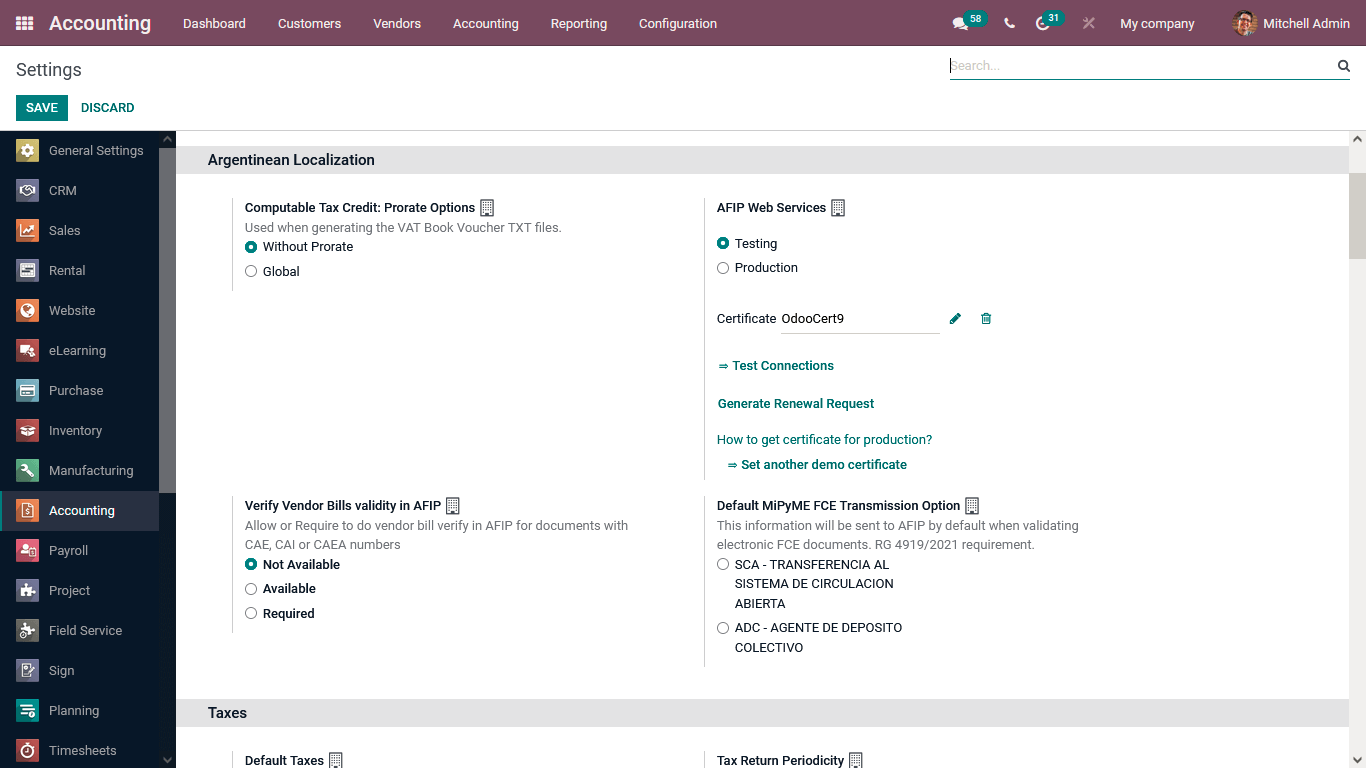

In the Settings menu of the Accounting module, the various aspects of the Argentinian Localization should be defined, which will lead to the operation of the effective management of the business functioning in Argentina. Initially, the Computable Tax Credit: Prorate Options schedule is defined, which can be set as Without Prorate or as Global. Further, the AFIP Webservices should be defined as Testing or as Production where the Testing can be set when the Odoo platform is not in the whole operation in controlling the business. In the Production stage, the company will be incomplete operation with full functional capability of the Odoo platform and its Financial management.

Moreover, the Certificate number for the AFIP Web services will be defined in the respective section, which can be attained upon the registry of the AFIP Web services. In need of the AFIP Web services renewal, you can select the Generate Renewal Request option available. This renewal request will be sent directly towards the AFIP registry will be renewed Certificate based on the aspects that are being defined. If you want to know how to renew a new certificate, you can select how to generate a Certificate for Production? An available option will enlighten you on aspects of certificate registration. To know how the certificate world, you can generate a new demo certificate by selecting the Set another Demo Certificate option available.

There is a specific option where the Verify Vendor Bill's validity in AFIP can be defined to verify the Vendor bill's validity. The option can be set as Not Available, Available, or Required. Further, the Default MiPyME FCE Transmission Option should be defined, which will allow you to send information to AFIP by default while validating the FCE documents. The option can be set as SCA - TRANSFERENCIA AL SISTEMA DE CIRCULACION ABIERTA or as ADC - AGENTE DE DEPOSITO COLECTIVO based on the functional need. These are the aspects of the Settings menu that need to be configured for the functioning of the Odoo platform with the Argentainial Localization operation. Let's now move on to the next section, which will define what change and additional aspects will the Argentinian Localization bring into the Odoo platform.

New aspects and Changes to the Odoo platform due to Argentinian Localization.

The Odoo platform is customizable and will encourage modification of the operational aspects of the business management based on the organization's needs. The region-based Localization in one among those aspects thesis is because each country pertaining parameters of the business and the norms and regulations by the authorities will be different. Therefore, the localization element in Odoo and a default operational tool will not be helpful. In the case of implementing the Argentinian Localization for the Odoo platform, there will be significant changes in the available menus, and new aspects of configuration will be added to it.

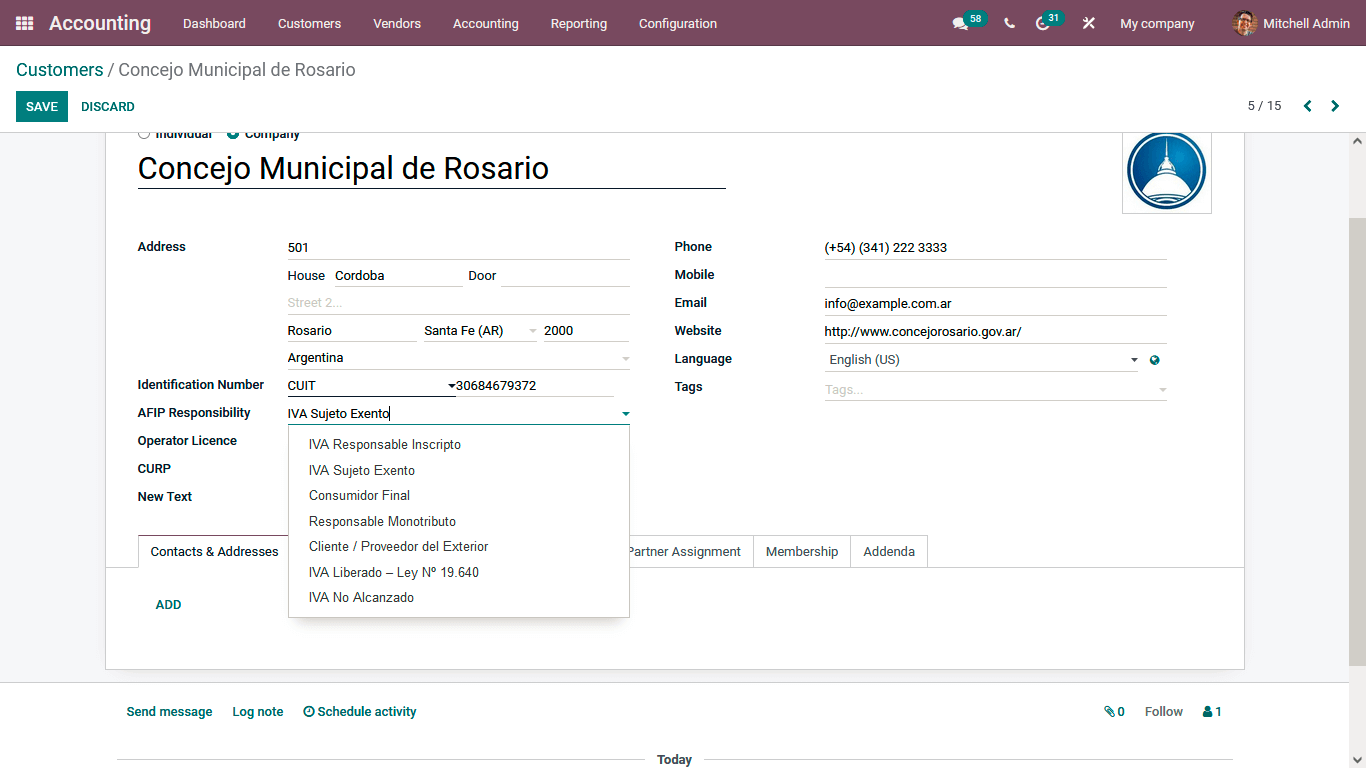

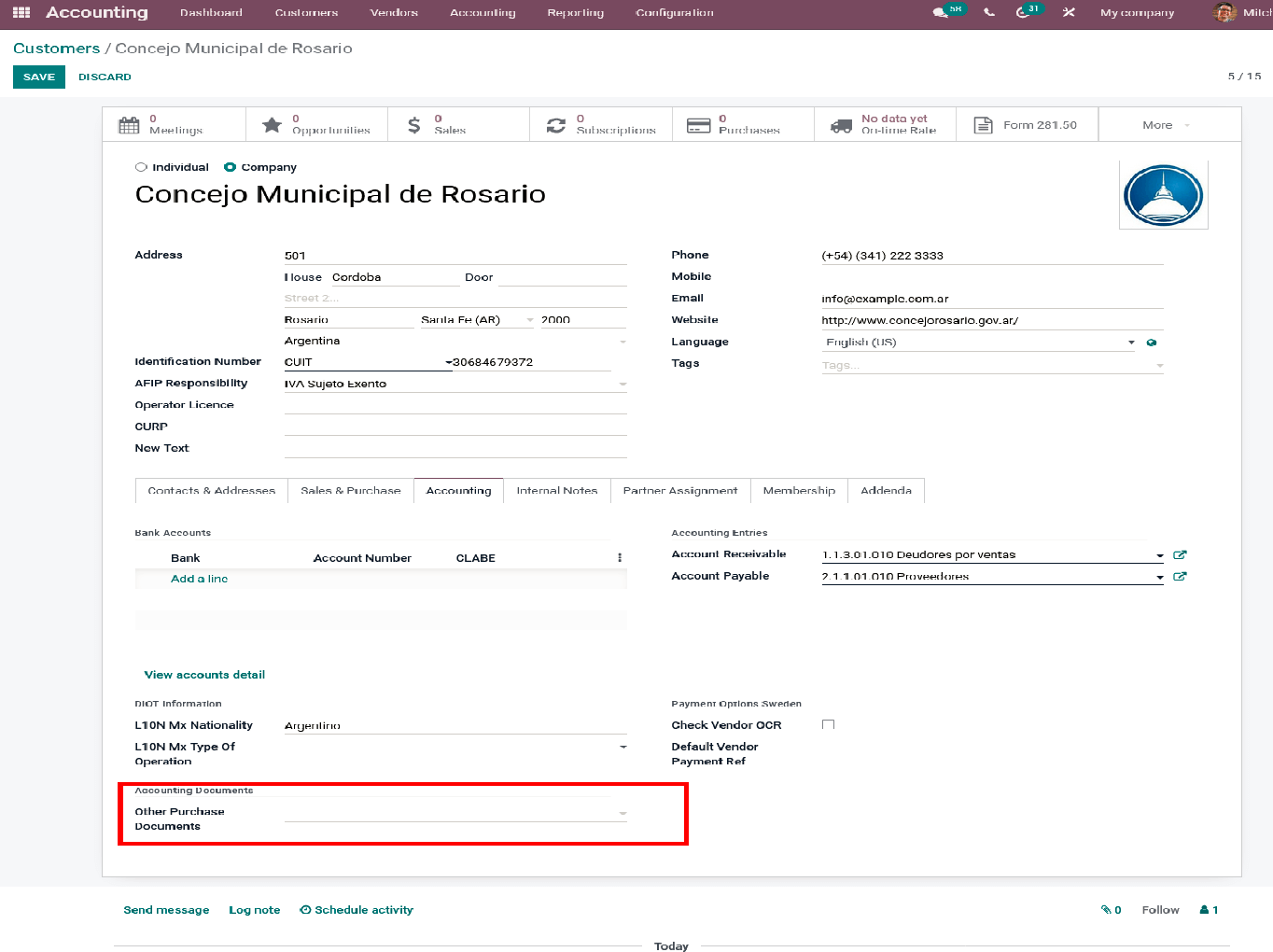

In the case of the Customer definition, there will be a new element that should be defined where the AFIP Responsibility should be assigned for each of the customers. This will come as a mandatory file that should be defined while creating the customer. Moreover,r representing the AFIP Responsibility will ensure that the smooth functioning of the AFIP operation will be helpful for the business as well as the authorities.

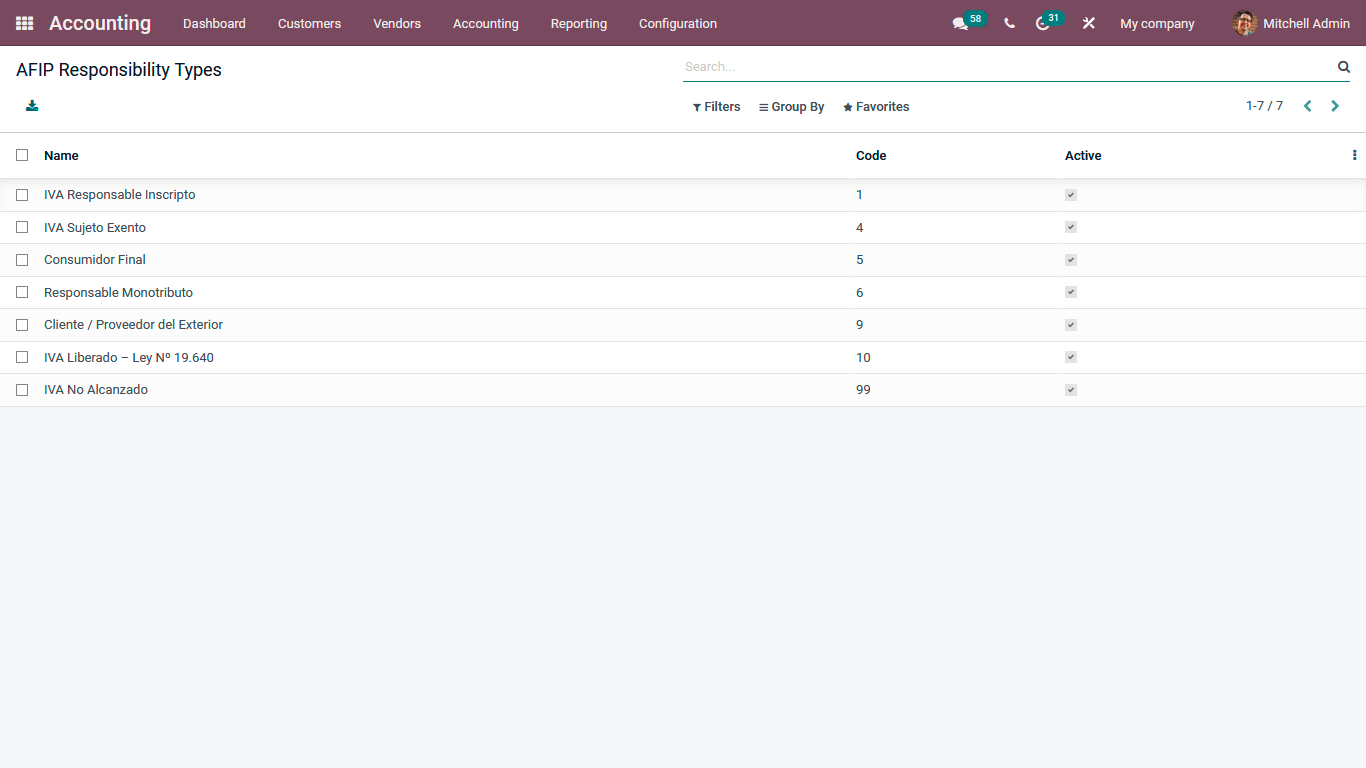

A new menu is available under the Configuration Tab of the Accounting module, where the AFIP Responsibility Types can be defined. The AFIP Responsibility Types will be based on the operational aspects of a business put forward by the authorities. There is an option to download the details of the menu, which can be used while exporting the parties to the newer Odoo platform.

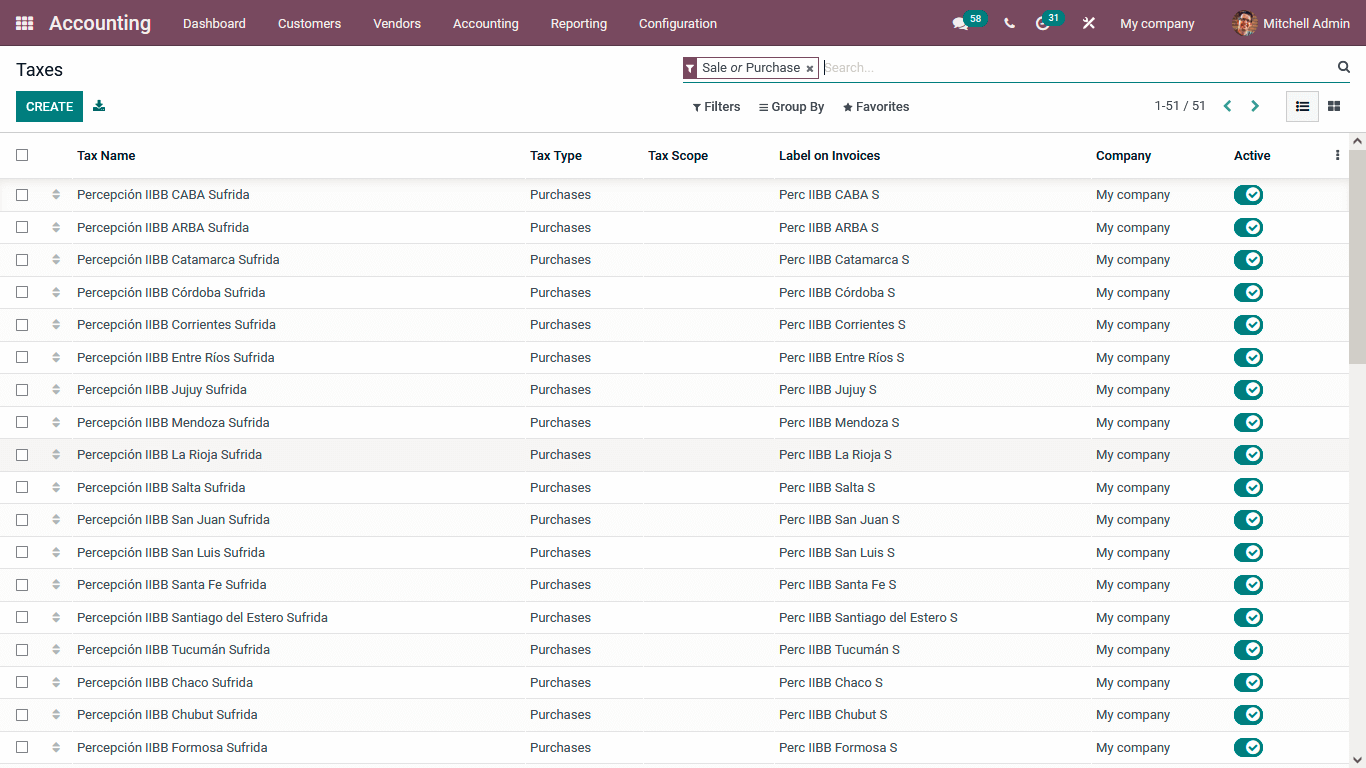

Another significant change in the Odoo platform will be the definition of Taxes of operation in the Argentinean Localization. Wheselectlected the Taxes menu available in the Configuration tab, you can see that all the default taxes used in Argentina will be defined. There is an option to create new ones based on the need, as depicted in the following screenshot.

In the Taxes menu, you will find the default taxes used in Argentina such as Perception IIBB CABA Suffered, Perception IIBB Catamarca Suffered, Perception IIBB Córdoba Suffered, Perception IIBB Entre Ríos Suffered, Perception IIBB San Juan Suffered, Perception IIBB Santiago del Estero Suffered and many more along with the various variations of it.

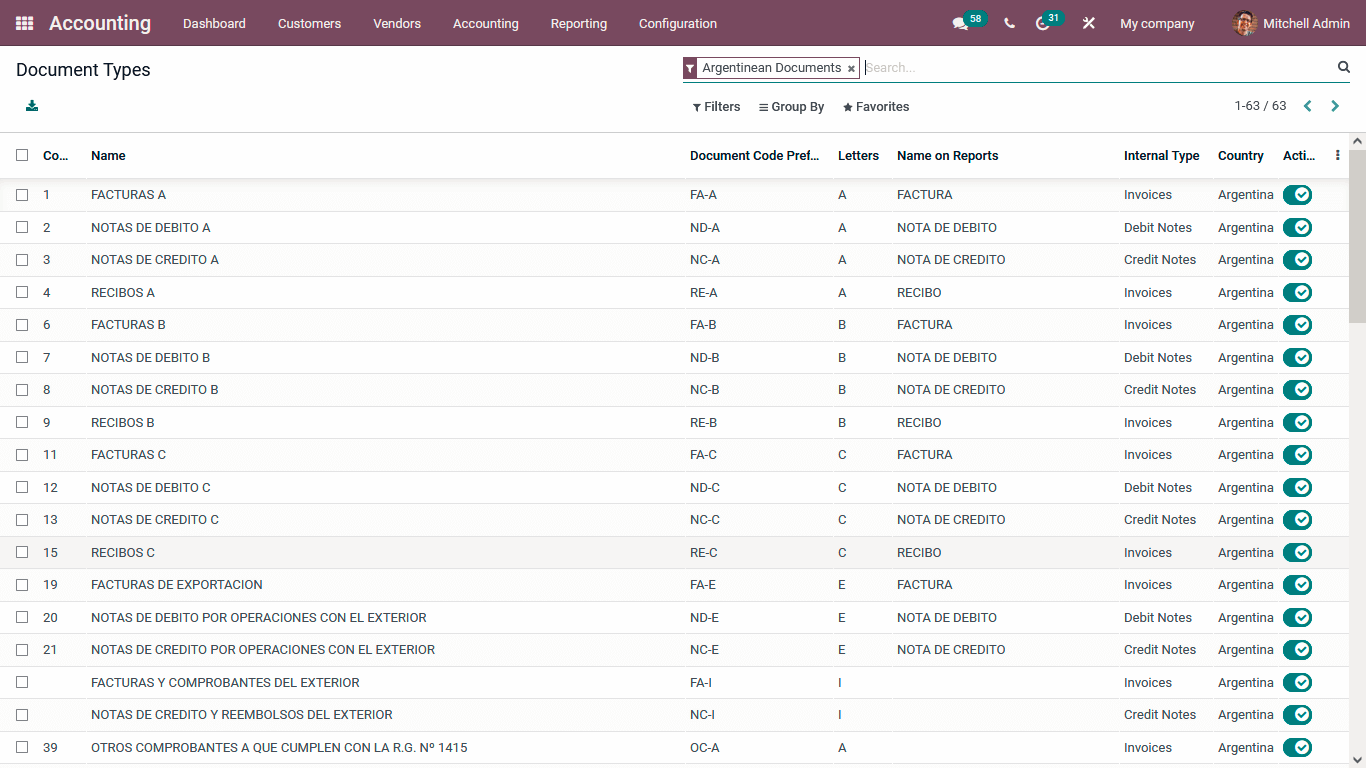

The Document Types are the format and types of documents the business uses regarding Argentinian localization. All the Document Types depicted in the following screenshot will be auto-defined when the Argentinian Localization elements and modules are defined in the Odoo platform.

The document types defined in the menu can be used to assign the Accounting Documents while defining the Customers in the Odoo platform. Moreover, the Other Purchase Document can be described here to support the Purchase operations.

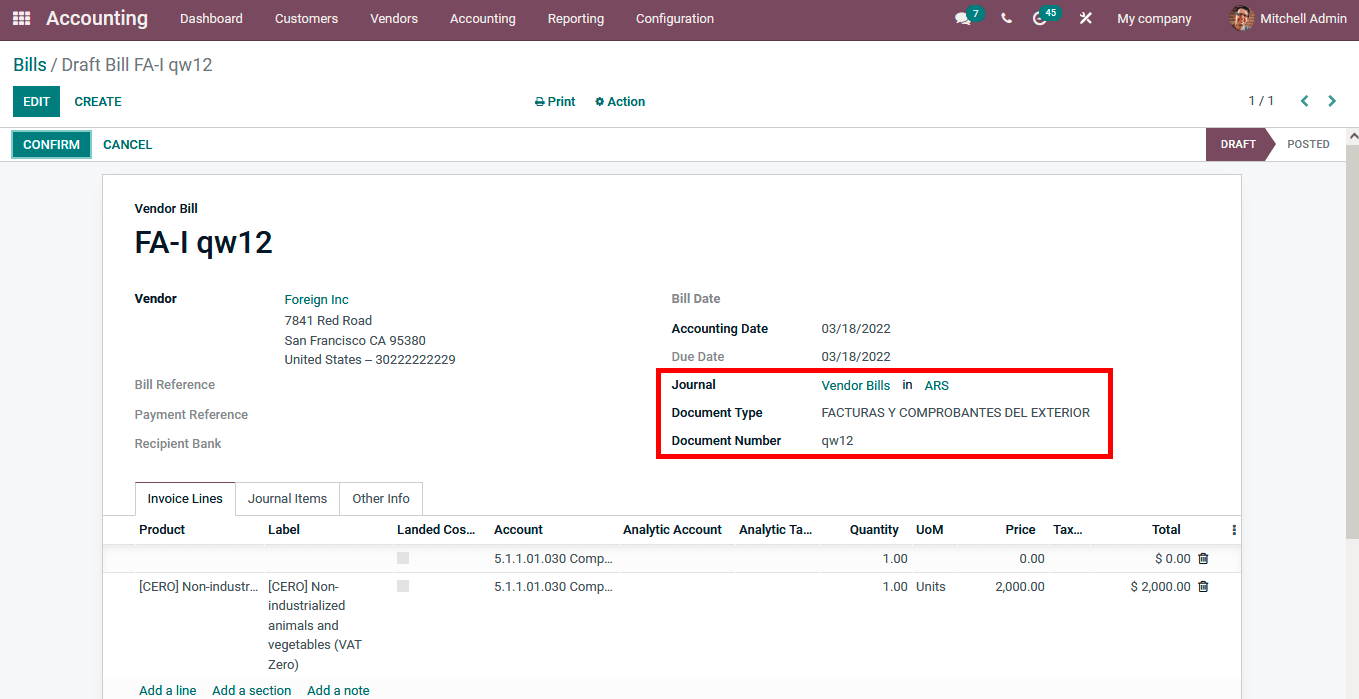

In the same manner, when the Vendor Bills are being defined, the Documents Types should also be assigned where all the documents depicted in the Document Type menu will be visible to choose from. Further, the Document Type number should also be defined, which is mandatory and helpful with the identification aspects.

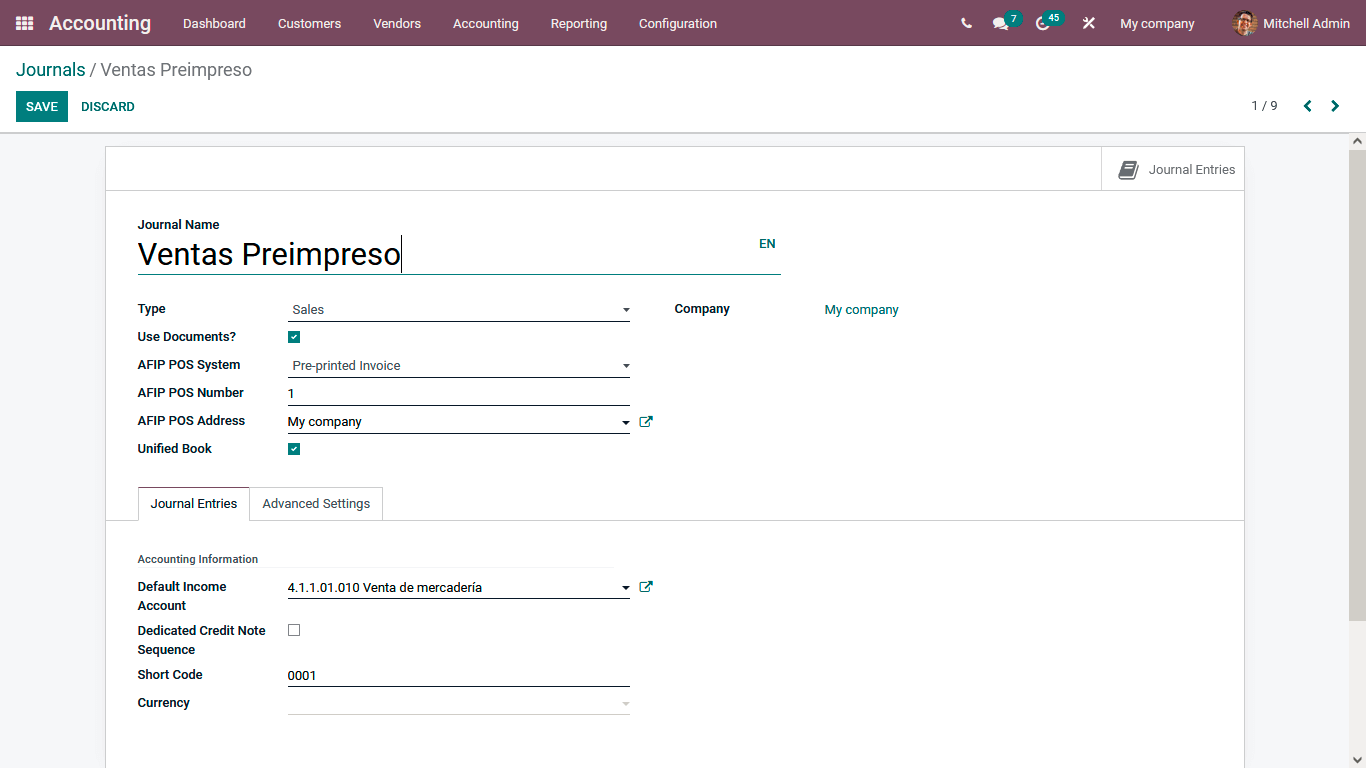

The next element of the Argentinian Localization in the Odoo platform will be the configuration of Journals which will provide the right capabilities with the Finances management operations of a business functioning in Argentina. Under the Journal definition tab, the Use Documents? The option can let you use the various document types defined. Further, the multiple aspects of the Journal operation, such as the AFIP POS System, AFIP POS Number, and the AFIP POS Address, can be described.

These are the specific changes that the implementation of the Argentinian Localization to the Odoo platform will bring, which will be helpful for the business in Argentina function effectively with Odoo. Let's now move on to the next section, where the advanced reporting functionalities which the Argentinean Localization will bring into the Odoo platform.

Argentinian Report Statement

Reporting is one of the advanced features of the Odoo platform. There are distinctive operations modules, all incorporated with dedicated report generation menus that will provide the rightful analytical insight into business operations and management. The various reporting statements available in the Odoo platform are based on the Argentinian localization, specifically the Accounting module.

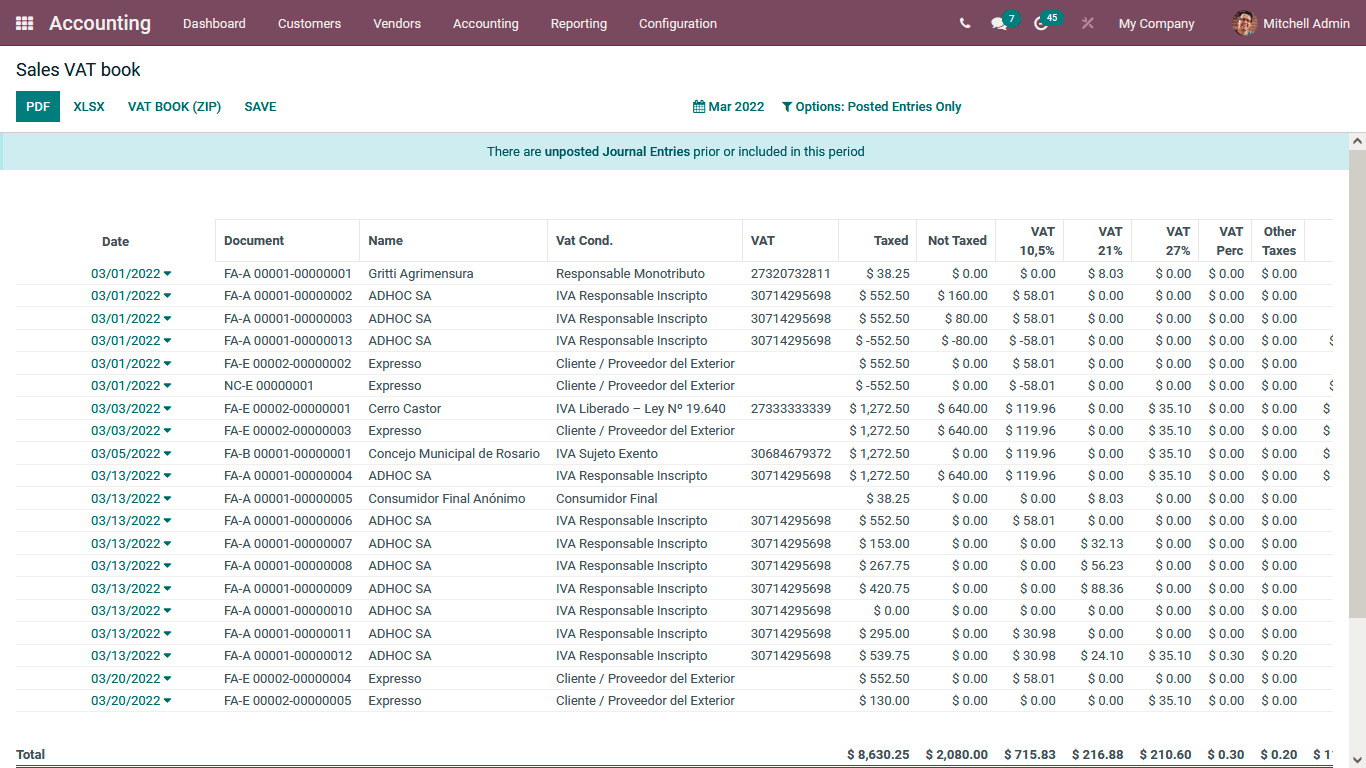

Sales VAT Book

The Sales VAT Book reporting will provide analytical insight into the VAT taxes to be provided for the Sales operations conducted.

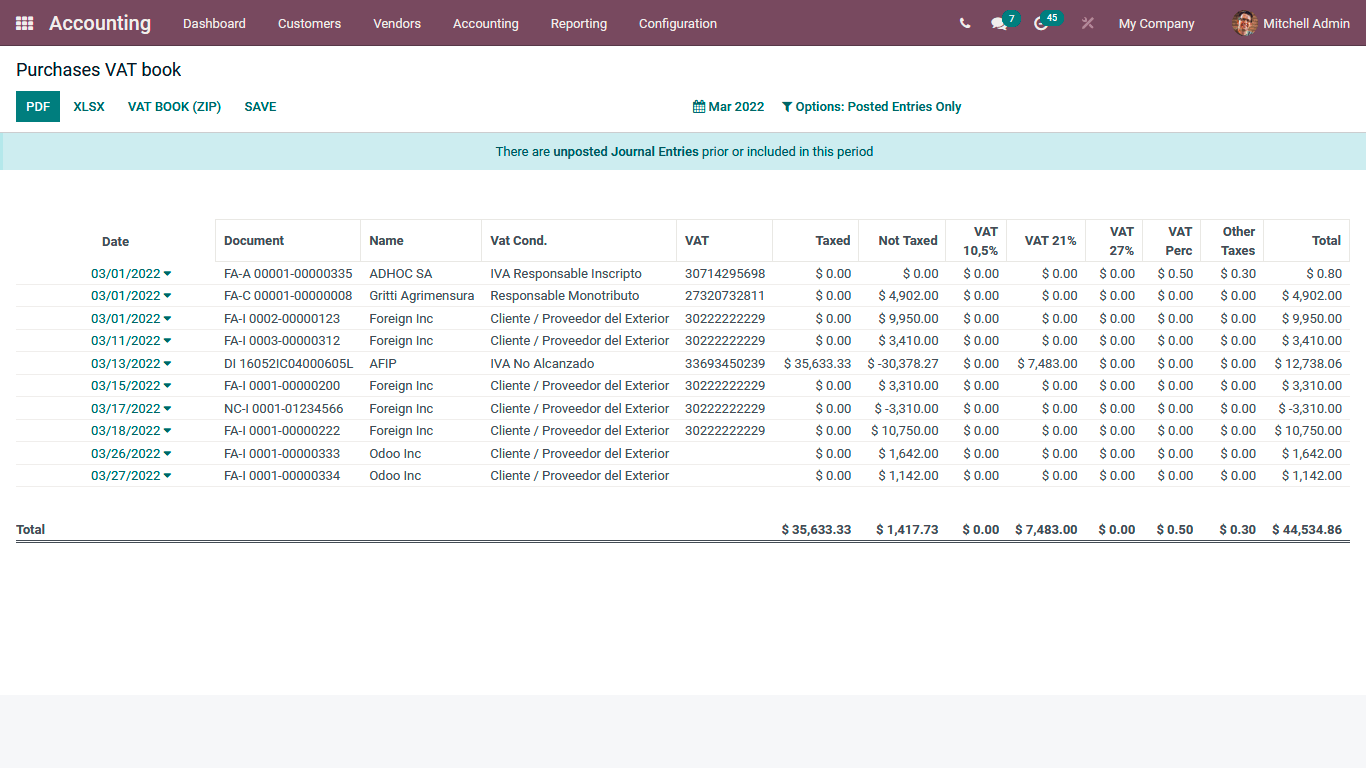

Purchase VAT Book

Similarly, the Purchase VAT Book will define the VAT taxes to be provided to the authorities for the Purchase operations conducted.

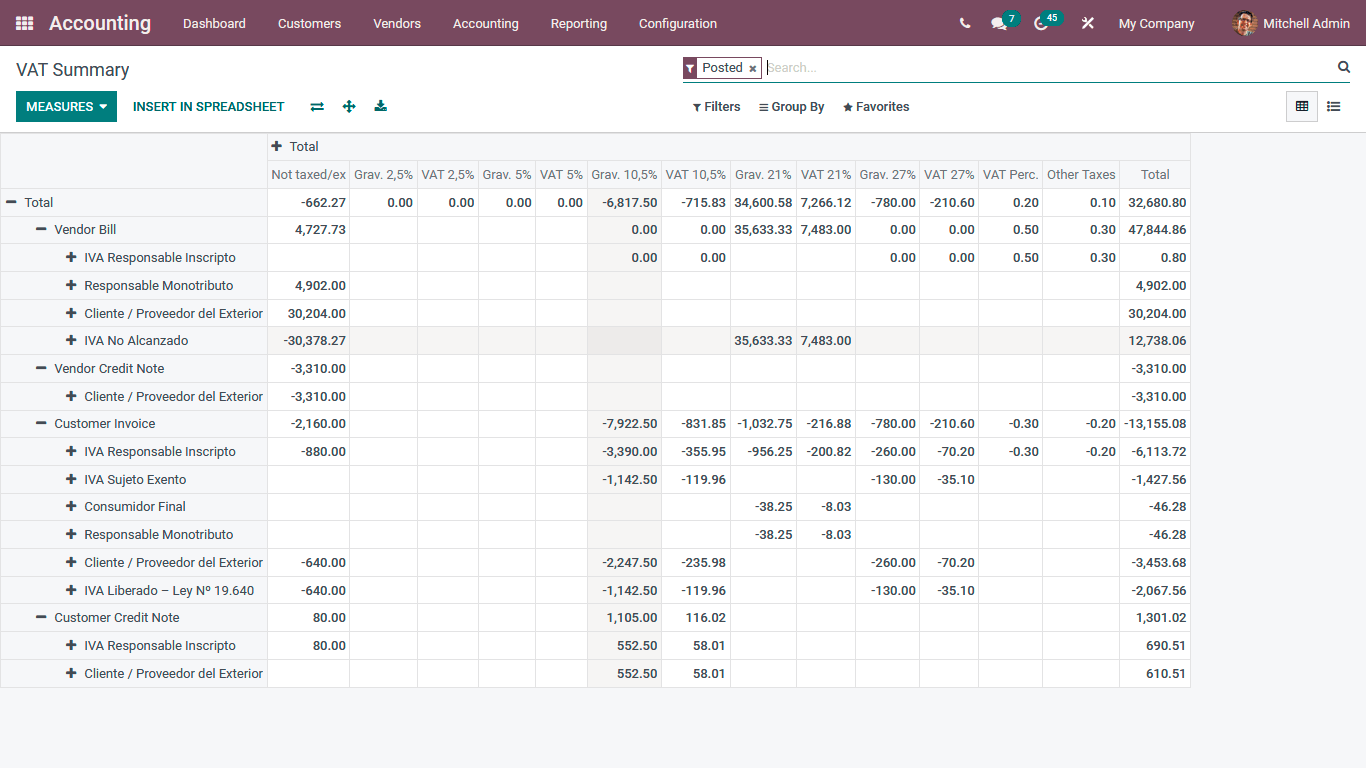

VAT Summary

The VAT Summary will provide the right insight into the complete VAT taxes, which are to be provided to the authorities as the liability based on the purchase and Sales operations along with all the other aspects of the business, which are conducted.

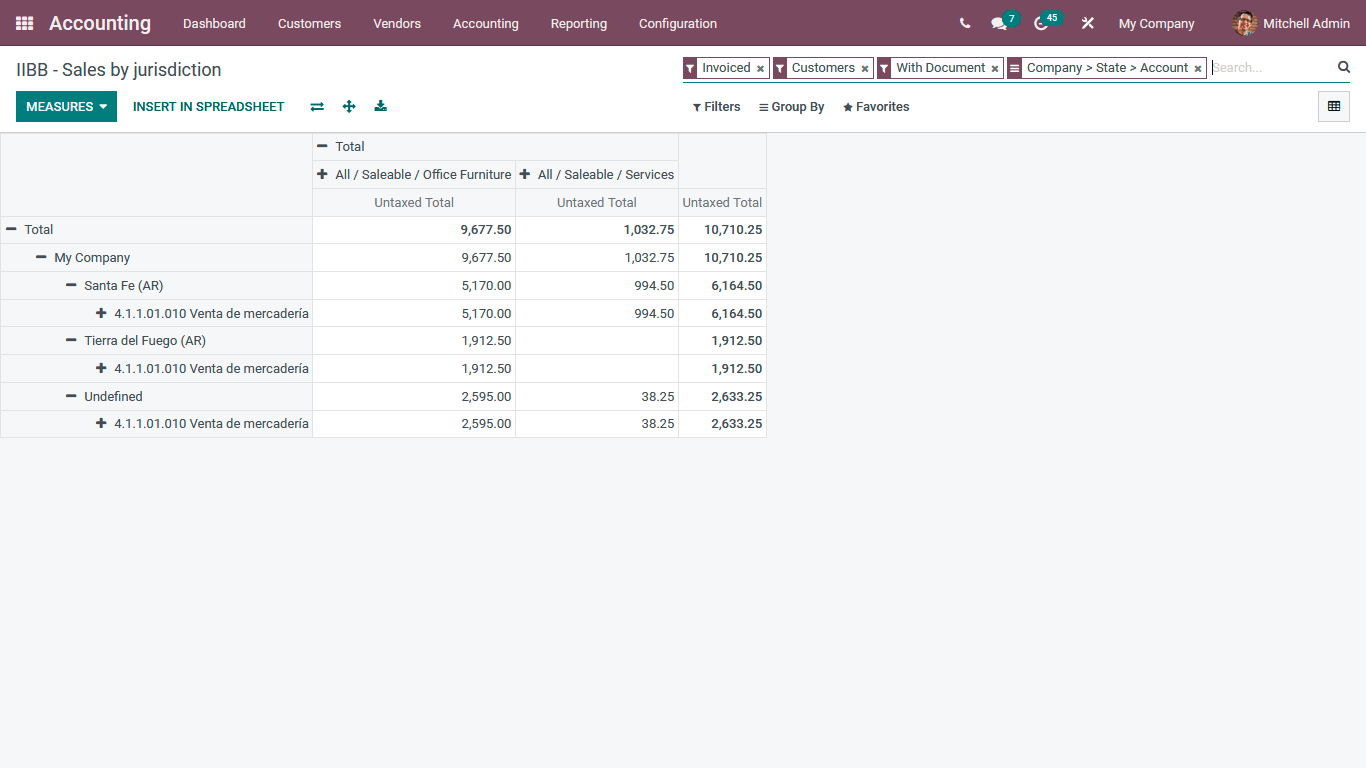

IIBB Sales by jurisdiction

IIBB stands for the Argentine gross revenues tax in the city of Buenos Aires, Argentina, and the IIBB Sales by jurisdiction will be used to define the taxes which are to be provided for the sales operations which are being conducted.

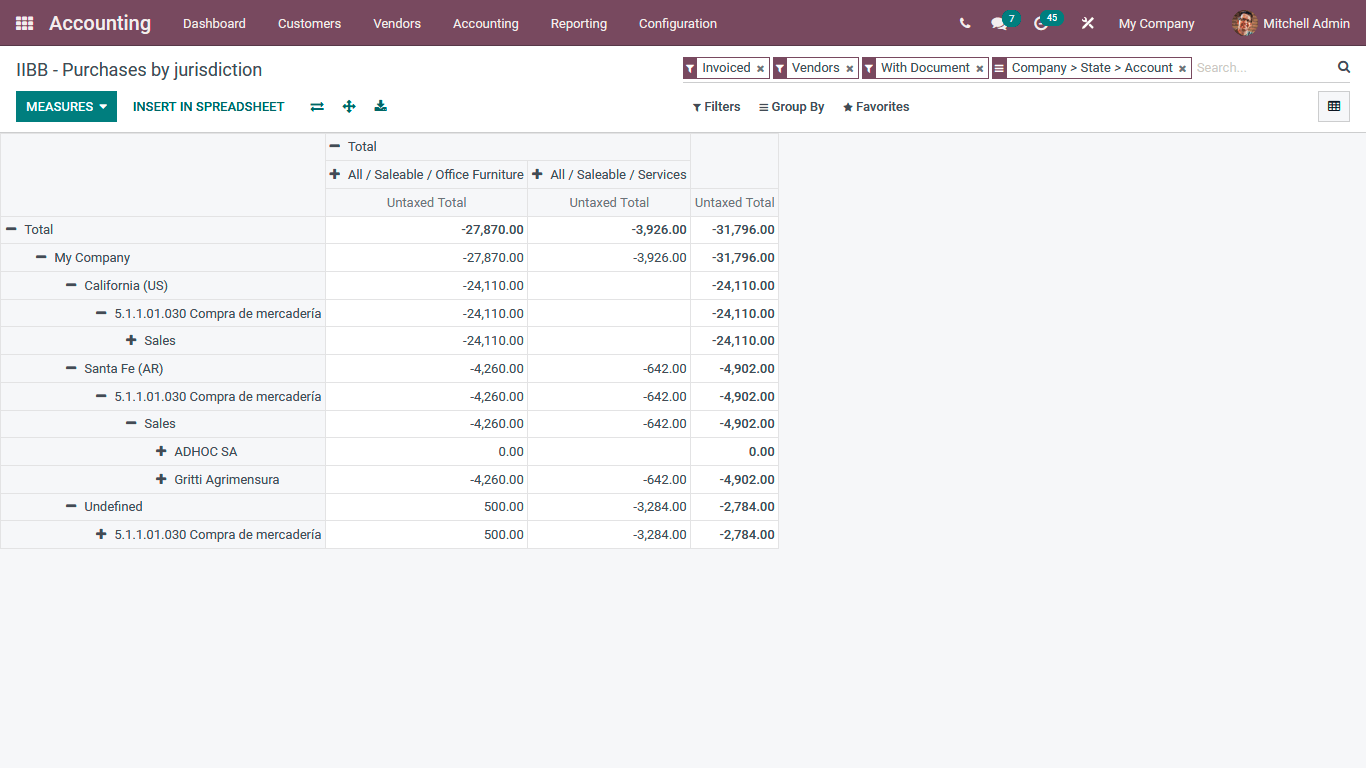

Similar to IIBB Sales by jurisdiction, the IIBB Purachse by jurisdiction is the tax to be provided to the authorities for the Purchase operation conducted in the region.

These are the reporting functionalities available in the Odoo platform for the Argentinian Localization aspects of business operation.

In conclusion, the Odoo Argentinian Localization will provide the business functioning in Argentina with the complete operational capability for the effective management of the functioning of the business.