To satisfy certain national requirements, most nations use a tax system. So in every accounting system tax element is a must.

We may create various types of taxes in Odoo. But to do this in Odoo, you need to be an advisor level user. Most others in accounting only have access to read.

To create a new tax, we shall go to Accounting -> Configuration -> Invoicing -> Taxes.

There we can create new taxes.

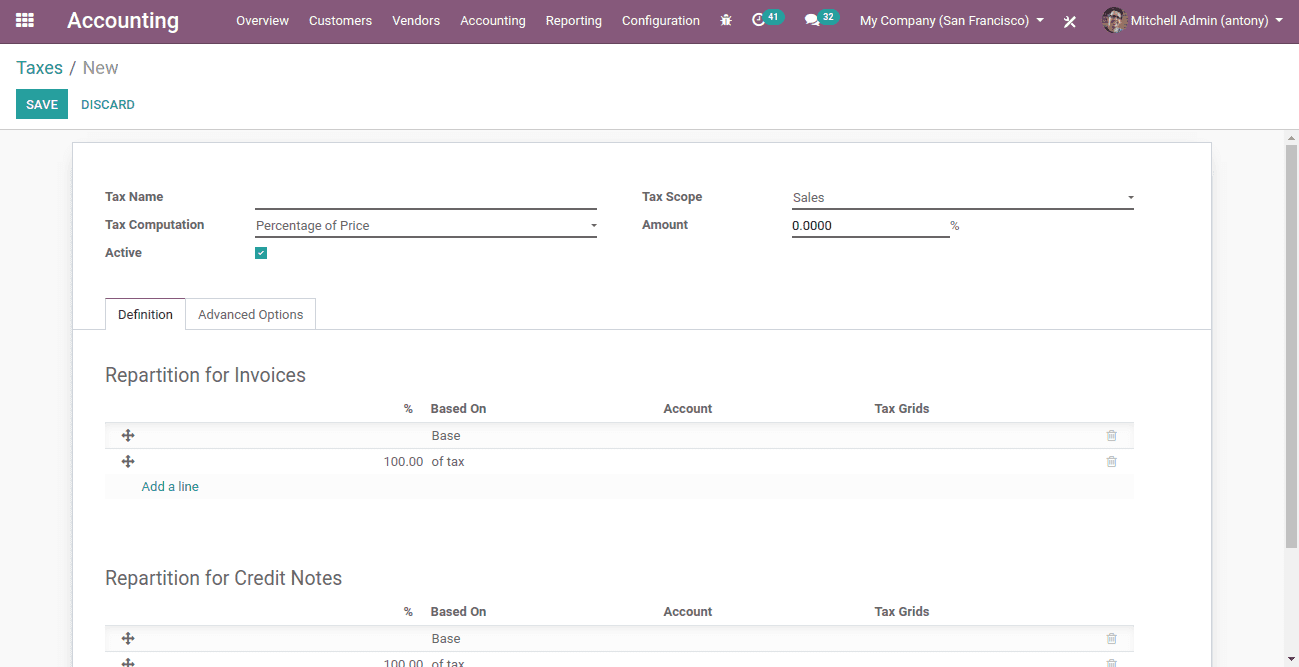

Here we can see all the mandatory fields to be filled.

Tax name: Here we shall give the name of the tax.

Tax scope: It implies where this tax we have to use, in sales or purchase. If you choose ‘None’ it will be used with other tax groups.

Tax computation: Here we have a default four types of tax computation, like,

Group of tax

Fixed

Percentage of price

Percentage of price tax included

Python code

Amount: This option appears only if the tax computation is fixed or, percentage of price or percentage of price tax included. Here we add the amount of tax.

Active: This tax is active only if we tick it. Only then can it be used.

Label on invoices: What we mention here is used in the invoice report.

Tax groups: Here we shall mention the tax groups. We have some tax groups that we create at the time of need.

Include in analytic cost: When we have this method then the amount determined by this tax will be assigned to the same analytical account listed in the line of invoices.

Included in price: The tax amount will be included in the unit price of the product

Affect base of subsequent taxes: When you choose this option, the total of the current base amount and the tax rate of this tax will be the base rate of subsequent taxes.

Reverse charge: This is the reverse charge of the tax.

Tax due: Under this, we have two options like, Based on Invoice and Based on Payment

We shall go to details with the tax computation methods.

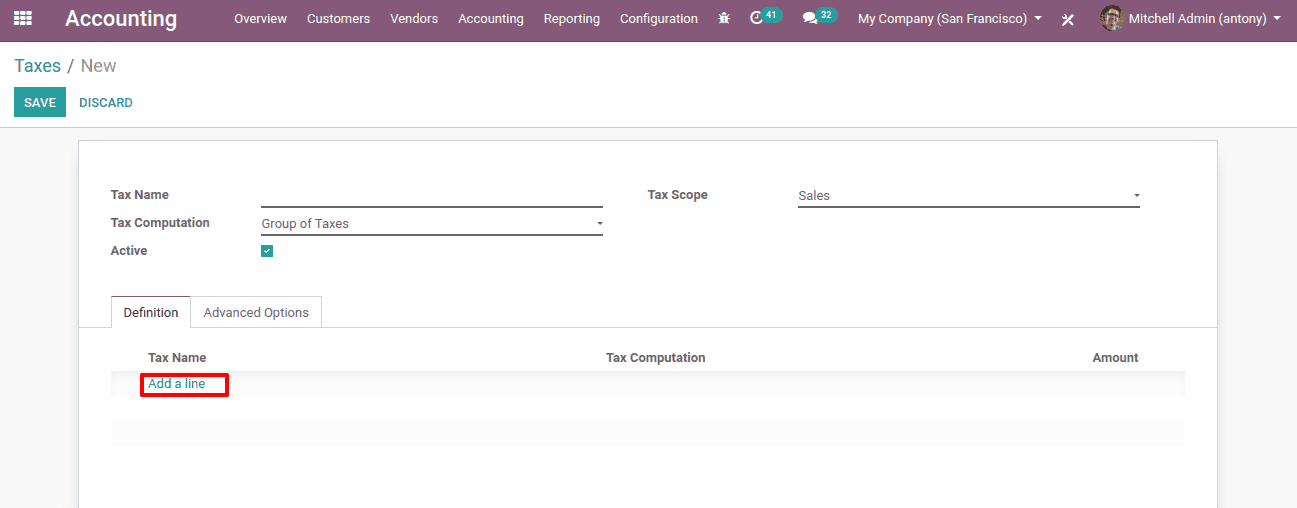

Group of taxes

This option allows us to customize the tax as a multitude of child tax collections. Odoo will make the child tax collection list available when you choose this "group of taxes" as a form of tax computation.

Here ‘Group of Taxes’ is the tax computation.

Here we shall click on ‘Add a line’ to add the child taxes.

Fixed

Here we set a fixed tax amount.

For example:

Base amount is:1000

Tax amount is:10

So the amount of tax is: 1010

Suppose we set ‘Included in Price’

Real amount is :990

Tax is :10

So the amount with tax is :1000

Percentage of price

The percentage of the price is the most used way of tax computation.

For example:

Base amount is:1000

Tax amount is:10%

Tax is:100

So the amount of tax is: 1100

Suppose we set ‘Included in Price’

Real amount is :909.09

Tax is :90.91

So the amount with tax is :1000

Percentage of price tax included

This method of estimation is used when the tax represents a percentage of the total amount. Hereby default, the price includes the tax.

For example:

Base amount is:1000

Tax amount is :10%

Tax is :100

So the amount with tax is :1000(tax is included in the price)

These are all the information we need to look after when configuring a tax.

After having configured the taxes we shall use it in the product or product category as a customer tax or a vendor tax. And when we select this particular product for sale or purchase or to create an invoice the Odoo selects this tax for you automatically.