Employers' taxes on salaries, tips, and wages are considered payroll taxes. Most taxes are withheld from employee paychecks and paid to the government. United States payroll taxes are a vital part of an employee payslip in a US company. The computation of these taxes is a challenging task for most firms when providing salaries to workers. By running ERP software, the generation of a salary slip for a worker is made easy in your company. The Odoo 16 Payroll application is beneficial for deducting US payroll taxes from the employee's wages on a payslip.

This blog specifies the deduction of US payroll taxes from employee wages using the Odoo 16 Payroll module.

You can access the batch and warning details in the Odoo 16 Payroll module. Analyzing the work entries and salary attachments for employees in a company is made possible through the reporting feature of Odoo 16. Let's see the procedure of deducting Payroll Taxes from Employee Wages in a US company within the Payroll application.

Analysis of US Payroll Taxes for Employees

Taxes are withheld from the paychecks of employees in a firm. These payroll taxes are local taxes, social security taxes, Medicare taxes, and federal state taxes. Most payroll taxes in the US are applicable to fund Social Security and Medicare. The tax reduced to fund social security and Medicare programs in the United States refers to federal payroll taxes. Few cities and states have income taxes on employees' wages. Moreover, these payroll taxes are collected by state governments in specific countries.

Both payroll and income taxes are deducted from the employee's paycheck. The fund paid to social security transfers to other trust funds, such as the OASI trust fund, which pays retirement benefits, and the disability insurance fund, which concerns disability benefits. Payroll tax assists in the enhancement and growth of entrepreneurship.

To Add Payroll Taxes as a Salary Rule in the Salary Structure

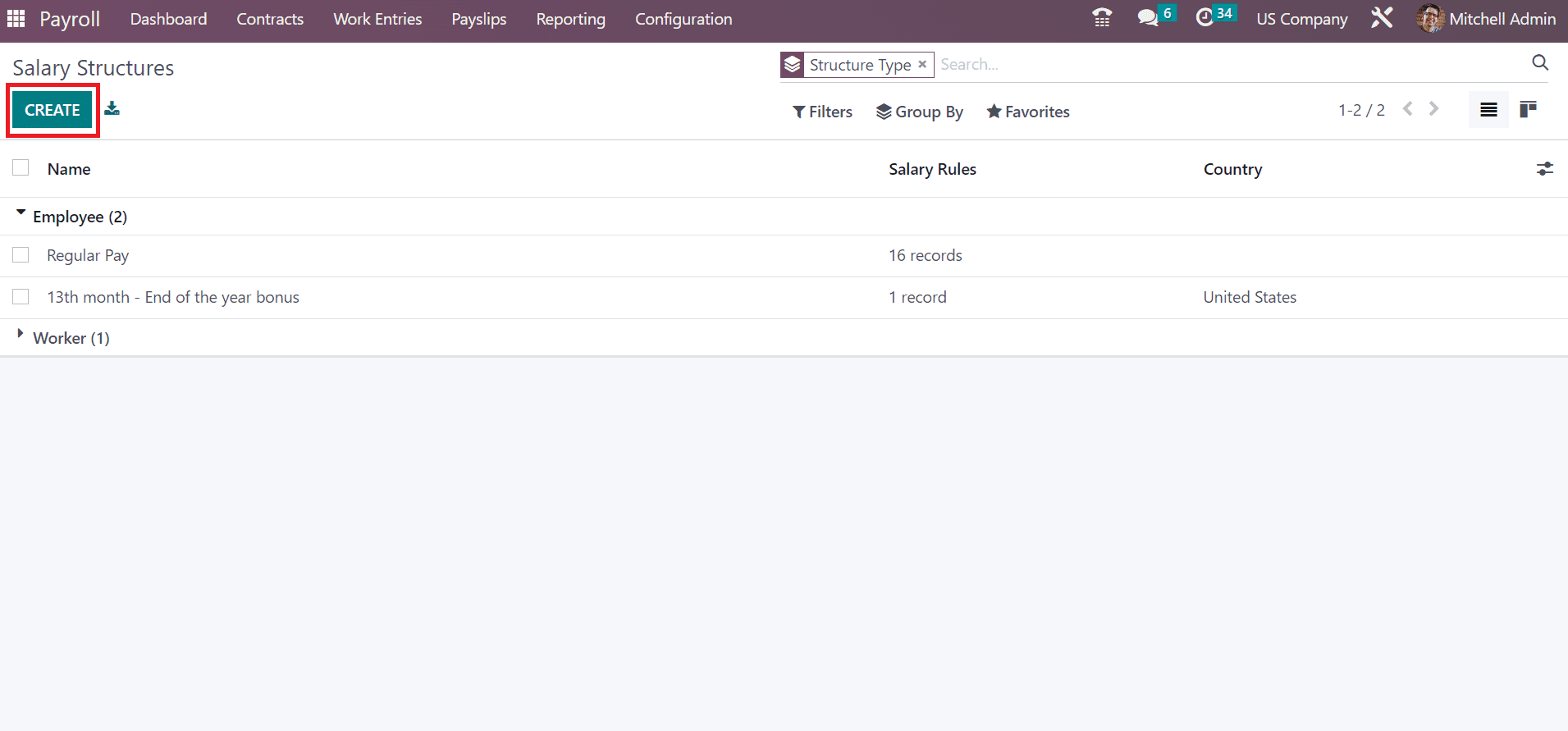

Choose the Structures menu from the Configuration tab to develop a new payroll structure. In the Salary Structure window, you can see the details of each structure distinctly. Click the CREATE button to establish a new structure, as stipulated in the screenshot below.

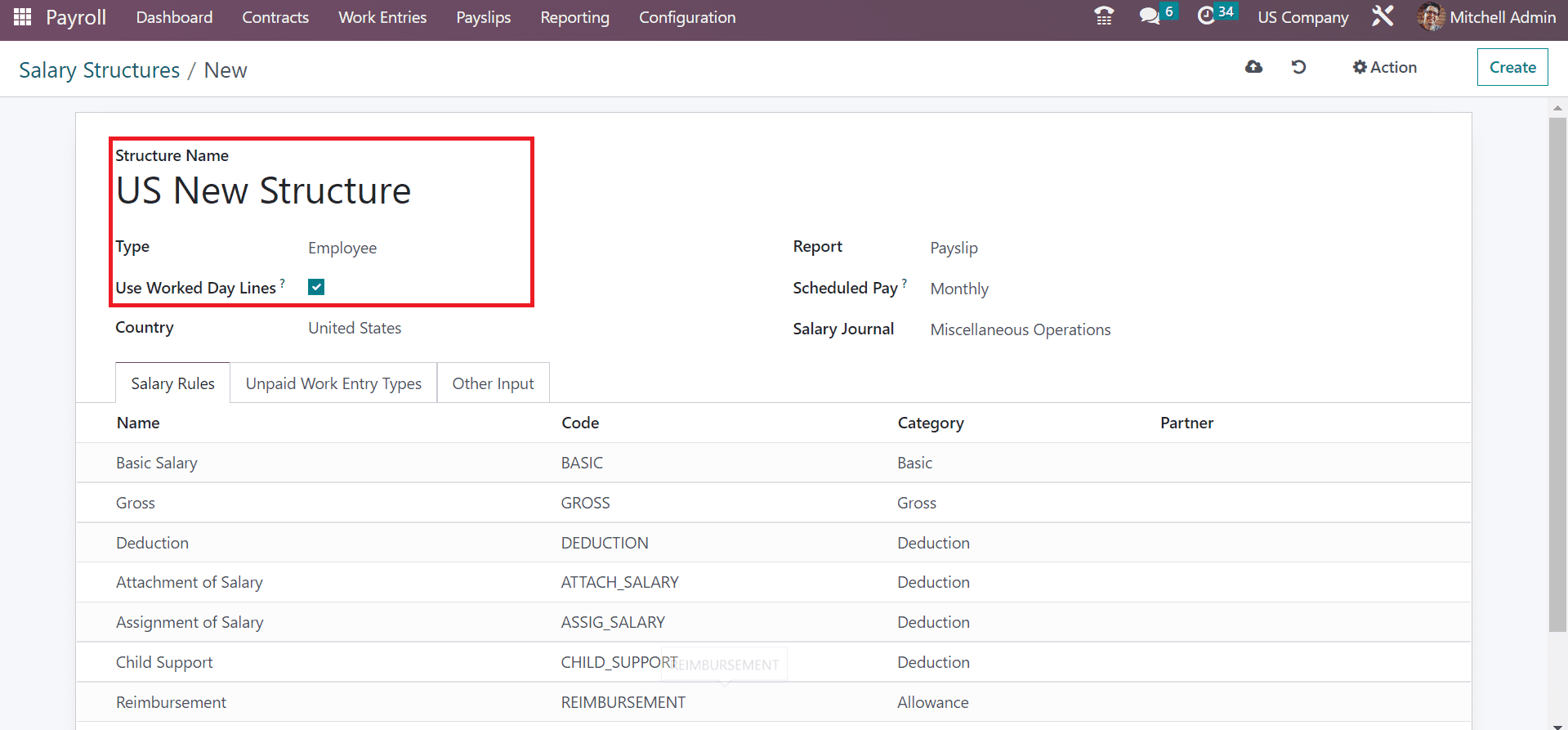

Add "US New Structure" as the structure name and select "Employee" as the type. As cited in the screenshot below, displaying workday lines on payslips is easy once the Use Worked Day Lines option is activated.

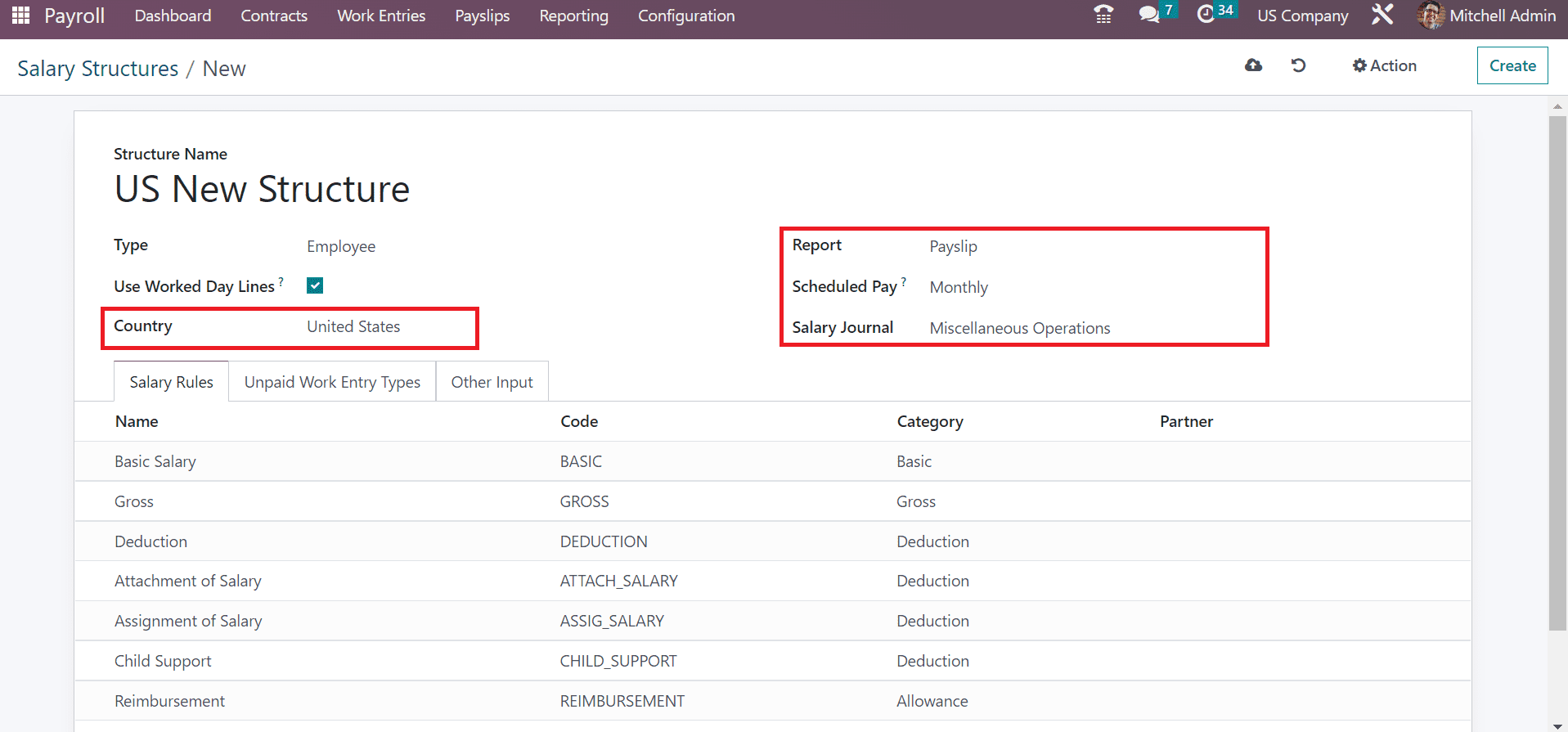

You must choose the United States in the Country field and pick the Payslip option from the Report field. Additionally, set the payment method for Employee in the Scheduled Pay field as Monthly. Users can also mention miscellaneous operations under the "Salary Journal" field, as shown in the screenshot below.

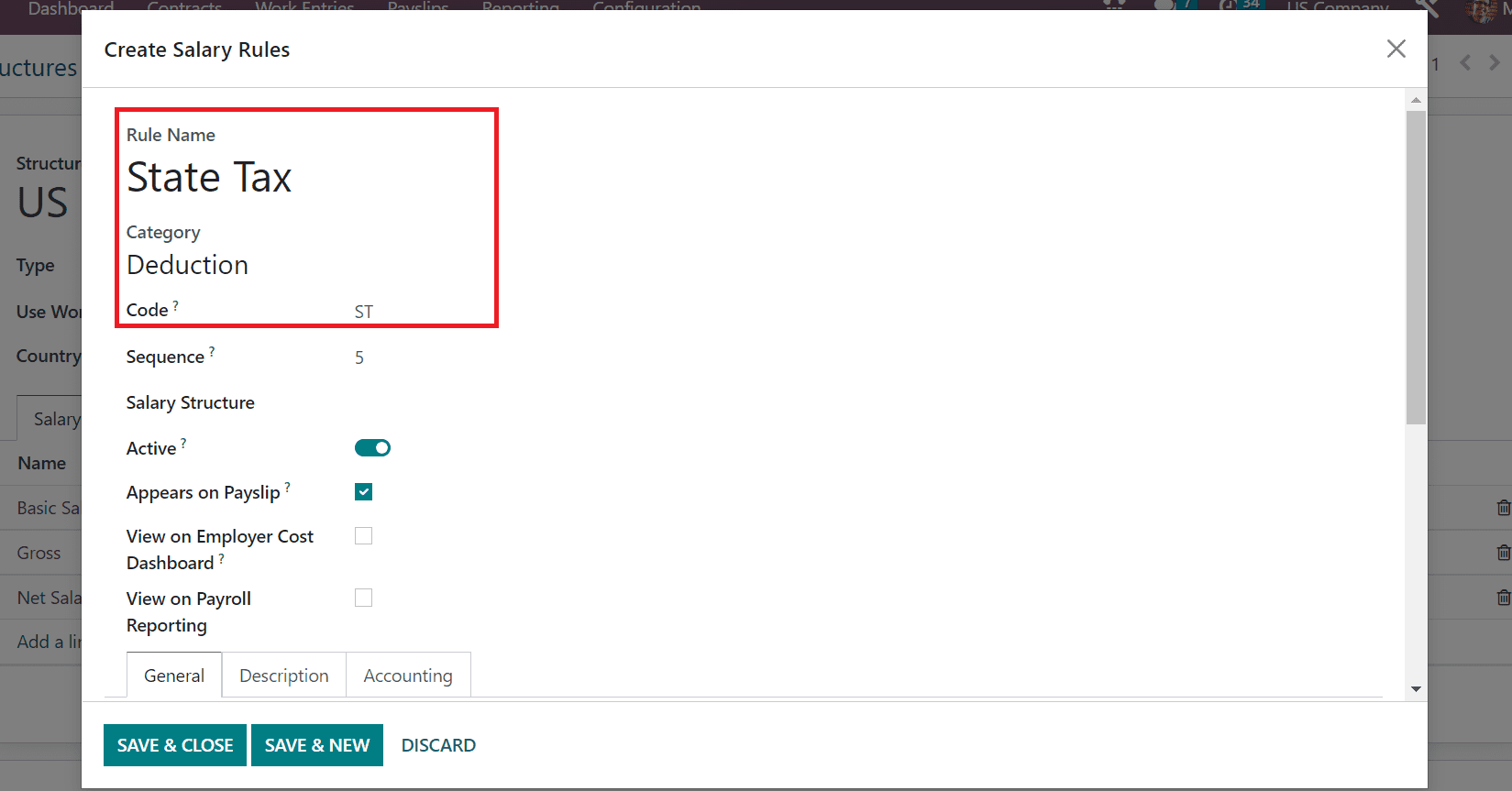

Next, we can apply each payroll tax separately as a salary rule by choosing the Add a line option under Salary Rules. In the new window, enter State Tax as the Rule Name and specify the Category as Deduction for State Tax as defined in the screenshot below.

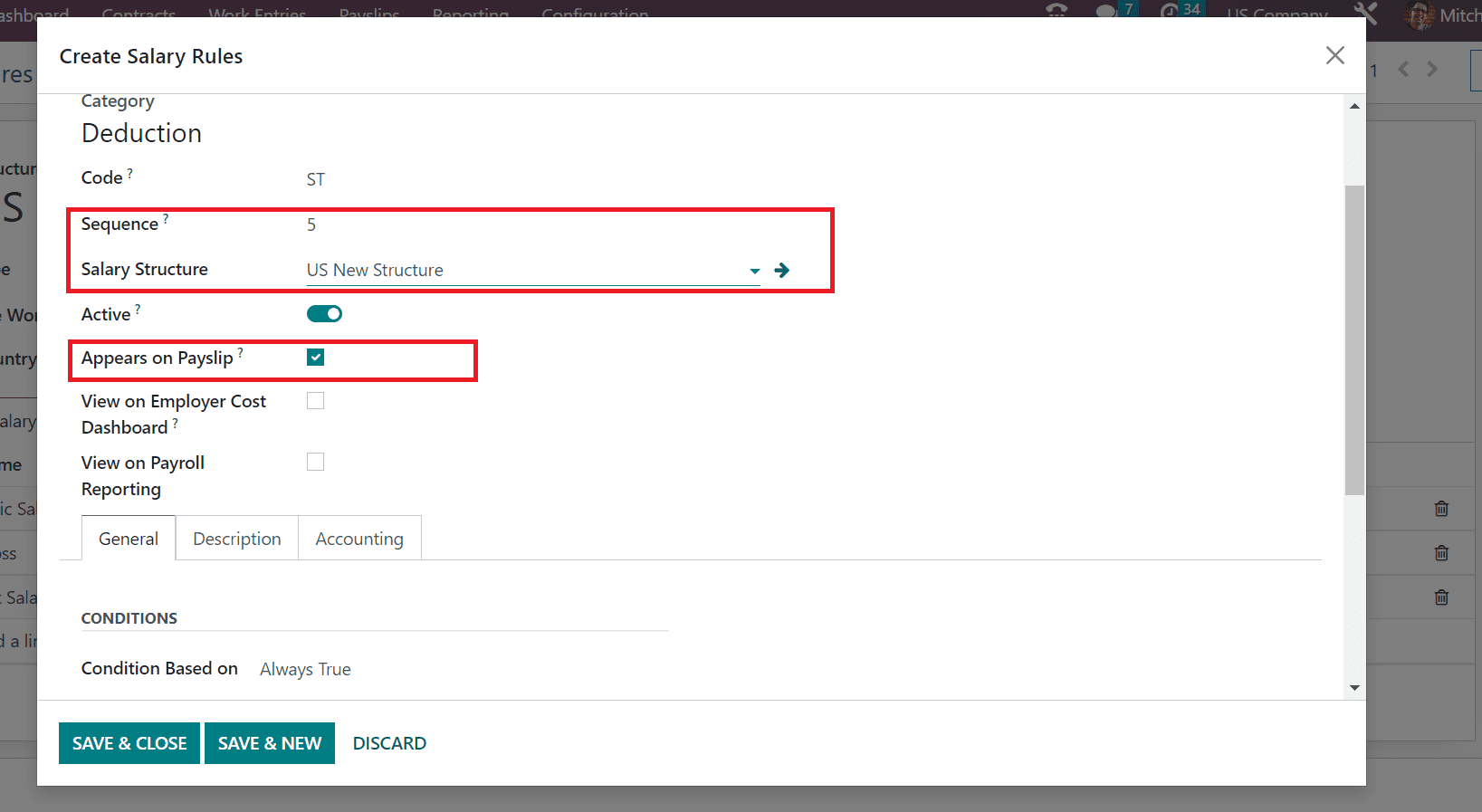

Here, you must add a code for your salary rule State Tax as ST. Users need to enter a sequence number to calculate the salary rule in the Sequence field. Moreover, choose the US New Structure option in the Salary Structure field. It is easy to obtain the salary rule on the payslip after enabling the Appears on Payslip field.

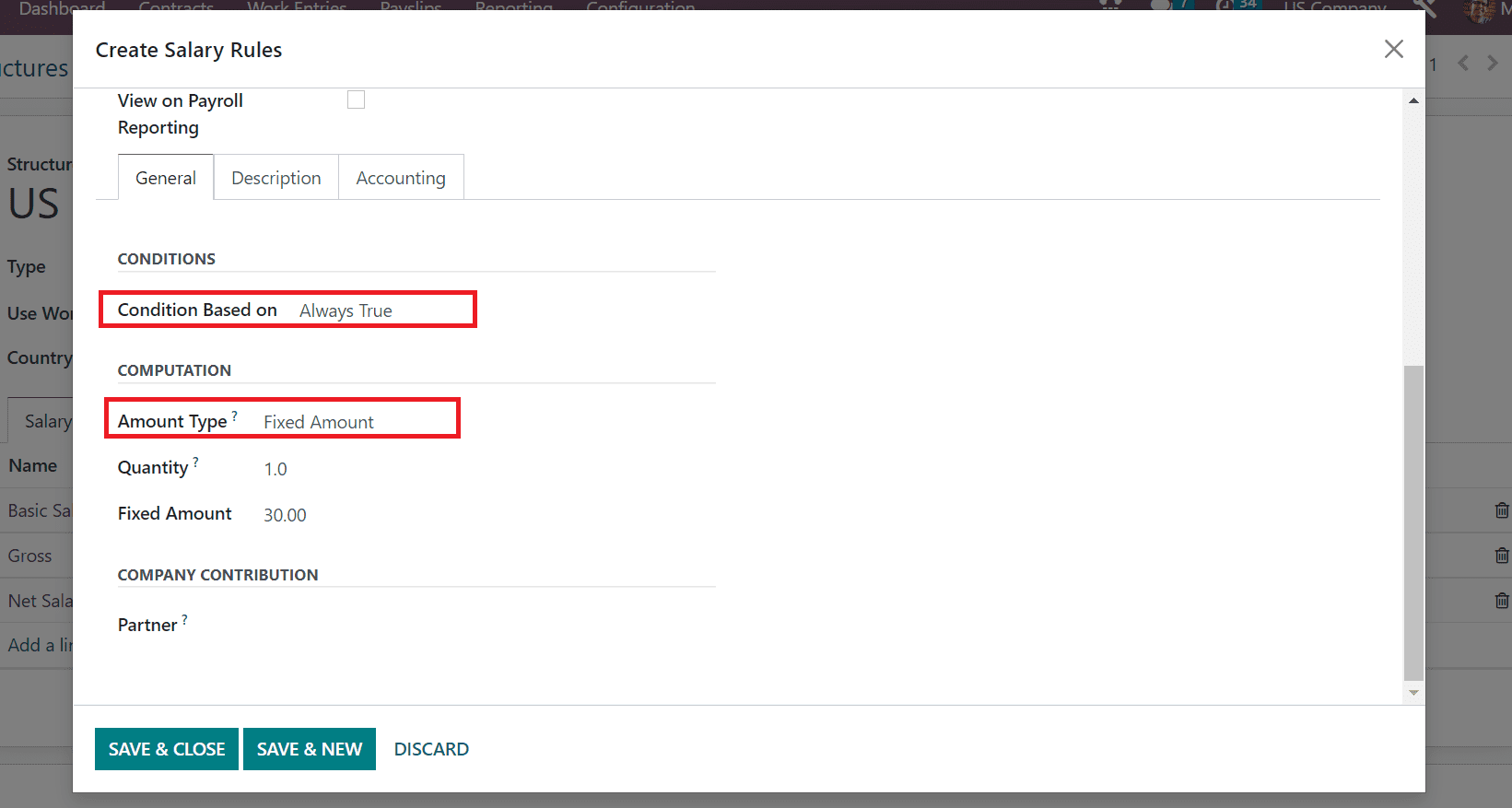

Now, we can elaborate on the conditions and calculation method of the salary rule. Choose the Always True option as Condition and set your calculator method as Fixed Amount in the Amount Type field, as displayed in the screenshot below.

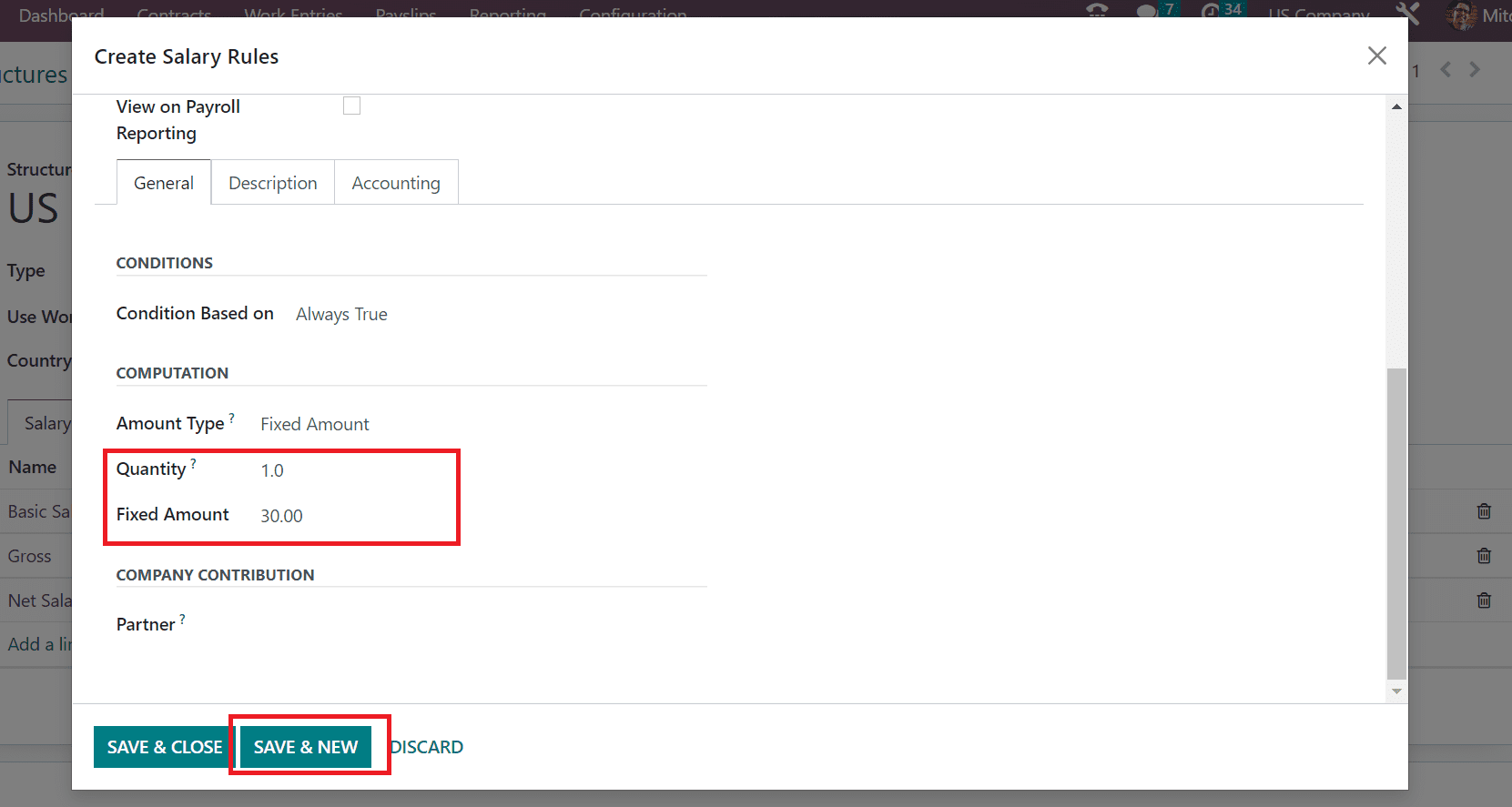

You can enter one Quantity after choosing the Fixed Amount as the computation method for the salary rule. Later, specify the Fixed Amount as 30 below the COMPUTATION section.

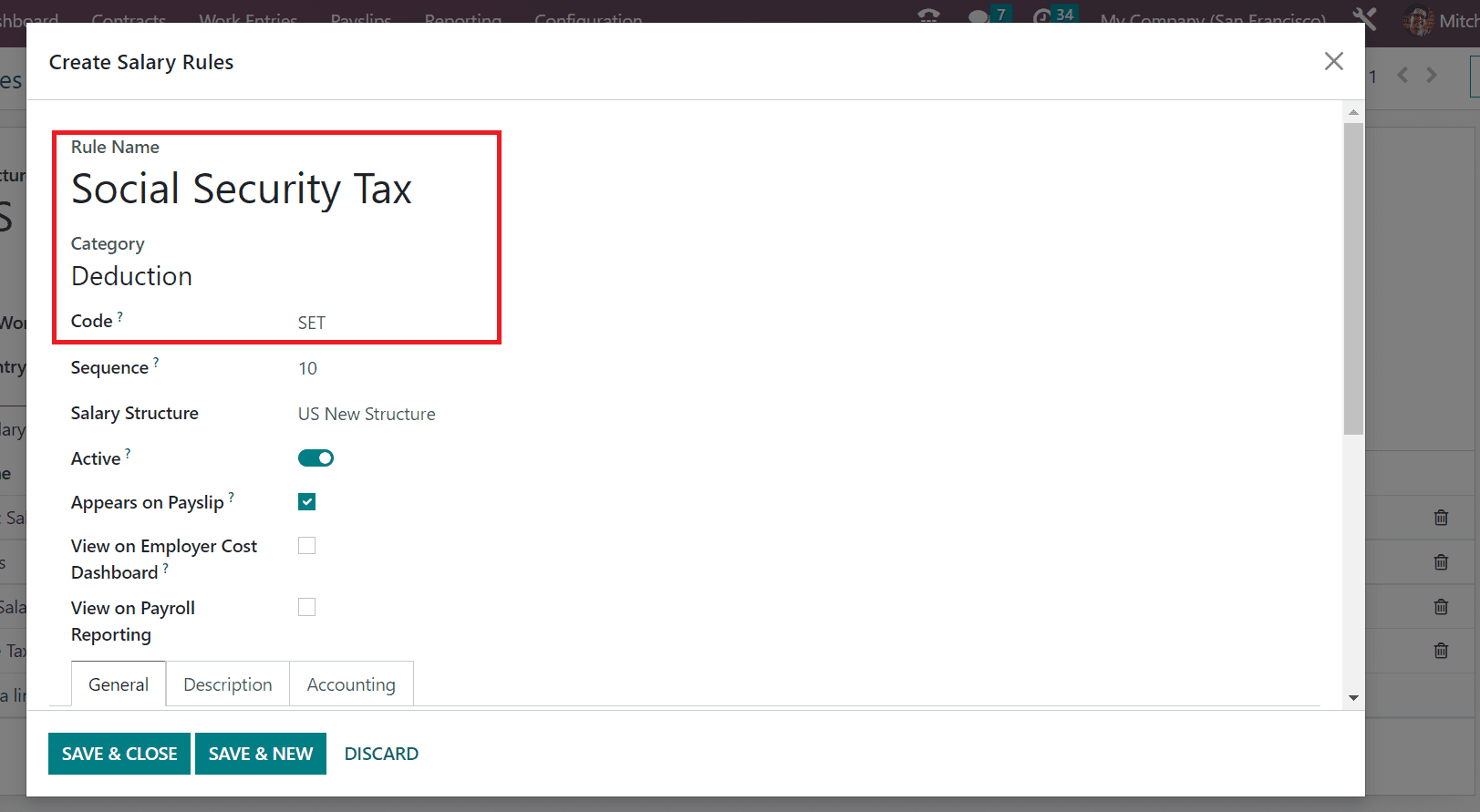

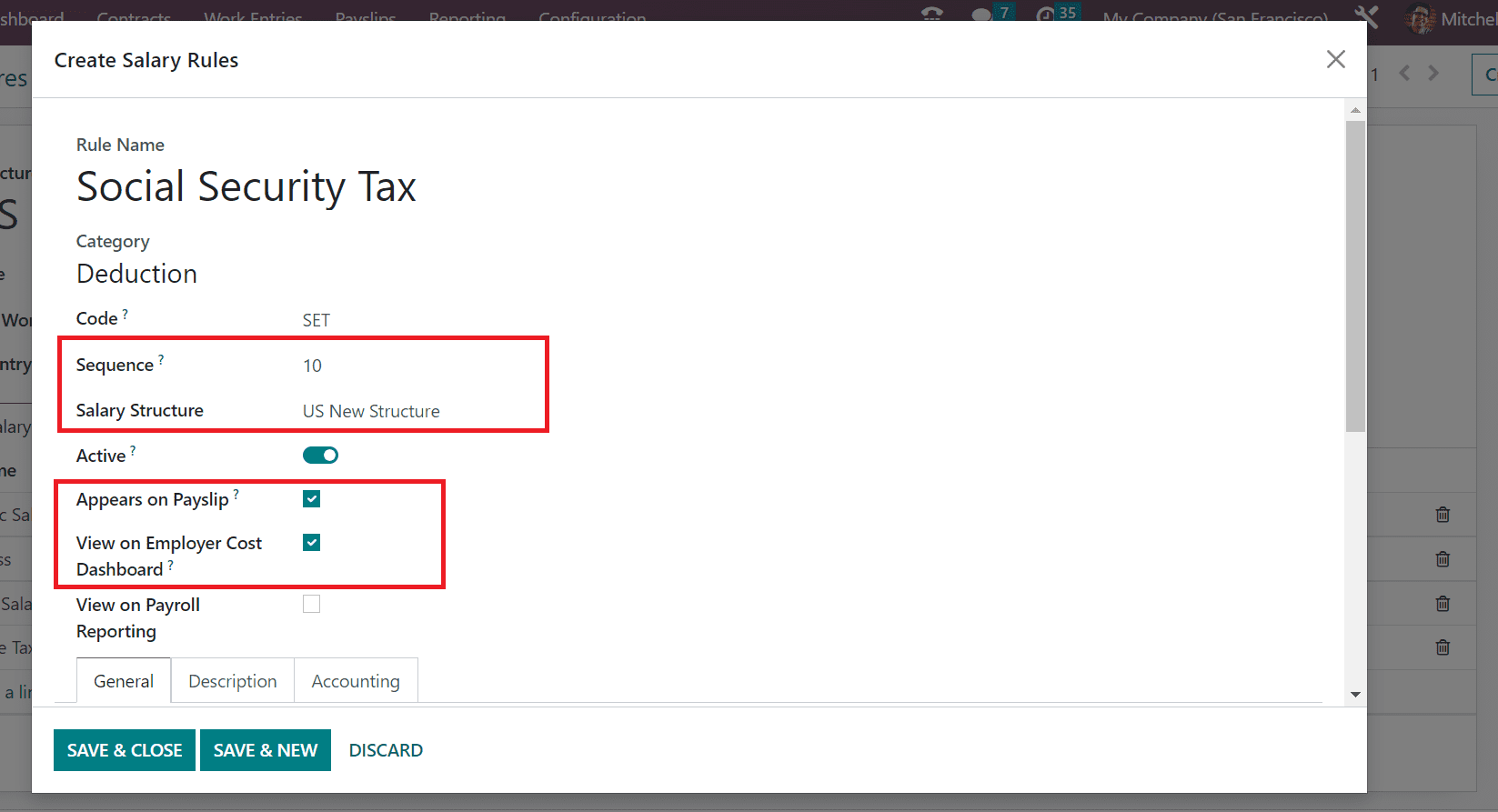

Once managing your data, click the SAVE & NEW icon, as shown in the screenshot above. In the open Create Salary Rules screen, let's add other payroll tax, such as Social Security Tax, as the Rule Name. In the Category section, state Deduction and apply the Code as SET.

Add your sequence number for Social Security Tax as ten and click US New Structure from the Salary Structure field. Furthermore, enable the Appears on Payslip field to obtain the specific salary rule on an employee payslip. To view the value on the employee dashboard, activate the View on Employer Cost Dashboard option.

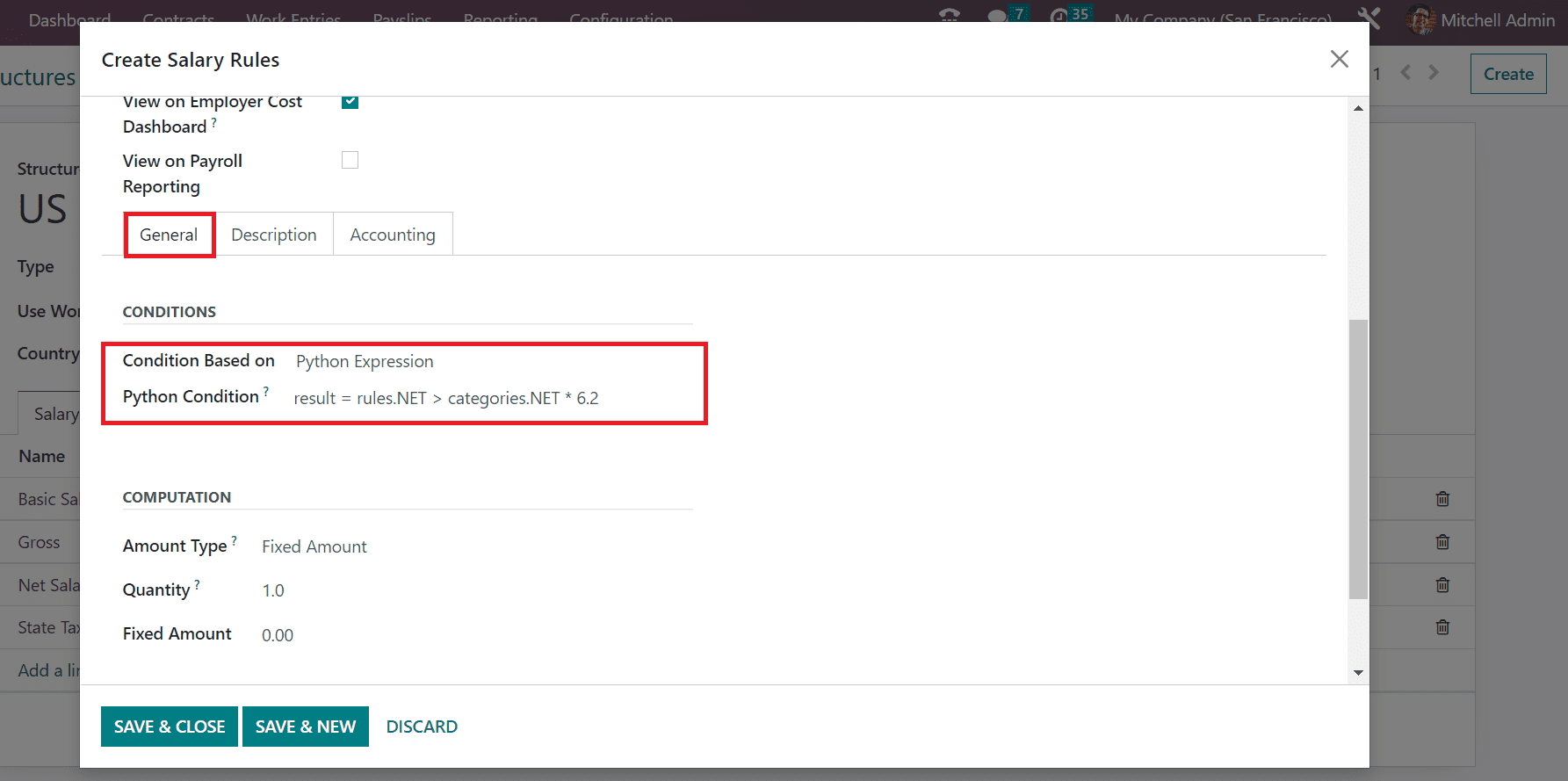

Below the CONDITIONS section of the General tab, set your Condition for Social Security Tax as a Python expression. Afterward, you need to enter the Python Expression as 'result = rules.NET > categories.NET * 6.2' because the social security tax of the US is considered as 6.2% of employee wages.

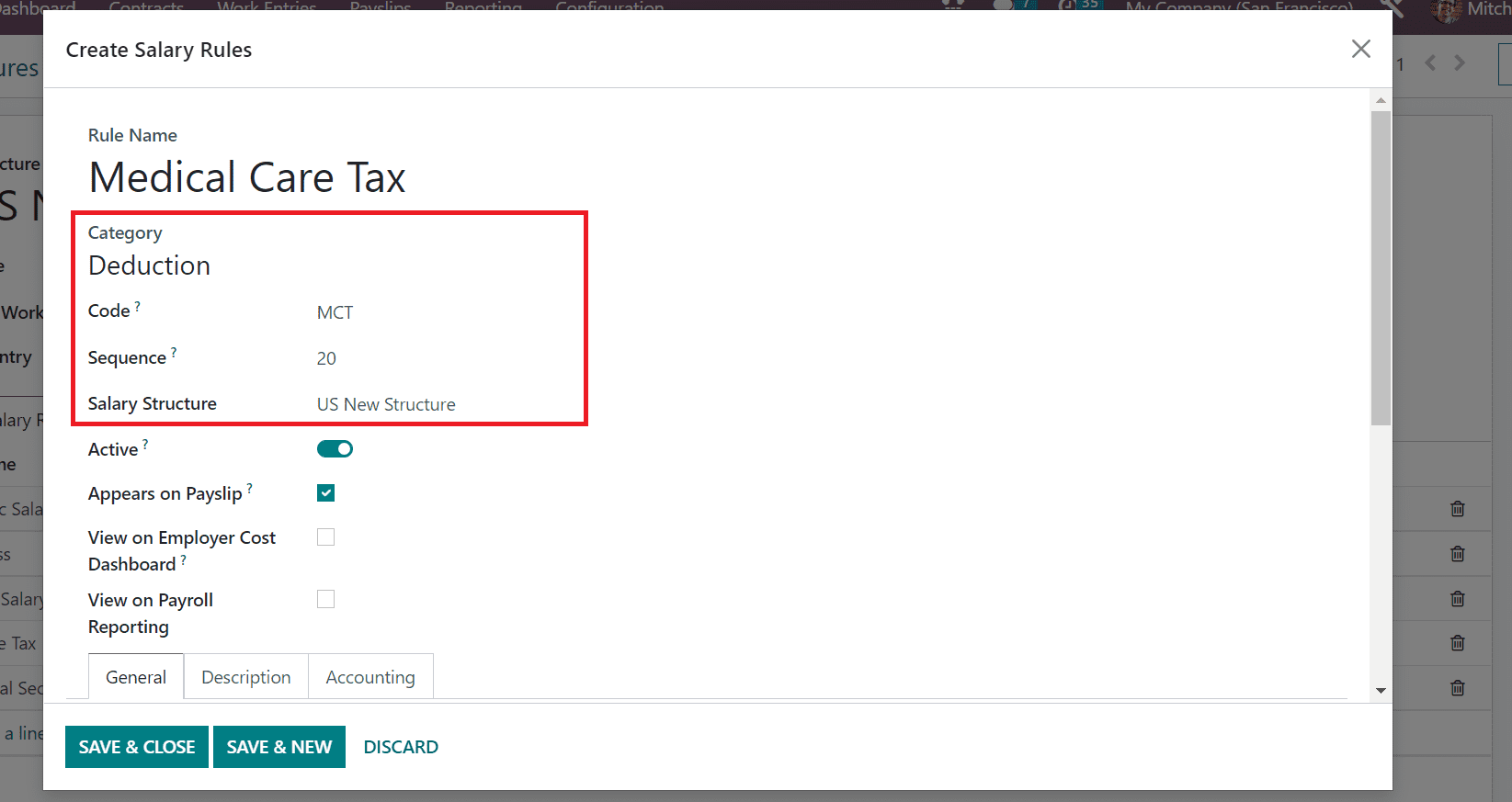

After saving the details, we can formulate Medical Care Tax as the next Salary Rule Name. Pick the Category as Deduction and the reference code as MCT for Medical Care Tax. Also, use a sequence number for the salary rule as 20 in the Sequence option.

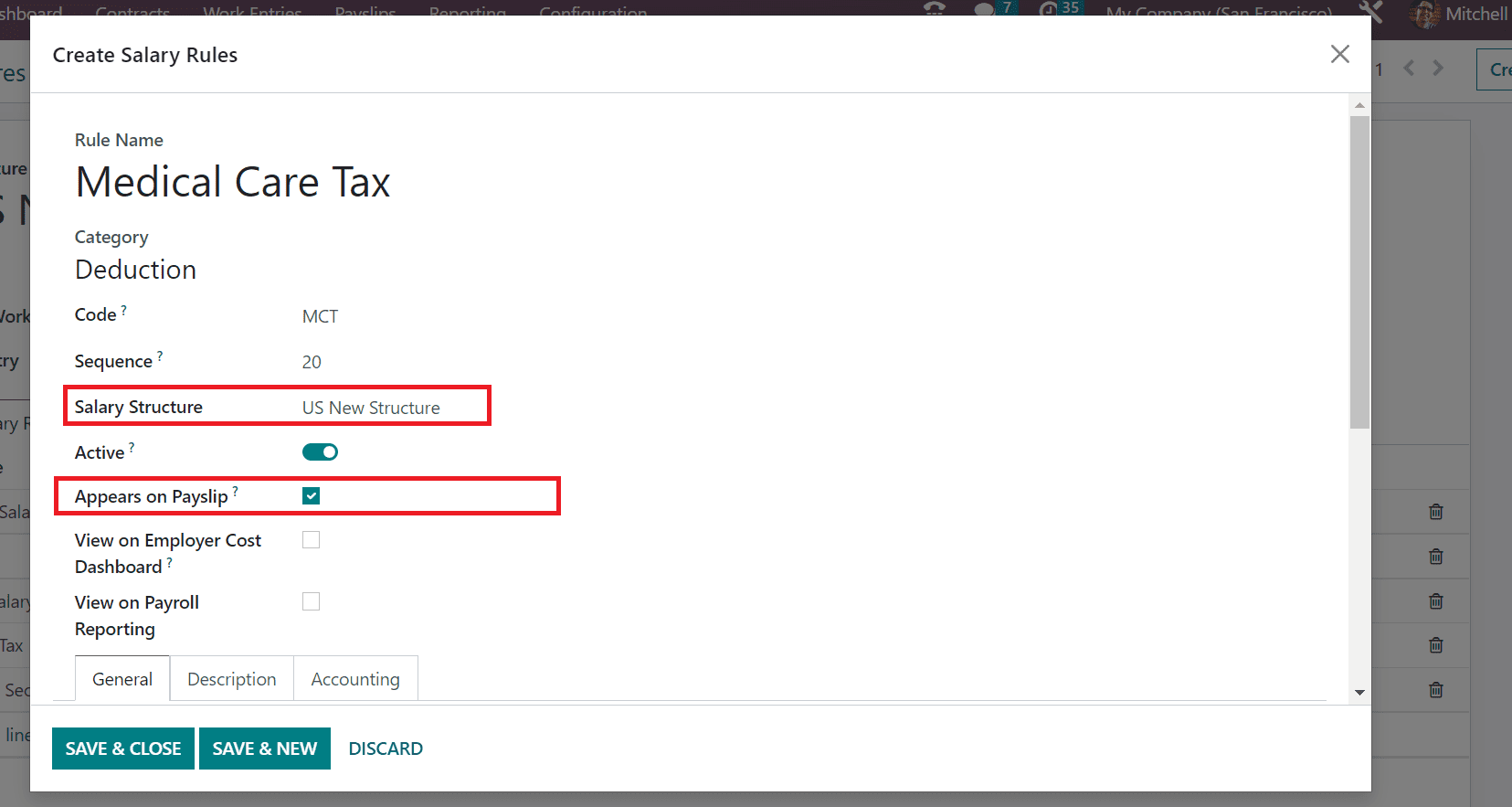

The user can mention US New Structure within the Salary Structure field. Later, activate the Appears on Payslip option to the visibility of pay rate on the employee pay statement.

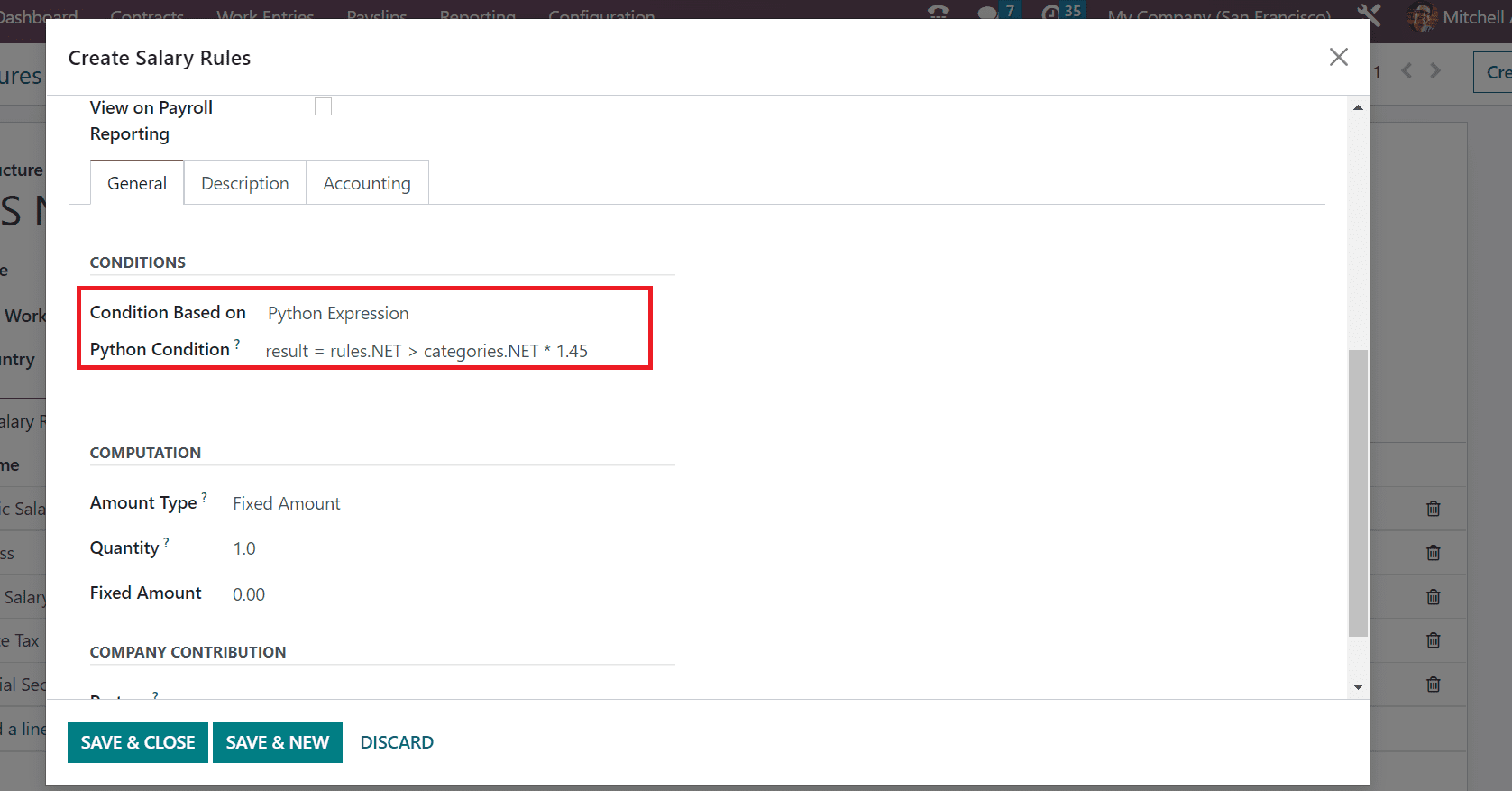

We can apply the Condition for Medical care Tax based on python expression. After selecting the Python Expression option in the Condition Based on field, mention the expression of the salary rule as described in the screenshot below.

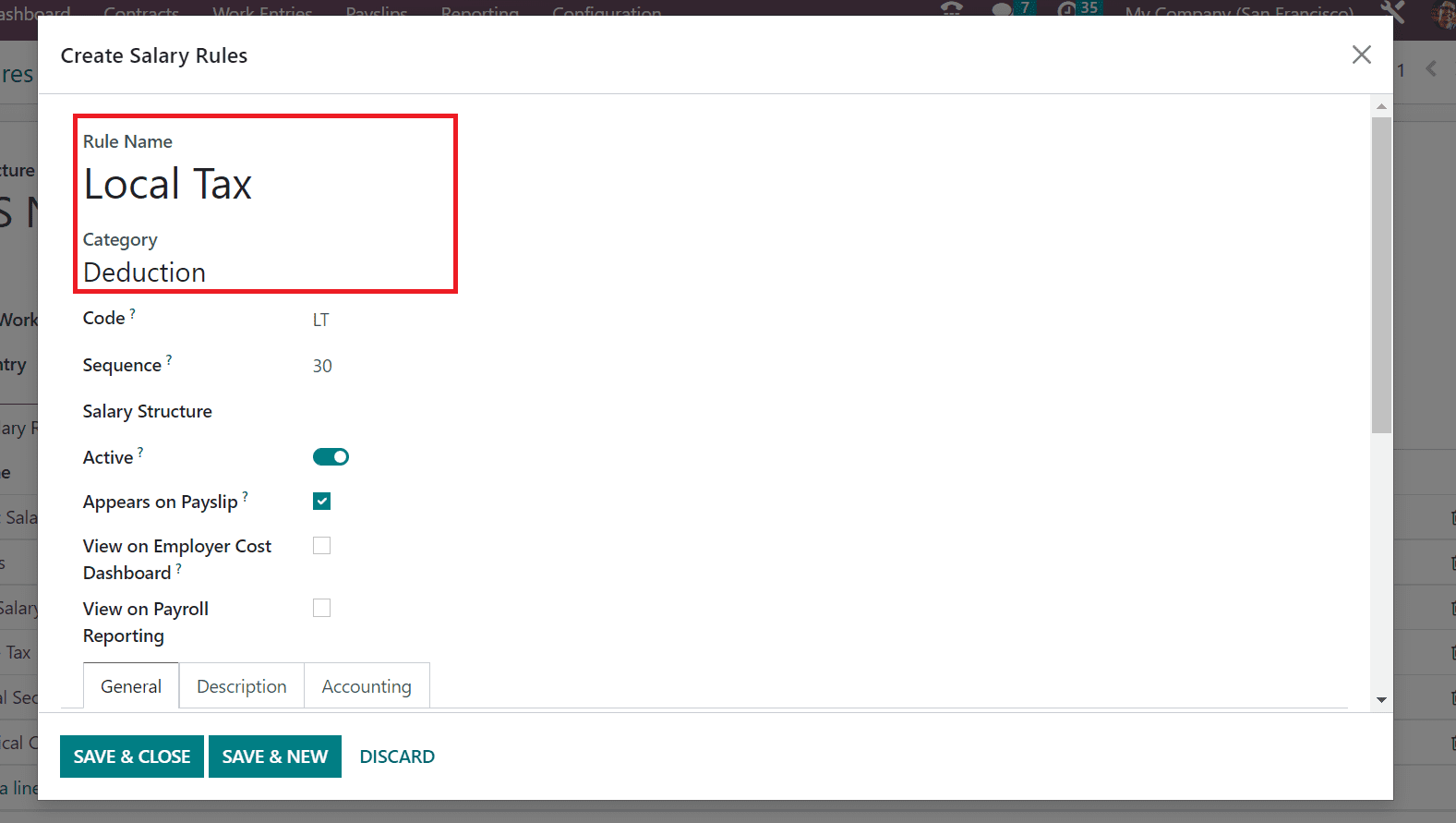

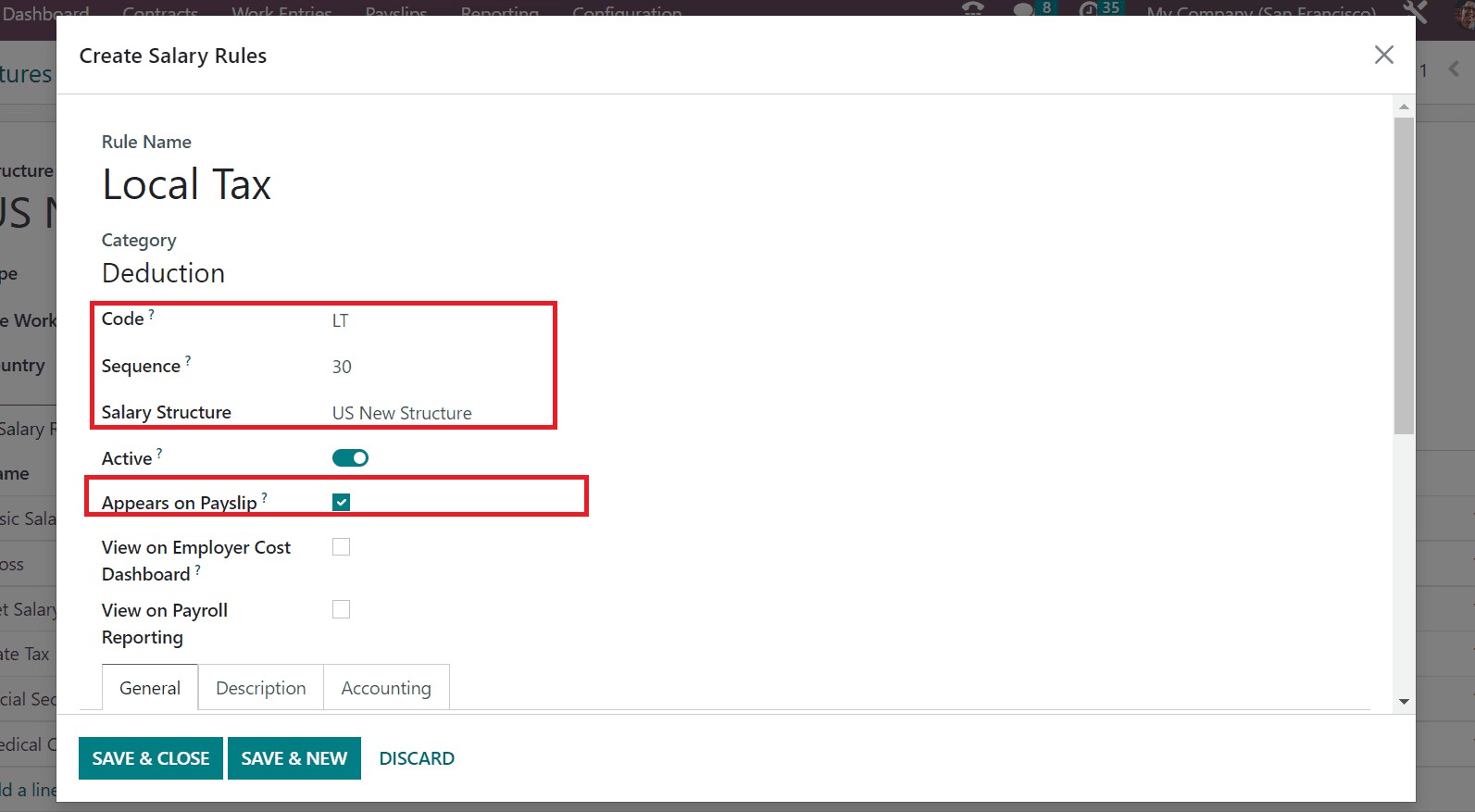

Here, you must add 1.45% of medical care tax in the US within the Python Expression field. After saving the information, we can develop another payroll tax detail as a salary rule. Enter Local tax as the Rule Name in the Create Salary Rule window and set the Deduction category.

You can mention the Code as LT for the Local Tax rule and enter a sequence number as 30. Additionally, select US New Structure as your Salary Structure and allow the Appears on Payslip option.

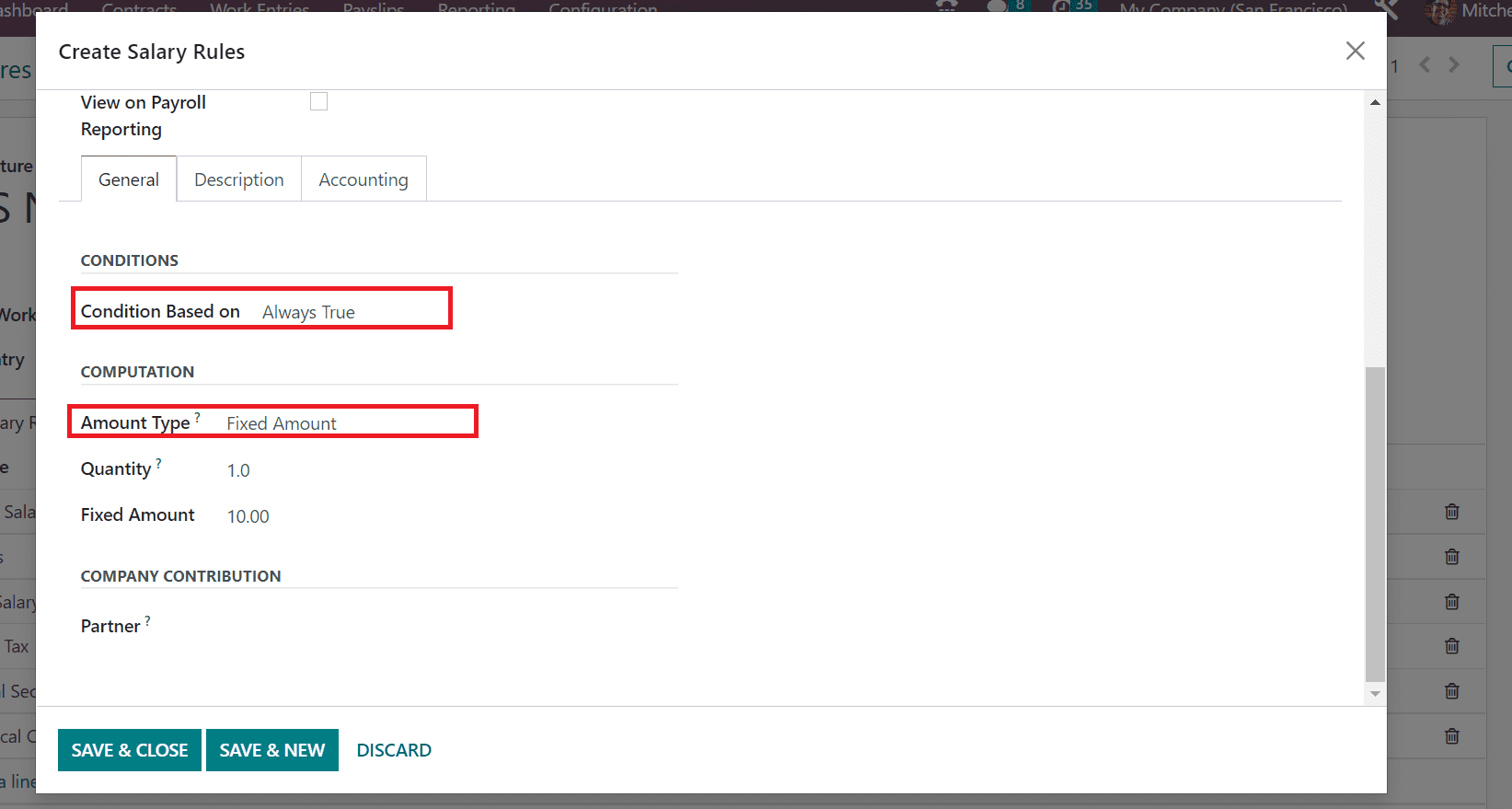

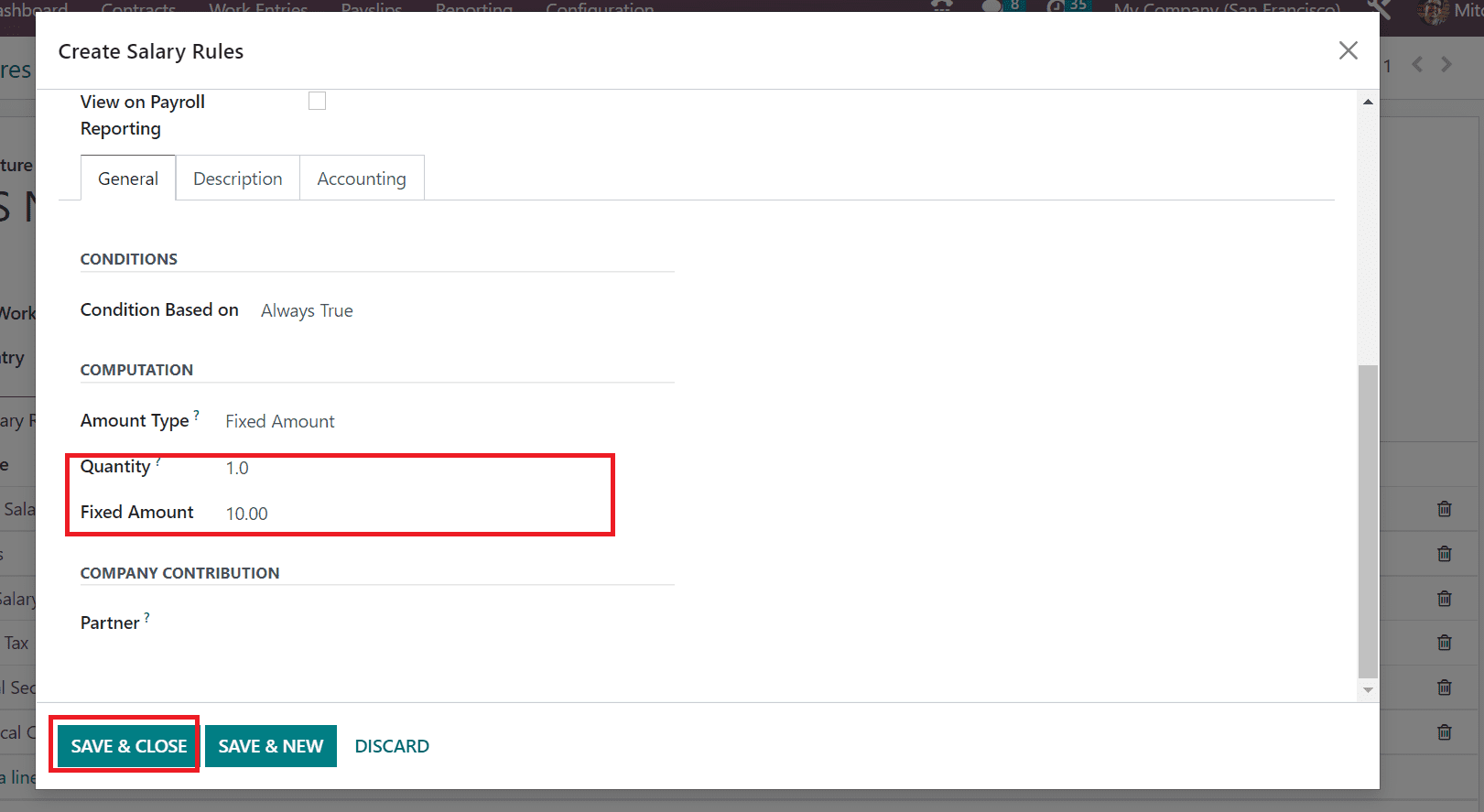

It is easy to set the Condition for Local Tax as Always True. After establishing the Condition, you can define the computation method below the COMPUTATIONS section. Select Fixed Amount as your calculation method for the Local Tax rule, as demonstrated in the screenshot below.

We mention the amount as 10 for Local Tax once setting the one Quantity. Click the SAVE & CLOSE button after applying all essential details.

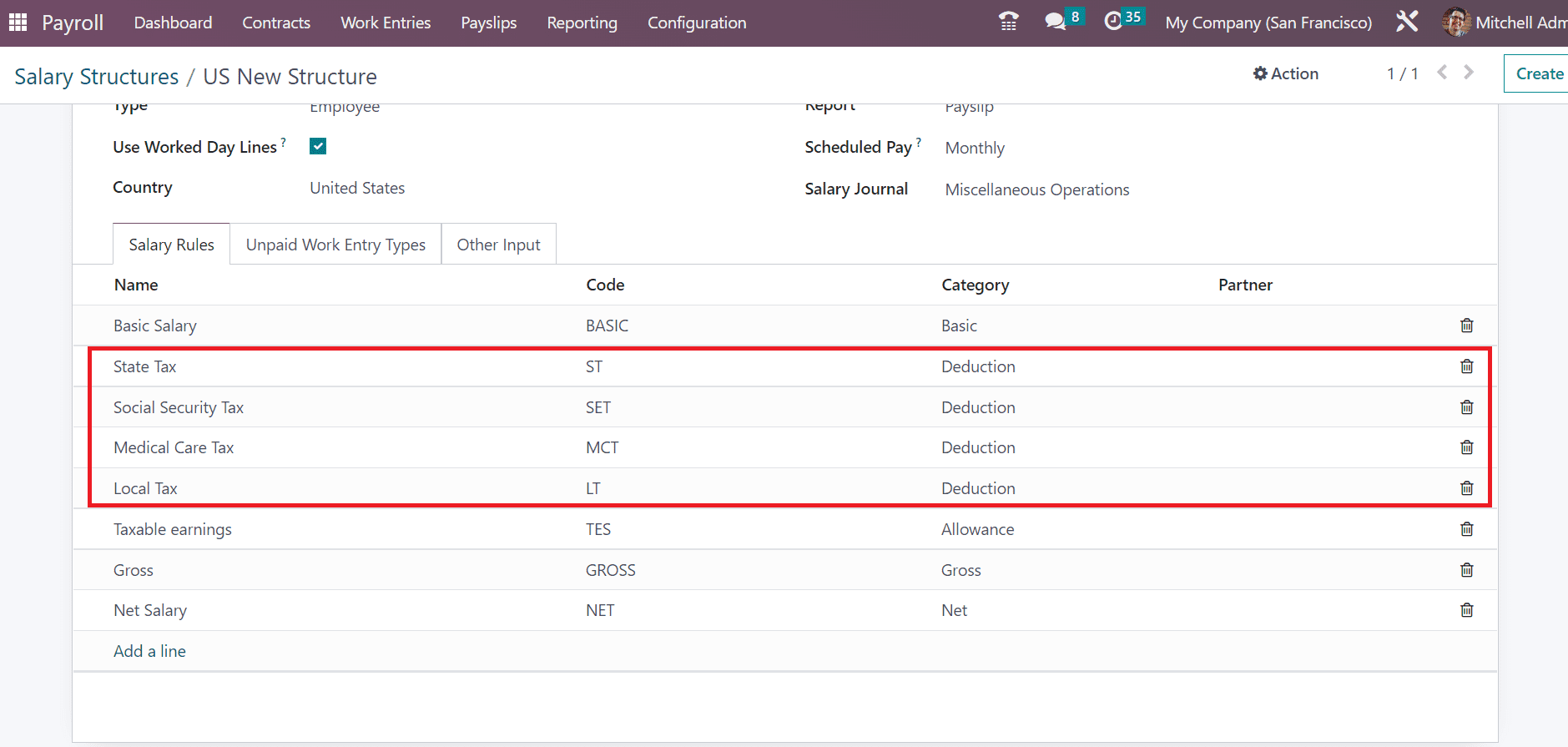

Similarly, the user can specify other rules such as basic salary, allowances, gross, and more inside the Salary Structure window. We can see all regulations under the deduction category below the Salary Rules tab. These added rules are deducted from employee wages once generated a salary slip.

Now, we can create salary slips after mentioning all rules for the Employee.

How to Define Employee Salary Slip after Deducting US Payroll Taxes?

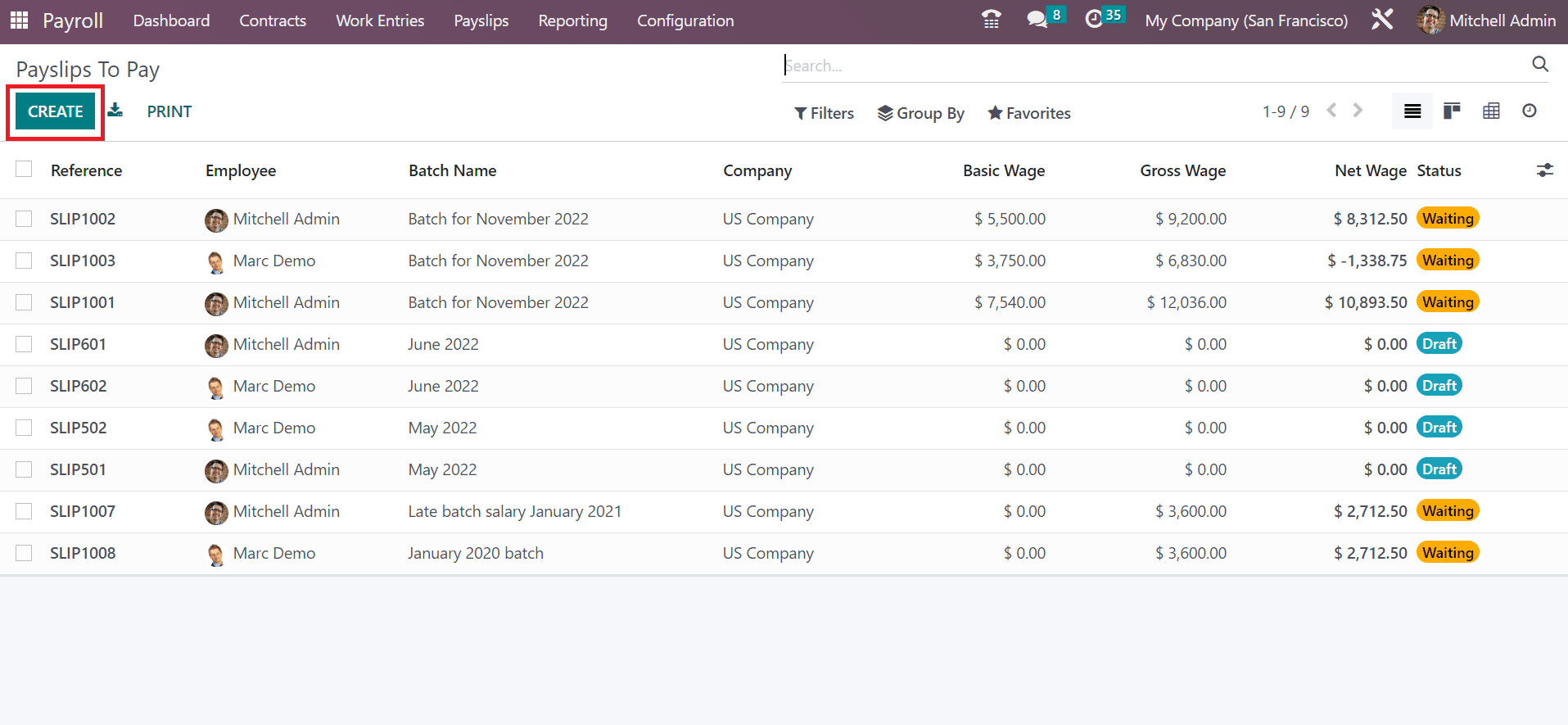

Select the To Pay menu under the Payslips tab to create a salary slip for a US employee. The record of each pay slip is acquirable to the user distinctly in the Payslips to Pay window. Click the CREATE button to design a new salary slip for your Employee based on US New Structure.

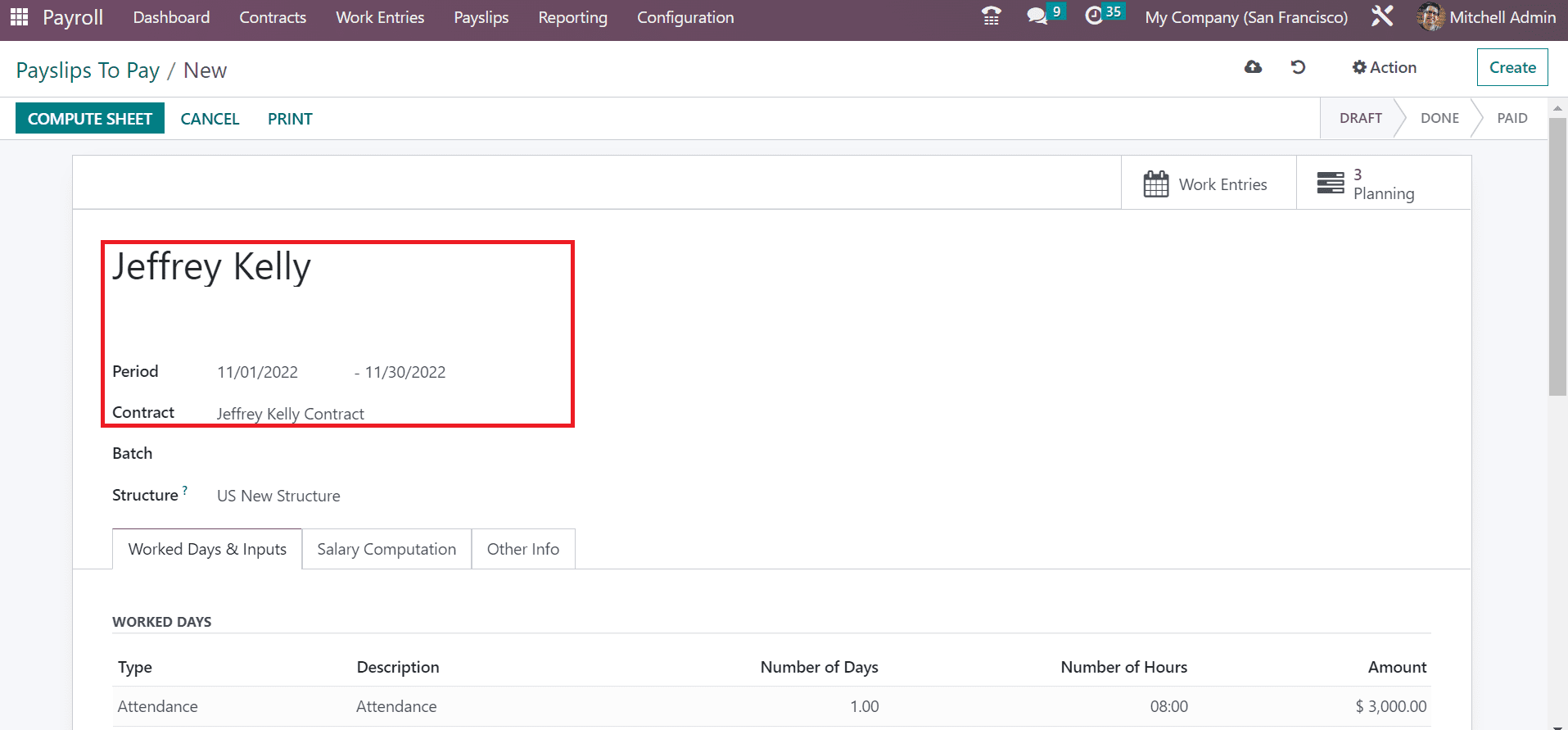

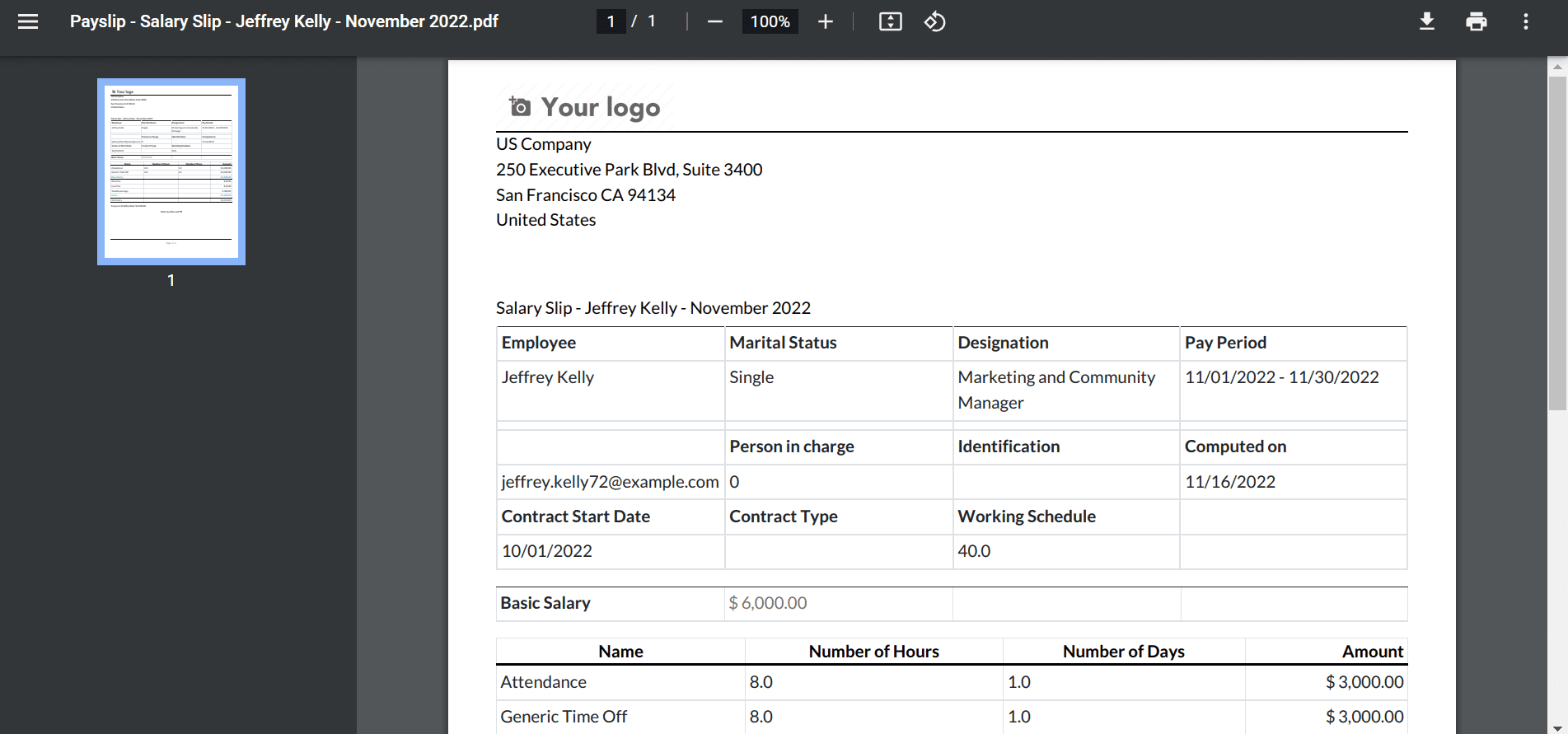

In the New window, add the employee name as Jeffrey Keller and choose the period of your salary slip concerning from and to date. We can also mention the Contract related to an employee's payslip, as portrayed in the screenshot below.

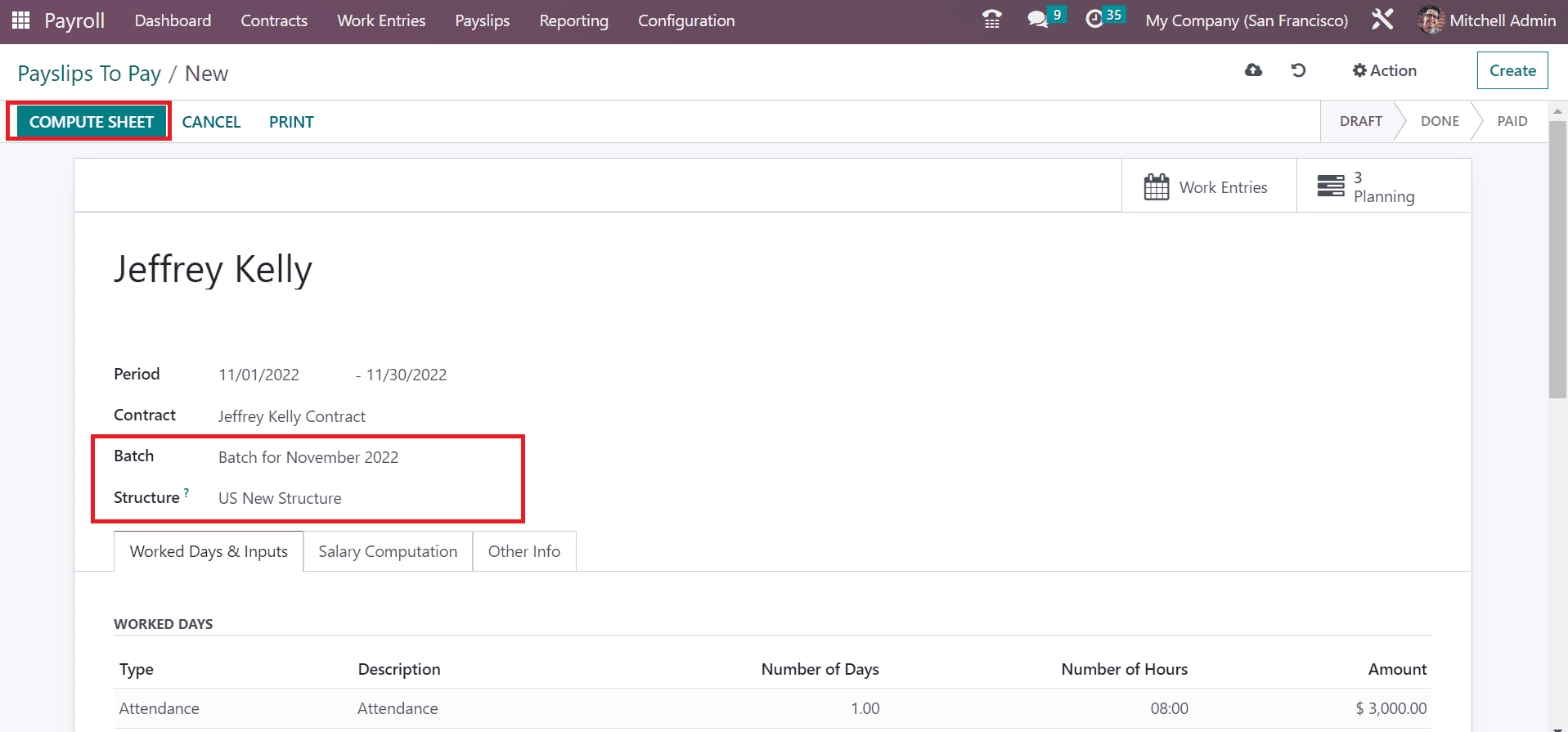

Choosing a Batch for the employee payslip from the Batch field is possible. Users can define the rule applied to payslips once selecting US New Structure in the Structure field as per the chosen Contract. Press the COMPUTE SHEET button after specifying all mandatory data of the payslip.

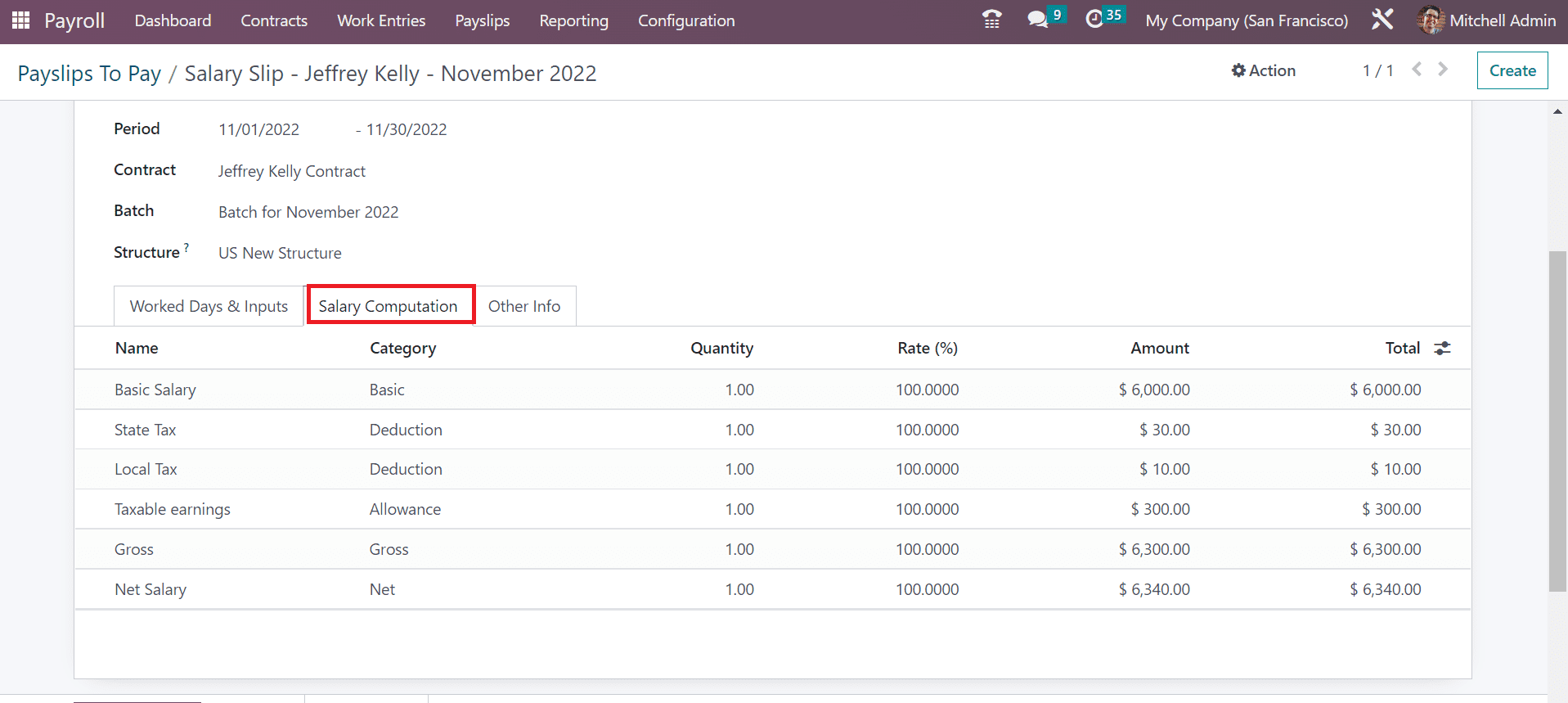

After the sheet computation, click the Salary Computation tab, and you can obtain the calculation of each salary rule separately.

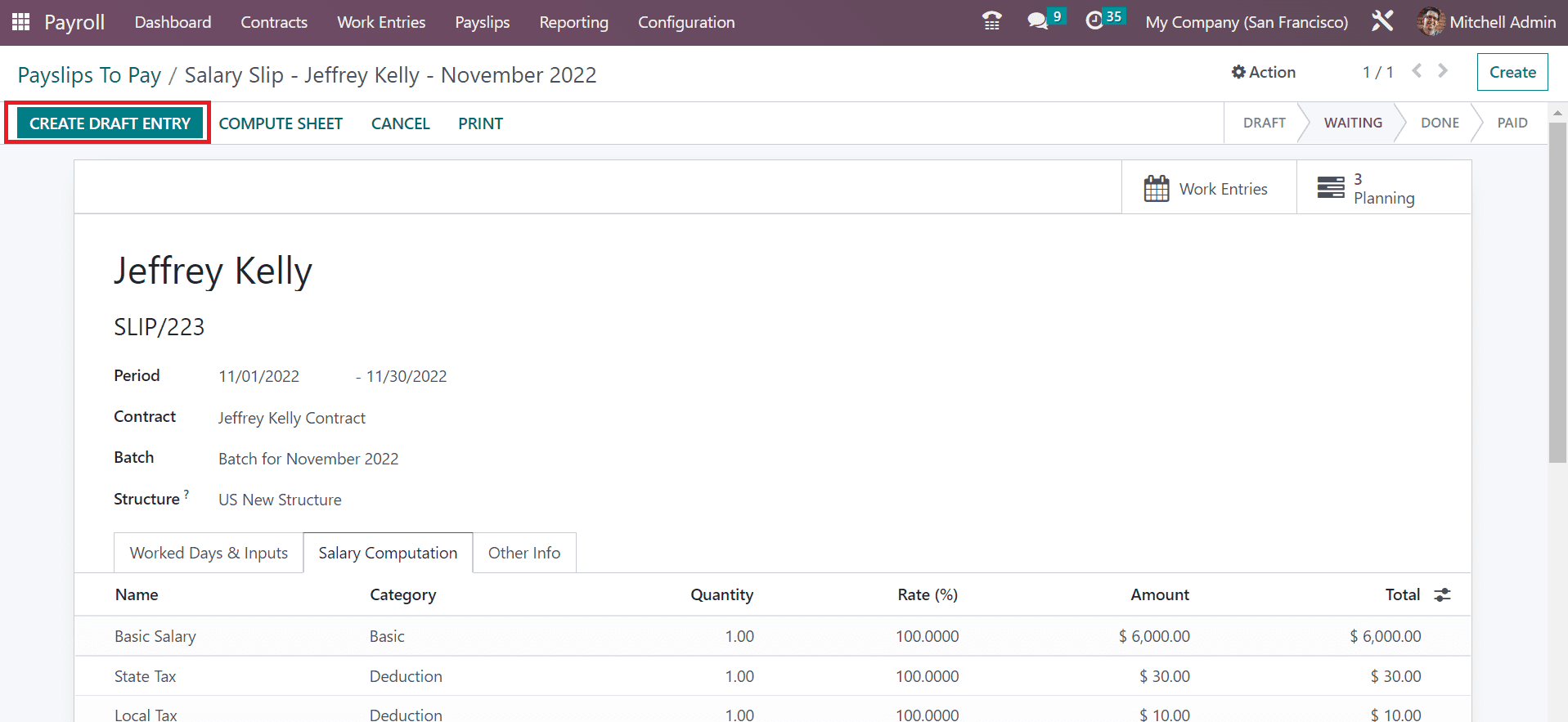

Now, we can proceed with a draft entry of the payslip by selecting the CREATE DRAFT ENTRY button, as illustrated in the screenshot below.

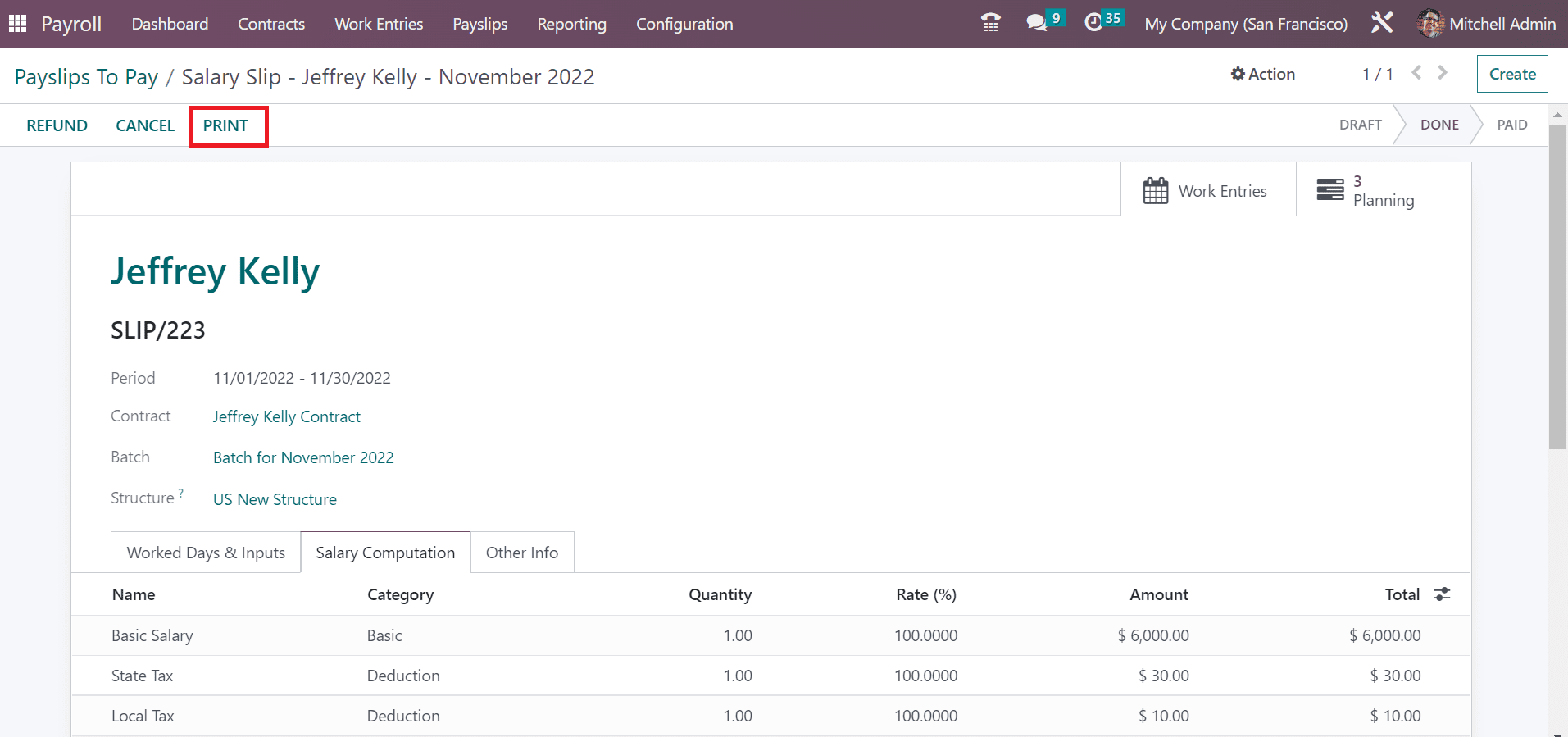

After proceeding with confirmation, let's take a printout of the document. For that, select the PRINT icon in Paylsips to Pay window, as signified in the screenshot below.

Later, the employee payslip is downloaded into your system and secured for future reference.

The deduction of US Payroll Taxes from employee payslips becomes an eays process in a company after imparting ERP software. All Types of taxes related to US payroll are easily computed with the salary structure feature in the Odoo 16 Payroll application. Check out the blog to know about US Payroll deductions in Odoo 16.