There are lots of factors, that are extremely important for businesses such as Customer happiness where maintaining customer satisfaction depends heavily on refunding. Offering a timely and painless refund when clients have problems with the goods or services they've bought can assist in remedying the issue and preserve good customer relations. Businesses can build their reputation and encourage customer loyalty by putting the needs of their customers first and efficiently refunding purchases. Legal and Regulatory Compliance, where Laws and regulations governing consumer protection frequently call for refunds. Customers have the right to a refund in many countries if goods or services are defective, not what was promised, or fall short of their expectations. Businesses show their dedication to compliance by following these regulatory regulations and processing refunds quickly, thus averting potential legal issues.

Another factor is Accounting Integrity, where refunding upholds the accuracy of financial records and the consistency of accounting procedures. Refunds that are not correctly accounted for might result in revenue deception and inconsistencies in the financial statements. Businesses can preserve transparency in their financial reporting and guarantee adherence to accounting rules by properly recording refunds. Effective refunding procedures are a factor in efficient cash flow management. Refunds that are given on time avoid needless delays in giving clients their money back, which can assist in keeping cash flow and liquidity in good shape. The risk of financial stress is reduced and organizations' overall financial stability is improved with proper refund management.

Refunding helps establish and preserve consumer trust, which is important for business reputation and trust. Businesses show their dedication to fair and ethical practices by handling refunds quickly, effectively, and honestly. Positive refund experiences boost client confidence in the company and help build a positive perception of the brand.

Customer Retention and Repeat Business: A smooth refunding process can have a good effect on keeping customers and promoting repeat business. Customers are more inclined to stay with a firm in the future when they have a favorable refund experience. Businesses can encourage customer loyalty, raise customer lifetime value, and create long-term business success by putting a priority on effective refunding.

Another notable factor is Better Decision-Making Accurate refund tracking and analysis offer insightful data on product quality, consumer preferences, and future improvement areas. Businesses may improve their product offers, customer service, and overall operational efficiency by analyzing refund data since it enables them to spot trends, handle persistent problems, and make well-informed decisions.

The processing of refunds in the Odoo 16 Accounting module comprises a number of processes to ensure accurate financial records and Refund management in the Odoo 16 Accounting module entails a number of measures to guarantee accurate financial records and effective handling of refund transactions. You can have a guide for handling refunds correctly in Odoo 16's Accounting module such as the Enable Refund feature in which Odoo 16's Accounting settings make sure that the refund feature is turned on. Making a Credit Note. Create a credit note in Odoo 16 to start a refund. A credit note is a record of the refund sum that connects it to the initial invoice. By opening the invoice for which you wish to make a refund and selecting the "Create a Credit Note" button, you can generate a credit note.

Refund option Indicate the refund option that works best for your refund procedure in the credit note form. Odoo 16 has a number of refund options, including manual refund, refund by invoice, refund by credit, and refund by payment. Depending on your unique requirements, select the best technique. Refunding is a crucial component of Odoo's Accounting module. It guarantees client happiness, legal compliance, accounting accuracy, effective cash flow management, business reputation, and consumer trust. Businesses can improve client connections, uphold fiscal integrity, and make wise decisions that will spur growth and success by giving priority to efficient refunding procedures.

Credit Notes for refunds are a possibility. Credit notes can be given for the entire amount or just a portion of it and are prepared based on the original invoice. They serve as a record of the refund and can be used to deduct from or reimburse customers for previous transactions. Refund via Payment is for giving the customer a direct reimbursement via a payment transaction. You can create a refund payment in Odoo 16 and link it to the original invoice. When you are giving the consumer a refund using the same payment method that they used to make their initial purchase, this method is appropriate.

Another one is Refund via Credit where the consumer may also receive a refund by having their account credited. In this situation, you add a credit entry to the client's account so that it can be used to pay for future transactions. The credit amount may be deducted from subsequent invoices or applied to the customer's credit balance.

Refund via Refund Invoice means, In rare cases, processing a refund may require you to establish a unique refund invoice. With negative values for the items that were reimbursed, Odoo 16 enables you to create a refund invoice based on the original invoice. With this approach, the refund is clearly documented and can be used for accounting needs. It's crucial to appropriately depict the financial impact on the accounts after processing the return.

Reconciliation entails comparing refund transactions to original invoices, updating payment records, and verifying that the right accounts are being debited or credited. Tools for reconciliation are available in Odoo 16 to make this process easier. And messages sent to customers, when handling refunds, good customer contact is crucial. You can create PDF versions of credit notes or refund invoices in Odoo 16 to deliver to customers. In Odoo, the refund status can also be tracked and updated, giving clients visibility into the status of their return as well.

Refund tracking and analysis can be done using the reporting tools in Odoo 16 accounting. To evaluate refund histories, track pending refunds, examine trends in refunds, and gauge the financial effects of refunds on your company, you can generate reports. These reports offer insightful information that is useful for financial analysis and decision-making. Integration with Other Modules is another method the refund management procedure may be made even more efficient by integrating with other Odoo modules like Sales and Inventory. Odoo 16 makes sure that appropriate accounts are automatically reconciled, sales orders are updated, and associated inventory stock is altered while processing refunds.

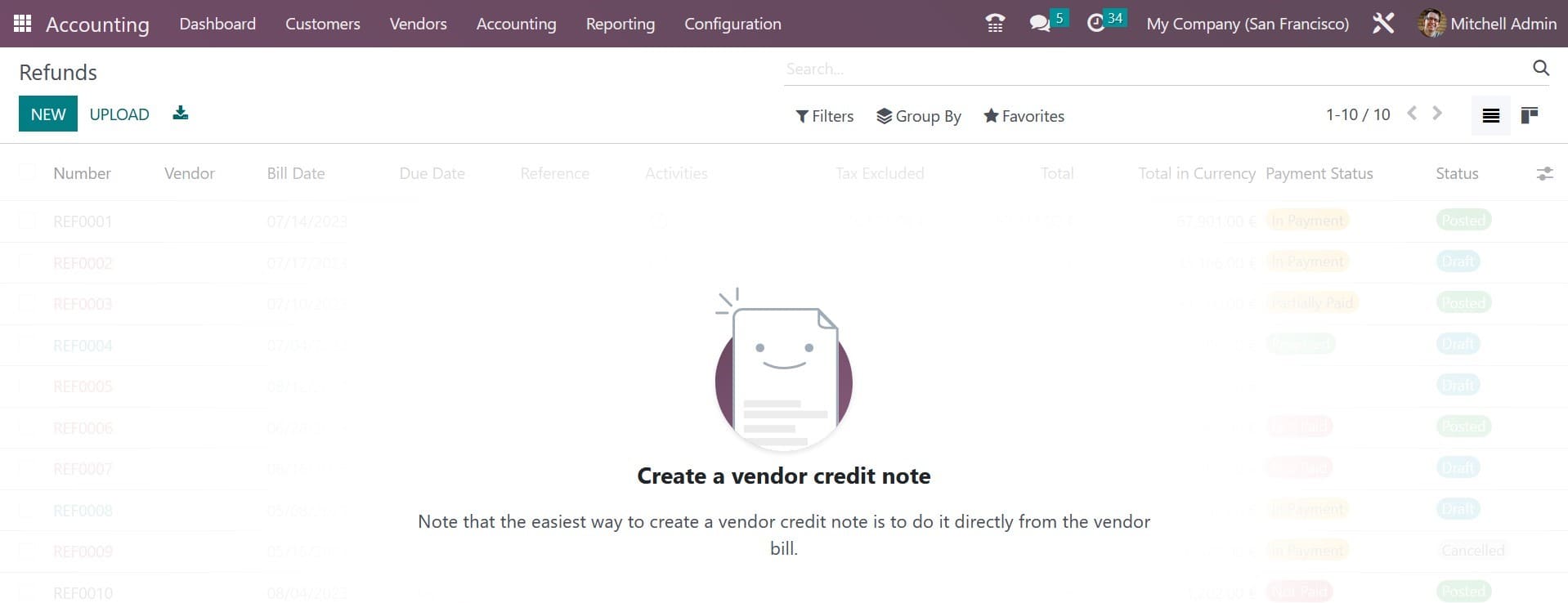

On opening the Accounting module, you will get the menu of vendors, where you have the option of a refund, as shown in the screenshot below.

Here, you can have the details, such as number, vendors, bill date, due date, reference, activities, and many more. You can make use of the NEW icon, in order to create a similar kind of refund.

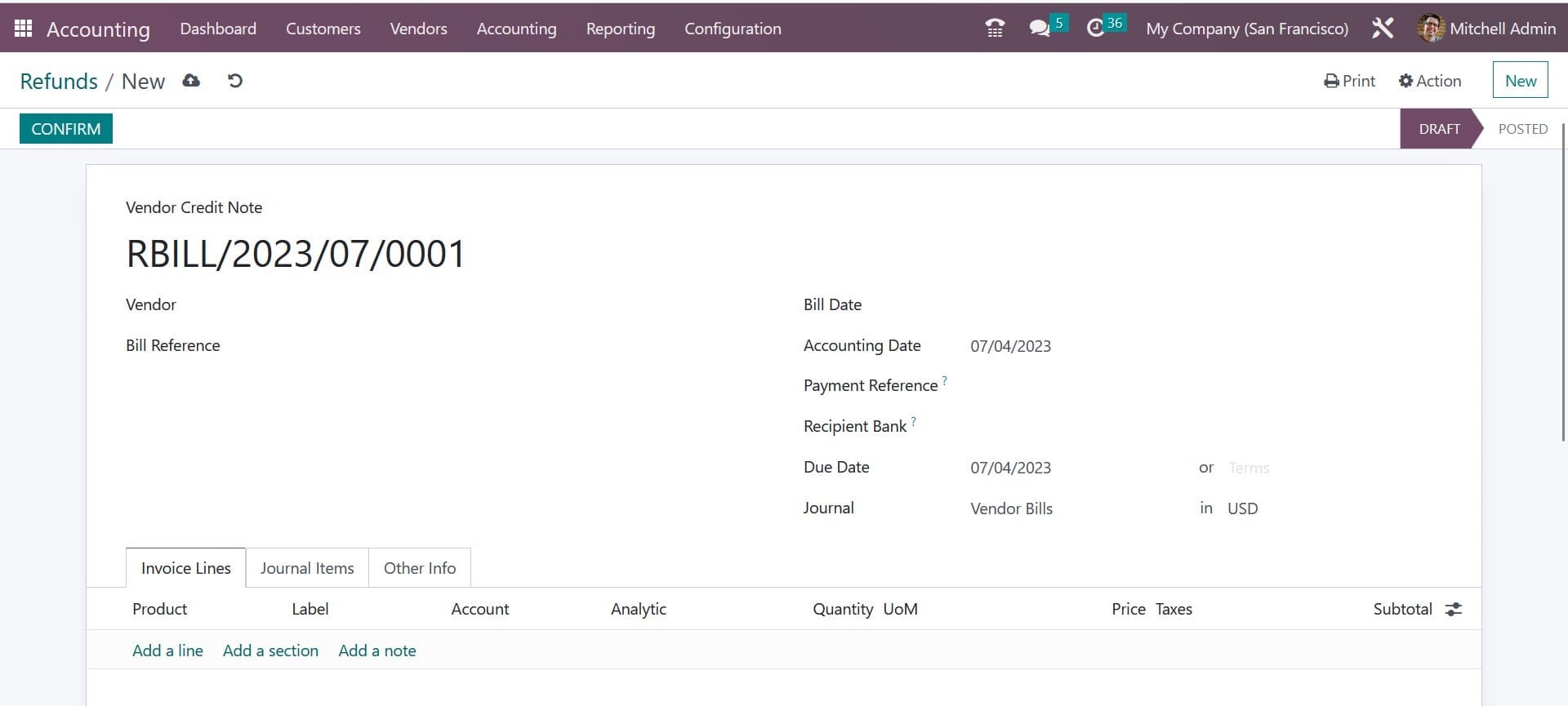

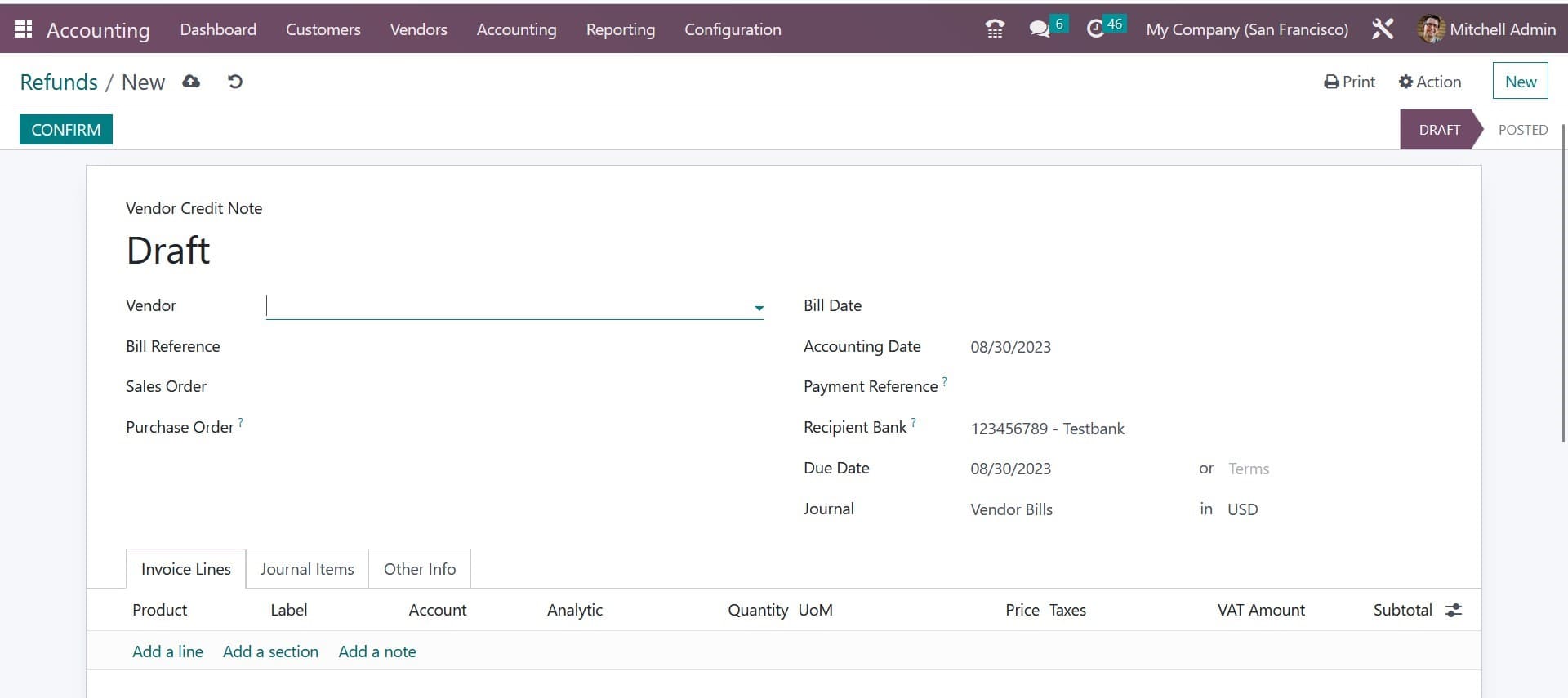

Here, on the creation page, you can add the vendor credit note, name of the vendor, and bill reference in the allotted spaces. Now, you can also add the vendor date, accounting date, payment reference, recipient bank, due date, and journal, respectively. Below that, you have the tabs, such as invoice lines, journal items, and other info, as in the image above. Under the invoice lines, you can have the spaces to add the product name, label, account, analytic, quantity, UoM, price, taxes, and subtotal, respectively. Now, under that, you have the options of Add a Line, Add a section, and Add a note, which can also be made use of.

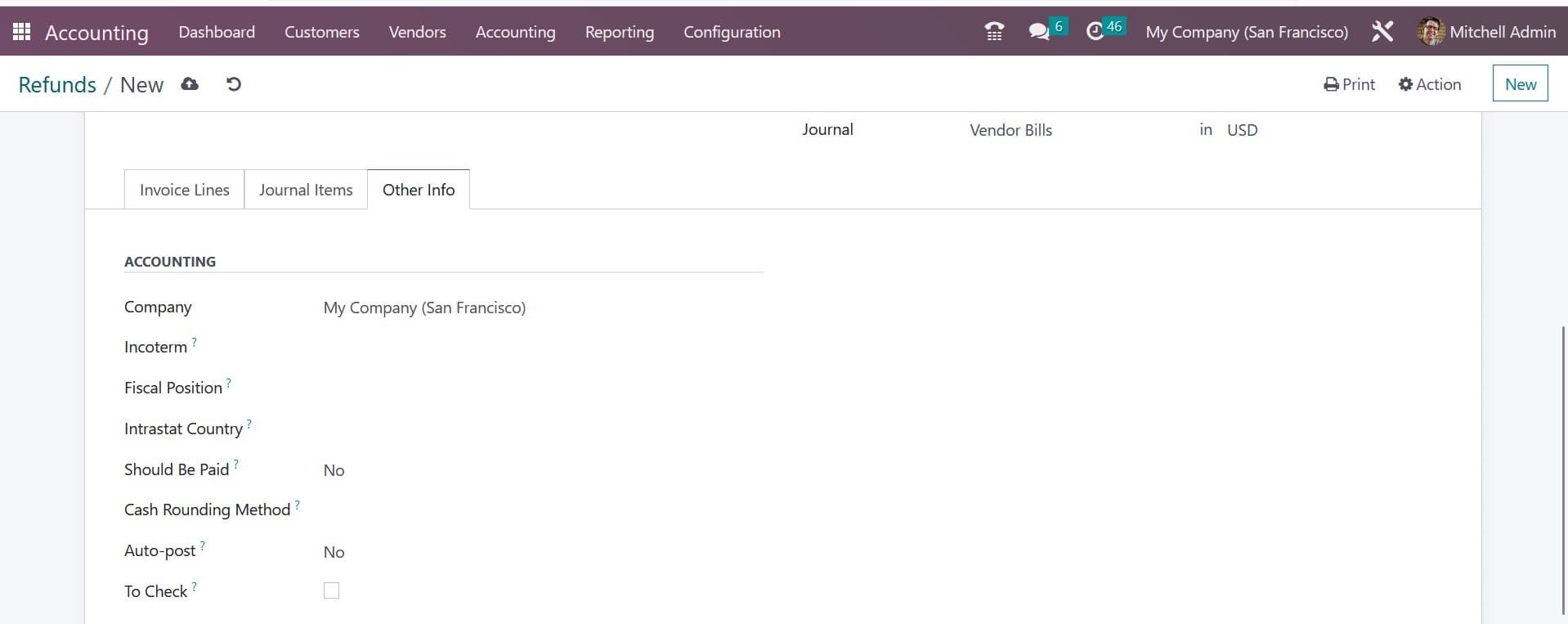

Here, you have the options of account, label, debit, credit, and tax grids to add. You can make use of the Add a Line option as well. Now, you have the other info tab, where you can add the details, such as name of the company, incoterm, fiscal position, auto post, and to check the option to activate.

When you are done with providing all the details, you can save the details. And this is how you will manage and create refunds in odoo 16 Accounting.