This guide provides an in-depth explanation of the new feature in Odoo 18 Accounting, which allows users to configure taxes in their company's currency. Because it streamlines financial reporting and guarantees proper tax computations, this function is especially helpful for companies that operate internationally or deal with numerous currencies. You can check the advantages of using the tax configuration in company currency according to your location.

Benefits of Tax Configuration in Company Currency in Odoo 18 Accounting Module

* Simplified Tax Calculation: Consistency in tax calculations across the organization reduces complexity.

* Accurate Financial Reporting: Taxes configured in the company's base currency ensure accurate financial reports.

* Better compliance level: The Odoo 18 Accounting Module aids businesses in adhering to national and international tax laws.

* Easier Reconciliation: Tax configuration in the company currency simplifies the reconciliation process.

* Reduced Risk of Currency Fluctuations: Configuring taxes in the company currency minimizes the risk of exchange rate fluctuations affecting payable or receivable tax amounts.

* Efficient Multi-Currency Handling: Odoo automatically handles currency conversion when necessary, maintaining the tax data in the home currency.

* Facilitates Audit Processes: Configuring tax in the company currency makes audits easier and more transparent.

* Better Cash Flow Management: Maintaining tax records in the company currency makes cash flow predictions more precise.

* Compatibility with Integrated Modules: Odoo’s modular system integrates Accounting with other ERP parts.

* Clear Overview for Stakeholders: Maintaining tax configurations in a single, unified currency enhances communication, transparency, and decision-making.

* Standardized Automation: Automated features like invoicing, payment reconciliation, and tax return generation operate more consistently with company currency tax settings.

* Improved Decision-Making: More accurate data analysis and reporting are possible with a standard tax setting.

Configuring and Managing Different Currencies in Accounting Database

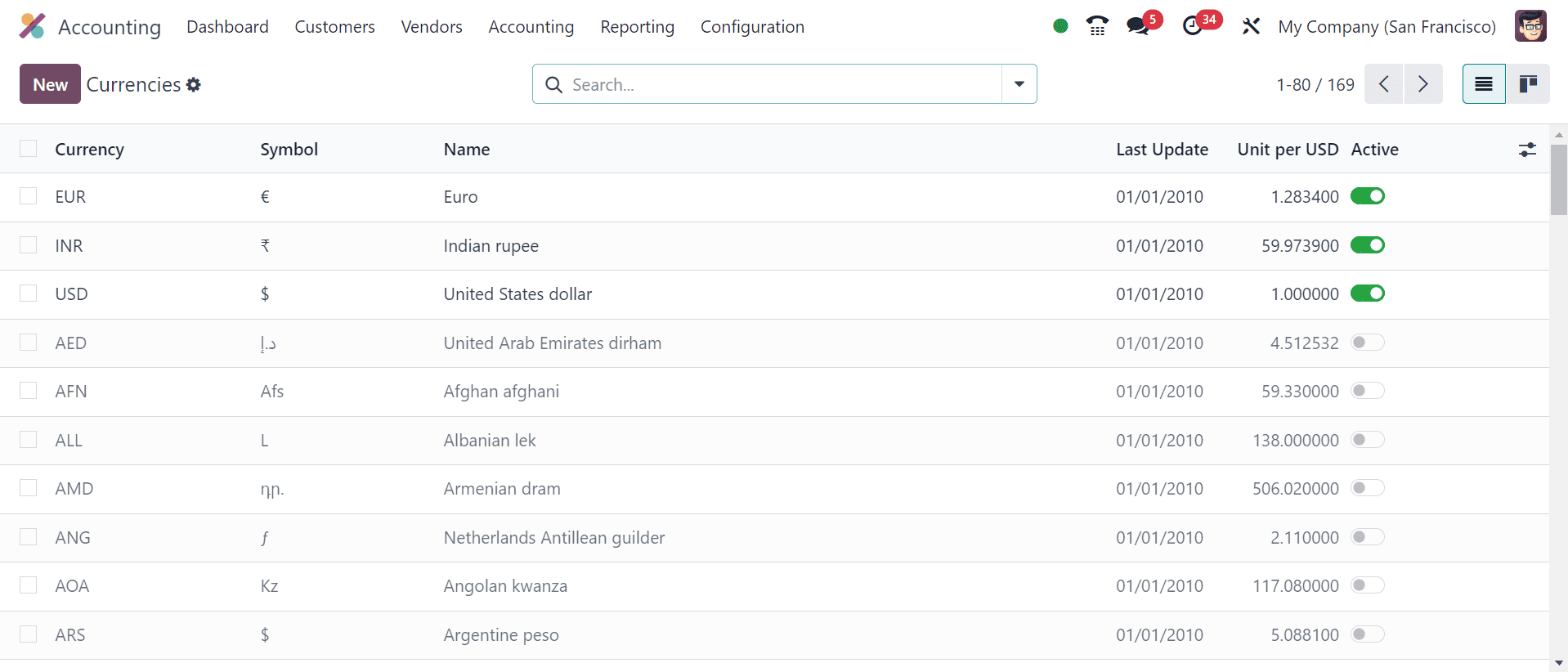

Before starting the tax configuration process, we have to create different currencies according to the requirements. This can be done using the ‘Currencies’ option available in the ‘Configuration’ menu.

This will display the list of different currencies that your accounting system supports and that you have already generated, as depicted in the screenshot below.

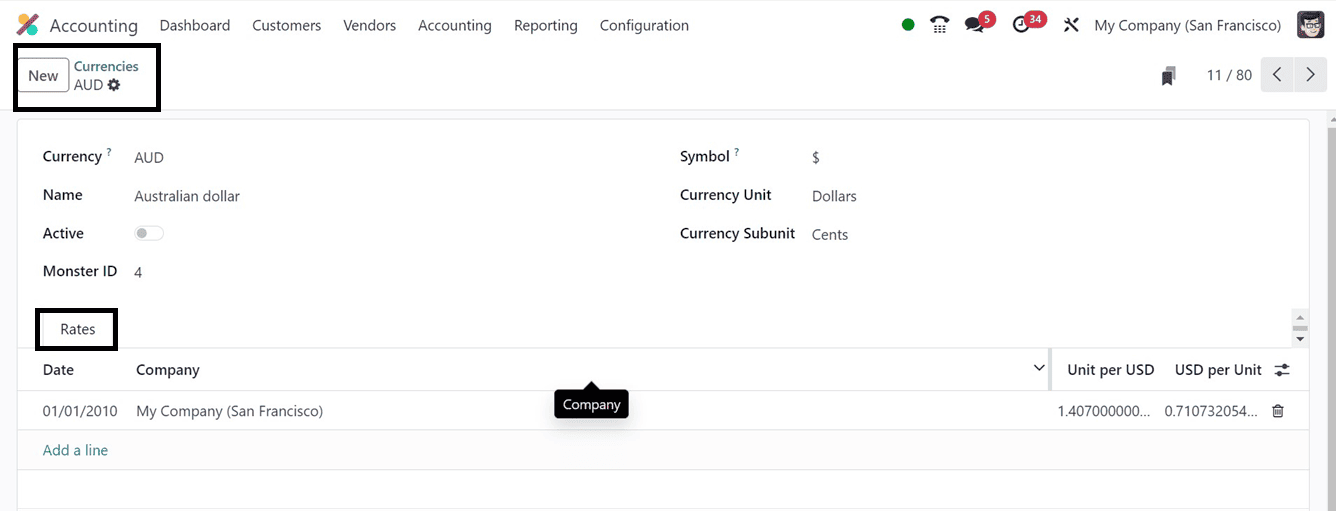

We can quickly create new currency by using the ‘New’ button and editing the required data fields, including Currency, Name, Symbol, Currency Unit, Currency Sub Unit, and various exchange Rates, as shown below.

To learn more about configuring a new currency in your accounting database.

Then, we can utilize the currencies for different accounting purposes according to the customer localities.

Configuring Taxes in Company Currency

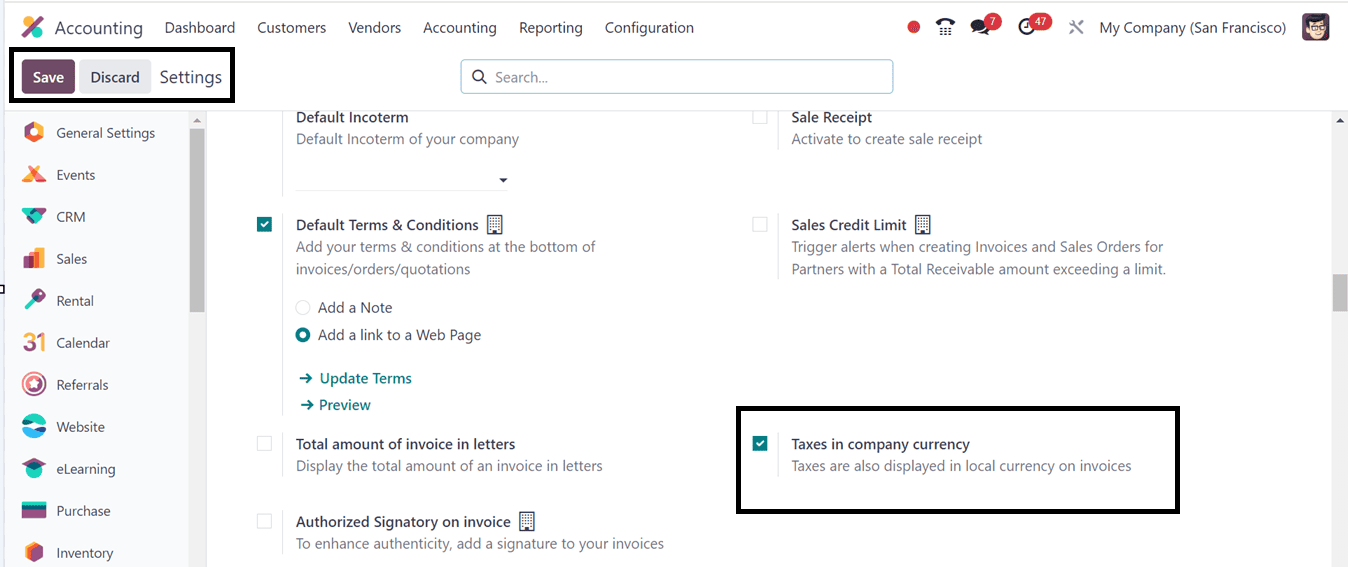

To begin, log into your Odoo 18 instance and select Dashboard. To adjust accounting settings, make sure you have administrator rights. Access the 'Configuration' menu in the 'Accounting' module and choose 'Settings.'

Then, find the 'Customer Invoices' area enable the ‘Taxes in Company Currency’ option and save the modifications.

After enabling the above feature, all the taxes are also displayed in local currency on invoices. Now, let’s create an invoice to check the feature.

Create Invoice

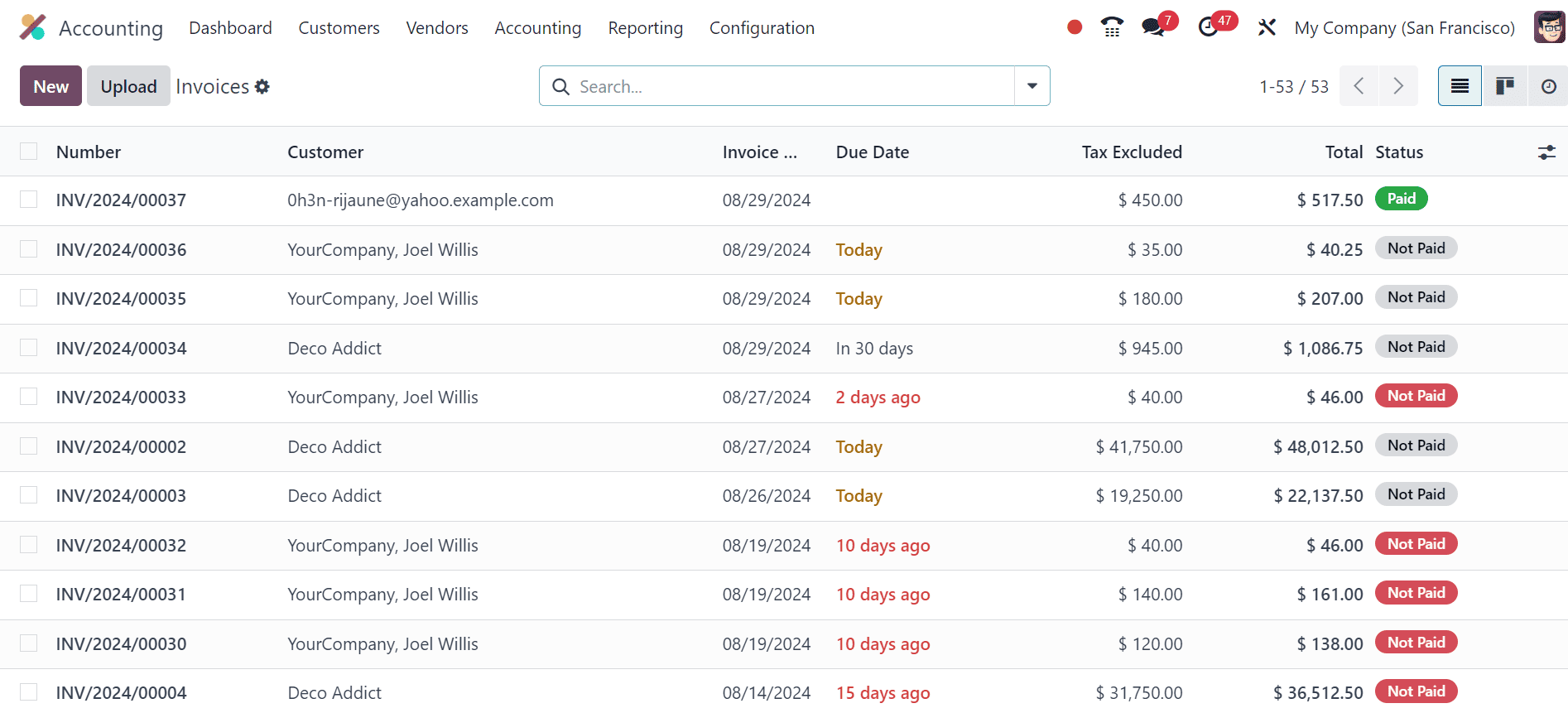

To create a new invoice, go to the Invoices option fount under the Customer Menu of the Accounting Module.

Create a new invoice and edit the invoice details, including Customer, Delivery address, Invoice Date, Payment Terms, and Journal details. Here, we can see the default currency of the invoice is USD, which can be seen near the Journal field, as illustrated in the screenshot below.

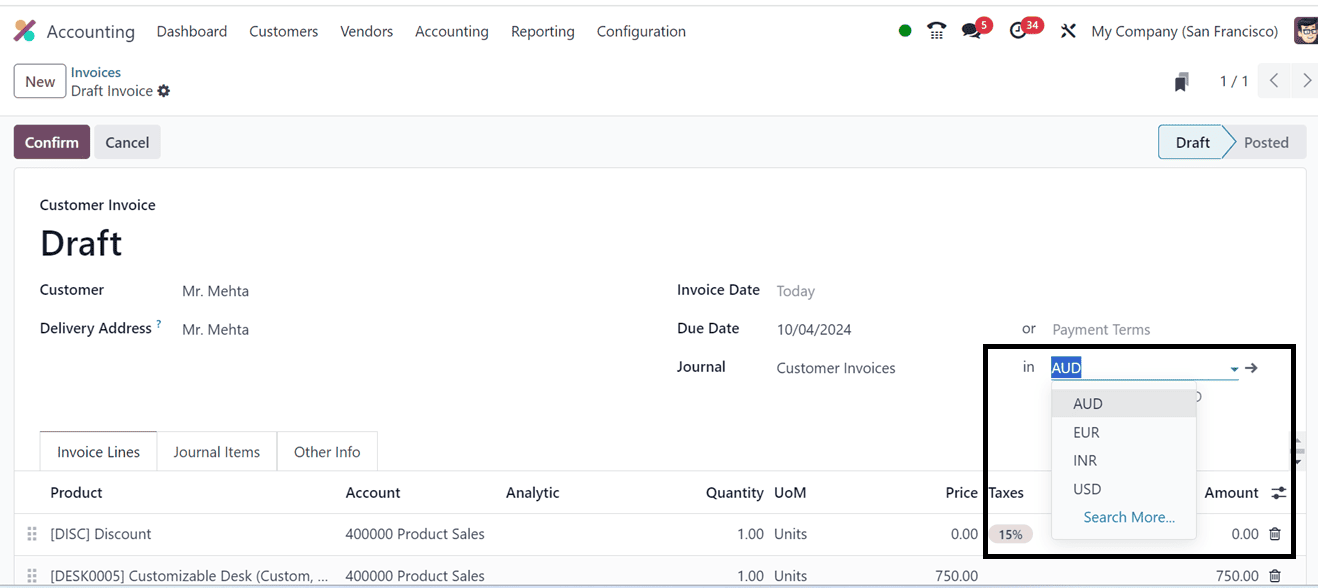

Inside the Invoice Lines Tab section, add the Product, Account, Analytic Distribution, Quantity, Price, Taxes, Amount, etc, using the Add a Line button. After adding the product, I will change the currency to Australian Dollar(AUD).

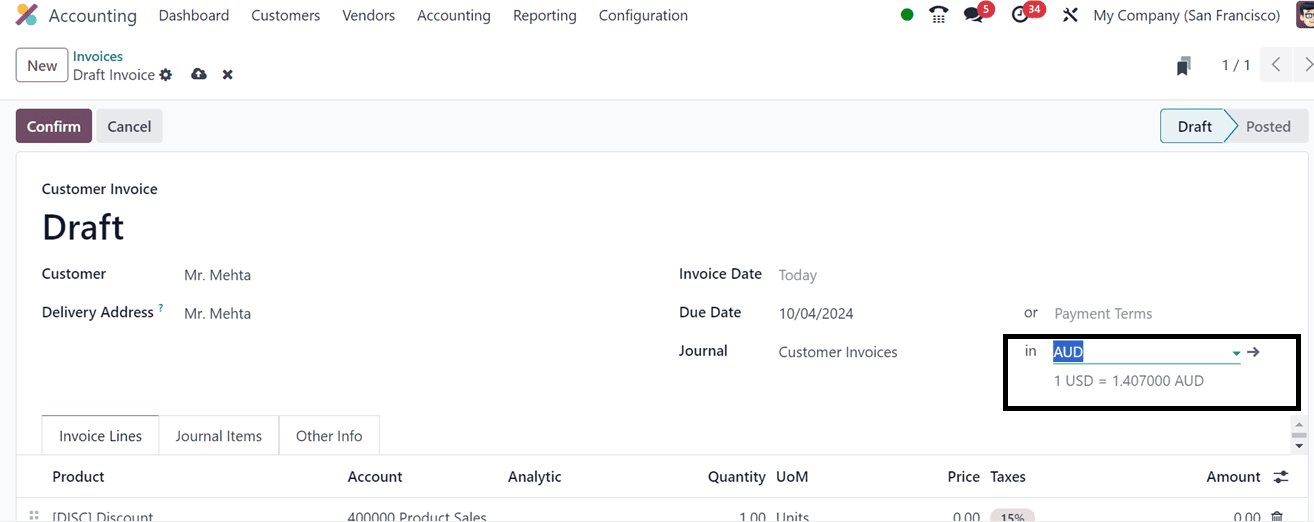

Immediately after providing a different currency, the invoice rate will be calculated and displayed in the current company’s currency, as illustrated below.

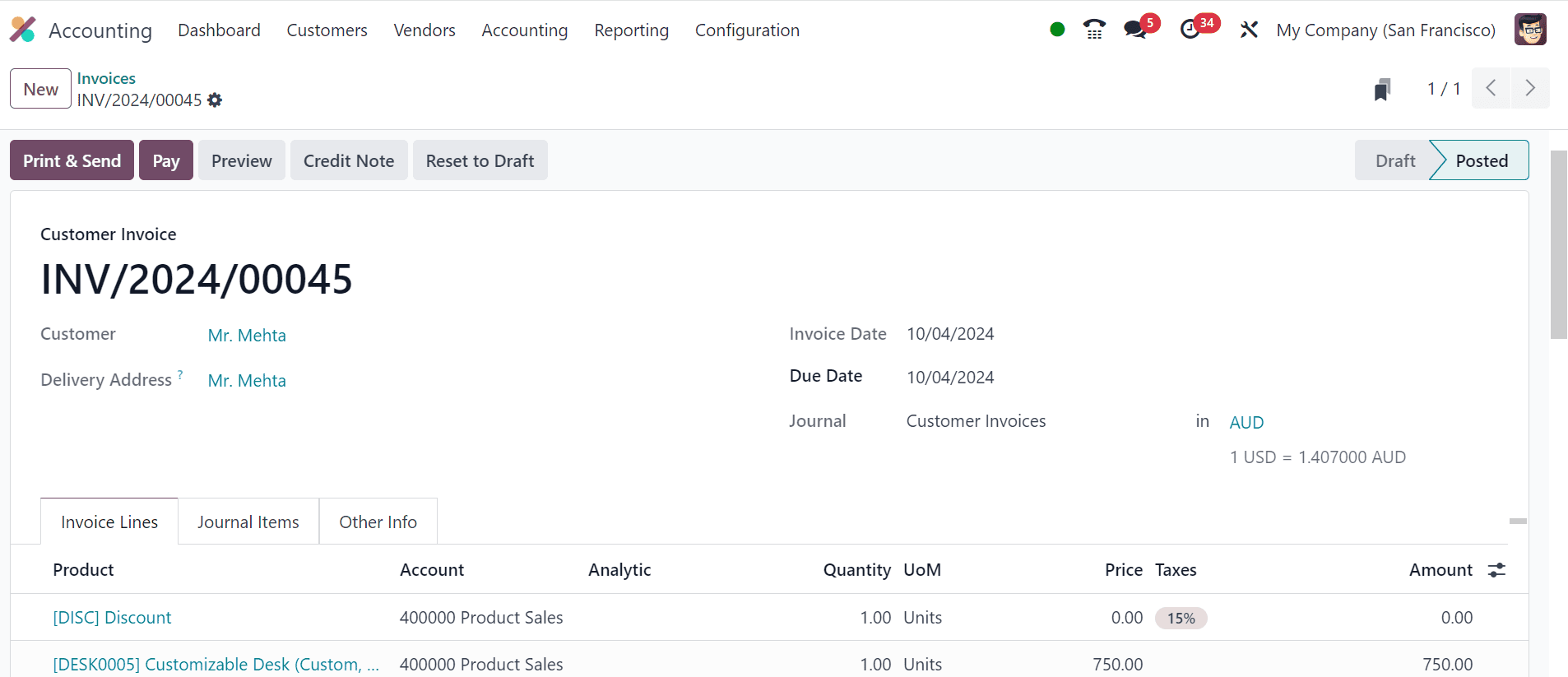

Then, we can confirm the invoice after editing all the required form fields, Journal Items, and other details in the Other Info tab using the Confirm button.

After confirming the invoice, we can print or send the invoice, check the invoice preview, make payments, and create credit notes using the “Print & Send,” “Pay,” “Preview,” “Credit Note,” and “Reset to Draft” buttons, respectively.

The total amount, as well as the tax amount details, can be viewed in local currency under the invoice window. We can check whether the odoo has converted the tax in company currency from the invoice bill.

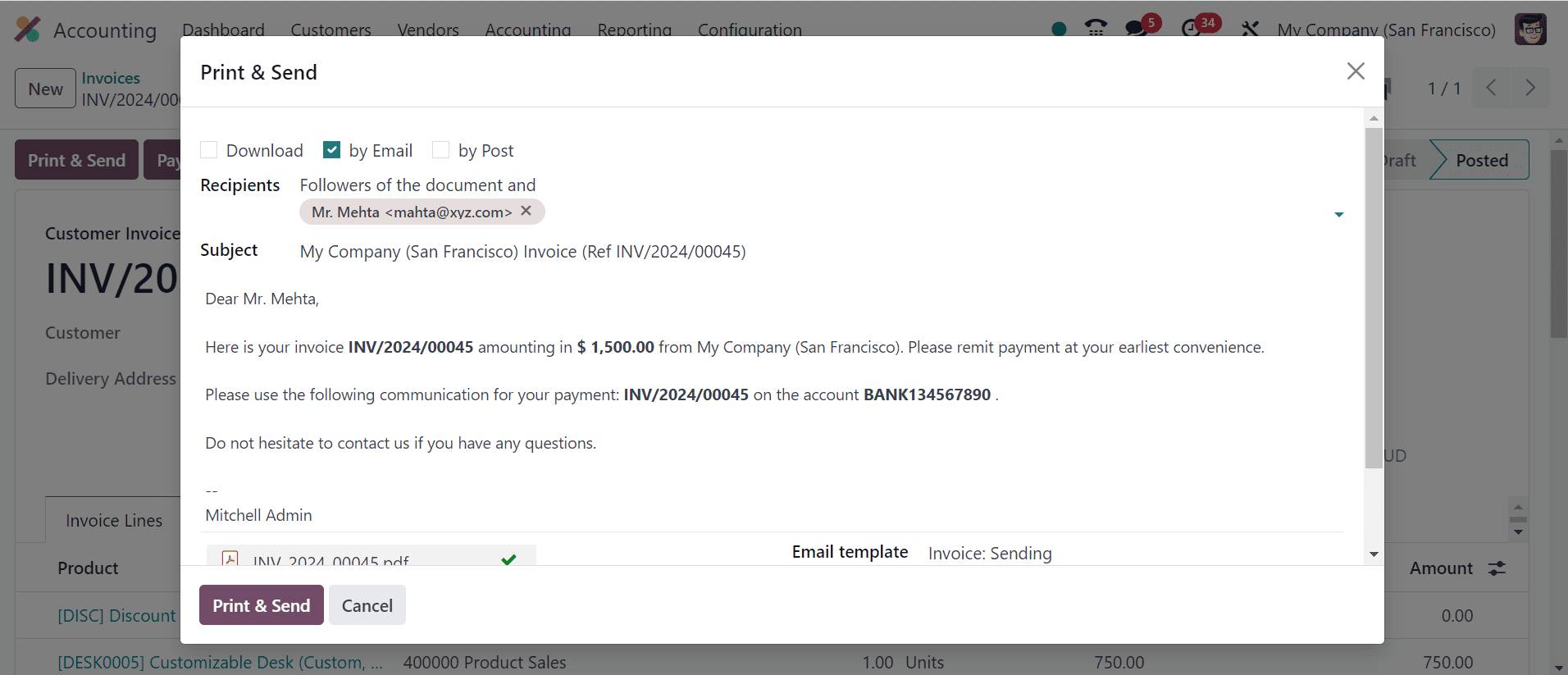

To check the feature, click on the Print&Send button. This will open a dialogue box where we can set the Email Recipients, Subject, and other details as shown below.

After, press the ‘Print&Send’ button. So, it will open the invoice as shown below.

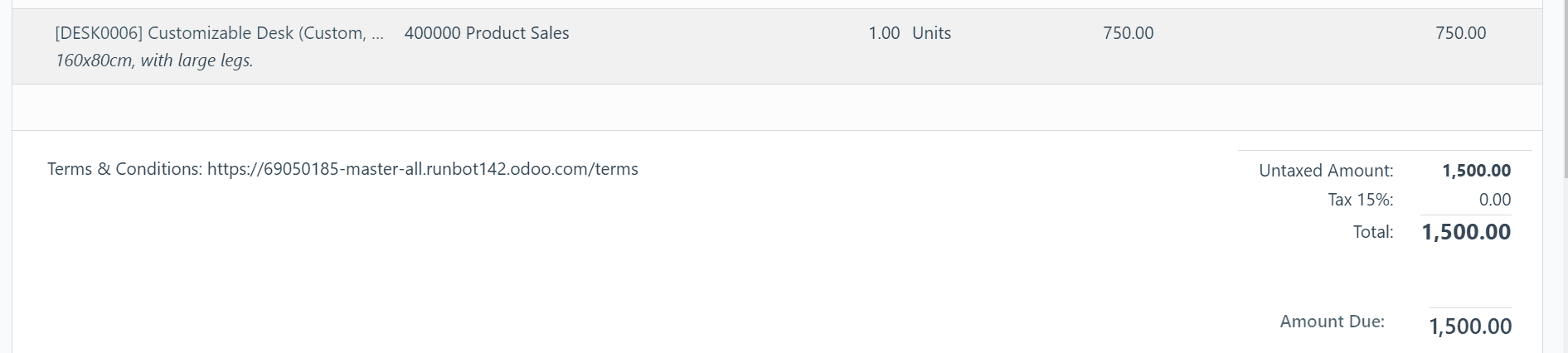

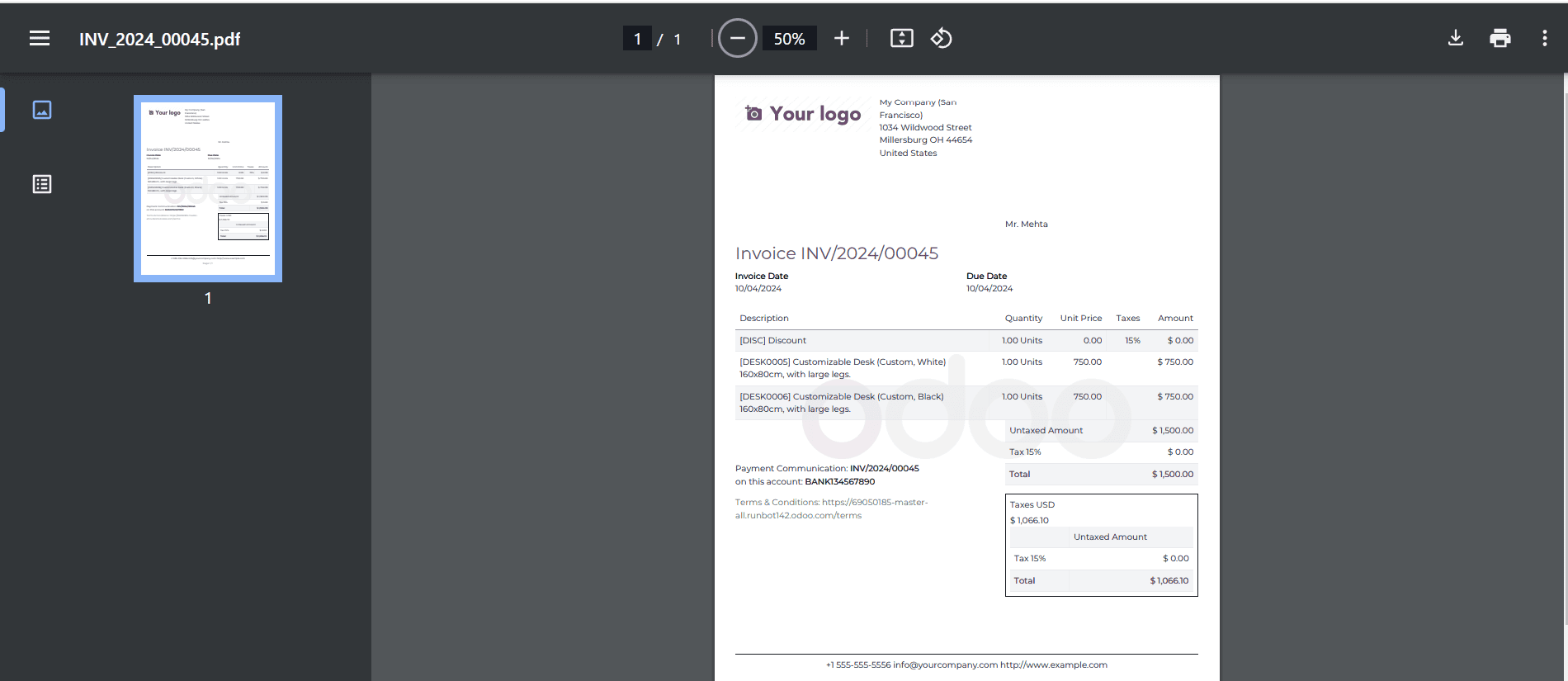

The invoice details, such as the Date, Product, and other information, are displayed here. Under the invoice, we can see the total amount, tax percentage, etc.

We can see the tax amount in the company’s local currency, which is USD, under the Taxes USD area.

Tax Configuration in Company Currency feature of the Odoo 18 Accounting offers to simplify tax management by allowing businesses to manage taxes directly in their company currency. This feature reduces errors and discrepancies, making it particularly beneficial for businesses in multi-currency environments or international transactions.

To read more about How to Manage Multi-currency in Odoo 17 Accounting, refer to our blog How to Manage Multi-currency in Odoo 17 Accounting.