Tax and tax reporting play a crucial role in the accounting module of any business or organization. Here are some key points highlighting their importance: Compliance with Legal Requirements: Tax laws and regulations are established by governments to ensure the collection of revenue and maintain a fair and equitable tax system. Businesses are obligated to comply with these laws, and accurate tax reporting is a fundamental requirement. Failure to comply can result in penalties, fines, and legal consequences.

Taxes significantly affect a company's financial situation and profitability. Financial Planning and Decision Making. Businesses can reduce their tax payments, utilize relevant tax benefits, and make wise financial decisions with the help of proper tax planning. Businesses can discover patterns, evaluate tax burdens, and create plans to reduce tax costs by analyzing tax data.

Calculating Tax Liability: A company's financial activities, including income, expenses, deductions, and credits, are fully visible in tax reporting. Businesses analyze their taxable income and establish the proper tax payment amount through precise tax reporting. It ensures financial statements are transparent and deters underreporting or tax fraud.

Communication with External Stakeholders: It is frequently necessary to exchange tax reports with a variety of external stakeholders, including lenders, investors, and auditors. These reports demonstrate a company's compliance with tax regulations and add transparency and credibility to financial statements. Accurate tax reporting ensures regulatory compliance while preserving stakeholder confidence.

Audit and Due Diligence: Tax reports are essential for assessing a company's financial stability and tax compliance in audit and due diligence situations. A company's tax condition and any possible dangers can be determined by auditors, investors, or potential buyers with the use of accurate and thoroughly documented tax reports that show financial activity, deductions, and credits.

Future Tax Planning: Tax reports from prior years are useful sources to use when making future tax arrangements. Businesses can discover areas where tax savings can be made, plan for anticipated tax payments, and make wise decisions to improve their tax status in the years to come by analyzing historical tax data.

Altogether, taxes and tax reporting are essential components of the accounting module because they help with decision-making, enable future tax planning, ensure compliance with legal requirements, facilitate financial planning, and determine tax liability. Maintaining accurate and current tax records is essential for businesses to meet their tax obligations and promote efficient financial management.

To manage and analyze taxes, Odoo 16 accounting additionally offers sophisticated reporting options. Tax reports that offer a thorough summary of tax transactions, tax liabilities, and tax payments can be generated by businesses. These reports assist companies in determining their tax liabilities, keeping track of compliance with tax laws, and making wise financial decisions. The reporting features of Odoo 16 allow businesses to understand their tax position, spot patterns, and evaluate how taxes affect their financial performance.

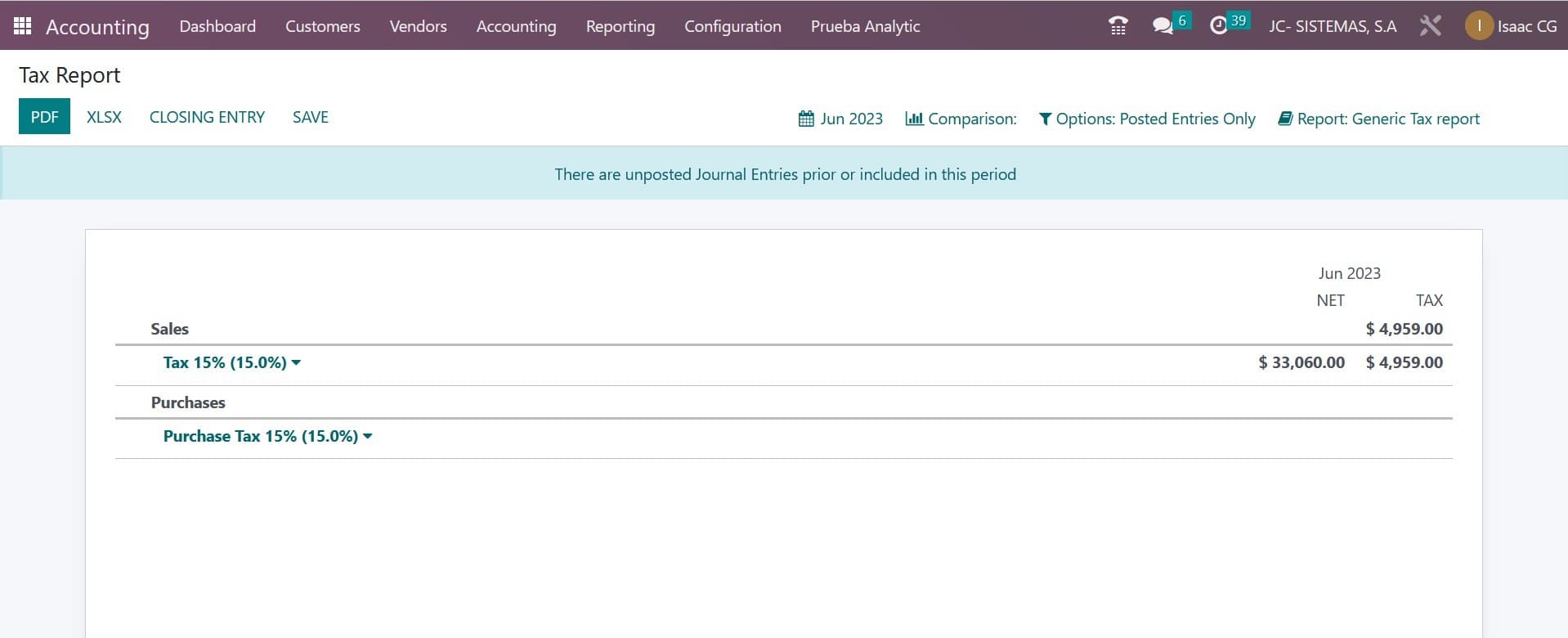

On selecting the reporting menu, you can have the tax report option, and the page of tax report will be, as shown in the screenshot below.

The Tax Reports platform, which is accessible via the Reporting menu, may produce thorough reports on sales and purchase taxes. You can submit the return tax for the chosen period using the Closing Entry option.

You can have the PDF format of the tax report using the provided icon as well. The accounting procedures of any organization must include effective tax management. To preserve compliance with tax legislation and guarantee accurate financial records, accurate tax adjustments are essential. To efficiently modify taxes, Odoo 16 accounting offers powerful capabilities and functionalities. We will go over the step-by-step procedure for changing taxes in Odoo 16 accounting in this blog. Configuring the tax settings in Odoo 16 is the first step toward tax adjustment. Go to Odoo's accounting settings and select the "Taxes" option. Depending on the tax requirements of your company, you can define the tax laws, rates, and tax codes here. To accommodate various tax jurisdictions or tax types, Odoo 16 enables you to design several tax rules and rates. Establish taxes in accordance with your local tax laws, taking into account the applicable tax rates, exemptions, and tax categories.

Assigning taxes to goods and services comes after the tax settings have been set up. Each good or service in Odoo 16 can be connected to a particular tax code or tax regulation. This makes sure that when creating invoices or documenting transactions involving these goods or services, taxes are automatically calculated and applied. In Odoo 16, you can choose the applicable tax codes or tax rules from a dropdown menu when establishing or modifying a product or service. This organization makes sure that when billing or recording transactions, the appropriate taxes are applied.

Additionally flexible in resolving tricky tax situations is Odoo 16. It enables you to specify tax rules depending on a variety of factors, like client geography, product categories, or particular circumstances. This makes it possible for firms to comply with particular tax exemptions, unique tax rates, or other special tax obligations.

Odoo 16 automatically calculates and applies the taxes when creating invoices or recording transactions thanks to the tax settings and product relationships in place. Based on the configured tax regulations and rates and taking into account the good or service being invoiced or transacted, the tax amounts are computed. Through automation, the possibility of human error is decreased, and accurate and consistent tax computations are made throughout the accounting procedures.

But there can be times when tax changes are required. These modifications might be necessary to fix mistakes, apply for exemptions, or handle unique tax circumstances. For particular invoices or transactions, Odoo 16 offers options for tax modifications. In Odoo 16, you can access the tax lines while reading an invoice or transaction and make necessary changes to the tax amounts, tax codes, or manual tax adjustments. When making tax changes, it's crucial to use prudence and make sure they're properly justified and documented.

Odoo 16 enables the freedom to design unique tax rules or formulae in situations where tax modifications are frequent or call for intricate computations. To handle special tax situations like multi-tiered taxes, compound taxes, or tax calculations based on particular circumstances, these rules or formulas can be modified. The Odoo 16 accounting system gives businesses the capacity to handle complex tax needs successfully thanks to the option to establish bespoke tax rules or formulae.

Reconciling tax accounts on a regular basis is essential to keeping correct financial records. Tax accounts are used in Odoo 16 accounting to track tax amounts apart from other financial activities. These tax accounts show the company's tax obligations and payments. Odoo 16 has a reconciliation capability for accounting for taxes. The ability to link tax payments or refunds with the associated tax liabilities is provided by this feature. The process of reconciling tax accounts helps find any inconsistencies or mistakes in tax transactions and guarantees that the tax liabilities are appropriately reflected in the financial records.

Odoo ERP ecosystem modules other than the main tax adjustment functionalities are integrated with Odoo 16 accounting. The flawless synchronization of tax changes across several modules, including sales, purchases, inventories, and reporting, is ensured through this integration. For instance, the applicable tax accounts, inventory values, and financial statements are instantly updated when a tax adjustment is made in an invoice. This integration gets rid of manual data entry, cuts down on errors, and gives a complete picture of the company's financial situation.

Furthermore, the tax adjustment process is simple and accessible because to Odoo 16's user-friendly interface and intuitive design. Users can quickly access and comprehend tax-related transactions thanks to the system's clear and straightforward information on taxes and tax changes. Additionally, businesses looking for tools or direction in properly adjusting taxes can turn to Odoo's large documentation and user community.

Odoo 16 accounting provides many capabilities and functionalities for efficient tax adjustment. Configuring tax settings, tagging goods and services with taxes, adding taxes automatically to transactions and invoices, adjusting taxes as needed, balancing tax accounts, and using reporting tools are all steps in the process. The user-friendly interface and connection with other modules of Odoo 16 improve the tax adjustment experience even more. Businesses may maintain compliance with tax laws, keep accurate financial records, and make wise financial decisions by utilizing the tax adjustment features of Odoo 16 accounting.

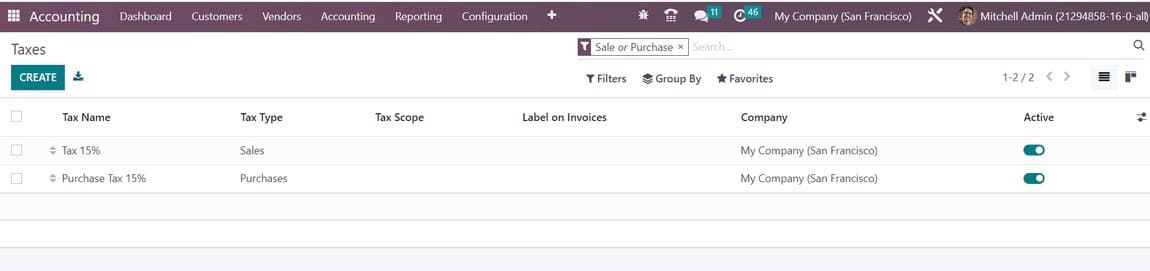

One of the difficult accounting management tasks that demand accuracy in execution is tax calculation. Your business is at risk even with a tiny calculation error. Tax computation has become much easier since the Odoo Accounting module was introduced. You may access the Taxes platform, where you can handle sales and purchase taxes, via the Configuration menu of the module.

The list of taxes that are readily available can be sorted according to Sales, Purchases, Services, Goods, Active, and Inactive. Depending on the company, tax type, and tax scope, you can categorize them. The Filters and Group By choices are fully customizable for the user. To set up a new tax, click the Create button now.

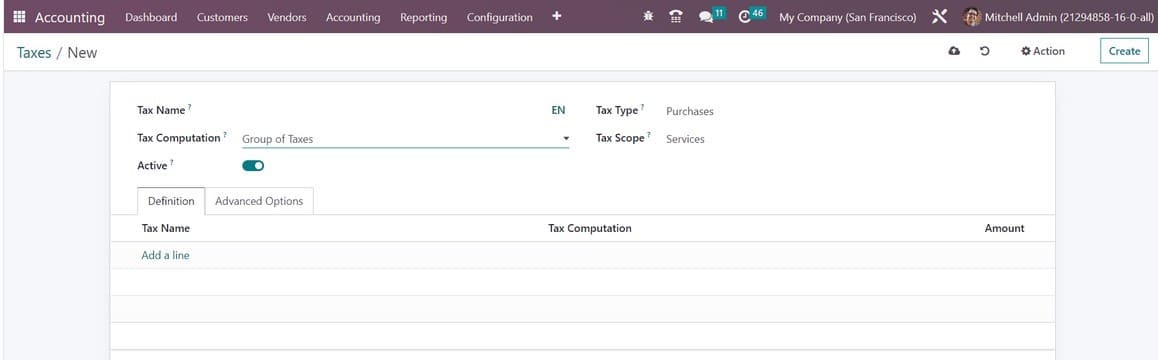

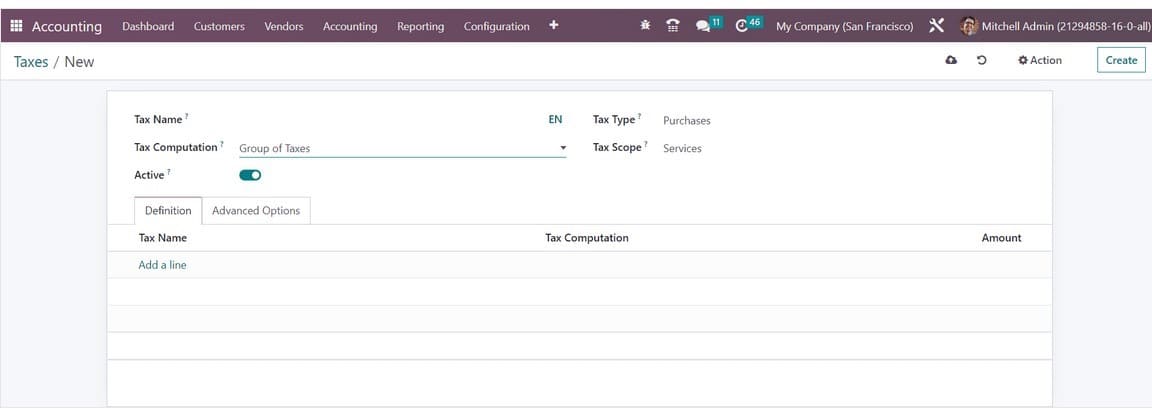

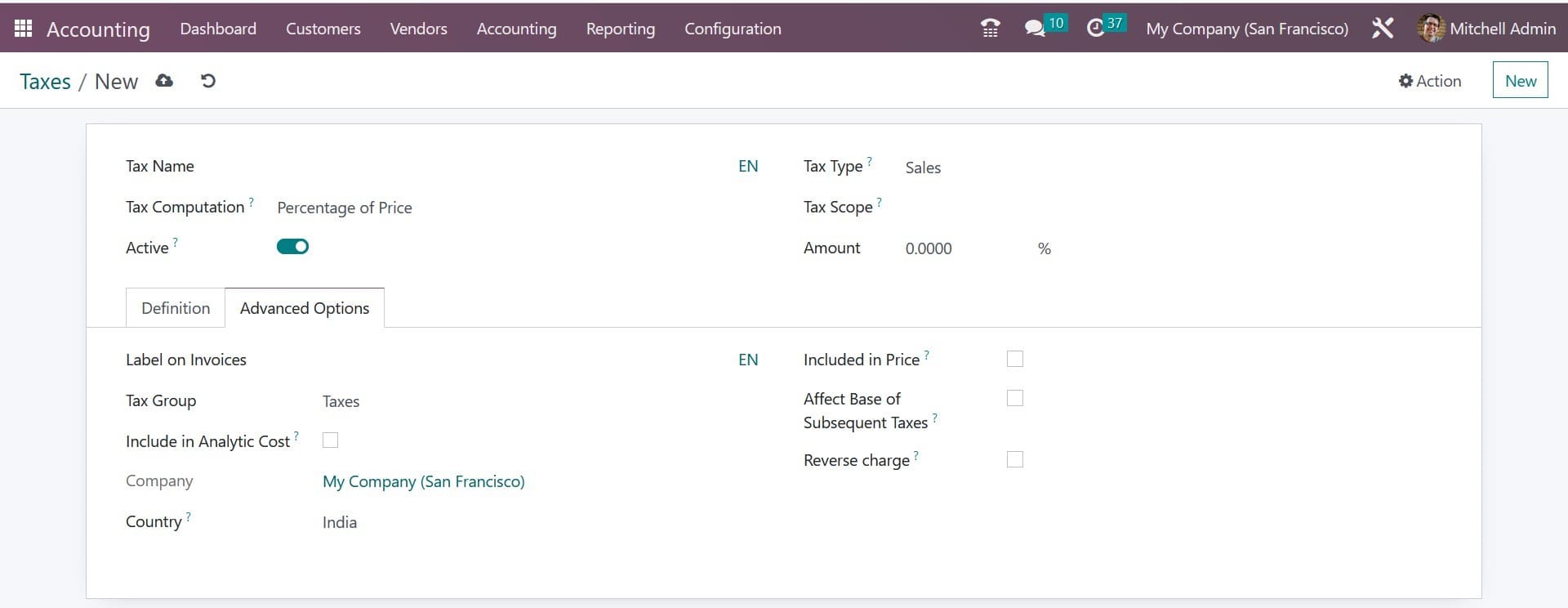

In the Tax Name area, give the new tax a name. You can choose between the sales and purchases tax types. It chooses the areas where the tax can be chosen. The tax cannot be used individually when the value is "none," but it may be applied to a group. By choosing the appropriate choice in the Tax Scope field, you can limit the application of taxes to a certain class of goods. To conceal the tax without deleting it, set the tax's Active property to false. You can choose from the Group of Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, and Python Code choices in the Tax Computation field to specify how taxes will be computed.

In the instance of the Group of Taxes, the tax is actually a collection of sub-taxes, and the sub-taxes are what are used to calculate the overall tax.

Using the Add a Line button, you may sequentially add the sub-taxes under the Definition tab.

You may get information about the Company and Country under the Advanced Options tab.

By choosing Tax Computation as Fixed, the tax amount is fixed regardless of the cost. By choosing the Percentage of Price as the tax computation method, the tax amount can be set as a specific percentage of the actual price. In the Percentage of Price Tax Included approach, the tax amount will be calculated as a fraction of the actual price. With the aid of the Python Code option, the tax can also be calculated using Python code. All of these techniques have the same setting choices.

Using the Add a Line button, you may choose the base on which the factor will be applied, the account on which to post the tax amount, and the tax grids to define the distribution for invoices and refunds individually under the Definition tab.

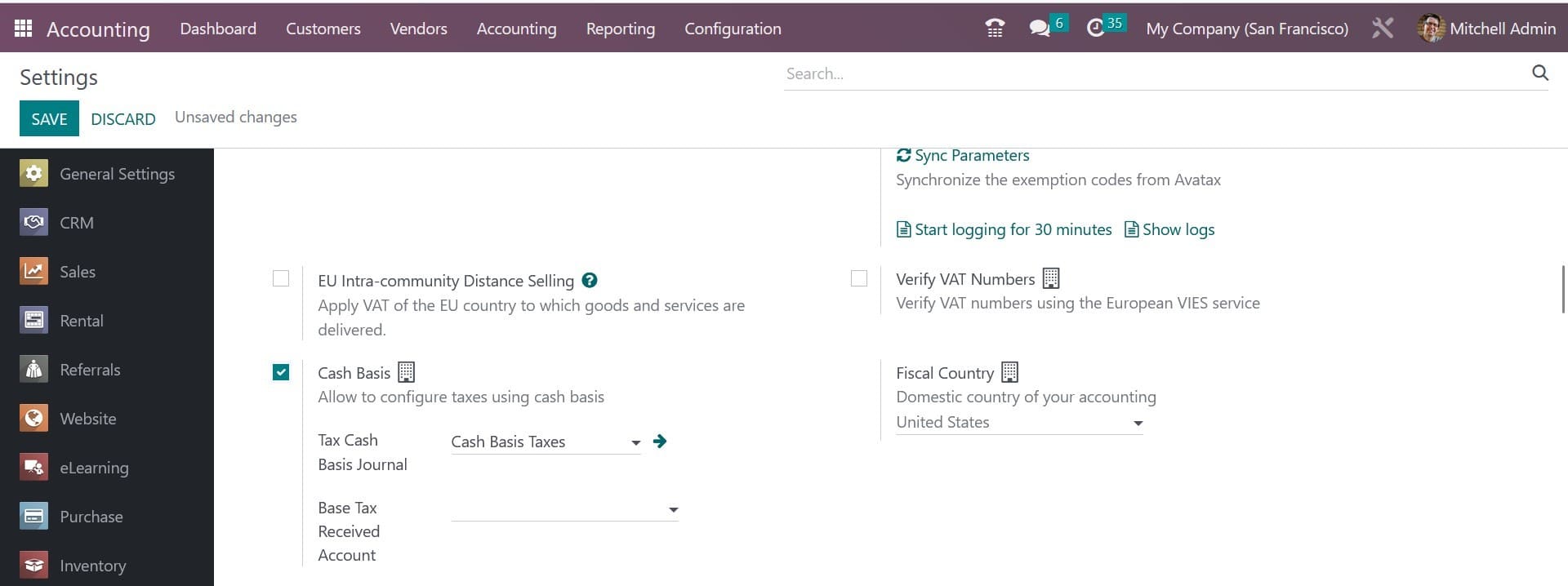

You can add them to invoices by mentioning the Label on Invoice option under the Advanced Options tab. From the available options, choose the most appropriate Tax Group. You can configure taxes using a cash basis by activating the Cash Basis function. If the taxes need to be calculated on a cash basis, you can turn on this feature, which will add an entry for those taxes to a particular account during reconciliation.

Details of the Base Tax Received Account and Tax Cash Basis Journal can be mentioned in the corresponding fields.

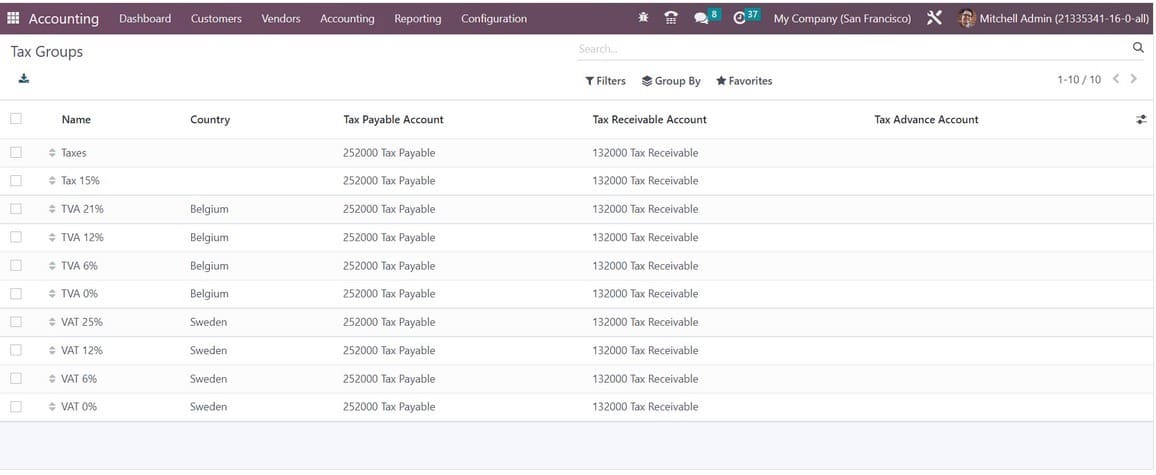

You may utilize these taxes on goods, services, suppliers, businesses, and accounts depending on how your firm operates. From the Configuration menu of the Accounting module, as shown below, you can view the list of Tax Groups that are currently supported by Odoo.

Details about Name, Country, Tax Payable Account, Tax Received Account, and Tax Advance Account are provided in the list view.

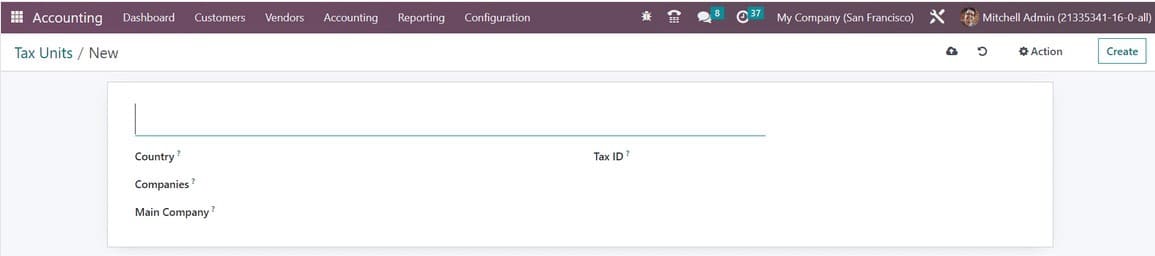

The Accounting module's Configuration menu's Tax Unit option is used to group the Accounting module's Tax Report Declaration. As seen below, the new Tax Units configuration window will appear.

You can specify the Country in which this taxing unit is used to aggregate your company's tax report declaration after adding a title to the taxing unit. You can enter the Companies and Main Company (the entity responsible for filing and paying taxes) in the corresponding fields. The Tax ID field can be amended to include the identifier to be used when submitting a report for this unit.

Default Taxes

When no other taxes are specifically indicated in financial operations, Odoo's default taxes will be picked for you automatically. The configuration of new items will automatically apply these tariffs. Later, you can modify it using the product form. If no other taxes are available, this will likewise be used in the local translation.

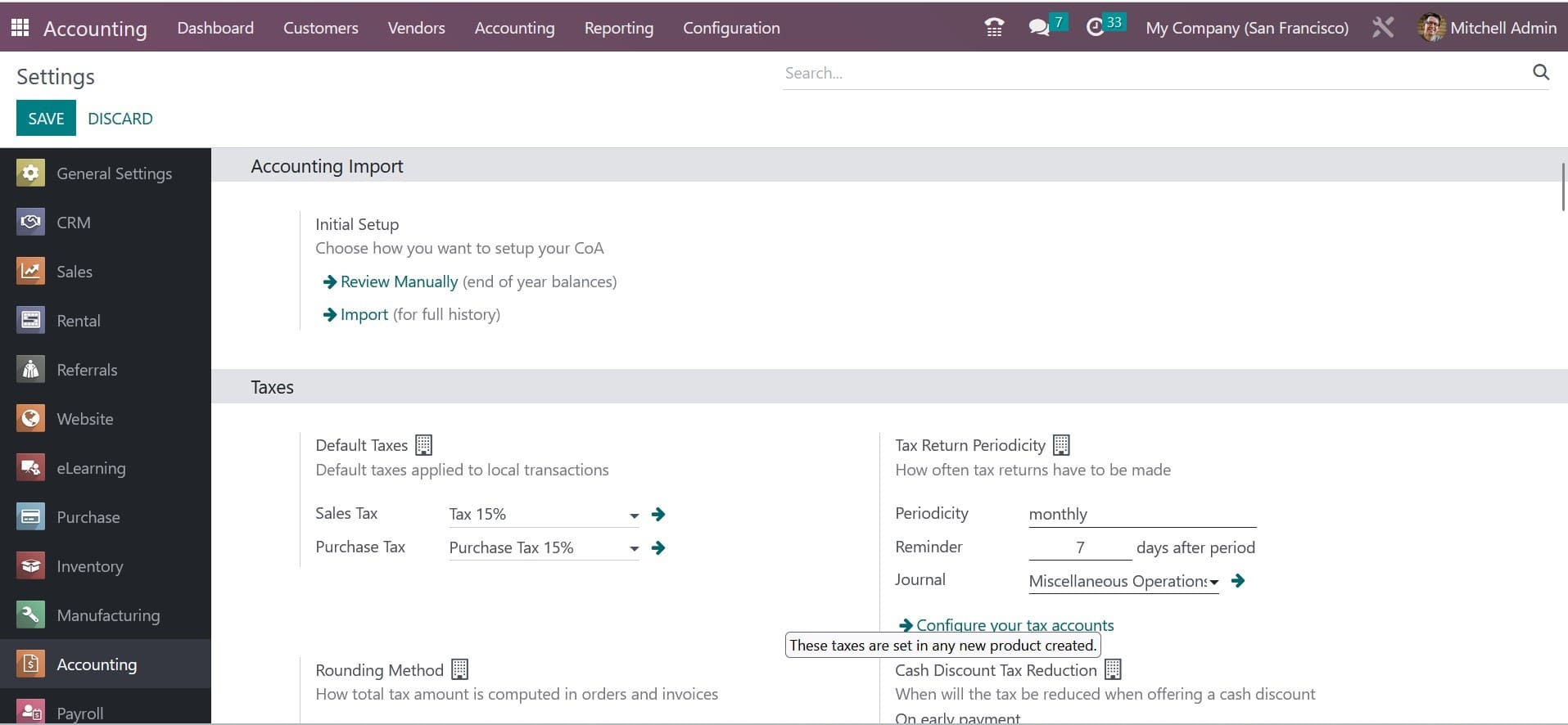

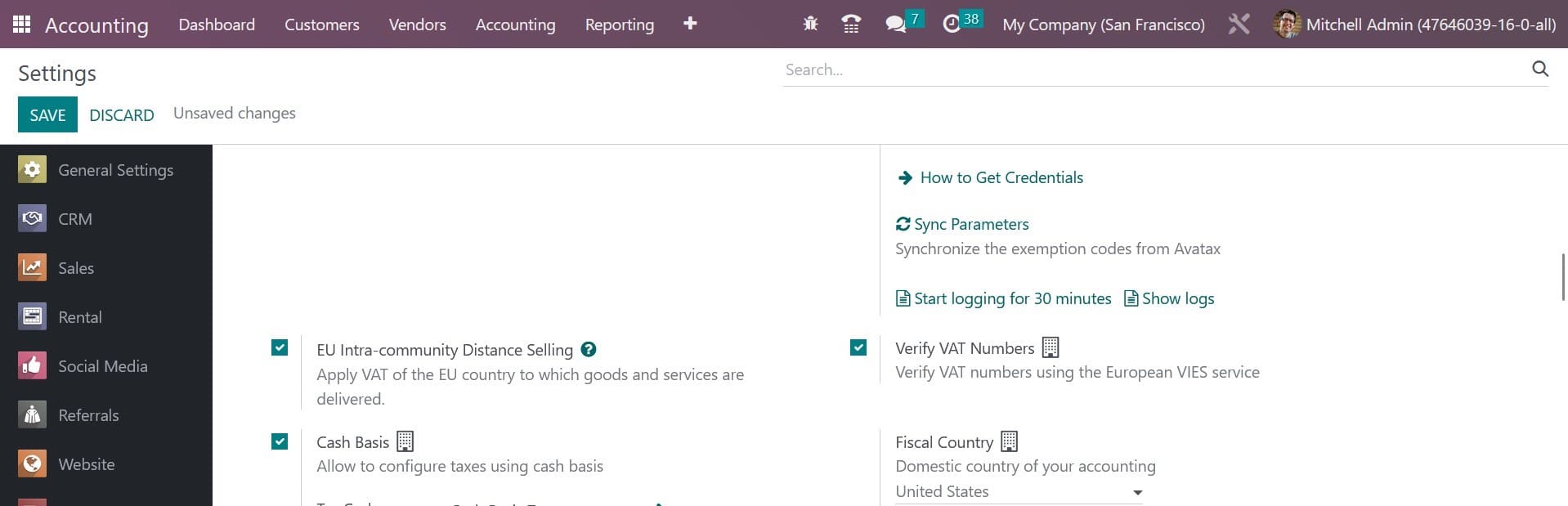

You can modify the Default Taxes for sales and purchases under the Accounting module's Settings menu, as seen in the image above. You can change the sales and purchase taxes by using the internal link present in the default taxes section. How frequently tax returns must be filed is specified in the Tax Return Periodicity parameter. Periodicity, Reminders, and Journals can all be used to record tax returns in the appropriate fields.

To specify how the total tax amount is computed in orders and invoices, utilise the Rounding Method section. You have two options to choose from here: round per line or round globally. If your pricing incorporates tax, it is advisable to round each line separately. The total with taxes is calculated by adding the line subtotals. You can specify the circumstances under which the tax will be waived when a cash discount is provided in the Cash Discount Tax Reduction section. It can be set to Always (upon invoice), On early payment, or Never. The Odoo 16 Accounting module now has this new capability.

Tax Cloud

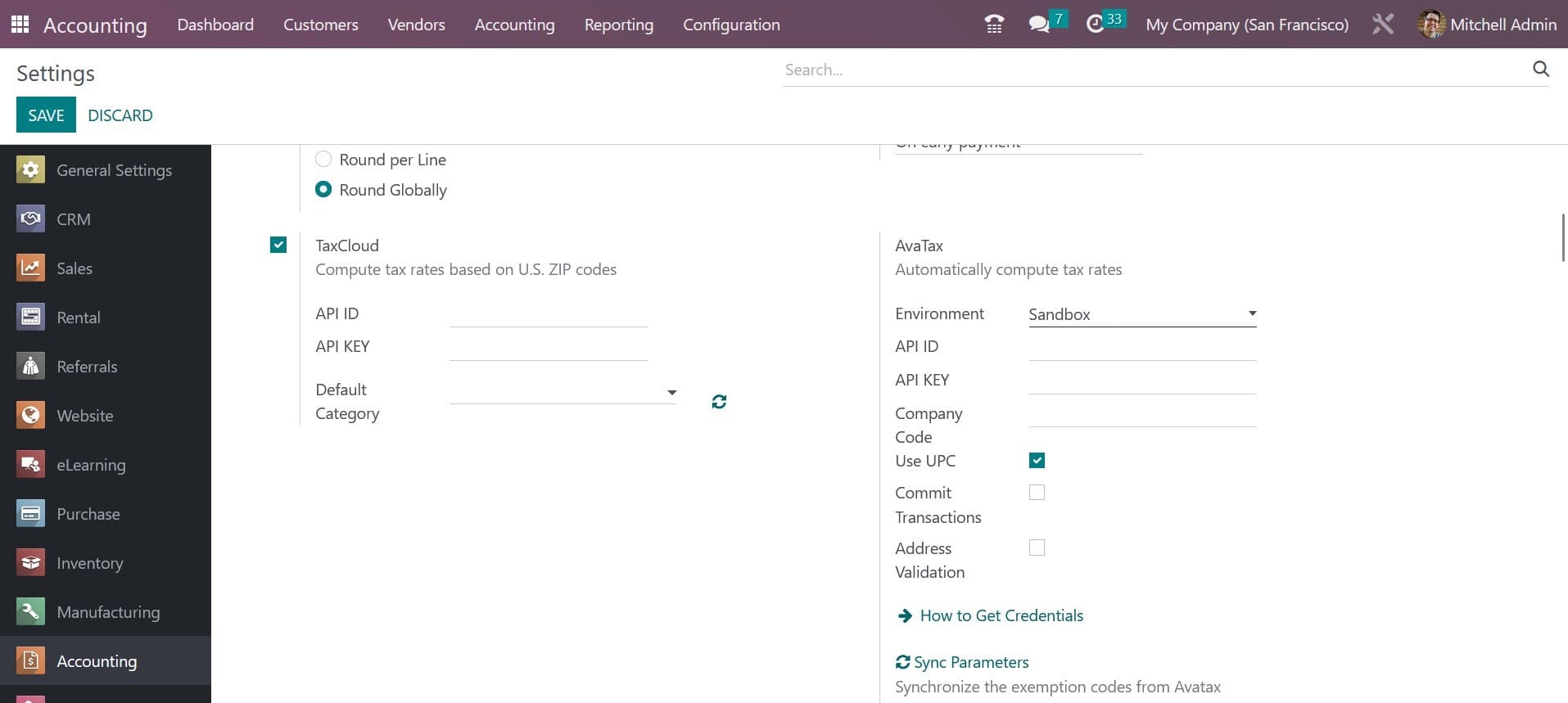

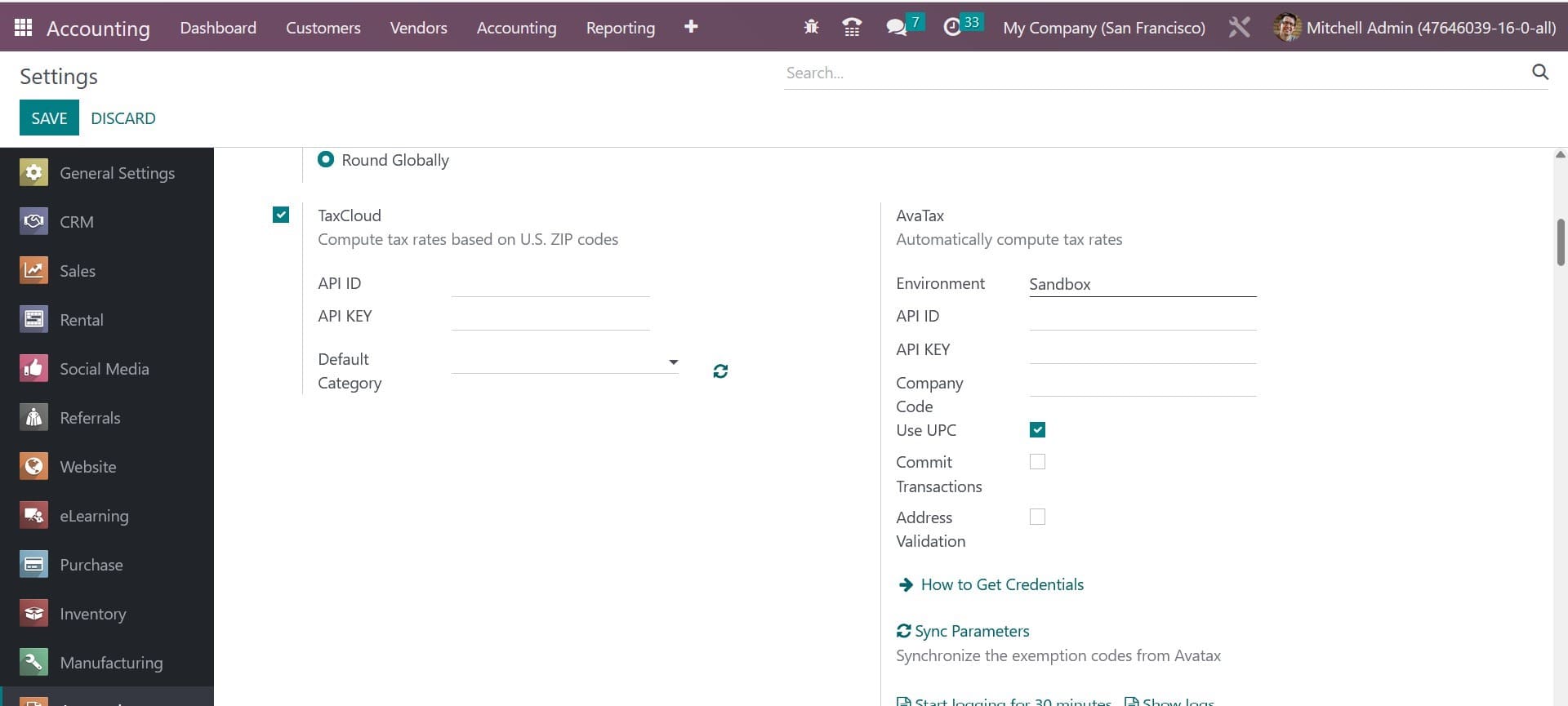

You may use Odoo to calculate the tax rates based on U.S. Zip codes by turning on the TaxCloud option from the Accounting module's Settings menu. You can enter the API ID, API KEY, and Default Category in the areas that are provided.

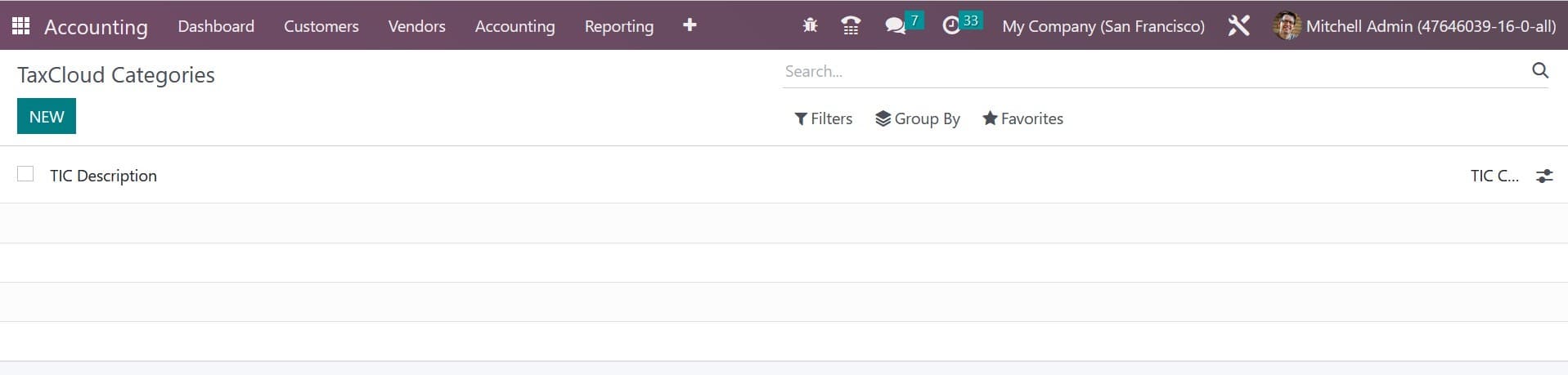

When there is no tax cloud specified on products or product categories, the default category will be applied. The Configuration menu of the module allows you to define several tax cloud categories, as illustrated below.

The TaxCloud Categories are located in the Configuration menu's Management tab. By stating the TIC Description and TIC Code, you may here create a new category.

The tax rates are automatically calculated by the tax computation service Avatax. Mention the Environment, API ID, API KEY, and Company Code in the appropriate fields. If necessary, turn on the Address Validation, Commit Transactions, and Use UPC options. You can establish Avatax categories on items and product categories while configuring them after giving sufficient information. The ability to automatically calculate taxes for orders and invoices is helpful.

EU Intra-community Distance Selling

VAT must be applied based on the delivery address when selling products and services to clients in another EU nation. You can do this by turning on the EU Intra-community Distance Selling function in the Accounting module's Settings menu, as illustrated below. Regardless of where you are, this rule is applicable.

Based on the country of your country, Odoo will automatically establish the appropriate taxes and fiscal positions needed for each EU member state.