Tax levied for retail services and goods means a sales tax. Mostly, it applied for all final consumptions with a few exceptions. Different tax rates are charged in the various states of the United States. A sales tax permit is vital for companies to gather taxes from consumers. Services and products in each state vary with different tax rates. Handling tax rates of sub-branches of an organization located in other states is complex. By installing Odoo ERP software, tax management becomes an easy process for a company. Using the Odoo 16 Accounting module, users can quickly calculate taxes and apply them to invoices/orders.

This blog specifies steps to develop Idaho(US) sales tax within the Odoo 16 Accounting application.

The accounting module of Odoo 16 assists you in administering automatic transfers, journals, budget analysis, cash roundings, and more. Additionally, users can evaluate the accounting performance of a company using Reporting feature. Let's view the procedure of developing Idaho(US) sales tax in Odoo 16 Accounting.

Brief of Idaho(USA) Sales Tax Rate

One of the additional costs borne by customers is sales tax. A state sales tax rate of 6% relies on Idaho. Also, a local sales tax of 3% is collected by local governments in the state. The maximum tax rate in Idaho is 9% in Sun Valley city. A seller must have a physical nexus in Idaho. Most tangible products and some services are taxable in a particular state. We can see exceptions in prescription drugs, farming, irrigation equipment, supplies, etc.

Some of the necessary information before registration of sales taxes are business entity type, personal identification number, business number, etc. Idaho Business registration application assists users in registering online quickly about sales tax. It is possible to remit and file quarterly monthly, or annual sales tax.

Idaho Company Set up in Odoo 16

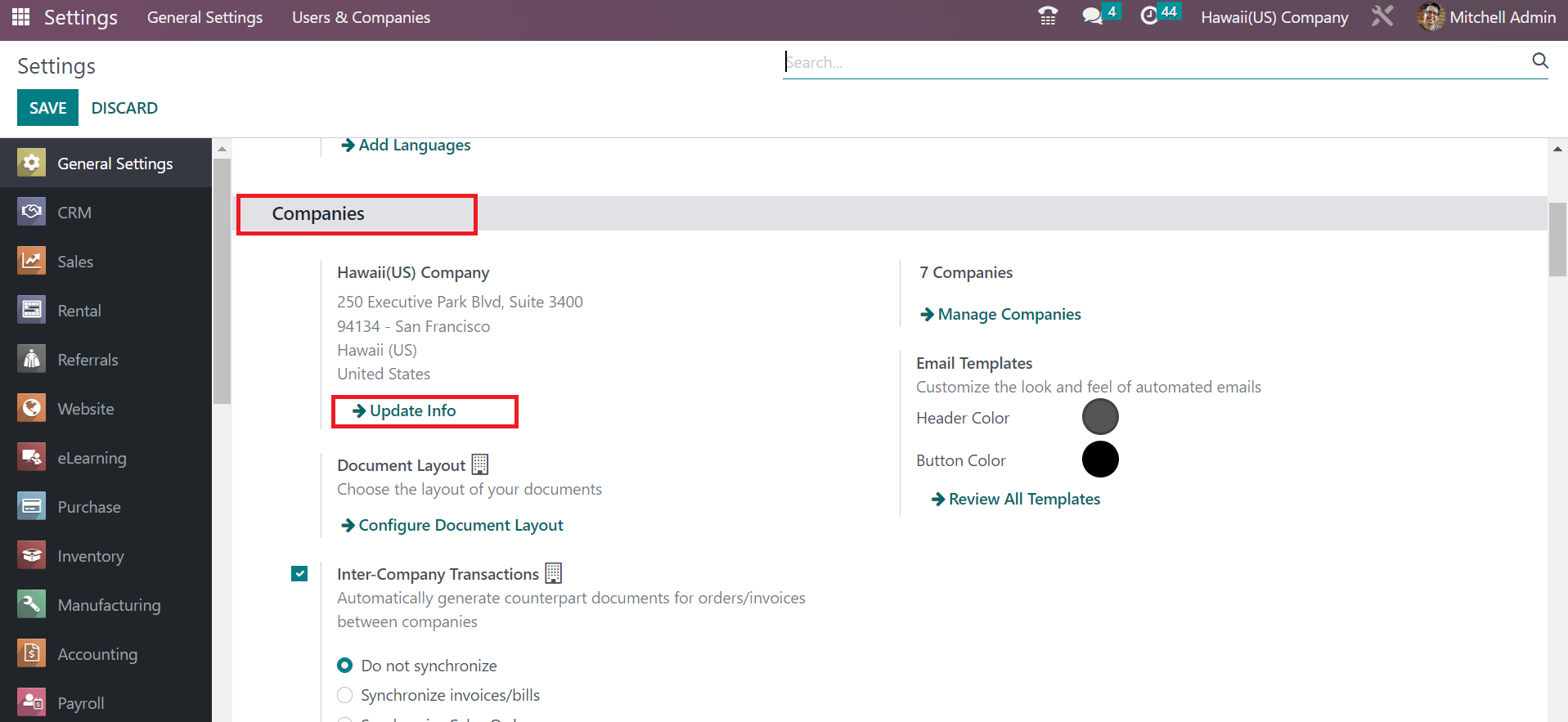

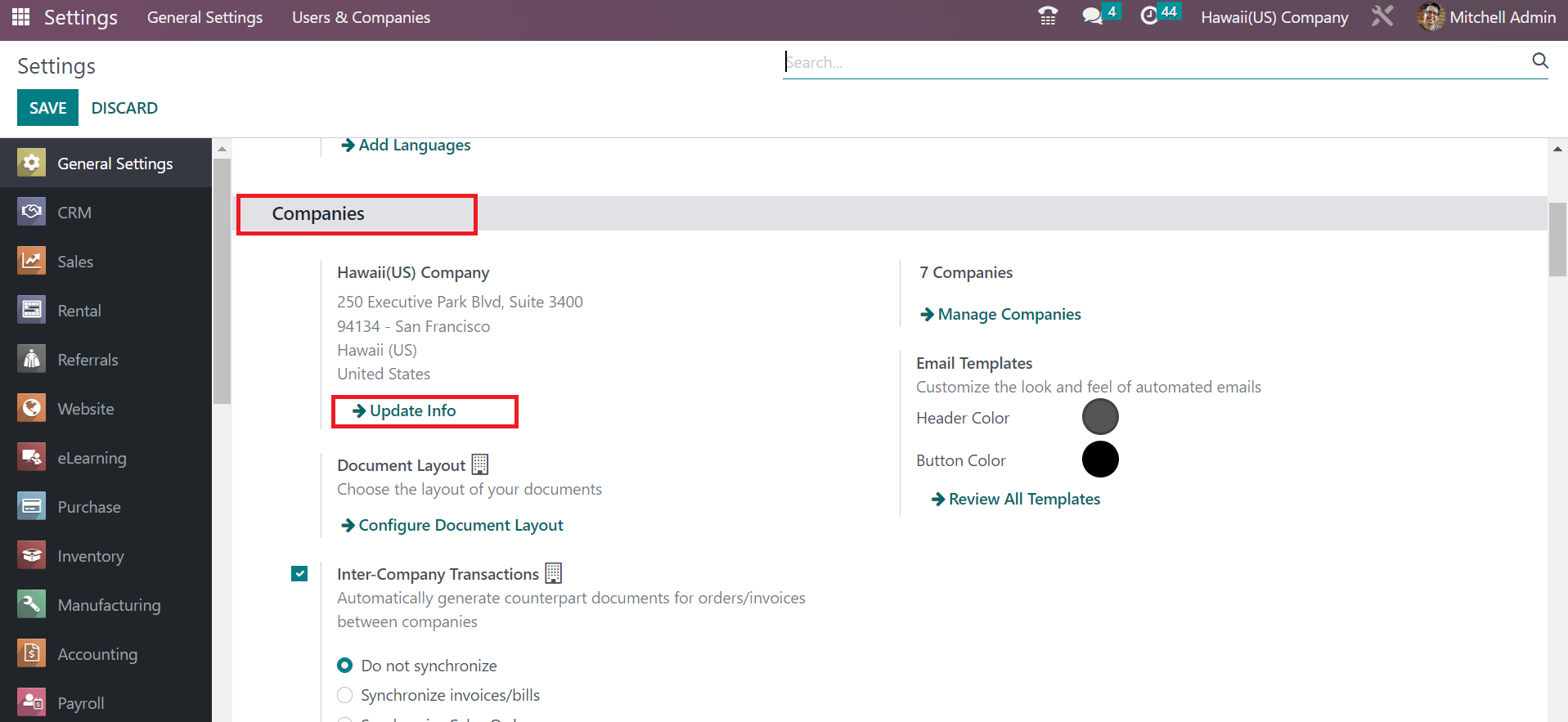

Below the Companies section of Odoo 16 Settings, it is possible to change your company information after clicking the Update Infor icon, as noted in the screenshot below.

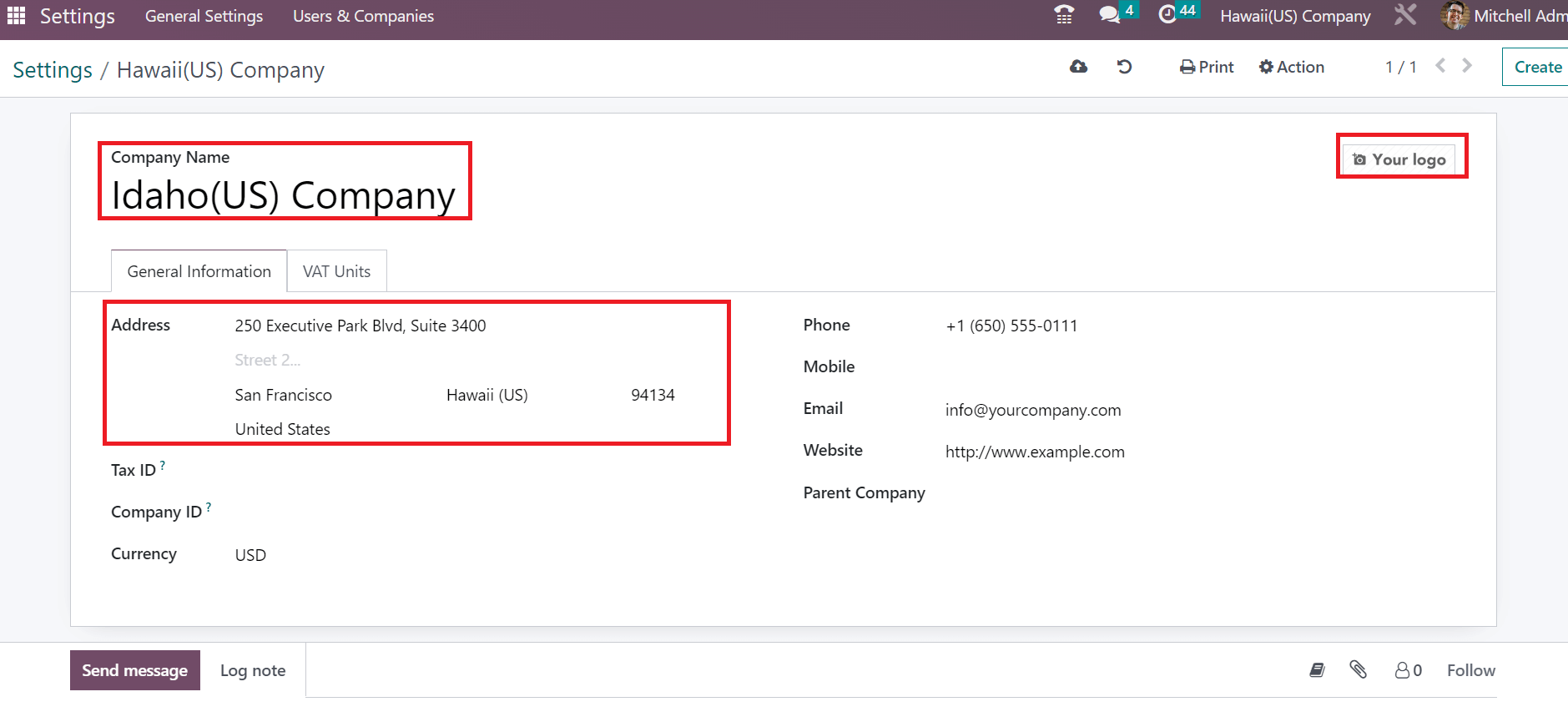

In the Companies window, add your firm's title in the Company Name field as Idaho(US) Company. Later, enter the address of your company, such as street name, pin code, state, country, and more. Add Idaho(US) and the United States in the state option in the country option, as indicated in the screenshot below.

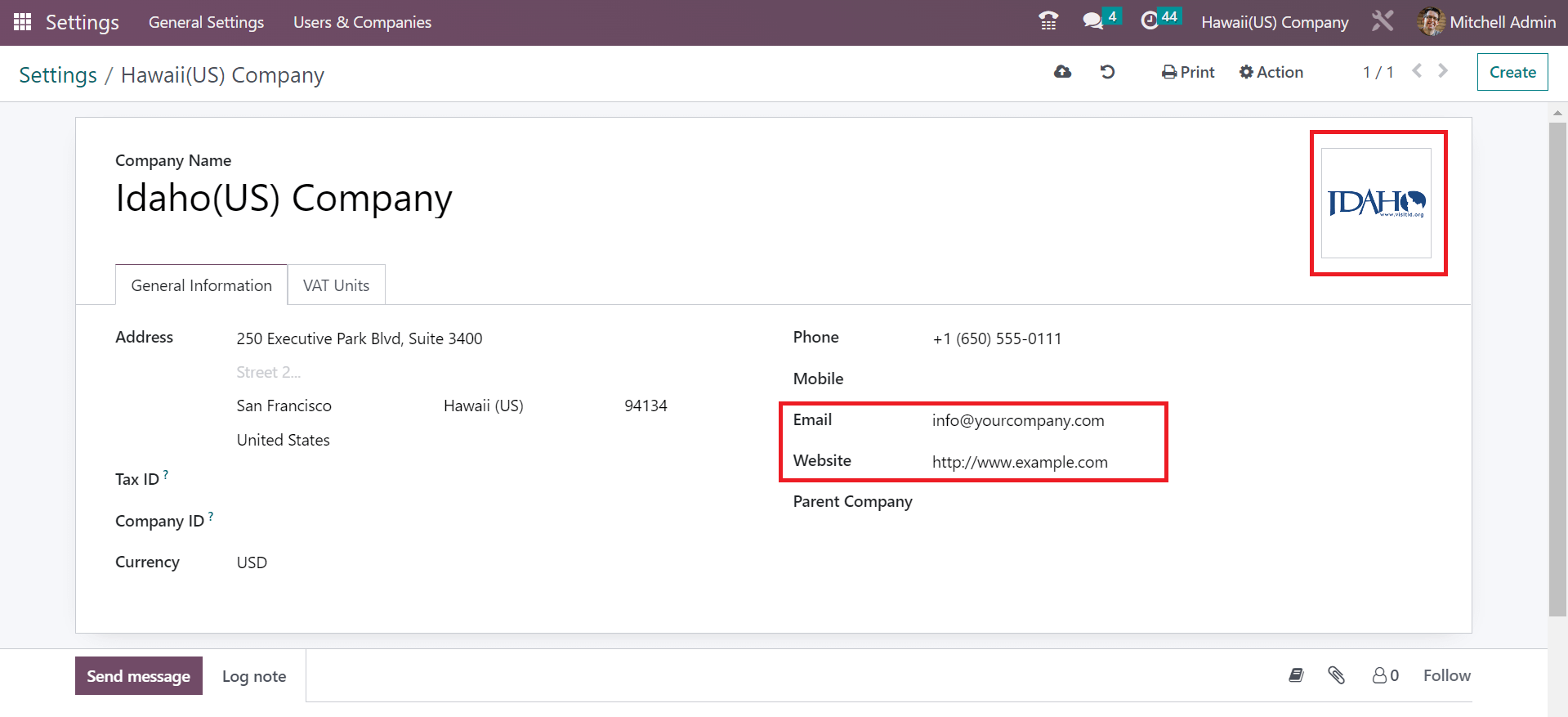

The user can update the company logo by clicking the Edit icon on the right end, as shown in the screenshot below. After uploading the logo, specify the email and website details of the company below the General Information tab.

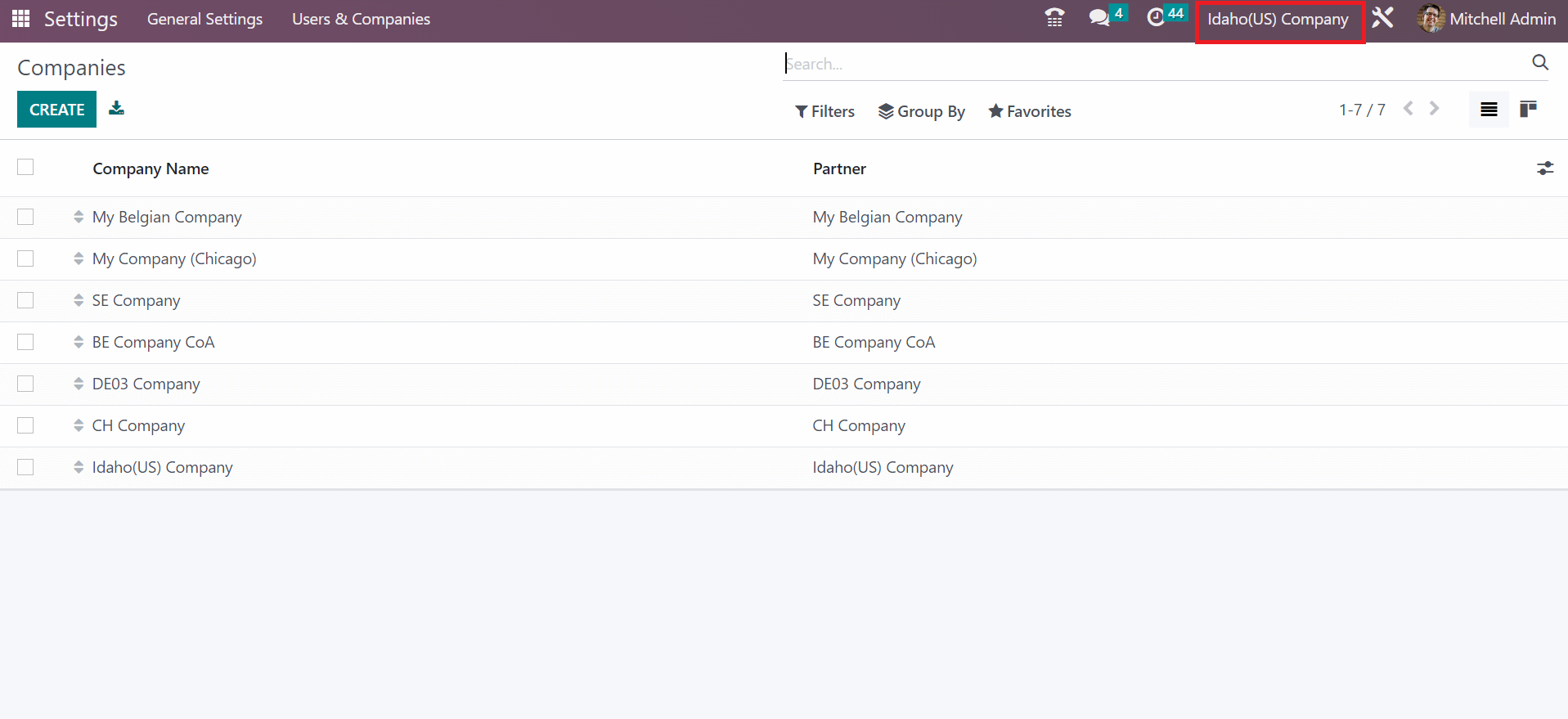

Each detail of your firm is saved manually in the Odoo 16 Accounting module. At the top right end, we can view the created company title, as cited in the screenshot below.

To Develop Idaho(USA) Sales Tax in the Odoo 16 Accounting

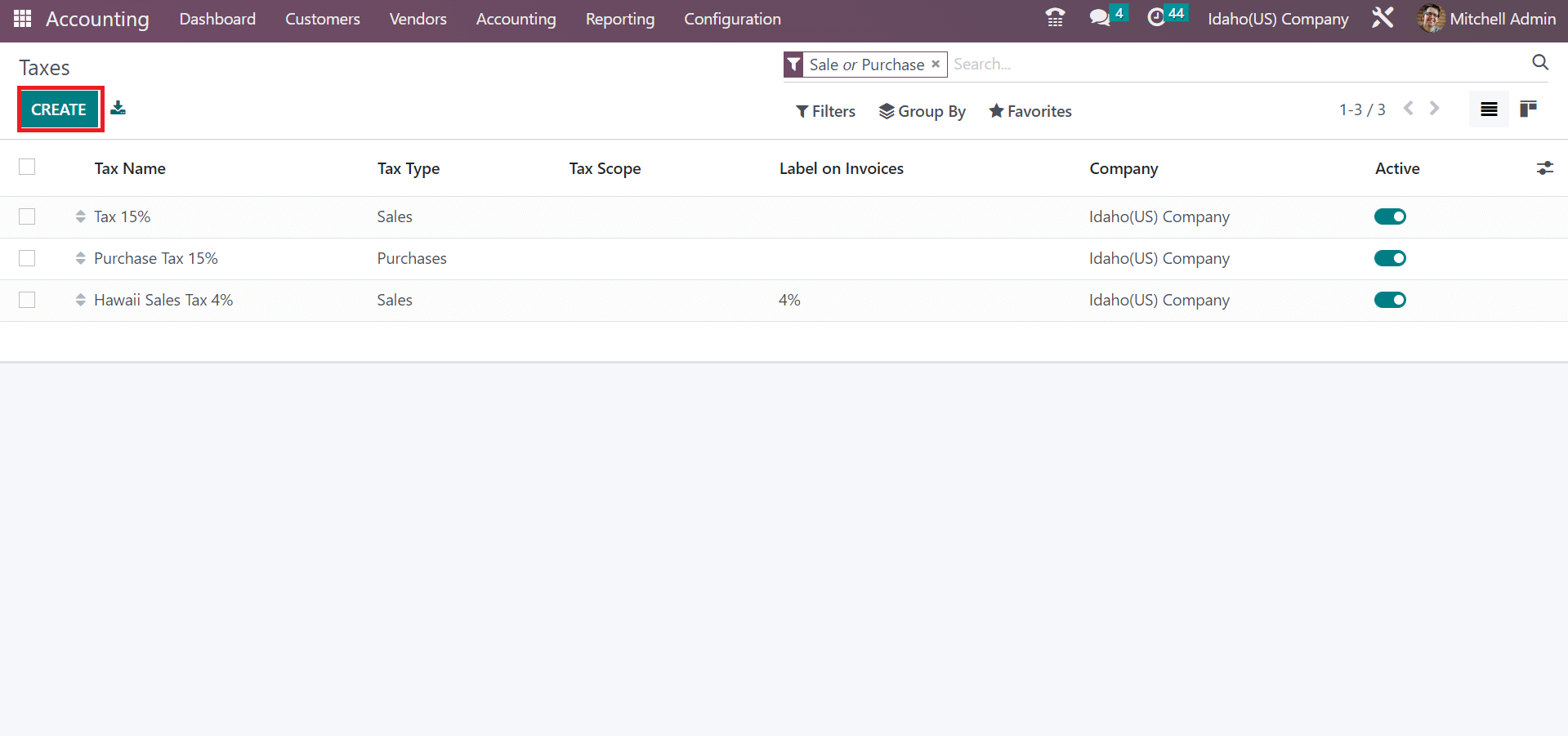

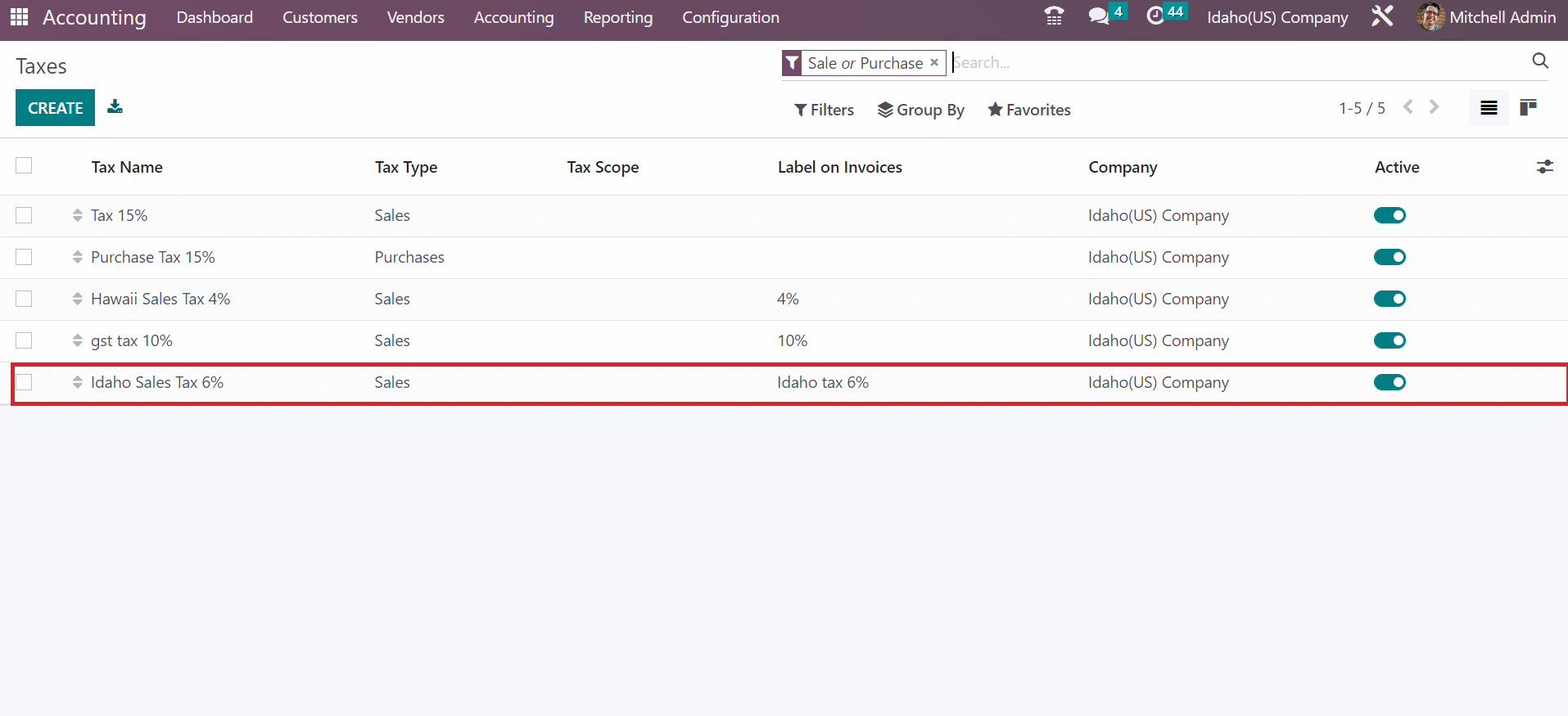

Tax computation for Idaho(US) is accessible by selecting the Taxes menu from Configuration. In the List view of Taxes window, you can view data related to each tax, including Label on Invoices, Active, Tax name, etc. By clicking on CREATE button, the user can proceed with a new tax for Idaho state as presented in the screenshot below.

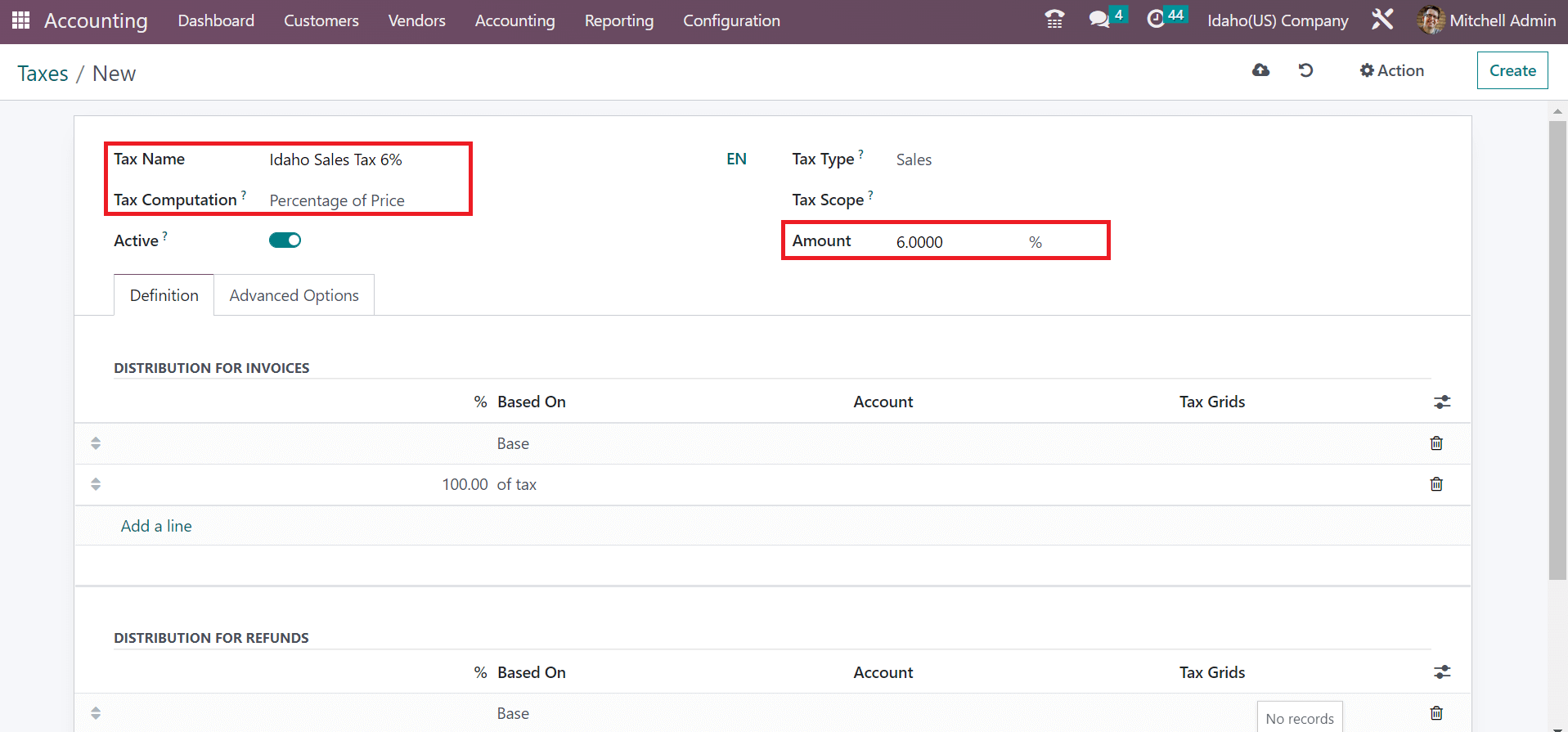

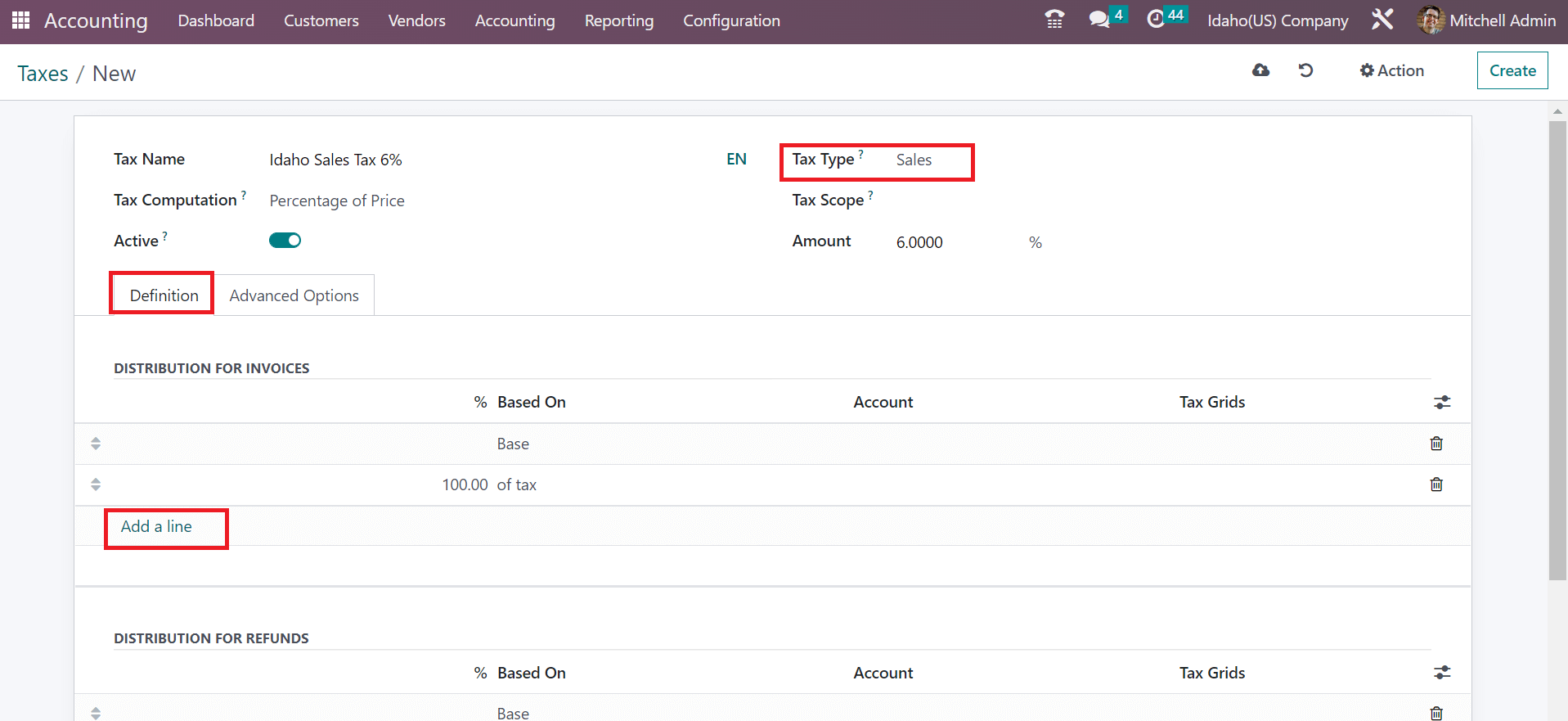

On the new page, apply the Tax Name as Idaho Sales Tax 6%. Later, the user can pick any computation method to calculate sales tax. In the Tax Computation field, choose a percentage of price option and specify the rate of Idaho sales tax in the Amount field.

Determine the Tax Type as Sales in the Taxes window. Distributing your tax for invoice and refund is easy after selecting the Add a line option in the Definition tab.

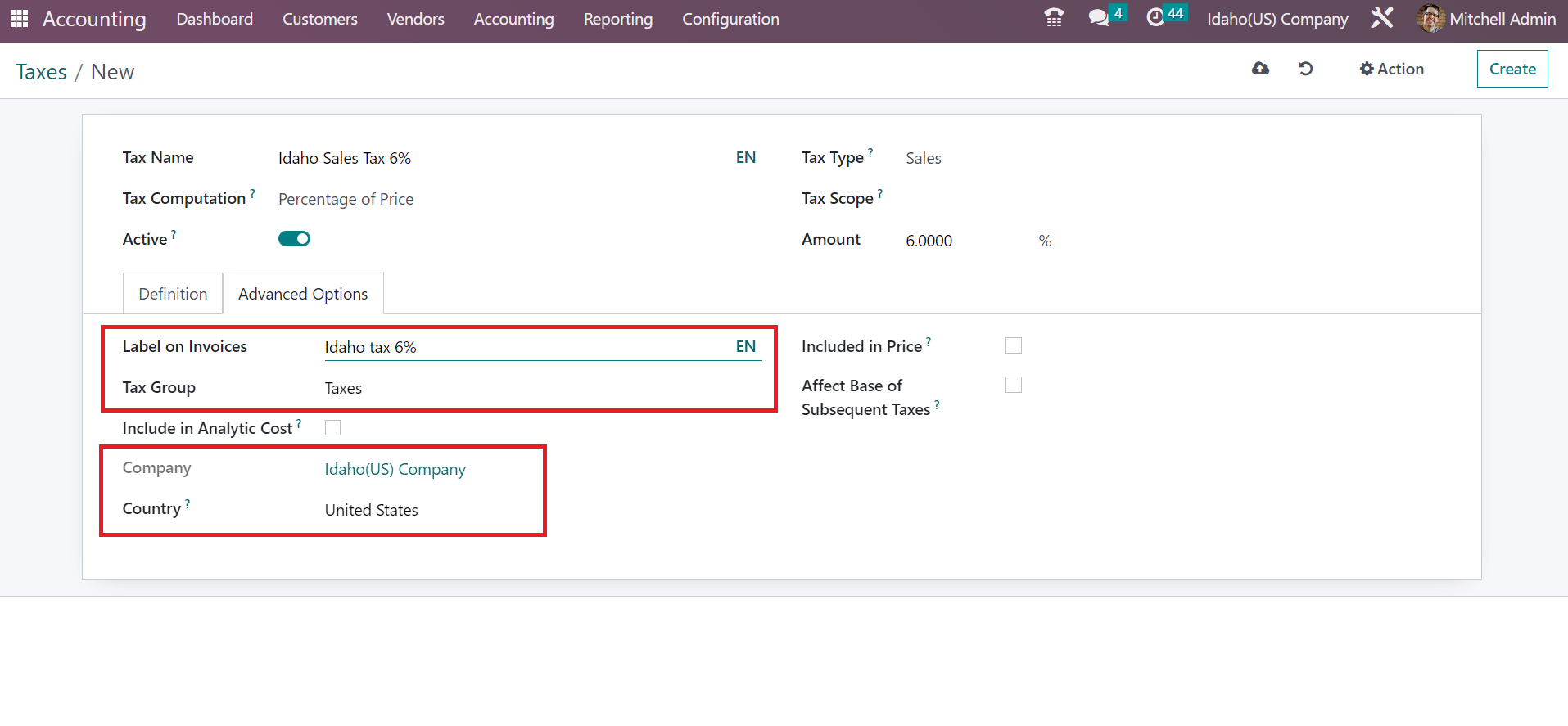

Set the label that is visible on invoices under the Advanced Options tab. Moreover, pick your tax group to relate to the created task. Information about Company and Country is easily accessible inside the Advanced Options tab.

After saving the details, your created company details are visible in the Taxes window, as noted in the screenshot below.

Next, let's apply the Idaho sales tax of 6% for a customer invoice in Odoo 16.

Idaho Sales Tax on a Customer Invoice using Odoo 16

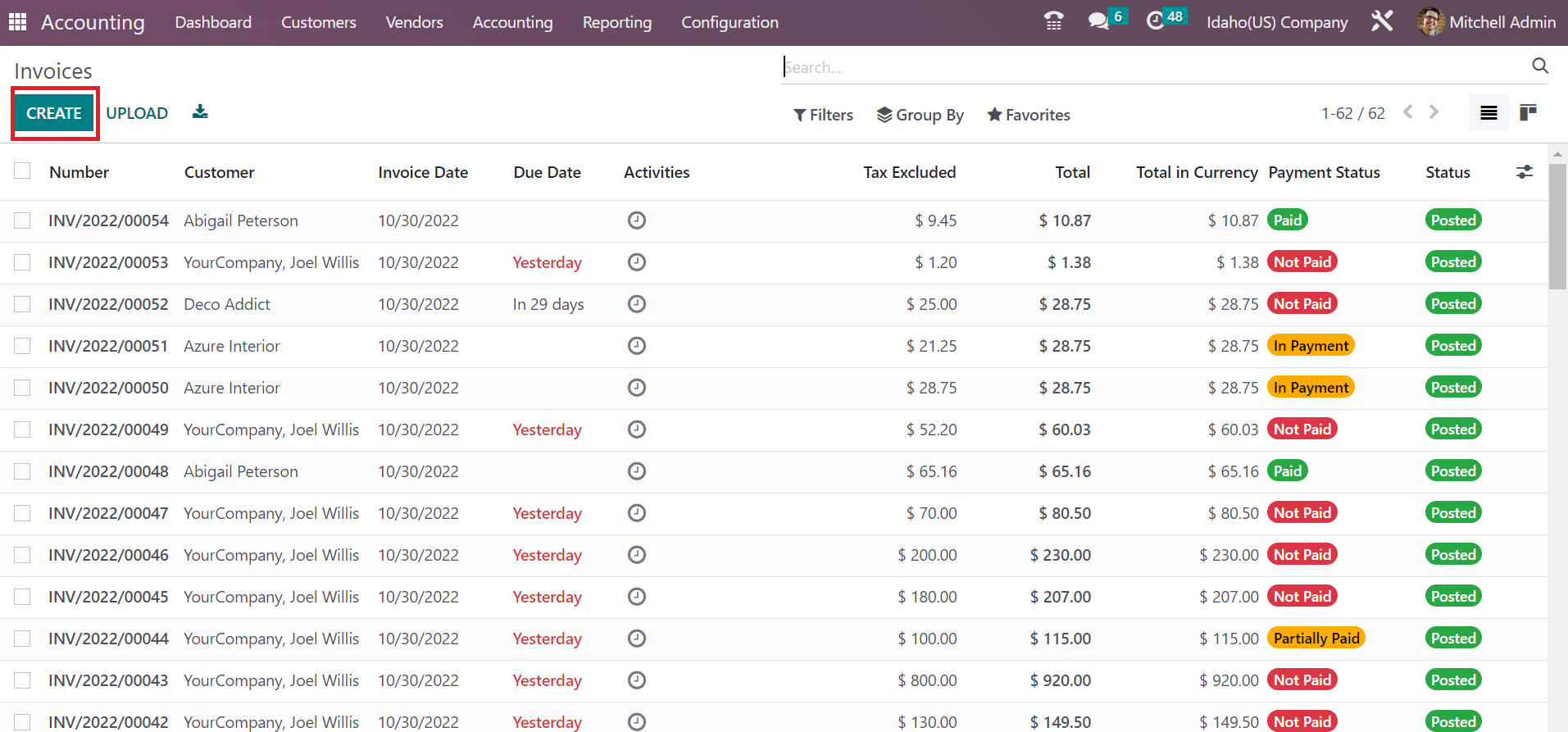

For developing an invoice using Idaho sales tax, you can obtain the Invoices menu under the Customers tab. In the Invoices window, the user can see the Payment status, Customer, Due date, and other data in the List view. To produce a new invoice, click the CREATE icon, as mentioned in the screenshot below.

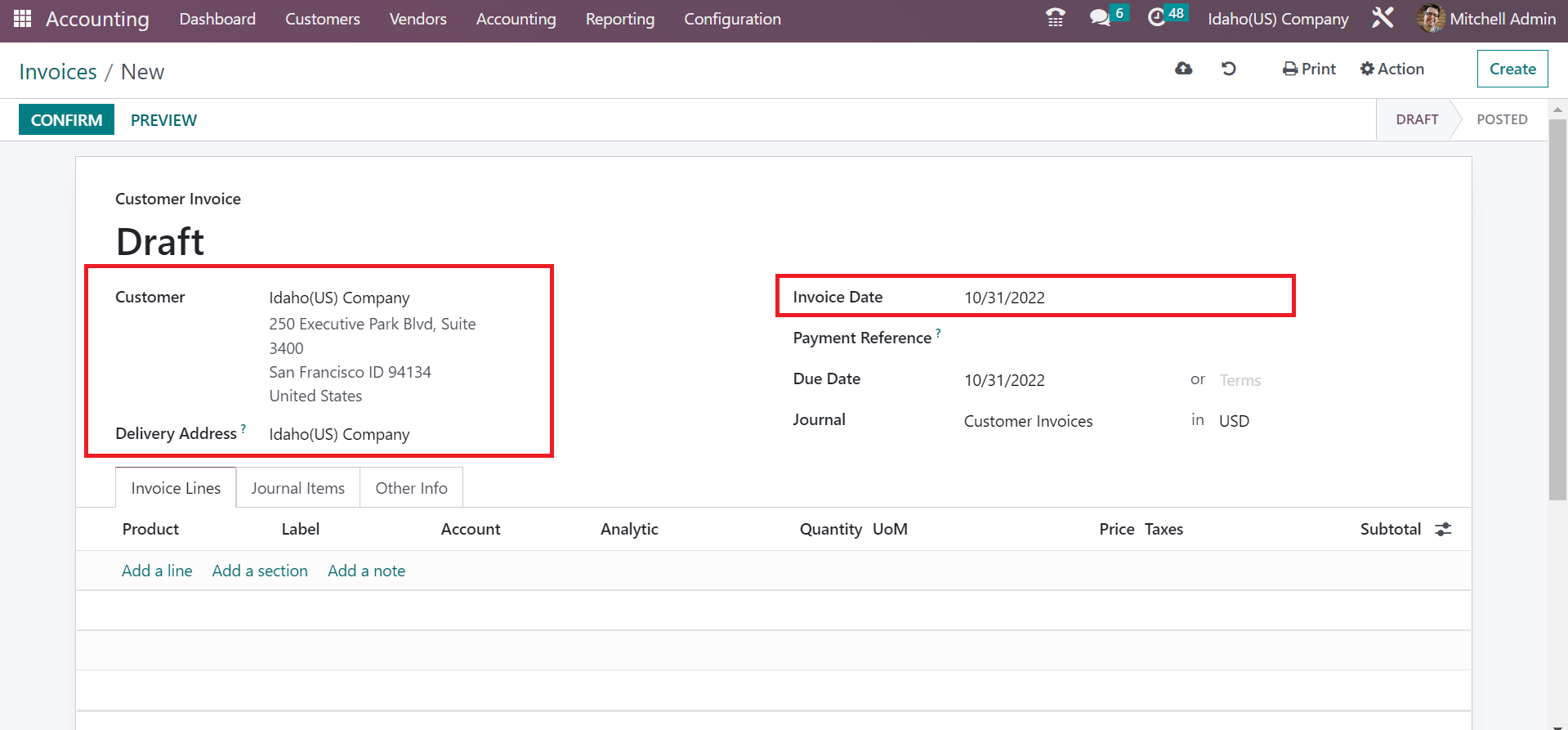

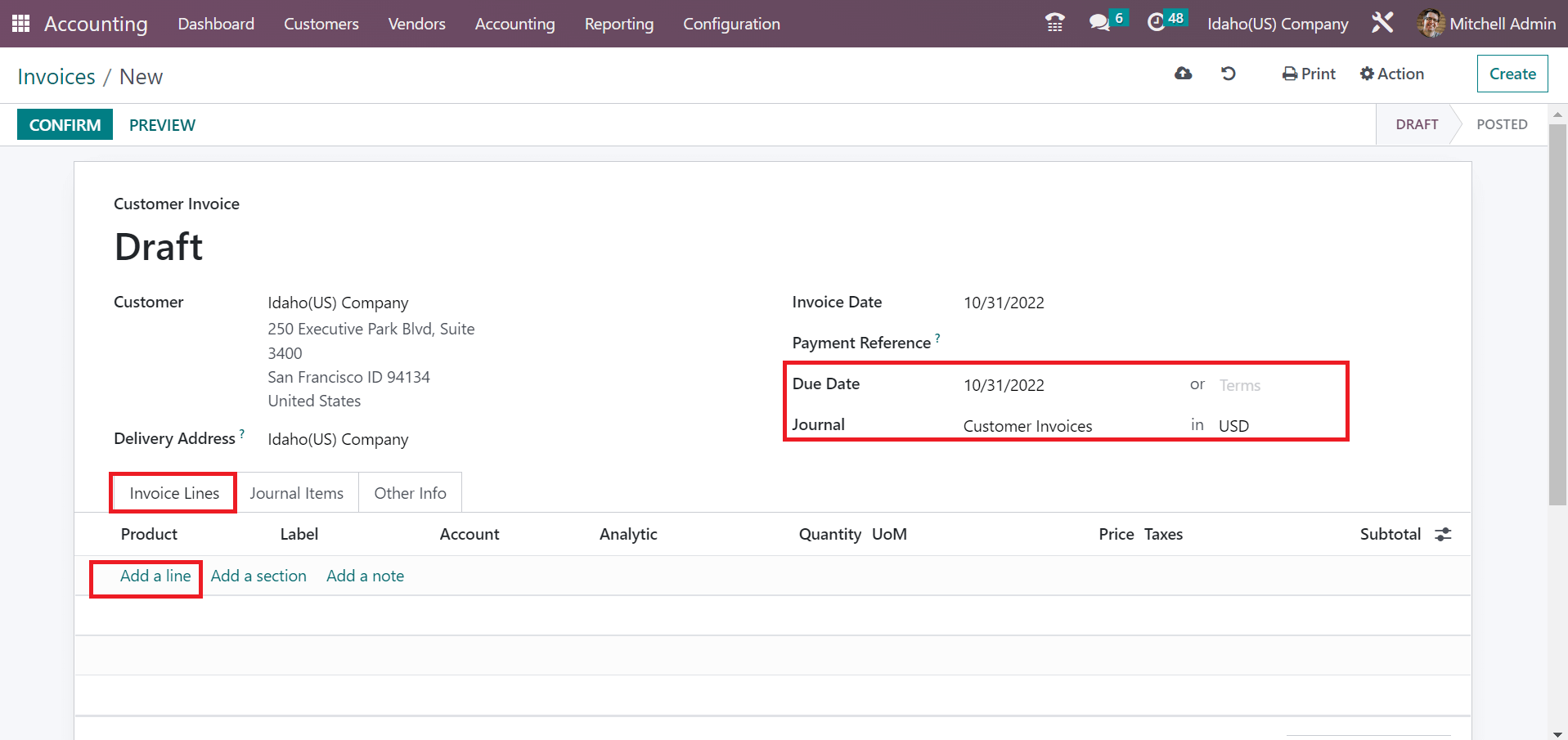

In the open draft page, set the Customer as Idaho(US) Company. The product delivery address to the customer is automatically viewable to a user in the Delivery Address field. Later, enter the beginning date of the customer invoice in the Invoice Date field, as noted in the screenshot below.

Add the last date of the invoice in the Due date field. Moreover, you can pick a journal for your customer invoice. To select a new product for a customer, choose the Add a line option in the Invoice Lines tab, as cited in the screenshot below.

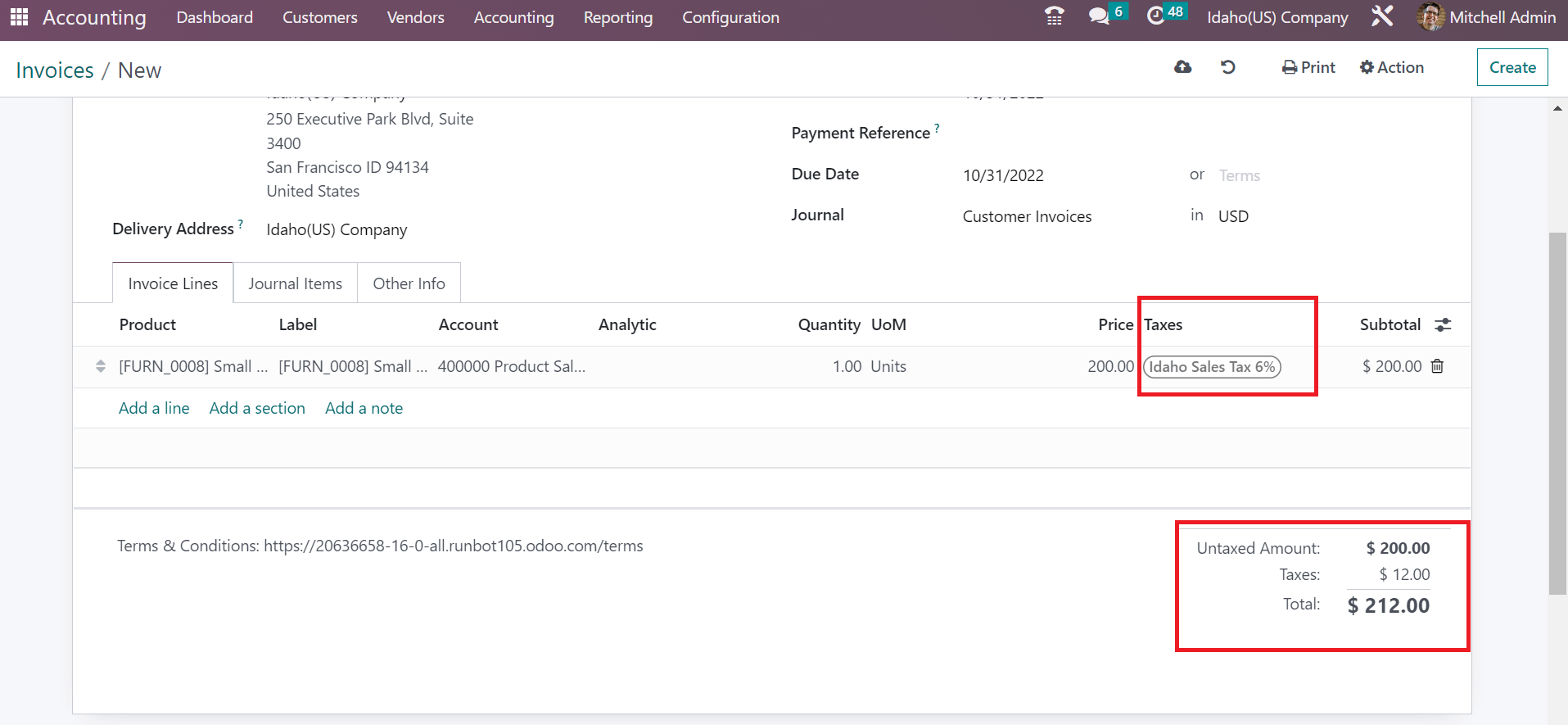

In the open space, we choose one quantity of small shelves with a price of 200. You must select the Idaho Sales Tax 6% inside the Taxes section in the open space. After choosing the tax, the total product cost with the applied tax is visible to the user, as illustrated in the screenshot below.

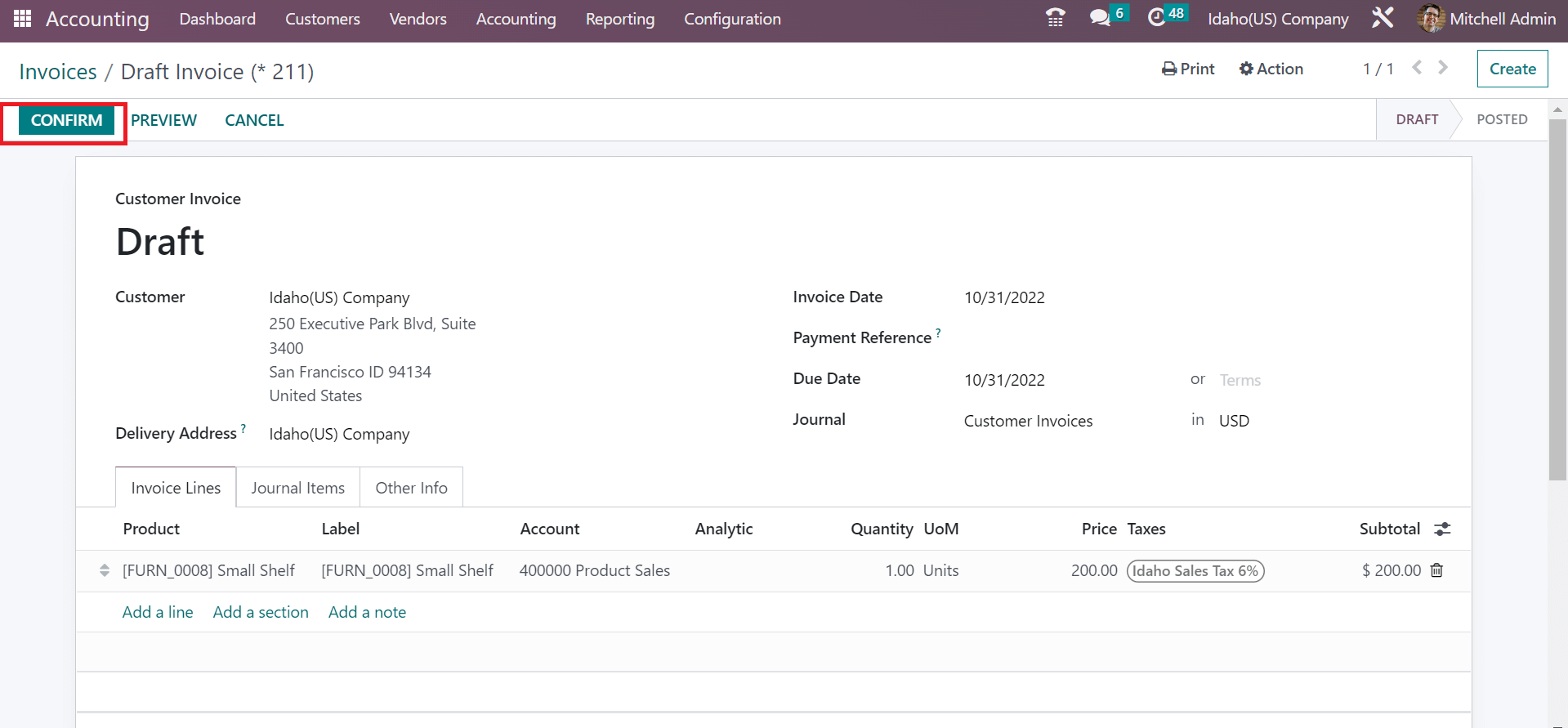

Click the CONFIRM icon after manually saving the customer invoice data.

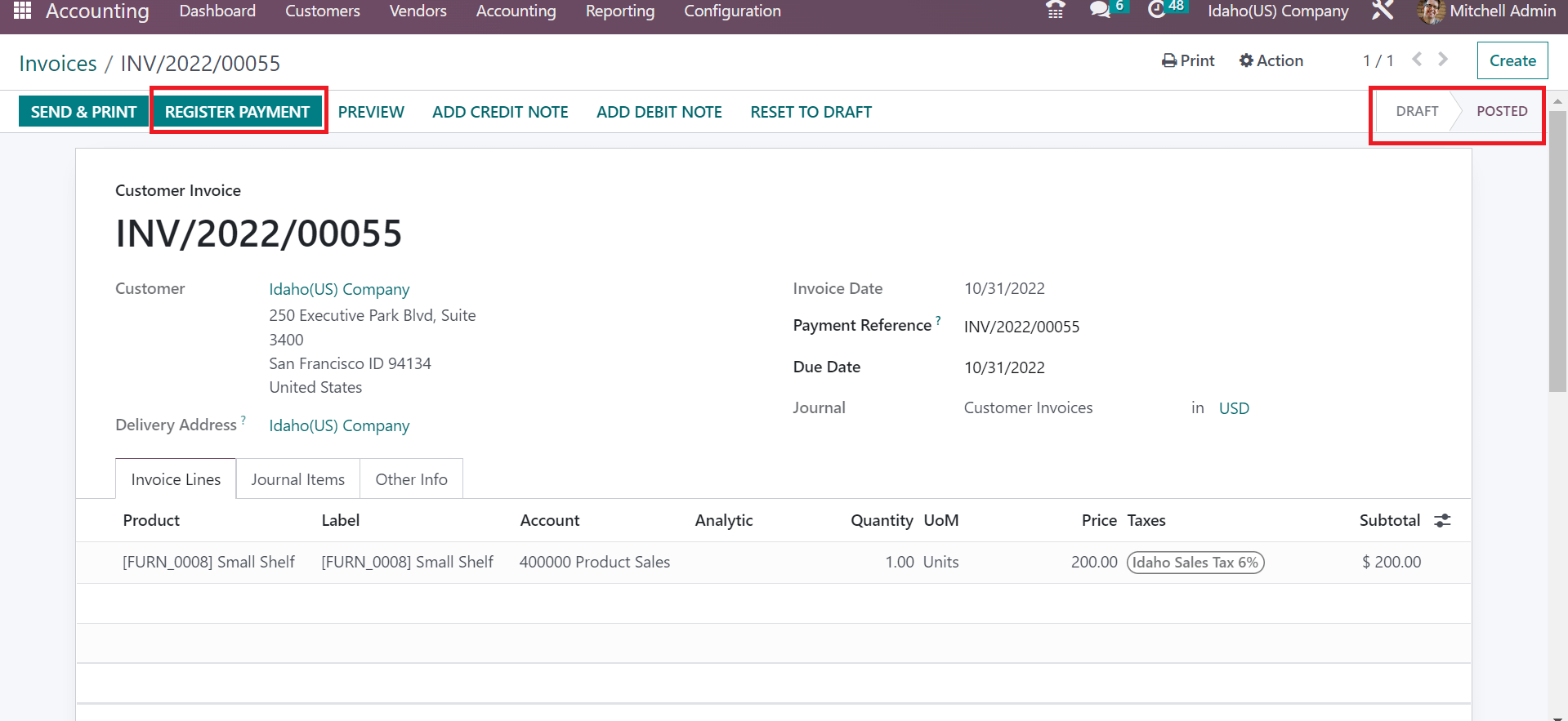

The DRAFT stage changed to POSTED after the confirmation of the customer invoice. Now, you can pay the invoice by choosing the REGISTER PAYMENT icon in Odoo 16.

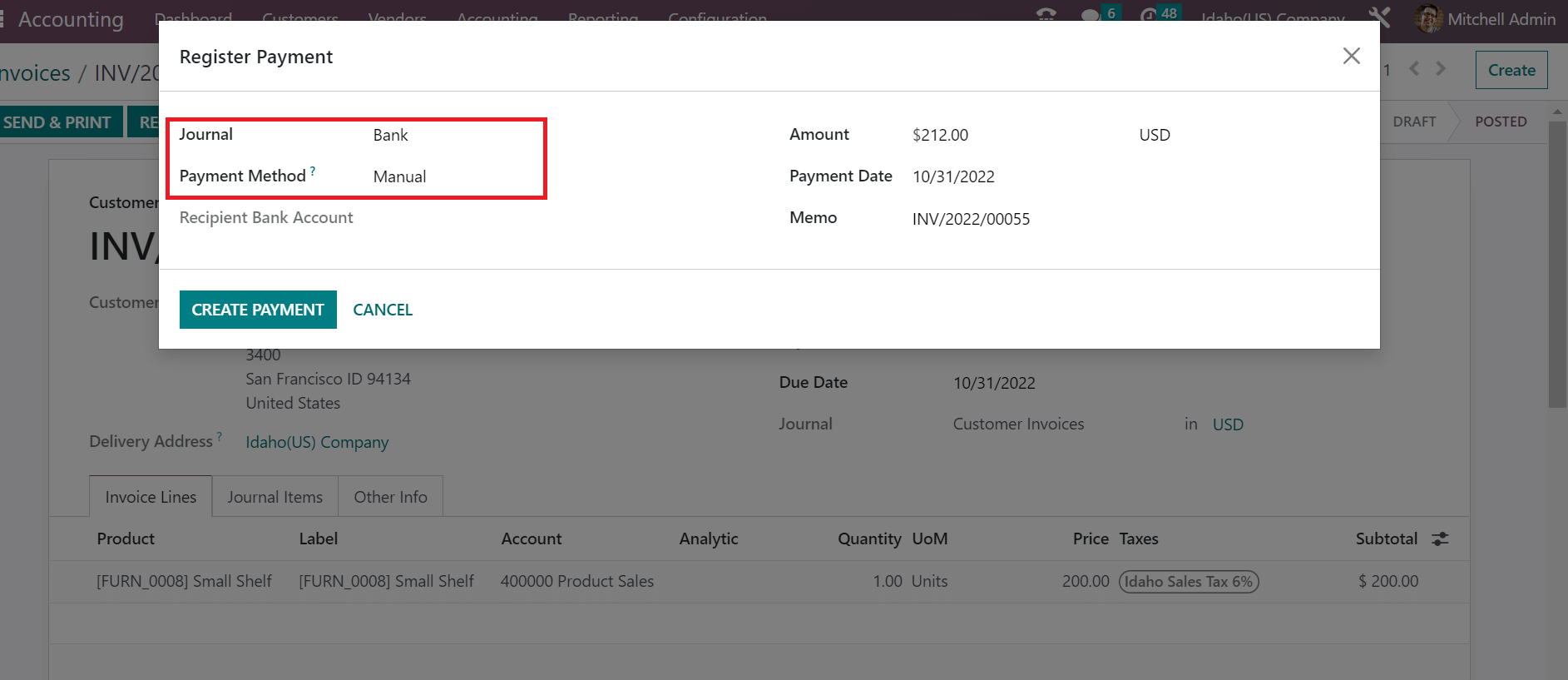

In the Register Payment window, choose the Bank option in the Journal field. Afterward, you can select a payment method for customer invoices as Manual means paying through any plan outside Odoo.

The total price of a commodity is accessible in the Amount field. Additionally, the user can see the Payment Date and Memo details manually viewable in the Register Payment window. Click the CREATE PAYMENT icon after managing all invoice segments, as portrayed in the screenshot below.

So, making payments for customer invoices in the Odoo 16 Accounting is easy.

Idaho, sales tax management becomes an easy task once running an Odoo ERP software. Users can compute taxes according to each location when using the Odoo 16 Accounting application. Check out the below link to learn more about California Sales tax calculation in Odoo 16