In today's rapidly changing business landscape, effective financial management is crucial for the success of any organization. To make informed decisions, businesses need access to accurate and tailored financial reports. Odoo Accounting, an integrated business management software, offers a powerful solution for creating customized financial and tax reports.

This blog explores the significance of customized financial and tax reports, the capabilities of Odoo Accounting in this regard, and the benefits it brings to businesses.

Odoo Accounting is a versatile and user-friendly accounting software that empowers businesses to create customized financial and tax reports effortlessly.

The Importance of Customized Reports:

Financial reports are essential tools for businesses to evaluate their financial performance, plan for the future, and meet regulatory requirements. However, generic reports may not always provide the insights necessary for specific business needs. Customized financial and tax reports offer several advantages:

1. Relevance: Customization ensures that reports reflect the unique financial aspects of a business, making them more relevant for decision-making.

2. Efficiency: Customised reports save time by focusing on key financial metrics, eliminating unnecessary data, and automating repetitive tasks. By customizing tax reports, businesses can streamline their tax preparation processes. Predefined templates and automated calculations in Odoo Accounting save time and effort, allowing finance teams to focus on more strategic tasks.

3. Compliance: Customization allows businesses to align reports with tax regulations, ensuring accurate and compliant reporting. Tax regulations vary greatly from one jurisdiction to another. Customized tax reports in Odoo Accounting enable businesses to adhere to local, regional, and national tax laws accurately. This ensures compliance, reduces the risk of penalties, and maintains a positive relationship with tax authorities.

4. Clarity: Personalized reports are often more intuitive and easier to understand, facilitating better financial analysis. Generic tax reports may not capture the intricacies of a particular business's financial transactions. Customization allows for the inclusion of specific data points and calculations, ensuring precise tax reporting.

5. Flexibility: The ability to customize tax reports means that businesses can adapt to changing tax regulations or unique financial circumstances. They can easily modify reports to account for new tax codes, deductions, or exemptions as needed.

Now, let’s check how to create and customize reports in Odoo 16 Accounting.

Customising Financial and Tax Reports in Odoo

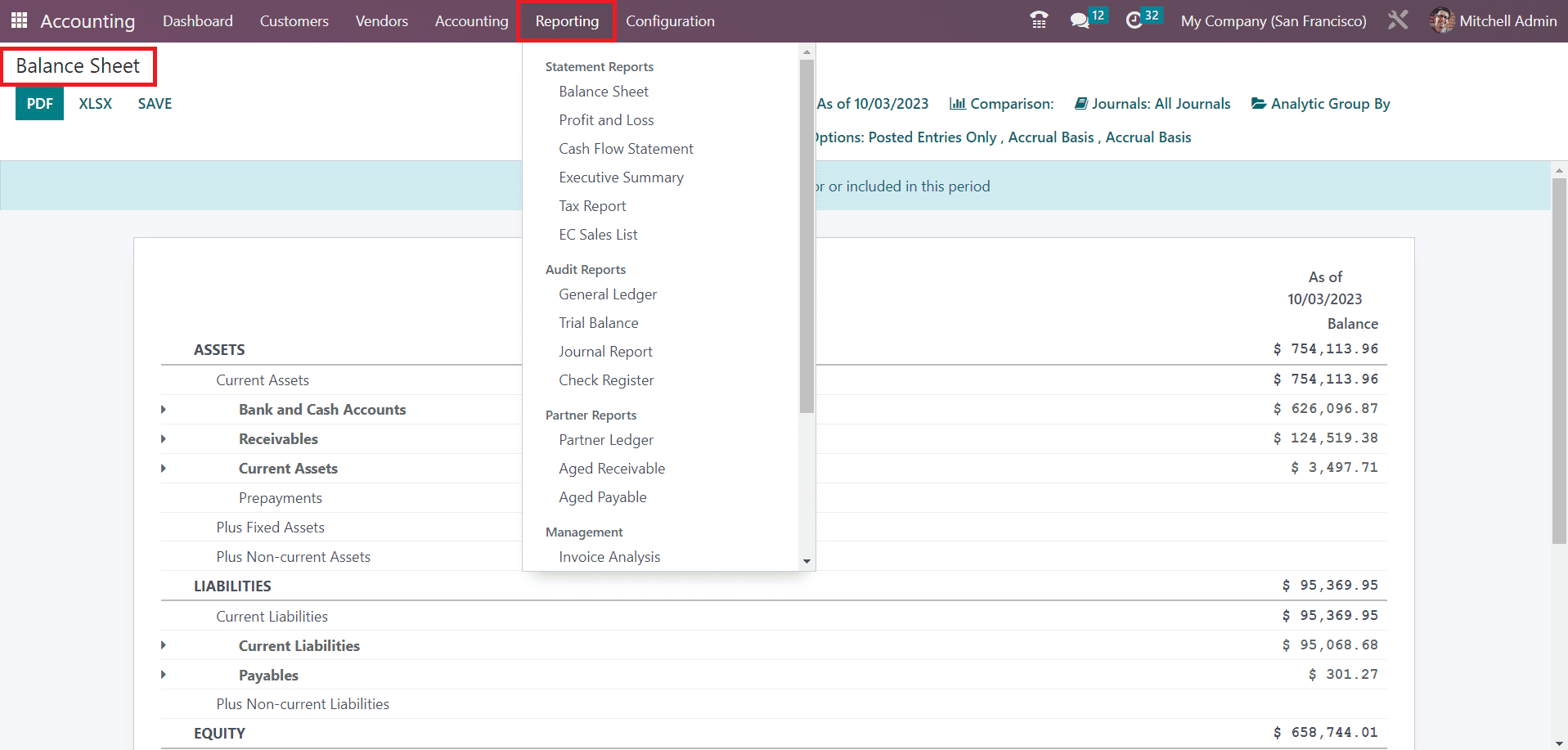

In Odoo, financial reports refer to a set of predefined and customizable documents that provide a detailed overview of a company's financial performance and transactions. These reports are generated from the financial data entered into the Odoo Accounting module and are essential for financial analysis, decision-making, and compliance purposes. You can find financial reports under the Reporting menu of the Accounting module.

Here, we opened the report window of the balance sheet. Balance Sheet report is a basic financial statement that gives an overview of a company's financial position at a specific point in time. It summarizes the company's assets, liabilities, and equity, showcasing the overall financial health of the business.

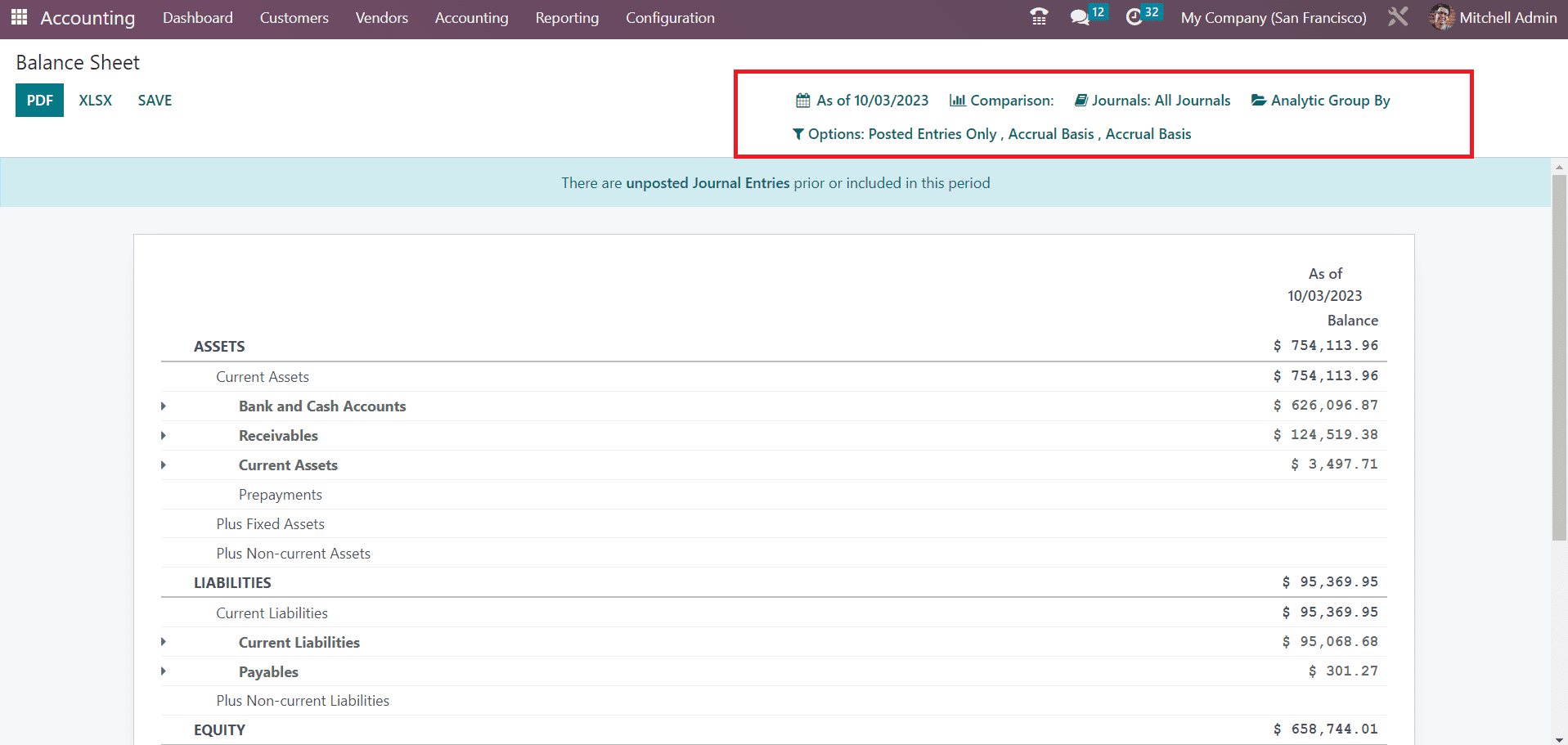

You can set a custom date using the calendar icon to get the Balance Sheet report of that particular date. The Comparison tool allows you to compare the current report with the previous period. It is possible to filter the report based on journals.

Now, you can add more lines or make changes to the financial report using the customization feature. For tax report customization also, we follow the same method.

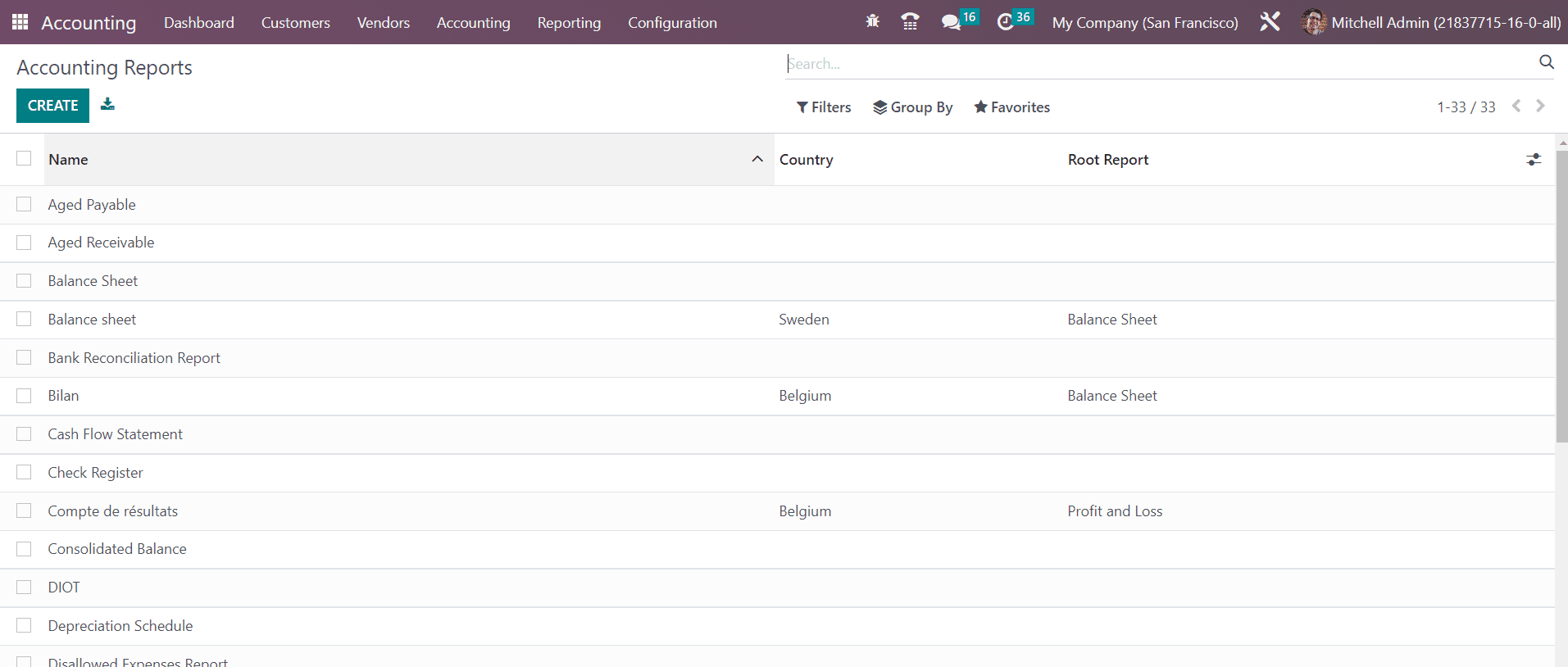

To customize your company's accounting reports to your specific needs, navigate to the Accounting Reports option within the Configuration menu of the Accounting module. This tool allows you to create reports customized to your requirements. Additionally, you can modify the settings of existing reports by selecting them from the provided list.

Let's illustrate this feature with an example: customizing the Aged Receivable report. Start by choosing 'Aged Receivable' from the list of reports.

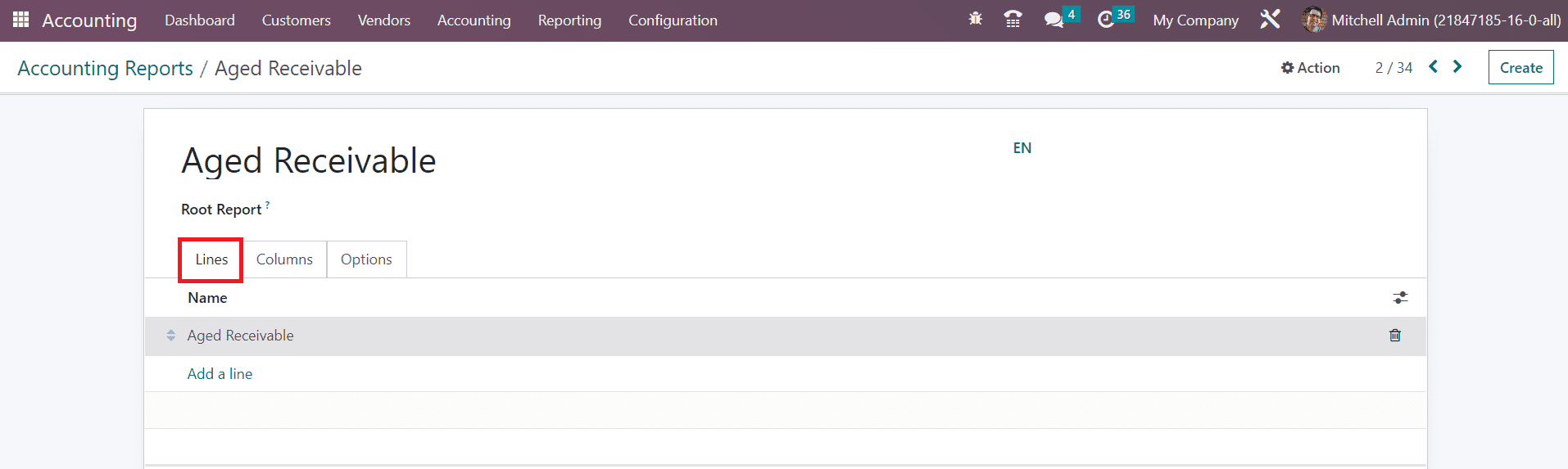

You will get the name of the report in the specified field. In the 'Root Report' field, you can specify the root report, with the current report serving as a variable of the chosen root report. In the 'Lines' tab, you can define new report lines using the 'Add a Line' button, where a pop-up window allows you to configure the details of the new report line.

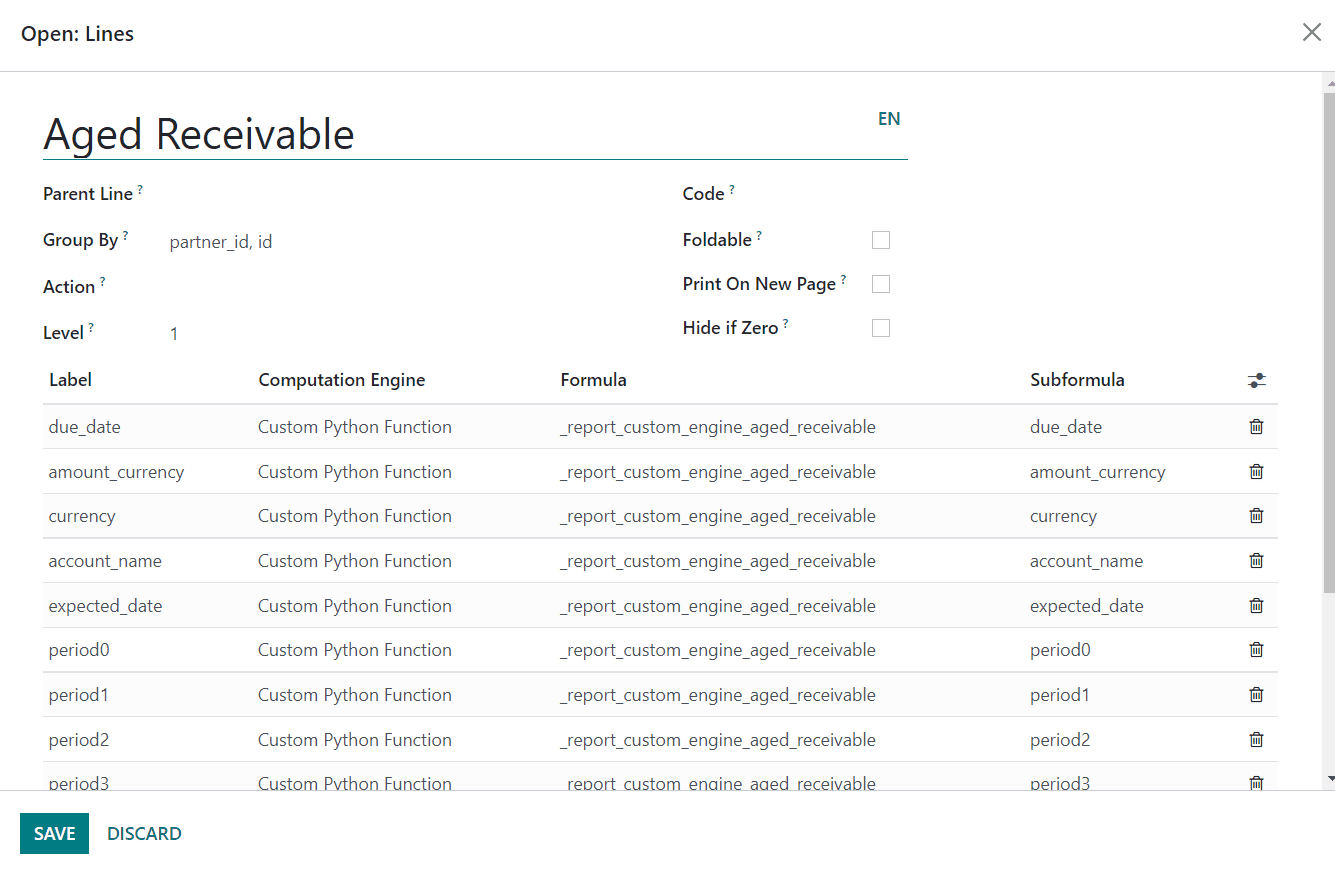

For instance, you can create a new report line named 'Aged Receivable' in your financial report. In the 'Partner Line,' specify the partner ID for this reporting line. By indicating keys in the 'Group By' field, you determine the fields that will appear in the report line. To make the report line a clickable link, use the 'Action' field. The 'Level' field displays the hierarchical level of this report line. You can assign a unique identifier to this line in the 'Code' field. Enabling the 'Foldable' field adds a folding button to the report, allowing you to fold this line. When 'Print on New Page' is activated, everything after it will be printed on a new page. The 'Hide if Zero' feature automatically conceals the line when all its columns have values of 0. Furthermore, you can specify the 'Label,' 'Computation Engine,' 'Formula,' and 'Subformula' using the 'Add a Line' button.

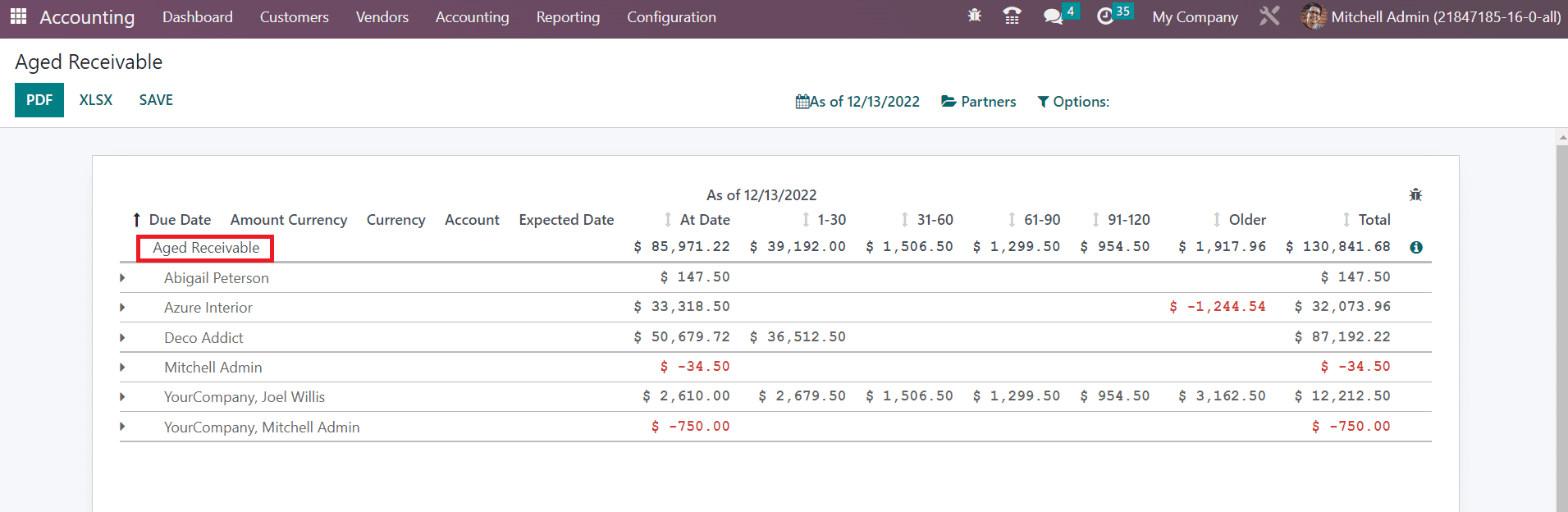

Once a new line is created, you can see it in the Aged Receivable report.

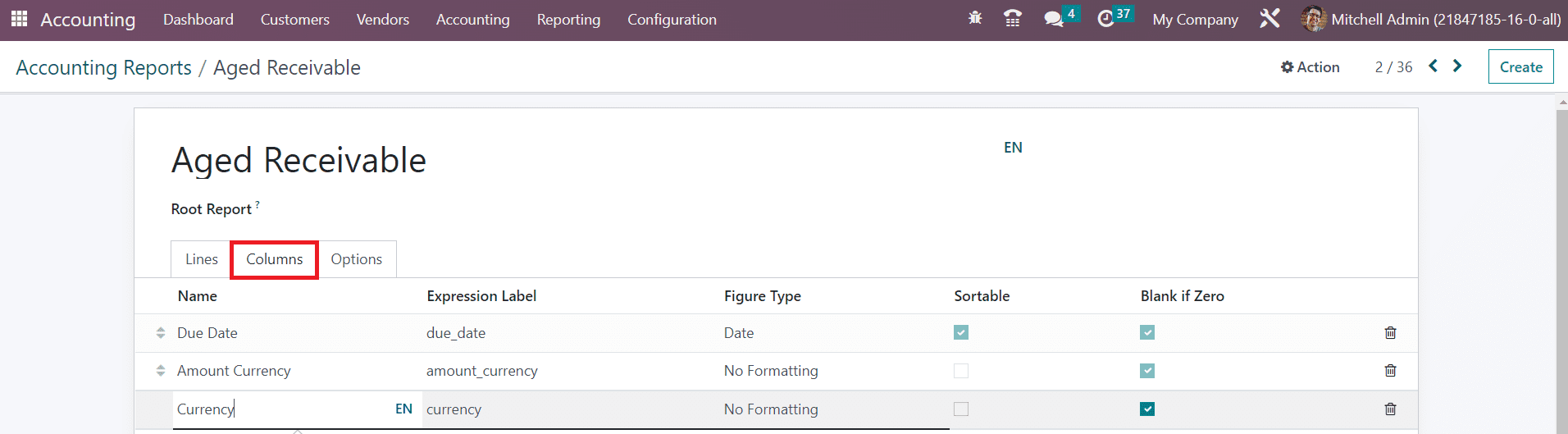

Next, let's add a new column to the report. Under the 'Column' tab, click 'Add a Line' to create new columns for the Aged Receivable report.

For example, you can add a 'Currency' column to the report, specifying the 'Name,' 'Express Label,' and 'Figure Type' in the respective fields. Activate the 'Sortable' and 'Blank if Zero' fields as needed.

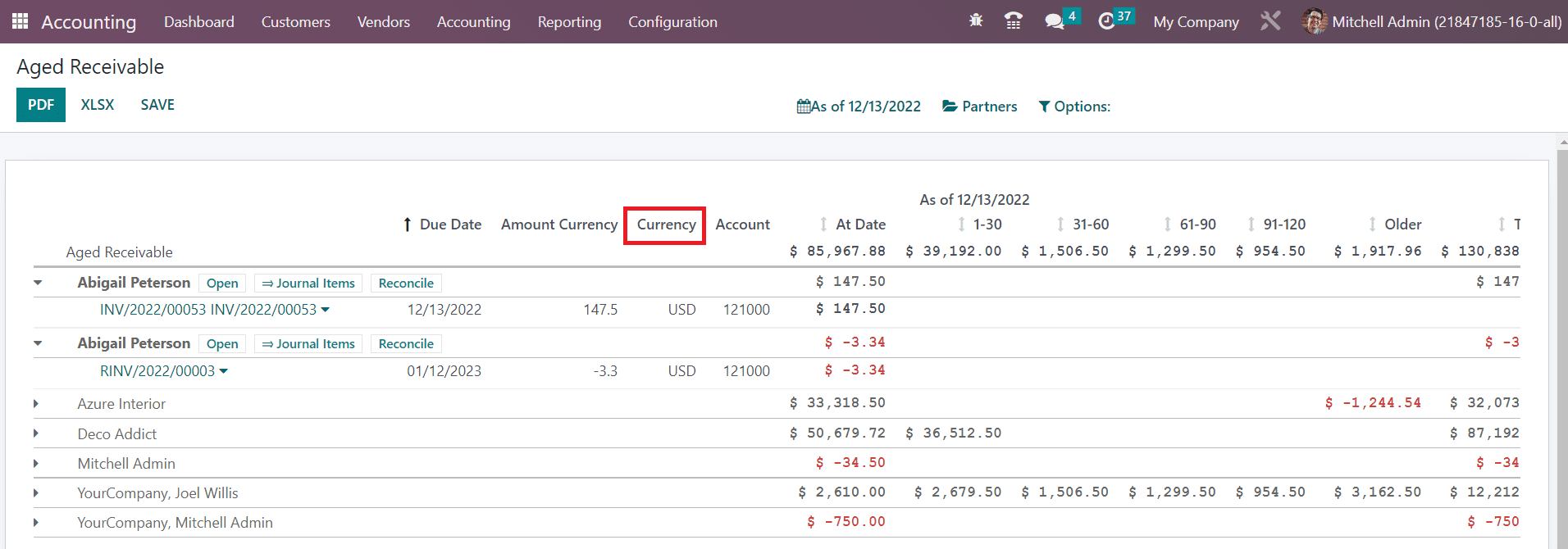

The new 'Currency' column will now appear in the Aged Receivable report as shown in the screenshot above.

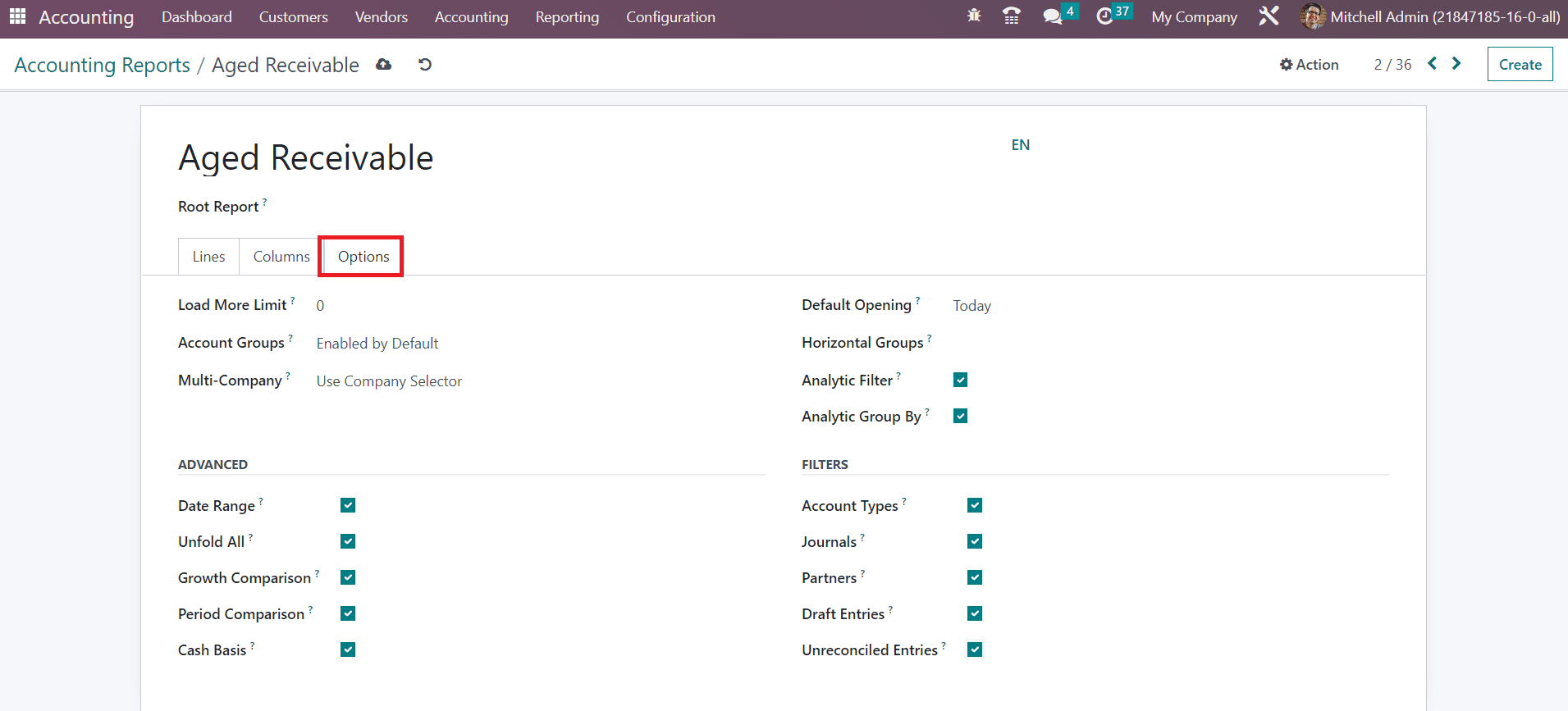

Under the 'Options' tab, you'll find advanced customization options to create the report according to your preferences.

The limit value can be set in the Load More Limit field. You can set the Account Groups feature as Enabled by Default, Never, or Optional. The filter Multi Company can be adjusted based on the Use Company Selector or Use Tax Unit. Set the field as Disabled if you want to disable the Multi-Company filter option. The Default Opening field can be used to set a time period and to show the report of the selected time period as default while opening the Aged Receivable report in Odoo. You can also add 'Horizontal Groups' and activate 'Analytic Filter' and 'Analytic Group By' options for additional sorting choices.

If you wish to display features like 'Date Range,' 'Unfold All,' 'Growth Comparison,' and 'Period Comparison' on the Aged Receivable report, activate the corresponding fields in the 'Advanced' section. Enabling 'Cash Basis' will provide the option to switch to cash basis mode. To add more filters to the report, enable 'Account Types,' 'Journals,' 'Partners,' 'Draft Entries,' and 'Unreconciled Entries' in the 'Filters' section.

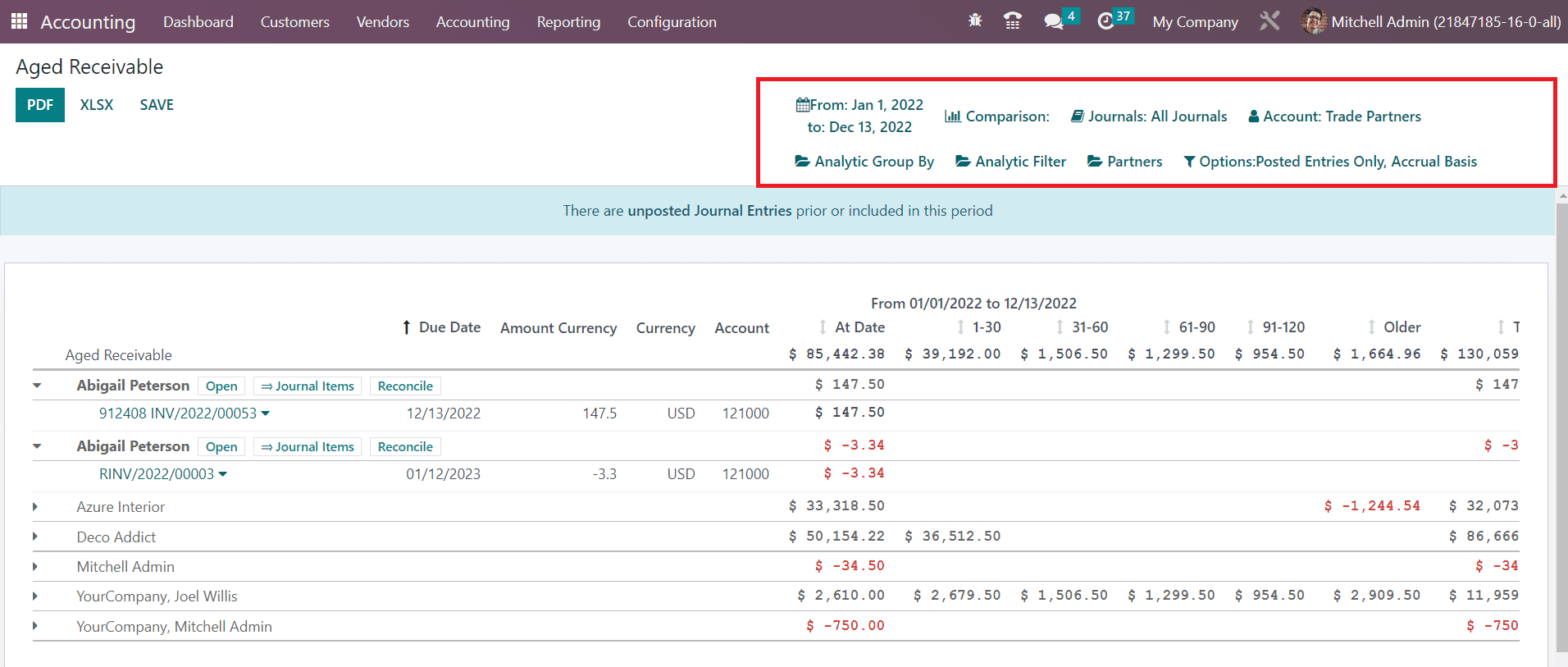

After adjusting the Aged Receivable report's settings as needed, you'll see the corresponding changes in the reporting platform.

Customized financial and tax reports are indispensable tools for businesses striving to achieve financial success and compliance. Odoo Accounting's robust customization capabilities empower organizations to tailor their reports to specific requirements, resulting in more informed decision-making, increased efficiency, and improved compliance. As businesses continue to evolve, the flexibility offered by Odoo Accounting ensures that financial reporting remains a valuable asset in achieving their goals.

To read more about customizing invoices with the help of Odoo 16 Accounting, refer to our blog How to Customize Invoices With the Help of Odoo 16 Accounting