Odoo accounting can handle many aspects like multi-company, multicurrency, and multi-user.

You may know that. Here I am discussing another area where I want you to go through.

We know that we can set default customer taxes and vendor taxes on the product form or on the product category form. But, do you know how to configure or do you face any difficulties to configure a special vendor tax for a specific vendor or vendors from a specific region ie, taxes by country or state?

This is where the fiscal position of Odoo comes handy. Using fiscal position we can map taxes with other taxes and account with another account.

I know It is confusing, I will explain how to do it.

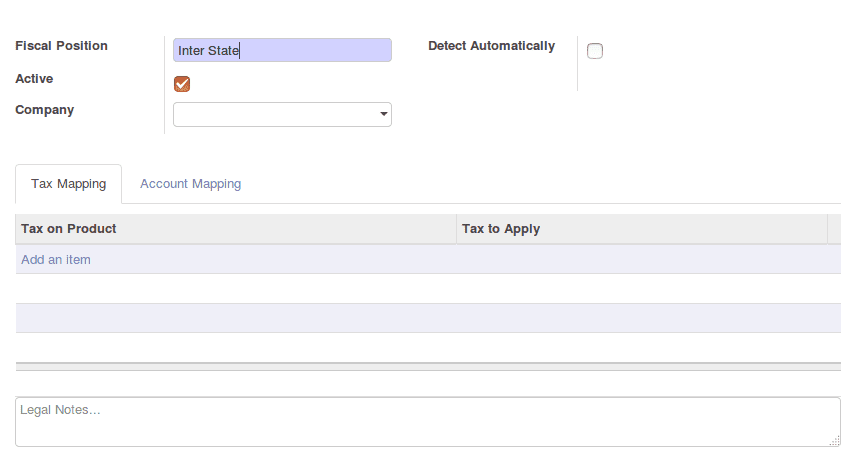

If you have an ‘Advisor’ level access in Odoo accounting, you can create a new fiscal position from

Accounting > Configuration > Accounting > Fiscal Position.

You can give a name for this fiscal position on the field highlighted in ‘Periwinkle’ color

Under this tax mapping tab, we can specify which tax has to be replaced(Tax on product) which tax (Tax to Apply)

For example:

Default customer tax or vendor tax specified on a product is VAT 10% and you want to replace this with VAT 12.5% for a customer/ vendor who is operating from another state.

Then we have to add a line like this under ‘Tax Mapping’ tab.

We can do same with the accounts under ‘Account Mapping’ tab

After saving this fiscal position we have to specify this on our customer/supplier master.

Now we have successfully configured a fiscal position for customer ‘Agrolait’.

Let’s have a look what is going to be the effect of this configuration when we make a Quotation or Customer invoice for this customer.

This is the product we are going to sell

You may have noticed that the customer tax is specified as VAT 10%.

Here is the effect on Quotation.

The tax VAT 12.5% is automatically selected. And it works when I change the customer even after all the order lines are added.

It also updates the Fiscal Position field under ‘Other Information’ tab of Quotation.

Same happens on invoices except is when I change the customer even after all the invoice lines are added

I hope now you have a clear idea about the fiscal position of Odoo.