The convenient method to collect tax revenue is retail sales tax in the US. Compared to complex purchase and income tax rates, sales tax is convenient to recognize. Local sales tax exists in some states for consumers in addition to state sales tax. The states that cover the highest tax rates are Washington, Tennessee, Mississippi, California, and more. Most states avoid groceries and medicines from the sales tax rates. Businesses face difficulty handling the sales tax of services and products in their companies based in several states. You can remove your worries by installing Odoo ERP software in a business.

This blog signifies the Maine(US) Sales tax formulation in Odoo 16 Accounting.

Managing default taxes, currencies, and customer invoices in a firm becomes simpler using the Accounting module of Odoo 16. Moreover, users can digitize documents, vendor bills, and payments in the Accounting application. Next, we can check the steps of formulation Sales tax of Maine(US) in Odoo 16 Accounting.

Maine(US) Sales Tax Information for Users

An individual sales tax rate of 5.5% relies on Maine(United States). The state did not compare local and sales tax to compute its sales tax rate. A low tax rate offers on specific items in Maine, including cigarette and gasoline taxes. We can see tax exemptions for military survivors or veterans whose income is under a military retirement plan. A physical nexus is necessary for a seller if they have an office/warehouse/ store in Maine.

Tangible personal properties and some services are taxable in a particular state. However, SAAS is untaxable in Maine. Maine Revenue Services assists users in registering for sales tax online. It would be best if you had a business entity type, identification info, and other description for registering the sales tax. The prepared food in Maine is taxed distinctly at a rate of 8%.

Maine (US) Company Setup in the Odoo 16

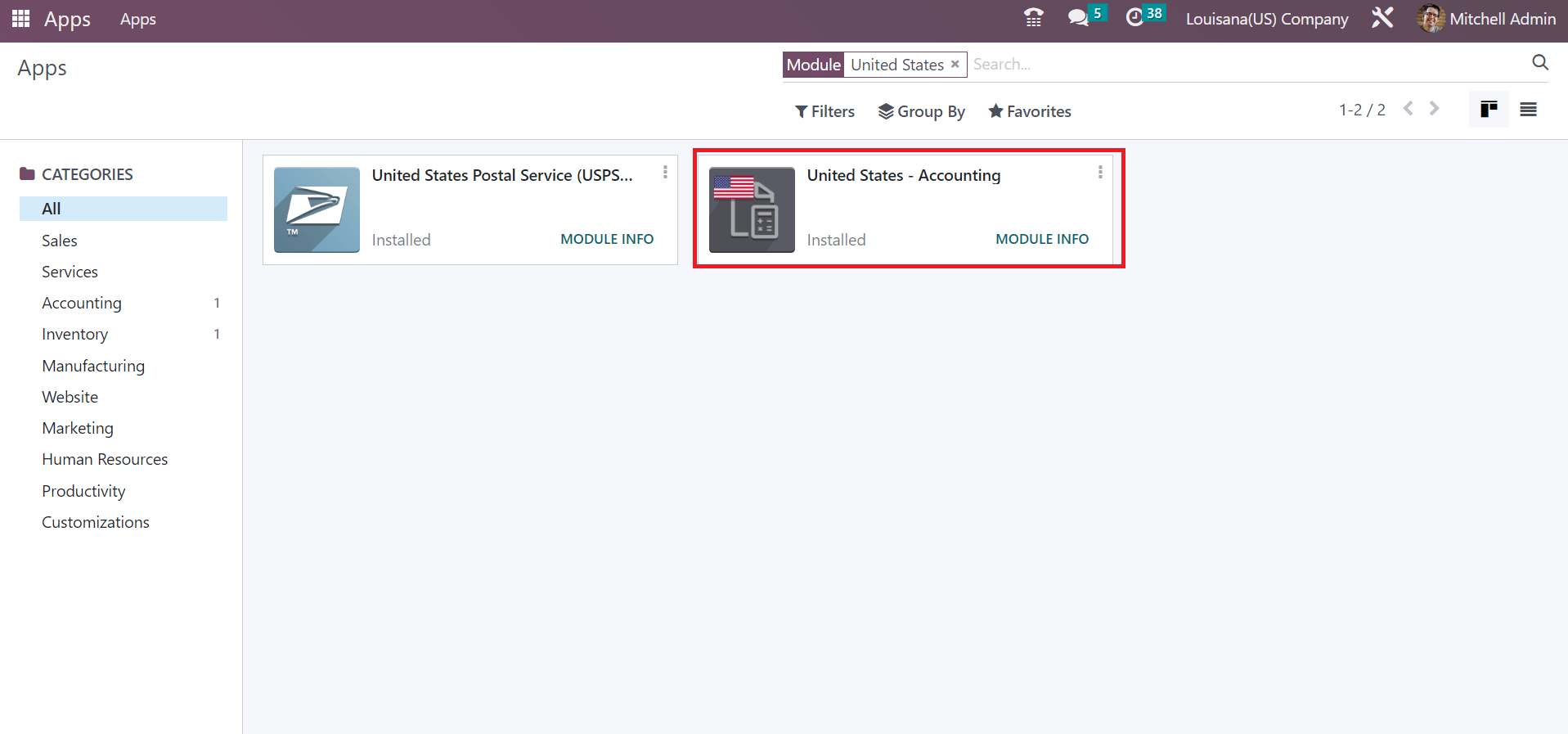

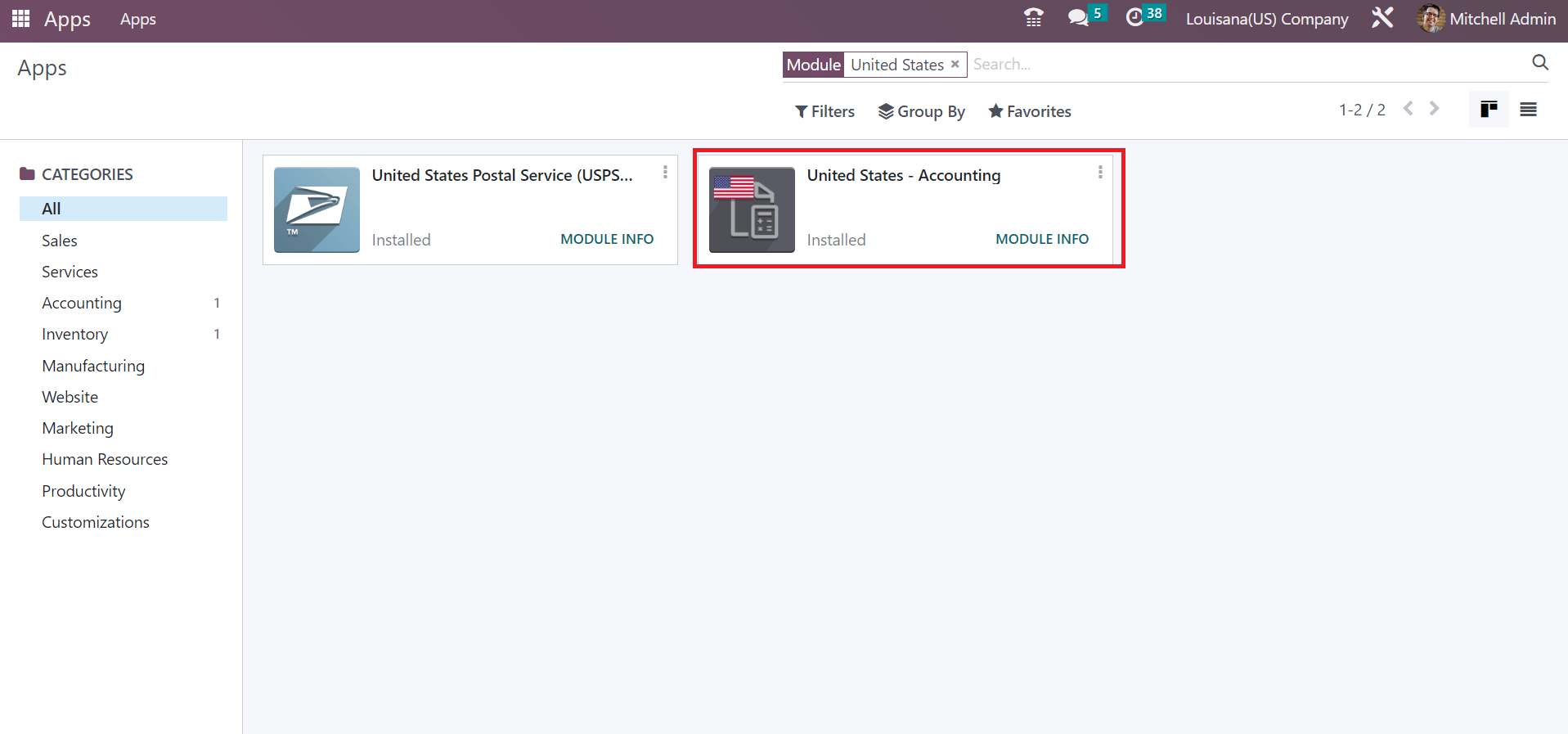

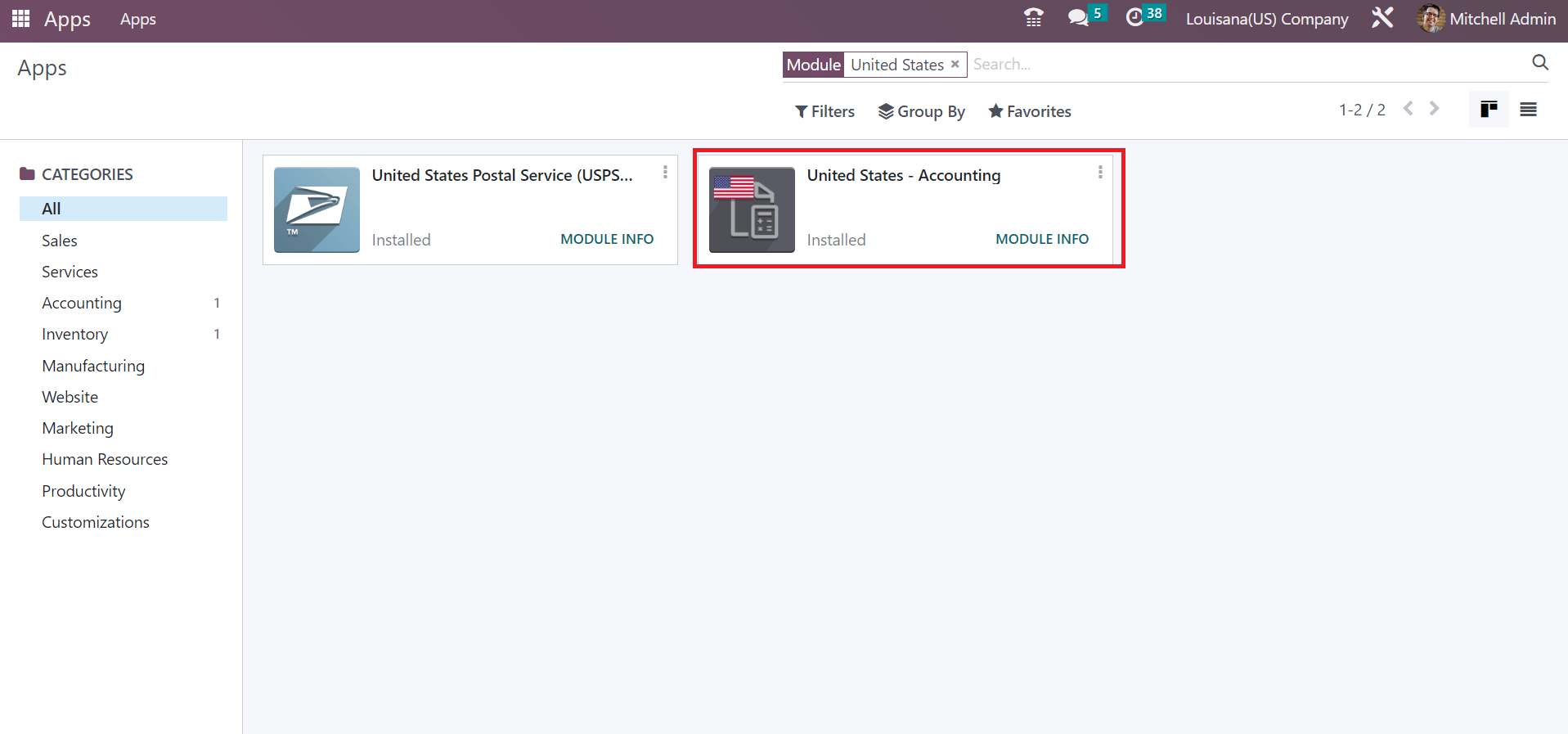

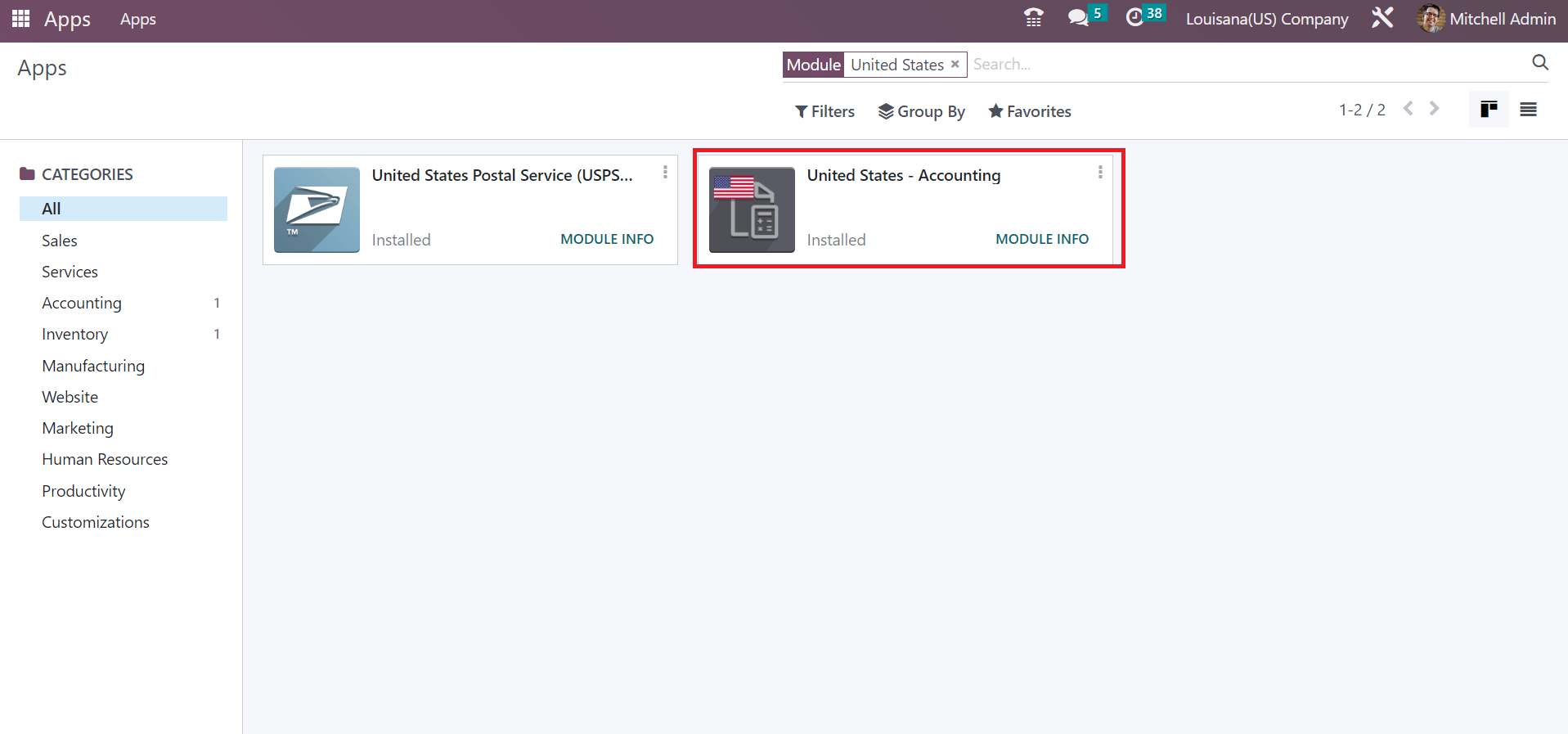

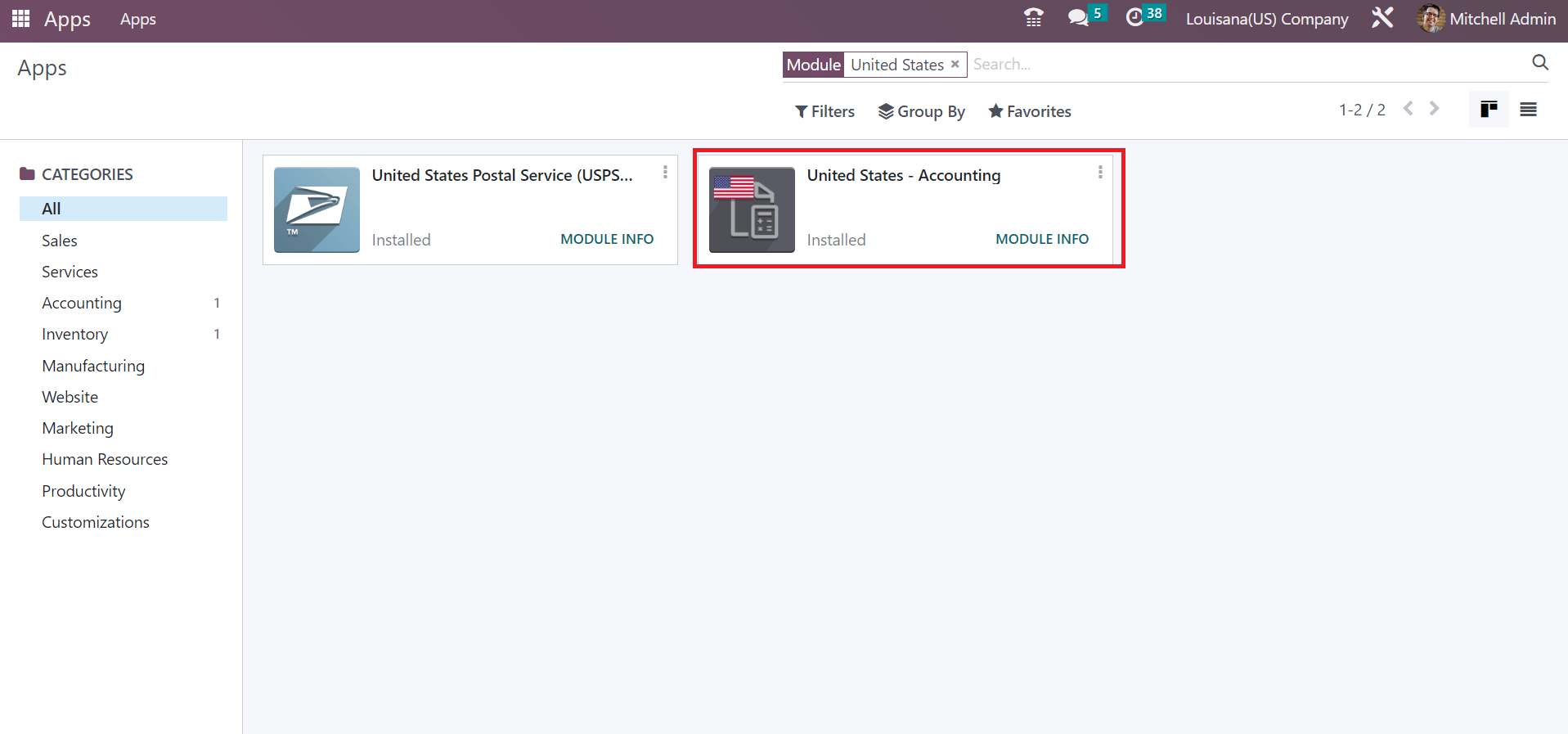

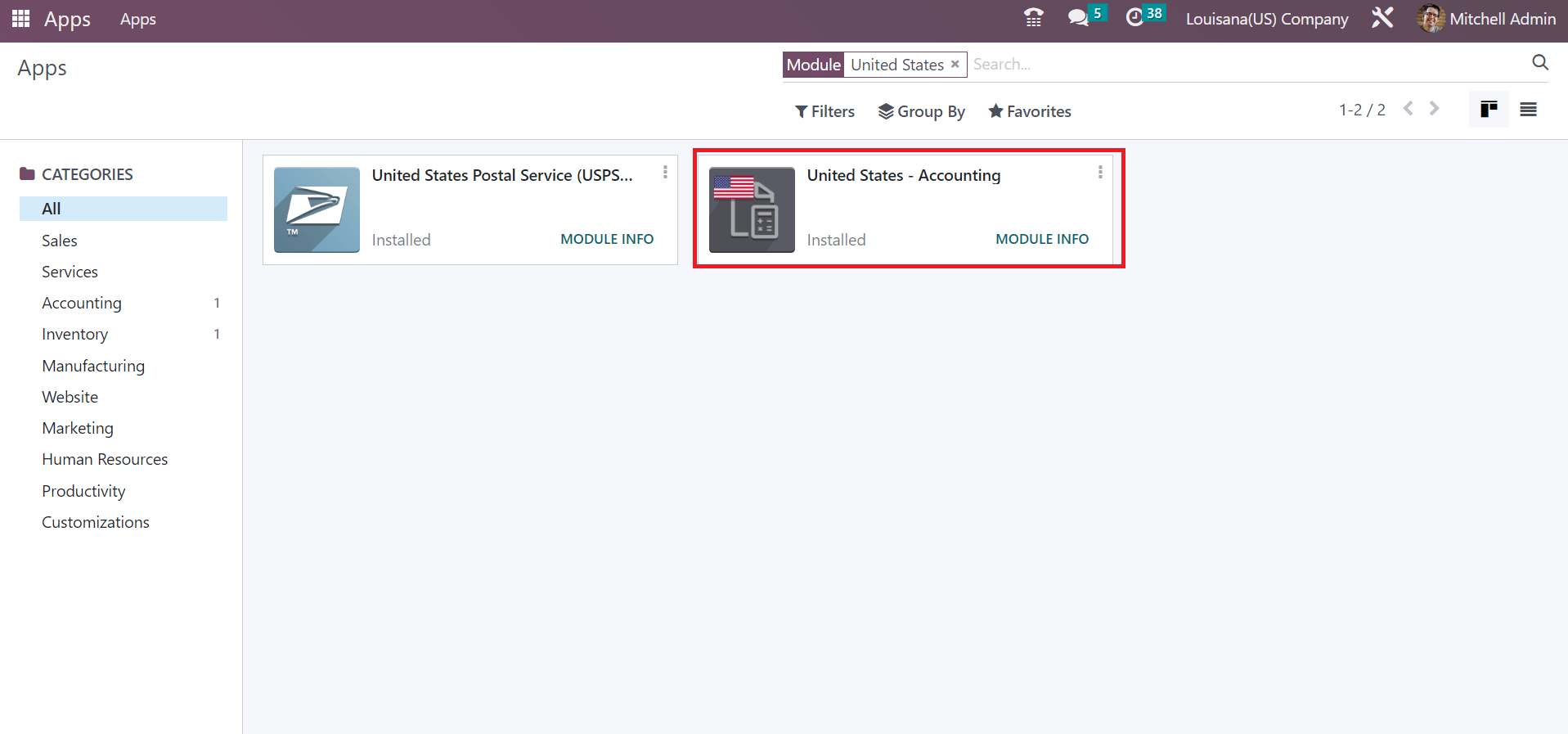

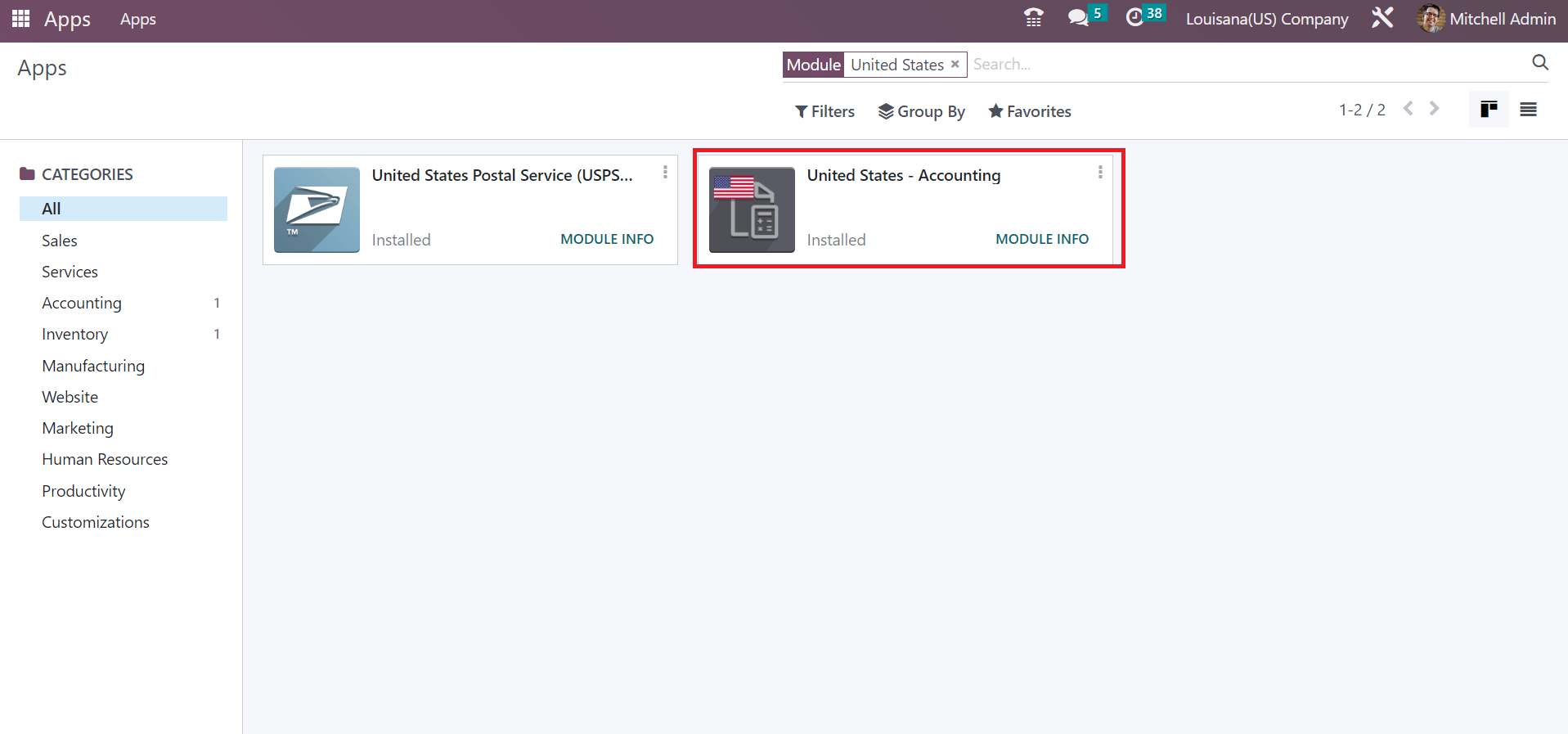

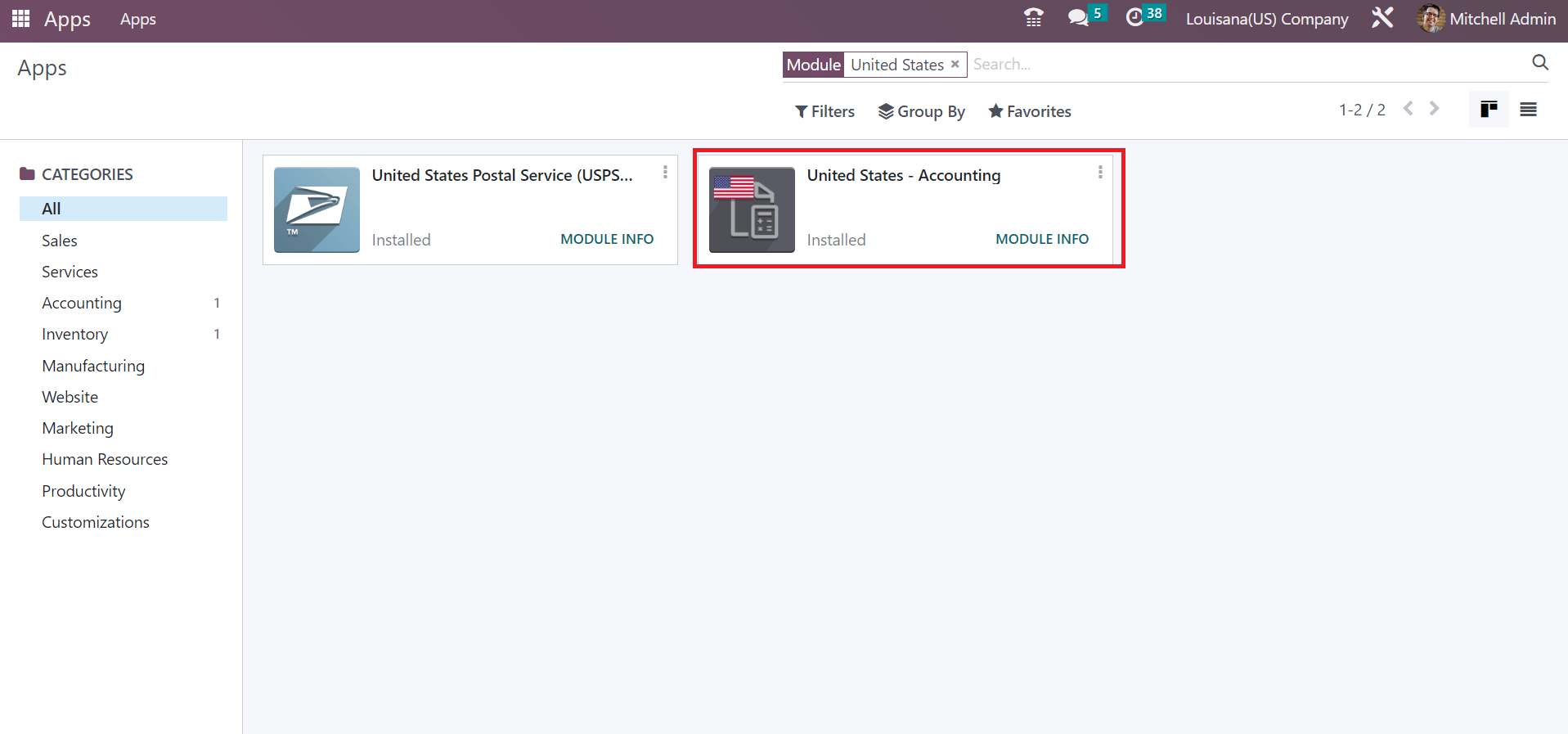

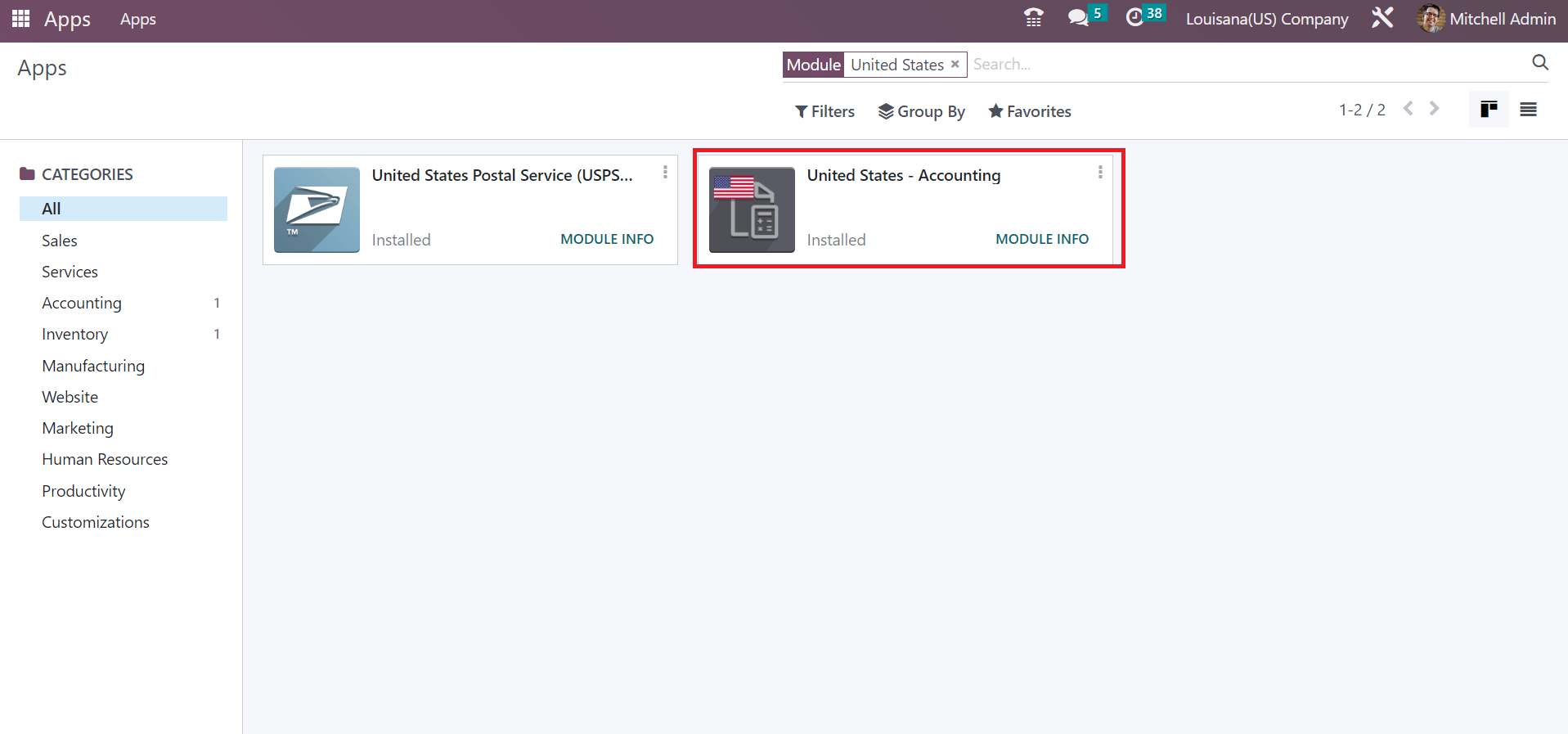

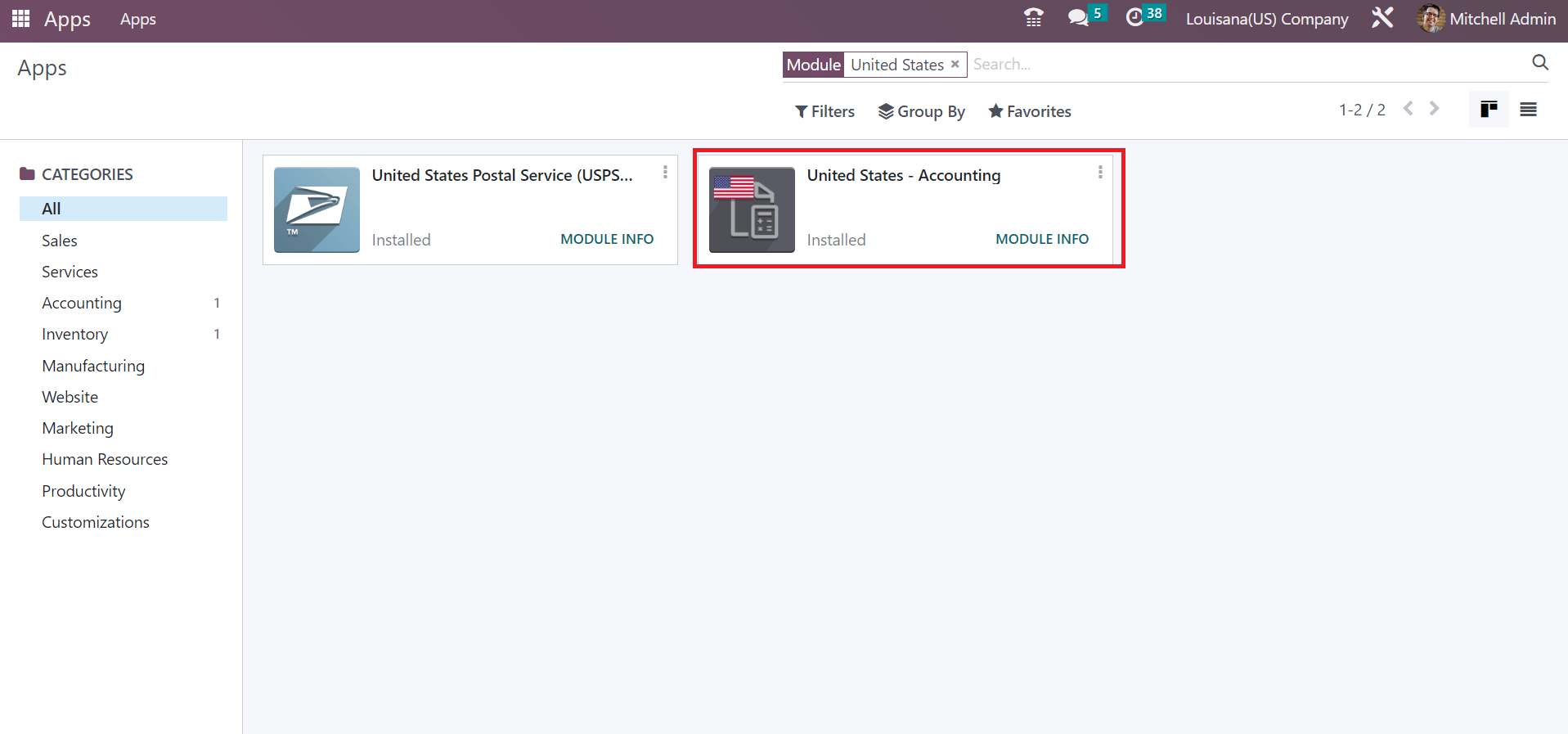

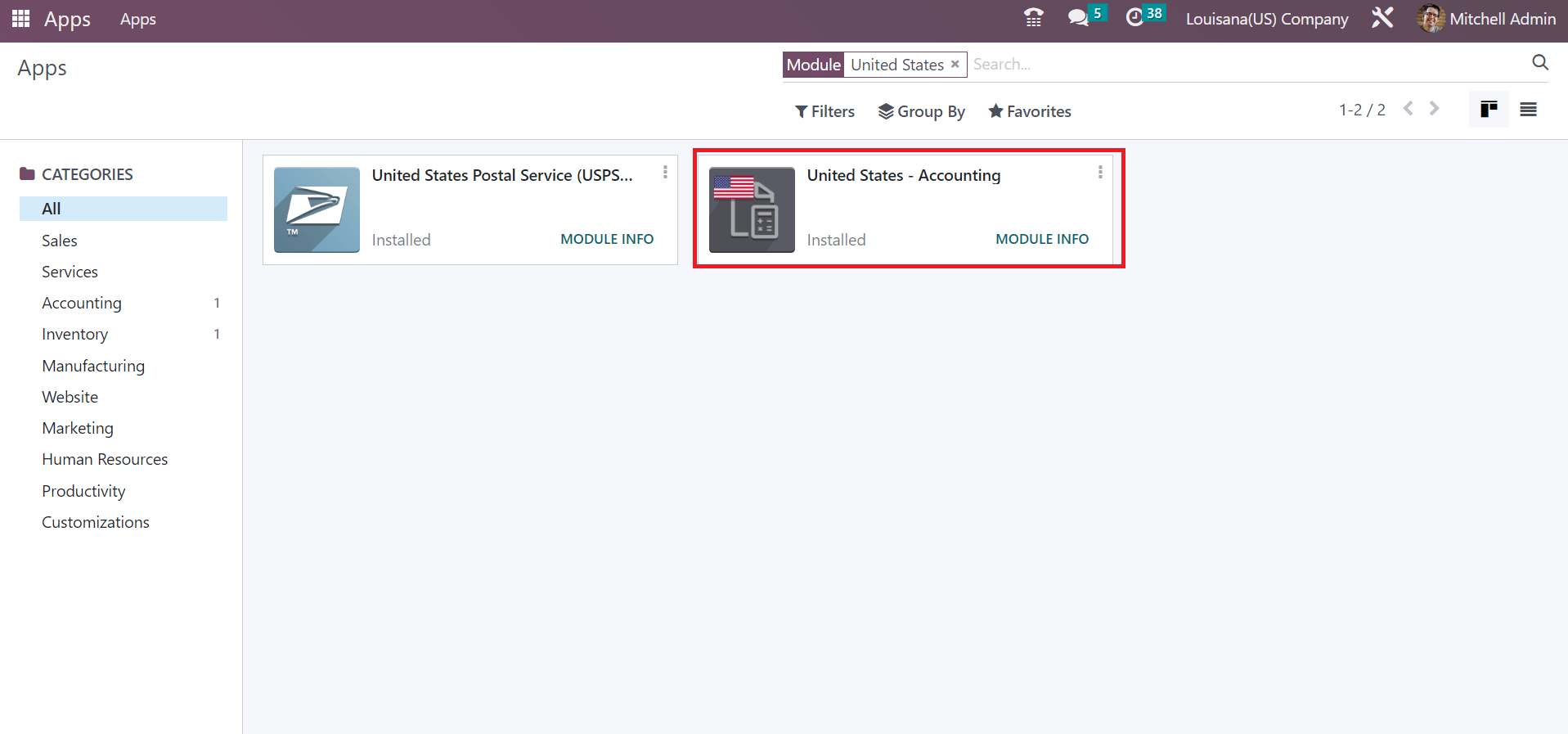

Before generating your company data, you must install the US Accounting application from the Odoo 16 Apps. Install the United States - Accounting app within the Odoo 16 as marked in the screenshot below.

After downloading this app, we can manage the company details in the Odoo 16. You can select the Companies menu in the Odoo 16 Settings window, and a list of each firm is viewable to the user. Selecting the CREATE icon allows us to move with new company data, as specified in the screenshot below.

Enter the company's name as Maine(US) Company for the user. Later, we can mention the detailed description of a firm in the Address field. You need to apply for Maine(US) as a state and enter the United States as a Country.

Mention your transaction currency of the company in the Currency field. Moreover, state your company Website, Email, and Phone number under the General Information, as depicted in the screenshot below

Users can add the contact number of companies for consumers within the Phone option. Also, enter the official mail id of a firm in the Email field and the company site link on the Website option.

To Design Maine Sales Tax in the Odoo 16 Accounting

For creating the sales for Maine, the user can choose the Taxes menu within the Accounting module of Odoo 16. The Taxes window shows data related to each tax separately, including Company, Tax name, etc. We can design a new sales tax for Maine after selecting the CREATE icon, as represented in the screenshot below.

Users can enter Maine sales tax 5.5% as the Tax Name, and we can set a calculation method. For that, select a computation method as Fixed, Percentage of Price, Python Code, and more. After picking the essential process, enter the percentage of the Amount as cited in the screenshot below.

Here, we applied 5.5% in the Amount option due to the sales tax rate of Maine. Furthermore, the user can pick the Tax Type as Sales because we are calculating the Maine sales tax rate. To run the particular tax on Odoo 16, you must enable the Active option in the Taxes window.

Under the Advanced Options, information related to Company and Country is manually viewable to a user. Users can add the text visible on an invoice in the Label on Invoices option. Also, choose the group of your Maine sales tax 5.5% in the Tax Group field, as portrayed in the screenshot below.

We can save the data manually after entering essential sales tax details. The created tax name is accessible on the main Taxes window, as mentioned in the screenshot below.

Formulation of Customer Invoice for a Marine Sales Tax in Odoo 16

In the Accounting dashboard, users can acquire different types of journals. The Customer Invoices journal shows the count of late and unpaid invoices. We can develop a customer invoice and apply sales tax by clicking on the NEW INVOICE icon.

In the new screen, enter your partner's name as Maine(US) Company in the Customer option. The address for your chosen partner is visible manually in the Delivery Address field.

Add the date on which the product is billed in the Invoice Date and enter a name or customer number in the Payment Reference field. Later, enter the deadline for the customer invoice in the Due Date field. You can also choose a record for your invoice in the Journal option, as described in the screenshot below.

We can mention the invoice line of a product after pressing the Add a line option. In the open bar, it is easy to specify your product name, quantity, and price. Select your formulated Maine sales tax of 5.5% inside the Taxes section, as illustrated in the screenshot below.

After choosing the Maine sales tax, the user can view the sales tax rate of 5.5% at the right end with the Untaxed Amount, as demonstrated in the screenshot above. Click the CONFIRM button after manually saving the details in the Customer Invoices window, as shown in the screenshot below.

Sales state tax rate as per country and state in a company publishes easily through Odoo 16 Accounting. We can quickly manage the customer invoices in a business and mention various sales taxes on products/services using Odoo ERP support.