The country-specific modules that impart a chart of accounts, pre-configured taxes, legal statements, and fiscal positions on a database refer as a fiscal localization package. Using localization, individuals from several countries can localize ERP commodities per a country's specific rules. Each country contains its own taxes, and the localization feature makes tax automation simpler. ERP software assists in removing all barriers in your organization easily. According to customers' business needs, Odoo ERP improvises localization features in almost every module. Odoo 16 Accounting module enables you to use different localization packages as country-specific.

This blog points out the introduction to Fiscal Localization in Odoo 16 Accounting.

We can run various processes in a company, such as taxes, currency, bank reconciliation, payments, and more in the Accounting application. Evaluation of journal entries, trial balance, balance sheet, etc., made accessible through Odoo 16 Accounting. Let’s view the essential introduction to Odoo Fiscal Localization in Odoo 16 Accounting.

Benefits of Odoo Fiscal Localization

The fiscal localization feature in Odoo 16 depends on several countries. Each country-based fiscal localization consists of its own peculiarities. Some of the common advantages of using Odoo fiscal localization are given below:

* The storage of electronic invoice documents in a system database is simple with fiscal localization. You can preserve the data for future reference of company requirements.

* Apply standard or new taxes on items and sales to manage the customer tax, withholding taxes, credits, book payments, and more.

* According to different business cycles, we can easily integrate the accounting transactions of a company using fiscal localization.

* Easily develop multiple reports as per similar localization and accounting features.

* The facilitation of report preparation is available by combining the foreign and domestic tax reports.

* Centralize the data in an organization to a single database based on reports.

To Set the Fiscal Year in a Company using Odoo 16 Accounting

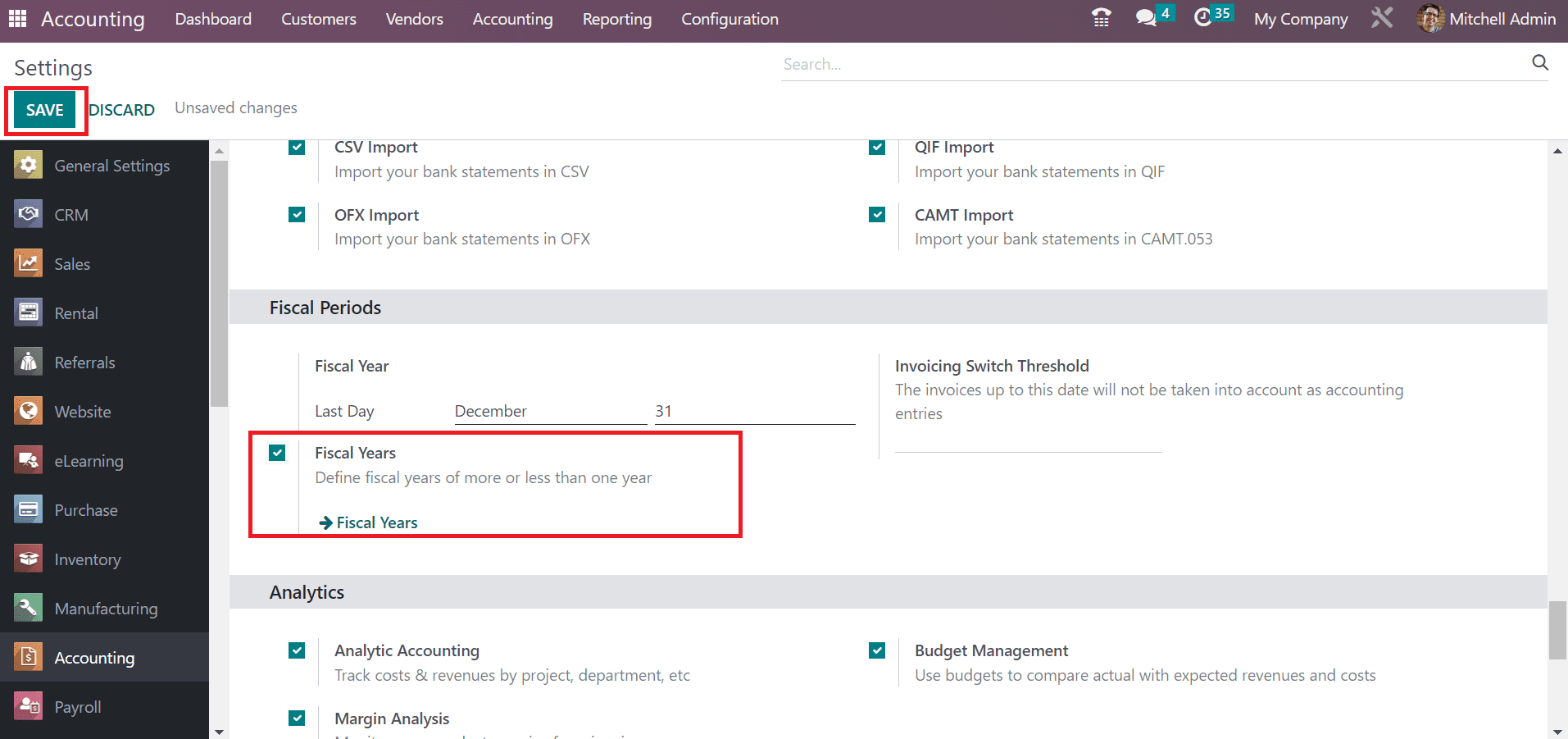

Users must activate the fiscal year feature by choosing the Settings menu in Configuration. Below the Fiscal Periods section, enable the Fiscal Years option to define the fiscal years of more or less than one year. After the activation, click the SAVE icon in the Settings window, as mentioned in the screenshot below.

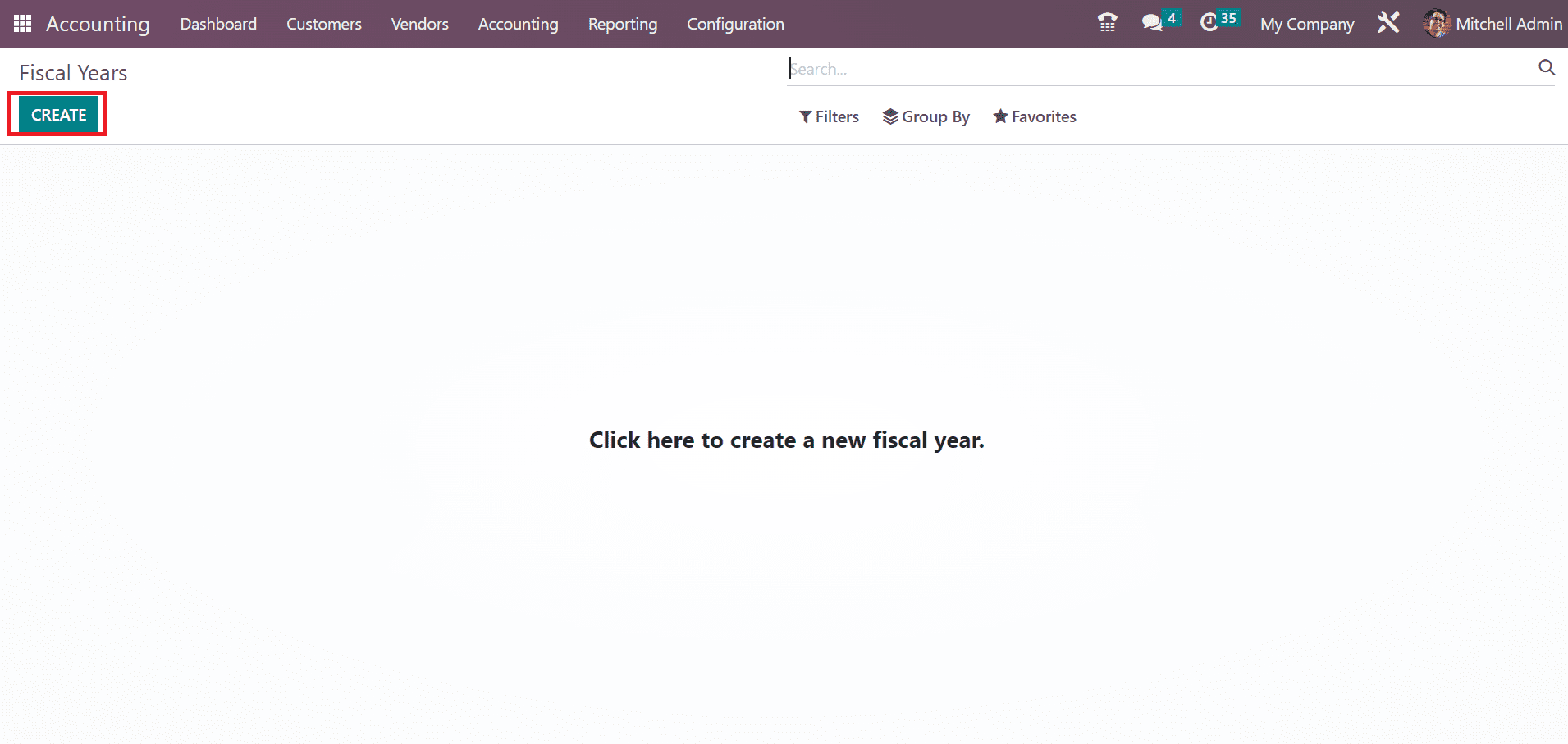

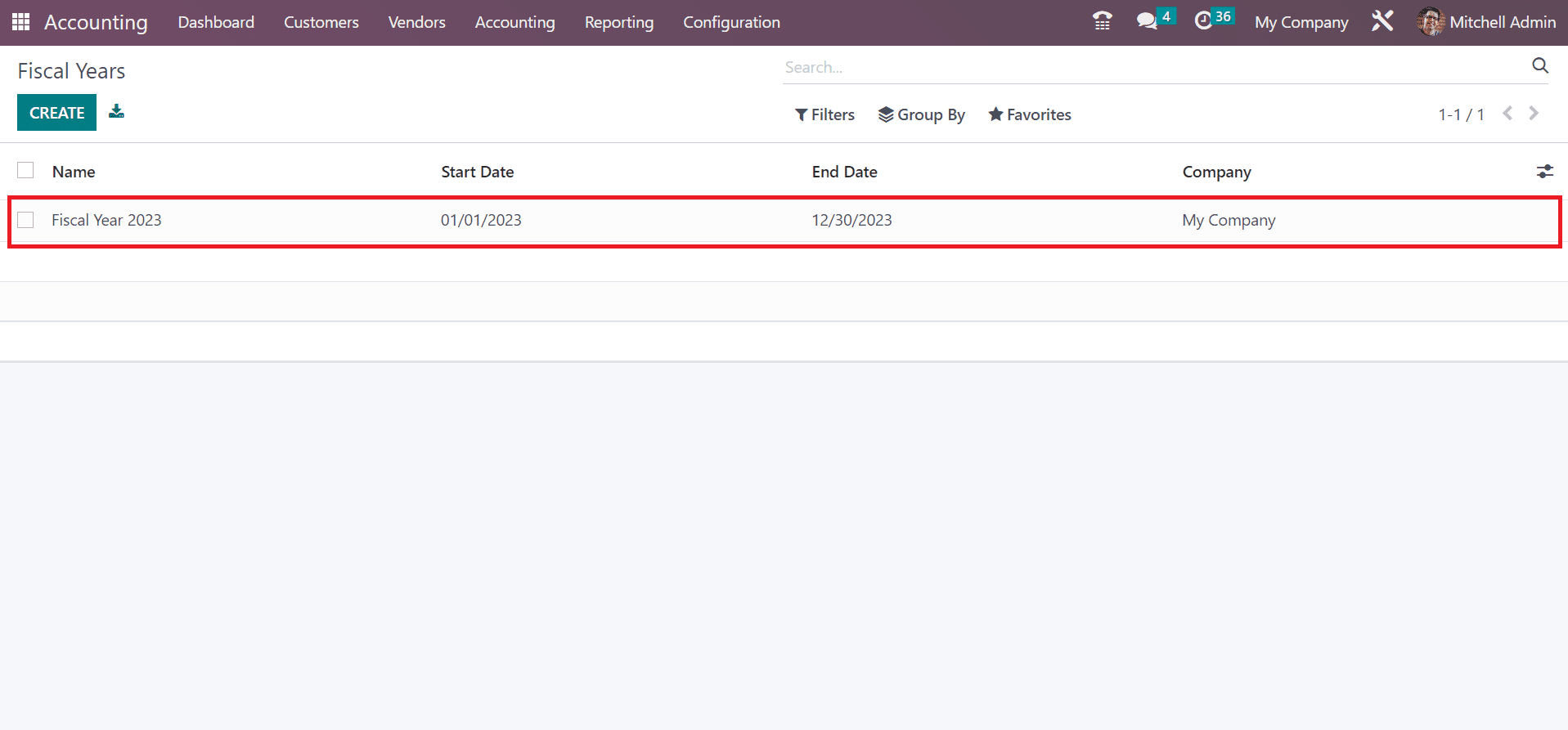

Now, the fiscal year feature is activated in the Odoo 16 Accounting. You can obtain the Fiscal years feature from the Configuration tab. In the new screen, a fiscal year for a company is defined easily by selecting the CREATE button as specified in the screenshot below.

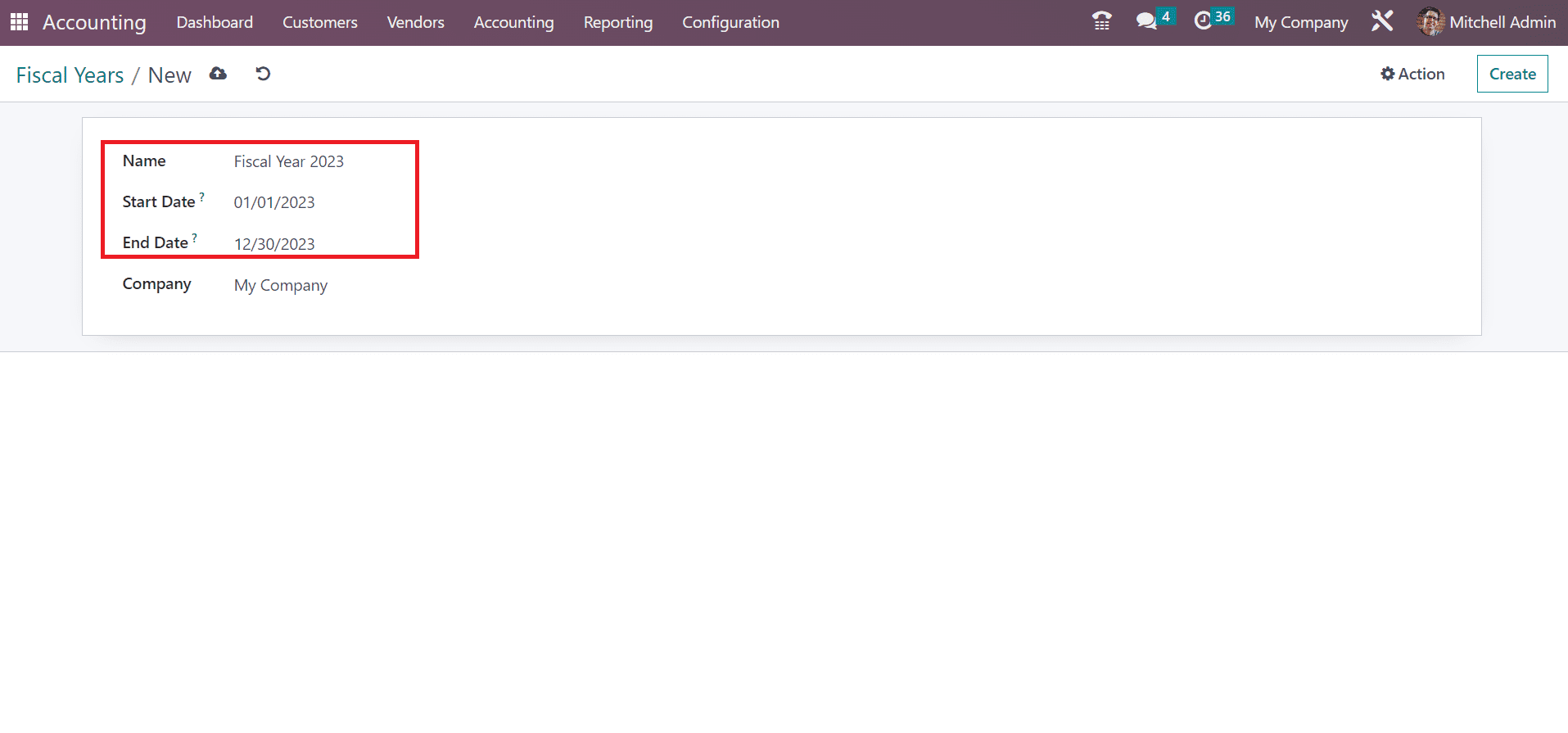

On the open page, add the year's title as the Fiscal Year 2023 in the Name field. Choose the beginning date included in your company's fiscal year with the Start Date field. On the other hand, the user can mention the last day of the company fiscal year in an End Date field, as defined in the screenshot below.

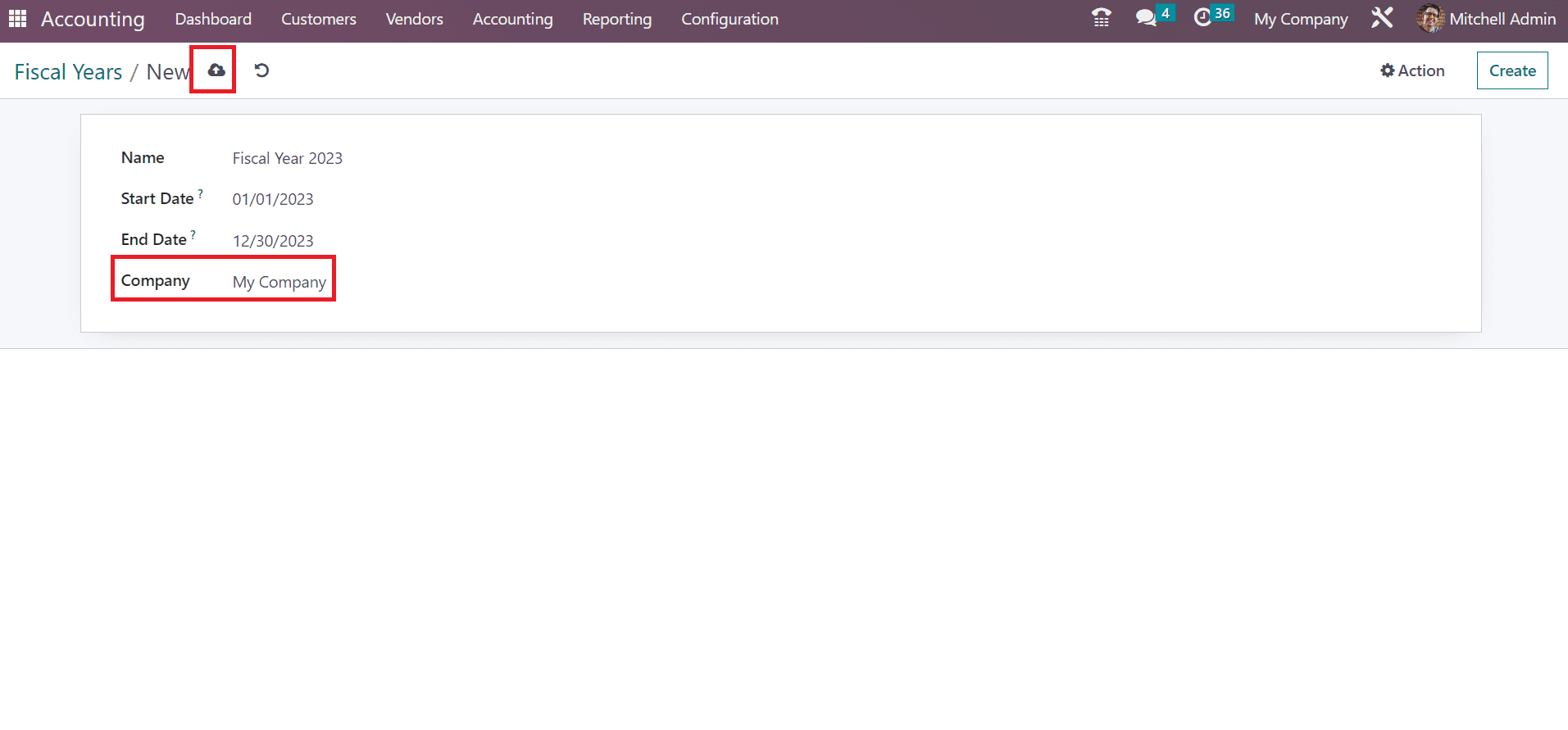

Select the My Company option from the Company field. After picking your firm name, click the Save manually icon in the Fiscal Years window, as noted in the screenshot below.

Your created fiscal year data is accessible in the main window, as pointed out in the screenshot below.

How to Create a Fiscal Position based on your Company in the Odoo 16?

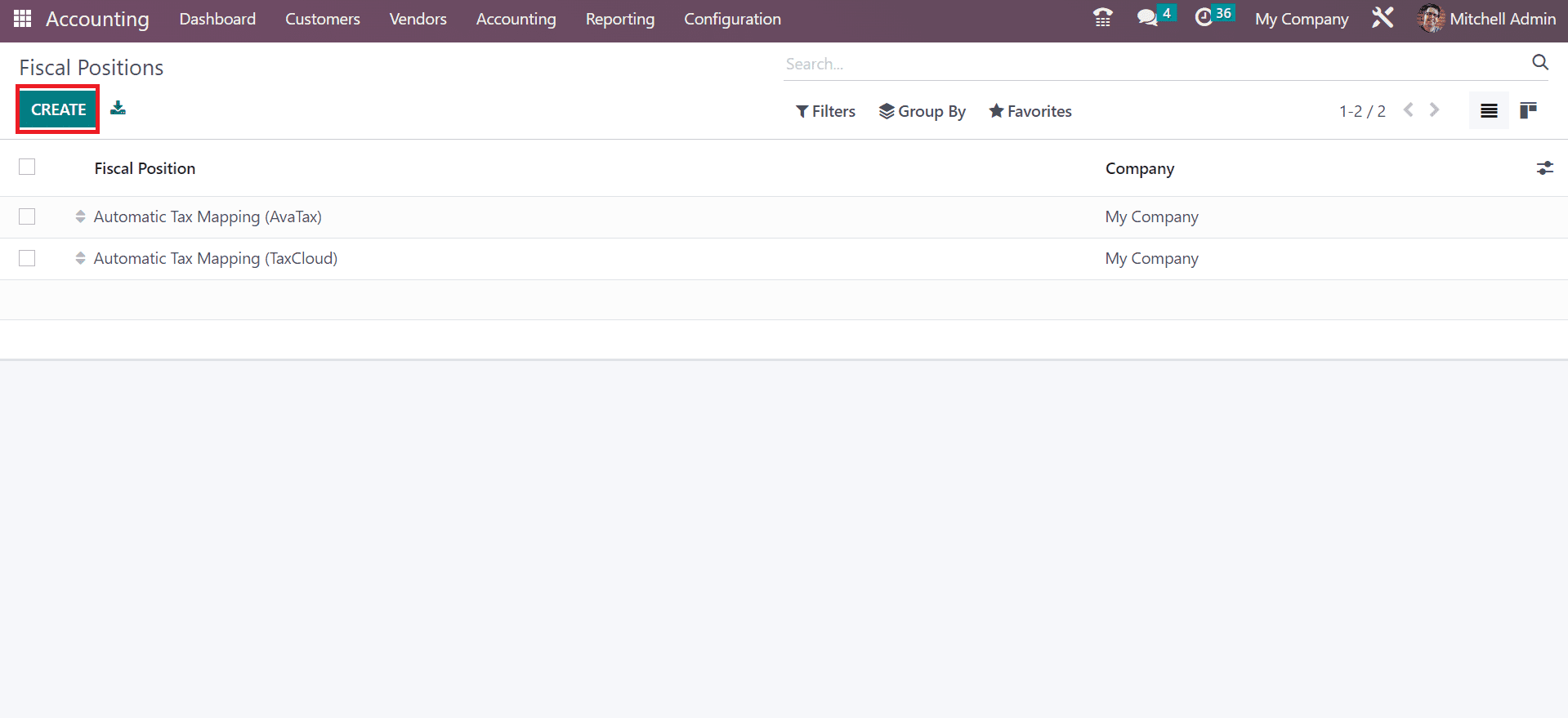

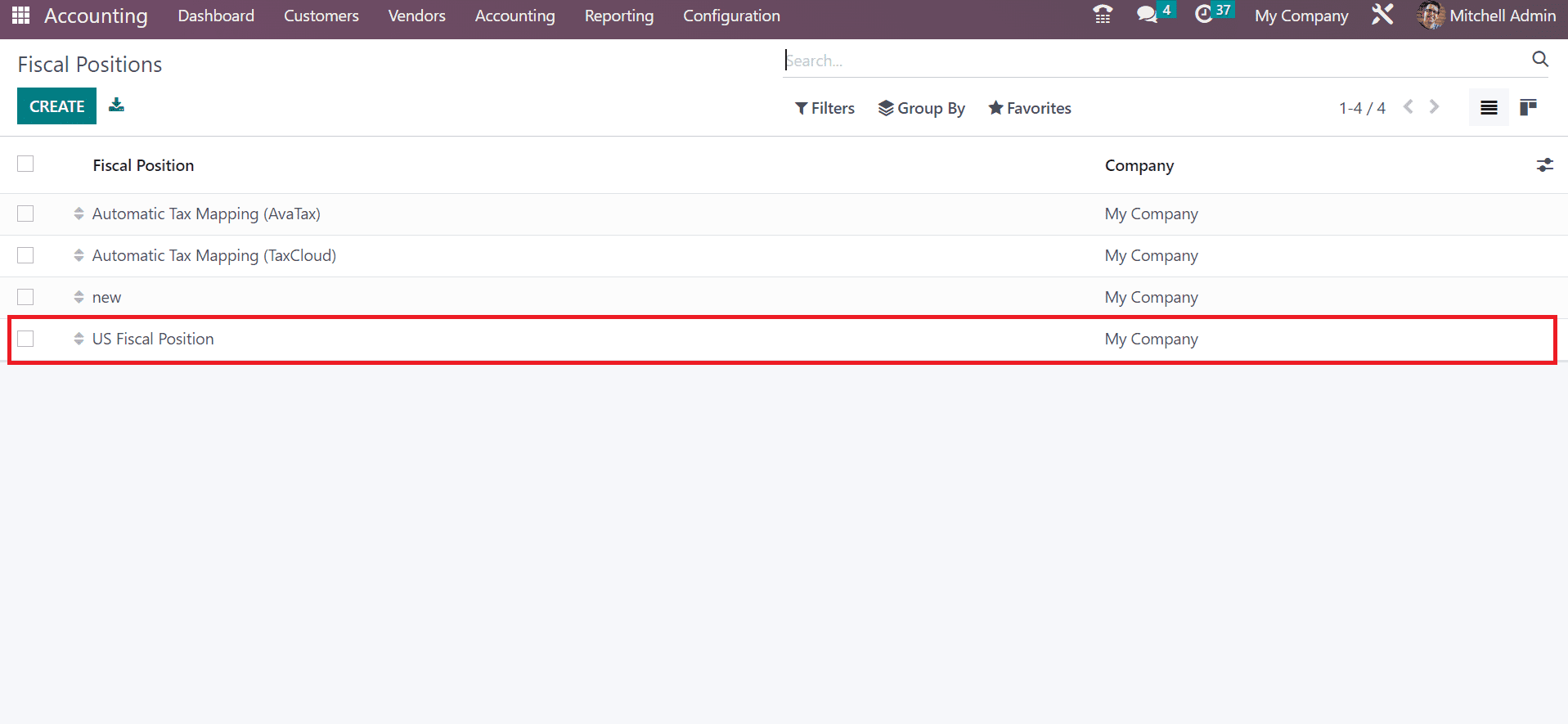

Management of various taxes is made easy through fiscal position based on a country. The fiscal position ensures users develop rules to adapt taxes manually and use transaction accounts. You can apply for these fiscal positions on different methods, such as manually on a transaction, automatically using particular rules, and easy to assign to a partner. By choosing the Configuration tab, you can acquire the Fiscal Position under the Accounting section. In the List view, you can see the record of each fiscal position uniquely, and it defines facts such as Company or Fiscal Position. Select the CREATE icon to formulate a new fiscal position for your firm.

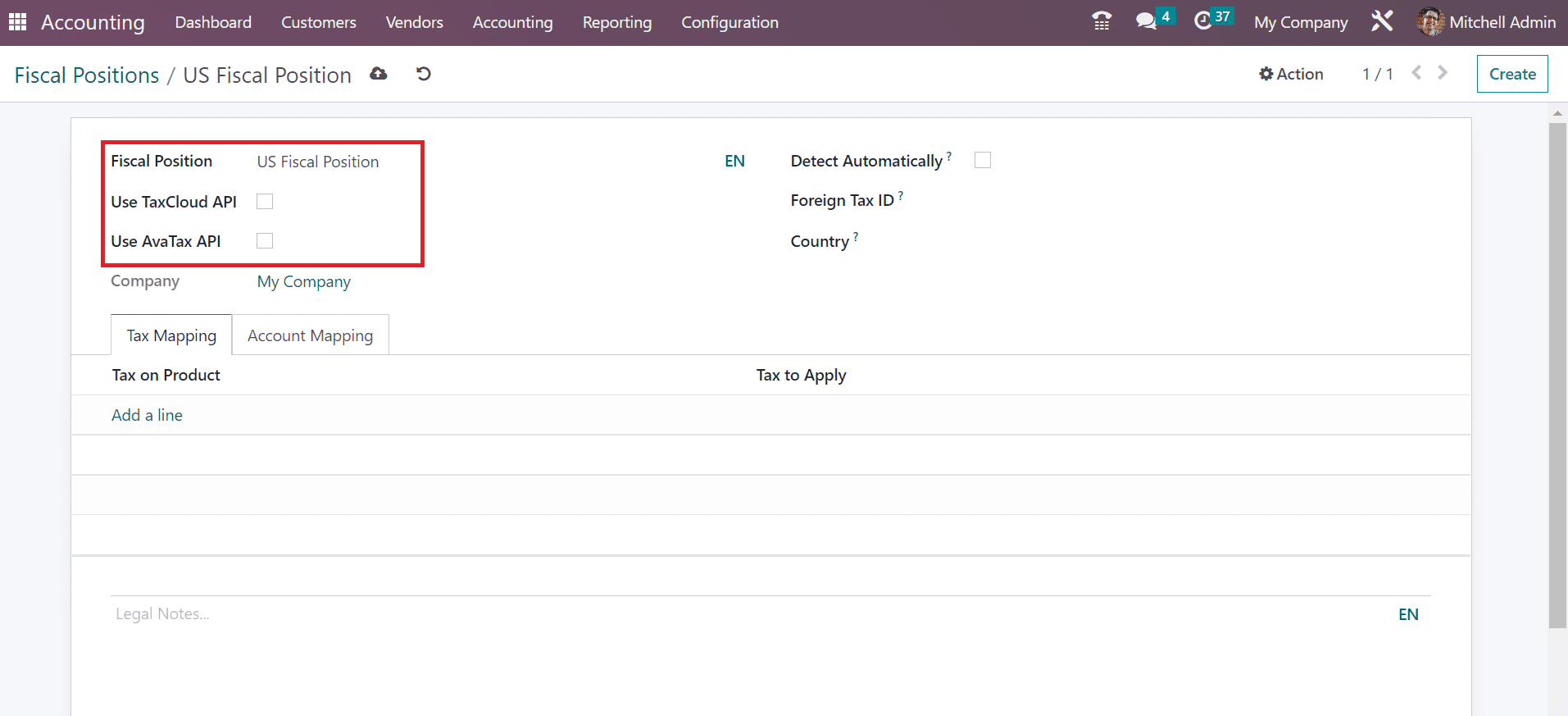

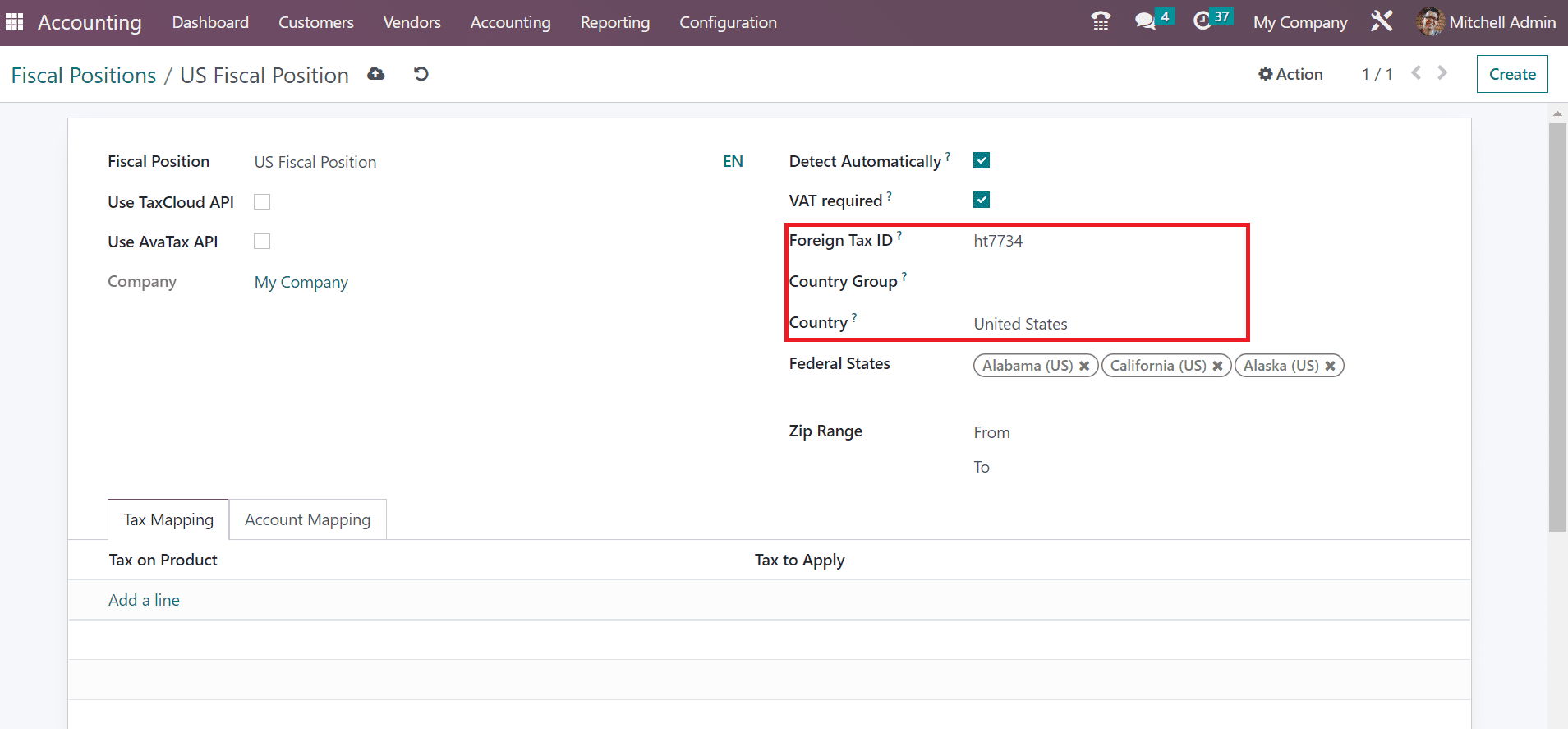

In the open page, add your fiscal position name as US Fiscal Position on the open page. Users can configure taxes based on tax cloud credentials once enabling the Use TaxCloud API option. Similarly, you can compute tax as per Avatax after activtaing the Use Avatax API option as indicated in the screenshot below.

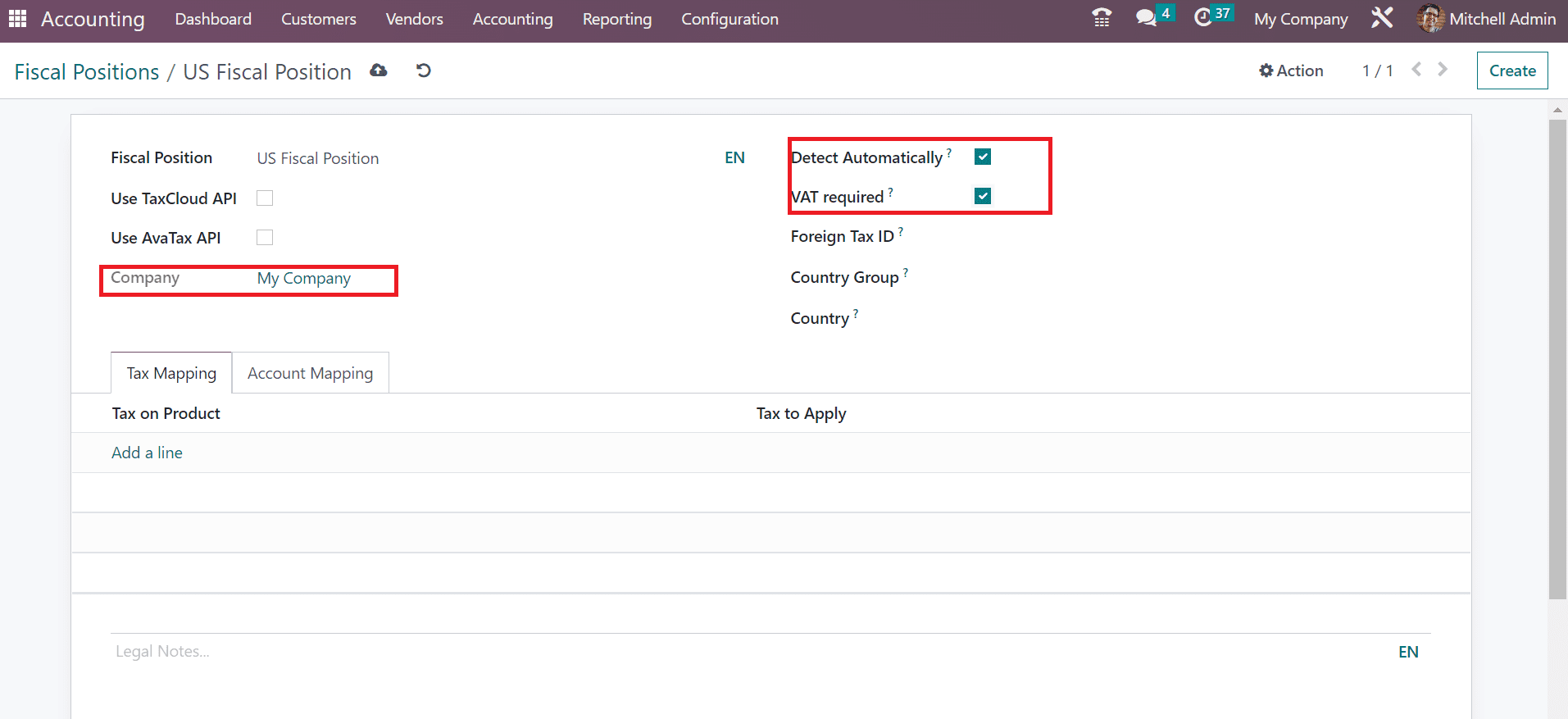

Later, pick your company as My Company. Users can automatically specify fiscal position by enabling the Detect Automatically field. Moreover, you can activate the VAT required field if the partner has a VAT number, as cited in the screenshot below.

Add the Tax ID mapped by your company fiscal position in the Foreign Tax ID field. Next, specify your country group if the delivery country is similar to the group. Pick your country that matches your company's fiscal position, as denoted in the screenshot below.

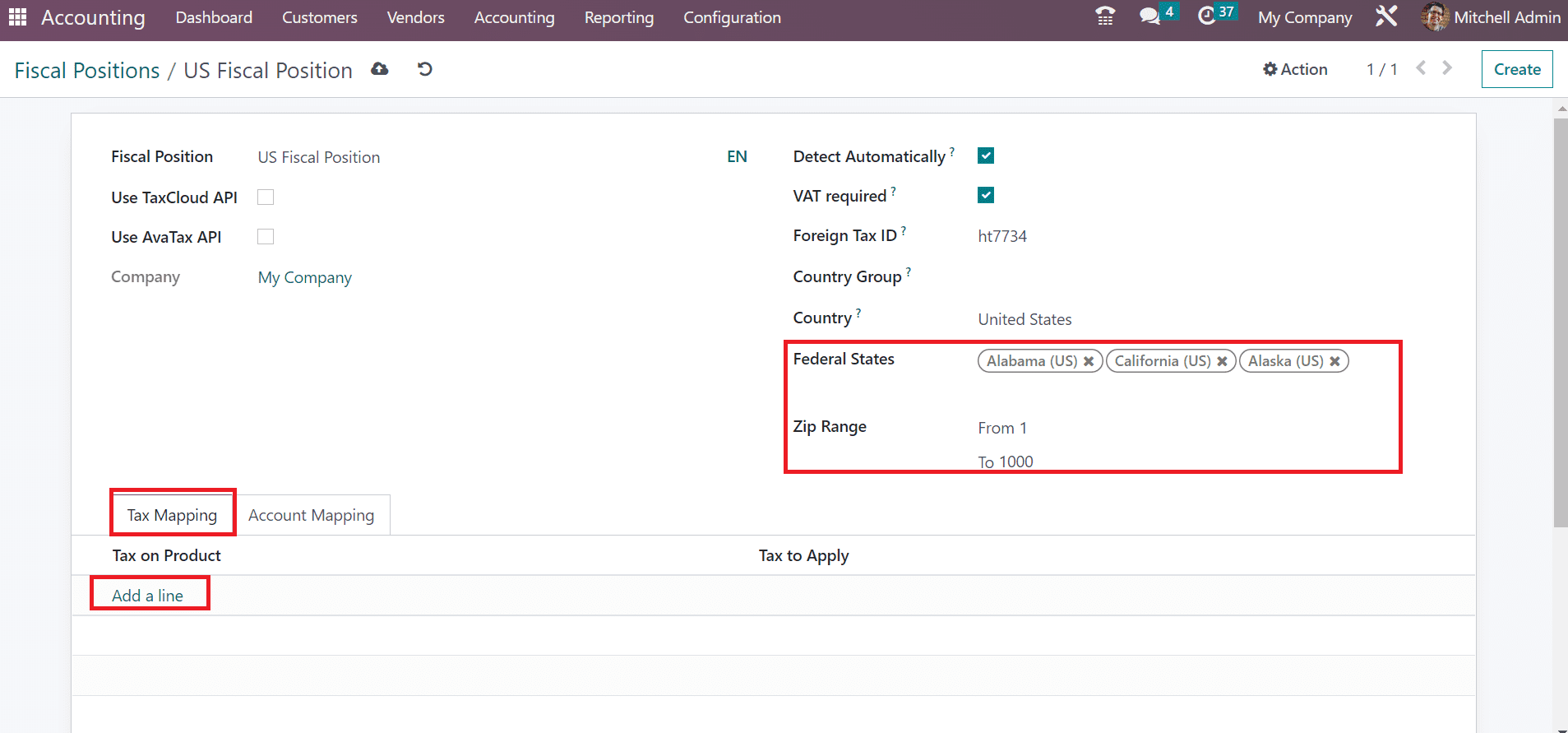

Mention the respective states relies upon your chosen country in the Federal States field. Afterward, enter the range count in the ZIP Range field. By selecting the Add a line option under Tax Mapping, you can apply tax on a commodity as described in the screenshot below.

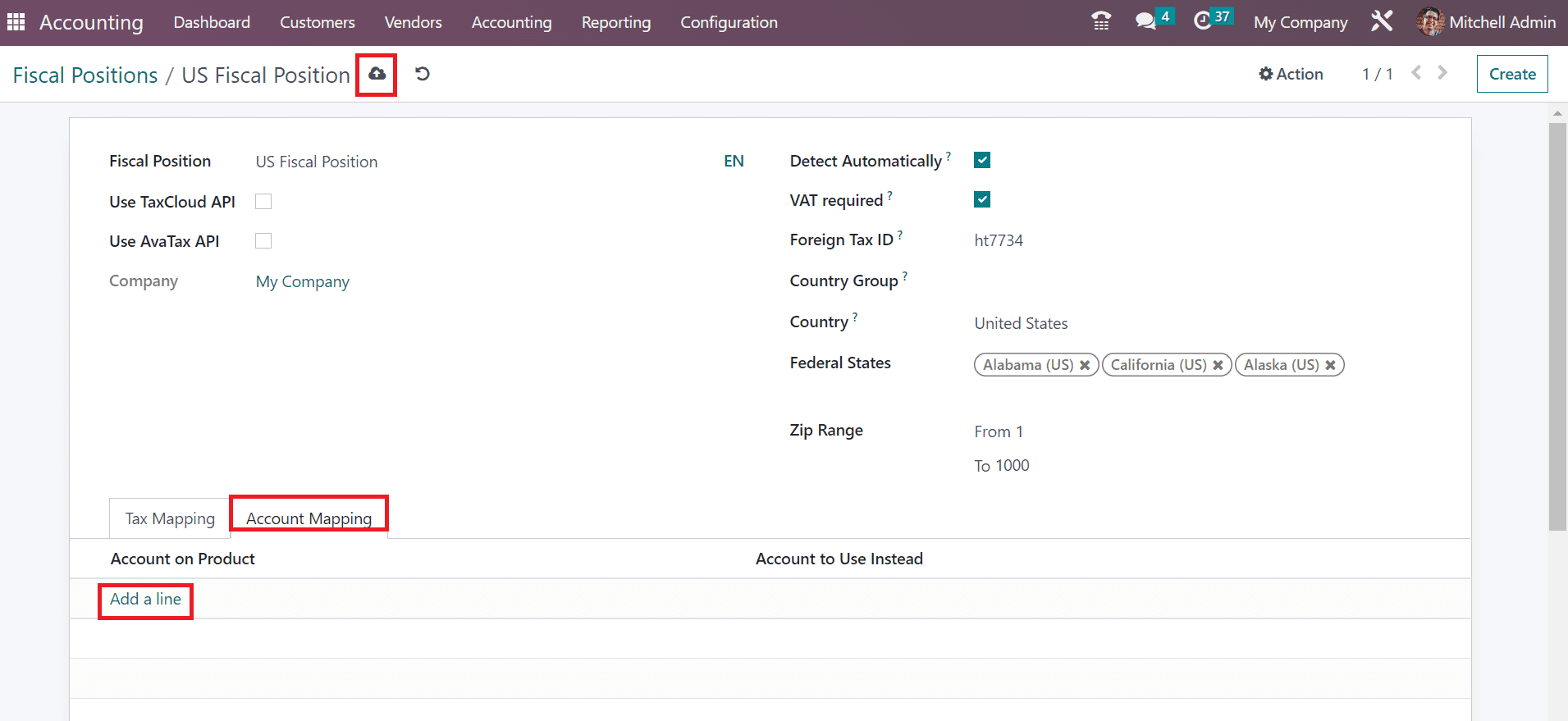

Users can pick a product account once selecting the Add a line option inside the Account Mapping section. Press the Save manually button after applying the information about US Fiscal Position in Odoo 16.

We can access the created position on the main Fiscal Positions window.

Fiscal Localization Packages

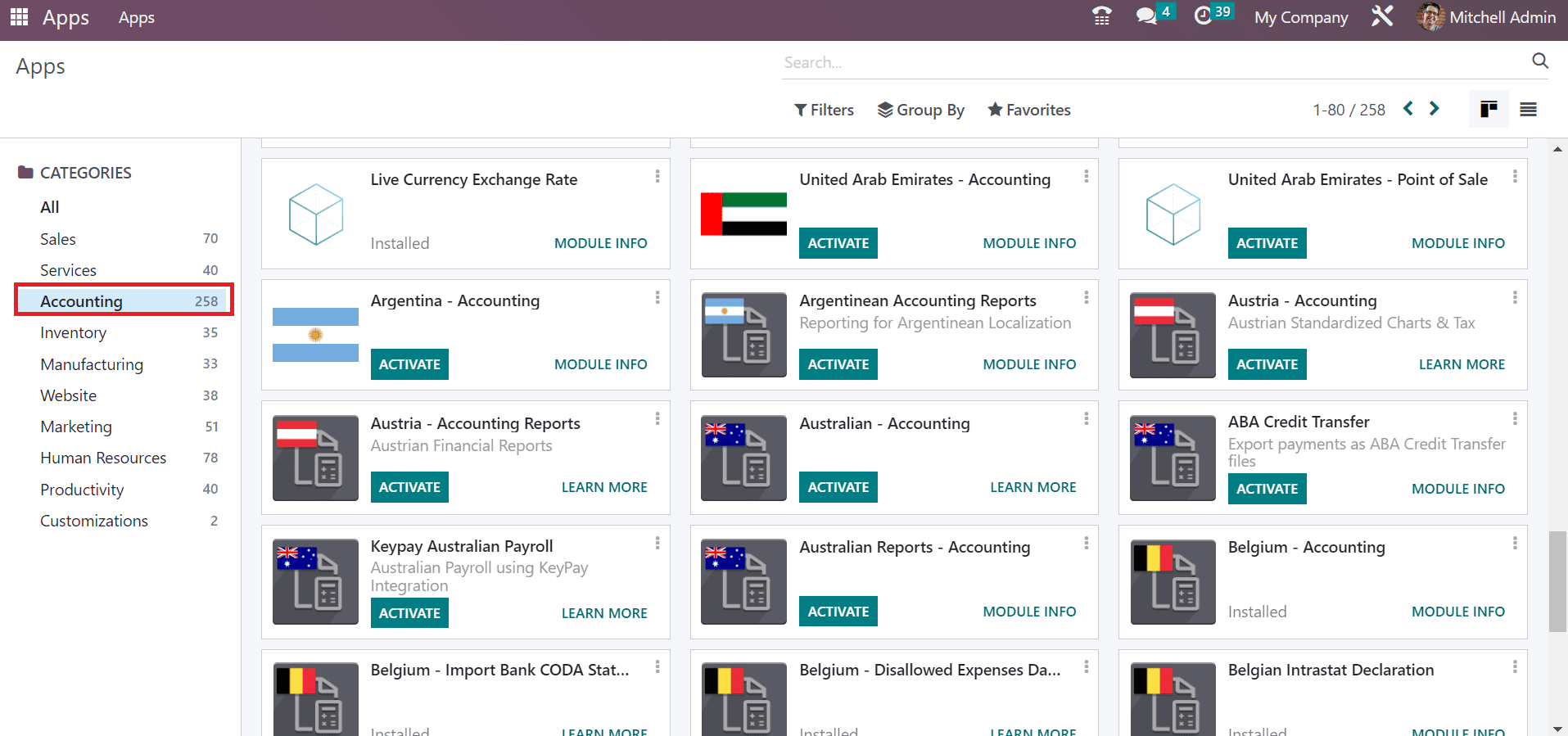

One of the country-specific modules installed for fiscal positions, legal statements, and more is referred to as the fiscal localization package. The appropriate package for your company will be installed automatically by Odoo as per your country. We can enable taxes and configure country statements/certifications per the company's needs using these packages. By implementing a specific country package, we can run Odoo 16 Accounting based on a particular country by implementing a specific country package. It is possible to download your country package by choosing the Apps module in Odoo 16. Choose the Accounting section in the Apps window; a list of all localization packages is accessible to the user, as represented in the screenshot below.

Here, you can view localization packages for countries such as Australia, UAE, Austria, Belgium, and more.

Odoo 16 Accounting module ensures users manage fiscal localization packages as per company requirements. It is easy to define the fiscal year, fiscal positions, and more to increase the workflow. Improvise your company's needs once implementing an Odoo ERP to your system.

Have a look at the following blog to explore more about How to Install Odoo 16 on Ubuntu