Odoo introduces a new feature of Storno accounting in Odoo 16, which records all the reverse entries in negative credit or debit. Usually, in a business, there are several scenarios where the reversals are of wide reasons. When accounting transactions are posted, there might be the possibility of errors if the journal entry is a manual. For example, the amount, tax, accounts, or accounting date provided in the journal entry may be wrong. So this has to be corrected by reversing. For another example, can consider invoices reversal like credit notes and refunds. All these are a kind of reverse journal entry that might be for different reasons. Thus in such entries, the storno accounting takes the credit and debit values as negative.

In Eastern European nations, the Storno Accounting method of accounting is widely employed. Storno Accounting is required in several nations, such as China, Czech Republic, Croatia, Poland, Romania, Russia, Serbia, Slovakia, Ukraine, etc.

They believe storno accounting is the ideal method for reversing journal entries with negative debits and credits so that the accounting system won't have duplicate figures. Reversals can happen for a number of reasons, such as when errors are found in the initial transaction or when the reimbursement for returned goods needs to be applied, etc. Because bookkeepers typically use red ink to record Storno entries, this accounting method is also known as Red Storno. The accounting reports will display all such items in red.

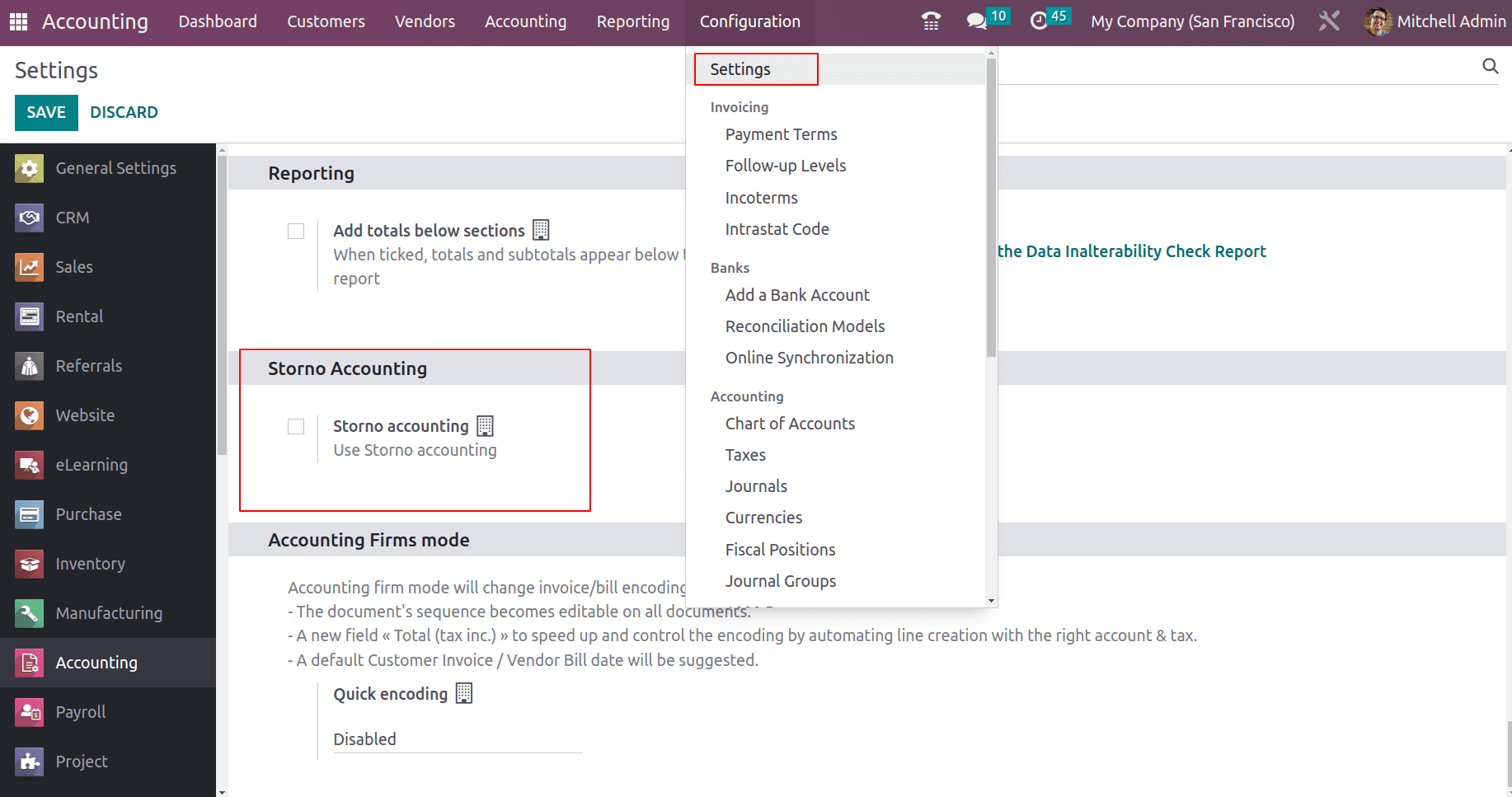

Let's see how the storno accounting is configured in odoo 16 Accounting. For the Goto

Accounting > Configuration > Settings > Enable Storno Accounting.

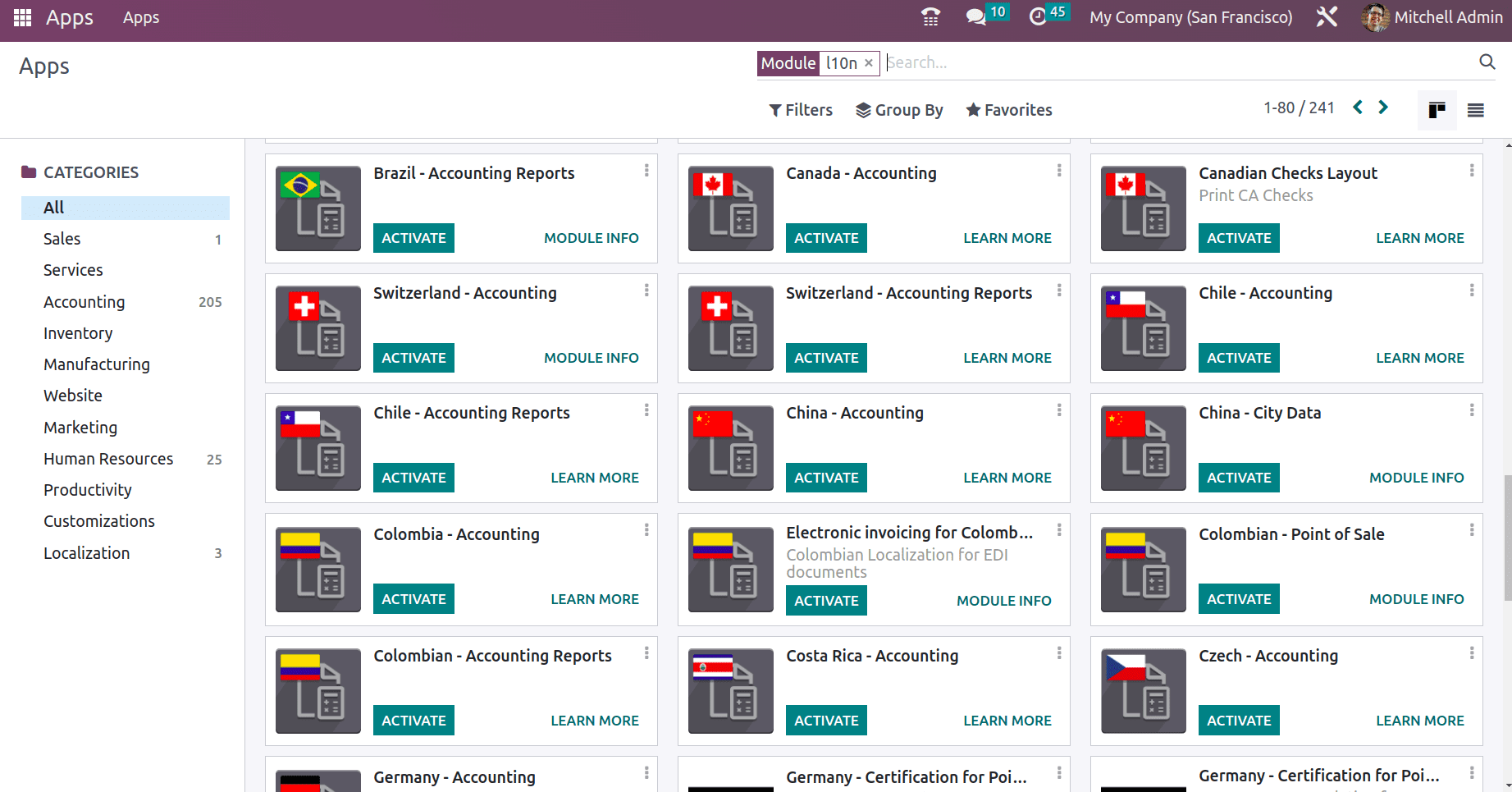

Enabling ‘Storno Accounting’ lets Odoo Accounting use storno accounting in Odoo 16 features. Odoo provides a lot of fiscal localization packages so that odoo accounting can be used in all those countries. You can find the localization packages when you search in odoo Apps.

One can activate the respective accounting localization package based on their country and some countries may use this storno accounting. So they can also activate the storno feature if required.

Now let’s see how these entries are affecting ledgers. Consider a scenario where a sales return is done. So the reversal amount is recorded with negative credit and debit. These negative credits/debits are also applicable to accounting journal entries and even stock journal entries. Since the reversal process includes the stock reversal also.

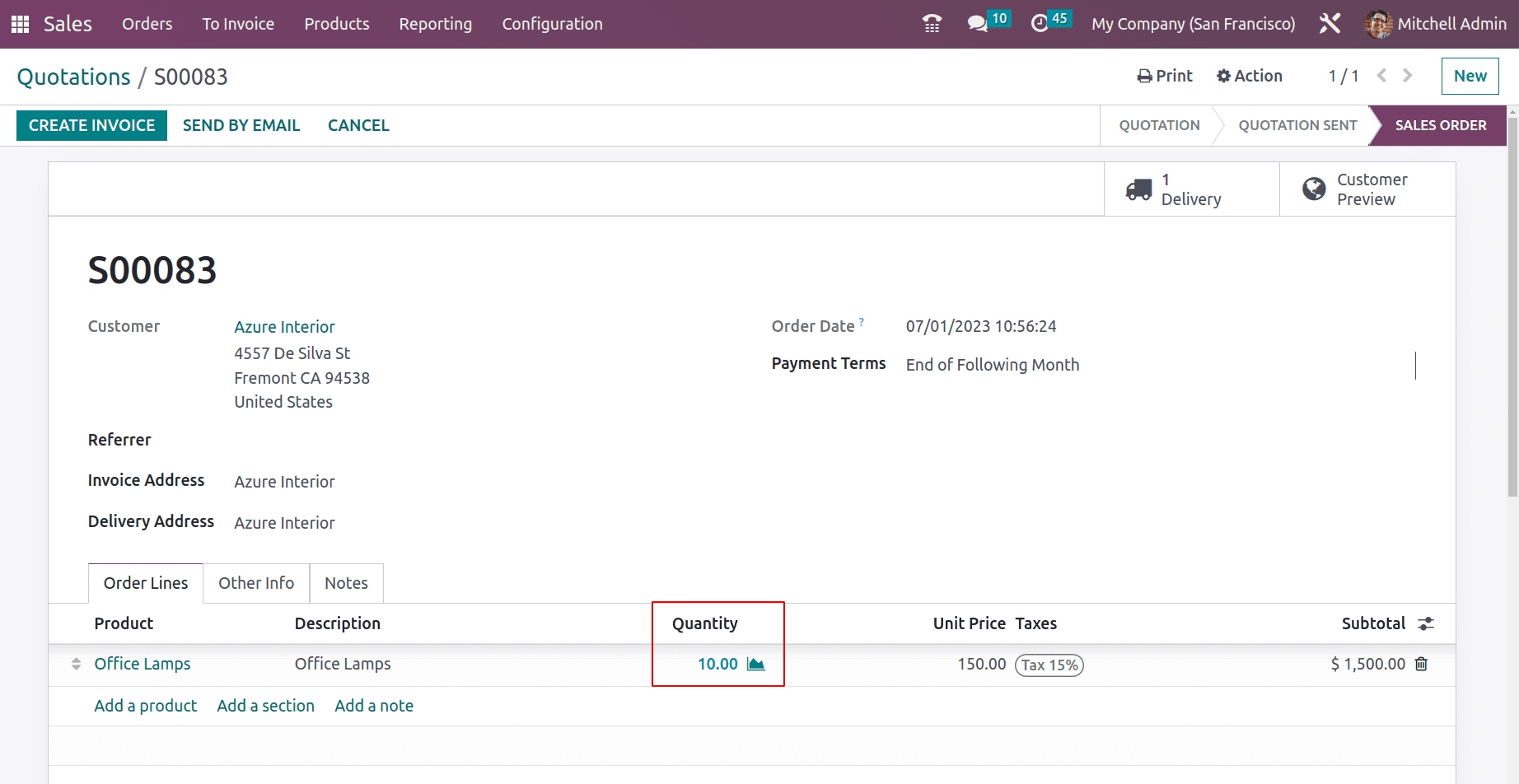

Now create a sales order for a product, where customers asked for 10 quantities.

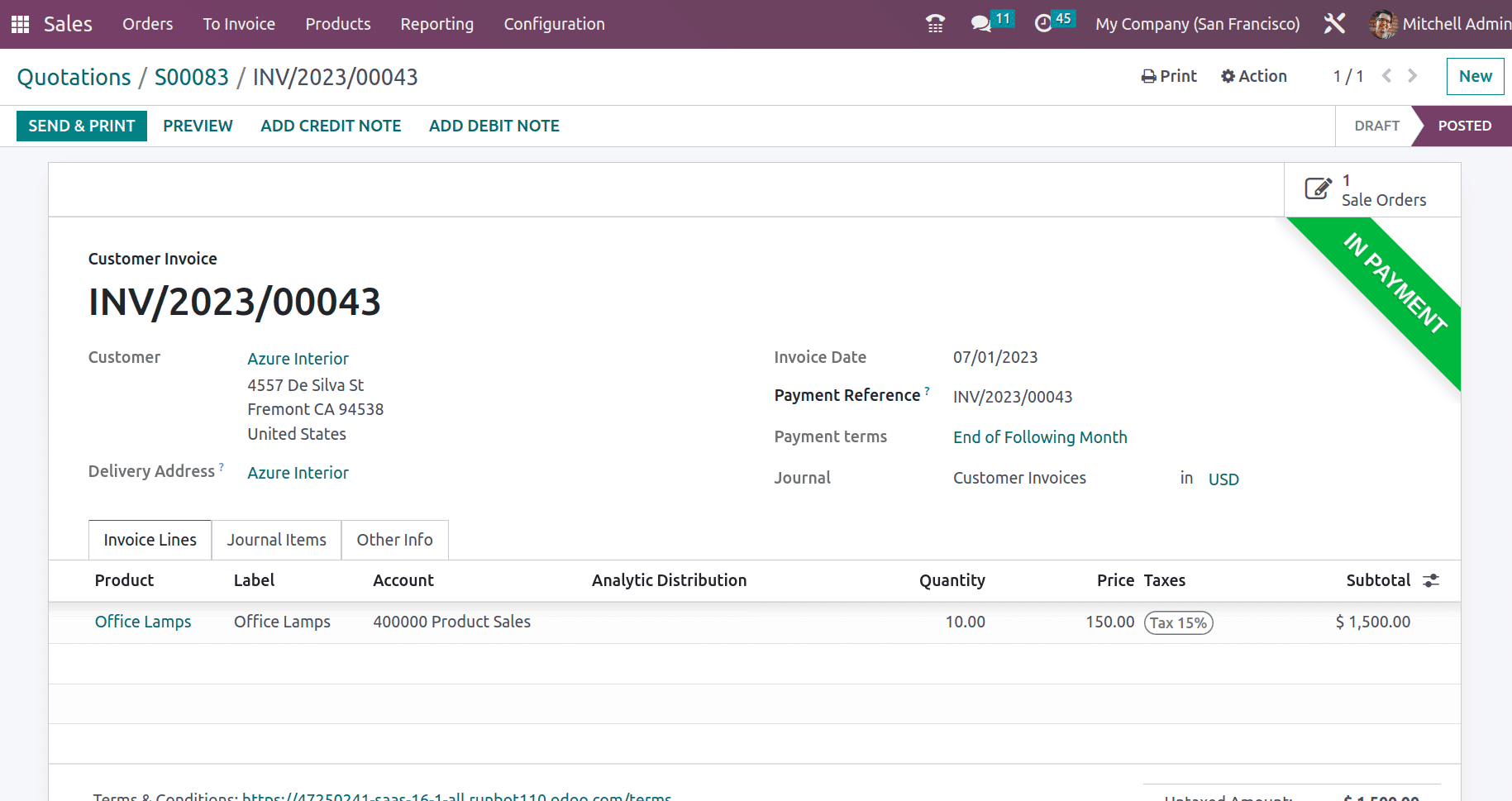

Now, we can send the invoice to the customer (sending an invoice can be based on invoicing policy). This time the invoice is sent to the customer and consider the customer made the payment already.

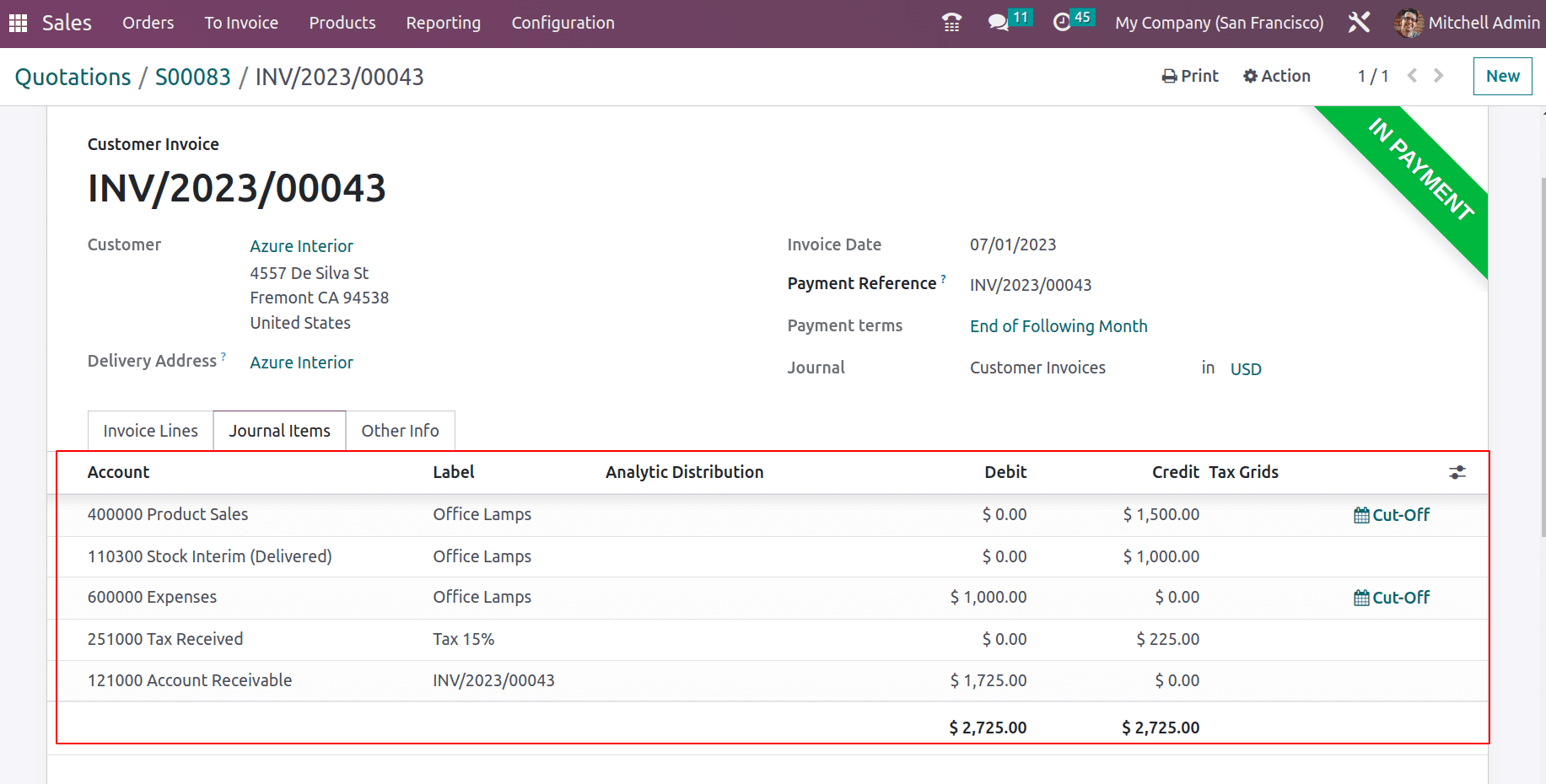

In the journal Items tab, we can see the ledger posting to the respective accounts.

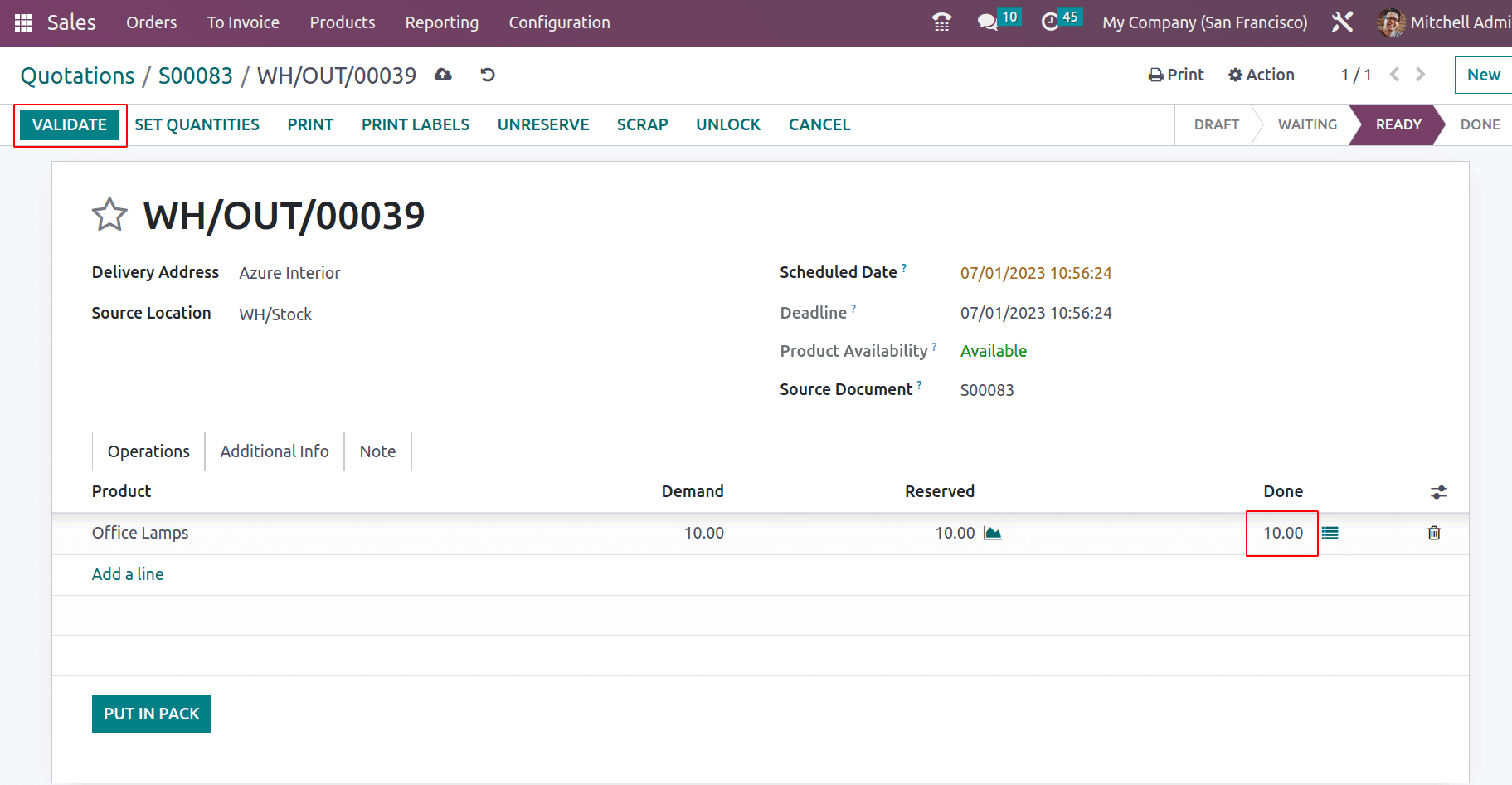

And as per the customer's request, 10 quantities are delivered to the customer.

Validating the transfer marks the status as DONE and the product will move from the stock to the customer. Product delivery may be completed after some days because it depends on the customer's lead time.

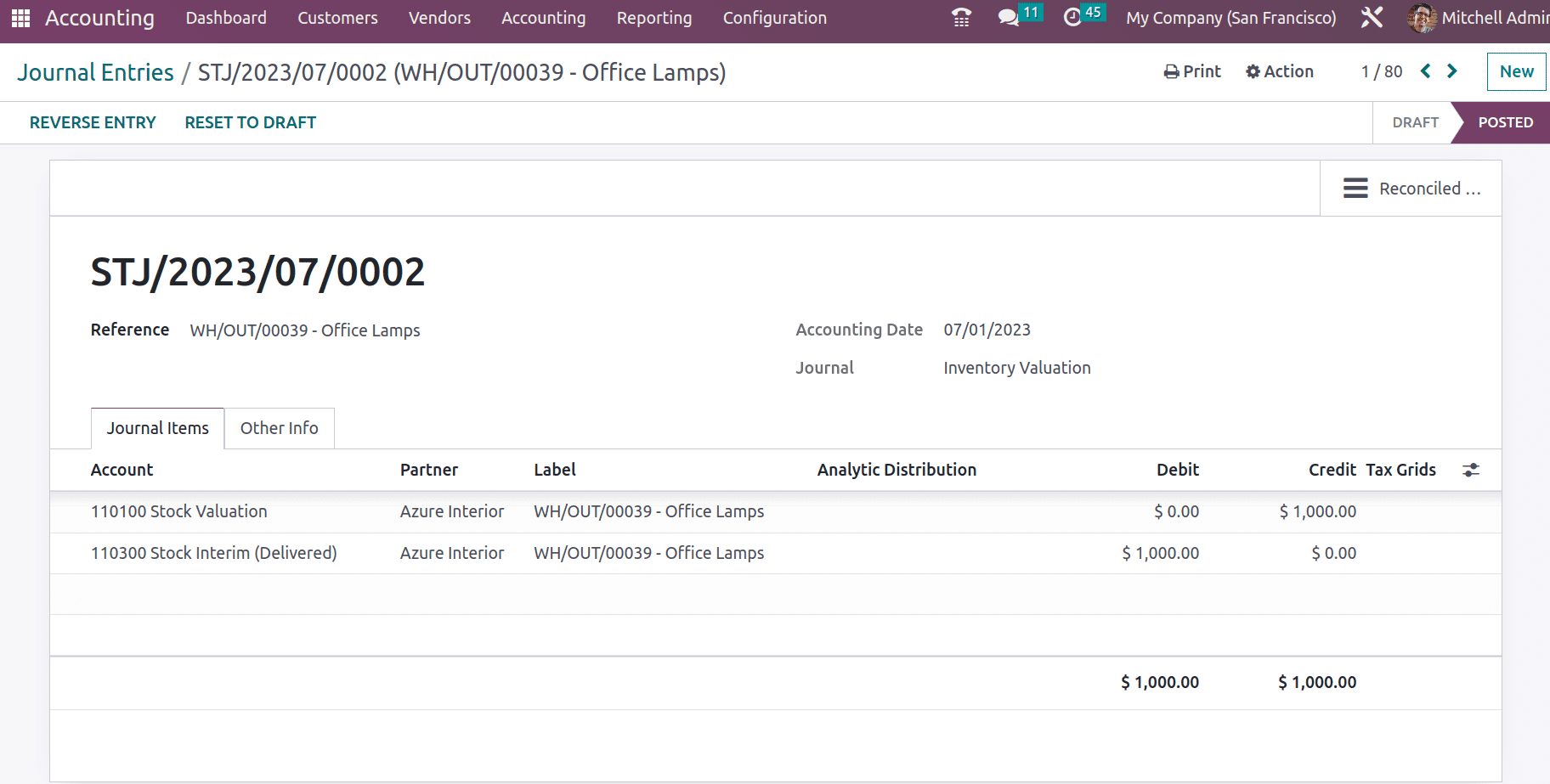

Let's see the stock journal entries for the delivery. Here the stock valuation account is debited and the stock output account is credited.

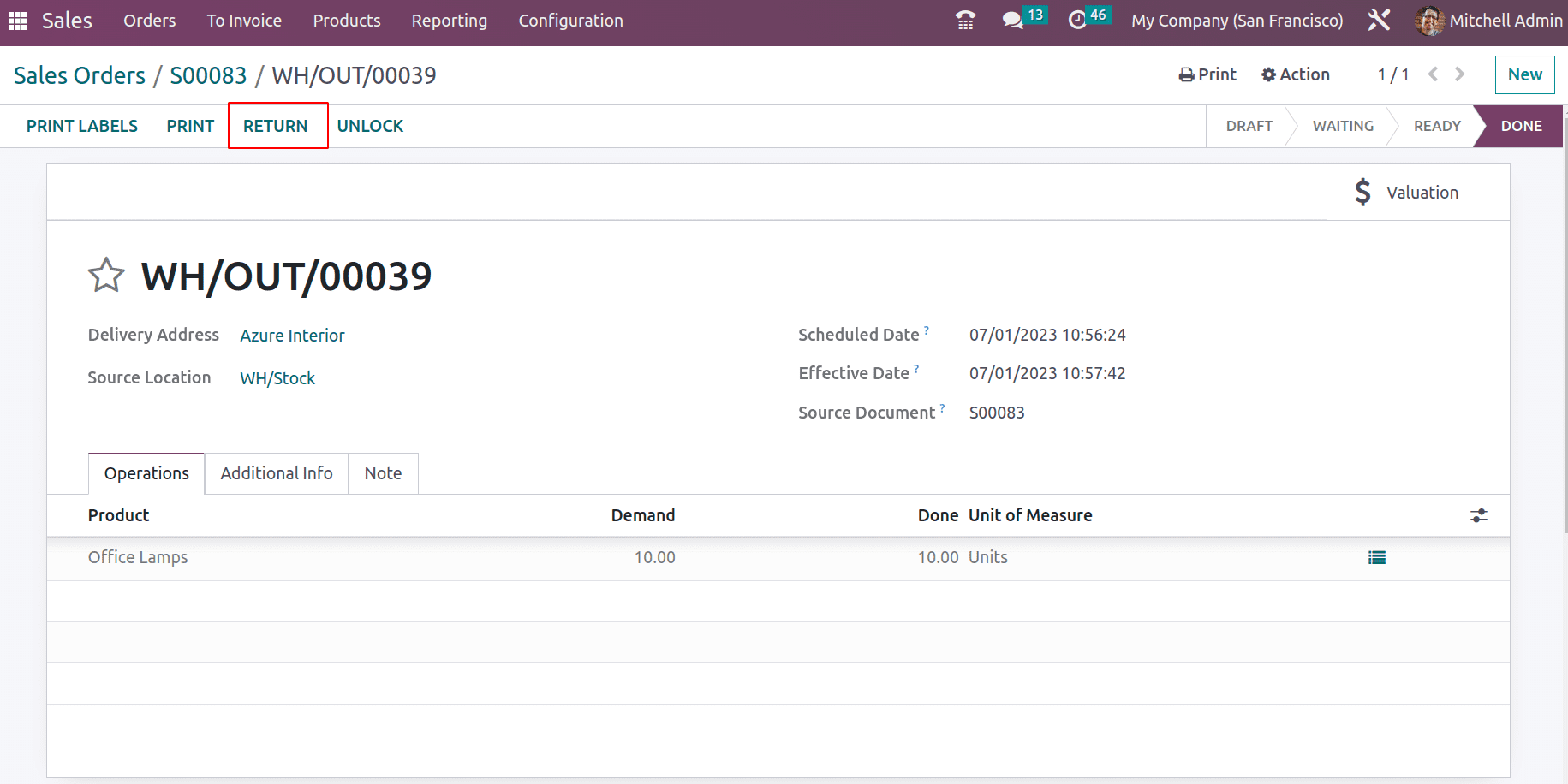

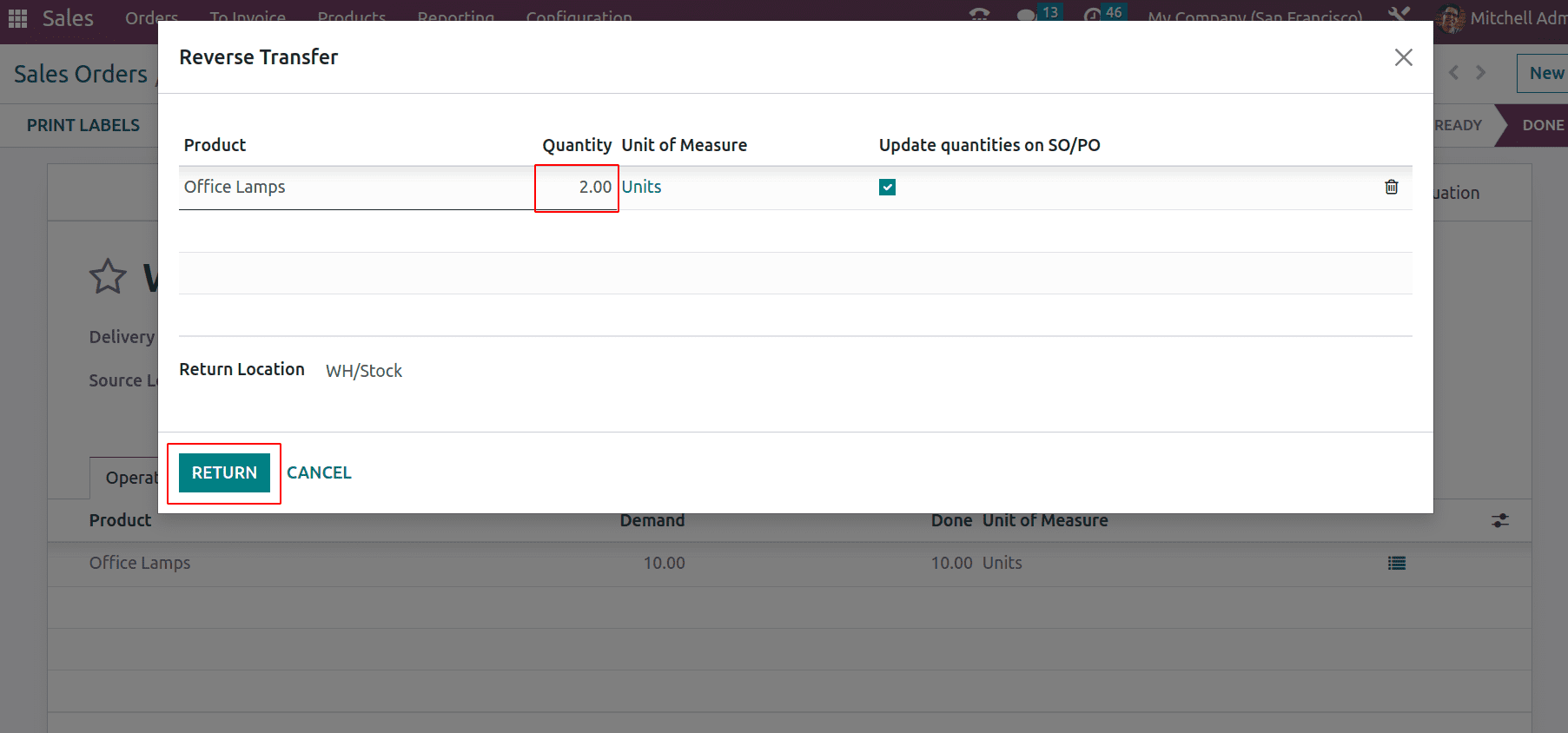

Suppose the customer found that 2 units of office lamps are not working. Thus he can return the damaged product to the company.

The return option enables you to return the item. A pop-up will appear when hit on the RETURN and users can mention the quantity that the customer is returned. Here the 2 units are returning and the quantity is added as 2 and click on RETURN.

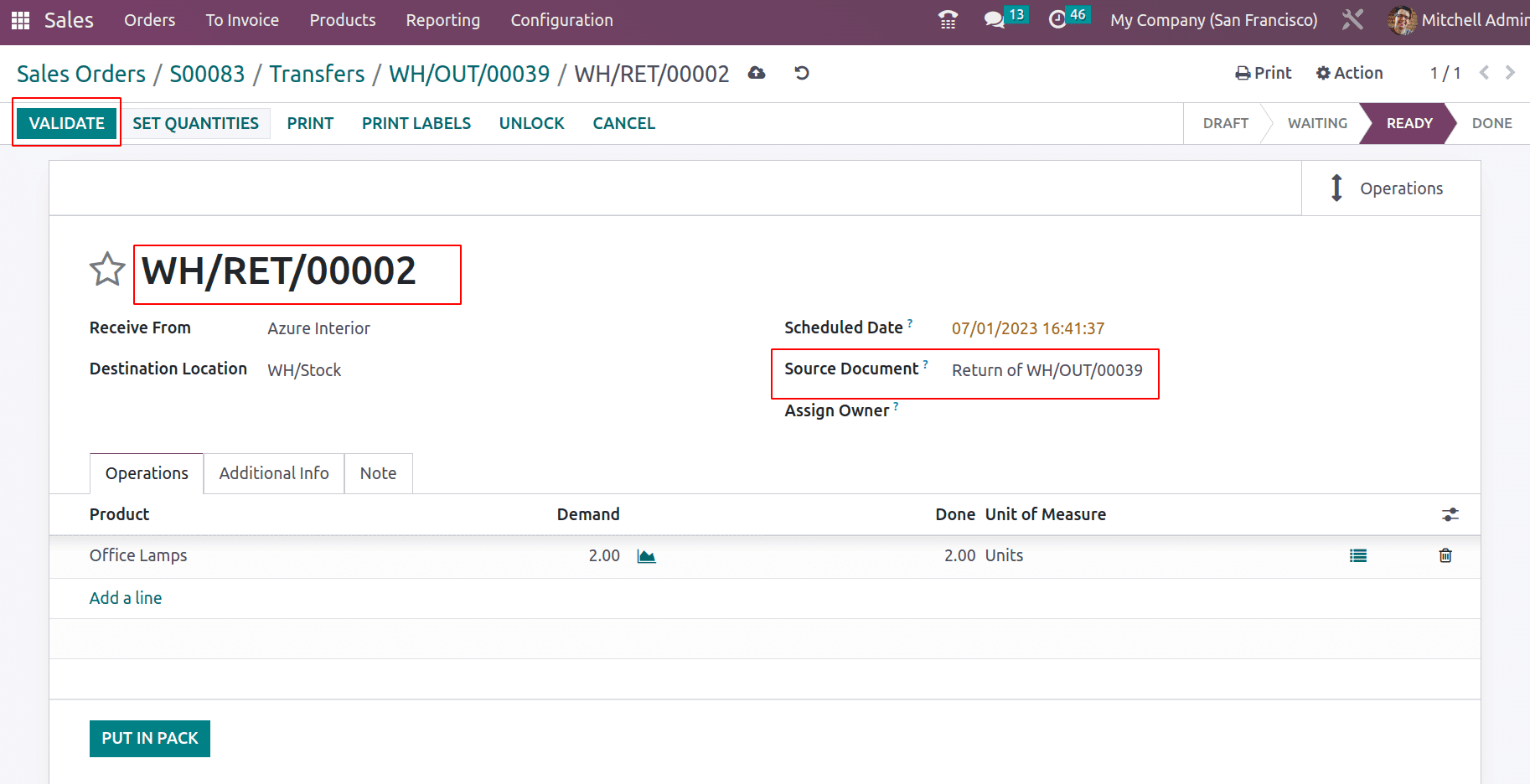

This will generate a return transfer and validate the return.

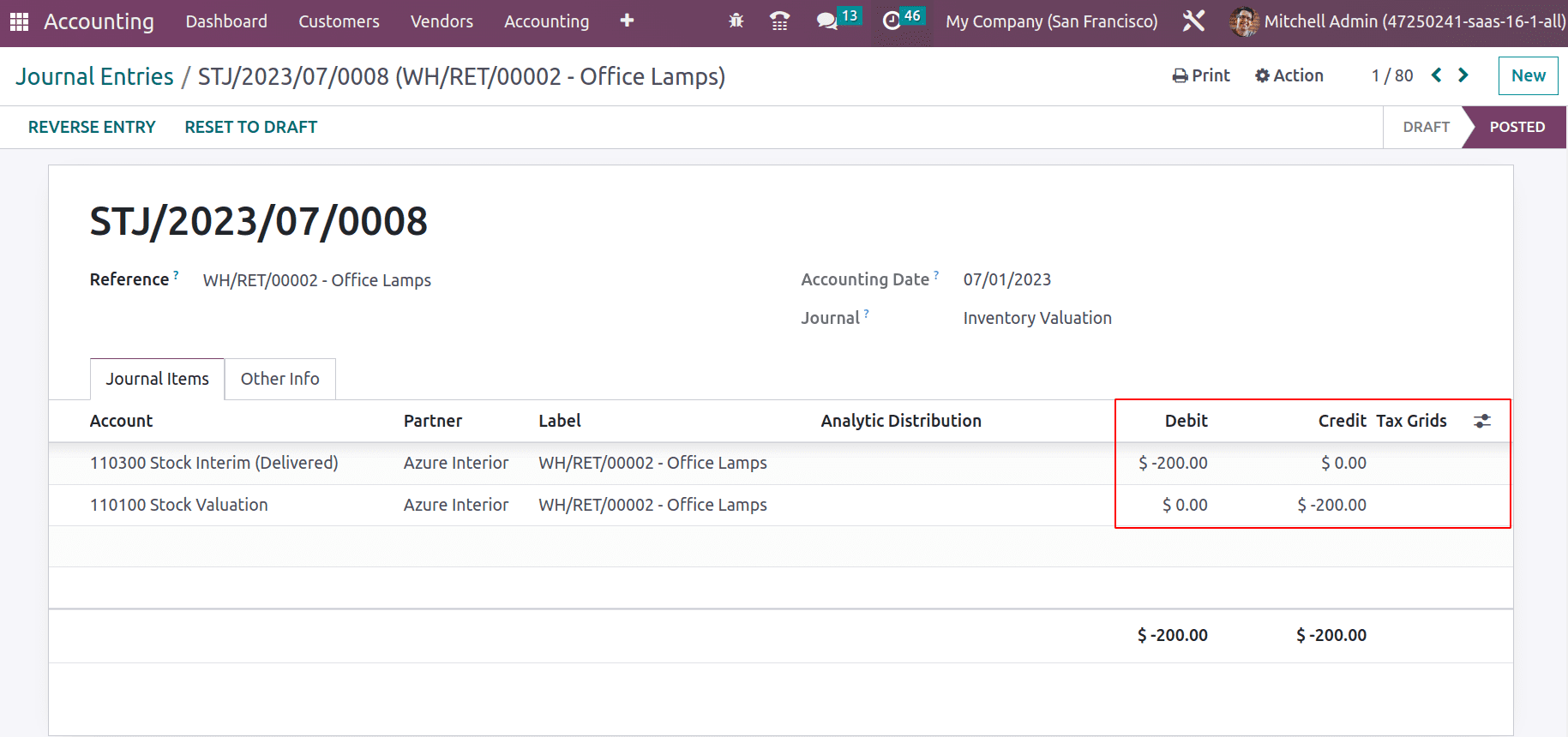

So this will create a reversal transfer of stocks. Thus let's check its stock journal entry.

The affected values in stock interim delivered are -(Debit) instead of credit and the stock valuation in -(Credit) instead of Debit.

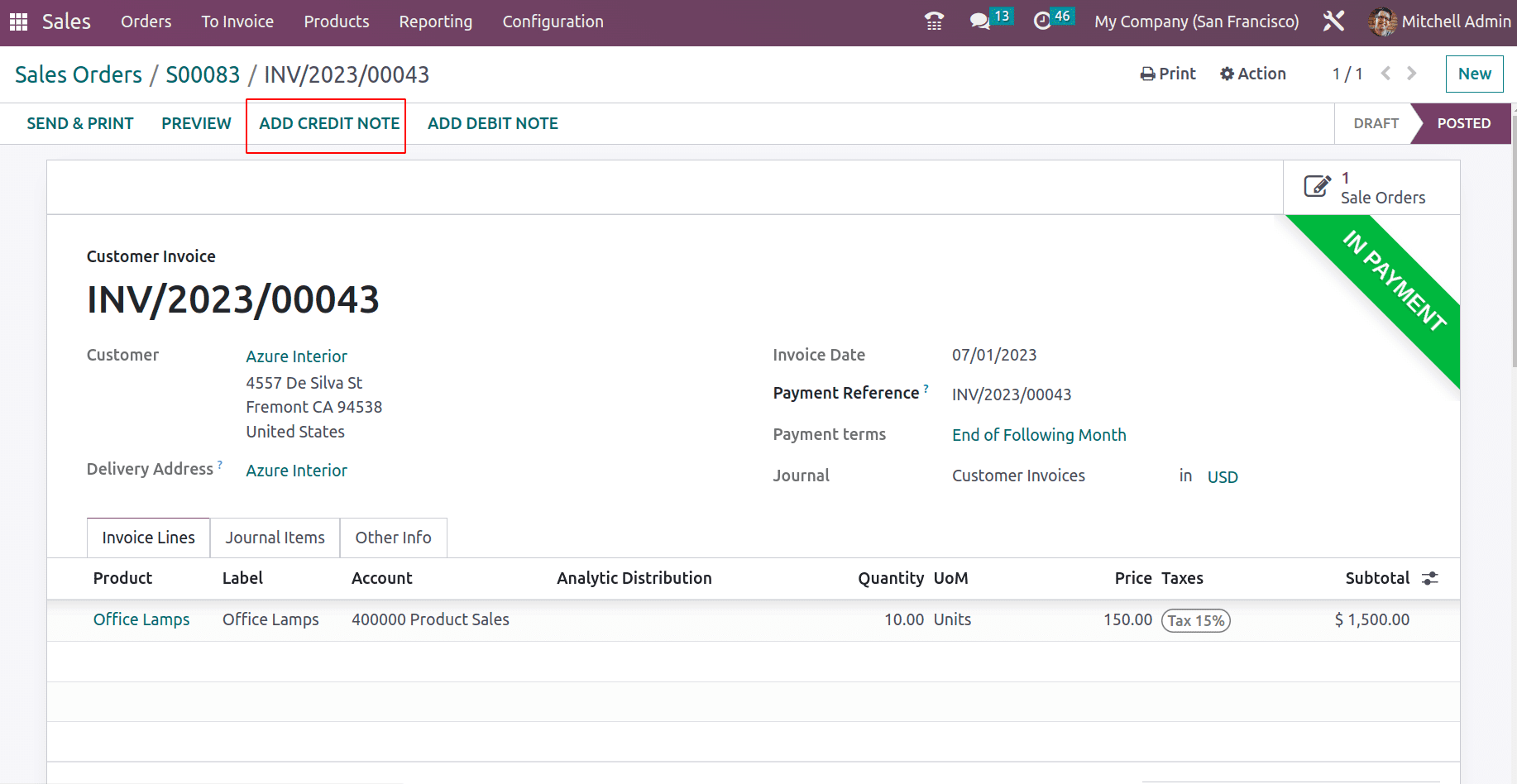

This is how the reversal journal entries are affected in the stock journal. Now the next step is that the company has to refund the paid amount to the customer. Thus create a credit note for that.

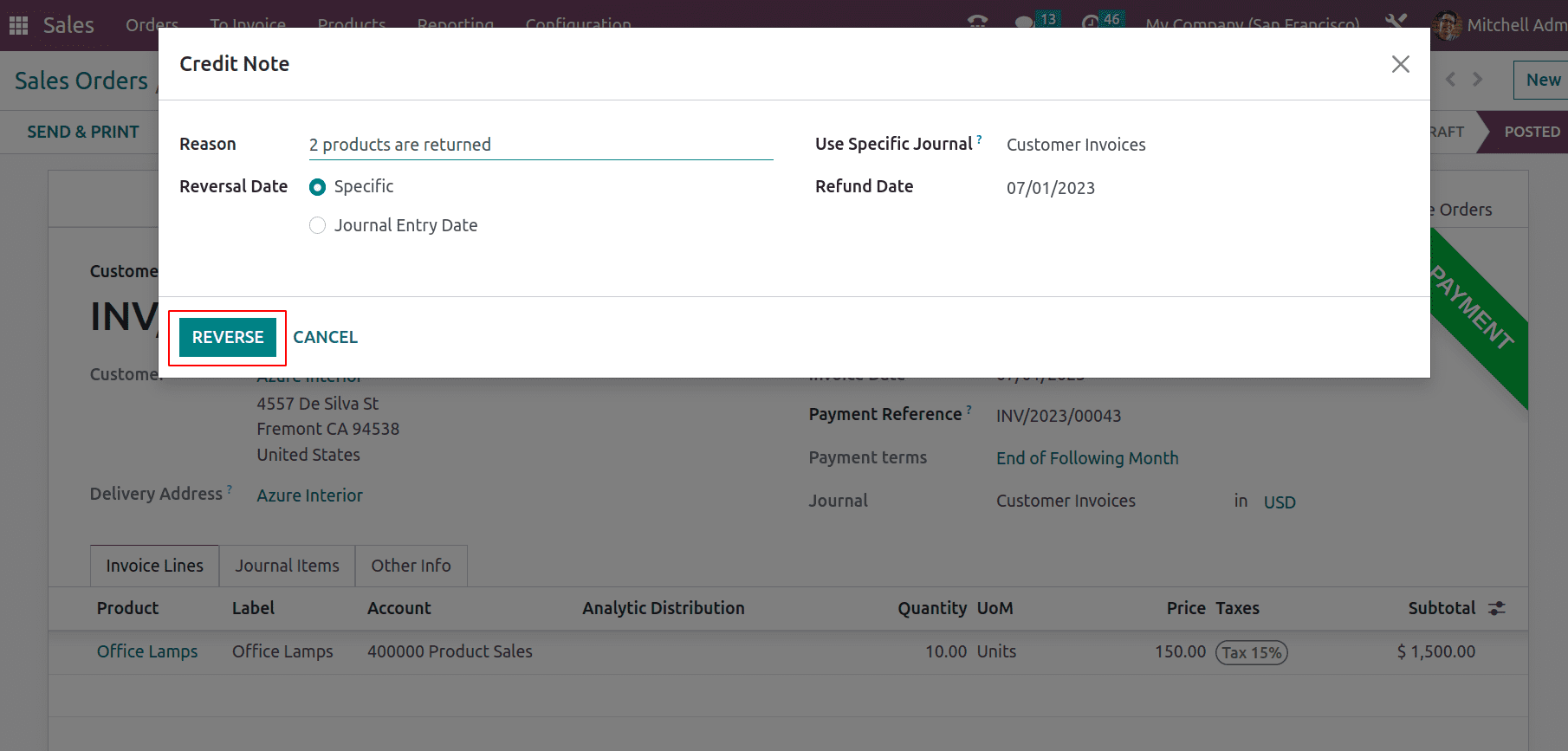

A pop-up appears when you click on ADD CREDIT NOTE, where the reason for credit not can add and create a reverse invoice.

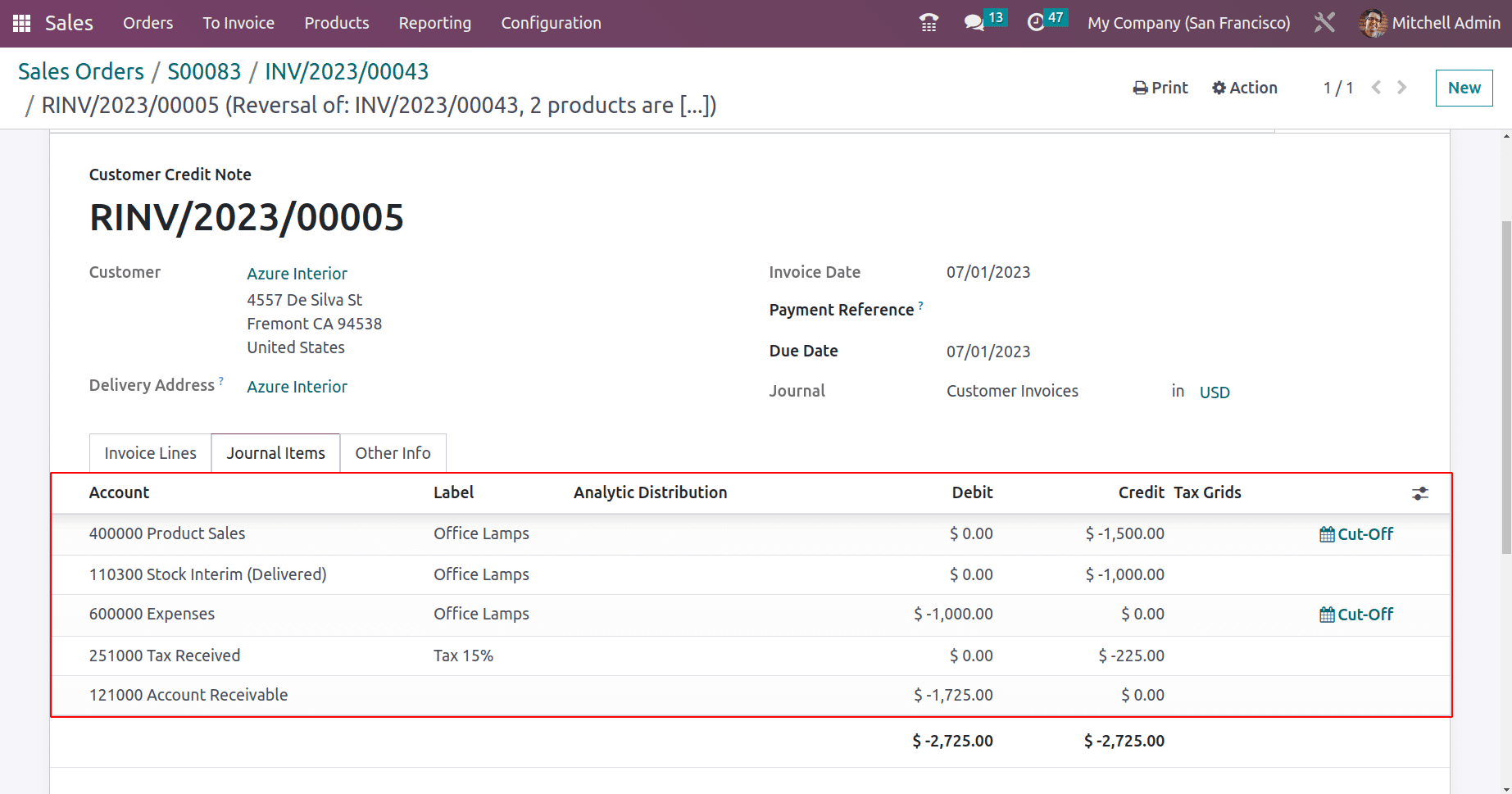

Now let’s check the ledger of the reverse invoice.

Here the income account is -(Credit) instead of debit and all others are depicted in negative.

In general, when an invoice is generated, the Accounts Receivable are debited and the Income Accounts are credited, and while reversing, the Income Account will debit and Accounts Receivable will both be credited. But in Storno accounting, the Account Receivable will be a "-ve" Debit and the Income Account a "-ve" Credit for the reverse entry.

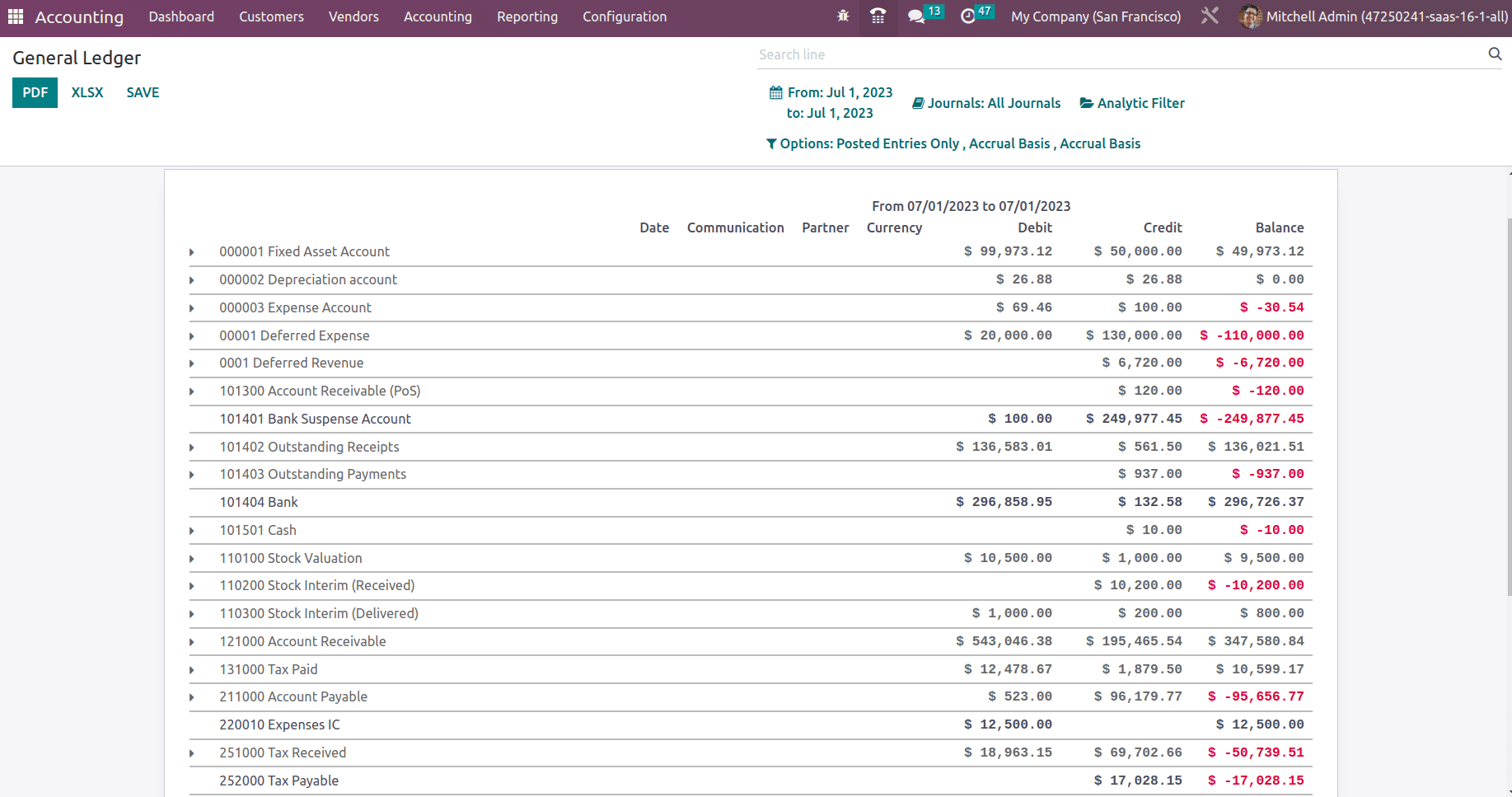

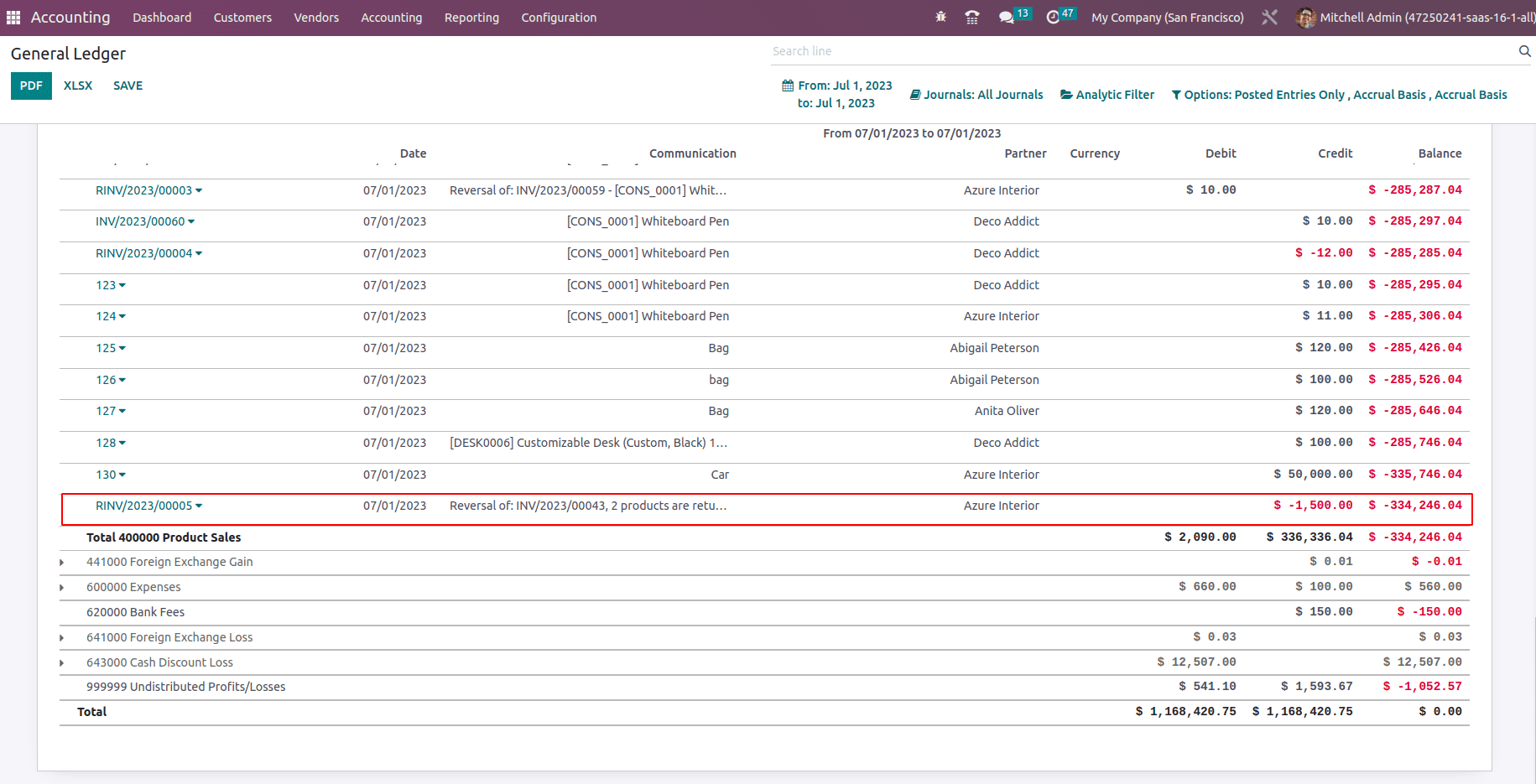

Also, this will depict in the accounting reports as negative and in red color. Go to the general ledger report and you can find all the balance amounts having negative amount are depicted in red color.

One can unfold the accounts and view the respective journal entries in each account.

Thus storno accounting is another accounting practice of accountants who record the reverse entries in negative and are depicted in red color to identify such entries easily.