A full support system for handling all accounting-related duties ought to be an accounting tool. The primary responsibilities of an accounting wing are to keep track of and oversee all transactions, both incoming and outgoing. It is necessary to track and compute both revenue and expenses to ensure that the company is making a profit.

With its comprehensive ERP solution for accounting-related concerns, Odoo Accounting guarantees support for optimal profit and loss management. It makes handling profit and loss statements simple, enabling the accounting team to quickly review the most significant numbers for any given time period. Additionally, you can compare profit and loss statements for various periods and generate reports with the tool's assistance.

A company can plan and manage all accounting activities and create a budget for the upcoming term with the aid of profit and loss. If not, profit and loss statements rank among the most important reports produced by an accounting department.

A company's income statement combined with its expense statement is what we might refer to as its profit and loss statement. Profit and loss statements are typically produced for a year or a single fiscal year. However, we are unable to simply manage the profit and loss statements with Odoo Accounting. With the help of this program, we can alter profit and loss statements. To manage the activities, we can provide inputs like the profit and loss period.

This statement will be necessary for the managers and investors to comprehend the company's performance in the market and determine if it is profitable or not.

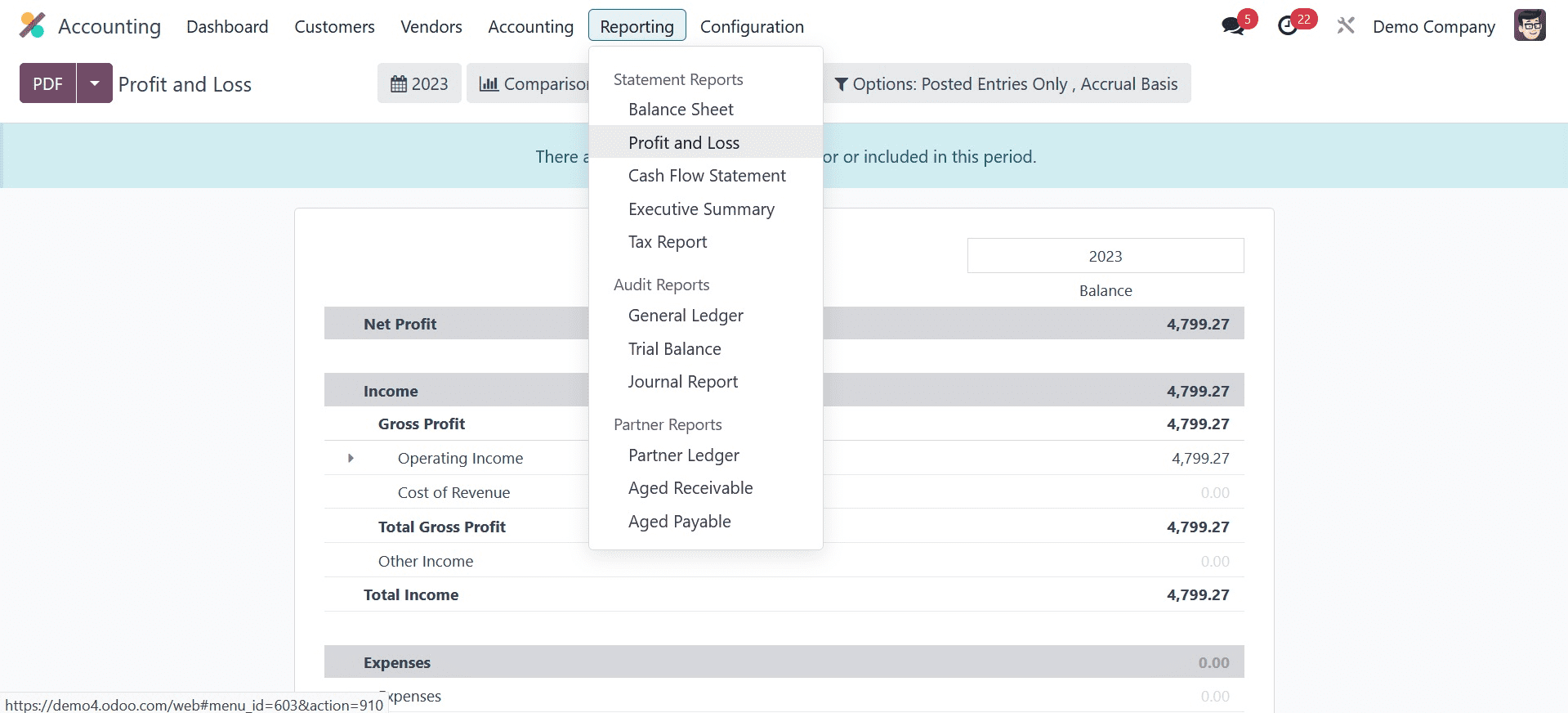

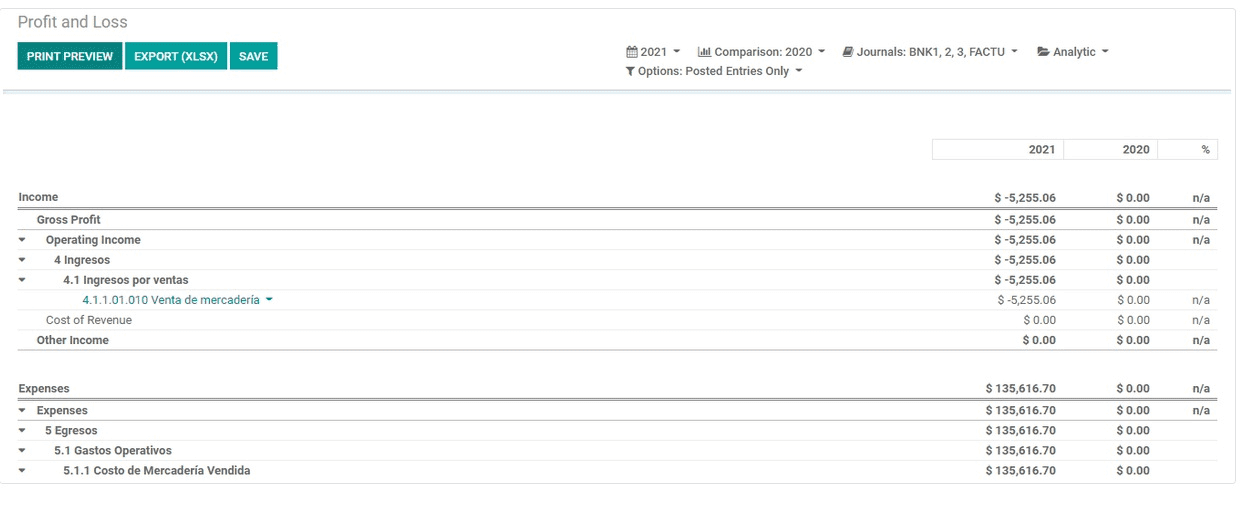

The Profit and Loss sheet is located when we access the Reporting menu, which is one of the many menus in the Odoo Accounting module.

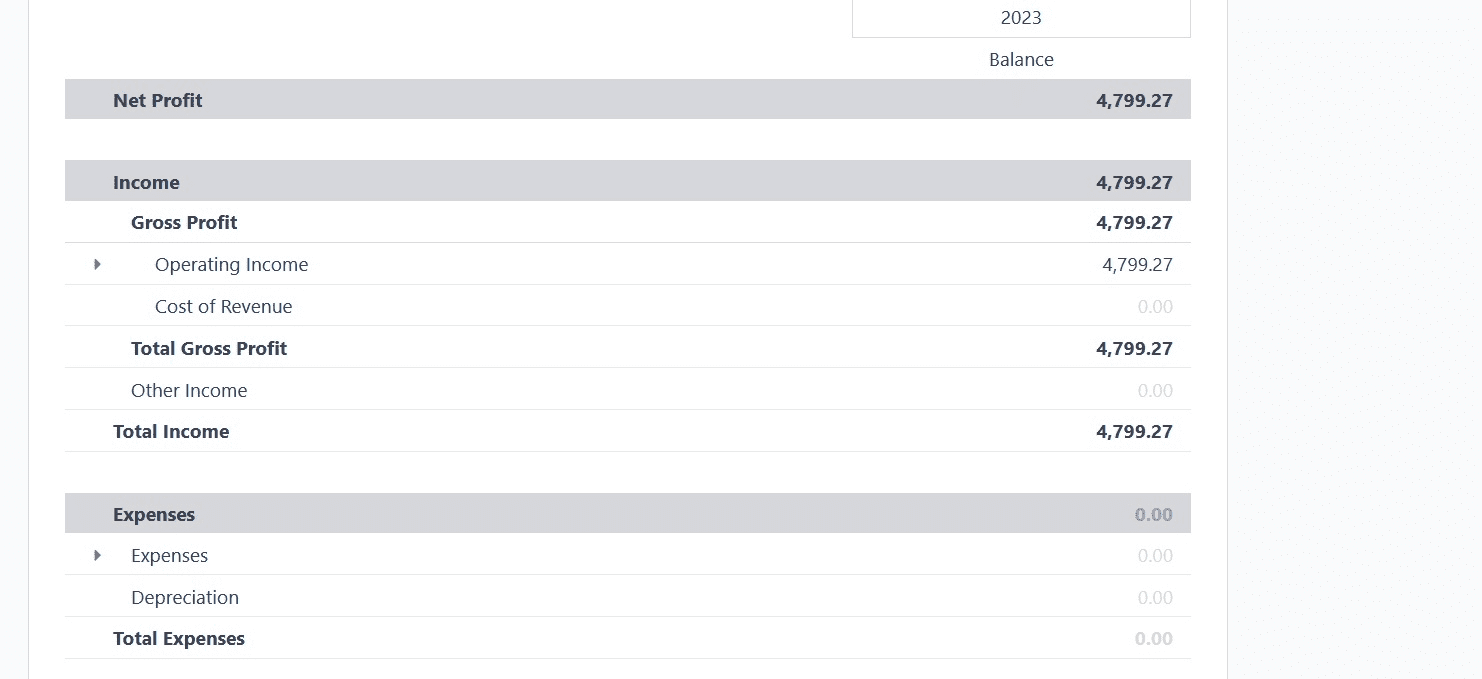

The profit and loss statement is shown here.

We may see various rows and columns here.

We can find Income at the top. Gross profit is shown below income. The cost of sales and operating income are also visible. There's also a picture of other income.

Revenue: The money we receive from customers when we sell them goods or services is known as revenue. We must deduct the expense from this as well.

Gross Profit: For a business, the amount left over after deducting the expenses paid during the production and sale of a good or service from revenue is known as the gross profit.

Operating Income: The profit we have made from running a firm is referred to as operating income. By subtracting the operational expense, this is computed. Depreciation or wages are examples of operating expenses.

Cost of Operation: The total of the many expenses we have spent after the creation, promotion, and delivery of goods or services to customers is known as the Cost of Revenue.

Then, there is a portion called Expenses.

Expenses are the money we spend on labour, materials, and other costs associated with producing a good or providing a service.

Depreciation: The process of figuring out an asset's cost based on how long it will last is known as depreciation.

We can locate expenses, depreciation, and so forth.

The Net Profit is listed at the bottom of the page as well. The income and expenses are used to compute the net profit.

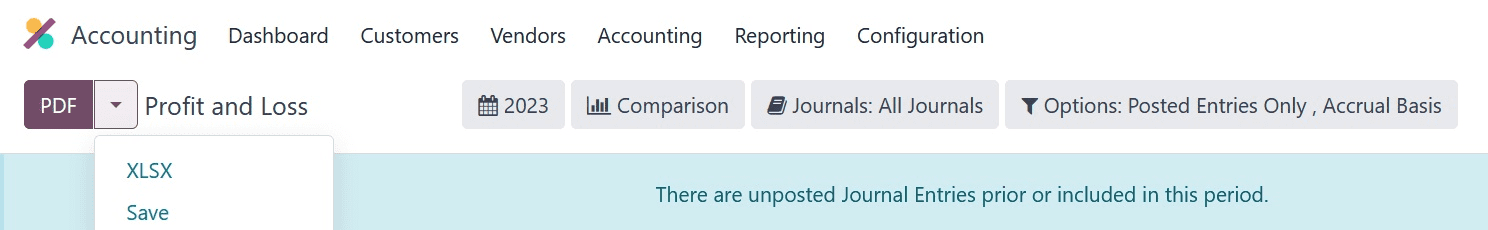

The Print Preview button allows us to obtain a print preview of the page. Saving or exporting the file can also be helpful.

With Odoo Accounting's profit and loss features, we can accomplish a lot more tasks.

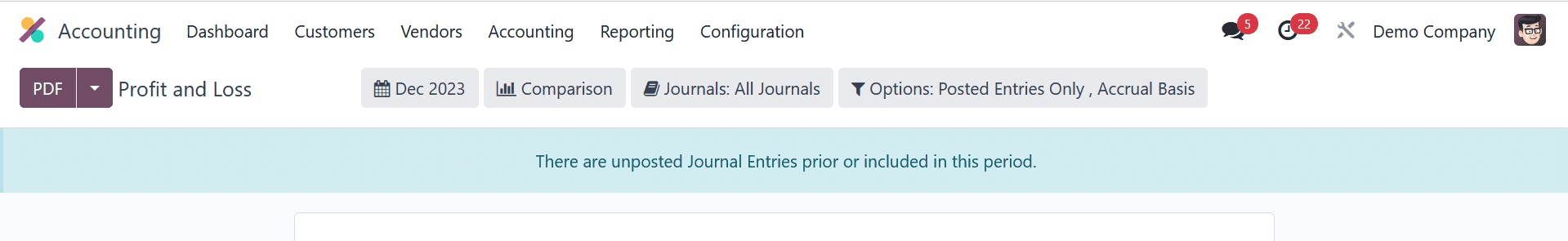

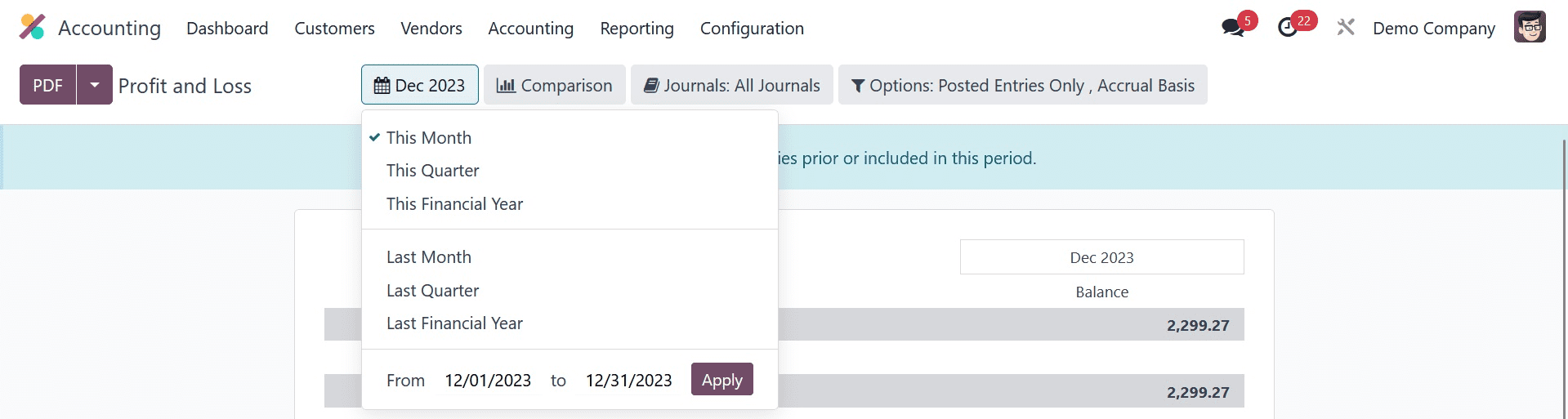

We can see the Profit and Loss report for various periods with the help of the calendar tab. We may create profit and loss reports with Odoo Accounting for a month, a quarter, a year, etc.

In addition, we are able to create a customized period for the purpose of creating the profit and loss report.

We also have an alternative. In contrast

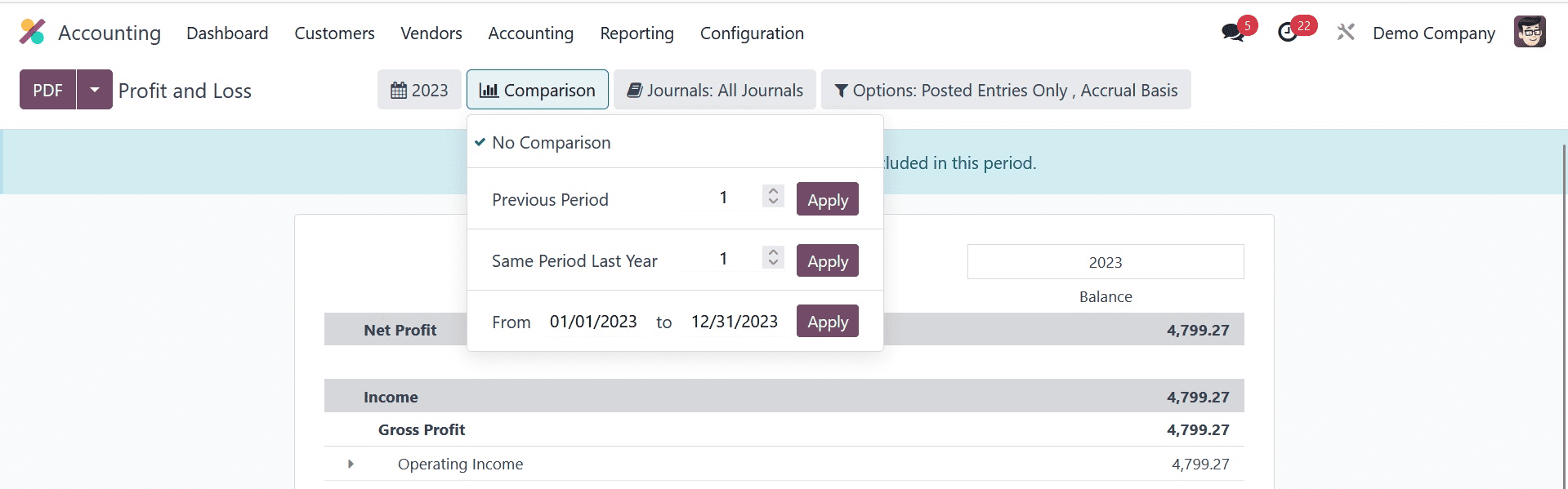

We can compare the chosen profit and loss statement with the profit and loss statement from a different period with the aid of the comparison tool.

Let's say you created the April 2021 profit and loss statement. We can compare it with this month, last month, or a custom period when you select the compare option. The comparison will make it simple for us to determine whether or not the company is growing.

Upon selecting the period, a window will appear.

After deciding how many periods to choose, click Apply.

We receive a comparison of the profit and loss for the specified periods upon application.

The profit and loss statement for the year 2023 is available here.

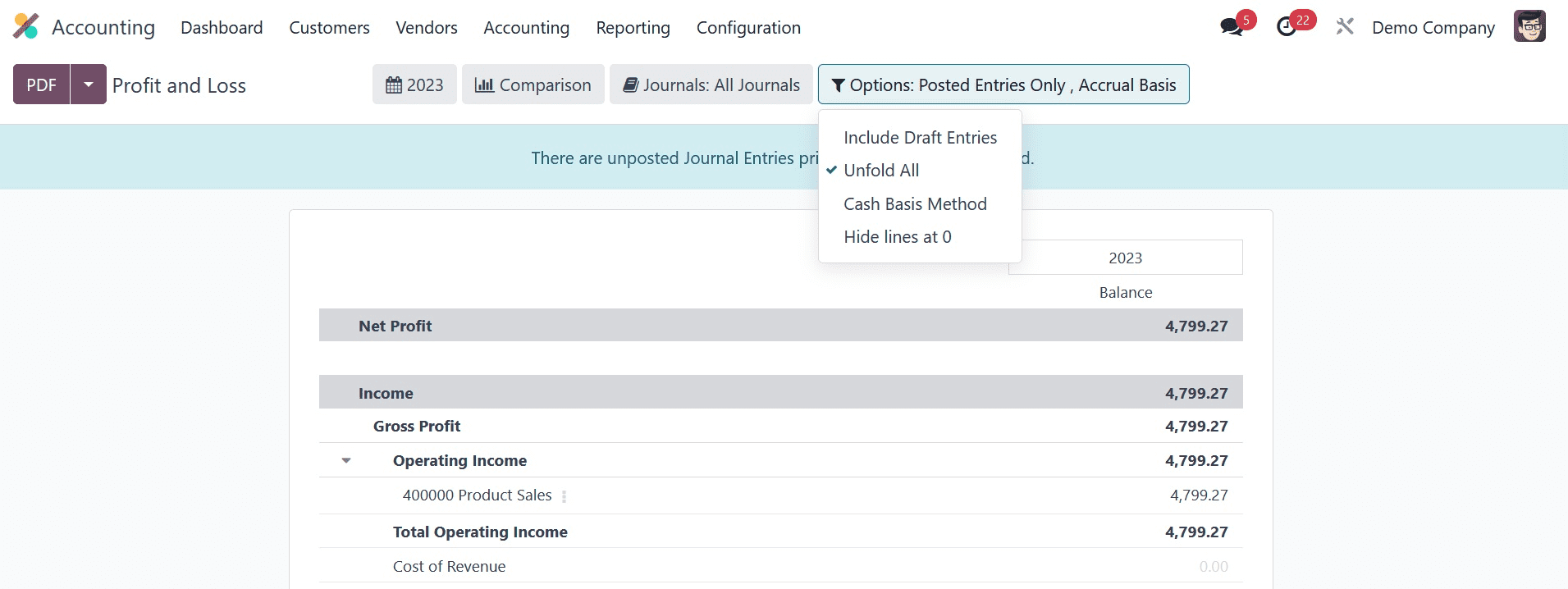

Additionally, a filter option allows us to select distinct facts.

We will be able to use cash basis, accrual basis, hierarchy, and subtotal approaches in addition to unposted entries thanks to this. You can see profit and loss statements that are based on these details.

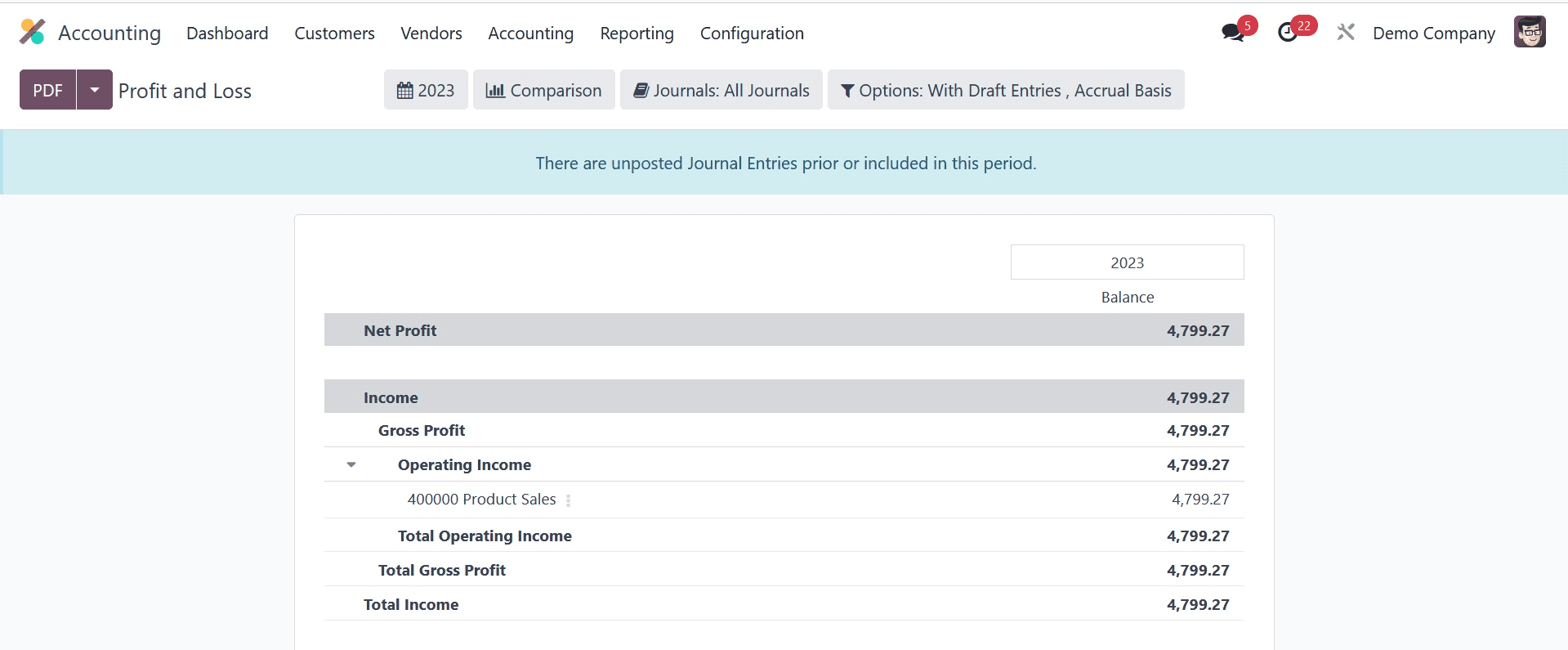

The information below was created by adding unposted entries.

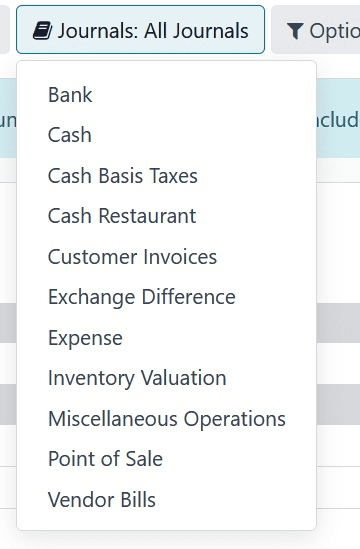

Profit and Loss determined by several journals

By choosing journals, we may decide which one to use to select the data needed to calculate profit and loss.

In this sense, Odoo Accounting facilitates the precise generation of profit and loss statements. The managers can utilize this statement to gauge and analyze the company's performance. Investors are able to gauge the company's rate of growth. When creating the budget, the accounting department can utilize the scenario and compare the statistical data. A well-created profit and loss statement can also be used to build a company's financial plans.